Abstract

This paper examines the born-global phenomenon in the context of an emerging country, Brazil. A literature review was conducted in order to develop an integrative model of the phenomenon under study. Three sets of internal variables were identified in the literature which seemed to explain why a firm would follow a born global, rather than a traditional, internationalization process: firm, network, and entrepreneur variables. The final conceptual model was tested in a Brazilian sample of 79 software firms, of which 35 followed the born-global process of internationalization and 44 followed the traditional process. Logistic regression was used to test the research hypotheses. Results showed that certain firm and entrepreneur variables seemed to be associated to the type of internationalization process chosen by these firms. Network variables did not significantly differentiate the two groups.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The emergence of a growing number of firms that have been international since their inception attracted the attention of researchers in the 1990s, both in the area of international marketing and entrepreneurship, giving birth to two distinct but related research streams: the studies on born-global firms and the research on international entrepreneurship. These new firms did not seem to follow the traditional pattern predicted by behavioral models of internationalization, such as the Uppsala Internationalization Process Model (Johanson and Vahlne 1977, 1990; Johanson and Wiedersheim-Paul 1975). Rather, they followed an early and accelerated process of internationalization, one not readily explained by traditional theories (Gabrielsson 2005; Evangelista 2005; Rialp et al. 2005a, b).

Part of the explanation did seem to come from changes in the business environment resulting from globalization. International markets had become more competitive and interdependent with technological changes (Knight et al. 2004). As consumer preferences changed towards customization and specialization, niche markets appeared that could accommodate smaller and more flexible firms; and new technologies, such as the internet, also enabled these firms to overcome scale disadvantages and international market barriers (Rennie 1993).

Firms from every country do not have equal propensities to be born global, since environmental conditions around the world are not homogeneous (Zucchella 2002). Country size (Bloodgood et al. 1996) seems to be one factor in predicting the emergence of born globals—firms in a small country tend to have easier physical access to neighboring markets. Small open economies (Gabrielsson 2005), economies with small domestic markets (Moen 2002), knowledge-intensive economies (Arenius 2005)—all seem to favor the appearance of born globals. Dominguinhos and Simões (2004) reviewed 55 studies on born globals from various countries, claiming that “born globals emerged in very different locations: they were identified in both small and large, highly developed and less advanced countries” (p.7). However, of the 55 studies reviewed, 45 looked at European firms (17 of which were from Scandinavia), 12 investigated US or Canadian firms, five were set in Australia or New Zealand, two in Israel, and one in India. Moreover, the two studies from a transitional and an emerging economy (the Czech Republic and India) were based on case studies and cannot, therefore, provide an accurate estimate of the incidence of born globals in these economies. Also, although born-global firms were identified in a number of different industries (Madsen and Servais 1997; Rennie 1993), the literature review conducted by Dominguinhos and Simões (2004) indicated that most studies had looked at firms in high-tech industries.

Despite the relevance of environmental factors in creating the conditions that give rise to a born-global firm, changes in the business environment alone cannot explain the emergence of born-global firms, since firms following the traditional internationalization path continue to enter international markets (Andersson and Wictor 2003; Rialp et al. 2005a, b; Sinkovics and Bell 2006), as well as firms from industries and countries that do not fit the observed patterns. This suggests that other factors, internal to the firm, might explain at least partially the new phenomenon. A number of research efforts have been developed in the last 15 years, since Rennie (1993) first named the phenomenon, in order to understand the factors that give rise to a born-global firm from the perspective of variables internal to the firm.

This paper aims to contribute to a better conceptualization and understanding of the born-global phenomenon by (1) developing an integrative model of the literature on firm and entrepreneur variables that have been advanced to explain why certain firms follow an early and accelerated internationalization process, while others adopt a traditional approach to internationalization; and (2) testing this model in a sample of Brazilian software firms to determine whether the same factors advanced in the literature can be used to explain the born-global phenomenon in an emerging economy. This is done by comparing the behavior of born-global firms with traditionally internationalized firms.

The paper proceeds as follows. First, we examine the literature, with the purpose of identifying contributions from the born global and international entrepreneurship research streams, and we propose an integrative model of the variables internal to the firm that may influence the choice of an early and accelerated internationalization path. Second, we explain the methodology used to test our research hypotheses. Third, the results of the tests of hypotheses are presented. Fourth, we discuss our findings; and fifth, we present our conclusions and opportunities for future research.

Literature review

The nature of a born-global firm

Born Global firms—also called International New Ventures, Global Start-ups, or Early Internationalizing Firms—have been defined in various ways and there is no consensus in the literature at this point as to what makes a firm a born global. The use of the term ‘global’ has been criticized by various scholars. For example, Hordes et al. (1995) suggested that the terms ‘international’ or ‘multinational’ would be more appropriate. Rasmussen et al. (2001), referring to newly internationalized firms in Denmark, advocated they should be in fact called ‘born German’, or ‘born European’, given their geographically restricted scope of operations; and Gabrielsson et al. (2004) proposed the terms ‘born international’ to be applied to firms that internationalized within their own region, leaving the term ‘born global’ for those with a substantial portion of their operations outside their region. In spite of these suggestions and following the mainstream in the literature, in the remainder of this paper, we adopt the term ‘born global’ to designate all firms with early and accelerated internationalization, irrespective of where in the world they operate.

Despite the lack of agreement on a definition (Rasmussen and Madsen 2002; Dominguinhos and Simões 2004), there is reasonable consistency among authors in the understanding of what a born global is. Nevertheless, the operationalization of the concept still lacks further development (Rialp et al. 2005a, b). When operationalizing the concept, researchers have arbitrarily defined the borders, adopting stricter or broader definitions. The following criteria have been adopted:

-

Date of foundation—Although the general view is that born-global firms typically started to operate after 1990 (Moen 2002; Moen and Servais 2002; Rasmussen and Madsen 2002), some studies have considered firms with an earlier inception (Rasmussen et al. 2001).

