Abstract

This study is the first to investigate the economic factors behind the recent rise of the one-child family in the United States. Using longitudinal data from the Panel Study of Income Dynamics (PSID) that runs from 1968 to 2013 and a variety of different model specifications with state and year fixed effect, including logistic regression, linear probability, and Cox proportional hazard models, the study examined the effect of absolute income volatility on the decision of having an only-child family. The study found that an increase in the standard deviation of income is associated with a decrease in the probability of having a second child for mothers who are in the second quartile of income distribution.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The fall in the fertility rate in the United States (1.87) below the replacement rate (2.1) projects a demographic risk and an increasing social security deficit.Footnote 1 The World Bank data show that the fertility rate (total birth per woman) in the United States fell sharply from 3.7 in the 1960s to 2.5 in the 1970s and steadily declined to 1.8 in 2015.Footnote 2 This decline in fertility in the last four decades in the United States is associated with an increase in the percentage of women with no children and women with one child by 50 and 80%, respectively.Footnote 3 According to the Pew Research Center, 18% of the women that are in the end of their childbearing years (between the ages of 40 to 44) have only one child; however, women usually desire more children than they actually have (Livingston 2014). According to the General Social Survey 2006–2008, 40% of US women nearing the end of their childbearing years have fewer children than what they had predicted (Livingston 2014), and that raises a question regarding why women decided to have fewer children than what they desired.

Fertility has increasingly become an individual decision since the development and the spread of knowledge of contraceptives in the last century. Becker et al. (1999) articulated in their model that parents pursue their goal of maximizing their family utility by simultaneously choosing their number of children and their investment in the human capital of each child, taking into consideration factors such as female labor force participation, real wage, and adult and child mortality. Previous research gives attention to the negative impact of economic insecurity on the individual decision of family size. Bernardi et al. (2008) outlined the insecurity hypothesis, which states that work-related economic uncertainty perceived by the individual stimulates postponement of long-term commitments, including parenthood. That was the case in East Germany (Conrad et al. 1996), Central and Eastern Europe (Ranjan 1999), Russia (Perelli-Harris 2006), and the 27 European countries (Hondroyiannis 2010). Most recently, the decrease in fertility due to the great recession was brought about not only by economic hardship, but also by economic uncertainty (Schneider 2015).

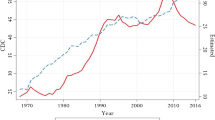

Despite the fact that the aggregate economy has been stabilizing in recent decades, income volatility has been rising on the level of households and firms. Rapid change in technology, the spread of globalization, the increase in the market behavior of creative destruction, the decline of unionization, a trend of cost cutting including pension reduction, and the increase of welfare reform have shifted economic risks from institutions, such as corporations and governments, to individuals. Outsourced jobs with payment for defined tasks have replaced full-time jobs which last until retirement and include health insurance and employer-supported pension. As a consequence, workers reported rising perceived job insecurity (Schmidt 1999), the standard deviation of transitory earnings almost doubled between the early 1970s and early 2000s (Gottschalk and Moffitt 2007), and individual labor earnings have become more volatile (Dynarski et al. 1997; Haider 2001).

I argue that fluctuations in family income generate uncertainties about present and future earnings and induce doubts about the future economic position. This creates economic insecurity, which will increase the likelihood to remain a one-child family as rational women will only choose to have children when they are able to support them in the current income situation and in the future.

Using longitudinal data from the Panel Study of Income Dynamics (PSID) that run from 1968 to 2013, this study extended the literature by empirically examining the proposition that fertility is a function of economic uncertainty generated by individual-level factors such as individual income volatility. It shed light on the economic factors behind the rise of only-child families and suggests the need for policies that reduce income volatility to stimulate fertility for families that tend to remain a one-child family. The study looked at actual fertility rather than desired fertility and utilized the shift from having one child to two children as an indicator of the change in fertility. The shift from one to two children gives insight on the decision to have more children as the marginal loss in utility is expected to be higher to forgo having the second child than the third or the fourth. Moreover, focusing on the shift from one to two children minimizes the unobservable characteristics that arise from including people who tend to have a higher number of children. Women who have one child and two children by the end of their child bearing period are of much interest regarding fertility as they comprise 18 and 35% of all women in the United States, respectively.

This study separated the impact of economic uncertainty represented by the absolute individual-income volatility from that of economic hardship represented by downward volatility. Absolute income volatility is calculated as the standard deviation of income, while downward volatility is calculated as the frequency of negative income change.

Background

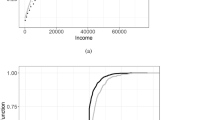

The relationship between income and family size has been subject to research since Becker (1960), contradictory to what he hypothesized, found a negative impact of income on fertility, a finding suggesting that children are “inferior goods” that have less demand if income increases. Becker (1960) highlighted what the data suggested of a decrease in the number of children with the increase in income. “It is tempting to conclude from this evidence either that tastes vary systematically with income, perhaps being related to relative income, or that the number of children is an inferior good” (p. 218).Footnote 4 The implication that children are inferior goods was strongly opposed by researchers. In an attempt to explain this perplexing income-fertility relationship, Becker (1960), Becker and Lewis (1973), and Willis (1974) suggested a trade-off between quality and quantity in the fertility decision. As income increases, parents tend to demand high-quality children, which in turn places pressure on quantity and reduces the number of children in the family. However, a positive income elasticity for the number of children would appear if child quality were to remain constant by being statistically controlled (Becker and Lewis 1973).

Borg (1989), working on a sample of 1355 married women aged 15–49 in a cross-sectional survey across Korea (Korean Institute for Population and Health 1977), found a significant positive effect of income on the total family size when the reduced form model includes controls that represent the quality of children desired by the family, such as the expected cost of education and the wife’s level of education and her labor force participation. Easterlin (1976) looked at the economic conditions relative to what the younger cohort experienced in their parents’ household. He suggested that fertility responds positively to how the couple’s level of affluence relates to their parents’.

