Abstract

This study examines the extent and the quality of environmental disclosure made by Indian companies using legitimacy theory. Content analysis of 137 companies’ annual reports for the years 2011–2012 and 2014–2015 finds that (a) the extent of disclosure and the quality of disclosure have increased over the two-year period (though the increase is not statistically significant), (b) quality is largely descriptive and (c) disclosures vary between industries and within industries. The results of the econometric model suggest that firm-specific characteristics like industry, size, age and foreign customers have significant positive influence on environmental disclosures (extent and quality), while leverage has negative impact on disclosures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Globally, businesses are concerned about environmental issues and the uncertainty regarding ways to address them, which remains a challenge (Elliot 2013). As awareness about environmental issues spreads, the pressure on corporate environmental disclosure (CED) is likely to increase from various stakeholders such as regulators, investors and the media (Global Environment Outlook-5 2013). In India, over the past few years, there has been an increase in environmental regulations and guidelines requiring disclosure by companies. In addition to command and control and market-based instruments, disclosures are increasingly being considered as reliable policy instruments to address environmental issues in developing nations (Kathuria 2009). However, our present understanding of environmental disclosures made by firms in India is very limited.

Previous studies have assessed the extent of environmental disclosure in India and have reported variations in disclosure (e.g. Batra 2013; Chatterjee and Mir 2008; Kansal et al. 2014; Pramanik et al. 2007; Sen et al. 2011). Assessment of the quality of CED, a critical issue in accounting research (Tregidga et al. 2012), however, remains restricted to studies conducted in developed nations. The findings of such research cannot be generalized to the Indian context for two reasons. First, developed nations such as the USA have stringent norms (Richardson and Welker 2001), and France has ‘explicit mandatory’ CED standards (Ahmad and Tower 2011), which make their reports comparatively superior in terms of coverage. Second, a company’s country of origin is an important factor in determining the applicable level and type of CED (Al-Tuwaijri et al. 2004), as culture and governance affect corporate social reporting (Haniffa and Cooke 2005). Additionally, earlier studies on firm-based factors influencing the extent and the quality of CED have reported mixed results. Extant research has found corporate size to be a significant variable (Baxi and Ray 2009; Sharma 2012), although Sen et al. (2011) and Batra (2013) noted disparity in the CED of larger-sized companies. Chatterjee and Mir (2008) and Shukla and Vyas (2013) found variation in CED in listed companies, while Chaklader and Gulati (2015) found no variation in the disclosure trend over period of 2009–2012. Further, new regulations on corporate environmental disclosures have been introduced that may affect earlier findings. Therefore, the question posited in the present study is whether there are differences in the extent and quality of CED across industries and between companies operating in the same industry. If ‘yes’, then what is the cause of this variability?

We propose to provide answers to these questions by (a) conducting a content analysis of the annual reports of Indian companies at two different time periods (2011–2012 and 2014–2015) to assess the quality and extent of environmental disclosure and (b) examining the variation in environmental disclosure using legitimacy theory as the conceptual framework. ‘Legitimacy’ refers to the condition or status resulting from congruency between a company’s value system and the value system of the larger social system to which it belongs (Lindblom 1994).

The next section presents a review of the CED literature and lays down the conceptual background of the study variables. This is followed by the methodology and empirical findings. Finally, the conclusions and scope for future research are discussed.

2 Literature review, conceptual framework and hypotheses

As per the Environment (Protection) Act, 1986 (MoEF 1986), India’s ‘environment’ encompasses water, air and land and the interrelationship which exists among and between water, air and land and human beings, other living creatures, plants, microorganisms and property (p. 2).

Studies on environmental disclosures made by companies have branched out from corporate social responsibility (CSR) disclosure (Neu et al. 1998), in which the environment is treated as one of its attributes (Cowen et al. 1987). CSR disclosures have been theorized using stakeholder, legitimacy and political economic perspectives (Neu et al. 1998), and the same methods have been extended in understanding environmental disclosures. Halme and Huse (1997) used corporate environmental management and stakeholder and agency theories to examine environmental disclosures, while Aerts and Cormier (2009), Cho and Patten (2007) and Neu et al. (1998) used legitimacy theory. Legitimacy theory recognizes that organizations are evolving within society (Deegan 2002) and that organizations seek to establish congruence between society’s expectations and an organization’s value system.

Legitimacy theory has been used to explain environmental disclosures in India, including mandatory disclosures because Indian corporate managers perceive that the regulations are poorly enforced with rare penalties (Sandhu et al. 2012). This provides a lot of discretion to companies on deciding how much to disclose and what to disclose within the mandate. In such cases, mandated reporting may also be used as potential legitimating device (Buhr 2007; Cho et al. 2012). Cho et al. (2012) further note that greater regulatory requirement does not necessarily translate in improved reporting even in developed nations like USA, France and Spain. Sandhu et al. (2012) find that Indian firms perceive legitimacy threat from customers (multinational organizations) in developed countries that makes them procure ISO 14000 certification (a voluntary certification). This is further affirmed by Chaklader and Gulati (2015) who note that certification like eco-label and ISO 14000 influence environmental disclosures in India. In addition, Kansal et al. (2014) find that a firm’s social reputation has a significant effect on environmental disclosures. The present study therefore examines both voluntary and mandatory disclosures as they may be used as legitimating device, similar to previous studies like Cho et al. (2012), Cho and Patten (2007) and Patten (2002).

