Abstract

Ethical decision-making is an important function among accountants. This paper sought to determine the factors influencing the ethical intentions of future accounting professionals. Specifically, this study tested the applicability of the theory of reasoned action (TRA), theory of planned behavior (TPB) and the extended model of the theory of planned behavior (ETPB) in predicting accounting students’ intentions to act unethically (breaching confidentiality and charging expenses). Data was collected via a survey questionnaire from 298 accounting students at a Caribbean university. Results revealed that the independent variables (attitudes, subjective norms, perceived behavioral control and moral obligation) significantly predicted students’ intentions to breach confidentiality and charge personal expenses. Our findings show that the ETPB is a good predictor of ethical intentions among future accounting professionals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

We are grateful for the insightful comments from the Editor and two anonymous reviewers.

In recent times, there have been many publicized events of unethical acts in the accounting profession within the developed countries. Notably, we are familiar with the Enron and WorldCom scandals. We saw one of the largest accounting firms, Arthur Andersen, forced to cease operations, due to being complicit in the affair and for failing to be ethical. Thus, ethics is a major focus for researchers.

Although within the Caribbean there have not been many major publicized events of unethical decision-making, we are being constantly reminded that this issue is coming closer to our midst. The collapse of the Allen Stanford Empire Footnote 2 highlights the fact that accountants and other finance professionals within the Caribbean are also faced with ethical dilemmas in everyday practice, especially with the increasing volumes of international trade with developed countries, and the impending gloom in economic forecasts for these territories.

The aim of this paper is to examine the ethical intentions of students enrolled in the accounting program at a Caribbean university. These students will be the future professional accountants in the Caribbean, and thus our study’s focus on ethics among this sample becomes critically important and relevant to accounting professionals in the Caribbean region. Students are recruited from this university, as has been the norm for many years. Furthermore, strict religious practices and childhood socialization in the Caribbean promote the knowledge of right and wrong at a very early age. Hence, by the time most of these students go to university, their moral compass and sense of ethical behaviors have already been shaped. These beliefs and behaviors are then taken into the workplace.

There has been a paucity of research on ethics in the accounting profession in the Caribbean. Most of the work on ethics to date in the Caribbean has been done by Alleyne and colleagues (Alleyne et al. 2006, 2010; Devonish et al. 2009; Alleyne 2010; Alleyne and Phillips 2011). Thus, more needs to be learnt about the ethics of professionals within emerging contexts such as the Caribbean. This study seeks to identify the contributing factors in the ethical decisions made by potential accountants in the Caribbean, in an attempt to prevent a prevalence of unethical practices within the profession, and to promote public confidence in financial accounting and reporting. In light of the current economic situation facing most of the larger developed countries and the impact of this on the smaller developing countries of the Caribbean, research into the area of a professional accountant’s willingness to make unethical decisions, is important in allowing us to identify factors which may allow for the influence of increased ethical decision-making in the profession.

Previous studies in ethical judgment have shown that business students in developing countries use a higher level of moral judgment than students in developed economies. One example of this is shown in the work of Priem et al. (1998), where they compared the moral judgment of Belizean students with that of U. S. students and found a higher level of moral judgment. The underlying culture of the Caribbean is also considered to be different to that of most developed countries, with a values based educational system that is heavily influenced by religious beliefs and practices. While this is a differentiating feature of such economies, these countries are still influenced by the culture of their developed counterparts, which makes the demographics of the current sample group unique for testing the variables involved in this study.

In this paper, we test the applicability of the Theory of Reasoned Action (TRA) (Fishbein and Ajzen 1975), the Theory of Planned Behavior (TPB) (Ajzen 1991), and the extension of the Theory of Planned Behavior (ETPB) (Beck and Ajzen 1991) to determine the usefulness of the theories in predicting ethical intentions of future accounting professionals in the Caribbean. Prior studies have used social psychological theories to predict behavior (Chang 1998; Buchan 2005). These studies have used the TRA (Fishbein and Ajzen 1975), and its extension, TPB (Ajzen 1991) to predict behaviors in many disciplines (e.g. Madden et al. 1992; Gibson and Frakes 1997). The rationale behind the use of these theories (specifically, TPB) for the present study is based on popular arguments in the literature highlighting that “[a]rguably, extending the framework to the moral domain is testing the boundary limits of the theory…[and] recent research efforts have demonstrated promise in this area” (Buchan 2005, p.178). Moreover, compared to other theories surrounding behavioral intentions, the TPB framework has demonstrated strong predictive validity in a wide range of domains and contexts (Armitage and Conner 2001).

An objective of this study is to test the validity and compare the explanatory power of the TRA, TPB and ETPB (the modified version). We also adopt and extend the approach taken by Buchan (2005), and answer his call for using the framework for understanding the factors influencing ethical intentions among accountants. For example, the TPB proposes that behavioral intention is influenced by a person’s attitude towards the behavior, subjective norms, and perceived behavioral control. This research will examine the extent to which each of these factors is inherent in the behavioral intention of the accounting student, as this will have an impact on the behavior of future accounting professionals.

