Abstract

Over the last few decades, closed-loop supply chain (CLSC) has received increasing attention due to concerns over the environment and social liability. Moreover, recycling and remanufacturing of the used products have been examined because of various factors such as concerns over the environment, lack of resources, government legislations. In this research, we consider a three-echelon closed-loop supply chain consisting of a manufacturer, a third party and a retailer. The manufacturer manipulates both manufacturing from raw materials and remanufacturing from the second hands products collected by third party simultaneously. We assume that the market demand depends on selling price and marketing efforts. First, we modeled the supply chain under centralized and decentralized policies and compared their performances using numerical examples. Then we compared and analyzed the optimal decisions under different scenarios by studying the impacts of marketing efforts and collection rate on the decision variables and concluded that the supply chain profit in centralized scenario is larger than decentralized one. Using a comprehensive sensitivity analysis, managerial insights are provided. Moreover, based on the derived results, from the perspective of remanufacturing process and consumers’ welfare, one can conclude that the manufacture-Stackelberg case is often the most effective scenario in CLSC.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and literature review

Nowadays, because of the environmental and economical advantages of closed-loop supply chain (CLSC), this topic has attracted more attentions in academic topics and industrial applications. CLSC can gain profit by collecting used products from consumers and elicit useful parts and remanufacturing them alongside with manufacturing new products from raw materials (Sasikumar and Kannan 2008). Remanufacturing process utilized in many industries like computers, printer and copier and causes 40–60% saving in production costs through remanufacturing the useful parts of the second hand products (Savaskan et al. 2004). Furthermore, in a forward supply chain, the retailer can promote market demand by marketing efforts such as advertising on product’s characteristics, improvement in brand reputations and furnishing attractive shelf space (Gao et al. 2015; Ma et al. 2013).

In this research, we propose a three-echelon CLSC including a manufacturer, a third party and a retailer. We investigate supply chain performance in different channels under decentralized policy and compare to the centralized one. Moreover, we used Stackelberg under which one firm in a market has greater brand equity or power rather than other firms and is better known and so can act as leader in market and other firms have to subordinate to leader and becomes followers. In Stackelberg game problem, the leader observes decisions of followers and then decides about the best reaction and decisions.

In our model, there are different channel leaderships in industry and each member (manufacturer, retailer and the third party) can have more power and becomes the leader of a market. For example, Toyota and General Motors are giant manufacturers and leader in market and influence on decisions of other supply chain members. In addition, there are some gigantic retailers who have key roles and remarkable power in their market such as Tesco, Gome and WalMart which act as the channel leader. Also nowadays, due to importance of remanufacturing process, giant companies (third parties) oblige other CLSC members to become their followers (Choi et al. 2013).

The purpose of this paper is achieving to response of the following research questions:

-

1.

What are the optimal decisions of supply chain members under centralized and different decentralized scenarios?

-

2.

What are the differences between the optimal decisions of various scenarios under fluctuation of marketing effort and collection rate?

-

3.

What are the marketing effort and collection rate impacts on consumer’s welfare and remanufacturing process?

-

4.

What are the manufacturing and remanufacturing cost impacts on profits of supply chain members?

The aim of our model is studying a centralized supply chain with different channel leaderships to obtain the optimal decisions and related profits and to compare all scenarios analytically. For this goal we consider a three-echelon CLSC with price and marketing effort-dependent demand and compare all scenarios in various markets with different marketing attractions and people’s tendency to restore the used products. Finally, we compare different scenarios from the perspective of remanufacturing process and consumers’ welfare and the impact of the manufacturing and remanufacturing costs on the profits.

The literature review of our research topic includes two streams: pricing in CLSC and influence of marketing effort on demand in supply chain. Also a comprehensive overview of the literature review on CLSC is presented by Guide and Van Wassenhove (2009), Pokharel and Mutha (2009), Atasu et al. (2008) and Govindan et al. (2015).

In the first stream, Savaskan et al. (2004) derived the optimal collection rate and price decisions in a CLSC by analyzing three models for remanufacturing system. They assumed that the used items can be collected by the third party, retailer or manufacturer and three different scenarios are studied. They also compared these models with centralized case and proposed a contract for supply chain coordination. Savaskan and Van Wassenhove (2006) extended pervious research by considering two competitive retailers and single manufacturer and studied optimal pricing and coordination decisions. Huang et al. (2013) developed a hybrid collection mathematical model for a CLSC including a retailer and a third party and compare this case to the centralized one. Furthermore, Hong et al. (2013) studied three types of dual collection scenarios and concluded that the collecting of the second hands products by both manufacturer and retailer simultaneously is the best scenario for their proposed remanufacturing system. Some researcher considered the quality level of used products in remanufacturing process as a decision variable such as Teunter and Flapper (2011), and Maiti and Giri (2014). Choi et al. (2013) studied a three-echelon CLSC pricing and coordination problem under different channel structures and show that the retailer-leader case is the best choice in reverse supply chain. Xu and Liu (2014) studied how the reference price influences the supply chain members’ strategies. Their results confirm when the reference price effect increases, producer and seller profits decrease, while the profit of third party increases. Zhang et al. (2014) developed a dynamic pricing model for a two-echelon SC including a producer and a retailer under two different scenarios. They showed that consumers who are sensitive to the reference price effect conferred benefits in both the centralized and decentralized systems. Giri et al. (2015) developed an integrated quality level and pricing mathematical model in a two-echelon SC by considering a single seller and multiple producers. Liu et al. (2015) applied a deferential game model with focus on the product’s design quality depending on advertising efforts. Wu (2015) considered two-period CLSC consisting of original equipment manufacturers (OEM) and a remanufacturer which competing on prices in sales and recycle markets. Giri and Sharma (2015) extended an integrated manufacturing inventory model in a multi-echelon CLSC including a producer, a seller, a supplier and a collector in which the producing process is imperfect and unhealthy items are repaired. Xiong et al. (2016) analyzed the performance of supplier-remanufacturing and manufacturer-remanufacturing in CLSC and also studied their advisability from different stakeholder viewpoint. Gao et al. (2016) studied the dual channel CLSC under uncertain demand and three different scenarios (Nash game and manufacturer and retailer-Stackelberg game).

