Abstract

The goal of this paper is to understand the effect of family decision-making on the investment decisions of married men and women. Using data from the Survey of Consumer Finances, we investigate how the spouse’s relative control over financial resources in the household and the life-cycle stage affect the investment choices of married women and men. The results show that married women who have more control over the financial resources are less likely to invest their Defined Contribution Plans (DCPs) in risky assets. Also, women who are married to relatively older men are less likely to take on risk with their DCPs. There is little evidence that the wife’s characteristics affect the investment decisions of married men.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

An increasing number of working men and women are now participating in Defined Contribution Plans (DCPs). Since the mid-1970s, the number of participants in DCPs increased steadily from 11.2 million in 1975 to 51.8 million in 2003, while the number of participants in defined benefit plans decreased from 27.2 million in 1975 to 21.3 million in 2003 (Employee Benefit Research Institute 2003; U.S. Department of Labor Employee Benefits Security Administration 2006). One property of DCPs is that participants can decide how to allocate their retirement savings across different assets. The degree to which participants are risk averse has a large impact on the asset allocation in their DCPs, and thus, their retirement income. With the future of Social Security growing uncertain, it is becoming more important that researchers and policymakers better understand the factors that influence the investment decisions of participants.

Previous studies that investigate determinants of risk aversion and investment decisions identify gender differences in financial decision-making (Bajtelsmit et al. 1999; Bernasek and Shwiff 2001; Dwyer et al. 2002; Hinz et al. 1997; Jianakoplos and Bernasek 1998; Sundén and Surette 1998; Young and Wallace 2009). These studies have showed that women invest their asset portfolios more conservatively than men, and women exhibit less financial risk-taking behavior. For example, the literature in experimental psychology suggests that women are different from men in their degree of risk aversion (Hudgens and Fatkin 1985; Levin et al. 1988; Powell and Ansic 1997). In addition, gender differences in risk-taking and risk perception are well documented in the literatures of psychology and sociology. Byrnes et al. (1999) reviewed over 150 papers on gender differences in risk perception that involved over 100,000 participants and concluded that the literature clearly indicated that male participants are more likely to take risks than female participants in most personal decisions such as sex, smoking and dental care.

Stylized facts also show that working women tend to invest their retirement assets more conservatively than men. Working men invested 44% of their DCPs in stocks in 1998, while the share of stocks in DCPs for women was 41% (Employee Benefit Research Institute 2001).

Studies that investigate the factors affecting the allocation of assets in retirement accounts also show that it is not gender alone that drives the investment decisions of working men and women, but rather a combination of gender and marital status (Bernasek and Shwiff 2001; Jianakoplos et al. 2003; Säve-Söderbergh 2003; Sundén and Surette 1998). These studies provide evidence that marital status plays an important role with respect to the investment behavior of men and women and suggest that the pension portfolio choices of married couples are likely to be the outcome of joint decision-making. However, studies that focus on gender differences in investment decisions typically have treated married households as single decision-making units (Bajtelsmit et al. 1999; Dwyer et al. 2002; Hinz et al. 1997; Jianakoplos and Bernasek 1998; Säve-Söderbergh 2003; Sundén and Surette 1998). One exception is Friedberg and Webb (2006). Exactly how financial decisions are made between spouses is the subject of ongoing research (Bernasek and Bajtelsmit 2002; Dobbelsteen and Kooreman 1997; Friedberg and Webb 2006; Woolley 2003).

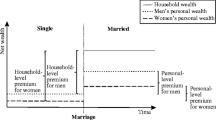

The goal of this paper is to understand the effect of family decision-making on the investment decisions of married men and women. Each spouse may differ in his or her attitude towards risk and age, which are known to be important determinants of portfolio choice.Footnote 1 What happens when two individuals with different risk preferences and ages make investment choices regarding their individual pension plans? One reason that marital status and gender are significantly related to investment decisions might be that married women and men integrate their spouses’ attitudes toward risk and the life-cycle stage to their investment decisions. Our first premise is that, assuming women are in general more risk averse than men, the wife would prefer her own and her spouse’s pension plans to be invested in less risky assets. If the wife has higher control over financial resources in the household, she should influence investment decisions in favor of her preference.

Portfolio choice models that include labor income or nontradeable assets predict that individuals optimally shift their portfolios to less risky assets in a pattern related to life-cycle and hold a greater fraction of their financial assets in risky assets when they are young (Ameriks and Zeldes 2004). Consequently, if males and females had equal risk tolerance, then females should have a higher share of risky assets than males of the same age, since females on average live longer and thus have a longer investment horizon. Wives typically being younger than their husbands, the age difference between the husband and wife may have an effect on the wife’s and husband’s investment decisions. Our second premise is that, to maximize the expected utility of his retirement consumption, the husband who is older than his wife prefers his wife to shift her retirement savings away from stocks to bonds.

In this paper, we use data from the Survey of Consumer Finances (SCF) to investigate how the spouse’s relative control over financial resources in the household and the life-cycle stage affect the investment choices of married women and men. Our results provide little evidence that the wife’s control over financial resources and age affect the investment decisions of married men. However, married women who have more control over financial resources are less likely to invest their DCPs in risky assets. Also, women married to older men are less likely to take on risk with their DCPs. We conclude that the asymmetry in our findings for married women and men cannot be explained by the predictions of the household unitary model. Our results provide evidence that bargaining models can be used to model the investment decisions of married women.

In the next section, we examine the theoretical and empirical evidence on the relationship between decision-making in the household and the investment and saving decisions of married men and women. Then, we describe the empirical model and the SCF, the data used in this study, and the summary statistics. Following that, we present the results of our analysis and distinguish our predictions and findings from alternative theories of asset allocation and present robustness checks. Finally, the results are discussed and limitations, implications, and conclusions are presented.

Related Theoretical and Empirical Literature

Previous studies show that gender and marital status are significantly related to allocation of assets in pension plans. Sundén and Surette (1998) found that the interaction term for “gender and marital status” had a significant effect on the way individuals chose to allocate their DCPs across different assets. The behavior of married men and women was significantly different from that of single men and women, in that single women and married men were less likely than single men to invest their DCPs mostly in stocks. However, married women were not significantly more likely to invest mostly in stocks than other gender-marital groups. Interestingly, when the authors omitted the interaction term from their models, the estimates showed that marital status had no effect on investment decisions and that women were more likely to invest their retirement plans in bonds than in stocks or a diversified portfolio.

Other studies also provide evidence of a link between gender and marital status.Footnote 2 For example, using data on the pension portfolio choices of Swedish workers, Säve-Söderbergh (2003) included interaction terms in her models for “gender and marital status” and “gender and cohabitant status.” She found that women who were in cohabitant relationships were more likely to choose high-risk portfolios than single and married women. In addition, marital status had a negative effect on the risk-taking behavior of men. Married men were less likely to invest in high-risk portfolios compared with single and cohabiting men.

