Abstract

This study investigated whether overconfidence with respect to one’s financial literacy affects stock market participation and retirement preparation and if so, how. Using an effective sample of 12,653 Japanese individuals, the empirical results confirm that financial literacy plays a positive role, while confidence in financial literacy also matters. For people with relatively low financial literacy, overconfidence can encourage taking financial action, while for people with high financial literacy, underconfidence can deter action. Confidence could have an effect equal to or greater than financial literacy. Moreover, it was also found that the positive effect of overconfidence is weaker for women than for men.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

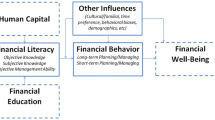

Financial literacy is an individual’s ability to process economic information and make informed decisions about household finances (Behrman et al., 2012). The literature, in general, documents that financial literacy plays an important role in an individual’s financial activity and welfare. For instance, people with higher financial literacy are more disposed to prepare for retirement, take out loans at lower interest, diversify stock portfolios, and accumulate greater wealth (Behrman et al., 2012; Disney & Gathergood, 2013; Jappelli & Padula, 2013; Klapper et al., 2013; Lusardi & Mitchell, 2007a, 2007b; Rooij et al., 2011, 2012; Sekita, 2011; Yeh, 2020).

Another strand of research indicates that not only objective (or actual) financial literacy, but also subjective (or perceived) financial literacy matters (Bannier & Schwarz, 2018; Bellofatto et al., 2018; Despard et al., 2020; Dorn & Huberman, 2005; Graham et al., 2009; Hadar et al., 2013; Henager & Cude, 2019; Woodyard & Robb, 2016; Xiao et al., 2011, 2014; Zhu, 2018). However, people have also been found to consistently overestimate their knowledge, abilities, and accuracy of information, that is, to be “overconfidentFootnote 1” (Barber & Odean, 1999; Deaves et al., 2010). It is quite plausible that people can have a perception not consistent with their actual financial literacy. What are the implications for financial behavior of overconfident people, that is, those who have higher subjective self-assessment of their financial literacy above their actual level? While finance literature in general finds that overconfident traders are inclined to trade too much and diversify less (Barber et al., 2019; Deaves et al., 2009; Goetzmann & Kumar, 2005; Grinblatt & Keloharju, 2009), the extant literature on overconfidence with respect to financial literacy is still scarce and the results are often mixed (Bellofatto et al., 2018).

The current study aims to provide additional evidence on the effect of overconfidence with respect to one’s financial literacy on two financial activities—stock market participation and saving for retirement, which are important activities for one’s financial well-being. There have been a few previous studies on this same question, based on evidence from China (Chen et al., 2019; Chu et al., 2017; Xia et al., 2014), the Netherlands (Ooijen & Rooij, 2016; Rooij et al., 2012), and the United States (Allgood & Walstad, 2016; Asaad, 2015). This study provides additional evidence based on Japanese individuals, who may display a different disposition towards overconfidence/underconfidence from other cultures. Furthermore, the current study also provides the results that account for endogeneity issues—i.e., financial literacy and overconfidence may be endogenously determined with the outcome variable. Many previous related studies ignored endogeneity, while some used instrumental variables (IV) to account for the endogeneity of financial literacy such as Rooij et al. (2012) and Asaad (2015). Only Rooij et al. (2012) and Bannier and Schwarz (2018) used instruments for both financial literacy and confidence (measured by subjective financial literacy). The current study applied Lewbel’s IV approach, also adopted by Bannier and Schwarz (2018), to provide results that account for endogeneity of both financial literacy and overconfidence.

This empirical study draws upon the Financial Literacy Survey, conducted by a Japanese government agency, the Central Council for Financial Services Information, in 2015. Using an effective sample of 12,653 individuals who are non-students below the age of 60, the empirical study found that financial literacy overconfidence encourages investment in stock market and retirement preparation, consistent with previous related studies investigating similar research questions (Allgood & Walstad, 2016; Chen et al., 2019; Rooij et al., 2012; Xia et al., 2014). It was also found that confidence in financial literacy could play an equal or more important role than financial literacy itself, particularly in terms of having a retirement plan, suggesting that confidence may supplement financial literacy.

This study contributes to the extant literature on financial literacy as well as on overconfidence, providing additional evidence on overconfidence with respect to one’s financial literacy, which is still scarce and shows somewhat mixed results (Bellofatto et al., 2018). The results of this study showed that financial literacy per se may not be sufficient for an individual to start investing in stocks or plan for future expenditure, but confidence in financial literacy is a deciding factor. Irrespective of the differences in the overconfidence disposition among different countries, this study predicated on Japanese evidence found that confidence can supplement financial literacy in motivating one to take financial action. The results reinforce the importance of accurate self-assessment and boosting confidence in one’s financial knowledge and ability. Furthermore, this study sheds light on gender differences in financial activity. Women seemed to adopt a more conservative style of investment. Moreover, the positive effect of confidence was weaker for women than for men. An overall implication of this study is that financial education initiatives should not only convey facts and methods but also boost people’s self-efficacy by helping them gain the ability to take charge of their personal finances. Interventions such as financial counseling and coaching can be provided to help individuals, particularly women, gain new skills and confidence to invest or save.

There are limitations to this study. While it was found that financial literacy confidence contributes to participation in the stock market and retirement preparation, this study did not address how financial literacy confidence is associated with stock investment performance due to the unavailability of data. Although evidence suggested that overconfident investors might trade excessively and perform worse, further research is needed to determine how financial literacy overconfidence is associated with investment performance.

The remainder of this paper is as follows. The next section reviews the related literature and states the research questions. The methods section, which follows, describes the data and methodology. The results of the empirical tests are presented in the subsequent section. The final section offers discussion and conclusions.

