Abstract

This paper investigates a firm’s equilibrium behavior under product compatibility, product differentiation, and the network effect. We find that a firm with a higher degree of compatibility has a greater competitive disadvantage due to its higher spillover effect with other firms. A firm under Cournot competition can increase its demand and profit by decreasing consumers’ subjective belief about the degree of differentiation between products, when the firm’s product compatibility and/or relative production cost is sufficiently small. When the relative production cost satisfies certain conditions, the principle of maximum differentiation exists. However, the principle of minimum differentiation never exists. Furthermore, when firms can freely determine their own compatibility, each firm will choose the lowest degree of compatibility, in contrast to the social optimum in which both firms choose the highest degree of compatibility. A social dilemma occurs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A system product is the combined usage of the group of components, together with an interface that allows the components to work together (Katz and Shapiro 1994; Grindley 1995).Footnote 1 In reality, we do see that many products are united when used to produce value or higher value; for example, the hardware and the software, the cash dispenser and the cash card, the video recorder and the videotape, cellular phone and battery, automobiles and replacement parts, etc. However, the parts/components of different brands may not work well together. For instance, the specialized software developed for a PC may not work (well) in Macintosh; data stored on one CD may not be read by a CD driver of other brands. Therefore, one product can use parts/components of its own brand and perhaps part of parts/components of other brands, which sums up the total number of parts/components the product works with.

Network externality (or network effect), which indicates that consumers’ evaluation or their willingness to pay increases along with the product compatibility (see Chou and Shy 1990, 1993; Shy 1995), usually exists in a system product. Economides (1996), using a leader-follower model and assuming that consumers’ willingness to pay increases with expected sales of the product, finds that the competition effect decreases but network effect increases the leader’s profits. He points out that a monopoly can earn more profits by inviting more firms to enter the market, even using subsidies.Footnote 2 Cabral et al. (1999), on the other hand, claim that a monopoly may establish an introductory price when the network externality exists. In software industry, Haruvy and Prasad (1998) find that firms would like to offer two brands to consumers when the population of high-valuation type consumers and the network effect are sufficiently large. Moreover, most studies in the software industry, such as Slive and Bernhardt (1998) and Shy and Thisse (1999), state that firms do not adopt any software protection policy when the network effect is sufficiently large.Footnote 3

Considering network externality as well as product compatibility has become a broadly studied issue recently in many industries (e.g., Katz and Shapiro 1994; Economides 1996; Cremer et al. 2000; Baake and Boom 2001; Foros and Hansen 2001; Kim 2002; Billand and Bravard 2004; Hermalin and Katz 2006; Klimenko and Saggi 2007). For example, Chou and Shy (1993) utilizes the Hotelling model and concludes that both the market share and the amount of a software increases when its compatibility increases. Contrarily, Kristiansen (1998) finds that a firm has little incentive to produce a product with higher compatibility when the network externality exists.Footnote 4 However, the relation between product compatibility and product differentiation is not clear and has received little attention in the literature. Our paper utilizes a traditional Cournot model with differentiated products and network externality to analyze the firms’ decisions about compatibility.

Our paper is mostly inspired by Cremer et al. (2000) and Foros and Hansen (2001). Following Katz and Shapiro (1986), Cremer et al. (2000) assume that consumers are heterogeneous in their basic willingness to pay for a product; internet backbone providers choose the level of compatibility (i.e., quality of interconnection) in the first stage; and they choose capacity in Cournot-type competition in the second stage. They find that the larger firm prefers a lower quality of interconnection than the smaller one. Following Cremer et al. (2000), Foros and Hansen (2001) assume that customers are heterogeneous and distributed on a line of length 1 and the two internet backbone providers are located at the extremes of this unit line. The two firms choose the level of compatibility in the first stage and compete via Hotelling in the second stage. Foros and Hansen find that the firms increase the level of compatibility in order to reduce the stage 2 competition under the network externality. In contrast to these studies, our paper uses the traditional Cournot competition, in which firms provide differentiated products and choose the level of compatibility and the output quantity under network externality. We then find that firms tend to decrease compatibility to reduce spillover effect in the second stage due to externality, which is the reverse of Foros and Hansen (2001). Furthermore, we find that a firm with a higher (lower) compatibility to other firms is more likely to increase (decrease) the degree of differentiation.

