Abstract

Uncertainty will not only harm the economy but may also provide an opportunity for technological innovation. It is well established from past studies that technological innovation is a useful tool for reducing uncertainty across countries. However, it is not known whether this uncertainty can contribute to innovation across countries. Hence, in this study, we develop an empirical model to examine the impact of uncertainty on technological innovation across a global panel of both developed and developing countries over the period 2013–2018. Using generalized methods of moment (GMM), we find that uncertainty have significant negative and positive impact on technological innovation in developing and developed countries, respectively. Given these findings, the study argues that the role of uncertainty in improving technological innovation significantly varies across both developed and developing countries. Therefore, significant implications have to do with the fact that developing countries need to initiate effective action to look uncertainty as a key to unlocking opportunity, while developed countries should take into consideration that uncertainty is a viable strategy for addressing innovation ideas.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, everybody knows technological innovation is restructuring the World faster than ever before and benefits consumers, business and the economy as a whole. The rapid pace of technological innovation is fundamentally changing people's way of living and working. It affects all fields, economies and industries, including how, what and where people manufacture and distribute goods and services and not just production. Generally, technological innovation influences future growth by changing the relative value of capital, transforming economic sectors, changing organizational thinking skills and capabilities (Fagerberg et al. 2010; Ramadani et al. 2013; Martin and Leurent 2017; Dauda et al. 2019; Chege et al. 2020). This creates opportunities for governments, firms, individual, and consumers to found a new way of doing things and to develop and adopt new kinds of products, production process, business and services and organizational model. While technological innovation is considered as a major force in future growth, the rapidly growing uncertainty is likely to offer another option to strengthen technological innovation.

Theoretically, technological innovation is a process that begins with the idea generation phase, which helps to discover new opportunity for achieving new or improved product and services (Schilling and Shankar 2019). Here, uncertainty can be seen as a major source for generating new ideas, identifying and inventing new innovative technology to manage uncertainty. If a country perceives high uncertainty, it tends to embrace more innovative technologies and thus reduce the risks associated with uncertainty. For example, production or yield uncertainties due to climate change led to the discovery of innovative ideas such as Robotic technologies, Infrared sensors for crop stress detection (Infrared Thermal Imaging Technology, Remote Sensing Techniques), Weather Foresting (Doppler Radar, Weather Satellites) technologies to support the global growth of sustainable agriculture and food production (Jalonen 2012; Kalamova et al. 2012; Martin and Leurent 2017). Similarly, social uncertainty allows for financial (FinTech) technology to be secured without any effort, practically without a person's assistance where financial operations such as money transfers, deposits, loans, and investment management are carried out. Given these explanations, uncertainty seen as the key to unlocking opportunity for countries to promote development and adoption of innovation.

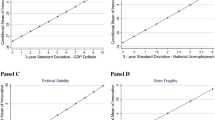

Besides putting a theoretical emphasis on the role of uncertainty and technological innovation, we take a very simple look at the real-world relationship between uncertainty and innovation for developed and developing countries over one decade. Figures 1 and 2 share different views on the relationship between uncertainty and innovation between developed and developing countries. For developed countries, higher uncertainty tended to lead a higher level of technological innovation while developing countries with higher uncertainty rate are experiencing a lower level of innovation. Given that developing countries seem unable to foster technological innovation in a situation of a high degree of uncertainty, which is contrary to our discussion above. For example, developed countries that score high on uncertainty tend to adopt more innovative technologies and thus minimize the risks associated with uncertainty relative to developing countries. Therefore, the impact of uncertainty on technological innovation remains highly ambiguous and still unanswered conclusively.

This paper proceeds as follows. Section 2 reviews the relevant literature. The effect of uncertainty on the technological innovation is modeled in Sect. 3. Section 4 discusses econometric modeling framework with empirical analyses and Sect. 5 concludes with a summary of the main findings and policy implication.

