Abstract

This paper aims to analyze the economy-wide and regional effects of climate change-induced productivity decrease in Brazil. Our methodological framework was based on the General Equilibrium Analysis of the Brazilian Economy Project—PAEGDyn, a dynamic CGE model. The results show that the projected falls in agricultural productivity impose reductions in the performance of Brazilian GDP over time. Even with the use by other sectors of the economy of the factors unemployed in agriculture, there is no intersectoral compensation in economic production over time able to bring it back to the reference trajectory. In addition, the impact will be greater in warmer and poor regions, which depend on agriculture and present greater income inequality, accentuated by the free mobility of production factors within the national border. Therefore, the main implication of this study is the need to allocate scarce resources for adaptation and mitigation policies primarily for these regions, including broadly stimulating economic development with more income distribution. This will allow these regions to protect themselves by making investments in new technologies and modern infrastructure for the agricultural sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The growing demand for goods and services due to the economic growth of the last decades around the globe has caused a significant increase in deforestation, depletion of fossil fuels, emission of pollutants and greenhouse gases (GHG), among other consequences for the stock of the planet´s natural resources that overload the biosphere´s resilience capacity (Riplle et al. 2017; IPCC 2014). This situation has resulted in the process called global environmental change, whose main manifestation is climate change.

In addition, it is widely known that, because agriculture is highly dependent on environmental conditions, mainly temperature, precipitation and soil quality, has become the economic sector most vulnerable to projected climate change for the coming decades (Tol 2018). Therefore, foreseeing these impacts, as well as how they will unfold for the rest of the long-term economy, is essential for the development of effective environmental and economic policies to minimize the negative effects.

The agronomic and economic literature on the effects of climate change in world agriculture is extensive and diverse. Research has increasingly expanded its scope, mainly in terms of models and databases used, the prediction of future climate scenarios, types of factors to be considered (CO2 level, rainfall change, etc.), the adoption of adaptation and mitigation policies, accompanying the degree of technological advancement, time horizons, regions considered, types of culture evaluated, prediction indicators (such as income groups most affected, for example) and so on. In this sense, research has been carried out to understand environmental and biophysical impacts on economic variables (GDP, income, prices, etc.), given the importance of the agricultural sector to the world economy, especially to poor countries.

This discussion has great relevance in Brazil, which is one of the most important players in the international agricultural products market. Analysis related to the country is highlighted by typical regional and sectoral issues due to its territorial extension and the expressive differences of climate, soil, type of predominant cultures, distinct technological patterns and other economic differences among Brazilian regions (Zilli et al. 2020; Domingues et al. 2016).

Considering that Brazil will play a fundamental role in guaranteeing the food supply to the world population in the coming decades, investigating the economic effects of changes in agricultural productivity resulting from climate change is highly relevant. In this regard, according to a recent report by the Brazilian Agricultural Research Corporation (Embrapa 2018), global food production increases of approximately 35% until 2030 are required. In this case, it is expected that Brazil should play a central role in this process by guaranteeing a significant portion of food production.

According to this same report, in the last five decades, the country has changed from being a food importer to one of the most important producers and exporters of food in the world, feeding approximately 1.5 billion people worldwide. The benefits of this turn-around have enabled more affordable prices for consumers, increased income and job creation, and boosted the percentage of agriculture participation in Brazilian GDP. Between 1977 and 2017, grain production, which was 47 million tons, grew more than five times, reaching 237 million, while planted areas increased by only 60%. The total area of land occupied and in use in Brazil is approximately 30%. In the 2016/2017 harvest, the country achieved its record grain production, ensuring domestic supplies and generating exportable surpluses for more than 150 countries on all continents (Embrapa 2018).

Given this scenario, investigating the impacts and economic consequences of climate change foreseen for the coming decades is essential for mapping the possible trajectories of selected indicators for each major region in the country and other countries in the world. It is intended to contribute to the elaboration of climate policies that guarantee the continuity of the high standard of Brazilian agricultural sector performance, as well as its feedback effects in relation to other regions in the world. The inevitable consequences of this phenomenon on sensitive issues should be highlighted, especially regarding regional development, income inequality and global food security, as previously pointed out by other studies (Zilli et al. 2020; Tol 2018; Nelson et al. 2014).

However, we want to emphasize that methodological advances still need to be made, since there are few projects in Brazil that use regionalized data that are connected with the rest of the world through dynamic computable general equilibrium (CGE) models and consider estimates of impacts on agricultural productivity due to climate change as inputs. This is one of the contributions that this paper intends to offer to the literature: to produce projections of the economic effects of climate change based on a global dynamic CGE model—PAEGDyn, linked to the GTAP (Global Trade Analysis Project), to assist in the analyses and propositions of economic, technological and adaptation policies.

Therefore, the objective of this paper is to evaluate the trend of the economic impact of the estimated changes in agricultural productivity for the coming decades by using a dynamic CGE model for the five major Brazilian regions and seven other regions, including all other countries in the world.

The paper is structured in five sections. After this introduction, the second section presents a brief literature review. In the third section, the economic model, the database and the simulation are described. The fourth section discusses the results. The last section summarizes the main conclusions and presents some policy recommendations.

