Abstract

This study is the first to evaluate the effect of sources of information on households’ consistency between their risk attitude when making savings and investment decisions and risk behavior displayed when they do save and invest. As the responsibility is being shifted to individuals to save for their own financial future, it is important that individuals and households save and invest in a manner that is consistent with their financial risk tolerance. Financial planners were found to provide significant value to households on the consistency of their financial risk attitude and behavior. The implications of this work are far-reaching in the financial planning arena.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Several key factors in people’s financial lives have simultaneously come into critical alignment, producing challenges that were not faced before. Defined benefit pension (DB) plans that guarantee retirement income are nearly a thing of the past. Replacing the DB plans are defined contribution (DC) plans that shift the responsibility of saving and investing to the participant. According to the US Department of Labor (2013), the total number of private DB plans was 103,346 in 1975 and 45,256 in 2011; and the total number of private DC plans was 207,748 in 1975 and 638,390 in 2011 (Fig. 1). This shift of responsibility puts more emphasis on individuals to save for their own financial future.

Another factor is the increased longevity. In 1950, the life expectancy at birth for both men and women in North America was age 68.7. In 2010, it had risen to age 79.0 (United Nations 2012, p. 4). It is expected to continue rising to age 83.2 by year 2045 (United Nations 2012, p. 4). Longevity risk is viewed from two perspectives: individuals and corporate entities (e.g., pension sponsors and insurance companies). Companies are concerned with the liabilities they have from providing defined benefit pension payments and insurance companies’ potential exposure to annuity payment guarantees and long-term care benefits. Individuals are concerned about exhausting their investment pool of resources in their later years.

The third factor is Social Security. Increased longevity coupled with decreased fertility is producing an increasing problem for workers and the systems designed to support them in their old age. When the Social Security system started in 1935, life expectancy was 61.7 years old and the earliest a participant could start receiving benefits was age 65 (Social Security Administration 2013). Early in the history of the Social Security System, there were over 40 people paying into the system for each recipient; by 2010, there were less than 3 and it is projected to be less than 2 by 2030 (Social Security Administration 2013). The Social Security system’s trust fund reserves will be depleted by 2033 and will only be able to pay 77 % of promised benefits after that time (Social Security Administration 2013). The once sound foundations for retirement income from Social Security for people older than 65 are now uncertain for future retirees.

All these factors have left individuals to fend for themselves financially to some degree. Unfortunately, individuals have proven to not be well adapted to taking good care of themselves financially (Gathergood 2012). The confluence of the aforementioned issues challenge the current generation to make the best financial decisions and require them to wager their financial lives on the outcome.

Meanwhile, the sheer volume of and sources for financial information grew exponentially. In 1984 (the first year the Census Bureau asked about computers), only 8.2 % of households had computers at home. Having an Internet connection was not yet even included as a question (File 2013). By 2011, computers were in 75.6 % of households and 71.7 % had an Internet connection. The Internet had become a viable complement to information of all sorts, including financial information (File 2013). The tsunami of information available has proven to be a mixed blessing (Carlson 2003; Ho and Tang 2001). To make a rational decision, an individual not only needs to have complete access to information, but also the ability to identify accurate information and process the information. Sheer volume of information is not enough; having time to sort it out and a good understanding of it all is what matters. To some extent, the financial information flood from the Internet has been useful; but in some respects, it has also worsened the problem of information overload. People can be paralyzed by having too much information to digest.

The coming together of the evolution of pension plans, the strain on Social Security’s resources, the increased longevity, the financial market volatility, and information overload has challenged people’s financial plans. Society has an obvious vested interest in the result of all these problems coming together. The better prepared individuals are to meet their financial challenges, the less likely they will be to rely on the public’s financial resources. Individual financial success could also affect the wealth distribution to future generations through intergenerational transfers. At this critical time, in order to have a successful financial future, it is more important than ever that individuals understand the financial situation they face, understand what they should do, and do what they plan to do.

During times of market and economic turmoil, people many times react in ways inconsistent with their long-term stated financial goals and risk tolerance (Ciccone 2011; Statman et al. 2006; Yao et al. 2013). This behavioral bias can negatively affect their long-term financial success by producing unnecessary realization of portfolio losses and imposing opportunity cost in the future. Investment behavior directly affects household wealth accumulation (Keister 2000). It is important that individuals and households save and invest in a manner that is consistent with their intended financial goals and risk tolerance.

This study is the first to evaluate the effect of sources of information on households’ consistency between their risk attitude when making savings and investment decisions and risk behavior displayed when they do save and invest. This study seeks to understand the effects of using various sources of information on households’ construction of portfolios. Specifically, it examines households’ self-stated risk tolerance and explores whether households’ current portfolio is consistent with their desired risk. In particular, this study examines whether one source of information is more effective in helping households act consistently with their self-stated risk tolerance than other sources and, if so, how. The implications of this work are potentially far reaching in the financial planning arena and beyond to other disciplines.

Review of Literature

The Concept of Risk Tolerance

Pratt (1964) and Arrow (1965) developed two different yet related concepts of people’s risk aversion when making decisions under risk. Under the assumption that wealth provided utility, Pratt (1964) showed that people who were more risk averse would invest a smaller portion of wealth in a risky asset. Arrow (1965) developed the concept of relative risk aversion and suggested if risk aversion decreases with wealth, people with more wealth would invest a larger portion of wealth in risky assets.