2 Literature review

In respect of past studies, several noticeable factors affected technological innovation have been identified such as corruption (Leff 1964; Lui 1985; Anokhin and Schulze 2009; Nguyen et al. 2016; Xu and Yano 2017; Dincer 2018; Riaz and Cantner 2019), inequality (Falkinger 1994; Zweimüller 2000; Pieroni and Pompei 2008a, b; Tselios 2011; Coccia 2014a, b), education (Edquist 1997; Furman et al. 2002; Lundvall et al. 2002; Chen and Puttitanun 2005; Varsakelis 2006; Serdyukov 2017) research and development expenditures (Acs et al. 2002; Furman et al. 2002; Bhattacharya and Bloch 2004; Schneider 2005; Akcali and Sismanoglu 2015, Coccia 2017a, b; Coccia 2019), corruption (Leff 1964; Lui 1985; Nguyen et al. 2016; Riaz and Cantner 2019; Gan and Xu 2019), climate change (Coccia 2015), governance (Coccia 2017a, b; Chen et al. 2020; Könnölä et al. 2021; Chen 2021), population growth (Coccia 2014a, b). As population growth causes resource management and socioeconomic system problems, an increase in the number of people associated with higher levels of democracy, good economic governance and institutions, and the accumulation of highly skilled human capital leads to more sustainable patterns of technological innovation. Due to the large number of publications on technological innovation, this review focuses only on selected works that presents factors influencing and limiting technology innovation development. It also refers to the impact of uncertainty on technological innovation.

Many scholars have debated the impact of technological innovation in the context of corruption (Leff 1964; Lui 1985; Anokhin and Schulze 2009; Nguyen et al. 2016; Xu and Yano 2017; Dincer 2018; Riaz and Cantner 2019; Gan and Xu 2019). Anokhin and Schulze (2009) for 64 countries; Nguyen et al. (2016) for Vietnam; Xu and Yano (2017) for China; Dincer (2018) for the USA; Riaz and Cantner (2019) for developing and emerging countries assessed the effects of corruption on technological innovation. Studies on corruption and innovation are primarily rooted in empirical indicates that corruption impede country technological innovation activities. Corruption negatively affects innovative activities due to a lack of property rights institutions, making innovation vulnerable to predation. Thereby, the country becomes less attractive, and the rate of innovative development slows down. Besides that, Myrdal (1968), De Waldemar (2012), Yang (2017) and Dincer and Fredriksson (2018) evolve around the sanding the wheels hypotheses observe that countries with more corruption tend to have high transactional costs and leading to the misallocation of resources and placing barriers to invest in innovative activities. On the other hand, Leff (1964), Lui (1985), Nguyen et al. (2016), and Riaz and Cantner (2019) identifying corruption as the greasing the wheels that are attractive for innovations. Corruption is desirable for innovative developments due to the loopholes in the legal system that help to ease and speed up innovative technological processes. Therefore, in the past studies, there seems to be no consensus about how corruption affects the technological innovation.

According to Falkinger (1994), Zweimüller (2000), Pieroni and Pompei (2008a, b), Tselios (2011), and Coccia (2014a, b) inequality affects technological innovation via two channels. The first strand of the previous studies relates to the inequality and innovation refer to the role of inequality in improving the technology by innovation. Falkinger (1994) and Tselios (2011) argue that inequality can be important determinants of innovation if the distribution of income influences product demand. The increased disparity between rich and poor raises demand for the innovative products and services, thus forcing the country to invest in innovative activities and fostering technological innovation. The reason for this is that the rate of demand for the technological aspect of a good or services increases with higher income of rich people compared to poor people. Therefore, it pushes the country toward technological innovation. Second, Johnson (1997), Zweimüller (2000) and Pieroni and Pompei (2008a, b) have shown contrasting results that increased income disparity slow technology innovation process. Johnson (1997), Zweimüller (2000) and Pieroni and Pompei (2008a, b) have shown that higher inequality leads to less favorable conditions for innovation by lowering the level of gross domestic product per capita. Given the discussion of past studies, income inequality affects technological innovation significantly. Furthermore, Edquist (1997), Furman et al. (2002), Lundvall et al. (2002), Chen and Puttitanun (2005), Varsakelis (2006), and Serdyukov (2017) believe that education can attract countries to accelerate product and process innovation. Edquist (1997), Furman et al. (2002), Lundvall et al. (2002), Chen and Puttitanun (2005), Varsakelis (2006), Vieluf et al. (2012), and Serdyukov (2017) find that education specifically affects the country-level innovations. Education is structured to provide people with knowledge, skills, and motivation to adopt technological innovation and therefore facilitates innovative activity. For example, a few descriptive works of literature on the impact of education on technology in India, Brazil, and Afghanistan indicates that higher education can be beneficial to innovation growth because it provides progressive ideas on innovation and prepares people with realistic awareness that the world is moving toward technological innovation. Such studies, therefore, show that growing education can help promote technological innovation.

