Abstract

While the association between financial strain and couple interaction has been well-established in the literature on economic stress, little research has investigated the association among middle-aged and older populations. The present study examined the relationships between financial strain and couple functioning of middle-aged, young-old, and old–old people using the 2010 Health and Retirement Study. Findings show that subjective financial strain was positively associated with partner undermining and negatively with partner support, controlling for the effects of objective financial situations among middle-aged, young-old, and old–old couples. There were gender and age differences in the interaction effects of financial strain and financial control on couple functioning. For middle-aged men, financial control may have different associations with couple behaviors depending on the level of financial strain. When the level of financial strain is high, the positive effect of financial control disappears and the effect changes even in a negative way. Findings provide suggestions for practitioners and researchers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Financial stress has increased over the years. A recent survey showed that three-quarters of Americans were stressed about money during the past month while one quarter was stressed about money most or all the time (American Psychological Association 2015). Such financial difficulties raise the concerns about the effect of the financial stress on family life. In the literature, the association between financial strain and couple relationship has been widely researched. Using the family stress model of economic stress, Conger and Elder (1994) proposed that economic pressure or strain caused by economic hardships increases risk for emotional distress, such as depression, which in turn exacerbates couple functioning and stability of couple relationship. Such relationships between financial strain and couple interactions as a part of the family stress model have been validated cross-sectionally (Conger et al. 1990), longitudinally (Conger et al. 1999; Dew and Yorgason 2010; Vinokur et al. 1996), and across diverse populations (Aytac and Rankin 2009; Falconier and Epstein 2010; Schramm and Adler-Baeder 2012).

Nevertheless, several gaps exist in the literature. Almost all preceding studies have studied younger populations—with the mean age of participants for the majority of the reviewed studies being 40 or below (e.g., 40 and 38 for husbands and wives, respectively, in Conger et al. 1990). Limited research is available about financial strain and couple relationships among older populations. However, the quality of relationship of middle-aged and older couples may be distinct from that of younger couples as they may have different couple characteristics. Middle-aged and older couples can be considered as survivors. In general, older couples have maintained their relationships over the long term compared to younger couples. Couples with relatively functional interactions can avoid divorce or dissolution of the relationship. Additionally, research showed that older couples, compared to younger couples, were reported to show more positive emotional interactions (Carstensen et al. 1995) and lower conflict (Dew and Yorgason 2010). Couples that have been involved in long-term marriages or relationships might have developed functional and stable interactions for dealing with life issues, which may have evolved over time. Therefore, older couples may undergo financial strain differently from younger couples. However, little research on the association between financial strain and middle-aged and older couples’ functioning is available.

Furthermore, there might be differences between middle aged and older couples. Older couples are more likely than middle age couples to encounter life events unique to later life, such as retirement, declining health, chronic illness and dependence on others, becoming a caregiver, and death of close family members and friends (Price and Humble 2010). Accordingly, the impact of financial strain in lives of older couples may differ from that of middle-aged couples. For example, older couples are likely to have higher levels of accumulated wealth for or in their retirement, compared to middle-aged couples according to the economic life-cycle theory. However, in recent years, financial insecurity for aging Americans has become a concern due to factors such as economic uncertainty, increasing individual responsibility of retirement, and rising health care costs. Furthermore, when there is a financial challenge, older couples may have limited opportunities for finding a new job to cope with such financial hardship. Alternatively, middle-aged couples may feel more distressed in financially challenging times because they may have more financial obligations compared to older couples (Pew Research Center 2013; Soldo 1996). For the older couples, the present study also differentiates older people into young-old (65–74) and old–old (75 or older) groups (Hooyman and Kiyak 2010), because these two groups may be different in many aspects such as in physical conditions, life concerns/problems, and social functioning (Price and Humble 2010).

Another gap in research is limited understanding about protective factors (moderators) in couple relationships. It has been suggested to examine factors that moderate predictions of family stress model for future research (Conger et al. 2010). A few studies (Conger et al. 1999; Lincoln and Chae 2010) suggested that supportive behavior, not positive evaluation of the relationship, may protect financially-distressed couples against psychological distress. However, any financial attributes were rarely considered as moderators. Often, financial management skill is required to cope with financial stress. Having control over daily financial lives has been regarded as a key component of financial management and well-being by financial professionals and experts (Consumer Financial Protection Bureau 2015). Additionally, detecting moderators may be useful in practical implications. Protective/moderating factors can be used to develop policies and educational programs as well as clinical treatments for intervention in financially distressed couples (Conger et al. 1999). The present study examines whether financial control modifies a path from financial strain to couple functioning.

Lastly, gender differences in responses to economic hardships have been documented (Conger et al. 1993; Falconier and Epstein 2011a). While both men and women experienced anxiety and depression, only men reported hostility, whereas females reported somatization (Conger et al. 1993). Additionally, Falconier and Epstein (2010) reported that only males’ financial strain elicited negative responses from both genders. Falconier and Epstein (2011b) also reported couples in financial strain showed a specific pursue-withdraw interaction pattern in which female partners pursue male partners and the male partners withdraw from the female partners. It is important to investigate how female and male partners respond to financial strain.

Theoretical Approach: ABC- X Model of Family Stress

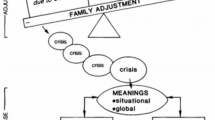

The present study adopts the ABC-X family stress model (Boss 1988; Hill 1958) as a conceptual framework (Fig. 1) because of its focus on strength-related factors and examination of interaction effects among component factors. While the Conger and Elder’s family stress model (1994) has been widely used in the literature, it focuses more on mediation rather than moderation.

The ABC-X family stress model (Boss 1988) suggests that life stressors (Factor A in Fig. 1) have the potential to lead to family stress (negative interactions among family members) which is indicated by high level of partner undermining and low level of partner support in the present study (Factor X in Fig. 1). Because positive behavior and negative behavior are distinct constructs that are not placed on a continuum (Bradbury et al. 2000; Schramm and Adler-Baeder 2012), we used both partner support and partner undermining as dependent variables. However, not all life stressors necessarily create a family stress. Besides, the extent to which the family is affected by the event depends on both the family’s resources or strengths (Factor B in Fig. 1) and the family’s perception of the event (Factor C in Fig. 1). That is, family responses are formed by interactions between multiple factors.

