Abstract

In contemporary electronic commerce, an infomediary displays electronic word-of-mouth (eWOM) information of customers and links shoppers to retail websites, thus acting as an intermediary between buyers and sellers. This paper studies an online supply chain system in which the infomediary presents demand-referral services to online retailers based on eWOM of customer information. It is assumed that online demand is affected by retailer price, referral service effort, and eWOM. The demand function is extended and developed based on Bass’s model. A Stackelberg game model of service cooperation is presented, and then the optimal decisions on retailers’ prices and infomediary service efforts in the decentralized supply chain are analyzed. Moreover, the profits and cumulative sales in supply chain equilibrium are analyzed under several parameters. A computational experiment is implemented to verify the validity and effectiveness of the model. The results show that price sensitivity has a significant negative effect on cumulative retailer sales and the profits of retailers and infomediary, but the effect of service sensitivity and sales periods on profits is absolutely positive. Specifically, eWOM has two different impacts on the profit of the retailer and infomediary respectively. Finally, conclusions and management implications for supply chain parties are presented, along with some possible directions for further research.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

E-commerce is undergoing rapid growth worldwide, under the vigorous innovation and wide application of information technology. With the radical implementation of e-commerce, the supply chain system can achieve a more responsive and more efficient method of communication among upstream supplier, manufacturer, retailer, and end customer, and can even transform the traditional business model to an unprecedented new one. The Internet has changed the mechanism of information sharing and the activity of coordination in the supply chain system [1].

Moreover, e-commerce offers consumers extensive selections of global products and sufficient capability to access price comparisons and quality descriptions. However, the lack of actual perceptions and the overload of mixed information can trigger additional risk or severe anxiety, and finally contribute to shopping dilemmas for the customer. At this time, online messages and experiences provided by other consumers will become a very important guide for potential buyers, assisting them in making purchasing decisions [2]. The behaviors of information communication and experience sharing can effectively reduce the uncertainty about products and providers and significantly decrease the risks incurred by potential consumers. In this way, the midstream party plays an important role between retailers and consumers in the supply chain [3].

E-commerce, especially social network, creates a new type of website termed an intermediary or infomediary [4]. An infomediary distributes lots of information about products and prices and links the seller and buyer. This is especially valuable in retail industries such as automotive, insurance, and real estate, where professional advice and frequent consulting are required. An infomediary can thus provide a unique value and create an information circle to generate transactions [5]. For example, Shopping.com is a leading price comparison website for a large amount of products such as clothing, electronics, and household goods. The site collects customer reviews, allows Internet users to read these comments, and recommends potential customers to visit the websites of linked retailers such as Ebay.com, Amazon.com, and Buy.com. Similarly, Douban.com is also a social network website in China. It provides users views of popular books, music, and movies and refers interested readers to online retailers. Until September of 2013 the average page view per day for Douban.com expanded to 210 million, and the registered users reached a volume of 75 million. The online review of movies has exceeded 320 million, and users can book tickets for over 500 movie theaters in major cities. The boost from infomediary websites reconstructs the new value aggregations of Internet supply chain. As a result, these changes provide new opportunities for businesses to innovate their marketing strategies.

This paper is organized as follows: Sect. 2 presents a review of the literature; Sect. 3 proposes the problem and outlines the supply chain framework, necessary assumptions, and demand models; Sect. 4 proposes the optimal policies in Stackelberg decentralized supply chain; Sect. 5 provides some numerical examples; and the paper concludes with some final remarks in Sect. 6.

2 Literature review

In the recent digital era, the Internet supply chain system significantly differs from the traditional one in that the information flow has transitioned from a physical one to an aggregation of new value [6]. For the sellers, the Internet and an online platform form customers’ ideas make it easier to adopt and act by word-of-mouth (WOM) marketing [7]. According to Cheung and Thadani [8], WOM can help buyers to choose or reject a certain product, brand, or service, based on the dissemination and sharing of information and opinions. At present, the Internet is becoming the most common method for customers to search for information and learn about specific products or providers, and thus the concept of electronic WOM (eWOM) has spontaneously evolved from the basic essence of WOM [9]. Based on the essential features of WOM, Litvin et al. [10] outlines eWOM as an Internet-based communication mode, by which related information about specific goods and services can spread from existing users to potential consumers. Generally, eWOM is the exchange of information via online media, in the form of scores or comments about products or services. Unlike traditional WOM, eWOM spreads with greater speed and has a wider diffusion range due to its unique features [11, 12]. Moreover, eWOM of the infomediary breaks up communication patterns and the scope of face-to-face WOM in the real world due to its anonymity, timelessness, and boundlessness.