Literature Review

Prior Ethical Decision-Making Models

Ethics means doing the right thing, and seeking to follow moral behavior. The study of ethics examines the conduct of an individual in light of their moral principles, addressing what is considered good and bad, or right and wrong. The ethical conduct of management, and specifically professional accountants, has important implications for the integrity and accountability in the accounting and financial systems of businesses today. Since the fall of large corporations such as Enron and WorldCom in the United States of America (USA), the integrity of the accounting profession has been faced with doubts as to the level of ethical behavior displayed. The accounting firm, Arthur Andersen, was closed as a result of its complicity in the Enron debacle (Toffler and Reingold 2003).

The literature is filled with models that are proposed to explain the ethical decision-making of individuals (Trevino 1986; Rest 1986; Kohlberg 1969; Jones 1991). For example, Kohlberg (1969) proposed a three-stage model of cognitive moral development (moral reasoning) to show the stages that individuals progress in terms of their moral development. Rest (1986) proposed a four-component model of ethical decision-making: ethical sensitivity, ethical judgment, ethical intentions and ethical behavior. Prior research has shown that the moral reasoning levels of accountants have been lower than the levels of other professionals (Armstrong 1987; Ponemon 1990).

Jones (1991) argued that ethical decision-making is issue-contingent, and that it is the moral issue in question that determines the final decision. Jones (1991) put forward six dimensions of his moral intensity construct: magnitude of consequences, social consensus, proximity, concentration of effect, probability of effect and temporal immediacy. Prior research has provided empirical support for moral intensity (especially magnitude of consequences and social consensus) and ethical decision-making (Marshall and Dewe 1997; Singer and Singer 1997). These models can be considered as attempts by researchers to try to understand the ethical decision-making processes of individuals. We believe that our research further extends the knowledge by exploring the variants of the TPB within the realm of ethical intentions among future accounting professionals.

The Theory of Planned Behavior

Fishbein and Ajzen (1975) developed the TRA, which proposed that an individual’s actual behavior is determined by his/her behavioral intention to perform that behavior. Intention is deemed as a strong predictor of actual behavior (Fishbein and Ajzen 1975). TRA further posits that an individual’s behavioral intention is influenced by one’s attitudes toward the behavior and subjective norms. The TRA’s predictive validity is called into question when the behavior is not under the individual’s complete volitional control (Chang 1998). It is recognized that some behaviors are under the control of the individual, while others are not. In addition, the TRA model does not provide for “the probability of failing to perform the behavior or consequences of failing to perform such behavior” (Chang 1998, p.1827).

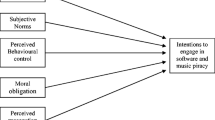

Hence, Ajzen (1991) further refined the TRA, by developing the Theory of Planned Behavior (TPB), and adding perceived behavioral control as a determinant of behavioral intentions (see Fig. 1). Thus, the TPB identifies three antecedents that are proposed to influence an individual’s behavioral intention: 1) attitudes toward the behavior; 2) subjective norms; and 3) perceived behavioral control (Ajzen 1991). Prior research has used the TPB in studies of ethical decision-making within accounting and financial contexts (Carpenter and Reimers 2005; Buchan 2005).

The theory of planned behavior adapted from Ajzen (1991)

Previous studies have shown that attitude is the largest contributing factor on an individual’s intentions, and that the culture of an organization will also significantly influence the decision-making process of managers (Buchan 2005; Flannery and May 2000). Flannery and May (2000) provide empirical support for the TPB in influencing ethical decision-making among environmental managers. Fang (2006) found that the TPB was indeed a good predictor of ethical decision-making among employees in Taiwan. Empirical support for the theory is also given by Randall and Gibson (1991) in their study of ethical decision-making in the medical profession, and Gibson and Frakes (1997) in their examination of ethics in the accounting profession. Chang (1998) concluded that the TRA and TPB can provide the required foundation for further investigations into unethical behavior. Hence, we argue that they would provide excellent theories to further investigate the unethical decisions of professional accountants in the Caribbean.

Behavioral Intentions (Ethical Intentions)

Ajzen’s (1991) TPB suggests that a person’s intention to perform or not to perform is a strong predictor of actual behavior. Ajzen and Fishbein (1980) argued that intentions encompassed factors that suggested how committed a person was to performing a given behavior. It follows therefore that the stronger a person’s intentions, the more likely it is for the individual to perform a certain behavior.

Measuring behavioral intentions is considered more practical and easier than measuring actual behavior, although it is believed that the best test of the TPB is the direct observation of behavior. This approach is encouraged by the work of Carpenter and Reimers (2005) who found a strong relationship between intentions and the subsequent behavior.