Risk aversion is how much households avoid risks. Risk tolerance, on the contrary, is how much households accept risks. Conceptually, risk tolerance is the opposite of risk aversion. Barsky et al. (1997) and Gron and Winton (2001) defined risk tolerance as the inverse of risk aversion. Grable (2000) defined risk tolerance as the most uncertainty a household would take when making a financial decision.

Measures of Risk Tolerance

Risk tolerance is not directly observable and, therefore, challenging to measure (Yao and Curl 2011). Two main methods were used in past research to measure risk tolerance: assessing risky investment behavior (objective measure) and using surveys to ask questions related to risk tolerance (subjective measure).

Objective measures were usually related to a ratio of risky assets divided by total assets (e.g., Riley and Chow 1992), total financial wealth (e.g., Guiso et al. 1996; Jianakoplos and Bernasek 2008), net worth (e.g., Chang et al. 2004), or total assets in DC plans (e.g., Bernasek and Shwiff 2001). Subjective risk tolerance involved ranking investment alternatives (e.g., McInish et al. 1993), choice of hypothetical income gamble questions (e.g., Kimball et al. 2008), investment and/or insurance decisions (e.g., Halek and Eisenhauer 2001; Chaulk et al. 2003), lottery participation decisions (e.g., Hartog et al. 2002), willingness to take financial risks (e.g., Yao et al. 2011), or a combination of questions related to risk attitudes (e.g., Grable 2000).

The Effect of Subjective Risk Tolerance on Objective Risk Tolerance

Among past research that examined the effect of subjective risk tolerance on objective risk tolerance, most used the Survey of Consumer Finances (SCF) data, some used the Health and Retirement Study (HRS) data, and others collected their own data.

Using the 2001 SCF data, Chang et al. (2004) examined the effect of subjective risk tolerance on objective risk tolerance. Subjective risk tolerance was measured based on respondents’ risk and expected return answers to the SCF risk tolerance question. Objective risk tolerance was measured as a ratio of risky assets to net worth. Subjective risk tolerance was found to positively affect objective risk tolerance. Fan and Xiao (2006) also used the SCF data and examined the effect of risk attitude on stock ownership. Subjective risk tolerance was found to positively affect American households’ stock ownership.

Using the first wave of the Health and Retirement Survey (1992 HRS), Hariharan et al. (2000) assessed risky behavior in investments, including the proportion of financial assets invested in risk-free securities, stocks, and bonds, and the fraction of risky assets devoted to bonds. The results showed that subjective risk tolerance was inversely related to an individual’s probability to purchase risk-free assets; however, subjective risk tolerance did not affect the composition of an individual’s portfolio of risky assets. Kimball et al. (2008) found that risk tolerance, as measured by answers to the hypothetical income gamble questions in the HRS, significantly affected household asset allocation decisions.

After analyzing data collected from 1740 respondents who participated in an internet survey, Grable et al. (2009) concluded that self-classified risk tolerance was significantly associated to the proportion of equity holdings in their portfolio. Although the sample size was not small, there may be systematic differences between people who participated in the Internet survey and those who chose not to participate. Caution should be used to interpret this result.

The Effect of Consulting a Financial Planner on Risk Tolerance: Attitudes and Behavior

As households became more responsible for the outcomes of their financial planning efforts, some turned to professional financial planners for information and advice. Several studies attempted to provide answers to the question of whether planners were up to the task of providing positive results. On one hand, research found that financial planners were qualified to provide accurate information and assistance to households (Nofsinger and Varma 2007). They could provide investors with net utility by taking advantage of economies of scale in acquiring desirable knowledge and helping investors avoid material errors (Bluethgen et al. 2008). On the other hand, past research concluded that the information and assistance provided by financial planners helped households (Bluethgen et al. 2008).

Other Determinants of Risk Tolerance

Previous research has found that factors that affect risk tolerance include demographic and economic characteristics and expectations of the future. Grable (2000) examined factors that affected the probability of households having a certain level of risk tolerance. He found that age, education, income, amount of financial knowledge, and economic expectations had positive effects on respondents’ risk tolerance. Being a male and being married were also positively associated with a higher level of risk tolerance, which was also confirmed by findings in Yao and Hanna (2005).

Coleman (2003) found Whites held a higher percentage of risky assets in their net worth than Hispanics. The author also found that age and education had a positive effect and household size had a negative effect on the likelihood of being willing to take some financial risks. However, using the HRS measure of risk tolerance, Halek and Eisenhauer (2001) found that Blacks and Hispanics were more risk tolerant than Whites. The difference in the findings on the racial/ethnic effect on risk tolerance of these two studies may be related to how risk tolerance was measured. Coleman (2003) and Yao et al. (2005) concluded that Blacks and Hispanics were less likely to be willing to take financial risks; however, among those who take some risks, Blacks and Hispanics were more willing to take substantial financial risks than Whites. It is likely that the HRS measure of risk tolerance coincides with the substantial financial risk tolerance measured in the SCF data. Given a small percentage of respondents who were willing to take substantial risks and a large percentage of respondents who were not willing to take some risks, it is reasonable that Blacks and Hispanics have a lower proportion of risky assets in their net worth on average.

Yao et al. (2005) found that income and wealth had a positive relationship with risk tolerance, and that self-employed respondents were more risk tolerant than employees. The authors also found that respondents with a good self-perceived health were more risk tolerant than those who reported fair or poor health. However, Halek and Eisenhauer (2001) concluded that self-employment decreased risk tolerance and that risk tolerance decreases with wealth until it reaches a certain level and then increases. Again, the differences in findings may be related to the measures of risk tolerance. Grable (2000) found that respondents who had more positive economic expectations were more risk tolerant than those with expectations that were not as positive.