The second stream of relevant literature is about researches that focus on influences of marketing effort on market demand. They also presented two contracts under symmetric and asymmetric information for supply chain coordination. Zhang et al. (2012) proposed a dual channel with marketing effort with two substituting products under different channel leaderships (manufacturer-leader, retailer-leader and vertical Nash) with symmetric and asymmetric information. Ghosh and Shah (2012) investigated greening policies in a two-echelon supply chain under different leadership channel by game theory and also obtain the optimal decisions for coordination of supply chain under a two parts tariff contract. Ma et al. (2013) studied the influence of retailer’s sales efforts and producer’s quality efforts on demand in a supply chain under different channel powers. In reverse supply chain, Gao et al. (2015) presented a CLSC where collection rate, selling price and marketing effort affecting the market demand and they analyzed the execution of supply chain under different channel leaderships. Hong et al. (2015) developed a CLSC in which three different scenarios based on the collector of used items who may be manufacturer, retailer and third party. They concluded that the retailer-collector case is the best choice for collecting the used products in remanufacturing system.

According to the above review and to the best of our knowledge, there are very few researches on pricing in a CLSC in which marketing effort is considered too. The main contributions of our work are that this paper investigates optimal pricing decisions in a three-echelon CLSC with price and marketing efforts-dependent demand under three different channel leaderships (manufacturer, retailer and third party leadership) where comprehensive analytical comparisons between the scenarios are performed as well. Also we separate market to three categories based on different marketing effort level and propose best scenario in each market from the perspective of remanufacturing process and consumers’ welfare. Moreover, the best scenario between different cases is proposed from the perspective of remanufacturing process and consumer’s welfare. Table 1 summarizes some noteworthy recent studies in the literature and its contrast to this research.

The rest of this paper is categorized as follows. The model description, mathematical modeling and deriving the optimal decisions under centralized and different decentralized channel leaderships are presented in Sect. 2. In Sects. 3, the optimal decisions in various scenarios are analytically compared. In Sect. 4, numerical examples and sensitivity analysis are performed. In Sect. 5 the managerial insights and finally in Sect. 6 the conclusion and future research directions are presented.

2 Model description

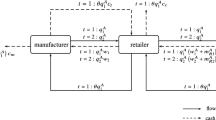

In this research, we develop four mathematical models for a CLSC consists of one manufacturer, one-third party and one retailer. The manufacturer, who incorporating remanufacturing operations into manufacturing procedure, produces the end products directly from raw materials or elicits useful parts of returned items and uses those to produce new items. Then the manufacturer sells new items to the retailer, and the retailer makes profits by setting the unit retail margin on products and selling them to the consumers. Also, the retailer can affect the demand by advertising effort which indirectly influences on the pricing and collecting decisions (Ma et al. 2013). In the backward supply chain, the third party collects used products from consumers and delivers to the manufacturer for remanufacturing process (See Fig. 1).

Parameters

- c m :

-

Manufacturing cost of new product from raw material ($/unit)

- c τ :

-

Remanufacturing cost of products from used products ($/unit)

- Δ:

-

Recycling saving cost, Δ = c m − c τ > 0 ($)

- c θ :

-

Marketing cost coefficient

- c τ :

-

Coefficient investment by the third party to collect used products

- A :

-

Average collecting cost for used products paid by the third party ($/unit)

- Φ :

-

Basic market size

- α :

-

Sensitivity of demand to the retail price

- β :

-

Sensitivity of demand to the retailer’s marketing efforts

Independent decision variables

- w :

-

Unit wholesale price ($/unit)

- b :

-

Unit transfer price which the manufacturer pays to the third party for used products ($/unit)

- m :

-

Unit retail margin ($/unit)

- θ :

-

Marketing effort level

- τ :

-

Collection rate of the third party channel

Dependent decisions variables

- p = w + m :

-

Unit retail price ($/unit)

- D :

-

Market demand

- Π i :

-

Profit of member i

- \(\varPi_{i}^{j}\) :

-

Profit of member i when the member j is the leader of Stackelberg model

Also the notations M, R, 3P, T and C refer to manufacturer, retailer, third party, whole supply chain and centralized case, respectively. The basic assumptions about proposed model are as follows:

-

1.

The market demand linearly depends on marketing effort and retail price, D = Φ − αp + βθ.

-

2.

We suppose that there are not distinctions between new and remanufactured products and all of collected products can be remanufactured and resold (Savaskan et al. 2004; Choi et al. 2013).

-

3.

Unit manufacturing cost is greater than unit remanufacturing cost, i.e., c m > c r .

-

4.

We assume that, Δ > b > A.