Behavioral intentions have been modeled as a function of attitudes, subjective norms and perceived behavioral control, based on the TPB. However, Ajzen and Fishbein (1980) highlighted the fact that the significance of these factors would fluctuate according to the type of behavior and conditions under which the behavior will be performed. Contemporary research has focused on understanding ethical intentions of individuals (e.g. Singhapakdi 2004; Buchan 2005). Singhapakdi (2004, p.262) defined ethical intention as the disposition by an individual to act ethically. Barnett and Valentine (2004, p.340) stated that “in a decision-making context, an individual’s behavioral intention is the expressed likelihood that he or she will engage in a particular action.” Consistent with the literature, in our study, behavioral intentions are modeled as ethical intentions. In this study, we examine intentions to behave ethically (or unethically), using examples of ethical behaviors such as breach of confidentiality and charging personal expenses to the company.

Attitudes and Ethical Intentions

Fishbein and Ajzen (1975) argued that an individual’s attitude towards the behavior can influence behavioral intentions. Ajzen (1991, p.188) stated that the attitude toward the behavior refers to “the degree to which a person has a favorable or unfavorable evaluation or appraisal of the behavior in question.” Prior research has found support for attitudes influencing behavioral intentions (Beck and Ajzen 1991; Harding et al. 2007; Whitley 1998). Gibson and Frakes (1997) found that attitudes predicted accountants’ ethical decision-making. Buchan (2005) also found strong support for attitudes influencing ethical intentions among accountants.

Research conducted by Carpenter and Reimers (2005) found a strong correlation between attitudes and behavioral intentions. These authors found that positive attitudes pertaining to the adherence of generally accepted accounting principles (GAAP) influence an individual’s decision or intentions to follow GAAP in order to meet earnings targets. We believe that this relationship will also hold among accountants. Thus, our first hypothesis is as follows:

-

Hypothesis 1a (H1a): Students’ attitudes toward unethical behavior will influence intentions to breach confidentiality

-

Hypothesis 1b (H1b): Students’ attitudes toward unethical behavior will influence intentions to charge personal expenses to the company.

Subjective Norms and Ethical Intentions

Ajzen (1991, p. 188) stated that subjective norms refer “to the perceived social pressure to perform or not to perform the behavior.” Specifically, subjective norms is the social component of the model which speaks to a person’s perception of how significant others view the behavior in question, and whether or not they would support the behavior. Significant others can include persons such as family members and friends whose support, or lack thereof, of a particular behavior, can influence intentions to act or not to act (Fishbein and Ajzen 1975).

Carpenter and Reimers (2005) found evidence that subjective norms exerted less influence than attitudes over managers’ decisions to be unethical. However, it still proved to be a very important factor. Gibson and Frakes (1997) found support for subjective norms influencing decision-making among accountants. Alleyne and Phillips (2011) found further support for subjective norms as a significant predictor of ethical intentions. We argue that subjective norms will influence accountants’ intentions to behave unethically (i.e. by breaching confidentiality and charging personal expenses). Thus, our second hypothesis is as follows:

-

Hypothesis 2a (H2a): Students’ perceptions that subjective norms endorse unethical behavior will influence intentions to breach confidentiality

-

Hypothesis 2b (H2b): Students’ perceptions that subjective norms endorse unethical behavior will influence intentions to charge personal expenses.

Perceived Behavioral Control and Ethical Intentions

Ajzen (1991) defined perceived behavioral control as an individual’s perception in terms of how easy or challenging (perceived ease or difficulty) it may be to perform the behavior. The TPB proposes that the stronger the perceived behavioral control, the greater the intentions to perform the behavior. Perceived behavioral control is a reflection of not only past experiences but also any probable obstacles (Ajzen 1991; Carpenter and Reimers 2005). Carpenter and Reimers (2005) found no support for the role of perceived behavioral control in managers’ intentions to contravene GAAP in order to meet earnings’ predictions. However, prior research has found support for perceived behavioral control influencing ethical intentions (Alleyne et al. 2010; Alleyne and Phillips 2011). High perceived behavioral control may be considered similar to perceived ease, while low perceived behavioral control can be construed as perceived difficulty. Thus, our third hypothesis is as follows:

-

Hypothesis 3a (H3a): Students’ high perceived behavioral control (i.e. perceived ease) in performing the unethical behavior will influence intentions to breach confidentiality.

-

Hypothesis 3b (H3b): Students’ high perceived behavioral control (i.e. perceived ease) in performing the unethical behavior will influence intentions to charge personal expenses.

Moral Obligation and Ethical Intentions

Moral obligation refers to one’s personal feelings regarding one’s duty or obligation to engage or to refuse to engage in a particular behavior (Ajzen 1991). Ajzen (1991, p.199) argued that “such moral obligation would be expected to influence intentions, in parallel with attitudes, subjective (social) norms and perceptions of behavioral control.” Support exists for a modified version of the TPB, which includes the added variable, moral obligation, to enhance the predictive capabilities of the theory in terms of ethical behavior (Beck and Ajzen 1991). According to Beck and Ajzen (1991), moral obligation should enhance the predictive power of the TPB model. Figure 2 depicts an extended version of the TPB, which states that actual behavior is influenced by behavioral intentions. Furthermore, an individual’s behavioral intention is determined by one’s attitude towards the behavior, subjective norms, perceived behavioral control and moral obligation. Prior research has found support for the inclusion of moral obligation in an extended version of the TPB (Kurland 1995; Beck and Ajzen 1991).

