Abstract

Age effects and birth cohort effects have not been differentiated in happiness studies. In this paper, age-period-cohort decomposition is applied to happiness data in the US. Since the relationship is linear, such as age = period − cohort, it is not possible to identify the three effects. This paper considers four identification models: the polynomial age-effect model, the proxy-variable model, the orthogonal period-effect model, and the principal component model. Happiness data are obtained from the General Social Survey for 1972–2008. Except for the polynomial age-effect model, three alternative models provide similar results. In particular, there is little difference between the decomposition results obtained by the orthogonal period-effect model and by the principal component model. The age effect shows downward movements for 18–55 and for 80–89, an upward movement for 56–69, and an almost flat movement for 70–79. The period effect shows cyclical movements slightly similar to unemployment rates fluctuations. The cohort effect shows a downward movement for the birth cohorts of 1894–1936, a dip for 1945–1958 (baby boomers), an upward movement for 1959–1969, and an almost flat movement for 1970–1987.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the seminal works by Easterlin (1974, 1995), determinants of an individual’s happiness or life satisfaction have been investigated in a large number of empirical studies. One serious drawback to these studies is the specification of life cycle factors. In almost all studies, the life cycle factor in happiness is specified as a second order polynomial in age. This specification means that the life cycle effect or age effect in happiness is expected to be convex, or U shaped. Table 1 presents explanatory variables in the happiness equation in recent empirical studies. This table clearly shows that the second order polynomial in age is adopted in all studies. This specification has two problems. First, the second order polynomial is too restrictive to describe the life cycle effect in happiness. For example, when the age effect is smallest at 50 years of age, the age effect movements for ages less than 50 and those for ages more than 50 are exactly symmetric. Second, except for the recent work by Yang (2008), the age effect cannot be separated from the birth cohort effect. For example, consider the case of a 50-year-old man responding as “unhappy” in the 2000 survey. There should be two possible demographic effects: age effect and cohort effect. Based on the cohort effect, his unhappiness is caused by the fact that he was born in 1950 and is a baby boomer.

The purpose of the present paper is to perform age-period-cohort analysis of happiness data. The age effect constitutes the obvious consequences of the life cycle: children mature, marry, and have children, who then grow up and start a family, as the cycle continues into another generation. Over this life cycle, a person first becomes a renter and then a homeowner, often moving to the suburbs. With regard to social security, given a pay-as-you-go structure, young people pay social security taxes, and when they retire, they get social security benefits. One critical point for the age effect on happiness is retirement. On the one hand, aging after retirement can cause increasing health problems and loss of important social relationships, which can decrease quality of life over the life course. On the other hand, as suggested by Gove et al. (1989), positive psychosocial traits such as satisfaction seem to grow with age, and these signs of maturity in turn can increase the quality of life with age. Hayo and Seifert (2003) analyzed subjective economic well-being in several Eastern European countries from 1991 to 1995 and concluded that the age effect is U shaped with a minimum at an age of 37.

The period effect occurs due to social and economic changes that are unique to time periods, inducing similar changes in household behavior for all ages. In the economy, the most obvious examples of this effect are movements in common variables such as asset prices, and interest rates. For example, a sharp increase in asset values may raise the wealth of all households in a given period. A decline in market interest rates relative to mortgage interest rates will have a positive effect on homeownership. Furthermore, inflation and unemployment both decrease happiness (Di Tella et al. 2001). These two macroeconomic variables are used for the misery index that measures the level of the nation’s unhappiness.

The cohort effect arises in that individuals born in the same time period behave differently from individuals born in other periods. In the economics of consumption, as predicted by the life-cycle model for a growing economy, cohort effects decline steadily from younger to older cohorts (Deaton and Paxson 1994). Other academic disciplines provide many alternative perspectives. First, cohort effects can arise as a result of the sheer size of the cohort. A large cohort creates greater competition for schooling and jobs, leading to negative consequences for socioeconomic achievement and subjective well-being (Easterlin 1980). Second, it is recognized that the cohort effect is established on the basis of external events that occur in early adulthood (Ryder 1965). Giuliano and Spilimbergo (2009) show that individuals growing up during recessions tend to believe that success in life depends more on luck than on effort and that recessions have a long-lasting effect on individual beliefs. In recent empirical studies, Benson and Brown (2011) found that the Boomers do have higher job satisfaction and a lower willingness to quit than their Generation × colleagues.

