Abstract

This study uses data from the 2005 Survey of Household Finances to investigate the existence of loss aversion in household saving behavior in Spain. Loss aversion refers to an asymmetry in saving behavior in response to increases and decreases in income, where income decreases have a greater effect than increases. Evidence of loss aversion in household saving behaviors in the U.S. has been presented in previous research, and evidence of loss aversion in saving has been found using aggregate data from Europe, but to date there are no household level studies on loss aversion and saving behaviors in Europe. The present results do not support the existence of loss aversion at the household level in Spain. The results indicate symmetry in the responses to positive and negative income changes, failing to provide support for loss aversion in household saving behaviors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Household saving is an important part of improving the economic well-being of households and protecting families from financial crises or economic hardship (Han and Sherraden 2009; Hira 1987; Lee et al. 2000). The concept of saving has thus been the focus of a considerable amount of theoretical and empirical research in the economic literature (Canova et al. 2005). In studies of household saving, the life-cycle model has been the main framework used for nearly 50 years (Fan and Abdel-Ghany 2004; Xiao and Olson 1993). However, in response to empirical findings that are inconsistent with the life-cycle model (see Avery and Kennickell 1991; Banks et al. 1998; Bernheim et al. 2001; Campbell and Mankiw 1990; Fershtman 1996; Mirer 1979; Sibly 2002; Thaler 1990), alternative models have recently been proposed (Hong et al. 2002). One alternative model that relaxes some of the assumptions made within the life-cycle framework is the model of consumption and saving presented by Bowman et al. (1999), which is based on the prospect theory of Kahneman and Tversky (1979).

Kahneman and Tversky (1979) argue that there are several cases in which individuals’ preferences systematically violate the axioms of expected utility theory. In particular, people treat expected gains and losses differently (Tversky and Kahneman 1986), overweighting prospective losses and underweighting equivalent gains (Attanasio and Banks 2001). In the loss aversion model (an extension of prospect theory), people resist lowering consumption in response to bad news about future income, which is greater than resistance to increasing consumption in response to good news (Bowman et al. 1999). Thus, declines in income lead to a greater decrease in saving than income rises lead to increases in saving.

Studies of household saving guided by these alternative models are relatively limited because the life cycle hypothesis has been the main framework used for nearly 50 years (Fan and Abdel-Ghany 2004; Xiao and Olson 1993). In addition, few researchers have explored saving behaviors at the household level in some regions of the world, instead using aggregate data, as household level data on assets and income is often unavailable. When investigating saving behaviors using aggregate data, nonprofit institutions and entities such as charities and churches are included in addition to households, and the saving rate is calculated by taking the difference between disposable personal income and personal consumption expenditures, then dividing this amount by disposable personal income. The use of aggregate data can thus make it difficult to investigate behaviors at the micro or household level, as some behaviors occurring at the household level can be hidden. For example, with the combination of nonprofit institutions and household data in aggregate data, it is unclear if relationships found in the data apply to the nonprofits, individual households, or both. The use of household-level data contributes substantially to our understanding of individual behavior, and makes it possible to evaluate the impact of specific factors across households (European Central Bank 2009).

The Spanish Survey of Household Finances (EFF), a nationally representative data set on household incomes, assets, debts, and consumption, was started in 2002, and is the only data set in Spain to link household financial characteristics such as assets and income (Bover 2008a). This data set provides a good source of information to explore loss aversion in the context of household saving behaviors. Previous studies using aggregate data and/or data from the U.S. provide evidence of loss aversion in saving and consumption behaviors, but the way households protect themselves from future risk varies significantly across countries (Sierminska et al. 2007), so whether this holds when using household-level data from countries other than the U.S. is unclear.

In the current study, the 2005 Spanish Survey of Household Finances dataset is used to investigate household saving based on the two-period model of consumption/saving of Bowman et al. (1999). Previous loss aversion studies have been based on experimental or aggregate data, and Schmidt and Traub (2002) argued that evidence of loss aversion may be due to the large extent of loss aversion at the aggregate level rather than a general occurrence at the individual level. The current study adds to the literature by investigating whether there is evidence of loss aversion in saving behaviors at the household level in Spain. As saving rates and behaviors differ from country to country (Marchante et al. 2001), empirical support for a particular model of saving in one country may not mean that the model is applicable to other countries. It is possible that different factors explain saving behaviors in countries with differing cultures. For example, empirical support for the use of loss aversion in explaining saving behaviors has been provided in the U.S., but we do not yet know if loss aversion is applicable in models of saving in other regions of the world.

Following Fisher and Montalto (2011), the likelihood of saving is modeled as a function of household income relative to the reference level of income, in addition to variables shown in the literature to affect saving behaviors. In a paper arguing for the use of replication studies in economics, Hamermesh (2007) stated that it is necessary to test theories from more than one economy in order to describe the behavior of consumers. The purpose of this paper is to replicate the study of Fisher and Montalto (2011) based on the U.S. using a data set from a European country, Spain. In the next section, a review of the literature is presented, including theoretical frameworks and empirical research. The data and empirical methodology are also discussed, followed by the results and discussion.

Literature Review

One of the main reasons why households accumulate assets is because they are exposed to risk and uncertainty (Azpitarte 2008). According to the standard economic approach to saving, people with temporarily high income will save more to compensate for lower future income, while those with temporarily low income will save less in anticipation of higher future income (Dynan et al. 2004; Friedman 1957). The life-cycle/permanent income hypothesis posits that people smooth consumption over their lifetime, even when income varies, basing consumption on lifetime wealth (Ando and Modigliani 1963). However, many researchers have found that consumption is too sensitive to current income to be consistent with a lifetime conception of permanent income (Avery and Kennickell 1991; Mirer 1979; Thaler 1990). Empirical studies suggest that individuals may quickly reduce or increase consumption in response to income drops or increases, respectively, rather than smooth consumption over their lifetime (Banks et al. 1998; Bernheim et al. 2001; Campbell and Mankiw 1990; Fershtman 1996; L’Haridon 2009; Sibly 2002).