Alleyne and Phillips (2011) found that moral obligation predicted ethical intentions among students. Prior accounting research has found empirical support for moral norms as being a significant predictor of ethical decision-making (Cohen et al. 1998, 2001). We argue that accountants have a moral obligation or personal responsibility to uphold the values of the profession, which includes being ethical. Thus, our fourth hypothesis is as follows:

-

Hypothesis 4a (H4a): Students’ moral obligation will influence intentions to breach confidentiality.

-

Hypothesis 4b (H4b): Students’ moral obligation will influence intentions to charge personal intentions.

Research Method

Research Design

This study has a cross-sectional design and used a self-administered survey questionnaire. We sought to test the relationships between attitudes, subjective norms, perceived behavioral control, moral obligation and ethical intentions. We did not seek to measure actual behavior. The constructs were used in a large number of previous studies and have shown high levels of scale reliability and validity. The subjects used were students and as such, this research was approved by the University’s Ethics Committee.

Sample and Data Collection Procedures

The study used a non-probability convenience sample of students in the accounting field from a Caribbean university. This university is in an English-speaking region with a predominantly black population. The university provides both undergraduate and graduate degree programs. Although non-random sampling was used, the subjects were representative of the profession under study and were deemed appropriate for sampling. The survey was administered during classes in the final two levels of the accounting program. These levels were chosen, as these students would have been exposed to some ethical studies in their program. Potential subjects received a survey with a cover letter requesting their voluntary participation in the study. The letter outlined the purpose of the study and assured the subjects of confidentiality and anonymity. The surveys were manually completed with no identification of the subject placed on the instrument and all completed questionnaires were returned to the researchers at the following class sessions.

Response Rate

We distributed 400 questionnaires and received 298 usable responses. Thus, the overall response rate of the study was 74.5 %. This response rate compares favorably to past studies in ethical decision-making (Kurland 1996; Gibson and Frakes 1997; Flynn 2001; Buchan 2005). The sample distribution obtained appeared reasonable and was considered representative of the student body pursuing an accounting career.

The first part of the questionnaire requested demographic data such as gender, religiosity (yes or no), age and number of courses done with ethics component (continuous variable). Table 1 shows the key characteristics of the sample. The sample comprised 298 accounting students, with 59.1 % being females. In addition, 82.9 % reported that they were religious. The sample was predominantly young, with the average age being approximately 25 years. On average, students were exposed to at least 3 courses with an ethics component. (M = 3.42, SD = 1.15).

Measures

Previous studies have included the use of scenarios to examine ethical decision-making (Buchan 2005). This is considered necessary since it is usually impractical to observe the actual ethical decision-making of individuals (Alleyne et al. 2010). The scenarios used in this study were used in prior studies by Claypool et al. (1990), Cohen et al. (1998), Flynn (2001), and Buchan (2005) (See Appendix for the scenarios). We chose these two scenarios since they addressed two ethical issues deemed important within the accounting profession. One scenario dealt with breach of confidentiality and the other dealt with charging personal expenses to the company.

The dependent variable, behavioral intentions (ethical intentions), was tested by asking participants to respond to three statements that were adapted from Beck and Ajzen’s (1991) study of unethical behavior using the TPB. Behavioral intentions were measured using the following 7-point fully anchored scales: “If I had the opportunity, I would perform the behavior described in the scenario (unlikely-likely)”; “I would never perform the behavior described in the scenario (false -true)”; and “I may perform the behavior described in the scenario in the future (false-true)”. High scores indicate high intentions to act unethically (that is, being unethical), while low scores indicate low intentions to act unethically (that is, being ethical). The Cronbach alphas for the behavioral intentions scales were as follows: confidentiality (α = 0.86) and charging personal expenses (α = 0.93).

Attitudes were measured using four 7-point anchored scales. Respondents were asked to read the scenario and report if they felt the behavior was: “bad-good”, “unethical-ethical”, “foolish-wise”, and “useless-useful”. The scales were adapted from Madden et al. (1992) and Buchan (2005). All items in this scale were summed and averaged to form a composite score. In this study, a high score indicates a favorable attitude toward the unethical behavior, while a lower score indicates an unfavorable attitude toward the unethical behavior. The Cronbach alphas for the attitudes scales were as follows: confidentiality (α = 0.82) and charging personal expenses (α = 0.91).

The subjective norms scale was adapted from Buchan (2005) and Madden et al. (1992). Respondents were asked the following questions regarding each scenario presented: “Most people who are important to me think I (should not - should) perform the behavior described”; “Most people who are important to me will look down on me if I perform the behavior in the scenario (unlikely-likely)” and “No one who is important to me thinks it is OK to perform the behavior in the scenario (disagree-agree)”. All questions used a 7-point anchored scale. All items in this scale were summed and averaged to form a composite score. High scores indicate perceptions that significant others do endorse the unethical behavior, while low scores indicate perceptions that significant others do not endorse the behavior. The Cronbach alphas for the subjective norms scales were as follows: confidentiality (α = 0.75) and charging personal expenses (α = 0.72).