Although the age-period-cohort analysis is expected to contribute to empirical studies in social sciences, its contribution has not been significant. As there is a linear relationship, such as period = age + cohort, it is not possible to distinguish the individual effects without employing an identifying assumption. It is natural to consider that different identifying assumptions can lead to different conclusions (see Fukuda (2010) for a recent and overall survey on age-period-cohort analysis). Yang (2008) was the first to apply the age-period-cohort analysis to happiness studies in the US population. Yang applied hierarchical age-period-cohort models to micro-data from the General Social Surveys for 1972–2004 and concluded that age effects are strong and indicate increases in happiness over the lifetime; that period effects show first decreasing and then increasing trends in happiness; and that baby-boomer cohorts report lower levels of happiness. One of the drawbacks of Yang’s work is the adoption of a second order polynomial in age. This unnatural specification causes monotonic increases in happiness over the lifetime.

In the present paper, four different identification methods are applied to micro-data from the General Social Surveys for 1972–2008. First, the age effect is specified by a polynomial equation consisting of quadratic, cubic, and other high-order polynomial terms. The introduction of these nonlinear terms simply overcomes the identification problem. This model is called the polynomial age-effect (henceforth, PAE) model. Second, the proxy-variable (PV) model is considered, following the work by Heckman and Robb (1985). This model assumes that the age or period or cohort effect is unobserved but can be explained by other observed variables. For example, it is generally believed that unemployment can make people be unhappier, and therefore the period effect is assumed to be explained by unemployment rates. Third, the Deaton and Paxson (1994) model is considered. Deaton and Paxson assume that period effects are mean zero and orthogonal to a linear time trend. This model is called the orthogonal period-effect (OPE) model here. The OPE model has been applied to a number of economic studies (Attanasio 1998; Kalwij and Alessie 2007, among others). Finally, the principal component (PC) model is considered. This identification method was first developed by Fukuda (2011). Although the conventional PC method has been applied to overcome the problem of many observed variables with possible co-linearity, the proposed PC method is applied to overcome the perfect co-linearity among age, period, and cohort dummy variables.

The rest of this paper is organized as follows. In Sect. 2, four identification models for age-period-cohort analysis are briefly reviewed. In Sect. 3, happiness data are briefly described. In Sect. 4, empirical results are discussed. Concluding remarks are provided in Sect. 5.

2 Four Identification Models

In this section, first the identification problem is addressed, and next four identification models are briefly explained.

2.1 Identification Problem

It is assumed that an observation y n (n = 1, …, N) for the respondent who is aged i in the survey year of j, obtained from the repeated survey such as General Social Surveys, is specified using the following model:

Here, α is the constant term; A i , the effect of the i-year-old person; P j , the effect of the survey year of j; C k , the effect of the k-th birth cohort; D n , some covariates; θ, the corresponding parameter vector; and ɛ n the disturbance term with mean zero and variance σ 2. Without loss of generality, the parameters A i , P j , and C k in (1) are subject to the following constraint.

In the estimation of model (1), the explanatory variables are composed of age dummies, period dummies, and cohort dummies, as follows.

Usually, the maximum likelihood procedure is used to obtain estimates of the parameter vectors (α, A 1,…, A I−1, P 1,…, P J−1, C 1,…, C K−1) and θ, but in this model, the estimates cannot be uniquely identified since the effect parameters are linearly dependent, corresponding to the equation k = I − i + j.