-

Time span between foundation and the beginning of international activities—There is much less agreement in defining the number of years after foundation when a firm started its international activities: up to 2 years (Moen 2002, Moen and Servais 2002); up to 3 years (Knight and Cavusgil 1996; Knight et al. 2004; Mort and Weerawardena 2006; Rasmussen and Madsen 2002; Rasmussen et al. 2001); up to 5 years (Zucchella 2002); up to 6 years (Zahra et al. 2000); up to 7 years (Jolly et al. 1992); up to 8 years (McDougall et al. 1994); up to 15 years to reach 50% of sales in another continent (Gabrielsson et al. 2004).

-

Relevance of international activities to the firm—Another issue refers to the percentage of international activities on the firm’s revenues: at least 5% (McDougall 1989); more than 25% (Knight and Cavusgil 2004; Knight et al. 2004; Moen 2002; Moen and Servais 2002; Mort and Weerawardena 2006; Rasmussen and Madsen 2002; Rasmussen et al. 2001); more than 50%, for firms originating from small open economies, such as Finland (Gabrielsson 2005; Gabrielsson et al. 2004); more than 75%, for firms from countries with small domestic markets, such as New Zealand (Chetty and Campbell-Hunt 2004).

-

Geographic scope of international operations—The extent to which a firm serves one or more international markets and the location of these international markets have also been of concern to researchers: one or a few international markets (Sharma and Blomstermo 2003), markets in the same region of the world; markets in various regions of the world (Chetty and Campbell-Hunt 2004; Gabrielsson et al. 2004; Gabrielsson 2005). McNaughton (2003) looked specifically at the number of markets served by these firms, and found that a larger number of served markets appeared in firms with small domestic markets and those operating in highly internationalized or knowledge-intensive industries.

In this study, we adopted a broader definition to consider a firm as born global: up to 5 years from inception to receive initial revenues from international operations. This is still within the range of previous studies (e.g., Jolly et al. 1992; McDougall et al. 1994; Zahra et al. 2000; Zucchella 2002). We did not include any other criteria, such as the date of foundation, the relevance of international activities, or the geographic scope of operations. The rationale for this decision is the fact that it is much more difficult for a Brazilian firm to internationalize than, for example, a European firm. Brazil is a continental country insulated within its borders, and the only relevant border contact (not blocked by insurmountable natural barriers) is with Argentina and Uruguay, in the South. The country is also a traditional exporter of commodities (agricultural and mining), and does not have a significant position as an exporter of industrial or high-tech products. For a small Brazilian firm in a high-tech industry to internationalize, it is necessary to overcome many more obstacles than a firm from a European country, where born globals are most commonly reported. These obstacles to internationalization may be more severe for a born global than for a traditionally internationalized Brazilian firm, because the latter have the chance of overcoming these barriers along an extended period of time, while born globals have to do it at a much faster pace. Therefore, to adopt the same criteria used in most US and European studies (i.e., 3 years) would not necessarily increase the comparability of our study with previous research, since the effort required from Brazilian firms to export (compared, for example, to European firms) is quite disproportionate.

Firm-specific variables

Which firm characteristics seem to favor the choice of a born global versus a traditional internationalization path? A number of studies have revealed different firm-level variables that influenced such process (Table 1).

The possession of unique intangible assets was found to be positively related to being a born global, including brand awareness (Kotha et al. 2001), market and product knowledge (Bell et al. 2001; Rialp et al. 2005a); and technical and scientific knowledge (Bell et al. 2001; Rialp et al. 2005a). Technological advantages have also been seen as characterizing born-global firms (e.g., Moen 2002; Knight and Cavusgil 2004). A related dimension, organizational innovativeness, was also found to be related to rapid internationalization.

In addition, marketing-related variables have been indicated as differentiating born globals from traditionally internationalized firms. For example, born globals have been found to use specialization, focus, or niche strategies in the global market more often (Etemad 2004; Gabrielsson et al. 2004; Rocha et al. 2004); to be more customer oriented (Rennie 1993; Zucchella 2002; Knight et al. 2004); and to rely more on product differentiation strategies (Bloodgood et al. 1996; Knight et al. 2004; Evangelista 2005).

Another aspect that has drawn the attention of various researchers is the extent to which born globals use information technology compared to other firms. The importance of this variable is based on the assumption that technological advances in information technology (IT) and telecommunications were one of the major reasons for the emergence of born globals, facilitating their access to international markets (e.g., Loane 2006; Nieto and Fernández 2006). Yu et al. (2005), too, explored the various ways by which IT might promote rapid internationalization. But although a number of studies have found a positive relationship between being a born global and the active use of IT (e.g., Kotha et al. 2001; Moen 2002), others have not confirmed such relationship (Chetty and Campbell-Hunt 2004).

The use of partnerships and networking is considered to be a major element in the ability of a smaller firm to internationalize (Coviello and Munro 1995, 1997). Many studies focusing on the use of relationships, partnerships, or networking by born globals have found a positive relationship between these variables and being a born global (e.g., Sharma and Blomstermo 2003; Pla-Barber and Escribá-Esteve 2006). In addition, the literature on regional clusters and industrial districts has underlined the importance of these firm agglomerations in providing a favorable environment for the rapid internationalization of smaller firms (Becchetti and Rossi 2000; Maccarini et al. 2004; Zucchella and Servais 2007). The underlying explanation for the role of relationship variables has to do mainly with the transfer of knowledge from one firm to another.

