Abstract

Why unemployment has heterogeneous effects on subjective well-being remains a hot topic. Using German Socio-Economic Panel data, this paper finds significant heterogeneity using different material deprivation measures. Unemployed individuals who do not suffer from material deprivation may not experience a life satisfaction decrease and may even experience a life satisfaction increase. Policy implications for taxation and unemployment insurance are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Why unemployment has heterogeneous effects on subjective well-being (SWBFootnote 1) remains a hot topic. The previous literature uses non-pecuniary factors to explain the negative effects of unemployment after income is controlled for. Various non-pecuniary factors are proposed to explain this phenomenon, such as the social work norm, psychological distress, and so on (see Winkelmann 2014 for a review). Two exceptions are Bayer and Juessen (2015) and Luo (2017), who suggest that the root cause is actually pecuniary. The heterogeneous effects of unemployment on SWB present a further controversy. Winkelmann (2009) and Gielen and Van Ours (2014) find that about half of the unemployed do not experience SWB losses; they may even feel that their SWB has increased. Ideally, unemployment could be identified as a neutral or positive event for some subgroups. The literature finds that the negative effects of unemployment differ depending on gender, age, education, wealth, local employment conditions, previous employment status, and SWB itself (Green 2011; Gathergood 2013; Chadi 2014; Binder and Coad 2015a, b; Hetschko 2016). However, few papers could identify a subgroup of unemployed individuals who suffer no SWB decrease or even experience a SWB increase.

Using German Socio-Economic Panel (GSOEP) data, this paper finds significant heterogeneity using different material deprivation measures. Unemployed individuals who do not suffer from material deprivation may not experience a life satisfaction decrease and may even experience a life satisfaction increase. Thus, this paper makes a unique contribution by identifying subgroups who experience neutral or positive life satisfaction changes after unemployment.

This paper highlights a unique feature of the unemployed, i.e., their household income is insufficient to support their living (as measured by the minimum required income for their living standard). Then, various objective measures (e.g., income) and subjective measures (e.g., economic concerns and financial satisfactions) of material deprivation are entered into a happiness regression. These measures can mediate the negative effects of unemployment.

More importantly, this paper uses these selected measures to analyze the heterogeneous effects of unemployment on happiness. Among unemployed individuals who have a large amount of investment income or still have a large income relative to their living standard, the life satisfaction change is small and statistically insignificant. Moreover, among those who do not suffer from economic concerns or remain highly satisfied with their financial situations, their life satisfaction could even increase after becoming unemployed. To control for the correlations between economic concerns/satisfaction and life satisfaction, this paper uses different methods, such as individual fixed effects, testing income and employment status uncorrelated concerns and domain satisfactions, and an instrumental variable approach. These methods provide supportive evidence for the conclusion of this paper. However, for those who remain suspicious about using subjective measures of material deprivation, this paper at least shows that significant heterogeneity exists using objective measures.

By showing that material deprivation plays an important role in SWB heterogeneity, this paper provides a consistent answer to one of the two salient questions in happiness economics as follows (Frey and Stutzer 2002; Powdthavee and Stutzer 2014): the relationship between SWB and unemployment. Besides the two questions discussed above (SWB decreases associated with unemployment and SWB heterogeneity), there is another question concerning SWB adaptation. Happiness economics finds that SWB adapts to various life events such as divorce, widowhood, marriage, childbirth, and disability; however, there is limited or no adaptation to poverty or unemployment (Anusic et al. 2014; Clark et al. 2008, 2016; Clark and Georgellis 2013; Von Scheve et al. 2017). Powdthavee (2012) explains the limited adaptation to unemployment by the fact that financial and social life satisfaction remains low after years of unemployment. Luo (2018a) shows that long-term unemployed individuals have an insufficient income to support their living (as measured by the minimum required income for their current living standards). Thus, there is no adaptation to financial satisfaction and SWB. Luo (2018b) provides a similar answer to the finding of Clark et al. (2016) that there is no SWB adaptation to poverty.

This paper also relates to the following salient topic in happiness economics: income and happiness. The “Easterlin paradox” shows that although in cross-sectional analyses, income increases SWB (i.e., at a given point of time people in richer countries are happier and rich people in a specific country are happier), in time series analyses, individuals’ income increase but SWB remains stable over time (Easterlin 1974, 2017). Stutzer (2004), Stutzer and Frey (2004), and Luo (2019b) explain this paradox by the fact that as an individual’s income increases, their living standards, as measured by the minimum required income, also increases. Thus, a consistent framework is provided for happiness economics.

The paper proceeds as follows. Section 2 reviews the previous literature. Section 3 describes the data source and empirical strategy. Section 4 presents the results, and Sect. 5 concludes.

2 Literature Review

2.1 Unemployment and SWB

The happiness literature finds that unemployment substantially decreases SWB after actual income is controlled for (see Frey and Stutzer 2002 for a review). The general consensus is that the loss of SWB is due to non-pecuniary costs. Various contributing factors have been identified, such as the social work norm (Clark 2003; Clark et al. 2009; Van Hoorn and Maseland 2013; Chadi 2014; Hetschko et al. 2014), social capital (Winkelmann 2009), expectations (Knabe and Rätzel 2011; Green 2011), psychological effects (Goldsmith et al. 1996; Darity and Goldsmith 1996; McKee-Ryan et al. 2005; Winkelmann 2014), and stigma (Cullen and Hodgetts 2001; O’Donnell et al. 2015).

Other non-pecuniary factors have been proposed, such as having less structured days (Jahoda 1979), and that work itself increases utility (i.e., work as utility) (Lane 1992; Spencer 2014). However, these factors have not been found to have any explanatory power. For example, Knabe et al. (2010) and Krueger and Mueller (2012) analyze the daily life structures of the unemployed and find that their time allocations are not chaotic. Hamermesh et al. (2017) find that having reduced working hours increases SWB, a contradiction to the idea of work as utility.

