Abstract

A firm can improve its innovation either by its internal research and development (R&D) efforts or by forming external collaborative R&D alliances. While previous studies on R&D collaboration and knowledge diffusion mainly focus on various external sources of R&D collaboration, little effort has been made to investigate the joint impact of competitive and non-competitive R&D collaborations on firm innovation simultaneously. By examining the data of 165 Taiwanese firms in the information and communication technology industry, we find that: (1) non-competitive R&D collaborations with universities have a positive direct impact on firm’s innovation performance; and (2) both non-competitive and competitive R&D collaborations have a positively moderating effect on the relationship between a firm’s internal R&D efforts and firm innovation and the positive moderating effect is higher for non-competitive R&D collaborations than that of competitive R&D collaborations. These findings suggest that R&D collaborations, either non-competitive or competitive, exhibit the nature of a win–win situation. We also derive implications for firms’ selection of R&D alliance partners and government policies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Facing fast technological changes and global competition, inter-organization collaborations have become increasingly important for firms to enhance their competitiveness. Inter-organizational collaborations are critical for a firm’s innovation, particularly when firms lack sufficient internal R&D resources (Lin 2003). A major objective of vicarious learning in the context of inter-organizational collaborations, alliances, or joint ventures is to absorb deeply embedded knowledge from partners (Hamel 1991). Particularly in the high-tech industry, research and development (R&D) collaborations with other organizations have been regarded as means of competitive strategy. Hagedoorn (1993) asserts that strategic alliances have become an important strategic tool for firms to exchange and share knowledge as well as resources in different industries. An increasing number of firms, particularly for the latecomers, use these alliances or collaborations as vehicles for accessing advanced knowledge. In addition, how a firm can successfully use the knowledge learned from different R&D collaborations has become increasingly important.

Inter-organizational collaborations can be differentiated into two types (Tsang 1999): competitive and non-competitive collaborations. A competitive collaboration is defined as the partners in a collaboration racing to learn. The firm that learns fastest dominates the relationship and becomes a more formidable competitor via cooperation (Parkhe 1991). The partner that first internalizes the knowledge obtained in the collaboration will gain a competitive advantage over the other partner. The outcome of competitive collaborations is therefore depicted as a win–lose situation (Tsang 1999). On the other hand, for a non-competitive collaboration, the partners are not direct competitors, or though the partners are direct competitors, they do not bring along the competitive mentality to the collaboration. The partners have no intention to compete in the same market in the foreseeable future but just enhance their skills and strengthen their positions in their respective markets. The outcome of non-competitive collaborations is more likely to be a win–win situation (Tsang 1999).

Prior studies have asserted that firms normally conduct R&D collaborations with different partners simultaneously (Belderbos et al. 2006; Un et al. 2010). How the synergy effect of competitive and non-competitive R&D collaborations contributes to a firm’s innovativeness has not yet been fully investigated. As mentioned earlier, while non-competitive collaborations are more likely to be a win–win outcome, competitive collaborations are more likely to be a win–lose outcome. Thus, our research attempts to examine whether firms can gain more for innovation from non-competitive and competitive R&D collaborations.

To meet the research objective, a secondary data together with a questionnaire survey of 165 Taiwan’s manufacturing firms in the information and communication technology (ICT) sector were collected. Then the negative binomial regression models were conducted to examine the research hypotheses. The empirical results supported our hypotheses, suggesting that both non-competitive and competitive R&D collaborations positively moderate the relationship between a firm’s in-house R&D and its innovation performance and the positive moderating effect is higher for non-competitive R&D collaborations than that of competitive R&D collaborations.

After the introduction, the second section reviews the literature and develops the research hypotheses. The third section describes the research methodology while the fourth and fifth sections present and discuss the statistical findings respectively. The last section concludes the paper.

2 Theoretical background and hypothesis development

2.1 Non-competitive and competitive R&D collaborations and firm innovation

An increasing complexity and variability of technologies amplify the need for external collaborations for complementary resources in recent years (Belderbos et al. 2006; Nooteboom 1999). Firms not only need external sources of competence to complement their in-house capability but also need inter-organizational linkages to advance existing knowledge into new types of knowledge or to develop new products, processes and services (Nonaka and Takeushi 1995; Un et al. 2010). Particularly, external R&D collaborations have been recognized as an important source of technology learning when firms have limited resources (Lin 2003).

The primary purpose of conducting R&D alliances is to acquire essential technologies. Such technologies may be any process by which basic understanding, information, and innovations moving from universities, research institutions, or government laboratories to firms (Parker and Zilberman 1993). Collaborations with universities or research institutions are non-competition oriented since they do not compete with a firm in the same market in the foreseeable future but enhance their own skills and strengthen their positions in their markets (Tsang 1999). A number of prior studies have focused on the collaborative projects between universities and firms (Arvanitis et al. 2008; Bayona et al. 2002; Niosi 2006; Perez and Sanchez 2003; Shane 2002; Steffensen et al. 2000; Zhang 2009). These results suggest that firms with R&D collaborations with universities outperform those without such collaborations in terms of innovation performance (Lockett et al. 2003; Powers 2003; Zucker et al. 2002). In addition to the university-industry alliances, another type of non-competitive R&D collaborations can be conducted with research institutions (Heher 2006; Kassicieh et al. 2002; Sakakibara and Dodgson 2003). Empirical studies suggest that firms conducting collaborative R&D alliances with research institutions have better technological performance (Blau 1999; Herbert 1995; Kennedy and Holmfeld 1989).

On the contrary, competitive collaboration, such as inter-firm R&D alliances, may also influence a firm’s innovation performance. An inter-firm R&D alliance is formed because none of the firms has sufficient resources necessary to achieve the target specification within a limited schedule. It is made possible if heterogeneous and complimentary resources possessed by different firms are combined in supplemental manners (Mothe and Quelin 2001). Particularly for some start-up firms, collaborative R&D alliances help partner firms to share knowledge and experience with each other (Inkpen 1996). There are abundant empirical studies investigating how inter-firm R&D alliances help firms to improve their innovation performance and most these studies find that firms conducing inter-firm R&D alliances tend to have better innovation performance (Harding 2001; Hemmert 2003; Koichi et al. 1990; Peters and Becker 1998; Walker 1995).

