Abstract

The standard of living reflected by one’s income and consumption is the primary explanation for the utility or satisfaction of the private consumer. However, empirical evidence very often demonstrates that the level of happiness is not necessarily higher for wealthy people in comparison to the poor. This holds within specific populations of a country, and in macro terms by comparison between the happiness of populations with low and high GDPppp per capita. Different research studies have used other economic and social explanatory variables for determining consumer happiness within countries. The present paper adds the new factor of income inequality that affects happiness. It is empirically proved that at extreme values of inequality measured by the Gini index, the effect of happiness is negative regardless of GDPppp per capita. However, at the intermediate ranges of the Gini index the effect of changes in the index on happiness is ambiguous. These results are found regardless of the actual values of GDPppp per capita.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent decades the study of happiness has been linked to economics. Although Easterlin (1974) was a pioneer in the field, not until 1990 did economists begin to contribute large-scale empirical analyses of the determinants of happiness in different countries and time periods. These studies defined various socioeconomic variables that influence the degree of one’s happiness such as personal income, inequality of income distribution, levels of healthcare and education, democracy, corruption, etc.

Since the beginning of the twentieth century, economists have developed a new understanding that utility should be considered and measured in terms of happiness. Research in the economics of happiness has established a systematic relationship between objective economic factors and reported well-being data. Economists have implemented subjective well-being data to investigate the following subjects: the income hypothesis (Easterlin 1974, 1995, 2001; Di Tella et al. 2003); the nonfinancial impacts of unemployment (Clark and Oswald 1994; Winkelmann and Winkelmann 1998); the relationship between happiness and economic growth (Kenny 1999); and the impacts of a political institution (Frey and Stutzer 2000). Happiness research adds considerable new insights to well-known theoretical propositions.

This paper examines the impacts of income, corruption, and democracy on self-reported well-being. However, our most important modification in this paper is in dealing with different aspects of inequality as a factor of happiness.

2 Literature Review

2.1 The Effects of Income

The following section begins with the literature review concerning the main variables that may affect happiness. It concludes with the literature that deals with the ambiguous effect of inequality on happiness.

Economists commonly accept that higher income leads to greater happiness. Empirical studies in many countries and in different cultures have consistently supported such an approach and demonstrated a positive correlation between higher income and greater happiness.

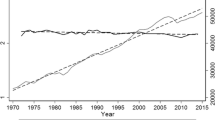

In his study, Easterlin (1974) finds that happiness is associated positively with higher incomes. Subsequent research appears consistent with Easterlin’s findings regarding the stagnant long-term relationship between happiness and real GDP in the United States (Easterlin 1995; Di Tella et al. 2003). According to the standard approach, increasing incomes should lead to increased utility but this simply does not necessarily occur. It can be explained with the introduction of income aspirations into utility. Income aspirations reflect the concerns of individuals for relative income and their adaptations to prior income levels (Easterlin 2001). Increasing the incomes of all individuals does not increase their happiness. This is due to the fact that material norms, which are the basis for self-assessment of well-being, increase in the same proportion as actual societal income. Thus, simultaneously increasing income for all individuals may lead to unchanged satisfaction for everyone. Easterlin’s empirical contribution is also supported by research studies that show for various populations and time periods that there is a strong correlation between favorable self-comparison of one’s income with other income levels, and higher reported well-being, while absolute income remains constant (see Van de Stadt et al. 1985; Tomes 1986; Clark and Oswald 1998, among others).

A general increase in income raises the societal average over time, so that the anticipated increase in happiness is offset by a decrease resulting from the higher average income. As a result, there is no net growth in the sense of well-being among individuals.

2.2 The Effects of Democracy

Does democracy result in greater economic prosperity and growth and as a result in satisfaction and happiness? It is unclear whether democracy in itself actually leads to increased economic growth as compared with other forms of government. Some arguments concerning the impact of democracy on economic growth include the fear of populist demands (Huntington 1968), excessive redistribution which may become detrimental for growth (Persson and Tabellini 1994), and agency problems between people and politicians (Buchanan and Gordon 1962).

In contrast, other assertions have been made with respect to the positive effect of democracy on economic growth. For example, based upon redistribution arguments, tax revenues subsidize education (Saint-Paul and Verdier 1993; Bourguignon and Verdier 2000) and improve capital market imperfections (Galor and Zeira 1993).

In addition, democracy can increase efficiency and reduce transaction costs, commitment constraints, and information asymmetries of political organization (Olson 1993; Sen 1999). Democracy can also increase economic growth with its positive impact on political stability and democratic institutions (Alesina and Perotti 1996; Acemoglu et al. 2005).

Based on cross-country analysis, empirical studies have indicated negligible effects of democracy on economic growth (Helliwell 1994; Barro 1996; Tavares and Wacziarg 2001). However, more recent panel data based research has demonstrated more significant effects (Rodrik and Romain 2005; Papaioannou and Gregorios 2008; Persson and Tabellini 2009). Acemoglu et al. (2014) show that democracy has a strong positive effect on GDP. Pozuelo et al. (2016) challenge recent findings that democracy has substantial impacts on economic growth and distinguish among different factors that may encourage or discourage the positive relationship between democracy and growth.

2.3 The Effect of Corruption on Happiness

Corruption involves unlawful behavior of public officials who misuse their power for the purpose of personal gain (Sandholtz and Koetzele 2000). A common indicator of government performance is the level of corruption (see Anderson and Tverdova 2003; Gerring et al. 2005; Warren 2004). Government performance may also affect individual well-being.

Personal experience with corruption is likely to have a negative effect on an individual’s well-being. People are unhappy when they are exposed to corruption (Chrikov and Ryan 2001; Ryan and Deci 2001). Corruption can also reduce subjective well-being due to increased crime and inequality (Montinola and Jackman 2002; Rose-Ackerman 1999). Economic and social cost may further decrease the ability of individuals to exercise competencies, pursue personal interests, and maintain relationships to satisfy their psychological needs (Ryan and Deci 2001, p. 153).

Corruption can have a negative impact on subjective well-being by weakening democratic political processes. Corruption substantially harms accountability, equality, and openness of democracies. It decreases the power of citizens to impact government decision-making through democratic participation (Dahl 1971; Warren 2004). When government decision-making is influenced by special interests instead of those of the people, it is likely to bring about feelings of exclusion and alienation (Warren 2004).

What are the effects of changes in the extent of corruption, and how are they evaluated? Empirical research (e.g. Lambsdorff 1999) has found that corruption affects various economic indicators, including among them government expenditures, total investment, capital flows and foreign direct investment, international trade, foreign aid and GDP per capita. Per capita GDP can be viewed as a measure including several economic effects of corruption. It likely reflects the welfare costs of corruption only in a rough and incomplete manner. The article of Welsch (2008) offers another approach to investigating the welfare effects of corruption. Following a growing literature in economics (Frey and Stutzer 2002), it uses self-rated subjective well-being (“happiness,” life satisfaction) elicited in surveys as an empirical approximation to general welfare and examines various ways in which welfare is affected by corruption. Since subjective well-being (SWB) prevailing in a country is linked to average income (Di Tella et al. 2003; Hagerty and Veenhoven 2003), one way in which corruption affects SWB involves the effect of corruption on per capita GDP. As noted by Lambsdorff (2003), corruption includes many kinds of behavior.