Milne and Patten (2002) explained legitimation as a process resulting from a firm’s interaction with the environment. Bansal and Roth (2000) identified legitimation as one of the three motivations behind corporate ecological response, along with competitiveness and responsibility. The authors argue that companies motivated by legitimation seek firm survival by complying with norms and regulations. They focus on the government, their local community and their stakeholders. Their decisions are influenced by the cost and risks of non-compliance. Firms taking ecological initiatives to be competitive aim for profitability through competitive advantage. They are innovative firms focusing on customers’ and investors’ needs, and their decision involves cost–benefit analysis. Last, the firms motivated by social responsibility aim at corporate morale. They may ignore commercial issues at times, in favour of social good. Gray et al. (1995) discussed four strategies, based on Lindblom’s (1994) work, that are employed by firms seeking legitimacy. These include educating and informing the ‘relevant public’, changing perceptions of the relevant public, manipulating perceptions of the relevant public and changing external expectations around the company’s performance.

The two main dimensions of CED are extent and quality. Quality is ‘subjective’ and ‘context dependent’ (Beattie et al. 2004). It describes the type of information disclosed by corporations (Halme and Huse 1997). Beattie et al. (2004) identified dimensions of disclosure quality as (a) the relative disclosure in comparison with the expected amount of disclosure, based on the size and complexity of the company, and (b) the spread of the disclosure across topics. Extent has been defined as the length of the environmental disclosure (Wiseman 1982) and refers to the quantity of information disclosed (Halme and Huse 1997). Studies have revealed that the extent or quantity of information disclosed is not representative of its quality (Guthrie and Abeysekera 2006; Halme and Huse 1997; Wiseman 1982). Thus, while the extent of information pertains to the question of how much information has been disclosed, the quality of information pertains to the question of what information has been disclosed. Previous studies on CED in India have largely examined extent of disclosure, while quality of disclosure has not received much attention. These studies are summarized in Table 1.

As shown in Table 1, studies in India have reported that disclosures are low (Batra 2013; Gupta 2012; Kansal et al. 2014; Pramanik et al. 2007), narrative in nature (Chatterjee and Mir 2008) and lack quantitative information (Baxi and Ray 2009; Sen et al. 2011; Shukla and Vyas 2013). Ahmad and Tower (2011) find that legitimacy threats influence firms to make higher disclosures, while mandatory requirements lead to consistent disclosures. Thus, variations in environmental disclosures may be better explained by legitimacy theory. Legitimacy theory suggests that firms from industries that are more environmentally sensitive are exposed to greater social and political pressure and hence make extensive disclosures (Cho et al. 2012; Kansal et al. 2014). Environmental sensitive industries are chemicals, metal, oil and gas, pulp and paper, chemicals and power (energy utilities) (Cho et al. 2002; Clarkson et al. 2008; and Patten 2002). This leads to the first research hypothesis.

H 1

There is positive association between the nature of industry and its environmental disclosure.

Further, larger firms, on account of their scale of operations, are at greater risk of facing legitimacy threat arising from society, institutions and customers as compared to smaller firms and have been found to make higher disclosures (Chaklader and Gulati 2015; Cho et al. 2012; Cho and Patten 2007; Clarkson et al. 2008; Patten 2002). Hence, we posit,

H 2

There is positive association between the size of a firm and its environmental disclosure.

Batra (2013), Kansal et al. (2014) and Sen et al. (2011) found variations even among larger-sized Indian firms, implying that size may not be a sufficient factor to explain variability in disclosures. Sandhu et al. (2012) found that companies face legitimacy threat from foreign organizational customers particularly from developed nations. This is because firms from less institutionally developed countries like India (Sandhu et al. 2012) attract negative perception when doing business on foreign soils (Marano et al. 2016). In order to address these legitimacy challenges, firms use environmental disclosures as a means to align themselves with global norms and expectations (Marano et al. 2016). Thus, companies that are suppliers to these foreign customers are likely to use environmental disclosures to show congruence with their firm’s activities. This leads to our third research hypothesis.

H 3

There is positive association between the firms’ supplying to foreign customers and its environmental disclosure.

Additionally, firms with long history (older firms) are found to be more concerned about their reputation as they face greater threat of legitimacy from society (Kansal et al. 2014; Sandhu et al. 2012). ONGC, an Indian company from oil and gas sector, incorporated in 1956, acknowledges reputation as one of the key focuses when they become a signatory to global initiatives on environmental issues (ONGC Annual Report 2011–2012). This leads to our fourth research hypothesis.

H 4

There is positive association between the age of a firm and its environmental disclosure.