Using information about household financial decision-making and the household members’ attitudes toward financial risk-taking, Bernasek and Shwiff (2001) investigated the effect of gender on the riskiness of an individual’s DCP. Those who are primary saving and investment decision-makers in the household invest in less risky portfolios. The most significant differences by gender were in attitudes toward the risk-taking behavior of partners such that married and cohabitating women and men react in opposite ways to their partners’ attitudes toward risk.

The works of Sundén and Surette (1998), Säve-Söderbergh (2003) and Bernasek and Shwiff (2001) provide evidence that marital status plays an important role with respect to the investment behavior of men and women and suggest that the pension portfolio choices of married couples are likely to be the outcome of joint decision-making. In addition, Uccello (2000) found that, among married households in which each spouse has a DCP, spouses invested their retirement assets similarly rather than diversifying and sharing risk. The previous studies treated married households as single decision-making units and have focused on estimating unitary models of family decision-making. The unitary model assumes that the husband and wife pool their income and maximize a single (joint) utility function. Since the household maximizes a single utility function, unitary models do not have predictions about how differences in preferences between partners affect financial decision-making.

An alternative to the unitary model is a bargaining approach. Within the bargaining framework, both the husband and wife are allowed to have different utility functions with different preferences. The decision process can be either non-cooperative or cooperative.Footnote 3 In a cooperative bargaining model, the higher a spouse’s threat point utility level, the more bargaining power and a larger share in the management of household finances the spouse has. The spouse with the higher bargaining power can influence household decisions in favor of his or her preferences.

In this paper, we assume a cooperative bargaining model much like the general cooperative framework proposed by Dobbelsteen and Kooreman (1997) for modeling financial management and household bargaining. Consider a collective bargaining model where the utility functions for the husband and wife are expressed as U H (Z, L H , L W ) and U W (Z, L H , L W ) where Z is the amount of the consumption good, and L H and L W are the hours of leisure for the husband and wife, respectively. The financial management function depends on the time inputs of the husband and wife, H H and H W , respectively, and the existence of the household requires a certain amount of financial management. Finally, each spouse’s total time endowment can be allocated to leisure (L H and L W ), financial management (H H and H W ) and working in a paid job (N H and N W ). The budget constraint for the household depends on N H and N W and the wage rates (w H and w W) of the husband and wife. If we consider the cooperative Nash bargaining solution, households choose their optimal allocations for L H , L W , H H , H W , N H and N W by maximizing:

subject to budget and time constraints. In this model, V H N and V W N are the utility levels for the husband and wife that correspond to the non-cooperative outcome and γ denotes the variables (besides wages) that determine the non-cooperative outcome for both spouses (i.e., non-labor income and education). The higher a spouse’s threat point utility level, the more bargaining power and a larger share in the management of household finances the spouse has. The spouse with the higher bargaining power can influence household decisions in favor of his or her preferences. According to this framework, assuming that women are in general more risk averse than men, a husband with more bargaining power (i.e., higher wages) prefers that his wife invest in a riskier portfolio. However, if the wife has more bargaining power than her husband, the model predicts that the wife will prefer to invest in a less risky portfolio.

Using a household bargaining model, Friedberg and Webb (2006), Jianakoplos and Bernasek (2008), and Woolley (2003) investigated the factors that affect each spouse’s involvement in financial decision-making. Friedberg and Webb (2006) analyzed the factors affecting whether a husband or wife “has final say” when making a major family decision such as when to retire, where to live, or how much money to spend on a major purchase. Their findings showed that decision-making power depends on the relative current earnings and lifetime earnings of the wife and the husband. Jianakoplos and Bernasek (2008) investigated whether the relative bargaining power of spouses played a significant role in explaining household financial risk-taking. They used the ratio of risky assets to wealth as the measure of financial risk-taking and did not find much support for women’s share of income having a significant effect on the financial risk-taking. Woolley (2003) identified income and age as one of the key determinants of bargaining power such that partners with higher income and younger in age have greater say in the household decision-making process, and thus in the family’s finances. Her results showed that, holding the wife’s income constant, a husband’s higher income decreases the degree of the wife’s control over money in the marriage.

Recent research has also employed household bargaining models to investigate how joint decision-making affects household saving and consumption behavior. Browning (2000) showed that when a wife is concerned about future consumption, the wife’s and also the household’s savings increase. Lundberg and Ward-Batts (2000) hypothesized that if the wife has greater bargaining power in a household, then that household should have greater net worth than a household in which the wife has less power. Their results provided some evidence that those households in which husbands have more education than their wives have lower net worth. Lundberg et al. (2003) used a bargaining model to explain the observed decline in household consumption around the age of retirement. Since the bargaining power in the household depends on relative control over resources, the husband’s retirement from a job may cause a decline in his ability to influence consumption and saving decisions. The results of their model provided evidence of a consumption drop at retirement for married couples but not for single households. Consistent with the life-cycle consumption models, single households do not exhibit a significant change in their consumption expenditures at retirement. Lundberg et al. (2003) also showed that a decline in consumption for married couples is more pronounced for households in which the age difference between the husband and wife is larger. Finally, Friedberg and Webb (2006) employed a bargaining model to understand the stock market investment decisions of the household. They found that, as the husband’s bargaining power increases, the likelihood of investment in the stock market and the share of financial assets invested in the stock market increases.

Note that life-cycle stage can also have a significant effect on portfolio choice. Initial models of financial asset allocation decisions showed that the share of portfolio invested in risky assets would be constant over the life-cycle under certain conditions (Merton 1969; Samuelson 1969). These conditions include (i) no labor income and nontradeable assets; (ii) independently and identically distributed asset returns, (iii) CRRA class utility function and (iv) frictionless and complete financial markets with no transaction costs. Ameriks and Zeldes (2004) reviewed the literature that relaxes these restrictive assumptions and discussed in detail how the portfolio decisions can vary with age and also with the variables that change with age. Upon relaxing some of the strict assumptions of the theory, the share of wealth invested in risky assets would optimally vary with the age of the investor and an older investigator would hold a less risky portfolio of assets than a younger investor.

Most financial planners advise their clients to shift their investments from stocks to bonds as they get older.Footnote 4 One justification for this advice is that older individuals do not have enough years of labor income ahead of them to recover from the potential losses associated with risky investments. Empirical studies on portfolio choice also suggest that age has a significant and negative effect on the amount of wealth invested in stocks. Heaton and Lucas (2000) showed that portfolio shares of stocks relative to both liquid and financial assets decline with age. Using the 1996 survey of TIAA-CREF participants. Bodie and Crane (1997) showed that the share of stocks in total assets decreases with age. Previous research, to our knowledge, has not used a family decision-making model to examine how the life-cycle stage of the spouse affects an individual’s investment decisions.