2.4 An Ambiguous Relationship Between Inequality or Equality of Income in a Country and its Economic Growth

In recent decades there has been great interest in the effect of income inequality on economic performance. However, the research has not yet formed a general position regarding the sign of the income inequality—economic growth relationship. There is a disparity in the results, both in empirical and theoretical studies. The investigation of a connection between income inequality and economic growth began with Kuznets (1955). He proposes that per capita incomes and inequality have an inverted U-shaped relationship. Following Kuznets (1955) various approaches regarding the relationship between income inequality and economic growth were developed. Some indicate a negative relationship, while others show a positive relationship, a sign-changing nonlinear relationship without any correlation, or inconclusive evidence of a correlation.

Many studies find a negative relationship between income inequality and growth (Alesina and Rodrik 1994; Clarke 1995; Persson and Tabellini 1994; De la Croix and Doepke 2003; Josten 2004; Castelló-Climent 2004). Knowles (2005) shows a significant negative correlation between inequality and economic growth within various developing countries. Pede et al. (2009) examine the connection between employment growth and family income inequality.

Additional research suggests a positive relationship between income inequality and growth (Partridge 1997; Forbes 2000; Li and Zou 1998). Nahum (2005) also finds evidence of a positive impact of initial income inequality on annual income.

Davis (2007) offers a way to consistently interpret and explain both a negative and a positive relationship. Using a simple model, he finds a negative relationship in the cross-country data, while the opposite is found within countries over time.

Other studies show sign-changing nonlinear relationships (Barro 2000; Banerjee and Duflo 2003; Pagano 2004; Voitchovsky 2005). Bengoa and Sanchez-Robles (2005) provide some empirical evidence of the relationship between equality and growth. Two different kinds of countries are studied using panel data. They include medium and high-income countries. In the medium-income countries, the relationship between equality that is measured by the Gini index and growth seems to have an inverted U-shape. In the high-income countries, it is clearly negative so that increased equality is detrimental for growth. Barro (2008) extends the work of Barro (2000). He finds a direct positive effect of international openness on income inequality. The effect of inequality on growth decreases as per capita GDP increases and may be positive for the richest countries. Castelló-Climent (2010) examines the effect of income and human capital inequality on economic growth in different regions. In the entire sample and in the low and middle-income economies, the effect of income and human capital inequality on economic growth is negative while in the higher-income countries the effect either disappears or becomes positive.

Other research finds no correlation or inconclusive evidence of a correlation (Dollar and Kray 2000; Deininger and Squire 1996; Ghura et al. 2002; Lee and Roemer 1998). Panizza (2002) uses a cross-state panel for the United States to investigate the relationship between inequality and growth. He does not find a positive relationship between the two but does find some evidence of a negative relationship. He also demonstrates that small differences in the method of measuring inequality can bring about substantial differences in the estimated relationship between inequality and growth.

2.5 An Ambiguous Relationship Between Inequality of Income in a Country and the Degree of Happiness or Satisfaction Among its Population

The empirical research concerning the connection between income inequality and happiness or subjective well-being focuses on cross-city comparisons (Hagerty 2000), cross-state comparisons (Alesina et al. 2004), or cross-national comparisons (Berg and Veenhoven 2010; Helliwell and Huang 2008). The studies are inconclusive. Some research finds a negative relation between income inequality and happiness, so that a high level of inequality decreases happiness (Alesina et al. 2004; Fahey and Smyth 2004; Oshio and Miki 2010; Schwarze and Härpfer 2007; Verme 2011; Xiaogang and Jun 2013). Oishi et al. (2011) find a negative association between income inequality and happiness among lower-income respondents. They explain this inverse relation by perceived unfairness and mistrust. Oishi et al. (2011) use time serial data sets in the United States, showing that on average Americans are happier during the years in which the level of national income inequality is lower than during the years in which it is higher. It is explained by the association between fairness and equality.

However, additional empirical findings show an insignificant or even a positive relationship between income inequality and happiness (Berg and Veenhoven 2010; Senik 2004; Graham and Felton 2006; Ohtake and Tomioka 2004; Clark 2003). Knight and Ramani (2010) demonstrate that rural residents in China tend to be happier in counties with higher Gini coefficients than in counties with lower Gini coefficients. Jiang et al. (2012) find that in urban China inequality, which is measured by city-level Gini coefficients, positively correlates with happiness.

The Economist, a popular non-academic publication, published an article entitled, “I dream of Gini” on October 12, 2011. The article states that “…the happiness gap (between the least and the most satisfied) seems to have a weak relationship with income inequality, as measured by Gini coefficient. That is odd. Since many people automatically assume that inequality leads to misery.”

The economic psychology literature includes two main contradictory theories regarding the relationship between inequality and life satisfaction.

According to their tunnel theory, Hirschman and Rothschild (1973) argue that in developing countries inequality increases life satisfaction. Some empirical studies support this theory in developed countries as well (Clark et al. 2009). However, new empirical findings concerning developed countries (FitzRoy et al. 2014) show a slightly different trend among young people as compared to adults. (Inequality increases life satisfaction among young people and decreases it among adults.) In contrast to the tunnel theory, theories of relative deprivation argue that inequality decreases life satisfaction (Stouffer et al. 1949; Runciman 1966).

Apart from the lack of clarity regarding the relationship between inequality and life satisfaction, the type of inequality and its impact on life satisfaction are also unclear. Studies of relative deprivation theory claim that relative deprivation increases with the Gini coefficient of inequality (Yitzhaki 1979; Solnick and Hemenway 1998), although given the relative deprivation theory it is reasonable to assume that life satisfaction will increase with increasing inequality among individuals who are not poor (Dittmann and Goebel 2010).

Nevertheless, experimental evidence shows that inequality is experienced both by the wealthy and the poor (Fehr and Schmidt 1999: Graham and Felton 2006; Ferrer-i-Carbonell and Ramos 2014; Layte 2012; Delhey and Dragolov 2014). This might be the reason that the research does not clearly state whether inequality increases or decreases life satisfaction (Verme 2011).

Regarding the type of inequality that affects satisfaction, the significant question is whether inequality is important due to its effects on crime, social gaps etc. or whether it is important in itself (Thurow 1971). In the latter case, inequality would decrease life satisfaction (Knies 2012; Ferrer-i-Carbonell and Ramos 2014). The results of cross-sectional studies over time indicate that populations with more equally distributed incomes are more satisfied (Oishi et al. 2011; Van Deurzen et al. 2015). Such studies, however, have certain limitations and cannot, for example, track the same individual’s life satisfaction.

The major claim in theories of distributive justice is that there is a long-run level of inequality, which is referred to as “normal” (Homans 1974; Lerner 1982; Jost et al. 2004). Empirical studies regarding distributive justice theories are unclear regarding the ways in which inequality affects life satisfaction (Alesina et al. 2004; Wilkinson and Pickett 2009, 2010; Schwarze and Härpfer 2007; Ferrer-i-Carbonell and Ramos 2014).

In his recent study, Schröder (2016) compares differences in happiness among Germans during times of high and low levels of income inequality. The results show that short-term increases in inequality decrease life satisfaction, but long-run levels of inequality do not. This study suggests that “people get used to long-run inequality, so that short-run increases in inequality, rather than long-run levels of inequality, make people unsatisfied with life. This may explain why populations of countries with persistently high inequality are as satisfied with life as populations of more equal countries, even though the same individual is less satisfied with life in those years in which inequality is above-average” (Schröder 2016, p. 1).