Literature review

The long-term impacts of climate change on agricultural productivity in Brazil, as well as in the world, using typical agronomic models are well documented in the literature. There are significant differences with respect to the level of modeling sophistication, agricultural crops and selected regions, and of course, the estimated magnitudes are still widely debated. In any case, it is the existing estimates that subsidize the complementary investigations, especially those of economic nature.

Rosenzweig et al. (2014) used a typical agronomic approach, i.e., global gridded crop models (GGCMs), to measure the impacts of global climate change on the production and productivity of important agricultural crops. Comparing the results of seven different models, the authors highlighted their sensitivity to structural differences and parameterization. Zhao et al. (2017) report results from various publications using different analytical models and show that independent methods consistently estimate the negative impacts of temperature increases on agricultural yields at the global and regional levels. The authors suggest that research and extension programs at the regional level be expanded with the objective of elaborating effective adaptation strategies to the expected impacts.

According to Nelson et al. (2014), the results of climate change impacts on agriculture from a series of economic models are shown, especially those referring to general equilibrium. Although there are differences in the choice of parameters and in the specification of these models, there is a certain convergence of results. The endogenous responses of economic models distribute the effects of climate change on economic variables. On the one hand, the negative effects on productivity lead to higher prices, but on the other hand, they activate more effective management practices, expansion of planted areas, reallocation of resources through international trade and reduction of consumption, especially in poorer areas. Therefore, knowing the differences and magnitudes of these effects are crucially important because of unfolding issues for human well-being.

Pires et al. (2016) and Zilli et al. (2020) analyzed the biophysical effects of climate change in Brazilian agriculture. In the first study, the authors used two mechanistic gridded crop models (the Light Use Efficiency Model—LUE and the Integrated Model of Land Surface Processes—INLAND) to evaluate the “soybean productivity in Brazil after climate change” considering different cultivars and plant dates in the double cropping systems (Pires et al. 2016, p. 286). In the second one, projections of climate change impacts on Brazilian soybean and maize production were carried out using the Global Biosphere Management Model (GLOBIOM-Brazil), a partial-equilibrium model that integrates “land-use competition and biophysical and economic aspects” (Zilli et al. 2020, p. 139384–1). The researchers conclude that there will be a reduction in Brazilian agricultural production and productivity in climate change scenarios. According to Pires et al. (2016, p. 286), “(…) short-cycle cultivars planted in late September, typically sowed by farmers who chose to grow two crops in the same agricultural calendar, may dramatically decrease”. Zilli et al. (2020, p. 139384–1) concluded that the reduction in soybean and maize production will be greater in the Cerrado region, causing “(…) southward displacement of agricultural production to near-subtropical and subtropical regions of the Cerrado and the Atlantic Forest biomes”.

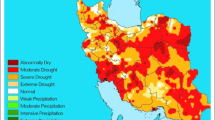

According to Cunha et al. (2015), in general, studies on Brazilian agriculture suggest that the effects of climate in the agricultural sector will be very different among regions. The studies identify the North, Northeast and part of the Midwest as the most vulnerable to climate change effects. On the other hand, municipalities located in the Southern Brazilian regions could benefit from the higher temperatures projected by climatological models. These evidences were demonstrated by Assunção and Chein (2016). According to the authors, the effects of climate change on the Brazilian agriculture sector impact will be very heterogeneous in the country. Therefore, “climate change is likely to increase regional disparities across Brazilian states and municipalities because the most affected areas are those that already show lower productivity” (Assunção and Chein 2016, p. 598).

In Ferreira Filho and De Moraes (2015), a static computable general equilibrium (CGE) model is used to evaluate the impacts of climate change on the Brazilian economy. Different models of income, capital mobility and endogenous investment were considered in the model, which gave it a long-term character, but static. The criteria used to simulate the impacts of climate change on agriculture are based on the concepts of viable agricultural areas or the loss of viable areas due to changes in climate. The most important result is the confirmation that the currently hottest and poorest regions will be most affected, with a reduction in workforce via migration. Therefore, the inevitable prediction is that, ceteris paribus, there will be a worsening effect on regional inequalities in Brazil.

Finally, Faria and Haddad (2017) developed an EGC model to evaluate the economic impacts of climate change scenarios on the Brazilian economy. The model has a broad specification of land use, “a factor directly related to the potential performance of agricultural products subject to external shocks” (Faria and Haddad 2017, p. 1750002–3). The results show that, in the short term, climate change does not compromise the Brazilian position in the international agricultural commodities market. However, internally, as the simulations consider longer periods of time and more pessimistic climatic scenarios, “the real GDP has increasingly stronger negative variations”, causing welfare reductions (Faria and Haddad 2017, p. 1750002–29). According to the authors, the economic sector most negatively affected will be agriculture, with the main losses occurring in the soybean, maize and coffee production chains.

These results generally indicate that, in the absence of more intensive adaptation and mitigation measures, climate change may represent a greater risk for historically underdeveloped or newly developed regions. This is one of the most important reasons for its scientific understanding and priority in terms of economic and climatic policy, although there may be controversies regarding the real net effect in worldwide terms in the long run, as discussed by Tol (2018).