2.2 Polynomial Age-Effect Model

The identification problem in age-period-cohort decomposition is caused by the linear relationship such as age = period − cohort. Hence, one of the simple methods for overcoming this problem is to introduce nonlinearity to the model. As discussed in Sect. 1, the age effect has been specified by a quadratic term in almost all empirical studies. In the present paper, a higher order term is considered for observation y n for the respondent who is aged i in the survey year of j as

2.3 Proxy-Variable Model

Heckman and Robb (1985) consider that age, period, and cohort effects are unobservable and it is difficult to identify each effect with a statistically satisfactory manner. Then, they assume that that the age or period or cohort effect is proportional to some other substantive variable. For example, it is assumed that the period effect can be explained by a macroeconomic variable V j , for example, unemployment rates. In this case, model (1) is changed to the following model.

Heckman and Robb (1985) termed this as the proxy variable (henceforth, PV) model.

2.4 Orthogonal Period-Effect Model

In the economics of consumption, as predicted by the life-cycle model for a growing economy, cohort effects decline steadily from younger to older cohorts (Deaton and Paxson 1994). A steady growth in period effects simply means that consumption is growing with age and declining with cohort, and it is appropriate to attribute the trend movements to age and cohort, not to period. Thus, Deaton and Paxson assume that period effects are mean zero and orthogonal to a linear time trend.

This period effect is identical to business cycle effect. The orthogonal period-effect (OPE) model has been widely applied in economics literature. For recent examples, Kalwij and Alessie (2007) applied to the estimation of wage equations, and Jianakoplos and Bernasek (2006) applied to modeling of financial risk taking.

2.5 PC Model

The conventional principal component (PC) model has been applied to overcome the problem of many observed variables with possible co-linearity. On the other hand, the proposed PC method is applied to overcome the perfect co-linearity among age, period, and cohort dummy variables. The proposed method is composed of the following three steps. In the first step, the PC model is applied to M( = I + J + K − 3) variables composed of age dummies, period dummies, and cohort dummies (A 1, …, A I−1, P 1, …, P J−1, C 1, …, C K−1) to obtain principal components. In this step, the variance–covariance matrix is used, and the obtained principal components have no meaning. This is because these components are mathematically obtained from age, period, and cohort dummy variables. Based on simulation results provided by Fukuda (2011), the number of principal components is M − 1. In the second step, I perform the conventional regression in which the dependent variable is y n (n = 1, …, N) and the independent variables are M − 1 principal components and covariates D n . In the present paper, the happiness data are ordinal, and therefore the ordered probit regression is implemented. In the third step, the estimate of effect parameter vector (A 1, …, A I−1, P 1, …, P J−1, C 1, …, C K−1) is automatically obtained, because any principal component is represented as a linear combination of observed variables composed of age dummies, period dummies, and cohort dummies.

2.6 Comparison Among the Four Identification Models

I consider the advantages and disadvantages of each model concerning happiness research. In the case of known proxy variables, the PV model is best. However, proxy variables for age, period, and cohort effects in happiness are unknown, and some alternatives should be considered. Since different proxy variables can provide different age-period-cohort decomposition and the correctness of the selected variables cannot be concluded, not only the PV but also the other models should be considered. As shown in Sect. 4, the poor performance of the polynomial age-effect model can be easily obtained, since the number of parameters for the age effect is too small and the specification is too deterministic. Regarding the OPE model, the model performance depends on the strong identification assumption of the orthogonal period effect. If time series fluctuations of happiness data have no trend and look like business cycles, the OPE model is useful. Generally and consequently, the PC model is better than the other three models, since the identification assumption of the PC model is purely mathematical and far from the arbitrariness. As there are few theories regarding age, period, and cohort effects in happiness, empirical results obtained by the PC model should be regarded as bench mark and other results should be compared with the PC results.

