Abstract

Using data from the Survey of Consumer Finances, this paper documented the positive correlation between the receipt of an inheritance and the expectation of leaving a bequest. Inheritance recipients were found to have a higher probability of planning to leave a bequest relative to households that had not received an inheritance. Conditional on having already received an inheritance, the likelihood of expecting to leave a bequest was even larger for households that anticipated to receive an inheritance in the future. The findings in this paper suggest that inheritances already received or expected to be received may be an important transmission mechanism underlying the bequest motive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Bequests have been a topic of interest in a range of academic literatures and also the popular press. According to a 2007 Gallup poll, it was reported that 36 % of Americans that had received an inheritance planned to leave a bequest (Rheault 2007). Within economics, it has been suggested that the act of altruism bestowed by the donor of an inheritance may influence the recipient’s preference to leave a bequest (Arrondel and Grange 2014; Stark and Nicinska 2015). Therefore, identifying the role of inheritance receipt would help enhance our understanding of the preferences underlying bequest behavior.

This paper examined whether households that received a bequest had a relatively higher likelihood of leaving a bequest. Using data from the Survey of Consumer Finances (SCF), the empirical strategy in this paper estimated a probit model to find that there was a statistically positive relationship between receiving an inheritance and the expectation of leaving a bequest. In addition, the effect of an expected inheritance on the planning of bequests was explored. There was a relatively stronger effect on the expectation of leaving an inheritance when households expected to receive an inheritance in the future. These findings suggest that bequest behavior is influenced by inheritance receipt.

We provided several additional robustness tests of the results reported in this paper. First, the probit regressions were repeated using multiple waves of data from the SCF to explore the effect of estate taxes on the relationship between bequest planning and inheritance receipt. Previous work suggested that estate taxation could potentially influence bequest behavior (Bernheim et al. 2004; Joulfaian 2005; Kopczuk and Slemrod 2003). In light of this, we examined whether bequest behavior was affected by the changes in the estate tax system called for by Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA 2001). This estate tax policy reform increased exemption levels on the value of estates and decreased the marginal estate tax rate over the period 2002–2010; the series of changes culminated in the federal estate tax system being repealed in 2010 (Figs. 1, 2).

If estate tax policy has an effect on bequest behavior, then it is reasonable to expect the estimated coefficients obtained from earlier waves of the SCF to be markedly different to the estimates from later waves because the cost of bequeathing wealth was relatively higher in the pre-EGTRRA 2001 period. However, this paper found that the empirical results were stable across the different waves that coincided with the federal estate tax reforms. As an additional test, the data sample was restricted to households with net worth above the 1998 federal exemption level of US$625,000 for individuals across all samples. This exercise allowed for the investigation of whether bequest behavior among relatively wealthy households responded differently due to the reduction in the cost of leaving a bequest. Ultimately, this paper finds that the link between inheritance receipt and the plan to leave a bequest is persistent.

The remaining robustness tests specifically examined the relationship between household characteristics and bequest behavior. We explored the differential effects on married and unmarried households, and on households with and without life insurance coverage. Then we stratified our sample into three age groups: younger (age 25–44), pre-retirement (age 45–64), and seniors (65 and up). We show that our empirical findings were robust across these different household characteristics.

This paper fits well in the literature examining the effect of inheritances on economic behavior. Using data from the Health and Retirement Survey, Brown et al. (2010) found that the receipt of an inheritance was associated with a higher likelihood of early retirement. In a closely related paper, Arrondel and Grange (2014) used historical data from France to show that there was a link between inherited wealth and the probability of transferring wealth. The current paper uses data from the United States, and also incorporates the expectation of inheriting wealth in the future along with changes to estate tax policy and household characteristics to estimate the effect of an inheritance receipt on bequest planning.

Furthermore, our paper contributes to the literature that asserted the transfer of assets across generations was intentional, rather than as an accident. According to Modigliani (1988), the life cycle model predicted that households will deplete their wealth in retirement; therefore, any wealth transferred at the end of the life cycle simply represented unconsumed wealth. In contrast, Kotlikoff and Summers (1981b) and Page (2003) argued that households intentionally saved in order to bequeath wealth. Furthermore, Gokhale et al. (2001) documented that intentional bequests may be a source of wealth inequality across households.