Regarding the factors influencing technological innovation, some scholars (Acs et al. 2002; Furman et al. 2002; Bhattacharya and Bloch 2004; Schneider 2005; Akcali and Sismanoglu 2015; Coccia 2017a, b) show that the level of innovation in the investigated countries is dependent on research and development expenditures. A review of the literature indicates that research and development is regularly examined by motivations theory (Acs et al. 2002; Furman et al. 2002; Bhattacharya and Bloch 2004; Schneider 2005; Akcali and Sismanoglu 2015). Research and development (R&D) refer to innovative activities undertaken by countries in creating or enhancing new goods or products or improving existing ones. Thereby R&D is an essential input for innovation because it affects country innovative behavior. R&D is a necessary condition for the development of innovative technological products and services because it creates incentives for new technologies which subsequently leads to more adaptive to technological innovation. Hence, higher research and development expenditures leads to developments in technological innovations.

Increased research and development expenditures can accommodate the degree of innovation that stimulates technological innovation due to greater willingness to utilize and enhance innovation and support innovative ideas, combined with higher education, which has resulted in higher innovation outcomes. While these factors allowing an innovative environment, the rapidly growing uncertainty is likely to offer another option to strengthen technological innovation. Schneider (2005), Chen and Puttitanun (2005), Bhattacharya et al. (2017), Coccia (2019), and He et al. (2020) are among the few studies examining the effects of uncertainty in innovative activity. Schneider (2005) and Chen and Puttitanun (2005) indicate that uncertainty is a major source of innovation development by modifying existing technologies, operating processes, and inventing new technologies, in particular, to overcome the uncertainty. Understanding the nature of uncertainty can create the need and tremendous opportunity for technological innovation which in turn help to manage current and future uncertainty. Dearing (2000), Jalonen and Lehtonen (2011), Wang et al. (2017), and Bhattacharya et al. (2017), on the other hand, has been argued that uncertainty traditionally associated with obstacles to innovation, which lower innovative probabilities. Uncertainty, including technological uncertainty (the possibility of choosing alternative (future) technological options), resource uncertainty (amount and availability of raw material, human and financial resource needed), and competitive uncertainty (competing technological options) may delay or even abandon innovation activities and performance.

Although there is a literature on how uncertainty affect innovation, the relationship between uncertainty and innovative activity are highly questionable and may be inaccurate. The basic idea is that countries have two options, either to stimulate a country to engage in technological innovation or can see as obstacles leading to lower innovation. A high level of uncertainty refers to the issue in which countries are accelerating the pace of technological innovation development and adoption. If a country perceives high uncertainty, it tends to embrace more innovative technologies and thus reduce the risks associated with uncertainty. There is also a possibility where, in a situation of high uncertainty, countries have not been able to promote technological innovation. Too many uncertainties may hinder the ability of countries to turn uncertainty into opportunity, to innovate and thus hinder the transition to technology. Given the mixed scenario and contrast relation, this study opts to examine the relationship between uncertainty and technological innovation for developed and developing countries. Examining the linkage for developed and developing, which face the lower and higher level of uncertainty seems to provide a better and more insightful direction to the technology experts.

3 Methodology

3.1 Data and measures of variables

This study used secondary data in which the data comes from different kind of sources because secondary data are more reliable and saves time. This study used a balanced panel data for 40 developing and 51 developed countries from 2013 to 2018 used to examines the role of uncertainty in explaining technological innovation. Additionally, the present study used various data sources to obtain the datasets on dependent and independent variables of developed and developing countries from 2013 to 2018. Table 1 provides a summary of each variable.