Prior studies suggest that firms can benefit from various types of R&D alliances at the same time. For instance, Hoang and Rothaermel (2005) suggest that experience learning from multiple external R&D alliances or collaborations can enhance a joint R&D project performance. According to Hoang and Rothaermel (2005), partner-specific alliance experience, defined as repeatedly having alliances with the same partners, has a negative effect on joint project performance. This implies that the more alliances with the same partners, the less joint project performance. Belderbos et al. (2006) examine a firm’s productivity of simultaneous engagement in R&D cooperation with different partners, such as competitors, clients, suppliers, and universities and research institutes. Nieto and Santamaría (2007) also suggest that collaborations with suppliers, clients, and research organizations (including universities and technology research institutions) have a positive impact on innovation whereas collaborations with competitors have a negative impact. However, most of these studies emphasize the direct effect of multiple R&D alliances on firm innovation performance and treat in-house R&D efforts as a control variable. In fact, based on the concept of absorptive capacity (Cohen and Levinthal 1990; Muscio 2007; Zahra and George 2002), firms with better capabilities of acquiring, assimilating, transforming and exploiting knowledge from external partners may better incorporate the acquired knowledge into innovation. This implies that a firm’s in-house R&D efforts or absorptive capacity interacted by R&D collaborations may affect its innovation performance. Thus, in this study, we were more interested in examining the moderating effect of R&D collaborations on the relationship between a firm’s in-house R&D and innovation performance.

2.2 The moderating role of R&D collaborations on firm innovation

While previous studies has advanced our understanding of the impact of R&D collaborations by investigating a casual relationship between a firm’s R&D collaborations and intermediate research outputs or performance indicators (Baum et al. 2000; Deeds and Hill 1996; Kotabe and Swan 1995; Lerner et al. 2003; Shan et al. 1994), they mainly investigate the relationship between R&D collaborations and firm innovation performance by assuming that firms engage in a single type of R&D collaborations once at a time. However, in fact, firms engage in multiple R&D alliances with different types of partners simultaneously. How the synergistic effect of simultaneous R&D collaborations contributes to a firm’s innovation has not yet been fully investigated. Though Belderbos et al. (2006) examine firm productivity of simultaneous engagement in R&D cooperation with different partners, they do not investigate how the interaction effects of these external R&D collaborations with in-house R&D efforts influence a firms’ innovativeness. Similarly, Un et al. (2010) also investigate the interaction effect among four types of external R&D collaborations (including universities, suppliers, customers, and competitors) on a firm’s product innovation. However, their studies are more interested in explaining how the joint effect of different types of R&D collaborations on firm innovation. Therefore, derived from the concept of absorptive capacity, the primary objective of this paper is to provide an investigation how a firm’s external R&D collaboration interacted by in-house R&D efforts on its innovation performance.

According to Cohen and Levinthal (1990), absorptive capacity is defined as ability to value, assimilate, and utilize new external knowledge. A firm with better absorptive capacity can better utilize external knowledge obtained from R&D collaborations. It is widely agreed that absorptive capacity is the result of cumulatively path-dependent R&D investments by a firm (Baum et al. 2000; Cohen and Levinthal 1990; Powell et al. 1996). Thus, in-house R&D efforts can be regarded as the extent of absorptive capacity. In-house R&D efforts, such as training programs, intensify interaction among individuals or organizations, which in turn amplify knowledge exploration and exploitation (Caloghirou et al. 2004). Thus, a high R&D spending firm characterized by greater absorptive capabilities is more likely to exploit knowledge synergy by making use of the external resources. As a result, a firm’s in-house R&D together with external resources may affect the level of its innovation. Prior studies also conclude that a firm’s internal R&D efforts can improve its technological competence and innovation (Caloghirou et al. 2004; Hitt et al. 2001; Pisano 1990).

Prior studies conclude that R&D collaborations with research organizations, including technology research institutions and universities, have a direct and positive impact on firm innovation (Nieto and Santamaría 2007). Research institutions and universities are not direct competitors and have no intention to compete with the firms they are cooperating with in the same markets in the foreseeable future (Tsang 1999). As a result, knowledge obtained from these non-competitive partners can further strengthen and complement a firm’s in-house efforts on innovation. Therefore, we expect that a firm’s in-house R&D efforts together with its non-competitive R&D collaborations will have a positive impact on the firm’s innovation performance. We then derive Hypothesis 1 as the following:

Hypothesis 1

Non-competitive R&D collaborations positively moderate the relationship between a firm’s in-house R&D and its innovation performance.

While R&D alliances with research institutions and universities may have a positive impact on firm innovation, inter-firm alliances, particularly with competitors, may have a negative impact on firm innovation (Nieto and Santamaría 2007). Prior evidences suggest that cooperation with direct competitors is more difficult to manage (Hamel et al. 1989) and more likely to spark learning races (Hamel 1991). The firm that learns fastest can dominate the relationship and becomes a more formidable competitor via cooperation (Parkhe 1991). The partner that first internalizes the knowledge obtained in a collaboration will gain competitive advantage over the other partner (Tsang 1999). This implies that partner firms in competitive R&D collaborations face the risk of knowledge diffusion. Because of the knowledge sharing or spillover effect, partner firms will implement some mechanisms to safeguard their knowledge (e.g., one partner does not assign the best engineer to a project). Without such mechanisms, competitive R&D collaborations raise the concern of opportunism (Hagedoorn 1993; Hagedoorn et al. 2000; Powell et al. 1996). It is very likely that both parties in a competitive R&D collaboration take safeguarding measures which lead to unsatisfactory results on a project base. However, when the engineers from two partner firms work together, the engineers of one firm is still capable of accessing useful information or knowledge to some extent through interaction with the engineers of the partner firm in a competitive R&D collaboration. Therefore, even a competitive R&D collaboration may not be successful on a project base, on a firm base, the learning of the engineers from both firms can be diffused at their own home institutions and create value in other R&D projects. How big the spillover effect is depends on how a firm exploits the knowledge learned. The acquired information or knowledge may be useful for this firm’s in-house R&D development and then leads to a higher innovation performance. Of course this effect holds for both parties in R&D collaborations. Thus, we expect that a firm’s competitive R&D collaborations exert an indirect effect on innovation, i.e., they positively moderate the relationship between in-house R&D and innovation performance. Hypothesis 2 is then derived as following:

Hypothesis 2

Competitive R&D collaborations positively moderate the relationship between a firm’s in-house R&D and its innovation performance.

