Abstract

This paper uses a census of Russian manufacturing firms to study the relationship between exports and productivity at the firm level. The period studied, 1996–2002, implies that the results are affected by the Russian financial crisis of 1998. Exporters are shown to be more productive and larger than non-exporters, seemingly an effect of more productive firms self-selecting into the export market, rather than learning effects. But learning effects are significant among new entrants. Additionally, in examining the effect of the direction of exports on productivity, the finding is that the difference in the productivity level of firms exporting to the OECD and the CIS is insignificant.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The opening up of the Russian economy has led to increased competition on the domestic market and the creation of new export opportunities, two factors that are important determinants of firm performance. This study focuses on the relationship between exports and firm productivity. Although it has been shown that exports and productivity are closely related, the question of the causality between them remains uncertain. Further, transition economies are different from other industrial countries in the sense that their producers were insulated from foreign competition and exports for a long time. There are only a few studies on the relation between exports and productivity in transition economies, and with the notable exception of Damijan et al (2004), the effect of the reorientation of exports on productivity has not been analysed.

The purpose of this paper is to analyse the differences in productivity between exporting and non-exporting firms in Russia. More specifically, we investigate the relationship between exports and productivity, using a large panel of Russian firms over the period 1996–2002, including the importance of the geographical direction of exports in fostering the transmission of knowledge.

The studied period is characterised by increasing total industry productivity, which may be attributed to inter-industry reallocation of resources, decreasing cost as a result of the rouble devaluation in 1998, and improvements in production technology.Footnote 1 The devaluation is expected to increase measured productivity in exporting firms in the short run as revenues increase relative to the costs. In addition, the reduction of competitive pressure on the domestic market gives domestic firms an opportunity to expand sales, but the effect on productivity will not be as immediate as for exporting firms. The devaluation in 1998–1999 has been followed by appreciating real exchange rates and increasing unit labour costs, worsening the position of exporting firms on the world market, although aggregated industry output has continued to increase. This, combined with the decreasing industry employment in 2002–2003, has resulted in higher productivity.

Empirical evidence suggests that exporting firms are more productive than non-exporting firms, since more productive firms become exporters and/or export activity increases productivity. Distinguishing between these two hypotheses has important policy implications. If more productive firms self-select into the export market, as suggested by numerous previous studies, policies aimed at stimulating competition on the domestic market will improve export performance. If, on the other hand, exports per se increase productivity, there is a case for supporting exporting firms and efforts should be made to reduce the cost of exporting. The factors behind differences in productivity between exporting and non-exporting firms might vary between countries and, presumably, between industries. In the case of transition economies the learning effects from exporting should be comparatively large. However, in the case of Russia the learning effect might be smaller than in other transition economies since a large proportion of Russian exports consist of raw materials.Footnote 2 The importance of the learning effect is also expected to depend on the export market. Transmission of knowledge is more likely from a developed market economy than from a developing country or countries of the former Soviet Union. The scope for transmission of knowledge is also likely to be affected by the specialisation of the country studied.

This paper is organized as follow: Sect. 2 contains a brief discussion of the theoretical considerations and previous empirical studies and introduces the data. Section 3 sets out to establish whether exporters outperform non-exporters. Sections 4 and 5 analyse the reasons for differences between exporters and non-exporters, namely if exporters self-select into the export market and if exports boost productivity. Section 6 examines the effect of the direction of exports on exporters’ productivity and Sect. 7 concludes the paper.

2 Background and data

2.1 Previous studies

Several theoretical models predict that exporters are more productive than non-exporters.Footnote 3 The basic theoretical framework for these models is monopolistic competition and heterogeneity among firms. A key assumption, supported by empirical findings, is the existence of fixed or sunk costs of exporting, explaining why export firms and non-exporting firms can coexist.Footnote 4 A common outcome of these models is that only more productive firms will export since they can cover the additional costs of exporting. In the model developed by Clerides et al. (1998) entry into the export market is induced by increased productivity, and firms experiencing a negative evolution of productivity will exit from the export market. This prediction is similar to that of the Melitz (2003) model, which explains how the aggregated productivity level and average firm profit level are endogenously determined in a general equilibrium setting. In contrast to the representative-firm models, where changes in aggregated productivity come from changes in the level of technology common to all firms, the aggregated productivity changes come from reallocations among firms in the Melitz (2003) model.Footnote 5 That is, less productive firms are forced to close down while more productive firms engage in exports and gain sales and profits; hence we would expect exporters to be larger and more productive.

In addition, Clerides et al. (1998) adapt their model to incorporate a possibility of learning from exporting, which can contribute to increased productivity. The existence of sunk costs and learning effects, modelled independently of the volume of exports, will increase dispersion of the productivity of exporting firms. The intuition is that sunk costs and learning effects increase the incentives to remain in the export market, even if productivity is temporarily decreased to avoid paying the sunk entry cost at re-entry and to benefit from positive learning effects.

Empirical studies find convincing support for the prediction that more productive firms enter the export market. Evidence of a learning effect on the other hand is mixed.Footnote 6 The opportunity for learning-by-exporting should be good in the case of transition economies with a relatively skilled workforce and a diversified industrial structure, compared to most developing countries. Moreover, firms in transition economies have more to learn from the most efficient producers in each industry than firms in developed economies, which are closer to the technical frontier; hence we would expect a significant learning effect in the case of Russia. In developing countries for example significant learning effects have been found by Blalock and Gertler (2004) and Alvarez and Lopez (2004) in the case of Indonesia and Chile, respectively. In Chile, however, the learning effect is only present for new exporters and not for continuous exporters.