3 Data

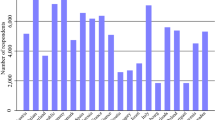

This study used data from the General Social Survey (GSS), which has monitored attitudes and behaviors of US adults (http://www.norc.org/GSS+Website). The GSS is among the best sources of national data on happiness in the country (Yang 2008). The GSS provides not panel data but repeated cross-section data. Anybody can easily download data in which any respondent was given an identification number in a given year. Each survey includes a nationally representative sample of non-institutionalized adults aged 18 and over. The sample sizes range from about 1,500 to 3,000 across survey years. The data on happiness are available annually from 1972 to 1994 (except for 1979, 1981, and 1992) and biannually from 1994 to 2008. In all years, the following question on happiness is used: “Taken all together, would you say that you are very happy, pretty happy, or not too happy?” In the present paper, an ordered probit analysis is performed in the next section, and the responses are coded as 1 = not too happy, 2 = pretty happy, and 3 = very happy. For 1972–2008, I obtained a sample of 53,043 respondents, but 4,725 observations are missing.

In happiness Eq. 1, the following individual-level variables, adopted by Yang (2008), are considered.Footnote 1 Considering the sample size defined by age and period, the respondent’s age is restricted to between 18 and 88 and the respondent’s birth year is between 1894 and 1987. The respondent’s race is selected from three alternatives (white, black, and others). With regard to education, the respondent’s time of schooling (in number of years) is provided but the following three categories are considered here: 0–11 years, 12–15 years, and 16 years and over. With regard to family income, the range of income rather than value of income is provided. Thus, in the present study, three income groups lower, middle, and upper are newly considered in each survey. The original number of categories of marital status is five, but the following four categories are considered here: divorced, widowed, single, and others. The original number of categories of work status is eight, but the following four categories are considered here: part-time worker, unemployed, retired, and others. The number of children the respondent has is provided but the following two categories are considered here: no children, and others. Finally, the original number of categories of religious attendance is eight, but the following three categories are considered here: once and over a week, never, and others.

In addition to the above variables, three variables are considered here, following earlier studies shown in Table 1.Footnote 2 First, following the work by Luttmer (2005), the variable “religious preference” is considered with the following two categories: no religion and others. Next, household size, the number of household members, is considered here. Finally, following Blanchflower and Aswald (2004), the variable “family 16” is considered. This variable is a response to the question “Were you living with both your own mother and father when you were 16 years old?” The number of original categories of family 16 is eight, but the following two categories are considered here: both parents and others. Whether a respondent lived with both father and mother in early adulthood is important. As discussed by Ryder (1965), traumatic episodes in early adulthood have a long-standing effect on life.

Table 2 provides descriptive statistics. Except for “happiness,” “age,” and “household size,” binary variables are considered. For the empirical analysis in the present paper, 46,898 observations are obtained.

4 Empirical Results

The empirical analysis is based on the ordered probit model with explanatory variables composed of age, period, and cohort effects, and of 18 variables described above. For age-period-cohort decomposition, four alternative identification models? the PAE model, the PV model, the OPE model, and the PC model? were applied. In the PV model, four proxy variables were considered: stock prices, interest rates, per capita growth rates of real GDP, and unemployment rates. Since the parameter estimate \( \hat{\gamma } \) in Eq. 2 is more significant for unemployment rates than those for other variables, only empirical results obtained by unemployment rates are considered subsequently.

4.1 Age-Period-Cohort Decomposition

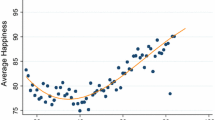

As discussed in Sect. 2.6, the PC model provides a baseline. However, first consider empirical results obtained by applying the PAE model. In this model, the polynomial order for the age effect is needed but the correct order is unknown. In the present paper, two alternative models are considered: one has the second-order polynomial and the other has the polynomial order from two to four (fourth order model). The first order term cannot be applied because of the identification problem. Figure 1 compared age-period-cohort effects on happiness obtained by the second-order model and by the fourth-order model. This figure presents very striking results. Different uses of polynomial order can provide very different decomposition results. As shown in Fig. 1, the trend movement of each effect obtained by the second-order model is the diametric opposite of that obtained by the fourth-order model. Hence, the PAE model should not be applied to empirical studies.