Overall, the studies mentioned above summarize what has been most used in empirical strategies: (i) partial equilibrium models, usually with the estimation of a typical production function or agronomic approaches; and (ii) general equilibrium models of static structure. Other important constraints in the literature are the low use of change estimates in productivity as inputs, more regionalized and disaggregated data in economic sectors of Brazil and in the rest of the world. Thus, our paper intends to point out possibilities for overcoming these limitations. As mentioned in the previous section, a global dynamic CGE model was used, focusing on the five Brazilian regions, using the projections of changes in agricultural productivity as inputs to measure the effects of economic overflow. In the next section, the methodology used is explained in detail.

Methodological framework

The general equilibrium analysis of the brazilian economy project (PAEG)

To determine the economic impact of the estimated productivity changes in agriculture due to climate change, PAEGDyn—a multiregional dynamic recursive version of the static PAEG model built on the GTAPinGAMS programming—was used in this paper. Methodologically, it is a significant advance in the literature, based on partial equilibrium econometric models or on static models of general equilibrium.

The original version of the General Economic Analysis of the Brazilian Economy Project (PAEG) is a static, global, multiregional and multisector computable general equilibrium model constructed for analyzing the Brazilian economy in a regional way, each of the five major regions represented by a structure of intermediate and final demand composed of selected sectors, as well as public and private expenditure on goods and services. It is a model that allows the study of the effects on technological changes in the agricultural sector (Teixeira et al. 2013). It is fully integrated with the Global Trade Analysis Project (GTAP) model and database, version 9.

PAEG has the basic structure of the GTAPinGAMS model, originally created by Rutherford (2010). GTAPinGAMS was elaborated as a nonlinear complementarity problem in the GAMS (General Algebraic Modeling System) programming language. In GTAP, the world is divided into regions, typically representing individual countries, and the final demand of each region is made up of private and public expenditure on goods and services. Therefore, the database encompasses a complete set of bilateral trade flows, including transport costs, export taxes and tariffs, and matched national input–output matrices (a full description of GTAP is presented in Hertel 1997).

In general, the CGE models assume the structure of a Walrasian competitive economy. The basic assumption is that in this economy, there are three main agents: firms, families and governments that produce, consume goods, services and factors, and pay taxes in national and international markets. PAEG, as well as its dynamic version, PAEGDyn is based on the neoclassical microeconomic presuppositions for agent behavior: the representative consumer seeks to optimize the well-being subject to a budget constraint, and the productive sector combines intermediate inputs and factors to minimize costs, given the technology (the microeconomic closure rules of PAEG are well documented in Teixeira et al. 2013).

By hypothesis, preferences are continuous and convex, resulting in continuous and homogeneous demand functions of degree zero in relation to prices, that is, only relative prices can be determined. On the firm side, technology is represented by a production function with constant returns to scale, meaning that firms' economic profit is zero in equilibrium, acting in perfectly competitive markets.

In this way, three essential conditions of database consistency can be enumerated: market equilibrium (supply equal to demand for all goods and factors); income balance, net income equal to the net expense for each economic agent, and finally, income is exhausted by productive units, given a set of identities that apply to each of the productive sectors: economic profit equal to zero.

The macroeconomic closure rules impose the distinction between the static and dynamic models, characterizing the use of PAEGDyn in this paper. Thus, it was necessary to specify the parameters that controlled capital accumulation and depreciation in the model. As it is a recursive dynamic model, these parameters showed the greater or lesser intensity of the changes from year to year. Investment and capital stock follow mechanisms of accumulation based on pre-established rules associated with the expected rate of return and capital stock depreciation. Thus, the investment made generates the capital stock in the period by means of accumulation standard rule discounted depreciation.

The initial specification was a depreciation rate of 5% for all regions annually. The annual investment return rate considered was 5% for the rich regions (United States of America, European Union, and Brazilian Southeast and South) and 15% for the other regions (Table 1, in the next section, presents the regions considered in the model). Initial capital was defined as the capital factor income in all regions. That is, the initial capital base according to the GTAP 9 database. The initial GDP is the sum of the values of private consumption with government consumption and the production value of capital goods (investment) plus the sum of net exports values in the first period. The initial values are calculated and adopted as a static version balance benchmark.

The investment was considered exogenous in the static PAEG. In PAEGDyn, it is endogenous and varies in the same proportion to consumption; that is, there is a marginal propensity to save constantly in the economy, and savings equals investment (neoclassical hypothesis). The investment price is specific to each region and is determined in the savings / investment market. Private demand is separate for Brazilian and non-Brazilian regions. The regional representative agent consumes the commodity denoted by the price pw (welfare level) and receives as income the allocation of factors.