3.2 Models and data analysis

This study extends the model of Zweimüller (2000), Pieroni and Pompei (2008a, b), and Tselios (2011) by including the world uncertainty index as determinants of technological innovation. This study also predicts that the presence of uncertainty may have significant effects on technological innovation. Schneider (2005) and Chen and Puttitanun (2005) have shown the possibility that higher levels of uncertainty tend to increase the level of innovation. In contrast, previous studies such as Dearing (2000) and Jalonen and Lehtonen (2011) found that uncertainty as a hindrance to innovation. In short, this study can synthesize from the past studies that uncertainty significantly affects innovative activities. Also, there is a lack of empirical studies that incorporated technological innovation. Empirical evidence is therefore required to examine the impact of uncertainty on technological innovation. The selection of control variables is built on past studies of Schneider (2005), Tselios (2011), Akcali and Sismanoglu (2015), Nguyen et al. (2016), Nguyen et al. (2016), Xu and Yano (2017), Serdyukov (2017), Dincer (2018), Riaz and Cantner (2019), and Riaz and Cantner (2019) by incorporating corruption, income inequality, research and development expenditures and education. The model form used in study is presented as follow:

where CORP is corruption, IE is income inequality, EDU is education and RD is research and development and UNCER is uncertainty. Econometrically, Eq. (2) in logarithmic form can be expressed as follows:

where the prefix “ln” represents the natural logarithm, \(\alpha_{1} ,\alpha_{2} ,\alpha_{3} , \alpha_{4} , {\text{and}}, \alpha_{5} \) are the slope parameters to be estimated subscripts i and t refers to country and year, respectively, and ε is an error term. \(\alpha_{1} ,\alpha_{2} , \alpha_{5}\) are expected to be significant and the impact of \(\alpha_{3} , {\text{and}}\alpha_{4} \) on innovation are expected to be positive.

On the basis of a short period employed in this study, this study estimates Eq. (3) by using GMM estimator. Hence, the modified dynamic panel data model under GMM can be simplified and shown as in Eq. (3):

Equation (3) represents the model at the level where the \(\ln {\text{TI}}_{i,t}\) depends on the vector of determinants, \(\ln X_{i,t}\) (i.e., corruption, income inequality, education, research and development, and uncertainty), and \(\gamma_{i}\) a country-specific effect.

Initially, the first-difference GMM estimation applied to eliminates the country-specific effect by transforming Eq. (3) into the first difference. This can be expressed as

Although the country-specific effect was eliminated by Eq. (4), the endogeneity issue still existed because a number of explanatory variables may be endogenous naturally. The problem of endogeneity usually relates to the presence of a correlation between explanatory variables and the error term. To resolve the endogeneity problem, Arellano and Bovver (1995) proposed the use of the lagged-level explanatory variables as instrumental variables, since by construction these variables are not correlated with the error term. Hence, we derive the following equations, as follows:

The estimation, therefore, eliminated endogeneity.

4 Results and discussion

We begin our analysis by looking at the descriptive analysis before continuing to estimating the panel data technique. The descriptive statistics for the independent and dependent variables are shown in Table 2. We find that the mean of technological innovation for the period is recorded as 4.546 and uncertainty during the same period is 4.054. The maximum technological innovation is 5.475 while the minimum value is 2.272. For uncertainty, the maximum value is 5.475 and the minimum value is 2.272. Particularly, the research and development have the highest mean, maximum and minimum value of 7.535, 6.826, and 3.836, respectively. Additionally, the standard deviation displays that corruption has the greatest variation of 0.410 and followed by research and development, education, income inequality, uncertainty, and technological innovation.

Here, we discuss results of the aggregated analysis in which we use we split the sample in developed (40 countries) and developing countries (51countries). Table 3 captures the results of two-step GMM estimator for developed and developing countries, respectively. In the dynamic panel model, the Hansen test of over-identifying restrictions and Arellano–Bond (AR) test are employed for the adequacy of the model and appropriateness of estimation method. It is observed that all p-values of the Hansen test is higher than significance level, thereby signifying the validity of the instruments. As can be seen from Table 3, the outcome of p-value of AR (1) in first difference rejects the null hypothesis that there is autocorrelation while AR (2) does not reject the null hypothesis. Lastly, the p-value of the Scalar static in GMM approach is greater than the significance level and can be confident that system GMM achieves greater efficiency than difference GMM for the model. Due to that this study focuses on SYS-GMM two-step for both developed and developing countries.