In contrast to the life cycle model of saving, the prospect theory framework posits that individuals treat gains and losses differently (Kahneman and Tversky 1979). Studies show that people tend to overweight losses while they underweight gains. Based on this idea, people resist reducing consumption in response to a decrease in current or future income when income uncertainty is present, but are likely to immediately increase consumption when there is an increase in current or future income (Bowman et al. 1999). According to Bowman et al. (1999), an income increase will not have as large of an effect on saving as will an income decline, with rises in income leading to increased saving and declines in income leading to a (greater) decrease in saving.

Prospect theory has been used over the past few decades to explain a variety of phenomena, and several researchers have utilized theoretical frameworks based on prospect theory to explore saving and consumption behaviors (Booij and van de Kuilen 2009; Bowman et al. 1999; Fisher and Montalto 2011; Kahneman and Tversky 1979; Shea 1995; Xiao and Anderson 1997). The main component of prospect theory used to guide the work of Bowman et al. (1999) and Fisher and Montalto (2011), as well as the current study, is the idea of loss aversion, which is discussed in the following section.

Income and Loss Aversion

Traditional models of saving imply that people with temporarily high income will save more to make up for lower future income, while people with temporarily low income will save less in anticipation of higher income in the future (Dynan et al. 2004). In agreement with this, prospect theory indicates that people will increase savings when income is high and will save less when income is low (Kahneman and Tversky 1979). However, prospect theory also posits that these saving decisions are not based on lifetime or permanent wealth but on a reference level of consumption. According to the prospect theory framework, people exhibit loss aversion in consumption and saving decisions, or resist reducing consumption following a decrease in income (when income uncertainty is present), but are more likely to immediately increase consumption following an increase in current or future income (Bowman et al. 1999). This idea of loss aversion is in contrast to traditional saving models, where no such asymmetry exists.

Loss aversion refers to the strong preference of individuals to avoid losses (Thaler and Benartzi 2001). In the context of saving, households adjust to a particular level of disposable income and view reductions in that level as a loss. Thus, those facing an income decline do not want to decrease their consumption, and resist doing so, because they want to continue consuming at the same level. Evidence of loss aversion has been found in a variety of empirical studies (e.g., Booij and van de Kuilen 2009). Using experimental data, Abdellaoui et al. (2005) found strong evidence of loss aversion at both aggregate and individual levels. In a study utilizing aggregate data, Bowman et al. (1999) found evidence of asymmetric reactions in consumption growth to anticipated good and bad news about income growth, whereby households may optimally refuse to reduce consumption in response to expected, but uncertain, drops in future income.

While many empirical researchers have concluded that loss aversion is a good descriptor of behavior in general, Schmidt and Traub (2002) argued that such a conclusion should be treated with caution, because evidence of loss aversion at the aggregate level could stem from the large extent of loss aversion rather than the general occurrence of loss aversion at the individual or household level. The extent of loss aversion is stronger among some individuals than others, so studies based on aggregate data could be capturing this rather than the existence of loss aversion among all households. In addition, household-specific factors may remain hidden in aggregate statistics, so their relevance must be assessed with micro-level data (European Central Bank 2009). Fisher and Montalto (2011) found evidence of loss aversion at the household level when exploring the saving behaviors of Americans using the U.S. Survey of Consumer Finances, but to the author’s knowledge, there are no other household-level studies on loss aversion and saving behaviors at this time. Models of saving are often empirically tested using data from the U.S., but it is not clear if we can apply these findings and models to other cultures unless they are investigated using data from other regions.

Other Variables Related to Saving

In addition to the measure of loss aversion, several other variables have been used to explain household saving behaviors. Frequently used determinants of household saving in empirical studies include sociodemographic variables such as age, education, and income, and household wealth variables (Furnham 1985, 1999; Aghevli et al. 1990). Saving rates increase until individuals reach their mid or late 60s, after which the saving rate drops (Bosworth et al. 1991). In Spain, households headed by a young person are the most vulnerable group in terms of a lack of reserves to protect against future contingencies (Azpitarte 2008). Education and saving are positively related, as are homeownership and saving (Hefferan 1982; Hong et al. 2002).

Income and wealth have also been shown to be positively associated with saving (Avery and Kennickell 1991; Bosworth et al. 1991; Davis and Schumm 1987; Hefferan 1982; Hong et al. 2002). Households with higher income risk are more likely to save (Carroll 1994; Deaton 1991; Lusardi 1998; Sandmo 1970; Zeldes 1989). However, Fisher (2010) found no significant relationship between income uncertainty and saving behavior while Fisher and Montalto (2011) found a negative relationship between income uncertainty and saving. According to Hondroyiannis (2010), economic uncertainty affects a wide range of individual and household behaviors, including the decision to marry and have children, which in turn affect consumption and saving behaviors.

Empirical researchers have also found that household composition affects saving, where single parents have the lowest saving rates in the population and married couples with no children have the highest saving rates (Avery and Kennickell 1991; Bosworth et al. 1991). The presence of children in a household reduces the likelihood of owning assets (Sanders and Porterfield 2010), and continuously married households hold more assets than households with non-married members (Browning and Lusardi 1996). Households in Spain with a single respondent are more likely to be wealth constrained, particularly those with children (Azpitarte 2008). These households may face difficulty in saving due to the absence of consumption economies of scale as well as their larger liquidity constraints (Japelli 1990). One of the characteristics of Spain and many other Mediterranean countries is the existence of strong family ties, where the share of young people living with their parents until marriage is much higher than in countries with weak family ties, such as the U.S. (Reher 1998). Elderly individuals in countries with strong family ties are also more likely to be living with an adult sibling.

