Abstract

Objective: To examine behavioral patterns of actual Internet gamblers who experienced gambling-related problems and voluntarily closed their accounts. Design: A nested case–control design was used to compare gamblers who closed their accounts because of gambling problems to those who maintained open accounts. Setting: Actual play patterns of in vivo Internet gamblers who subscribed to an Internet gambling site. Participants: 226 gamblers who closed accounts due to gambling problems were selected from a cohort of 47,603 Internet gamblers who subscribed to an Internet gambling site during February 2005; 226 matched-case controls were selected from the group of gamblers who did not close their accounts. Daily aggregates of behavioral data were collected during an 18-month study period. Main outcome measures: Main outcomes of interest were daily aggregates of stake, odds, and net loss, which were standardized by the daily aggregate number of bets. We also examined the number of bets to measure trajectory of gambling frequency. Results: Account closers due to gambling problems experienced increasing monetary loss as the time to closure approached; they also increased their stake per bet. Yet they did not chase longer odds; their choices of wagers were more probabilistically conservative (i.e., short odds) compared with the controls. The changes of monetary involvement and risk preference occurred concurrently during the last few days prior to voluntary closing. Conclusions: Our finding of an involvement-seeking yet risk-averse tendency among self-identified problem gamblers challenges the notion that problem gamblers seek “long odds” during “chasing.”

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The study of gambling consequences is a central topic that has stimulated interest among researchers, clinicians, and public policy makers (Griffiths 2004; National Research Council 1999; Petry 2005; Shaffer and Korn 2002). Although long-run mathematical expectations for gambling (e.g., “Gambler’s ruin” (Ross 2002)) have been documented, considerable complexity arises for those who try to predict actual gambling behaviors. Theoretical attempts to predict gambling behaviors are sometimes inconsistent with what ordinary people actually do. For example, The Saint Petersburg Paradox was published in 1738 from Daniel Bernoulli’s presentation of the problem. An individual is required to pay a fixed fee to enter a coin toss game. A fair coin will be tossed in sequence until a “tail” appears and ends the game. The payoff starts at 1 dollar and is doubled after each “head” appears. The individual wins the final payoff when the game ends with the first “tail”. The question is how much an individual should pay to enter the game. In theory, the expected value of the game is positive infinity; yet in reality, most people are willing to pay only a small amount of money to play the game. The Saint Petersburg Paradox highlights a classical example where in vivo people behave differently from what a naïve decision theorist recommends. A naïve decision theorist would suggest that people pay an infinite amount because the expected value of gambling is positive infinity; however, ordinary people usually follow heuristics rather than pure mathematical reasoning.

Theoretical constructs regarding the development and maintenance of gambling disorders often are not empirically developed and tend to remain untested against actual gambling behavior. One example is the construct of “chasing.” Researchers have defined chasing in several ways. Lesieur (1979) describes the “chase” as an individual episode or series of gambling events where gamblers increase their losses because they continue gambling compulsively to recoup previous losses. Lesieur (1984) asserts that the intensity of the “chase” escalates as the money loss increases. Similarly, the American Psychiatric Association defines pathological gambling as a persistent and recurrent pattern of maladaptive gambling that is characterized behaviorally as “needs to gamble with increasing amounts of money” and “after losing money…returns…to get even” or “chasing one’s losses” (American Psychiatric Association 1997). Pathological gambling also entails elevated monetary risk (Breen and Zuckerman 1999). Clinicians have considered “chasing losses” as a central attribute of pathological gamblers. Finally, Dickerson describes chasing losses as “to bet more…by a sequence of losing bets resulting in further betting with increased stakes and/or longer odds” (Dickerson 1984, p. 133).

The suggestion that a gambler’s choice for more risky bets, and a desire for a bigger win to “get even” more quickly, is inconsistent with the extant decision-making literature that shows “loss aversion” (Kahneman and Tversky 1979) motivates people more than “winning.” To advance the scientific literature on this topic, it is necessary to empirically investigate whether the behavior of in vivo gamblers corresponds to a conventional depiction of “chasing.” In this study, we primarily examine Dickerson’s two-part definition of chasing: increasing stakes and/or betting on propositions with longer odds to recoup losses. Further, we study the trajectory of gambling frequency as measured by the number of bets when loss occurs and continues. Conceptually, chasing is a construct that represents behavioral patterns of betting that evolve over time. Consequently, this study is the first longitudinal investigation of actual gambling behaviors that focuses on the nature of chasing.