Previous studies on portfolio choice suggest that age has a significant and negative effect on the amount of wealth invested in stocks (Bodie and Crane 1997; Heaton and Lucas 2000). For example, Heaton and Lucas (2000) showed that portfolio shares of stocks relative to both liquid and financial assets decline with age. Using the 1996 survey of TIAA-CREF participants, Bodie and Crane (1997) showed that the share of stocks in total assets decreases with age. This should not be surprising since most financial planners advise their clients to shift their investments from stocks to bonds as they get older.

On the one hand, if the husband has more bargaining power and has greater say in household financial decisions, the wife is likely to invest less conservatively. However, at the same time, as discussed above, a life-cycle model that uses more realistic assumptions implies that individuals will shift their portfolios to less risky assets as they approach retirement. Since wives are typically younger than their husbands, the age difference between the husband and wife might have an effect on the wife’s investment decisions. For example, to maximize his retirement consumption, a husband who is older than his wife may prefer that his wife shift her retirement savings away from stocks to bonds earlier. However, as the age difference between the husband and the wife increases, the effect of shifting away from stocks to bonds results in a lower return on the retirement savings for women. Therefore, it is important to take into consideration how the “interaction” between bargaining power and life-cycle stage impacts women’s investment choices. Given this, we expect to find that women’s investment decisions depend on both the bargaining power and life-cycle stage of her spouse. Specifically, we expect to show that women who are married to older men with more bargaining power are more likely to invest in less risky assets than if they were married to older husbands with less bargaining power. Similarly, we expect to find that women who are married to younger men with more bargaining power are more likely to invest in risky assets than if they were married to younger husbands with less bargaining power.

The Empirical Model

In general, the empirical model can be expressed as follows:

where D * i is the fraction of the DCP that the respondent i invests in risky assets, i.e., the amount of stocks divided by the total amount of DCP; X 1i is the characteristics of the respondent, X 2i is general characteristics of the household; X 3i the characteristics of the spouse and β 1 , β 2 , and β 3 are the parameter vectors. The data set used for this study does not include information on the specific allocation of portfolio shares for stocks and safer assets (i.e., bonds). Therefore, in this model, D * i is not observable. However, d i is observable such that:

The dependent variable, d i , is a discrete ordered outcome that is equal to 0 if the respondent invests the plan mostly in bonds, 1 if they invest it in a diversified portfolio, and 2 if they invest it mostly in stocks. It is assumed that investing retirement assets mostly in stocks is a riskier investment decision than investing in a diversified portfolio. Similarly, investing in a diversified portfolio is a riskier investment decision than investing mostly in bonds. There are two cut points, α 1 and α 2, that are unknown parameters estimated along with β 1 , β 2 , and β 3 . A standard normal distribution yields the following probabilities:

where Φ is the cumulative standard normal distribution function and \( \beta ^{\prime} X_{\text{i}} = \beta_{1}^{\prime } X_{1i} + \beta_{2}^{\prime } X_{2i} + \beta_{3}^{\prime } X_{3j} \). The log-likelihood is readily obtained and the parameters α 1, α 2, β 1 , β 2 and β 3 are estimated by maximum likelihood.

The characteristics of the respondent (X 1i ) include age, education, ethnicity, hourly earnings, occupation, and the level of financial risk the respondent is willing to take.Footnote 5 Household characteristics (X 2i ) include household net worth and the number of children living in the home. The model also controls for the spouse’s characteristics (X 3i ) such as age, education, employment status, and occupation.

Unfortunately, the decision-making power in households is not directly observed in the SCFs. We use relative hourly earnings (wife’s hourly earnings divided by the sum of wife’s and husband’s hourly earnings) to measure a spouse’s relative control over the financial resources. Relative current earnings have been identified as effective measures of household bargaining power in previous literature (i.e., Friedberg and Webb 2006; Lundberg et al. 2003; Lundberg and Ward-Batts 2000; Woolley 2003). In particular, using the information in the Health and Retirement Study on whether a husband or a wife has “the final say” when making major decisions, Friedberg and Webb (2006) found that current earnings have a significant influence on decision-making power.Footnote 6 To control for life-cycle effects, we use the ages of the husband and the wife and the number of years until retirement for both the husband and the wife.

Assuming women are in general more risk averse than men, the wife should prefer her own and her spouse’s pension plans to be invested in less risky assets. Therefore, we expect to find that the relative hourly earnings of the wife have a negative effect on the riskiness of assets in the DCPs of married women and men. In addition, individuals approaching retirement have a preference for income security. Therefore, we expect to find that if a husband is older than his wife, the wife is more likely to invest her DCP in less risky assets. Similarly, we expect to find that the age of the wife has a significant and negative effect on the riskiness of assets in the DCPs of married men.

Data

This study uses data from the 1995, 1998 and 2001 SCF, which is a triennial survey conducted by the Federal Reserve Board. Each survey consists of a representative sample of the U.S. population and a supplement of high-wealth households drawn from tax information provided by the Internal Revenue Service. The SCF contains detailed information on wealth, income, the employment status of the respondent and spouse, and other household characteristics. The Consumer Price Index Research Series Using Current Methods 1978–2001 (CPI-U-RS) is used to adjust all dollar amounts to reflect 2001 dollars.

The SCF produces five implicate observations per household. We present the results of the first of these implicates in our tables. However, we conduct our empirical analysis for all five implicates. In our tables, a control variable is denoted as significant if it is significant at 0.1 level for at least three out of five implicates. In the text, we present a variable as statistically significant if it is significant for at least three implicates. We acknowledge that the estimates that are significant when we run with each of the 5 implicates but might not be significant when we utilize the imputation inference technique (RII) procedure and that our choice of verifying the significance of our estimates with three replicates is arbitrary. However, using RII was not a practical option for the ordered probit model utilized in this paper. Lindamood et al. (2007) provide a careful discussion of how using one implicate may bias the results by reducing the standard errors of the estimates.

Although most information is collected at the household level, the SCF includes detailed questions on the respondent’s and spouse’s pension eligibility and benefits from current and past employers. Information on pension plans includes the type of plan, account balance, and whether the respondent or spouse can decide how the account is invested. Respondents and spouses are classified as having a DCP if they indicate (1) that they have an account-type pension plan and (2) that they have a choice about how the money is invested in the plan. In the SCF, the respondent and the spouse are also asked a categorical question about how their account is invested: “How is the money in your DCP invested? Is it mostly in stocks, mostly in interest earning assets, or is it split between these?” Responses to this question are used to construct the dependent variable used in this study.

For the purposes of this study, the sample is restricted to married couples where either the husband and/or wife have a DCP at their current main job.Footnote 7 We also restrict the sample to workers who report positive earnings in a given year and who report not being retired or over age 65.