Perceived behavioral control was measured using four items adapted from Madden et al. (1992). The scales used were developed from a series of studies developed by Ajzen and Madden (1986). The items used were as follows: “For me to perform the behavior described in the scenario is (difficult-easy)”, “If I wanted to, I could easily perform the behavior in the scenario (disagree-agree)”; “How much control do you have over the behavior described in the scenario (absolutely no control-complete control)” and “The number of events outside my control which could prevent me from performing the behavior described in the scenario are (very few – numerous)”. These items all used 7-point fully anchored scales. All items in this scale were summed and averaged to form a composite score. High scores indicate perceived ease in performing unethical behavior, while low scores indicate perceived difficulty. The Cronbach alphas for the perceived behavioral scales were as follows: confidentiality (α = 0.78) and charging personal expenses (α = 0.74).

Moral obligation was measured using three items adapted from Beck and Ajzen (1991). The items used 7-point fully anchored scales and asked the participants the following questions: “I would not feel guilty if I performed the behavior in the scenario (true-false)”; “Performing the behavior goes against my principles (unlikely-likely)”; “It would be morally wrong for me to perform the action in the scenario (unlikely-likely)”. All items in this scale were summed and averaged to form a composite score. High scores indicate high moral obligation, while low scores indicate low moral obligation. The Cronbach alphas for the moral obligation scales were as follows: confidentiality (α = 0.87) and charging personal expenses (α = 0.81).

Common Method Variance

We checked for the existence of common method variance (Podsakoff et al. 2003), using Harman’s (1976) single factor test on all variables of interest. The results of principal component factor analysis highlighted that all factors loaded consistently within the various constructs of interest. Thus, the results suggest that common method variance may not have influenced the findings in the study.

Data Analysis

Our data analysis was done to test the following: 1) to determine the adequacy of TRA in explaining ethical intentions; 2) to determine whether TPB is a better predictor of ethical intentions than TRA (Chang 1998); and 3) to determine whether ETPB is a better predictor of ethical intentions than TRA and TPB. As a result, we used hierarchical multiple regression to test the hypotheses.

Results

The Relationship of the Study’s Variables

Table 2 shows the Pearson’s bivariate correlations among the key variables in the study. The results reveal that moderate to strong correlations exist between attitudes, subjective norms, perceived behavioral control, and moral obligation and the dependent variables, intentions to be confidential and not to charge personal expenses. For example, the table showed that as students were more opposed to the idea of breaching confidentiality and charging personal expenses, their intentions to act unethically were reduced. Table 2 shows that attitudes exerted the most influence on the intentions, given the high correlations (r = 0.61 and r = 0.72). We also note that subjective norms exerted the least influence over students’ intentions to engage in unethical behavior. This is consistent with the work of Carpenter and Reimers (2005), who also found that subjective norms exerted less influence when compared to attitudes.

Hierarchical Regression Analyses for Ethical Intentions

Hierarchical regression analyses were conducted to test for the predictability of independent variables (attitudes, subjective norms, perceived behavioral control and moral obligation) influencing intentions to act ethically on issues of confidentiality and charging expenses for personal items. We included the demographic variables in the analyses based on their influence in the ethics literature, despite the fact that there were no significant relationships between the majority of the demographic variables and the dependent variables. Preliminary tests for multicollinearity were done using variance inflation factors from the SPSS collinearity statistics. We found that no multicollinearity existed in the data. The demographic variables were included as control variables in the first step. The components of the TRA, attitudes and subjective norms, were entered in the second step, followed by the third step which added perceived behavioral control as suggested by the TPB. The final step (step 4) included moral obligation, which we term as the modified version of the TPB (See Table 3).

Based on the TRA, in terms of step 2, attitudes and subjective norms explained a significant proportion of the variation in intentions to be ethical (that is not breaching confidentiality) (R-squared = 0.43) and not charging personal expenses (R-squared = 0.57). With the inclusion of perceived behavioral control in step 3, based on the TPB, this variable explained significant incremental variance in both intentions to not breach confidentiality (R-squared change = 0.02, p < 0.05) and intentions not to charge personal expenses (R-squared change = 0.02, p < 0.05) over and above attitudes and subjective norms in step 2, providing support for Ajzen’s (1991) theory of planned behavior. Finally in step 4 when moral obligation was introduced, results show that moral obligation explained significantly more incremental variance in intentions to be confidential (R-squared change = 0.05, p < 0.05) and intentions to charge personal expenses (R-squared change = 0.04, p < 0.001) than the other variables in the prior steps. Thus, in the final step, all of the independent variables (attitudes, subjective norms, perceived behavioral control and moral obligation) emerged significant, thereby supporting the study’s research hypotheses.