As far as we know only, Djankov and Hoekman (1997) Bleaney et al. (2000), Damijan et al. (2004), and De Loecker (2007) have addressed the issue of exports and productivity on the firm level in transition economies. Bleaney et al. (2000) use employment as an indicator of firm performance to study differences between exporting and non-exporting firms in a small sample of firms from Russia, Ukraine, and Belarus for 1996 and 1997. They conclude that there is a significant learning effect from exporting. De Locker (2007) and Damijan et al. (2004), using data from Slovenia, find support for the learning by exporting hypothesis. Moreover, Damijan et al. (2004) highlight the importance of the direction of exports in this context. Only firms exporting to developed markets (OECD) have higher productivity growth than non-exporters. The importance of the direction of trade was also illustrated by Djankov and Hoekman (1997), who found that trade reorientation towards the OECD had a significant positive impact on productivity in Bulgarian firms.

2.2 Data

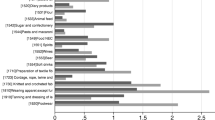

Our database consists of a census of Russian industrial firms and covers the period 1996–2002. We have excluded the electricity, fuel, chemical and metal sectors, since they are not comparable to other sectors, leaving a sample of manufacturing firms.Footnote 7 The sample period is limited to the period after 1996 due to lack of firm-level data on exports for earlier years. The industrial structure of the database, illustrated in Table 1, shows that we do disregard a substantial part of the industrial sector, in terms of employment, by excluding raw-material sectors. A large part of the remaining industry employment is concentrated to machinery. Calculations, based on our regression sample, see appendix Table A3, also show that exporting firms and non-exporting firms are concentrated in different sectors. In the medical sector, for example, almost 88% of the employees were employed in an exporting firm, while in the food sector exporting firms’ employment was slightly less than 34% of total sector employment in 1997; hence it is important to control for differences between sectors when comparing exporters to non-exporters. The last three columns in Table 1 illustrate the coverage of our sample in relation to total employment in each sector. The coverage is fairly good except for a few sectors in 1998 when a substantial number of firms, which recorded negative value added, were excluded from the sample.

The data on firm performance comes from the Russian Enterprise Registry Longitudinal Database (RERLD) and its sub-sample known as GNOZIS both of which are yearly enterprise censuses conducted by the Russian Statistical Agency.Footnote 8 The registry contains firm-level information on output, number of employees, book value of capital, total costs, and some other variables. The RERLD includes all Russian industrial firms except for firms with fewer than 100 employees and more than 75% privately owned. As a result we can only study the productivity of medium and large-sized firms. Both datasets have been cleansed of outliers and firms with single observations.Footnote 9 Missing values have been accounted for by using the value for the year in question as reported in censuses of subsequent years. Some missing values, as well as missing enterprises, were obtained from the GNOZIS database.Footnote 10

Firm-level data on exports by direction and commodity was partly extracted from the GNOZIS database (1996–1997), and partly from CEFIR (1998–2002). The export volumes in the database are based on what is reported by firms at the Russian border. The databases include all exports attributed to industrial firms, but there is no data about possible exports through intermediaries. Hence, given that intermediaries are quite widespread in some Russian industries, exports recorded in our database might understate the true exports.

Table 2 indicates that exporters, on average, are larger, more productive and more capital-intensive than non-exporters. These differences are significant at 1% with respect to all reported indicators. Despite favourable conditions for exports after the 1998 crisis, the number of exporting firms is falling in our sample. The share of exporting firms falls from just below 26% in 1997 to 21% in 2001 (see Table A3 in the appendix). This could be a result of the increasing use of intermediaries, or a decreasing number of exporting firms, or that some stopped reporting.Footnote 11 That the difference between the two sub-periods is substantial, is largely explained by the financial crisis 1998, which resulted in a significant devaluation of the currency, altering the conditions for both exporting and non-exporting firms. Exporting firms’ competitiveness increased as relative production costs decreased. On the domestic market, on the other hand, producers were given the opportunity to increase market shares as foreign competition decreased, but this might not necessarily have increased sales, since domestic demand also decreased. This has two effects: first, observed productivity may have increased as increasing sales might have led to better capacity usage; second, relatively low-productive firms may have been able to stay in business, reducing the observed average productivity. Table 2 confirms that the value of sales (nominal and real) rose for both firm types, but that exporters increased their sales more than non-exporters. The average labour productivity of exporting firms grew more than that of non-exporting firms, as a result of the former increasing sales and reducing their labour force.