Further, there are differences among developed and developing nations on account of economy structure, institutional set-up and compliance environment that influence firms’ environmental decisions (Arimura et al. 2016). Ahmad and Tower (2011) find that firms in France operating under mandatory environmental disclosures make higher disclosures when compared to firms in Australia operating under voluntary disclosures. Further, firms facing higher environmental pressure in their home country, particularly from developed countries, are found to make higher disclosures in emerging nations like China (Kim et al. 2015). Thus, country of origin may influence environmental disclosures in India, with foreign firms expected to make higher disclosures (a) owing to the strict environmental standards in their home country and (b) as a means to address legitimacy challenges arising from operating in an emerging nation. Past studies have considered a cut-off of 10 % of stocks held by foreign investors to classify the firm as a foreign firm (Golder 2011). This leads to our fifth research hypothesis.

H 5

There is positive association between foreign firms operating in India and their environmental disclosures.

In addition, past studies have shown that country-specific characteristics influence corporate governance (Hugill and Siegel 2014; Doidge et al. 2007) that may influence environmental disclosures. We therefore include corporate governance variables as control variables. Corporate governance is measured by debt-to-equity ratio, stock proportion held by financial institutions and stock proportion held by foreign institutions (on line with Nishitani et al. 2012).

The next section explains the research method for assessing disclosures and the variability in quality and quantity of disclosures across firms.

3 Methodology

3.1 Research design

An exploratory study (Sect. 3.2) followed by a statistical analysis (Sect. 3.3) is employed to understand the quality and extent of environmental information disclosed by companies in India. The unit of analysis is the ‘company’.

3.2 Study sample

We select companies listed under the sectoral indices of the Bombay Stock Exchange (BSE), as study sample. Past studies in India have also examined disclosures for BSE listed firms, ranging from 2 to 100 companies (refer to details in Table 1). Our sample includes 137 companies for 2011–2012 and 134 companies for 2014–2015 (Appendix 1 in Table 8), representing eleven different industries. The details of sample selection are illustrated in Fig. 1.

These companies own 65 % of total assets of BSE 500 companies and make 72–75 % of total profits made by companies in BSE 500 in 2011–2012 and 2014–2015. As per the industry breakdown, sample firms in consumer durables and power constitute more than 80 % of the firms listed on BSE 500. Table 2 presents the industry-wise breakdown of sample firms as compared to firms listed on BSE 500.

Overall, our sample firms are large and listed and they have multiple stakeholders; hence, they are expected to make higher environmental disclosures (Ahmad and Tower 2011; Liu and Anbumozhi 2009).

Past studies have used annual reports as the source of environmental disclosure information (Cho and Patten 2007; Patten 2002; Sen et al. 2011; Toms 2002) as they are central corporate documents (Toms 2002). Information disclosed in corporate annual reports is issued on a regular basis (Toms 2002) and is comprehensive (Aerts and Cormier 2009). However, some studies argue that the discretionary nature of environmental disclosures is better reflected using information on websites and standalone reports released by firms (Clarkson et al. 2008). Therefore, apart from annual reports, we examine the disclosures across different information sources to understand the nature and type of information disclosed. The time period of this study is year 2011–2012 and year 2014–2015. Past studies have largely used single-year data (like Cho and Patten 2007; Clarkson et al. 2008; Patten 2002; Sen et al. 2011; Toms 2002) as specific time period data are unlikely to affect the generality of the results (Richardson and Welker 2001). However, between the years 2011–2012 and 2014–2015, there have been a number of guidelines on corporate environmental reporting that may have affected disclosures in the year 2014–2015. Key environmental regulations that were introduced include: clause 55 of the listing agreement with the stock exchange (SEBI 2012) requiring the companies to include Business Responsibility Report based on the framework of National Voluntary Guidelines (NVG); Section 135 of the Companies Act, 2013, mandating corporate spending on social responsibility, which includes ensuring environmental sustainability, at 2 % of firms’ average net profits (Ministry of Corporate Affairs 2013) and disclosure made thereof as per Companies (CSR Policy) Rules, 2014; and mandatory energy audits for some firms—notification dated 27 May 2014. Thus, these two time periods provide the status and variability of environmental disclosures before and after the institutional pressure in the form of mandatory disclosure requirements.

3.3 Content analysis of environmental disclosure

Our study uses a thematic content analysis and disclosure index analysis to assess the extent and quality of CED in India. Content analysis is the most commonly used method for assessing CED (Al-Tuwaijri et al. 2004; Clarkson et al. 2008; Patten 2002; Sen et al. 2011). It involves systematic procedures for studying the content of written documents (Halme and Huse 1997). This type of analysis extends beyond mere word counts to an intense examination of language in order to classify the text into categories representing similar meanings and help in assessing the quality of narratives (Nurunnabi 2016). The content analysis method used in the present study involved the following steps: (a) identifying certain environmental issues, (b) assigning a score and (c) determining the aggregate score for each firm and sector.

-

a.

Identifying environmental issues

This step involves classifying environmental issues under broad groups or themes to form a disclosure grid. We adapted the grid developed by Aerts and Cormier (2009) that categorized environmental information in six categories, drawn from extensive research spanning over more than two decades, from Wiseman (1982) to Al-Tuwaijri et al. (2004). The items of the environmental grid are presented in Appendix 2. The grid meets the requirements of our target user group (Marston and Shrives 1991), which includes policy makers, companies, investors, researchers and society.

-

b.