3 Extension of the Epstein and Spiegel Approach

The approach introduced and examined above regarding the relationship among fairness, income inequality, and satisfaction or happiness is a little more complex. During the last four decades, many researchers have theoretically discussed and empirically investigated the issue of whether inequality may affect happiness.

The basic presumption in most of their research is that on average a higher degree of inequality leads to decreased happiness in the population due to the sense of an unfair distribution of the pie, in private as well as national terms (e.g. recent papers of Xiaogang and Jun 2013; Oishi et al. 2011). However, these findings that have been revealed for decades suggest ambiguous results, such that a necessary and significant negative correlation between happiness and inequality is not found. Moreover, the findings also show that with full equality in income, happiness is at a low level due to the subjective feeling that full equality is unfair. This leads us to the conclusion that the real and more reliable relationship between these two variables of happiness and inequality should be modified.

Our basic theorem states that at a certain degree of inequality measured by the Gini coefficient, the values of Gini should define neither a positive nor a negative effect of inequality on happiness. This is due to the fact that human beings are aware of the varying contributions of individuals that should be rewarded with differing incomes, salaries, or profits sharing. However, the ambiguous effect at some intermediate ranges of the Gini coefficient does not hold for extreme Gini values, whether for those that are too small, representing “too great a degree of equality,” or for those that are too large, representing a low degree of equality. In these ranges, approaching further extreme values of the Gini coefficients leads to a significant decrease in the measurement of happiness for society as a whole.

Our empirical findings using values of GDPppp, Gini, Democracy, and Corruption of Countries, validate our basic theoretical presumption, at least for large values of Gini. Moreover, at the turning point of Gini = 0.5, instead of an ambiguous effect of Gini on happiness, a negative and robust relationship is found.

These empirical results bring to mind an earlier theoretical paper of Epstein and Spiegel (2001), (hereinafter referred to as “E.S.”). In that paper they argue that certain extreme levels of Gini coefficient values, in which the levels of inequality approach Gini levels of 0.1, 0.2 and below, represent degrees of inequality that are too low. This generates a sense of unfair equality. On the other hand, another extreme occurs if the Gini approaches high values of 0.6, 0.7 and above, towards 1. This generates the opposite sense of unfairness regarding a high level of inequality. While in the micro context, E.S. discuss inequality in income among workers within a private company and its effect on the growth and productivity of the firm, our paper extends their idea towards the macro effect of inequality on happiness within a society. Let us emphasize this point more precisely.

The economic environment researched in the E.S. article is an environment of microeconomic analysis. The question that arises is whether and to what extent the level of inequality among groups of workers in the microeconomic context is desirable, acceptable, and represents fair reward for contribution. Factors such as effort, knowledge, expertise, etc. appear to justify unequal reward. Individuals are aware that such abilities and other characteristics are not identical. Therefore their contributions to the production and size of the national pie are different. While in every society individuals expect rewards that appropriately match their contributions, the distribution of income or reward that is either too small or too large may possibly reveal unfair and unjustified differences. Thus at extreme Gini values the effect on satisfaction or happiness is negative. The hypothesis raised in the E.S. article is that when the inequality between rewards and contributions is justified, it leads in the microeconomic context to higher productivity and efficiency among all the economic agents, workers as well as managers, due to their greater sense of commitment and loyalty to the firm.

In our present article we intend to implement these principles of E.S. in the macroeconomic perspective of the national context. The questions are: (1) whether the microeconomic perspective with respect to an individual firm also exists in the national perspective of inequality within the entire population including several income groups; (2) whether and in which direction the satisfaction or national happiness reacts accordingly, not only to the level of the real national product per capita, but also to the level and influence of national inequality in distribution of incomes among all population groups. In our case, an interesting fact also becomes apparent in the macroeconomic analysis. It shows that although according to the literature review presented above, inequality unambiguously creates either a positive or negative effect on satisfaction, our present research indicates two contradictory effects. In extreme situations of substantial equality or inequality and in approaching even more extreme positions, the level of happiness decreases. However, this is not the case at moderate levels of inequality, in which the association between inequality and satisfaction is actually ambiguous.

This paper emphasizes several additional new considerations. The significant difference between E.S. and our current work is that within the workplace environment the diversification among rewards is more likely to influence the productivity and efforts of workers. In an intimate and more often geographically isolated location, workers are more aware and informed not only of the discernible efforts, professional contributions, seniority, and experience of their colleagues, but also of their rewards. These rewards are expressed in terms of salary, profits, and other kinds of compensation.

The question arises whether these kinds of effects are evident in the macro environment, in which people are geographically very distant from each other. In urban and in rural neighbourhoods they are more anonymous and do not know very much about the skills and rewards of either their neighbours or other residents in their country. Individuals are aware, however, of diversified standards of living indicated by the size of a house, the quality of a car, education provided for children, health services, etc. Individuals who are not economists may generally not be familiar with the Gini coefficient or how it is measured, but they may evaluate how they live in comparison to other residents in the country. The information regarding standard of living that individuals may obtain from radio or television networks, newspapers or other written media, etc., has a great deal of influence on their morale and happiness. Our hypothesis is that the extremely high levels of either equality or inequality are associated negatively with happiness. While in E.S. the model discusses only a theoretical and conceptual relationship, in this paper we also incorporate an empirical discussion and results that prove our hypothesis and confirm our current theoretical framework of different effects of extreme and intermediate levels of inequality.

4 Theoretical Model

The basic model of the classical economists was introduced during the twentieth century as a fundamental statement accepted by most economists: Each private consumer has a utility that is a function of a consumed bundle. Higher income levels allows for larger, more diversified, and richer bundles, so that consumers gain a higher utility or satisfaction. As mentioned in the Introduction, only during the 1970’s were some reservations introduced, stating that happiness or well-being is not necessarily affected by more since more is better, but that it depends on various other factors that lead to more happiness.

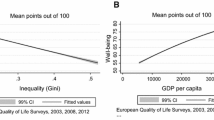

The basic new concept differentiates between more satisfaction and the degree of happiness. This can be interpreted from defining different standards of living due to GDPppp per capita and finding that it provides only a partial explanation for happiness. Several additional elements may influence and contribute to the consumer’s sense of happiness. Included among them are social support, healthy life expectancy, freedom to make life choices, generosity, and perceptions of corruption. These elements do not include inequality. See the World Happiness Report (WHR) 2016, p. 20, Ranking of Happiness 2013–2015 (Part 1). Moreover, by taking the regression of Happiness as a function solely of GDPppp per capita for all countries, the results are not as robust as those found by adding other factors such as inequality.

Thus the present study also looks for additional factors that contribute to happiness. Absolute income does not necessarily affect the well-being of the private consumer positively, and very often well-being is affected by one’s income relative to the surrounding community (e.g., relative income level as described by Duesenberry 1949). Therefore, the present study includes another factor, the variance of incomes in a given society, as measured by the Gini coefficient of societies.

The basic prediction is defined as:

Happiness = f (GDPppp per capita, Gini, Corruption Perceptions Index, Democracy Index).

The dependent variable, happiness, is indeed affected positively by GDPppp per capita, and by Gini. However several other factors should also be considered.

The signs of each independent variable are as follows:

Up to a certain level of GDPppp per capita, any increase allows for a higher level of happiness. As GDPppp per capita is higher, the basic necessities of food, clothing, and shelter can be attained, and thus the individual’s sense of well-being increases. Other factors such as better education, higher quality of health, more efficient public transportation, etc., continue the positive effect of a higher standard of living and happiness. This positive upward trajectory of GDPppp per capita may become less significant at very high levels of GDPppp per capita.

