Abstract

I document the existence of discontinuities in short- and long-term growth rates of satellite-recorded nighttime lights per capita across national borders, with growth rates of nighttime lights increasing abruptly as one crosses a border from a slower-growing country into a faster-growing one. I show that growth discontinuities are not driven by any special set of borders, or by differences in geographic and climatic conditions on the different sides of borders. I investigate multiple explanations for growth discontinuities, including differences in the determinants of growth across borders and differences in the extent to which borders form barriers to flows of goods, capital or people. I present evidence that differences in the quality of the rule of law are consistently helpful in explaining differences in growth between two countries at their border, and conclude that national-level variables such as institutions and policies may have rapid and important effects on growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is well known that rates of economic growth vary widely between countries. However, it is less well understood how growth varies within and across countries over space. Does economic growth rise gradually as one travels through a poorer country towards a richer one, or does it change abruptly at the border? Figure 1 shows the growth in satellite-recorded nighttime lights, an intuitive indicator of economic growth, over Ukraine and its neighbors between 1992 and 2000. Areas that gained light during this time period are represented in white, whereas areas that lost light are represented in black (gray areas were unlit in both years). It is obvious that the ex-Soviet republics in this picture—Ukraine and its southern neighbor Moldova—mostly lost nighttime lights, while the Eastern European countries outside the Soviet Union—Poland, Romania and Hungary—mostly gained nighttime lights. This is consistent with the fact that during the transition from communism in the 1990s, Ukraine and Moldova contracted much more severely than did Poland, Romania and Hungary, which had exceeded their 1992 GDP by 2000. What is striking about the picture is that growth in nighttime lights appears to be discontinuous at the borders between the ex-Soviet states and their neighbors. Not only are there very few white dots in Ukraine and Moldova, and very few black dots in the Eastern European countries, but the black dots in Ukraine extend all the way to its borders with the Eastern European countries, and are immediately replaced by white dots as soon as the border is crossed. Particularly striking is that many of these national borders are relatively new. The westernmost tip of Ukraine (Ruthenia) had been part of Ukraine for only 46 years before the transition to market institutions, and had been in a political union with Hungary, Slovakia and Romania for much of the past five hundred yearsFootnote 1, and yet, it experienced a decline in lights as did the rest of Ukraine, while the neighboring parts of Hungary, Slovakia and Romania experienced growth in lights. Moreover, Moldova and Romania share the same language, religion and culture (although they have been politically separate for most of their modern history), but have had radically different lights growth experiences in the 1990s with Romania’s lights increasing, Moldova’s lights declining, and the growth experience changing discontinuously at the border.

This paper presents evidence that Fig. 1 is not an anomaly, but part of a general pattern of discontinuities in the rates of economic growth around national borders. The key methodological tool that enables me to establish the presence of growth discontinuities at borders is measuring economic growth in narrow bands around national borders by computing growth rates of satellite-recorded nighttime lights in these regions. Night lights are an ideal and indispensable data source for this project because they are one of the few indicators of economic activity that exist at a sufficiently fine resolution to allow the analysis of narrow neighborhoods around national borders, as well as because the method of their collection is continuous across national borders. National accounts data is fundamentally unsuitable for such a project because it is available, at best, only at a regional level, and does not permit considering regions other than large political subdivisions, thus making it inappropriate for a regression discontinuity analysis. Survey data may overcome this problem as it samples individuals or villages rather than geographical units, but it would introduce an artificial discontinuity at borders because each survey is conducted within a single country. Hence, errors attributable to the questionnaire or to the performance of different survey teams would be different on different sides of national borders. On the other hand, even if there is important spatial heterogeneity in the way that satellites record lights data, the remote sensing process should be continuous, and therefore, roughly stable within a neighborhood around a given border.Footnote 2

Using satellite data on nighttime lights as a proxy for economic activity around borders, I document a strong and statistically significant relationship between differentials in growth of lights per capita across a border and differences in growth in the bordering countries over 5- and 18-year periods between 1992 and 2010. As one moves from a slower-growing to a faster-growing country, the 5-year growth rate of lights per capita rises on average by 1.48 percentage points (or by 0.13 standard deviations) and the 18-year growth rate of lights per capita rises on average by 1.28 percentage points (or 0.19 standard deviations). For every 1 percentage point difference in the 5-year growth rates of GDP per capita of two bordering countries, there is a 0.38 percentage point difference in the growth rate of lights per capita of these countries at their mutual border, and for 18-year growth rates, there is a 0.45 percentage point difference. Therefore, there is a sizeable elasticity (between a third and a half, though less than unity) of growth differentials at borders to growth differentials nationwide. Moreover, these differentials are not driven by borders in any particular region, suggesting that they are not results of composition bias, but rather an enduring feature of the data to be explained.

After establishing the existence of border discontinuities in economic growth around the world, I examine the factors that might explain these discontinuities. One immediate explanation for why we observe border discontinuities might be that borders are drawn endogenously, with terrain and climatic conditions that are more favorable for growth being predominantly located on the sides of borders that belong to faster-growing countries. Borders could also be drawn endogenously if they are drawn around populations with particularly high or low growth rates, such as when a high-growing region secedes from a country. In this case, the discontinuity in growth rates causes the border, rather than the other way around. I find weak evidence that discontinuities in economic growth tend to be stronger at borders with above-median rather than below-median differences in key geographic covariates, but the order of magnitude of border discontinuities is similar for borders whose sides are geographically similar as well as geographically different. Moreover, there is no systematic tendency for certain kinds of geographies to coincide with faster- rather than slower-growing sides of borders. While it is difficult to test whether borders may have endogenously been drawn to separate groups of different productivies and propensities for growth because growth data at borders is not available historically, I show that estimated growth discontinuities at borders are of similar magnitude for old and recent borders, curved and straight borders, borders over rugged or flat terrain and borders near or far away from capital cities, which indirectly suggests that the history of the formation of a border matters little for the the growth discontinuity across that border. Furthermore, since I consider differences in economic growth in narrow neighborhoods around borders, so long as the location of borders in these neighborhoods is not precisely determined with respect to economic growth, endogeneity in border placement should not be the driver of growth discontinuities at borders.

Aside from endogenous border placement, growth discontinuities at national borders is consistent with either (or both) of the two following hypotheses:

-

1.

The growth process is not smooth across space, but depends on national-level shocks or national-level potential determinants of growth (such as national institutions, the national stock of human capital, culture or history) that vary discontinuously across borders. In particular, models in which local institutions or local culture are key to economic growth, but vary substantially across space and straddle borders would not generate growth discontinuities.Footnote 3 The border must form a barrier to the ability of people to avail themselves of particular institutions, to cultural influences, to the ability to obtain an education (or work with people with high human capital), or to the operation of other determinants of growth.

-

2.

Even in the absence of any differences in growth determinants across borders, there may still be discontinuities in rates of economic growth because borders form barriers to random economic shocks. Since different sides of a national border often have different languages, cultures and regulatory regimes, and often have explicit discouragements to trade across the border because of tariffs, the economies on the two sides of the border are less connected by trade than two economically comparable regions within the same country. Therefore, a shock in one country—such as a fall in demand for oil or a poor harvest—may fail to spill over a national border because of the discontinuous increase in transaction costs along that border.