When applying the ABC-X model to understand financial strains, it is very important to distinguish a financial stressor from financial strain (Falconier and Epstein 2011a), which belongs to Factor A (provoking event) and Factor C (evaluation of the event) in Fig. 1, respectively. A financial stressor such as abrupt loss in income or asset is an objective event that happens outside one’s mind. Or it could be a change in job status such as unemployment. Also, a chronic and objective financial situation such as low levels of income and assets as well as long term unemployment can be stressors. These objective financial measures such as income, asset, and job status are found to influence financial strain (Wilkinson 2016). However, financial strain is a subjective evaluation of the stressor, which involves individual or collective cognitions and emotions. It was suggested that financial strain rather than financial stressors may influence family interactions (Falconier and Epstein 2011a). However, both objective and subjective financial factors should be taken into account for a more accurate picture of financial strain.

The ABC-X model is valuable in that it takes into account a family’s resources and strengths (Factor B in Fig. 1). Among diverse personal and couple strengths, personal control generally denotes “individuals’ beliefs about their capacities to exercise control in their own lives” (Gurin et al. 1978, p. 275). In particular, having control of financial situation may be regarded as a strength (Factor B in Fig. 1) in the ABC-X model and has the potential to positively impact couple functioning. However, it is unknown whether financial control (strengths) and the financial strain (evaluations) have only main effects on couple functioning independent of each other, or interaction effects (as indicated by asterisk in Fig. 1) above and beyond the main effects on couple functioning.

Personal Control

Theoretically, personal control is expected to play a positive role in family finance. Specifically, if one believes that he/she has control over an adverse situation (that is, he/she obtains personal control), even though he/she feels financially strained, he/she may try to actively cope with the situation by seeking information, planning strategies, and initiating actions to overcome the hardship (Skinner 1996). Empirical findings have supported such positive roles of personal control in the relationship between financial stress and health (Armstrong and Schulman 1990; Price et al. 2002). Additionally, having personal control has been linked to positive financial coping strategy, such as budgeting behavior (Kidwell et al. 2003; Consumer Financial Protection Bureau 2015) and job-seeking behaviors (Creed et al. 2012).

However, in stressful situations, personal control sometimes operates in negative ways (Averill 1973; Burger 1989). For example, the belief that one can control a situation may be accompanied by increased anxiety about failure of control and negative evaluations of the self (Burger 1989). Especially, in objectively unmanageable situations, it is not clear whether sense of control is beneficial or harmful (Skinner 1996). Economic hardship may be uncontrollable particularly for older couples who may face restricted economic opportunities such as nearing or in retirement and declining health. Furthermore, the positive role of personal control in finances was unclear in some studies (Dietz et al. 2003; Mewse et al. 2010; Wang et al. 2011).

Lastly, while most research examined personal control, a few studies have focused on financial control rather than general control over life (Dietz et al. 2003; Mewse et al. 2010). It has been suggested that the more specific the domain of personal control is, the more likely people will initiate actions in that domain (Lachman 1986). Therefore, control over finance may be more relevant in financial strains.

The Purpose of the Study

The present study contributes to the literature in several ways. First, little is known about the relationship between financial strain and couple functioning among middle-aged and older couples. The present study aims to examine whether financial strain is associated with intimate relationship in the older population as it is in the younger population. Second, one study of older population came from the data collected two decades ago when economic circumstances were very different (Dew and Yorgason 2010). The trends of increasing health care burdens, inadequate retirement savings, and growing debt problems of middle aged and older households intensified since the Great Recession. However, limited research is available about the context of the current economic hardship. With the purpose of addressing such gap, the present study analyzes the 2010 Health and Retirement Study (HRS). Third, different from Conger and Elder’s family stress model focusing on mediation (Kinnunen and Pulkkinen 1998; Ishii-Kuntz et al. 2010), the present study tests financial control as a moderator as well as a strength-related predictor, based on the ABC-X model of family stress.

Research Hypotheses

H1

Financial strain will be negatively associated with partner support, and positively with partner undermining.

H2

Financial control will be positively associated with partner support, and negatively with partner undermining.

H3

Financial control will moderate the relationship between financial strain and partner support and undermining.

Method

Data and Sample

The data set used in this study came from the Health and Retirement Study. HRS has been conducted every 2 years since 1992 using in-person interviews with Americans, aged 50 or more. In 2004, HRS added the Leave-Behind Questionnaires to assess psychosocial issues in middle and later life. The Leave-Behind questionnaires were self-administered without interviewers after the completion of the in-person core interview.

Several steps were taken to yield the final sample of the present study. First, of 22,034 subjects who participated in the survey in 2010, participants who did not respond to questions about partner support and partner undermining, the two dependent variables of the present study, in the Leave-Behind questionnaires were deleted, leaving a sample of 5532. Because “(L)eave-behind questionnaires were administered to a random sample of respondents,” (HRS 2008, p. 5) the dataset can still be considered nationally representative. For variables (employment status, education, and financial control) with missing values (2% or less of the subjects), we removed the cases, yielding a sample of 5434. Financial Strain held 198 (3.6%) missing cases. Based on the very high level of internal consistency (Cronbach’s alpha = .91) of financial strain items, for cases with only 1 missing item out of 4 items, prorated scale sum scores were used to maximize the number of subjects. Other missing cases with 2 or more missing items of 4 items were excluded, leaving a sample of 5372. We then deleted people aged less than 50 (spouses of targeting respondents aged 50 or more), earning a sample of 5103. Mental health held 184 (3.6%) missing cases. Based on the moderate level of internal consistency (alpha = .79) of mental health, for cases with 2 or less missing items of 9 items, prorated scale sum scores were used to maximize the number of subjects. Other missing cases with more than 2 missing items were deleted, yielding the final sample of 4935. Then, we broke the sample into six subsamples by age (50–64, 65–74, and 75 and older) and gender, finally reaching the samples of 1057 for middle-aged males, 761 for young-old males, 610 for old–old males, 1314 for middle-aged females, 760 for young-old females, and 433 for old–old females.

