Abstract

This study estimates the effect of complementary private health insurance (PHI) on the use of health care. The empirical analysis focuses on an institutional setting in which empirical findings are still limited; namely on PHI covering co-payment for treatments that are only partly financed by a universal health care system. The analysis is based on Danish data recently collected specifically for this purpose, which makes identification strategies assuming selection on observables only, and on both observables and unobservables also, both plausible and possible. We find evidence of a substantial positive and significant effect of complementary PHI on the use of prescription medicine and chiropractic care, a smaller but significant effect on dental care, weaker indications of effects for physiotherapy and general practice, and finally that the use of hospital-based outpatient care is largely unaffected. This implies that complementary PHI is generally not simply a marker of a higher propensity to use health care but induces additional use of some health care services over and above what would be used in the absence of such coverage.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

This paper addresses the issue of whether complementary private health insurance affects the use of health care services. It is well known that private health insurance may induce problems of moral hazard (Arrow 1963). The best empirical evidence of this is found in the RAND study (Manning et al. 1987). However, empirical studies of this phenomenon in a universal health care system are highly limited. In this setting, the universal health care system pays for part of any additional use induced by the complementary insurer, sometimes referred to as public moral hazard (Stabile 2001). The question of moral hazard is crucial for understanding the extent to which insurance is a key contributor to the increasing health care costs that are observed in many countries (and conversely, whether co-payment reduces health care consumption).

While the present study was conducted in the institutional setting of the Danish health care system, its results should also be of interest to policy makers in other countries with universal health care systems and/or complementary private health insurance, such as Canada, Portugal, Belgium and France.

Our empirical analysis is based on a dataset collected specifically for the current study, which provides several advantages: Most of the outcomes covered by the complementary health insurance can be measured, as can variables that a priori are likely to determine selection into health insurance and potential instrumental variables for health insurance. The Danish health care system is particularly suitable for empirical analysis of complementary health insurance, due to the dominance of a single supplier (the health insurance provider ‘danmark’) offering highly standardised insurance plans covering co-payment for health care services that are subject to co-payment under the universal system. General practice consultations are free at the point of use for all citizens, with general practitioners acting as gatekeepers in the sense that they can refer patients to more specialised treatment. For some health care services (such as prescription medicine, physiotherapy, and elective surgery), patients have to obtain a prescription or referral from their general practitioner in order to qualify for the public subsidy and reimbursement by ‘danmark’, while they have direct access to other services (such as dental and chiropractic care, eye doctors and optician services).

We consider the impact of holding complementary private health insurance on all the main services that it covers: prescription medicine, dental care, physiotherapy, chiropractic care and hospital-based outpatient care. We also analyse the effect on general practice, although this is free at the point of use and not subject to coverage by the complementary health insurer. However, the fact that, in some cases, patients are required to have a prescription or referral from their general practitioner in order to qualify for reimbursement by the private insurer implies that complementary private health insurance may indirectly increase the use of general practice.

We take the same approach as that used in Jones et al. (2006) and apply two fundamentally different identification strategies: joint parametric modelling (bivariate probit) relying on functional form and an exclusion restriction, but allowing for selection on unobservables, and propensity score matching assuming selection on observables only, but with no functional form assumptions. We use an indicator of wearing glasses or contact lenses as an instrumental variable to improve the identification of the bivariate probit model. This indicator is likely related to holding complementary insurance, because ‘danmark’ covers part of the expenses for glasses and contact lenses, but there are no restrictions with respect to the use of glasses or contact lenses upon enrolment in ‘danmark’. While we argue that, after conditioning on a wide set of covariates, the use of health care should not depend on whether or not individuals wear glasses or lenses, we cannot completely rule out the possibility that our instrumental variable is somehow related to the use of health care services.

Irrespective of method, we find a positive and significant effect of complementary insurance on the use of dental care and chiropractor care, suggesting the presence of moral hazard or supplier-induced demand. For the use of general practice, physiotherapy and prescription medicine, results differ across methods, while the use of hospital-based outpatient care is largely unaffected by complementary insurance. Effects from the models that assume selection on observables only are generally smaller than those from the models that allow for selection on unobservables.

The paper proceeds as follows. In “Background” section reviews the empirical literature and provides background information about voluntary private health insurance in Denmark. In“Data” section describes the data used in the empirical analysis. In “Estimation strategies” section accounts for the econometric methods. The results are reported in “Results” section and discussed in “Discussion” section. In “Concluding remarks” section concludes.

Background

Theoretical mechanisms

Several theoretical contributions in economics predict that private health insurance will increase the use of covered health care services. The most cited prediction is probably that private health insurance induces moral hazard in the use of health care services for which the demand is price elastic, by lowering the price that patients pay at the point of use, which leads to higher utilisation levels (Arrow 1963; Pauly 1968). In addition to moral hazard, private health insurance may also increase the use of health care through financial risk reductions, because the desired level of utilisation is higher under the financial certainty created by insurance than under financial uncertainty (Vera-Hernández 1999; de Meza 1983), an income transfer effect (Pauly 1968; Nyman and Maude-Griffin 2001) and supplier-induced demand (Evans 1974). The channels through which private health insurance may increase the use of covered health care services are referred to collectively as the incentive effect of private health insurance in the present study. In addition to the incentive effect outlined above, private health insurance may also be argued to induce moral hazard in the use of health care in the universal health care system. In the literature, the channels through which private health insurance may increase the costs of the universal health care system are referred to as public moral hazard (Folland et al. 2007; Stabile 2001). In the case of complementary insurance, the universal health care system pays for part of any additional use induced by the complementary insurer.Footnote 1 Moreover, private health insurance may place additional strain on general practice to the extent that reimbursement by private insurers is conditional on having a documented need for treatment, usually in the form of a referral or prescription from a general practitioner. Hence, the effect of complementary insurance on the use of general practice may be considered as a form of ‘pure’ public moral hazard.

The empirical literature

This section focuses on the identification strategies used in previous studies of how private health insurance affects health care use and summarises the results for the small body of literature focusing on complementary health insurance. To our knowledge, only six studies examine the presence of selection on unobservables (Jones et al. 2006; Chiappori et al. 1998; Bolhaar et al. 2012; Buchmueller et al. 2004; Riphahn et al. 2003; Schokkaert et al. 2010). These studies focus mainly on doctor visits and hospitalisations, while we cover a broader range of types of health care services covered by the complementary insurance.

The most comprehensive study of the impact of insurance on health care use to date is the RAND Health Insurance Experiment, which randomly assigned approximately 6000 US citizens to insurance plans with varying levels of cost sharing (Manning et al. 1987). However, the greater part of the empirical literature is based on observational data.