As shown in Table 3, the explanatory variables such as education, corruption, and income inequality carry the expected signs for developed and developing countries. In the dynamic model of developed and developing countries, education is having significant positive effect on technological innovation. For example, the coefficient 0.0727 indicate that every one percent increase in education is associated with an average increase in innovation by 0.0727%. This is in in-line with Furman et al. (2002), Lundvall et al. (2002), Chen and Puttitanun (2005), Varsakelis (2006), Vieluf et al. (2012), and Serdyukov (2017), who argue that education is an important variable that attracts innovation in both developing and developed countries. For instance, education encourages the innovation necessary for countries by increasing human cognitions levels and providing higher insight into how respond better and quickly to the new things. This may be leads to innovative consumers who adopt and accept the new product, thereby stimulate firm’s technological innovation level.

For developed and developing countries, corruption has shown negative and significant impact on technological innovation. The negative coefficient of the corruption confirms the notion that higher level of corruption reduces opportunities for country to engage in innovation. The results suggest that a one percent increase in corruption decreases technological innovation by 0.0439% and 0.0621% for the developing and developed countries. According to a number of studies, when a firm must pay bribes to manage innovation activities, the cost of doing so rises, potentially discouraging firms from doing so (Myrdal 1968; De Waldemar 2012; Yang 2017; Dincer and Fredriksson 2018). In contrast to the findings of Leff (1964), Lui (1985), Nguyen et al. (2016), Gan and Xu (2019) and Riaz and Cantner (2019), detecting corruption can increase the degree of innovation by reducing stiff barriers to investment and fostering innovation. Thus, the corruption variable, like Bloom et al. (2019), Nguyen et al. (2016), and Riaz and Cantner (2019), has a detrimental impact on innovation.

Regarding the independent variable for income inequality in Table 3, it is observed that the increase of inequality negatively contributes to technological innovation, confirming the findings of Johnson (1997), Zweimüller (2000) and Pieroni and Pompei (2008a, b). Estimates for developing and developed countries imply that a one percentage point increase in income inequality is connected with 0.0283 and 0.0939% increases in technological innovation, respectively. The reason is that the higher inequality reduces the desired pay for innovative products because some poor are already satisfied with non-innovative goods. This suggests that the unequal distribution of income decreases the demand for non-innovative products and decreases incentives for technological innovation.

Furthermore, the GMM result shows that research and development expenditures have a negative effect on innovation for developing countries, whereas that for the developed countries reveals the positive impact. According to coefficient estimates, a one percent increase in research and expenditure results in a 0.0161% decrease in technological innovation in developing countries, but a one percent increase in research and expenditure results in a 1.3776% reduction in technological innovation in developed countries. These results support the findings of Schneider (2005), Akcali and Sismanoglu (2015) and Coccia (2019), suggesting that developing countries' investments in research and development are ineffective in promoting technological innovation. In the case of developed countries, the findings show that research and development play an essential part in the technological innovation process, leading to increased capabilities to engage in innovative activities (Schneider 2005; Akcali and Sismanoglu 2015).

The main takeaways of the paper are uncertainty, which indicates that uncertainty have significant negative impact on technological innovation for developing countries. More precisely, a one percent rise in uncertainty declines technological innovation by 0.0244%. Our findings for the developing countries are similar to those of past studies (Dearing 2000; Jalonen and Lehtonen 2011; Coccia 2017a, b; Bhattacharya et al. 2017; Wang et al. 2017). In two ways, uncertainty can be significantly and negatively related to technological innovation. Firstly, rising uncertainty in developing countries are more likely associated with negative effects on economic growth appear to raise difficulties in strengthening innovation activities. For example, low growth in gross domestic product narrows the overall size of the economy and weakens fiscal condition leading to lower government expenditure and high taxes on innovative processes, which could link to reduced incentives to innovate. Secondly, high uncertainty also adversely affect innovation by altering firm decision to engage in innovative activities. This is because uncertainty reduces a company's financial capacity, causing it to postpone investments in innovative activities, discourage the development of new goods or the existing ones, and innovate. As a result, in developing countries, uncertainty becomes an impediment to technical innovation and similar to Dearing's (2000) and Jalonen and Lehtonen (2011).