The extant empirical foundation for the constructs used to identify gambling disorders is limited. For example, despite the popularity of inferring “loss of control” (Blaszczynski and Nower 2002) as a construct to explain “compulsive” or “pathological” gambling, this association remains uncertain and not immune to caveats; the reason for this uncertainty is that the empirical base for this explanation rests primarily on self-report. The notion of gambling as an irrational impulse control disorder derives primarily from gamblers who have sought help for the disorder and not from gamblers in the community. Clinicians typically diagnosis the presence of pathological gambling by interviewing help-seeking patients and then applying criteria and cutoff values (e.g., DSM-IV) (American Psychiatric Association 1997) to their self-reported gambling patterns. Self-report measures of gambling wins and losses can be unreliable. Both selection bias and recall bias compromise the reliability of clinical assessment. These biases also limit the validity of inferring how problem gamblers differ from other gamblers in their behavioral trajectories. Similarly, experiments (Potenza et al. 2003; Reuter et al. 2005) that shed light on the association between pathological gambling status and reduced efficacy of the mesolimbic reward system often rely on self-report interview questions. Further, the value of physiological evidence derived from gamblers experiencing artificial gambling tasks is uncertain: using gambling experiments as a substitute for in vivo gambling raises important validity concerns about whether proxy gambling can stimulate responses that are sufficiently similar to actual gambling to yield useful results (Anderson and Brown 1984).

In addition to the limitations of self-reported behavior, if we are trying to understand behavioral trajectories, cross-sectional research can be misleading. Longitudinal analysis is instrumental to understand the maintenance or escalation of gambling behavior (Slutske 2007). The longitudinal analytic approach in our study is a type of random-effects model that represents a common and unifying approach to fitting growth trajectories and repeated-measures data (Laird and Ware 1982). To the best of our knowledge, there are no studies that employ longitudinal analyses to investigate the patterns of actual gambling behaviors that reflect chasing-related monetary involvement, risk preference, and frequency.

Recently, researchers began to learn from the study of actual Internet gamblers (LaBrie et al. 2007, 2008; LaPlante 2008a, b). The present study extends this growing body of in vivo research by examining the natural course of gambling patterns evidenced by a group of Internet gamblers who reported gambling-related problems and, consequently, voluntarily ended their gambling accounts because of these problems. We will use a prospective cohort recently detailed in an epidemiological description of Internet gamblers (LaBrie et al. 2007). The advent of Internet gambling provides an ideal context to study gamblers who might experience gambling problems because this technology permits us to examine prospectively every bet, with its stake and odds. This study will focus on the behavioral trajectories of in vivo gambling that precede account closure. In addition, this study will allow us to test the prevailing wisdom that gambling problems increasingly are associated with higher levels of risk-seeking (i.e., increasing stakes and/or engaging in longer odds bets when experiencing increasing monetary loss).

Methods

Sample

The research cohort consisted of 47,603 individuals who sequentially subscribed to an Internet sports-betting service provider during February 2005. This service implemented a web-based account closure system that allowed gamblers to close their accounts voluntarily. To close an account, players were required to report one of three listed reasons for the account closing: (a) I am unsatisfied with the company; (b) I have no more interest in betting; (c) Gaming causes me financial, social or personal problems; therefore, I would like to close my account in context with the prevention of gaming addiction.

To be included in this study as a case, players must have wagered on live action events for 3 or more betting days and reported closing their accounts because of gambling problems (i.e., reason (c) above). Live gambling allows gamblers to follow the progress of a particular sports event and bet on various imminent outcomes. For example, as a tennis match progresses, a gambler can bet on “How many set points will the winner of the first set need to win the set?”, “Who will serve the first ace in the second set?”, “Who will be the 1st to win 10 points in the third set?” and so on. To examine how cases differ from other gamblers, we employed a nested case–control study design (Rothman and Greenland 1998). To approximate the risk set, we selected those who had open accounts on the day an individual’s account was closed due to gambling problems, but who did not close their accounts. We randomly sampled controls without replacement from the risk set. We employed a 1:1 ratio of case–control matching on age and sex variables. As a result, both cases and controls had the same distributions of the age and sex. We do not have other demographic variables such as income level or education for this cohort. The cases and controls were not matched for the number of betting days because this variable is fundamental to the imbalanced data structure for our longitudinal analysis.