Entrepreneur-level variables

Another set of variables that might have an influence on the internationalization path chosen by a firm is related to the characteristics of the entrepreneur himself. A large part of the literature on entrepreneur characteristics associated with the emergence of newly internationalized firms comes from the field of International Entrepreneurship—although born-global studies have also broached the subject, partly as a result of cross-fertilization between these two research streams. Table 2 presents the variables extracted from the literature.

How does the entrepreneur himself affect the internationalization path of a firm? The literature on international entrepreneurship has studied more deeply, and has attributed high importance to, the role of the entrepreneur in early and accelerated internationalization processes (e.g., Baker et al. 2005; Dimitratos and Jones 2005; Jones and Coviello 2005; Mtigwe 2006; Young et al. 2003) than the born-global perspective, and can thus offer a complementary view to the study of the phenomenon. McDougall et al. (1994) saw the entrepreneur as an individual that is more aware of opportunities than others, someone that is more capable of taking advantage of his superior informational capabilities to create competitive advantages before others become aware of such opportunities. Zahra and George (2002) suggested that it is the ability to accept risks and innovate (characteristic of the entrepreneur), that is successfully applied to the early identification, evaluation, and exploitation of opportunities in foreign markets by new international ventures (or born-global firms).

Consequently, studies on entrepreneur-related variables (e.g., Harveston et al. 2000) have focused on the development of a global mind-set (due to international orientation and experience or education abroad) and on typical entrepreneurial characteristics, such as higher tolerance to risk and superior innovative capabilities (due to the possession of technical and scientific know-how). Social capital (the use of personal or professional relationships and networks) has also been consistently identified as essential to the development and success of born-global firms (Arenius 2005; Evangelista 2005). Harris and Wheeler (2005) even went as far as to say that an entrepreneur’s international relationships should be seen as a critical asset and a main driver of the firms’ strategic behavior.

The conceptual model

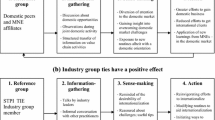

There are some efforts in the literature to build integrative models to explain the emergence of born-global firms (Zahra and George 2002; Autio et al. 2002; Etemad 2004; Oviatt and McDougall 2005). None of these models, however, fully incorporated the internal variables which were deemed to impact the internationalization path chosen by a firm. Figure 1 presents the conceptual model used in the present study, which emanates from the literature review.

Variables were grouped in three levels: firm, network, and entrepreneur. The combination of all network-related variables in one group, although unusual in the literature, follows the logic that relationships exist not in a vacuum, but rather, depend on specific individuals to establish and sustain themselves. Therefore, to separate firm-related networks and entrepreneur-related networks is theoretically untenable since they tend to be the same or related, especially when the object of study are small, young, entrepreneurial firms. The overwhelming importance attributed to network variables in born-global and international entrepreneurship studies (e.g., Harris and Wheeler 2005) also suggests that these variables should be studied separately from the other two blocs.

A general research hypothesis was advanced: Firm-, network- and entrepreneur-level variables are associated with the type of internationalization process followed, whether traditional or born global. This general hypothesis was then divided into 16 sub-hypotheses, each relating a greater occurrence of each specific variable to a higher probability of choosing a born-global internationalization path rather than a traditional one. Each sub-hypothesis is indicated in Fig. 1 and numbered according to the conceptual block it belongs to. Following previous studies, variables were operationalized whenever there were available operational definitions deemed adequate to the purposes of this research.

Method

A survey was conducted with a sample of Brazilian software development firms. It is estimated that the IT industry in Brazil comprises around 10,000-11,000 firms, of which around 3,000-5,000 are involved with software development, and around 96% are small firms or micro-enterprises of domestic origin (Cortezia and Souza 2007). These estimates are not reliable, since there is no complete list of the population.

The first step in the study, therefore, was to compile a list of software development firms using partial lists available in government agencies, industry associations, specialized institutes, etc. A total of 49 lists was obtained from state- and federal-level sources and consolidated into one final list. The preparation of the final list required the consultation of websites and telephone calls in order to exclude those firms involved exclusively with commercial activities and those of foreign origin. This direct consultation was only partially successful, since telephone numbers and websites in the original lists were sometimes unavailable. The final target population comprised 1,248 firms, suggesting that population size had been overestimated. It is also possible that the original estimates included firms that do not have a formal existence in the market, i.e., are part of the “informal economy” (often estimated to include around 30% of the Brazilian GDP); however, such firms would not be part of the target population of this study.

A letter was sent by e-mail to all firms inviting them to participate in the study. The letter emphasized the relevance of the study and its potential impact on public policymakers. Respondents were promised a summary of the study’s results. A structured questionnaire was posted in the internet. Because of the industry studied—software development—we believed that this survey method would reach the target population. Since it was not possible a priori to identify those firms with international activities, all firms were contacted to ask them to respond to the questionnaire, and filters were applied to separate those that were only domestic in scope. Extensive efforts were made to increase response rates, following Cavusgil and Elvey-Kirk’s (1998) advice. Up to seven e-mails were sent to each potential respondent inviting them to complete the questionnaire on the webpage, and providing them with a login and password. Follow-up contacts by telephone were also made. A total of 249 respondents completed the questionnaire, 218 of which were valid cases. Considering only valid questionnaires, 77% were completed by founders, and 23% by CEOs or top managers. The first quartile of respondents did not differ significantly from the fourth quartile in terms of revenue or year of foundation. Interestingly, firms with international activities were significantly over-represented in the first quartile, compared to the fourth quartile, suggesting that the percentage of internationalized firms in the total population is much smaller than in our sample. For this study, we used only the 79 cases of firms with international activities (44 of which had followed the traditional path and 35 were born globals).

