Abstract

Exchanges of assistance among kin are a common and important source of support for families; however, people are often hesitant to seek such assistance and broader economic contexts influence these exchange relationships. Existing studies overlook the potential role of credit cards in shaping exchanges of assistance among kin, which is surprising given the potential for credit to serve as a substitute for assistance from kin and the potential for credit to shape the economic contexts that influence exchange decisions. Drawing on social exchange theories and data from the Fragile Families and Child Wellbeing Study, we find that having a credit card is associated with a decreased likelihood of borrowing money from close social ties and that this relationship is conditional on marital status and income. These findings contribute to understandings of how exchanges of support are shaped by economic contexts and suggest the need for further research on how credit influences exchanges of assistance among family and friends.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The credit card market in the US is well developed (Guseva and Rona-Tas 2001), with total outstanding credit card debt standing at over one trillion dollars (Federal Reserve Bank of New York 2018). Past research has suggested that credit cards have the potential to serve as a “plastic safety net” or a “market-based supplement to the social insurance system” (Bird et al. 1999, p. 127). Indeed, research shows that reduced welfare spending facilitates the growth of the credit card market and that increased credit supply allows for further reductions in welfare provisions (Krippner 2012; Prasad 2012; Soederberg 2013, 2014). In this article, we extend this line of work on how credit cards act as an alternative to social systems of support by arguing that credit cards have the potential to reshape not only public forms of relief, but also private networks of support.

Specifically, individuals often rely on financial assistance from family and close social ties to weather hard times (Dominguez and Watkins 2003; Edin and Lein 1997; Mutchler and Baker 2009; Nichols et al. 2006; Stack 1974; Whitehead 2018). However, research finds that receiving such assistance can have social, psychological, and material costs, so that individuals often receive this help reluctantly (Meadows 2009; Offer 2012; Sherman 2006, 2013). Drawing on social exchange theory, we argue that, because credit cards allow families to meet financial obligations in the face of income deficits, they can serve as an alternative to informal financial support for those disinclined to seek help from family and friends. We also posit that marital status and household income shape the relative appeal of relying on kin networks versus formal credit instruments, and in turn, the relationship between credit cards and receiving financial assistance from social ties varies depending on those characteristics.

We use longitudinal data from the Fragile Families and Child Wellbeing Study (http://www.fragilefamilies.princeton.edu/) to examine the association between having a credit card and the likelihood of borrowing money from family or friends. Overall, by showing that credit cards can serve as an alternative to financial support from social ties, this article contributes to research on how credit shapes exchange relationships, an important and understudied topic. Our study also extends the literature on social support networks. In particular, past studies (Edin and Lein 1997; Mazelis 2016; Newman 2020; Stack 1974) find that exchanges of material assistance among kin are shaped by economic contexts—individuals turn to family and friends because the public safety net and labor market are oftentimes inadequate. We further this line of inquiry by exploring how access to credit is associated with kin-based networks of financial assistance. In what follows, we first provide an overview of social exchange theory before delineating our arguments regarding credit cards and financial assistance from close ties.

Social Exchange Theory

Social exchange theory constitutes a class of approaches to “interactions in which giving and receiving material assistance and intangible resources is at least partially predicated on the expectation of returns or reciprocity” (Uehara 1990, p. 523). Like market theories of exchange typical of economics, social exchange theory draws on utilitarianism as a model of human behavior (Cook et al. 2013). A key insight of this approach is that actors have a variety of alternative exchange partners with whom to trade both material and immaterial resources, and actors choose partners that yield the greatest benefits relative to costs. However, social exchange theories differ from other exchange theories in that their focus is less on the material outcomes of trade and more on “the social structures created by exchange relations” (Cook et al. 2013, p. 53). Importantly, social exchange theories also recognize that trades are shaped by the relationships in which they are embedded, in addition to being guided by maximization motives (Blau 1964).

For example, scholars have argued that exchanges can be emotionally rewarding and lead to emotional attachment. This attachment may yield a commitment to exchange partners and incentivize staying in existing exchange relationships, despite available alternatives that prove more attractive on a purely material level (Cook and Emerson 1978; Lawler and Yoon 1996). Social exchange theorists have also emphasized that power dynamics may arise through and structure ongoing exchanges. In particular, individuals with limited available channels to obtain goods and services may come to depend on their few exchange partners for critical resources, giving those partners the power to dictate terms of trades and sometimes social behaviors more generally (Blau 1964; Cook and Emerson 1978; Emerson 1962).

On a macro level, social norms also play a role in transactional dynamics. For example, cultural scripts related to family and kinship in contemporary US society can encourage individuals to support those social ties even when the resources deployed could yield higher returns if invested in other avenues (Finch 1991; O’Brien 2012; Wherry et al. 2019a, b). Similarly, Zelizer (1997) stressed that, through processes of cultural matching, rules of exchange may come to vary depending on the types of social ties linking trading partners. For example, in market situations, direct reciprocity through money is an expected behavior. However, this form of exchange is often viewed as inappropriate when engaging in resource trades with a close tie, at least in many contemporary western societies. In those contexts, deferred forms of reciprocity are often better suited, in which one service is swapped for the promise of another sometime in the future (Uehara 1990).

Social exchange theory has clear implications for potential associations between having a credit card and receiving financial assistance from close social ties. Specifically, a cornerstone concept of social exchange theories is that of alternative exchange partners: individuals have a variety of potential exchange partners, including family, friends, and institutions. When and with whom individuals exchange resources is shaped by social relationships and social structures. For those with unmet financial needs, family and friends are a potential source of support. However, if an individual has a credit card, then the credit lending institution is another potential exchange partner. In the following section, we discuss in more detail research that considers these possible sources of support for those in need of economic assistance.

Credit Cards as an Alternative to Financial Assistance from Kin

During hard times and when facing income deficits, individuals frequently rely on financial assistance from their relatives and friends and count on this assistance to avoid hardships (Campbell and Pearlman 2019; Harknett 2006; Harknett and Hartnett 2011; Hombrados-Mendieta et al. 2012). While some scholars view flows of financial support in personal networks as purely altruistic gestures (Becker 1981), many adopt a social exchange framework and view these flows as systems of reciprocal exchanges (Bianchi et al. 2008; Cox 1987; Offer 2012). As noted above, reciprocity in the context of kin and friendship networks is usually not direct, as it is in market exchanges, and support received is not compensated by money equivalents. Instead, benefiting from assistance initiates an implicit debt—an obligation to provide material or immaterial help in return at a point in time when the receiver will be back in a position to offer help (Offer 2012). Scholarship has also emphasized that reciprocity regimes in kin- and friendship networks may be “restricted”—implying that reciprocal help is due to the same person that provided support in the first place (Bernheim et al. 1985; Uehara 1990). For example, money received from a parent may be compensated by care provided to the parent in old age. However, in many cases, social networks of support instead operate based on a “generalized” reciprocity principle (Bearman 1997; Uehara 1990). Here, compensation is not expected to flow back to the same person that first provided assistance, but rather to anyone in the network who will next need help.

