Abstract

Child care subsidy programs serve to reduce the number of families for whom child care is a barrier to work. Child care is essential to economic self-sufficiency, and it can also support child development, particularly for low-income children. However, most research has an urban focus so little is known about rural settings where formal programs are limited and of lower quality. In this paper we examine the subsidy use of rural families, the care arrangements they make, and the quality of care received. We utilized data collected between 2004 and 2007 from the Family Life Project, a representative, longitudinal study of non-metro families in low-wealth counties (n = 1,292), oversampled for low-income and African-American families. Families who used subsidies were more likely to select center-based care, typically of higher quality. Further, these families were also more likely to receive higher quality care, regardless of the type chosen, even after accounting for a host of family and community factors. Findings suggest that subsidy programs have successfully moved low-income children into higher quality care beneficial for development. These findings point to the need to maintain subsidy programs and encourage eligible families to take advantage of such resources.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The United States federal government provides child care assistance to support low-income working families and those transitioning off public assistance. The primary subsidy mechanism, the Child Care and Development Block Grant (CCDBG), was designated as the funding mechanism to serve low-income families, including those on Temporary Assistance to Needy Families (TANF), those moving off TANF, and the working poor (Karpilow 1999). The CCDBG has two goals: to provide dollars to subsidize employment-related child care expenses for low-income families, and to support quality-improvement activities and consumer education (Blau 2003). Federal child care programs emphasize parental choice, with few restrictions on the type or characteristics of child care arrangements eligible for subsidies (Blau 2003). Thus families are able to select the arrangement that best fits their needs. Although enhanced funding for child care subsidies following recent welfare reforms increased employment (Queralt et al. 2000), families’ expenditures on child care have risen (Smith and Adams 2013). Many parents still reported child care as an obstacle to employment and over one-third of unemployed women reported leaving a job because of child care problems (Carnochan et al. 2003; Honig 2002; Lino 1998; Livermore et al. 2011). This challenge is even more pronounced in rural communities where single and married mothers with young children are more likely to work (Smith 2008; Son and Bauer 2010) and child care options are scarcer (Atkinson 1994; Whitener et al. 2002). Child care is essential for family economic self-sufficiency (Forry 2009), and evidence suggests good quality child care can also support child development (Loeb et al. 2005), particularly for low-income children who derive more benefits from high-quality care (Fuller et al. 2005; McCartney et al. 2007; Votruba-Drzal et al. 2004).

However, until now, most research has had an urban focus, so little is known about rural settings where formal programs are limited and of lower quality (Whitener et al. 2002; Zimmerman and Hirschl 2003). Thus, to better understand how low-income rural families use child care subsidies and the quality of care they receive, we addressed the following research questions with a unique sample of families enrolled in the Family Life Project (FLP), a study of families in rural, low-wealth counties in North Carolina and Pennsylvania: (1) Do eligible families access subsidies; (2) Which families access subsidies; (3) What arrangements do they make; and (4) Do children whose families take-up subsidies receive better quality care than those who do not? With a more thorough understanding of these issues we will be better able to tailor outreach, develop quality improvement efforts, and craft policies responsive to rural realities.

Literature Review

Child Care Quality and Subsidy Use

In developmental theory, human development is shaped by reciprocal interactions between individuals and persons, objects, and symbols in the immediate external environment, which depend on duration and intensity of exposure (Bronfenbrenner 1989; Bronfenbrenner and Evans 2000). Proximal processes, such as interactions in the microsystem of the home are the driving force. As the child grows, the microsystem extends beyond the home to other individuals, groups, and social settings in which the child is a direct participant, including child care settings (Bronfenbrenner and Evans 2000). Previous studies have shown that the quality of child care experiences is related to children’s early development (e.g., Burchinal et al. 2009; De Marco and Vernon-Feagans 2013).

Overall, child care quality in the Unites States is not high (e.g., Blau 2000; Burchinal and Cryer 2003; NICHD 2002; NICHD Early Child Care Research Network and Duncan 2003; Peisner-Feinberg et al. 1999; Phillips and Adams 2001; Zaslow 1991). Phillips and Adams (2001) reported that in most large-scale child care studies three-quarters of caregivers provided only minimal cognitive and language stimulation, while one-fifth interacted in moderately- or highly-detached ways. Approximately 20 % of settings fell below minimal thresholds of adequate care. Moreover, less than 25 % of infants in child care received care from highly-sensitive caregivers.

Research consistently demonstrated that child care has significant, though modest, effects on children’s academic, language, and social skills (Burchinal et al. 2009) and can ensure that children enter school ready to learn (Peisner-Feinberg et al. 1999; Winsler et al. 2008). Children in high quality programs performed better on measures of cognitive skill, social skill, and measures of problem behaviors in child care and during the transition to school. However, these effects varied by family income with greater impacts on cognitive development accruing to low-income children, while impacts were more modest for children from higher income families (Dearing et al. 2009; Fuller et al. 2005; Halle et al. 2005; Loeb et al. 2005; Votruba-Drzal et al. 2004). For low-income children in the urban Three-City Study, for example, Votruba-Drzal et al. (2004) found higher levels of quality were modestly associated with improvements in socio-emotional development. These benefits persisted through kindergarten and, in some cases, through the second or third grade and beyond (Halle et al. 2005; Reynolds 2000; Temple et al. 2000).

Quality of child care may differ based on the type of setting for child care (Broberg et al. 1990; Coley et al. 2006; Loeb et al. 2004; NICHD Early Child Care Research Network and Duncan 2003; Rigby et al. 2007; Sonenstein and Wolf 1991). Examining the settings of formal child care centers, family child care homes, and relative caregivers for a group of low-income families moving from welfare to work, Loeb et al. (2004), found strong positive cognitive effects for children in centers, particularly for measures of school readiness, even when controlling for a host of background characteristics including race, maternal education, welfare status, and income, compared to children in other care settings. Children attending family child care homes displayed more behavioral problems and higher levels of aggression than in other forms of care, but differences were only statistically significant as compared to children in a relative’s care. Bromer and Henly (2004) found that family child care homes and centers may be better able to provide effective family supports compared to relatives and other informal providers.

Research on use of child care subsidies has found positive effects for child care quality as subsidies can influence the type of care selected and the quality of care children receive (e.g., Berger and Black 1992; Blau and Tekin 2007; Ertas and Shields 2012; Fuller et al.1993; Ryan et al. 2011). Subsidy program participation seemed to move families away from parental and relative care and towards center care (Ertas and Shields 2012; Tekin 2005), which tended to be of higher quality (Coley et al. 2006; Governor’s Task Force on Early Childhood Care and 2002; NICHD Early Child Care Research Network 2002). Furthermore, center care tended to be of higher quality in the presence of greater subsidies (Fuller et al. 1993). Families who were more likely to prefer and select centers were also the most likely to use subsidies (Huston et al. 2002). In addition, those in subsidy programs reported a significantly higher level of satisfaction with their arrangements. Those who switched providers after receiving a subsidy reported a better physical environment, better meals, and better hours of service, indicating that both quality and convenience improve with subsidy receipt (Berger and Black 1992).