The questionnaire included both subjective (perceptual) variables (using a five-point Likert or semantic differential scale) and objective measures. Appendix 1 presents the operational definitions adopted in the study. Data was first analyzed using exploratory factor analysis and other data exploration techniques and tested for construct validity and applicability of multivariate tests. Binary logistic regression was then used to test the null hypotheses.

Results

Descriptive results

Compared to the firms that followed a traditional internationalization path, born globals were younger and smaller. Date of foundation for most born globals was after 1990, as pointed out in the literature, although two firms were founded in the 1980s. It should be noted, however, that the mean value for born globals was 1999, compared to 1990 for the firms that followed a traditional internationalization process. In fact, economic reforms in the early 1990s stimulated Brazilian firms to internationalize, irrespective of industry or date of foundation, thus making it difficult to defend 1990 as a starting date for the born-global phenomenon in Brazil.

Size was measured in terms of total annual revenue. The mean value for born globals was R$5,150,000 compared to R$13,700,000 for firms following the traditional path. This is probably partly due to firm age; younger firms tend to be smaller than older firms. However, born globals were quite homogeneous in terms of size, while firms that followed the traditional path tended to be spread over a much broader range of size, as measured by annual revenue.

The time span between the companies’s founding and the beginning of international activities was also measured. Because of the way born globals were defined, the cut-off point was 5 years. The means were 2.5 years for born globals and 11 years for traditionally internationalized firms. However, examining the graph in Appendix 2, it can be seen that the speed of internationalization after inception shows a reasonably balanced distribution by year since 1995 (or a time span of 12 years). Before this year, the frequency drops substantially to one or two firms internationalizing each year. There is, however, a slight decrease after 5 years, suggesting that our cut-off point to separate born globals from firms that internationalized following the traditional model was acceptable. Nonetheless, it should be noted that the highest frequency is associated with firms with synchronic internationalization, that is, that were bona fide ‘born international’ or ‘born global’.

Another aspect examined was the scope of international activities, measured by the number of world regions where the firm operated. Born globals operated in more regions of the world than firms following the traditional path. In fact, 50% of firms following the traditional path operated in only one market, compared to 37% of born-global firms. The mean was 1.77 for firms following the traditional model and 2.03 for born globals.

Evaluation of the constructs

The first analytical step included the depuration of the scales used to measure the theoretical constructs extracted from the literature, by means of factor analysis and Cronbach’s alpha. Items that did not perform well were excluded from the analysis. Variables were then tested for normality (Kolmogorov-Smirnoff) and homoscedasticity (Levene’s test). About half of the variables did not have a normal distribution and at least one distribution had unequal variance. These results suggested the use of binary logistic regression rather than discriminant analysis, which is quite sensitive to violations to normality and homoscedasticity.

Test of hypotheses

The test of hypotheses used binary logistic regression. Logistic regression permits to determine if and to what extent each of these independent variables contributes to the internationalization path followed by the firm. The dependent variable was type of internationalization process (traditional or born global). Fifteen independent variables in three blocs (firm, network, and entrepreneur variables) which remained after depuration were used to differentiate the two groups. The results of the binary logistic regression analysis, using direct (enter) and stepwise methods are presented in Table 3.

Both the stepwise model and the full model were statistically significant at the 0.5 level. The full model (using the Enter method with the full set of variables) showed better results in terms of the Cox and Snell R 2, the Nagelkerke R 2, and the Hosmer and Lemeshow statistic. The full model also showed better predictive accuracy; the hit ratio for the full model was 77.2% of the analysis sample cases correctly classified as compared to 65.8% for the stepwise model. Since the small sample size did not permit the adoption of split sample procedures, these results are subject to an upward bias. Table 4 presents the results of the classification matrix for the full model.

Table 5 presents the results of the tests of the coefficients of the logistic function. An examination of the coefficients and p values of the independent variables shows that only two variables reached the 0.05 significance level and other two variables reached the 0.10 level. Two firm-level variables were significant at the 0.10 level: “innovativeness” and “customer orientation”, and they showed the expected direction. None of the network-level variables were significant. As to the entrepreneur-level variables, two variables showed significance at the 0.05 level; but in one of them, the direction of the relationship was contrary to that hypothesized. The variable “technical knowledge” showed the expected direction, but “tolerance to risk” presented a negative signal, indicating that more risk tolerance was associated with the traditional internationalization path. All other variables failed to differentiate firms that followed a traditional internationalization path from those that followed a born global one.

Appendix 3 presents the mean values for the independent variables.

Discussion

Four sub-hypotheses were supported by the empirical evidence collected for this study. In this section, we discuss our findings; and in the next section, we elaborate on possible reasons that might explain these results.

Firms with higher R&D expenses (as a percentage of total expenses) tend to be born globals, compared to those that followed a traditional internationalization path. These results are consistent with theoretical propositions and empirical findings in the literature (e.g., Knight 1997; Autio et al. 2000; Dimitratos and Plakoyiannaki 2003; Etemad 2004; Knight and Cavusgil 2004; Gabrielsson 2005; Mort and Weerawardena 2006; Nieto and Fernández 2006; Zheng and Khavul 2005). The higher percentage of R&D expenses is a proxy for innovativeness; most authors found a positive relationship between innovativeness and the choice of a rapid and accelerated internationalization path. How does innovativeness relate to being a born global? It is believed that more innovative firms have more opportunities to operate in international markets because their products tend to be more competitive than those of less innovative firms, that is, they enjoy competitive advantages from differentiation. Nonetheless, our sub-hypothesis H1e, concerning differentiation, and sub-hypothesis H1f, concerning technological advantage, were not supported by our empirical findings.