The moderating effect of R&D collaborations on the relationship between in-house R&D and innovation performance should be more significant for non-competitive R&D collaborations than for competitive R&D collaboration. As mentioned earlier, opportunistic behaviors in competitive collaboration prevent partner firms from committing resources to collaborations, and even worse, on partner firm may attempt to lure away the other partner firm’s outstanding scientists or researchers. These actions hinder the positive effect of in-house R&D capability on firm innovation. In contrast, common interests and goals of non-competitive R&D collaborations encourage partners to exchange information and knowledge as much as possible. We therefore expect that the positive moderating impact on the relationship between a firm’s in-house R&D and its innovation performance is higher for non-competitive R&D collaborations than that of competitive R&D collaborations.

Hypothesis 3

The moderating impact on the relationship between a firm’s in-house R&D and its innovation performance is higher for non-competitive R&D collaborations than that of competitive R&D collaborations.

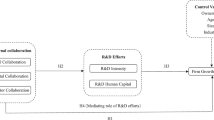

Figure 1 provides the research framework of this study. First, we expect that the direct impacts of in-house R&D on innovation performance which is in line with the literature. We then test different moderating effects of R&D collaborations on the main effects.

3 Research method

To empirically test the research hypotheses, a data set composed of secondary data and primary data based on a questionnaire survey of 165 Taiwan’s information and communication technology (ICT) firms was constructed. After data collection, the negative binomial regression was employed for data analysis.

3.1 Sample firms and data collection

The sample firms of this research were Taiwanese manufacturing firms in the information and communication technology sector. Due to dissimilarities between manufacturing firms and trade-only firms, the trade-only firms were excluded from our sample selection. Moreover, only firms with seven or more years of operations were included in our sample. Based on the above selection criteria, 415 sample firms were selected. The firms were selected on the basis of the stock code compiled by the Taiwan Stock Exchange Corporation (TSEC) and the Over-The-Counter (OTC). The codes starting with 23, 24, and 30, in the TSEC and 53, 54, 61, and 80 in the OTC were selected as sample firms. All other publicly held firms were identified by the code starting with 23 compiled by the Ministry of Economies Affairs (MOEA), Taiwan.

The questionnaire asked respondents whether firms had engaged in R&D collaborations between 1996 and 2002, including non-competitive R&D collaborations with universities and research institutions, and competitive R&D collaborations such as inter-firm alliances. The names of the intended respondents were collected in advance of the mailing. Recipients of the survey package were CEOs or senior executives of the sample firms. The first mailed survey was conducted in September 2002 while the second mailed survey was conducted in January 2003. Meanwhile, recognizing that it was more receptive for face-to-face interviews, we attended three trade exhibitions related to the information and communication technology industry in Taiwan between September 2002 and October 2002 to do some interviews. The numbers of respondents for the first mail survey, the second mail survey, and face-to-face survey, were 81, 58, and 30, respectively. After excluding four invalid responses, the total number of valid sample firms was 165, making a response rate of 40%. Recognizing a selection bias might be caused by the different data collection methods, a one-way ANOVA was taken to test the three sub-samples in terms of firm size and the result shows no significant difference between the three sub-sample (F = 1.230, P > 0.1). This suggests that selection bias might not be a problem.

In this study, secondary data, such as number of patents, was gathered via the official government publications, governmental databases maintained by the MOEA, and corporate financial statements.

3.2 Variable measurement

3.2.1 Dependent variable: innovation performance

Previous studies have used several intermediate research outputs or performance indicators, such as patenting tendency (Baum et al. 2000; Shan et al. 1994), level of product innovativeness (Kotabe and Swan 1995), products under development (Deeds and Hill 1996), or milestone stages reached (Lerner et al. 2003), to measure a firm’s innovation performance. However, due to different purpose of research, these indicators are used to measure different stages of innovation process. Among these indicators, patent is widely used in prior research (Miyazaki 1995). Particularly for the manufacturing firms in this study, patents in terms of process improvement can protect their innovative manufacturing processes. Thus, patent was used to measure firm innovation performance in our study. Considering a possible lag between R&D efforts and innovation outputs, firm innovation performance was measured by the total number of applied patents between 1996 and 2005 as an indicator of patent stock. Since firms usually have already used such technologies in their operations when they apply for patents, such un-granted but applied patents should be regarded as the outcomes of innovation. Almeida and Phene (2004) also use patent application number to measure innovation performance.

3.2.2 Independent variable: in-house R&D

A firm’s in-house R&D efforts can be measured either by R&D expenditures or by R&D personnel. R&D expenditures include all kinds of investment on facilities and equipments as well as on the costs of employing R&D personnel. Since this study focused on a firm’s in-house R&D capability to collaborate with external partners, the percentage of R&D personnel can better reflect the firm’s in-house R&D capability or absorptive capacity (Fritsch and Lukas 2001). Thus, we used the number of R&D personnel to total personnel as the measure of in-house R&D.

A firm’s in-house R&D was measured by the number of full-time scientists and engineers in this research. According to Miyazaki’s (1995), human capital is one attribute for the success of a firm’s innovation. Scherer (1965) applied R&D employment as an indicator of inventive input. OECD also employs the number of scientists and engineers as an indicator for measuring a country’s technological human resources (OECD 2002). Henderson and Cockburn (1996) find that there is a positive relationship between research efforts and research productivity in the pharmaceutical industry. Thus, the number of scientists and engineers can be used to measure a firm’s in-house R&D productivity. The question, ‘how many full-time scientists and engineers were employed in your firm from 1996 to 2002’, was asked the respondents to respond. In-house R&D (IRD) was then measured by R&D intensity (i.e., the number of full-time scientists and engineers divided by the number of total employees from 1996 to 2002) (Pfirrmann 1994).