I first show that borders that present greater barriers to economic flows—such as borders with low trade, migration and remittance flows, and high tariffs—tend to have the same magnitudes of border discontinuities as do borders with low barriers to economic flows. On the other hand, borders separating culturally more homogenous populations—such as those having the same language, or those that have had been colonized by the same country—tend to display smaller growth discontinuities. I then perform a correlational analysis of which of the determinants of economic growth that are most frequently cited in the literature help account for growth discontinuities at borders. I find that the rule of law measure from the World Governance Indicators (WGI) is correlated with growth of lights at the border, even conditional on various other covariates, while public goods provision, human capital and trust are not correlated with growth discontinuities conditional on institutional quality.

This paper is closest to Michalopoulos and Papaioannou (2014), who use night lights data to look at the (non)importance of national institutions for economic activity within African ethnicities split by national borders far away from their countries’ capitals. The major innovation of this paper is to consider discontinuities in growth rates, rather than levels, of economic activity across national borders. This innovation is valuable, since finding border discontinuities in economic growth rates, which tend to be volatile and much less persistent than is the level of economic activity, suggests that if these discontinuities can be attributed to policy variables, such as institutions, then policy might have nontrivial effects on economic growth.

The paper is organized as follows: Sect. 2 describes the data. Section 3 provides baseline results on border discontinuities in growth rates, as well as robustness checks to varying the econometric procedures and accounting for basic covariates that may be different on different sides of borders. Section 4 explores the heterogeneity of growth discontinuities across borders and provides suggestive evidence that they are not driven by a special subset of borders and that they are not explained by faster-growing sides of borders having different geography from the slower-growing sides of borders. Section 5 explores whether growth discontinuities at borders may be explained by the discontinuous barriers to economic interchange that borders pose. Section 6 discusses determinants of economic growth that may help statistically explain growth discontinuities at borders. Section 7 concludes.

2 Description of the data

In this section, I discuss the data sources used in this paper that are the most key to its contribution. Other sources, whose use is more standard, are described in Online Appendix 0.

2.1 The night lights dataset

Data on light radiance at night is collected by the DMSP-OLS satellite program and is maintained and processed by the Earth Observation Group and the NOAA National Geophysical Data Center. Satellites orbit the Earth every day, recording images of every location between 65 degrees south latitude and 65 degrees north latitude at a resolution of 30 arcseconds (approximately 1 square km at the equator) at approximately 8:30-10 PM local time. The images are processed to remove cloud cover, snow and ephemeral lights (such as forest fires) to produce the final product.Footnote 4

Each pixel (1 square kilometer) in the radiance data is assigned a digital number (DN) representing its brightness. The DNs are integers ranging from 0 to 63, with higher digital numbers corresponding to greater light density. Recent papers using nighttime lights data have constructed light density as some aggregate of powers of pixel DN’s in a region: for example, Henderson et al. (2011) and Michalopoulos and Papaioannou (2014) use the sum of all DNs, while Chen and Nordhaus (2010) use the sum of all DNs taken to the power 3 / 2. However, pixels with DN equal to 0 or 63 may be top- or bottom-censored. Another known problem with the lights data is the presence of overglow and blooming: light tends to travel to pixels outside of those in which it originates, and light tends to be magnified over certain terrain types such as water and snow cover. Overglow and blooming tend to make nearby pixels more similarly lit than they should be, thus working against finding discontinuities across borders.

The night lights dataset has been extensively analyzed in the remote sensing literature for its utility in predicting economic activity; see Elvidge et al. (1997), Sutton et al. (2007), Doll (2006), Ghosh et al. (2010) and Elvidge et al. (2012). Baugh et al. (2009) thoroughly describes the construction of the night lights dataset, and Doll (2008) comprehensively discusses its uses and pitfalls. Its pioneering use in the economics literature has been Henderson et al. (2011). Chen and Nordhaus (2010) discuss the limitations of the lights dataset; in particular, they argue that the relationship between light density and output density becomes uninformative because of top-censoring and bottom-censoring at \(DN=63\) and \( DN=0\). Pinkovskiy and Sala-i-Martin (2016) use nighttime lights as an independent benchmark to assess the quality of household survey means relative to national accounts data, and find national accounts to be more reliable than household surveys. Michalopoulos and Papaioannou (2014) use the night lights dataset to construct a proxy for output per capita in African ethnic territories to assess the consequences of partitioning ethnicities during the Scramble for Africa, and Alesina et al. (2016) use them to construct a proxy for incomes of ethnic groups more generally. Jerven (2013) points out that national income statistics may be notoriously mismeasured in parts of the developing world (e.g. Africa), suggesting that nighttime lights might even be more accurate than official economic statistics for such places.

2.2 Gridded population of the world data

The Gridded Population of the World (GPW) dataset is constructed and maintained by the Socioeconomic Data and Applications Center (SEDAC) at the Center for International Earth Science Information Network at the Earth Institute at Columbia University. The dataset compiles population information from national censuses for political units (typically very small ones, like municipalities and census tracts, but in some cases, much larger ones) in order to achieve its resolution. Within a political unit, population is distributed uniformly. In Sect. 3 I demonstrate that differences in the resolution of the population data across countries do not impact my results substantially.

3 Baseline results

3.1 The dependent variable

3.1.1 Calibration

To convert lights data into a single quantity comparable to GDP, I assume a low-parameter function approximating the relationship between DN and output density, and calibrate its parameters using aggregate light density for countries and national accounts data on GDP per capita in 2005 international dollars. Specifically, I estimate the parameters of the function using nonlinear least squares, in which I try to explain GDP density per unit area in a country with measures of light density for the country constructed using pixel digital numbers. The assumed relationship is

where i indexes countries, \(y_{i}\) is GDP density of country i (obtained from the World Bank), \(v_{j,i}\) is the fraction of pixels with digital number equal to j in country i, and \(\varepsilon _{i}\) is the error term. I use the transfer function \(\ln \left( 1+x\right) \) rather than \(\ln \left( x\right) \) because the latter is not defined for \(x=0\) while the former is defined for all nonnegative x (and some negative values of x as well). This is not a problem in the estimation of the calibration equation, as the light density of no country is equal to zero; however, the light density at some borders does attain the value zero, which explains the need to use such a specification. This specification is similar in spirit to the pixel-level specifications in Michalopoulos and Papaioannou (2014), which also consider variations in light density across small regions around national or ethnic borders.