Conceptual Model and Hypothesis

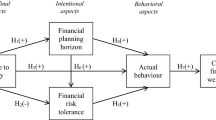

Households constantly face decisions. Information about the available alternatives is needed. This section provides a conceptual model to explain how rational households make a savings and/or investment decision and how they decide which source of information to utilize.

Expected Utility

Risk is an essential element in investment. Expected utility theory is an often-used normative rule in decision-making under risk. Individuals are assumed to be rational utility maximizers who have complete and accurate information (Magrabi et al. 1991). As a result, they are able to process information and independently make a rational decision that maximizes their utility. They are assumed to be consistent and have stable taste and preferences. Moreover, utility is assumed to be measurable and homogeneous.

With respect to financial decisions and based on above discussions, when individuals come to the point of decision-making they should have completed the information search, obtained adequate and accurate information, processed the information, and are able to make a rational decision that maximizes their utility. They should understand the alternatives, be able to identify the optimal choice based on their risk tolerance, and not be subject to behavioral biases. Consistency in risk attitude and behavior is one of the necessary conditions of rational decision-making. In other words, their choice should reflect their financial risk attitude.

Most individuals are risk-averse (Bailey et al. 1980). Therefore, when returns are equal, most people should choose the least-risky alternative. Individuals with a lower risk tolerance level may be willing to accept lower expected returns in exchange for lower risks. In a similar vein, individuals with a higher risk tolerance level may be willing to accept higher risks in exchange for higher expected returns.

Information Search

Information is one of the requirements for individuals to make financial decisions. According to marginal analysis, which is central to economic theory, individuals should continue pursuing additional information until the marginal cost of additional information is equal to its marginal benefit.

With the development of technology, the problem individuals are experiencing is not the scarcity of information but information overload. To sort through all information and decide what is accurate and useful takes not only time but also knowledge, experience, and ability. Understanding and managing risks in savings and investments is complex and requires substantial financial knowledge (Chang 2005). On average, people have inadequate financial knowledge (Hayslip et al. 1997) and tend to reduce the amount of effort they expend when decisions become more complex (Payne et al. 1993). Financial planners may have greater knowledge, experience and abilities than average individuals. They are expected to identify and provide information that is accurate and useful for individual financial decision-making. It is reasonable that people seek information from professionals when making investment decisions.

Hiring a financial planner makes economic sense as long as the expected benefit is more than its cost. In the investment market, individuals have many sources for information. Rational individuals would determine the amount of search necessary so that they obtain information that can help them achieve their goal at the lowest possible cost. Since individuals are assumed to be capable of collecting and processing information, the choice of information source should be a matter of preference after marginal analysis. For example, paying a financial planner may have a higher out-of-pocket cost for the information obtained, per se, but it may reduce an individual’s opportunity cost (e.g., income from doing alternative work and frustration during the information search). Therefore, for some individuals, paying a financial planner is the optimal way of information search. However, for other households, the information search process is enjoyable and the activity in-and-in-itself provides utility, further, they may have time to do so with minimal opportunity costs. For these households, financial planners may not be their optimal source of information. Regardless of the choice for the source of information, the information collected from the source of choice should be complete, accurate, and adequate for making a rational decision.

Hypothesis

Taken together, assuming wealth provides utility to households and households are risk averse, the theories of expected utility and information search imply that households are rational so their financial decision should lead to consistency in their risk attitude and behavior. Before they make a financial decision, households are expected to have completed the information search process and have chosen the optimal source of information to help them reach the consistency in their risk attitude and behavior. Therefore, the hypothesis of this study is that households acquiring information from financial planners should be equally likely to be consistent in their financial risk attitude and behavior compared to those who do not.

Data and Empirical Methodology

Data

This study pooled data from 1998 to 2010 Survey of Consumer Finances (SCF) to analyze the effect of financial planners on the consistency of financial risk attitude and behavior. The SCF is a cross-sectional survey conducted once every three years. This effort is supported by the Federal Reserve Board in cooperation with the Statistics of Income Division of the Internal Revenue Service in the United States.

In 1995, the SCF started to ask a question about the source of information used by households when making decisions about saving and investments. In the 1995 SCF, financial planners and brokers were included in one category. Starting with the 1998 SCF, financial planners and brokers were separated into two different categories. Since brokers are not planners, data prior to the 1998 SCF were excluded from this study. The number of households interviewed was 4305 in the 1998 SCF, 4442 in the 2001 SCF, 4519 in the 2004 SCF, 4418 in the 2007 SCF and 6482 in the 2010 SCF. The combined sample size for these SCF datasets was 24,166. In this study, all data were US data and the dollar values were US currency.

Dependent Variable

The financial risk attitude variable was constructed based on the response to the SCF risk tolerance question. Being willing to take substantial, above average, or average financial risks was defined to be some financial risk tolerance. Not being willing to take any financial risks was defined to be no financial risk tolerance. Although the question about the household’s tolerance for investment risks was asked of the respondent, the question referred to household risk attitude as a whole rather than the respondent’s perception about risks. It is possible that in a married/partnered household, two spouses/partners do not agree or collaborate regarding attitude toward financial risks; however, the surveys specifically framed the question so as to obtain a response for the household as a unit. Therefore, it was assumed that the respondent took this fact into consideration when s/he answered the question.