3.2.3 Moderating variables: competitive and non-competitive R&D collaborations

The types of R&D collaboration are our moderator variables. Since this study attempted to investigate the influence of multiple R&D collaborations on the relationship between in-house R&D and firm innovation performance, based on prior studies (Belderbos et al. 2006; Nieto and Santamaría 2007; Un et al. 2010), three types of external R&D collaborations were identified, including R&D collaborations with universities and with research institutions for non-competitive R&D collaborations, and inter-firm R&D collaborations for competitive R&D collaborations. Traditionally, the contribution of external R&D collaborations is measured by the number of collaborations formed by a firm (DeCarolis and Deeds 1999; Deeds and Hill 1996). However, Un et al. (2010) use a single-item question to measure whether a firm conducts external collaborations. Thus, in this study, we asked respondents that ‘Whether your firm conducted the three types of external R&D collaborations, namely, research institution collaborations (RIC), university collaborations (UC), and inter-firm collaborations (IFC), between 1996 and 2002.’ A dummy variable was used to measure this variable: 1 for having collaborations and 0 for no collaborations during this period.

3.2.4 Control variables

Firm size. Empirically, firm size is observed as having an impact on a firm’s innovation performance (Freeman 1982; Scherer 1965; Symth et al. 1975). Thus, this research needed to control for firm size. Following other studies (Bates and Nucci 1989; Mitton 2002), firm size (SIZE) was measured by the logarithm of 7-years averaged total assets between 1996 and 2002.

Industry difference. Industry difference is related to innovation outcomes since the competitive intensity and R&D activities may vary across industries (Lichtenthaler 2007). Industry difference was measured by the types of core business instead of the SIC code. Since all sample firms were in the ICT industry and Taiwan’s stock exchange corporation did not differentiate the ICT industry into sub-sectors, we could only distinguish sub-sectors by examining sample firms’ core businesses. As a result, five sub-sectors of the ICT industry were identified, including semiconductors (13.9%), computers and peripherals (46.1%), optical electronics (12.7%), communications (6.1%), and others (21.2%). Four dummy variables were created (i.e., Industry 1-Semiconductors, Industry 2-Computers, Industry 3-Optical, and Industry 4-Communications) and the sub-sector “others” was the base industry.

Competitive intensity (CI). Competitive intensity can affect a firm’s innovative activity (Aghion et al. 2006). We used the item “Competition is intense in our product markets” (1 = “strongly disagree”, 5 = “strongly agree”) to measure competitive intensity and added it to our models.

Intellectual property protection (IPP). Following Rapp and Rozek’s (1990) study, we used a scaled variable to measure how institutional environment affected a firm’s patent application (from 1 = “inadequate protection laws/no law prohibiting piracy” to 5 = “IP protection and law enforcement fully consistent with minimum standards proposed by the Government”). In this way, we controlled the possible effect of IP protection on patent application.

3.3 Statistical method

Since our dependent variable, innovation performance (measured by patents), is a count variable and has a non-negative integer value, the Poisson regression is normally suggested to deal with such dependent variable (Hausman et al. 1984). However, Poisson regression assumes that the mean and variance of the counts are equal. If the variance exceeds the mean, it results in the problem of over-dispersion, which tends to bias downward the estimated standard errors (Haunschild and Beckman 1998; Kogut and Zander 1992). Therefore, the negative binomial model has been used in prior studies (e.g., Keil et al. 2008), which can overcome the over-dispersion problem and also accounts for omitted variable bias. We followed their suggestions by using the negative binomial regression to examine our hypotheses. In order to test the moderating effect, four regression models were constructed. The first regression model was the base model, which was to establish a baseline against which the added contribution of the predictor variables could be estimated. The second regression model was used to examine the main relationships between firm innovation performance and in-house R&D. Models 3, 5, and 7 were used to examine the direct effect of three types of external R&D collaborations on firm innovation. Models 4, 6, and 8 were used to investigate whether the external R&D collaborations exhibits moderating effects.Footnote 1 Finally, we used an across-equation t-test to test the difference of the moderating effect of non-competitive and competitive R&D collaborations.

4 Analysis

4.1 Descriptive statistics and correlations

Our descriptive results show that more than 60% of Taiwanese firms had R&D collaborations with universities, research institutions, and other firms (with the number of 118, 104, and 106, respectively). Table 1 presents the cross-tabulation of three types of R&D collaborations. Firms with all three types of R&D collaborations accounted for 48.5% of total firms while there were 17.6% of firms had at least two R&D collaborations simultaneously, showing that more than 60% of the Taiwan’s ICT firms conducted multiple R&D collaborations simultaneously.

Table 2 provides the descriptive statistics for 165 firms in our study. The firm size in Table 2 was the logarithms of total assets and its mean was 14.84. The mean for in-house R&D (measured by full-time scientists or engineers divided by total employee) was 0.17. Table 2 also presents the correlation matrix among the variables. The results show that there were some moderate correlations among the variables such as three types of external R&D collaborations. In order to examine whether these moderate correlations would cause the multicollinearity problem, we ran each type of R&D collaboration separately (shown as Models 3, 5, and 7 in Table 3) and compared them with the full model (i.e., Model 9 in Table 3). The results show that the coefficients of each type of R&D collaborations were consistently significant between the individual models (Models 3, 5, and 7) and the full model (Model 9). This suggests that multicollinearity did not significantly influence the stability of the parameter estimates.

4.2 In-house R&D, external R&D collaboration, firm size, and firm innovation

As shown in Model 2 (Table 3), in-house R&D is positively associated with firm innovation performance (B = 2.379, p < 0.01), which is consistent with prior studies, suggesting that a higher level of in-house R&D improves a firm’s innovation performance (Caloghirou et al. 2004; Henderson and Cockburn 1996; Sakakibara and Dodgson 2003). Previous studies have concluded that the level of in-house R&D capacity, such as the number of R&D employees (Gambardella 1992) or the qualification of employees (Caloghirou et al. 2004; Lundvall and Nielsen 1999), is positively associated with firm innovation.

Models 5 and 7 indicate that R&D collaborations with research institutions and with other firms are not significantly associated with firm innovation performance (B = 0.094, p > 0.1; B = 0.101, p > 0.1). Model 3 shows that R&D collaborations with universities are significantly and positively associated with firm innovation performance (B = 0.413, p < 0.05). Unlike previous studies, our results suggest that only university collaborations exert a direct positive effect to increase firm innovation performance.

In all nine models, as shown in Table 3, firm size is positively associated with firm innovation performance. The findings are consistent with prior studies (Freeman 1987; Scherer 1965; Symth et al. 1975) suggesting that firm size has positive impacts on outputs of firm innovation.