Parameters were also created to express the increase in labor supply, labor productivity, land productivity, capital productivity, factors productivity and GDP growth relative to 2011. The increase in labor supply is specified with growth rates for the subsets of rich, European, middle-income and poor regions. From year 2, the annual growth rate of the rich regions was 0.5% (North American Free Trade Agreement—Nafta and Brazilian Southeast); for the countries in the European Union, it was 0.2%; middle-income regions, it was 1% (Brazilian Midwest and Brazilian South); and poor regions, it was 1.5% (Brazilian North, Brazilian Northeast and Rest of the World). For labor productivity, an annual growth rate of 1% was adopted. For capital productivity, annual growth is given at 0.75% for rich countries and 1% for others. For land productivity, the rate was 0.5% for the rich ones and 1% for others. Factor productivity is compounded by the variation in productivity of each factor. For the labor factor, productivity varies by the product of its rate of supply and productivity. In terms of GDP growth relative to 2011, annual growth rates are those occurring up to 2017 and those projected from 2018 are as follows: an average of 3% for the Brazilian regions; 2.5% for the United States and European Union countries; 6% for China; and 3% for others. These rates were taken from the World Bank Global Economic Prospects (World Bank 2018) document by 2021 and extrapolated until 2050.

Teixeira et al. (2013), Rutherford (1999) and Hertel (1997) present a complete exposition of the behavioral and equilibrium equations of the PAEG base model and its original sources: GTAP and GTAPinGAMS. The equations guarantee the presence of market equilibrium for all goods and factors, the balance of income of economic agents and the existence of zero profit conditions, according to the assumptions of the model.

In this sense, it is worth noting that the construction of a computable general equilibrium model also includes the attribution of functional forms to the economic agents, so that, presumably, they represent their behavior in the revenue generation, as well as the expenditure flows of the data matrix. The purpose is that the values expressed in these flows result from the optimal behavioral actions of the model agents.

Thus, the structure of the optimization problems of each economic agent, the respective technological decision tree and the equations derived from the equilibrium conditions of this study are exactly the same as the standard PAEG model. All parameters of substitution elasticities at each level of choice of the technology trees are taken from the GTAP version 9 database (Aguiar et al. 2016).

Regional and sectorial aggregation and database

The aggregation of PAEGDyn regions was organized to emphasize Brazil's main trading partners—USA, China and the European Union—and the country's regional division—North, Northeast, Midwest, Southeast and South (the remaining four global regions followed the aggregation proposed by the GTAP). In sectoral terms, the aggregation simultaneously met three requirements: considering the most important agricultural production chains in terms of Brazilian production and exports; the sectoral division of GTAP, to which PAEGDyn is linked; and the changes in agricultural productivity projected by Assunção and Chein (2016) and Nelson et al. (2014), which were used as shocks in the model.

Therefore, the model considers five sets of crop products (rice, corn and other cereals, soybeans and other oilseeds, sugar cane, sugar beet, and other agricultural products); two livestock products (meat and live animals, milk and milk products); the industrial sector (sugar industry, food products, textile industry, clothing and footwear, wood and furniture, paper, pulp and printing industry, chemical, rubber and plastics and the rest of the manufactured goods); and the service sector (industrial and utility, construction, trade, transport and other services, as well as public administration) (Table 1).

In addition to the five Brazilian regions, the aggregation includes Mercosul (Mercado Comum do Sul) countries (Argentina, Uruguay and Paraguay). The other Latin American countries form another region, called “Rest of America”. The United States is a single region, and Canada and Mexico are known as the “Rest of Nafta” (North American Free Trade Agreement). With regard to the European Union, 25 member countries are included, without considering the entry of the last three countries (Bulgaria, Romania and Croatia), but do not exclude the United Kingdom. China is also treated as a region, and the other countries contained in the GTAP database are considered the “Rest of the World”. Consequently, there are 12 regions, 19 sectors, and 3 production factors (land, labor and capital).

The PAEGDyn model uses a Brazilian interregional IO table compatible with GTAP 9 for 2011 as a reference for model calibration. The standard PAEG code, written in MPSGE (Mathematical Programming System for General Equilibrium), has also been modified to be adapted for the dynamic model and required shocks. The MPSGE, developed by Rutherford (1999), is a programming language developed to solve economic equilibrium models of the Arrow-Debreu type, using the GAMS programming language as the interface and allowing access and modification of both the database and the basic model of GTAP, according to the purposes of the research to facilitate the formulation and solution of computable general equilibrium models, MPSGE elaborates them as a mixed complementarity problem—MCP).

Simulation

This paper situates itself in the body of work that takes climate change expectations for the next decades as a precondition in seeking to measure its likely costs to the economy. More specifically, it is sought to estimate the impacts on macroeconomic variables, in terms of long-term trajectory deviation due to the expected variations in agricultural productivity. The scenario implemented in this paper is presented in Table 2.

We adopted the Representative Concentration Pathway (RCP) 8.5 from IPCC–AR5 (IPCC, 2013). This scenario considers global GHG emissions from the energy, industry, agriculture, and forestry sectors (Riahi et al. 2011). Although it is a very pessimistic scenario, it is the one that best represents the GHG emissions observed in the period from 2005 to 2014 (Fuss et al. 2014). Moreover, we choose it because, according to Pires et al. (2016, p. 288), it “(…) provides a very comprehensive description of land use change until the end of the twenty-first century, including the representation of transition from primary land to cropland, pasture, urban areas and also the shift from all of these previous uses to the others”. We considered a time horizon of just over 30 years, until 2050, the forecast period commonly used in the literature. The transition to the second half of the twenty-first century is considered a marker of long-term measurements in this field, and 30 years is the period used by the World Meteorological Organization (WMO) to define and predict climatic conditions.