Measures

Dependent Variables

Partner Support

Partner support signifies the respondent’s perception of the other partner’s positive behavior toward him/her. To assess partner support, respondents were asked about their positive interactions with partners/spouses with three items (e.g., “How much do they really understand the way you feel about things?”). Item responses ranged from 1 = a lot to 4 = not at all. Responses were reverse-coded, so that higher numbers indicate higher levels of partner support. The index of partner support was the respondent’s sum score for the three items and showed adequate internal consistency, with Cronbach’s alpha coefficients of .85 for middle-aged females, .83 for young-old females, .79 for old–old females, .79 for middle-aged males, .75 for young-old males, and .74 for old–old males.

Partner Undermining

Partner undermining denotes the respondent’s perception of the other partner’s negative behavior toward him/her. Respondents rated their partners’ undermining behaviors with four items (e.g., “How much do they criticize you?”). Item responses ranged from 1 = a lot to 4 = not at all. Reverse-coding was conducted, so that higher numbers indicate higher levels of partner undermining. The respondent’s sum score for the four items was used as the index of the partner undermining. The scale showed Cronbach’s alpha coefficients of .81 for middle-aged females, .73 for young-old females, .81 for old–old females, .80 for middle-aged males, .79 for young-old males, and .75 for old–old males.

Independent Variables

Financial Strain

Financial strain means negative evaluation of objective economic situation which involves negative cognitions and emotions. Financial strain was measured using four items (e.g., “How satisfied are you with your present financial situation?” “How satisfied are you with the total income of your household?” “How difficult is it for (you/your family) to meet monthly payments on (your/your family’s) bills?”). The fourth question asked if ongoing financial strain was happening to the respondent and asked the respondent to indicate how upsetting the strain has been. The first two questions were reverse coded, so that higher scores denote higher levels of financial strain. The financial strain index was the respondent’s sum score for the four items. The source of the first and third items was Williams et al.’s study (1997) on racial differences in health (the HRS Psychosocial Working Group 2008). The source of the fourth item was Troxel et al.’s study on chronic stress burden (2003) (The HRS Psychosocial Working Group 2008). The Cronbach’s alpha coefficients were .91 for middle-aged females, .90 for young-old females, .90 for old–old females, .92 for middle-aged males, .90 for young-old males, and .89 for old–old males.

Financial Control

Financial control denotes the respondent’s belief about the degree to which he/she exercises control in finance. To measure sense of control over financial situation, respondents were asked “how would you rate the amount of control you have over your financial situation these days?” The responses ranged from 0 (no control at all) to 10 (very much in control). The item came directly from another large survey, the National Longitudinal Study of Midlife in the United States (MIDUS) (The HRS Psychosocial Working Group 2008).

Control Variables

Objective Financial Stressor Variables

Financial stressors are objective financial circumstances that creates reactions of individuals and families. Three indicators such as household income, net worth, and job status were included in the study to measure one’s available financial resources. Household income is annual income of the household. Household net worth is total household assets minus total household debts. Household income and net worth were included as objective financial stressors. Additionally, job status such as unemployment, retirement, homemaker, and disabled was dummy-coded.

Demographic and Health Variables

Race and education were used as demographic variables. Self-rated health was measured using the item “would you say your health is excellent, very good, good, fair, or poor?” and coded as a continuous variable with higher scores meaning better health. Depressive symptoms are symptoms experienced during the past week and were assessed with the abbreviated nine-item Center for Epidemiologic Studies Depression Scale (CES-D). Participants answered yes or no to each question (e.g., “Much of the time during the past week, you felt that everything you did was an effort.”). Higher scores denote higher levels of depressive symptoms. The Cronbach’s alpha coefficients were .82 for middle-aged females, .80 for young-old females, .74 for old–old females, .81 for middle-aged males, .73 for young-old males, and .72 for old–old males.

Analytic Plan

To examine research hypotheses, we employed multiple regression analysis. Our first model regressed partner support and undermining on demographic variables such as age, race, and education. Model 2 added indicators of objective financial strain, such as income, net worth, and job status. Also included in Model 2 were health variables such as depressive symptoms and physical health. In the third model, the main independent variables of subjective financial strain and financial control were added. The full model (Model 4) added the interaction between financial strain and financial control. In order to ease the interpretation of interaction effects, the pick-a-point approach to probing interactions was used. The pick-a-point approach involves choosing values of the moderator (financial control) and estimating the conditional effect of the independent variable (financial strain) on dependent variable (partner support and undermining) at those values (Hayes 2013).

Results

Preliminary Analyses

SPSS version 22 was used for analyses. Descriptive statistics were conducted and examined for the normality of distribution of variables (e.g., skewness and kurtosis). Based on the degree of improvement of normality, we used square root transformation for income and net worth and log transformation for depressive symptoms. Financial strain and financial control were centered, so that multicollinearity was prevented among independent variables and the interactional term. The tolerance and VIF values in all regression models were acceptable. Thus, no multicollinearity was evident. The present study used multiple regression to examine moderating effects, which has been found more powerful than multigroup strategy (Stone-Romero and Anderson 1994).

Table 1 offers descriptive statistics by age and gender groups. Financial strain was relatively low to moderate, averaging 7.66 and 7.61 for old–old males and females, 8.16 and 8.32 for young-old males and females, and 10.27 and 9.97 for middle-aged males and females of a possible 4–19 on a scale where 19 means high financial strain. While the level of financial strain may be low, especially among older individuals, middle-aged people were experiencing moderate levels of financial strain. Middle-aged individuals may experience more financial strain from greater investment loss compared to older adults from Great Recession. Furthermore, old–old people may be vulnerable even with relatively low levels of financial strain due to their limited coping ability. The level of financial control was moderate to high, averaging 7.56 and 7.38 for old–old males and females, 7.43 and 7.32 for young-old males and females, and 6.67 and 6.84 for middle-aged males and females of a possible 0–10 on a scale where 10 indicates high financial control. Both older and middle-aged people reported high level of positive behaviors between partners. The averages of partner support were over 10 of a possible 4 to 12 across age and gender groups. The level of negative interactions between partners was low, averaging 7.24 and 7.78 for old–old males and females, 7.48 and 7.79 for young-old males and females, and 7.88 and 8.14 for middle-aged males and females of a possible 4–16.