Now, based on the assumptions made in the paper, the profits of the manufacturer, retailer and the third party are as follows, respectively.

In the following, we present the centralized CLSC model and three different decentralized CLSC scenarios with different channel power structures, when the manufacturer, the retailer and the third party are Stackelberg leaders, respectively. Also in each section of decentralized scenarios, we first explain the decisions of other members and finally the leader decides about the best decisions according to reactions of other members.

2.1 Centralized model

In the centralized policy, we analyze an integrated supply chain, in which all players simultaneously decide about all decision variables to maximize the total profit of CLSC. So the profit function of this case can be defined as follows:

From Eq. (4), we obtain the following proposition.

Proposition 1

In the centralized channel, if \(c_{\theta } > \frac{{\beta^{2} }}{4\alpha }\) and \(c_{\tau } > \frac{{\alpha^{2} c_{\theta } \left( {\Delta - A} \right)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }}\), then the optimal solutions for the optimization problem of centralized CLSC case are given by;

Therefore, the optimal profit of the centralized supply chain can be derived using Eq. (8).

Proof

See “Appendix 1”.

Lemma 1

The collection rate in different channel leadership and centralized case is between 0 and 1 if \(\frac{{\alpha c_{\theta } (\Delta - A)(\phi - \alpha c_{m} ) + \alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{(4\alpha c_{\theta } - \beta^{2} )}} < c_{\tau }\)

Proof

In Lemma 2, we demonstrate that \(0 < \tau^{M} ,\tau^{R} ,\tau_{1}^{3P} ,\tau_{2}^{3P} < \tau^{C}\), so for proving this lemma, we just need to show that 0 < τ C < 1, so using Eq. (6) we have;

2.2 Manufacturer-Stackelberg model

Stackelberg game is used when one firm in market has greater brand equity or power rather than other firms and is better known, so can act as a leader in market and other firms have to subordinate to leader and becomes followers. In Stackelberg game problem, the leader observes decisions of followers and then decides the best reaction and decisions.

Under the manufacturer-Stackelberg model, the manufacturer has strong channel power rather than the third party and the retailer, and he acts as the leader in the supply chain. In this model, the retailer determines unit retail margin, m, and marketing effort level, θ, and the third party determines collection rate, τ. Then the manufacturer takes the best reactions of the third party, and the retailer decides about the optimal wholesale price, w, and transfer price, b.

Proposition 2

The optimal solutions of the manufacturing-Stackelberg model are given by;

Also the profits of the manufacturer, the third party, the retailer and the CLSC are as follows:

Proof

See “Appendix 2”.

2.3 Retailer-Stackelberg model

In this model, the retailer is Stackelberg leader and other members are followers. First, the third party determines the collection rate, τ, and gives his best reaction to the manufacturer. Then the manufacturer determines transfer price, b, and the wholesale price, w, and gives his best response to the retailer. Finally, the retailer determines the optimal unit retail margin, m, and marketing effort level, θ.

Proposition 3

The optimal solutions of the retailer-Stackelberg model are given by;

Also the profits of the manufacturer, the third party, the retailer and the CLSC are;

Proof

See “Appendix 3”.

2.4 Third party-Stackelberg model

In this subsection, we assume that the third party acts as the channel leader, but two possible scenarios may occur. In the first scenario, because of environmental legislation, the government obliges the corporations to perform remanufacturing, so exerts the third parties to collect the used products. Therefore, the third party has more power in supply chain and determines the transfer price, b, for the manufacturer. In the second scenario, the manufacturer appoints the third party for collecting the used products and so specifies the transfer price, b. In both scenarios, the retailer first gives his reaction to the manufacturer and then the manufacturer gives the best response to the third party.

Proposition 4

The optimal solutions of the first scenario of the third party-Stackelberg model are given by;

Also the profits of the manufacturer, the third party, the retailer and the CLSC are as follows:

Proof

See “Appendix 4”.

In the second scenario, the retailer’s reaction does not including any term containing b, so the manufacturer’s profit function is declining with respect to b. Since, we presume that the manufacturer’s transfer price, b, is equal to the average of collecting price, A, and saving recycling cost, Δ, the unique transfer price of the manufacturer is considered as b = (A + Δ)/2. So, we obtain Proposition 5 as follows.

Proposition 5

The optimal solutions of the second scenario of the third party-Stackelberg model are given by;

Also the profits of the manufacturer, the third party, the retailer and the CLSC are equal to, respectively:

Proof

See “Appendix 5”.

It should be noted that if the conditions in all Propositions are not met, using optimization software we should determine the optimal solutions.

3 Comparative analyses

In this section, we compare the analytical results obtained from centralized and decentralized scenarios in pervious sections to comprehend the influences of different channel leaderships on decisions variables. In all of the following Lemmas, we consider three conditions extracted from Proposition (1) and Lemma (1) that we remind them again in the following Equations.

Lemma 2

The optimal collection rates behaviors in different channel leaderships and centralized case are as follows:

-

1.

\(\tau^{R} < \tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P} < \tau^{C} ,\quad {\text{if}}\frac{{3\beta^{2} }}{4\alpha } > c_{\theta }\)

-

2.

\(\tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P} < \tau^{R} < \tau^{C} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

3.

\(\tau^{R} < \tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P} < \tau^{C} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

Proof

See “Appendix 6”.

From above relationships, the collection rate in centralized scenario is more than all decentralized leaderships cases, because in centralized case, there is an integrated decision-making core that optimizes the profit of whole supply chain.