Thus, we calibrated a basic model of the predicted behavior of the Brazilian economy, integrated with other regions of the world in order to generate the trajectory of the reference dynamic balance over the years of the selected economic variables, without productivity shocks and denominated BAU (business as usual) scenarios. Then, for comparison and impact simulations, the scenario with shocks in the productivity of the main agricultural crops in several world regions were simultaneously included, the climatic change shock factor, called the SHK scenario.

In practice, these shocks were implemented in the respective production functions within the model code, and thus, they triggered chain consequences across economic activity over time. In addition, it was considered that these changes in productivities would be completed at the end of the cycle (2050). Therefore, the shocks were implemented in the respective production function gradually over the forecast period, following the pattern shown in Table 3. In other words, the average shock for each crop and region projected in Table 2 for the relevant time horizon was diluted annually in the model, starting in 2021, with a 1/30 fraction per year, until the average total shock was completed in 2050.

The macroeconomic variables chosen to measure the behavior of the economies were the gross domestic product (GDP) and aggregate household consumption, which are indicators of well-being and the consumer price index (CPI). It should be noted that the first two variables tend to grow in the BAU scenario, given the parameterization of the model shown above. Accordingly, the negative (or positive) impacts of the implemented shocks are relative reductions (increases) of SHK in relation to BAU, so they should not be read as an absolute decrease (increase) of a particular variable but as a growth deceleration (acceleration).

Results

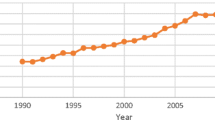

The following results (Fig. 1–3) show the trajectory of the selected macroeconomic variables for the 12 studied regions using PAEGDyn, as described in the previous section. As in the dynamic-recursive model, the SHK scenario must be prepared to reproduce the historical pattern of the variables before the shock, and the pre-2021 trajectory, as predicted, was identical for all variables in all regions; therefore, the results will be shown only from 2020.

Figure 1 shows the central results of this paper, considering that GDP is the main aggregate indicator of the regional economic activity. As presented by Yalew et al. (2018, p. 14), “the economy-wide (…) analysis shows that climate change reduces agricultural output, increases agricultural price, alters the international trade mix, and profoundly affects households’ welfare”. In this context, our first main result is that the projected falls in agricultural productivity for the next decades in the most pessimistic scenarios impose reductions in GDP performance, and in some cases, assume a marked downward trajectory, including especially three Brazilian regions. Even with the use by other sectors of the economy of the primary factors now redundant, there is no intersectoral compensation in the production of the economy over time able to bring it back to the reference trajectory. That is, if nothing were done about the damages of climate changes in agricultural productivity, there would be a downward bias for economic activity.

At the regional level, it can be inferred that there are roughly three sets of regions, divided by the performance of their economies: the first group is composed only of the Southern Brazilian region, with an upward bias in the trajectory of its GDP. This differentiated result can be explained by the fact that the Brazilian IO table is disaggregated for the five large Brazilian regions and the model allows for the mobility of the primary factors among them, not only sectors within the same region, as it happens in the others. Therefore, because it is geographically located in the south of the country, with a temperate climate, agricultural activity in this region tends to benefit (or be less affected) by gradual increases in temperature (as seen in Tables 2 and 3), a pattern that tends to occur worldwide, according to the abundance of literature. Therefore, capital and labor unused in other Brazilian regions due to a fall in agricultural production, migrate to the South, not only compensating for the inter-sectorial loss in the latter but also increasing its GDP. Such a result may be evidence that the existence or degree of factor mobility among regions or countries is important to understand or even minimize the economic results of climate change in certain regions.

Yalew et al. (2018) obtained similar results by studying the effects of climate change-induced agricultural productivity in Ethiopia’s economy using a CGE model. When they considered shocks to the mobility of labor supply, the economic performance of the benefited regions significantly improved. According to the authors, the positive effects could be even greater “if the future generation of labor force is directed towards professional and technical occupations” (Yalew et al. 2018, p. 12).

The second group is composed of seven regions: SDE, RMS (rest of Mercosul), USA, RNF (remainder of Nafta), ROA (rest of the Americas), EUR (European Union) and ROW. The results of these groups are characterized by a small deceleration of GDP growth, up to 2% more at the end of the period, with RMS, USA, RNF and EUR actually shifting even further during the stabilizing trend at the end. The other three regions of the group show a downward slope at the end of the period. As such, once again, the four least affected regions present colder climates and represent developed regions, except RMS (but also cannot be considered poor countries).

In Zilli et al. (2020), there is an interesting summary of the main economic and regional migration impacts of climate change on Brazilian agriculture and the possible adaptation strategies for the main crops. Using the RCP 8.5 scenarios for 2050, as in our study, the authors demonstrated that “(…) cropland expansion will occur mostly in central-southern Cerrado, southern Atlantic Forest and Pampa regions” (Zilli et al. 2020, p. 139384–5), i.e., Southern Brazilian region will benefit.

