Abstract

Inequality affects economic performance through many mechanisms, both beneficial and harmful. Moreover, some of these mechanisms tend to set in fast while others are rather slow. The present paper (i) introduces a simple theoretical model to study how changes in inequality affect economic growth over different time horizons; (ii) empirically investigates the inequality–growth relationship, thereby relying on specifications derived from the theory. Our empirical findings are in line with the theoretical predictions: Higher inequality helps economic performance in the short term but reduces the growth rate of GDP per capita farther in the future. The long-run (or total) effect of higher inequality tends to be negative.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past two decades, theoretical work has come up with a substantial number of channels through which inequality may affect economic growth. These contributions have made clear that the impact of inequality on growth is rather complex: Higher inequality may have positive as well as negative consequences for economic performance; moreover, some of these consequences tend to materialize quickly (short-term effects) while others are likely to affect growth only in the medium or long run (lagged effects). This ambiguity is also mirrored in the substantial empirical literature which finds both significantly positive and negative effects—and sometimes no effects at all.Footnote 1

This paper takes a fresh look at the inequality-growth relationship, both from a theoretical and an empirical perspective. There are two basic contributions. First, the paper introduces a parsimonious theoretical model of inequality and growth that allows for positive as well as negative effects of inequality. The model builds on the observation that the positive effects are mostly short-term effects while the negative consequences tend to set in with a lag. Our theoretical framework is highly tractable and allows us to systematically explore how changes in inequality may affect economic performance at different moments in the future. Second, guided by our theoretical framework, we empirically investigate the inequality–growth relationship, relying on a more comprehensive inequality dataset that covers up to 106 countries over a period from 1965 to 2005.

Our model is designed to capture an interesting pattern in the theoretical literature on inequality and growth. As mentioned above, it appears that the growth-enhancing effects of inequality tend to set in quickly while the negative channels are rather slow. To see this, consider some of the main theoretical channels. On the one hand, inequality is said to promote growth by fostering aggregate saving (Kuznets 1955; Kaldor 1955); by promoting the realization of high-return projects (Rosenzweig and Binswanger 1993); or by stimulating R&D (Foellmi and Zweimüller 2006). On the other hand, inequality is expected to hamper growth by promoting expensive fiscal policies (Perotti 1993; Alesina and Rodrik 1994; Persson and Tabellini 1994); by inducing an inefficient state bureaucracy (Acemoglu et al. 2011); by hampering human capital formation (Galor and Zeira 1993; Galor and Moav 2004); by leading to political instability (Bénabou 1996); or by undermining the legal system (Glaeser et al. 2003). Most of the positive effects (e.g., those operating through convex saving functions, market imperfections, or incentives for innovation) rely on purely economic mechanisms. It is therefore plausible to assume that they materialize in the short term. Most of the negative effects, however, involve the political process, the change of institutions, the rise of socio-political movements, or they operate through changes in the educational attainment of the population. Thus, arguably, these effects materialize only with a considerable lag.

Our empirical findings are consistent with this basic pattern in the theoretical literature. We find that the short-term effect of inequality on economic performance is positive while the lagged effect is negative. More precisely, our core results suggest that an increase in inequality has a positive impact on the average growth rate of real GDP per capita in the subsequent 5-year period. On the other hand, we find that such an increase reduces the average growth rate in the 5-year period following the initial one. Moreover, the lagged effect tends to be more important quantitatively so that the long-run effect of higher inequality tends to be negative. So, overall, our analysis echoes findings in the more recent literature using panel data (e.g., Forbes 2000, who finds a positive short-term effect) as well as earlier cross-country regression results (e.g., those in Alesina and Rodrik 1994, who find a negative long-run effect).

We rely on a sample that spans eight 5-year periods (from \(1965\) to \(2005\) ) and includes up to \(106\) countries. The primary source of the income inequality data is the widely-used Deininger and Squire (1996), henceforth “DS”, dataset.Footnote 2 The secondary source, to which we resort whenever a suitable DS observation is not available, is the UNU-WIDER (2008) World Income Inequality Database (WIID2c). We construct two alternative income inequality time series. The first one uses only “quality-1” WIID observations to amend the DS data while the second one relies on “quality-1” and, secondarily, “quality-2” WIID observations. The advantage of the second series is that the number of missing observations is substantially lower (while a less precise measurement of inequality might be a drawback). It turns out, however, that the basic empirical findings are largely unaffected by the choice of the inequality time series.

Our main estimator is the System GMM estimator pioneered by Arellano and Bover (1995) and Blundell and Bond (1998). An important advantage of this estimator (over the related first-difference GMM estimator) is that it also exploits the cross-sectional variation in the data—which accounts for a large share of the total variation.Footnote 3 The System GMM estimator has a one- and a two-step variant, both of which are used in practice. We also apply both alternatives and report the associated results.

To scrutinize our empirical analysis further, we experiment with different specifications and growth spells of different length (i.e., 10-year instead of 5-year spells). We find that these additional estimation results corroborate the basic empirical pattern outlined above. Finally, we estimate some of the core specifications using the first-difference estimator as this estimator requires a less restrictive set of assumptions. Yet, perhaps unsurprisingly in the light of the above discussion, the estimated impact of inequality is no longer statistically significant. However, in qualitative terms, some of the results are in line with those based on the preferred System GMM estimator.

The present paper is part of a small literature that tries to get a better grasp of the empirical picture with respect to the inequality-growth relationship. Earlier contributions include Banerjee and Duflo (2003), Voitchovsky (2005), and Castelló-Climent (2010). The first-mentioned paper presents evidence suggesting that changes in inequality (in any direction) are associated with reduced growth in the short run; as a result, the standard regression equation might be mis-specified in a way that—misleadingly—makes differences-based estimators indicate a positive relationship. Voitchovsky (2005), by contrast, argues that inequality coming from the top end of the income distribution is indeed likely to promote economic growth while bottom-end inequality tends to be harmful. She therefore suggests controlling separately for inequality coming from different parts of the distribution (and finds supportive evidence in a panel of rich countries). Finally, in line with Barro (2000), Castelló-Climent (2010) argues that the consequences of inequality may be different for poor and rich countries (and indeed finds a positive impact in the subset of the richest economies but a negative one in the large group of less affluent countries). None of these papers, however, deals specifically with the time dimension.

The remainder of this paper is organized as follows. Section 2 briefly reviews theoretical arguments and, based on this review, introduces a simple model of inequality and growth. In Sect. 3, we present the empirical analysis. Section 4 concludes.

2 Short-term versus lagged effects of inequality

The present section reviews theoretical channels through which inequality may affect economic growth, thereby highlighting that the positive effects tend to set in fast while the negative ones are rather slow. We then introduce a simple model that summarizes the main insights from the review in a concise way. The model will also be helpful in guiding the empirical analysis in the following section.

2.1 A brief review of theoretical arguments

Asset or income inequality affects economic performance through many channels, and theoretical work discusses both negative and positive effects. Yet, as the following overview shows, there seems to be a clear pattern in the literature: The positive effects of inequality tend to rely on purely economic mechanisms and should therefore be expected to set in fast. The negative effects, on the other hand, often involve political-economy arguments. As a result, they may need more time to materialize.