Income is intricately associated with many factors that affect fertility; for example, education increases the tendency toward smaller families and the awareness of family planning methods. Previous research suggested that rich families use contraception at earlier ages and with more frequency than poor families (Becker 1960), yet it is ambiguous whether this is a result of lack of knowledge about contraceptives or a desire to have more children. Becker (1960) found a significant impact of contraceptive knowledge on the income-fertility relationship. As income increases, the knowledge about contraceptives increases which negatively affects the family size and allows the quality of children to rise. Nevertheless, Borg (1989) found a negligible impact for the supply side (birth control, miscarriage, and child death) relative to the impact of the net price of a child.

Economic uncertainty is increasing on the individual level despite the increasing stability in the aggregate US economy. The great reduction in the volatility of the GDP growth rate in recent decades caused some authors to label the period from the mid-1980s to 2006 as “the great moderation” (Stock and Watson 2002). However, Americans are increasingly worried about their economic outlook. Gosselin and Zimmerman (2008), using data from a survey conducted by the International Survey Research Corporation, documented that, despite the recession in 1982, only 12% of the respondents were worried about being laid off, while that number surged to 46% in 1998 at the top of the business cycle and 35% in 2005.

Skepticism about the outlook of the economy is associated with lower fertility. Van Giersbergen and de Beer (1997) estimated that a rise of 10 percentage points in the consumer confidence index is associated with a 1.5% increase in total birth with a time lag of 2.25 years. More recently, Fokkema et al. (2008) estimated that with a 2-year time lag, a rise of 10 percentage points in consumer confidence in the Netherlands is associated with an increase in the total fertility rate (TFR) of about 0.04 percentage points, of which half is attributable to first births and half to second births.

Demand for durable goods positively associates with higher economic certainty and positive economic outlook (Hymans et al. 1970); surprisingly, Becker (1960) found that the demand for children was positively correlated with the demand for durable goods. This validates the hypothesis that fertility negatively correlates with economic uncertainty, a hypothesis that is tested in this study using the volatility in the family income as an indicator for economic uncertainty.

Economic insecurity rises in times of recession where waves of unemployment and high levels of mortgage foreclosure are perceived by individuals. Previous research focused on estimating the social consequences of recessions; one of these consequences was the effect on fertility decisions. A review of previous research indicates mixed results regarding the impact of the recession on fertility. While Butz and Ward (1979a, b) suggested that fertility tends to be counter-cyclical in a prosperous economy as lower unemployment of women increases the opportunity cost of raising a child, other research indicated that fertility in the US remains pro-cyclical as the lower price of women’s time fails to overtake the negative effects of unemployment on fertility (Macunovich 1996). Recession inflated the cost of having a child due to increased economic hardship and uncertainty (Morgan et al. 2011). Most recently, the great recession in the US has had a substantial negative impact on fertility measured on the national level and to a lesser extent on the area level. On the national level, the general fertility rate (GFR) declined with the onset of the Great Recession (Livingston and Cohn 2010; Morgan et al. 2011); on the area level, Ananat et al. (2013) studying county-level mass layoffs and GFRs in North Carolina between 1990 and 2010, found a negative effect on African-American teen birth rates yet no evidence of an impact on the fertility of white teens or on women in their early 20s.

The case is no different in Europe as Goldstein et al. (2009) documented a decline in the fertility rates across European countries following a relative rise from 1998 to 2008. In Spain, where unemployment surged to 20%, consequently, the period total fertility rate (TFR) dropped from 1.46 to 1.40 between 2008 and 2009 (INE 2010). In a survey conducted by the Pew Research Center, 21% of respondents aged 25–34 claimed they postponed marriage and 15% reported that they postponed having a child because of the 2008 recession (Wang and Morin 2009).

Most importantly, individuals perceive a sense of insecurity that comes from worsening economic conditions even though they are not directly affected. Kravdal (2002), using simulations, found a reduction of 0.08 in the total fertility rate in response to rising unemployment during the recession of 1993 in Norway. Most significantly, the reduction in fertility was dominated by the aggregate effect rather than by individual experiences of unemployment. A comparable result is found by Hoem (2000) studying fertility rates during the recession of the early 1990s. He found that the decline in the first-birth rate is more likely to be explained by variation in local employment levels, even when controlling for individual income and employment status.

This study extended the literature by estimating the impact of individual economic uncertainty on the decision of having children using individual-level factors, such as individual income volatility, rather than aggregate-level factors. The study also disentangled economic hardships and economic uncertainty by studying the impact of downward volatility in addition to the absolute volatility on the decision of having children. An increase in the income standard deviation is associated with a decrease in the probability of having the second child for mothers who are in the second quartile. These mothers are more likely to collect tax benefits when having the second child, which mitigates the loss in income. However, mothers in the lower and higher tail of income distribution are more likely to refrain from having their second child in response to negative income shocks if they already experience high absolute income changes. This is mostly attributed to a lower marginal tax benefit that the second child would bring for mothers in these income categories, as mothers in the lower tail already maximized their benefits while mothers in the higher tail are far from being eligible for such benefits.

Data and Methodology

Longitudinal data come from the Panel Study of Income Dynamics (PSID) that runs from 1968 to 2013. The first sample in 1968 consisted of roughly 5000 households, of which the core sample (3000) represents the US population as a whole, and the Census Bureau’s SEO sample (2000) represents the low-income families. The children of the original families and the families formed by those children have been followed. The survey was conducted on an annual basis until 1997 and biannually thereafter. PSID provides rich information including data on education, income, religion, infertility, and population weights.

The key dependent variable is a binary that indicates whether or not the woman has the second child; it equals 0 when the woman has her first child and 1 when she has her second child. This study used the shift from one to two children as an indicator of the decision to have more children. Excluding mothers who tend to have higher number of children minimizes the downwardly bias that may arise from allowing unobservable characteristics to affect the analyses as these mothers are more likely to experience high income volatility.