With respect to the Gini coefficient, the effect on Happiness is more complicated, since it depends on different ranges of the Gini values. It is clear that Gini coefficient levels represent different income distributions. At very low values of Gini, the distribution of rewards among all individuals is also very close and too close to equal. This most likely does not reflect a good match between the real contributions of individuals and their appropriate rewards. The same is true when Gini values are too high and closer to one. Then the rewards of wealthy individuals are also too high in comparison to their contributions, and in some sense “unfair” relative to their real efforts. The intermediate ranges of Gini are acceptable to the public and therefore one may expect a positive or no effect of Gini on happiness. In general, the sign of the Gini coefficient on Happiness may be ambiguous. This is illustrated in Fig. 1.

A simple linear regression can take all countries with certain values of Gini, but then the curve slope has only one value. The question to consider is whether all three ranges and the approximate borders between them can be defined. As shown in the next empirical statistical section, Range 1 is unachievable since the actual lowest Gini levels of countries are not less than 0.25. This range of Gini values does not exist in the data sets found for the countries. Thus Range 1 does not actually exist. However, the other two ranges of intermediate and high levels of Gini can be estimated and support the present hypothesis. At very high levels of the Gini coefficient, Happiness is indeed affected negatively by Gini, while the effect is ambiguous in an intermediate range.

5 An Empirical Analysis: Data Sources and Methods

5.1 Data

This section seeks to investigate the basic question raised earlier regarding the influences of standard of living and inequality growth on the happiness of a population in various countries.

For this purpose, the following database has been collected from these sources:

-

1.

Gross domestic product per capita in purchasing power parity (GDPppp) is based on the 2014 database. In several cases for which the data are unavailable, the data for the closest year are used instead.

The sources are:

-

The World Bank National Accounts Data, and OECD National Accounts data files—GDP per capita (current US$)

-

Quandl Database Economic Data—GDP By Country; GDP Per Capita By Country; GDP Per Capita at PPP By Country

-

The Central Intelligence Agency (CIA)—Country Comparison: GDP Per Capita (PPP)

-

Knoema Data repository—GDP per Capita by Country 1980–2014

-

IndexMundi—Economy—GDP-per capita (PPP)—Country Comparison

-

StatisticsTimes.Com—List of Countries by GDP (nominal) per capita 2014 Source: International Monetary Fund World Economic Outlook (April-2015)

-

-

2.

The Gini coefficient used is for the year 2013 unless a specific value for this year is missing and approximated data for the year 2011 or 2012, are used instead.

The source for the Gini coefficient is found primarily at:

-

World Bank, Development Research Group—GINI index

-

The Central Intelligence Agency (CIA)—Country Comparison: Distribution of Family Income—Gini Index

-

United Nations Development Program—Human development report (HDR)—Income Gini coefficient

-

Quandl Database Economic Data—Gini Index By Country

-

The Organization for Economic Co-operation and Development (OECD)—OECD Income Distribution Database (IDD): Gini

-

-

3.

The degree of happiness for each country relates to the years 2012–2014.

The source for the dependent variable of the degree of happiness is:

-

World Happiness Report (WHR) 2015.

In considering the increase of happiness, a very important aspect is the measurement of the happiness of individuals, both within and across societies.

The World Happiness Report is published by the United Nations Sustainable Development Solutions Network. It provides an overall picture of world happiness in the first decade of the twenty-first century, by using measures of subjective well-being that best reflect how people rate the quality of their lives.

-

-

4.

The Corruption Perceptions Index (CPI) relates to the year 2013.

The source for the dependent variable of the CPI is:

-

Transparency International the global coalition against corruption.

The CPI ranks countries and territories based on the extent to which their public sector is perceived as corrupt. A country or territory’s score indicates the perceived level of public sector corruption on a scale of 0–100, where 0 indicates that a country is perceived as “highly corrup” and 100 indicates that it is perceived as “very clea”. A country’s rank indicates its position relative to the other countries and territories included in the index.

-

-

5.

Democracy Index for the year 2013.

The source for the dependent variable of the Democracy Index of 2013 is:

-

The Economist Intelligence Unit’s Democracy Index 2015.

The Economist Intelligence Unit’s Democracy Index describes the state of democracy worldwide for 165 independent states and two territories. It includes almost the entire population and the majority of the states in the world, excluding micro-states. The Democracy Index examines five categories: electoral process and pluralism, civil liberties, the functioning of government, political participation, and political culture. Based on their scores on a range of indicators within these categories, each country is categorized as one of four types of regimes: full democracies, flawed democracies, hybrid regimes, and authoritarian regimes.

-

We collected variables for the available values of 162 countries. However, for 23 countries some values were missing. Therefore, the present statistical work is based only on 139 countries for which all values were available. Those countries can be divided into 41 developed countries and 98 developing countries. Based on this data set a statistical package SPSS 22 was used to analyze the relationship between the independent (explanatory) variables, GDPppp per capita (referred to herein as GDPppp), CPI, Democracy and Gini index (Gini), Corruption Perceptions Index, Democracy Index and the dependent variable, Happiness, H.

5.2 Analytical Model

In order to test the research hypotheses the following econometric models are estimated:

where the dependent variable, H, represents Happiness, and the explanatory independent variable is GDP PPP . In this case a positive relationship is expected between Happiness and GDPppp. Another possibility is to examine the relationships between Happiness as a dependent variable and GDP PPP , and the Gini coefficient as two independent variables.

Initially all 139 countries are treated as one block of countries. In this case a positive relation is expected between Happiness and GDP PPP , while the effect of Gini is negative. A further extension is described below:

where the dependent variable, H, represents Happiness, and the explanatory independent variables are GDP PPP , the CPI, Democracy and the Gini coefficient.

Initially all 139 countries are treated as one block of countries. The regression is between the four independent variables, GDPppp per capita, the CPI, Democracy and Gini, and the dependent variable, Happiness.

A significant improvement is expected in the production of Happiness with respect to the four independent variables. A positive relation of Happiness is expected with GDP PPP and with Democracy, while a negative relation is anticipated with respect to the CPI and Gini.

6 Results

6.1 Descriptive Statistics

This section provides descriptive statistics of the sample variables.

Table 1 summarizes the data set distribution in terms of Mean, Standard Deviation, and Size (n) of all the variables.

Table 2 introduces the ratio between Happiness and GDPPPP for all countries and for each group of developed and developing countries.

Table 2 indicates a significant difference between developed and developing countries regarding the influence of GDPppp and Happiness. According to the independent t test, the average level of Happiness per dollar GDPppp in developed countries is lower than in developing countries, t(137) = 6.41 p < 0.001.

Moreover, in the developed countries, one finds higher homogeneity of Happiness per GDP than in the developing countries, F(41,96), p < 0.0001, despite the fact that for both groups of countries a positive relationship exists between total Happiness and GDPppp.

The Z test, that examines the correlation between the dependent and the independent variables, indicates a larger and more powerful connection in the developed countries in comparison to the developing countries, Z = 3.33, p < 0.001.

The study also investigates the contribution of the Gini index to Happiness in addition to the GDPppp variable. For this purpose the sample of 139 countries is divided into categorical groups.