We performed a further assessment of the coefficients of determination between the model predicting intentions to be confidential compared to the model predicting intentions to charge personal expenses. It was revealed that the ETPB (TPB with the addition of moral obligation) made a better overall prediction of charging personal expenses than confidentiality (R-squared = 0.63 versus 0.50). We note that, in this study, attitudes had the largest coefficients in all steps when compared with the other variables, thus highlighting its salience in models predicting ethical intentions. Thus, this study shows that attitudes, subjective norms, perceived behavioral control and moral obligation are significant predictors of ethical intentions in this sample. Overall, hypotheses 1, 2, 3 and 4 (H1, H2, H3 and H4) were all fully supported.

Although not the focus of the current study, further investigation was done to test how moral obligation might affect attitudes toward the specific behavior. Controlling for the demographic variables, hierarchical regression analysis was done and results revealed that moral obligation significantly predicted attitudes towards specific behaviors (β = −0.28 for confidentiality and β = −0.18 for charging expenses) in this study (p < 0.05). This study found support for moral obligation leading to more negative attitudes toward the behavior in question. These results provide evidence of the influence of moral obligation on attitudes. Further research should consider testing for this influence and possible interactions on behavioral intentions.

Conclusion

Our research findings have given support for all constructed hypotheses in predicting students’ intentions to breach confidentiality and charge personal expenses. These findings suggest that attitudes, subjective norms, perceived behavioral control and moral obligation are significant predictors of students’ intentions to engage in unethical behavior. The results further provide ample support for the TRA (Fishbein and Ajzen 1975), the TPB (Ajzen 1991) and the ETPB (Beck and Ajzen 1991). Thus, it confirms the significance of moral obligation in influencing ethical intentions.

Our study contrasts favorably with the work of Buchan (2005), who found that the variable, attitudes, was the only significant predictor of ethical intentions in his study. Our work provides full empirical support for the four antecedents as influential factors of potential or future Caribbean accountants’ ethical intentions. Thus, our study further extends the literature on the applicability of the TPB as a useful framework for understanding ethical behavior among future Caribbean accounting professionals.

The results of the study are not surprising when one considers the background of the sample of students. The individuals who are university students have generally been exposed to material which would have influenced their thinking. In addition, the Anglo-Saxon socialization at home, religious upbringing and in some cases, the business environment, would have a significant impact on their responses. At present, the topic of ethics is covered in part in several courses at the University. It may be useful to introduce a full course in ethics covering the aspects of ethics in the accounting profession and also focusing on the codes of professional conduct. This could be in the form of a mandatory course for those majoring in the accounting program.

The findings of this research augur well for the Caribbean society by showing that the current students and hence future accounting professionals have an understanding of the ethical behaviors expected of them once they enter the profession; and that their intentions and attitudes are at the correct end of the ethical spectrum. This should therefore cause an increase in public confidence in the accounting profession and upcoming professionals of the business communities.

The findings show that the variable, attitudes, was the strongest predictor in all the models. This finding was consistent with prior research (Flannery and May 2000; Buchan 2005). This may be a reflection of the values taught in teaching at university, and the values instilled during their socialization in society. The results suggest that ethics courses are helping to shape the behaviors of the future entrants to the profession.

The results also revealed that moral obligation contributed significantly to the prediction of unethical behavioral intentions, above and beyond, the variables in the TPB. The result here supports prior research (Alleyne and Phillips 2011). The finding suggests that moral obligation represents an important addition to the TPB, which is worthy of future research. A key factor to consider is that moral obligation as an additional variable focuses on the moral dilemma, and hence it is not surprising that it significantly predicts behaviors of an ethical nature.

The ethical conduct of the professional accountant is one of the most important features in the accounting and financial systems of businesses today, and consequently, this research can be seen as an attempt to bridge the gap between theory and practice in the profession. The study of ethics can assist accountants within the profession in overcoming any ethical dilemma they may encounter. This current study’s findings can therefore assist in improving the integrity of a profession which has come under great scrutiny after a number of corporate failures such as Enron and WorldCom. This is necessary if the work of accountants is to be considered reliable. Having an understanding of the factors which contribute to persons’ ethical choices will greatly inform the work of professional bodies, policy makers and governments, by offering guidance on the setting and enforcement of acceptable accounting practices.

This study also provides evidence that factors such as attitudes, subjective norms, perceived behavioral control and moral obligation are important predictors of ethical intentions. Hence, ethical standards can be raised and maintained through purposive intervention strategies aimed at tapping into these factors. These strategies can include greater ethics education and training, as well as rewarding ethical conduct in both student and accounting practitioner settings. In addition, accounting firms can focus their recruitment and selection practices through the use of psycho-metric testing, which can target the relevant areas of professional ethics and conduct.