As to the positive channels, the literature has long argued that saving functions tend to be convex in wealth (see, e.g., Kuznets 1955; Kaldor 1955). So, other things equal, higher asset inequality is associated with higher aggregate saving and thus faster convergence to the balanced growth path. More recently, the focus has been on the impact of asset inequality on the selection of investment projects (see, e.g., Matsuyama 2000, in particular Sect. 4). The main argument here is that, if the financial system is imperfect, access to external finance depends on personal wealth. As a result, if wealth is widely spread among the population, nobody may be able to raise sufficient funds to realize high-return projects which require large investments. In this case, a more concentrated distribution of productive assets may put at least a limited number of entrepreneurs into a position to realize such projects—and thus boosts growth.Footnote 4 This effect is reinforced by the fact that the high-return projects are often the more risky ones (see, e.g., Rosenzweig and Binswanger 1993). As a result, with a relatively equal wealth distribution, the number of entrepreneurs who are sufficiently rich to absorb significant risks may be very small. So, once again, a more concentrated distribution of wealth may multiply the number of high-return projects realized. Finally, the literature also discusses positive demand-side effects. With a more unequal income distribution, a larger fraction of total demand falls on “high-end” products (as opposed to goods satisfying basic needs). Thus, innovators benefit from larger home markets which more easily support the investments required to develop novel or better varieties (see, e.g., Foellmi and Zweimüller 2006).Footnote 5

While working through different channels, these positive effects of inequality have one thing in common: They emphasize purely economic mechanisms so that it is plausible to assume that they materialize relatively fast. This is not true for the negative channels. Most of them rely on political-economy arguments. For instance, it has been pointed out that more unequal societies tend to have higher levels of redistribution and hence higher levels of taxation;Footnote 6 higher taxes, in turn, are thought to weaken the incentives to save and invest (see, e.g., Perotti 1993; Alesina and Rodrik 1994; Persson and Tabellini 1994). A related argument focuses on the composition of government expenditures. With higher asset inequality, the decisive voter supplies fewer production factors (i.e., physical or human capital). As a result, he may strongly prefer direct transfers over productive investments in public goods (e.g., productivity-enhancing spending on the country’s physical infrastructure or the contract-enforcement bureaucracy). Finally, even if the rich segment of society holds political power, inequality may still have a negative impact through the fiscal policy channel. As highlighted by Acemoglu et al. (2011), if inequality is high, an oligarchic government may set up (or fail to reform) an inefficient bureaucracy to avoid high taxation once the country is transformed into a democracy.Footnote 7

Yet, through these harmful channels, changes in inequality should not be expected to have an immediate effect. Arguably, it takes time for shifts in policy preferences to be reflected in similar changes within the legislative body. Moreover, even with a fresh legislature in place, altering tax laws (or changing the bureaucracy) is time consuming. Further negative effects are also unlikely to materialize quickly. If higher inequality reduces spending on education (see, e.g., Galor and Zeira 1993; Galor and Moav 2004), it may take a decade for the effects to be felt. Similarly, it may be a long time before disaffection caused by higher inequality leads to the formation of social movements which then may threaten political stability (see, e.g., Bénabou 1996) or before higher inequality has undermined the security of property rights (see, e.g., Glaeser et al. 2003).

2.2 A parsimonious theoretical model

We now introduce a tractable inter-temporal model of asset inequality and economic performance that reflects key aspects of the above review. The model includes both a positive short-term effect (i.e., an economic channel) and a negative lagged effect (i.e., a political-economy channel) of asset inequality. We then proceed by showing how this theoretical framework, which allows for a non-monotonic adjustment path of output, leads to a linear empirical model of income inequality and economic growth that is closely related to the empirical models commonly estimated in the literature.

2.2.1 Assumptions

2.2.1.1 Agents, preferences, and endowments

We focus on an infinite-horizon economy that is populated by a continuum \(1\) of risk-neutral individuals with discount factor \(\beta <1\). All individuals derive utility from consumption of a single (non-storable) output good. The preferences are represented by the intertemporal utility function

where \(c_{t}\) denotes consumption in period \(t\) and \(E_{t}\) is the expectations operator (conditional on information available in \(t\)). Individuals differ regarding their endowment with the productive asset (which we may interpret as “capital”, for instance). A fraction \(\sigma >1/2\) of the population (the “poor”, \(P\)) is endowed with \(\omega ^{P}(D_{t})<1\) units of this asset, where \(1\) is the average endowment in the economy. The endowment of the remaining agents (the “rich”, \(R\)) is given by \(\omega ^{R}(D_{t})=(1-\sigma \omega ^{P}(D_{t}))/(1-\sigma )>1.\)

The state variable \(D_{t}\in \{L,H\}\) represents the degree of inequality in the economy, where \(L\) stands for a “low” degree so that \(\omega ^{P}(L)>\omega ^{P}(H)\). At the beginning of each period, asset inequality may change exogenously. In particular, we have \( D_{t}=D_{t-1}\) with probability \(\pi >1/2\) and \(D_{t}\ne D_{t-1}\) with the complementary probability \(1-\pi .\) Thus, a high value of \(\pi \) mirrors strong persistence in inequality.

In practice, many factors may drive changes in the distributions of productive assets (i.e., physical or human capital). A sudden change to the distribution of physical capital, as can happen here, could be the result of a political event or constellation that allows one group to take over part of the assets of the other one.

2.2.1.2 Technologies and aggregate output

All individuals have access to a simple technology that uses the productive asset (i.e., physical capital) as an input factor. Following much of the literature on the role of capital market imperfections, this technology is characterized by a non-convexity. In particular, its productivity is relatively low if the use of the productive asset is below a critical threshold, denoted by \(\omega ^{c}\). In formal terms, the technology is characterized by the production function

where \(q\) is output and \(X(G_{t})\) stands for the level of the public good (e.g., the quality of the physical infrastructure or the contract-enforcement bureaucracy) provided by the government. The state variable \(G_{t}\in \{0,1\}\) reflects whether—in the previous period—the government has invested in the public good, with \(1\) indicating investment. As a result, we have \(X(1)-X(0)\equiv \triangle X>0.\)

To introduce a positive short-term effect of inequality, we make two assumptions. First, we assume that the endowment of the rich individuals allows them to achieve the high productivity level. The endowment of the poor agents, on the other hand, falls short of the critical threshold, \(\omega ^{c}\) (even if \(D_{t}=L\)). In formal terms, we impose

Second, we consider an environment with frictions in the financial system. In particular, to keep matters tractable, we assume that the productive asset cannot be traded (i.e., bought or borrowed) in the financial markets.Footnote 8 Together, these two assumptions imply that the poor agents run “firms” producing \(a^{l}\omega ^{P}(D_{t})X(G_{t})\) units of the final good while the firms run by the rich entrepreneurs generate \(a^{h}\omega ^{R}(D_{t})X(G_{t})\) units. As a result, the aggregate (private-sector) output is given by

Note that the aggregate output is below its first-best level (which is equal to \(a^{h}X(G_{t})\)). The reason is that a positive fraction of the total stock of the productive asset is used in firms which have a low average productivity.