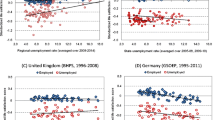

Two papers stand out for their use of pecuniary factors as explanations. First, Bayer and Juessen (2015) employ the theory of incomplete market, categorize income shocks as persistent or transitory, and categorize the labor force as unemployed or employed. Using German Socio-Economic Panel (GSOEP) data and various instrumental variables, they find that after controlling for permanent and transitory income shocks, the coefficient on employment becomes insignificant.

Second, Luo (2017) proposes a pecuniary explanation using a traditional approach. Using panel data GSOEP and combined cross-sectional datasets—the World Values Survey (WVS) and the European Values Study (EVS)—he shows that including different controls for pecuniary factors mediates a large portions of unemployment’s negative effects. Each non-pecuniary factors (social work norms, social capital, expectations, psychological effects, and stigma) mediates fewer effects of unemployment. Moreover, these factors are compatible with the pecuniary explanation. For example, having poor job prospects reduces the SWB of the unemployed through worsened financial evaluations. Finally, non-pecuniary factors may contain both pecuniary and non-pecuniary channels. For example, bad job prospects may reduce SWB because of fear of the loss of earnings associated with the job (pecuniary channel) or loss the job itself (non-pecuniary). Based on the above findings, Luo suggests that the root cause of SWB loss is pecuniary.Footnote 2

2.2 Unemployment and Heterogeneity

Although, in general, unemployment reduces SWB, Winkelmann (2009) and Gielen and Van Ours (2014) document that about half of the unemployed do not experience SWB loss; some may even experience an increase in SWB. Various factors are found to generate this heterogeneity among the unemployed. Green (2011) finds that the SWB and subjective mental health of the unemployed in Australia differ depending on job prospects, gender, education, and wealth. Gathergood (2013) documents the heterogeneity of psychological well-being, as related to gender and age, among the unemployed in England. Various papers find that the SWB of the unemployed is affected by the local unemployment rate and use social norms or job prospects as explanations (Clark 2003; Gathergood 2013; Chadi 2014). Hetschko (2016) finds that unemployment hurts the self-employed more than it hurts paid employees. The above factors, however, cannot mediate the negative effects of unemployment so that they become positive. Because about half of the unemployed experience no SWB decrease or even an SWB increase, an ideal explanation can turn the unemployment into a positive event.

The above-mentioned papers use traditional regression based on conditional mean analysis. Another approach is to utilize specific econometric tools designed for heterogeneity analyses. First, quantile regressions attempt to determine how the effects of an independent variable (unemployment) on a dependent variable (SWB) vary in the SWB distribution (Koenker 2005). Using British Household Panel Survey (BHPS) data, Binder and Coad (2015a, b) employ various SWB measures, including life satisfaction, mental well-being, and different domain satisfaction measures, and find that the negative effects of unemployment substantially decrease in the upper level of SWB; that is, individuals with higher SWB suffer less from unemployment. Schiele and Schmitz (2016) obtain similar findings for the SWB measures of physical health and mental health using German Socio-Economic Panel data. In other words, no factors, except SWB itself, have been identified to be ideal explanations.

Second, latent class analyses attempt to identify potential “unobserved heterogeneity”. The traditional approach separates groups by observable variables, such as income, and analyzes the differences among those groups. In contrast, the latent class approach groups by unobservable factors, such as preference, based on information from other available variables (e.g., Clark et al. 2005; Dardanoni and Donni 2012). For example, Falco et al. (2015) find that unemployment has different, but all negative, effects on individuals in different locations. This method is better for detecting than explaining heterogeneity (Falco et al. 2015; Sarrias 2019), and relatively few papers are devoted to the analysis of unemployment and SWB.

3 Data and Empirical Strategy

3.1 Data and Summary Statistics

The German Socio-Economic Panel (GSOEP) is a nationally representative longitudinal study of private households, conducted every year since 1984 by the German Institute for Economic Research (DIW Berlin). This dataset contains rich information, both objective and subjective; see Haisken-DeNew and Frick (2005) for more details. I use all waves from 1984 to 2017 and restrict the age range from 16 to 65 years, inclusively. The dependent variable, i.e., overall life satisfaction (LS), is measured using the following question: All things considered, how satisfied are you with your life? Please answer on a scale from 0 (completely dissatisfied) to 10 (completely satisfied). The appendix contains more detailed definitions of the variables.

There are approximately 480,000 observations (76,000 individuals) in the whole sample. The individuals’ employment status is employed, unemployed, not on labor force, or retired. Table 1 lists the summary statistics of the employed (column 1) and unemployed (column 2). The unemployed had a lower LS (5.9) than the employed (7.2). Column 3 shows that the hypothesis that the two groups have the same LS can be rejected at the 0.1% level. The employed have a sufficient monthly household income (3341 Euro, deflated using 2011 as the base year) to support their living standard (2479 Euro, measured by the minimum required income). Notably, 510 observations with a household income or minimum required income greater than 20,000 are excluded. This exclusion has limited effects on the summary statistics, except for it significantly reduces the standard error of household income and minimum required income. Moreover, the minimum required income is available for only 4 years (2002, 2007, 2012, and 2017). Therefore, the summary statistics of household income are also derived from these 4 years for a direct comparison. In contrast, the unemployed have an insufficient income (1677 Euro) for their living standard (1744 Euro). Consequently, they are more concerned about their economic situation (1.6 vs 2.1) and are less satisfied with their financial situation (4.2 vs 6.6). However, regarding the concerns and domain satisfaction, which are the least correlated with income, the unemployed have a value similar to that of the employed. For example, the unemployed have almost the same value for environment concerns (1.8 vs 1.8) and a similar value for environment satisfaction (5.9 vs 6.3). Regarding the demographic indicators, the unemployed are older, less educated, and less likely to be male or married. The unemployed have worse health satisfaction. Due to the large sample size, the two groups differ in each indicator at the 0.1% level.