In conclusion, the TPB and the modified theory (ETPB) serve to influence intentions to act ethically or unethically. We can argue again that another variable specific to the accounting profession can be added to the model to show more explanatory power. This may be achieved by adding another variable such as accountability to the model. Each of the variables identified by Ajzen (1991), using the TPB, can assist in providing information that may be useful in attempting to understand why professional accountants may engage in unethical behavior. This can assist in finding ways to implement interventions through education that will be effective in order to change the professional accountant’s willingness to act or behave in an ethical manner, by first influencing and impacting students’ ethical intentions.

This study has several limitations. Firstly, this study used a quantitative approach to collect data. Future research could use a qualitative approach such as interviews and focus groups to obtain opinions and feelings about the topic under study. Secondly, this study used students who will be the future accounting professionals. We do admit that students may not share the same traits as persons in the profession. Thus, future research should consider testing the models in practitioner settings. There may also be the scope to test for differences between those persons who have qualified and those who are still in the process of obtaining their accounting designations. Furthermore, our model did not include a separate construct to capture relevant information that may be distinct from subjective norms. As Buchan (2005, p.169) noted, most studies that used TPB were not done within an organizational context. Since our study did not measure organizational context, future research should consider including organizational factors as further extensions of the TPB. Finally, we note that we did not control for social desirability, hence there is a possibility of respondents providing socially desirable responses. Future research should control for social desirability.

Notes

Allen Stanford was a Texan billionaire who operated and invested funds in several Caribbean islands. He was sentenced to over 100 years in prison for his involvement in running an investment company which authorities revealed was an elaborate Ponzi scheme.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior & Human Decision Processes, 50, 179–211.

Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behavior. Englewoods Cliffs, NJ: Prentice-Hall.

Ajzen, I., & Madden, T. J. (1986). Prediction of goal directed behavior: attitudes, intentions, and perceived behavioral control. Journal of Experimental Social Psychology, 22(5), 453–474.

Alleyne, P. (2010). The influence of individual, situational and team factors on auditors’ whistle-blowing intentions. Unpublished PhD Thesis, University of Bradford, Bradford, UK.

Alleyne, P., & Phillips, K. (2011). Exploring academic dishonesty among university students in Barbados: an extension to the theory of planned behavior. Journal of Academic Ethics, 9(4), 323–338.

Alleyne, P., Devonish, D., Nurse, J., & Cadogan-McClean, C. (2006). Perceptions of moral intensity among undergraduate accounting students in Barbados. Journal of Eastern Caribbean Studies, 31(3), 1–26.

Alleyne, P., Devonish, D., Allman, J., Charles-Soverall, W., & Young Marshall, A. (2010). Measuring ethical perceptions and intentions among undergraduate students in Barbados. The Journal of American Academy of Business, 15(2), 319–326.

Armitage, C. J., & Conner, M. (2001). Efficacy of the theory of planned behavior: a meta-analytic review. British Journal of Social Psychology, 40(4), 471–499.

Armstrong, M. (1987). Ethics and professionalism in accounting education: a sample course. Journal of Accounting Education, 11(1), 77–92.

Barnett, T., & Valentine, S. (2004). Issue contingencies and marketers’ recognition of ethical issues, ethical judgments and behavioral intentions. Journal of Business Ethics, 57, 338–346.

Beck, L., & Ajzen, I. (1991). Predicting dishonest actions using the theory of planned behavior. Journal of Research in Personality, 25(3), 285–301.

Buchan, H. (2005). Ethical decision making in the public accounting profession: an extension of Ajzen’s theory of planned behavior. Journal of Business Ethics, 61(2), 165–181.

Carpenter, T. D., & Reimers, J. L. (2005). Unethical and fraudulent financial reporting: applying the theory of planned behavior. Journal of Business Ethics, 60(2), 115–129.

Chang, M. K. (1998). Predicting unethical behavior: a comparison of the theory of reasoned action and the theory of planned behavior. Journal of Business Ethics, 17(16), 1825–1834.

Claypool, G. A., Fetyko, D. F., & Pearson, M. A. (1990). Reactions to ethical dilemmas: a study pertaining to certified public accountants. Journal of Business Ethics, 9(9), 699–706.

Cohen, J. R., Pant, L. W., & Sharp, D. J. (1995). An international comparison of moral constructs underlying auditors’ ethical judgments. Research on Accounting Ethics, 1, 97–126.

Cohen, J. R., Pant, L. W., & Sharp, D. J. (1996). Measuring the ethical awareness and ethical orientation of Canadian auditors. Behavioral Research in Accounting, 8(Supplement), 98–119.

Cohen, J. R., Pant, L. W., & Sharp, D. J. (1998). The effect of gender and academic discipline diversity on the ethical evaluations, ethical intention and ethical orientation of potential public accounting recruits. Accounting Horizons, 12(3), 250–270.

Cohen, J. R., Pant, L. W., & Sharp, D. J. (2001). An examination of differences in ethical decision-making between Canadian business students and accounting professionals. Journal of Business Ethics, 30(4), 319–336.