Women who have no children are excluded from the sample. Although the percentage of childless women has increased over the last 40 years, investigating the shift from childless to having one child requires investigating the factors that cause women to voluntarily remain childless. Voluntarily having no children has many other reasons beyond economics. Women who voluntarily choose to be childless in their early life may change their decision later in life, while those who decide to remain childless are more likely to they make their decision based on social and psychological reasons (Bram 1975; Houseknecht 1977). Investigating social and psychological reasons is beyond the scope of this paper. Moreover, studying the fertility decision of mothers that have one child and two children by the end of their child bearing period is of much interest as they comprise 18 and 35% of all women in the United States, respectively. Furthermore, it is expected to have a higher marginal loss in utility to forgo having the second child than the third or the fourth which gives insight on the decision of having more children. Restricting the sample to mothers who have one child or two children reduced the number of respondents in the data from 38,017 women to 22,187 mothers. Mothers who have one year between their first and second child have also been excluded from the sample to avoid having insufficient volatility to measure. Excluding those mothers from the sample reduced the sample by 1977 mothers, leaving the total sample at 20,210.

In order to minimize the endogeneity that comes from adolescent pregnancy and the difficulties of having another child in the late thirties for some women, only women who have had their first child between the ages of 21 to 35 were included in the final sample. This restriction excluded 3197 mothers from the sample. Mothers who had their first child under the age of 21 are more likely to have higher income volatility due to a distraction away from their education attainment; moreover, they are more likely to have their second child due to a lower opportunity cost of their time. Therefore, including those mothers in the sample would bias the result downwardly. Furthermore, in some cases, those mothers are expected to be financially supported by their parents which reduces their income volatility and biases the results upwardly if those mothers were included. Mothers who have their first child after the age of 35 are more likely to have experienced a fertility issue or spent more time in education. Women who spent more time in education are more likely to have lower income volatility and the knowledge of medical complications that accompanied having children later in life and that influences them to have their second child quickly after the first. Therefore, including those mothers in the sample would bias the results upwardly. In regards to women with fertility issues, the lower their income volatility the more likely that they might be in seeking medical intervention in order to have children which will bias the result upwardly.

Mothers who have not been married or cohabitated for 5 years after having their first child were excluded from the sample to eliminate any effect that arises from unobservable factors when mothers who could not have the second child due to the absence of a partner are included in the sample. The exclusion of these mothers has reduced the sample by 2199 mothers. To eliminate other unobservable factors, such as the inability to have a child, mothers were eliminated from the sample if the mother or the husband had ever tried to have a child but found it was not possible due to fertility problems (63 mothers were eliminated). After including all the covariates, another 444 mothers were eliminated due to insufficient data. The final sample was 14,307 mothers.

The key independent variable is real income volatility that is calculated by combining the husband’s/cohabitant’s and wife’s taxable income then deflating the family income to the 1982–1984 dollar using the CPI index. PSID collects Head and Wife Taxable Income, which is comprised of three main sources of income: (a) Head/Wife earnings; (b) Head/Wife income from assets (including interest, dividends, trust funds, and rent); and (c) net profit from farm and/or business.Footnote 5 PSID utilizes a variety of imputation techniques to reduce the missing values in the income data.

To examine the hypothesis that the volatility in real income negatively affects the probability of having the second child, I monitored the volatility in income starting from the year that the first child was born. The hypothesis is that the more volatile the real income after the first child, the lower the likelihood of having the second child.

Income volatility was measured as a transitory component of earning following the methodology that is traditionally used in the literature of econometric and policy analysis of volatility (Gottschalk and Moffitt 1994), where the variance was calculated as the sum of the squared deviation of the logged income around the mean in a specific period of time. To provide a clearer interpretation, this study used the standard deviation of the non-logged income as shown in the following equation:

where \({y_{it}}\) is Head and Wife taxable income in thousands of dollars for woman \(i\) at time \(t\), and \(T\) is the number of years through which income volatility is calculated for woman \(i\), and \({y_i}\) is the average annual income for women \(i\) over \(T\).

The second key variable of interest is downward volatility, which measures the frequency of income loss. Downward volatility was measured by calculating the number of times that income negatively changed by more than 5% between successive interviews divided by the number of years for the same period. The change in income between two adjacent years was calculated by dividing the difference in the non-deflated income between the current and the following year by the income of the current year \((in{c_{t+1}} - in{c_t})/in{c_t}\). Therefore, the change of income in the period that precedes having the second child was excluded to avoid the negative change in income due to the delivery of the second child.

In addition to individual characteristics such as age and race (White, Black, Hispanic, and others), the reduced form equation includes a variety of background and socioeconomic factors that impact fertility. These factors are represented by the following variables: (a) the ratio of the average wife’s income to the average husband’s income, (b) family income, (c) age at which the woman has her first child, (d) level of education, (e) disability, (f) frequency of attendance at religious services, (g) family-level weight, (h) marital status, (i) and volatility in income that is generated in response to having the first child.

Including the ratio of the average wife’s income to the average husband’s income in the model controls for the price of having a child and the opportunity cost of the mother’s time. In regards to family income, Table 1 shows a positive correlation between income volatility and the family income. Including the three components (Earnings, Assets including interest, dividends, trust funds, and rent, and Net Profit from farm and/or business) in the Head and Wife taxable income suggests that a higher income fluctuation is associated with a higher level of income; therefore, it is crucial to control for the amount of income. It is reasonable to expect that greater earnings, returns on assets, and profit from farm/business are associated with higher fluctuation in income.

Women vary in the age of having their first child, therefore, a variable of the age at which the woman has her first child is also included in the equation. The level of education, as a variable, is the highest grade the woman has completed. It is a categorical variable where women were divided into three groups: (a) the base group is women who did not finish high school, (b) the second group is women who obtained their high school diploma and maybe some college, (c) and the third group is women who have completed a bachelor’s degree and/or beyond.

The model also includes a variable for disability—whether or not the woman was disabled or required extra care, or whether or not there were any physical or nervous conditions that limited the kind/amount of work she could do. Religion profile may affect the decision of fertility; therefore, the model controls for the frequency of attendance at religious services; a categorical variable that takes a value of zero if the respondent never attends a service, one if she attends once a month or occasionally, and two if she attends every week.

The analysis also included a family-level weight variable that was calculated originally in 1968. Sample members born into the family at a specific year receive either the average of the Head’s and spouse’s weights or in the event of a single Head, the child receives the Head’s weight in that year. “Probability-of-selection weights enable analysts to make estimates from the sample that are representative of the US population” (PSID User Guide—Hill 1991, p. 3). Marital status is a categorical variable that takes a value of one if the mother is married and zero otherwise. Mothers have to be married or cohabitant for 5 years after the first child to be included in the sample.