Assigning a score to the information disclosed

Our rating technique was adapted from Aerts and Cormier (2009) and Morgan (2013) and uses a score from ‘1’ to ‘3’. A score of ‘3’ was awarded if the information disclosed was both quantitative and qualitative, ‘2’ if the information disclosed was qualitative and ‘1’ if the item had just been mentioned briefly, but no detailed description was provided.

-

c.

Determining an aggregate score for each firm and sector

The method of measuring environmental disclosure has been adapted from previous studies measuring disclosure, particularly from Patten (2002) and Cho et al. (2012). For assessing the extent of disclosure, a two-way score of ‘0’ and ‘1’ was used, where ‘1’ signifies the presence of the item and ‘0’ signifies the absence of the item (Al-Tuwaijri et al. 2004; Guthrie and Abeysekera 2006).

Quantity disclosure score (Q nt DS) is given by the number of items for which information is disclosed:

where n represents the number of companies (137 in 2011–2012 and 134 in 2014–2015) and k represents the number of items (39) for which information has to be disclosed.

-

d in 0 if the item has not been disclosed.

-

d in 1 if the item has been disclosed.

This is further divided by the total number of items (39) to arrive at quantity disclosure scores on a scale of 1.

Quality disclosure score (Q lt DS) is given by the number of items for which information is disclosed multiplied by its weight:

where n represents the number of companies (137 in 2011–2012 and 134 in 2014–2015) and k represents the number of items (39) for which information has to be disclosed.

-

q in 0 if the item has not been disclosed.

-

q in 1 if the item has just been mentioned without any detailed description.

-

q in 2 if the item is explained in narratives or qualitative.

-

qin 3 if the item is explained qualitatively and quantitatively

This is further divided by total weighted score possible (39 × 3 = 117) to arrive at quality disclosure score on a scale of 1.

Content analysis was carried out in two stages. In the first stage, or pilot stage, one company from each of the 11 industries was randomly selected, resulting in a sample of 11 companies. The complete annual report of each company was analysed and coded by two independent coders. The recording unit was ‘sentences’. Previous studies in India have used content analysis of certain selected sections such as directors’ report and chairman’s speech (Sen et al. 2011); however, our first stage of content analysis found that apart from these two sections, there are other sections in which environment information is disclosed—namely health, safety and environment section, CSR or a separate environment section. The second stage therefore included content analysis of complete annual reports (including the ones that had already been coded initially) by another set of independent coders. This methodology is also described in Fig. 1.

As the content analysis was conducted manually, we took several measures to ensure reliability with regard to stability and reproducibility, as discussed by Milne and Adler (1999). In order to ensure stability, the test–retest method was adopted, whereby one of the coders re-analysed all the annual reports after a period of 4 weeks. Reproducibility was ensured through inter-rater reliability by calculating the coefficient of agreement. Coefficient of agreement is defined as the ‘ratio of the number of pair-wise inter-judge agreements to the total number of pair-wise judgments’ (Milne and Adler 1999). The coefficient of agreement was found to be more than 80 % for all the dimensions across industries. Moreover, as noted, the two stages of coding made use of two different sets of independent coders.

In addition to the content analysis of the annual report, we compare the quantity and quality of environmental disclosures made across two more different information sources: standalone report (Sustainability/Business Responsibility/CSR Annual Report) and corporate website. This was done for randomly selected 10 firms from our total sample of 137 firms in 2011–2012.

3.4 Statistical analysis

In order to examine the reasons for variability in the disclosures, an econometric model for cross-sectional data for the years 2011–2012 and 2014–2015 is estimated. We model the decision to make disclosures based on legitimacy theory as:

where disclosure is measured in quantity (extent) scores and quality scores.

-

Size Firm size is measured as the natural log of 2011–2012 sales and 2014–2015 sales and for banking firms—natural log of total income is considered.

-

Industry A dummy variable that takes the value of 1 is used to identify companies from environmental sensitive industries. In total, 33 firms were from environmentally sensitive industries.

-

Foreign Organizational Customers Measured by exports in 2011–2012 and 2014–2015 as proportion of sales in 2011–2012 and 2014–2015, respectively. A binary variable 1/0 is used to designate companies exporting.

-

Foreign Firms Binary variable (1/0) to indicate firms, where foreign investors owned more than 10 % of equity in 2011–2012 and 2014–2015.

-

Age Measured by the difference in the year of incorporation and year of study (2012 and 2015). In order to reduce the skewness, natural log has been considered.

-

Control Variables Corporate governance variables indicated by (a) debt-to-equity ratio—measured as long-term debt of firm in 2011–2012 and 2014–2015 as proportion of equity (paid-up)Footnote 1 in 2011–2012 and 2014–2015, respectively; for firms in banking sector, debt is measured as total borrowings (b) proportion of stock held by financial institution (banks and financial institutions) in 2011–2012 and 2014–2015, respectively, and (c) proportion of stock held by foreign institutional investors (promoters as well as non-promoters) in 2011–2012 and 2014–2015, respectively.

Data for the sample firms were obtained from CMIE Prowess database.