We only included gamblers with a history of live action gambling activities for three reasons. First, live action gambling requires quick evaluation and rapid decision for a sequence of outcomes while sporting events are taking place. This type of quick evaluation and rapid decision is common among various types of casino and poker games and research suggests that this type of rapid evaluation and decision-making can be made quickly, with autonomic arousal (Sharpe et al. 1995), and without conscious contemplation (Bechara et al. 1997). Second, using only live action gambling data prevents bias from sports fan preference about event outcomes that support their favorite teams, a common phenomenon in conventional fixed-odd sports gambling, that might preclude observation of chasing-like behavior. Third, unlike other fixed-odds gambling data where betting and event outcome can be separated by days, live action gambling data can be aggregated easily on a daily basis, an efficient way to construct a dataset suitable for longitudinal analysis.

During the period between Feb 1st 2005 and June 30th 2006 (study period), 264 gamblers who had a history of live action gambling closed their accounts because they reported gambling problems. To predict both group-average trajectories in a statistically meaningful way, we excluded gamblers who had less than three live action betting days. As a result, the number of cases in our study was a sub-sample of 226 gamblers.

Design

We employed a nested case–control design in our study. The outcome variables included net loss, stake, odds, and number of bets. We standardized the daily aggregates of stake, odds, and net winning by the daily aggregates of bets because the respective aggregates of stake, odds and winning were influenced by the number of the bets. We used log transformation to normalize the right skewness of stake per bet, odds per bet and the number of bets. The net loss per bet is, on average, positive (i.e., gamblers lose); this inevitable outcome is due, in part, to the “rake” collected by the gambling provider.

To operationally define the “time” variable for the longitudinal analysis of gambling behaviors prior to account closure, we used the following two schemes: (a) active betting days; and (b) calendar days. We counted backward in both schemes. In the first scheme, the last betting day was coded as 1, and the previous betting day was coded as 2 and so on, regardless of the calendar days. In the second scheme, we used the last day of our observation period (June 30, 2006) as day 1 and counted backward to Feb 1, 2005, yielding a total of 525 calendar days. We applied both schemes of coding “time” variable to the cases and controls.

Analyses

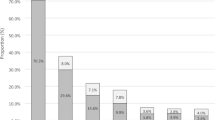

To determine the length of the time that would be included in the following analyses, we examined descriptive statistics. Prior to account closure, the number of active gambling days ranged from 3 to 299 days (Table 1) among the sub-sample of 226 gamblers. 50% had at least 23 gambling days and the mean gambling days was 45 days. We computed regression coefficients of the time effect using 23 days prior to account closure as the maximum analytic period because this time frame covered a majority of the cases. Therefore, day 1 represents the last betting day. A case might or might not have closed account on that day. We plotted the group average by the betting days prior to closing. We stratified these means by case–control status. We employed lowess smoother (smoother span = 1/3) on the plotted means to illustrate the trends.

Since the number of active betting days varied by individuals in our sample, we applied a two-stage random-effects model (Laird and Ware 1982; Ware 1985) to handle the imbalanced longitudinal data structure. We used the NLME package (Pinheiro et al. 2008) in R 3.1 to conduct the regression analysis. We used the Restricted Maximum Likelihood method to compute parameter estimates. For simplicity purpose, we assumed no within-subject serial correlations. Our basic model can be formulated as:

Y ij = β0 + β1 Time ij + β i0 + β i1 Time ij + e ij where Time ij denotes the time of the j measurement occasion on gambler i, and β 1 denotes the coefficient of the time effect. In other words, the corresponding change of Y associated with one unit change of Time (i.e., day). We assumed standard Gaussian distributions for β i0, β i1, and e ij . We estimated the time effect with and without adjusting for age and gender as covariates; this provides an opportunity to further determine the potential influence of these covariates. We used Q–Q plot to examine and confirm the Gaussian distribution assumptions for the random effects. We used the Bayesian Information Criterion (BIC) to examine model fit and confirm the assumption of no within-subject serial correlation. To investigate whether cases had different behavioral trajectories compared to the controls, we revised our basic model by adding a main effect of case status and examined the interaction term between case status and time in the interaction model.