3 Are exporters different from non-exporters?

We expect exporters to be more productive since, among other things, competition on the world market is fiercer than on the domestic market; hence only the most competitive firms will be able to export. Moreover, export firms have to pay some additional costs in order to export. Each firm’s productivity will be measured by its estimated total factor productivity (TFP), and as a robustness check we also use labour productivity (real value added per worker) as an alternative productivity measure.Footnote 12 In the baseline results shown in the main body of the text we assume that each 3-digit industry shares the same Cobb-Douglas production function. Since this is a rather restrictive assumption we also estimate TFP, assuming that each 2-digit industry shares a common translog production function. The translog production function allows non-linearity in the inputs, but this comes at the cost of restricting the estimated parameters to be equal over 2-digit industries for practical reasons. By and large, the qualitative results are the same no matter which production function is assumed, even though the translog based TFP measure tends to result in a slightly higher relative TFP of exporters compared to non-exporters. Cases in which the qualitative results differ are commented on, and the results from the translog model are included in the appendix.

The descriptive statistics in Table 2 above indicated that on average there are large differences between exporters and non-exporters. To establish weather these differences still are significant after controlling for the fact that the distribution of exporters and non-exporters across industries and regions of Russia is not the same, we control for industry, geographical, and time effects and estimate the export premium by applying the following empirical specification:

where Y it is a performance indicator (sales, employment, TFP, labour productivity and K/L-ratio) of firm i at time t. Exp it is a dummy variable equal to one if firm i exports at time t, and ln emp it is the natural log of the number of employees included as a measure of the size of the firm.Footnote 13 λ t , δ j , θ k are time, j industry (3-digit OKONKh) and k location (for each oblast) dummy variables, respectively. The model is estimated both with pooled-OLS and with fixed effects.Footnote 14 The fixed effect estimation treats μ 1 as fixed parameters that are included to control for time invariant characteristics of each firm; hence the time invariant dummy variables are not included in that regression. In the pooled-OLS model μ 1 is part of the error term and therefore assumed to be uncorrelated with the explanatory variables, but the standard errors have been adjusted to allow for unobserved firm heterogeneity.

Our main interest is the estimated coefficient of the export dummy variable indicating the difference between exporting and non-exporting firms. If exporters are larger and more productive, as indicated by previous studies using data from other countries, the coefficient of the export dummy variable will be positive. Since the dependent variable is in logarithms, the estimated coefficient has been transformed to indicate the difference in percent between exporters and non-exporters.Footnote 15 Note that the coefficients should not be used to make inference on the causality between exports and productivity but only as a measure of the difference between exports and non-exporters.

The results in Table 3 illustrate the large, significant difference between exporting and non-exporting firms clearly evident in all the performance indicators. Export firms are on average both larger (sales and employment) and more productive. Testing for poolability, we have found that pooling the data over firms is not appropriate, since firm-specific effects, not controlled for in the pooled model, are evident. The pooled model is included since several previous studies estimate a similar equation by OLS, on a single cross-section (e.g. Bernard and Jensen 1999) or a pooled sample (e.g. Hansson and Lundin 2004). The large differences between the two models indicate that many of the differences between exporters and non-exporters are explained by firm characteristics other than export activity and not controlled for in the OLS regression. But even after controlling for time-invariant firm characteristics by using fixed effects, the differences between exporting and non-exporting firms remain significant. The estimated export premium on TFP is over 40%, which is large compared to Sweden (Hansson and Lundin 2004) and the USA (Bernard and Jensen 1999).Footnote 16 But De Loecker (2007), investigating Slovenia, has found differences between exporting and non-exporting firms that are of the same order of magnitude.Footnote 17 We have not fully controlled for differences in human capital due to lack of reliable data, but they are at least partially controlled for by the fixed effects, since they may be constant over a short time period. Failing to fully control for these differences might bias the export premium, estimated by OLS, upwards, assuming that the labour force is more skilled in the export sector.

4 Do more efficient firms enter the export market?

Russian exporting firms are in general larger and more productive, which is in line with the predictions of theoretical models; that is, only more productive firms will become exporters. But do more productive firms self-select into the export market? The theoretical model predicts that only firms with relatively high productivity will enter the export market. The higher productivity before entry could, for example, be a result of restructuring production or product development, but could also be a result of knowledge transfer from foreign partners prior to export; hence a learning effect. Further, it is plausible to assume that a firm becoming more productive might not be able to start exporting at once, but might need some time to gather knowledge about foreign markets and search for customers; hence firms’ productivity might increase some time before they engage in export activities. In order to investigate whether Russian firms entering the export market were more productive than non-exporting firms s years before becoming exporters, we estimate the following equation, by pooled OLS and fixed effects:

on a sub-sample of firms not changing export status more than once and not exporting prior to year t+s. ln TEP it is the natural logarithm of the total factor productivity of firm i at time t. Exp it+s is a dummy variable, equal to one if the firm is an exporter in year t+s, ln emp it is the natural log of the number of employees and ws it is the share of workers in total employment. δ j , θ ter are industry and location dummy variables, respectively; λ t is a time dummy variable. The error term is defined in the same way as in Eq. 3.1 above. Previous studies (for example Bernard and Jensen (1999)) have indicated that variables such as the age and the ownership of the firm could be important in explaining the productivity. Omitting these variables may result in an omitted variables bias but due to lack of data we have not been able to include these variables in our regressions. Whenever possible we have included firm fixed effects that will reduce the risk of omitted variables bias. Another possible important variable omitted is the average wage that we have omitted as the quality of this variable is questionable. However, including average wage would not affect our main findings in the paper.

As we expect future export firms to be more productive before entering the export market, we expect the estimated coefficient of Exp it+s to be positive.