Looking at Eq. (3), one immediately observes that the aggregate output is greater in the state of high-inequality \((D_{t}=H)\) than in the state of low-inequality \((D_{t}=L)\), holding constant the supply of the public good. This is the result of the positive short-term effect of asset inequality: Higher inequality means that a larger share of the productive asset is used in firms which produce at an efficient scale.Footnote 9 Moreover, holding constant inequality, the aggregate output is increasing in the supply of the public good. It is thus clear that \(Y(H,1)\) and \(Y(L,0)\) represent, respectively, the highest and lowest possible output levels. But how does \(Y(L,1)\) compare to \(Y(H,0)\)? It is straightforward to verify that the former exceeds the latter if

i.e., if the productivity gap between small and large firms is not too big. As will become clear below, the long-run effect of inequality may be negative if (R1) holds.

2.2.1.3 Public sector

Turning to the public sector, we assume that the government has access to an income stream of \(Z\) units of the final good. We can think of this income as arising from a publicly owned enterprise, the natural resource sector, etc. Regarding public spending, the government has to set \(G_{t+1}\in \{0,1\}\) in each period \(t\). A decision to invest is associated with a contemporaneous cost of \(F<Z\) units of the final good. The resulting budget surplus, \( Z-G_{t+1}F\), is distributed to the population in a lump-sum manner.

Finally, we assume that the government has no choice but to implement the level of \(G_{t+1}\) preferred by the majority of the population. Since the poor represent more than half of the population, the choice of \(G_{t+1}\) will reflect the preferences of the representative poor individual. When individuals choose expenditure, \(D_{t}\) is common knowledge.

2.2.2 Analysis

We now describe the equilibrium pattern of public investment and discuss how changes in asset inequality affect the aggregate output over different time horizons.

In order to derive the equilibrium pattern of public investment, we have to introduce some notation. Denote by \(V^{i}(D_{t},G_{t})\) the value function associated with the intertemporal utility function (1) for a representative member of group \(i\in \{P,R\},\) where \(D_{t}\) and \(G_{t}\) are the two state variables. So, when thinking about the preferred level of the public good tomorrow, the representative poor individual (i.e., the decisive agent) has to solve a recursive problem of the form

A solution to this problem is a policy function \(G_{t+1}=G^{P}(D_{t},G_{t})\) which gives tomorrow’s level of the public good, \(G_{t+1},\) as a function of the two state variables. The following proposition characterizes this policy function.

Proposition 1

The politico-economic equilibrium shows fluctuations in the provision of the public good, with a positive level of investment in times of low inequality \((\)i.e., \(G_{t+1}=G^{P}(L,G_{t})=1)\) and no investment in times of high inequality \((\)i.e., \( G_{t+1}=G^{P}(H,G_{t})=0),\) if the following condition holds:

Otherwise, the public good is always provided (if \(1/\beta \) is less than the last expression in R2) or never provided (if \( 1/\beta \) is greater than the first expression in R2).

Proof

See Appendix 1. \(\square \)

Intuitively, when condition (R2) holds, the poor prefer direct transfers over public investment if inequality is high. High inequality means that the poor can gain little from the public good since they own only a small fraction of the productive asset. In the case of low inequality, however, this gain is sufficiently strong to make the poor prefer investment over higher lump-sum transfers. On the other hand, if condition (R2) is violated, the gain from public investment is such that the poor either consistently favor, or oppose, the provision of the public good. As a result, the public good is always or never provided.

As the following corollary highlights, the link between asset inequality and aggregate output is most involved if condition (R2) is satisfied. Under these circumstances, the direction of the impact of inequality in the short term differs from that in the long run, implying a non-monotonic adjustment path of the aggregate output.

Corollary 1

Suppose that condition (R2) holds. Moreover, assume that inequality changes in period \(t\) (but did not change in the preceding period and will not change in the following one). Then, the aggregate output responds as follows:

-

A rise in inequality causes first an increase in aggregate output \( (\Delta Y_{t}=Y(H,1)-Y(L,1)>0)\) and then a decline \((\Delta Y_{t+1}=Y(H,0)-Y(H,1)<0)\). The long-run (or total) effect, \(\Delta Y_{t}+\Delta Y_{t+1}\), is negative if and only if condition (R1) holds.

-

A fall in inequality causes first a decline in aggregate output \( (\Delta Y_{t}=Y(L,0)-Y(H,0)<0)\) and then an increase \((\Delta Y_{t+1}=Y(L,1)-Y(L,0)>0)\). The long-run (or total) effect, \(\Delta Y_{t}+\Delta Y_{t+1}\), is positive if and only if condition (R1) holds.

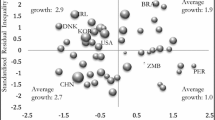

The intuition behind Corollary 1 is that the level of the public good is a state variable and hence cannot change quickly. An increase in inequality therefore has no immediate impact on the level of the public good—but improves the allocation of the productive asset. As a result, the aggregate output must rise in the short term. However, after a while, higher inequality undermines the supply of the public good so that all firms become less productive. In response, the aggregate output falls, possibly below its initial level. Figure 1 illustrates the first part of Corollary 1, assuming that (R1) holds.

Note, finally, that the link between inequality and output is simpler if condition (R2) is violated. Then, the supply of the public good is constant over time so that a rise in inequality is always associated with an increase in output (and vice versa).

2.2.3 Linking theory and evidence

We now transform the theoretical framework developed above into a linear model of income inequality and economic growth that is closely related, but not identical, to the empirical models commonly estimated in the inequality-growth literature. The transformation involves three steps: Linearizing the model, linking asset to income inequality, and linking income inequality to output growth.

2.2.3.1 Linearizing the model

In order to linearize the model, we impose \(\omega ^{P}(D_{t})=1-D_{t}\) so that \(D_{t}\in \{L,H\}\) is the difference between the average endowment and the endowment of the poor. Moreover, throughout, it is assumed that condition (R2) holds (Footnote 10 discusses how the results would change if R2 were violated).

We start by taking logs on both sides of Eq. (3). After rearranging terms, we get

Note that \(G_{t}\) is a choice variable that takes on the value \(1\) if \( D_{t-1}=L\) and \(0\) if \(D_{t-1}=H\). So \(X(G_{t})\) can be written as \(X(0)+\) \( \triangle X(H-D_{t-1})/(H-L).\) Using this result, and the fact that \(\omega ^{P}(D_{t})=1-D_{t},\) in Eq. (5), we obtain

Obviously, \(y_{t}\) is a non-linear function of the asset inequality indicators \(D_{t}\) and \(D_{t-1}.\) However, provided that the ratios \( (a^{h}-a^{l})/a^{h}\) and \(\triangle X/X(0)\) are not too big, \(y_{t}\) can be closely approximated by a linear function. In particular,

where \(\theta _{1}\equiv \sigma (a^{h}-a^{l})/a^{h}, \theta _{2}\equiv -\triangle X/(X(0)(H-L)),\) and \(\mu \) includes all constant terms.Footnote 10 Note that \(\theta _{1}>0\) captures the positive short-term effect of inequality while \(\theta _{2}<0\) mirrors the negative lagged effect. As in the non-linear version of the model, the sign of the long-run effect of inequality, \(\theta _{1}+\theta _{2}\), is negative if condition (R1) holds.