Devonish, D., Alleyne, P., Cadogan-McClean, C., & Greenidge, D. (2009). An empirical study of future professionals’ intentions to engage in unethical business practices. Journal of Academic Ethics, 7(3), 159–173.

Fang, M. (2006). Examining ethical intentions of individual employees of Taiwan from theory of planned behavior. The Business Review, Cambridge, 6(1), 257–263.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Reading, MA.: Addison-Wesley.

Flannery, B. L., & May, D. R. (2000). Environmental ethical decision making in the U.S. metal finishing industry. Academy of Management Journal, 43(4), 642–662.

Flynn, L. M. (2001). An empirical investigation of the impact of environment on individual ethical analysis by corporate accountants and human resource managers. Unpublished doctoral dissertation, Binghamton University.

Gibson, A. M., & Frakes, A. H. (1997). Truth or consequences: a study of critical issues and decision making in accounting. Journal of Business Ethics, 16(2), 161–171.

Harding, T., Mayhew, M., Finelli, C., & Carpenter, D. (2007). The theory of planned behavior as a model of academic dishonesty in engineering and humanities undergraduates. Ethics and Behavior, 17(3), 255–279.

Harman, H. H. (1976). Modern factor analysis (3 revth ed.). Chicago: University of Chicago Press.

Jones, T. M. (1991). Ethical decision making by individuals in organizations: an issue-contingent model. The Academy of Management Review, 16(2), 366–395.

Kohlberg, L. (1969). Stages and sequences: The cognitive developmental approach to socialization. In D. Goslin (Ed.), Handbook of socialization theory and research. Chicago, IL: Rand McNally.

Kurland, N. (1995). Ethical intentions and the theories of reasoned action and planned behavior. Journal of Applied Social Psychology, 25(4), 297–313.

Kurland, N. (1996). Sales agents and clients: ethics, incentives, and a modified theory of planned behavior. Human Relations, 40(1), 51–74.

Madden, T. J., Ellen, P. S., & Ajzen, I. (1992). A comparison of the theory of planned behavior and the theory of reasoned action. Personality and Social Psychology Bulletin, 18(1), 3–9.

Marshall, B., & Dewe, P. (1997). An investigation of the components of moral intensity. Journal of Business Ethics, 16(5), 521–529.

Podsakoff, P. M., Mackenzie, S. B., Russell, S. S., & Mohr, D. C. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Ponemon, L. (1990). Ethical judgements in accounting: a cognitive-developmental perspective. Critical Perspectives on Accounting, 1(2), 191–215.

Priem, R., Worrell, D., Walters, B., & Coalter, T. (1998). Moral judgment and values in a developed and a developing nation: a comparative analysis. Journal of Business Ethics, 17, 491–501.

Randall, D. M., & Gibson, A. M. (1991). Ethical decision making in the medical profession: an application of the theory of planned behavior. Journal of Business Ethics, 10(2), 111–122.

Rest, J. (1986). Moral development: Advances in research and theory. New York: Praeger.

Singer, M. S., & Singer, A. E. (1997). Observer judgments about moral agents’ ethical decisions: the role of scope of justice and moral intensity. Journal of Business Ethics, 16(5), 473–484.

Singhapakdi, A. (2004). Important factors underlying ethical intentions of students: implications for marketing education. Journal of Marketing Education, 26(3), 261–270.

Toffler, B., & Reingold, J. (2003). Final accounting: Ambition, greed and the fall of Arthur Andersen. New York, NY: Random House.

Trevino, L. (1986). Ethical decision making in organizations: a person-situation interactionist model. Academy of Management Review, 11(3), 601–617.

Whitley, B. E. (1998). Factors associated with cheating among college students. Research in Higher Education, 39(3), 235–274.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Ethical Scenario 1 – Confidentiality (adapted from: Claypool et al. (1990) and Cohen et al. (1995).

CPA Z serves as the auditor of Widget & Co., a privately held firm. Widget’s market share has declined drastically, and Z knows that Widget will soon be bankrupt. Another of Z’s audit clients is Solid Company. While auditing Solid’s accounts receivable, Z finds that Widget & Company owes Solid $200,000. This represents 10 % of Solid’s receivables.

Action: CPA warns the client, Solid Company, about Widgets’s impending bankruptcy.

Ethical Scenario 2 - Charging personal expenses to the firm (Adapted from Cohen et al. (1996, 1998); Flynn (2001)

A supervisor, the mother of two small children, has been promoted and assigned to an engagement which requires travel away from home for the firm on a regular basis. Because these trips are frequent and inconvenience her family life, she is contemplating charging some small personal expenses while traveling for the firm. She has heard that this is common practice in the firm.

Action: The supervisor charges the firm $1,500 for family gifts.

Rights and permissions

About this article

Cite this article

Alleyne, P., Weekes-Marshall, D., Estwick, S. et al. Factors Influencing Ethical Intentions Among Future Accounting Professionals in the Caribbean. J Acad Ethics 12, 129–144 (2014). https://doi.org/10.1007/s10805-014-9203-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10805-014-9203-5