Abstract

We analyze the implications of environmental policy on pollution in a stochastic framework with finite horizon and sustainability concern. The social planner seeks to minimize the social (environmental and economic) costs associated with pollution. We allow for the planner to attach different relative weights to the discounted and end-of-planning-horizon costs in order to assess how sustainability concern might affect the optimal level of policy intervention. We show that the optimal environmental policy increases with the degree of sustainability concern, reducing thus the amount of pollution the society is forced to bear. A calibration based on world \(\textit{CO}_2\) data supports our conclusions, further highlighting the importance of higher degrees of sustainability concern to achieve greener long run outcomes. It also allows us to show that under a realistic model’s parametrization the optimal environmental policy tends to rise with higher degrees of uncertainty in a precautionary manner.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic activities give rise to several environmental problems and how to regulate such an economic and environmental trade-off is still nowadays a critical open question. One of the issues which has attracted the largest interest in literature is linked to how to optimally control pollution. After decades of researches and debates, it is now clear to both academics and policymakers that regulating polluting activities is all but trivial. This is due to the fact that pollution contributes to several environmental problems, like those related to its transnational diffusion (Ansuategi and Perrings 2000; Ansuategi 2003) and climate change (Nordhaus 1982; Bollen et al. 2009), but it might also generate economic benefits, like increasing competition and promoting technological progress (Porter and van der Linde 1995; Buonanno et al. 2001). Despite the very large body of studies that can be found in literature, two aspects of the pollution control problem have been only marginally analyzed thus far: the implications of uncertainty on pollution and environmental policy,Footnote 1 and its relation with sustainability and intertemporal equity. This paper tries exactly to fill these gaps by developing a pollution control model which might help policymakers to make better decisions in the determination of the optimal environmental policy in a stochastic framework with rising sustainability concern.

The pollution control problem is quite dated and it consists of determining the optimal policy intervention in order to minimize the social costs (Bawa 1975) or alternatively maximize the social benefits (Forster 1975) associated with economic activities, by taking into account both economic and environmental effects. Some earlier studies include Forster (1972), and Keeler et al. (1973), while more recent works are represented by van der Ploeg and Withagen (1991), Athanassoglou and Xepapadeas (2012), and Saltari and Travaglini (2016). With the exception of Athanassoglou and Xepapadeas (2012) who develop a quite sophisticated and cumbersome robust pollution control model under Knightian uncertainty, all the aforementioned papers consider pollution to be perfectly known and deterministic. This is obviously a very strong simplification of reality in which, due to the uncertainty surrounding environmental and ecological dynamics, very little is known about the evolution of pollution. Since several developing countries are nowadays experiencing substantial increases in their income levels, accompanied by dramatic increases in emissions, energy demand and use of natural resources (Olivier et al. 2012; U.S. Energy Information Administration 2014), the question about how to determine environmental policy in a stochastic context is more relevant than ever. As a preliminary attempt to analyze this issue,Footnote 2 we develop a simple model of finite horizon pollution control subject to random shocks. Differently from Athanassoglou and Xepapadeas (2012), we do not focus either on the Knightian concept of uncertainty or on society’s response to the worst-case scenario. Thus, the work most similar to ours is Saltari and Travaglini ’s (2016), which analyzes a (deterministic) pollution control problem over a finite horizon. Differently from them, we do not focus on emission constraints and our objective function represents the social costs of pollution. This specific setting allows us to develop a tractable framework to analyze the impact of uncertainty on environmental policy and pollution dynamics.