However, we know little about how subsidies are related to quality in rural areas beyond the knowledge that compared to urban families, rural families who utilized subsidies, like child care users in rural areas in general, were less likely to use centers and were more likely to select family-based arrangements (Davis and Weber 2001; Swenson 2007). We know that the need for and potential impact of formal programs is great in rural settings as research on the Universal Pre-Kindergarten program in Georgia showed that the effects are the most pronounced and consistent in areas (rural and urban fringe) seeing the largest preschool participation increases (Fitzpatrick 2008). Participation in this program increased test scores for disadvantaged children, based on school lunch program eligibility, living in rural areas by as much as 12 % of a standard deviation.

Issues in Rural Communities

Much of the extant welfare reform research has focused on the urban poor (Whitener et al. 2002; Zimmerman and Hirschl 2003), although rural regions made up significant portions of states, including 30 % of the population in North Carolina and 16 % in Pennsylvania, where poverty and unemployment were also higher (Economic Research Service 2010; Rural Assistance Center [RAC] 2009). This urban focus failed to acknowledge that poverty in the rural United States differed from that in other parts of the country (Deavers and Hoppe 1992; O’Hare 2009; Parisi et al. 2003). Over half the children in rural areas lived below 200 % of the poverty line compared to 37 % in urban areas (Rivers 2005); children in rural areas lived in much deeper poverty, below 50 % of the federal poverty line, and for longer periods of time than children in more urban settings (O’Hare 2009). This poverty persisted even though two-thirds of rural poor families had at least one family member with a full-time job and one-quarter had two or more employed household members (Summers 1995). These data suggested that available jobs in rural areas were often low-wage and may be more at risk during economic downturns (Lichter et al. 2003). In the two FLP sites, North Carolina and Pennsylvania, per capita income was lower and poverty rates were higher in rural areas as compared to urban ones (Economic Research Service 2012a, b).

As such, the risk of poverty for families with children was higher in rural areas than for central cities or suburban areas, even after controlling for characteristics of the household head (Snyder and McLaughlin 2004). Moreover, of the officially poor in each group, those in rural areas were significantly less likely to use cash assistance than those in urban areas (56 vs 68 %), supporting the Rural Poverty Research Institute (1999) finding that nonmetro households living below 125 % of the poverty line had a lower rate of welfare reliance than urban or suburban dwellers, potentially due to higher stigma in rural areas (Rost et al. 1993). Further, important services often did not exist, were difficult to access, or when they did exist were frequently understaffed or underfunded. These included limited access to formal child care centers, public transportation, housing, and social services (Zimmerman and Hirschl 2003).

Rural Child Care

Child care utilization and services also differed in rural regions. There was less center-based care and parents were more likely to use informal providers (Beach 1997; Ghazvini et al. 1999; Keefer et al. 1996; Smith 2006; Walker and Reschke 2004; Whitener et al. 2002). Further, there was less state oversight and regulation in rural communities. Fewer regulated family child care homes existed, caregivers had less education and specialized training, facilities had higher child-to-staff ratios, and resources and training were more difficult to access (Magnuson and Waldfogel 2005; Maher et al. 2008). Moreover, child care was an impediment to both work and service use for rural families (Ames et al. 2006; Keefer et al. 1996; Monroe and Tiller 2001; Taylor 2001). For the working mothers in Keefer’s (Keefer et al. 1996) study three-quarters were using child care in their own homes with the care provided by siblings, husbands, selves, babysitters, and relatives, 18 % used care in relatives’ homes, 3.8 % were using licensed child care (FCCHs and centers), and 3.5 % were using services provided by churches. One third of those who were not working reported that the high cost of child care prevented them from entering the labor force and one fifth reported that it kept them out of school. Overall, their study found a dearth of local, affordable child care options for mothers who wanted to work, leading to concerns about these mothers’ ability to remain self-sufficient and avoid welfare dependence (Keefer et al. 1996).

Gaps in the Literature

Overall, research is limited on the experiences of low-income and welfare-participant families in rural communities (Findeis 2001), although the spatial disadvantage they face makes developing solutions much more challenging. Further, little research has looked at subsidy take-up by specific populations, including rural parents, and how those subsidies are related to the quality of child care young children receive. This study begins to fill those gaps by examining if rural families are taking up subsidies, who is taking up subsidies, and what types of child care arrangements they are selecting, and the quality of that child care. In order to ensure that the program works well for these families, allowing them to achieve self-sufficiency and supporting optimal child development, we must understand more about child care subsidy use in rural communities. This study not only provides information about subsidy use in these under-investigated communities, but also the longitudinal nature of the FLP allows us to examine these issues at various points in early childhood. As such we are well-placed to make recommendations valuable to practitioners, policy-makers, and researchers.

Methods

We utilized data from the longitudinal FLP, a representative sample of all babies born to mothers who resided in three rural, low-wealth counties in Eastern North Carolina and three in Central Pennsylvania over a 1-year period, oversampling for poverty and African American (Kainz et al. 2012). The FLPs primary goal was to develop a better understanding of how growing up in rural communities influenced the development of young children from birth through elementary school. In particular, FLP researchers sought to learn about how differences in children’s development were linked to variations in temperament, family experience, community structure, economic circumstances, and race/ethnicity. The FLP (n = 1,292) was designed to study families in two of the four major geographical areas of high rural child poverty (Dill 1999). Specifically, Eastern North Carolina (Sampson, Wayne, and Wilson counties) and Central Pennsylvania (Blair, Cambria, and Huntingdon counties) were selected to be indicative of the Black South and Appalachia, respectively. In addition, low-income families in both states and African American families in NC were over-sampled to ensure adequate power for dynamic and longitudinal analyses of families at elevated psychosocial risk (African-American families were not over-sampled in PA because the target communities were at least 95 % non-African-American). The FLP sample was representative of poor rural children with an 82 % acceptance rate among those eligible and a 2 % attrition rate. Extensive data were collected including demographics, work experiences, and child care, with observations in primary care arrangements at 6, 15, 24, and 36 months of age, between 2004 and 2007. The research was approved by the UNC IRB and all participants gave their informed consent prior to their inclusion in the study.