I estimate Eq. (1) for every satellite-year in the DMSP-OLS dataset, setting \(c=c_{0}=c_{1}=0\), \(c_{b}=1\) and \(d=3/2\) as my initial values.Footnote 5 For multiple years (in particular 2000 and 2005), the estimates of the top-censoring and bottom-censoring coefficients \(c_{0}\) and \(c_{1}\) are equal to zero, suggesting that top-censoring and bottom-censoring is not a particularly important limitation of the data.Footnote 6

3.1.2 Computation of the dependent variable

To obtain a lights-based proxy for economic growth around a given border for a given year, I construct neighborhoods containing all points whose shortest distance to the border is less than X kilometers, where X ranges from 10 to 70 in increments of 10 kilometers. Since national borders tend to differ substantially in length, I standardize them and the neighborhoods around them by dividing each border and its neighborhood into pieces corresponding to their intersections with a 1-degree by 1-degree grid superimposed on the world map of country borders and neighborhoods (CShapes, Weidemann et al. 2011). Having started with 270 borders, I obtain 1352 border pieces, each defined by the intersection of a border with the rectangular grid.Footnote 7 For each border piece, there are 7 associated neighborhood pieces (corresponding to the 7 neighborhoods around each border, partitioned by the grid) and 2 associated sides of the border piece within each neighborhood (corresponding to the two sides of the border, partitioned by the grid).Footnote 8 In all my computations of standard errors, I cluster the standard errors by border (rather than border piece) so I have 270 clusters. I then use an ArcGIS Python script to compute the fraction of pixels with each digital number for each side of the border within each neighborhood. Subsequently, I use the calibrated values of \(c,c_{0},c_{1},c_{b}\) and d to compute the right-hand side of Eq. (1) for each side of the border, thus obtaining a proxy for the output density of the given country within X kilometers of the given border. Finally, I multiply by the area and divide by the population of this region (as discussed in Sect. 2, I obtain population at nominal 2.5 arcminute resolution from the Gridded Population of the World dataset) to obtain a lights-based estimate of GDP per capita for the given country within X kilometers of the given border. I then compute the average annualized growth rate of this variable for the time intervals at which population data is available (1992–1995, 1995–2000, 2000–2005 and 2005–2010) as well as for the overall 18-year interval 1992-2010.

There are good reasons to expect that this calibration procedure creates a variable that is, on average, close to the true value of GDP growth per capita in the region of interest. Henderson et al. (2011) and Chen and Nordhaus (2010) document the tight association between GDP density and measures of light density that are similar to the one used in this paper. The fit of the selected specifications to the GDP data for countries is very good as the first panel of Fig. 4 attests: the lights explain approximately 73 % of the variation in GDP per capita, and the plot looks approximately linear. I also present the relationship between the 18-year growth of the calibrated lights series and the growth of GDP per capita in the second panel of Fig. 4. The fit is not as good (the lights explain only 23 % of the variation in growth), but still quite strong, and the positive correlation is unmistakeable.

3.2 Descriptive analysis and graphs

3.2.1 Descriptive statistics

Table 1 provides descriptive statistics for the main variables of interest: growth rates of lights per capita at borders for 5- and 18-year periods, growth of lights per capita and GDP per capita nationwide, and some covariates. I present the mean and the standard deviation of each variable, as well as the mean and the standard deviation of each variable computed on the side of each border corresponding to the faster-growing and slower-growing side of the border, respectively, and the mean and standard deviation of the difference. The descriptive statistics foreshadow more formal results. We immediately see that 5- and 18-year growth rates of lights per capita are higher on the sides of borders corresponding to faster-growing countries. The averages of these growth rates at the border are somewhat lower than the averages of these growth rates nationwide, but are approximately the same level as the averages of World Bank-recorded growth rates of GDP per capita. In panel 2 of the table, where we look at institutions and public goods, we see that the rule of law of the faster-growing country at a border is much better on average than the rule of law of the slower-growing country at that border. Public goods (proxied by the fraction of roads paved) are also better on average in the faster-growing country at a border, but the difference varies considerably across borders, as it does for trust and the number of years of schooling. Interestingly, local public goods (log roads near the border) are very close to each other on the faster-growing and slower-growing sides of borders on average.

3.2.2 Elementary discontinuity plots and correlations

I present several elementary graphs that suggest large discontinuities in growth rates of economic activity at national borders. First, Fig. 3 provides a basic illustration of my methodology by plotting the growth in nighttime lights per capita as a function of distance to the border for some of the Eastern European borders in Fig. 1. The discontinuities in the growth rates at the Romania-Moldova and the Romania-Ukraine borders are unmistakeable, and capture in a graph the stark message that Fig. 1 captures in a map. Panel 1 of Fig. 5 shows a more global illustration of growth discontinuities by presenting a discontinuity plot of the 5-year growth rate of lights per capita (predicted GDP per capita using lights) against distance from border in the direction of the faster-growing country (in terms of national GDP per capita) at the border. To construct this plot, I effectively compute a population-weighted average of plots like the ones in Fig. 3. I identify the faster-growing country and the slower-growing country at each border according to which one has the higher 5-year growth rate of World Bank GDP per capita. I then average the growth rates at the border (weighting by population in the relevant neighborhood of the border) of the slower-growing countries for 10-km intervals of distance to the border. I repeat the same procedure for the faster-growing countries and plot the averages as a function of distance to the border either for the faster-growing (on the right) or for the slower-growing (on the left) side.

It is apparent that there is a discontinuity at the border crossing point, with the side of the border corresponding to the faster-growing country having a 5-year border growth rate about 1.5 percentage points higher than the side corresponding to the slower-growing country. The last point on the poorer side (at -10 km) is approaching the points on the richer side, but the other points on the poorer side are far removed from those on the richer side (by at least the 1.5 percentage points of the discontinuity). This can be explained by overglow in the data: light from the faster-growing side of the border illuminates the slower-growing side, making it appear to be growing faster than it really is. Panel 2 presents a similar discontinuity plot for the 18-year growth rate. Both plots are qualitatively the same: the growth rate of lights is substantially smaller for the sides of borders corresponding to the slower-growing countries, with some convergence at the last 10 km, which is likely because of overglow. The growth discontinuities appear to be on the order of 1 percentage point or larger.

It is worth considering a few examples of growth discontinuities at borders outside Eastern Europe. Panel 1 of Fig. 7 shows the discontinuity at the border between Zimbabwe and Botswana in Africa. Botswana is one of the few middle-income countries in Africa and enjoys relatively rapid growth of about 2 % per year, while Zimbabwe’s economy has shrunk at a similar rate between 1992 and 2010 owing to the expropriations and hyperinflationary policy carried out by Robert Mugabe. We see that Botswana’s growth in nighttime lights at the border is much higher than Zimbabwe’s. (The fact that Botswana’s growth falls as one moves away from the border while Zimbabwe’s rises is likely explained by Zimbabwe’s population rising rapidly about 60 kilometers away from the border, while Botswana’s population falling off at a similar distance). Panel 2 shows the border between Cambodia and Vietnam. During the time period under consideration, Vietnam had implemented market reforms and increased trade with other Southeast Asian countries as well as with the United States, while Cambodia has struggled with political instability and with the legacy of a brutal dictatorship in the 1970s. We see that nighttime lights grow discretely faster in Vietnam than in Cambodia at their joint border. Panel 3 shows the border between Colombia and Venezuela. Over the period 1992 to 2010, the Colombian government was largely successful in ending a long-running civil war and asserting control of important parts of the country, while Venezuela experienced severe economic mismanagement under the regime of Hugo Chavez. Likely as a result of these trends, the Colombian economy grew at about 1.5 % per year, while the Venezuelan economy shrank on average. We see that at the border, growth in nighttime lights in Colombia is stably higher than it is in Venezuela. The magnitude of this discontinuity is around 2 percentage points in average annualized growth, which is close to the average magnitude of a growth discontinuity at a border. Lastly, Panel 4 shows the border between the U.S. and Mexico. Here, although the U.S. grew faster than Mexico during this period (1.4 % per year vs. 0.9 % per year), there appears to be no discontinuity in growth rates of nighttime lights at the border.Footnote 9 This is likely because northern Mexico receives large amounts of foreign investment from the U.S., and has been growing at a much faster rate than Mexico as a whole. In Sect. 5 we will consider the possibility that cross-border economic flows or their absence account for the absence or presence of growth discontinuities at borders, and we will conclude that they do not account for much variation in the magnitude of border discontinuities. Hence, the case of the U.S.-Mexico border is likely an exceptional one.