A few studies estimated the effect of private health insurance on the use of health care services, and treat insurance as exogenous, i.e. assumed that selection takes place on observables only, using extensive sets of control variables to mitigate potential selection bias. While some studies used various count data models (Stabile 2001; Christiansen et al. 2002; Pedersen 2005), others applied matching estimators (Barros et al. 2008; Søgaard et al. 2011; Kiil 2012). In the majority of the literature, selection on unobservables was allowed for by the use of various bivariate parametric models (Cameron et al. 1988; Coulson et al. 1995; Jones et al. 2006; Buchmueller et al. 2004; Riphahn et al. 2003; Schokkaert et al. 2010; Vera-Hernández 1999; Harmon and Nolan 2001; Höfter 2006; Holly et al. 1998; Savage and Wright 2003; Schellhorn 2001). In a similar vein to this paper, Jones et al. (2006) assessed the robustness of their results using both bivariate models and matching. However, these studies focus mainly on doctor visits and hospitalisations, while we cover a broader range of types of health care services covered by complementary insurance.

In principle, bivariate models are identified by functional form due to non-linearity, but all the studies that allowed for selection on unobservables supplemented the identification using an instrumental variable for health insurance. Holly et al. (1998) used age squared and body mass index squared as instrumental variables, i.e. relied on a non-linear functional form. A number of studies used various socioeconomic characteristics as instrumental variables (Buchmueller et al. 2004; Vera-Hernández 1999; Harmon and Nolan 2001; Höfter 2006). Finally, Jones et al. (2006) and Bolhaar et al. (2012) used lagged information on whether individuals had access to employer-provided free or subsidised health care or insurance as the instrumental variable for privately paid insurance. We find it fair to say that there is reason to be sceptical of the validity of socioeconomic variables as instrumental variables for insurance in health care use models. Numerous studies have found that such variables are intimately related to health care use (e.g. Doorslaer et al. 2004 and Fletcher and Frisvold 2009). Similar concerns could be raised regarding prior access to health care or other insurance types as instrumental variables.

Another branch of the literature relied on various natural experiments and regional variation, which could provide plausible exogenous variation in insurance status without theoretical justification. Chiappori et al. (1998) used variation in coverage stemming from a policy change, Ruthledge (2009) used variation in health plans across employers in the US, and Schellhorn (2001) used differences between Swiss cantons. Card et al. (2008), Anderson et al. (2012) and Kaestner and Khan (2012) used regression discontinuity designs arising from age limitations on various insurance plans in the US. Finally, Gerfin and Schellhorn (2006) estimated non-parametric bounds developed by Manski and Pepper (2000) for the effect of health insurance in Switzerland on the use of health care.Footnote 2

The results of the studies that focus on the effects of complementary health insurance in a universal health care system may be summarised as follows, starting with the six studies that accounted for endogeneity. Chiappori et al. (1998) found evidence of moral hazard for GP home visits but not for GP and specialist office visits, in the context of the French health care system. Also in the context of the French health care system, Buchmueller et al. (2004) found a strong and significant effect of complementary private health insurance on the use of physician services, but not on the decision to see a specialist rather than a GP. Schokkaert et al. (2010) found a positive effect of complementary insurance on the use of dental care and outpatient care, but no effect on the use of hospitalisations, GP visits, specialist visits and prescription medicine in the context of the Belgian health care system. Riphahn et al. (2003) used data from Germany and found that partly complementary health insurance had a positive effect on hospital use for males, but not for females, and found no effect on doctor visits for either gender. Jones et al. (2006) found a positive effect of complementary insurance on the probability of specialist visits in Ireland and Italy. In both cases, the bivariate probit model provided a higher estimate of the insurance effect than the corresponding binary probit model of specialist visits and complementary insurance coverage. Bolhaar et al. (2012) found no evidence of moral hazard in the use of neither GP, specialist visits nor hospital care in Ireland. Hence, the empirical evidence is mixed, even within countries, and the majority of the studies are restricted to considering the use of doctor visits and hospitalisations. Finally, three studies relied on identification from the absence of selection on unobservables, i.e. assumed that selection takes place on observables only. Pedersen (2005) found a positive effect on the use of dental care and physiotherapy, and Christiansen et al. (2002) found a positive effect on the use of dental and chiropractic care, but no effect on physiotherapy and prescription medicine use, both in the context of the Danish health care system. Stabile (2001) found that complementary private health insurance had a positive effect on the probability of both use and magnitude for doctor visits but not hospital stays, in a Canadian context. Overall, there are slightly more findings of no effect than findings of evidence of moral hazard, but the evidence is scattered across outcomes and countries, which makes it difficult to arrive at any firm conclusions.

The Danish health care system

The Danish health care system is a comprehensive tax-financed system with universal access. General practitioner and specialist care, hospital-based outpatient care and hospitalisations are free at the point of use for all citizens. General practitioners act as gatekeepers in the sense that, in most cases, a referral from a general practitioner is required for access to more specialised treatment.

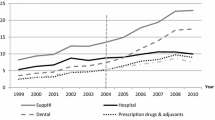

There is substantial private co-payment for adult dental care, prescription medicine, glasses and contact lenses, physiotherapy, chiropractic care and psychological counselling (Strandberg-Larsen et al. 2007). Private co-payment accounted for about 14 % of the total health expenditure in 2009 (OECD 2010). The presence of co-payment provides a basis for the existence of complementary private health insurance. The percentage of the Danish population with voluntary private health insurance in addition to the coverage provided by the tax-financed health care system has increased steadily over the past decades. In 2009, more than two million Danes (approximately 42 % of the adult population) were covered by private health insurance through the non-profit mutual insurance company ‘danmark’ (Health Insurance ’danmark’ 2009).

For certain types of health care services, such as prescription medicine, physiotherapy and elective surgery, patients must obtain a prescription or a referral from their general practitioner in order to qualify for the public subsidy and reimbursement by ‘danmark’. Patients have direct access to other services, such as dental care, chiropractic care, eye doctors and optician services (Strandberg-Larsen et al. 2007). People with eyesight problems usually see an optician in the first place (Larsen 2013). Opticians are required to hold a bachelor’s degree in optometry and have authorisation from the Danish Patient Safety Authority (Jacobsen 2009). They carry out eye examinations to fit glasses and contact lenses and sell these, but refer patients to an eye doctor for further examination and diagnosis in cases where disease is suspected. General practitioners do not carry out eye examinations for fitting of glasses or contact lenses.