Recent evidence illustrates that customer reviews and experience information have a significant effect on customers’ shopping decisions and provider selection [13]. The empirical research of Khammash and Griffiths [14] elaborates the reciprocity of customers online reading motives and behavioral constructs and depicts the influence mechanism between customers buying decision and communication behavior. According to a real dataset on enterprise security price, Luo [15] found that negative customer WOM has a significant and direct impact on enterprise finance performance, such as cash flow and stock price, regardless of whether it is short term or long term. Cheung and Lee [16] highlighted the inducement of positive e-WOM dissemination in Internet platforms of customers opinions and presented the positive relationship between the perception of the opportunity to enhance consumers’ own reputations and their eWOM intentions. Obviously, customers transform from pure product buyers to co-providers of valuable information in the Internet opinion websites [17]. On the social website of intermediary, positive eWOM becomes an outcome of high customer satisfaction in addition to product price and quality. Jeong and Jang [9] proposed that restaurant customers who experienced superior food, service, and atmosphere were more willing to express their positive eWOM. Craig et al. [18] suggested that the eWOM prior to a film’s release has an important influence on its subsequent box-office revenue. Ziegele and Weber [19] compared two forms of eWOM information and pointed out that single customer reviews can be more influential than aggregate rating scores. A study by Hennig-Thurau et al. [20] identifies eight motives for eWOM from both the perspective of customers and the platform and offers the primary motivations of eWOM behavior including social benefit, economic stimulus, care for other customers, and positive emotional exposure or self-enhancement. The vast majority of marketing research focuses on the exerting mechanism of eWOM communication regarding consumer attitudes and their decisions about products, purchasing, and recording comments.

Given the effect of eWOM, researchers have started to investigate business marketing strategy in association with the third party product reviews. Chen et al. [21] analyzed the marketing effect of referral infomediary and explored the service contract with retailers in the selling of demand-referral service. Chen and Xie [22] developed a fundamental model to illustrate pricing and advertising strategic responses of two competing retail firms to a third-party customer reviews provider. Viswanathan et al. [5] investigated the marketing function of online infomediaries and notices the inverse correlation between selling price and product information obtained by customers in the online automotive retail industry. Yan and Liu [23] considered the optimal production capacity decisions and beneficial sales policies of a manufacture under the profit maximization and the effect of customer WOM. Phuc et al. [24] studied the optimal production plan of a manufacturer in three-stage supply chain under the Bass model effect. Liu et al. [25] recommended a market skimming pricing strategy for software products considering the effect of illegal piracy and WOM communication. Huang et al. [26] investigated the relationship between the communication channel strategy of WOM and the result of product diffusion.

Most of the previous studies focus on the production decisions of manufacturers and pricing strategies of retailers in the presence of customer WOM, but they partly ignore the role and strategy of infomediary as the service provider of demand referral. Chen and Yao [27] begin to study the optimal referral service effort decision of infomediary in Internet supply chain based on stochastic demand model and proposed a horizontal service cooperation contract of marketing effort cost sharing [27]. Chen et al. [28] establish a simple dual-channel demand model considering the customer incentive, provided by infomediary, and explore the service cooperation strategy. But these two studies highlight the optimal service policy of infomediary and leave the impact of eWOM on demand out of consideration.