On the contrary, it appeared to generate innovation in the developed countries where a one percent rise in uncertainty stimulates innovation by 0.1223%. For developed countries, the results suggest that uncertainty has a positive impact on their innovation level. This study's findings are consistent with those of Schneider (2005) Chen and Puttitanun (2005) and He et al. (2020), who contend that uncertainty can encourage a country to engage in or invest in innovative activities. One finds that managing uncertainty contributes to further innovation, which allows us to turn uncertainty into a solution for problems. It seems that creating or implementing new ideas or approaches along the path of uncertainty is not only to minimize or remove uncertainty but also to promote innovation.

For robustness purpose, we have also conducted the GMM analysis with additional explanatory variables, namely foreign direct investment (FDI) and trade (TR). As it is possible to observe in Table 4, foreign direct investment, and trade can be seen to improve innovation in both developed and developing countries. Foreign direct investment is positively and significantly linked to technical innovation, with a one percent increase in FDI resulting in a 0.0118% and 0.4698% rise in the level of innovation in developed and developing nations, respectively. FDI promotes innovation activities of countries by expanding access to innovative technologies and resources in countries. This may increase their capacity to invest in research and development and process innovations that results either in a new kind of product or a better process for producing an existing product. Our findings are in-line with past studies. While trade also exerts a positive impact on innovations. The findings reveal that one percent increase in TR, leads to 0.0490% increase in technological innovation. Meanwhile, consistent with the main findings, uncertainty contributes to increasing innovations in developed countries, but it is not effective in motivating innovation in developing countries.

5 Conclusion

In this research, the relationship among the uncertainty and innovation in a panel of developed and developing countries with the most recent dataset from 2013 to 2018 were examined. The generalized method of moments estimation is utilized to scrutinize the association among the study core variables. The examined findings of the GMM specify that the uncertainty have a significant impact on innovation. One observes that uncertainty present different impact on developed and developing countries. The results indicate that in developed countries the effect of uncertainty on innovation is positive, while in developing countries the impact of uncertainty on innovation is negative. Besides, the results from the robustness tests lend support to this view that developed countries are more likely engage in innovation activities than developing countries during uncertainty times. Therefore, the findings confirm that uncertainty provides positive support for developed countries, whereas developing countries harms from uncertainty.

The study's findings have substantial policy implications. The response of uncertainty to technological innovation is asymmetric in both developing and developed countries; therefore, policymakers should develop policies that account for both the negative and positive impacts. Governments should enable developing countries' understanding of uncertainty to improve the ability of a country to transform or convert the uncertainty into innovations. To increase understanding, communication of information around uncertainty needs to strengthen as well as people's knowledge and skills in decision making required to overcome these challenges. Moreover, governments and other agencies need to provide financial aid to the developing countries for transforming uncertainty into opportunity. This is because developing countries usually seek additional funds to handle uncertainty, thus discouraging countries from converting increased uncertainty into incentives that promote innovation. Furthermore, it is widely accepted that collaboration and mutual combination of different policy tools between developed and developing countries is also critical in minimizing cost-management uncertainties and shifting their challenges to innovation. With this cooperation, developing countries can be encouraged to create, developing and diffuse new products or process, particularly during the uncertainty times.

This analysis limits in sample and variables in empirical analysis. Our primary goal is to examine the impact of uncertainty on technological innovation in developing and developed countries, but we measure uncertainty without regard to different types of uncertainty. Besides, the technological development of innovation is influenced by numerous factors associated with uncertainty, which are not addressed in this study. As a result, in future research, authors will need to clarify the influence of technological innovation by delving deeper into specific types of uncertainty and the factors related to uncertainty.