Examinations of the Association Between Financial Strain and Couple Functioning

Partner Support as an Outcome

Hypothesis 1 proposed that financial strain would be negatively associated with partner support, which was supported in all age and gender groups. Hypothesis 2 suggested that financial control would be positively associated with partner support, which was supported among young-old males, middle-aged females, and young-old females. Hypothesis 3 predicted that financial control would moderate the relationship between financial strain and partner support. This was supported only among middle-aged males. Results of regression models for partner support are shown in Table 2.

Specifically, different sets of factors of partner support by age and gender groups were detected. For middle-aged males, variables such as African American (β = − .09, p < .01), depressive symptoms (β = − .14, p < .001), and financial strain (β = − .11, p < .05) were negatively related to partner support. Being disabled (β = .08, p < .05) was positively related to partner support. While financial control did not show main effect on partner support, there was an interaction effect (β = − .09, p < .01) between financial strain and financial control. The regression model explained 7% of the variability in partner support (R 2 = .07, p < .001). For young-old males, a homemaker (β = − .09, p < .05), depressive symptoms (β = − .16, p < .001), and financial strain (β = − .09, p < .05) were negatively associated with partner support. Financial control was positively associated with partner support (β = .09, p < .05). There was no interaction effect between financial strain and financial control. The regression model explained 8% of the variability in partner support (R 2 = .08, p < .001). For old–old males, factors such as African American (β = − .11, p < .01), unemployment (β = − .10, p < .05), depressive symptoms (β = − .12, p < .01), and financial strain (β = − .11, p < .05) were negatively associated with partner support. Interaction effect between financial strain and financial control was not detected. The regression model explained 9% of the variability in partner support (R 2 = .09, p < .001).

For middle-aged females, African American (β = − .15, p < .001), depressive symptoms (β = − .17, p < .001), and financial strain (β = − .12, p < .001) were negatively associated with partner support, while unemployment (β = .06, p < .05) was positively associated with partner support. Financial control (β = .11, p < .001) was positively associated with partner support, but interaction effect was not detected. The model explained 14% of the variability in partner support (R 2 = .14, p < .001). For young-old females, African American (β = − .09, p < .05), depressive symptoms (β = − .18, p < .001), and financial strain (β = − .10, p < .05) were negatively related to partner support, while financial control (β = .09, p < .05) was positively related to partner support. There was no interaction effect of financial strain and financial control on partner support. The regression model statistically accounted for 11% of the variance of partner support (R 2 = .11, p < .001). For old–old females, other races (β = − .12, p < 05) and financial strain (β = − .15, p < .05) were negatively associated with partner support. Interaction effect between financial strain and financial control were not detected. Eleven percent of the variance of partner support (R 2 = .11, p < .001) was explained by the regression model.

Partner Undermining as an Outcome

Hypothesis 1 predicted that financial strain would be positively associated with partner undermining, which was supported in all age and gender groups. Hypothesis 2 proposed that financial control would be negatively associated with partner undermining, which was supported only among middle-aged women. Hypothesis 3 suggested that financial control would moderate the relationship between financial strain and partner undermining. Hypothesis 3 was supported only among middle-aged males. Results of partner undermining are presented in Table 3.

Specifically, for middle-aged males, African American (β = .10, p < .01), depressive symptoms (β = .11, p < .01), and financial strain (β = .16, p < .001) were positively associated with partner undermining. Being disabled (β = − .08, p < .05) was negatively associated with partner undermining. Financial control revealed no main effect on partner undermining. However, the moderating effect of financial control on the relationship of financial strain and partner undermining was significant (β = .14, p < .001). The regression model has explained 9% of the variance in partner undermining (R 2 = .09, p < .001). For young-old males, other races (β = .07, p < .05), depressive symptoms (β = .16, p < .001), and financial strain (β = .16, p < .001) were positively related to partner undermining. There was neither a main effect of financial control nor an interaction effect of financial strain and financial control on partner undermining. The regression model accounted for 10% of the variance of partner undermining (R 2 = .10, p < .001). For old–old males, African American (β = .12, p < .01), depressive symptoms (β = .13, p < .01), and financial strain (β = .10, p < .05) were significant. Financial control was not associated with partner undermining, and the interaction effect of financial strain and financial control was not detected. The model explained 8% of the variability in partner undermining (R 2 = .09, p < .001).

Among middle-aged women, African American (β = .09, p < .01), self-rated health (β = .07, p < .05), depressive symptoms (β = .20, p < .001), and financial strain (β = .09, p < .01) were positively related to partner undermining. While financial control was negatively related to partner undermining (β = − .14, p < .001), there was no significant interaction effect of financial strain and financial control on partner undermining. The model explained 12% of the variability in partner undermining (R 2 = .12, p < .001). For young-old females, depressive symptoms (β = .11, p < .01) and financial strain (β = .18, p < .001) were positively related to partner undermining. Retirement (β = − .10, p < .05) and unemployment (β = − .10, p < .01) were negatively associated with partner undermining. There was no interaction effect. Nine percent of the variance in partner undermining was explained by the regression model (R 2 = .09, p < .001). For old–old females, only financial strain (β= .15, p < .05) was positively related to partner undermining. However, being a homemaker (β = − .27, p < .05) was negatively associated with partner undermining. The financial control was not related to partner undermining, and financial control did not show any moderating effect. The model explained 7% of the variability in partner undermining (R 2 = .07, p < .05).

To summarize the findings of partner support and undermining, objective financial difficulties represented by income, net worth, and job status, did not contribute to the effects of partners’ interactions as much as did subjective financial strain. Also, it was mental health rather than physical health that was more significantly associated with partners’ interpersonal functioning. The expected positive role of financial control as a resource on couple functioning was not consistent across groups.