4 Results and discussion

4.1 Extent and quality of information disclosed in annual reports

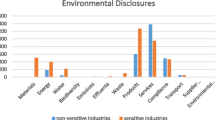

The results of content analysis show that the mean quantity disclosure score increased from 0.268 in 2011–2012 to 0.291 in 2014–2015. The t test (unpaired, two-tailed) of the means, however, shows that the increase is not significant (t value 0.982, p value 0.327). For majority of the sectors, disclosure quantity increased from 2011–2012 to 2014–2015, though there exists a lot of variation. The extent of disclosure and quality of disclosure across industries are shown in Table 3.

As shown in Table 3, the quality of disclosure score is lower than the quantity of disclosures for each of the sector under study. Mean quality disclosure score increased from 0.167 in 2011–2012 to 0.183 in 2014–2015, though the increase is not significant (t value 0.881, p value 0.379).

Frequency-based industry-wise disclosure analysis for the years 2011–2012 and 2014–2015 is presented as supplementary information (refer Appendix 2 in supplementary material). Between 2011–2012 and 2014–2015, the sampled firms have been subject to reporting and regulatory changes, resulting in improved quantity and quality of information. However, in absolute terms, the increase in the extent of disclosure (from 0.268 to 0.291) is more than the increase in the quality of disclosure (from 0.167 to 0.183) over the 2-year period. Overall, the metal sector made the highest disclosure in terms of both the quality and the quantity of disclosure, though the information availability declined in 2014–2015, as firms like Bhushan Steel disclosed very less environmental information on account of financial problems. This supports the previous findings of Batra (2013) and Sen et al. (2011) highlighting that steel companies made the highest disclosures.

Quality of disclosure appears to be influenced by company management in some cases. For instance, prior to reporting changes, in the year 2011–2012, Lanco Infratech disclosed the penalty, in rupee terms, that was imposed on the company for violating the environment permission of the Forest, Environment and Wildlife Management Department cum Appellate. Additionally, National Hydroelectric Power Corporation disclosed quantitative information on water tax and environment protection tax because of a change in the state laws; whereby, the state government passed the Jammu and Kashmir Water Resources (Regulation and Management) Act, 2010, fixing water-usage charges for the generation of electricity, that caused an increase in the company’s total expenditure. The detailed narrative text suggests that the company may have used disclosures as a legitimization tool to persuade their stakeholders and repair its social contract by disclosing information voluntarily. Similarly, after the reporting and regulatory changes, in the year 2014–2015, some firms have disclosed detailed information in their Business Responsibility Report, while some have simply directed the attention to the particular page numbers of their annual reports. Further, under Section 134(3)(M) of the Companies Act, 2013, and Rule 8 of the Companies (Accounts) Rules 2014, information on conservation of energy and technology is mandatory for manufacturing firms. However, whether the firm discloses the information in quantitative terms (physical units/monetary units) or qualitative terms is at the discretion of the management. In addition, while CSR expenditure is a mandate following the NVG principles, the particular areas for CSR investment decision depends upon company management. Firms have selected areas like sanitation, education, rural livelihood, agriculture, health and environment. Thus, firms investing in environmental activities have disclosed more information pertaining to the environment, while other firms have disclosed less, causing variability in the information. This suggests that even within the mandate to report, company management has the discretion on deciding how much to disclose and what to disclose. This finding is similar to the findings of Buhr (2007) and Cho et al. (2012).

4.2 Variability in the extent and quality of environmental disclosure in India

Table 4 presents the descriptive statistics for the two periods: 2011–2012 and 2014–2015. The sample firms mean size is INR 212.35 billion (based on 2011–2012 sales) and INR 216.76 billion (based on 2014–2015 sales). Further, the mean of firm age is 40.57 in 2011–2012 and 43.63 in 2014–2015. Stock proportion held by foreign investors at 27 % (29 %) in 2011–2012 (2014–2015) is higher as compared to stock proportion held by financial institutions in India.

A positive relation is predicted for all variables identified from legitimacy theory in the Indian context. Results of the cross-section OLS regression for the two time periods, based on the quantity and the quality of information disclosed, are presented in Table 5. Heteroskedasticity robust standard errors were used in the regression model.

Model 1 and Model 2 present the coefficients for quantity of disclosures, while, Model 3 and Model 4 present the results for quality of disclosures for 2014–2015. Similarly, Model 5, Model 6, Model 7 and Model 8 present the OLS estimates for year 2014–2015 under different assumptions. Model 1 and Model 5 are the basic regression models for quantity of disclosure, where control variables have not been included. After including control variables, the explanatory power of models has increased in both the cases. Further as shown in Table 5, size of company and industry has significant positive coefficients in both the years, supporting the first and second hypotheses. Thus, showing that large firms and firms from environmental sensitive industries make higher disclosures, in terms of both quantity as well as quality. This is consistent with earlier findings of Clarkson et al. (2008) and Patten (2002). Additionally, age and foreign customers are positively related to disclosures for both the years, supporting the third and fourth hypotheses. However, ownership of stock by foreign investors is not significant and has a negative coefficient in 2014–2015 (though non-significant). Hence, the fifth hypothesis is not supported. This is in contrast to findings of Kim et al. (2015) study conducted in China. A plausible reason may be that foreign firms do not have high environmental pressure in India. In addition, majority of the foreign firms in India have their stock ownership with foreign institutional investors, who may not be under high environmental pressure in their home country. Only a minority of these firms (seven) have foreign promoters. Among the corporate governance variables used as control variables, debt/equity (leverage) is negatively related to disclosures with a very low coefficient that has increased in 2014–2015, suggesting that high leverage firms make lesser disclosures. This finding is in contrast to Clarkson et al. (2008) but similar to Brammer and Pavelin (2006) who show that lower leverage provides the firms with the flexibility to raise funds, invest in environmental activities and make disclosures.