Investment asset ownership was defined as having any of the following assets: equities, total directly held non-equity mutual funds, individually held bonds, total quasi-liquid non-equity assets (e.g., IRAs and future pensions), other managed non-equity assets (e.g., trusts and annuities), net equity in nonresidential real estate, business interests, and selected other financial and nonfinancial assets. If respondents reported some household financial risk tolerance and some investment assets or no financial risk tolerance and no investment assets, they were defined to be consistent in their attitude and behavior. This definition is illustrated in Fig. 2.

Independent Variables

Independent variables included five categories: (1) survey years (with year 1998 being the reference category); (2) reported source of information used by the household when making saving and investments decisions (financial planner [reference category], self and social network, financial institutions, media and other sources); (3) demographic characteristics of the respondent and the household; (4) economic characteristics of the household; and (5) household expectations of the future (reported by the respondent).

Answers to the source of information question were open-ended. Up to 10 responses in the 1998 SCF dataset and up to 15 responses in subsequent SCF datasets were recorded, in the order given. Based on the respondent’s first answer, the source of information variable was categorized into five groups: (1) self and social network; (2) financial planner; (3) financial institutions; (4) media; and (5) other sources. The self and social network category included calling around, shopping around, asking friends/relatives, consulting with self and/or spouse/partner, doing personal research, belonging to investment clubs, and using past experience and material from work/business contacts. Lawyers and accountants often work as a team to assist financial planners in helping clients make saving and investment decisions, the financial planner category is broadly defined as using lawyers and accountants as well as financial planners. The financial institutions category was comprised of bankers, brokers, investment seminars, stores, dealers, insurance agents, and other institutional sources such as a social service agency. The distinction between financial planners and financial institutions was based on a compensation methodology. The preponderance of what lawyers, accountants and financial planners provide is services, whereas those in the financial institutions category mainly provide products. The media category includes magazines/newspapers, books, material in the mail, television/radio, internet/online services, advertisements, and telemarketers. Those who did not save or invest, did not shop around, always use same institution, or reported “other” when answering the information source question were placed into the “other” group.

Demographic variables included cohort, education and race/ethnicity of the respondent, as well as household type (gender and marital status) and presence of dependent children. Rationale for using cohorts instead of the commonly used variable age will be described in the methods section. Cohort included respondents with birth years between the following ranges: (1) 1903–1917 (reference category; oldest included in the SCF datasets); (2) 1918–1932; (3) 1933–1947; (4) 1948–1962; (5) 1963–1977; and (6) 1978–1992 (youngest included in the SCF datasets, with the youngest being 18 in the year of interview). Education of the respondent was categorized into: (1) less than high school (reference category); (2) high school/GED; (3) some college; (4) bachelor’s degree; and (5) graduate/professional degree. Race/ethnicity of the respondent included: (1) non-Hispanic White (reference category); (2) non-Hispanic Black; (3) Hispanic/Latino; and (4) non-Hispanic other race. Based on the respondents’ gender and marital status, a household type variable was defined and categorized into: (1) married males (reference category); (2) married females; (3) unmarried males; and (4) unmarried females. Married individuals include those who were married or living with a partner, regardless of the gender of the spouse or partner. Presence of related children under 18 was coded 1 for yes and 0 for no (reference category).

Household economic situations included home ownership (renter [reference category], homeowner with mortgage, and homeowner without mortgage), debt ownership (1 = yes, 0 = no [reference category]), employment status (working for others [reference category], self-employed, retired and not working), whether spending exceeded income (1 = yes, 0 = no [reference category]); income (less than $25,000 [reference category], $25,000–$49,999, $50,000–$74,999, $75,000–$99,999, and $100,000 or more), and nonfinancial assets. Non-financial assets was categorized into: (1) less than $50,000 (reference category); (2) $50,000–$149,999; (3) $150,000–$249,999; (4) $250,000–$499,999; and (5) $500,000 or more. To compare dollar amounts across time, household income and amount of non-financial assets were converted into year 2010 US dollars.

Expectations of the future variables included whether households expected to receive a substantial inheritance or transfer of assets in the future (1 = yes, 0 = no [reference category]), saving horizon (within the next year [reference category], next few years, next 5-10 years and longer than 10 years), and respondent self-perceived health status (excellent, good, fair and poor [reference category]).

Method of Analysis

Households with financial constraints may be more likely to have a mismatch between self-reported risk tolerance and their investment behavior. These households may be willing to tolerate more risks but are unable to invest as much as they would like to due to a lack of financial resources. Consequently, households with a negative net worth were excluded from this study. After applying this sample selection criterion, the total sample size was 22,463. In the SCF, the male in a mixed-sex-couple household or the older individual in a same-sex-couple household was designated as the “head” of the household. All data for those two individuals were swapped when the respondent was the spouse/partner. As a result, when data were collected from both individuals in a coupled household, this would not pose an issue; however, when only one response was collected from the respondent, the issue would be a mismatch between the response and the household head (may not be the respondent). In order to align the respondent and his/her responses, the two individuals involved were switched back in this study.

The SCF data is complex due to the sample design, multiple imputation of missing data, and issues related to confidentiality and disclosure. The Federal Reserve Board constructed a weight variable (Bricker et al. 2012) to account for the oversampling of wealthy households and the systematic deviations from the Current Population Survey estimates of homeownership by racial/ethnic groups. Since the SCF data are not collected by a completely randomized design but by a geographically stratified complex survey, the usual independence assumption necessary for running analysis is invalid. In order to correct this without releasing sensitive information about participating households, the Federal Reserve provides 999 bootstrap replicate weights for users to obtain correct standard errors. These weights were used in the statistical analyses in this study. Another issue is presence of missing values. A consistent multiple imputation method was used by the SCF to provide the best possible estimate for each missing value. Consequently, five complete datasets are generated for each survey year. This study used the “repeated-imputation inference” (RII) method (Kennickell and Woodburn 1999) to combine the five datasets for statistical analysis.