Literature Review and Research Questions

In the financial literacy literature, a vast number of studies have been conducted on the effect of financial literacy on financial behavior. However, Bellofatto et al. (2018) accentuated the importance of distinguishing between “objective” financial literacy (OFL) and “subjective” financial literacy (SFL). SFL is related to cognitive functioning, including recognition, identification, and problem solving, which plays an important role in one’s financial decision-making such as saving/investment (Park et al., 1988). SFL can be beneficial for several reasons. Financial decision-making, such as preparation for retirement, involves planning, an inherently complex task. Confidence in financial literacy can help one in collecting and processing relevant information for making a plan. In addition, confidence can elevate effort and motivation, thereby enhancing the likelihood of success (Larwood & Whittaker, 1977). Rooij et al. (2012) argued that individuals who are more confident in their knowledge are more likely to use new financial products and reap potential financial benefits.

On the other hand, empirical studies on subjective financial literacy reported somewhat mixed results (Bellofatto et al., 2018; Borden et al., 2008; Robb, 2011). On the one hand, there are studies reporting the beneficial effect of SFL. Hadar et al. (2013) indicated that SFL may be a critical driver of investment behavior. Zhu (2018) found that SFL leads to better perceived behavioral control for adolescent students. Bellofatto et al. (2018) showed that investors with higher SFL tend to trade more, and also display better performance, even after controlling for transaction costs on a risk-adjusted basis. Henager and Cude (2019) reported that SFL has a positive effect on budgeting decisions. Despard et al. (2020) indicated that SFL is positively associated with having an emergency fund. It was also found that SFL is related to greater financial satisfaction (Woodyard & Robb, 2016; Xiao et al., 2014).

On the other hand, Dorn and Huberman (2005) and Graham et al. (2009) found that while investors with high SFL display a more diversified portfolio, they also churn over their portfolios more frequently. Xiao et al. (2011) reported that SFL has a strong effect on the use of credit card debt. Bannier and Schwarz (2018) also showed that confidence increases wealth for men, but this effect is not observed for women.

Since SFL is based on a self-assessment of one’s own financial knowledge, one may misestimate their actual financial literacy. Previous studies have documented that people can be overconfident in their fields of expertise, where overconfidence can be considered the tendency to overestimate one’s knowledge, abilities, and accuracy of information, regardless of occupation (Barber & Odean, 1999; Deaves et al., 2010). The finance and management literature has reported the implications of overconfidence on financial behavior. When traders consider their information and analysis to be more accurate than it is, they take on too much risk, trade too much, and diversify less. Several studies confirmed that traders with a better-than-average effectFootnote 2 trade more (Deaves et al., 2009; Grinblatt & Keloharju, 2009). Goetzmann and Kumar (2005) argued that overconfidence is responsible for excessive trading and under-diversification. Barber et al. (2019) found that margin traders are more overconfident than cash traders and the former trade more, speculate more, and perform worse than the latter. Meanwhile, Hribar and Yang (2016) indicated that overconfident managers tend to miss earnings targets in forecasts and to manage earnings. Malmendier and Tate (2008) documented that overconfident managers engage in more mergers/acquisitions and destroy more firm value than less confident managers. Doukas and Petmezas (2007) concluded that overconfident bidders earn lower announcement returns than their counterparts.

In the context of financial literacy, overconfidence is usually defined as the difference between SFL and OFL. Some recent studies in China, the Netherlands, and the United States have emerged, examining the effect of overconfidence with respect to one’s financial knowledge. However, the results are somewhat mixed. Rooij et al. (2012) found that overconfidence is conducive to preparation for retirement but has no effect on wealth accumulation, while underconfidence has no effect on either outcome. It was also found that overconfidence leads to stock market participation or retirement planning (Allgood & Walstad, 2016; Chen et al., 2019; Chu et al., 2017; Xia et al., 2014). While Ooijen and Rooij (2016) found no effect of overconfidence on risk-taking decisions involving mortgages, Asaad (2015) documented that overconfident individuals have a higher propensity to engage in risky or costlier financial behaviors.

This study aims to provide additional evidence on the effect of overconfidence with respect to one’s financial literacy on financial activity—stock market participation and saving for retirement, which are important activities for one’s financial well-being. Investing in the stock market provides an opportunity to take advantage of the equity premium and to benefit from risk diversification (Rooij et al., 2012). Retirement planning is a very strong predictor of wealth accumulation (Lusardi & Mitchell, 2007a). Better preparation for retirement can also help maintain a similar living standard post-retirement.

This study is distinguished from previous studies in several aspects. First, we focus on Japanese individuals, who may have a different confidence disposition from other cultures, thus worth investigating with respect to the effect of overconfidence on financial behavior. We also tested if the effect of overconfidence differs between gender, given the finding by Bannier and Schwarz (2018) that observed no effect of subjective financial literacy for women. Second, in most related studies on financial literacy, overconfidence is measured by a categorical variable that classifies individuals into four types, according to the relative differences in SFL and OFL. Among the above-mentioned studies, only Ooijen and Rooij (2016) used a continuous variable to measure overconfidence. The current study employs both measures of overconfidence, categorical and continuous, to gain more insight and robust results. Lastly, most of the above-mentioned studies on SFL or overconfidence do not account for endogeneity issues—that is, the possibility that OFL, SFL, and overconfidence are endogenously determined with the outcome variable. Only Rooij et al. (2012) and Bannier and Schwarz (2018) used instrumental variables (IV) for OFL and SFL in their empirical tests. For studies related to overconfidence, only a few studies such as Rooij et al. (2012) and Asaad (2015) used IV for OFL, but not for overconfidence. The current study also provides the results based on the IV method that accounts for OFL and overconfidence, following the approach of Bannier and Schwarz (2018).