Apart from its implications on economic outcomes, the (optimal) regulation of polluting activities has also important implications on our ability to eventually achieve a sustainable development pathway. In fact sustainable development clearly requires us to ensure a certain equity across present and future generations (WCED 1987), not only in terms of economic opportunities but also in terms of environmental quality. In the sustainability literature, the traditional economic discounted utilitarian approach has often been criticized for its inability to take into account the welfare consequences of our today’s actions on (very) future generations (Chichilnisky et al. 1995).Footnote 3 Some alternatives have been proposed in order to formally allow also future generations to be considered in the planning problem (Marsiglio 2011). Chichilnisky (1997) proposes to modify the objective function in order to accompany the discounted sum of utilities with a long run utility level. In order to formally include in our analysis a certain degree of concern for sustainability issues and future generations we follow Chichilnisky’s (1997) approachFootnote 4 and accompany discounted instantaneous costs with an end-of-planning-horizon cost. We wish to understand how environmental policy and pollution are related to the increases in the degree of sustainability concern (representing the weight attached to the end-of-planning-horizon cost) that we are currently witnessing in industrialized economies.

This brief paper proceeds as follows. Section 2 presents our model, which consists of a finite horizon pollution control problem in which the stock of pollution is subject to random shocks, and the planner cares for future generations and the level of pollution they will have to bear. In Sect. 3 we explicitly solve the stochastic optimization problem and we characterize the optimal policy and the optimal dynamics of pollution, showing how they are affected by different degrees of sustainability concern and different degrees of uncertainty (in a specific limiting case of our model). Specifically, we show that the optimal environmental policy increases with the degree of sustainability concern, reducing thus the amount of pollution the society is forced to bear, and it rises with higher degrees of uncertainty in a precautionary manner. In Sect. 4 we present a calibration of our model based on \(\textit{CO}_2\) data at world level to support our analysis. We thus illustrate the predictions of our model under a realistic parametrization and we are able to assess how different degrees of uncertainty may affect environmental policy and pollution even in our more general setup. In Sect. 5 we present an extension of our baseline model in which we formally take into account, even if in a stylized fashion, capital dynamics; we show that our results hold true even by allowing for a time-varying capital growth rate. Section 6 contains concluding remarks and highlights directions for future research. All mathematical technicalities are included in the Appendices 1, 2, 3 and 4.

2 The Model

We consider a model of pollution control over a finite horizon in which the stock of pollution is subject to random shocks. The economic framework is very simple: economic agents at each instant of time consume completely their disposable income: \(c_t =(1- \tau _t )y_t\), where \(c_t\) denotes consumption, \(y_t\) income and \(\tau _t\in (0,1)\) the tax rate. The unique final consumption good, \(y_t\), is produced competitively by firms employing capital, \(k_t\), according to a linear production function, \(y_t=ak_t\), where \(a>0\) is a scale parameter. For the sake of simplicity, for the time being, we assume that capital grows exogenouslyFootnote 5 at a constant rate (normalized to unity without loss of generality); we will relax this assumption later on by considering a time-varying capital growth function to take into account more specifically the implications of a richer capital dynamics for our model. Since economic activity generates pollution as a side product, the tax revenue is used to limit pollution accumulation. Thus, an increase in \(\tau \) reduces pollution but at the same time lowers current consumption possibilities, identifying thus a clear (at least current) trade-off between economic and environmental performance.

The social planner wishes to minimize the social cost of pollution \(p_t\), by choosing the optimal level of the policy instrument, \(\tau _t\). The social cost function, \(\mathcal {C}\), is the weighted sum of two different terms: the expected discounted (\(\rho >0\) is the rate of time preference) sum of instantaneous losses generated by economic activities, and the discounted environmental damage associated with the remaining level of pollution at the end of the planning horizon, T. The instantaneous loss function, \(c(p_t,\tau _t)\), taking into account both environmental (\(p_t\)) and economic (\(\tau _t\)) costs, is assumed to be increasing and convex in both of its arguments, penalizing deviations from the no-pollution scenario (i.e., \(p_t = 0\)) and the strength of the policy instrument; for analytical tractability, such a function is assumed to take the following form: \(c(p_t,\tau _t)=\frac{p_t^2(1+\tau _t)^2}{2}\). The damage function, \(d(p_T)\), is assumed to be increasing and convex as follows: \(d(p_T)=\frac{p_T^2}{2}\). Pollution is a stock variable which increases with flow emissions generated by economic activity and decreases according to the rate of natural pollution absorption; economic output generates emissions which increase the stock of pollution at a rate \(\eta >0\), while the natural rate of pollution decay is denoted by \(\delta >0\). The amount of pollution associated with economic activity can be reduced by economic regulation, and one unit of output invested in environmental preservation reduces one unit of pollution; it then follows that the dynamics of pollution under economic regulation is given by the following linear differential equationFootnote 6: \(\dot{p}_t=\left[ \eta (1-\tau _t)-\delta \right] p_t\). The policy instrument \(\tau _t\) thus represents an environmental tax used to decrease the environmental inefficiencies of economic activities (i.e., the human-induced growth rate of pollution \(\eta \)). The previous differential equation describes the evolution of pollution in absence of uncertainty (as traditionally assumed in the pollution control literature); however, we allow for pollution to be subject to random shocks, assumed to be driven by a geometric Brownian motion.