This study investigates a firm’s strategy by considering product differentiation under system product competition with product compatibility as well as the network externality. Product differentiation is a subjective evaluation by the consumers while product compatibility is an objective fact, based on technical issues. Therefore, two perfect substitutes may not be completely compatible. To investigate this issue, we build a two-stage game model, in which two differentiated firms determine their level of compatibility in the first stage and then choose their own output in the second stage with Cournot competition and the existence of network externalities.

This paper is organized as follows. Section 2 develops a duopoly model with issues of compatibility and differentiation to describe the competition situation. Section 3, given product compatibility, studies the firm’s optimal output choice for the second stage. Section 4 analyzes the firm’s competition behavior and the social optimality when product compatibility is a choice variable. Finally, Section 5 presents conclusions.

Model with compatibility and differentiation

Assume that there are two firms, producing differentiated products with quantities q i and q j and marginal costs c i and c j , respectively. Also assume that the inverse market demand function is as followings:

Constant A is the potential market scale and θ ∈ [0, 1] measures the substitution between products (that is, the cross-price effect). When consumers subjectively affirm the two products to be close, the substitution effect between the products gets larger, and thereby θ increases. When θ = 1, the two products are thought as homogeneous goods, whereas θ = 0 indicates that the two products are thought as completely independent goods.

Components of a system may work perfectly well each other in the system, but may not function well with components of other system products. Suppose that components of system product j operate successfully on system i with probability α j , α j ∈ [0, 1]. We then define α j to be the product compatibility for system products j to i. When α i = α j = 0, components of one system cannot work at all in the other system, resulting two different standards in the market. On the contrary, if α i = α j = 1, components of one system can also function perfectly well in the other system, resulting in one standard in the market.

When the total number of users (referred to as the network size) of one system-product increases, users for the system product become more comfortable or convenient with using the product, which increases their willingness to pay for it. Therefore, as described in Shy (1995), the network size for system product i (defined as S i ) is its own sales (q i ) plus the expected users from system product j and is obtained as:Footnote 5

where q i is termed as the own effect, while α j q j is termed as the spillover effect. When product compatibility α j = 0, components of system product j cannot operate in system i, thereby reducing its network size to its own effect only. The setting adopts that in Shy (1995) and Economides (1996) and is different from Cremer et al. (2000) and Foros and Hansen (2001), in that the latter assume that the increase of firm i’s compatibility will increase consumers’ willingness to pay for product i. However, our setting on the compatibility in fact fits many stylized facts. For example, the CD driver of one brand may perfectly read its own CDs and partially read CDs of other brands. In software industry, the specialized software developed for PCs is not likely to work with a Macintosh. Therefore, the total number of software (i.e., S i ) works with a Macintosh equals those software packages developed for a Macintosh (i.e., q i ) plus part of those software packages developed for PCs (i.e., α j q j ).

When a firm’s network size increases, the usage cost of its consumers reduces, which then increases their utility and willingness to pay. Using function \( f\left( {S_i^e} \right) \) to represent the consumer’s extra willingness to pay for system product i when they expect the network sizes to be \( S_i^e \). Thus, \( f\left( {S_i^e} \right) \)represents the network effect in the industry. Following the concept of fulfilled expectations equilibrium in Katz and Shapiro (1986), we assume \( S_i^e = {S_i} \), thereby \( f\left( {S_i^e} \right) = f\left( {{S_i}} \right) \) where \( f\prime \left( {{S_i}} \right) > 0 \). Since the network effect increases with the network size, we follow the concept in Beladi and Choi (1995) to represent the network effect as a linear function of network size without loss of generality:Footnote 6

where the coefficient a∈ (0, 1) is a network-effect parameter of network size. The consumer’s willingness to pay for the product can then be presented as followings:Footnote 7

Since products i and j are strategic substitute goods under Cournot competition, θ - aα i > 0 in Eq. 3. Therefore, given product j’s output, a one-unit sale increase of firm i decreases the price one unit due to higher market competition, but increases a consumer’s willingness to pay by a units due to the increase of network size. An individual consumer’s willingness to pay for products i and j thus increases by a and aα j units, respectively. The effect of higher market competition and effect of network size, working in reverse, may result in a smaller self-price effect of output of firm i, \( \left| {d{P_i}/d{q_i}} \right| = {1} - a \), than cross-price effect, \( \left| {d{P_i}/d{q_j}} \right| = \theta - a{\alpha_j} \).Footnote 8 In addition, firm j’s profit is (indirectly) influenced by its own compatibility (α j ), even though this cannot be observed by Eq. 3. If α j increases, then q j increases, which strategically changes q i and prices under Cournot competition.

