Abstract

This paper examines innovation among very small firms and provides new insights into both internal and external determinants of patenting. Applying a non-linear panel data approach to about 160,000 observations on manufacturing firms in Sweden for the period 2000–2006, the following facts emerge: (i) in contrast to larger firms, innovation in micro firms with 1–10 employees is not sensitive to variation in internal financial resources, (ii) skilled labour is even more important for innovation among micro firms compared to other firms, (iii) affiliation to a domestically owned multinational enterprise group increases the innovation capacity of small businesses, (iv) small firms’ innovation is closely linked to participation in international trade and exports to the G7-countries, and (v) there is no statistically significant evidence that proximity to metropolitan areas, or presence in a specialized cluster, increases the innovativeness of the smallest firm.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The question of how firm size is related to innovation has inspired scholars to produce one of the largest bodies of literature in the field of industrial organization (Cohen and Levin 1989). Still, a substantial part of this research may be associated with the two contrasting Schumpeterian hypotheses—the importance of innovative activity increases or decreases more than proportionately with firm size. At least four main motivations can be crystallized for the massive and inexhaustible interest in this topic:

-

First and naturally, innovation is nowadays considered to be the main engine of growth (Aghion et al 2009).

-

Second, small innovative firms are assumed to be a key factor for entrepreneurial spirit and innovation. Baumol’s (2002) hypothesis of a ‘David-Goliath’ symbiosis between small and large firms and the Schumpeterian ‘Mark I’ hypothesis (Schumpeter 1934) emphasize the role of small innovative firms in introducing new technology and variety into the economic system. Much research in recent decades also shows that small firms account for a significant share of innovations and employment growth (e.g., Rothwell 1989; Acs and Audretsch 1988, 1991; Davidsson et al. 1994; Audretsch 2002).

-

Third, innovation is not observed in particular detail in statistics (Thoma et al. 2010), which is especially the case for small businesses. But substantial efforts to make improvements are in progress (Community Innovation Survey by Eurostat, PATSTAT by OECD and European Patent Office, the NBER patent database, to mention some of the more important).

-

Fourth, gradual improvement in the access to large datasets on various proxies for innovation accounting has created a surge of systematic analysis based on econometrics, which to some extent has managed to correct for selection bias in the samples and empirical shadow created by limited availability of detailed firm statistics.

The contribution of this paper is the evidence of the propensity to innovate among the very small firms, and we provide new insights into both internal and external determinants of innovation. The data material is comprehensive and its richness enables us to evaluate propositions and arguments with regard to the determinants of innovation derived from various strands of innovation literature: the neo-Schumpeterian literature and the resource-based view of the firm (RBV), the theory of agglomeration economies and the literature on international trade as a conduit for knowledge flows.

Two research questions are addressed: Are small firms different innovators compared to larger firms, and are very small firms different innovators compared to other small firms? Similar questions are asked by Breitzman and Hicks (2008), who suggest that the firm-size issue is not a small/large phenomenon. Analysing about 1,300 US firms with 15 or more patents issued over a 5-year period, they find that companies with fewer than 25 employees develop more patents per employee than firms with fewer than 50 employees, which in turn have a higher patent-to-employee ratio than firms with 100 employees.

Our study uses patent applications as an indicator of innovative activities and focuses on the characteristics of innovative micro and small firms, with large firms serving as a reference group. Patents have been found to be a good index of innovative activity (Griliches 1990), since they are granted for inventions which are novel, inventive, and have industrial application. For various purposes, researchers have used different patent-measures of innovation, such as simple counts of filed applications or granted applications, counts of weighted forward citations, years of renewal, patent family size and number of patent claims. Each one has its strengths and weaknesses. Our main motivation for the choice of dependent variable is that it better captures actual time of innovation than alternative measures (Griliches et al. 1988).

Applying a non-linear panel data approach, we examine how firms’ innovation activities vary in accordance with an extensive set of characteristics including observed and unobserved firm-specific information and knowledge spillovers through corporate ownership structure, international trade and the regional milieu. The data material consists of close to 160,000 observations on 34,742 unique manufacturing firms in Sweden over the period 2000–2006.

The data used in this paper originates from Statistics Sweden, the Swedish Custom Office and the Swedish Patent Office (PRV). The basic data set contains compulsory and audited register information on firm characteristics based on annual reports for all firms in Sweden. A unique identification number for each firm allows this data to be merged with data on firms’ international trade and patent applications, the educational level of the workforce and regional characteristics.

The data material is comprehensive and its richness enables us to evaluate propositions and arguments with regard to the determinants of innovation derived from various strands of innovation literature: the neo-Schumpeterian literature and the resource-based view of the firm (RBV), the theory of agglomeration economies and the literature on international trade as a conduit for knowledge flows.

The main results of this paper are as follows. First, in contrast to larger firms, innovation in micro firms with 1–10 employees is not sensitive to variation in internal financial resources. Second, skilled labour is even more important for innovation among micro firms compared to other firms. Third, affiliation to a domestically owned multinational enterprise group increases the innovation capacity within small businesses. Fourth, small firms’ innovation is closely linked to participation in international trade and exports to the G7-countries, and fifth, no statistically significant evidence is found that proximity to metropolitan areas, or belonging to a specialized cluster, increases the innovativeness of the smallest firm.

Section 2 of this paper presents propositions and arguments pertaining to the characteristics of the innovative firm and emanating from different strands of literature. These provide the basis for the selection of variables that are used to contrast innovative with non-innovative firms in the empirical analysis. Section 3 contains the data, variables and descriptive statistics. Section 4 sets out the empirical strategy and Sect. 5 the results of the econometric analyses of the relationships between our chosen variables and the firms’ patent applications. Section 6 concludes the paper by providing suggestions for further research and extensions.

