Abstract

Over the past half century, Western Europe has been part of varying currency regimes. Yet, whether under Bretton Woods, the European Monetary System, or the Euro, exchange-rate fluctuations have had an influence on these countries’ trade flows with the United States at the national and the industry level. This study looks at the case of Spain, examining the role of real exchange-rate fluctuations on trade with the United States for 74 industries. We find that the trade balances of only 40 industries are cointegrated with their macroeconomic determinants, but that 26 of these respond positively in the long run to a real depreciation. While industry characteristics do not seem to explain which industries are more likely to do this, we find that a relatively large share of industries in the Machinery sector see their trade balances improve after a depreciation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In 1999, the Euro replaced the national currencies of 11 European Union member states. While this has had a significant impact on the volume of intra-EU trade, mostly due to reducing transactions costs, it may also have had an effect on EU nations’ trade with countries outside the region. The introduction of a common currency was just the final phase of a number of fixed- and floating-rate regimes that have been in place in Europe over the past half century. Regardless of the choice of regime, the main determinants of trade flows—income and exchange rates—can still influence trade flows outside the region. This study looks at the case of Spanish trade over the period from 1962 to 2009 to address the role of these determinants on the country’s industry-level bilateral trade flows with the United States. Controlling for the switchover to the Euro, we find that for the majority of the 74 industries examined, currency depreciations or devaluations do not significantly improve the trade balance.

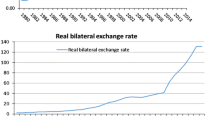

Since the 1973 collapse of Bretton Woods, which specified a fixed exchange rate of 60 (and later 70) pesetas per dollar, Spain has remained tightly integrated into the European exchange-rate system. Nevertheless, there has been ample room for nominal as well as real currency fluctuations. Under the European Exchange Rate Mechanism, which was instituted in 1979, the peseta was allowed to fluctuate within a wider band than many other European nations. Vis-à-vis the dollar, of course, the European currencies floated—just as the Euro does today. The Spanish–US real exchange rate, which exhibits alternating periods of appreciation and depreciation, but no overall recent trend, is shown in Fig. 1.

Previous studies tend not to focus on the specific case of Spanish trade, particularly with the United States. Perhaps this is because the countries are not considered to be “major” trade partners. Nevertheless, their combined exports and imports are generally around $1.5 billion per year. Certain studies that have examined the exchange-rate sensitivity of trade flows have included Spain in their list of countries, however. Some, which focus on the Marshall–Lerner condition, include Warner and Kreinin (1983), Andersen (1993), Bahmani-Oskooee and Niroomand (1998), and Bahmani-Oskooee and Kara (2005). Others, which take more of a “J-curve” approach, include Miles (1979), Himarios (1989), and Bahmani-Oskooee and Alse (1994). These tend to show that Spain’s trade balance responds little to exchange-rate changes. More recently, Langwasser (2009) confirms this, finding no long-run response to changes in the exchange rate for Spain.

Further discussion of these branches of the literature are provided by Bahmani-Oskooee and Ratha (2004), Bahmani-Oskooee and Hegerty (2010), and Bahmani-Oskooee et al. (2011). In general, because of the tendency of these studies not to find evidence of a link between currency changes and countries’ trade balances, the recent trend in the literature has been to disaggregate countries’ trade flows by industry, usually at the SITC three-digit level. This study does the same, examining the Spanish trade balance with the United States for 74 individual industries. Cointegration analysis using annual data show that only 40 industries exhibit a long-run relationship among the variables. For 26 of them, the trade balances improve after a currency depreciation.

This paper proceeds as follows: Sect. 2 outlines the empirical methodology. Section 3 provides the results, and Sect. 4 concludes. The data are described in detail in the Appendix.

2 Methodology

A country’s bilateral trade balance can most easily be analyzed with a reduced-form model in which both the exporting and the importing countries’ income, as well as a measure of the relative price, serve as the main determinants. Following Bahmani-Oskooee and Hegerty (2009), among others, we use the CPI-based real exchange rate as our price variable. We also include a dummy variable (which equals 1 beginning in 1999) to account for the Euro conversion.

Our choice of cointegration methodology is the Autoregressive Distributed Lag (ARDL) approach of Pesaran et al. (2001). This method has been shown to have good small-sample properties; works with stationary as well as I(1) variables; and is able to provide short-run estimates, long-run estimates, and a cointegration test within a single equation. We begin the procedure by identifying the long-run determinants of the trade balance of industry i outlined by Eq. (1):

where the trade balance is defined as ratio of Spain’s export of industry i to US over her imports of industry i from the US. As argued in the literature this measure is unit free and it allows us to express the model in natural log form. Three main long-run determinants are identified to be level of economic activity in the US denoted by Y US and in Spain denoted by Y Spain as well as the real exchange rate denoted by REX. We expect an estimate of β to be positive. As US economy grows, Spanish exports rise. By the same token an estimate of λ is expected to be negative since an increase in Spanish economic activity induces an increase in her imports. Finally, since an increase in REX reflects a real depreciation of pesota against US dollar, an estimate of θ is expected to be positive if depreciation is to improve industry i’s trade balance.