Data and Methodology

The data was drawn from the Financial Literacy Survey, a survey gauging the current state of financial knowledge and financial decision-making of Japanese individuals, conducted by the Central Council for Financial Services Information in 2015. The survey was conducted online on 25,000 individuals aged 18 to 79, selected in proportion to Japan’s demographic structure. Individuals over the age of 60 and students were excluded from the sample. The former are very likely to be retired and the latter are yet to enter the workforce or be at a stage to consider retirement. After further excluding those who did not reply to questions used for empirical analysis (such as household income), a sample of 12,653 respondents remained for analysis. Table 1 summarizes their descriptive statistics. The sample is evenly distributed gender-wise. Average age is 41. Of the sample, 16% are between 20 and 29, 30% between 30 and 39, 27% between 40 and 49, and 27% between 50 and 59, respectively. 48.5% of the sample are employed by a company, while the remaining are: part-time workers (16.3%), house-workers (16.4%), self-employed (6.8%), not employed (4.8%), and civil servants (5.7%). Close to half (57%) of the respondents have a 2- or 4-year university degree or more advanced education. Another 41% have graduated from senior high school or vocational school, with only a small portion (2.2%) having received education up to junior high school. As for annual household income, the largest cohort is 2.5–5 million yen (32.9%) and 5–7.5 million yen (24.5%). Only one-tenth or so of the respondents reported a household income of more than 10 million yen (equivalent to approximately $91,116, as of January 2020). The bottom of Table 1 reports the percentage of respondents in response to the “live-now attitude” question, “I tend to live for today and let tomorrow take care of itself,” on a scale of 1 to 5. The proportion of respondents from “strongly agree” to “strongly disagree” are 4%, 15%, 28%, 27%, and 26%, respectively.

Objective and Subjective Financial Literacy

The Financial Literacy Survey contains 26 questions to measure financial knowledge and judgement, 10 of which are comparable to those in surveys conducted by the U.S. Financial Industry Regulatory Authority’s Investor Education Foundation and the Organization for Economic Cooperation and Development (OECD). These 10 questions are related to “lifestyle design” (1 question), basic knowledge of economy and finance (5 questions), loan and credit (2 questions), and wealth management (2 questions). For computing a financial literacy measure, the current study adopts the following five questions relating to knowledge on interest rate compounding, inflation, risk diversification, bond price, and mortgage, following previous related studies (e.g., Allgood & Walstad, 2016; Asaad, 2015; Despard et al., 2020; Gathergood & Weber, 2017; Ooijen & Rooij, 2016).

Question 1 (interest rate): Suppose you put 1 million yen into a savings account with a guaranteed interest rate of 2% per year. How much would be in the account after 5 years? Disregard tax deductions. (1) More than 1.1 million yen. (2) Exactly 1.1 million yen. (3) Less than 1.1 million yen. (4) Impossible to tell from the information given. (5) Don’t know.

Question 2 (inflation): Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account? (1) More than today. (2) Exactly the same. (3) Less than today. (4) Don’t know.

Question 3 (risk diversification): True or false? “Buying a single company’s stock usually provides a safer return than a stock mutual fund.” (1) True. (2) False. (3) Don’t Know.

Question 4 (bond price): If interest rates rise, what will typically happen to bond prices? (1) They will rise. (2) They will fall. (3) They will stay the same. (4) There is no relationship between bond prices and the interest rate. (5) Don’t know.

Question 5 (mortgage): True or false? “When compared, a 15-year mortgage typically requires higher monthly payments than a 30-year loan, but the total interest paid over the life of the loan will be less.” (1) True. (2) False. (3) Don’t Know.

For each question, a dummy is formed, taking a value of one if the respondent correctly answers the questions. For the sample of 12,653 respondents, the percentage that correctly answered these five questions was 43.6%, 52.3%, 46.3%, 24.6%, and 68.9%, respectively. On average, 2.4 questions were answered correctly. For each respondent, the number of correct answers is multiplied by 20, which is defined as the “objective financial literacy (OFL)” measure. OFL has a minimum of zero, a maximum of 100, and an average of 47.1. The statistics are reported in Table 2.

Table 2 also reports information on one’s self-assessment of financial literacy. One survey question asked “How would you rate your overall knowledge about financial matters compared to others?” with available choices on a scale of 1 (very low) to 5 (very high). The percentage indicating “very low” was 14%, “low” 30%, “average” 43.6%, “high” 11.5% and “very high” 1.4%. The average of the self-assessment is 2.6. The results suggest that more respondents think they have a lower level of financial knowledge. To construct a “subjective” financial literacy (SFL) measure, the survey assigns 100 points to “very high,” 75 to “high,” 50 to “average,” 25 to “low,” and 0 to “very low.” The average of SFL is 39.2, which is lower than that of objective financial literacy (OFL = 47.1).

Variables Measuring Overconfidence

Previous studies have used a calibration testFootnote 3 or self-rating of certain positive personal attributes to measure overconfidence.Footnote 4 In this study, overconfidence is measured by comparing one’s subjective (SFL) with objective financial literacy (OFL). The level of overconfidence of an individual is quantified in two alternative ways. The first method computes a “confidence index (CI)” as the difference between SFL and OFL, following Ooijen and Rooij (2016). By this definition, CI can range from − 100 to 100. A larger positive value indicates higher overconfidence, while a smaller (negative) one indicates higher underconfidence. The middle of Table 2 reports that the respondents have an average CI of − 7.92. Though unreported here, the standard deviation, minimum, and maximum are 32.6, − 100, 100, respectively.

The second method classifies the respondents into four groups, a method often used in previous studies on overconfidence. Respondents are defined as belonging to the “overconfident group” if they have an SFL higher than 40.13, and OFL lower than 47.32 (40.13 and 47.32 are the mean SFL and OFL, respectively, for the entire 25,000 survey respondents). In other words, the “overconfident group” overestimate their actual financial literacy. On the other hand, respondents are defined as belonging to the “properly estimated group” (low OFL) if one has an SFL lower than 40.13, and OFL lower than 47.32; referring to people who are self-aware of their low actual financial literacy. In a similar manner, the “underconfident group” is defined for those with an SFL lower than 40.13, and OFL higher than 47.32, who underestimate their high actual financial literacy. Finally, the “properly estimated group” (high OFL) is defined for those with an SFL higher than 40.13, and OFL higher than 47.32—who are self-aware of their high actual financial literacy.

Table 2 summarizes the distribution of confidence types. The percentage of respondents classified in the “overconfident group” is 24.4%, “properly estimated group” (low OFL) 28.9%, “underconfident group” 14.6%, and “properly estimated group” (high OFL) 32.3%, respectively. These results suggest that only 61% or so of the respondents are able to properly estimate their actual financial knowledge.