According to Yao et al. (2011), the effect of age on risk tolerance includes three separate effects: the aging effect, the period effect, and the cohort effect. This study adopted the age-period-cohort (APC) analysis introduced by Yang and Land (2008) to decompose the effect of age to examine the effect of the three separate factors on the two levels of consistency in risk attitude and behavior. Instead of using a vague definition of generations, of which there has been no consensus in past research (e.g., Lancaster and Stillman 2002; Meredith and Schewe 1994), this study simply divided respondents into birth cohorts in 15-year intervals. This allowed the Variance Inflation Factor statistics to be lower than 10, which has been used as signal of the absence of multicollinearity issues (Freund and Wilson 1998). Age and cohort were highly correlated, which result in the age effect being nonsignificant and excluding age marginally improved the model fit using the method proposed by Archer et al. (2007). Consequently, age was not included as an independent variable in the logistic analysis.

Descriptive analysis was conducted to observe household consistency in risk attitude and behavior by source of information and survey year. To better understand whether acquiring information from financial planner when making saving and investments decisions helped improve households’ consistency in their financial risk attitude and behavior after controlling for other variables, a logistic regression was used. The dependent variable was equal to 1 if the household was consistent and 0 otherwise.

Results

Sample Characteristics

The characteristics of the sample households are reported in Table 1. The mean age increased slightly from 49.9 in 1998 to 51.9 in 2010 and the median age rose from 48.0 in 1998 to 51.0 in 2010. An average of 13.0 % of respondents did not complete a high school education, while 12.1 % had a graduate or professional degree. The overwhelming majority of respondents were White (overall mean = 75.1 %) and 12.3 % were Black. Married males accounted for 32.3 % of the total combined sample, 27.8 % were married females, 14.1 % were unmarried males, and 25.8 % were unmarried females. Less than half of the households (43.2 %) had children living with them.

The amounts of income, investment assets, and nonfinancial assets were adjusted to 2010 dollars. Mean household income was the highest in 2007 ($92,569). Median income peaked in 2004 at $51,997. On average, 75.0 % of households had investment assets. Mean and median investment assets were the highest in 2007 ($432,142 and $33,526, respectively). Mean and median nonfinancial assets peaked in 2007 as well ($485,327 and $179,887, respectively).

An overall average of 41.9 % of total respondents were not willing to take any financial risks. The percentage reporting an unwillingness to take financial risks started at 38.8 % in 1998 and reached 41.5 % in 2004, dropped to 41.0 % in 2007 but reached the peak in 2010 (46.7 %). An average of 29.8 % of households relied on self and/or their social network for information when making savings and investments decisions. Less than one-fifth (16.7 %) used a financial planner, 36.6 % used financial institutions, 7.0 % used media, and 9.9 % used other sources, did not shop around, or did not save or invest.

Less than one-third (28.2 %) of the total combined sample were renters. Homeowners without a mortgage made up 23.2 % and homeowners with a mortgage accounted for 48.6 % of the overall sample. The majority (55.4 %) of the total respondents worked for others, 10.9 % worked for themselves, 24.9 % were retired, and 8.8 % was not in the workforce for reasons other than retirement. Among the households in the combined sample, 62.6 % had debt other than mortgage, 17.0 % of household spent more than their household income, and 12.8 % expected a substantial inheritance or assets transfer. One third (33.9 %) of the total households reported savings and spending time horizons within the next year, while 14.2 % reported a horizon of longer than 10 years. Respondents who reported an excellent health status made up 28.4 % of the overall sample and 18.4 % reported fair health. Only 5.4 % reported having a poor health.

Consistency in Risk Attitude and Behavior by Source of Information and Survey Year

Overall, about half (51.1 %) of total households had some tolerance for financial risks and owned some investment assets. Close to a fifth (18.1 %) had no financial risk tolerance and no investment assets. The remaining 30.8 % of the households had a mismatch between their financial risk attitude and behavior. The first column of Table 2 shows the percent distribution of information sources when households make saving and investments decisions. In the combined dataset, only 16.7 % of households reached out to financial planners for information, ranking the third after financial institutions (36.6 %) and self and social network (29.8 %). This percentage was higher in later survey years (15.9 % in 1998 and 18.5 % in 2010), except for a slight dip in 2001 (14.8 %).

The remaining columns in Table 2 show the consistency in households’ risk attitude and behavior across various sources of information categories in each survey year. In the combined sample, 78.7 % of households who sought information from financial planners were consistent (highest among all information sources), with 72.9 % of them having some financial risk tolerance and some investment assets and 5.8 % having no risk tolerance or investment assets (lowest among all information sources). This pattern was also true in each survey year. Households who used financial planners were the most consistent (percentage ranging from 72.8 % in 2010 to 82.3 % in 1998) in their financial risk attitude and behavior.

Logistic Results of Consistency in Risk Attitude and Behavior

The results from logistic regression analysis confirmed the observation that households who obtained information from financial planners were the most consistent in their financial risk attitude and behavior. Compared to them, those who used other types of information sources were less likely to be consistent, with the likelihood ratio ranging from 71.5 % of households who used self and social network to 79.9 % of those who used media (Table 3). Results from additional logistic analyses showed that there were no statistically significant differences in consistency between risk attitude and behavior among the other types of information source groups.