The insurance contracts used by ‘danmark’ are highly standardised. Their primary purpose is to provide partial coverage of the private co-payment for treatments which are partly financed by and supplied under the public health care system. Hence, this type of private health insurance may be classified as being primarily complementary in relation to the tax-financed health care system (OECD 2004; Colombo and Tapay 2004). In addition to being reimbursed for co-payments, approximately 25 % of the members of ‘danmark’ are also partly reimbursed for elective surgery in private hospitals (according to internal material from ‘danmark’). The coverage provided by ‘danmark’ leaves a small co-payment to be paid out-of-pocket in order to counter moral hazard.

In order to be eligible for membership of ‘danmark’, applicants must be less than 60 years old at the time of enrolment in ‘danmark’, in good health (i.e. have no chronic conditions), and must not have used any medication or received treatment from physiotherapists, chiropractors or other health care providers during the last 12 months prior to enrolment (Health Insurance ’danmark’ 2010b). However, once a member it is possible to stay insured as long as one wishes, and, importantly, premiums are not risk rated. Children are covered free of charge through the parental membership until the age of 16.

The members of ‘danmark’ can choose between four groups of membership, which differ in terms of coverage levels and premiums (Health Insurance ’danmark’ 2010a). Group 5 provides partial coverage of co-payments related to medication, vaccination, dental care and glasses or contact lenses. Co-payment for physiotherapy and chiropractic care is also partly covered, as is co-payment for psychological counselling. In addition to the basic benefits, members of group 5 may take out an additional policy that partly covers expenditures related to elective surgery in private hospitals. In 2010, the annual premium for membership of group 5 amounted to DKK 1,312/EUR 176 per adult. Additional coverage for elective surgery costs DKK 480-1,200/EUR 64-161 per year.Footnote 3

Group 1 provides more extensive coverage of the same types of health care services as those covered by group 5. In particular, the reimbursement rate for co-payments related to medication is higher, and expenditures related to elective surgery at private hospitals are partially covered after 12 months’ membership. Members of group 1 paid an annual premium of DKK 2968/EUR 398 per adult in 2010.

Group 2 is designed for the approximately 0.7 % of the population that have opted for a scheme in the universal health care system under which they are free to visit any health care provider without referral from a GP against paying a small co-payment for all services except hospital treatment. In addition to the services covered by group 1, specialist care and diagnostic tests are also reimbursed for members of group 2. Hence, this group provides the most extensive coverage available under ‘danmark’. Members of group 2 paid an annual premium of DKK 3832/EUR 514 per adult in 2010.

Group 8 provides something that may be termed passive coverage, passive in the sense that it does not provide any direct benefits, but allows individuals to switch to one of the other groups at a later point in time without having to re-qualify for membership. Thus, this group is aimed at people who fulfil the eligibility requirements at the time of enrolment and expect to want active coverage at a later date. Members of group 8 paid an annual premium of DKK 396/EUR 53 per adult in 2010.

Private health insurance can also be purchased through other insurance companies than ‘danmark’ or obtained through the workplace. In 2009, approximately 6 % of the adult population held a private insurance other than ‘danmark’, and 28 % held an insurance contract obtained through the workplace by themselves or their partner (according to the data used in this paper). These types of insurance are supplied by commercial insurance companies, and they primarily cover elective surgery at private facilities (Statistics Denmark 2010; The Danish Insurance Association 2010). Hence, the overlap in coverage with that of ‘danmark’ is only partial. At the time the data used in this paper were collected, employees were tax-exempted for the value of private insurance premiums. Motivated by equity concerns, the tax-exemption was contingent on the insurance being offered to all employees in a company. The decision to offer insurance rests with the employer. However, in some industries it is negotiated as part of the collective agreement.

Data

The empirical analysis is based on data from a cross-sectional survey of the Danish population aged 18–75 collected in June 2009 using an internet-based questionnaire distributed via YouGov Zapera’s Denmark panel. It was decided to collect the data using an internet-based questionnaire, due to the relative speed and cost-effectiveness of this survey mode. Moreover, the possibility of incorporating automatic skip patterns in the questionnaire in order to avoid respondents being asked unnecessary questions was considered a major advantage of this particular survey. In total, 5447 respondents answered the questionnaire, corresponding to a response rate of 41 %. While a response rate of 41 % inevitably poses a challenge in relation to non-response and representativity, to the best knowledge of the authors no general health surveys or registries include information on which individuals are in ‘danmark’ rather than other private insurers.Footnote 4

Non-response and representativity

The development and testing of the questionnaire and the data collection process, including analyses of non-response and representativity, are fully documented in Kiil and Pedersen (2009) and Kiil (2011a, (2011b), on which this section is based. Of the 13,246 sampled individuals, 7799 did not respond, corresponding to an overall non-response rate of 59 %.

We have data on age, gender and region of residence for both respondents and non-respondents. The non-response rate is similar across the five regions of Denmark, but decreases with age for both genders and is higher for males compared to females across all age groups. The variation in non-response by age and gender may reflect a varying degree of interest in the subject of the survey, as well as a general tendency for males, especially younger males, to be less inclined than females to participate in surveys. YouGov Zapera used their knowledge of how response rates differ across age and gender to select the sample, in order to ensure that the resulting sample would be roughly representative of the Danish population with respect to these characteristics.

The representativity of the sample is assessed in Table 1—where the sample is compared with the population that it is intended to represent on various characteristics—and is briefly discussed in the following.

It can be seen from Table 1 that individuals from the Capital area are slightly overrepresented in the sample, while individuals from Northern Jutland are underrepresented. Considering age and gender, the younger age groups (18–55 years) are underrepresented, and the older age groups (56–75 years) are overrepresented among males. Among females, the age groups 18–25 years and 46–65 years are overrepresented, while the 65–75-year-olds are underrepresented. With regard to household size, smaller households with 1–2 persons are somewhat overrepresented in the sample, while households with 4 persons or more are underrepresented. For these characteristics, the differences between the sample and the population are small, though statistically significant. However, considering education level and occupation, the differences between the sample and the population are greater. The most substantial differences between the sample and the population are that individuals with little education and pensioners are underrepresented, while highly educated individuals and students are overrepresented. Finally, it can be seen from Table 1 that the average number of contacts to general practitioners and specialists is lower for the sample than for the general population, while the opposite is the case for visits to dentists, chiropractors and physiotherapists. These differences may in part be due to the fact that visits to chiropractors and physiotherapists that are paid for privately are not registered by Statistics Denmark. Moreover, inaccurate memory on the part of the respondents may also have contributed to the differences.Footnote 5

One could argue that the data should be adjusted to provide an accurate picture of the Danish population using probability weights.Footnote 6 However, when stratification is not exogenous, which is the case when experience with response rates is used to select a sample, probability weights are inappropriate (Cameron and Trivedi 2005). In addition, we only know the age, gender and region of residence of the individuals who were contacted by YouGov Zapera but did not respond to the survey, which precludes the possibility of using probability weights.