Measures

The Home Observation for the Measurement of the Environment (HOME Inventory) was used to assess child care quality. The HOME Inventory was designed to measure the quality and quantity of stimulation and support available to children in the child care environment (Bradley 1994; Bradley and Caldwell 1988; Caldwell and Bradley 1984; De Marco et al. 2009). For the purposes of providing a general sense of quality the HOME summarizes across multiple domains of quality (Child Trends 2009). The HOME consisted of 45 items clustered into six subscales: (1) Responsivity, (2) Acceptance of the child, (3) Organization of the environment, (4) Learning materials, (5) Parental involvement, and (6) Variety of experience. Only the sum of the Responsivity, Acceptance, and Learning materials subscales were used in the FLP. Each of these 28 items (e.g., “Caregiver’s voice conveys positive feelings toward the child”) was scored in a yes/no fashion by trained research assistants with scores ranging from zero to 28 from 6 to 24 months and from zero to 22 at 36 months when several items were added or dropped (e.g., presence of age-appropriate games or puzzles added). Higher scores indicated higher quality environments. In previous studies of child care quality with other data (Cronbach’s alpha = .82–.87; Dowsett et al. 2008) and FLP data (Cronbach’s alpha = .67; De Marco and Vernon-Feagans 2013), reliability was adequate. The HOME Inventory was selected for the FLP because many of the children were in informal arrangements, not in formal child care centers. For example, at 15 months of child age 54 % of settings were informal (50 % relative and 4 % family child care). The HOME focused largely on the relationship between caregiver and child, putting less emphasis on resources and environmental factors that may differ greatly between centers and informal settings. This measure has been widely used and has been particularly successful in studies of poor, minority families showing moderate relations with measures of child competence, adjustment, and health (Totsika and Sylva 2004). The measure showed good inter-rater reliability as well as good test–retest reliability. The HOME was a good predictor of later cognitive, social, and physical development in the child (Bradley et al. 2003). For the current study, Cronbach’s alpha for the total score of all subtests across each age group ranged from .66 to .81.

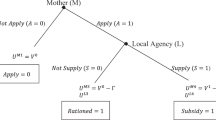

To indicate take-up of child care subsidy, subsidy eligibility was determined with two methods: (1) income and (2) TANF participation. Reported household income was compared to eligibility requirements in the county of residence to determine if a family was eligible for subsidy at each time point. If a family was receiving TANF benefits they were also determined to be eligible for child care subsidies as states typically prioritize TANF families for child care assistance (Shlay et al. 2004). At each time point primary caregivers were asked about forms of assistance they may receive, including child care subsidies (e.g., have you or anyone in your household received any government assistance in paying for child care/subsidized child care).

A measure of geographic isolation was developed by the FLP investigators using Global Positioning System (GPS) technology (Burchinal et al. 2009). GPS units were used to measure the longitude and latitude for the family residence. These measurements were then used to compute the physical distance between the family residence and the nearest 10 common community services, including those in neighboring counties if closest: gas station, physician’s office (any type), library, fire station, elementary school, high school, public park, supermarket, freeway on-ramp, and public transportation. A single summary score was computed at each time point, as needed, as the mean of the 10 distances and was log transformed to reduce skew in its distribution. For families who did not change residences over the course of the FLP study, the original variable created at the 6-month wave was used.

Control Variables

Socio-demographic control variables included state, number of children under 18 in the home, maternal age, race, marital status, and maternal education. Maternal age, number of children, and maternal education were all continuous variables. State was dichotomous with Pennsylvania coded as one. Family structure was coded such that married equaled one. Race was a dichotomous variable in the FLP sample (non-African American or African American). Poverty status was based on an income-to-needs ratio, where 1.0 indicated the poverty line for the size of the family. The FLP adopted the approach taken by Hanson et al. (1997) and based household income on anyone who resided in the household, not simply those people related by blood, marriage, or adoption. Individuals were considered to be co-residents if they spent three or more nights per week in the child’s household. Using this information, the total annual household income was divided by the federal poverty threshold for a family of that size and composition (thresholds vary based on number of adults and children) to create the income/needs ratio. We controlled for hours in care because, although research on child care quantity has been mixed, in some studies extensive hours were associated with increased quantitative skills and decreased behavior problems, whereas in others more hours were associated with negative outcomes (Brooks-Gunn et al. 2002; Loeb et al. 2005; NICHD Early Child Care Research Network 2004).

Analysis Plan

Descriptive statistics were used to examine if rural FLP participants were taking up subsidies, who was taking up subsidies, and what types of child care arrangements they were selecting. Bivariate analysis was used to compare the subsidy and the non-subsidy group on the types of child care programs selected at each time point. Bivariate and multivariate regression analyses were conducted to examine relationships between subsidy use and care quality.

Results

Descriptive statistics for the sample over time are displayed in Table 1. The sample was largely married (51 %), African American (53 %), and averaged 27 years old at the baseline data collection point when the focal children were 6 months old. Many of these characteristics, such as the percent African American, percent married, educational level, number of children, and income-to-needs ratio, were fairly stable across time, given the very low attrition rate in the FLP. The data on employment showed that more primary caregivers joined the workforce over time and were working close to full-time, on average. Examining research question 1, we found that at each of the four waves of data collection approximately 70 % qualified for child care subsidies, based on income and TANF participation. Of those eligible, between 23 and 33 % of families utilized subsidies at each point. At each point 75 % or more of eligible/subsidy-using families selected child care centers compared to 30 % or less of the eligible/non-using families and 34 % or less of the non-eligible families (research question 3; Table 1).

To address research question 2 logistic regressions were conducted to examine which families, among those income or TANF eligible, were likely to take up child care subsidies in these rural communities across the target children’s first three years (Table 2). A number of variables were positively related to subsidy use. At 6 months, older mothers were less likely to access subsidies (OR = 0.93, SE = 0.02, p < .01). Additional children (OR = 1.20, SE = 0.11, p < .05), African American families (OR = 2.53, SE = 0.79, p < .01), higher maternal educational attainment (OR = 1.09, SE = 0.05, p < .05), employment (OR = 2.93, SE = 0.69, p < .001), and receiving TANF (OR = 3.83, SE = 1.04, p < .001) were all associated with increased use of a child care subsidy. Given priorities to serve low-income working families and families receiving TANF, it was not surprising that those who were employed were over 100 % more likely and those with TANF benefits were over 200 % more likely to use subsides. As the children reached 15 months of age family structure became a significant predictor: Married mothers were 54 % less likely (OR = 0.46, SE = 0.11, p < .01) to access subsidies than their unmarried counterparts. Again, African American families (OR = 2.81, SE = 0.81, p < .001), higher maternal educational attainment (OR = 1.10, SE = 0.05, p < .05), employment (OR = 2.26, SE = 0.49, p < .001), and receiving TANF (OR = 3.67, SE = 1.17, p < .001) were all associated with increased use of a child care subsidy. These findings were consistent at 24 and 36 months, with African American families, families with a working mother, and families receiving TANF all well over 100 % more likely to take up subsidies than non-African American families, and those not working or accessing TANF.