The regression results in Table 4 indicate that future exporting firms are more productive than comparable firms that will not engage in export activities. Productivity 1-year before entry is significantly higher for future entrants, thus lending support to the self-selection hypothesis. Furthermore, the productivity of future exporters is not significantly higher 3 years before entry, implying that the higher productivity is important when a firm decides to enter the export market. If high productivity induces firms to enter the export market, we would expect increasing productivity in the period immediately prior to entry, as indicated by our estimates. However, the opposite might be true if the export decision is taken several years before entry. Firms might then divert resources away from production to information collection, searching for partners and so on, and this cause productivity to fall.

Since we have found that exporters are larger in terms of both employment and sales, and have a higher productivity level, these factors might affect the firms’ export decision. Further, the share of workers in total employment is included in the regression as a proxy for human capital.Footnote 18 The relative importance of these factors can be tested by estimating a linear probability model (Bernard and Jensen 1999). An alternative approach would be to estimate a logit model using the estimator proposed by Honoré and Kyriazidou (2000), but since this estimator does not allow time fixed effects we have chosen to estimate the linear probability model. We define the so called export decision equation:

where Exp it is a dummy variable indicating the current export status of the firm and Exp it−1, Exp it−2 are lags of the same variable; emp it−1 is the total number of employees at t − 1, included to control for the size of the firm; TFP it−1 is the total factor productivity of the firm at t − 1 and ws is the worker share in total employment at t − 1. The remaining dummy variables and the error term are as in Eq. 4.1.

Table 5 reports the results of estimating the export decision equation by different methods. The model includes lags of the dependent variable, implying that both the pooled OLS and the fixed effect estimators will be biased. The former produces an upward biased estimate of the coefficient of the lagged dependent variable, while the latter produces a downward biased estimate. The system-GMM estimator is therefore preferred and inference will be based on the GMM estimates, in column 5, including all firm types. Before interpreting the results the validity of the instruments should be confirmed. The Hansen J-test seems to indicate that the instruments are valid even though the instruments are weak. Moreover, the difference Hansen J-test indicates that the additional instruments included in the system-GMM, compared to the difference-GMM, are valid therefore the system-GMM specification is preferred over the difference-GMM. The positive and significant coefficient of the lagged export variable indicates the presence of sunk entry costs. The export status of the period prior to entry is less important when firms switching export status are included, indicating that new entrants and firms with some export experience do not face the same sunk costs when entering the export market. The total factor productivity in the prior period seems to affect the export decision but the most important factor is previous export experience, while the size of the firm (employment) is insignificant in our preferred model. The estimated coefficient for the lag of productivity is significant in all models when all firm types are included, thus giving robust support to the hypothesis that more productive firms self-select into the export market.

5 Does exporting boost productivity growth?

It is possible that exporting promotes productivity growth through different channels, for example through the transfer of knowledge. Exporters are in contact with customers with knowledge of, for instance, management and production methods that they could transfer to their suppliers, thus raising their productivity. A second more debatable channel is the high degree of competition on the world market, forcing exporting firms to be on or at least close to the technical frontier to stay in the export market. It is, however, unclear why a profit-maximising firm does not use the best available production methods even if it does not export. This is possibly connected to the costs of acquiring knowledge about the best production methods, which may be lower for exporters. A third channel is internal economies of scale, which are more important for firms with a small home market. If exporting promotes productivity, exporters will have higher growth rates of productivity than non-exporters. This is tested by estimating Eqs. 5.1 and 5.2.

where lnTFP ib is the natural log of TFP in the base year; Exp ib is a dummy variable taking the value 1 if the firm exports in the base year; ln emp ib and ws are the natural log of the total number of employees respectively the share of workers in total employment in the base year. δ j , θ ter are industry and location dummy variables, respectively.

Our primary interest is in the coefficient of the export dummy variable. A positive coefficient would indicate that the productivity of firms exporting in the base year has grown faster than in firms not exporting in the base year.

The estimation results in Table 6 (columns 1–2) show that the growth path differs between firms exporting and not exporting in the base year. In the first period exporters’ productivity growth exceeds that of non-exporters’. But contrary to what one might expect if firms are learning-by-exporting, the productivity of exporters decreases relative to non-exporters in the second period. TFP inferred from the translog production function, on the other hand, firmly indicates that exporters’ productivity growth is faster, relative to firms not exporting, in both periods (see Table A5). Having in mind that exporters are larger than importers and looking at the coefficient of the size variable, the discrepancy seems to be related to the effect of size inferred from the two production functions. In the baseline (Cobb-Douglas) size has a positive or no effect on productivity growth while in the translog case it has a negative effect. Both estimates show that the relative productivity growth of exporters is smaller in the second period. This outcome is, however, what one might expect keeping in mind the August 1998 financial crisis, which resulted in a significant devaluation of the rouble followed by an appreciation in the years after 1999.

So far the results give, at least, weak support to the learning hypothesis but a drawback of this way of estimating the productivity growth of exporters, as compared to non-exporters, is that some of the firms exporting in the base year exit from the export market and some of the firms not exporting in the base year enter the export market. This flow of firms in and out of the export market is not controlled for in the equation above. To correct this shortcoming we control for the flows of firms, which are quite substantial, in and out of the export market (see Table 7). This way we also gain interesting information on the productivity of firms leaving or entering the export market.