Complementary private health insurance (treatment)

Private health insurance status is measured by a dummy variable that is one for individuals who have taken out complementary private health insurance through active membership of ‘danmark’ (i.e. individuals in the passive group that have no actual coverage are classified as uninsured) and is otherwise zero.Footnote 7 However, in the analysis of hospital-based outpatient care we restrict the insurance dummy to indicate membership of group 1 or membership of group 5 combined with additional coverage of expenditures related to elective surgery in private hospitals. In other words, we consider members of ‘danmark’ without coverage of outpatient care to be uninsured, in this analysis. An intrinsic problem in studies of private health insurance is how to account for different types of insurance coverage and avoid control group members holding some sort of insurance. This problem is usually solved by combining all observed insurance types in a single group or simply ignoring the problem. Combining substantially different insurance types makes it difficult to look at the impact of insurance on the services covered. In the current study, we do the following: Individuals who do not know their insurance status are excluded from the data, reducing the sample size from 5447 to 5396. Moreover, 327 individuals who have purchased private health insurance from a commercial insurance company on an individual basis were also omitted from the data, further reducing the sample size to 5069. The reason for this restriction is that it can be difficult to control appropriately for selection into this type of private health insurance. Given that the coverage of the contracts from the commercial insurance companies varies considerably, but typically focuses on elective surgery, the indicator variable used to facilitate the identification of the impact of complementary insurance on health care use in our analysis (i.e. wearing glasses or contact lenses) cannot be used for these contracts. Individuals with employment-based private health insurance are kept in the sample, as it can be argued that self-selection is much more limited for this type of insurance and that coverage has been shown to be unassociated with membership of ‘danmark’ (Kiil 2011a, b). Finally, respondents who answered ‘Don’t know’ or ‘Other’ than the categories specified in the questionnaire on one or more of the covariates were omitted from the data, further reducing the sample size from 5069 to 4362. The analysis sample thus includes 4362 respondents, of whom 48.97 % are covered by complementary private health insurance through active membership of ‘danmark’ (53.03 % including passive members).

Health care use (outcomes)

The use of health care services is captured by a set of dummy variables indicating whether a person has had one or more consultations with the provider in question or used prescription medicine in the previous 12 months.Footnote 8 The use of prescription medicine (MED) and visits to a dentist (DEN), physiotherapist (PHY) and chiropractor (CHI) are included because a substantial share of the financing for these health care services is covered by co-payments, which are partly reimbursed by ‘danmark’. Hospital-based outpatient care (OUT) is included, due to the fact that approximately 25 % of the members of ‘danmark’ are partly reimbursed for elective surgery in private hospitals. Although the use of general practice is free of charge in the universal health care system, and thus not covered by ‘danmark’, consultations with general practitioners (GP) are included, because ‘danmark’ requires a referral from a GP in order to cover, for instance, physiotherapy, medication and elective surgery. Hence, it is possible that the presence of complementary private health insurance may increase use of GP indirectly. This phenomenon is commonly referred to in the literature as public moral hazard (Folland et al. 2007; Stabile 2001).

Table 2 shows some descriptive statistics for the outcome measures of health care use for the total sample and separately by complementary insurance status.

It can be seen from Table 2 that the percentage with one or more contacts to the providers in question in the previous 12 months is higher for the members of ‘danmark’ than for non-members for all types of health care services considered. Moreover, with the exception of hospital-based outpatient contacts the differences are statistically significant.

Covariates

The set of potential covariates includes the basic sociodemographic variables age, gender, household income and composition, highest level of education completed, occupational status and whether the individual has employment-based private health insurance coverage. Employment-based private health insurance coverage is included in the set of covariates, due to the possibility that individuals with this type of insurance may be less likely to enrol in ‘danmark’. We also include self-reported risk preferences measured on a scale from zero to ten, as risk preferences have been shown by economic theory to affect the demand for private health insurance (Cutler and Zeckhauser 2000) as well as the use of health care services (Nocetti and Smith 2010). Overall, a wide set of theoretically justified controls are included. It was also considered to include a set of variables indicating the presence of eight chronic conditions, self-assessed dental health and a number of lifestyle choices to proxy the need for health care. However, while the health variables are obvious candidates for sources of selection, they may also be affected by current or previous private health insurance coverage and could mask potentially important effects of insurance coverage.

In principle, the bivariate probit model is identified by the non-linearity of the bivariate normal distribution (Wilde 2000). However, we use an instrumental variable to improve the identification of the model. In the current study, we use as instrumental variable an indicator of wearing glasses or contact lenses (a similar instrument is used by Hopkins et al. 2013 in a study of private health insurance in Australia) to aid the identification of the impact of insurance on health care use. This indicator is likely related to holding complementary insurance, because ‘danmark’ covers part of the expenditures for glasses and contact lenses. A membership of ‘danmark’ thus constitutes a price reduction for foreseeable and recurrent expenditures without increasing the insurance premium for the individual.Footnote 9 However, there are no restrictions with respect to the use of glasses or contact lenses upon enrolment in ‘danmark’. One might worry that wearing glasses or lenses is itself the result of complementary health insurance status, particularly for poor people with less severe eye problems. However, given that people who need glasses or contact lenses but are unable to afford them can apply for financial assistance from their municipality, it is unlikely that people would choose to do without necessary visual aids depending on their complementary insurance status. We argue that—after conditioning on the wide set of covariates of age, gender, attitude towards risk and socioeconomic characteristics—the use of health care should not depend on whether or not individuals or not wear glasses or lenses.

Table 3 shows descriptive statistics for the full set of covariates and the exclusion restriction, for the total sample and separately by insurance status.

It can be seen from Table 3 that the individuals with complementary private health insurance through ‘danmark’ differ significantly from the non-members on the majority of the covariates included. In particular, the percentage of glasses or contact lens users is considerably higher for the members of ‘danmark’ than for non-members, i.e. the relevance criterion of our instrumental variable for complementary health insurance status is likely to be fulfilled.

We also investigate how individuals who wear glasses or contact lenses differ from those who do not, by regressing the instrumental variable on the set of covariates included in the analyses. These results are shown in Table 4. We find that, while the two groups are similar with respect to income and occupation, they differ in other respects, as expected. In particular, users of glasses or contact lenses are older, more likely to be females, more highly educated and more likely to hold employment-based health insurance. The crucial point is whether the instrumental variable (i.e. whether individuals wear glasses or lenses) is related to the use of health care services, once we have controlled for the set of covariates. The finding that individuals wearing glasses or lenses are more highly educated and more likely to hold employment-based health insurance could be taken to mean that wearing glasses or lenses is also correlated with unobserved determinants of education (and health), such as time preferences. However, the finding that wearing glasses or lenses is not related to employment status and long-term sickness, which are strong determinants of the need for health care, points in the opposite direction. We thus find it reasonable to argue that, although not perfect, use of glasses or contact lenses is an improvement upon some previous literature that has frequently used socioeconomic variables as instruments for private health insurance in health care use models. These instruments would likely not survive a test for being unrelated to employment status and long-term sickness.