2 The innovative firm and its characteristics

The main focus here is on the characteristics associated with innovative small firms. We use patent application as a proxy for the firm’s innovative activities. Although patents are typically considered as an output measure in some of the literature we refer to below, it may also be seen as an intermediate product in the innovation process. This is the view taken in this paper.

It should be emphasized that many innovative firms do not apply for patent protection and that a patent application is not an innovation, but only one of many possible innovation indicators. Though the use of patents as innovation indicators has been debated, many scholars argue that it is a proper measure of innovation (Griliches 1990). Acs et al. (2002) compare innovation and patents across US regions and conclude; “the empirical evidence suggests that patents provide a fairly reliable measure of innovative activity” (p. 1080).

A main criticism against simple counts of applications is that this measure cannot distinguish groundbreaking innovations from incremental technological discoveries (Fang et al. 2010). A simple alternative measure is granted patents, but these do not need to be commercially applied and differ greatly in their technical and economic significance (Griliches 1990). Moreover, the standard of novelty and utility for granting is not very highFootnote 1 and the value distribution of granted patents is highly skewed (Arundel and Kemp 2009). Also, Harhoff (2009) notes that applicants may have incentives to delay or drop the examination procedure, due to reasons other than quality issues.

Which of the characteristics of a firm and its environment are important for innovation? There is no established “general” theoretical model in the literature of the innovative firm. This paper relies on theories, arguments and propositions in three main strands of the literature on R&D, technology and innovation. These are; (i) the Schumpeterian literature and the resource-based view of the firm (RBV), (ii) the literature on agglomeration economies and (iii) the literature on international technology diffusion, which emphasizes international trade as a conduit for knowledge flows.

The three strands offer complementary perspectives on the determinants of innovation. While the neo-Schumpeterian and RBV frameworks stress internal characteristics, the literature on agglomeration economies and international trade puts focus on knowledge and information flows from the local environment and from abroad.Footnote 2 An example of the complementarities of the perspectives is that a firm’s human capital may affect its capability to internally generate new techniques and products. At the same time it reflects the absorptive capacity as regards knowledge and information flows from either the local environment or from abroad. Next, we discuss the three strands of the literature in more detail. We also take up our definitions of, and reasons for using, the variables that we apply in the empirical analysis of the determinants of innovation activity.

2.1 Internal firm characteristics

The neo-Schumpeterian and the RBV perspectives emphasize internal characteristics, such as R&D, physical capital, human capital and financial structure. A key assertion in the RBV literature is that a firm’s competitive advantage depends on internal heterogeneous resources and capabilities (Penrose 1959; Barney 1991). According to this perspective, firms’ innovation activities are primarily explained by their internal characteristics. The neo-Schumpeterian literature builds on similar premises, although the role of sector characteristics is typically more explicit, as manifested, for instance, by concepts such as technological regimes (Malerba and Orsenigo 1993).

Consistent with the RBV and the neo-Schumpeterian literature, several studies find that the characteristics of the firms and the sector they operate in are important for explaining a firm’s engagement in innovation activities (Kleinknecht and Mohnen 2002; Cohen 1995; Crépon et al. 1998; Pavitt 1984). We will now review a set of characteristics that this literature suggests is important for firms’ innovation activity, and show how they are defined in this paper. The characteristics include financial resources, physical capital, human capital, size, corporate ownership and sector affiliation.

2.1.1 Financial factors

Access to financing is seen to be a major challenge for small firms in general and small innovative firms in particular. As innovation is often associated with risks and costly investments in knowledge and technology, both internal financial resources and access to external capital are possible determinants of a firm’s innovation activity. The theoretical literature suggests that the presence of asymmetric information and moral hazard problems may be particularly serious for SMEs engaged in innovation activities Thus, profitability can be expected to be more important for small and young innovative firms, since they often have limited access to capital markets and difficulties in finding external sources of funds for their R&D investments (Himmerlfarb and Petersen 1994).Footnote 3 However, the unsuitability of debt as a source of finance for R&D and other innovation investment has been confirmed across different firm sizes (Hall 2005).

Following Fazzari et al. (1988), recent literature has applied the pecking order approach in order to investigate the relationship between innovation and financial factors. Key determinants are cash-flow, equity and long-term debt. The rationale is basically that a firm displaying sensitivity of long-term innovation investment to cash-flow over a period of time likely has weaker access to external finance than a firm not displaying such sensitivity.

Since our data includes the entire firm population of Swedish manufacturing firms with at least 1 employee, we are confronted with some particular data management issues not commonly discussed in the literature. In line with Brown et al. (2009), Fazzari et al. (1988) and Scellato (2007), most studies using the pecking order approach drop all firms with negative sums of cash-flow-to-assets during the sample period. However, applying this to our data would eliminate a substantial number of the very small firms, which are the focus of this paper. Instead, we exploit profit margin (gross profit divided by sales) as a measure of internal financial resources. Although our data shows that, on average, small firms have higher profit margins than other firms, we do not expect any correlation between profitability and innovation for the smallest businesses.

2.1.2 Physical capital and skilled labor

The empirical literature has convincingly shown that physical capital is a major driving force of economic growth at various levels of aggregation. One explanation is that new knowledge is embedded in capital investments (Hulten 2002). In contrast, the relationship between physical capital and innovation is less obvious. In fact, there is no consensus in the literature on the short-run relationship between firms’ investment in R&D and other innovation activities and investments in physical capital. It is only for the long run that a robust association has been documented (De Jong 2007). In our analysis, we use the stock of capital (corrected for depreciation and new investments) per employee as the capital variable.

Skilled labor (or human capital) is regarded as reflecting a firm’s capacity to absorb, assimilate and develop new knowledge and technology (Bartel and Lichtenberg 1987; Cohen and Levinthal 1990). Several empirical studies also find that technological change tends to be skill-biased and changes the relative labor demand in favor of highly skilled and educated workers (e.g., Berman et al. 1998; Machin and van Reenen 1998). Skilled labour is defined as employees with at least 3 years of university education. We expect, a priori, a close and positive association between skilled labour and patent application, and we also believe that this link is stronger for small firms compared to large firms.