The social planner needs to choose \(\tau _t\) in order to minimize the expected social cost function, given the evolution of pollution and its initial (deterministic) condition. The planner’s problem can be summarized as follows:

where \(\sigma \ge 0\) is the standard deviation of pollution and \(dW_t\) the increment of a Wiener process. The parameter \(\theta \in [0,1]\) in Eq. (1) measures the relative importance assigned by the social planner to the sum of instantaneous losses rather than the final environmental damage. Note that such a specification is consistent with the notion of sustainability, requiring to ensure a certain degree of intergenerational equity. Specifically, Eq. (1) reflects the so-called Chichilnisky’s criterion which proposes to consider a weighted average between the discounted sum of instantaneous costs and the long run cost associated with pollution (Chichilnisky 1997). For smaller values of \(\theta \), more emphasis is placed on future generations thus the social planner is more inclined to reduce current pollution (at the expense of reductions in current consumption) in order to leave the posterity with a cleaner environment. Since \(c_t=(1- \tau _t) y_t\), any attempt to lower emissions in order to reduce the stock of pollution (rising \(\tau _t)\) requires to sacrifice some consumption, clearly reflecting the (current) economic and environmental trade-off associated with economic development.

3 The Optimal Policy

For the sake of analytical tractability, we consider an equivalent but slightly different formulation of the above stochastic problem,Footnote 7 namely:

Solving this stochastic problem requires to find an explicit expression for the value function solving the Hamilton–Jacobi–Belllman (HJB) equation associated with the problem (4), (5) and (6). After some algebra it is possible to claim the following.

Proposition 1

The value function associated with the problem (4), (5) and (6) is given by:

where \(V_t\) is the solution of the following differential equation:

with the boundary condition \(V_T=\frac{1-\theta }{\theta } \ge 0\). Assume that:

where \(\underline{\theta }\equiv \frac{2\eta ^2}{2\eta ^2+2(\eta -\delta )-\rho +\sigma ^2+\sqrt{[2(\eta -\delta )+ \sigma ^2-\rho ]^2+4\eta ^2}}\), \(\overline{\theta }\equiv \frac{2\eta ^2}{2\eta ^2+2(\eta -\delta )-\rho +\sigma ^2 -\sqrt{[2(\eta -\delta )+ \sigma ^2-\rho ]^2+4\eta ^2}}\); then the optimal rule for the taxation rate, \(\tau _t^*\) and the optimal dynamic path of pollution are respectively given by:

where \(\tanh (z)=\frac{e^z-e^{-z}}{e^z+e^{-z}}\) and \({{\mathrm{arctanh}}}(z)=\frac{\log (1+z)-log(1-z)}{2}\), with \( -1<z<1\), are the hyperbolic tangent function and its inverse, respectively.