Examination of the Moderating Effect of Financial Control

The association between financial strain and couple functioning among middle-aged males was moderated by financial control. Thus, post hoc probing of the interaction among middle-aged men was conducted by plotting the interaction. Following Cohen et al.’s (2003) recommendation, one standard deviation above and below the mean were used as the high and low levels of financial control, respectively.

As illustrated in Fig. 2, the simple slopes analysis reported that the conditional effect of financial strain on partner support was significant only at the mean (b = − .05, p < .05) and high level (b = − .09, p < .001) of financial control. Surprisingly, when middle-aged men felt financially distressed, those with high financial control experienced less supporting behavior in their relationships than their counterparts. The tests of the main effect and interaction effect indicated that for middle-aged men, financial control was not significantly associated with partner support and it failed to moderate the negative effect of financial strain on partner support.

With regard to partner undermining, probing the interaction between financial strain and control revealed that the effects of financial strain on partner undermining were significant only at the mean (b = .11, p < .001) and high level (b = .20, p < .001) of financial control. Similarly to the finding above, high financial control did not protect against the adverse effect of financial strain on negative interactions between partners (Fig. 2). Rather, in financially challenging times, high financial control may have more negative influences on partner undermining than low financial control. These findings indicate that for males aged 50–65 when the level of financial strain is high, financial control may not be beneficial. Rather, it may be harmful—in the case of higher levels of financial strain, middle-aged male partners who believe they have control of the financial situation to a considerable degree are more likely to experience negative interactions and less likely to experience positive interactions in their couple relationship.

Discussion

The purpose of the present study was to examine the association between financial strain and couple functioning among middle-aged, young-old, and old–old couples in uncertain economic times. The current study also aimed to test for a main effect of financial control (strength/resource in the ABC-X model) on couple functioning and moderating effect of financial control on the association between financial strain and couple interaction. Using the 2010 HRS, the data were analyzed separately by gender (males vs. females) and age (50–64 vs. 65–74 vs. 75 or older).

As hypothesized, financial strain was associated with couple functioning of middle-aged, young-old, and old–old Americans. When combining with previous findings on younger age groups (e.g., Conger et al. 1999), the finding markedly indicates that there is no relieved stage in life where couple relationship is freed from money worries—note that even among females around age 80 whose intimate relationship is no longer influenced by depressive symptoms, the strongest factor of couple functioning in other life stages, financial strain still exerts negative influences. These findings clearly highlight the importance of financial strain in couple relationship throughout the life course.

The findings also support the ABC-X family stress model. That is, perceptions (Factor C) statistically predict couple responses (Factor X) to stressors (Factor A). Similar to the previous study (Falconier and Epstein 2011a), subjective financial strain was associated with couple functioning, but objective financial measures were not. Thus, how a family perceives financial stressors (Factor C) is more important than objective stressors themselves (Factor A) in relation to the family’s responses to the stressors (Factor X). More specifically, financial strain was associated with both positive and negative couple behaviors. These findings are consistent with previous studies using younger samples (Conger et al. 1990; Falconier and Epstein 2010), but this finding is not consistent with a previous study (Dew and Yorgason 2010) which reported that for older couples who have been retired at the point of the study economic pressure did not explain marital conflict. However, Dew and Yorgason (2010) measured marital conflict with fight in just three domains of couple life (spending time together, division of housework, and sex).

Reduced couple functioning caused by financial strain deserves careful consideration. According to the Double ABC-X model (McCubbin and Patterson 1983), the extended version of the original ABC-X model, the exacerbated relationship itself becomes a new stressor which, in turn, may worsen the subsequent couple relationship and financial situation, possibly forming a vicious cycle. For example, partners who experience financial strain are likely to experience reduced support and increased undermining in their relationship. These negative interactions may interrupt couples’ constructive communication and collaboration required to discuss financial issues and adhere to the budget or financial goal, eventually worsening the financial situation over time. Such unhealthy couple interactions may negatively affect individuals’ physical and mental health (Walker and Luszcz 2009), which, in turn, may worsen their objective financial situation. However, it is possible that partner undermining is one’s perception of a partners’ behavior, perhaps the result of one’s emotional response to feeling a loss of control due to financial strain, and may not reflect a change in a partners’ behavior.

The main effect of financial control varied by groups, partially supporting Hypothesis 2. For young-old males, middle-aged women, and young-old women, financial control was associated with couple functioning. Such positive role of financial control in stress-coping process is consistent with previous studies that highlighted value of personal control in relation to individual’s coping responses (Kidwell et al. 2003).

However, financial control was not associated with couple functioning among old–old females, middle-aged males, and old–old males. Also, for middle-aged males, perceived financial control did not buffer the negative effect of financial strain on couple functioning—rather, it unexpectedly intensified the association. Those who believe they are in control of their finances experience more positive couple interactions only when they are experiencing low levels of financial strain. In the event of high levels of financial strain, individuals with high financial control showed lower partner support and higher partner undermining than their counterparts. Consistent with the argument that sense of control may operate harmfully, particularly in stressful situations (Burger 1989), this study found that in a stressful situation, financial control may exert negative influence to some if not a large degree on the couple relationship particularly for middle-aged males.

This phenomenon involving gender and age differences may be explained by gender-related socialization and self-concept perspectives (Conger et al. 1993). Men are more likely than women to have assumed a family provider role. Particularly, men in middle life are often expected to demonstrate their active economic roles as a breadwinner, while older men experience the loss of many socially identified roles including economic roles (Price and Humble 2010). Given that men respond to economic hardship with hostility while women somatization (Conger et al. 1993), it may be possible in a financially challenging time that middle-aged males may feel very distressed, and the males who control the situation to a high degree may do so in more aggressive ways than do females who control finance to the same degree. For example, male partners may adopt several strategies to control the stressful situation, such as goal setting and budgeting, and they may force their female partners who may be the primary spender in the family due to their role as a homemaker to strictly adhere to the budget, which subsequently may induce their female partners’ reciprocal undermining responses. Such explanation may imply different types of controlling behavior by gender, with men’s high level of controlling behavior in a financially challenging time provoking more negative interaction between partners. Thus, it would be the specific type and quality of control that is more important in stressful times than the presence of control per se. Therefore, controlling behavior which does not harm intimate relationships may be useful in a financially hard time. However, such account is based on the assumption that middle-aged men and women take traditional family roles. The middle-aged men and women of the current study are baby-boomers born from 1946 to 1960 who might have experienced shifts in family roles. Accordingly, the explanation should be interpreted carefully. There might be couple-level dynamics that may influence the role of financial control in couple relationships. However, the current study examined the data at individual level, which is limited to see the couple dynamics.