This paper differs from the available literature in exploring the combination of service effort of the infomediary and eWOM impact on market demand. The dynamic models for market demand such as the Bass model depict the influence of product pricing as a single decision variable, but the empirical result of Hu et al. [12] shows the significant effect of information quality and service level of review websites on customer demand. We developed a dynamic model to investigate the impact of service effort of infomediary on demand referral and the effect of eWOM on potential demand. On the other hand, the supply chain cooperation is modeled using Stackelberg game, where a retailer may take advantage of the referral benefit to determine the optimal product pricing and service fee, and the infomediary may choose the optimal service effort to customers. The previous literature generally concentrated on the cooperation between retailer and customer, with consideration of eWOM. Our model introduces a new perspective of the digital service supply chain including the content provider customers, the service intermediary infomediary, and the final consumer retailer. Obviously, this chain is exactly the reverse flow of physical products. The primary interest of this paper is the effective marketing strategy for the retailer and the optimal service policy for the infomediary, which enriches the literature of both marketing and information systems. We will characterize the supply chain demands model, which considers the eWOM effect of customers and referral service level of infomediary simultaneously, and study equilibrium prices and referral service effort under the relative effect of eWOM, price, service sensitivity, and advertisement impact.

3 Model formulation and assumptions

Considering an online demand-referral supply chain, a retailer exhibits a specific product through its outlet as well as through an infomediary. The infomediary provides the online shoppers with product information and user reviews through its online website and recommends potential buyers to the retailer’s outlet. The retailer pays the price s of the demand-referral service in accordance with the agreement of the infomediary. Thus, the retailer independently fulfills the order, directly sells the product to the end user, and exclusively achieves the entire income. Some customers write their after-sales comments in the infomediary’s website, and these reviews become the eWOM records of this retailer and product. The supply chain system is presented in Fig. 1.

The classic Bass model describes new product diffusion and the likelihood of customer purchases under traditional marketing [29, 30]. Presently, the Bass model has been applied to forecast the market demand rate in supply chain management, inventory control, advertisement optimization, and other operational research fields. In online business, eWOM information has been identified as a dominant factor on listeners’ shopping decisions and online sales [31]. According to the empirical study of Martin and Lueg [32], eWOM information communication helps to drive the product diffusion process, and, simultaneously, usage of eWOM is an important driver of adopters’ decisions in the new product diffusion. Furthermore the product innovation characteristics are influenced by external factors such as mass advertisements and promotions; on the other hand, the imitation effect is reflected in eWOM through customers’ comments and ratings. Yan and Liu [23], Liu et al. [25] and Guo [33] all apply the Bass model to describe the influence of eWOM on market demand. Based on the previous research, we extend the basic model to discover the effect of eWOM on online demand. We consider the online sales rate X(t) at time t:

We assume the marketing efforts of infomediaries and eWOM have an effect on X(t). The parameters α, δ, β, and k denote product price sensitivity, referral service sensitivity, advertising effect, and impact factor of eWOM, respectively. The exogenous wholesale price w is determined by the manufacturer at the beginning of the selling season, and the retail price of the product at time t is p(t). Factor e(t) represents the online referral service of the infomediary at time t, and the retailer’s service pay depends on e(t) and unit price s. The term c i is the referral service cost [34, 35]. Furthermore, other costs of the retailer such as selling cost and logistics cost are ignored, and unsatisfied customers are lost. Given the service price s, during the period [0,T] the profit of the retailer and infomediary is,

The profit of the whole system is

4 Supply chain cooperation equilibrium and optimal polices

We assume that the online retail supply chain is a decentralized system. It is reasonable to assume that the retailer, which possesses the physical facility and service stuff, is more powerful than the online infomediary. The retailer acts as the Stackelberg leader in the game, and the cooperation between the retailer and the infomediary takes place in the following sequence in time: at first, the retailer simultaneously announces the referral service price s in order to maximize its profit \(\prod_{r}\); then the infomediary acts as the follower and decides its marketing service level, e(t), for the given price to maximize its profit \(\prod_{i}\); lastly, demand is realized based on the retail price p(t) and service level e(t) set by the two parties. We first analyze the optimal policy for the retailer, which is followed by a description of the service response of the infomediary.