4.3 Robustness check

In addition to OLS regression, we also used Tobit regression to check the robustness of the results, presented in Table 6. Tobit analysis deals with the censored dependent variables as in this study, wherein the disclosure scores range from 0 to 1. This method has also been used in previous studies like Clarkson et al. (2008).

As shown in Table 6, Tobit regression supports our initial results for both the years: 2011–2012 and 2014–2015. In addition, for year 2011–2012, disclosure quantity is positively influenced by stock proportion held by foreign investors.

4.4 Extent and quality of information disclosed across different information sources

The content analysis of environmental disclosure across three information sources: (a) annual reports; (b) standalone reports; and (c) website for randomly selected 10 firms are presented in Table 7.

As shown in Table 7, information disclosed in annual reports is superior in terms of both quantity and quality as compared to website information and standalone reports. In addition, there is no consistency in the standalone reports released by firms. Some companies release Business Responsibility Reports using the prescribed framework based on the principles of NVG, while others issue Sustainability Reports using the Global Reporting Initiative guidelines. There are some companies that disclose environmental information on a consolidated basis along with their group companies across different geographies. Thus, the findings suggest that environmental information is disclosed regularly, consistently and in comparable terms in annual reports. This corroborates with the findings of Toms (2002).

5 Conclusions

This study assesses and examines the extent, quality and variations in environmental disclosures made by companies in India for the years 2011–2012 and 2014–2015. It provides insights into the present status of disclosure. This assessment is crucial if we are to demand transparency in disclosures and impose new regulations, because the present status of the disclosures can predict future outcomes of new regulations.

The extent of information has improved from 2011–2012 to 2014–2015, though the increase is not significant. A plausible reason may be that 2014–2015 is the first year for many companies to comply with guidelines of CSR spending and reporting as per the Companies Act, 2013. The quality of information disclosed is descriptive and largely voluntary, as most of the disclosure requirements do not specify whether they should be qualitative or quantitative. This has improved in 2014–2015 with the introduction of framework for reporting of Business Responsibility Report by listing guidelines of SEBI. However, the increase is not significant. This is similar to results reported by Chaklader and Gulati (2015) based on a longitudinal study of 50 companies in India over 2009–2012. Institutional pressure for environmental disclosure is a recent phenomenon as previous studies like Chatterjee and Mir (2008, p. 615) note that: ‘There is no requirement under the Indian Companies Act, 1956, the Securities and Exchange Board of India Act, 1992 or Indian Accounting Standards to disclose environmental information’. Further the institutional pressure aims at bringing isomorphism through regulations, as found in this study as well, with the decline in variability of disclosure scores (SD of quantity score and quality score decreased from 0.216 to 0.157 and 0.184 to 0.103, respectively, over 2011–2012 and 2014–2015). Thus, we used legitimacy theory to explain the existing variability across scores. Variables were drawn from legitimacy theory like industry structure, size, age, foreign organizational customers and foreign firms. In addition, we used corporate governance variables as control variables measured through leverage, stock proportion held by foreign and financial investors. We found significant positive association between industry structure, size, age and foreign organizational customers with environmental disclosures, in the cases of both OLS regression and Tobit regression for the two time periods. This suggests that companies in India subscribe to legitimacy theory as companies from environmental sensitive industries are making higher disclosures. However, foreign firms’ coefficient is not significant. This suggests that the increase in disclosure scores is due to institutional pressure that affects both domestic and foreign firms alike; hence, the ownership of stock may not matter. Further, out of the three variables of corporate governance, debt/equity ratio is associated negatively with environmental disclosures. Thus, institutional pressure may be used to increase the disclosures, but there still exists variability across firms and sectors that are explained by legitimacy theory.

Previous studies have found that mandatory disclosures do not improve environmental reporting (Cho et al. 2012). The present study adds to this body of research by indicating that in a developing nation like India, mandatory reporting may increase the extent of information disclosed (the items on which information is disclosed), yet the quality of these disclosures may remain largely descriptive and lack quantitative details, as the criteria or guideline for the disclosures have not been clearly specified in the regulations. The quality of disclosure thus depends on company management. Our study should also prove useful for various stakeholder groups such as investors, regulators and company managers. Investors can better identify the industries and companies that are responding to the changing environment and are taking necessary steps towards mitigation or adaptation, as these companies would likely be those that deliver superior returns. Furthermore, as we move into a more regulated regime in which companies are directed to undertake measures towards ecological sustainability and to make full disclosures concerning these efforts, the present study will benefit regulators by helping them understand the present trends in environmental information disclosure, thereby facilitating policy planning and monitoring. Additionally, the findings of the study may serve as an effective guide for policy makers in other developing nations, as previous studies undertaken in some of these countries have also found the quantity and quality of environmental information disclosure to be markedly dismal, which concurs with the findings of the present study (Liu and Anbumozhi 2009; Nurunnabi 2016).