Financial Behaviors

The Financial Literacy Survey contains questions on the financial behavior of the respondents. Among the 12,653 sample respondents for analysis, 40.3% indicated that their households currently have loans (consumer loan, mortgage loan, or others). The survey also asked respondents if they had ever purchased stocks, mutual funds, or foreign currency deposits, respectively. We constructed a dummy variable taking a value of 1 if the respondents hold any of these assets. As reported in the bottom of Table 2, 36.7% indicated investment experiences in the stock (or foreign exchange) market.

The other questions relate to preparation for post-retirement living expenses. The survey asked: “What expenses do you think you will have to cover in the future?” with 67.2% of respondents indicating “living expenses for retirement.” For those who indicated as such, the respondent was further asked: “With regard to the living expenses for retirement you think you will have to cover in the future, are you aware of the amounts that will be required for your case?” “Do you have a financial plan for living expenses for retirement you think you will have to cover in the future?” And “Have you set aside funds for living expenses for retirement you think you will have to cover in the future?” The answers are yes/no choices. The last three rows of Table 2 show that 41.8% of respondents are aware of the amount required, however, only 29.2% have a plan and an even smaller proportion, 16.8%, have set aside funds for retirement.

Model Specification

Probit regression was performed to test the research questions, with the general specification as follows.

The dependent variable (\(y\)) refers to the respondent’s financial behavior of interest—dummy for investment experiences in stock (or foreign exchange), for having a plan for retirement, and for setting aside funds for retirement. \(\Phi (\bullet )\) is the standard normal cumulative distribution. The explanatory variables include the respondent’s objective financial literacy (\(OFL\)), confidence index (\(CI\)), an interaction term of CI and female dummy (\(Female\)). The coefficient of \(CI\) indicates the effect of overconfidence on financial behavior.

Control variables (\(X\)) include female dummy, (logarithm of) age, occupations, education attainment, household income, and residence dummies.Footnote 5 Lusardi and Mitchell (2008) found that a large majority of women in the United States have not done retirement planning. Age matters because as one gets closer to retirement, they are more likely to have started investing and saving. Occupations are also controlled for since companies provide retirement programs for their full-time employees. Education attainment may proxy for ability, which influences one’s capability of making informed decisions on personal finances. People with higher household income have more resources to invest or save. Lastly, people living in different prefectures (e.g. urban or rural) have different degrees of access to financial information/advice and information providers (e.g., financial institutions), which can affect their investment/saving decisions.

In some regressions, we also used the alternative categorical variable for the respondent’s confidence type in place of the continuous variable CI.

HL refers to the dummy for the overconfident group, HH the properly estimated group (high OFL), and LH the underconfident group. Their respective coefficients thereby measure the differences in the effect on financial behavior relative to the properly estimated group (low OFL), which serves as the benchmark.

For regressions of \(y\) using the dummy for having a plan for retirement, an additional control variable was included—the respondent’s “live-now” attitude, which may affect the preparation for retirement. Moreover, for regressions of \(y\) using the dummy for setting aside funds for retirement, another variable was added—a dummy for those respondent’s currently having a loan, whose payment obligation may hinder their saving ability.

Furthermore, we employed the Heckman model to account for a potential sample selection when the dependent variable is the dummy for having a plan (and setting aside funds) for retirement. In the survey, only those respondents who indicated that “they will have to cover living expenses for retirement” were further asked if they have a financial plan (and setting aside funds). First, using data on all respondents (12,653 non-students aged below 60), the selection equation was estimated by running a probit regression on the dummy variable for those indicating a need to cover their living expenses in the future, on an instrumental variable and the set of control variables (X). The instrumental variable is a dummy for respondents who correctly answered the survey question “What are the three major expenses in life?”Footnote 6. If one is aware of the three primary types of expenditure, he or she is more likely to indicate a need to provide for it in the future. Then, in the outcome equation, using data on those respondents who indicate a need to provide for living expenses in the future, a probit regression was conducted as specified in Eq. (1) or (2).

Lastly, we also conducted robust tests using an IV estimation method to account for the potential endogeneity of the two variables of interest, financial literacy and overconfidence. As the instrument for financial literacy, Rooij et al. (2012) and Assad (2015) used a dummy for respondents who had received financial education at schools.Footnote 7 In the current study, we used a dummy for respondents who have indicated that their “parents or guardians teach them how to manage finances.” As for the instrument for subjective financial literacy, Rooij et al. (2012) and Bannier and Schwarz (2018) used the financial condition of the respondent’s siblings, which is not available in the data set used for this current study. Therefore, following Bannier and Schwarz (2018), in addition to the instrument of receiving financial education at home, we also used instruments constructed by heteroscedasticity, an estimation method developed by Lewbel (2012), when none or insufficient external instruments are available.

Empirical Results

Univariate Tests

Table 3 reports the results of univariate tests comparing financial behaviors among people with different confidence dispositions. The first two columns compare the overconfident group and properly estimated group (low OFL), while the last two columns compare the underconfident group and properly estimated group (high OFL). The first row reports the differences in stock market investment among different groups. It can be seen that given a similar level of financial literacy, those with greater confidence are more likely to invest in stocks—30.0% in the overconfident group invested in stocks (or foreign exchange), greater than the 12.0% in the properly estimated group (low OFL), while 64.5% in the properly estimated group (high OFL) invested in stocks compared to 31.9% in the underconfident group. The differences are statistically significant.

The second row of Table 3 reports the respondents’ indication as to whether they think they will have to cover living expenses in the future. The difference between the overconfident group and the properly estimated group (low OFL) is only marginally significant (60% vs 62%, p-value = 0.049), while there is no significant difference between the properly estimated group (high OFL) and underconfident group (75% vs 73%, p-value = 0.135).

The third row of Table 3 reports the differences in having a plan for retirement. The overconfident group is more likely to have a financial plan than their less confident peers (33.1% vs. 13.5%), while the underconfident group is less prepared than their more confident peers (17% vs. 43.4%). The differences are statistically significant.