Other factors were also found to have significantly contributed to the likelihood of consistency. Compared to 1998, households were less likely to be consistent in 2004, 2007 and 2010 (odds ratios <1). Households whose respondent belonged to younger cohorts were more likely to be consistent than the oldest cohort, with odds ratios ranging from 1.293 for the second oldest cohort to 2.322 for the second youngest cohort. Respondent’s race affected consistency in risk attitude and behavior, with Blacks being 85.6 % as likely to be consistent as Whites. Married females were 68.9 % as likely and unmarried females were 85.2 % as likely as married males to be consistent. Higher education, higher income, having at least $500,000 non-financial assets, expecting substantial inheritance or asset transfers, and having a longer saving horizon positively affected households’ likelihood of being consistent in their risk attitude and behavior. Having debts other than a mortgage and overspending had a negative effect.

Discussion and Implications

This study found that financial planners provided significant value to households regarding the consistency of their financial risk attitude and behavior. Those who sought information from financial planners when making saving and investment decisions were more likely than households in all other information source groups to have a portfolio that matches their reported financial risk tolerance. This result is inconsistent with the hypothesis that there is no significant difference between households acquiring information from financial planners and those who do not in terms of the likelihood of being consistent in their financial risk attitude and behavior.

Taking less Portfolio Risks than Desired

Results of this study showed that a mismatch between one’s risk attitude and investment behavior is not rare. Overall, 7.0 % of households had some appetite for financial risks but did not have any investment assets (Table 2). A higher level of household income and having the highest level of non-financial assets ($500,000 +) were associated with a higher likelihood of being consistent (Table 3). At the higher end of the income or wealth spectrum, being willing to take financial risks but having no investment assets could simply be a choice that is less than optimal. At the lower end of the spectrum, this mismatch may be due to resource constraints.

The disadvantage of taking less risks than desired is mainly opportunity cost. For households with more resources, a thorough analysis is needed to understand the reasons for this mismatch. Education may be needed to help these households understand financial risks because it is plausible that they overestimated the amount of financial risks in their portfolio. For households with resource constraints however, when financial situations improve, they may become consistent by owning investment assets.

Taking more Portfolio Risks than Desired

The other type of mismatch between risk attitude and behavior, namely taking more portfolio risks than desired, was more prevalent than the previously mentioned mismatch. In the overall sample, 23.9 % of the households were not willing to take any financial risks but owned investment assets in their portfolio (Table 2). This type of mismatch between financial risk attitude and behavior may be due to underestimation of their portfolio risks.

The problem of this mismatch could bring unnecessary financial losses. During market downturns, unless a sale of investment assets is due to a need (e.g., an employment interruption, other unexpected decreases in income, or an unexpected increase in household expenses), such behavior would be an emotional reaction to the market movement that was likely caused by the mismatch between risk attitude and behavior. Financial planners should explore effective ways to educate these households about financial risks and consequences of owning investment assets and, at the same time, assist them transition to consistency.

Implications for Financial Planners

Households are being asked as never before to be responsible for the outcome of their financial planning efforts and some are turning to professional financial planners for advice. Are financial planners up to the task? Although the financial planning industry has existed for decades, findings of this study show that there is room for further expansion and improvement of this industry.

In all years combined and in each specific survey year, using a financial planner was positively associated with being consistent in risk attitude and behavior. This positive relationship was confirmed by logistic results—after controlling for survey years and other variables—using a financial planner provided a higher odds ratio for being consistent in risk attitude and behavior. However, only less than one-fifth of the total households reached out to them when making saving and investment decisions. This suggests there is room for further development and expansion of the financial planning industry.

Although using a financial planner was beneficial, the increasing trend of using financial planner and the decreasing trend of being consistent in risk attitude and behavior over time, as observed in Table 2, is disturbing. Moreover, among those who do use financial planners, more than one-fifth (21.4 %) were inconsistent in financial risk attitude and behavior, with the majority of the inconsistency in the category of having more financial risks in their portfolio than desired. This suggests that although using a financial planner is helpful, the quality of financial planning services (helping clients to be consistent in risk attitude and behavior) has decreased over time and further improvement in the financial planning services industry is needed.

It is possible that financial planners focus on a household’s objective situations (e.g., age, saving horizon, level of assets) and overlook the true financial risk attitude of the household. Some young clients might be very risk adverse even though their savings horizon is very long and investments would end up accumulating significantly more wealth for them. However, if they are not willing to take any financial risks, this demands that they either do not own investment assets or be challenged about their understanding of financial risks and, possibly, educated on what these risks entail. Constructing a risky portfolio for clients may bring a higher expected return to them; however, if this is inconsistent with the clients’ risk tolerance, it could be detrimental to the client. It is well known that many people cashed out of the market in the past recession, which indicated a lack of commitment caused by the inconsistency between people’s portfolio risk and their risk tolerance.

The objective of a financial planner should be to make sure the household understands the risks and opportunities of financial products, the risks taken in their portfolio, and how a portfolio constructed like that would perform over time, not only during periods when the market is up but also during down markets. If a young household has an exceedingly high level of income and a conservative life style, maybe a conservative portfolio that matches their life style is appropriate. Also, if an older household desires a high level of financial risks and has a saving objective that justifies such risks, letting them have a risky portfolio may be a good choice.