2.2.3.2 Linking asset to income inequality

Our theoretical framework includes two channels through which asset inequality (i.e., inequality in the distribution of capital) affects economic performance. Yet, empirical models of inequality and growth, including the one estimated in Sect. 3 below, usually rely on measures of income inequality, mostly because of data availability reasons.Footnote 11 In our framework, the two concepts are closely related, however. Consider the income inequality measure

which gives the (relative) difference between the average income and the income of the poor (and hence is the equivalent of the asset inequality measure \(D_{t}\)). Using the functional form of \(Y\) given in Eq. (3), and the fact that \(\omega ^{P}(D_{t})=1-D_{t}\), this income inequality measure can be approximated by an affine linear function of \(D_{t}\):Footnote 12

The structure of Eq. (7) reflects that income inequality is driven by two different factors: The rich individuals are wealthier (i.e., \(D_{t}>0\)) and also earn a higher return on their wealth (which is mirrored in the constant term on the right-hand side of 7).

Expression (7) enables us to relate the current level of log output, \(y_{t},\) to the current and past levels of income inequality (reflecting current and past levels of asset inequality). By solving (7) for \(D_{t}\) and using the result in Eq. (6), we obtain

where \(\delta _{1}\equiv \theta _{1}(a^{h}/a^{l})>0, \delta _{2}\equiv \theta _{2}(a^{h}/a^{l})<0,\) and \(\eta \) includes all constant terms. Note, finally, that there is a simple linear relationship between \(D_{t}^{y}\) and the Gini coefficient of the income distribution: \(\textit{GINI}_{t}^{y}\simeq \sigma D_{t}^{y}\).

2.2.3.3 Linking income inequality to output growth

Equation (8) expresses the level of log output, \(y_{t}\), as a function of inequality. In the empirical growth literature, however, it has been more common to estimate the impact of inequality on output growth (which is approximated by \(y_{t}-y_{t-1}\)), controlling for \(y_{t-1}\). There are several ways to adapt our framework in order to obtain such a standard specification. Following Aghion et al. (1999), a natural possibility is to assume that current firm productivity is affected by past aggregate production activities due to a learning-by-doing externality. For concreteness, suppose that production function (2) exhibits an additional multiplicative productivity parameter \(A_{t}\) that does not depend on the use of the productive asset. Assume further that \(A_{t}=(Y_{t-1})^{\phi },\) with \(\phi \in [0,1).\) Then, the relationship between output growth and inequality in the “fluctuations equilibrium” is given by

where \(\gamma \equiv \phi -1<0\).Footnote 13 Note that (R1) implies \(\delta _{1}+\delta _{2}<0\). So, as above, the sign of the long-run effect of inequality is negative if condition (R1) holds.

Equation (9) is the basis for the empirical model that will be estimated in the following section. The equation resembles the empirical models commonly used in the inequality-growth literature. However, it implies that current as well as past inequality may affect growth, albeit with a different sign. Well-specified regression equations should therefore simultaneously include indicators of both current and past levels of income inequality.

3 Empirical analysis

3.1 Specification and data

To estimate both the short-term and the lagged effect of inequality, we transform Eq. (9) into a 5-year panel data model. Specifically, we estimate

where \(i=1,\cdot \cdot \cdot ,N\) denotes a particular country and \(t=1,\cdot \cdot \cdot ,T\) is time (with \(t\) and \(t-1\) 5 years apart).Footnote 14 As in the previous section, \(y\) stands for the log of real GDP per capita (p.c.) so that the left-hand side of (10) approximates a country’s 5-year growth rate. On the right-hand side, we have (besides lagged GDP p.c.) a column vector \({\mathbf{x}}_{it-1}\) consisting of variable country characteristics; a period-specific effect \(\zeta _{t}\) to capture productivity changes common to all countries; a country-specific effect \( \eta _{i}\) to capture time-invariant and unobserved country characteristics; an idiosyncratic error term \(v_{it}.\)

Consistent with our theoretical framework, the vector \({\mathbf{x}}_{it-1}\) usually contains two Gini indices reflecting income inequality (\({\textit{GINI}}^{y}\)), the “current” one (which is measured at \( t-1\), i.e., at the beginning of the 5-year growth period considered) and the lagged one (measured at \(t-2\)). Moreover, in line with the existing inequality-growth literature, \({\mathbf{x}}_{it-1}\) sometimes includes up to three additional standard control variables. These additional variables are the average years of secondary schooling in the population aged over \(25\) (\({\textit{SCHOOL}}\))\(,\) the investment rate (\({\textit{INV\_RATE}}\)), and the price level of investment (\(PI\)), a variable that is meant to capture market distortions (due to, for instance, tariffs, government regulations, or corruption).Footnote 15 In general, these variables are measured at the beginning of each 5-year growth period (i.e., at \(t-1\)).

The analysis includes up to \(106\) countries and covers the period from \(1965\) to \(2005\) (i.e., eight 5-year periods). The time series on GDP p.c. (constant 2000 US$) and investment rates (gross fixed capital formation, % of GDP) are obtained from the World Development Indicators. The education data come from Barro and Lee (2010) and the source of the price level of investment is Heston et al. (2006; PWT 6.2). The Gini coefficients come from two different sources. The primary source is the standard Deininger and Squire (1996) database. The secondary source, which allows us to broaden our sample considerably both in the cross-sectional and the time-series dimension, is the UNU-WIDER (2008) World Income Inequality Database (WIID2c). We resort to this latter source whenever an “accept”-observation is not available from the Deininger-Squire dataset. Note that we construct two alternative inequality time series. The series \(\textit{GINI}^{y}\) \((Q1)\) includes only highest-quality (i.e., quality-1) WIID observations while \(\textit{GINI}^{y}\) \((Q12)\) includes quality-1 and, secondarily, quality-2 WIID observations (and hence shows a lower number of missing observations).

Table 1 presents a list of the \(106\) countries that are included in our analysis. Summary statistics for this sample are provided in Table 2. At the end of the table, we also describe how our inequality dataset has been constructed and how some pitfalls associated with the use of secondary datasets (see Atkinson and Brandolini 2001) have been addressed.