The discontinuity plots in Fig. 5 elide the fact that countries are extremely heterogeneous and the difference in economic activity at the border between a faster-growing and a slower-growing country may vary widely, even if it is large and positive on average. One would instead expect the difference at the border to be somehow related to the difference in economic growth between the two countries overall: countries with wide disparities in growth rates (like Ukraine and Romania) should have larger discontinuities at their common border than countries with similar growth rates (like France and Germany). Figure 6 presents plots of differences in growth rates in lights per capita at bordersFootnote 10 against differences in growth rates of GDP per capita in the bordering countries (each border difference being weighted by total population at the border, and with outliers as defined in Table 3 removed). The positive correlations and their strength are apparent, even though the dispersion of the data is large.

3.3 Baseline results

I now present formal analysis to document economic discontinuities at borders. I first run regressions at each border piece in each year of the form

where \(g_{i,b,t,d}\) is the value of the growth of lights per capitaFootnote 11 in country i, year t, border piece b and at distance d away from the border in border piece b. The parameters to be estimated are \( \tilde{g}_{i,b,t}\), the value of g at the border in country i, and \( \tilde{\delta }_{i,b,t}\), the slope of g at the border. I choose the bandwidth \(h_{i,b,t}\) to assign greater weight to observations close to the border using a cross-validation procedure that selects the bandwidth to maximize the accuracy of predictions 10 km away from the border for each regression I run. I therefore fit a separate local linear regression and choose a separate bandwidth in each country-border piece-year.

A complication in using local polynomial estimation to calculate border discontinuities with nighttime lights data is that the data generating process does not obey the standard assumption of independently generated data with the number of observations at each site going to infinity. Instead, the nighttime lights data constitute a global census of visible nighttime lights, taken at a fixed resolution. Therefore, the asymptotics for the regression discontinuity estimator must be calculated as the resolution of the data goes to infinity (the pixel size goes to zero) rather than as the domain of the pixels expands to infinity. Such an asymptotic scheme is referred to as infill asymptotics in the spatial econometrics literature. A natural assumption for such data is that the errors from trend of neighboring data points are correlated. A contribution of this paper is to derive the properties of the local polynomial estimator under infill asymptotics with correlated errors. I prove that with very general assumptions on the covariance structure of the outcome variable the local polynomial estimator is consistent, and has a smaller asymptotic variance than it would if the errors from trend were independentFootnote 12. Intuitively, the local polynomial estimator exploits the correlation in the errors, so that only their unpredictable component contributes to the asymptotic variance. In the special case that the error from trend is mean-square continuous (has no unpredictable component), the local polynomial estimator converges at a nonstandard rate of \(1/\sqrt{h}\), where h is its bandwidth. I describe this estimator in detail in Online Appendix II.

Having obtained estimates of growth in lights and of its slope at borders, I run regressions of the form

where \(\tilde{g}_{i,b,t}\) is the local linear estimate of the growth rate of lights per capita at border piece b in country i and year t, \( g_{i,t}\) is the corresponding growth rate of GDP per capita for country i as a whole, \(u_{i,b,t}\) is an indicator that country i has the larger corresponding growth rate of GDP per capita of the two countries at border piece b, \(\alpha _{b,t}\) and \(\chi _{b,t}\ \)are the border piece-year fixed effects in each regression, and \(\varepsilon _{i,b,t}\) and \(\upsilon _{i,b,t}\) are the error terms in each regression. The parameters of interest to be estimated are \(\beta \), the average percentage point rise in the growth rate of economic activity as one crosses a border from a slower-growing to a faster-growing country, and \(\gamma \), the elasticity of the difference of the growth rate of output at the border to the difference of the growth rate of GDP per capita of the bordering nations. I weigh all observations by the total population in a 70-km neighborhood on both sides of the border (so nearly empty borders, like those through the Sahara desert or in the Amazon rainforest, get very little weight), and I cluster all standard errors by border (not border piece). Finally, in order to account for the error of the first-step estimation of the growth rates of light at borders, I augment the variance of the regression by the first-step variances of the dependent variables from the local linear estimation as described in Online Appendix II.

It is worth noting that one can take the difference the two observations within a border piece b at time t in order to get rid of the fixed effects in the second-step regressions. Such a procedure would yield the following regressions:

These simple linear regressions produce numerically identical estimates of \(\beta \) and \(\gamma \) to the fixed-effects regressions (4) and (5), but are much easier to interpret: in the first case, we regress the difference in growth of lights at the border between the side corresponding to the faster-growing country and the side corresponding to the slower-growing country on a constant, and in the second case, we regress the difference in the growth of lights across the border on the difference in the growth of GDP per capita between the bordering countries without a constant. Hence, the parameters \(\beta \) and \(\gamma \) are, respectively, the average percentage point rise in the growth rate of economic activity as one crosses a border from a slower-growing to a faster-growing country, and the fraction of the difference of the growth rate of GDP per capita of the bordering nations (in percentage terms) that persists to the border.Footnote 13

Table 2 presents estimates of \(\beta \) and \(\gamma \) for 5-year and 18-year growth rates. The first row shows the baseline estimates. We see that average annualized 5-year growth in calibrated lights per capita jumps on average by 1.48 percentage points upon crossing from a slower-growing into a faster growing country. We also see that a 1 percentage point difference in national GDP per capita average annualized 5-year growth rates translates into a 0.38 percentage point difference in calibrated lights per capita growth rates at the countries’ joint border. The estimates when 18-year growth rates are used remain similar: \(\beta \) is 1.28 and \(\gamma \) is 0.45. All estimates are significant at least at the 5 % significance level. We can assess the magnitudes of these estimates from the second row of the table, which standardizes growth at the border and nationwide growth to have unit variance. We see that growth as measured by nighttime lights jumps by 0.13 to 0.19 standard deviations at the border between a slower-growing country and a faster-growing country, while a 1-standard deviation in the difference between national growth rates of two bordering countries is associated with about a 0.11 to 0.13 standard deviation jump in the difference between growth rates at the border. These numbers are likely to be lower bounds because the lights proxies very likely measure economic growth at borders with a large amount of noise; the standard deviation of growth rates at the border is nearly four times the size of the standard deviation of nationwide growth rates. The average bandwidth used to obtain these estimates is large, about 49 km when 18-year growth of lights per capita is used as the dependent variable. (I restrict my analysis to a 70-km neighborhood of the border, and allow a maximum bandwidth size of 60 km, which is attained for slightly under half of my observations). To assess the sensitivity of my estimates to bandwidth choice, I provide results with a bandwidth of 30 km for all countries. No coefficients lose significance, with the coefficients on 5-year growth rates and 18-year growth rates of lights per capita declining slightly in magnitude and the coefficients on the 18-year growth rates of light density rising slightly in magnitude.