Since the employed and unemployed differ, it is natural to analyze the transition to determine whether the unemployed are already in worse conditions before they enter unemployment and show the heterogeneity during the transition. Table 2 shows the summary statistics of the 8144 individual observations who are employed in year t but unemployed at year t + 1. When these individuals are employed, their household income is 2348 Euro, which is approximately 300 Euro higher than the minimum required income. However, the household income decreases to 1840 Euro. Although they downgrade their living standard to accommodate the income shock, the minimum required income, i.e., 1842 Euro, is higher than the income. Notably, the minimum required income may only capture spending on necessities, and their daily living may require more income (Chetty and Szeidl 2007, 2016). Thus, the unemployed describe their lives as follows: “I have lost my savings, retirement, credit rating…” (Blau et al. 2013, p. 258). Consequently, the unemployed become more concerned about their economic status and less financially satisfied. However, in comparison, their environment concern and satisfaction are the same. In addition, column 3 shows that the hypothesis that the values of environment concern and satisfaction remain the same cannot be rejected at any significance level.

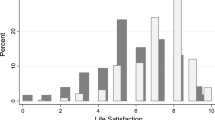

Figure 1 shows the changes in some indicators during the unemployment transition. Approximately half of the unemployed do not experience a decrease in life satisfaction, and approximately 1/4 maintain the same LS level. The distribution is asymmetric and skewed to negative values. For example, approximately 5% more individuals are clustered at − 1 (e.g., their life satisfaction is reduced by 1 point after being unemployed) than at 1. Thus, the average change is negative, covering significant heterogeneity. The distribution is consistent with that reported by Gielen and Van Ours (2014). Figure 1 also shows the changes in economic concern and environment concern. The distribution of economic concern change is also asymmetric and skewed to negative values. In contrast, the distribution of environment change is highly symmetric. The distributions of financial and environment satisfaction changes (not shown here) show similar patterns (asymmetric/symmetric for financial/environment satisfaction). The above preliminary evidence shows that the negative effects of unemployment on life satisfaction may be driven by material deprivation, and there could be significant heterogeneity in terms of these indicators. The following sections discuss more rigorous regressions.

3.2 Empirical Strategy

3.2.1 Mediation Effects

This paper first determines the mediation effects of the material deprivation indicators. If the negative effects of unemployment are largely driven by these indicators, including these indicators in the regression could mediate the effects. An individual-level fixed effects ordinary least squares (OLS-FE) model is used in this paper. The results of OLS regression enable easy interpretation. Individual FE helps to eliminate the endogeneity generated by time-invariant omitted variables, such as personality. For example, personality is found to significantly impact both SWB (Feist et al. 1995) and several right-hand variables in happiness regression, such as wealth and health (Graham et al. 2004). Ferrer-i-Carbonell and Frijters (2004) provide support for the use of OLS-FE. I use the traditional happiness regression

where \(LS_{it}\) is the life satisfaction of individual \(i\) in year \(t\), \(\alpha_{i}\) captures the individual fixed effect, \(ES_{it}\) is employment status (4 dummies, where the employment dummy is dropped as the reference level), \(Explanatory_{it}\) includes the explanatory variables (various material deprivation measurements in different specifications), \(X_{it}\) includes the demographic control variables (years of education, marital status, health status, age, and age square) and other control variables (survey year and residential region), and \(\varepsilon_{it}\) is the random error. All control variables cited above are frequently used in the literature. This paper uses health satisfaction as a control for health status because other indicators, such as self-rated health, are available only for limited years. I also attempt to replace health satisfaction with the limited self-rated health status or remove the health control from the regressions, and the results are similar.

3.2.2 Heterogeneity Analysis

The following step is to analyze the heterogeneity according to material deprivation. The traditional approach using interaction terms prevents a direct comparison between the unemployed and employed. For example, to analyze how sufficient income affects the unemployed, the traditional approach uses

in the regression and compares \(\beta_{1}\) (representing the unemployed without a sufficient income) and \(\beta_{1} + \beta_{2}\) (representing the unemployed with a sufficient income). To enable a direct comparison, this paper uses a different approach based on expanded dummy variables as an analog of Young (2012). The unemployment dummy is expanded based on the level of explanatory variables. For example,

Thus, \(\gamma_{1}\) and \(\gamma_{2}\) are direct comparisons to the employed. Mathematically, the two methods provide the same results, i.e.,

4 Results

4.1 Mediation Effects

Table 3 shows the mediation effects. The coefficients of the control variables are not listed due to space constraints. The interpretations are consistent with the literature as follows: marriage increases happiness, SWB is U-shaped based on age, and health increases SWB. Years of education have no significant impacts on SWB. After age 16, a person’s change in education is relatively small and has lower statistical significance. To verify this hypothesis, I run regression without individual fixed effects (the results are not shown here). The education coefficient becomes significant.

The focus of this subsection is the coefficient of unemployment. Without controlling for the pecuniary factors, the coefficient is − 0.62 (column 1), indicating that changing from employment to unemployment reduces the 11-scale life satisfaction by 0.62. After controlling for actual household income in column (2), the effects remain similar (− 0.56). The coefficient of the log household income is 0.27 and statistically significant. The above findings are consistent with those reported in the literature showing that the log income coefficient in the happiness regression is approximately 0.3 and that unemployment has a negative impact even after controlling for actual income. Subsequently, the minimum required income is included as an additional control. This variable is available for only 4 years. Column (3) replicates column (2) in these 4 years to enable a direct comparison. Column (4) includes the minimum required income, and the coefficient of unemployment remains similar to that shown in column 3, although the negative coefficient of the minimum required income is consistent with that reported in the literature (Stutzer 2004; Stutzer and Frey 2004).

The limited mediation effects of income and minimum required income may be due to the relatively generous unemployment benefits in Germany; thus, the income and minimum required income of the unemployed do not significantly decrease, thereby controlling for income or not having limited effects. To test this hypothesis, the household income is separated into individuals’ labor income and other household income.Footnote 3 Column (5) shows that individuals obtain a higher utility from labor income (coefficient 0.11) than other income (coefficient 0.07). This result is consistent with the literature showing that different sources of income affect SWB differently (Brown et al. 2005). Moreover, in this specification, the coefficient of unemployment decreases (0.05) and is statistically insignificant. The large decrease in labor income captures most negative effects of unemployment.