Understanding the effect of inheritances on bequest behavior is important for several reasons. First, if receiving an inheritance motivates households to leave a bequest, then existing models of the determinants of bequests may be lacking due to the omission of the receipt of inheritances. Second, the role of inheritances in shaping bequest motives may have implications for the accumulation of aggregate capital in the economy; and, as a consequence, the perpetuation of wealth inequality. Third, this paper has implications for the notion that bequests may undo the effects of government redistribution, which is a principal known as Ricardian Equivalence.

Literature Review

There exists a large literature on bequests that widely covers topics such as the response of bequests to estate taxes and the effects of bequests on health and child achievement. Kopczuk and Slemrod (2003) showed that individuals attempted to live longer in order to bequeath wealth when a favorable estate tax policy was in place. Their suggestion that estate taxes affect bequest behavior has been corroborated by other papers. For example, Page (2003) and Joulfaian (2005) documented that higher estate taxes are associated with less wealth being bequeathed.

Using historical French data, Arrondel and Grange (2014) suggested that the past receipt of inheritances influenced the recipients’ decision to leave a bequest. Stark and Nicinska (2015) used data from the Survey on Health, Ageing and Retirement in Europe (SHARE) to show that inheritance receipt and the expectation of receiving an inheritance had positive effects on the intention to leave a bequest. Zagorsky (2013) used survey data to show that households saved about half of the proceeds from an inheritance; this might suggest that some of the savings will be passed on as a bequest. This paper examines the effects of actual and expected inheritance receipts on the intention to leave a bequest for households in the United States during a period when the estate tax rate was changing.

Using the Health and Retirement Survey (HRS), Kim and Ruhm (2012a) found that inheritance receipt was associated with an increase in alcohol consumption for individuals that were seniors. However, the authors were unable to find a statistically significant effect of bequests on mortality and different measures of health outcomes such as obesity. Using earnings as a measure of a child’s achievement, Grawe (2010) found the effect of family size on earnings was larger for children who had received an inheritance.

Bequest planning has been cited as a source of wealth inequality (Gokhale et al. 2001). In a recent paper, Piketty and Saez (2013) discussed the importance of bequests in influencing wealth inequality. They argued that if society favors households that have little inheritances, then taxes on bequests should be relatively high. This type of estate tax policy will help to reduce wealth inequality, which was argued to be exacerbated by bequests in the literature. The findings in this paper add to literature on the potential role of bequests in generating wealth inequality.

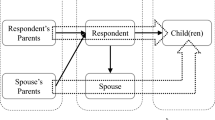

In previous work on the determinants of bequests, Barro (1974) and Becker (1974) showed that bequests were motivated by altruism where parents cared about the well-being of their children. Other work such as Kotlikoff and Spivak (1981a), Bernheim et al. (1985) and Cox and Rank (1992) argued that parents provided an inheritance to their children to elicit certain behavior from them. It remains an open question, which this paper aims to help answer, as to whether the recipients of inheritances will reciprocate by passing on wealth to their future heirs.

This paper empirically showed that past inheritance receipt and expected receipt were correlated with the household’s decision to leave a bequest. We further demonstrated the robustness of these findings by examining the effect of taxes on bequests and controlling for household characteristics that may influence bequest behavior.

Empirical Framework

In the empirical analysis, a probit model was estimated to examine the likelihood of expecting to leave an inheritance (Expect Leave Inheritance). The main independent variables were binary and indicated whether the household had received an inheritance (Inheritance), and whether receiving an inheritance was expected in the future (Expect Inheritance). Along with the main independent variables, the following control variables were included in the empirical model: age of the head of the household and a quadratic term for age, the number of children in the household, marital status of the head of the household, whether the head of the household had a college degree, health status of the head of the household, gender status of the head of the household, the log of household income, the log of household net worth, whether the household had provided financial support to others through gift giving (to control for inter vivos effects), and whether the head of the household had life insurance coverage. It is important to account for these variables since they represent household characteristics that may influence the household decision to leave a bequest.