One implication of those kinds of reciprocity regimes is that the nature or extent of compensation expected is typically not clearly defined nor negotiated. Instead, diffuse compensation expectations are formed through experience in the network, as participants observe, comment on, and learn what is viewed as an appropriate response to different sorts of assistance provided, depending on specific situations and capacities to help (Nelson 2005; Offer 2012). For providers of support, there is also a risk that their help to others might go uncompensated (Wherry et al. 2019a, b). This possibility, however, is mitigated by familial norms that promote an obligation to support one’s family members (Finch 1991; Offer 2012; Stack 1974). At a micro level, members of support networks also monitor each other’s behaviors, evaluating potential exchange partners’ ability to offer reciprocal help and reliability in doing so, circulating information about them throughout the network, and sanctioning those who fail to reciprocate by measures such as excluding them from the network or deploying strategies to obfuscate having to support them in the future (Blau 1964; Nelson 2005; Schwartz 1967; Wherry et al. 2019a, b).

This social exchange perspective on kin- and friendship networks of support emphasizes that, although the receipt of financial assistance from close social ties is often cast as beneficial and a social safety net critical to well-being, it is not free. The costs associated with receiving assistance are in part material. In the case of financial assistance, one must repay the amount received, either with money or through more practical forms of support like offering care. Such repayments can be taxing, especially for individuals possessing few resources (O’Brien 2012; Pilkauskas et al. 2017). Additionally, there are psychological and social costs associated with support obtained from kin or friends. Individuals who struggle or fail to make fair reciprocal contributions may acquire the reputation of being unattractive exchange partners and risk being excluded from support networks, leading to both the loss of a critical source of assistance and to increased social isolation (Menjívar 2000; Offer 2012). Because compensation expectations are usually not clearly stated, receivers of help may also fear becoming caught up in excessive demands from kin or friends as a result of depending on them for support (Desmond 2012; Mazelis 2016). Receiving financial assistance to meet pressing needs may also result in moral judgements from providers of support, at least in highly individualistic societies (although not necessarily in more collective societies), where economic independence and self-sufficiency are pervasive ideals. In those contexts, seeking financial assistance from relatives and friends clashes with these ideals and often carries a painful stigma (Hansen 2004; McIntyre et al. 2003; Schwartz 1967) that may diminish one’s sense of self-worth and social status (Domínguez and Watkins 2003; McIntyre et al. 2003; Nelson 2005).

Because of those costs of receiving financial assistance from close social ties, research finds that persons in need of economic help often ask for or accept it only reluctantly, with many even avoiding seeking assistance altogether, even in times of acute need. For example, Desmond (2012) found that individuals who had been evicted from their home would often forego asking kin for support due to a desire to avoid reproofs about irresponsible behavior. In line with the concept of alternative exchange partners of social exchange theories, we suggest that those disinclined to rely on kin support will look for substitute means of alleviating their financial needs, and we argue that credit in general, and a credit card in particular, may be viewed as one possible avenue. Indeed, credit cards are flexible instruments that can be used to generate liquidity or pay for virtually any product or service during hard times (Dwyer 2018). Drawing on credit surely has risks and costs of its own—high interest rates on unpaid balances can lead to substantial debt burdens and negatively impact credit scores. However, research finds that individuals may be unaware of those fees, in part because credit card contracts are (sometimes purposefully) difficult to interpret, leading to underestimates of the costs associated with credit card borrowing (Lusardi and Tufano 2015; Tach and Greene 2014).

Additionally, given that attitudes towards credit have become liberal and that credit card borrowing can be realized privately without opening up about this behavior (Calder 1999), individuals who borrow on their credit cards may not view this behavior as being at odds with their ideals of self-sufficiency as much as relying on financial support from close ties. Credit card borrowers neither have to endure the moral judgements of others nor do they run the risk of being excluded from their social networks should they fail to repay their debt, although they certainly expose themselves to the dangers of debt delinquency. Moreover, individuals may prefer the clearly defined repayment plan featured in a formal credit contract to the prospect of becoming ensnared in diffuse and unspecific reciprocity obligations that they believe are inequitable. As a result, individuals with a credit card may replace soliciting support from their kin and friends with a reliance on unsecured credit when they are disinclined to expose themselves to the disadvantages of kin-based financial assistance. To be more specific, we are not suggesting that borrowing on a credit card is somehow a preferable avenue for meeting pressing financial needs than relying on assistance from social ties. Rather, we suggest that in the current context of individualistic values, liberal attitudes towards credit, swelling credit supply, and asymmetries between borrowers and financial institutions leading to misconceptions regarding the costs of formal credit, some may come to view borrowing from a credit card as a lesser ill than asking for money from social ties when facing a difficult financial situation and opt for that alternative if it is available to them, in line with a social exchange perspective on alternative exchange partners and financial support in personal networks.

This argument leads us to expect having a credit card will be associated with decreased odds of receiving financial assistance from family and friends and our empirical analyses explore that relationship. Because several socio-demographic factors may be related to both the receipt of financial support and the likelihood of having a credit card, our analyses adjust for those potential confounders. Those variables include income and marital status. Indeed, research shows that higher income and married individuals tend to enjoy better access to credit than their poorer and single counterparts (Gutiérrez-Nieto et al. 2017). Those groups are at the same time less likely to receive financial support from relatives or friends (Gerstel and Sarkisian 2006). Similarly, age, education level, and race/ethnicity may drive both the odds of having a credit card and of receiving financial support and we take those factors into consideration in this study (Sarkisian and Gerstel 2004; Swartz 2009; Wherry et al. 2019b).

Additionally, previous research on social support networks leads us to expect the effects of having a credit card will vary across different social and demographic groups because the relative appeal or disinclination for accumulating debt through social ties or through formal credit institutions is likely conditional on social position. In particular, we expect relationship status and available household financial resources to moderate those relative disinclinations and therefore the link between having a credit card and receipt of financial help. We briefly consider each of these characteristics in turn.