3.2 Estimation

It is well known that the standard panel data methods (i.e., within-groups [WG] and random-effects [RE] estimations) are unlikely to provide consistent estimates of \(\gamma \) and \({\varvec{\delta }}\) (see, e.g., Bond et al. 2001). In the study of economic growth, a problem emerges when we see that model (10) can be rewritten as

Equation (11) highlights that controlling for convergence in a panel data growth model introduces a lagged dependent variable. As a result, both the RE and the WG estimator would be very likely to give inconsistent estimates of the parameters \(\gamma \) and \(\varvec{\delta }\) when the number of time periods is small.Footnote 16

To deal with these problems, the literature has developed specific GMM estimation techniques, most notably the first-difference GMM estimator and the System GMM estimator. The first-difference GMM estimator, developed by Arellano and Bond (1991), eliminates the country-specific effect by differencing model (11), while using sufficiently lagged values of \(y\) and \({\mathbf{x}}\) as instruments (which are valid provided that the error term \(v_{it}\) is not serially correlated). However, even though the first-difference GMM estimator “solves” the problems of unobserved heterogeneity and lagged dependent variables, its application in the present context may be problematic because variables like within-country inequality or educational attainment are quite persistent (but vary substantially across countries). More specifically, the concern is that a high degree of persistence in these time series may lead to weak instruments and give rise to large biases and imprecision (see, e.g., Blundell and Bond 1998; Bond et al. 2001).Footnote 17

The empirical analysis below therefore mainly relies on the System GMM estimator pioneered by Arellano and Bover (1995) and Blundell and Bond (1998). While requiring a more stringent set of restrictions, the System GMM procedure is likely to do better in terms of efficiency in the present setting. The reason is that it relies on an additional set of moment conditions based on the level equation (using suitably lagged differences as instruments) and hence also exploits the cross-country variation.

In the context of a basic growth regression, these additional moment conditions are valid if the Blundell-Bond (1998, p. 124) requirement is satisfied. This requirement says that the countries’ initial deviations (i.e., the deviations when the empirical study starts) from their steady states must be uncorrelated with the country-specific fixed effects. If there are further explanatory variables, as is the case in the present study, an additional requirement is that the differences of these explanatory variables are uncorrelated with the country fixed effect (Blundell-Bond 1998, p. 136). To detect possible violations of these requirements, we regularly apply difference-in-Hansen tests to the instruments for the level equation as a group (as suggested by Roodman 2009).

To explicitly state the moment conditions used in the GMM estimations below, we introduce the vector \({\mathbf{W}}_{it}^{\prime }=[y_{it}\;{\mathbf{x}} _{it}^{\prime }].\) The moment conditions considered based on the regression Eq. (10) in first differences are given by

which means that the set of instruments is restricted to lag \(2\) of output and the other explanatory variables. We introduce this restriction to avoid the problem of “instrument proliferation”, a problem that has been shown to lead to severe biases and weakened tests of instrument validity (see Roodman 2009). Finally, when using System GMM, the additional moment conditions based on the regression equation in levels are

i.e., they rely on the lagged first differences of \({\mathbf{W}}\) as instruments.

Note, finally, that both the first-difference GMM estimator and the System GMM estimator have one- and two-step variants. The two-step estimator is asymptotically more efficient, albeit the efficiency gains are reported to be typically small (see, e.g., Bond et al. 2001). Both alternatives are used in practice. We therefore also rely on both variants when estimating our core specifications. Whenever the two-step estimator is applied, the Windmeijer (2005) correction is used to calculate the standard errors.

3.3 Results

Core estimation results The main System GMM estimation results are shown in Table 3. The table consists of two parts, columns (1)–(4) and (5)–(8). The estimates in the first four columns rely on the one-step estimator while the latter four columns are based on the two-step variant. Consider first columns (1)–(4). The first and the second column present results based on a regression equation that includes only the current Gini coefficient (i.e., \(\textit{GINI}^{y}\) \( (Q1)_{t-1}\) in the first column and \(\textit{GINI}^{y}\) \((Q12)_{t-1}\) in the second one), similar to the models estimated in the literature. According to the theory presented in Sect. 2, these equations may be mis-specified because they omit the lagged Gini coefficient. In both columns, \(\textit{GINI}^{y}\) does not enter significantly.

The picture changes, however, when the current and the lagged Gini coefficient are jointly included, which is done in the third and the fourth column (again using the different inequality series \(\textit{GINI}^{y}\) \((Q1)\) and \( \textit{GINI}^{y}\) \((Q12)\), respectively). Consistent with the discussion in Sect. 2, the current Gini coefficient tends to have a positive impact on the subsequent 5-year growth rate while the lagged coefficient has a negative impact. In column (3), both coefficients are individually significant while the current Gini is insignificant in the fourth column. They are jointly significant in both columns, however, as the reported \(p\)-values on the Wald tests for joint significance suggest.

In quantitative terms, we find that a rise in the Gini coefficient by \(10\) points (which is about the size of the overall standard deviation) leads to an increase in the subsequent 5-year growth rate in the range of 1.4–3.2 percentage points. The lagged negative effect of inequality is quantitatively more important, however. The estimates suggest that a \(10\)-point increase in the Gini coefficient decreases the 5-year growth rate in the period starting in 5 years’ time by \(4.5\)–\(5.7\) percentage points (implying \(\delta _{1}+\delta _{2}<0\)).Footnote 18 As a result, the sign of the long-run effect of inequality is negative.

The validity of these estimates depends, among other things, on the absence of serial correlation in the error term, \(v_{it}.\) This means that the differenced error terms should not show second-order serial correlation (though they have a first-order correlation by construction unless the original error term has a unit root). The statistics \(M1\) and \(M2\) in Table 3 give the \(t\)-values associated with the tests for, respectively, first-order and second-order correlation in the \(\triangle v_{it}-\)series. As the numbers show, serial correlation does not appear to be an important concern. Similarly, focusing on the preferred specifications including both the current and the lagged Gini coefficient (columns 3 and 4), the \(p\)-values on the Hansen tests of over-identifying restrictions indicate that the Null of joint validity of all instruments cannot be rejected.Footnote 19 A similar conclusion holds for the subset of instruments used in the level equation. For the preferred specifications, the \(p\)-values on the difference-in-Hansen tests are typically above \(0.45\).

The second part of Table 3, consisting of columns (5)–(8), shows the two-step System GMM estimation results (with the specification in column 5 identical to that in column 1, and so on). Although statistical significance tends to be slightly lower, the two-step results confirm the findings in the first part of the table.

As discussed in Subsection 3.2, the results reported in Table 3 are obtained using a strongly restricted set of instruments. When this set is expanded (e.g., by additionally considering lag 3 of the explanatory variables), the results turn out to be very similar. The point estimates of the short-term and lagged effects of inequality change little while the Wald tests imply even stronger joint significance. We chose not to present these results here, however, as the \(p\)-values on the Hansen tests are close to 1, potentially mirroring an instrument-proliferation problem.Footnote 20 Further sensitivity checks are provided below.

Robustness To scrutinize the above findings, the present subsection goes through a number of additional estimation results. In particular, we estimate different specifications; consider 10-year growth spells (instead of 5-year spells); and use the first-difference GMM estimator (instead of the System GMM estimator).

Columns (1)–(3) of Table 4 report results which come from alternative empirical models, i.e., from specifications that omit the controls for either human capital (\(\textit{SCHOOL}\)) or physical capital investment (\(\textit{INV}\_\textit{RATE}\) ), or both. Although “capital” is kept constant in our theoretical framework, inequality may also affect economic performance through its possible effects on human and physical capital accumulation (see the discussion in Sect. 2.1). It is therefore interesting to explore whether and how leaving out these variables changes the empirical picture.Footnote 21 Comparing columns (1) to (3) of Table 4 to column (4) in Table 3, we see that dropping the controls for human capital or physical capital accumulation does not change the basic results. The findings are identical in qualitative terms and they are also quite similar in terms of economic and statistical significance. So, at least in the present empirical setup, we do not find evidence that inequality affects economic performance through factor accumulation. Note, however, that the \(p\)-values on the Hansen tests are low, casting doubt on the validity of the specifications. It therefore appears that specifications including controls for both human and physical capital accumulation are preferable (see also Footnote 15).