Another possible interpretation is that born globals presently invest more in R&D as a percentage of their sales than traditionally internationalized firms as a result of the larger size of the latter (therefore requiring a lower percentage of sales for the same amount of resources invested). Nevertheless, if this explanation is valid, then the type of internationalization process (traditional vs. born global) would not be associated to the percentage of R&D expenses, but rather to firm size.

In addition, there is also a question concerning when these measures of innovativeness should be taken in order to be truly comparable. Since traditionally internationalized firms in our sample are older firms, they may have been more innovative in earlier stages of their lives, and become less innovative later (as measured by R&D expenses).

Firms with more customized products (a proxy for customer orientation) would also tend to become born globals. When firms adapt their products (in this case, software solutions) to better fit the needs of each individual customer, they tend to be more oriented towards the customer than firms with standardized products (off-the-shelf solutions). Customer orientation has been previously indicated as one of the factors associated with the occurrence of born globals (Etemad 2004; Knight et al. 2004; Rennie 1993; Zucchella 2002). It is also possible that customized solutions require specific competencies in software development which are not easily available, leading to competitive advantages in international markets, thus permitting rapid and accelerated internationalization. Another possibility is that customized solutions tend to be associated with market segments formed by large customers, which also tend to be narrower than segments for standardized products. Nevertheless, this would suggest that born-global firms adopt a specialization/focus strategy (sub-hypothesis H1c), something not supported by our empirical findings. It is possible that the lack of significance for specialization/focus is more a result of our sample size than of a lack of difference between the two groups. The mean value (on a five-point scale) of specialization/focus for born globals was 2.71 and for traditionally internationalized firms, 2.00.

None of the hypotheses concerning the use of networks was supported empirically. In general, all firms scored high in the use of networks—both in domestic and foreign markets. This can be explained by the fact that (like other Latin American and most Asiatic cultures) Brazilian culture is relational; relationships are systematically used in order to foster business with other firms or individuals and are critical to operate successfully in political, social, and economic spheres. To use relationships could not, therefore, differentiate one group of firms from the other; 100% of born globals and 98% of traditionally internationalized firms had some sort of partnerships. The average number of partnerships during the last 3 years was 5.03 for born globals and 5.36 for those that followed the traditional internationalization path. And the average number of partnerships in foreign markets during the last 3 years was slightly higher (though not significantly) for born globals, compared to the other firms (1.63 versus 1.55).

We also did not find empirical support for the hypothesis that firms in industrial clusters or technology districts would tend to follow the born-global path rather than the traditional model, although 23% of traditionally internationalized and 31% of born-global firms were located in software clusters. In other words, the supposition that spatial agglomeration would favor an acceleration of the rhythm of internationalization as a result of belonging to a network of firms was not supported by our findings. Possible explanations come from insights from other research. Horizontal ties among firms in Brazilian clusters are often lacking, in contrast with the cooperation typically seen among members of Italian industrial districts. For example, a study on the Ceara software cluster found that firms with international experience had almost no contact with each other (Rocha et al. 2004), and therefore did not benefit from the access to international knowledge gained by other firms. Another study in the Porto Digital technology park (in the Northeastern state of Pernambuco) suggested that entrepreneurs had agreed among themselves not to hire employees from other firms in the park (Berbel 2008), thereby blocking potentially positive knowledge spillover effects caused by employee turnover. The hypothesized “systemic interactions” described in the literature of industrial clusters (Brusco 1990; Iammarino et al. 2006), characterized by inter-firm linkages, which permit the transfer of tacit knowledge (Maskell and Malmberg 1999), are not evident in the software clusters examined in these two studies. The lack of cooperation might explain why the potential advantages of clustering are not fulfilled and, as a consequence, clusters did not promote the emergence of born globals.

Regarding entrepreneur variables, the relationship between the technical knowledge of the entrepreneurs and being a born global (Dimitratos and Jones 2005; Evangelista 2005; Kundu and Renko 2005; Rasmussen et al. 2001) was empirically supported in our study. Tolerance to risk was also supported in this study, but showed a negative direction, contrary to expectations. This means that entrepreneurs from born globals, as opposed to those from traditionally internationalized firms, tend to agree more often with the statement that international markets were more risky than the domestic market (this operational measure was drawn from Ganitsky 1989, and is similar to the one used by Harveston et al. 2000). Since firms that followed the traditional path tended to be larger and older, it is possible that these characteristics reduced their risk perception. Also, born globals had a higher intensity of internationalization (measured by international activities as a percentage of total income); the means were 14.26% for born globals and 5.36% for traditionally internationalized firms (significant at the 0.05 level), a situation that might have influenced their managers’ risk perceptions of international activities. Also, our measure may not have been refined enough to explore various facets of the risk construct. To perceive higher risk in international markets may not necessarily mean that these entrepreneurs were not more eager to accept those risks. Furthermore, this measure was taken ex post facto, that is, after these entrepreneurs had already led their firms into international markets and thus learned about current risks. The relevant measure should probably have been taken at the time these companies started their international operations, since the low tolerance to risk may have been learned in the interim. Unfortunately, this requires the use of longitudinal studies, which are not easy to implement.