The model also controls for the volatility in income that is generated in response to having the first child. An example of this volatility would be a reduction in income due to maternity leave or working fewer hours during pregnancy. The standard deviation of Head and Wife real taxable income from the year preceding the year in which the first child was born to the year after the first child was born was calculated and included as a covariate in the reduced form equation. The age of the mother and a quadratic term for age were added as covariates since the relationship between fertility and age is not likely to be linear.

Summary Statistics

Table 1 shows summary statistics for some of the key variables such as the probability of having the second child, the duration between the first and second child, and the average number of children per woman in reference to the percentiles of the standard deviation of taxable Head and Wife income, mother’s age when she had her first child, and level of education. The probability of having the second child and the duration between the first and the second child are negatively correlated with the mother’s age at which she has her first child. The summary statistics show a positive correlation between the amount of income and income volatility. The lowest tail in the distribution of the income variance has the lowest average annual income per family; as income increases volatility rises.

Table 1 shows that mothers tend to have a lower number of children as income volatility increases; however, at the higher tail of income distribution, mothers increase their number of children. This is consistent with Becker’s suggestion that elasticity of quality is higher than that of quantity demanded for children. When income increases, parents tend to desire high-quality children, which will negatively impact the total number of children in the family; however, the data suggest that as income keeps increasing, parents eventually are able to afford increasing their number of children while maintaining the quality they previously desired. Parents with higher income are more educated and in a higher social status; hence, they tend to invest more in their children’s human capital.

The average number of children per family is 2.1 at the lowest tail of income volatility where the average taxable Head and Wife income is $6390 ($15,460 in today’s dollars); as income increases the number of children keeps falling at a decreasing rate (Table 2) and the likelihood of having the second child slightly decreases before it increases in the higher tail of income distribution (Table 1).Footnote 6 Women who have their first child at/above the age of 23 start to increase their number of children if the woman and her spouse make above $23,000 per year (1982–1984 dollar), which is about $55,000 in today’s dollars (Tables 1, 2).

The same pattern is likely to be realized with the level of education as educated mothers are more likely to have their first child at or above the age of 23. The data show that educated mothers that have a bachelor’s degree and beyond tend to increase their number of children when their family income reaches the threshold of $23,000 (1982–1984 dollar). Regardless of the age at which they have their first child and their level of education, women in the highest tail of income tend to have more children than their counterparts in every income quantile except the lowest tail of income.

Women who make the least money have the highest number of children; this could be explained by the lower opportunity cost to raise a child and the lower quality desired for their children, as these mothers are more likely to be less educated and to fall in a lower social status. The positive correlation between income volatility/amount of income and level of education appears in Table 3. The percentage of women with less than high school education is high in the lower tail of income volatility distribution and decreases as income moves upward along the income quantiles; in contrast, women with a bachelor’s degree and beyond are more concentrated in the higher income quantiles. Surprisingly, the highest tail of income volatility distribution, which also includes the highest level of income, mainly consists of uneducated women and a very low percentage of women who have a bachelor’s degree and beyond.

While Whites are more concentrated in the higher income quantiles, Blacks are more concentrated in the lower ones; Hispanics are uniformly distributed across all income quantiles. Table 3 does not suggest a relationship between the frequency of attendance at religious services and income volatility. Not surprisingly, women who delay having their first child are those who have a higher income (Table 3); this could be explained by a lengthier period of education or a desire to establish their careers. Table 3 shows that wife-to-husband income ratio is small at the lower and higher 10% of the income distribution which indicates that families with the lowest and highest income have less mother contributions toward family income. There is no significant differences in the years of marriage between families across different levels of income distribution. Mothers in the top 25% of income distribution have significantly fewer number of disabilities than mothers in the other levels of income.

Table 2 shows the percentage change in the number of children per woman when income variance or the amount of income moves across the quantiles. For example, a group of women can have 15.7% fewer children when their income variance moves from the lower tail (10%) to the 25% quantile. Women tend to decrease their number of children when their income fluctuation increases until they are in the highest tail in the income variance distribution (> 90%), where their accumulated wealth and high-income work as a buffer that reduces the impact of income shocks. In other words, those in lower income groups might feel the adverse effects of volatility more acutely than their higher income counterparts due to fewer buffering resources such as accumulated wealth.

A systematic increase in the per capita income in the United States, in addition to the rise in labor force participation for women through the second half of the last century, is anticipated to impact the fertility rate through an increase in contraceptive knowledge, a rise in the cost of children, and a decline in child mortality. Moreover, cyclical movements in macro variables such as the unemployment rate and the price level could also impact the decision of fertility through income changes. However, those income variations in this case, reflect transitions between employed and unemployed status. Therefore, this study used a year fixed effect structure to control for both the systematic change in income and the macro cyclical movements. The variation in the child care cost across states, in addition to other aspects of cost of living and time-invariant factors, could bias the results; hence, binary variables that represent states were included in a state fixed effect structure.

Children provide a utility with indifference curves shaped according to the relative preference for children (Becker 1960). Therefore, in an attempt to limit the variation in the preference for children, the model includes variables unrelated to economic factors, such as age, race, and the frequency of attendance at religious services. The model also controls for factors that influence fertility such as the age of the mother when the first child was born, the wife’s income relative to the husband’s income, partial or full disability, marital status, and whether or not the wife or the husband have ever had any fertility problem. In addition to the previous variable, the model also controls for socioeconomic factors such as income and the level of education.

Empirical Approach

Using multivariate logistic regression, I estimated the probability of having the second child in response to income volatility for women who already have the first child. The logit model basic equation is:

where \({y_{it}}\) is the outcome variable, a dichotomous coded zero if woman has her first child at time \(t\) between the ages of 21 and 35, and one if woman \(i\) has her second child at time \(t\). The key independent variable \({s_i}\) is the standard deviation of the income that is calculated as the square root of the sum of the squared deviation of the income around the mean for woman \(i\) and her husband/cohabitant during the years between having their first child and having their second child (last child). The vector \({x_{it}}\) is a vector of explanatory variables that represent socioeconomic factors, individual characteristics, highest grade, age at which the women have their first child, and the opportunity cost of having a child such as wife and husband taxable income, the ratio of average wife income to average husband income. Income volatility generated by the incidence of having the first child is represented by the \({\gamma _i}\), which is the standard deviation of the Head and Wife taxable income in three specific years: (a) the year before having the first child, (b) the year of having the first child, (c) and the year after having the first child. Income in those years may shift upward if women return to work from a maternity leave or shift downward due to a voluntarily reduction in worked hours or leaving work for maternity causes.