Note that the hourly earnings of those who are not currently working are not reported in the data. We imputed the hourly earnings for those who report an hourly wage of less than $5 and more than $500 using the estimated coefficients of the working group. Specifically, we estimated the hourly earnings equation separately for working women and men who earn more than $5 and less than $500 and used the estimated coefficients to calculate the hourly earnings for the rest of the group. The results of the estimation of the hourly earnings regression are available from the authors upon request. In our sample, 717 female spouses of 1,804 married men and 173 males spouses of 967 married women report that they earn an hourly wage of less than $5 or more than $500.

Of the total number of married individuals with DCPs (N = 2,771), 1,804 are married men and 967 are married women. The investment decisions of married women with respect to the allocation of assets in their DCPs are very similar to married men. Over 12.5% of married women report that they invest their plans mostly in bonds, 34.2% in a diversified portfolio of stocks and bonds, and 53.2% mostly in stocks, while 10.9% of married men indicate that they invest their plans mostly in bonds, 35.2% in a diversified portfolio of stocks and bonds, and 53.7% mostly in stocks.

The previous statistics suggest that, in the aggregate, there does not appear to be a difference in risk-taking behavior by gender. However, Table 1 provides information on how the demographics of the respondent and the characteristics of the spouse differ for married men and women with DCPs according to their investment choices. Table 1 also presents the statistical significance of differences in demographic characteristics across those who invest mostly in bonds, in a diversified portfolio and mostly in stocks. In general, regardless of gender, married individuals who invest mostly in stocks are more likely than those who invest mostly in bonds to be white and to be living in a household that is willing to take average or above average financial risks. Those who invest mostly in stocks are also more likely to have a spouse who is more educated, to have a managerial-type occupation, and to have a DCP.

With respect to gender, the summary statistics in Table 1 show that there are a number of differences between married women and men in terms of household net worth and investment decisions. Married men who invest mostly in stocks report higher levels of household net worth than married men who invest mostly in bonds.Footnote 8 In addition, for married men, the riskiness of the assets invested in a DCP increases with the amount invested in the pension plan.

The summary statistics in Table 1 suggest that the husband’s relative stage in the life-cycle is likely to play a significant role in determining the level of investment risk for married women. Married women who invest mostly in bonds are more likely than those who invest mostly in stocks to have husbands who are older. For example, 27.6% of married women who invest mostly in bonds have husbands who are 3 or 4 years older, compared to only 15.0% of married women who invest mostly in stocks. Interestingly, only 8.8% of married women who invest mostly in bonds are 3 or more years older than their husbands, compared to 12.9% of women who invest mostly in stocks. There is some evidence from Table 1 to show that the investment choices of married men may vary by age and by years until retirement of the husband and wife. For example, married men who invest mostly in bonds are slightly more likely than those who invest mostly in stocks to be older and have wives who are relatively older. However, the age difference between the spouses does not appear to play a significant role with respect to the investment choices of married women.

In our sample, 484 of the married women have spouses who also have a DCP. Table 1 also presents the investment choices of couples where both spouses have DCPs. Married couples tend to invest their DCPs similarly rather than diversifying the riskiness of their holdings across pension plans. Regardless of gender, if one spouse invests in a diversified portfolio or mostly in stocks, the other spouse also invests in a diversified portfolio or mostly in stocks. For example, 66.8% of married women who invest in a diversified portfolio also have husbands who invest in a diversified portfolio. Similarly, 77.5% of married women who invest mostly in stocks have husbands who invest mostly in stocks. However, the husbands of married women who invest mostly in bonds choose to invest their pension plans either mostly in bonds or mostly in stocks. For example, 40.6% married women who invest mostly in bonds have husbands who invest mostly in bonds and 36.7% of married women who invest mostly in bonds have husband who invest mostly in stocks.

Results

For each ordered probit model that is estimated, the observations from the 1995, 1998, and 2001 survey years are pooled, and year dummies are included to control for aggregate economic effects. Recall that the dependent variable for each model is equal to “0” if the respondent’s investment is “mostly bonds,” “1” if the respondent invests in a “diversified portfolio,” and “2” if the respondent’s investment is “mostly stocks.”

Table 2 presents the results from the ordered probit models for married women and men. We report two-tailed P-values and the significance levels in Table 2 and the preceding tables. Model I presents the coefficients for a model for married women and men that does not include the characteristics of the spouse. Model II includes all of the variables from Model I and the characteristics of the spouse (i.e., age, level of education, employment status, occupation, and the hourly earnings of the wife divided by the sum of hourly earnings of the wife and the husband). Married women who are white and who have higher hourly earnings are significantly more likely to invest in risky assets, while those with managerial-type occupations are significantly less likely to invest in risky assets. Compared to those who have household net worth below $35,000, women who have net worth above $500,000 are also less likely to invest in risky assets.Footnote 9 The household’s willingness to take average or above average financial risk does not a significantly affect the likelihood that married women invest in more risky assets.Footnote 10 In addition, the age of the woman and the number of children do not appear to significantly affect the investment decisions of married women.

The age of the married woman seems not to significantly affect investment decisions (Model I) and remains insignificant when we include the age of the husband in our empirical analysis. However, the age of the husband significantly affects the investment decisions of married women (Model II). Similarly, the age of married men significantly affects the investment choices and remains significant when we add the age of the wife in our regression (Model II).

The correlation matrix shows that both the age and education of the married women and their spouses are highly correlated (0.903 and 0.578, respectively). We carefully checked the nature and existence of multicollinearity in our regressions. Specifically, we created the variance inflation factors (VIF) and analyzed the nature of principal components and eigenvalues, as described in (Freund and Littell 2000, pp. 95–101). Among the variables that are included in Model II, the highest VIFs are for the age of the married woman and age of her spouse, which are 5.53 and 5.56, respectively. There is no clear-cut criterion for evaluating multicollinearity of linear regression models. Gujarati (2002) recommends that “as a rule of thumb, if the VIF of a variable exceeds 10, that variable is said to be highly collinear.”

Second, we produced eigenvalues and the condition index. Small eigenvalues indicate a high degree of collinearity. We have two eigenvalues that are smaller than 0.01 for married women in Model II. The condition index, which is the square root of the largest eigenvalue divided by the smallest eigenvalue, is 49.15. The criteria for a condition index to signify serious multicollinearity is arbitrary, with a value often quoted greater than 30 or 50. Belsley et al. (1980) suggest that values greater than 30 can be an indication of serious multicollinearity.

We looked for any sign of multicollinearity that might affect our findings. We do not have large standard errors on the age or education of the spouses such that we should be concerned that our estimates are unstable. This is easy to detect because we include the characteristics of the spouse only in Model II. When the spouse’s characteristics are added to the regression, the standard errors of age and education of married women or men do not substantially increase. When we delete the age of the married woman and the education of the married woman from our regression, the condition index reduces to 33.41, but our findings do not change.Footnote 11 In our robustness section, we present our estimations for different subsamples of married women, and there are no drastic changes in our estimates. Overall, we do not diagnose any problem that is created by collinearity between the age and education of the spouses in our specifications.