According to Eq. 2, we would solve the following problem:

According to Eq. 5, \(X(T) \,\) is the cumulative number at the end of the sale season T, and we introduce the Hamiltonian function H as follows:

then

Since \(\frac{\partial H}{\partial p(t)} = 0\), solving Eq. 7 according to p(t)

Furthermore we can obtain the adjoint differential equation,

And the transversality condition is

Substituting Eq. 8 with Eq. 9 and following Eq. 10, we obtain,

thus

Substituting Eq. 10 with Eq. 12 we obtain,

From Eqs. 8 and 13, we can obtain the optimal price function of the retailer, p(t)

Moreover, substituting Eq. 14 into Eq. 3, the optimal solution of infomediary satisfies the following function,

The Hamiltonian function H is,

We can obtain the adjoint differential equation as follows:

According to e(t)

Considering λ(T) = 0 and λ(t) ≡ 0, we can obtain the optimal referral service level \(e^{*} (t)\) of infomediary as follows:

And we substitute Eq. 19 with Eq. 14 to obtain the optimal price of retailer \(p^{*} (t)\) as follows:

Obviously, the optimal service level is a particular constant. For the given service price s, the optimal referral service level of the infomediary is decreasing in α and increasing in δ, but the time t has no effect. Thus, it is a rational option for the infomediary to elevate its service level of demand referral according to higher demand-referral efficiency and high sensitivity of online customers.

The sales rate of the retailer in the time interval [0, T] is a linear function, as follows:

Let \(\mu = \beta - k + \frac{1}{{T\exp^{{ - 1 - \alpha w + (\delta - \alpha s)\left( {\frac{1}{\alpha - \delta } + \frac{{c_{i} }}{s}} \right)}} }}\) and it is easy to verify \(\mu^{2} + 4k\beta > 0.\) Substituting Eq. (21) into Eq. (1) we can obtain,

Solving Eq. 22, the result is,

Let \(\prod_{r}^{*}\) and \(\prod_{i}^{*}\) denote the final optimal profit of the retailer and the infomediary. Substituting Eqs. 19 and 20, respectively, into Eqs. 2 and 3, it is easy to obtain,

and

After the expanding of Eq. 26, we have,

From Eq. 23, we can display the following characteristics:

Since \(\frac{\partial X(T)}{\partial T} = \frac{{\left( {\sqrt {\mu^{2} + 2k\beta } - \mu } \right)(\mu - \beta + k)}}{{2kT\sqrt {\mu^{2} + 2k\beta } }} > 0\), the cumulative sales and of retailer and profit of infomediary increase with T.

Since \(\frac{\partial X(T)}{\partial \beta } = \frac{{(\mu + k) - \sqrt {\mu^{2} + 2k\beta } }}{{2k\sqrt {\mu^{2} + 2k\beta } }}\) and \(\frac{\partial X(T)}{\partial k} = \frac{{(\mu + k)\sqrt {\mu^{2} + 4k\beta } + (\mu + k)(\mu + 2k - 2\beta ) - 2k\beta }}{{2k^{2} \sqrt {\mu^{2} + 4k\beta } }}\), the change of cumulative sales of the retailer and profit of the infomediary with advertising impact parameter β and k depends on its specific value.

Since \(\frac{dp(t)}{\partial \alpha } = \frac{ - 1}{{\alpha^{2} }} < 0\), more price sensitivity will lead to lower optimal price and result in less profit for the retailer.

5 Computational analyses

The computational analysis is applied to verify our previous model and display the figures. First, we consider the effect of parameters α, δ, and k on products sale rate and supply chain profit. Second, we highlight the relationship between the length of the sales period and decisions of the retailer and infomediary. Comparing the coefficients from the software products research by Liu et al. [25] we assume different scenarios of various customer price sensitivity, service sensitivity, and eWOM effect. The details of the parameter settings are listed in Table 1. We assume that the unit service price and referral cost of the infomediary are s = 0.1 and c i = 2, respectively. The original sale is zero, and the period of sale is [10, 60]. Without loss of generality we neglect the fix effect of the wholesale price and assume the wholesale price is zero.

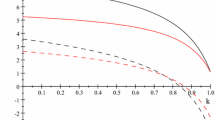

Let δ = 0.005, β = 0.05, k = 0.2, and T = 30. If product price sensitivity of the customer is increasing, the cumulative sales in the end of this period X(T) is decreasing from 0.732688 (α = 0.01) to 0.481729 (α = 0.1), as show in Fig. 2. Furthermore, we denote α = 0.05, β = 0.05, and k = 0.2. Following the increasing of customers service sensitivity X(T) is also increasing from 0.531941 (δ = 0.005) to 0.884525 (δ = 0.04), as show in Fig. 3. If the potential customers are more interested in the user experience, comments, and other related information, the high quality of referral service will become more attractive than a popular price. The dispute within product competition is less about how the product works and more about the customers’ impressions and experiences. The results provide evidence of online referral service value for the retailer and infomediary.