Table 3 shows the degree of Happiness in countries, depending on the Gini index and the GDPppp per capita, which were converted into categorical variables. The Gini index is divided into two groups. Group 1 represents the countries in which the value of the Gini index is in the intermediate range of \(0.25 \le {\text{Gini}} \le 0.48\). Group 2 represents the countries in which the Gini index is higher than 0.48. The region of low Gini in which \({\text{Gini}} \le 0.25\) does not exist in these data sets.

The GDPppp per capita index was converted into categorical variables from Group 1 to Group 3. Group 1 represents the countries in which the GDPppp per capita is low, below $6000. Group 2 represents the countries in which the GDPppp per capita is intermediate, $6000 \(\le\) GDPppp \(\le\) $20,000.

Group 3 represents the countries in which the GDPppp per capita is high, above $20,000.

By using the data set for the Gini variable, the following values are found.

F (1,132) = 7.03, p < 0.05 and η Squared = 0.05. For the GDPppp per capita variable the values are F (2,132) = 36.69, p < 0.01 and η Squared = 0.36.

The main conclusion from the above is that by increasing the Gini coefficient the positive effect of GDPppp per capita on Happiness increases. The contribution of GDPppp per capita on the explained variance is more than 36% while the contribution of Gini itself added a very limited value of only 5%.

6.2 Regression Estimate

6.2.1 The Entire Sample

This section provides an analysis of a hierarchical regression between Happiness as a dependent variable and the independent variables.

First a hierarchical regression between Happiness and the two explanatory variables of Gini and GDPppp per capita is examined (see Table 4 below). Then the two independent variables, CPI and Democracy index, are also added.

In the regression between H and the variables, GDPppp per capita and Gini, a positive relationship is revealed with both of them. In the first stage of the regression, 49% of the explained variance is related to GDPppp per capita, while in the second stage of the regression the Gini coefficient adds an additional explanation of only 1%.

The Gini coefficient does not contribute significantly to the Happiness level when the only two independent variables are GDPppp and Gini. Moreover, the positive sign of the Gini index coefficient indicates that more Happiness is generated by a higher degree of inequality. This seems doubtful. Therefore, another two new explanatory independent variables, CPI measure and Democracy index, are added to the two-stage hierarchic regression. The results are presented in Table 5.

In the regression between H and the variables GDPppp per capita, CPI, Democracy and Gini, a positive relationship is revealed with the variables GDPppp per capita and Democracy. In the first stage of the regression, 59.3% of the explained variance is related to them, while in the second stage of the regression an additional explanation of only 0.6% is added by Gini. By implementing the two independent variables, the \(R^{2}\) value significantly increases from 0.5 to 0.599.

However, in both Tables 4 and 5 we find that the Gini coefficient still has a very small effect (or even no impact at all) on the Happiness of countries. These results require further investigation: Perhaps the data regarding the Gini coefficient factor should be used differently. The use of a simple linear regression of Gini as an independent variable possibly leads to the ambiguous effect of Gini on Happiness. In the study, the distribution of the Gini values of countries was therefore divided into three distinct groups. Actually only the two groups of the high and intermediate Gini index are relevant since the low Gini value of Gini <0.25 does not exist in the sample.

We suggest that the reason for the poor results of the regression could be the fact that the sign related to the Gini effect on H is indeed ambiguous and might change in different ranges. At certain high values Gini influences H negatively, especially at extreme values of Gini that are either too small or too large. At some intermediate ranges of Gini values, its effect on H is expected to be either positive or ambiguous. The region of low Gini (where \({\text{Gini}} \le 0.25\)) does not exist in the data set.

However, one might expect according to the present approach that if these values really did exist, then by lowering Gini, Happiness would also be reduced. The effect of lowering the Gini coefficient might lead to a reduction of Happiness since it reflects sharing of rewards that is too equal. This possibility reflects a lack of matching between contributions and rewards that individuals would expect.

Examination of the data demonstrates that the relationship between the Gini index and Happiness is not straight and positive linear. The Gini index value of 0.48 is the turning point at which a negative correlation between Gini and Happiness later occurs. It is impossible to know the pattern of connections between the Gini index and Happiness, since Gini indices are extremely low (Gini values < 0.25). No country with low Gini is found in the database.

6.2.2 High and Intermediate Gini Index

A different technique is used to find a better and more reliable relationship between Happiness and the independent variables.

All 139 countries were categorized into three cells:

-

a.

68 countries have intermediate Gini (less than 0.48) and low and intermediate GDPppp per capita (less than $20,000).

-

b.

46 countries contain intermediate Gini and high GDPppp per capita.

-

c.

The 20 remaining countries have high Gini and low and intermediate GDPppp per capita.

Equations (4)–(6) below show the three regression equations: group (a) with intermediate Gini and low GDPppp per capita, group (b) with intermediate Gini and high GDPppp per capita, and group (c) with high Gini and low GDPppp per capita.

Three separate hierarchical linear regressions were conducted: the first for countries with intermediate Gini and intermediate GDPppp per capita values; the second for countries with intermediate Gini and high GDPppp per capita values; and the third for countries with high Gini and low GDPppp per capita values. In the first step of each of the regressions, only GDPppp per capita, CPI and Democracy variables were included as explanatory variables, while in the second step the Gini index was added to the other variables. Table 6 shows the improved results:

Based on Table 6, the following summarizes the results of the regressions for the three groups:

6.2.2.1 Group 1

The table shows the following for countries which have intermediate Gini and intermediate GDPppp per capita:

-

1.

31.7% of the variance found is explained by the four variables.

-

2.

CPI and Democracy are found to be not significantly related to happiness.

-

3.

The Gini index is found to be not significantly related to happiness.

-

4.

A significant and positive correlation is found for the GDPppp per capita index. This means that when the GNP is higher, so is the degree of happiness.

6.2.2.2 Group 2

The table shows the following for countries which have intermediate Gini and high GDPppp per capita:

-

1.

58.4% of the variance found is explained by the four variables.

Using only the three variables (GDPppp per capita, CPI and Democracy) and ignoring Gini explains 57.3% of the variability in Happiness.

-

2.

The Gini index is found to be not significantly related to happiness.

-

3.

A significant positive correlation is found for GDPppp per capita and Democracy. As the GDPppp per capita or Democracy is higher, so is the degree of Happiness.

6.2.2.3 Group 3

The table shows that the following results are obtained for countries which have high Gini and low GDPppp per capita:

-

1.

63.6% of the variance found is explained by the four variables.

-

2.

Using only the three variables and ignoring Gini explains 49.8% of the variance in Happiness. In contrast to the previous two groups of countries, in this group the Gini index adds another 13.8% of the explained variance.

-

3.

The Gini index is found to be negatively related to Happiness. In these countries, the higher the degree of inequality, the lower the degree of Happiness among their populations. Individuals are not tolerant of inequality at extremely high values of Gini.

-

4.

A significant positive correlation is found for GDPppp per capita. As the GDPppp per capita is higher, so is the degree of Happiness.

-

5.

A negative and significant correlation is found between levels of CPI and Happiness, and no significant correlation is found between levels of Democracy and Happiness.