By Eq. 3, a firm’s profit function can be represented as follows:

To guarantee an interior solution, the second order conditions for Eq. 4 must be negative. We therefore obtain that

A two-stage game model is built in this paper. In the first stage, each firm chooses its product compatibilities α i and α j . In the second stage, they decide quantities q i and q j under Cournot competition. The equilibrium is obtained by backward induction.

Decisions when product compatibility is fixed

In the second stage, a firm chooses its quantity given product compatibility and heterogeneity to maximize its won profit. The first order conditions of Eq. 4 are shown as (6):

Solving Eq. 6 for i and j simultaneously, we obtain the equilibrium output of individual firm i as shown in (7):

where \( {x_i} \equiv \frac{{A - {c_i}}}{{A - {c_j}}} \) is the inverse relative cost of firm i to firm j. We then obtain the necessary condition for \( q_i^* > 0 \), according to Eq. 5, as:

Therefore, when product differentiation is smaller (i.e., θ is higher), the equilibrium outputs are likely to be positive and thus Cournot market exists. We then propose Lemma 1.

Lemma 1

A Cournot market under externalities exists when product differentiation is sufficiently large such that \( \theta - a{\alpha_j} < 2\left( {1 - a} \right){x_i},\;\; {\hbox{i}},{\hbox{j}} = {1},{2},\;{\hbox{and}}\;{\hbox{i}} \ne {\hbox{j}} \).

According to Lemma 1, if firm j’s product compatibility with firm i is higher or the level of product differentiation is larger, then a Cournot market is more likely to exist. This implication is in accordance with reality: the level of product compatibility is lower, the higher the product differentiation is in consumers’ belief. Throughout this paper, we assume (8) to hold in order to rule out the corner solution.

Substituting \( q_i^* \) and \( q_j^* \) for Eqs. 3 and 4, in Appendix we obtain the equilibrium price and profit for individual firm i:

When firm i’s product compatibility to system product j increases, firm j’s network size increases, which on one hand induces higher demand of product i as the own effect, and on the other hand indirectly increases more sales of product j as the spillover effect. Accordingly, the spillover effect decreases firm i’s incentive to increase its product compatibility to product j. Unlike the product compatibility as an objective fact, the product differentiation is a more subjective judgment by consumers. To find out the effect of these two concepts on firms’ behavior, we first take derivatives with regards to α i and α j of Eq. 7 and obtain:

Moreover, applying the results of (7) and (9) to the derivatives of (10) with respect to α i and α j , we get:

By Eqs. 11–14, we observe the influence of product compatibility on a firm’s output and profit and thus develop Proposition 1:

Proposition 1

If a firm’s compatibility to other firms increases, then its equilibrium output and profit decreases, while the rival firm’s equilibrium output and profit increases.

When firm i increases its product compatibility (α i ), the spillover effect to firm j increases, which increases firm j’s network size and consumers demand. This reduces firm i’s profit and output due to the Cournot competition.

But the result may be different when we consider the effect of product differentiation because it is consumers’ subjective cognition between products and is improved by means of marketing such as advertisements in print, television, and on the internet. For actual firms in practice, product differentiation seems to be a more common factor for improving brand’s image. Therefore, it is worth investigating the effect of product differentiation on a firm’s output and profit under network externalities and given compatibilities. By taking derivatives with regards to θ of Eqs. 7 and 10, we obtain Eqs. 15 and 16, respectively:

Since \( {2}\theta - a\left( {{\alpha_i} + {\alpha_j}} \right) \) and \( {4}{\left( {1 - a} \right)^2} + \left( {\theta - a{\alpha_j}} \right)\left( {\theta - a{\alpha_j}} \right) \) are positive, both (15) and (16) are positive only when \( {2}\left( {A - {c_i}} \right)\left( {1 - a} \right)\left[ {{2}\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)\left] { > \left( {A - {c_j}} \right)} \right[{4}{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}} \right] \). With Lemma 1, we show in Appendix for Proposition 2:

Proposition 2

For firm i, if \( {x_i} > \frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}} \), then \( \frac{{\partial q_i^* }}{{\partial \theta }} > 0 \) and \( \frac{{\partial \pi_i^* }}{{\partial \theta }} > 0 \).