4.3 Moderating effects of external R&D collaborations

In order to examine the moderating effects of R&D collaborations, our study used negative binomial regression models with interaction term (shown as Models 4, 6, and 8). As shown in Table 3, the interaction effect of in-house R&D and university collaborations as well as in-house R&D and research institution collaborations are significantly associated with innovation performance (B = 2.075, p < 0.01 in Model 4; B = 1.979, p < 0.01 in Model 6). Our results indicate that the moderating effects of non-competitive R&D collaborations (research institutions and universities) have a positive impact on the relationship between in-house R&D and firm innovation performance, which supports the Hypothesis 1. Moreover, in-house R&D by inter-firm collaborations interaction is positively significant (B = 1.740, p < 0.01 in Model 8). This could be interpreted that inter-firm R&D collaborations may enhance a firm’s internal R&D capability on innovation, which also supports the Hypothesis 2. We thus can conclude that firms’ R&D personnel can benefit from learning during the progress of competitive or non-competitive collaborations, which in turn enhances their innovation.

We employed an across-equation t-test to further examine the moderating effects of non-competitive and competitive R&D collaborations on the relationship between in-house R&D and firm innovation. The results show that the interaction effect of R&D collaborations with universities (UC) by in-house R&D (IRD) is higher than that of inter-firm R&D collaborations with competitors (IFC) by in-house R&D (IRD) (t = 1.928, p < 0.05, one-tailed). However, no significant difference in the moderating effect is found between R&D collaborations with research institutions and with inter-firm collaborations with competitors (t = −0.090, p > 0.1). The results support the Hypothesis 3.

5 Discussion

5.1 In-house R&D and R&D collaborations

Our empirical findings suggest that in-house R&D (measured by the number of full-time engineers and scientists divided by total number of employees) is positively correlated with a firm’s innovation performance. This indicates that a firm is capable of fostering its innovation by enhancing its in-house R&D resources. In-house R&D are important to a firm’s innovation since in-house R&D efforts can enhance a firm’s learning experience (Reed and DeFillippi 1990) and absorptive capacity (Cohen and Levinthal 1990), which better improves its capabilities of acquiring, assimilating, transforming and exploiting knowledge (Zahra and George 2002). As a result, firms with a higher level of in-house R&D are more innovative.

Our empirical results show that firm innovation performance is not improved by research institution-firm collaborations (Model 5) but improved by university-firm collaborations (Model 3), which is partially consistent with prior research. However, there is a possibility of reverse causality in the relationship between R&D collaborations with universities and firm innovation, i.e., researchers at universities initiating R&D collaborations with the most innovative firms in the industry. Indeed, a university may decide which firms in an industry to cooperate with. However, in Taiwan, university-industry collaborations are usually initiated by firms and firms choose the professors or scientists to work with. This supports the causality assumed for this type of collaboration. Therefore, firms conducting R&D collaborations with universities lead to better innovation performance and our empirical result supports this argument.

Furthermore, no significant relationship is found between inter-firm R&D collaborations and firm innovation performance (Model 7). Our findings are not completely inconsistent with prior research. For instance, Nieto and Santamaría (2007) suggest that collaborations with universities and research institutions have a positive impact on firm innovation but collaborations with competitors have a negative impact on innovation. Our findings partially support the prior proposition. Because the partners in non-competitive collaborations are not direct competitors and they do not bring along the competitive mentality to the collaboration (Tsang 1999), firms can better utilize spillover effects from these collaborations, which in turn enhance their innovation performance. Nevertheless, the findings in our study suggest that no direct and negative impact of competitive collaborations on firm innovation performance. This result is not in line with prior research and implies that although firms have the motivation to prevent other partners from imitating their core technologies in competitive collaborations, this self-protection orientation seems to have no direct impact on firm innovativeness in our study. A possible explanation is that the negative effect of self-protection mentality on firm innovation may be offset by the gain from the race to learn over the partner firms. We will further show that competitive R&D collaborations may generate benefits to partner firms indirectly.

5.2 The moderating effect of competitive and non-competitive R&D collaborations

A resource-rich firm characterized by greater absorptive capabilities more likely acquires, assimilates, transforms, and exploits knowledge synergies by making use of external resources (Zahra and George 2002). Firms with higher in-house R&D capacity not only can better conduct R&D activities internally, but also have better capability to incorporate knowledge obtained from external R&D collaborations. Thus, we further examine how the interaction effect of non-competitive and competitive R&D collaborations by in-house R&D affects a firm’s innovation performance. Our findings suggest that in-house R&D by non-competitive collaborations with both research institutions and universities as well as by competitive collaborations (inter-firm collaborations) can further increase a firm’s innovativeness. While the results of the moderating effect of non-competitive R&D collaborations support our Hypothesis 1, the result of the moderating effect of competitive R&D collaborations supports our Hypothesis 2.

A positive moderating effect of competitive R&D collaborations on the relationship between in-house R&D and firm innovation performance suggests that a firm’s innovation performance will be more likely improved when the firm conducts competitive R&D collaborations. This implies that competitive R&D collaborations may cause increasing effect of existing in-house R&D efforts on overall firm innovation. This is an important finding that firms seeking potential complementary resources from external competitors may have an increasing impact of their existing internal resources on innovation. Our result provides a different perspective from prior research. While prior research asserts that competitive collaborations may have a direct negative impact on firm innovation (Nieto and Santamaría 2007), our study finds that a positive impact of competitive collaborations on firm innovation takes place indirectly on the relationship between in-house R&D and firm innovation.

While earlier studies assert that firms select alliance partners because of the resources they possess, recent studies suggest that firms also select partners that allow them to protect their valuable resources and sustain competitive advantage (Li et al. 2008). This implies that to protect valuable resources, firms will avoid negative spillover of valuable resources by selecting specific partners. Thus, a firm may send its R&D experts to learn particular knowledge during the progress of a competitive R&D collaboration while protecting its own valuable resources. This may lead to a positive spillover effect of competitive R&D collaborations on a firm’s innovation, particularly for those firms with opportunistic behaviors or with strong motivation to learn from their partners. For instance, in the 1980s, both IBM and Microsoft were potential competitors in the operation system (OS) and they collaborated with each other in the beginning of the development. In this collaboration, the researchers from both sides learned from each other. Though the collaboration itself was not so successful, in the end Microsoft was able to exploiting more value of the knowledge learned from the collaboration. This example suggests that a positive effect in competitor-oriented collaborations may take place indirectly through enhancing in-house R&D’s capabilities and therefore improve innovation performance.