Having observed growth discontinuities at borders, a natural falsification exercise is to re-run my regressions using fake borders, for which I should not expect a discontinuity. I perform two such exercises: one in which I draw the fake borders at a distance of 30 km from the real borders into the interior of the faster-growing country, and one in which I draw the fake borders at a distance of 30 km into the interior of the slower-growing country. The discontinuity estimates for the fake borders are statistically insignificant (except in one case out of 8), which is reassuring, but the magnitudes of some of these estimates are large (half or more of the baseline estimates), which is disconcerting. However, all the large, or statistically significant, estimates are negative, suggesting that growth rates fall as one approaches closer than 30 km to the border from the slower-growing side, or goes further than 30 km away from the border into the faster-growing side, which is not consistent with growth rising continuously as one moves closer to or further into the faster-growing side of the border. Finally, Row 6 presents estimates in which no local linear regression is used, and the dependent variables \( \tilde{g}_{i,b,t}\) are defined to be growth rates of lights per capita in a 50-km neighborhood of border \(b\,\ \)on the side of country i in year t. This methodology is more conventional than the two-step procedure that I employ for my baseline estimates, and is also more likely to be robust to overglow, but it may fail to capture convergence of growth rates at the border and find a discontinuity where none exists. With this methodology, we obtain discontinuity estimates that are very similar to the baseline estimates for 18-year growth rates and are about 25 % larger than the baseline estimates for the 5-year growth rates, which suggests that if the local linear procedure captures any convergence of light growth at the border (either because of overglow or because economic interchange smooths out discontinuities), this convergence is not particularly important.

3.4 Elementary robustness checks

Table 3 presents robustness checks of the baseline discontinuity results to changing the weighting scheme, removing outliers and adding controls that should be continuous across borders. The first row reproduces the baseline. Row 2 runs the regressions (4) and (5) weighting each border piece equally, rather than weighting them by population. The estimates shrink relative to the baseline in magnitude, but remain statistically significant at least at 10 %. Hence, while population weighting is important to estimating the magnitude of growth discontinuities, it is not crucial for finding that statistically significant discontinuities exist. The subsequent row reports estimates in which the original population weights are truncated at their median value. The next row reproduces the baseline excluding the borders for which either the difference in growth rates at the border or the difference in growth rates between the two bordering countries exceeds in absolute value the 99th percentile of the distribution of the absolute values of these differences in the sample. The resulting numbers of observations and borders are reported below: we see that no borders (but over 200 observations) are excluded for the 5-year growth rates, while approximately seven borders are excluded for the 18-year growth rates. Removal of outliers does not substantially change the magnitudes of any of the coefficients (if anything, some of them increase slightly).

I now address the hypothesis that different data collection procedures on different sides of borders, or omitted spatially varying variables on different sides of borders, may be driving the growth discontinuities at borders. First, whenever growth in lights per capita is the dependent variable, the estimates depend on population data from the Gridded Population of the World (GPW) dataset, which reports population estimates for small subnational units that vary in size from country to country. In some countries, such units are larger than others, leading to coarser spatial population estimates, and thus, potentially, spurious discontinuities in growth rates at national borders. This concern is partially addressed by presenting estimates with growth in light density as a dependent variable; however, as a further check in Row 5 of Table 3 I include the log average number of people per subnational unit per country and the log spatial resolution of the subnational unit grid of each country (both from GPW) as right-hand-side variables. The estimates appear to be largely unaffected, with some standard errors increasing. Another concern may be that different border pieces have different areas, or that growth in nighttime lights mismeasures growth in output in a way that is correlated with population (for example, if shared public goods contribute to nighttime lights, then growth in lights per capita understates actual growth in output per capita). To address these concerns, in Row 5 I reproduce the baseline specification augmented by separate quartic polynomials in log total population on a given side of a border piece in a given year (which is a 70-km wide neighborhood of the border) and in the log area of each such side. Adding these controls does not substantially affect my estimates. Rows 6 and 7 add climatic variables (described in Sect. 4) and local public goods variables (described in Sect. 6.2) as controls, with only minor changes to the estimated discontinuities. Finally, Row 8 includes all controls from rows 5–7, as well as the fraction of the area of each border piece covered by oil and gas flares (DMSP-OLS). The discontinuity estimates are slightly lower than in the baseline, but their magnitudes and significance levels remain very comparable despite the addition of such an extensive battery of control variables.

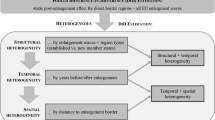

4 Heterogeneity of growth discontinuities at the border

As mentioned in the Introduction, one immediate explanation for discontinuities in the growth rate of economic activity may be that national borders tend to be drawn at discontinuous changes in geographic variables, such as altitude, slope of the terrain (a related measure, ruggedness, was investigated in Nunn and Puga [2012]), and climatic zones. The historical process through which the border was set may also shape patterns of economic growth on either side. In this section, I investigate whether the physical and historical characteristics of borders may explain border discontinuities in economic growth. Overall, I find only weak evidence that preexisting geographical discontinuities or border history play an important role in explaining the large differences in growth rates found on average at national borders.

4.1 Geographical differences across borders

I calculate average values of altitude, slope, and statistics of temperature and precipitation (means, maximums, minimums, variability measures) on either side of every border, obtained from WorldClimate at 30 arcsecond resolution. I also calculate, on either side of every border, the fraction of land belonging to each of the 14 climatic zones defined by the International Geosphere Biosphere Programme, by using the Global Land Cover Characteristics Data available from USGS, also at 30 arcsecond resolution.Footnote 14 First, in Tables 4 and 5, I investigate whether discontinuities in economic growth rates tend to be located on borders with large differences in some of these variables across the border, or whether they are also present at borders on which both sides are relatively similar in terms of these geographic variables. Specifically, I classify border pieces as having a difference in any particular geographical variable across the two sides of the border as above the median or below the median of such differences. I find that discontinuities in 5-year economic growth rates are present on border pieces with below-median border differentials in altitude, slope, temperature and its standard deviation, precipitation, fraction of land used as cropland, and fraction of land endowed with nutrients. Discontinuities in 18-year economic growth rates tend to be statistically insignificant on average on borders with below-median differentials in slope, in temperature and its standard deviation as well as in the fraction of land used as cropland. However, the point estimates of the 18-year economic growth rate discontinuities tend to be of the same order of magnitude on borders with below- as well as with above-median differentials in geographic covariates. Moreover, it is reassuring to see that borders with below-median differences in the fraction of land endowed with nutrients, a more exogenous measure of land suitability for agriculture than the fraction of land that is used as cropland, have statistically significant discontinuities in 18-year economic growth rates.

Even though there is some evidence that 18-year economic growth rates may be discontinuous mostly at borders with geographic differentials, it does not appear that these geographical differentials are driving the finding of border discontinuities in economic growth. First, I include all the geographic and climatic variables as covariates on the right-hand side in the regressions (4) and (5). In Row 5 of Table 3, I present the resulting discontinuity estimates. Including these controls weakens most of the estimated coefficients only slightly and increases a few. Second, I rerun the specifications given by Eq. (4) replacing the dependent variable by each of the 35 geographic variables used. Out of 70 possible tests, 2 reject at 5 %, which is below the number that one would expect if none of the geographic variables were discontinuous (which is about 4). I present the local linear regressions for the geographic variables thought to be potentially important for economic growth (and for which the type of border breakdowns were computed in Tables 4 and 5) in Table 6: altitude, slope, mean temperature, temperature standard deviation, mean precipitation, fraction of land that is cropland and fraction of land with good nutrient availability. All the variables are scaled to have mean zero and standard deviation equal to unity, and for all variables presented, the discontinuity estimate is not significant. It should be noted that the climatic (though not the altitude and slope) variables are interpolated from weather stations, and the land cover variables are categorical, making it less surprising that we do not find discontinuities in them. Both these checks imply that there is no systematic tendency for sides of borders corresponding to faster-growing countries to have higher or more volatile temperatures, or to be more rugged than the sides of borders corresponding to slower-growing countries.