The model takes into account that certain unobserved state specific variables that are constant over time may influence the decision of whether or not to have children. Under this assumption, a state-specific constant term \(stat{e_i}\) is added to the right hand side of the equation to allow the model to control for variations among the states. Using a time fixed effect structure, the model controls for the variations over time by adding the term\(~tim{e_t}\), which is individual invariant but varies over time, to capture time specific effects. Using the fixed effect model including state specific and time specific effects to estimate the equation should produce unbiased and consistent estimates of the coefficients. The error term is \({\varepsilon _{it}}\). The parameter of interest is \({s_i}\), where \({\beta _1}\) is the coefficient of interest that the model estimates. This coefficient provides the estimate of the effect of the absolute income volatility on the likelihood of having the second child. It is expected to have a negative sign, as the hypothesis is that income volatility has a negative effect on the likelihood of having the second child.

This study also used the Cox proportional hazards model as this model makes it possible to use the duration between the first and the second child to estimate the impact of income volatility on the risk of having the second child. Women were included in the sample when they have their first child; then they either survive if they maintain the status of one child or fail if they have the second child. The years of having the first child are considered the years of survival, while the failure is when the incidence of having the second child occurs. On average, women who have only two children waited 3.4 years after the first child to have the second child; the duration between the first and the second child ranged from 1 to 7 years.

Estimation Results

Table 4 shows a negative correlation between income volatility and the probability of having the second child. The impact is higher on the mothers who are in the second quartile of the income distribution. An increase of $1000 in the standard deviation of the Husband and Wife taxable income is associated with a decrease of 12.95 percentage points in the probability of having the second child. The impact is economically small (0.94 percentage points) for mothers in the lower tail of income distribution and statistically nonsignificant for mothers who are in the higher tail. For mothers in the lower tail, the economically nonsignificant effect could be attributed to mitigated income volatility by welfare programs, which are more likely to be received by mothers in the lower income tail. Mothers in the higher tail are not affected by income volatility due to a buffer of assets and return on investments.

The high impact for mothers who are in the second quartile of income distribution emphasizes the proposition that children are a normal good. Moreover, it supports the suggestion of Becker and Lewis (1973) and Willis (1974) that there is a trade-off between quality and quantity of children in the fertility decision. Mothers who are in the second quartile of the income distribution are more concerned about the quality of their children; however, they are more sensitive to income volatility due to the absence of capital buffering for mothers in the higher tail or welfare programs for mothers in the lower tail of income distribution. Therefore, they perceived income fluctuations as a threat that may reduce the quality of their children, a perception that leads them to abstain from having their second child. Having controlled for the mothers’ level of education, I am confident that this Model excludes any bias that is caused by variation in the knowledge of contraceptives.

The positive impact of income volatility while having the first child on the probability of having the second child could be explained by the positive income elasticity of fertility decision. Mothers who make more income are expected to sacrifice more income while having the first child but also are expected to have the second child, as children are normal goods. The analyses were restricted to women who only have two children as the loss of income due to pregnancy and delivery could reasonably be overtaken by the high marginal utility of having the second child. Nevertheless, in cases where the wife is making a higher income than the husband, a higher wife’s income failed to overtake the significant impact of the opportunity cost of having a child. Table 5 shows that 1% change in the wife-to-husband income ratio is associated with a decrease of 1.13 percentage points in the probability of having the second child for mothers in the second quartile of the income distribution. The impact is negligible and statistically nonsignificant for mothers in the third quartile, the lower tail, and the higher tail of income distribution. This emphasizes the significant impact of the opportunity cost of the mother’s time on the probability of having children and is comparable to the summary statistics in Tables 1, 2 and 3, where women who make the least money have the highest number of children.

Mothers in the second quartile of the income distribution are the most effected by their income when they make the decision to have their second child. While they tend to have the second child with a higher family income, they are less likely to have the child if their income is well above their husbands’ income. This is consistent with Becker’s suggestion that elasticity of quality is higher than that of quantity demanded for children. Women who are making a high income and are married/cohabitant to husbands who are making comparable income are more likely to have the second child than those who are married to husbands that make significantly less income. This could be explained by mothers perceiving the change in income while having the child as a threat to their desired quality for their children; as a result, they decide not to have the second child. The positive impact of the mother’s income concurrently with the negative impact of wife-to-husband income ratio on the probability of having the second child emphasizes what Becker and Lewis (1973), Willis (1974), and Borg (1989) suggested: That there is a significant positive effect of income on the total family size when the reduced form model includes controls that represent the quality of children desired by the family.

The age of the mother at which the first child was born has a significant impact on the decision of having another child. On average, a 1-year increase in the age of the mother when she has her first child decreases the probability of having the second child by 7.12 percentage points (Table 5). Mothers in this income segment usually spend more years on education before they have their children; thus, they are more likely to consider their health during pregnancy and maternity when they make decisions regarding having more children in later life.

The impact of income on the probability of having the second child is economically and statistically nonsignificant. This could be explained by the high marginal utility outweighing the marginal cost of having the second child. This also sheds light on the nonsignificant impact of permanent income changes on fertility, in contrast with the transitory income changes which are more likely to be perceived as economic insecurity. Investigating these issues is beyond the scope of this paper.