Estimate of Eq. (1) by any method does not allow us to infer the short-run effects or the J-Curve effect of a depreciation. The remedy is to express (1) in an error-correction format as in Eq. (2):

Equation (2) is an error-correction specification in which lagged level variables are included as a substitute for lagged error term from (1) in an Engle-Granger sense. The main advantage of this specification is that the short-run effects and the long-run effects are estimated by a single specification such as (2). Since this specification is to be estimated only, we add the mentioned dummy (i.e., EURO) at this stage. Pesaran et al. (2001) propose applying the F test for joint significance of lagged level variable to justify cointegration. However, the F test has new critical values that they tabulate.

Following the literature, in estimating (1) we use a set criterion such as Akaike Information Criterion to select the lag length (out of a maximum of four). Our short-run estimates are then obtained via the difference terms in this OLS estimation, while the long-run estimates are obtained by the estimates of θ2–θ4 normalized on θ1.Footnote 1

3 Results

We now examine the bilateral trade flows for our 74 industries over the (annual) period from 1962 to 2009. Our first step is to test for cointegration. As mentioned above we do this with Pesaran et al.’s (2001) F test for joint significance of lagged level variables in (2). The authors’ nonstandard set of critical values is extended by Narayan (2005) for small samples such as ours. This test requires both a lower bound value, below which the variables are not cointegrated, and an upper bound value, above which the variables have a long-run relationship. If an equation’s F-statistic falls in between the bounds, we use an alternative test, grouping the fitted values of the lagged level terms into a single variable (i.e., error-correction term denoted by ECMt−1) and re-estimating the equation after imposing the optimum lags. If the coefficient of the lagged error-correction term is significantly negative, we can say that any shock is eventually “undone” as the variables move together back toward equilibrium.Footnote 2

Our cointegration test statistics are provided in Table 1. We find that out of the 74 industries, 30 have F-statistics below Narayan’s (2005) lower bound of 2.873, while 23 statistics are above the upper bound of 3.973. Most of the remaining 21 industries that lie in the intermediate range are shown to be cointegrated when the ECM test is applied; overall, 40 of the 74 industries are shown to be cointegrated. We thus continue our analysis with short-run coefficients for all 74 industries, but examine the long-run estimates only for the 40 cointegrated industries.

Table 2 shows that, even in the short run, relatively few industries are affected by currency depreciations or devaluations. Of the 74 industries, 47 have at least one significant REX coefficient. This is a relatively low percentage, compared with similar studies of this type that have been performed for other countries, as detailed by Bahmani-Oskooee and Hegerty (2010). The signs of these coefficients are both positive as well as negative, and a single industry might have both at different lags. As we will discuss below, there is little evidence of any “J-curve” effect here.

Our long-run coefficients, given in Table 3, show that the determinants have a stronger effect. Here, though, the income coefficients do not consistently have their expected signs. Only eight industries carry the expected signs for both Spanish and US income; 10 industries actually carry “perverse” coefficients that are negative for US income and positive for Spanish income. The EURO dummy is significant in only eight cases. It is clear that something else is driving these trade flows.

The real exchange rate is by far the strongest determinant of the trade flows of these 40 cointegrated industries. Twenty-six have significant coefficients, all of which carry the expected positive sign. These are presented separately in Table 3. This proportion—26 out of 74—is consistent with those found in other industry-level studies. In the detailed analysis by Bahmani-Oskooee and Hegerty (2010), a large number of country studies find that around one-third to one-half of industries respond positively to an exchange-rate depreciation.

One interesting result of our analysis is that we find almost no evidence of any “J-curve,” by any definition. As Bahmani-Oskooee and Hegerty (2010) note, the J-curve effect (where a currency depreciation initially worsens a country’s trade balance before short-run rigidities are worked through and the trade balance improves) can be isolated in two ways with short- and long-run coefficients. In one, a J-curve can be determined when short-run exchange-rate coefficients are negative at early lags and positive at later lags. In another, short-run coefficients are negative while the long-run coefficient is positive. We find possible evidence of the first definition of the J-curve in only one industry (numbered #612), but this industry does not carry a significant long-run exchange coefficient. Support for the second definition is somewhat stronger, as four industries (numbered 532, 642, 696, and 724) fulfill the criteria. But, since 90% of our cointegrated industries and 94% of all industries do not, we cannot claim much overall support for this effect.