Tables 3 and 4 present findings about child care quality for research question 4. Table 3 gives bivariate statistics across time making two comparisons: (1) families using child care subsidies compared to the full child care-using sample and (2) families using subsidies compared to the subsidy-eligible sample who did not take up subsidies. For the most part, families who were using subsidies received comparable or higher-quality child care than their non-subsidy using counterparts. They received at least comparable quality care as their more affluent counterparts with the exception of the care received at 15 months when families on subsidy received significantly higher quality care. At every time point except for 24 months among those income-eligible for subsidy, those taking advantage of the benefit enrolled in higher quality care. Further, families who utilized subsidies were much more likely to use center-based care at each time point, particularly when compared to eligible, non-subsidy-using families.

In OLS regression, subsidy use was consistently and largely significantly positively associated with quality of care across time even after accounting for a host of child care, family, and community factors, with the strongest effect at 15 months, β = 0.38, p < .01 (Table 4) when the most subsidy-eligible children in the FLP sample were in child care. However, by 36 months the relationship between subsidy use and quality was only a trend, β = 0.11, p < .10. Race was the only consistent predictor among the control variables. African American children received lower quality care until they were 36 months of age, β = −0.30, p < .01 at 6 months, β = −0.23, p < .01 at 15 months, and β = −0.20, p < .05 at 24 months. By the 36 month wave of data collection African American children were no longer receiving significantly lower quality care, β = −0.11, p = .10.

Discussion

This study aims to provide an understanding of child care subsidy use in rural settings, namely who accesses subsidies, what type of care arrangements these families make, and how subsidy use is related to child care quality across the first 3 years of the children’s lives. Child care subsidy programs reduce the number of families for whom child care is a barrier to work, are essential to economic self-sufficiency, and also support child development (Forry 2009; Loeb et al. 2005), particularly for low-income children.

Up to now, little research has been conducted to examine child care subsidy use in rural settings where there is a dearth of formal programs and existing programs are of lower quality. In the FLP sample, a large majority of families qualified for child care subsidies at each wave based on income or TANF participation, given study oversampling for low-income households. Yet, few of those families actually accessed subsidies. There were several reasons why families may have chosen not to utilize subsidies including stigma, application burden, lack of awareness or understanding of the program, and lack of real or perceived need (Mammen et al. 2011; Shlay et al. 2004; Taylor 2001). Although we did not directly assess stigma, it has been shown to limit participation in means-tested government programs, like child care subsidy (Moffitt 1983). In rural communities, where there was less anonymity than in more urbanized settings, poverty and public assistance use was particularly stigmatized (Rank and Hirschl 1988; Rost et al. 1993). Many Americans viewed welfare participants as undeserving of support largely because of the assumption that participants were not working (Cook and Barrett 1992). Further, stigma was fostered by the ways in which these programs are implemented, as well as negative prior enrollment interactions with case workers and long wait times for service and were aggravated by minority status (Stuber and Schlesinger 2006).

We also found that families who used subsidies were more likely to select center-based care. This was consistent with previous research in primarily urban settings in which subsidy program participation seemed to move families away from parental and relative care and towards center care (e.g., NICHD Early Child Care Research Network 2002; Tekin 2005), which tended to be of higher quality (Governor’s Task Force on Early Childhood Care and Education 2002; NICHD Early Child Care Research Network 2002). Center use was very high even when these rural children were as young as 6 months. This increased center use was consistent with previous research in rural settings (Crosby et al. 2005; Ertas and Shields 2012) although somewhat surprising given the limited access to formal child care providers in rural settings (Whitener et al. 2002). This may be indicative of the level of rurality represented by these study counties. In order to ensure sufficient recruitment numbers and allow for the oversampling of African American and low-income families, the most rural counties in each state were not selected for participation. For example, in North Carolina the study counties have up to 64 licensed child care centers, compared to less than 20 in some of the most remote counties and well over 200 in the most populous (North Carolina Division of Child Development n. d.). Thus, families in the FLP counties may have had access to more child care centers than in other more remote rural settings allowing an increased potential for use of center-based care. However, our findings differed from research in other rural settings. Using data from the National Household Education Survey (NHES), Early Childhood Program Participation Survey (ECPP) Swenson (2007) found that rural families utilizing subsidies, like child care users in rural areas in general, were less likely to use centers and more likely to select family-based arrangements. Similarly, in a large study of subsidy use in rural Oregon, over 50 % of the subsidy-using families selected family child care homes, 18 % were using centers, less than 18 % were using relative care, and 4 % were using care in their homes by a non-relative (Davis and Weber 2001). Over 60 % of this care was unregulated. This is likely to be at least in part a function of race as subsidy-using families in Oregon were largely White (Grobe et al. 2008) and African American families were more likely to select center-based care particularly as they aged, as seen in previous research with the FLP sample (De Marco et al. 2009) and other work (Liang et al. 2000; Early and Burchinal 2001).

We then examined which families were more likely to access subsidies at each time point, finding little difference as children aged. Mothers with higher educational attainment were more likely to access subsidies, which may indicate an increased ability to manage the paperwork and procedures that accompanied applying for benefits and periodically recertifying as subsidy eligible. Further, at each time point families with a working mother or who received TANF benefits were much more likely to access benefits, two groups prioritized within subsidy programs, consistent with another recent study of rural families (Mammen et al. 2009). The African American families in the sample were more likely to access subsidies at each time point, in line with research in more urban areas (Shlay et al. 2010). Further, after 6 months of child age, maternal marital status was predictive of subsidy acceptance. Married mothers were less likely to access benefits, perhaps because they have more resources and support available through a marital partner (Shlay et al. 2004). Further, given the dearth of formal child care options in very rural locales one might expect that these isolated families would need to rely on informal providers, such as neighbors and relatives, and may have the misperception that such providers are ineligible for subsidy (Shlay et al. 2004). However, level of geographic isolation was not a significant predictor of subsidy take-up in this study.

Finally, findings suggested that subsidy programs successfully moved low-income children in these rural communities into higher-quality care beneficial for development, even after accounting for a host of family and community factors. Subsidy use was a significant predictor of child care quality up to the 36-month wave of data collection. Perhaps this fade out of the relationship between subsidy and quality as children age was related to moving increasingly into center-based care, typically of higher quality (Coley et al. 2006; Rigby et al. 2007). The finding up to 36 months was consistent with previous, urban research (Ryan et al. 2011); however in previous research no differences in quality were found for the care received by African American children regardless of subsidy use (Weinraub et al. 2005).

Limitations

Although this study has important implications for social policy and practice, the findings should be considered in light of the limitations. The findings may be restricted in their generalizability as the sample was drawn from rural counties in two states and was not a national sample. Child care subsidy use and the relationship with child care quality may differ in other regions. However, the FLP is representative of the study counties and as such, can be generalized to similar settings. Further, these data were collected from 2004 to 2007 and TANF rules may have changed that influence maternal employment. A final issue relates to the somewhat low alpha for one of the time points for the HOME Inventory, which although not low enough to preclude use, is an issue for generalizability. The HOME Inventory was originally developed for use in familial home environments, where higher alphas were obtained (.89; Bradley 1994). As such, it may not as accurately reflect quality in the child care setting. However, this measure was included in the FLP through consultation with R. Bradley, the measure’s co-developer, who also trained the data collectors.