The third and last group are formed by the regions that lose most in GDP growth in the simulation exercise: NOR (Brazilian North), COE (Brazilian Midwest), NDE (Brazilian Northeast) and CHN. This result may be explained by considering that Brazilian regions have estimated losses in productivity disaggregated and high dependence on agricultural activities, as well as an inability to count on greater positive effects of economic activity that occur in more aggregated units (such as a country or block of countries), and the negative interregional migratory effect mentioned above. In the case of China, the result was to be expected, although it did not have the greatest losses in productivity, since it is one of the greatest agricultural powers in the world, incurring considerable relative losses in consumption and an increase in domestic prices.

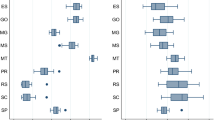

Next, the findings for household consumption are presented in Fig. 2. These results can also be taken as an indicator of the evolution of the population's welfare. We can observe that regional welfare reflects, in terms of trend, the same behavior of GDP, that is, of long-term growth reduction. This was to be expected, considering the high share of this component in the GDP formation of these regions (average of 60%). In this sense, it is more correct to say that the GDP trajectory will be strongly determined by the type of consumption trajectory due to the climatic effects in agriculture. It is noteworthy that, of course, the South Brazilian region is again an exception, for the same reasons presented above, since with greater use of factors there is a greater income payment that stimulates consumption.

Effects of projected decrease in Brazilian agricultural productivity on regional consumption (or welfare) by 2050. The vertical axis unit (Δ%) represents the negative (or positive) effects of the implemented productivity shocks relative to BAU scenario, i.e., a deceleration (acceleration) of consumption (or welfare) growth

However, two details can be highlighted: China showed a deviation in consumption growth (− 3%) lower vis-à-vis GDP (− 4%) at the end of the period (in 2050), which may be justified by lower participation of household expenditures on national wealth, making the other agents more responsive to variations in GDP. The COE and NOR regions, on the other hand, showed greater welfare deviations (− 5% and − 7%) and higher vis-à-vis GDP (− 4% and -6%) at the end of the period, which means that the families had a relative loss to other agents (government and external sector) in the composition of the national wealth, implying an aggravation of the families situation in these regions (with a downward trend), certainly due to their greater economic dependence on the agricultural sector. The other regions maintained deviations within similar intervals in the two variables.

Figure 3 shows the deviation along the shock horizon for the consumer price index. The SUL, USA, RNF and EUR regions achieved a slight positive deviation, and the Southeast region achieved a negative deviation, with variations in the interval between 0.5% and − 0.5%, tending to stabilize over time. This behavior of prices is consistent with the GDP and consumption trajectory seen above for these regions, since they exhibited more favorable performances vis-à-vis the others, mainly due to the attractiveness of their other economic sectors, impacting less on the prices. Although it was fairer to place the Southeast region in a sort of “imaginary threshold” of this group, this was because it is possible to see clearly its position slightly below the group standard. This is due to the economic dynamism of the region: it loses much with the agricultural shock but also gains with the increase of production and demand in the other sectors.

Effects of projected decrease in Brazilian agricultural productivity on regional Consumption Price Index by 2050. The vertical axis unit (Δ%) represents the negative (or positive) effects of the implemented productivity shocks relative to BAU scenario, i.e., a deceleration (acceleration) of Consumption Price Index growth

At the extremes are China and the Rest of Mercosul with rising prices and the North, Northeast and Midwest of Brazil with a downward slope. In the first case, there appears to be a proportionally greater increase in demand, which can be explained by the size of the Chinese economy and the lower share of consumption in GDP; by the proximity and already existing commercial partnership among RMS and the Brazilian regions that may have increased the demand through imports, including for being a common area of commerce. This is a point that deserves further detailed investigation, which the authors intend to address in a future article, as well as other commercial and sectoral developments suggested by the results. ROW and ROA presented slight upward trends, remaining in an intermediate zone.

Faria and Haddad (2017), using a long-term CGE model to measure the effects on the Brazilian economy of climate change on land use, found similar aggregate results for the three indicators considered here: reduction in GDP, reduction in welfare and increase in price index for the most affected regions. According to the authors, “the real GDP had increasingly stronger negative variations as the time periods became more distant (Faria and Haddad 2017, p. 1750002–29). As in our study, Faria and Haddad (2017) concluded that the Brazilian poorer regions will have greater negative impacts on their economic activity levels. The authors also identified additional adverse effects, e.g., the increase in the conversion of legal reserve forest to agriculture use. This consequence has the potential to cause even more climate change (Pires et al. 2016), aggravating the negative impacts on the economy that we demonstrated in the present study.

These findings for the variations in consumer prices, with the highest deviations from prices in CHN, RMS, NOR, NDE, COE and also in ROW and ROA (although with less intensity), together with the previous evidence, seem to suggest two blocks of regions most affected by the productivity shock due to climate change: (i) the seven mentioned; and (ii) the others of the model: SUL, SDE, USA, RNF and EUR. Thus, it is easy to see that, roughly speaking, the two characteristics that distinguish these two groups are exactly the climate and income level. The aggravating circumstance is that these countries with a tropical climate, in addition to having lower per capita income, usually include a high dependency on agriculture in the formation of household income and high-income inequality, with the income of the poorest people highly sensitive to the behavior of the price of agricultural products.