Implications

These findings provide interesting insights for financial professionals and therapists/counselors who work with middle-aged, young-old, and old–old couples. First, as hypothesized, subjective financial strain is very important in couples’ life. Given the importance of sound couple relationships with regard to family finance as well as each partner’s well-being, professionals need to pay attention not only to indicators of objective financial strain but also to subjective financial strain among middle-aged, young-old, and old–old couples. If dysfunctional interactions caused by financial strain become a new or secondary stressor in the couple relationship, the couple interactions should be modified first so that the subsequent intervention can focus on the original, primary stressor of the economic problem (Epstein and Baucom 2002).

Also, professionals need to pay attention to the varying roles of financial control by gender and age. As expected, financial control is a good quality to have for young-old males, middle-aged females, and young-old females regardless of the current financial climate. However, for middle-aged males, financial control could operate in negative ways in the couple relationship in a financially stressful situation.

A few strategies may be employed by professionals. We recommend professionals focus on intrapsychic processes of clients first then move on to their objective behaviors, because financial strain is by nature a subjective perception of an objective situation. However, note that the following strategies are not mutually exclusive, and using more than one strategy is more adaptive than adopting only one strategy (Sideridis 2006). First, the counselors/professionals can help clients focus on cognitive aspects of intrapsychic processes. Regarding cognitive coping strategies (Price et al. 2010), partners with high financial control may hold strict cognitive standards on financial situation. They may believe they must take control in any situation, even in challenging, sometimes uncontrollable, circumstances. When they face the circumstances which are not easy to control, they may feel more distressed, compared to those with more flexible standards. Counselors/professionals can help them realize they have strict cognitive standards and change them into more flexible ones.

Alternatively, the counselors/professionals can help them control their emotional reactions to financial strain, which is referred to as emotion-focused coping strategies (Lazarus and Folkman 1984) that is the type of coping behavior older people employ more than do younger people (Folkman et al. 1987). Since the mediating role of emotional responses (e.g., depression, anxiety, and anger) between financial strain and couple behavior is well-established in the literature (Conger et al. 2010), interventions addressing emotions can be useful (Bourne 2005; Epstein and Baucom 2002). Also, one partner may feel they are undermined by the other partner even in the situation that the other partner did not behave that way, because his/her emotional states which become negative due to financial strain may influence his/her perceptions. Cognitive therapists call such cognitive distortion as emotional reasoning (Epstein and Falconier 2014). If this is the case, therapists may help clients to examine whether his/her subjective emotional cues are objectively valid. To do this, financial professionals can collaborate with family or individual therapists.

After (or while) addressing clients’ cognition and emotion, professionals may deal with problem-focused coping (Lazarus and Folkman 1984) which is behavior directed at changing the objective, stressful situation. Counselors/professionals can help them maintain their sense of control over their financial situations by making them focus more on specific skills of financial management. They can help their clients start with easy and specific, thus controllable, tasks rather than overwhelming them with a mess of threatening financial factors. For example, counselors help them develop a monthly budget adjusted to the situation, monitor the implementation, and show them they can have control over a specific task before they develop a comprehensive long-term plan.

Partners with high financial control may also try to control their partners’ financial behaviors, such as spending and saving, by criticizing their partner thereby making them comply with the budget they set up. In such cases, their undermining behaviors may not be helpful in improving the financial situation, particularly in the long-term. Counselors/professionals can show possible unintended negative consequences of their behaviors and emphasize the importance of collaboration between partners to improve financial situation (Falconier and Epstein 2011a).

Limitations

The present research is not free from some flaws. First, although this study revealed the association between financial strain and couple relationship among middle-aged, young-old, and old–old couples, dyadic dynamics between partners were not addressed. To understand the experience among the elderly couples more accurately, future studies need to employ dyadic analysis strategies. Also, although the associations among variables of interest were examined, due to the cross-sectional nature of the study, information on causality among factors which requires the time-order of events cannot be drawn. Future studies should investigate the association among variables through longitudinal data analyses. Also, the present study used only the self-report modality of measurement. Self-report method is beneficial in that it measures respondents’ perception of constructs. However, it is limited in that it fails to uncover the objective reality of constructs (Kazdin 2003). Future studies may be able to use observational coding methods—for example, couples can be asked to discuss a financial issue in their relationship in a laboratory and their actual support and undermining behaviors can be recorded and systematically coded (Kerig and Baucom 2004). Lastly, financial control was measured with one general item. Even though it is assumed that measuring domain-specific control might be simpler than doing general control over life, the multifacetedness of the phenomenon of financial control may not be measured using only one item. Additional research is needed regarding the development of financial control measures.

Conclusion

The current study contributes to the knowledge on financial strain and couple relationships. Family finance is commonly understood as one of the core domains of family life. The present study used nationally representative data collected during the economic crisis to show that financial problems takes a toll on the couple relationship in the middle-aged, young-old, and old–old populations. This study reveals that the influence of financial problems on couple/family life is significant regardless of life stages. Also, the present study highlights the possible negative effects of perceived personal control over finance among middle-aged males. Financial control has generally been regarded as a positive element in financial management. In the presence of high levels of financial strain, financial control of middle-aged males can associate with negative interactions between partners, which may worsen the collaboration between partners that is required to overcome financial hardship. Theoretically, the present study suggests that the perception of a stressor is the most important factor in family responses to the stressor. Although the stressor is involved in the family process, the impact of the factor is secondary compared to that of the perception factor, which is consistent with the ABC-X family stress model (Hill 1958).

References

American Psychological Association (2015). Stress in America: Paying with our health. Retrieved from http://www.apa.org/news/press/releases/stress/2014/stress-report.pdf.