7 Conclusions

Most classical economists recognize that individual happiness is influenced by a higher standard of living that is based on income and other factors of human well-being, including among them medical conditions, health services, education, etc. However, many macroeconomists question whether the same conclusions can be reached regarding the happiness of nations. As the average GDPppp per capita rises in real terms within a population, does the degree of happiness also increase? Moreover, even if individuals are happier in developed countries with higher GDPppp per capita, how much happier are they than individuals in developing countries? Researchers have also investigated which other factors may positively impact happiness when it is clear, after all, that the primary contribution to happiness is the average GDPppp per capita. While the research uses GDPppp national averages, it should also use another factor indicating its distribution in relation to the average. Does this distribution indicate a small or a large deviation from the average? Simply stated, how does the Gini coefficient affect the happiness of the entire population within each country?

This is the focus of the current paper that accepts the fundamental classical statement that GDPppp per capita is the most important and relevant factor positively affecting happiness. Nevertheless, the additional factor of inequality that is measured by the Gini coefficient should also be considered. The basic a priori hypothesis is that inequality at too high a level may reduce happiness since the majority of people are envious of others when comparing their relative incomes to those of the few very wealthy individuals in a population. However, the same argument may be applied to the other extreme case in which a deviation of incomes is too small when the Gini coefficient is low. This can also indicate insufficient matching between reward and contribution within the population. Thus the degree of happiness may again be low.

Clearly, inequality as an explanatory factor of happiness may generally lead to ambiguous results. This is probably a reason that the Gini coefficient has not been considered in earlier studies. The present research considers it as long as the Gini values are not divided into different ranges. Upon distinguishing between intermediate and high ranges of Gini, more significant effects of inequality on happiness are identified for the countries. Furthermore, in different ranges the effects change signs and sizes, thereby leading to the basic conclusions presented by Epstein and Spiegel (2001) in the micro context of a negative relationship between inequality and productivity in a firm. These negative relationships are applied in this paper to the macro context of the inequality of a nation’s income and the degree of happiness. The primary important conclusions are presented below:

-

a.

The measure of GDPppp per capita is the most important factor positively and significantly affecting the degree of happiness within any population.

-

b.

The positive effect of the factor of GDPppp per capita is stronger in developing countries, in which the levels of GDPppp per capita are lower than the intermediate or high values found in developed countries. These results are found by using regressions for groups of countries in the sample rather than for individual countries.

-

c.

Without the separation between Gini coefficient groups, the Gini coefficient does not show any significant effect on happiness and the greatest influence is derived from GDPppp per capita.

-

d.

When a distinction is made between two different Gini coefficient groups, the very important conclusion is that a higher degree of inequality negatively affects the degree of happiness regardless of the GDPppp per capita of the countries.

-

e.

When the Gini coefficient is high, its effect on happiness is definitely negative regardless of the GDPppp per capita values. However, the negative effect of low Gini coefficient values on happiness holds only in developed countries with high values of GDPppp per capita.

-

f.

In general, taking only the factor of GDPppp per capita as the explanatory variable for happiness allows for less robust results than when additional factors are used, including the issue of inequality as described in the present study.

An appropriate extension to the present study is identifying additional explanatory variables for the very important question of what enables more satisfaction and happiness among citizens worldwide, especially when dealing with large populations rather than private individuals.

By adding another two explanatory variables of democracy and the Corruption Perceptions Index to the original variables of GDPppp and Gini, the effect on happiness become more significant. Only when the Gini ranges are divided into two levels of 0.25 < Gini < 0.48 and Gini > 0.48 does the additional variable contribute to happiness. For high GDPppp and intermediate Gini index democracy affects happiness significantly, while no connection to CPI is revealed. However, when Gini is larger than 0.48 and GDPppp is low as in several underdeveloped countries, one finds that Gini which is too high and CPI both have a significant negative effect on happiness, while democracy has no effect.

References

Acemoglu, D., Johnson, S., Robinson, J. A., & Yared, P. (2005). From education to democracy? The American Economic Review, 95(2), 44–49.

Acemoglu, D., Naidu, S., Restrepo, P., & Robinson, J. A. (2014). Democracy does cause growth. NBER Working Paper No. 20004.

Alesina, A., DiTella, R., & MacCulloch, R. (2004). Happiness and inequality: Are Europeans and Americans different? Journal of Public Economics, 88, 2009–2042.

Alesina, A., & Perotti, R. (1996). Income distribution, political instability, and investment. European Economic Review, 40(6), 1203–1228.

Alesina, A., & Rodrik, D. (1994). Distributive politics and economic growth. Quarterly Journal of Economics, 109(2), 465–490. doi:10.2307/2118470.

Anderson, C. J., & Tverdova, Y. V. (2003). Corruption, political allegiances, and attitudes toward government in contemporary democracies. American Journal of Political Science, 47(1), 91–109.

Banerjee, A. V., & Duflo, E. (2003). Inequality and growth: What can the data say? Journal of Economic Growth, 8(3), 267–299. doi:10.2139/ssrn.232731.

Barro, R. J. (1996). Determinants of economic growth: A cross-country empirical study. NBER Working Paper No. 5698.

Barro, R. J. (2000). Inequality and growth in a panel of countries. Journal of Economic Growth, 5(1), 5–32. doi:10.1023/A:1009850119329.

Barro, R. J. (2008). Inequality and growth revisited. Asian Development Bank Working Papers (p. 11).

Bengoa, M., & Sanchez-Robles, B. (2005). Does equality reduce growth? Some empirical evidence. Applied Economics Letters, 12(8), 479–483. doi:10.1080/13504850500120177.

Berg, M., & Veenhoven, R. (2010). Income inequality and happiness in 119 nations. In B. Greve (Ed.), Social policy and happiness in Europe (pp. 174–194). Cheltenham, England: Edgar Elgar.

Bourguignon, F., & Verdier, T. (2000). Globalization and endogenous educational responses: The main economic transmission channels. DELTA Working Papers 2000-24, DELTA (Ecole normale supérieure).

Buchanan, J. M., & Gordon, T. (1962). The calculus of consent: Logical foundations of constitutional democracy. Indianapolis: Liberty Fund.

Castelló-Climent, A. (2004). A reassessment of the relationship between inequality and growth: What human capital inequality data say?. Valencia: Instituto Valenciano de Investigaciones Economicas, S.A. (Ivie).

Castelló-Climent, A. (2010). Inequality and growth in advanced economies: an empirical investigation. Journal of Economic Inequality, 8(3), 293–321. doi:10.1007/s10888-010-9133-4.

Chrikov, V. I., & Ryan, R. M. (2001). Control versus autonomy support in Russia and the U.S.: Effects on well-being and academic motivation. Journal of Cross-Cultural Psychology, 32, 618–632.

Clark, A. E. (2003). Inequality aversion and income mobility: A direct test. Delta Working Papers (p. 11).

Clark, A. E., Kristensen, N., & Westergård-Nielsen, N. (2009). Job satisfaction and co-worker wages: Status or signal? The Economic Journal, 119, 430–447.

Clark, A. E., & Oswald, A. J. (1994). Unhappiness and unemployment. Economic Journal, 104, 648–659.

Clark, A. E., & Oswald, A. J. (1998). Comparison-concave utility and following behaviour in social and economic settings. Journal of Public Economics, 70(1), 133–155.

Clarke, G. R. (1995). More evidence on income distribution and growth. Journal of Development Economics, 47(2), 403–427. doi:10.1016/0304-3878(94)00069-O.

Dahl, R. (1971). Polyarchy. New Haven, CT: Yale University Press.

Davis, L. S. (2007). Explaining the evidence on inequality and growth: Informality and redistribution. B. E Journal of Macroeconomics. doi:10.2202/1935-1690.1498.