Meanwhile, company managers can use the findings of this paper to make a comparative study between their disclosure practices and those of other industries and adopt measures accordingly towards the restoration of the environment. This study provides the ground for further research in which small and unlisted companies are examined for their levels and quality of disclosure. Our sample size of 137 may be argued as being small, considering that more than 5000 companies are listed on the BSE, but the purpose of this study is to provide a general understanding of the variation in and status of environmental information disclosure across diverse sectors. Further, future studies may examine the legitimacy strategy used by companies in the Indian context. Additionally, with the regulatory and reporting changes, the role of institutional pressure may be examined in detail using longitudinal data of future disclosures.

Notes

Previous studies have measured debt–equity ratio in different ways. Clarkson et al. (2008) use a measure of ratio of total debt divided by total assets; Cho et al. (2012) use measure of debt to capital; Nishitani et al. (2012) use measure of debt divided by equity. We found that model results remain unchanged when we use total assets as denominator.

References

Aerts, W., & Cormier, D. (2009). Media legitimacy and corporate environmental communication. Accounting, Organizations and Society, 34(1), 1–27.

Ahmad, R. A. R., & Tower, G. (2011). Regulatory and industry influences on the communication of environmental information: A comparative study of top French and Australian Firms. Journal of the Asia-Pacific Centre for Environmental Accountability, 17(1), 5–27.

Al-Tuwaijri, S. A., Christensen, T. E., & Hughes Ii, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, Organizations and Society, 29(5), 447–471.

Arimura, T. H., Darnall, N., Ganguli, R., & Katayama, H. (2016). The effect of ISO 14001 on environmental performance: Resolving equivocal findings. Journal of Environmental Management, 166, 556–566.

Bansal, P., & Roth, K. (2000). Why companies go green: A model of ecological responsiveness. Academy of Management Journal, 43(4), 717–736.

Batra, G. S. (2013). Environment management and environmental disclosures: A comparison of corporate practices across Malaysia, Singapore and India. South Asian Journal of Management, 20(1), 62.

Baxi, C. V., & Ray, R. S. (2009). Corporate social and environmental disclosures and reporting. Indian Journal of Industrial Relations, 44(3), 355–375.

Beattie, V., McInnes, B., & Fearnley, S. (2004). A methodology for analysing and evaluating narratives in annual reports: A comprehensive descriptive profile and metrics for disclosure quality attributes. Accounting Forum, 28(3), 205–236.

Brammer, S., & Pavelin, S. (2006). Voluntary environmental disclosures by large UK companies. Journal of Business Finance & Accounting, 33(7–8), 1168–1188.

Buhr, N. (2007). Histories of and rationales for sustainability reporting. In J. Unerman, J. Bebbington, & B. O’Dwyer (Eds.), Sustainability accounting and accountability (pp. 57–70). London: Routledge.

Chaklader, B., & Gulati, P. A. (2015). A study of corporate environmental disclosure practices of companies doing business in India. Global Business Review, 16(2), 321–335.

Chatterjee, B., & Mir, M. Z. (2008). The current status of environmental reporting by Indian companies. Managerial Auditing Journal, 23(6), 609–629.

Cho, C. H., Freedman, M., & Patten, D. M. (2012). Corporate disclosure of environmental capital expenditures: A test of alternative theories. Accounting, Auditing and Accountability Journal, 25(3), 486–507.

Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32(7), 639–647.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4/5), 303–327.

Cowen, S. S., Ferreri, L. B., & Parker, L. D. (1987). The impact of corporate characteristics on social responsibility disclosure: A typology and frequency-based analysis. Accounting, Organizations and Society, 12(2), 111–122.

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures—A theoretical foundation. Accounting, Auditing and Accountability Journal, 15(3), 282–311.

Doidge, C., Karolyi, G. A., & Stulz, R. M. (2007). Why do countries matter so much for corporate governance? Journal of Financial Economics, 86(1), 1–39.

Elliot, S. (2013). A transdisciplinary exploratory model of corporate responses to the challenges of environmental sustainability. Business Strategy and the Environment, 22(4), 269–282.

Global Environment Outlook 5. (2013).Impacts of a changing environment on the corporate sector. United Nations Environment Programme. ISBN: 978-92-807-3344-0.

Golder, B. (2011). Energy intensity of Indian manufacturing firms effect of energy prices, technology and firm characteristics. Science Technology & Society, 16(3), 351–372.

Gray, R. H., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing and Accountability Journal, 8(2), 47–77.

Gupta, V. K. (2012). Environmental accounting and reporting-an analysis of Indian corporate sector. http://wbiconpro.com/110-Gupta.pdf. Accessed 7 Sept 2013.

Guthrie, J., & Abeysekera, I. (2006). Content analysis of social, environmental reporting: What is new? Journal of Human Resource Costing and Accounting, 10(2), 114–126.

Halme, M., & Huse, M. (1997). The influence of corporate governance, industry and country factors on environmental reporting. Scandinavian Journal of Management, 13(2), 137–157.

Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391–430.