The specification of the empirical model also includes the variable Ordinary labour defined as employees with less than 3 years of university education. This variable is commonly considered as a size variable in the literature, but since we have already split the sample into different size groups, a substantial part of its explanatory power is eliminated.

2.1.3 Corporate ownership structure

A further characteristic is corporate ownership structure. We distinguish between individual firms and firms belonging to a corporate group. Three types of corporate groups are analyzed: (i) uninational corporations, (ii) domestic-owned multinational enterprises (MNE) and (iii) foreign-owned MNEs. Following the literature, we assume there are important differences between non-MNEs and MNEs, as well as between domestic-owned MNEs and foreign-owned MNEs regarding technological dissemination and innovation. Swedish MNEs can also be expected to have a distinct role in the Swedish “innovation system”, since they tend to concentrate their R&D-investments domestically.

By definition, MNEs have established links to several markets and thereby a coupling to several knowledge sources and innovation systems (cf. Dachs et al. 2008). Typically, they also have strong internal capabilities pertaining to the development of proprietary information and knowledge within the enterprise (Phaffermayr and Bellak 2002).Footnote 4 Small firms that are part of a MNE (either domestic- or foreign-owned) may thus be expected to be more innovative because of access to the MNE’s knowledge and information networks and technology. It is also well known that mergers and acquisitions are an important means by which MNEs expand. One reason why a MNE may acquire a micro firm is that the latter may have developed new knowledge and technology pertinent to the MNE. Small innovative firms are often the source of the expansion of technological capabilities in large and established firms (Granstrand and Sjölander 1990).

2.1.4 Sector classification and year dummies

A typical argument in the neo-Schumpeterian literature is that the characteristics of a particular sector or industry with which a firm is affiliated may influence its innovation activity. Different sectors have different technology and innovation opportunities, and are thus characterized by different technological regimes (Malerba and Orsenigo 1993). Over a sequence of periods certain industries may be characterized by rapid technological progress, translating into high technology and innovation opportunities, which is typically the case in the early phases of a technology’s life cycle (cf. Vernon 1966). Small firms tend to have an innovation advantage precisely in high-technology and skill-intensive sectors in which technology and innovation opportunities are high.

Our empirical analysis includes sector dummies based on the overall technology intensity of the sector a firm is affiliated with. We consider four broad OECD classifications; high technology, high-medium technology, low-medium technology and low technology sectors. We also include year dummies to capture unobservable time-varying macro factors, such as general economic conditions, interest rate, inflation, money supply and tax rates, common to all firms.

2.2 Networks and linkages to foreign markets

Firms engaged in international trade are regularly claimed to have better access to foreign knowledge and technology, and such access may be important as domestic R&D is often a small fraction of the ‘global’ R&D stock. The literature on international knowledge spillovers (or technology diffusion) suggests international trade as a conduit for flows of knowledge and technology (see e.g., Keller 2004). Links to customers and suppliers in different markets may foster a firm’s accumulation of knowledge about customer preferences, production techniques and technology, and as such stimulate innovation.

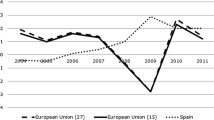

An important issue is that a firm’s international trade status may be endogenous to the firm’s productivity and innovation. Several studies of international trade through the lens of the individual firm find that, conditional on an extensive set of firm characteristics, firms that participate in international trade are more productive (see Greenaway and Kneller 2007 or Wagner 2007 for surveys). Recent evidence from Sweden is provided by Andersson et al. (2008). The literature offers two non-mutually exclusive hypotheses capable of explaining such a pattern. The first is that firms engaged in international trade have ex ante productivity advantages, presumably based on some form of innovation, enabling them to overcome sunk costs associated with foreign sales. The second is ‘learning-by-exporting’ and rests precisely on the argument that firms that trade internationally have better access to foreign knowledge and technology, which stimulates innovation and productivity.

Much of the literature linking international trade to innovation focuses on imports and technology and knowledge embodied in differentiated intermediate capital goods (cf. Rivera-Batiz and Romer 1991; Coe and Helpman 1995). Domestic firms exploit foreign R&D by importing the intermediate product. From this perspective, trade linkages with R&D intensive economies, such as G7 countries accounting for over 80% of the total R&D investments in the world, are supposed to be an important source of knowledge and technology (Acharya and Keller 2007). Lööf and Andersson (2010) find that the fraction of G7 imports influences productivity at the level of individual firms.

Motivated by the arguments discussed above, our empirical analysis includes measures of the firms’ participation in international trade as innovation determinants. These measures are assumed to reflect the potential for international knowledge flows. The first is exports and imports, to and from the G7 countries, as fractions of total exports and total imports, respectively. The second variable is the number of export destinations and import origin countries for the firms’ export and import flows. Finally, we include dummies to indicate whether a trading firm (i) only imports, (ii) only exports or (iii) imports and exports. The expectations regarding the trade variables are that trade in general and G7 in particular are positively associated with innovation activity in both small and large firms.

2.3 Location characteristics and agglomeration economies

The literature on agglomeration economies emphasizes firms’ local environment and that the density of firms and the spatial concentration of human capital bring about place-specific external economies of scale that may influence the performance of the firms. Marshall (1920) maintained that concentrations of firms in a similar industry give rise to localization economies in the form of knowledge and information spillovers, labor pooling (advantages of thick markets for specialized skills) and backward and forward linkages. Ohlin (1933) and Hoover (1937) distinguished between urbanization and localization economies, the former pertaining to larger urban regions with a diversified economy.