Proof

See “Appendix 1”. \(\square \)

Note that in order for the optimal level of taxation \(\tau ^*_t\) to be well defined, the inverse hyperbolic tangent function needs to be well defined too, and this happens whenever the value of the parameter \(\theta \) falls in the interval \(\theta \in (\underline{\theta };\overline{\theta })\) as specified in Eq. (9). Such a condition is a merely technical condition which however does not affect in any substantial way our analysis, since for a realistic model’s parametrization (see the calibration in the next section) it is always automatically satisfied. From now onwards we proceed by assuming that such a condition holds. Proposition 1 clearly shows that the optimal level of taxation is not constant, and as a result the trend of the pollution stock (even in a purely deterministic framework) is time-varying too. The same comment applies to the trend of pollution stock, which (even in absence of shocks) tends to change as a result of the time evolution of the optimal taxation level. From Eq. (10) we can note that the optimal policy, determining the amount of resources diverted from economic to environmental activities, strictly depends upon the planner’s degree of sustainability concern (i.e., \(1-\theta \)). The degree of sustainability concerns indirectly (through the optimal taxation channel) affects also the dynamics of pollution [see Eq. (11)], and thus it is natural to wonder whether the increasing sustainability concern that we are currently experiencing (at least within industrialized countries) is going to generate positive or negative consequences on the amount of pollution our society will have to bear in the long run. Despite the quite complex expression for \(\tau ^*\), it is possible to show that the following result holds.

Proposition 2

Provided that \(\theta \in (\underline{\theta };\overline{\theta })\) holds, the optimal taxation level (i.e., \(\tau _t^*\)) increases with the degree of sustainability concern (i.e., \(1-\theta \)).

Proof

See “Appendix 2”. \(\square \)

Proposition 2 shows the existence of a positive relationship between the optimal level of (environmental) policy intervention and the degree of sustainability concern. Intuitively, this result suggests that the more the planner cares for sustainability issues, the more convenient it will be to actively intervene in order to limit the amount of pollution the society will have to bear in the long run. As a result, the level of taxation will be larger dampening economic activities and simultaneously reducing the stock of pollution. This suggests that the current trend of a growing environmental and sustainability concern might be effective in achieving a more sustainable development path in the long run, but such an increased sustainability will occur at the cost of reductions in consumption opportunities. However, promoting further increases in the degree of sustainability concern, through environmental education, sensibilization and green campaigns, might be a valuable tool for supporting a greener and more sustainable future.

The above results are all related to the relationship between the degree of sustainability concern and economic policy, and we have not analyzed what role uncertainty plays in this context. However, because of the complex expression for \(\tau _t^*\), it is possible to derive only a sufficient condition ensuring that \(\tau _t^*\) is monotonically related to \(\sigma ^2\), and specifically it monotonically increases with \(\sigma ^2\). This allows us to state the following result.

Proposition 3

Provided that \(\theta \in (\underline{\theta };\overline{\theta })\) holds, the optimal taxation level (i.e., \(\tau _t^*\)) increases with the degree of uncertainty (i.e., \(\sigma ^2\)) whenever \(\sigma ^2 \le \rho -2(\eta -\delta )-\frac{2\theta }{1-\theta }\).

Proof

See “Appendix 3”. \(\square \)

Proposition 3 shows that \(\frac{\partial \tau _t^*}{\partial \sigma ^2}\) turns out to be undoubtedly positive if a certain condition holds, while nothing can be explicitly said whenever such a condition is not met. Note that for \(\theta \in [0,1]\) the condition above can hold only for very small values of \(\theta \). In fact, whenever \(\theta \rightarrow 0\), the condition reads as \(\sigma ^2 \le \rho -2(\eta -\delta )\), which (provided that \(\rho \) is sufficiently large) identifies a threshold value for the uncertainty parameter below which increases in uncertainty undoubtedly lead to increases in the optimal level of taxation. The case \(\theta =0\) is a very extreme case representing a situation in which the degree of sustainability concern is maximal and thus social costs are defined according to the green golden rule criterion (Chichilnisky et al. 1995). In our setup such a criterion states that only the long run costs should be considered in order to determine the level of policy intervention. Intuitively, in such a framework higher levels of pollution stock are definitely undesirable and since the economic costs associated with pollution reduction are not considered (see how the social cost function (1) would read whenever \(\theta \rightarrow 0\)), with rising uncertainty it is clearly convenient to firmly intervene in order to limit as much as possible the pollution stock.Footnote 8 However, apart from this very special limiting case, the condition in Proposition 3 cannot be realistically met thus nothing can be said from an analytical point of view on the role of uncertainty in our general setting.