When firm i has lower product compatibility (α i ) with j and a higher inverse relative cost x (i.e., a lower relative cost), then Proposition 2 becomes easier to satisfy. Accordingly, by manipulating the subjective variable θ to be larger (which can be accomplished by means of advertisement and marketing), firm i increases its profit and output.Footnote 9 Therefore, to have higher market share and to reap more profit, firms with lower objective compatibility to other firms can persuade consumers to subjectively believe that products are homogenous by means of advertisement campaign (if it has a relatively lower production cost). On the other hand, firms with higher objective compatibility with other firms give out a larger spillover effect, which further increases when consumers subjectively believe that products are less differentiated. In order to increase more sales and reap more profit, firms will try to make its product more clearly distinguishable, i.e., to increase degree of differentiation.

Corollary 1

A firm with higher (lower) degree of compatibility to other firms is more likely to increase (decrease) its degree of product differentiation to other firms.

Using Lemma 1, in Appendix, we rewrite Proposition 2 as (17) and (18):

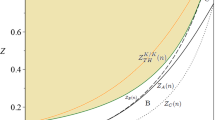

Equations 17 and 18 build four possible cases of economic conditions. For case 1, \( \frac{{\partial q_\cdot^* }}{{\partial \theta }} > 0 \) and \( \frac{{\partial \pi_\cdot^* }}{{\partial \theta }} > 0,\; \cdot \in \;\left\{ {i,j} \right\} \), when both (17) and (18) hold. In this case, both output and profit of a firm increase when the consumers believe that product differentiation is lower (i.e., θ is larger). Thus, both firms certainly prefer to reduce differentiation, which is similar to “the principle of minimum differentiation” in the location literature.Footnote 10 Unfortunately, case 1 never exists because r1 > r2, as shown in Appendix.

For case 2, \( \frac{{\partial q_i^* }}{{\partial \theta }} > 0,\frac{{\partial q_j^* }}{{\partial \theta }} < 0,\frac{{\partial \pi_i^* }}{{\partial \theta }} > 0,\;{\hbox{and}}\;\frac{{\partial \pi_j^* }}{{\partial \theta }} < 0 \) if Eq. 17 holds but Eq. 18 fails. In this case, firm i has the incentive to reduce the degree of differentiation to increase profit and output when its production cost or product compatibility are lower, such that x > r1 . In contrast, firm j in this case would like to increase product differentiation in order to increase its profit and output.Footnote 11

Case 3, \( x < {{\hbox{r}}_1} < {{\hbox{r}}_2},\frac{{\partial q_i^* }}{{\partial \theta }} < 0,\frac{{\partial q_j^* }}{{\partial \theta }} > 0,\frac{{\partial \pi_i^*}}{{\partial \theta }} < 0,\;{\hbox{and}}\;\frac{{\partial \pi_j^* }}{{\partial \theta }} > 0 \) when (17) fails but (18) holds. A reverse reason as case 2 applies to this case. To earn more profit, firm i has the incentive to increase product differentiation, but firm j would like to reduce it.

Finally, in case 4, which is the opposite of case 1, both (17) and (18) fail to hold, so that \( \frac{{\partial q_i^* }}{{\partial \theta }} < 0,\frac{{\partial q_j^* }}{{\partial \theta }} < 0,\frac{{\partial \pi_i^* }}{{\partial \theta }} < 0,\;{\hbox{and}}\;\frac{{\partial \pi_j^* }}{{\partial \theta }} < 0 \). That is, when relative cost is situated to generate r1 > x > r2, firms’ outputs and profits both decrease if consumers believe that product differentiation is lower (namely θ is larger). Accordingly, both firms prefer to increase the product differentiation, which is similar to “the principle of maximum differentiation” in the location literature.

With notations defined as above, \( {x_i} \equiv \frac{{A - {c_i}}}{{A - {c_j}}},{r_1} \equiv \frac{{2{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}} \), and \( {{\hbox{r}}_2} \equiv \frac{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{2{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}}} \), we then build Proposition 3:

Proposition 3

Under system product competition, when product differentiation becomes smaller (i.e., θ is larger), then:

-

(1)

both firms won’t have simultaneous profit (output) increase;

-

(2)

both firms’ profits (outputs) simultaneously decrease if the relative cost satisfies r1 > x > r2;

-

(3)

one firm’s profit (output) increases but the other firm’s profit (output) decreases if r1 < x (r2 > x).