Another possible reason for the limited mediation effects of income is that individuals consider their future financial perspectives (Dolan et al. 2008). To test this hypothesis, the first method is to control for the incomes in future years. However, the minimum required income is only available for 4 years. The second method is to use subjective income indicators as controls because these subjective indicators capture how a person feels about their financial status and future financial functioning (Wang 2012). Column (6) shows that including the 3-scale economic concern in the regression reduces the coefficient of unemployment to − 0.46 compared with − 0.56 in column (2). Another subjective indicator, i.e., financial satisfaction, further reduces the coefficient of unemployment to − 0.38 because the 11-scale indicator captures more variation than the 3-scale economic concern. Moreover, as expected, in both specifications, the subjective indicators have a strong influence on life satisfaction.

The above evidence shows that the objective and subjective income indicators have substantial mediation effects on the negative effects of unemployment on life satisfaction. The following subsection discusses the heterogeneity analysis.

4.2 Heterogeneity Analysis

In Table 4, column (1) shows the heterogeneity analysis by separating the unemployed into two groups according to whether their household income is greater than the minimum required income. The group with a sufficient income to support their lives suffers less (− 0.41) than those with an insufficient income (− 0.49). However, the difference is small. Notably, in the following specifications, the household income is already controlled for. The coefficients of the other employment statuses are controlled for but not shown for simplicity. Column (2) shows the result by separating the unemployed into 4 groups according to household income with cutoffs of average log(income) and average \(\log \left( {income} \right) \pm 2 \times s.d.\), where \(s.d.\) is the standard error of average log household income. There is a clear pattern that more income is associated with higher LS. The heterogeneity is larger than that in column (1) but is still limited.

The limited heterogeneity may be due to individuals considering their future financial situations (Dolan et al. 2008). In total, 4 different methods can be used to test this hypothesis. The first method is to extend the specification to future years. However, the minimum required income is available for only 4 discrete years.

The second method is to analyze the group with a large investment income (derived from rents, dividends, and interests). This group is likely to have sufficient income for their daily living, even after being unemployed. “Large” is defined as a monthly investment income greater than 850 Euro, representing a balance between the amount of money and number of observations (297). Column (3) shows that this group suffers much less (− 0.10) from unemployment, and the coefficient is statistically insignificant. Columns (4) to (6) provide the summary statistics of the two unemployed groups. Most unemployed (30,732 observations) do not have enough income (1645 Euro) for their living standard requirement (1731). While those with a large investment income have higher living standards (2608) and a much higher monthly household income (3864). This finding also sheds light on the literature related to the labor supply of lottery winners. Significant heterogeneity is observed in the labor response of lottery winners. For example, people who win less are more likely to continue to work, while people who win a large amount of money are more likely to quit their jobs (see Gilbert et al. 2018 for a discussion). This paper implies that if the lottery winning is large enough such that investment income is enough to support daily living, the individuals do not suffer from unemployment and are likely to quit their jobs, which has been described in Smith and Razzell (1975). Thus, a small amount of basic income guarantee does not reduce the labor supply as reported by Gilbert et al. (2018).

The third method is to further separate the unemployed into 7 groups according to 6 income levels. This 7-scale categorical variable could capture more variation. The group with a very good income is defined as those whose household income is larger than the value obtaining by answering the question “What do you consider a very good income?” Notably, the “a very bad income” question is a cutoff for the groups “a very bad income” and “worst income”. Thus, there are 6 income levels but 7 income groups. In Table 5, column (1) shows that generally, the negative effects of unemployment decrease as the income level increases. Columns (2) to (4) provide the summary statistics. Column (4) shows that the living standard increases as the income level increases. However, the income increases more quickly, i.e., the household income after individuals are unemployed. Thus, the negative effects of unemployment decrease. Among the group with a good income, the negative effects decrease to − 0.06 and are statistically insignificant. The group with the highest income is an exception, but notably, there are only 54 observations in this group.

The fourth method is to use subjective income indicators because these indicators capture how a person feels about their future financial situations (Wang 2012). In Table 6, column (1) shows the results by separating the unemployed according to their economic concerns. Again, there is a clear trend in the coefficients of unemployment. Moreover, a unique feature is that the unemployed with no economic concern experience a life satisfaction increase. It is possible that they regard unemployment as a chance to take a rest or seek a better position. It is also possible that similar to some lottery winners, they will attempt to obtain some more education before returning to work (Gilbert et al. 2018). Columns (2) to (4) show the summary statistics. The living standards are similar among the three groups, but the household incomes differ. Those without concern have significantly more income than the minimum required. Column (5) separates the unemployed by the level of financial satisfaction and shows a clear trend with the top 2 groups exhibiting a life satisfaction increase.

4.3 Alternative Explanations

4.3.1 Ordinal Scale by Logit Regression

A potential argument concerns the OLS because life satisfaction is treated as a cardinal scale. However, life satisfaction is generally regarded as ordinal. Various fixed-effects ordered logit regressions (which treat the dependent variable as an ordinal variable) are developed in the literature. This paper uses the latest method proposed by Baetschmann et al. (2015) to test this argument. In Table 7, column (1) shows the results. Similar to column (1) of Table 6, the groups show a clear trend, and the group without concern experiences life satisfaction increases.

4.3.2 Subjective Indicators

A potential objection to using subjective indicators, such as economic concerns, is that both these indicators and life satisfaction are subjective and may be affected by mood effects (Schwarz and Strack 1999). Thus, economic concerns could “mediate” the unemployment effects even though this variable has no “real” effects. A subjective indicator that is the least correlated with income or employment status, i.e., environment concern, is used to test this argument. As shown in column (2) in Table 7, all groups of unemployed significantly suffered from unemployment, which contradicts this argument. Using environment satisfaction (not shown here), the coefficients of all unemployed groups are also significantly negative.