Therefore, the movements likely to occur are as follows: (i) temperature increases will favor temperate countries up to a certain limit or, in other cases, more extremely, less harmed, but countries with a tropical climate will be more harmed. Put in another way, the warmer the region, ceteris paribus, the more impaired by the increase in temperature; (ii) because of the expected increases in prices of basic necessities and since there is a larger concentration of lower-income populations in tropical countries who depend on agriculture produce for income, these will probably be the most affected classes. Consequently, it is very likely that there will be an increase in inter- and intracountry income inequality.

Actually, this trend has been recurrently reported in the literature. According to Tol (2018), for at least three reasons, developing countries would be more vulnerable to climate change: (i) the central importance of agriculture and natural resources in economic activity as rich countries, to some extent, can rely on their other manufacturing and service sectors to protect themselves; (ii) since poor countries are already located in hot places and therefore close to their biophysical limits, there will be no technological pattern to emulate, while rich countries will have already accumulated technical know-how; and, finally, (iii) poor countries tend to have limited adaptation capacity due to a number of factors such as availability of technology, capital for investment and innovation, lack of institutions and modern and adequate infrastructure (insurance market, irrigation system, etc.).

However, it is worth remembering that the estimates of reduction in agricultural productivity for the next decades used in this study do not consider possible adaptive and mitigating measures that would reduce or even reverse the expected losses (it therefore represents a measure of the economic cost of not implementing adaptive and mitigating measures). Faria and Haddad (2019), for example, showed that the positive changes in agricultural productivity in Brazil in the period between 2008 and 2015 (more intensive use of machines, better credit conditions, etc.), effectively aiming to mitigate the consequences of climate change, in general, favored the Midwest and Northeast Brazilian regions, in addition to contributing to the reduction of regional inequalities.

Therefore, the key question for the coming decades is how each region will use the conditions and resources available to adapt. It seems obvious that, especially in developing regions, broadly stimulating economic development with more income distribution will allow them to protect themselves by investing in new technologies and modern infrastructure for the agricultural sector.

Conclusions

The main objective of this paper was to determine the aggregate economic impact of projected changes in agricultural productivity for the coming decades using a dynamic computable general equilibrium model, PAEDyn linked to GTAP, for the five major Brazilian regions and seven selected regions, which includes all the other countries in the world.

It is worth mentioning that the development and implementation of mitigation and adaptation policies in the agricultural sector is in progress throughout the world and the technological progress in agriculture expected in the coming years will certainly reduce the negative effects of simulated shocks, except for the occurrence of environmental catastrophes or large-scale war events. However, for the purpose of a counterfactual exercise of a pessimistic scenario in which nothing was done and as an exercise to open up new possibilities of sophistication in modeling, this paper presents an aggregated regional perspective of the dynamic trend of its economic cost, which would justify expenditures in the neutralizing actions mentioned.

Thus, in accordance with what has been presented in the literature, the preliminary results seem to indicate, in a general way, a more pessimistic scenario of falling productivity, reduction in the pace of economic growth in (1) NOR, NDE, COE, RMS, ROA, CHN and ROW, the most affected, with the characteristics of being warmer countries or regions, having lower income levels and a greater dependence on agriculture and an already existing level of large income inequality, with emphasis on the three Brazilian regions, due to the free factor of mobility within the national border; and (2) SDE, SUL, USA, RNF and EUR on the other hand of the climate spectrum being mainly economic in nature.

Therefore, the derived policy suggestion is to allocate scarce resources for adaptation and mitigation policies primarily for the countries and regions of the first group, including broadly stimulating economic development with more income distribution. This will allow them to protect themselves through the development of other economic activities, boost political-institutional evolution and accumulate sufficient capital for investments in new technologies and modern infrastructure for the agricultural sector.

More detailed research on the role of capital and labor migration and on the evolution of international trade in the final interregional outcome is also suggested. These two factors have the potential to counteract early trends and establish new evidence over time. Obviously, we also recommend further sophistications and refinements of the models, scenarios, and parameters used.

Code availability

Idem.

References

Aguiar, A., Narayanan, B., & McDougall, R. (2016). An Overview of the GTAP 9 Data Base. Journal of Global Economic Analysis, 1(1), 181–208.

Assunção, J., & Chein, F. (2016). Climate change and agricultural productivity in Brazil: future perspectives. Environment and Development Economics, 21(5), 581–602.

Cunha, D. A., Coelho, A. B., & Féres, J. G. (2015). Irrigation as an adaptive strategy to climate change: an economic perspective on Brazilian agriculture. Environment and Development Economics, 20(1), 57–79.

Domingues, E. P., Magalhães, A. S., & Ruiz, R. M. (2016). Cenários de mudanças climáticas e agricultura no Brasil: impactos econômicos na região Nordeste. Revista Econômica do Nordeste, 42(2), 229–246.