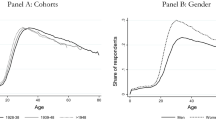

Next, consider empirical results obtained by applying the PV, OPE, and PC models. Figure 2 depicts age, period, and cohort effects on happiness. As shown in this figure, wiggly rather than smooth movements were obtained for the age effects since not deterministic but stochastic age effects were estimated. Comparisons among the three models provide the evidence that the age effects estimated by the three models are very similar. On the other hand, fluctuations of the period effects estimated by the PV model are smoother than those obtained by the other two models, since unemployment rates changed smoothly. Regarding the cohort effects, the trend movements appear to be U shape and are similar among the three models, particularly between the OPE and PC models. However, the birth cohorts for the bottom of this U shape are not similar. The bottoms are detected for the birth cohorts of 1955–1964 (late baby boomers) by the PV model and for the birth cohorts of 1945–1958 (early baby boomers) by the OPE and PC models. The following findings are provided by the OPE and PC models.

First, the age effect shows a downward movement for ages from 18 to 55, and next an upward movement for 56–69. For 70–79, there seems to be an almost flat movement. A considerable downward movement is detected for 80–89. As discussed in Sect. 1, almost all empirical studies have specified the age effect as a second-order polynomial in age. This specification is too restrictive to describe life cycle movements correctly. There are eight recent studies as shown in Table 1. Except for the work by Yang (2008), it was concluded that the age effect movements are U shaped. However, the bottom of the age effect is detected at different ages in different studies, ranging from 33 to 50 years.

Second, the period effect shows cyclical movements slightly similar to unemployment rates fluctuations. The correlation coefficients between unemployment rate and the period effect obtained by the OPE and PC models are −0.22 and −0.34, respectively. As discussed in Sect. 1, the period effect occurs due to social and economic changes that are unique to time periods and induces similar changes in household behavior for all ages. The unemployment rate has been recognized as one of the most important indicators for measuring national welfare. It is widely known that unemployment considerably decreases happiness (Blanchflower and Aswald 2004; Di Tella and MacCulloch 2008). However, it is not possible to consider that the period effect is derived only by unemployment rates.

Third, the trend movements of the cohort effect show simple patterns, while the year-by-year fluctuations are very volatile. The cohort effect shows a downward movement for the birth cohorts of 1894–1936, and a small inverted V shape for the birth cohorts of 1937–1944. For the birth cohorts of 1945–1958, which belong to the early part of the baby boomer generation, the cohort effect is small and nearly flat. On the other hand, the cohort effect shows an upward movement for the birth cohorts of 1959–1969, the late baby boomers.Footnote 3 For the birth cohorts of 1970–1987, fluctuations of the cohort effect are very volatile but show an almost flat movement. The dip in the cohort effect for 1945–1958 was also detected by Yang (2008). As discussed in Sect. 1, a large cohort, such as that of the baby boomers, tends to have negative consequences for socioeconomic achievement and subjective well-being (Easterlin 1980). Consequently, the trend movements of the cohort effect look like a U shaped function.

Finally, the difference between the OPE result and the PC result should be noted. One minor difference between the two decompositions is that the difference between the period effects for 1972 and 2008 is smaller in the OPE method than in the PC method, because there is rigorously no trend in the OPE method, by definition.

4.2 Effects of 18 Explanatory Variables

In this subsection, I examine parameter estimates for 18 explanatory variables briefly, because the main purpose of the present paper is to perform age-period-cohort decomposition and to check the validity of the specification of the second-order polynomial for the age effect. Table 3 presents the correlation matrix and the variance inflation factor which corresponds to the magnitude of collinearity. We find no correlations above 0.3 (with the exception of three pairs) and a maximum variance inflation factor of 1.78, well below the level of concern.Footnote 4 The parameter estimates obtained by the OPE model are exactly the same as those obtained by the PC model. The reason of this result is purely a mathematical topic (see Appendix).