A main argument in the literature is the local environment as a source of knowledge and ideas (Feldman 1999; Andersson and Johansson 2008). In particular, dense urban environments with richness in knowledge sources are regarded as stimulating face-to-face interaction and localized knowledge flows (Duranton and Puga 2001). These conjectures find support in ample empirical analyses. Innovation activities are more concentrated in space than standard production activities (Audretsch and Feldman 1996), patent citations are geographically localized (Jaffe et al. 1993) and innovations tend to diffuse faster within clusters (Baptista 2000). Moreover, flows of labor and technical personnel between firms tend to be greater in dense locations, thus stimulating the diffusion of competencies and knowledge embodied in people (Almeida and Kogut 1999).

An interesting finding in the literature is that the local knowledge flows appear to be particularly important for small firms. Acs et al. (1994) investigated the sources of innovation inputs for small firms, since they produce innovation output with limited R&D resources compared to large firms. The authors tested the hypothesis that small firms capitalize on flows of knowledge and information from corporate R&D in large firms and universities, and that such flows are stimulated by their geographical proximity. They applied the model developed in Jaffe (1989) in such a way that innovation activity in US states was regressed on industry R&D, university R&D and an index of their geographical coincidence. By partitioning each state’s total innovations into those developed by small and large firms, they showed that the geographical coincidence index was only significant for small firm innovations. Although they did not control for characteristics of the firms, as suggested by the RBV and Schumpeterian literature, their findings indicate the importance of local knowledge and information flows for innovation activity in small firms. Ample subsequent studies have found that the characteristics of locations pertaining to the potential and frequency of such flows are important, not only for innovations in small firms but also start-up activity. It is now established in the literature that “…entrepreneurial activity will tend to be greater in contexts where investments in new knowledge are relatively high, since the new firm will be started from knowledge that has spilled over from the source actually producing that knowledge” (Acs et al. 2006, p. 12).

In view of the arguments presented above, the empirical analysis includes basic agglomeration measures reflecting the potential for knowledge and information flows as characteristics associated with innovation in the region in which each firm is located. Sweden has one major functional regional (Stockholm) and only two additional metropolitan regions with more than 300,000 inhabitants (Goteborg and Malmo). We include three separate dummies for Sweden’s three metropolitan regions with the purpose of ascertaining whether firms located in these regions have a higher propensity to apply for patents and more patent applications than firms located elsewhere in Sweden. The literature on agglomeration economies suggests a positive relationship between innovation and metro-regions. The second agglomeration variable is regional employment fraction, which measures the size of the sector the firm belongs to in the region where the firm is located, as a fraction of the region’s total employment in private sectors. It is assumed to reflect the potential for external scale economies associated with sectoral geographic concentration. The sectors are broadly defined and refer to the four OECD sector aggregates in terms of technology level. We expect the employment fraction to positively affect knowledge spillovers and patent activities.

3 Data and descriptive statistics

3.1 Data

The data source used is this paper covers the period 2000–2006 and consists of about 160,000 observations on manufacturing firms in Sweden. To the best of our knowledge, this data is almost unique in terms of the extensive information on incentives to patent among small businesses. Micro firms (1–10 employees) constitute 71.4% of the population, small firms (11–25 employees) 14.5% and the rest of the firms 14.1% of the population.

The data set is unbalanced. In total 34,742 firms have been observed, of which 40% have been in the sample for all 7 years. About 80% of the firms are observed for 3 years or more. Five sources of data have been matched, based on a unique identification number of each firm. The basic data set contains compulsory and audited register information on firm characteristics based on annual reports for all firms in Sweden. This data has been merged with data on (i) educational statistics, (ii) trade statistics, (iii) regional characteristics and (iv) patent applications, representing more than 95 percent of all national patent applications by Swedish manufacturing firms during the period 2000–2006. All the data originates from Statistics Sweden, the Swedish Customs Office and the Swedish Patent Office (PRV).

3.2 Descriptive statistics

Table 1 presents the summary statistics of key firm characteristics over the period 2000–2006, as motivated and defined in Sect. 2. Definitions of each variable are presented in Appendix. The sample is separated into three size-classes: 1–10 employees, 11–25 employees and more than 25 employees. Several things stand out. First, the fraction of patent applications differs considerably across the size-classes. While only 0.3% of the micro firms applied for one or more patents during the period, the corresponding fraction for “large” (more than 25 employees) is 6%. Second, of the three size-classes, patenting firms have 3–5 times more skilled labour than non-patenting firms. Third, innovative firms (all size classes) are more profitable and have better access to bank loans. Fourth, a considerably larger fraction of patent applications is associated with a Swedish MNE compared to non-patenting firms. Fifth, patenting firms tend to be more capital-intensive and technology-intensive than other firms. The descriptive statistics show that the average fraction of patent applications is 0.3% for micro firms, 1.1% for firms with 11–25 employees and 5.9% for larger manufacturing firms. Finally, like many other studies, we show that small innovative firms obtain many more patents per employee than larger firms. The patent-to-employee ratio is 0.5 for micro firms, 0.8 for other small firms and 0.2 for the larger firms.

Table 2 shows the descriptive statistics for the trade variables applied in the regression analysis. Two interesting things should be noted. First, patenting micro firms have a six times larger G7 fraction in their export-basket compared to other micro firms. They also import more from G7 and are much more globally oriented than other micro firms. Second, G7 and the international market are of great importance for all patent applicants, but this region is of particular importance for small innovative firms: the G7 fraction of total exports is 3% for all micro firms compared to 20% for the average patenting micro firm. Overall, patenting firms are more internationalized than non-patenting ones.

Table 3 reports descriptive statistics for regional characteristics over the period 2000–2006. Only minor differences are found between patent applicants and others. Based on the previous literature on agglomeration economies and innovation, one would expect patenting firms to be more frequent in the metropolitan areas of Sweden. Surprisingly, it is shown that patenting firms are not overrepresented in the three metropolitan regions of Sweden. Moreover, the statistics associated with the variable ‘Emp-share LA region’, which measures the relative size of the sector in the region where the firms are located, also suggest that patenting firms are not overrepresented in regions where the sector to which the firms belong is large.