This paper estimated the following baseline equation using probit analysis with the inclusion of a constant term \((\beta _0)\):

where \(X_i\) was a vector of control variables, \(\epsilon _i\) was the error term, i indexed households and \(\Phi\) was the cumulative distribution function. Equation 1 was estimated separately for each of the cross-sectional waves of the SCF. For some specifications reported in this paper, Eq. 1 was estimated using a pooled sample of the cross-sectional waves along with year fixed effects to control for macroeconomic shocks. After estimating the coefficients in Eq. 1, the estimated marginal effects evaluated at the means were reported along with robust standard errors that were adjusted for imputation bias since the SCF used a multiple imputation method to impute missing values when it assembled the surveys.Footnote 1

Data

The data used in this paper came from the triennial waves of the Survey of Consumer Finances (SCF), which are publicly provided by the Federal Reserve. The SCF collected survey responses from a nationally representative sample of households in the United States on demographic characteristics, wealth, and investment decisions along with other items related to the composition and economic behavior of the household. In this study, the 1998, 2001, 2004, 2007, and 2010 waves of the SCF were used in the empirical estimations. The SCF had not followed the same household over time; rather, it interviewed a new sample of households every three years. Descriptive statistics for the various SCF waves are reported in Table 1.

Using the responses collected by the SCF, information was gathered on whether or not households expected to leave an inheritance. Households who were uncertain of whether they expect to leave an inheritance were excluded, and the sample of households was further restricted to those headed by adults aged 25 and above for whom we expect to see more financial planning.Footnote 2 In the final samples, the number of households surveyed ranged from 3230 in 1998 to 4618 in 2010. In Table 1, we report that the share of households that expected to leave an inheritance was 48 % in 2010. In the same survey year, 24 % of households had received an inheritance and 12 % expected to receive an inheritance at some point in the future.

In this study, we used information on the characteristics of the head of the household such as age, marital status, gender, health status, college educated, and self-employed.Footnote 3 Including characteristics of the head of the household in this analysis is important to control for factors that may influence financial decisions because it is reasonable to assume that the head ultimately makes the financial decisions in the household.Footnote 4 For example, Whitaker et al. (2013) documented that women tended to save more compared to men, and this may indicate that households headed by women may have had higher net worth. We also included variables to indicate whether the household was White or non-White, the number of children in the household, whether the household had life insurance coverage, and whether the household had provided financial support to others in the form of gifts (inter vivos transfers).

According to Table 1, in 2010, the average age of the heads of the household was 53 years, 56 % of the heads of the household were married, 48 % of the heads of the household had a college degree, 22 % of the heads of the household were self-employed, and 23 % of households are headed by females. Self reported health status ranged from excellent to poor health and, in 2010, average health status was reported as good for the head of the household. Furthermore, 90 % of households had between 0–2 children, 74 % were White, 70 % had life insurance coverage, and 20 % had provided gifts.

Financial variables such as total household income before taxes and net worth were included in the estimations. The median household in 1998 earned roughly US$46,000 in income with that figure reaching a peak of US$52,000 in 2004 before falling back to US$46,000 in 2010. Median net worth was reported to be US$94,000 in 1998 but fell by 15 % to US$80,000 in 2010. The measure of net worth excluded the cash value of life insurance policies, which was reported as US$42,344 in 2010.Footnote 5 The financial variables, income, net worth, and the cash value of life insurance policies, were deflated using the Bureau of Labor Statistics’ consumer price index (\(2010=100\)), and were transformed into logarithms.Footnote 6

Results

Figures 3 and 4 plot the individual shares of households from the 2010 SCF wave who expected to leave an inheritance, conditional on whether the household received an inheritance or if an inheritance was expected to be received. Our analysis found that 64 % of households who received an inheritance expected to leave an inheritance while 43 % of households who had not received an inheritance expected to leave an inheritance. A similar pattern is observed in the shares of households who expected to leave an inheritance conditional on whether an inheritance was expected to be received. When expecting to receive an inheritance, 75 % of all households expected to leave an inheritance; conditional on not expecting to receive an inheritance, 44 % of households expected to leave an inheritance. All else equal, these results indicate that households who received or expected to receive an inheritance were more likely to bequeath wealth and, thus, describe a significant bequest pass through mechanism.

Going beyond these conditional probabilities, we statistically examined the relationship between the expectation to leave a bequest and inheritance—whether already received or expected to be received. Table 2 displays the baseline results obtained by estimating Eq. 1 using the 2010 SCF wave. In Column 1, it is found that having received an inheritance was associated with a 22 percentage point increase in the expectation of leaving an inheritance. When the full set of control variables were included, the expectation of leaving an inheritance had fallen by 6 percentage points to 16 percentage points. As can been seen in Table 2, there is statistically significant evidence that households who had received or expected to receive an inheritance had a higher expectation of leaving bequests, and models including the full set of control variables had consistently produced a better explanatory framework as suggested by the higher pseudo R-squared. Also, probit regressions were estimated with and without the control variables to demonstrate that the estimated coefficients on the main independent variables are not spurious or biased because of potential correlation with control variables such as income and net worth.