Moreover, eWOM has a direct impact on cumulative sales. As the decision-making process for online customers is increasingly influenced by eWOM, cumulative product sales grow with decreasing speed of sales, as show in Fig. 4. It is interesting that more powerful advertising effect results in lower product sales at the same effect of eWOM. The possible explanation of this result is the eWOM marketing is more important than advertisement under certain parameters of customer preference and cost structure in the online demand-referral pattern. In today’s retail industry, social media marketing, customized by personal preference, is becoming the dominant strategy rather than mass advertising marketing.

Figure 5 depicts the cumulative sales for various product lifespans. When the planning horizon and impact factor of eWOM increase, the quantity of sales grows but at a slower speed. Obviously, with the increase of collected reviews, information overload becomes a major issue in the online shopper’s choice, and the customer concentrates on the quality not the quantity of other customer reviews [36]. Therefore, the retailer and infomediary should take advantage of the dominant value of eWOM in the early periods of sale season and devote concerted effort to improving the quality of eWOM in the following seasons.

Let δ = 0.005, β = 0.05, k = 0.2 and T = 30. The optimal retail price of retailer and service level of infomediary are shown in Fig. 6, and the profits of both parties are presented in Fig. 7. Furthermore, let α = 0.05, β = 0.05, k = 0.2, and T = 30 in examining the optimal decisions and profit of the retailer and infomediary, shown in Figs. 8 and 9. If online customers have lower sensitivity for referral information service and only concentrate on product price, they cannot see all the perceived efficiency and effectiveness in using the infomediary [37]. The tasks of the infomediary become simpler, and the infomediary only needs to provide the price comparison to help customers make decisions. On the contrary, higher customer service sensitivity pushes the infomediary to invest greater effort in providing better referral service to improve customers’ perceived efficiency and effectiveness. This makes other value-added services such as user comments and product reviews much more alluring to customers. Moreover, according to the empirical evidence of Viswanathan et al. [5], customers who only obtain price-related information from infomediary pay a significantly lower price compared to that paid by customers who obtain product-related information. Consequently, a rational retailer is forced to discount heavily to attract customers, and the infomediary reduces the service effort investment to cancel value-added service. As a result of such a vulnerable price strategy, the profits of the retailer and infomediary will decline with the increase of price sensitivity, as shown in Fig. 7. Conversely, higher service sensitivity of customers pushes the infomediary to adopt greater referral service effort and provide more product-related information. Thus, customers can experience the utilitarian benefits of using the infomediary and pay higher retail prices as shown in Fig. 8. Also, the service sensitivity has the capacity to simultaneously improve both the profit of the retailer and the infomediary (Fig. 9).

Let α = 0.01, δ = 0.005, β = 0.05, k = 0.2 and T = 30. Figure 10 shows the changes of profits of the retailer and infomediary under various eWOM conditions. We observe that when the effect of eWOM grows, the retailer’s profit decreases and the infomediary’s profit increases. The higher effect of eWOM means that increasing numbers of customers recognize the benefits of an infomediary and are determine to use this information service in their online shopping process. Further, communication by eWOM results in transparency in online retail pricing. Thus retailers have to accept the lower retail price and less profit segment for the same product. Therefore, from the perspective of supply chain, as Internet shoppers become more dependent on the information services of infomediaries, and infomediaries will have a greater role in the e-supply chain. In contrast, the advantage and power of retailers are gradually mitigated, and they must take part in this cooperation and accept this altered situation.

Let α = 0.01, δ = 0.005 and β = 0.05. We find that the profits of retailers and infomediaries increase as the sales period grows (Fig. 11). Contrarily, when the effect of eWOM increases from k = 0.2 to k = 0.6, the infomediary’s profit continues to increase as the retailer’s profit decreases, and the distance between the two profit lines diminishes, as shown in Fig. 12. Following the influence of increasing eWOM, the social network externality effect of a website becomes significant, such that it helps the infomediary build an extensive user data resource [38], attracting more potential consumers through eWOM and improving the website’s “stickiness” for customers. In addition, the infomediary will become more powerful in cooperative negotiations with retailers, achieving advancement in game equilibrium.