4.3.3 Instrumental Variable Approach

Several other concerns about the relationship between subjective indicators and life satisfaction may exist. First, these variables could be affected by the same factors, such as personality. Second, life satisfaction may affect the subjective indicators backwardly. Third, the measurement error in the subjective indicators could attenuate the coefficient of these indicators. However, the above concerns should be alleviated by the fixed effects and the comparison to environment concern/satisfaction. This subsection further uses a traditional approach of economics, i.e., instrumental variables (IVs) to instrument the subjective indicators. Stutzer (2004) suggests that finding IVs that affect individual’s evaluation but not LS is difficult; however, aggregate-level variables are potential candidates. Per Stutzer, the IVs are average equivalent household income and the percentage of rich people in each state.Footnote 4 Using this approach, the unemployed have to be treated as one group. If the coefficients of the subjective indicators are more positive, higher heterogeneity exists within the unemployed at different levels of these indicators. Thus, this approach is indirect. More details follow.

In Table 8, column (1) first replicates column (6) in Table 3, but economic concern is treated as a continuous variable. The result is similar, i.e., unemployment on average reduces life satisfaction by 0.44. One level of economic concern boosts life satisfaction by 0.47, i.e., if the LS for the unemployed who are very concerned about the economic situation is \({-}\alpha\), then those unemployed who are somewhat concerned/not concerned have an LS of \({-}\alpha + 0.47\) and \({-}\alpha + 0.94\).

In column (2), the average income is used to instrument the financial concern. The coefficient of unemployment is significantly reduced (− 0.15) and becomes statistically insignificant. In contrast, the coefficient of economic concern becomes more positive (3.40), which is consistent with the literature showing that instrumenting income indicators renders the coefficients of these indicators more positive (Luttmer 2005; Powdthavee 2010; Stutzer 2004). The first stage passes underidentification and weak identification tests. The hypothesis that financial concern is exogenous can be rejected. Column (3) uses both the average income and percentage of rich people as instruments and yields similar results. The overidentification hypothesis cannot be rejected (p = 0.42), suggesting that the IVs are valid. If economic concern is replaced by financial satisfaction (not shown here), the conclusion is similar. The interpretation of column (3) is that the unemployed on average do not suffer after financial situation is controlled (see also Bayer and Juessen 2015), while the LS for those 3 groups with different economic concern levels are \({-}\alpha\), \({-}\alpha + 2.81\), and \({-}\alpha + 5.62\).

The IV approach provides evidence that the subjective income indicators mediate more effects of unemployment, and more heterogeneity exists among the unemployed. Notably, the IV approach could be controversial in terms of the IVs used. However, this paper also shows that objective indicators, such as the income level, also contain significant heterogeneity, representing a take home message for those who remain suspicious of subjective indicators and the IV approach.

4.3.4 Self-selection into Unemployment

A potential argument concerns the self-selection problem, i.e., the unemployed essentially differ based on whether they choose to be unemployed. Although the negative effects of unemployment suggest that the voluntary unemployment argument is implausible, there are two methods to test this argument. First, the use of individual fixed-effects could alleviate this concern because the personal invariant characteristics are controlled for. Second, this paper uses the company closure induced unemployment as a test. Company closure, which is an exogenous shock, is frequently used in the literature to address backward causality or self-selection (Kassenboehmer and Haisken-DeNew 2009; Baetschmann et al. 2015; Schiele and Schmitz 2016). Under this specification, company closure poses an exogenous shock both in employment status and income to individuals. For simplicity, the unemployed who enter unemployment for other reasons are excluded from the sample. Only 993 observations of the unemployed remain.

In Table 9, column (1) shows the results by separating unemployment by investment income, while column (2) separates by economic concern. These 2 specifications are chosen because the unemployed are separated in relatively fewer groups. In column (1), each group suffers more from unemployment than in column (2) of Table 4. The result is consistent with the literature showing that company closure causes a larger decrease in SWB (Kassenboehmer and Haisken-DeNew 2009; Baetschmann et al. 2015). In both columns, the groups suffering least from unemployment have statistically insignificant coefficients (− 0.19 and 0.15) most likely due to the small samples (19 and 65 observations).

Another concern is related to the controls. Some controls, such as income and health, are correlated with unemployment. Including the controls mediates the effects of unemployment. To test this argument, columns (3) and (4) replicate columns (1) and (2) without any controls. Consistent with the hypothesis, each group suffers more from unemployment.

Although the above analysis casts doubt on the conclusion that some groups may experience a life satisfaction increase, such result is likely due to the small sample. The conclusions that significant heterogeneity exists and that some groups may not experience life satisfaction changes remains unchanged.

5 Conclusion and Discussion

The happiness literature finds that unemployment largely decreases SWB, even after controlling for income. However, about half of those who become unemployed do not experience SWB loss, and some may even experience an increase in SWB. Thus far, few factors, except for SWB, can distinguish subgroups of the unemployed who experience neural or positive SWB changes. Using German Socio-Economic Panel (GSOEP) data, various objective and subjective material deprivation measures are selected. These measures mediate the negative effects of unemployment and identify the following subgroups with neutral or positive SWB changes: those who have a household income substantially greater than the minimum required for their current living standard or those who do not suffer a decrease in their subjective financial evaluation.

This paper has strong policy implications. First, the heterogeneity implies that unemployment benefits are important and should be means-tested because those with a sufficient income from other sources may not experience SWB losses from unemployment. Notably, various policies, such as job search monitoring and sanctions, could be employed to reduce the disincentive effects of unemployment benefits (e.g., Card et al. 2018). Other forms of support, such as job search assistance, should also focus on people with the fewest income sources. Moreover, this finding justifies progressive taxation as follows: those with large incomes from wealth or other sources might not experience SWB decreases from a job loss, and thus, these individuals may choose to become unemployed voluntarily (Smith and Razzell 1975).Footnote 5

Second, a large portion of the unemployed suffers from lower financial well-being and SWB, suggesting that unemployment is not voluntary for these individuals. Thus, the European approach to policy for unemployment (focus on the structural factors) may be favorable over the American approach (focus on individual motivation). Notably, in America, even 50 years after President Lyndon Johnson declared the War on Poverty in 1964, the most disadvantaged African Americans have become increasingly isolated and are less likely to find gainful employment (Edin and Shaefer 2015; Wilson 1996, 2012).