When we estimated the time effect, we restricted the range of data points to the cumulative gambling days prior to account closing. Specifically, for the duration of the 23-day analytic period, we computed a total of 21 coefficients (from 1st–3rd day to 1st–23rd day) for the time effect. For example, since each of the 226 gamblers had at least three observations of daily aggregates, we computed the coefficient of the time effect for the last three gambling days prior to closing using a total of 678 observations of daily aggregates, 3 days from each of these 226 gamblers. Further, we computed the coefficient for the last four gambling days prior to closing by restricting the data to the last four daily aggregates; gamblers with only three observations contribute all 3 days to form their respective trajectories. Because we computed the trajectory for each individual cumulatively using the algorithm just described, we computed and interpreted the group average trajectories as cumulative time effects prior to closing. To illustrate the patterns of the time effect coefficients near account closure, we plotted the coefficients of the time effect against the days prior to closing. We reversed the signs of the effects in the plot so that the coefficients correspond to the time effects approaching account closure. Similar to the means, we stratified these coefficients by case–control status.

Results

Monetary Loss

Figure 1 illustrates that both cases and controls experienced loss, but the cases evidence increasing loss per bet for the last several betting days. For example, the average losses per bet on the last 3 betting day were €3.3, €4.7, and €7.5 (day 1) per bet for the cases. The average losses per bet on the equivalent last 3 betting day among the controls were €3.5, €3.7, and €3.7 per bet. Figure 1 indicated that gamblers who closed their account due to gambling problems experienced an increase of monetary loss—on average €2 per bet—each day during the last 3 betting days prior to account closing. When we examined the last 6 betting days among the cases, we observed a statistically significant rate of change (β = 1.02, p-value = 0.03, 95% CI [0.08, 1.97]). This rate of change with respect to loss per bet increased from €1 per bet during the last 6 betting days to €2 per bet during the last 3 betting days. Based on the stratified analysis, the magnitude of the rate of change appears to be greater among the cases as they near their account closing time. This observation reveals the increasing tendency toward monetary loss among those who eventually closed their accounts due to gambling problems. The rate of change regarding loss per bet among the controls remained constant during this time in Fig. 1.

Monetary Involvement: Stake Per Bet

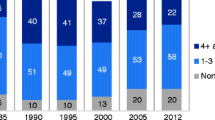

Figure 2 shows an increasing average log-scaled stake per bet among the cases as they near their account closure dates. For example, the average log-scaled stake per bet for the last 3 betting days among the cases were 1.71, 1.75, and 1.91; the average stake per bet for the same period were €17.4, €18.8, and €23.3. Among the controls, the average log-scaled stake per bet for similar period were 1.40, 1.32, and 1.32; the average stake per bet were €15.1, €12.8, and €15.7. T-tests on the log-scaled stake per bet suggested significantly greater monetary involvement among the cases as compared to the controls (i.e., t = 2.2, 3.1, and 4.0; p-value <0.05, <0.01, and <0.001, respectively). Lowess smoothers in Fig. 2 suggest that a declining monetary involvement among the controls for the 23-day analytic period. The decline was much less salient among the cases; on the contrary, the beginning of an uptrend was evident near 5th day prior to closure. Figure 2 compares the rates of change of stake per bet (log scale) in the days preceding the closure for the cases and controls. For example, for the last 5 betting days prior to closure, the coefficient of the time effect is around 0.05 (p-value = 0.02) with 95% CI [0.01, 0.09]. That is, 1 betting day nearer to the closure is significantly associated with an increase of stake per bet by about 5%. Similarly, the rate of increase of stake per bet among the last 3 betting days shows a 10% increase per day as the gamblers approaches their account closure dates. In contrast, the rates of change for the controls appear to be constant near zero. This means that, among the controls, there is no statistically significant stake per bet changes during parallel analytic periods, even for the equivalent period prior to account closure. The rates of change for the interaction terms in the interaction models corroborated the results of the stratified analyses: the coefficients for the interaction terms increased from 0.04 (p-value = 0.04) with 95% CI [0.002, 0.07] for the last 9 days to 0.14 (p-value = 0.02) with 95% CI [0.02, 0.26] for the last 3 days. Coding “time” according to calendar days yields similar trend results: the nearer cases get to their account closure dates, the percentage increase of their stake per bet advances at a more rapid rate.