A covariate that represents negative income changes is added to the Model (Table 5) to control for downward income volatility. Stripping the economic hardship out of the economic insecurity rendered higher effect for mothers in the second income quartile (− 26.42 percentage points), slight effect for mothers in the third quartile (− 0.67 percentage points), and no effect on mothers in the lower and higher tails. Only mothers who are in the second quartile are significantly impacted by the absolute change in income, a decrease of 26 percentage points in the likelihood of having the second child in response to an increase of $1000 in the standard deviation of income. The impact of downward volatility is nonsignificant for mothers in all quartiles of the income distribution except those who are in the second quartile (3.66 percentage points). Downward volatility is positively associated with the likelihood of having the second child. This is explained by a decrease in the opportunity cost of having a child. The analysis showed that mothers in the second quartile are those who are impacted by the absolute and downward changes in income. They are intolerant to economic insecurity as well as economic hardship. While economic insecurity drives them to reduce fertility, economic hardship induces them to have the second child, most likely by reducing the opportunity cost of the mother’s time.

The negative and significant coefficients of the interaction term for the mothers in the first and last income quartiles in Table 5 indicate that when absolute income volatility is high, an increase in the downward volatility is associated with mothers abstaining from having the second child. However, mothers that are in the second and third income quartiles are more likely to have their second child in response to an increase in the downward changes in income when they already experience a high absolute income volatility. This could be attributed to the small marginal financial benefit of having a second child for mothers that are in the lower and higher tail of the income distribution. In contrast, mothers who are in the second and third income quartiles are more likely to pay fewer income taxes and earn tax benefits such as a child tax credit if they have the second child.

Adding downward income volatility to the reduced form equation renders nonsignificant coefficients for the first and fourth quartile for absolute income volatility, income volatility during having the first child, wife-to-husband income ratio, and age at which the first child was born.

This study used data that only represent the US population. The decision of having a child is affected by economic, geographic, and demographic factors. Average family income, labor profile, age of the population, cultural characteristics, religion, and traditions are expected to differ across regions and countries. Such factors are expected to affect the outcome of this analysis which prohibits this study to generalize the conclusion and extends the findings to other populations than the US. However, using a panel data, such as PSID, provided sufficient information and respondents besides being representative to the US population. The data enabled the analysis to confidently draw conclusions that apply to the US population. Nevertheless, future research will apply the analysis using different data from other countries.

This study also focused on the shift between having one child to having two children, and it is difficult to generalize the conclusions on gross fertility; however, focusing on the one child case helps understanding the economic reasons behind the phenomena of the rise of the one-child family. Future research will consider other cases regarding the number of children in the family and will draw conclusions that are more general on fertility.

Robustness Check

For the sake of robustness, this study used different model specifications such as linear probability model (LPM). Model (a) in Table 7 is a replica of the logistic regression in Table 5 but in an LPM structure. I replaced the dependent variable which is the binary response of whether or not the mother has had her first child with the number of total births (Table 7, Models b and c). The LPM Model (Table 7, Model a) renders comparable estimates to what is in Tables 5 and 6. An increase of $1000 in the standard deviation of income is associated with a decrease of 1.5 percentage points in the probability of having the second child. Similar to the estimates in Tables 4 and 5, while downward volatility is associated with an increase in the probability of having the second child, wife-to-husband income ratio is associated negatively with the probability of having the second child.

In Table 7, Models b and c, where the binary variable of whether or not the mother has had her second child is replaced with the number of total births and the Head and Wife taxable income standard deviation is calculated over the mother’s lifetime, income volatility renders economically nonsignificant coefficients. Income was demeaned in Model (c) by subtracting the average income for each age group from the mother’s income. The absolute changes in the wife and husband taxable income over the mother’s lifetime does not impact the total number of children in the family. Using total birth as a dependent variable that represents fertility allows the preference for children to bias the analysis by including mothers that have great number of children as well as mothers who have no children. Thus, the association between income volatility and the total number of birth in the family is expected to be negligible. Over the lifetime of an average mother, and in contrast with its positive association with the probability of having the second child, downward income volatility is negatively associated with the number of total births. This indicates that over the average mother’s lifetime, long-term commitment such as parenthood is more impacted by economic hardship, which negatively impacts the decision of fertility.

Mothers who were not married all the years since they have had their first child were excluded from the sample in Table 8. The results were parallel to those in Tables 4 and 5. There is no effect on mothers who are in the lower and higher tails of income distribution. Mothers in the second quartile are the most impacted. A $1000 increase in the income standard deviation is associated with a reduction of 46 percentage points in the likelihood having the second child for mothers in the second quartile of income distribution. Excluding mothers that have never been unmarried since having the first child shrank the sample significantly; however, the result was comparable to what was found previously yet with a higher magnitude. Mothers in the second quartile are those who are impacted by the absolute and downward changes in income. They are intolerant to economic insecurity as well as economic hardship, most likely due to a reduction in the opportunity cost of the mother’s time.

The interaction term did not change in sign indicating no change in the previous analysis. Mothers that are in the second and third income quartiles are more likely to have their second child in response to an increase in the downward changes in income when they already experience a high absolute income volatility. The impact of the age at which the first child was born turned out to be statistically nonsignificant for mothers in every income quartile.

Using the duration between the first and the second child, I ran survival analysis utilizing Cox Proportional Hazard model to estimate the impact of income volatility on the risk of having the second child. The mother survives as long as she keeps the status of having one child and fails when having the second child. The hazard model in Table 6 rendered results that conform to those of the logit regression in Tables 4 and 5. While income volatility is found to negatively impact the probability of having the second child using the logit model, it reduces the risk of having the second child using the hazard model. An increase of $1000 in the standard deviation of income after having the first child for women who had their first child between 21 and 35 years old is associated with 5.70% (1–0.9530) lower hazard of having the second child. The effect is higher for women who are in the second and third quartiles at 19 and 16.3%, respectively. Downward volatility is found to increase the risk of having the second child, which is comparable to the positive impact on the likelihood of having the second child that is found using the logit model.

Conclusion

This study used longitudinal data from the Panel Study of Income Dynamics (PSID) that runs from 1968 to 2013, and a variety of different model specifications including linear and non-linear probability models to estimate the probability of remaining a one-child family. The study also used a Cox Proportional Hazard model that enables the analysis to exploit the duration between the first and second child to draw a conclusion. This study found a significant positive impact for economic insecurity on the probability to remain a one-child family for mothers who are in the second quartile of the income distribution. After controlling for economic hardships, an increase of $1000 in the standard deviation of income is associated with a decrease of 26 percentage points in the probability of having the second child.