The last row, examining securing funds for retirement, also shows similar results. The overconfident group is more likely to set aside funds for retirement than their less confident peers (21.3% vs. 6.8%), while the underconfident group is less so than their more confident peers (10% vs. 24.4%). The differences are also statistically significant.

It is worth noting that the overconfident group has an equal or stronger tendency than the underconfident group to invest in stocks and prepare for retirement. For instance, the overconfident respondents are more likely to have a plan (33.1%) than the underconfident respondents (17.7%). This suggests that a less financially literate but disproportionately overconfident person can be more prepared than a highly financially literate but disproportionately underconfident person.

Furthermore, it is also evident that, on average, more financially literate people (regardless of their confidence) are more likely to participate in the stock market and prepare for retirement than less financially literate ones. That is, people in the properly estimated group (high OFL) and underconfident group, as a whole, are more likely to participate than people with low OFL. Such results are consistent with previous studies that found a positive association between financial literacy with stock market participation and retirement preparation (Lusardi & Mitchell, 2007b; Rooij et al., 2011, 2012).

Taken together, the univariate results suggest that overconfidence in financial literacy, in addition to financial literacy level, makes a difference in financial activity.

Multivariate Regressions of Participating in Stock or Foreign Exchange Market

This section reports the results for estimating Eqs. (1) and (2) using the dummy for participation in the stock or foreign exchange market as the dependent variable. Table 4 reports the probit estimates using the heteroskedasticity-robust standard errors. Average marginal effects (AME) for explanatory variables relating to overconfidenceFootnote 8 are also reported at the bottom of the table.

The first column shows that both confidence index (CI) and objective financial literacy (OFL) are positive and significant. The AME of CI is 0.5% (p-value = 0.000). A finite-difference estimate of AME indicates that, holding other variables at their observed values, increasing the confidence index from the 25th percentile to the 75th percentile boosts the probability of investing in stocks by 17.1%, from 29.7% to 46.7%.

In the second column, only three dummy variables for confidence type are included, with the properly estimated group (low OFL) being excluded and serving as the reference group. The overconfident group has a significant coefficient, suggesting greater proclivity for stock investment than their low OFL peers (the reference group). Comparison between the properly estimated group (high OFL) and underconfident group shows that the former has a higher coefficient. The contrasts in AME show the effects of changes between different types of confidence. Holding other variables at their observed values, the overconfident group has a 16% higher probability (p-value = 0.000) of investing in stocks than the properly-estimated (low OFL) group, while the underconfident type has a 27.8% lower probability (p-value = 0.000) than the properly-estimated (high OFL) group. Moreover, overconfident type also has a probability marginally higher by 2.2% (p-value = 0.098) than the underconfident type, which suggests that overconfidence can, to some degree, supplement financial literacy in spurring stock investment.

Additionally, the objective financial literacy shows statistically significant and positive coefficients. It is also noted that the coefficient for the female dummy is significantly negative, suggesting that females are less likely to invest in stocks than males with equivalent financial literacy and overconfidence level. Females might be less willing to invest in riskier financial products than males, other things being equal. Other control variables that show significant coefficients are age and education—people with greater age or higher education are more likely to invest in stocks. People with household income greater than 10 million yen are also more likely to invest.

Multivariate Regressions of Preparing for Retirement

Table 5 reports the Heckman model results for the outcome equation with “having a financial plan for retirement” as the dependent variable. The table also reports the estimate for the instrument used in the selection equation.

In the first column, the result also shows that having a plan is significantly and positively associated with CI and OFL. The AME of CI variable is 0.34% (p-value = 0.000). The finite-difference estimate of AME shows that, holding other variables at their observed values, increasing the confidence index from the 25th percentile to the 75th percentile increases the probability of having a financial plan by 13.3%, from 18.0% to 31.2%.

The second column includes the three dummy variables for confidence type. The AME results suggest that, holding other variables at their observed values, the overconfident type increases the probability of having a retirement plan by 10.6% (p-value = 0.000) than the properly estimated type (low OFL), while the underconfident type decreases the probability by 15.6% (p-value = 0.000) than the properly estimated type (high OFL). Moreover, the overconfident type also has a probability higher by 8.9% (p-value = 0.000) than the underconfident type, again suggesting that confidence could play a larger role than financial literacy in one’s retirement planning.

Table 6 reports the results for the outcome equation with “setting aside funds for retirement” as the dependent variable. In column 1, the AME of CI is 0.21% (p-value = 0.000). A finite-difference estimate of AME shows that an increase in confidence index from the 25th percentile to the 75th percentile raises the probability by 8.5%, from 10.2% to 18.7%. The second column shows that, holding other variables at their observed values, the overconfident type increases the probability of securing retirement funds by 8.7% (p-value = 0.000) than the properly estimated type (low OFL), while the underconfident type decreases the probability by 7.4% (p-value = 0.000) than the properly estimated type (high OFL). Moreover, the overconfident type also has a probability higher by 7.8% (p-value = 0.000) than the underconfident type.

The effects of other control variables are also observed in Tables 5 and 6. The objective financial literacy continues to show statistically significant and positive coefficients. A “live now” attitude and the burden of mortgage repayment decrease preparation. Older people and people with higher education are more likely to prepare for retirement. Civil servants (compared with company employees) and individuals with higher household income (particularly earning more than 10 million yen) are also more prepared. Female respondents are also more prepared than males.

Effect of Overconfidence between Genders

The analyses in the preceding sections found that overconfidence plays a positive role in one’s financial activity. This subsection investigates the possibility that the effect of overconfidence may not be the same between genders. The regressions in the preceding sections were repeated, adding an interaction term of confidence index (CI) with the female dummy variable. Because the magnitude of the interaction effect in nonlinear models does not equal the marginal effect of the interaction term (Ai & Norton, 2003), we used the method suggested by Norton et al. (2004), in which the interaction effect is estimated by the mean cross-partial derivative, i.e., the average of the cross-partial derivative (with respect to CI and the female variable) over all observations in the data set.Footnote 9 The average of the cross-partials (interaction effect), the associated standard error, and z-value are also provided in Table 7.