Differences by Relationship Status

Spouses typically engage in constant, ongoing exchanges with each other and in the sharing and pooling of their resources (Eickmeyer et al. 2019; Heimdal and Houseknecht 2003; Himmelweit et al. 2013; Pahl 1989). However, while marriage is associated with a notable commitment to an exchange relationship between spouses, marriage is also associated with a retreat from other exchange relationships. Married people are less likely to call or visit relatives, less likely to give emotional support or advice to relatives, and less likely to provide relatives with practical and financial support (Gerstel and Sarkisian 2006; Sarkisian and Gerstel 2008). This withdrawal from exchange relationships also extends beyond relatives. Compared to those who are married, the unmarried are more likely to exchange social support with non-family ties (Liebler and Sandefur 2002; Sarkisian and Gerstel 2016). This has led family scholars to describe marriage as a “greedy institution” where resources remain within the marriage (Coser 1974; Gerstel and Sarkisian 2006). Because they participate less intensively in support networks than the unmarried, married couples may face barriers in obtaining support in times of financial need: their relatives and friends may be more hesitant to provide help or have greater compensation expectations.

In addition to inducing a retreat from broader family relationships, marriage has symbolic significance that shapes how people view their social position. In particular, for many, marriage is representative of economic independence and self-sufficiency (Edin 2000; Edin and Kefalas 2005; Edin and Reed 2005; Smock, Manning, and Porter 2005). For example, Smock, Manning, and Porter (2005) found that many individuals in cohabiting relationships expressed a belief that financial stability should precede marriage. Thus, the conflict that asking help from social ties raises with respect to ideals of financial independence may be especially difficult to manage for married couples. These insights lead us to expect that married individuals are particularly hesitant to solicit their relatives and friends for financial assistance when facing difficult times and more likely to view credit card borrowing as a less troublesome alternative. Therefore, we expect that decreases in the likelihood of borrowing money from social ties associated with having a credit card will be particularly pronounced among those who are married.

Differences by Household Income

Financial instability and material hardships are common even among middle-income and affluent households (Iceland and Bauman 2007; Mayer and Jencks 1989; Neckerman et al. 2016; Sullivan et al. 2008). Yet, few studies have examined how higher income households respond to financial hardships. Instead, research on informal exchanges of support during periods of hardship have largely focused on low-income households, while studies of private financial transfers among higher income households have tended to focus on inter-vivos transfers from parents to their children, highlighting how financial gifts for items like home purchases or higher-education financing facilitate upward advancement (Keister 2000; Killewald et al. 2017; Lareau and Weininger 2008; Quadlin 2017).

While few studies have examined how middle- and higher-income households respond to financial hardships, Katherine Newman’s (1988) influential study of downward mobility is informative. Newman found that middle-class individuals who experience downward mobility were particularly embarrassed by their financial troubles and especially hesitant to discuss their financial troubles with social ties. In a similar vein of research, Lindsay Owens (2015) studied homeowners seeking a mortgage modification because of the risk of foreclosure and found that working-class homeowners openly discussed their financial difficulties with neighbors, friends, and co-workers, while middle class-homeowners seldom discussed their financial troubles with social network ties because of deep embarrassment and were reluctant to seek help from social ties. Both Newman and Owens found that middle-income individuals facing financial troubles often attributed their situation to personal shortcomings, which made them particularly ashamed and reticent to seek help from social ties. While both studies focus on middle-income households, these same mechanisms likely apply for higher income households. These results lead us to posit middle-income and affluent households may be particularly unwilling to seek assistance from social network ties and particularly likely to consider credit an attractive substitute.

Moreover, while the unsecured credit market has expanded dramatically over the last several decades, there are still cleavages in access to credit instruments and in the quality of instruments available across income strata. As research on financial exclusion and the poverty penalty highlights, middle-income and affluent households have access to better credit options compared to lower-income households, who are more likely to be denied credit or charged higher interest rates (Buckland 2012; Gutiérrez-Nieto et al. 2017; Han et al. 2018; Wherry et al. 2019b). Because of higher interest rates and since low-income families have limited economic resources, relying on credit may be less easily available and not as attractive as an alternative to financial assistance from social ties for those families compared to higher income families. In fact, research shows that when faced with an unexpected spell of unemployment, low-income households do not rely on credit during income shortfalls, while middle-income and affluent households are more likely to do so (Sullivan 2008). Given these differences, we expect the association between having a credit card and the receipt of financial assistance from family and friends to be conditional on household income.

Methods

Data and Measures

We used data from the Fragile Families and Child Wellbeing Study (FFCWS). FFCWS is a longitudinal study of nearly 5,000 urban births that were originally sampled between 1998 and 2000 with an oversample of non-marital births. Mothers were sampled at the time of the birth of the focal child in 20 US cities with populations greater than 200,000. Follow-up interviews were conducted when the focal child was 1, 3, 5, 9, and 15 years old. At the baseline interview, respondents completed a 30- to 40- minute in-person interview. The interviews took place in the hospital shortly after the birth of the focal child. In the follow-up waves, respondents completed surveys by telephone (for a complete description of the sample and study design, see Reichman et al 2001).

We draw data from the mother surveys.Footnote 1 Of the 4,898 mothers who completed the baseline survey, 89%, 86%, 85%, 74%, and 73% participated in the 1, 3, 5, 9, and 15 year surveys, respectively. The sample overrepresents minority and economically disadvantaged mothers. In addition to collecting data on parenting, romantic relationships, and child wellbeing, FFCWS also captured data on household finances. Importantly, FFCWS collected data on both credit card ownership and the receipt of financial assistance from close social ties. Additionally, while this data does not represent the entire US population, but rather only mothers of children and adolescents, this group is especially likely to need and receive financial assistance from family of friends (Harknett and Hartnett 2011).

Items related to the receipt of financial assistance from kin were not included in the initial survey. Therefore, we limited the sample to the 1, 3, 5, 9, and 15-year follow-up surveys. Additionally, we restricted the sample to be complete on all covariates. The final analytic sample consisted of 3,099 mothers and 14,074 person-waves. Compared to the full sample, mothers in the analytic sample were less likely to be married, less likely to be born in the United States, and less likely to own a home at the year 1 survey. Mothers in the full sample also had a lower average household income and lower levels of education. However, there were no differences in the likelihood of having recently borrowed money from social ties and minimal differences in the likelihood of having a credit card (45% for those in the analytic sample and 40% for those in the full sample). Overall, the full sample is more economically disadvantaged than the analytic sample. We discuss how this may influence our findings in the discussion.

Financial Assistance from Family and Friends

Our dependent variable is a measure of the receipt of financial assistance from family and friends and is based on the following question: “In the past twelve months, did you borrow money from friends or family to help pay bills?” Mothers who reported borrowing money from friends or family were coded as having received financial assistance (1 = received financial assistance; 0 = did not receive financial assistance). Descriptive statistics are presented in Table 1. Across all waves, a little over 25% of the sample received financial assistance from family or friends. Additionally, nearly 60% of mothers reported receiving financial assistance from family or friends at least once (not shown in table).