References

Acs ZJ, Anselin L, Varga A (2002) Patents and innovation counts as measures of regional production of new knowledge. Res Policy 31(7):1069–1085

Akcali BY, Sismanoglu E (2015) Innovation and the effect of research and development (R&D) expenditure on growth in some developing and developed countries. Procedia Soc Behav Sci 195:768–775

Anokhin S, Schulze WS (2009) Entrepreneurship, innovation, and corruption. J Bus Ventur 24(5):465–476

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Bhattacharya M, Bloch H (2004) Determinants of innovation. Small Bus Econ 22(2):155–162

Bhattacharya U, Hsu P-H, Tian X, Xu Y (2017) What affects innovation more: Policy or policy Uncertainty? J Financ Quant Anal 52(5):1869–1901

Bloom N, Van Reenen J, Williams H (2019) A toolkit of policies to promote innovation. J Econ Perspect 33(3):163–184

Chege SM, Wang D, Suntu SL (2020) Impact of information technology innovation on firm performance in Kenya. Inf Technol Dev 26(2):316–345

Chen Y (2021) Does political turnover stifle or stimulate corporate innovation? Int Rev Econ Financ 76:1126–1145

Chen Y, Puttitanun T (2005) Intellectual property rights and innovation in developing countries. J Dev Econ 78(2):474–493

Chen S, Mao H, Feng Z (2020) Political uncertainty and firm entry: evidence from Chinese manufacturing industries. J Bus Res 120:16–30

Coccia M (2014a) Driving forces of technological change: the relation between population growth and technological innovation-analysis of the optimal interaction across countries. Technol Forecast Soc Chang 82(2):52–65. https://doi.org/10.1016/j.techfore.2013.06.001

Coccia M (2014b) Religious culture, democratization and patterns of technological innovation. Int J Sustain Soc 6(4):397–418. https://doi.org/10.1504/IJSSOC.2014.066771

Coccia M (2015) Spatial relation between geo-climate zones and technological outputs to explain the evolution of technology. Int J Transit Innov Syst 4:5–21. https://doi.org/10.1504/IJTIS.2015.074642

Coccia M (2017a) Varieties of capitalism’s theory of innovation and a conceptual integration with leadership-oriented executives: the relation between typologies of executive, technological and socioeconomic performances. Int J Public Sect Perform Manag 3(2):148–168. https://doi.org/10.1504/IJPSPM.2017.084672

Coccia M (2017b) Sources of disruptive technologies for industrial change. L’industria -Rivista Di Economia e Politica Industriale 38(1):97–120. https://doi.org/10.1430/87140

Coccia M (2019) Why do nations produce science advances and new technology? Technol Soc 59:101124. https://doi.org/10.1016/j.techsoc.2019.03.007

Dauda L, Long X, Mensah CN, Salman M (2019) The effects of economic growth and innovation on CO2 emissions in different regions. Environ Sci Pollut Res 26(15):15028–15038

De Waldemar FS (2012) New products and corruption: evidence from Indian firms. Dev Econ 50(3):268–284

Dearing A (2000) Sustainable innovation: drivers and barriers. Innovation and the environment. OECD: Paris, pp 103–125

Dincer OC, Fredriksson PG (2018) Corruption and environmental regulatory policy in the United States: Does trust matter? Resour Energy Econ 54:212–225

Edquist C (1997) Systems of innovation: technologies, institutions and organizations. Pinter, London

Fagerberg J, Srholec M, Verspagen B (2010) Innovation and economic development. Handbook of the economics of innovation, Volume 2. Elsevier, pp 833–872. https://doi.org/10.1016/S0169-7218(10)02004-6

Falkinger J (1994) An Engelian model of growth and innovation with hierarchic consumer demand and unequal incomes. Ric Econ 48(2):123–139

Furman JL, Porter ME, Stern S (2002) The determinants of national innovative capacity. Res Policy 31:899–933

Gan W, Xu X (2019) Does anti-corruption campaign promote corporate R&D investment? Evidence from China. Financ Res Lett 30:292–296

He F, Ma Y, Zhang X (2020) How does economic policy uncertainty affect corporate innovation?-Evidence from China listed companies. Int Rev Econ Financ 67:225–239

Hites Ahir (International Monetary Fund), Nicholas Bloom (Stanford University) and Davide Furceri (International Monetary Fund) (2020) World uncertainty index. Retrieved September 2020. http://policyuncertainty.com/wui_quarterly.html