The first column in Table 7 reports the results on regressions with “investing in stock or foreign exchange market” as the dependent variable. The AME of confidence index (CI) is 0.51% (p-value = 0.000), a level similar to that reported in Table 4 (column 1). For the interaction effect of CI and female, the mean interaction effect is negative (− 0.102%) and generally statistically significant. In other words, the average change in the predicted conditional probability of investing in stock or foreign exchange market for a one-unit increase in confidence index differs between men and women by 0.1%, with women having lower marginal effects on average.

The second column shows the results with “having a plan for retirement” as the dependent variable. The CI variable still shows a significantly positive coefficient, with an AME of 0.54%. The mean interaction effect is negative (− 0.12%) and generally statistically significant, suggesting that women have lower marginal effect.

The third column reports the results with setting aside funds for retirement as the dependent variable. The confidence index variable still shows a significantly positive coefficient, with an AME of 0.34%. The mean interaction effect is still negative (− 0.09%) and generally statistically significant.

Robust Tests Using IV Estimation

This subsection provides additional tests using Lewbel’s IV estimation method. Table 8 reports the Lewbel estimates for the regressions as estimated in Table 7. The first-stage results from the standard IV regression show that the external instrument, financial education at home, is positively and significantly related to objective financial literacy, satisfying the exclusion restriction. The Lewbel (2012) estimation approach rests on the heteroscedasticity in the errors of the first stage regression. The White test as well as the Breusch and Pagan test for heteroscedasticity are significant, meeting the assumption of heterogeneous error terms. On the other hand, the test results for weak instruments, the Cragg and Donald statistic, may not be highly satisfactory. The null hypothesis of weak instruments can be rejected if we are willing to tolerate a 30% relative bias, based on critical values provided by Stock and Yogo (2005).

In Table 8, the coefficients for objective financial literacy (OFL) and confidence index (CI) are still positive and significant in all columns. The interaction term of CI and female dummy displays a negative and significant coefficient in all three columns. Note that the magnitudes of these coefficients are not directly comparable with those reported in Table 7, because the Lewbel estimator is based on linear regression models while coefficients in Table 7 are probit estimates. In fact, we can interpret the Lewbel estimated coefficient as marginal effect. The marginal effect of confidence index is 0.66%, 0.54% and 0.26%, respectively, in the three regressions. In Table 7, the AME in the three regressions is 0.51%, 0.53% and 0.34%, respectively. Furthermore, the interaction term of CI and female under Lewbel’s approach is close to − 0.1% in Table 8, while the mean interaction effect, as reported in Table 7, is also around − 0.1%. In general, Lewbel’s IV results are similar to the probit results as reported in Table 7.

Discussion

This study investigated whether overconfidence with respect to one’s financial literacy affects stock market participation and retirement preparation and if so, how. It was found that people perceive their financial literacy wrongly. Indeed, 41% of the respondents in this study either overestimated or underestimated their actual financial knowledge. A comparison of the confidence disposition of the sample subjects also reveals some differences across different studies. Although not completely comparable, 24% of the Japanese sample in this study were classified into the overconfident group, while 28% of the Dutch sample in Rooij et al. (2012), 42% of Chinese in Chen et al. (2019), 24% of Chinese in Xia et al. (2014), and 16% of the Americans in Allgood and Walstad (2016), respectively, were classified into the overconfident group. On the other hand, 15% of the Japanese sample in this study were classified in the underconfident group, while 40% of the Dutch sample in Rooij et al. (2012), 14% of Chinese in Chen et al. (2019), 19% of Chinese in Xia et al. (2014), and 25% of the Americans in Allgood and Walstad (2016), respectively, were classified into the overconfident group. The figures are not directly comparable due to differences in the size and composition of the sample and measures of financial literacy. However, it appears that the Japanese and Chinese samples showed larger overconfident percentages than underconfident percentages, while in contrast, the Dutch and American samples had much larger underconfident percentages. Explaining these differences requires further research.

Irrespective of the differences in confidence disposition, the results indicated that overconfidence in financial literacy can encourage one to invest in stocks and prepare for retirement, which are consistent with previous studies investigating the same research questions (Allgood & Walstad, 2016; Xia et al., 2014), and between overconfidence and retirement preparation (Chen et al., 2019; Rooij et al., 2012). As can be seen in Table 5, among those with low objective financial literacy (OFL), the overconfident type was 10.6% more likely to have a retirement plan than their low OFL peers, while among those with high OFL, the underconfident type was 15.6% less likely to do so than their high OFL peers.

Moreover, the results in Tables 3 and 6 showed that the overconfident group (High SFL but low OFL) is equally or more likely than the underconfident group (Low SFL but high OFL) to invest or save. For instance, the overconfident group was estimated to be 8.9% more likely to have a retirement plan than the underconfident group, after controlling for other factors (Table 5). In this sense, confidence could supplement financial literacy to some extent in spurring financial action, or alternatively speaking, underconfidence can offset the positive effect of high financial literacy. While the results showed that financial literacy continued to have positive and significant effect, consistent with existing literature (e.g., Behrman et al., 2012; Disney & Gathergood, 2013; Jappelli & Padula, 2013; Klapper et al., 2013; Lusardi & Mitchell, 2007b; Rooij et al., 2011, 2012; Sekita, 2011; Yeh, 2020), confidence can play an equal or larger role in affecting one’s financial activity.

We also try to compare the marginal effect of overconfidence/underconfidence in this study with that of previous related studies. Since the model specifications and the set of explanatory variables are somewhat different across these studies, the results are not directly comparable. With this cautionary note in mind, a comparison may reveal intriguing differences. Allgood and Walstad (2016) reported that marginal effect on stock investment differs by 8.8% between overconfident and properly estimated (low OFL) group, and –12% between underconfident and properly estimated (high OFL) group. The respective values in this current study are 16% and –27.8%. Rooij et al. (2012) reported the OLS coefficients for the overconfident and underconfident groups as 14% and –4.8%, with the dummy for “having a retirement plan” as the dependent variable. We rerun a similar regression as column 2 in Table 5 but using OLS estimation, with the coefficients for the overconfident and underconfident groups being 12.6% and –17%. Again, although not directly comparable, the effect of overconfidence reported in this study is similar or larger than that in previous studies. Furthermore, on average, the effect of underconfidence is even stronger than that of overconfidence in terms of magnitude. In this sense, overconfidence and underconfidence are not symmetrical in the magnitude of their effect on financial behavior. Dutch and American people may suffer to a greater extent from underconfidence than do Japanese and Chinese people, as the former groups have greater underconfidence percentages. Further research in the future may explore the differences in the effect of overconfidence (underconfidence) among multiple countries using a unified model specification.