Estimation strategies

This section describes the methods used to identify and estimate the effect of complementary health insurance on health care use. As in Jones et al. (2006), we use a bivariate probit model and matching to obtain knowledge on the effects of complementary health insurance on health care use. These two methods complement each other and therefore provide more robust evidence:Footnote 10 While identification and consistent estimation hinges upon the assumption that selection takes place on observables only for matching estimators, this assumption is relaxed in the bivariate probit.

Given the observed covariates X, we can write the bivariate probit model for received treatment D and outcome Y in terms of a latent variable specificationFootnote 11:

where U and V are unobserved latent variables, which follow bivariate standard normal distributions with a correlation coefficient, \(\rho \), \(\beta _{1}\) and \(\beta _{2}\) are vectors of coefficients for the covariates X, and \(\gamma \) is the coefficient for the treatment D. Assuming that the model is correctly specified, \(\rho \ne 0\) implies that D is endogenous with respect to Y. Consistent estimation of the unknown parameters in the model can be achieved using the method of maximum likelihood.

In contrast, matching estimators avoid the functional form restrictions (correct mean specification) that are implicit in the bivariate probit model. We apply propensity score matching to circumvent the curse of dimensionality. The treated and controls were matched using kernel matching. Standard errors including the variance due to the estimation of the propensity score, and the imputation of common support were obtained by bootstrapping. This has been shown to provide valid inference for kernel matching (Abadie and Imbens 2008). The standard errors of average treatment effects for the bivariate probit models were also obtained by bootstrapping.

Results

This section presents selected results for the various estimation strategies. All estimations were carried out in Stata/IC 11.Footnote 12 For the matching estimator, treated and controls were matched using kernel matching with an Epanechnikov kernel and a bandwidth of 0.04.Footnote 13 Also, the matching estimator restricted the analysis to the region of common support, by dropping treated individuals with propensity scores outside the range of the propensity scores for the controls.

The main results reported in this section are based on the set of covariates and the exclusion restriction discussed in “Covariates” section and the model specification discussed in “Estimation strategies” section. Some of the included variables may be argued to be endogenous with respect to the use of health care services. Particularly income, education level and occupational status may be affected by health care use, and the coefficients on these variables should therefore not be interpreted as causal. Table 5 reports average treatment effects of complementary health insurance coverage.Footnote 14 The full results underlying the estimates from the bivariate probit models are reported in Appendix 1.

Overall, it appears that the effect of complementary insurance differs across health care services, as well as between estimation strategies. However, there are some central tendencies. Considering first the results of the models relying only on selection on observables, the estimates obtained by propensity score matching are relatively small and positive for all types of health care. Various checks of matching quality reported in Appendix 1 indicate that matching succeeds in balancing the covariates between the treated and control groups, and that the overlap condition does not pose a problem.

Once selection on unobservable characteristics is taken into account in the joint parametric model, the estimated effects are generally seen to increase. The magnitude of the increase ranges from a factor of approximately three for dental care to a factor of 25 for prescription medicine.

The joint parametric model allows us to test whether individuals select themselves into complementary insurance based on unobservables, i.e. whether insurance status is endogenous, by assessing the significance of the correlation coefficient, \(\rho \). The likelihood-ratio tests of the null hypothesis that \(\rho =0\) reported in Table 5 reject the hypothesis of no selection on unobservables at a 5 % significance level in the models of prescription medicine and chiropractic care, and at a 10 % significance level for physiotherapy, whereas the hypothesis cannot be rejected for general practice, hospital-based outpatient care and dental care. In addition, it can be seen from the full results shown in Appendix 1 that the instrumental variable, i.e. wearing glasses or contact lenses, is relevant in the sense of it having a greater positive impact on the probability of being insured.

Corresponding results excluding individuals with passive coverage or classifying them as insured are very similar in nature to the results reported in this section (where individuals with passive coverage are classified as uninsured). These results are available from the corresponding author upon request.

Discussion

Overall, the estimates based on an assumption that selection takes place on observables only, i.e. the propensity score matching results, are generally lower than the estimates from the joint parametric model, which is in line with the results of Jones et al. (2006). Hence, even if \(\rho \) is statistically insignificant, it vastly affects the results. Possible explanations for this divergence are that the assumption regarding selection on observables only does not hold, or that the bivariate probit models identify a local average treatment effect. The latter is the effect for individuals complying with the instrument (Angrist et al. 1996), which in the present case are those who take out complementary private health insurance because they wear glasses or contact lenses. Given the relatively small reimbursement for glasses or contact lenses, these individuals may be particularly price sensitive and may therefore also respond more to price changes for other health care services.

Irrespective of method, the results point towards an incentive effect of insurance, suggesting the presence of moral hazard or supplier-induced demand for some of the health care services considered. The tests for selection on unobservables provided by the joint parametric models indicated that insurance status could be considered exogenous in the analyses of general practice, hospital-based outpatient care and dental care use and endogenous when considering the use of prescription medicine, physiotherapy and chiropractic care. Hence, the evidence seems to favour the findings of significant and substantial effects of complementary private health insurance on the use of prescription medicine and chiropractic care, a smaller but significant effect on dental care, weaker indications of effects for physiotherapy and general practice, while the use of hospital-based outpatient care is largely unaffected.