With respect to the characteristics of the husband, several findings are worth noting (see Model II for married women in Table 2). Married women with husbands who are relatively older are significantly less likely to invest in risky assets. The marginal effects for Model II, which are calculated at the sample means for each investment category, are presented in Table 3. For continuous variables, the marginal effects represent the change in the predicted probability that married men or women fall into a particular investment category as a result of a unit change in the continuous dependent variable. For dummy variables, the marginal effects represent the change in the predicted probability compared to the omitted group in the estimation of the model. See Greene (2003, p. 738) for more details on the calculation of the marginal effects for ordered probit models.

Controlling for the age of the woman, an increase in the age of the husband increases the probability of investing mostly in bonds by 0.5% points and decreases the probability of investing mostly in stocks by 1% point. In addition, women who have a higher share of earnings than their husbands are significantly less likely to invest mostly in stocks. Specifically, a 10% point increase in the ratio of hourly earnings of the wife and husband results in a 1.3% point increase in the probability of investing mostly in bonds, a 1.4% point increase in the probability of investing in a diversified portfolio, and a 2.7% point decrease in the probability of investing mostly in stocks. These marginal effects are statistically significant at the 10% level. Are they also economically significant? The predicted probability that women invest mostly in bonds is 11.3%, so a 10% point increase in the ratio of hourly earnings results in an 11.5% increase in the likelihood of investing mostly in bonds. Using the predicted probabilities that married women invest in a diversified portfolio (35.4%) or a portfolio of mostly stocks (53.3%), we find that a 10% point increase in the ratio of hourly earnings results in a 3.9% increase in the likelihood of a diversified portfolio and a 5.1% decrease in the likelihood of a portfolio of mostly stocks. Overall, these findings show that women who have more control over financial resources are more likely to invest in less risky assets.

Findings in Table 2 show that married men who are older are less likely to invest in risky assets while those who have higher hourly earnings are more likely to invest in risky assets. The household’s willingness to take average or above average financial risk increases the likelihood that married men invest in more risky assets.Footnote 12 However, the level of education, occupation, household net worth, and the number of children do not appear to significantly affect the investment choices of married men. With respect to the characteristics of the wife, men with more educated wives are significantly more likely to invest their plans in more risky assets. There is little evidence that the wife’s age and control over financial resources within the household affect the investment decisions of married men.

Robustness

Our findings in Tables 2 and 3 show that the age difference between the husband and wife has a significant negative effect on the investment choices of married women. However, if the couples choose to retire together and the wife retires when the husband retires, it should not be surprising to find that the age of the husband has a significant effect on the investment choices of married women. To ensure that we are capturing the effect of the differences in investment horizon on the investment decisions of married women, we estimate a model that includes the number of years until retirement for the wife and husband. We replace the age of the husband and the wife with two variables that indicate the number of years the husband and wife are from retirement. The results are presented in Model I in Table 4. We find that women who are married to men who are further away from retirement are more likely to invest in risky assets. The number of years until the wife retires appears to have no effect on the investment decisions of the wife.

The summary statistics in Table 1 suggest that couples make similar investment decisions with regard to their DCPs. As another robustness check, we estimate the ordered probit models for married women separately for those whose husbands have a DCP and those whose husbands do not have a DCP. We investigate whether the age differences between the husband and wife and the ratio of hourly earnings, which is our measure of relative control over financial resources, have symmetric effects on the allocation of assets in DCPs for those whose husbands have and those whose husbands do not have a DCP.

There might be different reasons why the wife’s investment choices depend on whether the husband has a DCP. Investment in risky assets is associated with high information and transaction costs and, in general, women may not have the financial sophistication because of their lack of experience. A husband with a DCP may influence his wife to invest more heavily in stocks through a “peer effect”. Women whose husbands do not have a DCP may lack vital financial information since their husbands are not familiar with these types of plans. In addition, the previous literature found a positive relationship with the level of wealth and willingness to take risks (Donkers et al. 2001). If the husband does not have a DCP, the wife may choose to invest in less risky assets because the household does not have retirement assets to offset potential investment losses.

The findings are reported in Models II and III in Table 4. Model II presents results for married women whose husbands also have a DCP. We continue to observe that those who are white and those with higher hourly earnings are more likely to invest in risky assets. With respect to the age difference between the husband and the wife, we find that women who are married to men who are relatively older are significantly less likely to invest in risky assets. In this scenario, the ratio of hourly earnings that we use to measure control over financial resources within the household loses its significance. Model III in Table 4 presents the results for married women whose husbands do not have a DCP. In this estimation, the wife’s relative control over financial resources does not have a significant negative effect on the riskiness of assets in DCPs.

Our results show that the effect of the wife’s control over financial resources varies by the husband’s ownership of a DCP. Those women whose husbands do not have a DCP can be seen to be more conservative investors as their control over the financial resources increases. One could argue that our measure of relative control over financial resources (the ratio of hourly earnings) may in reality be a measure of risk aversion rather than of bargaining power. Our measure may be capturing the stream of future income, and households where only the wife has a DCP may not have financial resources and/or may expect a low stream of future earnings. Therefore, individual members of the households may be more risk averse and choose to invest in less risky assets.

If this argument is true, we should not find a significant effect of the wife’s control of resources for those with high levels of income or high levels of retirement savings. We estimate our model for the sample of married women whose savings in their DCPs is more than $15,000 and whose husbands do not have DCP plans. The estimation results are reported in Model IV in Table 4. Unfortunately, the sample size is very small. For this sample of 188 married women, the wife’s relative control over financial resources has a large significant negative effect. However, this estimate is only significant in two out five implicates due to small sample size.

Finally, we assume that if the husband does not have a DCP plan or does not have any other retirement plan, he should be in control of investment decisions regarding nonretirement accounts. Similarly, for those couples where both spouses have DCPs, both spouses should have decision-making power over the allocation of assets in nonretirement accounts. We investigate the effect of the wife’s control over resources on financial assets, excluding retirement accounts, for those households where both spouses have DCPs, for those households where the husband does not have a DCP and, finally, for those households where the husband does not have a DCP or a defined benefit plan. Our dependent variable is the amount of stocks divided by amount of financial assets excluding retirement accounts.

The findings from the Tobit estimation are reported in Table 5. For those couples where both spouses have a DCP plan, the wife’s control over financial resources has a significant negative effect on the allocation of assets (Model I). In addition, for those couples where the husband does not have DCP plan, the wife’s relative control over financial resources has a significant effect (Model II) and for those couples where the husband does not have a DCP plan or a defined benefit plan, the wife’s relative control over resources has a significant effect (Model III).