There is no evidence that absolute income volatility affects mothers’ decisions to have the second child for mothers in the upper half and the lower tail of the income distribution. The analysis found evidence that mothers in the second income quartile are more likely to have the second child when they experience a decrease in the opportunity cost of their time as they are less likely to have the child if their income is well above their husbands’ income. Negative income changes are associated with an increase of the probability of having the second child for mothers in the second income quartile. However, mothers in the lower and higher tail of the income distribution are more likely to refrain from having their child in response to negative income shocks if they already experience high absolute income changes. This could be attributed to the small marginal tax benefit of having a second child for mothers that are in the lower and higher tail of income distribution. In contrast, mothers who are in the second and third income quartiles are more likely to pay less income taxes and earn tax benefits such as a child tax credit if they have the second child.

The analysis failed to find evidence that total births per mother is a function of economic uncertainty that is generated by individual-level factors such as absolute income volatility, yet it showed that economic hardships represented by negative income changes throughout the mother’s life time is associated with a decrease in the number of total births. Nevertheless, investigating the impact of income changes on gross fertility is beyond the scope of this text and will remain a subject for future research.

This study highlighted the trend in the US population in becoming a voluntarily one-child family society (an increase of 80%) which potentially affects the fertility rate. The fall in the fertility rate (from 3.7 to 1.8) in the last 50 years materialized in a social security deficit and a projecting demographic risk. This study shed light on the economic factors behind one component in the fall of the fertility rate which is the rise of the one-child family. The study provided analysis that concluded that the rise in the income volatility contributes significantly to the rise of the phenomena of the one-child family. Other research pointed to the ongoing shift of economic risks from institutions, such as corporations and governments, to individuals which contributes to the rise of income volatility for those individuals.

Previous research focused on the impact of the changes in the aggregate variables, such as the employment rate and Gross Domestic Products (GDP) on fertility; however, this paper is a gateway to more research on the impact of the changes in the individual-level economic factors on fertility. The analysis provided results that suggest implementing policies that stabilize the fluctuations in income to reduce economic insecurity specifically for American middle class mothers who fall in the middle of the income distribution as these mothers have higher tendency to limit their family size at one-child family if their income volatility increases.

Notes

According to the Social Security Office of Retirement and Disability Policy (ORDP), in 2035, there will only be enough taxes to pay for 75% of scheduled benefits. The ORDP attributes this imbalance to the drop in the birth rate from 3 to 2 children per woman rather than increasing lifespans. This decrease in the birth rate, if left unchecked, will change the age structure of the US over time. Eventually, it will leave the society with insufficient tax payers to cover the pension and benefits for the retirees who will be collecting social security.

According to the Pew Research Center, the percentage of childless women has increased from 10% in the 1970s to 15% in 2014 while mothers with one child has increased from 10 to 18%. Mothers with two children have increased from 22 to 35%. Mothers with three and four children have decreased from 23 to 20% and from 36 to 12%, respectively.

Becker (1960) stated the following: “An increase in income must increase the amount spent on the average good, but not necessarily that spent on each good. The major exceptions are goods that are inferior members of a broader class, as a Chevrolet is considered an inferior car, margarine an inferior spread, and black bread an inferior bread. Since children do not appear to be inferior members of any broader class, it is likely that a rise in long-run income would increase the amount spent on children” (p. 210).

According to PSID terminology, a Head is designated as a husband in the family unit or a cohabitant with whom the woman has been living for at least 1 year.

All dollar values are in US currency.

References

Ananat, E. O., Gassman-Pines, A., & Gibson-Davis, C. (2013). Community-wide job loss andteenage fertility: Evidence from North Carolina. Demography, 50(6), 2151–2171. https://doi.org/10.1007/s13524-013-0231-3.

Becker, G. S. (1960). An economic analysis of fertility. In Universities National Bureau Committee for Economic Research (Eds.), Demographic and economic change in developed countries (pp. 209–231). Princeton: Princeton University Press.

Becker, G. S., Glaeser, E. L., & Murphy, K. M. (1999). Population and economic growth. The American Economic Review, 89(2), 145–149. https://doi.org/10.1257/aer.89.2.145.

Becker, G. S., & Lewis, H. G. (1973). On the interaction between the quantity and quality of children. Journal of Political Economy, 81(2), S279-S288. Retrieved from http://www.jstor.org/stable/1840425.

Bernardi, L., Klärner, A., & Von der Lippe, H. (2008). Job insecurity and the timing of parenthood: A comparison between Eastern and Western Germany. European Journal of Population, 24(3), 287–313. Retrieved from http://www.jstor.org/stable/40271508.

Borg, M. O. M. (1989). The income-fertility relationship: Effect of the net price of a child. Demography, 26(2), 301–310. Retrieved from http://www.jstor.org/stable/2061527.

Bram, S. (1975). To have or have not: A social psychological study of voluntarily childless couples, parents-to-be, and parents, Unpublished doctoral dissertation, Department of Psychology, University of Michigan, Ann Arbor.

Bureau of Labor Statistics. (2016). CPI Detailed Report Data for April 2016 [Report]. Retrieved from http://www.bls.gov/cpi/cpid1604.pdf.

Butz, W. P., & Ward, M. P. (1979a). The emergence of countercyclical U.S. fertility. The American Economic Review, 69(3), 318–328. Retrieved from http://www.jstor.org/stable/1807367.

Butz, W. P., & Ward, M. P. (1979b). Will US fertility remain low? A new economic interpretation. Population and Development Review, 5(4), 663–688. Retrieved from http://www.jstor.org/stable/1971976.

Conrad, C., Lechner, M., & Werner, W. (1996). East German fertility after unification: Crisis or adaptation? Population and Development Review, 22(2), 331–358. Retrieved from http://www.jstor.org/stable/2137438.

Dynarski, S., Gruber, J., Moffitt, R. A., & Burtless, G. (1997). Can families smooth variable earnings? Brookings Papers on Economic Activity, 1, 229–303. Retrieved from https://EconPapers.repec.org/RePEc:bin:bpeajo:v:28:y:1997:i:1997-1:p:229-303.