The literature shows that, relative to countries such as the U.S. and the UK, households in Spain prefer to hold more illiquid assets such as housing (Bover 2004; Christensen et al. 2005). Almost 82% of Spanish households own their main residence, with more than 30% holding another form of real estate. Saving behavior and wealth are also affected by the health status of an individual, where those in poor health are less likely to save and have lower levels of wealth (e.g., Davies 1981; Fisher and Montalto 2010, 2011; Palumbo 1999; Ulker 2009).

Empirical researchers have also found a strong link between longer planning horizons and saving behavior (Fisher and Montalto 2010, 2011; Lee et al. 2000; Rabinovich and Webley 2007). Smith (1995) argues that one of the most cited reasons for lower saving among the poor is their focus on the present or shorter planning horizons. DeVaney et al. (2007) found planning horizon to affect moving up the savings hierarchy from no savings, where those planning for a period of 1 year or greater were more likely to move up the hierarchy than those with a planning horizon of the next few months. Saving horizon was also included in a study by Pence (2001) on 401(k)s and household saving in order to control for saving tastes, although no direct information was provided for the effect of this saving horizon variable on saving.

Characteristics of Spanish Households

The household net saving rate in Spain was 6.1% in 2008, where saving is measured as a proportion of disposable household income (OECD 2010). This rate was higher than the net saving rates in previous years, which ranged from 3.6 to 6% between 2000 and 2007. The average life expectancy in Spain is 78.8 years, with an average retirement age of 61.4 years for men and 58.9 years for women (Banks et al. 2002). The Spanish Social Security System for old age pensions is financed by current workers’ contributions, and individuals must contribute for 15 years to be eligible and can begin collecting at the age of 60 (with a penalty; Sanchez Martin 2001). Spain’s retirement system has been undergoing changes in recent years, and the compulsory retirement age was increased to 67 years (from 65 years) in early 2011 (Minder 2011). About 40% of the population in Spain is 65 years or older (Bank of Spain 2008).

Spain is a nation with strong family ties, and young adults are likely to co-reside with their parents (Del Rio and Ruiz-Castillo 2002; Martinez-Granado and Ruiz-Castillo 2002), making the structure of households different from households in countries such as the U.S. About 14% of households in Spain contain only one person, with almost half (46.2%) containing five or more members (Bank of Spain 2008). Recent labor conditions such as high unemployment and the frequency of temporary, low paying jobs among the young in Spain coupled with the high enrollment rate in higher education contribute to the delay in young adults leaving their parents’ home (Azpitarte 2008). About 65% of men aged between 25 and 29 years and 48% of women in that age group still live with their parents (Fernandez-Cordon 1997). Only 5.7% of households in Spain are headed by a person under the age of 30 (Azpitarte 2008), and the rate of single person households in Spain is 16.9% (Bover 2008a).

The average income of Spanish households at the end of 2005 was €32,400 with median income of €23,100 (Bank of Spain 2008). The median net wealth of households in 2005 was €177,000 while the average was €257,000. Average and median wealth both increase with education and income. Spaniards exhibit a large preference for less liquid assets, and housing wealth in particular (Azpitarte 2008; Bover 2004; Christensen et al. 2005). Real assets account for 89% of the total value of household assets in Spain, with the majority of this coming from homes, followed by other residences and businesses (Bank of Spain 2008). In addition to the almost 82% of Spanish households owning their main residence, an additional 30% own another form of real estate (Azpitarte 2008). About 28% of homeowners in Spain have mortgage debt, and about 25% have non-mortgage debt. Less than 7% of all households in Spain have zero or negative net worth, which is considerably less than the proportion of households with zero or negative net worth in countries such as the U.S. (Bover 2008a). A large majority of households (92.3%) report having some form of bank account that can be used to make payments. For more detailed information on the financial characteristics of Spaniards, see Bank of Spain (2008).

Hypotheses

The loss aversion model of consumption and saving of Bowman et al. (1999) and the empirical literature indicate that households will be more likely to save if their income is above the reference level and less likely to save if their income is below the reference level, with the effect of income falling below the reference level having a greater effect on saving than having income above the reference level. “Normal” income and the relationship between current income and normal income is based on the household’s response to the following question (after being asked questions regarding their annual income): “Is this income unusually high or low compared to what you would expect in a “normal” year, or is it normal?” Based on the premise of Bowman et al.’s (1999) model of consumption and saving, the following hypotheses are proposed.

Hypothesis 1

Having higher income than normal leads to an increase in the likelihood of saving.

Hypothesis 2

Having lower income than normal leads to a decrease in the likelihood of saving.

Hypothesis 3

The decrease in the likelihood of saving due to having lower income than normal is greater than the increase in the likelihood of saving due to having higher income than normal.

Data and Methodology

Data

The current study uses data from the 2005 wave of the Spanish Survey of Household Finances (EFF), which provides rich, reliable information on household assets and debts along with socioeconomic variables relative to households and their members (Bover 2008b). The Bank of Spain began conducting the EFF in 2002, and is the only statistical source in Spain to allow the linking of incomes, assets, debts, and consumption at the household level (Bover 2008a). EFF data collection employs oversampling of wealthy households, following the example of the U.S. Survey of Consumer Finances (SCF) in order to obtain data on assets held by only a small fraction of the population (Bover 2004). In the 2005 wave, 5,962 valid interviews were completed.

Methods

The EFF sampling process does not follow an equal-probability design, so weights are critical for interpreting the survey data (see Bover 2004). Cross-sectional weights are used to produce the descriptive statistics provided in Table 1. Multiple imputation techniques are also used in the EFF to deal with missing responses, and the programs used for the SCF multiple imputation are used (Bover 2004; Kennickell 1997). The multiple imputation technique produces five complete data sets which are referred to as “implicates” (Board of Governors of the Federal Reserve System 2009). Thus, the 2005 EFF consists of five complete implicates, and the number of observations in the full data set is five times the actual number of respondents. All five implicates are used for the current study.