Notes

In this paper SWB, happiness, and life satisfaction are used interchangeably.

See also Luo (2019a).

The value of labor income among the unemployed is − 2 (does not apply) and is reset to 1.

The equivalent household income is defined as household income divided by the square root of the household size. Rich is defined as an equivalent household income greater than 1.5 times the average equivalent income.

Smith and Razzell (1975) also find that lottery winners choose not to work because their labor income faces a high marginal tax rate due to their large capital income derived from investment. Thus, labor income and other sources of income should be taxed separately.

References

Anusic, I., Yap, Stevie C. Y., & Lucas, R. E. (2014). Testing set-point theory in a swiss national sample: Reaction and adaptation to major life events. Social Indicators Research, 119(3), 1265–1288. https://doi.org/10.1007/s11205-013-0541-2.

Baetschmann, G., Staub, K. E., & Winkelmann, R. (2015). Consistent estimation of the fixed effects ordered logit model. Journal of the Royal Statistical Society: Series A (Statistics in Society). https://doi.org/10.1111/rssa.12090.

Bayer, C., & Juessen, F. (2015). Happiness and the persistence of income shocks. American Economic Journal: Macroeconomics, 7(4), 160–187. https://doi.org/10.1257/mac.20120163.

Binder, M., & Coad, A. (2015a). Heterogeneity in the relationship between unemployment and subjective wellbeing: A quantile approach. Economica, 82(328), 865–891. https://doi.org/10.1111/ecca.12150.

Binder, M., & Coad, A. (2015b). Unemployment impacts differently on the extremes of the distribution of a comprehensive well-being measure. Applied Economics Letters, 22(8), 619–627. https://doi.org/10.1080/13504851.2014.962219.

Blau, G., Petrucci, T., & McClendon, J. (2013). Correlates of life satisfaction and unemployment stigma and the impact of length of unemployment on a unique unemployed sample. Career Development International, 18(3), 257–280. https://doi.org/10.1108/CDI-10-2012-0095.

Brown, S., Taylor, K., & Price, S. W. (2005). Debt and distress: Evaluating the psychological cost of credit. Journal of Economic Psychology, 26(5), 642–663. https://doi.org/10.1016/j.joep.2005.01.002.

Card, D., Kluve, J., & Weber, A. (2018). What works? A meta analysis of recent active labor market program evaluations. Journal of the European Economic Association, 16(3), 894–931. https://doi.org/10.1093/jeea/jvx028.

Chadi, A. (2014). Regional unemployment and norm-induced effects on life satisfaction. Empirical Economics, 46(3), 1111–1141. https://doi.org/10.1007/s00181-013-0712-7.

Chetty, R., & Szeidl, A. (2007). Consumption commitments and risk preferences. The Quarterly Journal of Economics, 122(2), 831–877. https://doi.org/10.1162/qjec.122.2.831.

Chetty, R., & Szeidl, A. (2016). Consumption commitments and habit formation. Econometrica, 84(2), 855–890. https://doi.org/10.3982/ECTA9390.

Clark, A., Etilé, F., Postel-Vinay, F., Senik, C., & Van der Straeten, K. (2005). Heterogeneity in reported well-being: evidence from twelve European countries. The Economic Journal, 115(502), C118–C132. https://doi.org/10.1111/j.0013-0133.2005.00983.x.

Clark, A., Knabe, A., & Rätzel, S. (2009). Unemployment as a social norm in Germany. Schmollers Jahrbuch, 129(2), 251–260.

Clark, A. E. (2003). Unemployment as a social norm: Psychological evidence from panel data. Journal of Labor Economics, 21(2), 323–351. https://doi.org/10.1086/345560.

Clark, A. E., D’Ambrosio, C., & Ghislandi, S. (2016). Adaptation to poverty in long-run panel data. The Review of Economics and Statistics, 98(3), 591–600. https://doi.org/10.1162/REST_a_00544.

Clark, A. E., Diener, E., Georgellis, Y., & Lucas, R. E. (2008). Lags and leads in life satisfaction: A test of the baseline hypothesis. The Economic Journal, 118(529), F222–F243. https://doi.org/10.1111/j.1468-0297.2008.02150.x.

Clark, A. E., & Georgellis, Y. (2013). Back to baseline in Britain: Adaptation in the British Household Panel Survey. Economica, 80(319), 496–512. https://doi.org/10.1111/ecca.12007.

Cullen, A., & Hodgetts, D. (2001). Unemployment as illness: An exploration of accounts voiced by the unemployed in Aotearoa/New Zealand. Analyses of Social Issues and Public Policy, 1(1), 33–51. https://doi.org/10.1111/1530-2415.00002.

Dardanoni, V., & Donni, P. L. (2012). Reporting heterogeneity in health: An extended latent class approach. Applied Economics Letters, 19(12), 1129–1133. https://doi.org/10.1080/13504851.2011.615728.

Darity, W., Jr., & Goldsmith, A. H. (1996). Social psychology, unemployment and macroeconomics. The Journal of Economic Perspectives, 10(1), 121–140.

Dolan, P., Peasgood, T., & White, M. (2008). Do we really know what makes us happy? A review of the economic literature on the factors associated with subjective well-being. Journal of Economic Psychology, 29(1), 94–122. https://doi.org/10.1016/j.joep.2007.09.001.

Easterlin, R. A. (1974). Does economic growth improve the human lot? Some empirical evidence. In R. David & M. Reder (Eds.), Nations and households in economic growth: Essays in honor of Moses Abramovitz (pp. 89–125). New York: Academic Press.

Easterlin, R. A. (2017). Paradox lost? Review of Behavioral Economics, 4(4), 311–339. https://doi.org/10.1561/105.00000068.