The method used to compare the productivity growth of different types of firms is similar to the one used above to compare exporters and non-exporters, with the important difference that we now include dummy variables to control for flows in and out of the export market. Further, we exclude firms not reporting for all years in the relevant period.Footnote 19 More formally the estimated equation is:

where we have added a set of dummy variables, Exp i , Start i , Stop i , Switch i , indicating the type of firm, to Eq. 5.1. Exporters are firms exporting in all years; start indicates that firms start exporting, while stop indicates that firms stop exporting once during the period; Switch refers to firms changing export status more than once during the relevant period.

The estimated β indicates the difference in performance between the relevant group and firms not exporting at all during the period. The results are given in Table 6 (columns 3–4).

Firms that start exporting seem to experience higher productivity growth than non-exporters in both periods, even though the second period coefficient is only significant at 10%. This could indicate that productivity growth induces entry or that entry is coupled with learning effects. Except for that finding, the results in Table 6 are unclear and depend on the time period studied. Turning to the translog TFP, the results are less contradictive: new exporters’, exporters’ and switchers’ productivities increase faster than non-exporters’, while exiting firms have a slower productivity growth than exporters and new exporters, thus indicating the existence of learning effects.Footnote 20

So far we have only considered the average differences between groups of firms assuming implicitly that all exporters and entrants experience the same effect on productivity from exporting independent of their export intensity. Previous studies such as Castellani (2002) and Girma et al. (2004) have shown that this may not be true and that the export intensity may be an important determinant of productivity growth of entrants into the export market. Testing this along the lines described in Girma et al. (2004) we have found that the export intensity does not contribute to explain the productivity growth of new exporters (see the appendix).

Comparing the results in Table 6 (columns 1 and 2 to 3 and 4) points to the importance of controlling for flows in and out of the export market when analysing the relation between exports and productivity. Table 7 illustrates the magnitude of these flows in and out of the export market and the relative weights of the different firm types in the sample. The numbers of exporting firms are small compared to non-exporting and the firms ceasing to export outnumber firms starting to export each year, implying a decreasing number of exporters. The flows in and out of the export market are large, for example, in 2002 about 20% of the exporters decided to exit from the export market. It is also worth noting that both entry and exit decrease in 1998 and 1999, which was a time period of high uncertainty. This is what is to be expected from industrial organisation models, with sunk entry costs, which predict that exit and entry from an industry decrease in times of uncertainty.Footnote 21

The analysis above does not indicate whether the differences between exiting and entering firms are due to increasing (decreasing) productivity before or after entry (exit). To illustrate how productivity of the firm types, defined above, evolves over time we follow Bernard and Jensen (2004) and Hansson and Lundin (2004) and estimate:

for the sub-period 1998–2002 and a sub-sample of firms operating (reporting) for all of these years. The index e on the dummy variable indicates which of the five groups (exporting all period, not exporting, start exporting, stop exporting, and switching export status more than once) the firm i belongs to. The index p indicates the relative relation between the time period t and the point in time when a firm started/stopped exporting, or the relation between time period t and year 2000 in the case of switch as well as exporters and non-exporters. The estimated dummy variables indicate deviations from non-exporting firms and the year 1998. The path of productivity (TFP) is graphed in Fig. 1 (estimated coefficients are given in appendix Table A2).

Evolution of TFP before and after entry/exit. Exporters are firms exporting for all years 1998–2002; Non-exporters are those not exporting at all for the same time period and Switch are those changing export status more than once; Entry and Exit are firms starting (ceasing) to export once in the period 1998–2002. Industry, time, and location dummy variables are included in the regression, but unaccounted for in the diagrams above

Figure 1 confirms that exporters are, indeed, more productive than other firms. Moreover, the productivity of firms that start exporting increases after entry, thus indicating that exporting promotes productivity. Firms leaving the export market, on the other hand, experience decreasing productivity before and after exiting. Besides, their productivity is significantly lower than firms staying in the export market even before they leave the export market; hence our findings support the predictions of the theoretical models that less productive firms will exit from the export market.

Our findings in Fig. 1 do not, in contrast to the results in Table 4, seem to support the idea that only more productive firms enter the export market. Productivity in future exporting firms does not increase significantly prior to entry, as indicated by Fig. 1, and the productivity of entrants in the year of entry is lower than that of non-exporting firms in 1998. But the productivity of non-exporting firms decreases between 1998 and 1999, as a result of the 1998 crisis; hence comparing the productivity of firms starting to export with the productivity of non-exporting firms in 1998 might be misleading. If future exporters are not different from non-exporters, their productivity should also show a decrease between 1998 and 1999 and, as we have no observations of entry in 1998 by construction, when comparing non-exporters and firms that start exporting, it is reasonable to use the productivity of non-exporting firms in 1999 or later. However, firms that start exporting are still not more productive in the year of entry. This could indicate that firms starting to export experience increased costs related to the initiation of exports. The results in Table 4 are more general comparing exporters to non-exporters for all the years, while the results in Fig. 1 are sensitive to the time period studied.