We provide diagnostic statistics in Table 4. In general, our model appears to be free of serial autocorrelation (via a Lagrange multiplier test), functional misspecification (RESET test) and instability (CUSUM and CUSUM-squared tests of residuals). In addition, adjusted R 2 is relatively high.

It is clear from Table 3 that all classes of industry have significant, as well as insignificant REX, coefficients. Are there any characteristics that might help us describe which sectors or industries might be more likely to respond significantly to exchange-rate fluctuations? To answer this question, we first rank the industries according to certain classifications and then examine how these ranks differ for cointegrated industries and those that have significant REX coefficients. These results are given in Table 5.

We rank the industries in three ways: By growth (in the trade balance over the 1962–2009 period), the size of each industry’s trade balance in 2009, and each industry’s 2009 trade share. These shares and their construction are given in Table 1; the others are available upon request. We then compare the average rank once we separate the industries by different types of statistical significance. The average rank of each group should be 37.5, since 74 industries are examined. We then look for a wide gap between the set that contains a significantly positive REX coefficient and the other groups. If this group has a noticeably lower average rank, we can say that faster-growing or large industries are more likely to benefit from a depreciation in the long run. Likewise, larger average ranks suggest that benefits would accrue to slower-growing or smaller industries.

We compare three sets of groups, but find that these characteristics explain relatively little. First, we compare cointegrated versus uncointegrated industries. The average rank of the two groups is very similar for our industry characteristics. This implies that industries with a large trade share are no more or less likely to be cointegrated. The one characteristic where the average trade shares diverge is growth, suggesting that growing industries (with a low rank) are more likely to be cointegrated.

These patterns persist in our other two choices of groups. When we compare three groups (industries with a significantly positive REX coefficient, those that are cointegrated but have an insignificant coefficient, and uncointegrated industries), we again find very little difference in average rankings for the trade balance and trade share, but a possible relationship where faster-growing industries are more likely to respond positively to a real depreciation. When we combine all industries that do not have a significant REX coefficient (regardless of cointegration) with those that do, we confirm our results above. We are not surprised that industries where the trade balance is growing might be responding to the exchange rate, as that is the point of our study. We can only say that large trading industries do not seem to respond any differently than small ones to currency fluctuations in the long run.

We also examine our industries by sector, assessing what fraction of the industries within each 1-digit SITC classification experience an increase in the trade balance after a depreciation. These fractions are given in Table 6. Within most sectors, between 20 and 40% of the three-digit industries have significantly positive long-run REX coefficients. The only sector with a relatively large share is category 7 (Machinery and Transport Equipment), with six of 13 industries responding. On the other hand, category 8 (Miscellaneous Manufactured Articles) has a share that is lower than 20 percent. Considering these results alongside those of category 6 (Manufactured Goods), for which only a quarter of industries were affected, we can say that there is no specific pattern regarding durable versus non-durable goods. Again, industry characteristics provide only limited explanation of which types of product might be more sensitive to exchange-rate fluctuations.

4 Conclusion

While Western Europe has often linked its countries’ currencies to one another in the post-Bretton Woods era—culminating in the Euro—exchange rates have nevertheless floated freely against the US dollar. As a result, real appreciations and depreciations have the capacity to hinder or help European trade with the largest economy in the world. At the same time, individual industries might respond differently from one another, due to specific characteristics that might influence their particular sensitivity to currency fluctuations. The recent trend in the literature has been to analyze the effects of currency movements on industry-level trade flows rather than aggregate or bilateral ones.

This study examines the specific case of Spain’s trade with the United States, particularly for 74 individual industries. We model each industry’s trade balance as a function of Spanish and US income, as well as the real exchange rate. Using cointegration analysis, we then test what effect real depreciations vis-à-vis the dollar have on trade in the short- and long run.

We find that only slightly more than half of the industries show a significant short-run relationship, which is fewer than similar studies of other countries’ industry trade have found. Our long-run evidence, however, finds some support for long-run improvements in the trade balance: While only 40 of the 74 industries show evidence of cointegration, the trade balances of 26 of these (about a third of the total) increase after a devaluation. This is a similar proportion to what has been found in previous studies.

We then rank the countries according to their growth and relative trade share and compare whether these characteristics are more likely to be found among the industries that respond to a devaluation. We find little relationship, except for some evidence that industries with faster-growing trade might also be sensitive to the real exchange rate. Another analysis, where we examine what proportion of trade flows in broader, SITC 1-digit sectors are sensitive to devaluations, find that category 7 (Machinery) has the largest fraction of industries that respond to changes in the real exchange rate.