Risk Preference: Odds Per Bet

From the lowess smoother in Fig. 3, there appears to be a small downtrend of risk preference among the cases several days preceding closure. The average log-scaled odds per bet among the cases for the last 3 days were 1.01, 1.07, and 0.96; the average log-scaled odds per bet among the controls for the last 3 days were 1.10, 1.08, and 1.12. The log-scaled odds per bet among the cases for the last 3 days was significantly lower than the controls (t = 1.97, p-value < 0.05). The downtrend appears to begin around the 5th day preceding closure. Figure 3 shows that the rate of change in log-scaled odds per bet among the cases is decreasing prior to closure; however, this rate of change is not statistically significant. Based on the data from the last 5 betting days, 1 day closer to the account closure is associated with a 2% decrease of odds per bet for cases’ risk preference. A decrease of odds (or shorter odds) per bet suggests involvement with less risky bets (i.e., bets with more certainty). Among the controls, the log-scaled odds per bet remain constant in Fig. 3. Using calendar day as the “time” variable, we also observed a conservative risk preference (i.e., less risky) as indicated from the downtrend of negative coefficients, where some coefficients near the closure time were significantly less than zero (i.e., β = −0.0005 for the last five day period, p-value = 0.02, 95% CI [−0.001, −0.0001]; β = −0.00045 for the last six day period, p-value <0.05, 95% CI [−0.001, −0.00001]).

Risk Preference: Number of Bets

Figure 4 illustrates downtrends of the average log-scaled number of bets for both the cases approaching their account closing and for the controls. Figure 4 also shows a consistent downtrend of the significant rates of change with respect to number of bets per day. This downtrend indicates that the percentage of decrease in the number of bets per betting day increased for all gamblers. In other words, gamblers with problems and the controls appear to make fewer and fewer bets over time. In addition, none of the 21 coefficients of the interaction terms in the interaction models were statistically significant, suggesting that the tendency to make fewer bets is common among both cases and controls.

Discussion

Using evidence from a group of Internet gamblers who identified themselves as having gambling problems, we examined the patterns of actual gambling behavior that led these gamblers to voluntarily close their online gambling accounts. We observed that while they experienced increasing loss preceding account closure, these gamblers appeared to try recouping their losses by increasing their stake per bet on events that were probabilistically less risky. We also observed decreasing gambling frequency as measured by number of bets during the analytic period.

Our findings of in vivo Internet gamblers extend the risk preference literature. Among a group of gamblers who identified themselves as having gambling problems, we unexpectedly observed evidence of a risk-averse gambling pattern. The construct of “chasing,” episodic interview records among Gamblers Anonymous members (Lesieur 1979, 1984), and structured questionnaires that assess pathological gambling (American Psychiatric Association 1997) suggest an increasing risk-seeking tendency among those with gambling-related problems. However, the results of this study reveal the downtrends of average log-scaled odds per bet and negative coefficients (Fig. 3) as well as some significant departure from zero using calendar day as the coding scheme for the “time” variable. These findings may reflect the tendency of problem gamblers to increasingly become probabilistically risk-averse. Instead of making more risky bets by increasing their stake on probabilistically longer odds, as Dickerson (8) had suggested, this group of gamblers tried to recoup losses by increasing their stake on events with higher probabilities of winning (i.e., they become more risk averse and, therefore, bet more conservatively).

Previously, some research seemed to suggest the opposite: using a simulated gambling task to study rapid processing of monetary gains and loss, Gehring and Willoughby found that betting choices after losses were riskier (Gehring and Willoughby 2002). Instead, we observed a risk-averse pattern of live action gambling during a period when gamblers experienced loss and increasing loss. The difference in our research focus might explain the contrast in the findings. Our longitudinal data was constructed using daily aggregates; we aimed at estimating in vivo behavioral tendencies, rather than experimental event-based responses. Thus, “instant utility” (Kahneman 1999), a mental state resulting from sequential event-based evaluations, had little influence on this data. Further, the short-term mood or emotional states that can impact event-based gambling sequences had little impact on our findings. We employed a longitudinal data structure (i.e., daily aggregates) that operationally represents and is consistent with the premise that (a) “the long-term chase is the distinguishing feature of compulsive gambling” (Lesieur 1984; O’Connor and Dickerson 2003) and (b) the DSM-IV behavioral cross-session criterion that a disordered gambler “often returns another day to get even.” With actual behavioral data, our findings advanced the knowledge base focusing on the human tendency toward “loss aversion” during a period when problem gamblers experienced increasing monetary losses, an aspect not previously studied in the above-mentioned event-based experiment.