4 A Calibration Based on Global \(\textit{CO}_2\) Data

In order to shed some more light on this relationship between uncertainty and policy intervention and to illustrate the implications of different degrees of sustainability concern on environmental policy, we rely on a calibration based on global \(\textit{CO}_2\) data. In order to obtain an estimate of our parameter values, we need first of all to consider that the dynamic stochastic equation describing the evolution of pollution over time, namely Eq. (2), suggests an exponential growth for pollution. In order to quantify pollution variations we focus on atmospheric \(\textit{CO}_2\) concentrations, expressed in parts per million (ppm). We rely on two sets of data about \(\textit{CO}_2\) levels: the long (2000-year) record from the Law Dome ice core in Antarctica, provided by the Carbon Dioxide Information Analysis Center of the U.S. Department of Energy (Etheridge et al. 1998), and the more recent years time series made available by the Earth System Research Laboratory of the National Oceanographic and Atmospheric Administration (Dlugokencky and Tans 2015). We rely on the former to obtain concentrations data from the 1750 to 1979, and on the latter for data from 1980 to 2015. By joining these two data sets, we can see that nowadays the global level of \(\textit{CO}_2\) is about 400 ppm, and the \(\textit{CO}_2\) concentration at world level has followed an exponential growth pattern since the industrial revolution (see Fig. 1). This provides some clear support for our formulation of pollution dynamics, as expressed in Eq. (2).

We extrapolate the exponential growth rate from the 1750–2015 time series, obtaining a net (of natural absorption) rate of pollution growth, \(\eta -\delta \) equal to 0.001. By following Saltari and Travaglini (2016), we set the natural pollution decay rate, \(\delta \), equal to 0.05, implying that the rate pollution growth, \(\eta \). is equal to 0.051. The value of the standard deviation, \(\sigma \), has been calculated simply averaging the annual level of standard deviations of the recent data from Dlugokencky and Tans (2015), obtaining 0.164. As traditionally assumed in literature we set the rate of time preference, \(\rho \), equal to 0.04 (Saltari and Travaglini 2016). The time horizon has been arbitrarily set at 30 years, but it is possible to show that even extending the time frame does not qualitatively modify our results. The initial value of the pollution stock, \(p_0\), is set equal to the current (2015) level of \(\textit{CO}_2\) concentration, that is 400.23 ppm. We thus consider the following parameter values: \(\eta =0.051\), \(\delta =0.05\), \(\sigma =0.164\), \(\rho =0.04\), \(p_0=400.23\) and \(T=30\). We allow for different values of \(\theta \) in order to show how economic policy and pollution stock vary with different degrees of sustainability concern (represented by \(1-\theta \)). Specifically, we consider three different values of \(\theta \), representing a low (\(\theta =0.9\)), medium (\(\theta =0.5\)) and high (\(\theta =0.1\)) degree of sustainability concern.

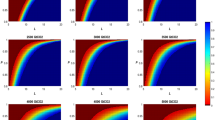

The outcome of our calibration is illustrated in Fig. 2, in which we first consider a purely deterministic framework (i.e., \(\sigma =0\)) and we represent the dynamic evolution of the optimal taxation rate (on the left panel) and the pollution stock (on the right panel). It is clear that \(\tau ^*\) monotonically falls with \(\theta \) while \(p^*\) monotonically rises with \(\theta \) (these monotonicity results are robust even considering a wider range for \(\theta \)). These diametrically different effects of the degree of sustainability concern on the taxation rate and pollution stock are due to the negative relationship between \(p^*\) and \(\tau ^*\) [see Eq. (11)] . What these results show is that the larger the weight attached to the long run level of pollution (the lower \(\theta \)), the stricter the optimal environmental policy (the higher \(\tau ^*_t\)) and thus the healthier the environment (the smaller \(p^*_t\)).