Lemma 3

The relationship of optimal transfer prices in different channel leaderships is given by \(b^{R} = b^{M} = b_{2}^{3P} < b_{1}^{3P}\).

Proof

See “Appendix 7”.

When the third party is the leader and determines the transfer price, b, prefers to consider a high value for b to gain more profit. In other Stackelberg games in which the manufacturer determines the transfer price, he uses b = (A + Δ)/2. Because if the manufacturer allots a small value for b, the collection rate by third party is decreased and he does not try to collect more used products and the number of collected product for recycling will be decreased. In the other hand, if the manufacturer considers a large value for b, the differences between the manufacturing and remanufacturing costs decrease and remanufacturing process and reverse logistics do not include enough profit for the manufacturer.

Lemma 4

The relationships of optimal wholesale prices of different channel leaderships are as follows:

-

1.

\(w^{M} < w^{R} < w_{2}^{3P} < w_{1}^{3P} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta } \quad {\text{and}}\quad c_{\tau 2} > c_{\tau }\)

-

2.

\(w^{R} < w^{M} < w_{2}^{3P} < w_{1}^{3P} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta } \quad {\text{and}}\quad c_{\tau } > c_{\tau 2}\)

-

3.

\(w^{R} < w^{M} < w_{2}^{3P} < w_{1}^{3P} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\)

Proof

See “Appendix 8”.

The wholesale price, w, in third party leadership-first scenario is more than other decentralized scenarios because when third party assigns a large value of transfer price, b, the manufacturer has to increase w, to offset the remanufacturing process loss.

Lemma 5

The relationships of optimal retail prices of different channel leaderships and centralized case are as follows:

-

1.

\(p^{R} < p_{1}^{3p} < p_{2}^{3p} < p^{M} < p^{C} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta }\)

-

2.

\(p_{1}^{3p} < p^{R} < p_{2}^{3p} < p^{M} < p^{C} ,\quad {\text{if}}\;\frac{{\beta^{2} }}{2\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\)

-

3.

\(p^{C} < p^{M} < p_{2}^{3p} < p^{R} < p_{1}^{3p} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{5\alpha } > c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\)

-

4.

\(p^{C} < p^{M} < p^{R} < p_{2}^{3p} < p_{1}^{3p} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{5\alpha }\quad {\text{and}}\quad c_{\tau 4} > c_{\tau }\)

-

5.

\(p^{C} < p^{M} < p_{2}^{3p} < p^{R} < p_{1}^{3p} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{5\alpha }\quad {\text{and}}\quad c_{\tau } > c_{\tau 4}\)

-

6.

\(p^{C} < p^{R} < p^{M} < p_{2}^{3p} < p_{1}^{3p} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

7.

\(p^{C} < p^{M} < p^{R} < p_{2}^{3p} < p_{1}^{3p} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau 4} > c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

-

8.

\(p^{C} < p^{M} < p_{2}^{3p} < p^{R} < p_{1}^{3p} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > c_{\tau 4}\)

Proof

See “Appendix 9”.

Similar to Lemma 4, since the wholesale price, w, and the retail price, p, affect on each other directly, the retail price, p, in the third party leadership scenario is more than in other cases. Also, because of existence of integrated decision-making process in the centralized policy, the retailing price decreases when the numbers of consumers increase.

Lemma 6

The relationships of optimal marketing efforts of different channel leadership and centralized case are as follows:

-

1.

\(\theta^{R} < \theta_{1}^{3P} < \theta_{2}^{3P} < \theta^{M} < \theta^{C} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta }\)

-

2.

\(\theta_{1}^{3P} < \theta^{R} ,\theta_{2}^{3P} < \theta^{M} < \theta^{C} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\)

-

3.

\(\theta_{1}^{3P} < \theta_{2}^{3P} < \theta^{M} < \theta^{R} < \theta^{C} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

4.

\(\theta_{1}^{3P} < \theta^{R} ,\theta_{2}^{3P} < \theta^{M} < \theta^{C} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

Proof

See “Appendix 10”.

Similar to pervious Lemmas, in most cases, the marketing efforts in the centralized policy are maximum while is minimum in the third party leadership scenario.

Lemma 7

The profit of the centralized supply chain is more than all of different channel leaderships in decentralized policy.

Proof

See “Appendix 11”.

4 Computational and Practical Results

In this section, numerical experiments are used to analysis the results of centralized and decentralize scenarios. The input parameters of Φ = 100, α = 0.15, β = 0.75, c θ = 10, c m = 150, c r = 30, A = 20, c τ = 3000 are considered. The optimal results under the centralized and the decentralized scenarios are shown in Table 2.

The results obtained from the centralized and the decentralized scenarios are shown in Table 1. One can observe that the optimal decisions and profit of each member in the decentralized manufacturer-leadership and the third party leadership-second scenario are approximately equal, because in both scenarios the collection rate and transfer price are obtained equally. Also, the decentralized third party leadership case has the least profit among all scenarios, because remanufacturing process is not an economical system in this scenario and the profit of each member and whole supply chain decreases consequently. Also as expected, the profit of the centralized supply chain is more than all of different channel leaderships in the decentralized policy, because the collection rate increases in this case and remanufacturing process has more ratio rather than manufacturing system. Figure 2a–c show the effectiveness of manufacturing cost, c m , on profits of each member under different channel leaderships.