It is intriguing to consider the concurrency between the monetary involvement and risk preference behavioral changes that emerge for cases prior to closing their accounts. Although the plots of slopes by days prior to closing suggest that the stake per bet and odds per bet rate changes appear to begin near the 5th day preceding account closing, it is not sufficient from this study to proclaim the exact location of this dynamic change. However, this finding can suggest that contemplating a decision to self-exclude is perhaps a relatively brief temporal process, during which gamblers increase their stake and reduce their probabilistic risk to recover loss. If loss continued to escalate, however, it did not take long before players made a decision to close their account. This phenomenon of gambling larger stakes prior to voluntary closure resonates with the clinical observation of substance abusers who stop using psychoactive drugs after taking a “last fling.” That gamblers bet a larger stake while simultaneously becoming more conservative in their risk preference provides support for the notion that losing encourages people to become more “loss averse” than “gain motivated” under conditions of uncertainty. Future research should focus on identifying possible break points where gamblers’ change their behaviors with long series of data points.

In general, the comparisons between the cases and controls based on the stratified analysis and the interaction models appear to be consistent. The gamblers who closed their accounts due to gambling problems evidenced heavier stake per bet than the controls, although both groups appear to experience loss and engage in fewer bets. This finding also was consistent when we employed other 1: n matching ratios (n > 1) with more precise standard errors (these results are available from the authors upon request).

The estimates of the cumulative time effect were consistent when we used adjusted models (i.e., for age and sex) instead of the unadjusted models reported in this paper (these results are available from the authors upon request). We expected this correspondence because, by matching on age and sex, these two covariates were uncorrelated with caseness; therefore, the estimates of the cumulative time effect in the unadjusted model should not be biased without controlling for age and sex. Moreover, although we observed that the two coding schemes for the “time” variable (e.g., whether calendar days or betting days were used) influenced the magnitude of the coefficient, the direction of the time effects on the outcomes was consistent regardless of coding scheme. Finally, the random effects employed in our models appeared to fit the Gaussian assumption. According to BIC, the assumption of no within-subject serial correlation fit the data well when the cumulative time spans were near the account closure.

This study has several limitations. First, we did not have information about individuals’ wealth, other gambling activities (i.e., Internet or land-based venues), personality (Blaszczynski et al. 1986), and cognitive determinants; some of these attributes can be linked to the development and maintenance of gambling disorders (Breen and Zuckerman 1999; Shaffer and Korn 2002). Because wealth can affect both monetary involvement and gambling frequency, controlling for wealth should yield a more accurate estimate of the cumulative time effect. In the absence of wealth information, our choice of a nested case–control design should limit possible confounding, but not entirely. Further, monetary loss has been presumed as the main reason why gamblers closed accounts. Despite the absence of wealth information, our findings about greater tendency of gambling loss among the account closers near the closure time confirmed the existence and nature of salient behavioral changes. Second, seasonality can impact gambling behaviors associated with sporting events, which is not accounted for in our longitudinal models. However, seasonality might not be an influential factor in our analyses because the gamblers’ dates of voluntary termination varied during the observation period. Because our analyses focused on live action gambling, a type of gambling similar to casino games and poker games that requires rapid decisions and quick evaluation, seasonality likely has limited impact on our findings. Third, the current cohort represents Internet sports gamblers. Therefore, their gambling behaviors might not readily generalize to other types of gambling. Nevertheless, it is worth noting that live action gambling shares some similar cognitive characteristics as Poker and some Casino games where rapid evaluation and decisions are cognitively engaged. Finally, the last daily aggregate (day 1) in Fig. 4 should not be interpreted as a full-day aggregate because the time of the day when a gambler closes account might vary. Therefore, the last observation (day 1) in Fig. 4 among the cases must be read with caution: the average log-scaled number of bets for day 1 should be greater than the reading in Fig. 4. Nevertheless, the gambling frequency is trending downward among both the cases and controls. The measurements for stake, odds, and net loss were valid as well because we standardized these indices by the number of bets.