4.2 Discontinuities by continent

It is important to understand which borders contribute most to my baseline finding, and whether particular clusters of borders drive my results. Table 7 begins by presenting estimates of border discontinuities for the world excluding particular regions to ensure that no region is driving my main result. It is apparent that the estimates are similar across regions. Subsequently, Table 7 presents estimates of discontinuities in the growth rates of lights per capita at borders between OECD countries, between post-Communist countries and other (potentially not post-Communist) countries, in Asia, Africa and in the Americas.Footnote 15 The borders with the strongest discontinuity estimates are the borders of post-Communist countries and Asian borders, followed by borders in Africa, the Americas and among OECD countries. Growth discontinuities at African borders, though typically not statistically significant have a similar magnitude as the baseline growth discontinuity estimates.

4.3 Discontinuities by type of border

It is instructive to compare discontinuities in economic growth across partitions of the set of borders that are other than continents. Table 8 presents estimates of growth discontinuities for borders that differ in age, artificiality and remoteness from the bordering countries’ heartlands. Column 1 reproduces the baseline estimates. Columns 2 and 3 contrast growth discontinuities across recently established borders—those that have become national borders since the collapse of the Soviet Union, Czechoslovakia and Yugoslavia—with growth discontinuities across all other borders, which typically date at least to the decolonization period of the 1960s. The sample of newly established borders is very small, but because the ex-republics of the former Soviet Union had very different growth experiences after independence, there is good reason to believe that it may be illustrative. In fact, we do observe discontinuities in growth rates at the border for both the old and the new borders, with the magnitudes of the discontinuities roughly similar (although the discontinuities across the newly established borders are not always precisely estimated). Finding similar growth discontinuities across both types of borders is reassuring because the lack of growth discontinuities across new borders could be consistent with growth discontinuities arising from long-term processes that may also be endogenous to border formation.

It is also interesting to ask whether growth discontinuities are similar across borders that have been drawn artificially and borders that appear to follow some natural geographic formation. Finding no discontinuities across artificially drawn borders may be concerning for the same reason as it would be to find no growth discontinuities across recently formed borders: it would suggest that the endogeneity of border creation might play a part in whether there is a growth discontinuity across the border or not. To measure border artificiality, I use an index of fractal dimension that is similar to the measure of Alesina et al. (2011), and compute separate fractal indices for all borders in my dataset.Footnote 16 I break up my sample of borders into two at the border population-weighted median of the fractal index; the borders with higher fractal index I refer to as “squiggly” and the borders with lower fractal index I refer to as “straight.” Columns 4 and 5 show that, if anything, growth discontinuities are somewhat stronger at straight borders than at squiggly borders, though this varies by the dependent variable used to measure growth discontinuities at borders, and all of the growth discontinuity estimates are fairly close to their baseline values. Another way of partitioning natural and artificial borders is to consider whether the border is highly rugged,Footnote 17 which would suggest that it is a natural border. Using the ruggedness measure based on WorldClimate data from Sect. 3, I partition border pieces into two groups:Footnote 18 those with average ruggedness in a 70-km strip around the border higher than the border population-weighted median of this measure, and those with lower average ruggedness. Columns 6 and 7 show that the border discontinuity estimates are similar to each other and to the baseline estimates in magnitude for rugged as well as for flat borders (this similarity is particularly evident for regressions on differences in national growth rates rather than for regressions on indicators).

Michalopoulos and Papaioannou (2014) find that discontinuities in economic activity at a border that bisects an ethnic group are low for African borders far away from the bordering countries’ capitals and high for African borders close to the bordering countries’ capitals, and explain this finding by noting that distance to the capital is strongly associated with the extent of the reach of the state (in Africa). It therefore is interesting to ask whether border discontinuities around the world may be stronger for borders near the bordering countries’ capitals. Hence, I divide the border pieces sample into border pieces near to the bordering countries’ capitals and border pieces far from the bordering countries’ capitals. (It makes sense to do this at the border piece level because, for example, the Chile-Argentina border is closer to the two countries’ capitals in the north than it is in the south, so it is probably incorrect to treat all of it as being at the same distance to their capitals as it is in the north). Each border piece whose maximum distance to a bordering country capital is less than the median of all these distances is considered to be near the bordering countries’ capitals, and the rest are classified as far from the bordering countries’ capitals. It once again does not appear that there is a noticeable difference in the strength of growth discontinuities across these groups of border pieces; the magnitudes of the discontinuity estimates being similar for border pieces near their capitals and border pieces far from capitals.

Cust and Harding (2014) document that when oil fields straddle borders, investors choose to drill for oil on the better institutionalized side. It is interesting to examine the extent to which differential fossil fuel extraction explains growth discontinuities at borders more generally. Using the dataset of gas flares provided by DMSP-OLS,Footnote 19 I partition border pieces according to whether they contain gas flares, which are good indicators of fossil fuel extraction activity going on at the border.Footnote 20 We observe that restricting the sample only to border pieces without flares yields results very similar to the baseline, while on the sample of border pieces with flares, the discontinuities are typically statistically insignificant. This analysis suggests that gas flares are not responsible for growth discontinuities at borders. The fact that there are no growth discontinuities at borders with gas flares is intuitive, because flares propagate continuously across space and blur any discontinuity that may otherwise be observed. There are also relatively few borders with gas flares: only 236 of the 1352 border pieces in our analysis have gas flares.

5 Barriers to economic activity across borders

5.1 Growth discontinuities and economic barriers

As I have discussed in the introduction, if border location does not appear to explain discontinuities in economic growth at borders, then the existence of growth discontinuities at borders is consistent with certain variables that are determinants of growth (such as institutions or culture) being different on different sides of borders and the border acting as a barrier to their diffusion. Growth discontinuities are also consistent with the determinants of growth on both sides of the border being the same, but the border acting as a barrier to the spread of economic shocks. In this section, I will explore the second hypothesis. I will find some evidence that measures of the extent to which borders act as barriers to trade and economic exchange, and therefore to economic shocks, do not affect the size of growth discontinuities at these borders.

It is well-known that national borders act as discontinuous increases in transaction costs for trade (McCallum 1995). Even in a world with countries having identical institutions, public goods provision, culture and other determinants of economic growth, we could then still see discontinuities in economic activity at borders because local economic shocks would not transmit to neighboring countries but would remain contained in the country of origin. If borders were completely impermeable to economic exchange such as trade, investment and migration, different market equilibria would prevail in each country, and shocks that affect one country’s equilibrium would have no effect on its neighboring country, thus creating a discontinuity in prices, wages, quantities, and most likely economic growth across the countries’ common border.

I test whether this transaction costs channel is important by looking at whether the presence of economic exchange—trade, migration or capital—mitigates discontinuities in economic activity at borders. Since the transaction costs channel should manifest itself through differences in the cross-border flows mentioned above, if the extent of cross-border flows across the border (suitably normalized to account for some of their obvious determinants) does not affect whether or not growth discontinuities are present at borders, then it is unlikely that borders pose sufficient barriers to economic exchange to explain the existence of growth discontinuities. Instead, different growth determinants, such as different institutions or culture, must prevail on different sides of borders, with the border preventing them from directly influencing growth on the other side.