As shown in Table 4, estimation results seem to be reasonable and consistent with those in earlier empirical studies. First, females and whites are happier than males and non-whites, respectively. Second, higher education and higher income both lead people to be happier. Third, married people are happier than those divorced, widowed, and never married. Fourth, unemployment makes people less happy. However, it is not statistically clear whether or not part-time work makes people less happy and whether or not retirement leads people to be happier. Fifth, having children and a large household both lead people to be less happy. Sixth, attending religious services leads people to be happier, and no religion makes people less happy. Finally, parents’ divorce in early adulthood makes people less happy.

4.3 Comparisons with Yang’s (2008) Results

As discussed in Sect. 1, Yang (2008) was the first to introduce the age-period-cohort framework to happiness studies. Samples and explanatory variables in the present study are different from those in Yang’s study. Furthermore, empirical models are also different between the two studies. However, effects of explanatory variables are very similar, as shown in Table 5. Only different results are considered here. First, education level affects happiness significantly (p ≤ 0.001) in this study but not in Yang’s study. The present paper’s result is more convincing than Yang’s result, since most of the empirical studies (4 of 6 studies in Table 1) provide the evidence that education level positively affects happiness. Second, part-time work and retire negatively and positively affect happiness significantly (both p ≤ 0.01) respectively in Yang’s study but not in this study. Other empirical results supporting Yang’s results are scarce. Based on 7 articles in Table 1, only one of the two articles provides clear evidence on part-time work, and only one of the five articles provides clear evidence on retirement effect. The present paper’s results are more convincing than Yang’s results.

The most crucial difference between Yang’s results and the present results is the estimate of the age effect. In Yang’s study, the age effect is specified as the second-order polynomial in age and shows the inverted U shape with the peak age of the mid-60 s. This result is very unnatural. As discussed in Sect. 1, all empirical studies, except Yang’s study, have presented that the age effect fluctuates like a U shape with the bottom aged of 33–50 years.

5 Conclusion

One serious drawback of earlier empirical studies on happiness is that the age effect is specified as the second-order polynomial in age. This specification is too simple to describe movements of the age effect correctly. Furthermore, except for one recent study, the cohort effect has never been considered. This ignorance confuses demographic effects on happiness. For example, consider the case in which a 60-year-old respondent selected the category of “not too happy” in the 2008 survey. What caused this lack of happiness? His or her age? Or the fact that he or she is a baby boomer?

Since relationship between age, period, and cohort is linear, as with age = period − cohort, it is not possible to identify the three effects without an identification assumption. This paper considers four identification models: the polynomial age-effect model, the proxy-variable model, the orthogonal period-effect model, and the principal component model. Regarding happiness data from the General Social Survey, except for the polynomial age-effect model, three models provided similar age-period-cohort decompositions, and particularly there is little difference in empirical results between the orthogonal period-effect model and the principal component model. These two models provided the following findings. The age effect shows downward movements for 18–55 and for 80–89, an upward movement for 56–69, and an almost flat movement for 70–79. Obtained results show that the age effect movement is too complex to specify as the second-order polynomial in age. The period effect shows cyclical movements slightly similar to unemployment rates fluctuations. The unemployment rate has been widely recognized as one of the most important indicators for measuring national welfare. The cohort effect shows a downward movement for the birth cohorts of 1894–1936, a dip for 1945–1958, an upward movement for 1959–1969, and an almost flat movement for 1970–1987. The dip for the baby boomers can be caused by the size of this cohort. The large cohort can have negative consequences for socioeconomic achievement and subjective well-being.

There are some issues for further research. First, it should be examined whether obtained results are the same for satisfaction, although happiness and satisfaction are used interchangeably in empirical research. For example, Diener (1984) suggested that the difference between these two cannot be due to differences in the cognitive or emotional nature but that the relationship is more complicated. Second, another model for age-period-cohort decomposition in happiness should be developed. Fukuda (2010) provided empirical and simulated results that the Bayesian model is better than the other models, but the Bayesian model is time consuming and only applied to aggregate data.