6 Conclusions

The majority of this article focuses on the effect of eWOM, the service policy of infomediaries and the decision of retailers in the Internet retailing supply chain. Unlike previous research, which concentrates primarily on pricing and production strategy of retailer and supplier, we extend market demand function based on Bass’s new product model and two echelon service supply chain structures, each of which consists of a retailer and a infomediary. We develop and analyze this E-supply chain service cooperation model to explore the optimal retailing price equilibrium, service effort, and cumulative sales and profits. The numerical results provide detailed analysis of the influence of operational parameters including price sensitivity, service sensitivity, advertisement, eWOM, and sales periods. This research has yielded a number of marketing insights and has testable implications. Service cooperation between offline and online channels leads to added value for customers and extended segments for retailers. We believe that these results will be feasible and effective in the marketing strategy planning of online retailing supply chain.

The impact of eWOM on customers’ decision-making and firms’ marketing strategy is extraordinary important, especially in the booming e-commerce industry. The information overload will lead to customer confusion and helplessness in decision-making and selection of products and suppliers. The infomediary has the capacity to help customers to compare and locate the preferred target product. It takes advantage of the eWOM effect and improves its unique information value in the Internet supply chain.

In future research, we will highlight the different referral services related to distinct products provided by competing retailers. In the current study, we assume that the product is absolutely identical in the supply chain system, and the service provided by the infomediary is homogeneous. If we extend to multiple kinds of products and various referral service efforts, the retailer will alter its marketing strategies. Furthermore, we assume the infomediary is the follower in the Stackelberg Game. If the infomediary becomes more powerful and becomes the leader of the cooperation, the variables of optimal decisions will be altered according to the new game. Other possible outcomes are service capacity constraint and mechanisms to impact referral quality of infomediaries, whose effect we will describe in regard to optimal policies of Internet supply chain members.

References

Liu Y, Sun Y, Hu J (2013) Channel selection in e-commerce age: a strategic analysis of co-op advertising models. J Ind Eng Manag 6(1):89–103

Chu W, Choi B, Song MR (2005) The role of on-line retailer brand and infomediary reputation in increasing consumer purchase intention. Int J Electron Commer 9(3):115–127

Adelaar T (2000) Electronic commerce and the implications for market structure. J Comput Med Commun 5(3):1–20

Hagel J III, Rayport JF (1997) The new infomediaries. McKinsey Quart 4:54–70

Viswanathan S, Kuruzovich J, Gosain S, Agarwal R (2007) Online infomediaries and price discrimination: evidence from the automotive retailing sector. J Mark 71(3):89–107

Ordanini A, Pol A (2001) Infomediation and competitive advantage in B2B digital marketplaces. Eur Manag J 19(3):276–285

Trusov M, Bucklin RE, Pauwels K (2009) Effects of word-of-mouth versus traditional marketing: findings from an internet social networking site. J Mark 73(5):90–102

Cheung CMK, Thadani DR (2012) The impact of electronic word-of-mouth communication: a literature analysis and integrative model. Decis Support Syst 54(1):461–470

Jeong E, Jang S (2011) Restaurant experiences triggering positive electronic word-of-mouth (eWOM) motivations. Int J Hosp Manag 30(2):356–366

Litvin SW, Goldsmith RE, Pan B (2008) Electronic word-of-mouth in hospitality and tourism management. Tour Manag 29(3):458–468

Park C, Lee TM (2009) Information direction, website reputation and eWOM effect: a moderating role of product type. J Bus Res 62(1):61–67

Hu N, Bose I, Gao Y, Liu L (2011) Manipulation in digital word-of-mouth: a reality check for book reviews. Decis Support Syst 50(3):627–635

Chen Y, Xie J (2008) Online consumer review: word-of-mouth as a new element of marketing communication mix. Manag Sci 54(3):477–491

Khammash M, Griffiths GH (2011) `Arrivederci CIAO.com, Buongiorno Bing.com’–Electronic word-of-mouth (eWOM), antecedences and consequences. Int J Inf Manag 31(1):82–87