Experience and education abroad, which have been shown to be related to the probability of being a born global, however, did not differentiate the two groups: around 50% of the born globals and 60% of the traditionally internationalized firms were run by entrepreneurs who had no experience abroad; and 74% and 80%, respectively, were led by entrepreneurs who had not been educated abroad. One interesting finding—although not capable of differentiating the two groups—was the high percentage of entrepreneurs who worked for multinational firms in Brazil prior to founding their own businesses: 54% in born globals and 60% in traditionally internationalized firms. However, this is something that might be typical of the software industry.

International orientation did not significantly differentiate the two groups. This variable, though, suffers from the typical ex post facto measurement bias, since it was measured after firms went international. In the absence of longitudinal studies; however, it is difficult to determine whether international orientation or other attitudinal variables is in fact associated with a born-global experience.

Conclusions

Departing from a conceptual model and based on a thorough review of the literature, this study found significant differences between born-global firms and firms that followed the traditional internationalization path in a sample drawn from the population of Brazilian software firms.

The study suffered from several limitations. The most important limitation is sample size, which may have impacted our results. It should be noted, however, that every effort was made to increase the response rate. In addition, our response rate is in line with other studies on born globals (e.g., Jones 1999; Burgel and Murray 2000; Harveston et al. 2000; Knight and Cavusgil 2004). This is particularly so with respect to studies from Latin European countries (e.g., Moen and Servais 2002, Pla-Barber and Escribá-Esteve 2006). Response rates may be even lower in a developing country because firms are not used to answering questionnaires. Also, absent is the culture of contributing to academic research. A related limitation refers to the use of a non-probabilistic sample, due to the lack of a complete list of the population of Brazilian software firms, as well as of firms in the industry that internationalized. This is a common limitation in developing countries and one that is often faced by researchers who wish to study this specific type of environment.

Another limitation to be mentioned is the fact that certain variables were measured ex-post facto, which can affect both the direction and the significance of the relationships studied. We have pointed out in the discussion section to this potential bias, commonly found in cross-sectional research.

To use a sample of Brazilian software firms to study the occurrence and characteristics of the born-global phenomenon is a relevant contribution to the growing literature on the subject, since the majority of past studies have been conducted in developed countries. In fact, as mentioned earlier, only two studies were found whose data was drawn from transitional and emerging economies, and in both cases, the studies were case-based.

The results of the study suggested that these born globals were more innovative, more customer oriented, and were led by entrepreneurs with higher technical knowledge than their more traditional counterparts. Also, entrepreneurs in born-global firms seemed to be more sensitive to the risks associated with operations in international markets than those in firms that followed the gradual internationalization path, a result counter to existing evidence in the literature. Other variables examined did not significantly differentiate between the two groups.

Nevertheless, the fact that most variables did not significantly differentiate the two groups suggests that a more holistic interpretation may be required. Essentially, the two groups seemed to have followed a similar path, even if they differed in certain aspects. Certain characteristics of the Brazilian environment might have influenced our results. Specifically, the opening of the Brazilian economy in the 1990s may have delayed the earlier entry of many firms in international markets, forcing them to expand later than they otherwise would have, if institutional barriers had not impeded or slowed down their potential internationalization. This is to say that these firms might have the characteristics of born globals, but were impeded from expanding rapidly to foreign markets. These specific environmental constraints might have partially blurred the differences between the two groups.

A related aspect—one that deserves to be mentioned—has to do with the definition of a born global. In this study, we arbitrarily established the cut-off point at 5 years between foundation and internationalization, following certain authors in the literature. However, the data does not show a neat separation between the two groups, but rather a continuous inflow of newly internationalized Brazilian software firms between 1995 and 2007 which were established from 0 to 12 years before the beginning of international activities. The figure in Appendix 2 does not suggest any ‘natural’ cut-off point, although there is a decline in the number of firms after the fifth year. The use of an arbitrary cut-off point to define born globals may have blurred some of the differences between the two groups.

Another issue that deserves further investigation is whether specific aspects found in certain studies as characteristic of born-global firms might in fact be associated with firms that internationalized, either following the born global or the traditional internationalization path. This is a real possibility, since a number of studies on born globals did not compare the two groups. A comparison between domestic, born globals, and firms that followed the traditional internationalization path may help to clarify this issue.

Finally, we advocate more studies in developing countries, especially those with large domestic markets (such as the BRIC countries) in order to better understand the nature of this phenomenon. The study of how born globals use networking—an important feature according to the literature—also needs to be further studied in the context of relational cultures.

References

Andersson S, Wictor I (2003) Innovative internationalization in new firms: born globals—the Swedish case. J Int Entrep 1(3):249–276

Arenius P (2005) The psychic distance postulate revised: from market selection to speed of market penetration. J Int Entrep 3:115–131

Autio E, Lummaa H, Arenius P (2002) Emergent “born globals”: crafting early and rapid internationalization strategies in technology-based new firms. Proceedings of the 22nd Annual International Conference of the Strategic Management Society. Paris, France

Autio E, Sapienza HJ, Almeida JG (2000) Effects of age at entry, knowledge intensity, and imitability on international growth. Acad Manage J 43(5):909–924

Baker T, Gedajlovic E, Lubatkin M (2005) A framework for comparing entrepreneurship processes across nations. J Int Bus Stud 36:492–504

Becchetti L, Rossi SPS (2000) The positive effect of industrial district on the export performance of Italian firms. Rev Ind Organ 16(1):53–68

Bell J, Mcnaughton R, Young S (2001) ‘Born-again global’ firms—an extension to the ‘born global’ phenomenon. J Internat Manag 7:173–189

Berbel ACA (2008) O processo de internacionalização de um cluster de empresas de software: o caso do Porto Digital. Rio de Janeiro, Coppead/UFRJ. Thesis