De la Croix, D., & Doepke, M. (2003). Inequality and growth: Why differential fertility matters. American Economic Review, 93(4), 1091–1113. doi:10.2139/ssrn.279521.

Deininger, K., & Squire, L. (1996). A new data set measuring income inequality. World Bank Economic Review, 10(3), 565–591.

Delhey, J., & Dragolov, G. (2014). Why inequality make Europeans less happy: The role of distrust, status anxiety, and perceived conflict. European Sociological Review, 30, 151–165.

Di Tella, R., MacCulloch, R. J., & Oswald, A. J. (2003). The macroeconomic of happiness. Review of Economics and Statistics, 85, 809–827.

Dittmann, J., & Goebel, J. (2010). Your house, your car, your education: The socioeconomic situation of the neighbourhoods and its impact on life satisfaction in Germany. Social Indicators Research, 96, 497–513.

Dollar D., & Kray A. (2000). Growth is good for the poor. The World Bank Development Research Group.

Duesenberry, J. S. (1949). Income saving and the theory of consumer behavior. Cambridge, MA: Harvard University Press.

Easterlin, R. A. (1974). Does economic growth improve the human lot? In A. D. Paul & W. R. Melvin (Eds.), Nations and households in economic growth: Essays in honour of Moses Abramovitz. New York: Academic Press Inc.

Easterlin, R. A. (1995). Will raising the incomes of all increase the happiness of all? Journal of Economic Behavior & Organization, 27, 35–47.

Easterlin, R. A. (2001). Income and happiness: towards a unified theory. The Economics Journal, 3, 465–484.

Epstein, G., & Spiegel, U. (2001). Natural inequality, production and economic growth. Labour Economics, 8, 463–473.

Fahey, T., & Smyth, E. (2004). Do subjective indicators measure welfare? Evidence from 33 European societies. European Societies, 6(1), 5–27.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economic, 114, 817–868.

Ferrer-i-Carbonell, A., & Ramos, X. (2014). Inequality and happiness. Journal of Economic Surveys, 28, 1016–1027.

FitzRoy, F., et al. (2014). Testing the tunnel effect: Comparison, age and happiness in UK and German panels. IZA Journal of European Labor Studies, 3, 24.

Forbes, K. J. (2000). A reassessment of the relationship between inequality and growth. American Economic Review, 90(4), 869–887. doi:10.1257/aer.90.4.869.

Frey, B. S., & Stutzer, A. (2000). Happiness, economy, and institution. Economic Journal, 110(466), 918–938.

Frey, B. S., & Stutzer, A. (2002). What can economists learn from happiness research? Journal of Economic Literature, 40, 402–435.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The Review of Economic Studies, 60, 35–52.

Gerring, J., Thacker, S. C., & Moreno, C. (2005). Centripetal democratic governance: A theory and global inquiry. American Political Science Review, 99(4), 567–581.

Ghura, D., Leite, C. A., & Tsangarides, C. (2002). Is growth enough? Macroeconomic policy and poverty reduction. IMF Working Paper No. 118.

Graham, C., & Felton, A. (2006). Inequality and happiness: insights from Latin America. The Journal of Economic Inequality, 4, 107–122.

Hagerty, M. R. (2000). Social comparisons of income in one’s community: Evidence from national surveys of income and happiness. Journal of Personality and Social Psychology, 78, 764–771.

Hagerty, M. R., & Veenhoven, R. (2003). Wealth and happiness revisited: Growing national income does go with greater happiness. Social Indicators Research, 64, 1–27.

Helliwell, J. F. (1994). Empirical linkages between democracy and economic growth. NBER Working Paper No. 4066.

Helliwell, J. F., & Huang, H. (2008). How’s your government? International evidence linking good government and well-being. British Journal of Political Science, 38, 595–619.

Hirschman, A. O., & Rothschild, M. (1973). The changing tolerance for income inequality in the course of economic development: with a mathematical appendix. The Quarterly Journal of Economics, 87, 544–566.

Homans, G. C. (1974). Social behaviour: Its elementary forms. New York: Harcourt Brace.

Huntington, S. P. (1968). Political order in changing societies. New Haven and London: Yale University Press.

IndexMundi—Economy-GDP-per capita (PPP)—Country Comparison. http://www.indexmundi.com/g/r.aspx?v=67.

Jiang, S., Lu, M., & Sato, H. (2012). Identity, inequality, and happiness: Evidence from urban China. World Development, 40(6), 1190–1200.

Jost, J. T., Banaji, M. R., & Nosek, B. A. (2004). A decade of system justification theory: Accumulated evidence of conscious and unconscious bolstering of the status quo. Political Psychology, 25, 881–919.

Josten, S. D. (2004). Social capital, inequality, and economic growth. Journal of Institutional and Theoretical Economics (Zeitschrift Fur Die Gesamte Staatswissenschaft), 160(4), 663–680. doi:10.1628/0932456042776087.

Kenny, C. (1999). Does growth cause happiness, or does happiness cause growth? Kyklos, 52(1), 3–25.

Knies, G. (2012). Income comparisons among neighbours and satisfaction in East and West Germany. Social Indicators Research, 106, 471–489.

Knight, J., & Ramani, G. (2010). The rural-urban divide in China: Income but not happiness? Journal of Development Studies, 46, 506–534.

Knoema Data repository—GDP per Capita by Country 1980–2014. https://knoema.com/pjeqzh/gdp-per-capita-by-country-1980-2014.

Knowles, S. (2005). Inequality and economic growth: The empirical relationship reconsidered in the light of comparable data. Journal of Development Studies, 41(1), 135–159. doi:10.1080/0022038042000276590.

Kuznets, S. (1955). Economic growth and income inequality. American Economic Review, 45, 1–28.

Lambsdorff, J. G. (1999) Corruption in empirical research. Transparency International Working Paper. http://www.transparency.org/documents/work-papers.

Lambsdorff, J. G. (2003). How corruption affects productivity. Kyklos, 56, 457–474.

Layte, R. (2012). The association between income inequality and mental health: testing status anxiety, social capital, and neo-materialist explanations. European Sociological Review, 28, 498–511.

Lee, W., & Roemer, J. E. (1998). Income distribution, redistributive politics, and economic growth. Journal of Economic Growth, 3(3), 217–240. doi:10.1023/A:1009762720862.

Lerner, M. J. (1982). The belief in a just world: A fundamental delusion. New York: Plenum Press.

Li, H., & Zou, H. F. (1998). Income inequality is not harmful for growth: Theory and evidence. Review of Development Economics, 2(3), 318–334. doi:10.1111/1467-9361.00045.

Montinola, G. R., & Jackman, R. W. (2002). Sources of corruption: A cross country study. British Journal of Political Science, 32, 147–170.

Nahum, R. A. (2005). Income inequality and growth: A panel study of Swedish counties 1960–2000. Institute for Future Studies, 5. http://www.iffs.se/media/1112/20051201134748fil2bHPWzoboxFPAiu48eY3.pdf.

Ohtake, F., & Tomioka, J. (2004). Happiness and income inequality in Japan. A paper presented at International Forum for Macroeconomic Issues. ESRI Collaboration Project.

Oishi, S., Kesebir, S., & Diener, E. D. (2011). Income inequality and happiness. Psychological Science, 22(9), 1095–1100. doi:10.1177/0956797611417262.

Olson, M. (1993). Dictatorship, democracy, and development. The American Political Science Review, 87, 567–576.