Limitation of This Study and Implications for Future Research

One limitation of this study is that the self-reported risk tolerance was obtained from the respondent. Although the question asked for the household’s risk tolerance (respondent and the spouse/partner), it is at best an estimation of the household’s risk tolerance in a household where the respondent was married or living with a partner. It is possible that spouses/partners communicate very well with each other and the respondent understands the risk tolerance of the spouse/partner and incorporated it into his/her answer to the SCF risk tolerance question. However, it is also possible that such communication was inadequate. The spouse/partner is likely to contribute to the investment decision-making in the household. Therefore, the self-reported household risk tolerance may or may not accurately reflect the household’s risk tolerance for married/partnered households. SCF reveals no decision-making information and, therefore, how decisions were made within the household could not be examined. Future research may consider investigating whether couples discuss their financial risk tolerance as one unit and make financial decisions accordingly or one spouse/partner contributes more in this decision-making process.

Consistency in household risk attitude and behavior is an important ongoing task for households, their financial planners, consumer educators and researchers. A mismatch in risk attitude and behavior may cause opportunity cost or unnecessary realized financial loss, which is counterproductive to households making efforts to accomplish their financial goals. While topics related to this area have been examined in some detail, this is the first research to investigate the influence of various sources of information on household’s consistency between the risk they say they want and what they actually have.

Future research should expand this study to further examine how to better align different levels of financial risk tolerance with various portfolio compositions, how to accurately measure the financial risk tolerance for all household types, how to help households identify their true risk tolerance level, and how to help them act consistently with their risk tolerance when making savings and investment decisions.

References

Archer, K. J., Lemeshow, S., & Hosmer, D. W. (2007). Goodness-of-fit tests for logistic regression models when data are collected using a complex sampling design. Computational Statistics & Data Analysis, 51(9), 4450–4464. doi:10.1016/j.csda.2006.07.006.

Arrow, K. J. (1965). Aspects of the theory of risk bearing. Helsinki: Yrjo Jahnsson Foundation. (Reprinted in Arrow, K. J., 1971. Essays in the theory of risk-bearing. Chicago: Markham Publishing Company).

Bailey, M. J., Olson, M., & Wonnacott, P. (1980). The marginal utility of income does not increase: Borrowing, lending, and Friedman-Savage gambles. American Economic Review, 70(3), 372–379. doi:10.1257/aer.97.3.543.

Barsky, R. B., Juster, T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the Health and Retirement Study. Quarterly Journal of Economics, 112(2), 537–579. doi:10.1162/003355397555280.

Bernasek, A., & Shwiff, S. (2001). Gender, risk and retirement. Journal of Economic Issues, 35, 345–356. Retrieved from http://www.jstor.org/stable/4227666.

Bluethgen, R., Gintschel, A., Hackethal, A., & Mueller, A. (2008). Financial advice and individual investors’ portfolios. SSRN Working Paper No. 968197. Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=968197. doi:10.2139/ssrn.968197.

Bricker, J., Kennickell, A. B., Moore, K. B., & Sabelhaus, J. (2012, February). Changes in U.S. family finances from 2007 to 2010: Evidence from the Survey of Consumer Finances. Federal Reserve Bulletin, 98(2). Retrieved from http://www.federalreserve.gov/pubs/bulletin/2012/PDF/scf12.pdf.

Carlson, C. N. (2003). Information overload, retrieval strategies and internet user empowerment. In C. N. Carlson (Ed.), The good, the bad and the irrelevant (pp. 3–5). Helsinki: University of Art and Design.

Chang, M. L. (2005). With a little help from my friends (and my financial planner). Social Forces, 83(4), 1469–1497. doi:10.1353/sof.2005.0061.

Chang, C., DeVaney, S. A., & Chiremba, S. T. (2004). Determinants of subjective and objective risk tolerance. Journal of Personal Finance, 3, 53–67.

Chaulk, B., Johnson, P. J., & Bulcroft, R. (2003). Effects of marriage and children on financial risk tolerance: A synthesis of family development and prospect theory. Journal of Family and Economic Issues, 24(3), 257–279. doi:10.1023/A:1025495221519.

Ciccone, S. (2011). Investor optimism, false hopes and the January effect. Journal of Behavioral Finance, 12(3), 158–168. doi:10.1080/15427560.2011.602197.

Coleman, S. (2003). Risk tolerance and the investment behavior of Black and Hispanic heads of household. Journal of Financial Counseling and Planning, 14(2), 43–52.

Fan, J. X., & Xiao, J. J. (2006). Cross-cultural differences in risk tolerance: A comparison between Chinese and Americans. Journal of Personal Finance, 5(3), 54–75.

File, T. (2013). Computer and internet use in the United States. Current population survey reports, 20-568. U.S. Census Bureau, Washington, DC. Retrieved from https://www.survata.com/docs/Census_Internet.pdf.

Freund, R. J., & Wilson, W. J. (1998). Regression analysis. San Diego: Academic Press.

Gathergood, J. (2012). Self-control, financial literacy and consumer over-indebtedness. Journal of Economic Psychology, 33(3), 590–602. doi:10.1016/j.joep.2011.11.006.

Grable, J. E. (2000). Financial risk tolerance and additional factors that affect risk taking in everyday money matters. Journal of Business and Psychology, 14(4), 625–630. doi:10.1023/A:1022994314982.

Grable, J. E., McGill, S., & Britt, S. (2009). Risk tolerance estimation bias: The age effect. Journal of Business and Economics Research, 7(7), 1–12.

Gron, A., & Winton, A. (2001). Risk overhang and market behavior. The Journal of Business, 74(4), 591–612. doi:10.1086/321939.

Guiso, L., Jappelli, T., & Terlizzese, D. (1996). Income risk, borrowing constraints, and portfolio choice. American Economic Review. 86(1), 158–172. Retrieved from http://www.jstor.org/stable/2118260.