The large and positive effect found for prescription medicine may be partly contributable to the fact that we analyse the probability of having had any use in the previous 12 months. The reason for this is that the public subsidy scheme is designed so that the co-payment level starts out at 100 % and decreases as the medicine expenditure increases. Hence, since ‘danmark’ covers a percentage of the co-payment, the coverage provided by ‘danmark’ matters the most for initial use. The difference between the undoubtedly large and positive effect for chiropractic care and the weaker evidence for physiotherapy appears puzzling at a first glance, given that the co-payment levels for these two types of care do not differ notably. However, the less convincing indication of a positive effect for physiotherapy could be due to the fact that the members of ‘danmark’, like everybody else, have to obtain a referral to see a physiotherapist from their general practitioner, in order for this to be covered by the public subsidy as well as ‘danmark’, while they have direct access to chiropractic care. Moreover, the absence of an incentive effect of complementary insurance on hospital-based outpatient care may reflect the presence of restrictions in the coverage provided by ‘danmark’ for this type of treatment. Firstly, private insurance patients in ‘danmark’ must, like everybody else, obtain a referral to elective surgery, typically from their general practitioner, who acts as a gatekeeper in this respect. Secondly, ‘danmark’ provides indemnity coverage of hospital-based outpatient care in the sense that it covers various elective procedures by reimbursing a fixed amount of money, which usually does not cover the full price of the surgery. In addition, the waiting times for many outpatient treatments at public hospitals have reduced in recent years, reducing the incentive to seek private care, just as many types of outpatient care are only available in public hospitals. Finally, the finding that complementary insurance increases the use of general practice may be interpreted as evidence of a form of ‘pure’ public moral hazard, though of a limited magnitude and only statistically significant at a 10 % level. The large and negative correlation coefficients indicate that the insured persons are less likely to use the considered health care services, irrespective of insurance status. This implies that the models relying on selection only on observables identify lower bounds for the true effects of complementary insurance. The negative correlation coefficients may be due to the eligibility requirements imposed by ‘danmark’ (i.e. that applicants must be less than 60 years old and in good health at the time of enrolment). Moreover, this is in line with a hypothesis of advantageous selection into private health insurance (de Meza and Webb 2001; Finkelstein and McGarry 2006; Hemenway 1990). Advantageous selection into ‘danmark’ may occur if more risk-averse individuals are more likely to both enrol in ‘danmark’ and engage in health-promoting behaviours. If the health-promoting behaviours lead to better health, the members of ‘danmark’ will be less likely to need health care, irrespective of their insurance status. Previous evidence of advantageous selection into complementary private health insurance in a European setting includes that found in Bolhaar et al. (2012), who analysed data from Ireland and found advantageous selection largely driven by heterogeneity in education and income, with the highly educated and paid both more likely to be insured and be in better health.

As for all studies, there are limitations to this study. Firstly, the test for selection on unobservables and the effects estimated by the joint parametric model are conditional on the instrumental variable being valid. In order to render the instrumental variable invalid, it must be the case that individuals wearing glasses or contact lenses are more prone to use health care. Our assessment of the exclusion restriction in “Covariates” section indicates that individuals wearing glasses or lenses are more highly educated and more likely to hold employment-based health insurance, which could be taken to mean that wearing glasses or contact lenses is also correlated with unobserved determinants of education (and health), such as time preferences. However, the finding that wearing glasses or lenses is not related to employment status and long-term sickness, which are strong determinants of need for health care, points in the opposite direction. Hence, after conditioning on the set of covariates, we see little reason to believe that the use of health care should depend on whether individuals wear glasses or lenses. Moving on to considering the data, the use of data collected using an internet-based questionnaire constitutes a source of bias, if the individuals who can be reached through the Internet differ from those without internet access on the characteristics that are subject to investigation. Given that 86 % of the Danish population had internet access in their homes in 2009 (Statistics Denmark 2009a), and that this study restricts analysis to individuals aged 18–75, the use of an internet-based questionnaire is not expected to be a major issue in this particular study. However, the assessment of the representativeness of the sample in “Non-response and representativity” section indicated that low-educated individuals and pensioners are underrepresented, while more highly educated individuals and students are overrepresented, which may in part be due to the survey mode. Finally, as we do not know whether the use of the health care services under consideration is efficient or inefficiently high or low in the absence of complementary insurance, it is not possible to investigate how the increase in use induced by private health insurance affects the welfare of society based on the results of this study.

Concluding remarks

There is an ongoing research agenda in the field of health economics on how to identify the causal effect of voluntary private health insurance on health care use. As experimental data are rare, one is usually left with observational data and inherently untestable identifying assumptions. This paper contributes to the literature by focusing on a particular institutional setting in which empirical findings are still limited; namely voluntary private health insurance that is complementary to a tax-financed health care system. Moreover, the empirical analysis is based on a dataset recently collected specifically for this purpose, which allows us to measure most of the outcomes covered by the complementary health insurance and includes a selection of relevant variables making identification strategies assuming both selection on observables only and selection on both observables and unobservables plausible and possible.

Altogether, the evidence of this study tends to favour the conclusion that complementary private health insurance in addition to the coverage provided by the tax-financed health care system has a considerable positive and significant impact on the use of prescription medicine, dental care and chiropractic care, and a lesser impact on the use of physiotherapy and general practice, and that the use of hospital-based outpatient care is largely unaffected. This implies that complementary private health insurance is generally not merely a marker of a higher propensity to use health care but induces additional use of some health care services over and above what would be used in the absence of such coverage. The main limitation of these results is the validity of our instrumental variable. While the relevance criterion of our instrumental variable (use of glasses or contact lenses) for complementary health insurance status is likely to be fulfilled, it can be questioned whether our instrumental variable is truly unrelated to the use of health care services, even after conditioning on a wide set of covariates.

Notes

If, for example, the universal health care system covers 60 % of a physiotherapy treatment worth EUR 50 and the remaining 40 % is financed by a co-payment—which may or may not be covered by complementary insurance—and complementary insurance induces three additional visits at EUR 50 over and above what would have been used in its absence, the presence of complementary insurance leaves the universal health care system with an additional expenditure of EUR 0.6 * 150 \(=\) 90.

This approach has also been examined in the current study, but most bounds were too wide to be of any value.

Conversions from DKK to EUR were undertaken using the March 2011 average exchange rate of 745.74. (Danske Bank 2011).

The Danish Health Interview Survey (in Danish: Sundhed og Sygelighed i Danmark) contains information on private health insurance coverage and health care use in the Danish population. However, the level of detail of the information on private health insurance coverage is considerably lower than that of the data used here.

Based on the observed pattern, one might speculate that it is easier to remember visits for which a co-payment was made, sometimes perhaps even more visits than actually took place.

Probability weights are defined as the inverse of the probability that the individual under consideration was sampled from the population, i.e. the number of individuals in the population that each sampled respondent represents.

We perform a sensitivity analysis to check whether excluding passive individuals or classifying them as being insured changes the results substantially.

The choice of dummy variables indicating whether any use took place is motivated by the fact that the main choice that individuals face is whether to see a given health care provider or not, while further visits are, to a large extent, beyond their control (Barros et al. 2008; Gerfin and Schellhorn 2006). Moreover, a dummy variable captures the majority of the variation in outcomes, due to there being a large number of zeros and ones in the number of contacts.

All complementary insurance plans cover a maximum of DKK 360/USD 68 for single focal glasses or sunglasses, DKK 680/USD 128 for multifocal glasses and DKK 38/USD 7 per month for contact lenses (Health Insurance ’danmark’ 2010a). This is almost half the premium for complementary insurance coverage.