More importantly, while prior research suggests that non-competitive R&D collaborations have a positive impact on firm innovation but competitive collaborations, particularly with competitors, have a negative impact on firm innovation (Nieto and Santamaría 2007), our findings suggest that R&D collaborations, either with competitors or non-competitors, have indirect and positive impact on firm innovation. These findings depict a win–win situation for R&D collaborations: working with non-competitors, partners enjoy direct and indirect benefits on innovation, and, working with competitors, partners still enjoy indirect benefits on innovation. This explains why firms, understanding the downside of competitive R&D collaborations, still cooperate with competitors. They know that, due to their safeguarding behaviors or less commitment, R&D collaborations may fail but they expect to get something from their competitors which eventually lead to improved performance in innovation.

Further, the impact on the relationship between in-house R&D and firm innovation is stronger for non-competitive collaborations (i.e., collaborations with universities in this study) than for competitive R&D collaborations. This is because firms in competitive collaborations are more competitive-oriented and taking more safeguarding behaviors, which hinder the flows of knowledge or information exchange between partners, than those in non-competitive collaborations. Putting all the findings together, we may conclude that R&D collaborations do enhance a firm’s innovation but the expectations should take into account the nature of the collaborators.

5.3 A ‘win–win’ situation?

As shown in Table 4, our study provides a comprehensive research distinguished from prior research. While prior studies suggest that both non-competitive and competitive collaborations may have direct impact on firm innovation, our research finds that non-competitive collaborations (particularly with universities) have a positive direct impact on firm innovation while both non-competitive and competitive collaborations have a positive moderating impact on the relationship between in-house R&D and firm innovation. Without a doubt, non-competitive R&D collaborations can fulfill the interests of both parties in the collaborations, more precisely, the channel of accessing the advanced knowledge or technology for the firms and the possibility of commercializing the advanced technologies for the universities or research institutions, which in turn leads to a ‘win–win’ situation.

However, our findings also illustrate a ‘win–win’ situation for competitive collaborations. Prior research suggests that the outcome of competitive collaborations, defined as the partners in a collaboration racing to learn, is more likely to be a win–lose situation (Tsang 1999). We show that a negative direct impact of competitive collaborations is not found but, instead, a positive indirect impact of competitive collaborations does exist. This implies that, due to safeguarding behaviors, though the direct result of a competitive collaboration may not be successful, the participating firms still can learn from each other and exchange information and knowledge with each other during the process of the collaboration. As a result, all participating firms may enhance their innovation, which leads to a possible ‘win–win’ situation in competitive collaborations.

6 Conclusion

This study helps to visit and to investigate the theories of the R&D collaborations and innovation as well as provides empirical evidences for developing such concepts. Our empirical investigation shows a mixed result for R&D collaborations. Non-competitive R&D collaborations (particularly with universities) are found positively correlated with firm innovation while competitive R&D collaborations are also found positively moderating the relationship between in-house R&D and firm innovation. Moreover, another main contribution of this study is helping us to understand that competitive R&D collaborations, through interacting with a firm’s in-house R&D, can still contribute to a firm’s innovation.

Previous studies suggest that seeking complementary resource is a major motivation for R&D collaborations (Nonaka and Takeushi 1995; Nooteboom 1999; Lin 2003), which implies that R&D collaborations can bring firms complementary resource for enhancing their innovation. Our findings suggest that competitive R&D collaborations may indeed increase the contribution of the existing internal resource (in-house R&D) for a firm’s innovativeness. This provokes an important issue—not only can the complementary resource derived from non-competitive R&D collaboration improve a firm’s innovation, but also competitive R&D collaboration may contribute to a firm’s in-house R&D to its innovation. Our result also suggests that a firm is encouraged to conduct non-competitive and competitive R&D collaborations to enhance its innovation though competitive R&D collaborations may generate less benefit, in terms of innovation performance, to firms due to safeguarding mechanisms to prevent the leakage of firm advantage.

Business practitioners can take lessons from this research to help them develop effective R&D policies. According to the RBV researchers, a firm’s technological competence or innovation is a source of competitive advantage (Dosi 1982; Prahalad and Hamel 1990; Schumpeter 1934; Teece et al. 1990). A more innovative firm might enjoy surplus profits and a firm’s level of innovation will determine its future profitability. In-house R&D in terms of full-time scientists and engineers is a key factor for enhancing a firm’s innovation. Our findings suggest that not only their technical expertise can contribute to R&D activities, but also their learning in R&D collaborations can contribute to firm innovation. Thus, if firms, particularly for the high-tech firms, would like to generate profits in the future, they should pay more attention to attract and retain more skilled R&D employees to engage in in-house R&D activities. Another important implication for business practice is that non-competitive R&D collaborations are more helpful for accessing the needed complementary resource to improve a firm’s innovativeness than competitive R&D collaborations. Therefore, firms with a higher level of in-house R&D shall engage in more non-competitive collaborations, particularly with universities. Our findings also have implications for policy makers. We showed that R&D alliances with certain external partners (such as universities and competitors) are conductive to firm innovation. Because the aggregation of all firms’ innovation determines the extent of a nation’s innovation, which in turn affects a nation’s economic development (Freeman 1987; Lundvall 1992; Nelson 1993), governments should develop policies to encourage firms to work with external organizations to accelerate the pace of firm innovation.

Finally, our findings lead to several future research directions. First, future studies are encouraged to explore how firms can develop mechanisms to guard their own technology know-how while working with other firms on R&D projects. Second, researchers can also further examine what the best portfolio of R&D collaborations is as firms conducting multiple R&D collaborative projects simultaneously. Finally, future research can extend this stream of research with an investigation on how open innovation can successfully work in competitive and non-competitive R&D collaborative projects.