Implications

Findings suggested that subsidy programs have successfully moved low-income children into higher quality care that may be beneficial for development. These findings point to the need to maintain subsidy programs and encourage eligible families to take advantage of such resources. With a more thorough appreciation of these relationships we will be better equipped to craft outreach, quality improvement efforts, and policies responsive to the realities of rural life. Outreach efforts are needed to improve subsidy take-up rates as well as additional funding to lessen wait list stays. Wake County, North Carolina, home of the capital city of Raleigh, has recently implemented a universal application for all public child care programs. This system serves as a one-stop portal for families who are seeking child care services and puts the onus on administrators to determine which programs families are eligible for and to direct them accordingly (Dowdy 2012). Such a system may be valuable in increasing benefit utilization as joint marketing can be done between agencies that administer public early childhood programs such as Head Start and the Department of Social Services, who sponsor application events throughout the community (Wake County SmartStart 2012).

Further, while we did not directly assess stigma, it has been shown to limit participation in public assistance programs (Moffitt 1983; Shlay et al. 2004) through negative interactions with case workers and long wait times (Stuber and Schlesinger 2006). Efforts should be made to address these shortcomings in the system such as by allowing enrollment outside of welfare offices as has been successful with Medicaid (Stuber and Schlesinger 2006).

Future Directions

To further advance work examining the use of child care subsidy in rural settings in the US it would be valuable to examine why take-up rates are so low in the FLP. This knowledge would help to better design and target marketing efforts to increase awareness of eligibility as well as components of subsidy programs, such as the ability to use subsidy for informal child care providers. It would also be valuable to further explore the role that geographic isolation plays in subsidy use and access to quality child care, as Taylor (2001) notes a number of barriers presented by isolation, including lack of transportation options in particular. Because child care center use was so high in this sample we know less about the experiences of families who took their subsidies to family child care homes or other less formal providers. As subsidy users in other rural locales are more likely to use such providers (Davis and Weber 2001) it is important to also understand what level of quality they receive. It will also be important to further investigate the experiences of these children in the subsidy programs to determine if those who are able to access higher quality care benefit from these services in the long run as research on the effects of Universal Pre-K programs in Georgia found the programs to be particularly beneficial for rural children (Fitzpatrick 2008). We are well placed to examine these relationships in the longitudinal FLP. Child care subsidy can be a powerful tool for improving the lives of low-income families, particularly those in rural communities where so many other resources are lacking.

References

Ames, B. D., Brosi, W. A., & Damiano-Teixeira, K. M. (2006). “I’m just glad my three jobs could be during the day”: Women and work in a rural community. Family Relations, 55, 119–131. doi:10.1111/j.1741-3729.2006.00361.x.

Atkinson, A. M. (1994). Rural and urban families’ use of child care. Family Relations, 43, 16–22. doi:10.2307/585137.

Beach, B. A. (1997). Perspectives on rural child care. Charleston, WV: Clearinghouse on Rural Education and Small Schools.

Berger, M. C., & Black, D. A. (1992). Child care subsidies, quality of care, and the labor supply of low-income, single mothers. The Review of Economics and Statistics, 74, 635–642. doi:10.2307/2109377.

Blau, D. M. (2000). The production of quality in child care centers: Another look. Applied Developmental Science, 4(3), 136–148. doi:10.1207/S1532480XADS0403_3.

Blau, D. (2003). Child care subsidy programs. In R. A. Moffitt (Ed.), Means-tested transfer programs in the United States (pp. 433–516). Chicago, IL: University of Chicago Press. Retrieved from: http://www.nber.org/chapters/c10260.pdf.

Blau, D., & Tekin, E. (2007). The determinants and consequences of child care subsidies for single mothers in the USA. Journal of Population Economics, 20, 719–741. doi:10.1007/s00148-005-0022-2.

Bradley, R. H. (1994). The home inventory: Review and reflections. In H. W. Reese (Ed.), Advances in child behavior and development (Vol. 25, pp. 241–288). Orlando, FL: Academic Press.

Bradley, R. H., & Caldwell, B. M. (1988). Using the HOME inventory to assess the family environment. Pediatric Nursing, 14(2), 97–102.

Bradley, R. H., Caldwell, B. M., & Corwyn, R. F. (2003). The child care HOME inventories: Assessing the quality of family child care homes. Early Childhood Research Quarterly, 18(3), 294–309. doi:10.1016/S0885-2006(03)00041-3

Broberg, A. G., Hwang, C. P., Lamb, M. E., & Bookstein, F. L. (1990). Factors related to verbal abilities in Swedish preschoolers. British Journal of Developmental Psychology, 8, 335–349. doi:10.1111/j.2044-835X.1990.tb00849.x.

Bromer, J., & Henly, J. R. (2004). Child care as family support: Caregiving practices across child care providers. Children and Youth Services Review, 26, 941–964. doi:10.1016/j.childyouth.2004.04.003.

Bronfenbrenner, U. (1989). Ecological systems theory. Annals of Child Development, 6, 187–249.

Bronfenbrenner, U., & Evans, G. W. (2000). Developmental science in the 21st century: Emerging questions, theoretical models, research designs, and empirical findings. Social Development, 9(1), 115–125. doi:10.1111/1467-9507.00114.

Brooks-Gunn, J., Han, W. J., & Waldfogel, J. (2002). Maternal employment and child cognitive outcomes in the first three years of life: The NICHD Study of Early Child Care. Child Development, 73, 1052–1072. doi:10.1111/1467-8624.00457.

Burchinal, M., & Cryer, D. (2003). Diversity, child care quality, and developmental outcomes. Early Childhood Research Quarterly, 18, 401–426. doi:10.1016/j.ecresq.2003.09.003.

Burchinal, M., Kainz, K., Cai, K., Tout, K., Zaslow, M., Martinez-Beck, I., et al. (2009). Early care and education quality and child outcomes (Research-to-Policy, Research-to-Practice Brief #2009-15). Washington, DC: Child Trends.

Caldwell, B. M., & Bradley, R. H. (1984). Home observation for measurement of the environment. Little Rock: University of Arkansas at Little Rock.

Carnochan, S., Ketch, V., De Marco, A., Taylor, S., Abramson, A., & Austin, M. J. (2003). Assessing the initial impact of welfare reform: A synthesis of research studies (1998–2002). In Welfare-to-Work Services in the San Francisco Bay Area: An Exploratory Study of the Perceptions of CalWORKs Participants and Staff (pp. 1–36). Berkeley, CA: Bay Area Social Services Consortium.