Conclusions

Past studies treat married households as single decision-making units. Little attention has been given to investigating the effect that joint decision-making has on the investment decisions of married men and women. This study examines how a spouse’s relative control over financial resources and the spouse’s life-cycle stage affect the investment choices of married women and men. The results show that women who have more control over resources within the household are less likely to take on risk with their pension plans. Those who are married to older men are also less likely to invest their pension plans in risky assets. There is little evidence that the characteristics of the wife affect the husband’s investment decisions.

The asymmetry in our findings for married women and men suggest that a unitary model cannot explain the investment choices of individual members of the household. So far, household bargaining models have focused on spouses’ labor supply, consumption, and saving decisions. Previous research may not have adequately controlled for the effect of household decision-making on investment decisions. Our results provide evidence that bargaining models can be used to model the investment decisions of married women.

Our findings suggest that marriage may have a significant impact on the resources available to women during their retirement years. Especially for households where the husband is older than the wife, being married may increase the gap between a man’s and a woman’s retirement savings, since women who are married to older men are more likely to invest in less risky assets with lower returns. In addition, the life-cycle stage of the husband has a significant effect on the allocation of assets in nonretirement accounts, especially for those households where the husband does not a DCP plan. Our finding that married women with older spouses invest in safer assets can be explained from a human capital perspective that the component of human capital in total household wealth is lower for those who have older spouses and thus these women prefer to hold the optimal portfolio in safer assets. There may also be a cohort effect. If each successive generation is more likely to invest in stocks, those women with older spouses may be likely to absorb their spouse’s conservatism.

Overall, while this study provides substantial insight into the impact that marriage has on women’s retirement investment decisions, it is primarily descriptive and limited in the following respects. First, the data set used for this study does not include specific information on the process of financial decision-making within the household. We do not know which spouse is specifically making the financial decisions regarding the allocation of assets nor how and when those decisions are being made. Second, our analysis only focuses on individuals who have DCPs. However, individuals who have DCPs can be different from individuals who do not have DCPs plans. Women can be more or less likely to seek out employment opportunities with DCPs than otherwise similar men. For those who do not have DCPs, we do not observe their investment decisions. Having DCPs might be correlated with unobservable characteristics that affect the investment choices, and using only individuals who have DCPs might produce results that are unbiased only for those who have DCPs. We compare the demographic characteristics of individuals who have DCPs to those who do not have DCPs in Appendix Table 6. In 1995, 1998 and 2001, there were a total of 2,766 working married women and 3,102 working married men who did not have DCPs. The ratio of married women who have DCPs to the married women who do not have DCPs is 0.34 while the ratio of married men who have DCPs to married men who do not have DCPs is 0.58. A lower percentage of working women have DCPs than working men. In general, regardless of gender, those who have DCPs are older, have higher education, higher hourly earnings, and household net worth. At the same time, household net worth and education levels of married women and men who have DCPs are comparable to each other. Our ordered probit analysis was unable to address this potential selection issue that individuals who have DCPs can be different from individuals who do not have DCPs.

We are also unable to adequately control for the impact an employer may have on these decisions. Note that the choices of many DCP participants may be constrained with the limited availability of competitive bond funds. Investment choice may also be largely determined by the default option or peer effects.

In addition, the characteristics of the spouse may be proxies for the characteristics of the investment plans, wealth holdings, or other financial behaviors of the spouse, such as whether or not the spouse has a DCP, which limits the inferences that can be made. A more complete analysis would take into account in more detail how the investment decisions of the spouse affect the investment decisions of the respondent. Also, our results provide evidence that the presence or absence of DCPs influences the mix of the couple’s other financial assets (i.e., their willingness to take risks by investing in stocks). The investment decisions of couple’s other financial assets seem to be simultaneously determined with the DCP investment decisions of the respondent. Given data limitations, these econometric issues are difficult to address and our analysis is unable to account for these added complications.

Further research is needed to investigate financial decision-making within the household to further flesh out our understanding. Also, further research is needed to investigate how couples decide on the allocation of assets in the household portfolio, both retirement and nonretirement assets. In particular, we need to understand why the wife’s characteristics have no effect on the riskiness of retirement and nonretirement accounts when the husband makes the investment decisions.

A continuing shift from defined benefit plans to DCPs increases the importance of understanding the impact of factors that affect financial decisions on the well-being of families during retirement. As DCPs increasingly become the primary plan for employees, the participants take more direct responsibility for risks related to allocation of assets in these accounts. These new responsibilities frequently require the participants to make a variety of complex financial decisions in both the asset accumulation phase and in the retirement phase. There is concern in the research community and among policy makers that many participants need more guidance with key investment decisions. Retirement security for some participants might be threatened by suboptimal asset allocation that may reflect a lack of basic financial literacy, and women participants may even be in a more disadvantageous position since their constraints are different than men.

If individuals do not make the appropriate investment decisions in their retirement accounts (either through too much risk exposure or too little), it is possible they will end up with insufficient retirement wealth, a situation which has tremendous individual and societal consequences. In addition, during the asset accumulation stage and retirement, the participants are exposed to various risks, including market risk, longevity risk, and inflation risk. Our results provide evidence that longevity risk might be an important issue for married women.

Recently, new financial vehicles have been designed and become available to simplify the investment process for the participants of DCPs. These products aim to offer new means to address the needs of participants who lack the skill, interest or time to effectively manage their DC plan assets. Lifecycle funds are examples of these vehicles. These can be classified into two broad categories: “target date” funds that target a specific retirement date and “target risk” funds that target the investor’s risk tolerance (e.g., conservative, moderate and aggressive). Our findings show that for women participants, both target date and target risk may be different from her personal characteristics, so even these funds may not sufficiently help to achieve financial security during retirement.

Policy makers have been concerned with designing and implementing policies to insure that the elderly have adequate retirement wealth and are able to maintain a satisfactory financial status at the end of their life cycle. Our research has shed some light on possible Social Security reform that would allow workers to redirect some of their payroll tax to a personal account. If part of the Social Security payroll tax could be invested into a personal account, policymakers should know who might be more likely to set up such an account, and most importantly, how these accounts will be allocated to a variety of assets. While our analysis does not provide answers to the first issue, our findings suggest that the worker’s characteristics, including age, gender and marital status might have an impact on the investment decisions. Policymakers should also contemplate what default options for asset allocation in these accounts, if any, should be utilized. Furthermore, employees tend to remain in default options, so these default options can help to realize the policy objectives. If the policy objective were to insure minimum retirement wealth during retirement for everyone independent of their marital status and gender, the default should be use of Lifecycle funds with the target date set as the worker’s own retirement age and the target risk as moderate. We know that women usually use their husband’s retirement age as a target date and their husband’s risk tolerance as the target risk. Therefore, this type of default option might help them achieve financial security during retirement.