Columns (4) and (5) of Table 4 are based on a 10-year panel data model that includes only one Gini coefficient, capturing income inequality at the beginning of the 10-year growth period considered (i.e., at \(t-1\), where \(t\) and \(t-1\) are 10 years apart).Footnote 22 Because the findings so far imply that inequality reduces growth over a 10-year horizon, it is interesting to explore whether the coefficient on \(\textit{GINI}^{y}\) \( (Q\cdot )_{t-1}\) turns negative in such an alternative setup. We use the full set of control variables (as in Table 3) and report the results for the two different inequality time series. In both cases, the estimates suggest a significant negative relationship between the Gini coefficient and the subsequent 10-year growth rate. Moreover, in the 10-year panel data model, inequality appears to have a stronger negative effect on the 10-year growth rate than in the standard setting. While these results are consistent with the previous ones in qualitative terms, they should nonetheless be interpreted with caution. Under the premise that an increase in inequality has a positive short-term effect and a negative lagged effect, the findings presented in columns (4) and (5) are obtained using a mis-specified empirical model.

Table 5, finally, shows estimation results based on the first-difference GMM estimator. On the one hand, it is interesting to consider this alternative estimator as it requires a less stringent set of assumptions (i.e., the Blundell-Bond requirement does not need to hold). On the other hand, using the first-difference estimator may be problematic in the present context because, as discussed in Sect. 3.2, a high degree of persistence in some of the series may lead to weak-instrument problems (and to a strong sensitivity to measurement error, as pointed out by, e.g., Barro 2000; Hauk and Wacziarg 2009). Note further that the number of countries falls from \(82\) (Table 3, column 4) to \(58\) while the number of observations decreases from \(270\) to \(182\). This fall in observations is related to the fact that the first-difference GMM estimator requires a country to have at least three consecutive inequality observations to be part of the sample. Relying on the standard xtabond2-command in Stata, this is not true for the System GMM estimator which uses additional moment conditions based on the level equation. The basic reason is that xtabond2 converts missing values in the instruments to zeros so that two consecutive inequality observations are sufficient to be part of the sample.Footnote 23

To address the potential weak-instrument problem, we treat some of the explanatory variables as predetermined rather than endogenous.Footnote 24 Natural choices in this regard are the Gini coefficient (\(GINI^{y}\)) and the stock of human capital (\(SCHOOL\)) because both of these variables tend to be persistent. The three remaining left-hand side variables, \(y_{it-1}\), \(INV\_RATE_{it-1},\) and \(PI_{it-1},\) are likely or certain to correlate with the disturbance term, \(v_{it-1},\) and hence must be treated as endogenous.Footnote 25

Column (1) of Table 5 sticks to the approach taken so far and treats all explanatory variables as potentially endogenous; in column (2), \(GINI^{y}\) is treated as the sole predetermined variable while in column (3) both \( GINI^{y}\) and \(SCHOOL\) are considered to be predetermined (columns (4)–(6) show the related two-step estimator results). Yet, irrespective of the choice of predetermined variables, we do not find significant effects of inequality. Note, however, that the broad pattern in columns (1)–(3) matches the results in Table 3: The coefficient on the current Gini index is positive while the lagged Gini enters negatively. In general, though, the results based on the first-difference estimator are fragile—which is not too surprising considering the potential weak-instrument problems and the fact that a switch to the first-difference estimator means a loss of about one third of the observations. It is also due to these facts that we view the System GMM estimates, which are consistent and robust, as our prime results.

As noted above, the results reported in Tables 3, 4, 5 rely on different numbers of countries and observations. Table B-1 in Appendix B (Online Resource 1) addresses this issue by re-running some of the specifications on alternative country sub-samples.

4 Conclusions

This paper offers a new perspective on an important, yet still unresolved, topic that has attracted a lot of attention over the past decades: The inequality-growth relationship. Our argument is that higher inequality helps growth in the short term but may be harmful over longer periods of time. A plausible explanation is that the positive and negative effects of inequality tend to cluster in a specific way: The growth-promoting effects arise from purely economic mechanisms (convex saving functions, capital market imperfections, innovation incentives) and hence set in relatively fast. The growth-reducing effects, on the other hand, involve the political process, the change of institutions, the rise of socio-political movements, or they operate through changes in the educational attainment of the population. Arguably, these effects materialize only with a substantial lag.

To make our basic argument in a concise way, we develop a parsimonious theoretical model of inequality and growth that allows for such a reversal in the impact of inequality. The model illustrates how output adjusts in a non-monotonic fashion if inequality has uneven effects over time and also guides the empirical analysis in the paper. Deviating from approaches usually taken in the literature, our empirical specifications include indicators of current as well as lagged income inequality. It turns out that the empirical findings are largely supportive of the basic theoretical conjecture: A rise in inequality tends to have a positive impact on the average growth rate of GDP p.c. in the 5-year period that follows immediately (positive short-term effect); on the other hand, such an increase reduces the average growth rate in the 5-year period following the initial one (negative lagged effect). Moreover, the lagged effect appears to be more important in quantitative terms so that the long-run impact of higher inequality is negative. Consistent with these findings obtained in our baseline 5-year panel structure, the impact of inequality turns negative when we switch to 10-year growth spells.

Thanks to the merger of two inequality databases (Deininger and Squire 1996; UNU-WIDER 2008), our empirical findings are based on a comparatively large dataset that covers up to 106 countries over a period from 1965 to 2005. Moreover, the reported results are robust to a number of sensitivity checks (e.g., relating to different variants of the System GMM estimator; different empirical specifications; different minimum quality standards for the inequality measure). Yet, unfortunately, the still scant availability of inequality data makes further sensitivity checks or the exploration of further interesting questions difficult. For instance, we would need longer inequality time series to experiment in a meaningful way with different lags of the inequality indicator. Finally, a broader country coverage would be very helpful if we wanted to assess whether the temporal structure of the impact of inequality is different in poor and rich economies. At the moment, we have to leave these questions to future research.

Notes

Estimates based on time-series variation only (e.g., those in Li and Zou 1998; Forbes 2000) are often positive. Estimates which also or exclusively rely on cross-sectional variation tend to be negative, however. Examples include Barro’s (2000) random-effects approach or earlier cross-country OLS studies (e.g., Alesina and Rodrik 1994; Persson and Tabellini 1994; Clarke 1995; Deininger and Squire 1998). Using different estimation methods, Banerjee and Duflo (2003) find that changes in inequality (both positive as well as negative ones) are associated with lower growth rates in the subsequent period.