Hugill, A., & Siegel, J. I. (2014). Which does more to determine the quality of corporate governance in emerging economies, firms or countries?. Harvard Business School Strategy Unit Working Paper (13-055).

Kansal, M., Joshi, M., & Batra, G. S. (2014). Determinants of corporate social responsibility disclosures: Evidence from India. Advances in Accounting, 30(1), 217–229.

Kathuria, V. (2009). Public disclosures: Using information to reduce pollution in developing countries. Environment, Development and Sustainability, 11(5), 955–970.

Kim, N., Moon, J. J., & Yin, H. (2015). Environmental pressure and the performance of foreign firms in an emerging economy. Journal of Business Ethics. doi:10.1007/s10551-015-2568-6.

Lindblom, C. K. (1994). The implications of organizational legitimacy for corporate social performance and disclosure. Paper presented at the Critical Perspectives on Accounting Conference, New York, NY.

Liu, X., & Anbumozhi, V. (2009). Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. Journal of Cleaner Production, 17(6), 593–600.

Marano, V., Tashman, P., & Kostova, T. (2016). Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. Journal of International Business Studies,. doi:10.1057/jibs.2016.17.

Marston, C. L., & Shrives, P. J. (1991). The use of disclosure indices in accounting research: A review article. The British Accounting Review, 23(3), 195–210.

Milne, M. J., & Adler, R. W. (1999). Exploring the reliability of social and environmental disclosures content analysis. Accounting, Auditing & Accountability Journal, 12(2), 237–256.

Milne, M. J., & Patten, D. M. (2002). Securing organizational legitimacy. Accounting, Auditing & Accountability Journal, 15(3), 372–405.

Ministry of Corporate Affairs. (2013). The Companies Act. http://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf. Accessed 02 Jan 2014.

MoEF. (1986). Environment (Protection) Act, 1986. http://www.moef.nic.in/sites/default/files/eprotect_act_1986.pdf. Accessed 09 Aug 2013.

Morgan, G. G. (2013). Purposes, activities and beneficiaries: Assessing the use of accounting narratives as indicators of third sector performance. Qualitative Research in Accounting & Management, 10(3/4), 6.

Neu, D., Warsame, H., & Pedwell, K. (1998). Managing public impressions: Environmental disclosures in annual reports. Accounting, Organizations and Society, 23(3), 265–282.

Nishitani, K., Kaneko, S., Fujii, H., & Komatsu, S. (2012). Are firms’ voluntary environmental management activities beneficial for the environment and business? An empirical study focusing on Japanese manufacturing firms. Journal of Environmental Management, 105, 121–130.

Nurunnabi, M. (2016). Who cares about climate change reporting in developing countries? The market response to, and corporate accountability for, climate change in Bangladesh. Environment, Development and Sustainability, 18, 157–186.

ONGC. (2012). Annual report. http://ongcindia.ongc.co.in/wps/wcm/OngcHTML/Annual_Report_2011-12/Annual_Report_2011-12.html. Accessed 17 July 2013.

Patten, D. M. (2002). The relation between environmental performance and environmental disclosure: A research note. Accounting, Organizations and Society, 27(8), 763–773.

Pramanik, A. K., Shil, N. C., & Das, B. (2007). Environmental accounting and reporting with special reference to India. The Cost and Management Accountant, 35(6), 16–27.

Richardson, A. J., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society, 26(7), 597–616.

Sandhu, S., Smallman, C., Ozanne, L. K., & Cullen, R. (2012). Corporate environmental responsiveness in India: Lessons from a developing country. Journal of Cleaner Production, 35, 203–213.

SEBI. (2012). Business Responsibility Reports. Securities and Exchange Board of India. http://www.sebi.gov.in/cms/sebi_data/attachdocs/1344915990072.pdf. Accessed 17 May 2016.

Sen, M., Mukherjee, K., & Pattanayak, J. K. (2011). Corporate environmental disclosure practices in India. Journal of Applied Accounting Research, 12(2), 139–156.

Sharma, V. K. (2012). Environmental accounting and reporting in India: An appraisal. Advances in Management, 5(9), 61–65.

Shukla, A., & Vyas, N. (2013). Environmental accounting & reporting in India (A comparative study of Bharat Petroleum Company Limited and Oil & Natural Gas Company Limited). Pacific Business Review International, 5(7), 52–59.

Toms, J. S. (2002). Firm resources, quality signals and the determinants of corporate environmental reputation: Some UK evidence. British Accounting Review, 34(3), 257–282.

Tregidga, H., Milne, M., & Lehman, G. (2012). Analyzing the quality, meaning and accountability of organizational reporting and communication: Directions for future research. Accounting Forum, 36(3), 223–230.

Wiseman, J. (1982). An evaluation of environmental disclosures made in corporate annual reports. Accounting, Organizations and Society, 7(1), 53–63.

Author information

Authors and Affiliations

Corresponding author

Appendix 2: Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix 1

Rights and permissions

About this article

Cite this article

Prasad, M., Mishra, T. & Kalro, A.D. Environmental disclosure by Indian companies: an empirical study. Environ Dev Sustain 19, 1999–2022 (2017). https://doi.org/10.1007/s10668-016-9840-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-016-9840-5