Also, Fig. 2d shows the influence of manufacturing cost, c m , on profit of whole supply chain under different channel leaderships. Because the manufacturer leadership and the third party-second scenario leadership are very similar, the results of them are approximately similar too and the figures of them coincide approximately. In all figures, by increasing c m , the profit of each member and whole supply chain decreases. Also, in Fig. 2a–c, each member who acts as Stackelberg leader has more fluctuation rather other members by changing the manufacturing cost, c m .

Furthermore, Fig. 3a–c demonstrates the influences of remanufacturing cost, c r , on profits of each member under different decentralized scenarios and also, Fig. 3d shows the effectiveness of remanufacturing cost, c r , on profit of whole supply chain under different scenarios. Similar to Fig. 2, by increasing c r , the profit of each member and whole supply chain diminishes as shown in Fig. 3a–d, but the fluctuation in Fig. 3 is less than in Fig. 2, because the manufacturing system has more ratio rather than remanufacturing process and c m has more effective role rather than c r in supply chain.

5 Managerial insights

In this section, we discuss about remanufacturing process and consumers’ welfare. The importance of remanufacturing process has been recognized widely in recent years; so whatever the collection of used products increases, the environmental concerns descend. Furthermore, consumer welfare is the second important issue in supply chain management. Whatever the retailing price of products in market decreases, the consumers have greater potential to purchase the products and then their welfares increase. For discussing two mentioned issues, we use the results obtained from comparative analysis in Sect. 4.

First, we compare the centralized scenario with various decentralized scenarios. As we expect, in the centralized supply chain, the retailing price is lower than the retailing prices in all decentralized scenarios. On the other hand, the collection rate is bigger in the centralized case and it has the best performance in remanufacturing process too. Thus, the centralized scenario is the best scheme in supply chain, but there is only a viewpoint that if marketing cost coefficient decreases, the retail price of the centralized case increases and becomes larger than the retail price in all decentralized scenarios. The reason of this event can be expressed when c θ is lower than the certain threshold. Moreover, advertising and marketing plays significant role and market demand is more influenced by marketing effort rather than retail price (β has more effect on demand rather than α). So for gaining more profit, the retailing price and marketing efforts level should be larger than the retailing price and marketing efforts level of other scenarios.

Marketing cost coefficient (c θ ) relates to the power and potential of marketing on growth of market demand and sale quantity. Whatever c θ is set at a big value, we need more investing on marketing effort. Now for comparing remanufacturing process and consumers’ welfare level in different decentralized scenarios, we separate marketing cost coefficient to three levels (low, moderate and high). In all cases, each scenario having the bigger collection rate and the lower retailing price is the best one.

-

1.

c θ -low: in this case, we have \(\tau^{R} < \tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P}\) and \(p^{R} < p_{1}^{3p} < p_{2}^{3p} < p^{M}\).

In this case, marketing structure is general and we can increase market demand with little marketing cost. For example, in mobile industry with inexpensive marketing tools such as internet, we can increase market demand. In this situation, the retailer-Stackelberg scenario creates the most welfare for consumers, but in remanufacturing process has lower performance rather than other decentralized scenarios. According to the consumer’s welfare and remanufacturing process having so importance, this scenario is the best one. However, according to mentioned relationships, the third party-leader-first scenario can be considered as a balanced scenario.

-

2.

c θ -moderate: in this state, we have \(\tau^{R} < \tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P}\) and \(p^{M} < p^{R} ,p_{2}^{3p} < p_{1}^{3p}\).

In this case, we need more marketing cost for increasing market demand and marketing tools become slightly professional. For example in computer industry, we need marketing tools such as Internet, banners and hiring smart sales associates. In this situation, the manufacturer-leader case creates more recycling level and also more welfare for consumers so plays the most effective role in CLSC.

-

3.

c θ -high: in this case, marketing infrastructure is so professional and for increasing market demand, a high marketing cost should be paid. For example in automobile industry, we need marketing tools such as mass media (television, radio), preparing attractive shop store and smart sales associates. In this case, we have two different situations depending on recycling investment coefficient.

-

3.1

When c τ is low, we have \(\tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P} < \tau^{R}\) and \(p^{R} < p^{M} < p_{2}^{3p} < p_{1}^{3p}\).

In this situation, the retailer-leader case has the best scenario and the third party-leader-first scenario is the worst scenario.

-

3.2

When c τ is high, we have \(\tau^{R} < \tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P}\) and \(p^{M} < p^{R} ,p_{2}^{3p} < p_{1}^{3p}\).

This case coincides to c θ -moderate state and similarly, the manufacturer-leader case is more effective rather than decentralized scenarios. Also in industry, the marketing and recycling investments are generally high, so this case occurs more than other cases and eventually we expect that the manufacturing-leader scenario becomes more effective rather than other scenarios in CLSC.

6 Conclusions

In this research, we study a pricing problem in a three-echelon CLSC under centralized and decentralized policies and four different channel leaderships (manufacturer, retailer, third party-first scenario and third party-second scenario) with Stackelberg game theory when the demand depends on selling price and marketing efforts. From comprehensive analytical comparisons, we conclude that under different marketing efforts and collection rate investments, the optimal decisions are varied, but the manufacturer-Stackelberg case is often the most effective scenario in CLSC. In other words from the remanufacturing process and consumers’ welfare point of views, the manufacturer-Stackelberg policy has the most collected used products and the least retailing price in some cases.