When imputation techniques are used to fill in missing data, extra variability is found in the data due to the missing values, and this variability can be incorporated into empirical estimates through the use of “repeated-imputation inference” (RII) techniques (Montalto and Sung 1996; Rubin 1987). RII techniques, which are recommended in order to produce estimates incorporating the variability in the data due to missing values, are used in the present analyses to obtain the measures of central tendency for continuous variables as well as for the logistic regression analyses in the present study. SAS 9.2 has been used to conduct the analyses, with the coefficients in the logistic regression specifications estimated based on the average value of other attributes.

Empirical Model

Psychologically, saving can be viewed as the result of a conscious decision making process and to save as the act of regularly putting away resources for a goal (Canova et al. 2005; Lewis et al. 1995; Wärneryd 1999). Saving can be measured by examining the change in wealth during a specific time period or looking at the difference between income and consumption (Browning and Lusardi 1996; Beverly et al. 2003). Holding other variables such as income and wealth constant, saving can also be viewed as the complement to consumption (Xiao and Olson 1993).

EFF respondents are asked whether their expenses over the previous 12 months, excluding the purchase of a home and financial investments, were higher, lower or the same as their income over the previous year. The question is used to create the dependent variable, coded as 1 if expenses were less than income over the previous year (indicating the household had the potential to save), and 0 if expenses were equal to or more than income over the past year (indicating the household did not have the potential to save). This question has been used by the U.S. Federal Reserve Board to construct the measure of saving for SCF reports, and was also used as the measure of saving in the study of loss aversion and household saving by Fisher and Montalto (2011).

To investigate loss aversion, measures for an income decline and an income increase are included as independent variables. These dummy variables are based on a question EFF respondents are asked about whether their current income is higher than their usual annual income, lower than their usual annual income, or about the same as their normal annual income. Responses to this question are used to create three categories representing income level in relation to the reference level of income: high, normal (reference category), and low. The direction and significance of the high and low income dummy variables in the logistic regression are used to assess whether there is evidence of loss aversion in saving behaviors in Spain. According to Menard (1995), the most accurate method to evaluate the statistical significance of an independent variable’s contribution to the explanation of the dependent variable is the likelihood ratio test. Therefore, likelihood ratio tests are also used to evaluate the statistical significance of the high income and low income variables, where the full model is estimated and compared to two models: (1) the model excluding the high income dummy variable, and (2) the model excluding the low income dummy variable.

Other independent variables in the model include income uncertainty, unemployment, retired, risk tolerance, education, marital status of the respondent, health, age, number of household members, income, and wealth. Income uncertainty takes a value of 1 if the respondent does not have a permanent, seasonal, or civil servant employment contract (and therefore has less predictable income), and 0 otherwise. Unemployment takes a value of 1 if the respondent and/or spouse/partner (if present) is unemployed and 0 otherwise. The retired variable takes a value of 1 if the respondent or spouse/partner is retired and 0 otherwise. Risk tolerance is based on households’ response when asked about the amount of financial risk they are willing to accept when making an investment, with three categories used in the current study: low risk tolerance (not willing to take on financial risk), average risk tolerance (reference category; willing to take on a medium level of risk expecting an average profit), and above average to high risk tolerance (willing to take on a reasonable amount of risk expecting an above-normal profit or a lot of risk in the expectation of obtaining a lot of profit).

Three education categories are included in the model, based on the categorization used in Bank of Spain reports: below secondary education, secondary education, and university education. For marital status, married is the reference category, with four other categories: living with a partner, separated/divorced, widowed, and never married. Dummy variables for health status are included and are based on the respondent and spouse’s (if present) self-reported health status, with good to excellent health for the respondent and/or spouse (if present) serving as the reference category, and two other categories: fair health and poor health. Continuous variables are included for age of respondent, number of household members, income (scaled by 100,000), and wealth (scaled by 1,000,000).

Results

Sample Characteristics

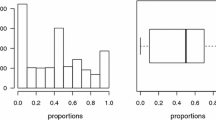

Table 1 presents the weighted descriptive statistics of the model variables for the total EFF sample in the 2005 wave. About 33.2% of non-retired Spanish households reported that their expenses were lower than their income in the previous year, indicating the ability to save. Around 5.5% of the sample had income above their reference level in the previous year, with 58.9% at the reference level of income and 35.6% having income below their reference level. About 10.0% of households in the sample were facing income uncertainty. The majority of respondents (82.6%) had low risk tolerance, while 14.7% had average risk tolerance and only 2.8% had above average to high risk tolerance. Almost two-thirds of the sample respondents (62.4%) were married, with 5.8% living with a partner, 5.8% separated/divorced, 13.3% widowed, and about 12.7% never married. About two-thirds of respondents (and spouse, if present; 66.8%) were in good or excellent health, with 24.5% reporting to be in fair health (respondent and/or spouse, if present) and 11.6% in poor health. The mean age of respondents was 52 years. The average number of household members in the sample was 2.79. The mean income for the sample was €30,420, with mean wealth of €200,374.

Logistic Regression Results

The results of the logistic regression analysis are presented in Table 2. The tolerance measures were evaluated to assess any multicollinearity problems, and based on the recommendations of Allison (1999), multicollinearity is not a problem. Having income above the reference level significantly increases the likelihood of saving (p < 0.001 in logistic regression analyses and likelihood ratio test), and having income below the reference level significantly decreases the likelihood of saving (p < 0.001 in logistic regression analyses and likelihood ratio test). The odds of saving for a household with income above the reference level are 71% higher, while the odds of saving for a household with income below the reference level saving are 60% lower. Having income above the reference level significantly increases the likelihood of saving in the logistic regression, supporting Hypothesis 1, and having income below the reference level significantly decreases the likelihood of saving, supporting Hypothesis 2. As having income higher or lower than normal both significantly affect the likelihood of saving, the results fail to support Hypothesis 3.