In Columns 3 and 4, inheritance was dropped from Eq. 1 and the binary dependent variable was regressed on a main variable indicating whether the household expected to receive an inheritance. It is found with statistical significance that the expectation of leaving a bequest had increased by 33 and 27 percentage points without and with controls, respectively. In Columns 5 and 6, both variables, had received an inheritance and the expectation of receiving an inheritance, were included in the probit models. With controls included, the effect of having received an inheritance was associated with a 14 percentage point increase in the expectation of leaving an inheritance; expecting to receive an inheritance was associated with a 25 percentage point increase in the expectation of leaving a bequest.

In the specifications with the full set of control variables, age and a quadratic for age were included; the latter was included to account for a non-linear relationship between age and the expectation of leaving a bequest. Younger households were found to have a lower expectation to leave a bequest. Also, in these specifications, it is found that households with more children had a relatively higher expectation of leaving a bequest. A lower expectation of leaving a bequest was associated with households headed by an individual with relatively poorer health. Heads of the household who are self-employed were found to have a higher expectation of leaving a bequest. For these households, it could be the case that the self-employed own a small business which they plan to leave as a bequest. Furthermore, households with heads who have a college degree had a higher expectation of leaving an inheritance, but those headed by females were found to have a lower expectation of leaving a bequest.

Across the different specifications used in Table 2, financial variables were associated with an increase in the expectation of leaving an inheritance. Increases in log income and log net worth were each associated with small but statistically significant increases in the expectation of leaving an inheritance. If households provided financial support to others in the form of gifts (inter vivos transfers), the expectation of leaving an inheritance had increased by 16 percentage points in Column 6. Also, in Column 6, having life insurance coverage increased the expectation of leaving an inheritance by 6 percentage points. This points to life insurance and inter vivos transfers not competing with the bequest motive. Rather, life insurance, inter vivos transfers, and bequests seem to operate as complementary means by which intergenerational wealth is transferred.

According to Table 2, the increase in the expectation of leaving an inheritance was two times greater than expecting to receive an inheritance for those having already received an inheritance. This finding suggests that expecting to receive an inheritance matters more for bequest planning than does previous inheritance receipt. A plausible explanation for this finding is that the household may choose to consume, or had consumed, a received inheritance and plans to set aside the inheritance it expects to receive as a bequest. Nonetheless, we show that prior or expected inheritance receipt were correlated with a higher expectation of leaving a bequest. Arrondel and Grange (2014) suggested that family tradition plays a role in bequest behavior and that households who received inherited wealth were more likely to bequeath wealth. It may be the case that to continue the tradition of passing resources among generations, the current generation that received an inheritance is more likely to bequeath wealth to the future generation.

An issue not addressed by the results in Table 2 is that taxes on estates may increase the cost of bequeathing wealth, which in turn affect economic behavior. Without controlling for this effect, the estimates reported in Table 2 may be biased. We address this issue by using the 2010 SCF wave as our baseline sample because federal estate taxes were broadly repealed that year.Footnote 7 In this setting, we observed that having received an inheritance and expecting to receive an inheritance were associated with increases in the expectation of leaving an inheritance.

To explore the implications of estate tax changes on economic behavior, the baseline equation was estimated separately for each wave of the SCF. Later waves coincided with the Economic Growth Tax Relief and Reconciliation Act enacted in 2002, which was intended to reduce the tax burden associated with bequeathing estates. The 1998 and 2001 waves represent the pre-EGTRRA samples and 2004, 2007 and 2010 are the post-EGTRRA samples. The results reported in Table 3 demonstrated that changes in the US estate tax law regime had not altered the relationship previously observed between inheritance receipt or expecting to receive an inheritance and the expectation of leaving an inheritance. We used a pooled sample of all households across all waves of the SCF and included year fixed effects in Column 6 to control for macroeconomic shocks. The results reported are similar to those contained in Column 5, which represents our baselines estimates using the 2010 SCF wave.