Coley, R. L., Li-Grining, C. P., & Chase-Lansdale, P. L. (2006). Low-income families’ childcare experiences: Meeting the needs of children and families. In N. J. Cabrera, R. Hutchens, & E. Peters (Eds.), From welfare to child care (pp. 149–170). Mahwah, NJ: Erlbaum.

Cook, F., & Barrett, E. (1992). Beliefs about recipient deservingness and program effectiveness as explanations of support. Support for the American welfare state: Views of Congress and the public (pp. 95–145). New York, NY: Columbia University Press.

Crosby, D. A., Gennetian, L., & Huston, A. C. (2005). Child care assistance policies can affect the use of center-based care for children in low-income families. Applied Developmental Science, 9(2), 86–106. doi:10.1207/s1532480xads0902_4.

Davis, E. E., & Weber, R. B. (2001). The dynamics of child care subsidy use by rural families in Oregon. American Journal of Agricultural Economics, 83, 1293–1301. doi:10.1111/0002-9092.00281.

De Marco, A., Crouter, A. C., & Vernon-Feagans, L. (2009). The relationship of maternal work characteristics to childcare type and quality in rural communities. Community, Work, & Family, 12, 369–387. doi:10.1080/13668800802528249.

De Marco, A., & Vernon-Feagans, L. (2013). Rural neighbourhood context, child care quality, and relationship to early language development. Early Education & Development, 24, 792–812. doi:10.1080/10409289.2013.736036.

Dearing, E., McCartney, K., & Taylor, B. A. (2009). Does higher quality early child care promote low-income children’s math and reading achievement in middle childhood? Child Development, 80, 1329–1349. doi:10.1111/j.1467-8624.2009.01336.x.

Deavers, K. L., & Hoppe, R. A. (1992). Overview of the rural poor in the 1980s. In C. M. Duncan (Ed.), Rural poverty in America (pp. 3–20). New York, NY: Auburn House.

Dill, B. T. (1999). Poverty in the rural U.S.: Implications for children, families, and communities. Literature review prepared for The Annie E. Casey Foundation.

Dowdy, P. (2012, November). Wake County SmartStart: Foundation, collaboration, results. Presentation to the NC House Select Committee on Early Childhood Education Improvement. Retrieved from http://www.smartstart.org/wp-content/uploads/2012/01/Wake-County-SmartStart-Jan.-5-Legislative-Presentation-final.pdf.

Dowsett, C. J., Huston, A. C., Imes, A. E., & Gennetian, L. (2008). Structural and process features in three types of child care for children from high and low income families. Early Childhood Research Quarterly, 23, 69–93. doi:10.1016/j.ecresq.2007.06.003.

Early, D. M., & Burchinal, M. R. (2001). Early childhood care: Relations with family characteristics and preferred care characteristics. Early Childhood Research Quarterly, 16, 475–497. doi:10.1016/S0885-2006(01)00120-X.

Economic Research Service. (2010). Rural income, poverty, and welfare: Summary of conditions and trends. Retrieved from http://www.ers.usda.gov/Briefing/incomepovertywelfare/overview.htm.

Economic Research Service. (2012a). State fact sheet: North Carolina [Updated May 2, 2012]. Retrieved from http://www.ers.usda.gov/data-products/state-fact-sheets.aspx.

Economic Research Service. (2012b). State fact sheet: Pennsylvania [Updated May 2, 2012]. Retrieved from http://www.ers.usda.gov/data-products/state-fact-sheets.aspx.

Ertas, N., & Shields, S. (2012). Child care subsidies and care arrangements of low-income parents. Children and Youth Services Review, 34, 179–185. doi:10.1016/j.childyouth.2011.09.014.

Findeis, J. (2001). The labor shortage is finally here. Choices, 16(1), 1.

Fitzpatrick, M. D. (2008). Starting school at four: the effect of universal pre-kindergarten on children’s academic achievement. The B.E. Journal of Economic Analysis & Policy, 8(1), Article 46. Retrieved from: http://www.bepress.com/bejeap/vol8/iss1/art46.

Forry, N. D. (2009). The impact of child care subsidies on low-income single parents: An examination of child care expenditures and family finances. Journal of Family and Economic Issues, 30(1), 43–54. doi:10.1007/s10834-008-9135-6.

Fuller, B., Livas, A., & Bridges, M. (2005). How to expand and improve preschool in California: Ideals, evidence, and policy options (Working Paper 05-1). Berkeley, CA: Policy Analysis for California Education.

Fuller, B., Raudenbush, S. W., Wei, L., & Holloway, S. D. (1993). Can government raise child-care quality? The influence of family demand, poverty, and policy. Educational Evaluation and Policy Analysis, 15, 255–278. doi:10.3102/01623737015003255.

Ghazvini, A. S., Mullis, A. K., Mullis, R. L., & Park, J. J. (1999). Child care issues impacting welfare reform in the rural South (No. 9). Mississippi State, MS: Southern Rural Development Center.

Governor’s Task Force on Early Childhood Care and Education. (2002). Early care and education: The keystone of Pennsylvania’s future. Harrisburg, PA: Commonwealth of Pennsylvania.

Grobe, D., Weber, R. B., & Davis, E. E. (2008). Why do they leave? Child care subsidy use in Oregon. Journal of Family and Economic Issues, 29, 110–127. doi:10.1007/s10834-007-9094-3.

Halle, T., Hair, E., Terry-Humen, E., Zaslow, M., Pitzer, L., Lavelle, B., & Scott, E. (2005, April). The effect of type and extent of child care on low-income children’s outcomes in kindergarten, first, and third grades. Paper presented at the meeting of the Society for Research in Child Development, Atlanta, GA.

Hanson, T. L., McLanahan, S., & Thomson, E. (1997). Economic resources, parental practices, and children’s well-being. In G. J. Duncan & J. Brooks-Gunn (Eds.), Consequences of growing up poor (pp. 190–238). New York, NY: Russell Sage Foundation.

Honig, A. S. (2002). Choosing child care for young children. In M. H. Bornstein (Ed.), Handbook of parenting (2nd ed., Vol. 5, pp. 375–405). Mahwah, NJ: Erlbaum.

Huston, A. C., Chang, Y. E., & Gennetian, L. (2002). Family and individual predictors of child care use by low-income families in different policy contexts. Early Childhood Research Quarterly, 17, 441–469. doi:10.1016/S0885-2006(02)00185-0.

Kainz, K., Willoughby, M. T., Vernon-Feagans, L., & Burchinal, M. R. (2012). Modeling family economic conditions and young children’s development in rural United States: Implications for poverty research. Journal of Family and Economic Issues, 33, 410–420. doi:10.1007/s10834-012-9287-2.

Karpilow, K. (1999). Understanding child care: A primer for policy makers. Sacramento, CA: Institute for Research on Women and Families.