Income uncertainty is associated with a lower likelihood of saving, decreasing the odds of saving by 33% (p < 0.01). Having above average to high risk tolerance significantly decreases the likelihood of saving (p < 0.05) relative to average risk tolerance, lowering the odds by 28%, as does low risk tolerance, which decreases the odds of saving by 22% (p < 0.001). None of the age variables are significant in the model. Higher levels of education increase the odds of saving, where households with a respondent who completed secondary education are 33% more likely to save than those with less than a secondary education (p < 0.001). Households with a respondent who completed a university education are 60% more likely to save than those with less than a secondary education (p < 0.001).

Households with a partnered, widowed, or single respondent are not significantly different from households with a married respondent in terms of the likelihood of saving. However, households with a separated or divorced respondent are 52% less likely to save than households with a married respondent (p < 0.001). Having fair or poor health significantly is associated with a significant decrease in the likelihood of saving. Having a respondent and/or spouse (if present) in fair health decreases the odds of saving by 19% while poor health of the respondent and/or spouse (if present) decreases the odds of saving by 35%. An increase in the number of household members leads to a decrease in the odds of saving, where each additional household member decreases the odds of saving by 12%. Both income and wealth are positively associated with an increased likelihood of saving (p < 0.001 and p < 0.01, respectively).

Discussion

The current study investigates whether there is evidence of loss aversion in household saving behaviors in Spain. Previous research shows that experiencing an income decline leads to a greater effect on the likelihood of saving than the effect of an income increase (Bowman et al. 1999; Fisher and Montalto 2011). However, the results of the current study using data from Spain do not support this asymmetry in the response to income changes. The majority of Spanish households own a home, which may moderate the effect of negative income shocks. In addition, the information is self-reported, and some respondents may not be fully honest or accurate when discussing behaviors such as spending more than income. Due to the limitation of using cross-sectional data for this study focused on saving, a behavior that is based on more than one point in time, a future study using panel data would be informative. Another issue could be the statistical methods used for the analyses, as loss aversion may affect saving behaviors among Spaniards, but it may be to a lesser extent than the effect found among Americans (Fisher and Montalto 2011).

The study is also limited by the use of a dummy variable as the saving measure, where households with expenses less than income over the previous year were considered to have saved. An income increase or decrease may affect the amount saved, which was not explored in the present study. Therefore, future studies examining the amount saved using data from Spain could provide further information on whether there is evidence of loss aversion in household saving behaviors in this country. The EFF has information on income and consumption in the previous year as well as a panel component that could be explored for this purpose in the future. Using aggregate data from several countries, including several in Europe, Bowman et al. (1999) found evidence of loss aversion in saving and consumption behaviors, and further investigation of loss aversion in household saving behaviors is needed.

Interestingly, only about 33% of Spanish households indicated having expenses lower than their income in the previous year, which is much lower than the proportion of American households (56.5%) in SCF publications reporting that their expenses are lower than their income. This was unexpected because the U.S. is known for a low national saving rate by international standards (Carroll et al. 1994), and the work of Bover (2008b) indicates that there are considerably more households with zero or very low levels of wealth in the U.S. as compared with Spain and Fontes (2011) found higher rates of retirement savings asset ownership among immigrants from Europe. Households in Spain have a much larger portion of their wealth in real estate, so it is possible that the forms of saving in the two countries differ, leading to this difference. Spaniards may also interpret the question differently than Americans, so further investigation could provide more information. In addition, the variables that affect saving in the U.S. and Spain could differ. Kim et al. (2011) found that family processes affect financial socialization, and with different family structures in the U.S. and Spain, the financial socialization and learned habits of individuals may differ. Thus, the exploration of variables related to saving in Spain and the development of a more flexible model may lead to interesting results. The results also show that models of saving that are applicable in one nation may not be as relevant in other regions with different cultures.

The results of the current study show that increased education is associated with an increased likelihood of saving, as other studies have shown (Fisher and Montalto 2010; Hefferan 1982; Hong et al. 2002). Having low risk tolerance is found to decrease the likelihood of saving, which is in agreement with the findings of Finke and Huston (2003) that higher risk tolerance is associated with greater net worth as well as the finding of Fisher and Montalto (2011) that households with low risk tolerance are less likely to save. However, having high risk tolerance is also found to decrease the likelihood of saving as compared with average risk tolerance, which is not found in Finke and Huston (2003) or Fisher and Montalto (2011). The empirical literature shows that households that are unwilling to take any financial risk are less likely to save, and these households are less likely to purchase assets that are riskier and have a greater return. This puts households with low risk tolerance at a great financial disadvantage, and further research on the relationship between low risk tolerance and saving is needed. Chaulk et al. (2003) found differences in risk tolerance based on family variables, such as young individuals with children being less risk tolerant than their counterparts without children, which is also an important consideration in the study of risk tolerance and financial behaviors.

In line with the existing literature, the results show that being in fair or poor health negatively affects the likelihood of saving. There are many reasons why this may be. For example, those in poor health may have high medical expenses or be unable to work and therefore have decreased income. They may also feel that they will not live long due to their health problems, and therefore not save (Fisher and Montalto 2011). The relationship between health and saving behaviors is extremely complex, so further study of this relationship using data sets with information on medical expenditures is necessary.

Having a household head who is separated or divorced makes the household significantly less likely to save, which is not surprising due to the frequently cited negative effect of dissolution of marriage. No other marital status variables have a significant effect. Tamborini et al. (2011) found a positive association between marital dissolution and women’s labor market involvement and earnings, so although both spouses may have higher earnings after divorce, their increased consumption needs due to supporting two households in addition to child care costs may prevent them from saving. The non-wage income of women often declines dramatically after a separation, and alimony and child support do not fully replace the contribution of a former spouse’s earnings (Huang 2003). Another factor is that economic stress may lead to increased marital stress, which can then lead to divorce (Yeung and Hofferth 1998), so the divorce is not necessarily the only effect on saving behavior, as couples that divorce could be financially worse off prior to the separation or divorce.