4 Empirical strategy

We use two measures of patent applications: (i) an indicator variable showing whether firm i has applied for a patent in year t, (ii) count-data reporting the number of patent applications by firm i in year t. An application may have several applicants from different firms, motivating adjustment with weights. However, this requires assumptions of the particular contribution from each of the firms. Since our sensitivity analysis only shows marginal differences between weighted and non-weighted applications in the econometric regressions, we apply the former.

In order to estimate the relationship between innovation activity, as evidenced by patent applications, and the determinants in Sect. 2, we apply two classes of non-linear estimators; a binary outcome model and a count-data model. In the binary outcome model, a dummy variable indicates whether the firm applied for a patent in a given year. In the count data model, the dependent variable is the number of patent applications by each firm. The typical small firm engaged in patent activities made 1 application and the typical firm with more than 25 employees made 5 applications or more in the period 2000–2006.

To be more precise, we first use the logit firm-specific effects model and estimate the marginal effects. The general model is specified as

where y it denotes the probability that firm i will apply for a patent in year t, x it are regressors, α i the firm-specific effects, and ε it an idiosyncratic error.

The general count data model can be specified as

where y it represents number of patents to be explained for firm i at time t, μ it = exp (x it ) refers to explanatory variables, ν i = exp(η i ) is the individual effect mean, and u it is an idiosyncratic error term.

Some of the standard complications in analyzing count data include the presence of unobserved heterogeneity due to omitted variables, an “excess” of zero observations and overdispersed data. The dependent variable patent application in our data is considerably overdispersed because the sample variance is 42 times the sample mean. The negative binomial model has the advantage of being flexible enough to accommodate over-dispersion.

For the dependent variable and most of the regressors, the vast majority of the variation in the data consists of the between variation rather than the within variation. Applying the fixed-effects estimator, the coefficients of the time-invariant regressors are not identified and more than 90% of the observations are dropped because there is no variation in y it over t. Therefore, the fixed-effects estimator is not very efficient, since it relies on within variation, and therefore we use random-effects.

5 Results

We now turn to the results of the binary and count-data models. The two dependent variables are the propensity to apply for a patent and the number of patent applications. Our focus is on micro and small firms and the coefficient estimates for these two groups are contrasted with the results for firms with more than 25 employees.

Table 4 shows the estimates for the variables in the basic model, which is based on the neo-Schumpeterian literature and the resource-based view of the firm (RBV), and includes financial resources, physical capital, skilled labour as a proxy for R&D, firm size, corporate ownership structure, sector classification and year dummies. The basic model is augmented in Tables 5 and 6 with export variables and import variables, respectively. Our last results are in Table 7, which shows the estimated impact of location characteristics using the variables in the basic model as covariates.

The tables are organized in the following way: The left part of the tables presents the logit estimates and the right the count-data estimates. For each of the two models the results are separated into three columns; micro (1–10 employees), small (11–25 employees) and larger firms (more than 25 employees).

5.1 Basic model

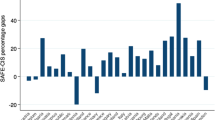

Historically, both patent filings and R&D have moved in parallel with the development of the market demand (OECD 2009; Griliches 1995), showing the close correlation between cash-flow and innovation. Our study uses profit margin for testing the sensitivity of innovation to internal financial resources. Confirming our a priori assumptions, the coefficient estimates from both the logit model and the count data model are non-significant for the very smallest firms and highly significant only for the largest firms. Although expected, this result is interesting since almost all previous systematic analyses on the relationship between finance and innovation are based on observations of larger firms than our study. Here we can confirm that there is a distinct difference in financing innovation between micro-firm and larger firms. The profit estimate for the middle group, 11–25 employees, is positive in both models but significant (at the 10% level) only for the binomial result. The estimates for short term debt and physical capital are non-significant in all six regressions.

We next consider the estimated coefficients for skilled labour (employees with 3 years of education or more). Klette and Kortum (2004) argue that a firm’s innovation rate depends on its knowledge capital, which consists of all the skills and know-how that it possesses when it attempts to innovate. A large part of this knowledge capital is embodied in the workers in the firm. The estimated coefficients from the logit regression are positive and significant for all three size classes. However, two interesting findings should be noted. First, the estimate is only significant at the weakest acceptable significance level for firms with more than 10 employees and the size of the estimate is close to zero. Second, the coefficient estimate is significantly larger for micro firms compared to the middle group. The output-pattern of the count-data models is almost identical to the binary outcome.

Ordinary labour is commonly considered to be a size-variable when estimating determinants of innovation. However, our classification of the firms into three different groups partly accounts for the size-effect and hence the estimated size-effect is almost negligible in the regressions.

The corporate ownership structure is assumed to be associated with knowledge spillovers, and domestic multinational firms have been found to be of particular importance in the so-called national innovation system in Sweden (Johansson and Lööf 2008). This paper confirms previous findings and shows that the membership in a domestic MNE group is positively correlated to our measures of patent activity for large firms, small firms and micro firms as well. Only among large firms do we find a link between foreign ownership and patent application in Sweden, which suggests the presence of international technological diffusion.

In particular, the results for the smaller firms are interesting since this finding is not well documented in the literature. Affiliation to a domestic-owned multinational enterprise group increases the innovation capacity within small businesses. How can this be understood? The literature has shown that MNEs tend to concentrate their R&D activities to the home country, partly because of strong complementarities between the knowledge base of the MNE and the technological competencies of the “innovation system” in the home country (Patel and Pavitt 1991). Naturally, this system of innovation includes small innovative firms. Given that MNEs often buy small innovative firms in order to acquire knowledge and technology, we interpret the results as meaning that domestic MNEs are better equipped than foreign MNEs to scan the Swedish market and accumulate information on small innovative firms as potential members of their corporate group. Notably, membership in a uninational group is negatively associated with national patent application.