Bloodgood JM, Sapienza HJ, Almeida JG (1996) The internationalization of new high-potential US ventures: antecedents and outcomes. Entrep Theory Pract 20(4):61–76

Brusco S (1990) The idea of industrial district: its genesis. In: Pyke F, Becattini G, Sengenberger W (eds) Industrial districts and inter-firm cooperation in Italy. Geneva, International Institute of Labour Studies, 10–19

Burgel O, Murray GC (2000) The international market entry choices of start-up companies in high-technology industries. J Int Mark 8(2):33–62

Callaway S (2004) Elements of infrastructure: factors driving international entrepreneurship. New England J Entrep 7(1):27–37

Cavusgil ST, Elvey-Kirk L (1998) Mail survey response behavior: a conceptualization of motivating factors and an empirical study. Eur J Mark 32(11/12):1165–1192

Chetty S, Campbell-Hunt C (2004) A strategic approach to internationalization: a traditional versus a “born-global” approach. J Int Mark 12(1):57–81

Cortezia S, Souza Y (2007) Aprendizagem na internacionalização de micro e pequenas empresas da indústria de software. Anais do ENANPAD 2007. Rio de Janeiro, ANPAD

Coviello NE, Munro HJ (1995) Growing the entrepreneurial firm: networking for international market development. Eur J Mark 29(7):49–61

Coviello N, Munro H (1997) Network relationships and the internationalization process of small software firms. Int Bus Rev 6(4):361–386

Dimitratos P, Jones M (2005) Future directions for international entrepreneurship research. Int Bus Rev 14:119–128

Dimitratos P, Plakoyiannaki E (2003) Theoretical foundations of an international entrepreneurial culture. J Int Entrep 1:187–215

Dominguinhos P, Simões V (2004) Born globals: taking stock, looking ahead. Proceedings of the 30th EIBA Annual Conference. Ljubljana, Slovenia, European International Business Academy

Etemad H (2004) Internationalization of small and medium-sized enterprises: a grounded theoretical framework and an overview. Can J Admin Sci 21(1):1–21

Evangelista F (2005) Qualitative insights into the international new venture creation process. J Int Entrep 3:179–198

Freeman S, Edwards R, Schrader B (2006) How smaller born-global firms use networks and alliances to overcome constraints to rapid internationalization. J Int Mark 14(3):33–63

Gabrielsson M (2005) Branding strategies of born globals. J Int Entrep 3:199–222

Gabrielsson M, Kirpalani V (2004) Born globals: how to reach new business space rapidly. Int Bus Rev 13:555–571

Gabrielsson M, Kirpalani V, Luostarinen R (2002) Multiple channel strategies in the European personal computer industry. J Int Mark 10(3):73–95

Gabrielsson M, Sasi V, Darling J (2004) Finance strategies of rapidly growing Finnish SMEs: born internationals and born globals. Eur Bus Rev 16(6):590–604

Ganitsky J (1989) Strategies for innate and adoptive exporters: lessons from Israel’s case. Int Mark Rev 6(5):50–65

Harris S, Wheeler C (2005) Entrepreneurs’ relationships for internationalization: function, origins and strategies. Int Bus Rev 14:187–207

Harveston P, Kedia B, Davis P (2000) Internationalization of born global and gradual globalizing firms: the impact of the manager. Adv Compet Res 8(1):92–99

Hordes M, Clancy J, Baddaley J (1995) A primer for global start ups. Acad Manage Exec 9:7–11

Iammarino S, Sanna-Randacio F, Savona M (2006) Obstacles to innovation and multinational firms in the Italian regions: firm-level evidence from the Third Community Innovation Survey. In: Tavares AT, Teixeira A (eds) Multinationals, clusters and innovation: does public policy matter? Palgrave, New York, pp 63–83

Johanson J, Vahlne J (1977) The internationalization process of the firm—a model of knowledge development and increasing foreign market commitments. J Int Bus Stud 8(1):23–32

Johanson J, Vahlne J (1990) The mechanism of internationalisation. Int Mark Rev 7(4):11–24

Johanson J, Wiedersheim-Paul F (1975) The internationalization of the firm—four Swedish cases. J Manag Stud 12:305–322

Jolly VK, Alahuta M, Jeannet J-P (1992) Challenging the incumbents: how high-technology firms start-ups compete globally. J Strateg Change 1:71–82

Jones MV (1999) The internationalization of small high-technology firms. J Int Mark 7(4):15–41

Jones M, Coviello N (2005) Internationalisation: conceptualising an entrepreneurial process of behaviour in time. J Int Bus Stud 36:284–303

Knight G (1997) Emerging paradigm for international marketing: the born global firm. Department of Marketing and Supply Chain Management, Michigan State University, Michigan (Unpublished PhD Dissertation)

Knight G, Cavusgil S (1996) The born global firm: a challenge to traditional internationalization theory. In: Cavusgil S, Madsen K (eds) Export internationalizing research—enrichment and challenges. Advances in International Marketing, 8:11–26

Knight G, Cavusgil S (2004) Innovation, organizational capabilities, and the born-global firm. J Int Bus Stud 35:124–141

Knight G, Madsen T, Servais P (2004) An inquiry into born-global firms in Europe and the USA. Int Mark Rev 21(6):645–665

Kotha S, Rindova V, Rothaermel F (2001) Assets and actions: firm-specific factors in the internationalization of US internet firms. J Int Bus Stud 32(4):769–791

Kundu S, Renko M (2005) Explaining export performance: a comparative study of international new ventures in Finnish and Indian software industry. In: Katz J, Shepherd D (eds) International Entrepreneurship. Advances in entrepreneurship, firm emergence and growth 8:43–84