Households with net worth above the federal estate tax exemption level may behave differently compared to those with net worth below the exemption level. In Table 4, we accounted for potential heterogeneous effects from estate taxes by estimating the baseline equation separately for all waves of the SCF based on samples restricted to households with net worth above the 1998 estate tax exemption level. Across all SCF waves and adjusting for inflation the 1998 US$625,000 estate tax exemption level for individuals, it was found that households who potentially faced paying estate taxes were associated with having a higher expectation of leaving a bequest when they had received an inheritance or expected to receive an inheritance. It is noteworthy that the basic results do not change for this group; having had received an inheritance or expected to receive an inheritance were positively correlated with the expectation of leaving a bequest. Additionally, there is no evidence that changes to the estate tax system markedly altered the calculus of expecting to leave a bequest for either the full sample or the subset of wealthier households in the SCF.

In Table 5, the baseline regression was estimated separately for households with non-married and married heads, and for households with and without life insurance coverage. The effect of inheritance receipt was found to be twice as large for households headed by unmarried individuals than for households headed by married individuals. However, the marginal effects for those who expected to receive an inheritance were similar between married and unmarried households. Comparing households with and without life insurance coverage, the effect of inheritance was documented to be larger for households with no life insurance coverage. Consistent with Columns 1a and 1b, the effect of expecting to receive an inheritance was similar across life insurance and no life insurance households. In Column 2a, we included the log of the cash value of life insurance policies and found that an increase in the cash value of life insurance policies was associated with an increase in the expectation of leaving an inheritance.

In Table 6, the 2010 SCF sample was disaggregated into three distinct age groups and the baseline equation was estimated for each group. We classify households headed by adults aged between 25 and 44 as younger, between 45 and 64 as pre-retirement, and over 64 as seniors. The effect of inheritance on the expectation of leaving an inheritance was not statistically significant for younger households. However, younger households who expected to receive an inheritance had a higher expectation of leaving an inheritance. The roles of inheritance receipt and expected inheritance receipt influenced the expectation of leaving an inheritance for pre-retirement and senior households. Interestingly, there was a stronger correlation between net worth and the expectation of leaving an inheritance for seniors compared to younger and pre-retirement households. This may not be surprising since Kim et al. (2012b) found a correlation between a bequest motive and stock ownership among seniors, which may indicate that seniors attempt to build wealth through stock ownership to bequeathe. Finally, life insurance coverage and gift giving had positive effects on the expectation of leaving a bequest for younger and pre-retirement households, but not for senior households.

Discussion and Conclusion

This study began with the insight that past inheritance receipt may influence the household’s decision to leave a bequest. In this paper, the relationship between inheritances (received and expected to receive) and the expectation of leaving a bequest for households was empirically evaluated using the SCF. Specifically, a probit function was estimated, which produced marginal effects computed at the means. The results show that inheritance receipt was positively associated with an increase in the expectation of leaving a bequest. Specifically, inheritance receipt was associated with a 14 percentage point increase in the expectation of leaving a bequest. In addition, the expectation of a receiving an inheritance was correlated with a 25 percentage point increase in the expectation of leaving a bequest.

The results reported in this paper were also robust to changes in estate tax policy and controlling for household characteristics. Previous work had shown that estate taxes influenced bequest planning. Our results suggest that the correlation between inheritance receipt (actual or expected) and the decision to leave a bequest was unaffected by changes in estate tax policy. Finally, after controlling for household characteristics such as household income and the number of children in the household, the positive correlation between inheritance receipt and the decision to leave a bequest was persistent.

To summarize, this paper provides suggestive evidence that households who expect to receive, or had already received, an inheritance had a higher expectation of leaving a bequest. This indicates that there is an inheritance-bequest link that may be supported by the idea that households want to continue the tradition of family transfers of resources across generations. In addition, households might reciprocate the act of altruism associated with receiving an inheritance by passing on a bequest. Johar et al. (2015) suggested empirical evidence that there is reciprocation between parents and children in financial transfers. Overall, our results contribute to the literature by suggesting that inheritance receipt may be an important factor underlying the bequest motive, and, hence, the decision to leave a bequest.