Finally, consistent with ample previous studies, the estimated coefficients for the sector dummies show that innovation activity in the form of patent applications is more likely for firms active in high-technology sectors. The results in Table 4 verify that this is also the case for small and micro firms.

5.2 International trade characteristics

We now consider the basic model, presented in Table 4, augmented with variables reflecting each firm’s participation in international trade. These variables are motivated by the literature on trade as a conduit for international knowledge flows. The estimates in the upper part of Table 5 indicate that a firm’s fraction of exports to the most R&D-intensive countries in the world, G7-exports, is closely correlated with innovation activity. The binary model and the count model show a very robust pattern for micro firms and large firms. The propensity to apply for a patent and the patent count increase considerably with G7-trade, which is consistent with the literature on ‘learning-by-exporting’ and international technology diffusion. Interestingly, no significant association between innovation activity and G7 exports is found for firms in the size group 11–25 employees.

The two estimators produce very similar estimates for small and large firms regarding the number of export destinations. The propensity to apply for a patent and the number of patent applications are increasing functions of international presence in different markets only when a firm has reached a particular size level. Thus, we find non-significant estimates only for micro-firms.

The lower part of Table 5 presents coefficient estimates for three categories of dummy variables: firms with only exports, firms with only imports and firms with both exports and imports. The typical trading firm is engaged in exports as well as imports, and is also somewhat more likely to apply for patents than a firm that only exports or only imports. This finding is consistent across the three size classes. Our interpretation is that exporting and importing firms have a two-pronged international link to both customers and suppliers in different countries, and thus many potential channels open for knowledge and information flows from abroad.

Surprisingly, in contrast to G7-exports, we do not find that the fraction of G7 countries of a firm’s total imports has any impact on patent applications of small firms with 1–10 employees (Table 6). The coefficient estimate for G7 imports is significantly different from zero only for large firms. The results of the number of import origins and the three dummy variables are similar to those in Table 5. Both models report that number of origin markets correlates positively with innovation for all size-classes. However, this variable is significant only for firms with more than 10 employees. Finally, the results confirm the strong association between innovation activity and a firm’s engagement in export and imports.

Overall, the results in Tables 5 and 6 suggest that the variables reflecting a firm’s participation in international trade are significantly related with innovation activity. This is consistent with the hypothesis that links to foreign markets are a conduit for international knowledge flows, which stimulate innovation. The new finding is the important role of international markets in general, and the role of exports to G7 in very small innovative firms in particular.

5.3 The regional milieu

The literature has convincingly shown that there is a positive inter-relationship of agglomeration and innovation and productivity (see Sect. 2.2). Using cross-sectional CIS data for Sweden, Johansson and Lööf (2008) find that there is a “Stockholm-effect” as regards productivity. Everything else equal, firms in Stockholm are more productive than in the rest of Sweden. Based on arguments in the literature on agglomeration economies, we now ask if there is a link between location and patent activity similar to the one established for location and productivity.

Table 7 reports the estimated coefficients associated with the variables reflecting agglomeration phenomena. In addition to the covariates from the basic model reported in Table 4, we include dummy variables for Sweden’s three metropolitan regions and an agglomeration variable. The latter variable is constructed as follows: First, we separate the observed firms into 81 labour market regions. Second, we calculate the employment size, as a fraction of the total national employment in this sector and region, of the specific 2 digit industry to which a firm belongs.

Starting with the metropolitan-variables, Table 7 shows no “Stockholm-effect” as regards firms’ patent activities. The estimated parameters for both models are insignificant for all size-classes. Considering the two other metropolitan areas, the logit estimates are insignificant for micro firms and the largest firms. Regarding firms with 11–25 employees, the results actually suggest a negative relationship between the propensity to apply for patents and location in Gothenburg or Malmo.

Based on a large and expanding literature on the advantages of agglomerations, we expected the metropolitan variables to be correlated with innovation among small business. But the results presented in Table 7 strongly reject this assumption. How can the surprising results be explained? One possible interpretation is that findings in the existent literature are not applicable to very small firms. Due to an empirical shadow created by limited availability of good detailed data for this group of firms, this has not been elucidated in the literature. Another conceivable explanation is limitations in our choice of proxy for innovation. It is probable that other patent measures, such as counts of weighted forward citations, years of renewal, patent family size or number of patent claims, would have changed the results. Recent research on Swedish data shows that the concentration of quality-adjusted patents to metropolitan regions is much higher than for raw counts of patents (Ejermo 2007). However, since we are controlling for factors such as technology intensity, research intensity (captured by skilled labours) and firm size, the differences in quality are at least partly accounted for in the regressions.

The final estimate investigates the importance of specialization. There is no significant evidence that presence in local “clusters” is beneficial for the innovation activities of small businesses. Indeed, both models present positive coefficient estimates for micro-firms, but outside the 10% level of significance. In contrast, the regressions reveal that local specialization is associated with the innovation of manufacturing firms with more than 25 employees.

6 Summary and conclusions

Two research questions are addressed in this paper: Are small firms different innovators compared to larger firms; and are very small firms different innovators compared to other small firms? The data is almost unique in terms of patenting and incentives to patent among micro firms.

Applying nonlinear panel logit and binomial estimators to a sample consisting of account data and information on national patent applications, education, corporate ownership, international trade and location of the entire population of manufacturing firms in Sweden with at least one employee over the period 2000–2006, provides new insights into the link between innovation and firm size.

The summarized finding is that the smallest firms, micro firms with 1–10 employees, finance their innovation activities differently to other small firms and larger firms. They are less dependent on incomes related to market demand and more dependent on external financial sources. This paper also shows that skilled labor is even more important for the innovation of micro firms compared to other firms. Several similarities are also found between small innovative businesses and larger firms. Affiliation to a domestically owned multinational enterprise group increases the innovation capacity, and innovation is closely linked to participation in international trade and exports to the G7-countries.