In contrast to the framework of consumption/saving presented by Bowman et al. (1999) and the empirical study by Fisher and Montalto (2011), where there is an asymmetry in the response to a decrease or increase in current or future income, the current results indicate that households in Spain are likely to immediately save when income is higher than normal and not save when income is lower than normal, with no asymmetry in this relationship. However, the results show the importance of a household’s reference level of income and the effect this reference level has on saving. As Fisher and Montalto (2011) argued, how the reference level is set and changes is an area requiring further exploration. Walther (2010) explored the issue of gains being discounted at higher rates than losses, referred in his paper as the sign effect, and found that the sign effect disappears in some cases. The structure and composition of households in Spain could play a role in the lack of evidence of loss aversion or a sign effect in saving behaviors.

Although the same framework guided both studies, it is difficult to compare the results of the current study using data from Spain to those of Fisher and Montalto (2011) using data from the U.S. for two reasons. First, the EFF does not provide information on saving or planning horizon, which is important in determining intertemporal behavior (Lea et al. 1995; Rabinovich and Webley 2007) and was significant in explaining household saving in the U.S. (Fisher and Montalto 2011). As the EFF develops, it would be helpful for a question on time horizon to be included. Gouskova et al. (2010) found that the family may play an important role in transmitting time preferences to children, which would be interesting to investigate in a culture with strong family ties. Muske and Winter (2001) found that family financial managers focus on the short term, such as paying current bills, but the results of Fisher and Montalto (2011) indicate that many households do focus on the longer term in regards to their saving and spending decisions.

The current study provides information on the relationships between household factors and household saving in Spain. Analyses of the determinants of saving in developed countries show large differences in the average propensity to save (Marchante et al. 2001), and it is still unclear whether there is a common model of saving applicable to most countries. For instance, Fisher and Montalto (2011) found empirical support for the loss aversion framework of saving using data from the U.S., while the current results based on data from Spain do not provide such support. However, these studies have several limitations and further research using this framework is necessary before solid conclusions are made. Developing a better understanding of the factors related to saving in various regions of the world can enable policymakers, financial professionals, and educators to develop policies and programs to improve the economic well-being of individuals and households.

References

Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2005). Loss aversion under prospect theory: A parameter-free measurement. Management Science, 53, 1659–1674.

Aghevli, B., Boughton, J., Montiel, P., Villanueva, D., & Woglom, G. (1990). The role of national saving in the world economy: Recent trends and prospects. (International Monetary Fund Occasional Paper No. 67).

Allison, P. D. (1999). Logistic regression using the SAS System: Theory and application. Cary, NC: SAS Institute Inc.

Ando, A., & Modigliani, F. (1963). The “life cycle” hypothesis of saving: Aggregate implications and tests. American Economic Review, 53, 55–84.

Attanasio, O., & Banks, J. (2001). The assessment: Household saving–issues in theory and policy. Oxford Review of Economic Policy, 17, 1–19.

Avery, R., & Kennickell, A. B. (1991). Household saving in the U.S. Review of Income and Wealth, 37, 409–432.

Azpitarte, F. (2008). The vulnerability of households to poverty: The role of household wealth in Spain and in the United Kingdom. Paper presented at the 30th General Conference of the International Association for Research in Income and Wealth. Retrieved on March 25, 2010, from http://www.iariw.org/papers/2008/azpitarte.pdf.

Bank of Spain. (2008, January). EFF2005: methods, results and changes between 2002 and 2005. Economic Bulletin.

Banks, J., Blundell, R., Disney, R., & Emmerson, C. (2002). Retirement, pensions, and the adequacy of saving, Briefing Note No. 29. London: Institute for Fiscal Studies.

Banks, J., Blundell, R., & Tanner, S. (1998). Is there a retirement-savings puzzle? American Economic Review, 88, 769–788.

Bernheim, B. D., Skinner, J., & Weinberg, S. (2001). What accounts for the variation in retirement wealth among U.S. households? American Economic Review, 91, 832–857.

Beverly, S. G., McBride, A. M., & Schreiner, M. (2003). A framework of asset-accumulation stages and strategies. Journal of Family and Economic Issues, 24, 143–156.

Board of Governors of the Federal Reserve System. (2009). Codebook for 2007 Survey of Consumer Finances. Retrieved May 19, 2009 from Federal Reserve Board website, http://www.federalreserve.gov/pubs/OSS/oss2/2007/codebk2007.txt.

Booij, A. S., & van de Kuilen, G. (2009). A parameter-free analysis of the utility of money for the general population under prospect theory. Journal of Economic Psychology, 30, 651–666.

Bosworth, B. P., Burtless, G., & Sabelhaus, J. (1991). The decline in saving: Evidence from household surveys. Brookings Papers on Economic Activity, 1, 183–256.

Bover, O. (2004). The Spanish Survey of Household Finances (EFF): Description and methods of the 2002 wave. Occasional Paper Series, 0409, 1–30.

Bover, O. (2008a). The Spanish Survey of Household Finances (EFF): Description and methods of the 2005 wave. Occasional Paper Series, 0803, 1–30.

Bover, O. (2008b). Wealth inequality and household structure: U.S. vs Spain. Working Paper Series, 0804, 1–42.

Bowman, D., Minehart, D., & Rabin, M. (1999). Loss aversion in a consumption-savings model. Journal of Economic Behavior and Organization, 38, 155–178.

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34, 1797–1855.

Campbell, J. Y., & Mankiw, J. G. (1990). Permanent income, current income, and consumption. Journal of Business and Economic Statistics, 8, 365–379.

Canova, L., Rattazzi, A. M., & Webley, P. (2005). The hierarchical structure of saving motives. Journal of Economic Psychology, 26, 21–34.

Carroll, C. D. (1994). How does future income affect current consumption? The Quarterly Journal of Economics, 109, 111–148.