Also as expected, the profit of centralized policy is greater than decentralized case. Furthermore, numerical example and sensitivity analysis show that by increasing manufacturing and remanufacturing costs, the profit of supply chain decreases, but the impact of manufacturing cost is more than remanufacturing costs. Moreover, the rations of manufacturing and remanufacturing in various supply chains are different. In the decentralized scenarios, the manufacturing has more share of production, while in the centralized case, the remanufacturing system has important role in production process. For future researches, we suggest investigation of competitive manufacturers or multiple retailers in a CLSC. Also, considering multi-period problem, different quality levels for products, two-level marketing effort level and refund policy are very interesting topics for extension of this paper.

References

Atasu, A., Guide, V. D. R., & Wassenhove, L. N. (2008). Product reuse economics in closed-loop supply chain research. Production and Operations Management, 17(5), 483–496.

Choi, T. M., Li, Y., & Xu, L. (2013). Channel leadership, performance and coordination in closed loop supply chains. International Journal of Production Economics, 146(1), 371–380.

Gao, J., Han, H., Hou, L., & Wang, H. (2015). Pricing and effort decisions in a closed-loop supply chain under different channel power structures. Journal of Cleaner Production, 112(3), 2043–2057.

Gao, J., Wang, X., Yang, Q., & Zhong, Q. (2016). Pricing decisions of a dual-channel closed-loop supply chain under uncertain demand of indirect channel. Mathematical Problems in Engineering, 2016, 6053510.

Ghosh, D., & Shah, J. (2012). A comparative analysis of greening policies across supply chain structures. International Journal of Production Economics, 135(2), 568–583.

Giri, B., Chakraborty, A., & Maiti, T. (2015). Quality and pricing decisions in a two-echelon supply chain under multi-manufacturer competition. The International Journal of Advanced Manufacturing Technology, 78, 1927–1941.

Giri, B., & Sharma, S. (2015). Optimizing a closed-loop supply chain with manufacturing defects and quality dependent return rate. Journal of Manufacturing Systems, 35, 92–111.

Govindan, K., Soleimani, H., & Kannan, D. (2015). Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. European Journal of Operational Research, 240(3), 603–626.

Guide, V. D. R., Jr., & Van Wassenhove, L. N. (2009). OR FORUM-the evolution of closed-loop supply chain research. Operations Research, 57(1), 10–18.

Hong, X., Wang, Z., Wang, D., & Zhang, H. (2013). Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. The International Journal of Advanced Manufacturing Technology, 68(5–8), 1851–1865.

Hong, X., Xu, L., Du, P., & Wang, W. (2015). Joint advertising, pricing and collection decisions in a closed-loop supply chain. International Journal of Production Economics, 167, 12–22.

Huang, M., Song, M., Lee, L. H., & Ching, W. K. (2013). Analysis for strategy of closed-loop supply chain with dual recycling channel. International Journal of Production Economics, 144(2), 510–520.

Liu, G., Zhang, J., & Tang, W. (2015). Strategic transfer pricing in a marketing–operations interface with quality level and advertising dependent goodwill. Omega, 56, 1–15.

Ma, P., Wang, H., & Shang, J. (2013). Supply chain channel strategies with quality and marketing effort-dependent demand. International Journal of Production Economics, 144(2), 572–581.

Maiti, T., & Giri, B. C. (2014). A closed loop supply chain under retail price and product quality dependent demand. Journal of Manufacturing Systems, 37, 624–637.

Pokharel, S., & Mutha, A. (2009). Perspectives in reverse logistics: A review. Resources, Conservation and Recycling, 53(4), 175–182.

Sasikumar, P., & Kannan, G. (2008). Issues in reverse supply chains, part II: Reverse distribution issues—an overview. International Journal of Sustainable Engineering, 1(4), 234–249.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: the case of competing retailers. Management Science, 52(1), 1–14.

Teunter, R. H., & Flapper, S. D. P. (2011). Optimal core acquisition and remanufacturing policies under uncertain core quality fractions. European Journal of Operational Research, 210(2), 241–248.

Wu, C. H. (2015). Strategic and operational decisions under sales competition and collection competition for end-of-use products in remanufacturing. International Journal of Production Economics, 169, 11–20.

Xiong, Y., Zhao, Q., & Zhou, Y. (2016). Manufacturer-remanufacturing vs supplier-remanufacturing in a closed-loop supply chain. International Journal of Production Economics, 176, 21–28.

Xu, J., & Liu, N. (2014). Research on closed loop supply chain with reference price effect. Journal of Intelligent Manufacturing. doi:10.1007/s10845-014-0961-0.

Zhang, J., Chiang, W. Y. K., & Liang, L. (2014). Strategic pricing with reference effects in a competitive supply chain”. Omega, 44, 126–135.

Zhang, R., Liu, B., & Wang, W. (2012). Pricing decisions in a dual channels system with different power structures. Economic Modeling, 29(2), 523–533.

Zhao, J., & Wei, J. (2014). The coordinating contracts for a fuzzy supply chain with effort and price dependent demand. Applied Mathematical Modeling, 38(9), 2476–2489.

Acknowledgments

The authors thank the anonymous reviewers for their helpful suggestions that have strongly enhanced this paper. The author would like to thank the financial support from the University of Tehran for this research under Grant Number 30015-1-02. This work is supported by Iran National Science Foundation (INSF).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Proposition 1

The Hessian matrix of Π C is;

To ensure Π C is jointly concave in p, θ and τ, we check that,

Under the above conditions, the Hessian matrix is negative definite and the optimal decision can be obtained through solving the first-order derivatives of Eq. (4) with respect to p, θ and τ.