Having a Credit Card and Control Variables

The focal independent variable is a time-varying measure of whether the household had a credit card. This was measured with the question, “Do you [or your husband or partner] have a credit card?” (1 = “yes”; 0 = “no”). As shown in Table 1, across all waves, 44% of our sample had a credit card. A little over 70% of the sample had a credit card for at least one wave.

The analyses included control variables for household income (in 10,000 s), relationship status, perceived availability of in-kind and small financial support, perceived availability of large financial support, number of children under the age of 18 in the home, education (less than high school, high school, some college, college), race/ethnicity (non-Hispanic White, non-Hispanic Black, Hispanic of any race, other race/ethnicity), age, a dummy variable for whether the respondent lived with both parents at age 16, a dummy variable for whether the respondent was born in the US, a dummy variable for whether the respondent owned her home, and dummy variables for time period. Relationship status was measured as single, cohabiting with a partner, or married, with married mothers serving as the reference group. Following Turney and Harknett (2010), we created two separate measures of perceived social support from family and friends. First, we included a measure of perceived in-kind and small financial support, which is an index variable (Cronbach’s Alpha: 0.72) based on the sum of three dichotomous items: the mother had someone who could loan her $200, could provide emergency childcare, or could provide a place to live. Second, we included a measure of perceived access to large financial support, which is an index variable (Cronbach’s Alpha: 0.82) based on the sum of: the mother had someone who could loan her $1,000, would cosign a bank loan for $1,000, or would cosign a bank loan for $5,000.

Hypotheses

Following research on social exchange theory and social support networks, we set three hypotheses:

(1) Having a credit card will be associated with a decreased likelihood of receiving financial assistance from family and friends.

(2) The association between having a credit card and the receipt of financial assistance will be conditional on relationship status, with decreases in the likelihood of borrowing money from social ties particularly pronounced among those who are married.

(3) The association between having a credit card and the receipt of financial assistance will be conditional on household income.

Analyses

To test our first hypothesis, we used pooled, person-wave data and estimated logistic random effects models. Mothers contributed one observation for each wave of data where they had valid responses. The random effects models measure both variation across mothers and over time within mothers. The random effects adjust for the non-independence of observations due to mothers contributing multiple observations. We included all control variables in these models.

Next, to test our second and third hypotheses—whether the association between having a credit card and receipt of financial assistance is conditional on social position and relationships—we estimated logistic random effects models that included interaction terms between having a credit card and relationship status and between having a credit card and household income. To ease interpretation of these findings, we present predicted probabilities of the key findings.Footnote 2

We then estimated a series of supplemental analyses to further support our main findings. First, to address potential endogeneity in time-invariant unobserved characteristics that influence both access to credit and financial exchanges, we estimated fixed effects models. By focusing on within-person variation, the fixed effects models remove biases introduced by time-constant omitted variables. If, for example, the likelihood of having a credit card and the likelihood of borrowing money are both influenced by an unobserved characteristic like, for example, thriftiness, then the random effects models would produce biased estimates. However, if we assume thriftiness is a time-constant characteristic, then the effect of thriftiness would be differenced out of the equation and the fixed effects model would produce unbiased estimates without the need to observe or measure thriftiness. While fixed effects remove potential biases introduced by time-constant omitted variables, fixed effects models are sensitive to unobserved time-variant characteristics. We estimated both linear and conditional fixed effects models. With conditional fixed effects, individuals who have constant values over time on the dependent variable do not contribute to model estimation, and thus these observations are dropped from the model (Chamberlain 1980; Hsiao 2014). We find qualitatively similar results with both linear and conditional fixed effects.

Second, we limited the sample to mothers who reported experiencing a material hardship in the past year and estimated our main random effects models. Mothers were coded as having experienced a material hardship if they reported experiencing food hardship, housing hardship, difficulty paying bills, utility cut off, or medical hardship. If we assume that respondents who have a credit card are in a better financial position than respondents who do not have a credit card, then a possible alternative explanation to our findings is that households with a credit card are less likely to borrow money because of their superior financial position, not that they rely on credit instead of social ties. By limiting the sample to those who have recently experienced a material hardship, these analyses reduce the likelihood that the findings merely reflect differences in economic position between those who have a credit card and those who do not. In these analyses, all households recently experienced hardship, suggesting they all had a need to borrow money.

Last, at each wave, respondents were asked about borrowing money in the past year and current possession of a credit card. As a result, the temporal ordering is not definitive. A potential issue is that people may borrow money from kin and then get a credit card to help repay kin or to avoid having to again borrow money from kin. If this is the case, we would observe a positive relationship between having a credit card and borrowing money. To further address this issue, we limited the sample to the year 1, year 3, and year 5 surveys—the stretch of surveys with only a 2-year gap between waves—and estimated our main models with a lagged measure of having a credit card. In short, by using a measure of having a credit card at time t-1 and a measure of borrowing money at time t, these analyses help address potential issues related to temporal ordering.

Findings

Table 2 reports estimates from logistic random effects models. The first column shows that net of control variables having a credit card was associated with a decreased likelihood of borrowing money from kin (b = -0.283; p < 0.001). Estimates of the predicted probability of borrowing money from kin show that having a credit card was associated with a 15% decrease in the probability of borrowing money. Consistent with our first hypothesis, we found that having a credit card had a modest negative impact on the likelihood of receiving financial assistance from family and friends.

Other covariates in the first model were generally in line with expectations. We found those who were cohabiting and single were both more likely to borrow money than those who were married. We also found that income, education, age, and home ownership were negatively associated with the likelihood of borrowing money.

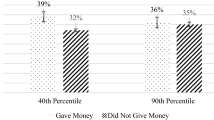

The second column of Table 2 reports estimates from a logistic random effects model that includes an interaction term between having a credit card and relationship status. To better illustrate these results, we have presented the central estimates as predicted probabilities in Fig. 1. Consistent with our second hypothesis, we found that relationship status and having a credit card interact in important ways. Most strikingly, for those who were single and cohabiting, having a credit card is unimportant—those who had a credit card were as likely to borrow money from social ties as those who did not have a credit card. However, for those who were married, having a credit card was associated with a significant decrease in the odds of borrowing money from kin—married mothers who had a credit card were one-third as likely to borrow money as compared to their married counterparts who did not have a credit card.

Predicted probabilities of the association between having a credit card and receiving financial assistance from kin, by relationship status. Predicted probabilities were estimated using coefficients from Table 2. To calculate the predicted probabilities, each respondent retained their own values for all covariates except credit card and relationship status. The probability of borrowing money was then calculated for each respondent at each category of credit card and relationship status. The simulated probabilities were then averaged across respondents

The third column of Table 3 presents estimates from a model that includes an interaction term between having a credit card and household income. Estimates in terms of predicted probabilities are presented in Fig. 2. The findings show that at low incomes, having a credit card was not associated with the likelihood of borrowing money from family and friends. At middle and higher incomes, however, those with a credit card were less likely to borrow money from social ties. Our results are in line with our third hypothesis, showing that having a credit card was associated with reduced odds of borrowing from kin more strongly in higher-income groups.