Keefer, P. B., Monroe, P. A., Atkinson, E. S., & Garrison, M. E. (1996). Child care as an impediment to rural women’s labor force participation. Family Perspective, 30, 257–274.

Liang, X., Fuller, B., & Singer, J. D. (2000). Ethnic differences in child care selection: The influence of family structure, parental practices, and home language. Early Child Research Quarterly, 15, 357–384. Retrieved from http://128.32.250.11/research/PACE/reports/FULLER_ethnic_differences.PDF.

Lichter, D. T., Roscigno, V. J., & Condron, D. J. (2003). Rural children and youth at risk. In D. L. Brown & L. E. Swanson (Eds.), Challenges for rural America in the twenty-first century (pp. 97–108). University Park: The Pennsylvania State University Press.

Lino, M. (1998). Child care and welfare reform. Family Economics and Nutrition Review, 11(1&2), 41–48. Retrieved from http://www.cnpp.usda.gov/familyeconomicsandnutritionreview.htm.

Livermore, M., Powers, R. S., Davis, B. C., & Lim, Y. (2011). Failing to make ends meet: Dubious financial success among employed former welfare to work program participants. Journal of Family and Economic Issues, 32(1), 73–83. doi:10.1007/s10834-010-9192-5.

Loeb, S., Bridges, M., Bassok, D., Fuller, B., & Rumberger, R. (2005). How much is too much? The influence of preschool centers on children’s development nationwide [Technical Report]. Stanford, CA: Stanford University and University of California.

Loeb, S., Fuller, B., Kagan, S. L., & Carrol, B. (2004). Child care in poor communities: Early learning effects of type, quality, and stability. Child Development, 75(1), 47–65. doi:10.1111/j.1467-8624.2004.00653.x.

Magnuson, K. A., & Waldfogel, J. (2005). Early childhood care and education: Effects on ethnic and racial gaps in school readiness. The Future of Children, 15, 169–196. doi:10.1353/foc.2005.0005.

Maher, E. J., Frestedt, B., & Grace, C. (2008). Differences in child care quality in rural and non-rural areas. Journal of Research in Rural Education, 23(4), 1–13. Retrieved from http://eric.ed.gov/ERICWebPortal/detail?accno=EJ809596.

Mammen, S., Lass, D., & Seiling, S. B. (2009). Labor force supply decisions of rural low-income mothers. Journal of Family and Economic Issues, 30, 67–79. doi:10.1007/s10834-008-9136-5.

Mammen, S., Lawrence, F. C., Marie, P. S., Berry, A. A., & Knight, S. E. (2011). The earned income tax credit and rural families: Differences between non-participants and participants. Journal of Family and Economic Issues, 32, 461–472. doi:10.1007/s10834-010-9238-8.

McCartney, K., Dearing, E., Taylor, B. A., & Bub, K. (2007). Quality child care supports the achievement of low-income children: Direct and indirect effects through caregiving and the home environment. Journal of Applied Developmental Psychology, 28, 411–426. doi:10.1016/j.appdev.2007.06.010.

Moffitt, R. (1983). An economic model of welfare stigma. The American Economic Review, 73, 1023–1035. Retrieved from http://www.jstor.org/stable/1814669.

Monroe, P. A., & Tiller, V. V. (2001). Commitment to work among welfare-reliant women. Journal of Marriage and Family, 63, 816–828. doi:10.1111/j.1741-3737.2001.00816.x.

NICHD Early Child Care Research Network (2002). Early child care and children’s development prior to school entry: Results from the NICHD Study of Early Child Care. American Educational Research Journal, 39(1), 133–164. Retrieved from http://www.jstor.org/stable/3202474.

NICHD Early Child Care Research Network. (2004). Type of child care and children’s development at 54 months. Early Childhood Research Quarterly, 19, 203–230. doi:10.1016/j.ecresq.2004.04.002.

NICHD Early Child Care Research Network, & Duncan, G. J. (2003). Modeling the impacts of child care quality on children’s preschool cognitive development. Child Development, 74, 1454–1475. doi:10.1111/1467-8624.00617.

O’Hare, W. P. (2009). The forgotten fifth: Child poverty in rural America. Manchester, NH: Carsey Institute.

Parisi, D., McLaughlin, D. K., Grice, S. M., Taquino, M., & Gill, D. A. (2003). TANF participation rates: Do community conditions matter? Rural Sociology, 68, 491–512. doi:10.1111/j.1549-0831.2003.tb00148.x.

Peisner-Feinberg, E. S., Burchinal, M. R., Clifford, R. M., Culkin, M. L., Howes, C., Kagan, S. L., et al. (1999). The children of the cost, quality, and outcomes study go to school: Executive summary. Chapel Hill, NC: Frank Porter Graham Child Development Institute.

Phillips, D. A., & Adams, G. (2001). Child care and our youngest children. Future of Children, 11(1), 35–51. doi:10.2307/1602808.

Queralt, M., Witte, A. D., & Griesinger, H. (2000). Changing policies, changing impacts: Employment and earnings of child care subsidy recipients in the era of welfare reform. Social Service Review, 74, 588–619. doi:10.1086/516426.

Rank, M. R., & Hirschl, T. A. (1988). A rural-urban comparison of welfare exits: The importance of population density. Rural Sociology, 53, 190–206. Retrieved from http://eric.ed.gov/ERICWebPortal/detail?accno=EJ382722.

Reynolds, A. (2000). Success in early interventions: The Chicago child-parent centers. Lincoln: University of Nebraska Press.

Rigby, E., Ryan, R. M., & Brooks-Gunn, J. (2007). Child care quality in various state policy contexts. Journal of Policy Analysis and Management, 26, 887–907. doi:10.1002/pam.20290.

Rivers, K. (2005, February). Rural southern children falling behind in well-being indicators. Retrieved from website of Population Reference Bureau at http://www.prb.org/Publications/Articles/2005/RuralSouthernChildrenFallingBehindinWellBeingIndicators.aspx.

Rost, K., Smith, G. R., & Taylor, J. L. (1993). Rural-urban differences in stigma and the use of care for depressive disorders. Journal of Rural Health, 9(1), 57–62. doi:10.1111/j.1748-0361.1993.tb00495.x.

Trends, Child. (2009). What we know and don’t know about measuring quality in early childhood and school-age care and education settings (OPRE Issue Brief #1). Washington, DC: Child Trends.

North Carolina Division of Child Development. (n.d.). Child care facility search site. Retrieved from http://ncchildcaresearch.dhhs.state.nc.us/search.asp.

Rural Assistance Center. (2009). North Carolina. Retrieved from http://www.raconline.org/states/northcarolina.php.

Rural Poverty Research Institute. (1999). Rural America and welfare reform: An overview assessment (No. 99-3). Rural Poverty Research Institute. Retrieved from http://www.rupri.org/pubs/archive/old/welfare/p99-3.