I use four proxies of cross-border flows: (1) total trade in goods and services in 2000, normalized by the product of the trading countries’ GDPs, (2) total migration flows in 2011, normalized by the product of the countries’ populations, (3) average tariff levels across each border in 2000, and (4) total remittances between the bordering countries in 2011, normalized by the product of their GDPs. The trade variable is from IMF’s Direction of Trade Statistics, while the other three variables are from the World Bank.

A direct way to look at the association between border pemeability and the magnitudes of growth discontinuities at borders is simply to look at whether borders with high cross-border flows have smaller differences in growth rates at the border. To do so, I run the OLS regression:

where \(\left| \Delta \tilde{g}_{i,b,t}\right| \) are absolute values of growth differentials, and \(\alpha \) and \(\delta \) are coefficients to be estimated.Footnote 21 The variable \(T_{b}\) is one of the measures of cross-border flows described above. It is scaled to have mean zero, unit variance, and to have larger values of \(T_{b}\) imply stronger cross-border flows (hence, the trade barriers variable would be multiplied by -1). If growth discontinuities exist at borders because the borders are barriers to the propagation of economic shocks, then the coefficient \(\delta \) should be negative and statistically significant.

Additionally, we would expect borders with stronger cross-border flows to have a weaker relationship between growth at the border and growth nationwide. To measure this, I augment the regressions in Sect. 3 by an interaction of a cross-border flow measure with the faster-growing country indicator or the gap in the growth rates of the bordering countries. The regressions from Sect. 3 then become

where \(\tilde{\beta }\) and \(\tilde{\gamma }\) are coefficients on the interaction term of one of the cross-border measures with either the faster-growing country indicator or with the national growth rate of a country. All other variables are as defined in Sect. 3.Footnote 22 The idea behind these regressions is that if the absence of cross-border flows explains growth discontinuities, then borders with more cross-border exchange should exhibit a weaker relationship between differences in growth rates at the border and differences in growth rates between bordering countries. Therefore, \(\tilde{\beta }\) and \(\tilde{\gamma }\) should be negative and large, so that for borders with larger values of \(T_{b}\), growth discontinuities are smaller.Footnote 23 All the border permeability variables are obviously at the border level, and hence are captured by border fixed effects, so I can use them only to create interaction terms in regressions.Footnote 24

I present results for the specifications (8), (9) and (10) in Table 9. For each cross-border flow measure, Table 9 presents first the results from the univariate regression (8), and then from the interaction specifications (9) or (10). The univariate regression results suggest that trade barriers are low (given the sign convention) on borders with high discontinuities, and that migration is high across borders with large discontinuities (which is not surprising, since people might be willing to migrate only if their income at the destination is likely to grow much faster than their current income), but the estimates for remittances and trade volume do not have a consistent sign. For the interaction specifications, the coefficients \(\beta \) and \(\gamma \) remain approximately the same size and significance as in Table 2, while the coefficients on the interaction terms are either positive (suggesting that cross-border flows take place across borders with large discontinuities) or are negative but statistically insignificant and with small absolute value (so that a value that is 2 standard deviations above the mean for any of the cross-border flow measures would produce an effect double the size of the coefficient and would not nullify the discontinuity associated with the difference in national growth rates between the bordering countries). The signs of the interaction coefficients in the interaction specifications also do not match the signs of the coefficients in the univariate regression, which suggest that remittances tend to flow more across borders with smaller discontinuities, while trade and migration tends to flow more across borders with larger discontinuities. Since the extent of the specific cross-border interactions studied here does not predict heterogeneity in border discontinuities, I conclude that border discontinuities are unlikely to arise from the imperfect propagation of stochastic shocks to growth from one side of the border to the other. However, this conclusion depends on the mechanisms discussed in this section (mostly relating to trade and migration) being the relevant measures of border permeability, and it could be that other flows (such as of ideas and technologies, which may be important, though difficult to measure) may be true measures of barriers to the propagation of economic shocks at borders.

5.2 Growth discontinuities and cultural barriers

Another explanation for growth discontinuities at borders could be cultural differences between countries. For example, Algan and Cahuc (2010) find strong effects of trust on economic well-being of ethnic groups in the United States and Gorodnichenko and Roland (2016) find that differences in individualism (instrumented by the extent to which the country’s blood type profile differs from that of the US or the UK) helps explain cross-country income differences. Tabellini (2010) also finds that trust, instrumented by historical literacy rates and historical political institutions, has a positive effect on growth. While a national culture may arise through government policy (e.g. through inculcating certain values in national curricula or state-owned mass media), the mere fact that there exist barriers to cross-border interactions suggests that people in two different countries will be in different social networks and therefore will tend to develop different cultures. If culture indeed has direct effects on economic growth, such convergence to different cultural equilibria on different sides of national borders could lead to discontinuities.Footnote 25

To measure cultural similarity across borders, I obtain data on the genetic distance between populations of different countries from Spolaore and Wacziarg (2009). I also obtain data on whether the bordering countries share a common official language, whether the two countries were ever under the same colonizer, and the average distance between two randomly chosen people in the two bordering countries, all from Mayer and Zignago (2011). Using these variables, I re-run Eqs. (9) and (10), with cultural similarity variables in place of the border permeability measures \(T_{b}\). I normalize the cultural similarity variables in the same way as I did the border permeability measures in the previous section (except the indicator variables), so negative coefficients mean that countries with greater cultural similarities have smaller growth discontinuities at borders. Table 10 presents the results. The magnitudes of the baseline discontinuity estimates (the main effects \(\beta \) and \(\gamma \)) decline slightly. For genetic distance and for population-weighted distance, the interaction coefficients tend to be negative, and are statistically significant in several specifications, suggesting that borders with large cultural barriers have smaller discontinuities. However, their magnitudes are only large enough to overwhelm the main effect for borders with cultural similarities being two or more standard deviations above the mean, hence only for the upper tail of national borders. For the same official language and same colonizer variables, the interaction coefficients generally are statistically insignificant, smaller in magnitude relative to the main effect, or positive. Hence, cultural barriers may play a greater role in explaining border discontinuities than the economic variables of the previous subsection.Footnote 26

6 Determinants of growth and border discontinuities

6.1 Correlates of growth discontinuities

Numerous factors have been hypothesized to explain differences in cross-country growth rates. One important hypothesis that I will investigate is that growth discontinuities at borders are explained, at least in part, by institutional differences between bordering countries. A large literature (going back to Adam Smith’s Wealth of Nations) has identified institutions such as the rule of law (or the security of property rights) as important for economic growth and many papers have used it to proxy for institutional development more generally: notably, Acemoglu et al. (2001, 2005, 2014); Rodrik et al. (2004), and Michalopoulos and Papaioannou (2014). Acemoglu et al. (2001, 2002a, 2003) argue that institutions of private property are more important than geography, culture (proxied by religion and colonizer identity) and macroeconomic policies. On the other hand, Glaser et al. (2004) and Gennaioli et al. (2013) argue that human capital explains cross-country (or cross-regional) income differences. Yet other researchers, for example Algan and Cahuc (2010), have hypothesized that differences in trust can explain differences in growth. It is therefore interesting to examine whether these factors help explain the discontinuities in growth rates at national borders that we have observed, although these results are quite tentative as there are no additional sources of identification, and the recovered correlations cannot be taken as causal.