The SCF is a comprehensive dataset containing information on household’s expectation of leaving an inheritance as well as prior inheritance receipt and the expectation of receiving an inheritance. The goal of this paper was to estimate reduced form models using the SCF data to ascertain the correlation between the planning of bequests and inheritance receipt. However, there are limitations in our method as the data was purely observational and the source of the data was based entirely on survey responses. Nonetheless, the strength of the patterns reported in this paper and their consistency across a very broad range of socioeconomic circumstances suggested that our findings were likely to be an important and useful contribution for future research on understanding bequest behavior.

Furthermore, this study is important because of the growing concern about rising wealth inequality in the United States. Policymakers and researchers had suggested that inheritances and family financial support were among the mechanisms driving the inequality of wealth. Inheritance receipt was more likely to add to wealth and, therefore, lead to further widening of the wealth gap between households that had received an inheritance and those that had not. In the popular press, the idea that rich households will continue to amass wealth while poor households remain trapped in poverty has gained a lot of concern. There is growing support that government should do something to help the less affluent build wealth. Our study suggested that policy changes aimed at reducing the wealth gap, such as establishing automatic savings into retirement plans, should promote wealth accumulation among households that had not received an inheritance to help them build financial assets that they can pass on to future generations.

While our results make some progress towards further understanding the bequest motive, other related questions immediately arise. First, if the uneven distribution of inheritances increases the inequality of wealth distribution, how much of wealth inequality may be accounted for by our observed pass-through mechanism? Second, if saving to create estates is an important source of capital in the economy, should taxes on estates be avoided? The stability of our results across cohorts facing varying tax regimes suggests the relationship between inheritances and bequests is not easily manipulated by policy changes. Third, would a more stable change in tax law result in a markedly different outcome? The tax changes implemented under EGTRRA were temporary and gradual. It is possible that a permanent change in policy would markedly alter the pass-through mechanism. We leave these issues, and other potential extensions, for future work.

Notes

The procedure used to adjust the standard errors for imputation bias is taken from the Survey of Consumer Finances. A detailed description of this procedure can be found in the 2010 SCF codebook.

When excluding households who are uncertain of whether they expect to leave an inheritance and households headed by adults younger than 25, the total number of households in 2010 was reduced from 6482 to 4618.

These variables are standard in the analysis of bequests. For example, Kao et al. (1997) use these variables in their analysis of the expectation of leaving a bequest using SCF 1989 data.

In married-couple and unmarried-partner households, especially, it is difficult to determine who is the financial decision maker. However, it may be reasonable to use the individual who was declared as the head of the household as a proxy for the financial decision maker.

Net worth was defined as financial assets + physical assets − liabilities. Furthermore, the measure of net worth included balances on defined benefit retirement instruments and thrift plans, but excluded the current cash value of whole life insurance policies.

In the case that a financial variable, denoted as a generic variable z, takes a value of 0, we applied the following transformation: log(1 + z). In addition, in the case that net worth takes a negative value, the following transformation was applied: sign(net worth) × log(1 + abs(net worth)). Both of these transformations ensured that all observations were included in the sample regardless if the financial variables took a 0 or negative value.

Although the estate tax was repealed in 2010, heirs of decedents had a choice of applying either the 2010 or 2011 tax laws to their inherited estates. In 2010, the stepped up basis was repealed which made estates bequeathed in that particular year subject to capital gains taxes; however, the stepped up basis was reenacted in 2011 which allowed estates to be exempt from capital gains taxation. Heirs may have found it financially favorable to apply the 2011 estate tax law (35 % estate tax rate and US$5 million exemption level) in 2010 if their total estate tax bill was lower than the potential capital gains tax they would have paid in 2010. Also, some state governments enacted their own inheritance tax policies in response to the enactment of EGTRRA 2001. Therefore, although some households did not pay estate taxes to the federal government in 2010, they might have paid estate taxes to state governments.

References

Arrondel, L., & Grange, C. (2014). Bequests and family traditions: The case of nineteenth century France. Review of Economics of the Household, 12, 1–21. doi:10.1007/s11150-013-9216-7.

Barro, R. J. (1974). Are government bonds net wealth? Journal of Political Economy, 82, 1095–1117. doi:10.1086/260266.

Becker, G. S. (1974). A theory of social interactions. Journal of Political Economy, 82, 1063–1093. doi:10.1086/260265.

Bernheim, B. D., Shleifer, A., & Summers, L. H. (1985). The strategic bequest motive. Journal of Political Economy, 93, 1045–1076. doi:10.1086/261351.