From a policy perspective it is possible to identify some important aspects in this paper. Policies attempting to broadly improve external equity for small innovative firms are desirable, as are measures to stimulate recruitment of skilled labor to small businesses and to help smaller firms to establish themselves in markets across the border.

The research in this paper can be extended in several ways. One area for future research is to assess causality issues associated with the characteristics considered here. For instance, is the significant relationship between affiliation to a domestic MNE and innovation in small firms due to the fact that domestic MNEs are successful in acquiring already innovative firms, or is it due to such an affiliation stimulating innovation in small firms? Similar questions apply to the firms’ participation in international trade. Another area for further research is to extend the analysis beyond manufacturing firms. We have focused on small firms in manufacturing sectors, but there is plenty of evidence that innovation in service sectors, especially small knowledge-intensive business services (KIBS), plays an important role in the contemporary economy, which to a large extent is characterized by advanced services.

Notes

The USPTO grants about 80% of patent applications, the European Patent Office grants about 70% of patent applications, and in Sweden the grant rate for applications from operating commercial firms is close to 70%.

It should also be emphasized that the various propositions as regards the characteristics of innovating firms from the different strands of literature considered here are ‘open-ended’, such that the verification of hypotheses derived from one type of literature does not preclude hypotheses from the others.

Scherer (1999) maintains that R&D outlays in large established firms are often of such magnitude that “…they can be financed through routine cash flow and, if need be, can resort to outside capital sources willing to provide funds on full faith and credit without detailed inquiry into the specific uses to which the funds will be put” (ibid. p. 72). He argues further that this is one reason why empirical studies of internal cash flow and R&D among larger firms do not find systematic relationships.

MNEs have high ratios of R&D relative to sales, a large number of scientific, technical and other ‘white-collar’ workers as a percentage of their workforce, high value of intangible assets and large product differentiation efforts, such as high advertising to sales ratios (van Marrewijk 2002).

References

Acharya, R. C., & Keller, W. (2007). Technology transfer through imports. NBER Working Paper.

Acs, Z., Anselin, L., & Varga, A. (2002). Patents and innovation counts as measures of regional production of new knowledge. Research Policy, 31, 1069–1085.

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: an empirical analysis. American Economic Review, 78, 678–690.

Acs, Z. J., & Audretsch, D. B. (1991). Innovation and size at the firm level. Southern Economic Journal, 57, 739–744.

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2006). The knowledge spillover theory of entrepreneurship. CESIS WP, Royal Institute of Technology, Stockholm.

Acs, Z. J., Audretsch, D. B., & Feldman, M. P. (1994). R&D spillovers and recipient firm size. Review of Economics and Statistics, 76, 336–340.

Aghion, P., Van Reenen, J., & Zingales, L. (2009). Innovation and institutional ownership. NBER WP 14769.

Almeida, P., & Kogut, B. (1999). The localization of knowledge and the mobility of engineers. Management Science, 45, 905–917.

Andersson, M., & Johansson, B. (2008). Innovation ideas and regional characteristics—innovations and export entrepreneurship by firms in Swedish regions. Growth and Change, 39, 193–224.

Andersson, M., Lööf, H., & Johansson, S. (2008). Productivity and international trade—firm-level evidence from a small open economy. Review of World Economics, 144, 774–801.

Arundel, A., & Kemp, R. (2009). Measuring eco-innovation. UNU-MERIT Working Paper 2009-017.

Audretsch, D. B. (2002). The dynamic role of small firms—evidence from the US. Small Business Economics, 18, 13–40.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. American Economic Review, 86, 630–640.

Baptista, R. (2000). Do innovations diffuse faster within geographical clusters? International Journal of Industrial Organization, 18, 515–535.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Bartel, A. P., & Lichtenberg, F. R. (1987). The comparative advantage of educated workers in implementing new technology. Review of Economics and Statistics, 69, 1–11.

Baumol, W. J. (2002). Entrepreneurship, innovation and growth: the David-Goliath symbiosis. Journal of Entrepreneurial Finance and Business Ventures, 7, 1–10.

Berman, E., Bound, J., Griliches, Z., & Machin, S. (1998). Implications of skill biased technical change: international evidence. Quarterly Journal of Economics, 113, 1245–1279.

Breitzman, A., & Hicks, D. (2008). An analysis of small business patents by industry and firm size. Small Business Administration, Office of Advocacy.

Brown, J. R., Fazzari, S. M., & Petersen, B. C. (2009). Financing innovation and growth: Cash-flow, external equity, and the 1990 s R&D boom. Journal of Finance, 64, 151–185.

Coe, D., & Helpman, E. (1995). International R&D spillovers. European Economic Review, 39, 859–887.

Cohen, W. (1995). Empirical studies in innovative activity. In P. Stoneman (Ed.), Handbook of the economics of innovation and technological change (pp. 182–264). Oxford: Blackwell.

Cohen, W., & Levin, R. (1989). Empirical studies of innovation and market structure. In R. Schmalensee & R. Willig (Eds.), Handbook of industrial organisation (Chap. 18, pp. 1060–1107). North-Holland.

Cohen, W., & Levinthal, D. (1990). Absorptive capacity—a new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation, and productivity: An econometric analysis at the firm level. Economics of Innovation and New Technology, 7, 115–156.

Dachs, B., Ebersberger, B., & Lööf, H. (2008). The innovative performance of foreign-owned enterprises in small open economies. Journal of Technology Transfer, 33, 393–406.

Davidsson, P., Lindmark, L., & Olofsson, C. (1994). New firm formation and regional development in Sweden. Regional Studies, 28, 395–410.

de Jong, P. (2007). The relationship between capital investment and r&d spending: A panel cointegration analysis. Applied Financial Economics, 17, 871–880.