Moreover, if the number of time series observations is small and the variables are highly persistent (as is the case here), the first-difference GMM estimator has been shown to do worse in terms of biases and imprecision than the System GMM estimator (see Blundell and Bond 1998).

It has also been argued that, with convex technologies and financial markets imperfections, higher inequality worsens economic performance because investment returns are more heterogeneous. However, as shown by Foellmi and Oechslin (2008), this is by no means a robust theoretical prediction.

The large-scale investment channel as well as the demand-side channel may be of different relevance in low and high-income countries, reflecting differences in the severity of financial frictions (more severe in low-income countries) and the importance of R&D (more important in high-income countries).

The empirical picture is mixed. Earlier papers (e.g., Perotti 1996) find little evidence of a systematic association between the distribution of the disposable income and fiscal variables. Milanovic (2000), on the other hand, documents a strong positive link between factor-income inequality and the extent of redistribution towards the poor. Interestingly, however, the middle class does not appear to be a net beneficiary of such redistribution, a finding that casts doubt on the relevance of the median voter channel.

More generally, based on the experience of the colonization of the New World, Sokoloff and Engerman (2000) argue that huge wealth inequalities may promote institutions that protect the privileges of the elites and restrict opportunities for the broad masses—with adverse consequences for economic development.

The existence of a positive short-term effect of inequality does not require the absence of financial markets. In combination with technology (2), a simple imperfection (such as unreliable ex-post contract enforcement) is sufficient to imply that (i) not the entire supply of resources is used in the most productive way; (ii) higher inequality may mitigate resource misallocation (see, e.g, Matsuyama 2000, Sect. 4).

Note that the short-term effect of inequality would be negative if the endowment of the poor were greater than \(\omega ^{c}\) in the state of low inequality but less than \(\omega ^{c}\) if \(D_{t}=H\) (as discussed in the influential paper by Galor and Zeira (1993), which started the literature on the impact of inequality in presence of financial frictions and indivisibilities in human capital investments). However, our short-term channel is not meant to capture the (long-run) effect of inequality on human capital accumulation. Rather, it is meant to reflect that in presence of financial frictions higher wealth inequality may quickly increase the stock of physical capital invested in large high-return investment projects (as discussed in Section 2.1). In this context, assuming \( \omega ^{P}(L)<\omega ^{c}\) seems natural.

If condition (R2) were violated, there would never be a change in the level of the public good. As a result, \(\theta _{2}\) would be equal zero (while \(\theta _{1}\) would be unchanged).

There are some important exceptions, however. Deininger and Squire (1998), for instance, explore the impact of land inequality (i.e., a specific form of asset inequality) on growth; similarly, Castelló and Doménech (2002) investigate how human capital inequality affects subsequent growth rates. More recently, by simultaneously including measures of the distributions of human capital and income, Castelló-Climent (2010) explores whether asset and income inequality have different effects on growth.

It is straightforward to check that this approximation relies on the fact that the product of the three shares \((a^{h}-a^{l})/a^{h},\ \sigma \), and \( \omega ^{P}\) is close to zero. In practice, it is clear that factors unrelated to the asset distribution may affect \(D_{t}^{y}\), which could be mirrored in expression (7) through an additional additive term (constant or variable). Obviously, the higher the variability of this term (relative to the variability of \(D_{t}\)), the lower is the quality of \(D_{t}^{y}\) as a proxy for \(D_{t}\) in an empirical setting.

Next to ensuring comparability with existing studies, we too chose to include these standard regressors because the Gini index could proxy for them if they were omitted. For instance, suppose that the implementation of economic reforms jointly increases investment and inequality. If that were the case, and if we did not control for the investment rate, we would run the risk that the estimated coefficient on the current Gini index is biased because it captures investment-driven increases in short-run growth.

The problem with the RE estimator is that \(\eta _{i}\) and \(y_{it-1}\) are correlated by construction; WG does not work because the transformed error term will be correlated with the transformation of \(y_{it-1}\).

More recently, relying on Monte Carlo simulations, Hauk and Wacziarg (2009) have demonstrated that these biases can be greatly exacerbated in presence of measurement error.

A rise in the Gini coefficient by \(3\) points (which is about the size of the within-country standard deviation) leads to a rise in the subsequent 5-year growth rate in the range of \(0.42\)–\(0.97\) percentage points and to a fall in the following 5-year growth rate in the range of \(1.35\)–\( 1.71\) percentage points.

The \(p\)-values for the specifications that do not include the lagged Gini coefficient (columns 1 and 2) are substantially lower (\(0.19\) and \(0.23\), respectively), which could be a sign of mis-specification.

Note also that we ran additional regressions treating persistent explanatory variables like \(\textit{GINI}\) and \(\textit{SCHOOL}\) as predetermined (rather than endogenous). The results are virtually unchanged (quantitatively and also in terms of statistical significance) and so we chose not to report them here. We return to this issue in greater detail when we discuss the first-difference GMM results below.

To save space, we present only the one-step System GMM results based on the \( \textit{GINI}^{y}\) \((Q12)\)-series. The two-step results, no matter whether based on \( \textit{GINI}^{y}\) \((Q1)\) or \(\textit{GINI}^{y}\) \((Q12)\), are very similar.

The 10-year growth spells are 1965–1975, 1975–1985, 1985–1995, 1995–2005. The set of instruments is again restricted to lag 2 of \(W\) (differenced equation) and the lagged first difference of \(W\) (level equation).

To see exactly why this approach of treating missing instruments implies that the two estimators rely on different numbers of observations, consider the following example. Suppose that there are two consecutive observations of the Gini coefficent, \(D_{it-1}\) and \(D_{it-2}\), while \(D_{it-3}\) is missing. Then, the calculation of the error term in levels, \((\eta _{i}+v_{it}),\) is feasible, whereas the difference \((D_{it-2}-D_{it-3})\) in the associated instrument vector \((W_{it-1}-W_{it-2})\) is missing. Yet, xtabond2 converts the missing instrument value to zero and lets the observation stay in the System GMM regression. Consider now the error term in first differences, \((v_{it}-v_{it-1})\). To calculate this difference, \( D_{it-3}\) is required. As a result, \((v_{it}-v_{it-1})\) cannot be found and the observation drops out of the first-difference regression.

Table 5 Additional results II: first-difference GMM results A predetermined variable is uncorrelated with the present as well as all future realizations of the error term. An endogenous variable may be correlated with the present realization (but is also uncorrelated with all future ones). So suppose that \({\tilde{\mathbf{x}}}_{i}\) is a vector of predetermined variables. Then, \(E\left\{ (v_{it}-v_{it-1}){\tilde{\mathbf{x}}} _{it-1}\right\} ,\) \(t\ge 2,\) are valid moment conditions that are used by the first-difference GMM estimator.

Note further that the investment rate is calculated as an average over the entire 5-year growth period considered. If investment were measured at the beginning of the growth period (as is the case when we use the System GMM estimator), the impact of \(INV\_RATE\) would be negative, reflecting cyclical short-run fluctuations that are captured in the time-series dimension of the dataset.

References

Acemoglu, D., Ticchi, D., & Vindigni, A. (2011). Emergence and persistence of inefficient states. Journal of the European Economic Association, 9(2), 177–208.