The results also found differences between genders. The effect of overconfidence was observed for both men and women, with the effect more pronounced in men than in women. Bannier and Schwarz (2018) also found a stronger effect of confidence (measured by subjective financial literacy) on wealth—confidence had a positive and significant effect on wealth for men, but insignificant effect for women. Further research may explore further why the impact of overconfidence on financial activity differs between genders.

The results in this study have implications for different stakeholders. Individuals are bearing more responsibility in managing the money in their pension scheme, as many developed countries, including Japan, have been moving from employer-invested defined benefit pensions to employee-invested defined contribution pensions. Individuals need to strengthen their financial knowledge and boost their confidence. Employers can provide financial education programs to help employees to increase their financial knowledge, and offer financial counseling and coaching to boost their confidence. Such guidance is particularly useful for underconfident individuals, who underperform a greater deal compared to overconfident people in investing and saving. More resources should be dedicated to females because they underperform males in terms of financial literacy and the marginal effect of confidence. Government can also promote financial education programs to the general public, particularly teenagers or students. Exposure to money education or money management experiences in early stages of life not only increases financial knowledge and motivation, but can also build confidence in financial matters. For instance, although Japan has no formal personal finance education in its mandatory education curriculum, some government agencies (such as the Central Council for Financial Services Information) have begun engaging with school teachers and students to promote financial education. More such efforts are necessary to boost students’ objective and subjective financial literacy.

Data Availability

Available upon permission of the data source.

Notes

Other related attributes include better-than-average effect, illusion of control, and excessive optimism.

“Better-than-average effect” is related to overconfidence, which means that people, when asked to rate themselves relative to average on certain positive personal attributes such as skill or ability, rate themselves as above average on those attributes.

For example, respondents are asked multiple-choice questions on common knowledge. Then, they are asked to rate the accuracy of their answers. If someone self-reports an accuracy level of 90% while getting 70% of the questions right, then he or she is considered overconfident.

Some others used the tendency of CEOs to voluntarily hold a large number of in-the-money-options as a proxy for overconfidence (Malmendier and Tate, 2008).

These residence dummies are Tohoku (including prefectures of Aomori, Iwate, Miyagi, Akita, Yamagata, Fukushima, and Hokkaido), Kanto (Ibaragi, Tochigi, Gunma, Saitama, Chiba, Kanagawa, and Yamanashi), Tokyo, Chubu (Niigata, Toyama, Ishii, Fukui, Nagano, Gifu, Shizuoka, Aichi, and Mie), Keihan (Kyoto and Osaka), Kinki (Shiga, Hyogo, Nara, and Wakayama), Chugoku (Tottori, Shimane, Okayama, Hiroshima, and Yamaguchi), Shikoku (Tokushima, Kagawa, Ehime, and Kochi), and Kyushu (Fukuoka, Saga, Nagasaki, Kumamoto, Oita, Miyazaki, Kagoshima, and Okinawa).

The choices are: (1) living expenses for own lifetime, children's educational expenses, and medical expenses for self, (2) children's educational expenses, costs of buying a house, and living expenses for own retirement, (3) costs of buying a house, medical expenses for self, and costs of nursing care for parents, and (4) Don’t know.

Other instruments for financial literacy include the mathematical ability during the teens (Gathergood and Weber, 2017; Jappelli and Padula, 2013), the experience of family members (Behrman et al., 2012; Rooij et al., 2011), or the number of universities or newspaper circulating in the neighborhood (Klapper et al., 2013).

Marginal effect at the means is not informative since there are many categorical variables in the regressions.

For each respondent, we calculate the difference in the marginal effect of CI on the dependent variable between men and women, which is the interaction effect. After obtaining the interaction effect, the associated standard error and z-value for all respondents, the averages of these statistics are computed.

References

Ai, C. R., & Norton, E. C. (2003). Interaction terms in logit and probit models. Economics Letters, 80(1), 123–129

Allgood, S., & Walstad, W. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697

Asaad, C. T. (2015). Financial literacy and financial behavior: Assessing knowledge and confidence. Financial Services Review, 24, 101–117

Bannier, C. E., & Schwarz, M. (2018). Gender- and education-related effects of financial literacy and confidence on financial wealth. Journal of Economic Psychology, 67, 66–86

Barber, B.M., Huang, X., Ko, J., & Odean, T. (2019). Leveraging overconfidence. Retrieved December 1, 2019, from https://ssrn.com/abstract=3445660

Barber, B. M., & Odean, T. (1999). The courage of misguided convictions. Financial Analysts Journal, 55(6), 41–55

Behrman, J., Mitchell, O., Soo, C. K., & Bravo, D. (2012). How financial literacy affects household wealth accumulation. American Economic Review, 102, 300–304

Bellofatto, A., D’Hondt, C., & Winne, R. (2018). Subjective financial literacy and retail investors’ behavior. Journal of Banking and Finance, 92, 168–181

Borden, L., Lee, S., Serido, J., & Collins, D. (2008). Changing college students’ financial knowledge, attitudes and behaviors through seminar participation. Journal of Family and Economics Issues, 29, 23–40

Chen, B., Chen, Z., Yao, T. (2019). Behaviors financial literacy confidence and retirement planning: Evidence from China. Retrieved December 1, 2019, from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3282478

Chu, Z., Wang, Z., & Xiao, J. J. (2017). Financial literacy, portfolio choice and financial well-being. Social Indicators Research, 132(2), 799–820