There are also some limitations in this research. First, since we used the 7-years data for independent variable (R&D collaboration types) and 10-years data for dependent variable (patents) to smooth out the possibility of fluctuation effect of yearly data, a time lag issue between independent variables and dependent variable may not be appropriately dealt with. Future studies can use annual data to investigate this time lag issue. Moreover, the analytical unit of this research was at a firm level instead of at a collaboration (or project) level, which limits our investigation of the performance of the partner firms involved. Future studies are encouraged to investigate the impact on the basis of a collaboration and to gather the data of both parties to compare the gains to each party.

Notes

Since IRD has high correlations (above 0.8) with the interaction terms (i.e., IRD × UC, IRD × RIC, and IRD × IFC), in order to deal with the possible multicollinearity problem between interaction terms and independent variables, we re-examined the negative binomial regression models for each type of R&D collaboration and its interaction term separately.

References

Aghion, P., Griffith, R., & Howitt, P. (2006). Vertical integration and competition. American Economic Review, 96(2), 97–102.

Almeida, P., & Phene, A. (2004). Subsidiaries and knowledge creation: The influence of the MNC and host country on innovation. Strategic Management Journal, 25(8/9), 847–864.

Arvanitis, S., Sydow, N., & Woerter, M. (2008). Do specific forms of university-industry knowledge transfer have different impacts on the performance of private enterprises? An empirical analysis based on Swiss firm data. Journal of Technology Transfer, 33(5), 504–533.

Bates, T., & Nucci, A. (1989). An analysis of small business size and rate of discontinuance. Journal of Small Business Management, 27(4), 1–7.

Baum, J. A. C., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294.

Bayona, C., Marco, T. G., & Huerta, E. (2002). Collaboration in R&D with universities and research centres: An empirical study of Spanish firms. R&D Management, 32(4), 321–341.

Belderbos, R., Carree, M., & Lokshin, B. (2006). Complementarity in R&D cooperation strategies. Review of Industrial Organization, 28(4), 401–426.

Blau, J. (1999). Research collaborations drive Global Telecoms industry. Research Technology Management, 42(4), 4–5.

Caloghirou, Y., Kastelli, I., & Tsakanikas, A. (2004). Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance. Technovation, 24(1), 29–39.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning an innovation. Administrative Science Quarterly, 35(1), 128–152.

DeCarolis, D. M., & Deeds, D. L. (1999). The impact of stocks and flows of organizational knowledge on firm performance: An empirical investigation of the biotechnology industry. Strategic Management Journal, 20(10), 953–968.

Deeds, D. L., & Hill, C. W. L. (1996). Strategic alliances and the rate of new product development: An empirical study of entrepreneurial biotechnology firms. Journal of Business Venturing, 11(1), 41–55.

Dosi, G. (1982). Technological paradigms and technological trajectories. Research Policy, 11(3), 147–162.

Freeman, C. (1982). The economics of industrial innovation (2nd ed.). Cambridge, Mass.: MIT Press.

Freeman, C. (1987). Technology and economic performance: Lessons from Japan. London: Pinter.

Fritsch, M., & Lukas, R. (2001). Who cooperates on R&D? Research Policy, 30(2), 297–312.

Gambardella, A. (1992). Competitive advantages from in-house scientific research: The US pharmaceutical industry in the 1980s. Research Policy, 21(5), 391–407.

Hagedoorn, J. (1993). Understanding the rationale of strategic technology partnering: Interorganizational modes of cooperation and sectoral differences. Strategic Management Journal, 14(5), 371–385.

Hagedoorn, J., Link, A., & Vonortas, N. (2000). Research partnerships. Research Policy, 29(4/5), 567–586.

Hamel, G. (1991). Competition for competence and inter-partner learning within international strategic alliances. Strategic Management Journal, 12(Summer Special Issue), 83–103.

Hamel, G., Doz, Y. L., & Prahalad, C. K. (1989). Collaborate with your competitors—And win. Harvard Business Review, 67(1), 133–139.

Harding, R. (2001). Competition and collaboration in German technology transfer. Industrial and Corporate Change, 10(2), 389–418.

Haunschild, P. R., & Beckman, C. M. (1998). When do interlocks matter? Alternate sources of information and interlock influence. Administrative Science Quarterly, 43(4), 815–844.

Hausman, J., Hall, B., & Griliches, Z. (1984). Econometric models for count data with application to the patents-R&D relationship. Econometrica, 52, 909–938.

Heher, A. D. (2006). Return on investment in innovation: Implications for institutions and national agencies. Journal of Technology Transfer, 33(4), 403–414.

Hemmert, M. (2003). International organization of R&D and technology acquisition performance of high-tech business units. Management International Review, 43(4), 361–382.

Henderson, R., & Cockburn, I. (1996). Scale, scope, and spillovers: The determinants of research productivity in drug discovery. RAND Journal of Economics, 27(1), 32–59.

Herbert, F. (1995). Industrial research—Where it’s been, where it’s going. Research Technology Management, 38(4), 52–56.

Hitt, M. A., Bierman, L., Shimizu, K., & Kochhar, R. (2001). Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective. Academy of Management Journal, 44(1), 13–28.

Hoang, H., & Rothaermel, F. T. (2005). The effect of general and partner-specific alliance experience on joint R&D project performance. Academy of Management Journal, 48(2), 332–345.

Inkpen, A. (1996). Creating knowledge through collaboration. California Management Review, 39(1), 123–140.

Kassicieh, S. K., Kirchhoff, B. A., Walsh, S. T., & McWhorter, P. J. (2002). The role of small firms in the transfer of disruptive technologies. Technovation, 22(11), 667–674.

Keil, T., Schildt, M. M. H., & Zahra, S. A. (2008). The effect of governance modes and relatedness of external business development activities on innovative performance. Strategic Management Journal, 29(8), 895–907.

Kennedy, K. J., & Holmfeld, J. D. (1989). A corporate R&D metric. International Journal of Technology Management, 4(6), 665–672.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397.

Koichi, F., Yoshiya, T., & Makoto, K. (1990). Network Organization for inter-firm R&D activities: Experiences of Japanese small businesses. International Journal of Technology Management, 5(1), 27–40.

Kotabe, M., & Swan, K. S. (1995). The role of strategic alliances in high-technology new product development. Strategic Management Journal, 16(8), 621–636.

Lerner, J., Shane, H., & Tsai, A. (2003). Do equity financing cycles matter? Evidence from biotechnology alliances. Journal of Financial Economics, 67(3), 411–446.