Empresa Brasileira de Pesquisa Agropecuária – Embrapa. (2018). Visão 2030: o futuro da agricultura brasileira. Brasília, DF: Embrapa, 212 p

Faria, W. R., & Haddad, E. A. (2019). Modelagem do uso da Terra e Efeitos de Mudanças na Produtividade Agrícola entre 2008 e 2015. Estudos Econômicos, 49(1), 65–103.

Faria, W. R., & Haddad, E. A. (2017). Modeling land use and the effects of climate change in Brazil. Climate Change Economics, 8(1), 1–37.

Ferreira Filho, J. B. S., & de Moraes, G. I. (2015). Climate change, agriculture and economic effects on different regions of Brazil. Environment and Development Economics, 20(1), 37–56.

Fuss, S., Canadell, J. G., Peters, G. P., Tavoni, M., Andrew, R. M., JacksonCiais, P. R. B., et al. (2014). Betting on negative emissions. Nature Climate Change, 4(10), 850–853.

Hertel, T. W. (1997). Global trade analysis: modeling and applications. New York: Cambridge University Press.

Intergovernmental Panel on Climate Change – IPCC. (2014). Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

Intergovernmental Panel on Climate Change – IPCC. (2013). Summary for policymaker, in: Stocker, T., Qin, D., Plattner, G.K., Tignor, M., Allen, S., Boschung, J., Nauels, A., Xia, Y., Bex, V., Midgley, P. (Eds.), Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, pp. 1–27. Cambridge, United Kingdom and New York, NY, USA.

Nelson, G. C., Valin, H., Sands, R. D., Havlík, P., Ahammad, H., Deryng, D., et al. (2014). Climate change effects on agriculture: Economic responses to biophysical shocks. Proceedings of the National Academy of Sciences, 111(9), 3274–3279.

Pires, G. F., Abrahão, G. M., Brumatti, L. M., Oliveira, L. J., Costa, M. H., Liddicoat, S., et al. (2016). Increased climate risk in Brazilian double cropping agriculture systems: Implications for land use in Northern Brazil. Agricultural and Forest Meteorology, 228, 286–298.

Riahi, K., Rao, S., Krey, V., Cho, C., Chirkov, V., Fischer, G., et al. (2011). RCP 8.5 — A scenario of comparatively high greenhouse gas emissions. Climatic Change, 109, 33–57.

WJ Ripple C Wolf TM Newsome M Galetti M Alamgir E Crist MI Mahmoud WF Laurance 15,364 scientist signatories from 184 countries 2017 World Scientists’ Warning to Humanity: A Second Notice BioScience 67 12 1026 1028

Rosenzweig, C., Elliott, J., Deryng, D., Ruane, A. C., Müller, C., Arneth, A., et al. (2014). Assessing agricultural risks of climate change in the 21st century in a global gridded crop model intercomparison. Proceedings of the National Academy of Sciences, 111(9), 3268–3273.

Rutherford, T. F. (1999). Applied general equilibrium modeling with MPSGE as a GAMS subsystem: an overview of the modeling framework and syntax. Computational Economics, 14(1), 1–46.

Rutherford T. F. (2010) GTAP7inGAMS. Center for Energy Policy and Economics, Working Paper.

Teixeira, E. C., Pereira, M. W. G., & Gurgel, A. C. (2013). A Estrutura do PAEG. Campo Grande: Life Editora.

Tol, R. S. J. (2018). The economic impacts of climate change. Review of Environmental Economics and Policy, 12(1), p-4–25.

World Bank. (2018). Global Economic Prospects, January 2018: Broad-Based Upturn, but for How Long? (Advance ed.). Washington, DC: World Bank.

Yalew, A. W., Hirte, G., Lotze-Campen, H., & Tscharaktschiew, S. (2018). Climate change, agriculture, and economic development in Ethiopia. Sustainability, 10(10), 3464.

Zhao, C., Liu, B., Piao, S., Wang, X., Lobell, D. B., Huang, Y., et al. (2017). Temperature increase reduces global yields of major crops in four independent estimates. Proceedings of the National Academy of Sciences, 114(35), 9326–9331.

Zilli, M., Scarabello, M., Soterroni, A. C., et al. (2020). The impact of climate change on Brazil´s agriculture. Science of the Total Environment, 740, 139384.

Funding

This research was funded by Conselho Nacional de Desenvolvimento Científico e Tecnológico—CNPq (Grant Nos. 437907/2016–3, 312975/2017–1 and 305807/2018–8) and by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior—Brasil—CAPES (Finance Code 001). The funding sources had no such involvement in study design; neither in the collection, analysis and interpretation of data; nor in the writing of the report; and in the decision to submit the article for publication.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

No conflict of interest.

Availability of data and material

The datasets generated during the current study are not publicly available due the data source licensing policy (GTAP) but are available from the corresponding author on reasonable request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nazareth, M.S., Gurgel, A.C. & da Cunha, D.A. Economic effects of projected decrease in Brazilian agricultural productivity under climate change. GeoJournal 87, 957–970 (2022). https://doi.org/10.1007/s10708-020-10286-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10708-020-10286-1