Armstrong, P. S., & Schulman, M. D. (1990). Financial strain and depression among farm operators: The role of perceived economic hardship and personal control. Rural Sociology, 55, 475–493. doi:10.1111/j.1549-0831.1990.tb00693.x.

Averill, J. R. (1973). Personal control over aversive stimuli and its relationship to stress. Psychological Bulletin, 80, 286–303. doi:10.1037/h0034845.

Aytac, I. A., & Rankin, B. H. (2009). Economic crisis and marital problems in Turkey: Testing the family stress model. Journal of Marriage and Family, 71, 756–767. doi:10.1111/j.1741-3737.2009.00631.x.

Boss, P. (1988). Family stress management: A contextual approach (2nd edn.). Newbury Park, CA: Sage.

Bourne, E. J. (2005). The anxiety and phobia workbook. Oakland, CA: New Harbinger Publications.

Bradbury, T. N., Fincham, F. D., & Beach, S. R. H. (2000). Research on the nature and determinants of marital satisfaction: A decade in review. Journal of Marriage and Family, 62, 964–980. doi:10.1111/j.1741-3737.2000.00964.x.

Burger, J. M. (1989). Negative reactions to increases in perceived personal control. Journal of Personality and Social Psychology, 56, 246–256. doi:10.1037/0022-3514.56.2.246.

Carstensen, L. L., Gottman, J. M., & Levenson, R. W. (1995). Emotional behavior in long-term marriage. Psychology and Aging, 10, 140–149. doi:10.1037/0882-7974.10.1.140.

Cohen, J., Cohen, P., West, S. G., & Aiken, L. S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences (3rd edn.). New York, NY: Routledge.

Conger, R. D., Conger, K. J., & Martin, M. J. (2010). Socioeconomic status, family processes, and individual development. Journal of Marriage and Family, 72, 685–704. doi:10.1111/j.1741-3737.2010.00725.x.

Conger, R. D., & Elder, G. H. Jr. (1994). Families in troubled times: Adapting to change in rural America. New York, NY: Aldine de Gruyter.

Conger, R. D., Elder, G. H. Jr., Lorenz, F. O., Conger, K. J., Simons, R. L., Whitbeck, L. B.,…, & Melby, J. N. (1990). Linking economic hardship to marital quality and instability. Journal of Marriage and Family, 52, 643–656. doi:10.2307/352931.

Conger, R. D., Lorenz, F. O., Elder, G. H., Simons, R. L., & Ge, X. (1993). Husband and wife differences in response to undesirable life events. Journal of Health and Social Behavior, 34, 71–88. Retrieved from http://www.jstor.org/stable/2137305.

Conger, R. D., Rueter, M. A., & Elder, G. H. Jr. (1999). Couple resilience to economic pressure. Journal of Personality and Social Psychology, 76, 54–71. doi:10.1037/0022-3514.76.1.54.

Consumer Financial Protection Bureau (2015). Financial well-being: What it means and how to help. Retrieved from http://files.consumerfinance.gov/f/201501_cfpb_digest_financial-well-being.pdf.

Creed, P. A., Hood, M., & Leung, L. Y. (2012). The relationship between control, job seeking, and well-being in unemployed people. Journal of Applied Social Psychology, 42, 689–701. doi:10.1111/j.1559-1816.2011.00798.x.

Dew, J., & Yorgason, J. (2010). Economic pressure and marital conflict in retirement-aged couples. Journal of Family Issues, 31, 164–188. doi:10.1177/0192513X09344168.

Dietz, B. E., Carrozza, M., & Ritchey, P. N. (2003). Does financial self-efficacy explain gender differences in retirement saving strategies? Journal of Women & Aging, 15, 83–96. doi:10.1300/J074v15n04_07.

Epstein, N. B., & Baucom, D. H. (2002). Enhanced cognitive-behavioral therapy for couples: A contextual approach. Washington, DC: American Psychological Association.

Epstein, N. B., & Falconier, M. K. (2014). Cognitive-behavioral therapies for couples and families. In J. L. Wetchler & L. L. Hecker (Eds.), An introduction to marriage and family therapy (2nd edn., pp. 259–318). New York: Routledge.

Falconier, M. K., & Epstein, N. B. (2010). Relationship satisfaction in Argentinean couples under economic strain: Gender differences in a dyadic stress model. Journal of Social and Personal Relationships, 27, 781–799. doi:10.1177/0265407510373260.

Falconier, M. K., & Epstein, N. B. (2011a). Couples experiencing financial strain: What we know and what we can do. Family relations, 60, 303–317. doi:10.1111/j.1741-3729.2011.00650.x.

Falconier, M. K., & Epstein, N. B. (2011b). Female-demand/male-withdraw communication in Argentinean couples: A mediating factor between economic strain and relationship distress. Personal Relationships, 18, 586–603. doi:10.1111/j.1475-6811.2010.01326.x.

Folkman, S., Lazarus, R. S., Pimley, S., & Novacek, J. (1987). Age differences in stress and coping process. Psychology and Aging, 2, 171–184. doi:10.1037/0882-7974.2.2.171.

Gurin, P., Gurin, G., & Morrison, B. M. (1978). Personal and ideological aspects of internal and external control. Social Psychology, 41, 275–296. doi:10.2307/3033581.

Hayes, A. F. (2013). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach. New York, NY: The Guilford Press.

Health and Retirement Study (2008). Guide to content of the HRS psychosocial leave-behind participant lifestyle questionnaires: 2004 & 2006. Ann Arbor, MI: Institute for Social Research, University of Michigan.

Hill, R. (1958). Generic features of families under stress. Social Casework, 39, 139–150.

Hooyman, N. R., & Kiyak, H. A. (2010). Social gerontology: A multidisciplinary perspective (9th edn.). New York: Pearson.

Ishii-Kuntz, M., Gomel, J. N., Tinsley, B. J., & Parke, R. D. (2010). Economic hardship and adaptation among Asian American families. Journal of Family Issues, 31, 407–420. doi:10.1177/0192513X09351271.

Kazdin, A. E. (2003). Research design in clinical psychology (4th edn.). Boston, MA: Allyn and Bacon.

Kerig, P. K., & Baucom, D. H. (2004). Couple observational coding systems. New York, NY: Routledge.