Loane S (2006) The role of the internet in the internationalization of small and medium sized companies. J Int Entrep 3:263–277

Maccarini ME, Scabini P, Zuchella A (2004) Internationalisation strategies in Italian district-based firms: theoretical modeling and empirical evidence. Working Paper 2004/3, Varese, Italy, Università dell’Insubria, Facoltà di Economia

Madsen TK, Servais P (1997) The internationalization of born globals: an evolutionary process? Int Bus Rev 6(6):561–583

Maskell P, Malmberg A (1999) Localised learning and industrial competitiveness. Camb J Econ 23(2):167–185

McDougall P (1989) International versus domestic entrepreneurship: new venture strategic behavior and industry structure. J Bus Venturing 4(6):387–400

McDougall P, Oviatt B (1996) New venture internationalization, strategic change, and performance: a follow-up study. J Bus Venturing 11(1):23–40

McDougall P, Shane S, Oviatt B (1994) Explaining the formation of international new ventures: the limits of theories from international business research. J Bus Venturing 9(6):469–487

McNaughton R (2003) The number of export markets that a firm serves: process models versus the born-global phenomenon. J Int Entrep 1(3):297–311

Moen O (2002) The born globals: a new generation of small European exporters. Int Mark Rev 19(2):156–175

Moen O, Servais P (2002) Born global or gradual global? Examining the export behavior of small and medium-sized enterprises. J Int Mark 10(3):49–72

Mort G, Weerawardena J (2006) Networking capability and international entrepreneuship: how networks function in Australian born global firms. Int Mark Rev 23(5):549–572

Mtigwe B (2006) Theoretical milestones in international business: the journey to international entrepreneurship theory. J Int Entrep 4:5–25

Nieto M, Fernández Z (2006) The role of information technology in corporate strategy of small and medium enterprises. Jour Int Entrep 3:251–262

Oviatt B, McDougall P (1994) Toward a theory of international new ventures. J Int Bus Stud 25(1):45–64

Oviatt B, McDougall P (1995) Global start-ups: entrepreneurs on a worldwide stage. Acad Manage Exec 9(2):30–43

Oviatt B, McDougall P (2005) Defining international entrepreneurship and modeling the speed of internationalization. Entrep Theor Prac 29(5):537–553

Pla-Barber J, Escribá-Esteve A (2006) Accelerated internationalisation: evidence from a late investor country. Int Mark Rev 23(3):255–278

Rasmussen E, Madsen T (2002) The born global concept. Proceedings of the 28th EIBA Annual Conference. Athens, Greece: European International Business Academy

Rasmussen ES, Madsen TK, Evangelista F (2001) The founding of the born global company in Denmark and Australia: sensemaking and networking. Asia Pac J Mark Log 13((3):75–107

Rennie M (1993) Global competitiveness: born global. McKinsey Q 4:45–52

Rialp A, Rialp J, Knight G (2005a) The phenomenon of early internationalizing firms: what do we know after a decade (1993-2003) of scientific inquiry? Int Bus Rev 14:147–166

Rialp A, Rialp J, Urbano D, Vaillant Y (2005b) The born-global phenomenon: a comparative case study research. J Int Entrep 3:133–177

Rocha A, Mello R, Dib L, Maculan A (2004) Empresas que nascem globais: estudo de caso no setor de software. In: Hemais C (ed) O desafio dos mercados externos: teoria e prática na internacionalização da firma. Rio de Janeiro, Mauad, vol 1, 172–221

Sharma D, Blomstermo A (2003) The internationalization process of born globals: a network view. Int Bus Rev 12:739–753

Sinkovics R, Bell J (2006) Current perspectives on international entrepreneurship and the internet. J Int Entrep 3:247–249

Young S, Dimitratos P, Dana L (2003) International entrepreneurship research: what scope for International Business theories? J Int Entrep 1:31–42

Yu J, De Koning A, Oviatt BM (2005) Institutional and economic influences on Internet adoption and accelerated firm internationalization. In: Katz J, Shepherd D (eds) International Entrepreneurship. Advances in entrepreneurship, firm emergence and growth 8:85–110

Zahra SA, George G (2002) International entrepreneurship: the current status of the field and future research agenda. In: Hitt M, Ireland R, Camp M, Sexton D (eds) Strategic leadership: creating a new mindset. Blackwell, London, pp 255–288

Zahra SA, Ireland RD, Hitt M (2000) International expansion by new ventures firms: international diversity, mode of market entry, technological learning, and performance. Acad Manage J 43(5):925–950

Zheng C, Khavul S (2005) Capability development, learning and growth in international entrepreneurial firms: evidence from China. In: Katz J, Shepherd D (eds) International Entrepreneurship. Advances in entrepreneurship, firm emergence and growth 8:273–296

Zucchella A (2002) Born global versus gradually internationalizing firms: an analysis based on the Italian case. Proceedings of the 28th EIBA Annual Conference. Athens, Greece: European International Business Academy

Zucchella A, Servais P (2007) Firm internationalization and business to business relationships: the issue of local and international networking in a multiple embeddedness framework. http://www.impgroups.org/uploads/ papers/5791.pdf. Accessed 31 January 2008.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors acknowledge the contribution of the three double-blind peer reviewers and of the editor of this manuscript and the financial support of Pronex/CNPq/Faperj to this research.

Rights and permissions

About this article

Cite this article

Dib, L.A., da Rocha, A. & da Silva, J.F. The internationalization process of Brazilian software firms and the born global phenomenon: Examining firm, network, and entrepreneur variables. J Int Entrep 8, 233–253 (2010). https://doi.org/10.1007/s10843-010-0044-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10843-010-0044-z