The regressions that I run in this section will take the form:

where \(Z_{i,b}\) is a vector of covariates of country i (implicitly at border b, but these covariates are country-level and are not different border by border), \(\Phi \) is a vector of coefficients on these covariates, and the remaining notation is the same as in Sect. 3.Footnote 27 This equation can be rewritten more intuitively as follows:

Hence, this is just a regression of the difference of growth rates at the border on the differences of possible national-level correlates of discontinuities between the two bordering countries. The covariates \(Z_{i,b}\) can be thought of as a way of parametrizing the faster national growth rate indicator \(u_{i,b,t}\) or the national growth rate \(g_{i,t}\) from previous specifications.

Table 11, Panel 1 presents an analysis of the correlations of nighttime lights 5-year growth rates at the border with measures of institutions, public goods provision (paved roads), education and trust. Throughout the analysis, all right hand-side variables are normalized to have mean zero and unit variance, so the magnitudes of the coefficients are comparable. In the first column, I regress growth of nighttime lights at the border on border-piece by year fixed effects and on the quality of the rule of law as measured using the methodology of Kaufmann et al. (2009) in the World Governance Indicators. Recall that if there are no border discontinuities (growth in nighttime lights is the same on both sides of borders except for random noise), then the border-piece by year fixed effects should take out all the variation from the dependent variable, and there should be no correlation between nighttime lights at the border and the rule of law. However, I find that the rule of law has a coefficient of 1.52, which is statistically significant at 1 %. This means that a one standard deviation increase in the rule of law measure increases the average annualized growth rate of lights at that country’s border by 1.52 percentage points. Columns 2 through 4 report similar univariate relationships of growth in nighttime lights at the border for several other potential determinants of growth. We see that the fraction of roads that are paved, and the fraction of survey respondents saying that “most people can be trusted” (Inglehart and Welzel 2008) are correlated with growth in nighttime lights at the border (although their coefficients are somewhat lower), but the average years of schooling measure of Barro and Lee (2010) is not. Columns 5 through 7 run horse races of the growth determinants in columns 2 through 4 against the rule of law variable. In all three regressions, the coefficient on the rule of law remains statistically significant, and of larger or comparable magnitude to column 1, while the coefficients on the other growth determinants fall relative to the univariate regressions and are never statistically significant. In column 8, we see that including all three growth determinants together as controls also does not weaken the rule of law coefficient. Panel 2 provides results for 18-year growth rates, which are essentially the same. Hence, of the potential determinants of growth considered, the rule of law appears to be robustly correlated with growth of nighttime lights at the border while the other determinants are not.

We further investigate the association between growth of nighttime lights at the border and the rule of law in Table 12, in which we experiment with alternative specifications and with more controls. Column 1 reproduces the baseline. Column 2 replicates the baseline regression without population weighting. We see that the coefficient on the rule of law variable declines by about a third of its magnitude, but remains statistically significant at 1 % and large. Column 3 replaces the rule of law variable with an indicator for the country having the larger value of the rule of law of the two countries at the given border. We see that having the larger value of the rule of law of the two bordering countries is associated with a 1 % higher average annual growth rate of lights at that border, although the statistical significance of those estimates is somewhat reduced. Column 4 removes outliers from the regression (all border pieces with absolute difference in growth rates per capita or national institutions greater than the 99th percentile of these variables in the baseline sample), which does not change the coefficient relative to column 1. Column 5 includes polynomials in population and area at the border, as well as climate and local public goods variables at the border, also with little change to the coefficient. Column 6 includes the spatial controls in column 5, as well as a bevy of additional control variables relating to contracting institutions, the size of government, the disease environment, regional controls and cultural controls, all of which only increases the coefficient on the rule of law variable. Lastly, column 7 replaces the rule of law variable with a combination of the expropriation risk measure from Acemoglu et al. (2001), where missing values of the measure have been imputed using the Fraser Institute’s property rights index, and Fraser Institute’s property rights index with missing values imputed from the expropriation risk measure. The coefficient on this alternative measure is somewhat lower than in column 1, but is still statistically significant and large.

It is interesting to ask how the association between the rule of law and border growth differences varies by continent. Table 13 presents estimates of Column 1 of Table 11 separately for each continent, as well as for the world as a whole with continents dropped one by one. We see that the rule of law coefficient is robust to dropping any continent, and that it is quantitatively large (around unity or greater) when the regression is performed on each continent alone except the Americas in the 5-year panel. We do see, however, that the rule of law coefficient loses significance if we restrict the estimation sample to be composed of borders that were drawn only recently (the borders between the post-Soviet states, and within the former Yugoslavia and Czechoslovakia), and shrinks substantially if we look at new borders in the 18-year panel.

The regressions in Tables 11, 12, and 13 differ from the specifications in Sects. 4 and 5. In the previous sections, I have investigated how border discontinuities change in magnitude depending on a characteristic of the border, such as its shape, its date of creation, how much trade goes across it, and whether the people on the opposite sides of it have the same or different culture. Here, however, I consider characteristics not of the border itself, but of the bordering countries, such as their institutional or educational endowments. While it is possible to convert characteristics of bordering countries into characteristics of the border (for example, by constructing a measure of difference between institutions at a border, and running a regression with it as a border barrier measure, in the manner of Sect. 5), this is not the most efficient use of the data, because it ignores information about which country has the greater and which country has the lesser value of the characteristic in question. For example, if I use the difference between institutions at the border as a barrier measure, I lose any data on which country has better institutions (and might be expected to have more light at the border) and which country has worse institutions (and may be expected to have less light at the border). However, running these specifications is useful to assess to what extent cross-country differences in various variables explain the magnitude (rather than the direction) of border discontinuities.

In Table 14 I present estimates from specifications (8), (9) and (10) in which the cross-border flow measure \(T_{b}\) is defined to be the absolute value of the difference in institutions between the bordering countries for the first panel, the absolute value of the difference in average years of schooling for the second panel, and so on. There are virtually no effects of the cross-country difference in institutions, roads or trust on the size of the growth discontinuity at the border between these countries. Larger educational differences between bordering countries are actually associated with smaller growth discontinuities at borders. In the last panel of the table, I use the absolute value of the differences in national 18-year growth rates as the measure \(T_{b}\). While this absolute value is strongly correlated with the absolute value of the difference of growth at the border, it is not correlated with the growth rate of the faster-growing side of the border. Therefore, using absolute values of differences of covariates as indicators of border barriers leaves out a lot of the information that these covariates contain.

We learn from Table 14 that institutions have explanatory power for the direction of the growth discontinuity at a border (the sides of borders with better institutions have faster growth at borders), but the magnitude of the institutional gap at a border does not predict the magnitude of the gap in growth rates at that border. In particular, variation in institutions still leaves a large fraction of variation in growth discontinuities at borders unexplained. One rationalization for this pattern could be that the magnitudes of institutional differences are measured poorly, but the signs of institutional differences are measured relatively well (the latter being consistent with Row 2 of Table 12). This could happen, for example, if measures of freedom or political risk for each of two neighboring countries are constructed by people who know both of the neighboring countries much better than they know the rest of the world, so they get the ranking right between the neighboring countries, but not necessarily between those countries and other, non-neighboring countries. Such a pattern of data collection is plausible because many organizations that measure institutions make use of regional experts.

6.2 Local Variation in Public Goods