Notes

Health status is an important factor for happiness and adopted in Yang (2008), but is not considered here because of sample loss (more than 5,000 samples). In 1978, 1983, and 1986, this variable was neglected in the GSS.

Homeownership, denoted by “dwelown” in the GSS, is an important factor for happiness and adopted by Powdthavee (2005) and Luttmer (2005), but is not considered here. This variable was neglected in 1972–1984. Similarly, whether the respondent lives in an urban or rural area is an important issue for happiness and adopted by Di Tella and MacCulloch (2008) and Powdthavee (2005), but this variable, denoted by “srcbelt” in the GSS, is not considered here. This variable was not available in 2008.

Myers and Lumbers (2008) note that the late baby boomers grew up in an optimistic era of technological advancements and growing social awareness and that their consumer confidence is based on the economy prospering.

The three pairs are as follows. First, the correlation coefficient is −0.48 for “Income 1” (lower income) and “Income 2” (higher income). Second, the correlation coefficient is 0.44 for “Attendance 1” and “Religion.” These correlations are self-evident and the exclusion of one variable from four variables has little influence on regression results. Finally, the correlation coefficient is 0.59 for “Single” and “Children (no children).” This correlation is also self-evident but the exclusion of the variable of “Single” changed the sign of the regression coefficient for “Children” plus to minus. However, this result is reasonable, since the statistical significance of the variable “Single” is much larger than that of the variable “Children.”.

References

Attanasio, O. P. (1998). Cohort analysis of saving behavior by U.S. households. Journal of Human Resources, 33, 575–609.

Benson, J., & Brown, M. (2011). Generations at work: Are there differences and do they matter? International Journal of Human Resource Management, 22, 1843–1865.

Blanchflower, D. G., & Aswald, A. J. (2004). Well-being over time in Britain and the USA. Journal of Public Economics, 88, 1359–1386.

Deaton, A., & Paxson, C. (1994). Saving, growth, and aging in Taiwan. In D. A. Wise (Ed.), Studies in the economics of aging (pp. 331–357). Chicago: Chicago University Press for NBER.

Di Tella, R., & MacCulloch, R. (2008). Gross national happiness? As an answer to the Easterlin Paradox. Journal of Development Economics, 86, 22–42.

Di Tella, R., MacCulloch, R. J., & Oswald, A. (2001). Preferences over inflation and unemployment: Evidence from surveys of happiness. The American Economic Review, 91, 335–341.

Diener, E. (1984). Subjective well-being. Psychological Bulletin, 95, 542–575.

Easterlin, R. A. (1974). Does economic growth improve the human lot? Some empirical evidence. In R. David & M. Reder (Eds.), Nations and households in economic growth: Essays in honor of Moses Abramovitz (pp. 89–125). New York: Academic Press.

Easterlin, R. A. (1980). Birth and fortune: The impact of numbers on personal welfare. Chicago: Chicago University Press.

Easterlin, R. A. (1995). Will raising the incomes of all increase the happiness of all? Journal of Economic Behavior & Organization, 27, 35–47.

Ferrer-i-Carbonell, A., & Frijters, P. (2004). How important is methodology for the estimates of the determinants of happiness? Economic Journal, 114, 641–659.

Fukuda, K. (2010). Household Behavior in the US and Japan: Cohort analysis. New York: Nova Science Publishers.

Fukuda, K. (2011). Age-period-cohort decompositions using principal components and partial least squares. Journal of Statistical Computation and Simulation, 81, 1871–1878.

Giuliano, P., & Spilimbergo, A. (2009). Growing up in a recession: Beliefs and the macroeconomy. NBER Working Paper No. 15321.

Gove, W. R., Ortega, S. T., & Style, C. B. (1989). The maturational and role perspectives on aging and self through the adult years: An empirical evaluation. American Journal of Sociology, 94, 1117–1145.

Hayo, B., & Seifert, W. (2003). Subjective economic well-being in Eastern Europe. Journal of Economic Psychology, 24, 329–348.