Predicted probabilities of the association between having a credit card and receiving financial assistance from kin, by household income. Predicted probabilities were estimated using coefficients from Table 2. To calculate the predicted probabilities, each respondent retained their own values for all covariates except credit card status and income. The probability of borrowing money was then calculated for each respondent at each category of credit card status and income level. The simulated probabilities were then averaged across respondents

In our first set of supplemental analyses, we estimated our main results using within-person fixed effects models (Table 3). The first column of Table 3 reports estimates from linear fixed effects and the second column reports estimates from conditional fixed effects. Overall, we found substantively similar patterns: having a credit card was associated with a decreased likelihood of borrowing money from family and friends. The observed effects were smaller than in the random effects models, however, reflecting that some of the random effect results could be attributable to time-stable unobserved characteristics.

Next, we limited the sample to those who recently experienced a material hardship and estimated our main logistic random effects models (Table 4). The first column shows that having a credit card was negatively associated with the likelihood of borrowing money from social ties even among those who recently experienced a hardship (b = − 0.293; p < 0.001). The second and third column show that, consistent with our main results, the relationship between having a credit card and borrowing from kin was conditional on relationship status and household income.

Finally, we limited the sample to the 1, 3, and 5 year surveys and estimated our main logistic random effects regression models with a lagged measure of having a credit card (Table 5). Consistent with our main findings, the first column shows that the lagged measure of having a credit card is negatively associated with the likelihood of borrowing money. Moreover, the second column shows that the lagged measure of having a credit card is strongly associated with a decreased likelihood of borrowing money for those who are married and also for those who are cohabiting, but not for those who are single. The third column shows that the lagged measure of having a credit card is more strongly associated with a decreased likelihood of borrowing money for those with higher incomes.

Discussion

Starting in the 1980s with the deregulation of the credit industry, credit markets, including the credit card market, have dramatically expanded. Despite the growing importance of credit and debt in the economic experience of contemporary individuals and households, sociologists and family scholars have paid too little attention to how the widespread use of formal credit instruments may influence exchange relationships and exchanges of support among kin. This study helps address this gap in research by exploring how having a credit card is associated with financial exchanges among friends and family. Using data from the Fragile Families and Child Wellbeing Study, we found that having a credit card was associated with a decreased likelihood of borrowing money from kin and friends. Furthermore, this effect was moderated by marital status and income. In particular, we found that having a credit card reduced the likelihood of borrowing money from social ties among individuals who were married, but not among those who were cohabiting or were single. Our findings also show that having a credit card reduced reliance on financial support from kin networks at middle- and high-incomes, but not at lower-incomes.

Our analyses carry some limitations. First, our findings are descriptive. Having a credit card is endogenous and correlated with financial wellbeing. We attempt to address this through the use of extensive controls (e.g. household income, home ownership, education, perceived access to social support), through alternative model specification (i.e. fixed effects models that account for unobserved-time constant characteristics), and a supplemental analysis that is limited to those who are less likely to be financially stable (i.e. those who have recently experienced a material hardship like utility disconnection or food insecurity). Nonetheless, our findings should be interpreted as descriptive. Future research that establishes causal associations—perhaps by exploiting overtime changes in policy and the expansion of credit markets—is needed.

Second, our measure of financial assistance from social ties focuses on receiving assistance to help pay bills. This is not an exhaustive measure of all the situations when people receive financial assistance or other forms of material assistance from social ties. Third, while the data used in this research offer longitudinal data on financial assistance from social ties and having a credit card, the sampling frame was drawn from an urban population of mothers. The extent to which our findings generalize to rural and suburban areas is unclear. Additionally, while mothers are especially likely to need and receive financial assistance from family and friends, others engage in exchanges of financial support with close social ties. Our data do not allow us to explore how credit cards shape receipts of financial support in those populations. Fourth, as with all longitudinal data, respondents were lost over time. Those lost to attrition were more likely to be economically disadvantaged. Given the results that show no differences in likelihood of borrowing money at lower incomes, this suggests that the estimates from our main models may underestimate the association between having a credit card and receiving financial assistance from social ties, although this is not testable. Finally, we explore potential moderating effects of household income and relationship status on the association between having a credit card and receiving financial assistance from social ties. Given that relationship status and income predict the likelihood of having a credit card, it is possible that having a credit card may also serve as an intervening variable. Research that explores this pathway, possibly through a moderated mediation model, is needed.

Despite these limitations, our results have implications for scholarship on credit and kin networks. In particular, our findings help extend social exchange theories and affirm its relevance as a framework for understanding the provision of financial support among kin and friends. While much scholarship highlights the benefits of receiving support from relatives during times of hardship, social exchange theories posit that there are costs to this assistance, including stigmatization and diffuse reciprocity obligations that may exceed the benefits of assistance. When considering those costs, social exchange theories argue that individuals will evaluate their alternatives and may opt for other sources of relief. In line with those ideas, Desmond (2012) found that poor tenants who had recently been evicted from their homes often relied on “disposable ties”—new acquaintances with whom they temporarily shared housing and other expenses—instead of seeking help from close social ties. We provide further evidence of this type of alternative-seeking behavior by showing that reliance on credit cards may constitute a potential substitute for financial kin support (especially as attitudes towards credit have liberalized) and offering evidence consistent with the idea that those credit instruments may sometimes replace dependence on personal networks for financial assistance.

Another key insight of social exchange theories is that transactions are shaped by the social contexts in which they are embedded. Our study speaks to this idea by suggesting that class and marital status influence alternative-seeking logics, as they shape both available substitute possibilities and their appeal relative to kin support. More specifically, our results show that having a credit card is associated with a reduced likelihood of receiving financial support only among higher-income and married mothers, not also in lower-income and unmarried ones. Those patterns are consistent with the notion that marriage is often viewed as representative of economic independence and leads to a retreat from other social relationships when possible (Coser 1974; Edin 2000; Edin and Reed 2005; Gerstel and Sarkisian 2006; Smock et al. 2005). Those patterns also align with the idea that middle-income and affluent households are particularly hesitant to seek help from social ties (Newman 1988; Owens 2015), while low-income households may face higher credit costs and more difficult access to it (Buckland 2012; Gutiérrez-Nieto et al. 2017; Han et al. 2018; Wherry et al. 2019b). Through these processes, class and marital status may shape whether or not credit cards are available as a substitute for asking close ties for support and the relative cost–benefit ratios of those two coping strategies.