Carroll, C. D., Rhee, B.-K., & Rhee, C. (1994). Are there cultural effects on saving? Some cross-sectional evidence. The Quarterly Journal of Economics, 109, 685–699.

Chaulk, B., Johnson, P. J., & Bulcroft, R. (2003). Effects of marriage and children on financial risk tolerance: A synthesis of family development and prospect theory. Journal of Family and Economic Issues, 24, 257–279.

Christensen, A.-K., Dupont, J., & Schreyer, P. (2005). International comparability of the Consumer Price Index: Owner-occupied housing. Paper presented at the OECD Seminar, inflation measures: too high–too low–internationally comparable? Paris, France. Retrieved March 25, 2010 from http://www.oecd.org/dataoecd/14/18/34987270.pdf.

Davies, J. (1981). Uncertain lifetime, consumption, and dissaving in retirement. Journal of Political Economy, 89, 561–578.

Davis, E. P., & Schumm, W. R. (1987). Savings behavior and satisfaction with savings: A comparison of low- and high-income groups. Home Economics Research Journal, 15, 247–256.

Deaton, A. (1991). Saving and liquidity constraints. Econometrica, 59, 1221–1248.

Del Rio, C., & Ruiz-Castillo, J. (2002). Demographic trends and living standards during the 1980s. Review of Economic Applications, 30(10), 5–24.

DeVaney, S. A., Anong, S., & Whirl, S. E. (2007). Household savings motives. The Journal of Consumer Affairs, 41, 174–186.

Dynan, K., Skinner, J., & Zeldes, S. (2004). Do the rich save more? Journal of Political Economy, 112, 397–444.

European Central Bank. (2009). Survey data on household finance and consumption: Research summary and policy use (Occasional Paper Series No. 100). Retrieved January 17, 2011 from the European Central Bank website, http://www.ecb.int/pub/pdf/scpops/ecbocp100.pdf.

Fan, J. X., & Abdel-Ghany, M. (2004). Patterns of spending behavior and the relative position in the income distribution: Some empirical evidence. Journal of Family and Economics, 25, 163–178.

Fernandez-Cordon, J. A. (1997). Youth residential independence and autonomy: A comparative study. Journal of Family Issues, 18(6), 576–607.

Fershtman, C. (1996). On the value of incumbency—Managerial reference points and loss aversion. Journal of Economic Psychology, 17, 245–257.

Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: Financial risk tolerance and wealth. Journal of Family and Economics, 24, 233–256.

Fisher, P. J. (2010). Gender differences in personals saving behaviors. Journal of Financial Counseling and Planning, 21, 14–24.

Fisher, P. J., & Montalto, C. P. (2010). Effect of saving motives and horizon on saving behaviors. Journal of Economic Psychology, 31, 92–105.

Fisher, P. J., & Montalto, C. P. (2011). Loss aversion and saving behavior: Evidence from the 2007 U.S. Survey of Consumer Finances. Journal of Family and Economic Issues, 32(1), 4–14. doi:10.1007/s10834-010-9196-1.

Fontes, A. (2011). Differences in the likelihood of ownership of retirement saving assets by the foreign and native-born. Journal of Family and Economic Issues,. doi:10.1007/s10834-011-9262-3.

Friedman, M. (1957). A theory of the consumption function. Princeton: Princeton University Press.

Furnham, A. (1985). Why do people save? Attitudes to, and habits of saving money in Britain. Journal of Applied Social Psychology, 15, 354–373.

Furnham, A. (1999). The saving and spending habits of young people. Journal of Economic Psychology, 20, 677–697.

Gouskova, E., Chiteji, N., & Stafford, F. (2010). Pension participation: Do parents transmit time preference? Journal of Family and Economic Issues, 31, 138–150.

Hamermesh, D. (2007). Replication in economics, Discussion Paper Series, No. 2760. Bonn: Institute for the Study of Labor.

Han, C.-K., & Sherraden, M. (2009). Attitudes and saving in individual development accounts: Latent class analysis. Journal of Family and Economic Issues, 30, 226–236.

Hefferan, C. (1982). Determinants and patterns of family saving. Home Economics Research Journal, 11, 47–55.

Hira, T. K. (1987). Money management practices influencing household asset ownership. Journal of Consumer Studies and Home Economics, 11, 183–194.

Hondroyiannis, G. (2010). Fertility determinants and economic uncertainty: An assessment using European panel data. Journal of Family and Economic Issues, 31, 33–50.

Hong, G.-S., Sung, J., & Kim, S.-M. (2002). Saving behavior among Korean households. Family and Consumer Sciences Research Journal, 30, 437–462.

Huang, J. (2003). Unemployment and family behavior in Taiwan. Journal of Family and Economic Issues, 24, 27–48.

Japelli, T. (1990). Who is credit constrained in the U.S. economy? Quarterly Journal of Economics, 105, 219–234.

Kahneman, D., & Tversky, A. (1979). Prospect theory. Econometrica, 47, 263–292.

Kennickell, A. (1997). Multiple imputation and disclosure protection: The case of the 1995 Survey of Consumer Finances. Retrieved October 9, 2009 from the Federal Reserve Board website, http://www.federalreserve.gov/PUBS/oss/oss2/papers/impute98.pdf.

Kim, J., LaTaillade, J., & Kim, H. (2011). Family processes and adolescents’ financial behaviors. Journal of Family and Economic Issues,. doi:10.1007/s10834-011-9270-3.

L’Haridon, O. (2009). Behavior in the loss domain: An experiment using the probability trade-off consistency condition. Journal of Economic Psychology, 30, 540–551.

Lea, S. E. G., Webley, P., & Walker, C. M. (1995). Psychological factors in consumer debt: Money management, economic socialization, and credit use. Journal of Economic Psychology, 16, 681–701.

Lee, S., Park, M., & Montalto, C. P. (2000). The effect of family life cycle and financial management practices on household saving patterns. Journal of Korean Home Economics Association English Edition, 1, 79–92.