Luo X (2009) Quantifying the long-term impact of negative word of mouth on cash flows and stock prices. Mark Sci 28(1):148–165

Cheung CMK, Lee MKO (2012) What drives consumers to spread electronic word of mouth in online consumer-opinion platforms. Decis Support Syst 53(1):218–225

Dai H, Salam AF (2011) Antecedents and consequents of service consumption experience in electronic mediated environment: empirical evidence from electronic service industry in China. J Syst Manag Sci 1(1):141–151

Craig CS, Greene WH, Versaci A (2015) E-word of mouth: early predictor of audience engagement. J Advert Res 55(1):62–72

Ziegele M, Weber M (2015) Example, please! Comparing the effects of single customer reviews and aggregate review scores on online shoppers’ product evaluations. J Consum Behav 14(2):103–114

Hennig-Thurau T, Gwinner KP, Walsh G, Gremler DD (2004) Electronic word-of-mouth via consumer-opinion platforms: what motivates consumers to articulate themselves on the Internet? J Interact Mark 18(1):38–52

Chen Y, Iyer G, Padmanabhan V (2002) Referral infomediaries. Mark Sci 21(4):412–434

Chen Y, Xie J (2005) Third-party product review and firm marketing strategy. Mark Sci 24(2):218–240

Yan X, Liu K (2009) Optimal control problems for a new product with word-of-mouth. Int J Prod Econ 119(2):402–414

Phuc PNK, Yu VF, Chou S-Y (2013) Manufacturing production plan optimization in three-stage supply chains under Bass model market effects. Comput Ind Eng 65(3):509–516

Liu Y, Cheng HK, Tang QC, Eryarsoy E (2011) Optimal software pricing in the presence of piracy and word-of-mouth effect. Decis Support Syst 51(1):99–107

Huang L, Zhang J, Liu H, Liang L (2014) The effect of online and offline word-of-mouth on new product diffusion. J Strateg Mark 22(2):177–189

Chen Y, Yao J (2012) Referral service of infomediary in B2C supply chain. Int J Netw Virtual Organ 10(3/4):414–426

Chen Y, Zhang W, Yang S, Wang Z, Chen S (2014) Referral service and customer incentive in online retail supply Chain. J Appl Res Technol 12(4):261–269

Bass FM (1969) A new product growth for model consumer durables. Manag Sci 15(5):215–227

Bass FM (2004) Comments on “A new product growth for model consumer durables”: the bass model. Manag Sci 50(12):1833–1840

Lee S-H, Noh S-E, Kim H-W (2013) A mixed methods approach to electronic word-of-mouth in the open-market context. Int J Inf Manag 33(4):687–696

Martin WC, Lueg JE (2013) Modeling word-of-mouth usage. J Bus Res 66(7):801–808

Guo Z (2012) Optimal decision making for online referral marketing. Decis Support Syst 52(2):373–383

Krishnan H, Kapuscinski R, Butz DA (2004) Coordinating contracts for decentralized supply chains with retailer promotional effort. Manag Sci 50(1):48–63

Tsay AA, Agrawal N (2004) Channel conflict and coordination in the e-commerce age. Prod Oper Manag 13(1):93–110

Yang CC, Chung A (2004) Intelligent infomediary for web financial information. Decis Support Syst 38(1):65–80

Son JY, Kim SS, Riggins FJ (2006) Consumer adoption of net-enabled infomediaries: theoretical explanations and an empirical test. J Assoc Inf Syst 7(7):473–508

Ghose A, Mukhopadhyay T, Rajan U (2007) The impact of Internet referral services on a supply chain. Inf Syst Res 18(3):300–319

Acknowledgments

This research is supported by the Philosophy and Social Science Research Project of Zhejiang Province under Grant No. 13NDJC054YB and the National Natural Science Foundation of China under Grant Nos. 71271188 and 71472163.

Conflict of interest

The authors declare that they have no conflict of interest.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, Y., Yang, S. & Wang, Z. Service cooperation and marketing strategies of infomediary and online retailer with eWOM effect. Inf Technol Manag 17, 109–118 (2016). https://doi.org/10.1007/s10799-015-0237-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-015-0237-1