Notes

One can argue that due to sorting in marriage markets, spouses may have similar risk preferences and be close in age to each other. Unfortunately, we do not directly observe the risk preference of each spouse in the Survey of Consumer Finances, which is the data set used in this study. The data (2001 Survey of Consumer Finances) show that 25% of women have husbands 5 years or more older and 10% of women have husbands 3 years or more younger.

See Chaulk, Johnson and Bulcroft (2003) for the effect of marital status and children on financial risk tolerance, Ulker (2009) for the role of marital history in wealth holdings, Molina and Montuenga (2009) for the effect of motherhood on women’s wage, and Yilmazer (2008) for the role of children in household savings. Malone et al. (2010) examine perceptions of financial well-being among women with and without children who lived in different family forms including marriage, cohabitation, stepfamilies, as well as women who were single and show that women in nontraditional families (single mothers, cohabitors, and stepfamilies) had significantly greater worries about their financial futures than women in first marriages. Additionally, Sanders and Porterfield (2010) investigate the factors associated with asset accumulation of female headed households and show the presence of children reduced the likelihood of having owning assets.

In the non-cooperative framework, each spouse maximizes his or her own utility given the behavior of his/her partner, and there is no pooling of resources and no joint consumption. The game-theoretic outcome in this case is the Nash equilibrium, where the outcome is determined by each spouse’s wages as well as other resources held by each spouse such as non-labor income or education. Alternatively, it is possible for the spouses to reach a cooperative outcome that is the result of an agreement between the two spouses. In the cooperative model, the spouse with less bargaining power is more likely to make concessions during the bargaining process. The utility levels that result from the non-cooperative outcome serve as the default position or “threat point.” Based on this threat point, spouses choose from a set of Pareto-optimal allocations. See Lundberg and Pollak (1996) for a survey of household bargaining models, and Lundberg and Pollak (1994) for a survey of non-cooperative bargaining models.

In the SCF, the respondent of the survey, who may be the husband or the wife, answers the question on the willingness to take financial risks. Our findings do not vary when we exclude this variable from the empirical analysis.

The Health and Retirement Study is the only survey that includes information about the distribution of power within the household. One limitation of the survey, however, is that it includes only households with a member aged between 51 and 61 in 1992.

The questions in the SCF are designed such that a respondent provides information about his or her “spouse or partner.” For the purposes of this study, married households are defined as being legally married or living together with a member of the opposite sex. Less than 8.0% of the sample reported living together with a member of the opposite sex. Excluding these observations from the sample does not significantly alter the results.

Retirement wealth is not included in household assets. Household assets include all other types of financial and nonfinancial assets. Financial assets include the amount invested in checking accounts, savings accounts, CDs, savings bonds, money market accounts, mutual funds, stocks, bonds, call accounts at brokerages, and any other financial assets held by the household. Nonfinancial assets include the value of vehicles, primary residence, other real estate, business assets, and other non-financial assets that are not included elsewhere. Household debt includes the amount of mortgages, lines of credit, credit card balances, installment loans and other types of liabilities. Household net worth is defined as household assets minus household debt.

This finding is consistent with the literature that found evidence of decreasing relative risk aversion (Friend and Blume 1975; Riley and Chow 1992; Siegel and Hoban 1982). The findings in the literature are shown to be sensitive to the way which wealth is defined. We investigate the robustness of our results using only financial assets instead of the sum of financial and nonfinancial assets. The negative correlation between assets and the riskiness of investment decisions regarding assets in DCPs did not disappear.

This finding is consistent with Sung and Hanna (1998) where they found that risk tolerance has an insignificant effect on the wife’s investment decision of retirement funds.

The regression estimates are not presented but are available from the authors upon request.

This result is consistent with Finke and Huston (2003) where they show risk tolerance among those over age 65 is among the strongest predictors of a higher net worth. The risk tolerance seems to affect the investment decisions for all ages.

References

Ameriks, J., & Zeldes, S. P. (September 2004). How do household portfolio shares vary with age? TIAA-CREF working paper. Retrieved April 10, 2008, from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=292017.

Bajtelsmit, V., Bernasek, A., & Jianakoplos, N. (1999). Gender differences in defined contribution pension decisions. Financial Services Review, 8, 1–10.

Belsley, D. A., Kuh, E., & Welsch, R. E. (1980). Regression diagnostics: Identifying influential data and sources of collinearity. New York: Wiley.

Bernasek, A., & Bajtelsmit, V. (2002). Predictors of women’s involvement in household financial decision-making. Financial Counseling and Planning, 13, 39–48.

Bernasek, A., & Shwiff, S. (2001). Gender, risk, and retirement. Journal of Economic Issues, 35, 345–356.

Bodie, Z., & Crane, D. B. (1997). Personal investing: Advice, theory and evidence. Financial Analysts Journal, 53(6), 13–23.

Browning, M. (2000). The saving behavior of a two-person household. Scandinavian Journal of Economics, 102, 235–251.

Byrnes, J., Miller, D. C., & Schafer, W. D. (1999). Gender differences in risk taking: A meta-analysis. Psychology Bulletin, 125, 367–383.

Chaulk, B., Johnson, P. J., & Bulcroft, R. (2003). Effects of marriage and children on financial risk tolerance: A synthesis of family development and prospect theory. Journal of Family and Economic Issues, 24, 257–279.

Dobbelsteen, S., & Kooreman, P. (1997). Financial management, bargaining and efficiency within the household: An empirical analysis. De Economist, 145, 345–366.

Donkers, B., Melenberg, B., & Van Soest, A. (2001). Estimating risk attitudes using lotteries: A large sample approach. Journal of Risk and Uncertainty, 22, 165–195.

Dwyer, P. D., Gilkenson, J. H., & List, J. A. (2002). Gender differences in revealed risk taking: Evidence from mutual fund investors. Economic Letters, 76, 151–158.

Employee Benefit Research Institute. (2001). Women in retirement. Retrieved April 10, 2008, from http://www.ebri.org/pdf/publications/facts/1101fact.pdf.

Employee Benefit Research Institute. (2003). Private pension plans, participation, and assets: Update. Retrieved April 10, 2008, from http://www.ebri.org/publications/facts/index.cfm?fa=0103fact.

Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: Financial risk tolerance and wealth. Journal of Family and Economic Issues, 24, 233–256.

Freund, R. J., & Littell, R. C. (2000). SAS system for regression. Cary: SAS Institute.

Friedberg, L., & Webb, A. (2006). Determinants and consequences of bargaining power in households. NBER working paper series, 12367. Retrieved April 10, 2008, from http://www.nber.org/papers/w12367.

Friend, I., & Blume, M. E. (1975). The demand for risky assets. American Economic Review, 65, 900–922.