Lewis, A., Webley, P., & Furnham, A. (1995). The new economic mind. The social psychology of economic behaviour. Hemel Hempstead: Harvester Wheatsheaf.

Lusardi, A. (1998). On the importance of the precautionary saving motive. American Economic Review Papers and Proceedings, 88, 449–453.

Marchante, A. J., Ortega, B., & Trujillo, F. (2001). Regional differences in personal saving rates in Spain. Papers in Regional Science, 80, 465–482.

Martinez-Granado, M., & Ruiz-Castillo, J. (2002). The decisions of Spanish youth: A cross-section study. Journal of Population Economics, 15(2), 305–330.

Menard, S. (1995). Applied logistic regression analysis. Thousand Oaks: Sage Publications.

Minder, R. (2011, January 7). Spain to raise retirement age to 67. The New York Times. Retrieved January 27, 2011 from http://www.nytimes.com/2011/01/28/world/europe/28iht-spain28.html.

Mirer, T. W. (1979). The wealth-age relation among the aged. American Economic Review, 69, 435–443.

Montalto, C. P., & Sung, J. (1996). Multiple imputation in the 1992 Survey of Consumer Finances. Financial Counseling and Planning, 7, 133–146.

Muske, G., & Winter, M. (2001). An in-depth look at family cash-flow management practices. Journal of Family and Economic Issues, 22, 353–372.

OECD. (2010). OECD Factbook 2010. Retrieved January 17, 2011 from http://www.oecd-ilibrary.org/sites/factbook-2010-en/02/02/03/index.html?contentType=&itemId=/content/chapter/factbook-2010-14-en&containerItemId=/content/serial/18147364&accessItemIds=&mimeType=text/html.

Palumbo, M. G. (1999). Uncertain medical expenses and precautionary saving near the end of the life cycle. The Review of Economic Studies, 66, 395–421.

Pence, K. M. (2001). 401(k)s and household saving: New evidence from the Survey of Consumer Finances. Retrieved February 6, 2007 from Federal Reserve Board of Governors website: http://www.federalreserve.gov/Pubs/feds/2002/200206/200206pap.pdf.

Rabinovich, A., & Webley, P. (2007). Filling the gap between planning and doing: Psychological factors involved in the successful implementation of saving intention. Journal of Economic Psychology, 28, 444–461.

Reher, D. S. (1998). Family ties in Western Europe: Persistent contrasts. Population and Development Review, 24, 203–234.

Rubin, D. B. (1987). Multiple imputation for nonresponse in surveys. New York: Wiley.

Sanchez Martin, A. R. (2001). Endogenous retirement and public pension system reform in Spain. Working Paper. Retrieved January 17, 2011 from http://e-archivo.uc3m.es/bitstream/10016/249/1/we013503.pdf.

Sanders, C. K., & Porterfield, S. L. (2010). The ownership society and women: Exploring female householders’ ability to accumulate assets. Journal of Family and Economic Issues, 31. Retrieved January 19, 2010 from http://www.springerlink.com/content/j257775466502757/.

Sandmo, A. (1970). The effect of uncertainty on saving decisions. Review of Economic Studies, 37, 353–360.

Schmidt, U., & Traub, S. (2002). An experimental test of loss aversion. Journal of Risk and Uncertainty, 25, 233–249.

Shea, J. (1995). Union contracts and the life-cycle/permanent-income hypothesis. The American Economic Review, 85, 186–200.

Sibly, H. (2002). Loss averse customers and price inflexibility. Journal of Economic Psychology, 23, 521–538.

Sierminska, E., Brandolini, A., & Smeeding, T. (2007). The Luxembourg wealth study: A cross country comparable database for household wealth research. Journal of Economic Inequality, 4, 375–383.

Smith, J. P. (1995). Racial and ethnic differences in wealth in the health and retirement study. Journal of Human Resources, 30, S158–S183.

Tamborini, C., Iams, H., & Reznik, Gayle. (2011). Women’s earnings before and after marital dissolution: Evidence from longitudinal earnings records matched to survey data. Journal of Family and Economic Issues,. doi:10.1007/s10834-011-9264-1.

Thaler, R. H. (1990). Anomalies: Saving, fungibility, and mental accounts. Journal of Economic Perspectives, 4, 193–205.

Thaler, R. H., & Benartzi, S. (2001). Save more tomorrow: Using behavioral economics to increase employee savings. Retrieved March 13, 2006 from Research Papers in Economics website, http://www.journals.uchicago.edu/cgi-bin/resolve?JPE112118PDF.

Tversky, A., & Kahneman, D. (1986). Rational choice and the framing of decisions. Journal of Business, 69, S251–S278.

Ulker, A. (2009). Wealth holdings and portfolio allocation of the elderly: The role of marital history. Journal of Family and Economic Issues, 30, 90–108.

Walther, H. (2010). Anomalies in intertemporal choice, time-dependent uncertainty and expected utility—A common approach. Journal of Economic Psychology, 31, 114–130.

Wärneryd, K.-E. (1999). The psychology of saving. A study of economic psychology. Cheltenham: Edward Elgar Publishing.

Xiao, J. J., & Anderson, J. G. (1997). Hierarchical financial needs reflected by household financial asset shares. Journal of Family and Economic Issues, 18, 333–355.

Xiao, J., & Olson, G. I. (1993). Mental accounting and saving behavior. Home Economics Research Journal, 22, 92–109.

Yeung, W. J., & Hofferth, S. L. (1998). Family adaptations to income and job loss in the U.S. Journal of Family and Economic Issues, 19, 255–283.

Zeldes, S. P. (1989). Consumption and liquidity constraints: An empirical investigation. Journal of Political Economy, 97, 305–346.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fisher, P.J. Is There Evidence of Loss Aversion in Saving Behaviors in Spain?. J Fam Econ Iss 34, 41–51 (2013). https://doi.org/10.1007/s10834-012-9290-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-012-9290-7