Halek, M., & Eisenhauer, J. G. (2001). Demography of risk aversion. Journal of Risk and Insurance, 68, 1–24. doi:10.2307/2678130.

Hariharan, G., Chapman, K. S., & Domian, D. L. (2000). Risk tolerance and asset allocations for investors nearing retirement. Financial Services Review, 9(2), 159–170. doi:10.1016/S1057-0810(00)00063-9.

Hartog, J., Ferrer-I-Carbonell, A., & Jonker, N. (2002). Linking measured risk aversion to individual characteristics. Kyklos, 55(1), 3–26. doi:10.1111/1467-6435.00175.

Hayslip, B., Bezerlein, M., & Nichols, S. (1997). Assessing anxiety about retirement: The case of academicians. International Journal of Aging and Human Development, 44, 15–36. doi:10.2190/BY4B-HMQA-RDY1-HF5B.

Ho, J., & Tang, K. (2001). Towards an optimal resolution to information overload: An infomediary approach. In S. Ellis, T. Rodden, & I. Zigurs (Eds.), Proceedings of the 2001 International ACM SIGGROUP Conference on Supporting Group Work (pp. 91–96). Boulder, CO: ACM Press. doi: 10.1145/500286.500302.

Jianakoplos, N. A., & Bernasek, A. (2008). Family financial risk taking when the wife earns more. Journal of Family and Economic Issues, 29, 289–306. doi:10.1007/s10834-008-9102-2.

Keister, L. A. (2000). Race and wealth inequality: The impact of racial differences in asset ownership on the distribution of household wealth. Social Science Research, 29, 477–502. doi:10.1006/ssre.2000.0677.

Kennickell, A. B., & Woodburn, L. R. (1999). Consistent weight design for the 1989, 1992, and 1995 SCFs and the distribution of wealth. Review of Income and Wealth, 45(2), 193–215. doi:10.1111/j.1475-4991.1999.tb00328.x.

Kimball, M. S., Sahm, C. R., & Shapiro, M. D. (2008). Imputing risk tolerance from survey responses. Journal of the American Statistical Association, 103(483), 1028–1038. doi:10.1198/016214508000000139.

Lancaster, L. C., & Stillman, D. (2002). When generations collide. Who they are. Why they clash. How to solve the generational puzzle at work. New York: Collins Business.

Magrabi, F. M., Chung, Y. S., Cha, S. S., & Yang, S.-J. (1991). The economics of household consumption. New York: Praeger.

McInish, T. H., Ramaswami, S. N., & Srivastava, R. K. (1993). Do more risk-averse investors have lower net worth and income? The Financial Review, 28(1), 91–106. doi:10.1111/j.1540-6288.1993.tb01339.x.

Meredith, G. P., & Schewe, C. (1994). The power of cohorts. American Demographics, 16(12), 22–31.

Nofsinger, J. R., & Varma, A. (2007). How analytical is your financial advisor? Financial Services Review, 16, 245–260.

Payne, J. W., Bettman, J. R., & Johnson, E. J. (1993). The adaptive decision maker. Cambridge: Cambridge University Press.

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica, 32(1/2), 122–136. doi:10.2307/1913738.

Riley, W. B., & Chow, K. V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 48, 32–37. doi:10.2469/faj.v48.n6.32.

Social Security Administration. (2013). Social security board of trustees: No change in projected year of trust fund reserve depletion [Press release]. Retrieved from http://www.ssa.gov/pressoffice/pr/trustee13-pr-alt.pdf.

Statman, M., Thorley, S., & Vorkink, K. (2006). Investor overconfidence and trading volume. Review of Financial Studies, 19, 1531–1565. doi:10.1093/rfs/hhj032.

United Nations, Department of Economic and Social Affairs, Population Division. (2012). World Mortality Report 2011. Retrieved from http://www.un.org/en/development/desa/population/publications/pdf/mortality/worldMortalityReport2011.pdf.

US Department of Labor Employee Benefits Security Administration. (2013, June). Private Pension Plan Bulletin Historical Tables and Graphs. Retrieved from http://www.dol.gov/ebsa/pdf/historicaltables.pdf.

Yang, Y., & Land, K. C. (2008). Age-period-cohort analysis of repeated cross-section surveys: Fixed or random effects? Sociological Methods and Research, 36(3), 297–326. doi:10.1177/0049124106292360.

Yao, R., & Curl, A. L. (2011). Do market returns influence risk tolerance? Evidence from panel data. Journal of Family and Economic Issues, 32(3), 532–544. doi:10.1007/s10834-010-9223-2.

Yao, R., Gutter, M. S., & Hanna, S. D. (2005). The financial risk tolerance of Blacks, Hispanics and Whites. Journal of Financial Counseling and Planning, 16(1), 51–62.

Yao, R., & Hanna, S. D. (2005). The effect of gender and marital status on financial risk tolerance. Journal of Personal Finance, 4(1), 66–85.

Yao, R., Sharpe, D. L., & Wang, F. (2011). Decomposing the age effect on risk tolerance. Journal of Socio-Economics, 40, 879–887. doi:10.1016/j.socec.2011.08.023.

Yao, R., Ying, J., & Micheas, L. (2013). Determinants of defined contribution plan deferral. Family and Consumer Sciences Research Journal, 42(1), 55–76. doi:10.1111/fcsr.12038.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Park, E., Yao, R. Financial Risk Attitude and Behavior: Do Planners Help Increase Consistency?. J Fam Econ Iss 37, 624–638 (2016). https://doi.org/10.1007/s10834-015-9469-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-015-9469-9