Aghion, P., Caroli, E., & Garcia-Penalosa, C. (1999). Inequality and economic growth: The perspective of the new growth theorie. Journal of Economic Literature, 37(4), 1615–1660.

Alesina, A., & Rodrik, D. (1994). Distributive politics and economic growth. Quarterly Journal of Economics, 109(2), 465–490.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Atkinson, A., & Brandolini, A. (2001). Promise and pitfalls in the use of “secondary” data-sets: Income inequality in OECD countries as a case study. Journal of Economic Literature, 39(3), 771–799.

Banerjee, A., & Duflo, E. (2003). Inequality and growth: What can the data say? Journal of Economic Growth, 8(3), 267–299.

Barro, R., & Lee, J.-W. (2010). A new data set of educational attainment in the world, 1950–2010. NBER Working Paper 15902.

Barro, R. (2000). Inequality and growth in a panel of countries. Journal of Economic Growth, 5(1), 5–32.

Bénabou, R. (1996). Inequality and growth. In B. Bernanke & J. Rotemberg (Eds.), NBER Macroeconomics Annual 1996. Cambridge, MA: MIT Press.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Bond, S., Hoeffler, A., & Temple, J. (2001). GMM estimation of empirical growth models. CEPR Discussion Papers 3048.

Caselli, F., Esquivel, G., & Lefort, F. (1996). Reopening the convergence debate: A new look at cross-country growth empirics. Journal of Economic Growth, 1(3), 363–389.

Castelló, A., & Doménech, R. (2002). Human capital inequality and economic growth: Some new evidence. Economic Journal, 118(March), C187–C200.

Castelló-Climent, A. (2010). Inequality and growth in advanced economies: An empirical investigation. Journal of Economic Inequality, 8(3), 293–321.

Clarke, G. (1995). More evidence on income distribution and growth. Journal of Development Economics, 47(2), 403–427.

Deininger, K., & Squire, L. (1996). A new data set measuring income inequality. World Bank Economic Review, 10(3), 565–591.

Deininger, K., & Squire, L. (1998). New ways of looking at old issues: Inequality and growth. Journal of Development Economics, 57(2), 259–287.

Foellmi, R., & Zweimüller, J. (2006). Income distribution and demand-induced innovations. Review of Economic Studies, 73(4), 941–960.

Foellmi, R., & Oechslin, M. (2008). Why progressive redistribution can hurt the poor. Journal of Public Economics, 92(3–4), 738–747.

Forbes, K. (2000). A reassessment of the relationship between inequality and growth. American Economic Review, 90(4), 869–887.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. Review of Economic Studies, 60(1), 35–52.

Galor, O., & Moav, O. (2004). From physical to human capital accumulation: Inequality and the process of development. Review of Economic Studies, 71(4), 1001–1026.

Glaeser, E., Scheinkman, J., & Shleifer, A. (2003). The injustice of inequality. Journal of Monetary Economics, 50(1), 199–222.

Hauk, W., & Wacziarg, R. (2009). A Monte Carlo study of growth regressions. Journal of Economic Growth, 14(2), 103–147.

Heston, A., Summers, R., & Aten, B. (2006). Penn World Table Version 6.2. Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania (electronic resource).

Kaldor, N. (1955). Alternative theories of distribution. Review of Economic Studies, 23(2), 83–100.

Kuznets, S. (1955). Economic growth and income inequality. American Economic Review, 45(1), 1–28.

Li, H., & Zou, H-f. (1998). Income inequality is not harmful for growth: Theory and evidence. Review of Development Economics, 2(3), 318–334.

Manuel, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Matsuyama, K. (2000). Endogenous inequality. Review of Economic Studies, 67(4), 743–759.

Milanovic, B. (2000). The median-voter hypothesis, income inequality, and income redistribution: An empirical test with the required data. European Journal of Political Economy, 16(3), 367–410.

Perotti, R. (1993). Political equilibrium, income distribution, and growth. Review of Economic Studies, 60(4), 755–776.

Perotti, R. (1996). Growth, income distribution, and democracy: What the data say. Journal of Economic Growth, 1(2), 149–187.

Persson, Torsten, & Tabellini, Guido. (1994). Is Inequality Harmful for Growth? Theory and Evidence. American Economic Review, 84(3), 600–621.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158.

Rosenzweig, M., & Binswanger, H. (1993). Wealth, weather risk and the composition and profitability of agricultural investments. Economic Journal, 103(Jan.), 56–78.

Sokoloff, K., & Engerman, S. (2000). History lessons: Institutions, factors endowments, and paths of development in the new world. Journal of Economic Perspectives, 14(3), 217–232.

UNU-WIDER (2008). World Income Inequality Database, Version 2.0c (electronic resource).

Voitchovsky, S. (2005). Does the profile of income inequality matter for economic growth? Journal of Economic Growth, 10(3), 273–296.

Windmeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics, 126(1), 25–51.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix 1

Appendix 1

Proof of Proposition 1

We prove the proposition by showing that the proposed policy functions are in fact solutions to the recursive problem (4), given that the relevant parameter constellation holds. One way to do so is to establish that in any given period \(t\) it is indeed optimal to stick to the proposed policy function, provided that this policy function is applied in all future periods, \(t+1\), \(t+2\), \(\cdot \cdot \cdot \).

Suppose now first that parameter constellation (R2) holds. Then, we have to establish that – irrespective of the value of \( G_{t} \) – the representative poor agent finds it optimal to choose (\(a\)) \( G_{t+1}=1\) if \(D_{t}=L\) and (\(b\)) \(G_{t+1}=0\) if \(D_{t}=H\) (again, provided that this rule is invariably applied in the future). The formal condition for point (\(a\)) to hold is

where the second line in the above expression gives the value if the decision is in favor of the alternative choice, \(G_{t+1}=0.\) Rearranging terms yields the much simpler restriction

which is indeed independent of \(G_{t}.\) Similarly, for point (\(b\)) to be true, we must have

which is again independent of the current level of the public good, \(G_{t}\).

To proceed, we have to find explicit expressions for the differences \( V^{P}(L,1)-V^{P}(L,0)\) and \(V^{P}(H,1)-V^{P}(H,0)\) which show up in (12) and (13). Assuming that the proposed policy function is applied in all (future) periods, the two differences are given by

with \(D\in \{L,H\}.\) Using this last expression in conditions (12) and (13) confirms that points (a) and (b) indeed hold (given that parameter constellation R2 holds).

A corresponding approach can be chosen to verify the proposed policy functions under the possible alternative parameter constellations. Note in this regard that there exist just the two alternatives stated in the proposition since the first expression in (R2) must be strictly greater than the last one \(\left( {\text {as}}\; \pi >1/2 {\text { and }} \omega ^{P}(L)>\omega ^{P}(H)\right) \).

Rights and permissions

About this article

Cite this article

Halter, D., Oechslin, M. & Zweimüller, J. Inequality and growth: the neglected time dimension. J Econ Growth 19, 81–104 (2014). https://doi.org/10.1007/s10887-013-9099-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-013-9099-8