Greene, W. H. (2003). Econometric analysis (5th ed.). New Jersey: Prentice Hall.

Gujarati, D. N. (2002). Basic econometrics (4th ed.). New York: McGraw-Hill College.

Heaton, J., & Lucas, D. (2000). Portfolio choice and asset prices: The importance of entrepreneurial risk. Journal of Finance, 55, 1163–1198.

Hinz, R., McCarthy, D., & Turner, J. (1997). Are women conservative investors? Gender differences in participant-directed pension investments. In M. Gordon, O. Mitchell, & M. Twinney (Eds.), Positioning pensions for the twenty-first century. Philadelphia: University of Pennsylvania Press.

Hudgens, G. A., & Fatkin, L. T. (1985). Sex differences in risk taking: Repeated sessions on a computer-simulated task. Journal of Psychology, 119, 197–206.

Jianakoplos, N. A., Bajtelsmit, V. L., & Bernasek, A. (2003). How marriage matters to pension investment decisions. Journal of Financial Service Professionals, 57, 48–57.

Jianakoplos, N. A., & Bernasek, A. (1998). Are women more risk averse? Economic Inquiry, 36, 620–630.

Jianakoplos, N. A., & Bernasek, A. (2008). Family financial risk taking when the wife earns more. Journal of Family and Economic Issues, 29, 289–306.

Levin, I. P., Synder, M. A., & Chapman, D. P. (1988). The interaction of experiential and situational factors and gender in a simulated risky decision-making task. Journal of Psychology, 122, 173–181.

Lindamood, S., Hanna, S. D., & Bi, L. (2007). Using the survey of consumer finances: Methodological considerations and issues. Journal of Consumer Affairs, 41, 195–214.

Lundberg, S. J., & Pollak, R. (1994). Non-cooperative bargaining models of marriage. American Economic Review, 84(2), 132–137.

Lundberg, S. J., & Pollak, R. (1996). Bargaining and distribution in marriage. Journal of Economic Perspectives, 10(4), 139–158.

Lundberg, S. J., Startz, R., & Stillman, S. (2003). The retirement-consumption puzzle: A marital bargaining approach. Journal of Public Economics, 87, 1199–1218.

Lundberg, S. J., & Ward-Batts, J. (2000). Saving for retirement: Household bargaining and household net worth. Working paper. University of Michigan: Michigan Retirement Research Center. Retrieved April 10, 2008, from http://www.mrrc.isr.umich.edu/publications/conference/pdf/cp00_lundberg.pdf.

Malone, K., Stewart, S. D., Wilson, J., & Korsching, P. F. (2010). Perceptions of financial well-being among American women in diverse families. Journal of Family and Economic Issues, 31, 63–81.

Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The time case. Review of Economics and Statistics, 51, 247–257.

Molina, J. A., & Montuenga, V. M. (2009). The motherhood wage penalty in Spain. Journal of Family and Economic Issues, 30, 237–251.

Powell, M., & Ansic, D. (1997). Gender differences in risk behavior in financial decision-making: An experimental analysis. Journal of Economic Psychology, 18, 605–628.

Riley, W. B., & Chow, K. V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 48(6), 32–37.

Samuelson, P. A. (1969). Lifetime portfolio selection by dynamic stochastic programming. Review of Economics and Statistics, 51, 239–243.

Sanders, C. K., & Porterfield, S. L. (2010). The ownership society and women: Exploring female householders’ ability to accumulate assets. Journal of Family and Economic Issues, 31, 90–106.

Säve-Söderbergh, J. (2003). Pension wealth: Gender, risk and portfolio choices. Essays on gender differences in economic decision-making, Ph.D. Dissertation, Swedish Institute for Social Research: Stockholm University.

Siegel, F. W., & Hoban, J. P. (1982). Relative risk aversion revisited. Review of Economics and Statistics, 64, 481–487.

Sundén, A. E., & Surette, B. J. (1998). Gender differences in the allocation of assets in retirement savings plans. American Economic Review, 88(2), 207–211.

Sung, J., & Hanna, S. D. (1998). The spouse effect on participation and investment decisions for retirement funds. Financial Counseling and Planning, 9, 47–58.

Uccello, C. E. (2000). Do spouses coordinate their investment decisions in order to share risks? Center for Retirement Research, WP 2000–2009. Retrieved April 10, 2008, from http://crr.bc.edu/images/stories/Working_Papers/wp_2000-09.pdf.

Ulker, A. (2009). Wealth holdings and portfolio allocation of the elderly: The role of marital history. Journal of Family and Economic Issues, 30, 90–108.

U.S. Department of Labor Employee Benefits Security Administration. (2006). Private pension plan bulletin abstract of 2003 from 5500 annual reports. Retrieved April 10, 2008, from http://www.dol.gov/ebsa/PDF/2003pensionplanbulletin.PDF.

Woolley, F. (2003). Control over money in marriage. In S. A. Grossbard-Shechtman (Ed.), Marriage and the economy: Theory and evidence from advanced industrial societies. Cambridge: Cambridge University Press.

Yilmazer, T. (2008). Saving for children’s college education: An empirical analysis of the trade-off between the quality and quantity of children. Journal of Family and Economic Issues, 29, 307–324.

Young, M. C., & Wallace, J. E. (2009). Family responsibilities, productivity, and earnings: A study of gender differences among Canadian lawyers. Journal of Family and Economic Issues, 30, 305–319.

Acknowledgements

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) to the Center for Retirement Research at Boston College (CRR). This grant was awarded through the CRR’s Steven H. Sandell Grant Program for Junior Scholars in Retirement Research. The opinions and conclusions are solely those of the authors and should not be construed as representing the opinion or policy of SSA or any agency of the Federal Government or of the CRR. We are grateful to the U.S. Social Security Administration and the Center for Retirement Research at Boston College (CRR) for their generous financial support. This research was awarded the CFP Board’s American Council on Consumer Interests (ACCI) Financial Planning Paper Award. We graciously thank the CFP Board for their recognition and support of this research. We also thank Vickie Bajtelsmit, Alexandra Bernasek, Julianne Cullen, Shoshana A. Grossbard, Nancy Jianakoplos, Kristin Kleinjans, Ann Huff Stevens, and three anonymous referees and the editor, Jing Xiao, the associate editor, Alberto Molina, and seminar participants in the Department of Economics at the University of Illinois Urbana-Champaign and Boğaziçi University, and the ASSA meetings, and public finance participants in the CSWEP Junior Faculty Mentoring Program for providing us valuable feedback.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Yilmazer, T., Lyons, A.C. Marriage and the Allocation of Assets in Women’s Defined Contribution Plans. J Fam Econ Iss 31, 121–137 (2010). https://doi.org/10.1007/s10834-010-9191-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-010-9191-6