Notes

More precisely the lagged error-correction term is formed using \( {\text{ECM}}_{t - 1} = \ln \left( {\frac{{X_{i,t - 1} }}{{M_{i,t - 1} }}} \right) - \frac{{\hat{\theta }_{2} }}{{\hat{\theta }_{1} }}\ln Y_{t - 1}^{\text{US}} - \frac{{\hat{\theta }_{3} }}{{\hat{\theta }_{1} }}\ln Y_{t - 1}^{\text{Spain}} - \frac{{\hat{\theta }_{4} }}{{\hat{\theta }_{1} }}\ln {\text{REX}}_{t - 1} \) formula.

References

Andersen PS (1993) The 45°-rule revisited. Appl Econ 25(10):1279–1284

Bahmani-Oskooee M, Alse J (1994) Short-run versus long-run effects of devaluation: error-correction modeling and cointegration. East Econ J 20(4):453–464

Bahmani-Oskooee M, Hegerty SW (2009) The effects of exchange-rate volatility on commodity trade between the US and Mexico. South Econ J 75:1019–1044

Bahmani-Oskooee M, Hegerty SW (2010) The J- and S-curves: a survey of the recent literature. J Econ Stud 37(6):580–596

Bahmani-Oskooee M, Kara O (2005) Income and price elasticities of trade: some new estimates. Int Trade J 19(2):165–178

Bahmani-Oskooee M, Niroomand F (1998) Long-run price elasticities and the Marshall-Lerner condition revisited. Econ Lett 61(1):101–109

Bahmani-Oskooee M, Ratha A (2004) The J-curve: a literature review. Appl Econ 36(13):1377–1398

Bahmani-Oskooee M, Tanku A (2008) The black market exchange rate vs. the official rate in testing PPP: which rate fosters the adjustment process. Econ Lett 99:40–43

Bahmani-Oskooee M, Harvey H, Hegerty SW (2011) Empirical tests of the Marshall Lerner condition: a literature review. J Econ Stud (forthcoming)

De Vita G, Kyaw KS (2008) Determinants of capital flows to developing countries: a structural VAR analysis. J Econ Stud 35:304–322

Halicioglu F (2007) The J-curve dynamics of Turkish bilateral trade: a cointegration approach. J Econ Stud 34:103–119

Himarios D (1989) Do devaluations improve the trade balance? The evidence revisited. Econ Enq 27:143–168

Langwasser K (2009) Global current account adjustment: trade implications for the Euro area countries. Int Econ Econ Policy 6:115–133

Miles MA (1979) The effects of devaluation on the trade balance and the balance of payments: some new results. J Polit Econ 87(3):600–620

Mohammadi H, Cak M, Cak D (2008) Wagner’s hypothesis: new evidence from Turkey using the bounds testing approach. J Econ Stud 35:94–106

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990

Narayan PK, Narayan S, Prasad BC, Prasad A (2007) Export-led growth hypothesis: evidence from Papua New Guinea and Fiji. J Econ Stud 34:341–351

Payne JE (2003) Post stabilization estimates of money demand in Croatia: error correction model using the bounds testing approach. Appl Econ 35(16):1723–1727

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Tang TC (2007) Money demand function for Southeast Asian countries: an empirical view from expenditure components. J Econ Stud 34:476–496

Warner D, Kreinin ME (1983) Determinants of international trade flows. Rev Econ Stat 65:96–104

Wong KN, Tang TC (2008) The effects of exchange rate variability on Malaysia’s disaggregated electrical exports. J Econ Stud 35:154–169

Acknowledgments

Valuable comments of two anonymous referees are greatly appreciated.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Data definitions and sources

All data are annual (1962–2009) and are collected from the following sources:

-

(a)

The World Bank.

-

(b)

The International Financial Statistics of the IMF.

1.1.1 Variables

\( \left( \frac{X}{M} \right) \) = For each industry, this is the ratio of Spain’s exports to the United States over its imports from the United States. The data for 74 industries come from source a; Y Spain = Spanish real GDP. The data come from source b; Y US = US real GDP, source b; REX = Real bilateral exchange rate between the Spanish peseta and the dollar, defined as \( \left( {\frac{{{\text{CPI}}_{\text{US}} \times {\text{NEX}}}}{{{\text{CPI}}_{\text{Spain}} }}} \right), \) where CPI is the Consumer Price Index. NEX is the nominal bilateral exchange rate defined as number of pesetas per dollar. Thus, an increase in REX reflects a real depreciation of Spain’s currency. Beginning in 1999, the Euro/dollar nominal rate is converted to pesetas at the rate of 166.386 pesetas per Euro. All these variables come from source b.

Rights and permissions

About this article

Cite this article

Bahmani-Oskooee, M., Harvey, H. & Hegerty, S.W. Regime changes and the impact of currency depreciations: the case of Spanish–US industry trade. Empirica 40, 21–37 (2013). https://doi.org/10.1007/s10663-011-9176-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-011-9176-1