Another key contribution of our study is to extend research on associations between credit markets and the public safety net. Specifically, multiple studies have argued that households accumulate increasing amounts of debt through a growing variety of credit instruments as a strategy to cope in the face of shrinking public services. At the same time, widespread availability of credit has limited demands for increased public services (Ansell 2012; Krippner 2012; Prasad 2012; Soederberg 2014). Our results add to this line of work as they stress that the credit market, in particular the credit card market, can substitute for informal sources of support coming from relatives and friends. This insight, however, raises important questions regarding the conditions under which individuals decide to trade informal social support for credit card borrowing. Indeed, while borrowing through formal credit instruments may not carry the same social and psychological costs as receiving informal support from social ties, it can have steep monetary implications and result in a severe worsening of one’s financial situation, especially in the case of credit card borrowing, due to the high interest rates charged on unpaid balances (Dwyer 2018). Research on predatory lending, however, suggests that prospective borrowers may not always foresee the potentially significant consequences of credit card borrowing. For instance, high interest-rates are often deliberately concealed through small-print contracting and other strategies by financial institutions looking for ways to increase profits (Williams 2004). As a result, borrowers may accumulate debt without fully grasping the economic implications and eventually become caught in devastating cycles of debt delinquency and potentially bankruptcy (Morduch and Schneider 2017). Given those potential consequences, more research is needed on whether individuals who trade informal financial support for credit card borrowing are aware and prepared to face the added economic costs. Additionally, research should explore the long-term consequences associated with opting for credit card debt versus informal financial support.

Our findings also have implications for understanding the financial needs of families. Many families face income deficits and need access to small loans. Credit cards have the potential to serve that role and are likely better than alternatives like payday loans or car title loans. Yet, credit cards can still be costly to consumers and the terms are often poorly understood by borrowers (Littwin 2007; Tach and Greene 2014). Regulations that make credit cards safer for borrowers are important (Bar-Gill and Warren 2008; Littwin 2007), but a stronger public safety net that meets needs is vital. Short of that, greater availability of small-dollar lending programs through banks and credit unions which offer lower interest rates, annual percentage rate caps, installment payment plans, and financial counseling would offer a valuable alternative to credit card borrowing (see Bair 2005).

Last, family research has long stressed that economic conditions shape exchanges of material assistance among kin (Edin and Lein 1997; Newman 2020; Stack 1974). Because individuals turn to family and friends as a function of their needs and can only help to the extent of their resources, broader economic conditions—for example the strength of the public safety net and the health of the labor market—shape kin support (Esping-Andersen 1990). Our findings further this line of inquiry by suggesting that access to credit is an additional dimension of the broader economic context in which kin-based networks of financial assistance operate. Scholars interested in the dynamics of mutual support in kin networks should consider extensive measures of economic contexts that incorporate measures of access to credit and levels of debt.

Notes

Primary caregivers were interviewed for the 15-year follow-up survey. We exclude the 12% of cases where the primary caregiver was someone other than the mother.

We also conducted stratification analyses to test whether it is appropriate to treat marital status and household income (binned into quartiles) as moderators or if they should instead be viewed solely as confounders. Tarone tests indicate that relationship status and household income may be effect moderators of the association between having a credit card and borrowing money in addition to being potential confounders of this relationship. Thus, our multivariable regression analyses that treat income and marital status as potential moderators through interaction terms are warranted. In addition, because income and marital status can be potential confounders even as they moderate the effect of credit cards on support received, our interaction analysis includes main effects for income and marital status to adjust for the possible confounding effects of those variables.

References

Ansell, B. (2012). Assets in crisis: Housing, preferences and policy in the credit crisis. Swiss Political Science Review, 18(4), 531–537.

Bair, S. (2005). Low-cost payday loans: Opportunities and obstacles. Baltimore, MD: Annie E. Casey Foundation.

Bar-Gill, O., & Warren, E. (2008). Making credit safer. University of Pennsylvania Law Review, 157(1), 1–102.

Bearman, P. (1997). Generalized exchange. American Journal of Sociology, 102(5), 1383–1415. https://doi.org/10.1086/231087.

Becker, G. S. (1981). Altruism in the family and selfishness in the market place. Economica, 48(189), 1–15. https://doi.org/10.2307/2552939.

Bernheim, B. D., Shleifer, A., & Summers, L. H. (1985). The strategic bequest motive. Journal of Political Economy, 93(6), 1045–1076.

Bianchi, S. M., Hotz, V. J., McGarry, K., & Seltzer, J. A. (2008). Intergenerational ties: Theories, trends, and challenges intergenerational caregiving. In A. Booth, A. C. Crouter, S. M. Bianchi, & J. A. Seltzer (Eds.), intergenerational caregiving (pp. 3–43). Washington: The Urban Insitute Press.

Bird, E. J., Hagstrom, P. A., & Wild, R. (1999). Credit card debts of the poor: High and rising. Journal of Policy Analysis and Management: The Journal of the Association for Public Policy Analysis and Management, 18(1), 125–133.

Blau, P. M. (1964). Exchange and power in social life. New Jersey: Transaction Publishers.

Buckland, J. (2012). Hard choices: Financial exclusion, fringe banks and poverty in urban canada. Toronto: University of Toronto Press.

Calder, L. (1999). Financing the American dream. New Jersey: Princeton University Press.

Campbell, C., & Pearlman, J. (2019). Access to social network support and material hardship. Social Currents, 6(3), 284–304. https://doi.org/10.1177/2329496518820630.

Chamberlain, G. (1980). Analysis of covariance with qualitative data. The Review of Economic Studies, 47(1), 225–238.

Cook, K. S., Cheshire, C., Rice, E. R. W., & Nakagawa, S. (2013). Social exchange theory. In J. DeLamater & A. Ward (Eds.), Handbook of social psychology (pp. 61–88). Heidelberg: Springer.

Cook, K. S., & Emerson, R. M. (1978). Power, equity and commitment in exchange networks. American Sociological Review, 43(5), 721–739. https://doi.org/10.2307/2094546.

Coser, L. A. (1974). Greedy institutions; patterns of undivided commitment. New York: Free Press.

Cox, D. (1987). Motives for private income transfers. Journal of Political Economy, 95(3), 508–546. https://doi.org/10.1086/261470.

Desmond, M. (2012). Disposable ties and the urban poor. American Journal of Sociology, 117(5), 1295–1335. https://doi.org/10.1086/663574.

Dominguez, S., & Watkins, C. (2003). Creating networks for survival and mobility: Social capital among African-American and Latin-American low-income mothers. Social Problems. https://doi.org/10.1525/sp.2003.50.1.111.