We have also estimated the models using univariate probit models, and the results are very similar to the matching results, indicating that functional form assumptions are not a problem. However, these are not reported, due to considerations of space.

A related estimator is the two-stage least squares estimator, but due to the discrete nature of both treatment and outcomes this will at best be an approximation.

The propensity score matching estimator was implemented using version 3.1.5 of the ‘psmatch2’ module written by Leuven and Sianesi (2003).

Sensitivity analyses, which are available from the corresponding author upon request, showed that the results are insensitive to reducing the bandwidth to 0.02 and increasing it to 0.06 and 0.08, respectively.

The average treatment effects for the treated are very similar and are hence not presented.

References

Abadie, A., & Imbens, G. W. (2008). On the failure of the bootstrap for matching estimators. Econometrica, 76, 1537–1557.

Anderson, M., Dobkin, C., & Gross, T. (2012). The effect of health insurance coverage on the use of medical services. American Economic Journal, 4, 1–27.

Angrist, J. D., Imbens, G. W., & Rubin, D. B. (1996). Identification of the causal effects using instrumental variables. Journal of the American Statistical Association, 91, 444–455.

Arrow, K. J. (1963). Uncertainty and the welfare economics of medical care. American Economic Review, 53, 941–973.

Barros, P. P., Machado, M. P., & Sanz-de-Galdeano, A. (2008). Moral hazard and the demand for health services: A matching estimator approach. Journal of Health Economics, 27, 1006–1025.

Bolhaar, J., Lindeboom, M., & Klaauw, B. (2012). A dynamic analysis of the demand for health insurance and health care. European Economic Review, 56, 669–690.

Buchmueller, T. C., Couffinhal, A., Grignon, M., & Perronnin, M. (2004). Access to physician services: Does supplemental insurance matter? Evidence from France. Health Economics, 13, 669–687.

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics: Methods and applications. New York: Cambridge University Press.

Cameron, A. C., Trivedi, P. K., Milne, F., & Piggott, J. (1988). A microeconometric model of the demand for health care and health insurance in Australia. Review of Economic Studies, 1, 85–106.

Card, D., Dobkin, C., & Maestas, N. (2008). The impact of nearly universal coverage on health care utilization: Evidence from Medicare. American Economic Review, 98, 2242–2258.

Chiappori, P., Durand, F., & Geoffard, P. (1998). Moral hazard and the demand for physician services: First lessons from a French natural experiment. European Economic Review, 42, 499–511.

Christiansen, T., Lauridsen, J., & Kamper-Jørgensen, F. (2002). Demand for private health insurance and demand for health care by privately and non-privately insured in Denmark (Working paper), University of Southern Denmark, Odense.

Colombo, F., & Tapay, N. (2004). Private health insurance in OECD countries: The benefits and costs for individuals and health systems. In Towards high-performing health systems: policy studies. Paris: OECD.

Coulson, N. E., Terza, J. V., Neslusan, C. A., & Bruce, S. (1995). Estimating the moral-hazard effect of supplemental medical insurance in the demand for prescription drugs by the elderly. American Economic Review, 85, 122–126.

Cutler, D. M., & Zeckhauser, R. J. (2000). The anatomy of health insurance. In A. J. Culyer & J. P. Newhouse (Eds.), Handbook of health economics. Amsterdam: Elsevier.

Danske Bank (2011, April 27). Middelkurser i København, marts 2011 [Average exchange rates in Copenhagen, March 2011].

de Meza, D. (1983). Health insurance and the demand for medical care. Journal of Health Economics, 2, 47–54.

de Meza, D., & Webb, D. C. (2001). Advantageous selection in insurance markets. RAND Journal of Economics, 32, 249–262.

Doorslaer, Ev, Koolman, X., & Jones, A. M. (2004). Explaining income-related inequalities in doctor utilization in Europe. Health Economics, 13, 629–647.

Evans, R. G. (1974). Supplier-induced demand: Some empirical evidence and implications. In M. Perlman (Ed.), The economics of health and medical care. New York: Wiley.

Finkelstein, A., & McGarry, K. (2006). Multiple dimensions of private information: Evidence from the long-term care insurance market. American Economic Review, 96, 938–958.

Fletcher, J. M., & Frisvold, D. E. (2009). Higher education and health investments: Does more schooling affect preventive health care use? Journal of Human Capital, 3, 144–176.

Folland, S., Goodman, A. C., & Stano, M. (2007). The economics of health and health care. New Jersey: Pearson.

Gerfin, M., & Schellhorn, M. (2006). Nonparametric bounds on the effect of deductibles in health care insurance on doctor visits—Swiss evidence. Health Economics, 15, 1011–1020.

Harmon, C., & Nolan, B. (2001). Health insurance and health services utilization in Ireland. Health Economics, 10, 135–145.

Health Insurance ‘danmark’ (2009). Årsrapport 2009 [Annual Report 2009]. Retrieved April, 2011, from http://www.sygeforsikring.dk/Default.aspx?ID=23.

Health Insurance ‘danmark’ (2010a). Dækning [Coverage]. Retrieved May, 2011, from http://www.sygeforsikring.dk/Default.aspx?ID=439

Health Insurance ‘danmark’ (2010b). Helbreds- og alderskrav [Health- and age requirements]. Retrieved May 25, 2011, from http://www.sygeforsikring.dk/Default.aspx?ID=343.

Hemenway, D. (1990). Propitious selection. Quarterly Journal of Economics, 105, 1063–1069.

Höfter, R. H. (2006). Private health insurance and utilization of health services in Chile. Applied Economics, 38, 423–439.

Holly, A., Lucien, G., Gianfranco, D., & Brigitte, B. (1998). An econometric model of health care utilization and health insurance in Switzerland. European Economic Review, 42, 513–522.

Hopkins, S., Kidd, M. P., & Ulker, A. (2013). Private health insurance status and utilisation of dental services in Australia. Economic Record, 89(285), 194–206.

Jacobsen, C. S. (2009). Hvad optikeren skal, må og absolut ikke må [What the optician must, may and definitely may not]. Retrieved February 16, 2016, from http://www.optikerforeningen.dk/Files/Billeder/2010_og_tidligere/Artikler/2009_3_1_Hvad_optikeren_maa.pdf.

Jones, A. M., Koolman, X., & van Doorslaer, E. (2006). The impact of having supplementary private health insurance in the use of specialists. Annales d’Economie et de Statistiques, 83–84, 251–275.