Figure 1, in addition, sheds some light on the results shown earlier (Table 6). We found that exporters’ productivity grew faster than non-exporters’ between 1996 and 1999, but not in the period 1999–2002. The figure shows that the productivity of exporters was relatively high in the years following the depreciation of the Russian currency in 1998 and 1999, as could be expected, while the productivity of non-exporters decreased. With the real appreciation of the currency in the years 2001 and 2002, the productivity of exporters decreased and the productivity of non-exporters increased slightly; hence the 1998 crisis seems to have affected exporters and non-exporters differently. This has affected the results (shown in Table 6) of comparing the productivity growth of exporters and non-exporters. Strictly speaking, physical productivity should not be affected by exchange rate changes, but the measured productivity might be since we do not observe physical input and output but use sales and value of capital as proxies. Moreover, we are unable to control for capacity utilisation, hence measured productivity will increase whenever capacity utilisation increases.

6 Learning by exporting: direction of exports

We expect the potential of knowledge transfers from firms in developed market economies to be larger than from less developed Commonwealth of Independent States (CIS) markets, because, among other reasons, firms in the more industrialised countries are believed to have superior knowledge of organisation and production and because trade with such countries gives exporters better access to international capital markets and intermediate goods. Furthermore, consumers in developed markets might have a taste for higher quality products, forcing producers to install new technology to meet those quality requirements and thus increasing productivity. Indeed, the destination of export seems to affect the potential of learning from exporting, according to previous studies; hence we will distinguish between export flows to developed market economies (OECD) and exports to the countries within the former Soviet Union (CIS) and other countries.Footnote 22 We will classify firms exporting more than 50% of their export either to the OECD or CIS countries as OECD and CIS exporters, respectively. The classification is quite easy since most of the firms exporting more than 50% to one of the groups exports almost nothing to the other, as shown in Table A7. The table also shows some important differences between OECD and CIS exporters. While the former export about 20% of their output, the latter only export a small share of their output (5–6%). Besides, the number of firms mainly exporting to CIS markets is about twice as large, indicating that the cost of entry to a CIS market might be smaller than to OECD markets. The difference in export shares might be due to the size of the markets. A productive firm exporting to the OECD operates on a larger market and might be able to sell more.

If there is a learning effect, we expect it to appear in firms mainly exporting to developed market economies. The learning effects might be realised either before a firm starts exporting or while it is exporting. It is likely that possible knowledge transfer and other forms of spillovers before exporting will appear rather close to the time of engaging in export activities.

Export structure is probably an important determinant of knowledge transfer, the potential of which should be greater when firms engage in exports of more advanced products rather than raw materials. However, a preliminary analysis does not indicate any significant differences between groups of goods classified according to factor-contents, hence our focus on the effect of direction of exports found to be important in the case of Slovenia (Damijan et al. 2004).Footnote 23

Still the first question to answer is whether there is a difference between firms exporting to developed market economies and firms exporting to other countries. Once again we use the export premium equation, focusing on total factor productivity and replacing the single export dummy with separate dummy variables for exports to the three groups described above.

where lnTFP it is the natural logarithm of TFP of firm i at time t. Exp igt is a set of dummy variables equal to one if firm i exports mainly (over 50% of its exports) to the country group g (OECD, CIS, Other countries) at time t, and lnemp it is the natural log of the number of employees included as a measure of the size of the firm. ws is the share of workers in total employment. The industry and location dummy variables δ j , θ ter are wiped out by the within transformation, but are included in the OLS regression. λ t is a set of time dummy variables.

The coefficients of the export dummy variables show the difference between firms exporting to the indicated group of countries and non-exporting firms, and the differences between the export dummy variables show whether the direction of export matters. The relative size of the coefficients should not be used to draw conclusions on whether there is a positive learning effect from exports to developed market economies, since the estimates merely indicate a difference but give no guidance to the causes.

Exporters are more productive than non-exporters independently of the direction of exports and the estimation technique. According to the OLS estimates, presented in Table 8, firms exporting mainly to developed market economies (OECD) are significantly more productive than their counterparts exporting mainly to the CIS or other countries. However, after controlling for firm-specific factors by applying fixed effects, the difference in TFP is no longer significant.Footnote 24

To find out whether the higher productivity among firms exporting to developed market economies is an effect of learning by exporting, we retain the country groupings from above, but focus on productivity growth. The sample is divided into two four-year periods, with the base years 1996 and 1999 and then the equation below is estimated on the sub-samples. Firms changing export status are excluded and firms changing the direction of exports during the period are classified as Others.

Positive learning effects from exporting to developed market economies are indicated by a larger (positive) estimated coefficient of the OECD export dummy variable than the other export dummy variables. The coefficients themselves indicate deviations of the group from non-exporting firms. The results are found in Table 9.

Firms exporting mainly to developed countries (OECD) have a higher productivity growth than firms mainly exporting to CIS or other countries and non-exporting firms in the first period. However, their productivity decreases relative to non-exporting firms as well as CIS exporters in the second period. Therefore, the evidence with regard to learning from exporting to developed markets is inconclusive. Estimating the equation with the translog TFP, see Table A6, indicates higher productivity growth for OECD exporters (not significant in the second period). With Fig. 1 in mind, it seems like 1999 was a year with rather high productivity of exporting firms and low productivity of non-exporting firms; hence the unclear results. Firms exporting to CIS countries, on the other hand, do not significantly differ from non-exporting firms in the first period, but have slower productivity growth in the second; hence there is no evidence of the learning effect from exporting to CIS countries.Footnote 25 This is contradicted by the results in Table A6 based on the translog based TFP, indicating a larger productivity growth among CIS exporters compared to non-exporters.