Edin, K. J., & Shaefer, H. L. (2015). $2.00 a day: Living on almost nothing in America. Boston: Houghton Mifflin Harcourt.

Falco, P., Maloney, W. F., Rijkers, B., & Sarrias, M. (2015). Heterogeneity in subjective wellbeing: An application to occupational allocation in Africa. Journal of Economic Behavior & Organization, 111(March), 137–153. https://doi.org/10.1016/j.jebo.2014.12.022.

Feist, G. J., Bodner, T. E., Jacobs, J. F., Miles, M., & Tan, V. (1995). Integrating top-down and bottom-up structural models of subjective well-being: A longitudinal investigation. Journal of Personality and Social Psychology, 68(1), 138–150. https://doi.org/10.1037/0022-3514.68.1.138.

Ferrer-i-Carbonell, A., & Frijters, P. (2004). How important is methodology for the estimates of the determinants of happiness? The Economic Journal, 114(497), 641–659. https://doi.org/10.1111/j.1468-0297.2004.00235.x.

Frey, B. S., & Stutzer, A. (2002). What can economists learn from happiness research? Journal of Economic Literature, 40(2), 402–435.

Gathergood, J. (2013). An instrumental variable approach to unemployment, psychological health and social norm effects. Health Economics, 22(6), 643–654. https://doi.org/10.1002/hec.2831.

Gielen, A. C., & Van Ours, J. C. (2014). Unhappiness and job finding. Economica, 81(323), 544–565. https://doi.org/10.1111/ecca.12089.

Gilbert, R., Murphy, N. A., Stepka, A., Barrett, M., & Worku, D. (2018). Would a basic income guarantee reduce the motivation to work? An analysis of labor responses in 16 trial programs. Basic Income Studies. https://doi.org/10.1515/bis-2018-0011.

Goldsmith, A. H., Veum, J. R., & Darity, W. Jr. (1996). The impact of labor force history on self-esteem and its component parts, anxiety, alienation and depression. Journal of Economic Psychology, 17(2), 183–220. https://doi.org/10.1016/0167-4870(96)00003-7.

Graham, C., Eggers, A., & Sukhtankar, S. (2004). Does happiness pay? An exploration based on panel data from Russia. Journal of Economic Behavior & Organization, 55(3), 319–342. https://doi.org/10.1016/j.jebo.2003.09.002.

Green, F. (2011). Unpacking the misery multiplier: How employability modifies the impacts of unemployment and job insecurity on life satisfaction and mental health. Journal of Health Economics, 30(2), 265–276. https://doi.org/10.1016/j.jhealeco.2010.12.005.

Haisken-DeNew, J. P., & Frick, J. R. (2005). Desktop companion to the German Socio-Economic Panel (GSOEP). Technical report. https://www.diw.de/documents/dokumentenarchiv/17/diw_01.c.38951.de/dtc.409713.pdf.

Hamermesh, D. S., Kawaguchi, D., & Lee, J. (2017). Does labor legislation benefit workers? Well-being after an hours reduction. Journal of the Japanese and International Economies, 44, 1–12. https://doi.org/10.1016/j.jjie.2017.02.003.

Hetschko, C. (2016). On the misery of losing self-employment. Small Business Economics, 47(2), 461–478. https://doi.org/10.1007/s11187-016-9730-0.

Hetschko, C., Knabe, A., & Schöb, R. (2014). Changing identity: Retiring from unemployment. The Economic Journal, 124(575), 149–166. https://doi.org/10.1111/ecoj.12046.

Jahoda, M. (1979). The impact of unemployment in the thirties and seventies. British Psychological Society Bulletin, 32, 309–314.

Kassenboehmer, S. C., & Haisken-DeNew, J. P. (2009). You’re fired! The causal negative effect of entry unemployment on life satisfaction. The Economic Journal, 119(536), 448–462. https://doi.org/10.1111/j.1468-0297.2008.02246.x.

Knabe, A., & Rätzel, S. (2011). Scarring or scaring? The psychological impact of past unemployment and future unemployment risk. Economica, 78(310), 283–293. https://doi.org/10.1111/j.1468-0335.2009.00816.x.

Knabe, A., Rätzel, S., Schöb, R., & Weimann, J. (2010). Dissatisfied with life but having a good day: Time-use and well-being of the unemployed. The Economic Journal, 120(547), 867–889. https://doi.org/10.1111/j.1468-0297.2009.02347.x.

Koenker, R. (2005). Quantile regression. Econometric society monographs. Cambridge: Cambridge University Press.

Krueger, A. B., & Mueller, A. I. (2012). The lot of the unemployed: A time use perspective. Journal of the European Economic Association, 10(4), 765–794. https://doi.org/10.1111/j.1542-4774.2012.01071.x.

Lane, R. E. (1992). Work as ‘disutility’ and money as ‘happiness’: Cultural origins of a basic market error. Journal of Socio-Economics, 21(1), 43–64.

Luo, J. (2017). Unemployment and unhappiness: The role of pecuniary factors. SSRN Scholarly Paper ID 2813844. Rochester, NY: Social Science Research Network. http://papers.ssrn.com/abstract=2813844.

Luo, J. (2018a). Unemployment and happiness adaptation: The role of the living standard. New York: Mimeo.

Luo, J. (2018b). Why is happiness adaptation to poverty limited?. New York: Mimeo.

Luo, J. (2019a). Is work a burden? The role of the living standard. New York: Mimeo.

Luo, J. (2019b). Income and happiness adaptation: The role of the living standard. New York: Mimeo.

Luttmer, E. F. P. (2005). Neighbors as negatives: Relative earnings and well-being. The Quarterly Journal of Economics, 120(3), 963–1002. https://doi.org/10.1093/qje/120.3.963.

McKee-Ryan, F., Song, Z., Wanberg, C. R., & Kinicki, A. J. (2005). Psychological and physical well-being during unemployment: A meta-analytic study. Journal of Applied Psychology, 90(1), 53–76. https://doi.org/10.1037/0021-9010.90.1.53.