Dwyer, R. E. (2018). Credit, debt, and inequality. Annual Review of Sociology, 44, 237–261. https://doi.org/10.1146/annurev-soc-060116-053420.

Edin, K. (2000). What do low-income single mothers say about marriage? Social Problems. https://doi.org/10.2307/3097154.

Edin, K., & Lein, L. (1997). Making ends meet: How single mothers survive welfare and low-wage work. New York: Russell Sage Foundation.

Edin, K., & Reed, J. M. (2005). Why don’t they just get married? Barriers to marriage among the disadvantaged. The Future of Children, 15(2), 117–137.

Eickmeyer, K. J., Manning, W. D., & Brown, S. L. (2019). What’s mine is ours? Income pooling in American families. Journal of Marriage and Family, 81(4), 968–978. https://doi.org/10.1111/jomf.12565.

Emerson, R. M. (1962). Power-dependence relations. American Sociological Review, 27, 31–41.

Esping-Andersen, G. (1990). The three worlds of welfare capitalism. New Jersey: Wiley.

Federal Reserve Bank of New York. (2018). Household debt and credit report Q1 2018. Federal Reserve Bank of New York.

Finch, J. (1991). Family obligations and social change. Cambridge: Polity.

Gerstel, N., & Sarkisian, N. (2006). Marriage: The good, the bad, and the greedy. Contexts, 5(4), 16–21.

Guseva, A., & Rona-Tas, A. (2001). Uncertainty, risk, and trust: Russian and American credit card markets compared. American Sociological Review, 66(5), 623–646. https://doi.org/10.2307/3088951.

Gutiérrez-Nieto, B., Serrano-Cinca, C., Cuéllar-Fernández, B., & Fuertes-Callén, Y. (2017). The poverty penalty and microcredit. Social Indicators Research, 133(2), 455–475. https://doi.org/10.1007/s11205-016-1368-4.

Han, S., Keys, B. J., & Li, G. (2018). Unsecured credit supply, credit cycles, and regulation. The Review of Financial Studies, 31(3), 1184–1217. https://doi.org/10.1093/rfs/hhx114.

Hansen, K. V. (2004). Not-so-nuclear families: Class, gender, and networks of care. New Jwesey: Rutgers University Press.

Harknett, K. (2006). The relationship between private safety nets and economic outcomes among single mothers. Journal of Marriage and Family, 68(1), 172–191. https://doi.org/10.1111/j.1741-3737.2006.00250.x.

Harknett, K. S., & Hartnett, C. S. (2011). Who lacks support and why? An examination of mothers’ personal safety nets. Journal of Marriage and Family, 73(4), 861–875. https://doi.org/10.1111/j.1741-3737.2011.00852.x.

Heimdal, K. R., & Houseknecht, S. K. (2003). Cohabiting and married couples’ income organization: Approaches in Sweden and the United States. Journal of Marriage and Family, 65(3), 525–538. https://doi.org/10.1111/j.1741-3737.2003.00525.x.

Himmelweit, S., Santos, C., Sevilla, A., & Sofer, C. (2013). Sharing of resources within the family and the economics of household decision making. Journal of Marriage and Family, 75(3), 625–639. https://doi.org/10.1111/jomf.12032.

Hombrados-Mendieta, I., García-Martín, M. A., & Gómez-Jacinto, L. (2012). The relationship between social support, loneliness, and subjective well-being in a Spanish sample from a multidimensional perspective. Social Indicators Research, 114(3), 1013–1034. https://doi.org/10.1007/s11205-012-0187-5.

Hsiao, C. (2014). Analysis of panel data. Cambridge: Cambridge University Press.

Iceland, J., & Bauman, K. J. (2007). Income poverty and material hardship: How strong is the association? The Journal of Socio-Economics, 36(3), 376–396. https://doi.org/10.1016/j.socec.2006.12.003.

Keister, L. A. (2000). Wealth in America: Trends in wealth inequality. Cambridge: Cambridge University Press.

Killewald, A., Pfeffer, F. T., & Schachner, J. N. (2017). Wealth inequality and accumulation. Annual Review of Sociology, 43, 379–404. https://doi.org/10.1146/annurev-soc-060116-053331.

Krippner, G. R. (2012). Capitalizing on crisis: The political origins of the rise of finance. Cambridge, Mass: Harvard University Press.

Lareau, A., & Weininger, E. B. (2008). Class and the transition to adulthood. In A. Lareau & D. Conley (Eds.), Social class how does it work? New York: Russell Sage Foundation.

Lawler, E. J., & Yoon, J. (1996). Commitment in exchange relations: Test of a theory of relational cohesion. American Sociological Review, 61(1), 89–108. https://doi.org/10.2307/2096408.

Liebler, C. A., & Sandefur, G. D. (2002). Gender differences in the exchange of social support with friends, neighbors, and co-workers at midlife. Social Science Research, 31(3), 364–391. https://doi.org/10.1016/S0049-089X(02)00006-6.

Littwin, A. (2007). Beyond usury: A study of credit-card use and preference among low-income consumers. Texas Law Review, 86(3), 451–506.

Lusardi, A., & Tufano, P. (2015). Debt literacy, financial experiences, and overindebtedness. Journal of Pension Economics & Finance, 14(4), 332–368. https://doi.org/10.3386/w14808.

Mayer, S. E., & Jencks, C. (1989). Poverty and the distribution of material hardship. The Journal of Human Resources, 24(1), 88–114. https://doi.org/10.2307/145934.

Mazelis, J. M. (2016). Surviving Poverty: Creating Sustainable Ties Among the Poor. Manhattan: NYU Press.

McIntyre, L., Officer, S., & Robinson, L. M. (2003). Feeling poor: The felt experience low-income lone mothers. Affilia, 18(3), 316–331. https://doi.org/10.1177/0886109903254581.

Meadows, S. O. (2009). Is it there when you need it? Mismatch in perception of future availability and subsequent receipt of instrumental social support. Journal of Family Issues, 30(8), 1070–1097. https://doi.org/10.1177/0192513X09333759.

Menjívar, C. (2000). Fragmented ties: Salvadoran immigrant networks in America. California: University of California Press.

Morduch, J., & Schneider, R. (2017). The financial diaries: How American families cope in a world of uncertainty. New Jersey: Princeton University Press.

Mutchler, J. E., & Baker, L. A. (2009). The implications of grandparent coresidence for economic hardship among children in mother-only families. Journal of Family Issues, 30(11), 1576–1597. https://doi.org/10.1177/0192513X09340527.