By solving above equations, Proposition 1 is obtained.

Appendix 2: Proof of Proposition 2

First, we analyze the retailer’s reaction to maximize its own profit. Using Eq. (2), we have the first-order derivatives of ΠR with respect to m and θ and the Hessian matrix of ΠR as follows:

The Hessian matrix of ΠR is a negative definite for all values of m and θ if \(c_{\theta } > \frac{{\beta^{2} }}{4\alpha }\). With solving above equations,

Then, we investigate the third party’s reaction to maximize its own profit. Using Eq. (3), from the first-order derivative of Π3P respect to τ, we have;

The optimal collection rate is derived by setting the first-order derivative of profit function respect to collection rate equal to zero as follows:

After taking the best reactions of the retailer and the third party, the manufacturer by substituting m, θ and τ to own profit, determines optimal wholesale price, w, and transfer price, b. The Hessian matrix and the first-order derivatives of Eq. (1) with respect to w and b are;

and,

The Hessian H is negative definite if \(c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4(4\alpha c_{\theta } - \beta^{2} )}}\).

By setting the first-order derivatives equal to zero, we obtain the optimal w and b and by substituting them into pervious equations, Proposition (2) is obtained.

Appendix 3: Proof of Proposition 3

Similar to the proof of Proposition (2), the best response of the third party for collection rate, τ, is;

Then, by substituting τ into manufacturer’s profit, we obtain Hessian matrix and the first-order derivative of manufacturer’s profit.

The Hessian matrix H is negative definite if \(c_{\tau } > \frac{{\alpha (\Delta - A)^{2} }}{8}\). The optimal w and b, according to the above conditions, are

After getting the reactions of the manufacturer and the third party, the retailer specifies the unit retail margin, m, and marketing effort level, θ. The retailer maximizes its own profit by using the first-order derivatives of Eq. (2) with respect to m and θ and setting them equal to zero. Then by substituting them into pervious Equations, Proposition 3 is obtained.

And the Hessian matrix is negative definite if \(c_{\tau } > \frac{{\alpha (\Delta - A)^{2} }}{8}\) and \(c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{8\alpha c_{\theta } - \beta^{2} }}\)

Appendix 4: Proof of Proposition 4

Similar to the proof of Proposition (2), the best response of the retailer for unit retail margin m and marketing effort level θ is;

moreover,

so,

eventually, the third party gets reactions of the manufacturer and the retailer and determines collection rate, τ, and transfer price, b. So,

The Hessian matrix is negative definite if \(c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\left( {4\alpha c_{\theta } - \beta^{2} } \right)}}\).

Finally, by substituting τ and b into pervious equations, Proposition 4 is obtained.

Appendix 5: Proof of Proposition 5

The proof of Proposition (5) is similar to Proposition (4) by this difference that the manufacturer determines transfer price b, so we omit this proof.

Appendix 6: Proof of Lemma 2

From Propositions (2), (4) and (5), we conclude that \(\tau^{M} = \tau_{1}^{3P} = \tau_{2}^{3P}\). Also from “Appendix 1”, we have \(c_{\theta } > \frac{{\beta^{2} }}{4\alpha }\) and \(c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }}\). Furthermore, we have \(\phi - \alpha p > 0\) and \(p > c_{m}\), so \(\phi - \alpha c_{m} > 0\). By substituting these inequalities in each equation, we can prove subsequent Lemmas easily.

Furthermore, with comparing τ M and τ R, we extract the following relationships:

-

1.

\(\tau^{R} < \tau^{M} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta }\)

-

2.

\(\tau^{R} < \tau^{M} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

3.

\(\tau^{R} < \tau^{M} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

Finally, by summarizing all of above relationships, Lemma (2) is obtained.

Appendix 7: Proof of Lemma 3

From Propositions (2), (3) and (5), we conclude \(b^{M} = b^{R} = b_{2}^{3P}\). Also

From above inequality, Lemma (3) is concluded.

Appendix 8: Proof of Lemma 4

First, we prove easily, \(w_{2}^{3P} < w_{1}^{3P}\), \(w^{M} < w_{2}^{3P}\) and \(w^{R} < w_{2}^{3P}\), because;

Then, we compare \(w^{M}\) with \(w^{R}\) and derive two roots \(c_{\tau 1} ,c_{\tau 2}\) from the following equations if \(c_{\theta } < \frac{{\beta^{2} }}{2\alpha }\).

Also if \(\frac{{3\beta^{2} }}{8\alpha } > c_{\theta }\), we infer \(c_{\tau 1} < c_{\tau }^{*} = \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }} < c_{\tau 2}\) and according to condition shown in inequality (50), we have c τ1 < c τ . So we conclude that w M < w R if c τ2 > c τ and w R < w M if c τ > c τ2. As well as, if \(\frac{{\beta^{2} }}{2\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\), we infer \(c_{\tau 1} < c_{\tau 2} < c_{\tau }^{*} = \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }}\) and according to inequality (50), we conclude that w R < w M. Otherwise if \(c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\), the equation shows the difference between w M with w R does not have real roots, therefore w R < w M. Finally, by summarizing all of above results, Lemma (4) is concluded.