Kaestner, R., & Khan, N. (2012). Medicare part D and its effect on the use of prescription drugs, use of other health care services and health of the elderly. Journal of Policy Analysis and Management, 31, 253–279.

Kiil, A. (2011a). Determinants of employment-based private health insurance in Denmark. Nordic Journal of Health Economics, 1, 1–47.

Kiil, A. (2011b). Private health insurance in a universal tax-financed health care system—An empirical investigation. PhD thesis, University of Southern Denmark. Retrieved September 11, 2015, from http://www.kora.dk/media/339382/aki_private_health_insurance.pdf.

Kiil, A. (2012). Does employment-based private health insurance increase the use of covered health care services? A matching estimator approach. International Journal of Health Care Finance and Economics, 12, 1–38.

Kiil, A., & Pedersen, K. M. (2009). The Danish survey of voluntary health insurance 2009. Data documentation: Population, design, and descriptive statistics (Working paper), University of Southern Denmark.

Larsen, B. (2013). Briller og kontaktlinser [Glasses and contact lenses]. Retrieved February 16, 2016, from http://www.netdoktor.dk/ojne/briller_linser.htm.

Leuven, E., & Sianesi, B. (2003). PSMATCH2: Stata module to perform full Mahalanobis and propensity score matching, common support graphing, and covariate imbalance testing. Version 3.1.5. Retrieved April 29, 2011, from http://ideas.repec.org/c/boc/bocode/s432001.html.

Manning, W. G., Newhouse, J. P., Duan, N., Keeler, E., Benjamin, B., Leibowitz, A., et al. (1987). Health insurance and the demand for medical care: Evidence from a randomized experiment. American Economic Review, 77, 251–277.

Manski, C. F., & Pepper, J. (2000). Monotone instrumental variables: With an application to the returns to schooling. Econometrica, 68, 997–1010.

Nocetti, D., & Smith, W. T. (2010). BE Journal of Economic Analysis & Policy, 10(1).

Nyman, J. A., & Maude-Griffin, R. (2001). The welfare economics of moral hazard. International Journal of Health Care Finance and Economics, 1, 23–42.

OECD (2004). Proposal for a taxonomy of health insurance. OECD study of private health insurance (Working document). Paris: OECD.

OECD (2010). Health data: Health expenditure by financing agent/scheme (Data tables). Retrieved May 3, 2011, from www.oecd.org/dataoecd/46/36/38979632.xls.

Pauly, M. V. (1968). The economics of moral hazard: Comment. American Economic Review, 58, 531–537.

Pedersen, K. M. (2005). Voluntary supplementary health insurance in Denmark. Public Finance and Management, 5, 544–566.

Riphahn, R. T., Wambach, A., & Million, A. (2003). Incentive effects in the demand for health care: A bivariate panel count data estimation. Journal of Applied Econometrics, 18, 387–405.

Ruthledge, M. S. (2009). Asymmetric information and the generosity of employer-sponsored health insurance. PhD thesis, University of Michigan, Ann Arbor.

Savage, E., & Wright, D. J. (2003). Moral hazard and adverse selection in Australian private hospitals. Journal of Health Economics, 22, 331–359.

Schellhorn, M. (2001). The effect of variable health insurance deductibles on the demand for physician visits. Health Economics, 10, 441–456.

Schokkaert, E., van Ourti, T., de Graeve, D., Lecluyse, A., & van de Voorde, C. (2010). Supplemental health insurance and equality of access in Belgium. Health Economics, 19, 377–395.

Søgaard, R., Bech, M., & Olsen, J. (2011). Effekten af private sundhedsforsikringer på forbruget af offentligt finansierede sundhedsydelser [The effect of private health insurances on the use of publicly financed hospital services (Report)], Centre for Applied Health Services Research and Technology Assessment (CAST), Odense.

Stabile, M. (2001). Private insurance subsidies and public health care markets: Evidence from Canada. The Canadian Journal of Economics, 34, 921–942.

Statistics Denmark (2009a). Befolkningens brug af internet 2009 [Population internet use 2009]. Retrieved April 29, 2011, from http://www.dst.dk/pukora/epub/upload/14039/it.pdf.

Statistics Denmark (2009b). Various tables from StatBank Denmark. Retrieved August 7, 2009, from www.statistikbanken.dk/statbank5a/default.asp?w=1280.

Statistics Denmark (2010). AKU1: Population (15–66 years) in thousands by labour status, age and sex. BEF05 (18–75). (Data tables). Retrieved April 29, 2011, from http://www.statistikbanken.dk/statbank5a/default.asp?w=1280.

Strandberg-Larsen, M., Nielsen, M. B., Vallgårda, S., Krasnik, A., & Mossialos, E. (2007). Denmark: Health system review. Health Systems in Transition, 9(6), 1–164.

The Danish Insurance Association (2010). Sundhedsforsikringer - hovedtal 2003–2008 [Health insurance—Key figures 2003–2008]. (Data tables). Retrieved April 29, 2011, from http://www.forsikringogpension.dk/presse/Statistik_og_Analyse/statistik/forsikring/antal/Documents/Sundhedsforsikring%20--%20Antal%20forsikrede,%20pr%E6mier%20og%20erstatninger/Sundhedsforsikringer_2009.pdf.

Vera-Hernández, A. M. (1999). Duplicate coverage and the demand for health care: The case of Catalonia. Health Economics, 8, 579–598.

Wilde, J. (2000). Identification of multiple equation probit models with endogenous dummy regressors. Economic Letters, 69, 309–312.

Acknowledgments

The collection of the data used in the article was supported financially by the Danish Health Insurance Foundation (Helsefonden). The paper has benefitted greatly from discussions with Kjeld Møller Pedersen, Tor Iversen, Terkel Christiansen, Kristian Bolin, Lars Peter Østerdal, and participants in the 2010 Nordic Health Economists’ Study Group Meeting in Umeå, the 2011 Danish Symposium in Applied Statistics in Copenhagen and the 8th World Congress on Health Economics (IHEA), 2011, in Toronto. We also gratefully acknowledge the comments of two anonymous reviewers. Any errors are the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Regression results

This appendix contains the regression results underlying the parametric models for which treatment effects are presented in Table 5.

See Table 6.

Appendix 2: Assessment of matching quality and common support

This appendix contains some diagnostics of matching quality for the propensity score matching estimator.

Rights and permissions

About this article

Cite this article

Kiil, A., Arendt, J.N. The effect of complementary private health insurance on the use of health care services. Int J Health Econ Manag. 17, 1–27 (2017). https://doi.org/10.1007/s10754-016-9195-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-016-9195-3

Keywords

- Private health insurance

- Moral hazard

- Health care utilization

- Treatment effects

- Parametric estimators

- Propensity score matching