7 Summary

This paper analyses the relation between productivity and exports in Russian manufacturing firms. We have benefited from an extensive database on Russian firms, giving us the opportunity to investigate not only the causality between exports and productivity, but also whether the direction of exports affects productivity. The interpretation of the results is, however, complicated by the financial crisis in 1998, causing a large devaluation of the currency and affecting exporters and non-exporters asymmetrically. There is conclusive evidence that exporters are larger and more productive than non-exporters. Moreover, firms exporting to developed market economies are more productive than firms exporting to other countries, but it seems to be an effect of firm-specific characteristics rather than of export activity per se. Firms leaving the export market are less productive than exporters, and firms that start exporting are more productive than non-exporters before entry, their productivity increasing in the years subsequent to entry. Besides, exporters seem to experience higher productivity growth than non-exporters. That is, more productive firms self-select into the export market, improving their productivity for some time after entry, and there is some evidence of learning effects as well.

Unlike previous studies of transition economies (eg. Damijan et al. 2004 and Djankov and Hoekman 1997), we come to the conclusion that the geographical direction of exports has a limited effect on productivity. The evidence with regard to learning effects from exporting to developed market economies is inconclusive. Productivity growth is higher in firms exporting mainly to the OECD in the period up to 1999, but lower in the period after 1999. This seems to be an effect of the 1998 financial crisis.

Notes

For a discussion on Russian industry restructuring and productivity see Ahrend (2004).

In 2003 the export share of petroleum, petroleum products and Gas (SITC, rev 3 code 33, 34 respectively) exceeded 50% (Ahrend 2004).

Roberts and Tybout (1997), for example, find empirical support for the existence of sunk entry costs.

For examples of representative-firm models see Helpman and Krugman (1985).

For a summary of empirical studies on export and productivity of firms/plants, see Wagner (2007).

Transfer pricing and price regulations make it difficult to assess the productivity in the electricity and fuel sectors. The metal sector is heavily dependent on natural resources and the chemical sector is linked to the oil industry.

For a more detailed discussion of the databases and their limitations see Bessonova et al. (2003).

Firms with less than 25 employees all years, with negative costs as percent of sales, with larger exports than total sales, with more workers than total number of employees, with costs more than 20,000% of sales have been excluded from the sample.

GNOZIS is a database, which includes statistical and balance sheet information on Russian firms. Coverage of firms in GNOZIS is similar to that in the Russian Enterprise Longitudinal Database.

The use of intermediates when conducting exports is rather common in Russia, as pointed out by seminar participants at CEFIR. Unfortunately, we cannot control for that, hence we prefer not to use export-shares, but rather a simple dummy variable indicating export status.

Calculations of the productivity measures and real value added are described in the appendix.

We have tried including other firm characteristics such as workers’ share of total employment and K/L-ratio, but the estimated coefficients were non-significant and the data quality is poor. Therefore, they have been omitted in our selected specification.

The random effect model was rejected by standard Hausman tests against the fixed effect model.

Since the standard transformation is likely to be biased, we apply the formula suggested by van Garderen and Shah (2002) to derive the % effect of the relevant dummy on the dependent variable and its standard errors: \( \hat{p}_{i} = 100{\left[ {\exp {\left( {\hat{c}_{i} - \frac{1} {2}\hat{v}{\left( {c_{i} } \right)}} \right)} - 1} \right]}{\text{ and }}\hat{v}{\left( {\hat{p}_{i} } \right)} = 100^{2} \exp {\left( {2\hat{c}_{i} } \right)}{\left[ {\exp {\left( { - \hat{v}{\left( {\hat{c}_{i} } \right)}} \right)} - \exp {\left( { - 2\hat{v}{\left( {\hat{c}_{i} } \right)}} \right)}} \right]} \) where \( \hat{p}_{i} \) is the transformed coefficient to calculate; \( \hat{c}_{i} \) is the estimated coefficient belonging to the relevant dummy variable; \( \hat{v}{\left( {\hat{c}_{i} } \right)} \) is the estimated variance of the same dummy variable.

The estimated export premium (TFP) in Sweden is less than 11.1% (Hansson and Lundin 2004).

The estimated export premium (Labour productivity) in Slovenia is slightly less than 30%.

Other variables such as average wage and K/L-ratios have been excluded since they have been found to be insignificant in the fixed effect estimations.

A description of the number of observations of each firm type in the periods used can be found in the appendix, Table A1.

The results are shown in the appendix, Table A5.

See for example Ghosal (2003).

Our analysis of the relationship between export composition and learning-by-exporting encountered several problems and the issue merits further research, but that goes beyond the scope of this paper. Note that firms classified in raw material sectors are excluded from our sample.

Labour productivity is higher in firms exporting mainly to the OECD than in firms exporting mainly to the CIS. The results are available from the corresponding author on request.

Differences in the use of barter transactions between exporters to the CIS and the OECD may affect our estimated TFP, leading to a downward bias of CIS exporters’ TFP, assuming that barter transactions are more frequent in intra-CIS trade. We thank Pertti Haaparanta for drawing our attention to this issue.