Ryan, R. M., Johnson, A. D., Rigby, D. E., & Brooks-Gunn, J. (2011). The impact of child care subsidy use on child care quality. Early Childhood Research Quarterly, 26, 320–331. doi:10.1016/j.ecresq.2010.11.004.

Shlay, A. B., Weinraub, M., & Harmon, M. (2010). Child care subsidies post TANF: Child care subsidy use by African American, White and Hispanic TANF-leavers. Children and Youth Services Review, 32, 1711–1718. doi:10.1016/j.childyouth.2010.07.014.

Shlay, A. B., Weinraub, M., Harmon, M., & Tran, H. (2004). Barriers to subsidies: Why low-income families do not use child care subsidies. Social Science Research, 33, 134–157. doi:10.1016/S0049-089X(03)00042-5.

Smith, K. (2006). Rural families choose home-based child care for their preschool-aged children (Paper 9). Retrieved from Carsey Institute website at http://scholars.unh.edu/carsey/9.

Smith, K. (2008). Working hard for the money: Trends in women’s employment 1970–2007 (Paper 59). Retrieved from Carsey Institute website at http://scholars.unh.edu/carsey/59.

Smith, K., & Adams, N. (2013, Spring). Child care subsidies critical for low-income families amid rising child care expenses (Policy Brief No. 20). Durham: University of New Hampshire, Carsey Institute.

Snyder, A. R., & McLaughlin, D. K. (2004). Female-headed families and poverty in rural America. Rural Sociology, 69(1), 127–149. doi:10.1526/003601104322919937.

Son, S., & Bauer, J. W. (2010). Employed rural, low-income, single mothers’ family and work over time. Journal of Family and Economic Issues, 31, 107–120. doi:10.1007/s10834-009-9173-8.

Sonenstein, F. L., & Wolf, D. A. (1991). Satisfaction with child care: Perspectives of welfare mothers. Journal of Social Issues, 47(2), 15–31. doi:10.1111/j.1540-4560.1991.tb00285.x.

Stuber, J., & Schlesinger, M. (2006). The sources of stigma in government means-tested programs. Social Science and Medicine, 63, 933–945. doi:10.1016/j.socscimed.2008.03.023.

Summers, G. (1995). Persistent rural poverty. In E. Castle (Ed.), The changing American countryside: Rural people and places (pp. 213–228). Lawrence: University Press of Kansas.

Swenson, K. (2007). Child care subsidies in urban and rural counties. Washington, DC: US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation. Retrieved from http://aspe.hhs.gov/hsp/07/cc-subsidies/report.pdf.

Taylor, L. C. (2001). Work attitudes, employment barriers, and mental health symptoms in a sample of rural welfare recipients. American Journal of Community Psychology, 29, 443–463. doi:10.1023/A:1010323914202.

Tekin, E. (2005). Child care subsidy receipt, employment, and child care choices of single mothers. Economics Letters, 89, 1–6. Retrieved from http://www.nber.org/papers/w10459.

Temple, J. A., Reynolds, A. J., & Miedel, W. T. (2000). Can early intervention prevent high school dropout? Evidence from the Chicago Child–Parent Centers. Urban Education, 35, 31–56. doi:10.1177/0042085900351003.

Totsika, V., & Sylva, K. (2004). The home observation for measurement of the environment revisited. Child and Adolescent Mental Health, 9, 25–35. doi:10.1046/j.1475-357X.2003.00073.x.

Votruba-Drzal, E., Coley, R. L., & Chase-Lansdale, P. L. (2004). Child care and low-income children’s development: Direct and moderated effects. Child Development, 75, 296–312. doi:10.1111/j.1467-8624.2004.00670.x.

Wake County SmartStart. (2012). Wake County pre-kindergarten program application process for 2012. Retrieved from http://www.carolinabusinessconnection.com/cbc/article.html?id=20270.

Walker, S., & Reschke, K. (2004). Child care use by low income families in rural areas: A contemporary look at the influence of women’s work and partner availability. Journal of Children and Poverty, 10, 149–167. doi:10.1080/1079612042000271585.

Weinraub, M., Shlay, A. B., Harmon, M., & Tran, H. (2005). Subsidizing child care: How child care subsidies affect the child care used by low-income African American families. Early Childhood Research Quarterly, 20, 373–392. doi:10.1016/j.ecresq.2005.10.001.

Whitener, L. A., Duncan, G. J., & Weber, B. A. (2002). Reforming welfare: What does it mean for rural areas? (Food Assistance and Nutrition Research Report Number 26-4). Washington, DC: United States Department of Agriculture.

Winsler, A., Tran, H., Hartman, S. C., Madigan, A. L., Manfra, L., & Bleiker, C. (2008). School readiness gains made by ethnically diverse children in poverty attending center-based childcare and public school pre-kindergarten programs. Early Childhood Research Quarterly, 23, 314–329. doi:10.1016/j.ecresq.2008.02.003.

Zaslow, M. J. (1991). Variation in child care quality and its implications for children. Journal of Social Issues: Child Care Policy Research, 47, 125–138. doi:10.1111/j.1540-4560.1991.tb00291.x.

Zimmerman, J. N., & Hirschl, T. A. (2003). Welfare reform in rural areas: A voyage through uncharted waters. In D. L. Brown, L. E. Swanson, & A. W. Barton (Eds.), Challenges for rural America in the twenty-first century (pp. 363–374). University Park: The Pennsylvania State University Press.

Author information

Authors and Affiliations

Consortia

Corresponding author

Additional information

The members of Family Life Project Key Investigators is listed in Appendix.

Appendix

Appendix

The Family Life Project Phase I Key Investigators include: Lynne Vernon-Feagans, University of North Carolina; Martha Cox, University of North Carolina; Clancy Blair, New York University; Peg Burchinal, University of North Carolina; Linda Burton, Duke University; Keith Crnic, Arizona State University; Ann Crouter, Pennsylvania State University; Patricia Garrett-Peters, University of North Carolina; Mark Greenberg, Pennsylvania State University; Stephanie Lanza, Pennsylvania State University; Roger Mills-Koonce, University of North Carolina; Emily Werner, Pennsylvania State University and Michael Willoughby, University of North Carolina. We would like to acknowledge the valuable assistance of Christina Galunas, Frank Porter Graham Child Development Institute, and Cathy Zimmer, Odum Institute for Social Sciences Research, at the University of North Carolina – Chapel Hill. This research was supported by NICHD P01-HD-39667 and ACF #90YE0126, with co-funding by NIDA.

Rights and permissions

About this article

Cite this article

De Marco, A., Vernon-Feagans, L. & Family Life Project Key Investigators. Child Care Subsidy Use and Child Care Quality in Low-Wealth, Rural Communities. J Fam Econ Iss 36, 383–395 (2015). https://doi.org/10.1007/s10834-014-9401-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-014-9401-8