Duranton, G., & Puga, D. (2001). Nursery cities: Urban diversity, process innovation, and the life cycle of products. American Economic Review, 91, 1454–1477.

Ejermo, O. (2007). Regional innovation measured by patent data—does quality matter? CIRCLE Working Paper 2007-8.

Fang, W., Tian, X., & Tice, S. (2010). Does stock liquidity enhance or impede firm innovation? Working Paper, Rutgers University.

Fazzari, S. M., Hubbard, R. G., & Petersen, B. C. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1, 141–195.

Feldman, M. (1999). The new economics of innovation, spillovers and agglomeration—a review of empirical studies. Economics of Innovation and New Technology, 8, 5–25.

Granstrand, O., & Sjölander, S. (1990). The acquisition of technology and small firms by large firms. Journal of Economic Behavior & Organization, 13, 367–386.

Greenaway, D., & Kneller, R. (2007). Firm heterogeneity, exporting and foreign direct investment. Economic Journal, 117, 134–161.

Griliches, Z. (1990). Patent statistics as economic indicators—a survey. Journal of Economic Literature, 28, 1661–1707.

Griliches, Z. (1995). Econometric results and measurement issues. In P. A. Stoneman (Ed.), Handbook of the economics of innovation and technological change (pp. 52–89). Cambridge, MA: Blackwell.

Griliches, Z., Pakes, A., & Hall, B. H. (1988). The value of patents as indicators of inventive activity. NBER WP 2083.

Hall, B. H. (2005). The financing of innovation. In S. Shane (Ed.), Blackwell handbook of technology and innovation management. Oxford: Blackwell.

Harhoff, D. (2009). The role of patents and licenses in securing external finance for innovation. EIB papers volume 14 n°2/2009, European Investment Bank, Luxemburg.

Himmerlfarb, C., & Petersen, B. (1994). R&D and internal finance—a panel study of small firms in high-technology industries. Review of Economics and Statistics, 76, 38–51.

Hoover, E. (1937). Location theory and the shoe and leather industries. Cambridge: Harvard University Press.

Hulten, C. R. (2002). Total factor productivity: A short biography. In E. R. Dean, & M. J. Harper (Eds.), New developments in productivity analysis. National Bureau of Economic Research (Studies in Income and Wealth).

Jaffe, A. (1989). Real effects of academic research. American Economic Review, 79, 957–970.

Jaffe, A., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics, 63, 577–598.

Johansson, B., & Lööf, H. (2008). Innovation activities explained by firm attributes and location. Economics of Innovation and New Technology, 17, 533–552.

Keller, W. (2004). International technology diffusion. Journal of Economic Literature, 42, 752–782.

Kleinknecht, A., & Mohnen, P. (Eds.). (2002). Innovation and firm performance: econometric explorations of survey data. Basingstoke: Palgrave.

Klette, T. J., & Kortum, S. (2004). Innovating firms and aggregate innovation. Journal of Political Economy, 112, 896–1018.

Lööf, H., & Andersson, M. (2010). Imports, productivity and the origin markets–the role of knowledge intensive economies. World Economy, 33, 458–481.

Machin, S., & van Reenen, J. (1998). Technology and changes in skill structure: Evidence from seven OECD countries. Quarterly Journal of Economics, 113, 1215–1244.

Malerba, F., & Orsenigo, L. (1993). Technological regimes and firm behavior. Industrial and Corporate Change, 2, 45–74.

Marshall, A. (1920). Principles of economics. London: MacMillan.

OECD. (2009). Science, technology and industry scoreboard 2009. OECD Publishing. doi: 10.1787/sti_scoreboard-2009-en.

Ohlin, B. (1933). Interregional and international trade. Cambridge: Harvard University Press.

Patel, P., & Pavitt, K. (1991). Large firms in the production of the world’s technology: An important case of non-globalisation. Journal of International Business Studies, 22, 1–21.

Pavitt, K. (1984). Sectoral patterns of technical change—towards a taxonomy and a theory. Research Policy, 134, 343–373.

Penrose, E. T. (1959). The theory of the growth of the firm. New York: Wiley.

Phaffermayr, M., & Bellak, C. (2002). Why foreign-owned firms are different: A conceptual framework and empirical evidence for Austria. In R. Jungnickel (Ed.), Foreign-owned firms: Are they different? (pp. 13–57). Basingstoke: Palgrave Macmillan.

Rivera-Batiz, L., & Romer, P. (1991). International trade with endogenous technological change. European Economic Review, 35, 971–1001.

Rothwell, R. (1989). Small firms, innovation and technological change. Small Business Economics, 1, 51–64.

Scellato, G. (2007). Patents, firm size and financial constraints: An empirical analysis for a panel of Italian manufacturing firms. Cambridge Journal of Economics, 31, 55–76.

Scherer, F. M. (1999). New perspectives on economic growth and technological innovation. Washington: Brookings Institution Press.

Schumpeter, J. A. (1934). The theory of economic development (8th ed.). Cambridge: Harvard University Press.

Thoma, G., Torrisi, S., Gambardella, A., Guellec, D., Hall, B. H., & Harhoff, D. (2010). Harmonizing and combining large datasets—an application to firm-level patent and accounting data. NBER WP 15851.

van Marrewijk, C. (2002). International trade and the world economy. Oxford: Oxford University Press.

Vernon, R. (1966). International investment and international trade in the product cycle. Quarterly Journal of Economics, 80, 190–207.

Wagner, J. (2007). Exports and productivity—a survey of the evidence from firm level data. World Economy, 30, 60–82.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Andersson, M., Lööf, H. Small business innovation: firm level evidence from Sweden. J Technol Transf 37, 732–754 (2012). https://doi.org/10.1007/s10961-011-9216-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-011-9216-9

Keywords

- Innovation

- Innovative firms

- Entrepreneurship

- Small firms

- Intellectual property rights

- Technology transfer

- Location