Kidwell, B., Brinberg, D., & Turrisi, R. (2003). Determinants of money management behavior. Journal of Applied Social Psychology, 33, 1244–1260. doi:10.1111/j.1559-1816.2003.tb01948.x.

Kinnunen, U., & Pulkkinen, L. (1998). Linking economic stress to marital quality among Finnish marital couples: Mediator effects. Journal of Family Issues, 19, 705–724. doi:10.1177/019251398019006003.

Lachman, M. E. (1986). Locus of control in aging research: A case for multidimensional and domain-specific assessment. Journal of Psychology and Aging, 1, 34–40. doi:10.1037/0882-7974.1.1.34.

Lazarus, R. S., & Folkman, S. (1984). Stress, appraisal, and coping. New York, NY: Springer.

Lincoln, K. D., & Chae, D. H. (2010). Stress, marital satisfaction, and psychological distress among African Americans. Journal of Family Issues, 31, 1081–1105. doi:10.1177/0192513X10365826.

McCubbin, H. I., & Patterson, J. M. (1983). The family stress process: The double ABCX model of adjustment and adaptation. Marriage & Family Review, 6, 7–37. doi:10.1300/J002v06n01_02.

Mewse, A. J., Lea, S. E. G., & Wrapson, W. (2010). First steps out of debt: Attitudes and social identity as predictors of contact by debtors with creditors. Journal of Economic Psychology, 31, 1021–1034. doi:10.1016/j.joep.2010.08.009.

Morin, R., & Tyalor, P. (2009). Different age groups, different recessions: Oldest are most shelterd. Retrieved from Pew Research Center website:http://www.pewsocialtrends.org/2009/05/14/different-age-groups-different-recessions/.

Pew Research Center. (2013, January 30). The sandwich generation: Rising financial burdens for middle-aged Americans. Retrieved from http://www.pewsocialtrends.org/files/2013/01/Sandwich_Generation_Report_FINAL_1-29.pdf.

Price, C. A., & Humble, A. M. (2010). Stress and coping in later life. In S. J. Price, C. A. Price & P. C. McKenry (Eds.), Families & change: Coping with stressful events and transitions (4th edn., pp. 51–71). Thousand Oaks, CA: Sage Publications.

Price, R. H., Choi, J. N., & Vinokur, A. D. (2002). Links in the chain of adversity following job loss: How financial strain and loss of personal control lead to depression, impaired functioning, and poor health. Journal of Occupational Health Psychology, 7, 302–312. doi:10.1037/1076-8998.7.4.302.

Price, S. J., Price, C. A., & McKenry, P. C. (2010). Families coping with change: A conceptual overview. In S. J. Price, C. A. Price & P. C. McKenry (Eds.), Families & change: Coping with stressful events and transitions (4th edn., pp. 1–23). Thousand Oaks, CA: Sage Publications.

Schramm, D. G., & Adler-Baeder, F. (2012). Marital quality for men and women in stepfamilies: Examining the role of economic pressure, common stressors, and stepfamily-specific stressors. Journal of Family Issues, 33, 1373–1397. doi:10.1177/0192513X11428126.

Sideridis, G. D. (2006). Coping is not an ‘either’ ‘or’: The interaction of coping strategies in regulating affect, arousal and performance. Stress and Health, 22, 315–327. doi:10.1002/smi.1114.

Skinner, E. A. (1996). A guide to constructs of control. Journal of Personality and Social Psychology, 71, 549–570. doi:10.1037/0022-3514.71.3.549.

Soldo, B. J. (1996). Cross pressures on middle-aged adults: A broader view. Journal of Gerontology, 51B, 271–273. doi:10.1093/geronb/51B.6.S271.

Stone-Romero, E. F., & Anderson, L. E. (1994). Relative power of moderated multiple regression and the comparison of subgroup correlation coefficients for detecting moderating effects. Journal of Applied Psychology, 79, 354–359. doi:10.1037/0021-9010.79.3.354.

The HRS Psychosocial Working Group (2008). Guide to content of the HRS psychosocial leave-behind participant lifestyle questionnaires: 2004 & 2006. Retrieved from http:// http://hrsonline.isr.umich.edu/sitedocs/userg/HRS2006LBQscale.pdf.

Troxel, W. M., Matthews, K. A., Bromberger, J. T., & Sutton-Tyrrell, K. (2003). Chronic stress burden, discrimination, and subclinical carotid artery disease in African American and Caucasian women. Health Psychology, 22, 300–309. doi:10.1037/0278-6133.22.3.300.

Vinokur, A. D., Price, R. H., & Caplan, R. D. (1996). Hard times and hurtful partners: How financial strain affects depression and relationship satisfaction of unemployed persons and their spouses. Journal of Personality and Social Psychology, 71, 166–179. doi:10.1037/0022-3514.71.1.166.

Walker, R. B., & Luszcz, M. A. (2009). The health and relationship dynamics of late-life couples: A systematic review of the literature. Ageing & Society, 29, 455–480. doi:10.1017/S0144686X08007903.

Wang, L., Lu, W., & Malhotra, N. K. (2011). Demographics, attitude, personality and credit card features correlate with credit card debt: A view from China. Journal of Economic Psychology, 32, 179–193. doi:10.1016/j.joep.2010.11.006.

Wilkinson, L. R. (2016). Financial strain and mental health among older adults during the Great Recession. Journals of Gerontology, 71, 745–754. doi:10.1093/geronb/gbw001.

Williams, D. R., Yu, Y., Jackson, J. S., & Anderson, N. B. (1997). Racial differences in physical and mental health: Socio-economic status, stress and discrimination. Journal of Health Psychology, 2, 335–351. doi:10.1177/135910539700200305.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Woochul Park and Jinhee Kim declares that they have no conflict of interest.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Rights and permissions

About this article

Cite this article

Park, W., Kim, J. How Are Money Worries Affecting Middle-Aged, Young-Old, and Old–Old People’s Perceived Couple Relationship?. J Fam Econ Iss 39, 34–48 (2018). https://doi.org/10.1007/s10834-017-9547-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-017-9547-2