O’Donnell, A. T., Corrigan, F., & Gallagher, S. (2015). The impact of anticipated stigma on psychological and physical health problems in the unemployed group. Frontiers in Psychology. https://doi.org/10.3389/fpsyg.2015.01263.

Powdthavee, N. (2010). How much does money really matter? Estimating the causal effects of income on happiness. Empirical Economics, 39(1), 77–92. https://doi.org/10.1007/s00181-009-0295-5.

Powdthavee, N. (2012). Jobless, friendless and broke: What happens to different areas of life before and after unemployment? Economica, 79(315), 557–575. https://doi.org/10.1111/j.1468-0335.2011.00905.x.

Powdthavee, N., & Stutzer, A. (2014). Economic approaches to understanding change in happiness. In K. M. Sheldon & R. E. Lucas (Eds.), Stability of happiness (pp. 219–244). San Diego: Academic Press. https://doi.org/10.1016/B978-0-12-411478-4.00011-4.

Sarrias, M. (2019). Do monetary subjective well-being evaluations vary across space? Comparing continuous and discrete spatial heterogeneity. Spatial Economic Analysis, 14(1), 53–87. https://doi.org/10.1080/17421772.2018.1485968.

Scheve, V., Christian, F. E., & Schupp, J. (2017). The emotional timeline of unemployment: Anticipation, reaction, and adaptation. Journal of Happiness Studies, 18(4), 1231–1254. https://doi.org/10.1007/s10902-016-9773-6.

Schiele, V., & Schmitz, H. (2016). Quantile treatment effects of job loss on health. Journal of Health Economics, 49(September), 59–69. https://doi.org/10.1016/j.jhealeco.2016.06.005.

Schwarz, N., & Strack, F. (1999). Reports of subjective well-being: Judgmental processes and their methodological implications. In D. Kahneman, E. Diener, & N. Schwarz (Eds.), Well-being: The foundations of hedonic psychology (pp. 61–84). New York, NY: Russell Sage Foundation.

Smith, S., & Razzell, P. (1975). The pools winners. London: Caliban Books.

Spencer, D. A. (2014). Conceptualising work in economics: Negating a disutility. Kyklos, 67(2), 280–294. https://doi.org/10.1111/kykl.12054.

Stutzer, A. (2004). The Role of income aspirations in individual happiness. Journal of Economic Behavior & Organization, 54(1), 89–109. https://doi.org/10.1016/j.jebo.2003.04.003.

Stutzer, A., & Frey, B. (2004). Reported subjective well-being: A challenge for economic theory and economic policy. Schmollers Jahrbuch: Journal of Applied Social Science Studies/Zeitschrift Für Wirtschafts- Und Sozialwissenschaften, 124(2), 191–231.

Van Hoorn, A., & Maseland, R. (2013). Does a protestant work ethic exist? Evidence from the well-being effect of unemployment. Journal of Economic Behavior & Organization, 91(July), 1–12. https://doi.org/10.1016/j.jebo.2013.03.038.

Wang, M. (2012). Health and fiscal and psychological well-being in retirement. In J. Hedge & W. Borman (Eds.), The Oxford handbook of work and aging (pp. 570–584). Oxford: Oxford University Press.

Wilson, W. J. (1996). When work disappears: The world of the new urban poor. New York: Knopf.

Wilson, W. J. (2012). The truly disadvantaged: The inner city, the underclass, and public policy. Chicago: University of Chicago Press.

Winkelmann, R. (2009). Unemployment, social capital, and subjective well-being. Journal of Happiness Studies, 10(4), 421–430. https://doi.org/10.1007/s10902-008-9097-2.

Winkelmann, R. (2014). Unemployment and happiness. IZA World of Labor. https://doi.org/10.15185/izawol.94.

Young, C. (2012). Losing a job: The nonpecuniary cost of unemployment in the United States. Social Forces, 91(2), 609–633.

Acknowledgements

I am indebted to Neel Rao for his helpful advice. I am grateful to the editors Talita Greyling and Stephanie Rossouw and two anonymous referees for valuable comments. I thank Alex Anas, Jinquan Gong, Zhiqiang Liu, and Peter Morgan for their suggestions. The data used in this publication, the German Socio-Economic Panel Study (SOEP), were made available by the German Institute for Economic Research (DIW), Berlin. I thank the people from DIW for their help in accessing and interpreting the data.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Definitions of the Variables

Appendix: Definitions of the Variables

Life Satisfaction: How satisfied are you with your life, all things considered? Please answer on a scale from 0 to 10. [0] for completely dissatisfied and [10] for completely satisfied.

Monthly Net Income: The net monthly income of all of the members of your household. In other words, the income after deductions for taxes and social security, including regular income such as pensions, housing allowances, child benefits, grants for higher education, maintenance payments, etc.

Minimum Required Income: What would you personally consider the minimum net household income to be that you would need in your current living situation? We are referring here to the net monthly income that your household would need to get by.

Financial/Environment Satisfaction: How satisfied are you today with the following areas of your life? Your household income/The environmental conditions in your area. [0] for completely dissatisfied and [10] for completely satisfied.

Economic/Environment Concerns: How concerned are you about the following issues? Your own economic situation/Environmental protection. [1] for very concerned, [2] for somewhat concerned, and [3] for not concerned at all.

Labor Income: What did you earn from your work last month? Please state your net income, which is your income after the deduction of taxes, social security, unemployment and health insurance.

Household Asset Income: Asset flows include income from interest, dividends, and rent.

What do you consider good or bad income in relation to your personal living conditions and living standards? In each case, please state your net household income per month: a very bad income; a bad income; a somewhat inadequate income; a barely adequate income; a good income; a very good income.

Rights and permissions

About this article

Cite this article

Luo, J. A Pecuniary Explanation for the Heterogeneous Effects of Unemployment on Happiness. J Happiness Stud 21, 2603–2628 (2020). https://doi.org/10.1007/s10902-019-00198-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-019-00198-4