Deaves, R., Lüders, E., & Luo, G. Y. (2009). An experimental test of the impact of overconfidence and gender on trading activity. Review of Finance, 13(3), 555–575

Deaves, R., Lüders, E., & Schröder, M. (2010). The dynamics of overconfidence: Evidence from stock market forecasters. Journal of Economic Behavior and Organization, 75(3), 402–412

Despard, M. R., Friedline, T., & Martin-West, S. (2020). Why households lack emergency savings? The role of financial capability. Journal of Family and Economic Issues, 41(3), 542–557

Disney, R., & Gathergood, J. (2013). Financial literacy and consumer credit portfolios. Journal of Banking and Finance, 37, 2246–2254

Dorn, D., & Huberman, G. (2005). Talk and action: What individual investors say and what they do. Review of Finance, 9(4), 437–481

Doukas, J. A., & Petmezas, D. (2007). Acquisitions, overconfident managers and self-attribution bias. European Financial Management, 13(3), 531–577

Gathergood, J., & Weber, J. (2017). Financial literacy, present bias and alternative mortgage products. Journal of Banking and Finance, 78, 58–83

Goetzmann, W. N., & Kumar, A. (2005). Equity portfolio diversification. Review of Finance, 12, 433–463

Graham, J. R., Harvey, C. R., & Huang, H. (2009). Investor competence, trading frequency, and home bias. Management Science, 55(7), 1094–1106

Grinblatt, M., & Keloharju, M. (2009). Sensation seeking, overconfidence and trading activity. The Journal of Finance, 64(2), 549–578

Hadar, L., Sood, S., & Fox, C. (2013). Subjective knowledge in consumer financial decisions. Journal of Marketing Research, 50(3), 303–316

Henager, R., & Cude, B. J. (2019). Financial literacy of high school graduates: Long-term and short-term financial behavior by age group. Journal of Family and Economic Issues, 40(3), 564–575

Hribar, P., & Yang, H. (2016). CEO overconfidence and management forecasting. Contemporary Accounting Research, 33(1), 204–227

Jappelli, T., & Padula, M. (2013). Investing in financial literacy and saving decisions. Journal of Banking and Finance, 37, 2779–2792

Klapper, L., Lusardi, A., & Panos, G. A. (2013). Financial literacy and its consequences: Evidence from Russia during the financial crisis. Journal of Banking and Finance, 37, 3904–3923

Larwood, L., & Whittaker, W. (1977). Managerial myopia: Self-serving biases in organizational planning. Journal of Applied Psychology, 62, 194–198

Lewbel, A. (2012). Using heteroscedasticity to identify and estimate mismeasured and endogenous and endogenous regressor models. Journal of Business and Economic Statistics, 30, 67–80

Lusardi, A., & Mitchell, O. S. (2007a). "Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205–224

Lusardi, A., & Mitchell, O. S. (2007b). Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics, 42(1), 35–44

Lusardi, A., Mitchell, O.S. (2008). Planning and financial literacy: How do women fare? The American Economic Review, Vol. 98, No. 2, Papers and Proceedings of the One Hundred Twentieth Annual Meeting of the American Economic Association, 413–417.

Malmendier, U., & Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of Financial Economics, 89(1), 20–43

Norton, E. C., Wang, H., & Ai, C. R. (2004). Computing interaction effects and standard errors in logit and probit models. The Stata Journal, 4(2), 154–167

Ooijen, R., & Rooij, M. (2016). Mortgage risks, debt literacy and financial advice. Journal of Banking and Finance, 72, 201–217

Park, C. W., Gardner, M. P., & Thukral, V. K. (1988). Self-perceived knowledge: Some effects on information processing for a choice task. American Journal of Psychology, 101, 401–424

Robb, C. A. (2011). Financial knowledge and credit card behavior of college students. Journal of Family and Economic Issues, 32(4), 690–698

Rooij, M., Lusardi, A., & Alessie, R. J. M. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472

Rooij, M., Lusardi, A., & Alessie, R. J. M. (2012). Financial literacy, retirement planning and household wealth. Economic Journal, 122, 449–478

Sekita, S. (2011). Financial literacy and retirement planning in Japan. Journal of Pension Economics and Finance, 10(4), 637–656

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In J. H. Stock & D. W. K. Andrews (Eds.), Identification and inference for econometric models: Essays in Honor of Thomas J. Rothenberg.Cambridge University Press.

Woodyard, A. S., & Robb, C. A. (2016). Consideration of financial satisfaction: What consumers know, feel and do from a financial perspective. Journal of Financial Therapy, 7(2), 41–61

Xia, T., Wang, Z., & Li, K. (2014). Financial literacy overconfidence and stock market participation. Social Indicators Research, 119(3), 1233–1245

Xiao, J. J., Chen, C., & Chen, F. (2014). Consumer financial capability and financial satisfaction. Social Indicators Research, 118(1), 415–432

Xiao, J. J., Tang, C., Serido, J., & Shim, S. (2011). Antecedents and consequences of risky credit behavior among college students: Application and extension of the theory of planned behavior. Journal of Public Policy and Marketing, 30(2), 239–245

Yeh, T. (2020). An empirical study on how financial literacy contributes to preparation for retirement. Journal of Pension Economics and Finance. https://doi.org/10.1017/S1474747220000281

Zhu, A. Y. F. (2018). Parental socialization and financial capability among Chinese adolescents in Hong Kong. Journal of Family and Economic Issues, 39, 566–576

Acknowledgements

The authors are grateful to the referees and the editor for their valuable comments. We also appreciate the comments from Prof. Konari Uchida and participants at the research seminar in Kyushu University in 2019. We would also like to thank Editage for English language editing.

Funding

The corresponding author acknowledges financial support from JSPS KAKENHI (JP17K03807) and Nomura Foundation Social Science Research Grant.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yeh, Tm., Ling, Y. Confidence in Financial Literacy, Stock Market Participation, and Retirement Planning. J Fam Econ Iss 43, 169–186 (2022). https://doi.org/10.1007/s10834-021-09769-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-021-09769-1