Bernheim, B. D., Lemke, R. J., & Scholz, J. K. (2004). Do estate and gift taxes affect the timing of private transfers? Journal of Public Economics, 88, 2617–2634. doi:10.1016/j.jpubeco.2003.11.004.

Brown, J. R., Coile, C. C., & Weisbenner, S. J. (2010). The effect of inheritance receipt on retirement. Review of Economics and Statistics, 92, 425–434. doi:10.1162/rest.2010.11182.

Cox, D., & Rank, M. R. (1992). Inter-vivos transfers and intergenerational exchange. Review of Economics and Statistics, 74, 305–314. doi:10.2307/2109662.

Gokhale, J., Kotlikoff, L. J., Sefton, J., & Weale, M. (2001). Simulating the transmission of wealth inequality via bequests. Journal of Public Economics, 79, 93–128. doi:10.1016/S0047-2727(00)00097-9.

Grawe, N. D. (2010). Bequest receipt and family size effects. Economic Inquiry, 48, 156–162. doi:10.1111/j.1465-7295.2008.00208.x.

Johar, M., Maruyama, S., & Nakamura, S. (2015). Reciprocity in the formation of intergenerational coresidence. Journal of Family and Economic Issues, 36, 192–209. doi:10.1007/s10834-013-9387-7.

Joulfaian, D. (2005). Choosing between gifts and bequests: How taxes affect the timing of wealth transfers. Journal of Public Economics, 89, 2069–2091. doi:10.1016/j.jpubeco.2004.11.005.

Kao, E. Y., Hong, G., & Widdows, R. (1997). Bequest expectations: Evidence from the 1989 Survey of Consumer Finances. Journal of Family and Economic Issues, 18, 357–377. doi:10.1023/A:1024943421055.

Kim, B., & Ruhm, C. J. (2012). Inheritances, health and death. Health Economics, 21, 127–144. doi:10.1002/hec.1695.

Kim, E. J., Hanna, S. D., Chatterjee, S., & Lindamood, S. (2012). Who among the elderly own stocks? Ability and bequest motive. Journal of Family and Economic Issues, 33, 338–352. doi:10.1007/s10834-012-9295-2.

Kopczuk, W., & Slemrod, J. (2003). Dying to save taxes: Evidence from estate-tax returns on the death elasticity. Review of Economics and Statistics, 85, 256–265. doi:10.1162/003465303765299783.

Kotlikoff, L. J., & Spivak, A. (1981). The family as an incomplete annuities market. Journal of Political Economy, 89, 372–391. doi:10.1086/260970.

Kotlikoff, L. J., & Summers, L. H. (1981). The role of intergenerational transfers in aggregate capital accumulation. Journal of Political Economy, 89, 706–732. doi:10.1086/260999.

Modigliani, F. (1988). The role of intergenerational transfers and life cycle saving in the accumulation of wealth. Journal of Economic Perspectives, 2, 15–40. doi:10.1257/jep.2.2.15.

Page, B. R. (2003). Bequest taxes, inter vivos gifts, and the bequest motive. Journal of Public Economics, 87, 1219–1229. doi:10.1016/S0047-2727(01)00177-3.

Piketty, T., & Saez, E. (2013). A theory of optimal inheritance taxation. Econometrica, 81, 1851–1886. doi:10.3982/ECTA10712.

Rheault, M. (2007). Most Americans don’t expect to receive an inheritance. http://www.gallup.com/poll/28519/most-americans-dont-expect-receive-inheritance.aspx.

Stark, O., & Nicinska, A. (2015). How inheriting affects bequest plans. Economica, 82, 1126–1152. doi:10.1111/ecca.12164.

Whitaker, E. A., Bokemeiner, J. L., & Loveridge, S. (2013). Interactional Associations of Gender on Savings Behavior: Showing gender’s continued influence on economic action. Journal of Family and Economic Issues, 34, 105–119. doi:10.1007/s10834-012-9307-2.

Zagorsky, J. L. (2013). Do people save or spend their inheritances? Understanding what happens to inherited wealth. Journal of Family and Economic Issues, 34, 64–76. doi:10.1007/s10834-012-9299-y.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

DeBoer, D.R., Hoang, E.C. Inheritances and Bequest Planning: Evidence from the Survey of Consumer Finances. J Fam Econ Iss 38, 45–56 (2017). https://doi.org/10.1007/s10834-016-9509-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-016-9509-0