Easterlin, R. A. (1976). The conflict between aspirations and resources. Population and Development Review, 2(3–4), 417–425. Retrieved from http://www.jstor.org/stable/1971619.

Fokkema, T., De Valk, H., De Beer, J., & Van Duin, C. (2008). The Netherlands: Childbearing within the context of a “Poldermodel” society. Demographic Research, 19(21), 743–794. https://doi.org/10.4054/DemRes.2008.19.21.

Goldstein, J. R., Sobotka, T., & Jasilioniene, A. (2009). The end of ‘lowest-low’ fertility? Population and Development Review, 35(4), 663–699. Retrieved from http://www.jstor.org/stable/25593682.

Gosselin, P., & Zimmerman, S. (2008). Trends in Income Volatility and Risk, 1970–2004. Retrieved from the Urban Institute website: http://www.urban.org/research/publication/trends-income-volatility-and-risk-1970–2004.

Gottschalk, P., & Moffitt, R. (1994). The growth of earnings instability in the US labor market. Brookings Papers On Economic Activity, 2(25), 217–272. Retrieved from http://www.jstor.org/stable/2534657.

Gottschalk, P., & Moffitt, R. (2007). Trends in Earnings Volatility in the US: 1970–2002. Paper presented to the Annual Meetings of the American Economic Association, Chicago, January 2007.

Haider, S. J. (2001). Earnings instability and earnings inequality of males in the United States: 1967–1991. Journal of Labor Economics, 19(4), 799–836. https://doi.org/10.1086/322821.

Hill, M. (1991). PSID User Guide. Retrieved from https://psidonline.isr.umich.edu/Guide/ug/psidguide.pdf.

Hoem, B. (2000). Entry into motherhood in Sweden: The influence of economic factors on the rise and fall in fertility, 1986–1997. Demographic Research, 2, 4. https://doi.org/10.4054/DemRes.2000.2.4.

Hondroyiannis, G. (2010). Fertility determinants and economic uncertainty: An assessment using European panel data. Journal of Family and Economic Issues, 31(1), 33–50. https://doi.org/10.1007/s10834-009-9178-3.

Houseknecht, S. K. (1977). Wives but not mothers: Factors influencing the decision to remain voluntarily childless (Doctoral dissertation, Pennsylvania State University).

Hymans, S. H., Ackley, G., & Juster, F. T. (1970). Consumer durable spending: explanation and prediction. Brookings Papers on Economic Activity, 2, 173–206. Retrieved from https://www.brookings.edu/bpea-articles/consumer-durable-spending-explanation-and-prediction/.

INE. (2010). Vital Statistics and Basic Demographic Indicators [Press release]. Retrieved from http://www.ine.es/en/prensa/np600_en.pdf.

Kravdal, Ø (2002). The impact of individual and aggregate unemployment on fertility in Norway. Demographic Research, 6(10), 263–294. https://doi.org/10.4054/DemRes.2002.6.10.

Livingston, G. (2014). Birth rates lag in Europe and the U.S., but the desire for kids does not. Retrieved from Pew Research Center website: http://www.pewresearch.org/fact-tank/2014/04/11/birth-rates-lag-in-europe-and-the-u-s-but-the-desire-for-kids-does-not/.

Livingston, G., & Cohn, D. (2010). US birth rate decline linked to recession. Retrieved from Pew Research Center website: http://www.pewsocialtrends.org/2010/04/06/us-birth-rate-decline-linked-torecession/.

Macunovich, D. J. (1996). Relative income and price of time: Exploring their effects on US fertility and female labor force participation. Population and Development Review, 22(Supp.), 223–257. Retrieved from http://www.jstor.org/stable/2808013.

Morgan, S. P., Cumberworth, E., & Wimer, C. (2011). The great recession’s influence on fertility, marriage, divorce, and cohabitation. In D. B. Grusky, B. Western & C. Wimer (Eds.), The great recession (pp. 220–245). New York, NY: Russell Sage Foundation.

Perelli-Harris, B. (2006). The influence of informal work and subjective well-being on childbearing in post-Soviet Russia. Population and Development Review, 32(4), 729–753. Retrieved from http://www.jstor.org/stable/20058925.

Ranjan, P. (1999). Fertility behaviour under income uncertainty. European Journal of Population, 15(1), 25–43. Retrieved from http://www.jstor.org/stable/20164053.

Schmidt, S. R. (1999). Long-run trends in workers’ beliefs about their own job security: Evidence from the general social survey. Journal of Labor Economics, 17(4, pt 2), S127–S141. Retrieved from http://www.jstor.org/stable/10.1086/209945.

Schneider, D. (2015). The great recession, fertility, and uncertainty: Evidence from the United States. Journal Of Marriage And Family, 77(5), 1144–1156. https://doi.org/10.1111/jomf.12212.

Stock, J. H., & Watson, M. W. (2002). Has the business cycle changed and why? NBER Macroeconomics Manual, 17, 159–218. https://doi.org/10.3386/w9127.

Van Giersbergen, N. P. A., & De Beer, J. (1997). Geboorteontwikkeling en consumentenvertrouwen: een econometrische analyse (Birth trends and consumer confidence: An econometric analysis). Maandstatistiek van de Bevolking, 45(11), 23–27. Retrieved from http://library.wur.nl/WebQuery/titel/1008526.

Wang, W., & Morin, R. (2009). Home for the holidays…and every other day. Retrieved from Pew Research Center website: http://pewsocialtrends.org/assets/pdf/home-for-the-holidays.pdf.

Willis, R. J. (1974). Economic theory of fertility behavior. In T. W. Schultz (Ed.), Economics of the family (pp. 25–75). Chicago, IL: University of Chicago Press.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Fady Mansour declares that he has no conflict of interest.

Human and Animal Rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

I am indebted to Professors Charles Baum and Michael Roach at Middle Tennessee State University for helpful comments, and would like to thank Professors Joachim Zietz and Jason M. Debacker for comments on an earlier draft.

Rights and permissions

About this article

Cite this article

Mansour, F. Economic Insecurity and Fertility: Does Income Volatility Impact the Decision to Remain a One-Child Family?. J Fam Econ Iss 39, 243–257 (2018). https://doi.org/10.1007/s10834-017-9559-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-017-9559-y