Decisions when product compatibility is changeable

In this section, we solve for the degree of compatibility, which is a choice variable in the first stage. Expecting the optimal output in the second stage (as in Section 3), firms choose their optimal level of compatibility to maximize their own profits. The first order conditions of firm i’s and j’s profit function with respect to α i and α j are same as Eqs. 13 and 14, respectively. This shows that a firm’s profit always increases when its compatibility to other products decreases, which implies α i = 0 is firm i’s optimal strategy. Therefore, under Cournot equilibrium, neither firm’s strategy will allow its product to work in any other product system, resulting in two standards (α i , α j ) = (0, 0) in the market. Because a firm (say firm i) with higher compatibility to other firm increases spillover effect to the rival firm, which causes lower profits to firm i due to Cournot competition. Therefore, when product compatibility is a choice variable, firms will choose their lowest level of compatibility to reduce the spillover effect and maximize their profits.

Proposition 4

Under system product Cournot competition, the firm’s optimal compatibility is to set different standard in the market, i.e., (αi, αj) = (0, 0).

In the market, firms will choose incompatibility with other firms, which may not be the best choice for the social welfare (SW). The social welfare equals consumer surplus (CS i and CS j ) plus firms’ profits.Footnote 12 The consumer surplus can be calculated as Eq. 19 and therefore the social welfare is obtained as Eq. 20:

Taking derivatives with respect to α i for social welfare function, we get:

There are clearly two parts in Eq. 21: the own effect \( {{q_i^* \cdot \partial q_i^* } \mathord{\left/{\vphantom {{q_i^* \cdot \partial q_i^* } {\partial {\alpha_i}}}} \right.} {\partial {\alpha_i}}} \) and the cross effect \( q_j^* {{ \cdot \partial q_j^* } \mathord{\left/{\vphantom {{ \cdot \partial q_j^* } {\partial {\alpha_i}}}} \right.} {\partial {\alpha_i}}} \). According to Eqs. 11 and 12, we know that the own effect is negative and the cross effect is positive. Compared with Eq. 12, Eq. 21 illustrates that firms under Cournot competition ignore the term of positive externality (i.e., the cross effect), which implies that the social optimal compatibility will not be less than firms’ optimal compatibility.

There can be three possible cases. First, when the own effect is greater than the cross effect, (21) < 0, implying that it is socially optimal for the two system products to be completely incompatible, i.e., to have two completely different standards, (α i , α j ) = (0, 0). This is identical to firms’ optimal strategy. Second, when the own effect is smaller than the cross effect, (21) > 0, then the industry has only one set of product standards, (α i , α j ) = (1, 1). It is social optimal for the two system products to work completely compatible and to support each other completely. Finally, if the own effect is equal to the cross effect, (21) = 0, then it exists an an interior social optimum (0, 0) < (α i , α j ) < (1, 1). That is, the social welfare will be maximized when the two system products are partially compatible. However, in Appendix, we prove that Eq. 21 is always positive.

Proposition 5

Under system product Cournot competition, the social optimal compatibility is one set of product standard in the market, i.e., (αi, αj) = (1, 1).

Under this situation, each firm’s product can function perfectly with the other system’s product, giving out more spillover effect to the other firm. For firm i’s increase of its compatibility, the spillover effect increases its rival’s market scale and demand, which is more than the output decrease of firm i. Therefore, total output consumed in the society increases, and hence the social welfare increases.

But a social dilemma occurs. Each firm under Cournot competition equilibrium chooses the lowest compatibility (i.e., α I = α j = 0) according to Proposition 3, but the social optimal would occur when both firms choose the highest compatibility (i.e., α i = α j = 1). This leaves room for government regulation.

In reality, the government often regulates and intervenes in firms’ decisions for compatibility. It is common in countries to set up institutes especially to regulate standards. For example, in United States, the American Standards Institute establishes domestic standards and represents the United States in the International Organization for Standardization. Moreover, Federal Communications Commission (FCC) has sometimes used regulatory policies. It adopted, for example, a color television system that was incompatible with the existing black and white system in 1950, but then was soon stopped by an order of the Director of Defense Mobilization. This shows that the social dilemma of all firms lowering their product compatibility can only be corrected by government regulation to maintain public welfare.

Concluding remarks

Using a two-stage game model with two firms, we suppose that firms decide their degrees of product compatibility and then choose their outputs under Cournot competition. Through this setting, we explore the equilibrium choice of product compatibility and differentiation when network effect exists.

First, under a fixed degree of product compatibility, we find that a firm with a higher degree of compatibility with other products has a greater competitive disadvantage. Because the higher degree of compatibility gives greater spillover effect with other firms, which thereby has larger network size, output, and profit. The disadvantage due to the high degree of compatibility of a firm exists even when the firm has a smaller relative production cost.