This study has several important theoretical implications. The dictum that “losses loom larger than gains” (Kahneman and Tversky 1979) might have played an important role in how gamblers chase their losses. This study suggests that people, even those who self-identify as having gambling problems, are more “loss averse” than “gain motivated” under conditions of uncertainty; they choose more conservative wagers to prevent further loss—despite their willingness to bet with greater stake size. It is possible that when players employed a more conservative gambling strategy, the momentum of losing might have triggered a decision to voluntarily terminate their account. If so, this new model of chasing raises important questions about the capacity for self-control during periods of excessive gambling. Because most Internet gamblers also are land based gamblers, it is possible that similar behavioral patterns exist within land based gambling settings. However, due to the lack of in vivo data derived from players in those settings, our current understanding of “chasing” remains limited because of the recall bias associated with participants in land-based gambling research. Our findings suggest that it is possible for some gamblers to self-control (e.g., self-exclude) some aspects of their gambling behavior even under adverse circumstances. More research will be necessary to better identify (1) the heuristics that guide Internet players’ decisions to close their accounts, (2) the temporal sequencing of the associated behavioral changes, (3) the mediators of these processes (i.e., co-occurring disorders, cognitive processes), and (4) the unique attributes of these gamblers compared with other types of gamblers.

Statistically, the expected value of any bet is negative because of the service provider’s “rake.” Therefore, from a behavioral economics perspective, engaging in gambling voluntarily without contemplating the negative expected value is paradoxical and irrational (Wagenaar and Albert 1988). We can view the self-initiated voluntary account closing by a problem gambler as a measure of self-control; this control represents a transitional state from irrational to rational. By providing actual gambling behavior as an evidence base, this study advances our understanding of the choice of risk before problem gamblers decide to close.

In sum, regarding the construct of “chasing losses,” we observed evidence that supports the construct with respect to increasing stake during increasing monetary loss. However, we also observed that, among this group of gamblers who experienced gambling problems, betting long odds is a path “less traveled by.” We observed reduced gambling frequency among these problem gamblers. This apparent paradox reflects an intriguing example of how studies focusing on actual behavior can contradict a prior theoretical proclamation.

References

American Psychiatric Association. (1997). Diagnostic and statistical manual of mental disorders. Washington, DC: American Psychiatric Association.

Anderson, G., & Brown, R. I. (1984). Real and laboratory gambling, sensation seeking and arousal. The British Journal of Psychology, 75, 401–410.

Bechara, A., Damasio, H., Tranel, D., & Damasio, A. R. (1997). Deciding advantageously before knowing the advantageous strategy. Science, 275, 1293–1295. doi:10.1126/science.275.5304.1293.

Blaszczynski, A., & Nower, L. (2002). A pathways model of problem and pathological gambling. Addiction (Abingdon, England), 97, 487–499. doi:10.1046/j.1360-0443.2002.00015.x.

Blaszczynski, A., Wilson, A. C., & McConaghy, N. (1986). Sensation seeking and pathological gambling. British Journal of Addiction, 81, 113–117. doi:10.1111/j.1360-0443.1986.tb00301.x.

Breen, R. B., & Zuckerman, M. (1999). ‘Chasing’ in gambling behavior: Personality and cognitive determinants. Personality and Individual Differences, 27, 1097–1111. doi:10.1016/S0191-8869(99)00052-5.

Dickerson, M. (1984). Compulsive gamblers. London: Longman.

Gehring, W. J., & Willoughby, A. R. (2002). The medial frontal cortex and the rapid processing of monetary gains and losses. Science, 295, 2279–2281. doi:10.1126/science.1066893.

Griffiths, M. (2004). Betting your life on it. BMJ (Clinical Research Ed.), 329, 1055–1056. doi:10.1136/bmj.329.7474.1055.

Kahneman, D. (1999). Objective happiness. In D. Kahneman, Ed. Diener, & N. Schwarz (Eds.), Well-being: Foundations of hedonic psychology (pp. 3–25). New York: Russell Sage Foundation.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–292. doi:10.2307/1914185.

LaBrie, R. A., Kaplan, S. A., LaPlante, D. A., Nelson, S. E., & Shaffer, H. J. (2008). Inside the virtual casino: A prospective longitudinal study of actual internet casino gambling. European Journal of Public Health, 18, 410–416. doi:10.1093/eurpub/ckn021.

LaBrie, R. A., LaPlante, D. A., Nelson, S. E., Schumann, A., & Shaffer, H. J. (2007). Assessing the playing field: A prospective longitudinal study of internet sports gambling behavior. Journal of Gambling Studies, 23, 347–362. doi:10.1007/s10899-007-9067-3.

Laird, N. M., & Ware, J. H. (1982). Random-effects models for longitudinal data. Biometrics, 38, 963–974. doi:10.2307/2529876.