Heckman, J., & Robb, R. (1985). Using longitudinal data to estimate age, period, and cohort effects in earnings equations. In W. M. Mason & S. E. Fienberg (Eds.), Cohort analysis in social research (pp. 137–150). New York: Springer.

Jianakoplos, N. A., & Bernasek, A. (2006). Financial risk tanking by age and birth cohort. Southern Economic Journal, 72, 981–1001.

Kalwij, A. S., & Alessie, R. (2007). Permanent and transitory wages of British men, 1975–2001: Year, age and cohort effects. Journal of Applied Econometrics, 22, 1063–1093.

Luttmer, E. F. P. (2005). Neighbors as negatives: Relative earnings and well-being. Quarterly Journal of Economics, 120, 963–1002.

Myers, H., & Lumbers, M. (2008). Understanding older shoppers: A phenomenological investigation. Journal of Consumer Marketing, 25, 294–301.

Oswald, A. J., & Powdthavee, N. (2008). Does happiness adapt? A longitudinal study of disability with implications for economists and judges. Journal of Public Economics, 92, 1061–1077.

Powdthavee, N. (2005). Unhappiness and crime: Evidence from South Africa. Economica, 72, 531–547.

Rao, C. R., & Mitra, S. K. (1971). Generalized inverse of matrices and its applications. New York: Wiley.

Ryder, N. B. (1965). The cohort as a concept in the study of social change. American Sociological Review, 30, 843–861.

Stutzer, A. (2004). The role of income aspirations in individual happiness. Journal of Economic Behavior & Organization, 54, 89–109.

Yang, Y. (2008). Social inequalities in happiness in the United States, 1972 to 2004: An age-period-cohort analysis. American Sociological Review, 73, 204–226.

Acknowledgments

I am grateful to the editor in chief and the anonymous reviewers for very constructive comments and suggestions. Needless to say, any remaining errors are mine.

Author information

Authors and Affiliations

Corresponding author

Appendix: The Identity Between the Parameter Estimates Obtained by the OPE Model and by the PC Model

Appendix: The Identity Between the Parameter Estimates Obtained by the OPE Model and by the PC Model

Based on aims and scope of the journal, not a purely mathematical proof but a few hints concerning this identity are provided. The regression model (1) for I age groups, J survey periods, K birth cohorts, and N explanatory variables is re-specified as follows.

where Y is the T × 1 (T = I × J) vector of happiness data, X is the T × (M + N) (M = I + J + K − 3) matrix for age, period, and cohort effects dummies and explanatory variables, β is the parameter vector to be estimated, and e is the vector of the disturbance term. X can be partitioned as X = (DE), where D is T × (I + J + K − 3) design matrix corresponding to age, period, and cohort effects dummies, and E is T × N matrix composed of explanatory variables. The OLS estimates for the model (3) is obtained as

I newly define as (X′X)−1 X′ = (P′Q′)′, where P is M × T matrix for age, period, and cohort effects, and Q is N × T matrix for explanatory variables. The parameter estimates for explanatory variables is calculated as QY. Q is obtained as follows.

The Eq. 4 shows that the matrix D(D′D)−1 D′ is essential to the identity. Since the linear relationship between age, period, and cohort effects, the rank of the matrix D ′ D is not M but M − 1, not ordinal inverse (D ′ D)−1 but generalized inverse matrix (D′D)− is applied. Based on Rao and Mitra (1971), the following result is obtained.

Furthermore, the generalized inverse for D′D is not unique. In the present paper, the OPE model and PC model provide different matrices of the generalized inverse for D′D, while both models make the rank of D′D(M − 1). The Eq. 5 shows that the matrix Q in (4) obtained by the OPE model is completely the same as that obtained by the PC model. Hence, the identity is obtained.

Rights and permissions

About this article

Cite this article

Fukuda, K. A Happiness Study Using Age-Period-Cohort Framework. J Happiness Stud 14, 135–153 (2013). https://doi.org/10.1007/s10902-011-9320-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-011-9320-4