Li, D., Eden, L., Hitt, M. A., & Ireland, R. D. (2008). Friends, acquaintances, or strangers? Partner selection in R&D Alliances. The Academy of Management Journal, 51(2), 315–334.

Lichtenthaler, U. (2007). The drivers of technology licensing: An industry comparison. California management review, 49(4), 67–89.

Lin, B. W. (2003). Technology transfer as technological learning: A source of competitive advantage of firms with limited R&D resources. R&D Management, 33(3), 327–341.

Lockett, A., Wright, M., & Franklin, S. (2003). Technology transfer and universities: Spin-out strategies. Small Business Economics, 20(2), 185–200.

Lundvall, B. A. (1992). National innovation systems. London: Pinter.

Lundvall, B. A., & Nielsen, P. (1999). Competition and transformation in the learning economy—Illustrated by the Danish case. Revue d’Economie Industrielle, 88, 67–90.

Mitton, T. (2002). A cross-firm analysis of the impact of corporate governance on the East Asian financial crisis. Journal of Financial Economics, 64(2), 215–241.

Miyazaki, K. (1995). Building competences in the firm. London: Macmillan Press Ltd.

Mothe, C., & Quelin, B. V. (2001). Resource creation and partnership in R&D consortia. The Journal of High Technology Management, 12(1), 113–138.

Muscio, A. (2007). The impact of absorptive capacity on SME’s collaboration. Economics of Innovation & New Technology, 16(8), 653–668.

Nelson, R. R. (1993). National systems of innovation. New York: Oxford University Press.

Nieto, M. J., & Santamaría, L. (2007). The importance of diverse collaborative networks for the novelty of production innovation. Technovation, 27(6/7), 367–377.

Niosi, J. (2006). Success factors in Canadian academic spin-offs. Journal of Technology Transfer, 31(4), 451–457.

Nonaka, I., & Takeushi, H. (1995). The knowledge-creating company. New York: Oxford University Press.

Nooteboom, B. (1999). Innovation, learning and industrial organisation. Cambridge Journal of Economics, 23(2), 127–150.

OECD. (2002). OECD science, technology and industry outlook 2002. Paris: OECD.

Parker, D. D., & Zilberman, D. (1993). University technology transfers: Impacts on local and US economies. Contemporary Policy Issues, 11(2), 87–96.

Parkhe, A. (1991). Interfirm diversity, organizational learning, and longevity in global strategic alliances. Journal of International Business Studies, 22(4), 579–601.

Perez, M. P., & Sanchez, A. M. (2003). The development of university spin-offs: Early dynamics of technology transfer and networking. Technovation, 23(10), 823–831.

Peters, J., & Becker, W. (1998). Vertical corporate networks in the German automotive industry: Structure, efficiency, and R&D spillovers. International Studies of Management & Organization, 27(4), 158–185.

Pfirrmann, O. (1994). The geography of innovation in small and medium-sized firms in West Germany. Small Business Economics, 6(1), 41–54.

Pisano, G. P. (1990). The R&D boundaries of the firm: An empirical analysis. Administrative Science Quarterly, 35(1), 153–176.

Powell, W. W., Koput, K. W., & Smith-Doerr, L. (1996). Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Administrative Science Quarterly, 41(1), 116–145.

Powers, J. B. (2003). Commercializing academic research: Resource effects on performance of university technology transfer. The Journal of Higher Education, 74(1), 26–50.

Prahalad, C. K., & Hamel, G. (1990). The core competence of the corporation. Harvard Business Review, 90(3), 79–91.

Rapp, R., & Rozek, R. P. (1990). Benefits and costs of intellectual property protection in developing countries. Journal of World Trade, 24(5), 75–102.

Reed, R., & DeFillippi, R. J. (1990). Casual ambiguity, barriers to imitation and sustainable competitive advantage. Academy of Management Review, 15(1), 88–102.

Sakakibara, M., & Dodgson, M. (2003). Strategic research partnership: Empirical evidence from Asia. Technology Analysis and Strategic Management, 15(2), 227–245.

Scherer, F. M. (1965). Firm size, market structure, opportunity, and the output of patented inventions. American Economic Review, 55(5), 1097–1125.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge, Mass.: Harvard University Press.

Shan, W., Walker, G., & Kogut, B. (1994). Interfirm cooperation and startup innovation in the biotechnology industry. Strategic Management Journal, 15(5), 387–394.

Shane, S. (2002). Executive Forum: University technology transfer to entrepreneurial companies. Journal of Business Venturing, 17(6), 537–552.

Steffensen, M., Rogers, E. M., & Speakman, K. (2000). Spin-offs from research centers at a research university. Journal of Business Venturing, 15(1), 93–111.

Symth, D. J., Boyes, W. J., & Pessau, D. E. (1975). The measurement of firm size: Theory and evidence for the United States and United Kingdom. Review of Economics and Statistics, 57(1), 111–114.

Teece, D., Pisano, G., & Schuen, A. (1990). Firm capabilities, resources, and the concept of strategy. CCC Working Paper No. 90-8, University of California, Berkeley.

Tsang, E. W. K. (1999). A preliminary typology of learning in international strategic alliances. Journal of World Business, 34(3), 211–229.

Un, C. A., Cuervo-Cazurra, A., & Asakawa, K. (2010). R&D collaborations and product innovation. Journal of Product Innovation Management (Forthcoming).

Walker, W. E. (1995). Technological innovation, corporate R&D alliances and organizational learning. The RAND Graduate School, AAT 0530186.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Zhang, J. (2009). The performance of university spin-offs: An exploratory analysis using venture capital data. Journal of Technology Transfer, 34(3), 255–285.

Zucker, L. G., Darby, M. R., & Armstrong, J. S. (2002). Commercializing knowledge: University science, knowledge capture, and firm performance in biotechnology. Management Science, 48(1), 138–153.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, KF., Yu, CM.J. The effect of competitive and non-competitive R&D collaboration on firm innovation. J Technol Transf 36, 383–403 (2011). https://doi.org/10.1007/s10961-010-9155-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-010-9155-x

Keywords

- In-house R&D

- R&D alliances

- R&D collaboration

- Innovation

- Partner selection

- Taiwan’s information and communication technology industry