LaPlante, D. A., Nelson, S. E., LaBrie, R. A., & Shaffer, H. J. (2008a). Stability and progression of disordered gambling: lessons from longitudinal studies. Canadian Journal of Psychiatry, 53, 52–60.

LaPlante, D. A., Schumann, A., Labrie, R. A., & Shaffer, H. J. (2008b). Population trends in internet sports gambling. Computers in Human Behavior, 24, 2399–2414. doi:10.1016/j.chb.2008.02.015.

Lesieur, H. (1979). The compulsive gambler’s spiral of options and involvement. Psychiatry, 42, 79–87.

Lesieur, H. (1984). The chase: Career of the compulsive gambler. Cambridge, MA: Schenkman Publishing Co.

National Research Council. (1999). Pathological gambling: A critical review. Washington, DC: National Academy Press.

O’Connor, J., & Dickerson, M. (2003). Definition and measurement of chasing in off-course betting and gaming machine play. Journal of Gambling Studies, 19, 359–386. doi:10.1023/A:1026375809186.

Petry, N. M. (2005). Pathological gambling: Etiology, comorbidity, and treatment. Washington, DC: American Psychological Association.

Pinheiro, J., Bates, D., DebRoy, S., Sarkar, D., & the R Core team. (2008). nlme: Linear and nonlinear mixed effects model. R package version 3.1-89.

Potenza, M. N., Leung, H.-C., Blumberg, H. P., Peterson, B. S., Fulbright, R. K., Lacadie, C. M., et al. (2003). An fMRI stroop task study of ventromedial prefrontal cortical function in pathological gamblers. The American Journal of Psychiatry, 160, 1990–1994. doi:10.1176/appi.ajp.160.11.1990.

Reuter, J., Raedler, T., Rose, M., Hand, I., Gläscher, J., & Büchel, C. (2005). Pathological gambling is linked to reduced activation of the mesolimbic reward system. Nature Neuroscience, 8, 147–148. doi:10.1038/nn1378.

Ross, S. (2002). A first course in probability. Upper Saddle River, NJ: Prentice-Hall.

Rothman, K. J., & Greenland, S. (1998). Types of epidemiologic study. In K. J. Rothman & S. Greenland (Eds.), Modern epidemiology (pp. 67–78). Philadelphia, PA: Lippincott Williams & Wilkins.

Shaffer, H. J., & Korn, D. A. (2002). Gambling and related mental disorders: A public health analysis. Annual Review of Public Health, 23, 171–212. doi:10.1146/annurev.publhealth.23.100901.140532.

Sharpe, L., Tarrier, N., Schotte, D., & Spence, S. H. (1995). The role of autonomic arousal in problem gambling. Addiction (Abingdon, England), 90, 1529–1540. doi:10.1111/j.1360-0443.1995.tb02815.x.

Slutske, W. S. (2007). Longitudinal studies of gambling behavior. In G. Smith, D. C. Hodgins, & R. J. Williams (Eds.), Research and measurement issues in gambling studies (pp. 127–151). Oxford: Elsevier, Academic Press Publications.

Wagenaar, W. A. (1988). Paradoxes of gambling behaviour. Hove: Lawrence Erlbaum Associates Ltd., Publishers.

Ware, J. H. (1985). Linear models for the analysis of longitudinal studies. The American Statistician, 39, 95–101. doi:10.2307/2682803.

Acknowledgements

The authors extend special thanks to Richard LaBrie, James Ware, Debi LaPlante, Sarah Nelson, Anja Broda, and Chrissy Thurmond for their important contributions to this project. Ziming Xuan had full access to all of the data in the study and takes responsibility for the integrity of the data and the accuracy of the data analysis.

bwin.com, Interactive Entertainment, AG provided primary support for this study. The National Institute of Mental Health (NIMH), National Institute of Alcohol Abuse and Alcoholism (NIAAA), National Institute on Drug Abuse (NIDA), and the National Center for Responsible Gaming (NCRG) provided additional support. None of these supporters or any of the authors has personal interests in bwin.com and its associated companies that would suggest a conflict of interest.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Xuan, Z., Shaffer, H. How Do Gamblers End Gambling: Longitudinal Analysis of Internet Gambling Behaviors Prior to Account Closure Due to Gambling Related Problems. J Gambl Stud 25, 239–252 (2009). https://doi.org/10.1007/s10899-009-9118-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10899-009-9118-z