Secondly, when consumers subjectively think both products are highly undifferentiated, firms with higher compatibility with other products can induce more demand and earn more profit. Since the degree of differentiation is recognized subjectively, it can be well influenced by marketing and advertisement. We find that a firm can increase its demand and profit by decreasing consumers’ subjective belief about the degree of differentiation between products, when the firm’s product compatibility and/or relative production cost is sufficiently small. However, the principle of minimum differentiation as in location literature does not exist under our Cournot model, but the principle of maximum differentiation exists when the relative production cost satisfies certain conditions. When the principle of maximum differentiation holds, both firms can increase their sales and profits by increasing the consumers’ subjective differentiation between goods. The condition that makes one firm’s profit and sales increase and the other firm’s decrease, is also obtained.

Finally, considering compatibility as a choice variable, a social dilemma occurs. Firms under Cournot equilibrium will choose the lowest degree of compatibility, but the social optimum occurs when both firms choose the highest degree of compatibility. Alternatively speaking, under Cournot competition, two totally incompatible product standards will exist, though there should be only one product standard under the social optimum.

Notes

Based on compatibility and standardization, Shy (1996) divided the economic models for system product into three categories. Firstly, the supporting services approach needs not assume the network externality to exist with the consumer utility coming from the preference of the core product and the quantities or categories of the complement products. Secondly, the component model explores the source of network effect by studying the complementary between the components. Lastly, the network externality model, which is adopted in our paper, assumes that the value of product increases with the numbers of users. For more details, readers can refer to Shy (1995), pp. 254–277.

Beladi and Choi (1995) uses a linear spillover effect on resource allocation, g(S) = a + bS, where a = 1 and b ≥ 0. Therefore, we do not discuss the issue of critical mass.

This setting is similar to that in Economides (1996), who uses a generalized function \( P\left( {Q;S} \right) = P\left( {Q;0} \right) + f(S) \).

Without network externalities, the self-price effect is generally larger than the cross-price effect, i.e., \( \left| {d{P_i}/d{q_i}} \right| > \left| {d{P_i}/d{q_j}} \right| \).

How advertising and marketing can effect consumers’ subjective belief is not the focus of this paper, and so is not discussed herein, though it would be interesting for a topic. Throughout the paper, we see product differentiation as an exogenous variable to investigate its comparative statics, not a choice variable.

In the linear city model, when firms choose locations, the measure of differentiation, more close to (distant from) each other, the product differentiation is minimized (maximized) and is called the principle of minimum (maximum) differentiation. Readers can refer to Shy (1995, pp149–153).

In fact, the social optimal equilibrium compatibility here is not the first best solution, but the second best, as footnote 17 in page 453 of Martin (2002). The first best solution must be derived considering both the quantity and the compatibility choices to maximize the social welfare function at the same time. Our paper fixes the quantity so as to focus on the effect of compatibility change.

References

Baake P, Boomb A (2001) Vertical product differentiation, network externalities, and compatibility decisions. Int J Ind Organ 19(1-2):267–284. PII: S0167-7187(99)00029-6

Beladi H, Choi EK (1995) On the emergence of multinational corporations in developing economies: a note. Reg Sci Urban Econ 25(5):675–684. doi:10.1016/0166-0462(95)02103-2

Billand P, Bravard C (2004) Non-cooperative networks in oligopolies. Int J Ind Organ 22(5):593–609. doi:10.1016/j.ijindorg.2004.01.004

Cabral LMB, Salant DJ, Woroch GA (1999) Monopoly pricing with network externalities. Int J Ind Organ 17(2):199–214. doi:10.1016/S0167-7187(97)00028-3

Choi JP (1994a) Irreversible choice of uncertain technologies with network externalities. Rand J Econ 25(3):382–401

Choi JP (1994b) Network externality, compatibility choice, and planned obsolescence. J Ind Econ 42(2):167–181

Chou C-F, Shy O (1990) Network effect without network externalities. Int J Ind Organ 8(2):259–270. doi:10.1016/0167-7187(90)90019-W

Chou C-F, Shy O (1993) Partial compatibility and supporting services. Econ lett 41(2):193–197. doi:10.1016/0165-1765(93)90196-J

Conner KR (1995) Obtaining strategic advantage from being imitated: when can encourage clone pay? Manage Sci 41(2):209–225

Cremer J, Rey P, Tirole J (2000) Connectivity in the commercial internet. J Ind Econ 48(4):433–472