Jalonen H (2012) The uncertainty of innovation: a systematic review of the literature. J Manag Res 4(1):1–12

Jalonen H, Lehtonen A (2011) Uncertainty in the innovation process. In: European conference on innovation and entrepreneurship. Academic Conferences International Limited

Johnson GE (1997) Changes in earnings inequality: the role of demand shifts. J Econ Perspect 11(2):41–54

Kalamova M, Johnstone N, Haščič I (2012) Implications of policy uncertainty for innovation in environmental technologies: the case of public R&D budgets. In: Costantini V, Mazzanti M (eds) The dynamics of environmental and economic systems. Springer, Dordrecht, pp 99–116

Könnölä T, Eloranta V, Turunen T, Salo A (2021) Transformative governance of innovation ecosystems. Technol Forecast Soc Chang 173:121106

Leff NH (1964) Economic development through bureaucratic corruption. Am Behav Sci 8(3):8–14

Lui FT (1985) An equilibrium queuing model of bribery. J Polit Econ 93(4):760–781

Lundvall BA, Johnson B, Andersen ES, Dalum B (2002) National systems of production, innovation and competence building. Res Policy 31:213–231

Martin C, Leurent H (2017) Technology and innovation for the future of production: accelerating value creation. World Economic Forum, Geneva Switzerland

Myrdal G (1968) Corruption: its causes and effects. In: Asian drama: an inquiry into the poverty of nations, vol II. Pantheon, New York (Reprinted in Political corruption: a handbook. Edited by a Heidenheimer et al. Transaction Publishers, New Brunswick, 1989:953–961)

Nguyen NA, Doan QH, Nguyen NM, Tran-Nam B (2016) The impact of petty corruption on firm innovation in Vietnam. Crime Law Soc Chang 65(4–5):377–394

Pieroni L, Pompei F (2008a) Evaluating innovation and labour market relationships: the case of Italy. Camb J Econ 32:325–347

Pieroni L, Pompei F (2008b) Labour market flexibility and innovation: geographical and technological determinants. Int J Manpow 29:216–238

Ramadani V, Gërguri S, Rexhepi G, Abduli S (2013) Innovation and economic development: the case of FYR of Macedonia. J Balkan near East Stud 15(3):324–345

Riaz MF, Cantner U (2019) Revisiting the relationship between corruption and innovation in developing and emerging economies. Crime Law Soc Chang 73(November):1–22

Schilling MA, Shankar R (2019) Strategic management of technological innovation. McGraw-Hill Education

Schneider PH (2005) International trade, economic growth and intellectual property rights: a panel data study of developed and developing countries. J Dev Econ 78(2):529–547

Serdyukov P (2017) Innovation in education: What works, what doesn’t, and what to do about it? J Res Innov Teach Learn 10(1):4–33

Tselios V (2011) Is inequality good for innovation? Int Reg Sci Rev 34(1):75–101

Varsakelis NC (2006) Education, political institutions and innovative activity: a cross-country empirical investigation. Res Policy 35(7):1083–1090

Vieluf S, Kaplan D, Klieme E, Bayer S (2012) Teaching practices and pedagogical innovation: evidence from TALIS. OECD Publishing, Paris

Wang Y, Wei Y, Song FM (2017) Uncertainty and corporate R&D investment: evidence from Chinese listed firms. Int Rev Econ Financ 47:176–200

World Bank (2019) World development indicators. Retrieved September 2020 from http://data.worldbank.org/indicator

World Intellectual Property Organization (2019) Global innovation index. Retrieved September 2020 https://www.wipo.int/global_innovation_index

Xu G, Yano G (2017) How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. J Comp Econ 45(3):498–519

Yang JS (2017) The governance environment and innovative SMEs. Small Bus Econ 48(3):525–541

Zweimüller J (2000) Schumpeterian entrepreneurs meet Engel’s law: the impact of inequality on innovation-driven growth. J Econ Growth 5(2):185–206

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Subramaniam, Y., Loganathan, N. Uncertainty and technological innovation: evidence from developed and developing countries. Econ Change Restruct 55, 2527–2545 (2022). https://doi.org/10.1007/s10644-022-09402-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09402-7