References

Ahrend R (2004) Accounting for Russia’s Post-crisis Growth. OECD Economics Department Working Papers No. 404, OECD Publishing, http://caliban.sourceoecd.org/vl=1596894/cl=24 /nw=1/rpsv/cgi-bin/wppdf?file=5lgsjhvj75wd.pdf

Alvarez R, Lopez R (2004) Exporting and performance: evidence from Chilean plants. Can J Econ 38(4):1384–1400

Bernard AB, Jensen J (1999) Exceptional exporter performance: cause, Effect or both? J Int Econ 47(1):1–25

Bernard AB, Jensen J (2004) Export and productivity in the USA. Oxford Rev Econ Policy 20(3):343–357

Bessonova E, Kozlov K, Yudaeva K (2003) Trade liberalization, Foreign Direct Investment, and Productivity of Russian Firms. CEFIR Working paper No. 39, New Economic School, Moscow, http://www.cefir.org/download.php?id=81

Blalock G, Gertler P (2004) Learning from exporting revisited in a less developed setting. J Dev Econ 75(2):397–416

Bleaney M, Filatotchev I, Wakelin K (2000) Learning by exporting: evidence from three transition economies. GLM Research Paper 2000/6, Centre for Research on Globalisation and Labour Markets, School of Economics, University of Nottingham, http://www.nottingham.ac.uk/ economics/leverhulme/research_papers/00_6.pdf

Castellani D (2002) Export behaviour and productivity growth: evidence from Italian manufacturing firms. Rev World Econ 138(4):605–628

Clerides S, Lach S, Tybout JR (1998) Is learning-by-exporting important? Micro-dynamic evidence from Colombia, Mexico, and Morocco. Q J Econ 113(3):903–947

Damijan JP, Polanec S, Prasniak J (2004) Self-selection, Export market heterogeneity and productivity improvements: firm level evidence from Slovenia. LICOS Discussion Paper 148/2004, LICOS Centre for Transition Economics, Katholieke Universiteit Leuven, Leuven http://www.econ.kuleuven.ac.be/licos/DP/DP2004/DP148.pdf

De Loecker J (2007) Do exports generate higher productivity? Evidence from Slovenia. J Int Econ 73(1):69–98

Djankov S, Hoekman B (1997) Productivity growth in Bulgarian enterprises. World Bank Policy Research Working paper 1707, The World Bank, Washington, DC, http://www.worldbank.org/research/trade/pdf/ wp1707.pdf

Ghosal V (2003) Impact of uncertainty and sunk cost on firm survival and industry dynamics. WZB Working paper SP II 2003-12, Social Science Research Center Berlin, http://skylla.wz-berlin.de/pdf/2003/ii03-12.pdf

Girma S, Greenaway D, Kneller R (2004) Does exporting increase productivity? A microeconometric analysis of matched firms. Rev Int Econ 12(5):855–866

Goskomstat (various issues) ‘Promyshlennost Rossii’, Moscow: Russian Statistical Agency

Hansson P, Lundin NN (2004) Exports as an indicator on or promoter of successful Swedish manufacturing firms in the 1990s. Rev World Econ 140(3):415–445

Helpman E, Krugman P (1985) Market structure and foreign trade: increasing returns, imperfect competition, ant the international economy. MIT press, Cambridge, MA

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus FDI with heterogeneous firms. Am Econ Rev 94(1):300–316

Honoré BE, Kyriazidou E (2000) Panel data discrete choice models with lagged dependent variables. Econometrica 68(4):839–874

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Roberts MJ, Tybout JR (1997) The decision to export in Colombia: an empirical model of entry with sunk costs. Am Econ Rev 87(4):545–564

Roodman D (2005) xtabond2: stata module to extend xtabond dynamic panel data estimator. Center for Global Development, Washington http://econpapers.repec.org/software/bocbocode /s435901.htm

Wagner J (2007) Exports and productivity: a survey of the evidence from firm level data. World Econ 30(1):60–82

van Garderen KJ, Shah C (2002) Exact interpretation of dummy variables in semilogarithmic equations. Econometr J 5(1):149–159

Acknowledgements

We would like to thank two anonymous reviewers for helpful comments and suggestions. Previous versions of this paper was presented at the NOITS 8th annual workshop in Helsinki, CEFIR and Lund University and the authors would like to thank the participants for helpful comments. We are indebted to Yves Bourdet, Joakim Gullstrand and Christian Jörgensen for valuable comments. Fredrik gratefully acknowledges financial support from The Crafoord foundation, Stiftelsen för främjande av ekonomisk forskning vid Lunds universitet and Sparbanksstiftelsen Färs & Frosta and the help of Guido Friebel.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Estimation of the TFP

First, value added is calculated as: sales - costs + wage bill. Value added is deflated by the output price index at the 5 digit industry level. Second, we estimate a Cobb-Douglas production function on 3-digit industry level (about 28 industries) or a translog production function on 2-digit industry level (6-industries) using one-way fixed effects. TFP is then calculated as the difference between the observed and predicted value for each firm and time period.

1.2 Results using the translog production function to estimate the productivity

Rights and permissions

About this article

Cite this article

Wilhelmsson, F., Kozlov, K. Exports and productivity of Russian firms: in search of causality. Econ Change 40, 361–385 (2007). https://doi.org/10.1007/s10644-008-9038-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-008-9038-4