Oshio, T., & Miki, K. (2010). Income inequality, perceived happiness, and self-rated health: Evidence from nationwide surveys in Japan. Social Science and Medicine, 70, 1358–1366.

Pagano, P. (2004). An empirical investigation of the relationship between inequality and growth, Bank of Italy. Economic Research Department

Panizza, U. (2002). Income inequality and economic growth: Evidence from American data. Journal of Economic Growth, 7(1), 25–41. doi:10.1023/A:1013414509803.

Papaioannou, E., & Siourounis, G. (2008). Democratisation and growth. The Economic Journal, 118, 1520–1551.

Partridge, M. D. (1997). Is inequality harmful for growth? Comment. American Economic Review, 87(5), 1019–1032.

Pede, V. O., Florax, R. J. G. M., & Partridge, M. D. (2009). Employment growth and income inequality: Accounting for spatial and sectoral differences. In 2009 annual meeting, 26–28 July 2009, Milwaukee, Wisconsin. Agricultural and Applied Economics Association.

Persson, T., & Tabellini, G. (1994). Is inequality harmful for growth? American Economic Review, 84(3), 600–621.

Persson, T., & Tabellini, G. (2009). Democratic capital: The nexus of political and economic change. American Economic Journal: Macroeconomics, 1, 88–126.

Pozuelo, R.J., Slipowitz, A., & Vuletin, G. (2016). Democracy does not cause growth: The importance of endogeneity arguments. IDB Working Paper Series, 694. The Brookings Institution Columbia University Inter-American Development Bank.

Quandl Database Economic Data—GDP By Country; GDP Per Capita by Country; GDP Per Capita at PPP by Country. https://www.quandl.com/collections/economics/gdp-by-country, https://www.quandl.com/collections/economics/gdp-per-capita-by-country, https://www.quandl.com/collections/economics/gdp-per-capita-at-ppp-by-country.

Quandl Database Economic Data—Gini Index by Country. https://www.quandl.com/collections/demography/gini-index-by-country.

Rodrik, D., & Romain, W. (2005). Do democratic transitions produce bad economic outcomes? American Economic Review, 95, 50–55.

Rose-Ackerman, S. (1999). Corruption and government: Causes, consequences, and reform. New York: Cambridge University Press.

Runciman, W. G. (1966). Relative deprivation and social justice: A study of attitudes to social inequality in twentieth century. England. Berkeley, CA: University of California Press.

Ryan, R. M., & Deci, E. L. (2001). On happiness and human potentials: A review of research on Hedonic and Eudemonic well-being. Annual Reviews of Psychology, 52, 141–166.

Saint-Paul, G. T., & Verdier, A. (1993). Education, democracy and growth. Journal of Development Economics, 42, 399–407.

Sandholtz, W., & Koetzele, W. (2000). Accounting for corruption: Economic structure, democracy, and trade. International Studies Quarterly, 44(1), 31–50.

Schröder, M. (2016). How income inequality influences life satisfaction: Hybrid effects evidence from the German SOEP. European Sociological Review, 32(2), 307–320. doi:10.1093/esr/jcv136.

Schwarze, J., & Härpfer, M. (2007). Are people inequality averse, and do they prefer redistribution by the State? Evidence from German longitudinal data on life satisfaction. Journal of Socio-Economics, 36(2), 233–249.

Sen, A. (1999). Development as freedom. Oxford: Oxford University Press.

Senik, C. (2004). When information dominates comparison: Learning from Russian subjective panel data. Journal of Public Economics, 88, 2099–2123.

Solnick, S. J., & Hemenway, D. (1998). Is more always better? A survey on positional concerns. Journal of Economic Behavior & Organization, 37, 373–383.

StatisticsTimes.Com—List of Countries by GDP (nominal) per capita 2014 Source: International Monetary Fund World Economic Outlook (April-2015). http://statisticstimes.com/economy/countries-by-gdp-capita.php.

Stouffer, S. A., et al. (1949). The American soldier: Adjustment during army life. Princeton, NJ: Princeton University Press.

Tavares, J., & Wacziarg, R. (2001). How democracy affects growth. European Economic Review, 45, 1341–1378.

The Central Intelligence Agency (CIA)—Country comparison: Distribution of family income—Gini index. https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html.

The Central Intelligence Agency (CIA)—Country comparison: GDP per capita (PPP). https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html.

The Economist Intelligence Unit’s Democracy Index 2015. http://www.yabiladi.com/img/content/EIU-Democracy-Index-2015.pdf.

The World Bank National Accounts Data, and OECD National Accounts data files—GDP per capita (current US$). http://data.worldbank.org/indicator/NY.GDP.PCAP.CD?page=1.

Thurow, L. C. (1971). The income distribution as a pure public good. The Quarterly Journal of Economics, 85, 327–336.

Tomes, N. (1986). Income distribution, happiness and satisfaction: A direct test of the interdependent preferences model. Journal of Economic Psychology, 7, 425–446.

Transparency international the global coalition against corruption. http://www.transparency.org/cpi2013/results.

United Nations Development Program—Human development report (HDR)—Income Gini coefficient. http://hdr.undp.org/en/content/income-gini-coefficient.

Van de Stadt, H., Kapteyn, A., & Van de Geer, S. (1985). The relativity of utility: Evidence from panel data. Review of Economics and Statistics, 67, 179–187.

Van Deurzen, I., Van Ingen, E., & Van Oorschot, W. J. H. (2015). Income inequality and depression: The role of social comparisons and coping resources. European Sociological Review, 31, 477–489.

Verme, P. (2011). Life satisfaction and income inequality. Review of Income and Wealth, 57, 111–127.

Voitchovsky, S. (2005). Does the profile of income inequality matter for economic growth? Journal of Economic Growth, 10(3), 273–296. doi:10.1007/s10887-005-3535-3.

Warren, M. (2004). What does corruption mean in a democracy? American Journal of Political Science, 48(2), 328–343.

Welsch, H. (2008). The welfare costs of corruption. Applied Economics, 40(14), 1839–1849. doi:10.1080/00036840600905225.

Wilkinson, R. G., & Pickett, K. E. (2009). Income inequality and social dysfunction. Annual Review of Sociology, 35, 493–511.

Wilkinson, R. G., & Pickett, K. (2010). The spirit level: Why greater equality makes societies stronger. New York: Bloomsbury Press.

Winkelmann, L., & Winkelmann, R. (1998). Why are the unemployed so unhappy? Economica, 65(257), 1–15.

World Bank, Development Research Group—GINI index. http://data.worldbank.org/indicator/SI.POV.GINI.

World Happiness Report (WHR). (2015). http://worldhappiness.report/wp-content/uploads/sites/2/2015/04/WHR15.pdf.

World Happiness Report (WHR). (2016). Update: http://worldhappiness.report/wp-content/uploads/sites/2/2016/03/HR-V1Ch2_web.pdf (p. 20).

Xiaogang, W., & Jun, L. (2013). Economic growth, income inequality and subjective well-being: Evidence from China. Population Studies Center Research Report (pp. 13–796).

Yitzhaki, S. (1979). Relative deprivation and the Gini coefficient. The Quarterly Journal of Economics, 93, 321–324.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tavor, T., Gonen, L.D., Weber, M. et al. The Effects of Income Levels and Income Inequalities on Happiness. J Happiness Stud 19, 2115–2137 (2018). https://doi.org/10.1007/s10902-017-9911-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-017-9911-9