Neckerman, K. M., Garfinkel, I., Teitler, J. O., Waldfogel, J., & Wimer, C. (2016). Beyond income poverty: Measuring disadvantage in terms of material hardship and health. Academic Pediatrics, 16(3), S52–S59. https://doi.org/10.1016/j.acap.2016.01.015.

Nelson, M. (2005). The social economy of single motherhood: raising children in rural America. UK: Routledge.

Newman, K. S. (1988). Falling from grace: The experience of downward mobility in the American middle class. New York: Free Press.

Newman, K. S. (2020). Ties that bind/unwind: The social, economic, and organizational contexts of sharing networks. The ANNALS of the American Academy of Political and Social Science, 689(1), 192–201. https://doi.org/10.1177/0002716220923335.

Nichols, L., Elman, C., & Feltey, K. M. (2006). The economic resource receipt of new mothers. Journal of Family Issues, 27(9), 1305–1330. https://doi.org/10.1177/0192513X06287249.

O’Brien, R. L. (2012). Depleting capital? Race, wealth and informal financial assistance. Social Forces, 91(2), 375–396. https://doi.org/10.1093/sf/sos132.

Offer, S. (2012). The burden of reciprocity: Processes of exclusion and withdrawal from personal networks among low-income families. Current Sociology, 60(6), 788–805. https://doi.org/10.1177/0011392112454754.

Owens, L. A. (2015). Intrinsically advantageous? Reexamining the production of class advantage in the case of home mortgage modification. Social Forces, 93(3), 1185–1209. https://doi.org/10.1093/sf/sou087.

Pahl, J. (1989). Money and Marriage. New York: Palgrave Macmillan.

Pilkauskas, N. V., Campbell, C., & Wimer, C. (2017). giving unto others: Private financial transfers and hardship among families with children. Journal of Marriage and Family, 79(3), 705–722. https://doi.org/10.1111/jomf.12392.

Prasad, M. (2012). The land of too much: American abundance and the paradox of poverty. Cambridge, Mass: Harvard University Press.

Quadlin, N. (2017). Funding sources, family income, and fields of study in college. Social Forces, 96(1), 91–120. https://doi.org/10.1093/sf/sox042.

Reichman, N. E., Teitler, J. O., Garfinkel, I., & McLanahan, S. S. (2001). Fragile families: Sample and design. Children and Youth Services Review, 23(4–5), 303–326. https://doi.org/10.1016/S0190-7409(01)00142-6.

Sarkisian, N., & Gerstel, N. (2004). Kin support among blacks and whites: Race and family organization. American Sociological Review, 69(6), 812–837.

Sarkisian, N., & Gerstel, N. (2008). Till marriage do us part: Adult children’s relationships with their parents. Journal of Marriage and Family, 70(2), 360–376. https://doi.org/10.1111/j.1741-3737.2008.00487.x.

Sarkisian, N., & Gerstel, N. (2016). Does singlehood isolate or integrate? Examining the link between marital status and ties to kin, friends, and neighbors. Journal of Social and Personal Relationships, 33(3), 361–384. https://doi.org/10.1177/0265407515597564.

Schwartz, B. (1967). The social psychology of the gift. American Journal of Sociology, 73(1), 1–11. https://doi.org/10.1086/224432.

Sherman, J. (2006). Coping with rural poverty: economic survival and moral capital in rural America. Social Forces, 85(2), 891–913. https://doi.org/10.1353/sof.2007.0026.

Sherman, J. (2013). Surviving the great recession: Growing need and the stigmatized safety net. Social Problems. https://doi.org/10.1525/sp.2013.60.4.409.

Smock, P. J., Manning, W. D., & Porter, M. (2005). “Everything’s there except money”: How money shapes decisions to marry among cohabitors. Journal of Marriage and Family, 67(3), 680–696. https://doi.org/10.1111/j.1741-3737.2005.00162.x.

Soederberg, S. (2013). The US debtfare state and the credit card industry: Forging spaces of dispossession. Antipode, 45(2), 493–512. https://doi.org/10.1111/j.1467-8330.2012.01004.x.

Soederberg, S. (2014). Debtfare states and the poverty industry: Money, discipline and the surplus population. UK: Routledge.

Stack, C. B. (1974). All our kin: Strategies for survival in a Black community. New York: Harper & Row.

Sullivan, J. X. (2008). Borrowing during unemployment unsecured debt as a safety net. Journal of human resources, 43(2), 383–412. https://doi.org/10.3368/jhr.43.2.383.

Sullivan, J. X., Turner, L., & Danziger, S. (2008). The relationship between income and material hardship. Journal of Policy Analysis and Management: The Journal of the Association for Public Policy Analysis and Management, 27(1), 63–81. https://doi.org/10.1002/pam.20307.

Swartz, T. T. (2009). Intergenerational family relations in adulthood: patterns, variations, and implications in the contemporary United States. Annual Review of Sociology, 35, 191–212. https://doi.org/10.1146/annurev.soc.34.040507.134615.

Tach, L. M., & Greene, S. S. (2014). “Robbing Peter to pay Paul”: Economic and cultural explanations for how lower-income families manage debt. Social Problems. https://doi.org/10.1525/sp.2013.11262.

Uehara, E. (1990). Dual exchange theory, social networks, and informal social support. American Journal of Sociology, 96(3), 521–557. https://doi.org/10.1086/229571.

Wherry, F. F., Seefeldt, K. S., & Alvarez, A. S. (2019a). To lend or not to lend to friends and kin: Awkwardness, obfuscation, and negative reciprocity. Social Forces, Online First. https://doi.org/10.1093/sf/soy127.

Wherry, F. F., Seefeldt, K. S., Alvarez, A. S., & Quinonez, J. (2019b). Credit where it’s due: rethinking financial citizenship. New York: Russell Sage Foundation.

Whitehead, E. M. (2018). “Be my guest”: The link between concentrated poverty, race, and family-level support. Journal of Family Issues, 39(12), 3225–3247. https://doi.org/10.1177/0192513X18776449.

Williams, B. (2004). Debt for sale: A social history of the credit trap. Philadelphia: University of Pennsylvania Press.

Zelizer, V. (1997). The social meaning of money: Pin money, paychecks, poor relief, and other currencies. New Jersey: Princeton University Press.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest.

Research Involving Human Participants

The research presented in this manuscript does not constitute human subjects research as defined by federal regulation and does not include research-like activities that require institutional review board approval either by federal regulation or university policy. The data used in this study do not include identifying information that is available to the authors of this study.

Informed Consent

Informed consent was obtained from all participants included in the data used in this study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Campbell, C., Pugliese, M. Credit Cards and the Receipt of Financial Assistance from Friends and Family. J Fam Econ Iss 43, 153–168 (2022). https://doi.org/10.1007/s10834-021-09751-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-021-09751-x