Appendix 9: Proof of Lemma 5

First, we prove easily, \(p_{1}^{3P} < p_{2}^{3P}\), \(p_{2}^{3P} < p^{M}\), \(p^{R} < p^{C}\) and \(p^{M} < p^{C}\) if \(\frac{{\beta^{2} }}{2\alpha } > c_{\theta }\) and \(p_{2}^{3P} < p_{1}^{3P}\), \(p^{M} < p_{2}^{3P}\), \(p^{C} < p^{R}\) and \(p^{C} < p^{M}\) if \(c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\), because

Furthermore, with comparing p R and \(p_{1}^{3P}\), we extract the following relations:

-

1.

\(p^{R} < p_{1}^{3P} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta }\)

-

2.

\(p_{1}^{3P} < p^{R} ,\quad {\text{if}}\;\frac{{\beta^{2} }}{2\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\)

-

3.

\(p^{R} < p_{1}^{3P} ,\quad {\text{if}}\;c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\)

And also with comparing p M and p R, we have:

-

1.

\(p^{R} < p^{M} ,\quad {\text{if}}\;\frac{{\beta^{2} }}{2\alpha } > c_{\theta }\)

-

2.

\(p^{M} < p^{R} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\)

-

3.

\(p^{R} < p^{M} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

4.

\(p^{M} < p^{R} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

Then, we compare p R with \(p_{2}^{3P}\) and extract two roots \(c_{\tau 3} ,c_{\tau 4}\) from the following equations if \(\frac{{19\beta^{2} }}{72\alpha } > c_{\theta }\) or \(c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\).

Also \(c_{\theta } = \frac{{\beta^{2} }}{2\alpha }\) is another root for above equation. So if \(\frac{{19\beta^{2} }}{72\alpha } > c_{\theta }\) or \(\frac{{\beta^{2} }}{2\alpha } > c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\), we infer \(c_{\tau 3} < c_{\tau 4} < c_{\tau }^{*} = \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }}\) and according to inequality (50), one can derive that \(p^{R} < p_{2}^{3P}\). As well as, if \(\frac{{3\beta^{2} }}{5\alpha } > c_{\theta } > \frac{{\beta^{2} }}{2\alpha }\), we conclude \(c_{\tau 3} < c_{\tau 4} < c_{\tau }^{*} = \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }}\) and earn \(p_{2}^{3P} < p^{R}\) consequently. Also, if \(c_{\theta } > \frac{{3\beta^{2} }}{5\alpha }\), we infer \(c_{\tau 3} < c_{\tau }^{*} = \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{4\alpha c_{\theta } - \beta^{2} }} < c_{\tau 4}\) and according to inequality (50), we conclude that \(p^{R} < p_{2}^{3P}\) if \(c_{\tau 4} > c_{\tau }\) and \(p_{2}^{3P} < p^{R}\) if \(c_{\tau } > c_{\tau 4}\). Otherwise if \(\frac{{3\beta^{2} }}{8\alpha } > c_{\theta } > \frac{{19\beta^{2} }}{72\alpha }\), then \(c_{\tau 3} ,c_{\tau 4}\) are not real roots and therefore \(p^{R} < p_{2}^{3P}\). Finally, by summarizing all of above results, Lemma (5) is proved.

Appendix 10: Proof of lemma 6

First, we prove easily, \(\theta_{1}^{3P} < \theta^{M}\), \(\theta^{M} < \theta^{C}\), \(\theta^{R} < \theta^{C}\), \(\theta_{1}^{3P} < \theta_{2}^{3P}\) and \(\theta_{2}^{3P} < \theta^{M}\), because

Also with comparing θ M and θ R, we infer following relationship;

-

1.

\(\theta^{R} < \theta^{M} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{4\alpha } > c_{\theta }\)

-

2.

\(\theta^{M} < \theta^{R} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }} > c_{\tau }\)

-

3.

\(\theta^{R} < \theta^{M} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{4\alpha }\quad {\text{and}}\quad c_{\tau } > \frac{{\alpha^{2} c_{\theta } (\Delta - A)^{2} }}{{2\beta^{2} }}\)

Furthermore, with comparing \(\theta_{1}^{3P}\) and θ R, then we have;

-

1.

\(\theta^{R} < \theta_{1}^{3P} ,\quad {\text{if}}\;\frac{{3\beta^{2} }}{8\alpha } > c_{\theta }\)

-

2.

\(\theta_{1}^{3P} < \theta^{R} ,\quad {\text{if}}\;c_{\theta } > \frac{{3\beta^{2} }}{8\alpha }\)

Finally, by summarizing all of above results, Lemma (6) is proved.

Appendix 11: Proof of Lemma 7

We prove easily, \(\varPi_{T}^{3P,1} < \varPi_{T}^{M}\), \(\varPi_{T}^{3P,2} < \varPi_{T}^{M}\), \(\varPi_{T}^{M} < \varPi_{T}^{C}\) and \(\varPi_{T}^{R} < \varPi_{T}^{C}\), because

By summarizing all of above results, Lemma (7) is proved too.

Rights and permissions

About this article

Cite this article

Sane Zerang, E., Taleizadeh, A.A. & Razmi, J. Analytical comparisons in a three-echelon closed-loop supply chain with price and marketing effort-dependent demand: game theory approaches. Environ Dev Sustain 20, 451–478 (2018). https://doi.org/10.1007/s10668-016-9893-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-016-9893-5