De Bijl PWJ, Goyal S (1995) Technological change in markets with network externalities. Int J Ind Organ 13(4):307–325. doi:10.1016/0167-7187(94)00457-D

Economides N (1996) Network externalities, complementarities, and invitations to enter. Eur J Polit Econ 12(2):211–233. doi:10.1016/0176-2680(95)00014-3

Farrell J, Saloner G (1986) Installed base and compatibility: innovation, product preannouncement, and predation. Am Econ Rev 76(5):940–955

Farrell J, Saloner G (1992) Converters, compatibility, and the control of interfaces. J Ind Econ 40(1):9–35

Foros O, Hansen B (2001) Competition and compatibility among internet service providers. Info Econ Pol 13(4):411–425. doi:10.1016/S0167-6245(01)00044-0

Grindley P (1995) Standards strategy and policy: case and stories. Oxford University Press, New York

Haruvy E, Prasad A (1998) Optimal product strategies in the presence of network externalities. Info Econ Pol 10(4):489–499. doi:10.1016/S0167-6245(98)00014-6

Hermalin BE, Katz ML (2006) Your network or mine? The economics of routing rules. Rand J Econ 37(3):692–719

Katz ML, Shapiro C (1986) Technology adoption in the presence of network externalities. J Pol Econ 94(4):822–841

Katz ML, Shapiro C (1994) Systems competition and network effects. J Econ Perspect 8(2):93-115

Kim JY (2002) Product compatibility as a signal of quality in a market with network externalities. Int J Ind Organ 20(7):949–964. PII: S0167-7187(01)00058-3

Klimenko M, Saggi K (2007) Technical compatibility and the mode of foreign entry with network externalities. Can J Econ 40(1):176–206

Kristiansen EG (1996) R&D in markets with network externalities. Int J Ind Organ 14(6):769–784. doi:10.1016/0167-7187(96)01012-0

Kristiansen EG (1998) R&D in the present of network externalities: timing and compatibility. Rand J Econ 29(3):531–547

Kristiansen EG, Thum M (1997) R&D incentives in compatible network. J Econ 65(1):55–78

Martin S (2002) Advanced industrial economics, 2nd ed. Blackwell publishers.

Matutes C, Regibeau P (1988) Mix and match: product compatibility without network externalities. Rand J Econ 19(2):221–234

Moore J (1993) Predatory and prey: a new ecology of competition. Harvard Business Review. May–June, pp. 75–86.

Purohit D (1994) What should you do when your competitors send in the clones? Mark Sci 13(4):392–411

Regibeau P, Rockett KE (1996) The timing of product introduction and the credibility of compatibility decisions. Int J Ind Organ 14(6):801–823. doi:10.1016/0167-7187(95)01001-7

Shy O (1995) Industrial organization: theory and application. MIT, Cambridge

Shy O (1996) Technology revolutions in the presence of network externalities. Int J Ind Organ 14(6):785–800. PII S0167-7187(96)01011-9

Shy O, Thisse JF (1999) A strategic approach to software protection. J Econ Manage 8(2):163–190

Slive J, Bernhardt D (1998) Pirated for profit. Can J Econ 31(4):886–899

Thum M (1994) Network externalities, technological progress, and the competition of market contracts. Int J Ind Organ 12(2):269–289. doi:10.1016/0167-7187(94)90017-5

Waldman M (1993) A new perspective on planned obsolescence. Q J Econ 108(1):273–283

Xie J, Sirbu M (1995) Price competition and compatibility in the presence of positive demand externalities. Manag Sci 41(5):909–926

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Deriving Eq.10:

Substituting \( q_i^* \) and \( q_j^* \) of Eq. 7 for Eq. 4, we obtain:

Calculations of Proposition 2 and Proposition 3:

Applying Lemma 1, the interior solution exists when \( x \geqslant \frac{1}{2}\frac{{\theta - a{\alpha_j}}}{{1 - a}} \) for firm i and \( x \leqslant 2\frac{{1 - a}}{{\theta - a{\alpha_i}}} \) for firm j. If \( {2}\left( {A - {c_i}} \right)\left( {1 - a} \right)\left[ {{2}\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right] > \left( {A - {c_j}} \right)\left[ {{4}{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}} \right] \) and \( x{ } \geqslant { }\frac{1}{2}\frac{{\theta - a{\alpha_j}}}{{1 - a}} \), that is, if \( x > \,\,\max \left\{ {\frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}},\;\frac{1}{2}\frac{{\theta - a{\alpha_j}}}{{1 - a}}} \right\} \), then \( \frac{{\partial q_i^* }}{{\partial \theta }} > 0 \) and \( \frac{{\partial \pi_i^* }}{{\partial \theta }} > 0 \). For firm j, if \( {2}\left( {A - {c_j}} \right)\left( {1 - a} \right)\left[ {{2}\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right] > \left( {A - {c_i}} \right)\left[ {{4}{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}} \right] \) and \( x \leqslant 2\frac{{1 - a}}{{\theta - a{\alpha_i}}} \), i.e., if \( x\, < \min \left\{ {2\frac{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}}},2\frac{{1 - a}}{{\theta - a{\alpha_i}}}} \right\} \), then \( \frac{{\partial q_j^* }}{{\partial \theta }} > 0 \) and \( \frac{{\partial \pi_j^* }}{{\partial \theta }} > 0 \).

Letting \( {{\hbox{r}}_1} = \frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}} \) and \( {{\hbox{r}}_2} = 2\frac{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}}} \), we then calculate the each useful difference values as follows:

\( {{\hbox{r}}_1} - { }\frac{1}{2}\frac{{\theta - a{\alpha_j}}}{{1 - a}} = \frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_j}} \right)}^2} - \left( {\theta - a{\alpha_j}} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}} = \frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} - \left( {\theta - a{\alpha_i}} \right)\left( {\theta - a{\alpha_j}} \right)}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}} > 0 \), which can be deduced by Eq. 5. Hence, \( \max \left\{ {\frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha _j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha _i} + {\alpha _j}} \right)} \right]}},\:\:\frac{1}{2}\frac{{\theta - a{\alpha _j}}}{{1 - a}}} \right\} = \frac{1}{2}\frac{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha _j}} \right)}^2}}}{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha _i} + {\alpha _j}} \right)} \right]}}. \)

Moreover,

Therefore, \( \min \left\{ {2\frac{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}}},{ }2\frac{{1 - a}}{{\theta - a{\alpha_i}}}} \right\} = 2\frac{{\left( {1 - a} \right)\left[ {2\theta - a\left( {{\alpha_i} + {\alpha_j}} \right)} \right]}}{{4{{\left( {1 - a} \right)}^2} + {{\left( {\theta - a{\alpha_i}} \right)}^2}}}. \)

We obtain that r1 - r2

Proof of Proposition 5:

Letting \( A = 4{\left( {1 - a} \right)^2} - \left( {\theta - a{\alpha_j}} \right)\left( {\theta - a{\alpha_i}} \right),\,{B_i} = 2\left( {A - {c_i}} \right)\left( {1 - a} \right) - \left( {A - {c_j}} \right)\left( {\theta - a{\alpha_j}} \right) \), according to Lemma 1 the necessary condition for positive output is B i > 0, for any individual firm i. Using (7), (11), and (12), we derive Eq. 21 to obtain the first-order conditions as follows:

Substituting (A2) into (A1), we obtain \( \left[ {{4}{{\left( {{1} - a} \right)}^2} - \left( {\theta - a{\alpha_i}} \right)\left( {\theta - a{\alpha_j}} \right)} \right]{B_j} > 0 \), which contradicts (A1). Similarly, substituting (A1) into (A2) and we obtain \( \left[ {{4}{{\left( {{1} - a} \right)}^2} - \left( {\theta - a{\alpha_i}} \right)\left( {\theta - a{\alpha_j}} \right)} \right]{B_i} > 0 \), which contradicts (A2). Therefore, either (A1) or (A2) must be greater than zero.

First, change (A1) to be greater than zero as shown in (A3), and leave (A2) unchanged:

which gives \( {B_i} < \frac{{2\left( {1 - a} \right)}}{{\left( {\theta - a{\alpha_i}} \right)}}{B_j} \). Substituting it for (A2), we obtain:

which contradicts (A2). Therefore, we are sure that (A2) must be greater than zero, too. Similar reasoning applies when we change (A2) to be greater zero and leave (A1) unchanged; we then find (A1) should also be changed to be greater than zero. This verifies that both (A1) and (A2) should be changed to be greater than zero:

which means that the optimal solution is (α i , α j ) = (1, 1).

Rights and permissions

About this article

Cite this article

Chen, HC., Chen, CC. Compatibility Under Differentiated Duopoly with Network Externalities. J Ind Compet Trade 11, 43–55 (2011). https://doi.org/10.1007/s10842-009-0066-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-009-0066-1