In order to better understand the impact of different degrees of sustainability concern on economic policy and environmental outcomes, it might be convenient to fix one point in time, \(t = \widetilde{t}\) (e.g., \(\widetilde{t} = \frac{T}{2}\)) for a while. This allows us to assess to what extent in a purely static framework a different \(\theta \) is going to affect the taxation and pollution levels. As clearly shown by Fig. 3, the optimal level of taxation decreases at its fastest pace with low values of \(\theta \), while the change in \(\tau \) is barely evident for larger values. This suggests that increases in the degree of sustainability concern (decreases in \(\theta \)) may have relevant effects only whenever the society (i.e., the social planner) does not care enough about sustainable outcomes, since whenever the care for the long run outcome is already high further decreases in \(\theta \) may have only negligible effects. This suggest the existence of a threshold value determining the effectiveness of policies aiming to eventually promote increases in the degree of sustainability concern. Indeed, the degree of sustainability concern has to be above a certain threshold to actually translate into a leap of policy intervention. Accordingly, by looking at the right panel of Fig. 3, we can see that the pollution stock decreases substantially only when the degree of sustainability concern is above a certain threshold (that is \(\theta \) is substantially small), boosting policy intervention and consequently curbing the accumulation of pollution.

The conclusions that we have discussed thus far are all derived from a deterministic framework, thus we might be wondering whether such results still hold also when uncertainty is taken into account. In Fig. 4 we compare the evolution of the taxation rate in a stochastic (left panel) and deterministic (right panel) contexts. Despite the fact that for all the \(\theta \) values considered the sufficient condition in Proposition 3 does not hold, the optimal taxation in the stochastic case is always greater than the deterministic one, consistently with a precautionary motive (Athanassoglou and Xepapadeas 2012). This states that under a realistic model’s parametrization, environmental costs outweigh economic costs such that with a higher uncertainty in pollution dynamics it is convenient to adopt stricter policy measures in order to minimize the social costs.

Even if it is true that \(\tau \) in the stochastic case is always greater than the deterministic one, by considering the same level of \(\theta \), it is also possible to note that the difference in the optimal taxation between the two scenarios decreases as time goes by, meaning that the effect of uncertainty on the optimal policy path decreases over time. This can be explained by the fact that an optimal policy intervention reduces the impacts of uncertainty on the pollution stock, such that in the very long run its level is determined for the largest extent by the degree of sustainability concern. This can be seen in the left panel of Fig. 5 which shows the time evolution of the difference in the optimal taxation between the stochastic and the deterministic case for a certain value of the degree of sustainability concern, that is \(\theta =0.5\). Moreover, as it is possible to note from the right panel of Fig. 5, which focuses on the same difference at \(t=0\), at the beginning of the time interval the difference in taxation between the stochastic and deterministic case are larger the smaller the value of \(\theta \), implying that the uncertainty induced (economic) cost associated to the optimal policy is higher the smaller \(\theta \), that is the higher the degree of sustainability concern.

5 An Extension: Time-Varying Capital Accumulation

The model that we have discussed thus far describes how pollution evolves because of productive activities, in a situation in which capital grows at an exogenously given constant rate. Such an assumption as traditionally discussed in the growth literature can mainly be interpreted as a description of the long run macroeconomic behavior only. Thus, whenever we adopt a shorter time horizon perspective as we are doing in our model’s setup, and this might be needed in order to account for the different time scale between economic and environmental processes (Xepapadeas 2010), such an assumption may be very restrictive and thus a more sensible approach would rather be considering a time-varying capital growth.

This is exactly what we do in this section where we relax our baseline assumption that capital growth is constant and by considering a time-varying capital growth we more realistically take into account capital dynamics. We do not restrict the law of motion of capital to take any specific functional form, but we simply assume that the growth rate of capital is time-varying. Specifically, we keep assuming that output linearly depends on capital as follows \(y_t=a k_t\), but now we assume that capital evolves according to the following dynamics: \(dk_t=(1+\gamma _t) k_t dt\), where \(\gamma _t\) is a general time-varying function measuring the excess of capital growth from its long run trend rate.Footnote 9 Thus, our extended optimization problem consists of minimizing the social costs of pollution by taking into account the dynamic evolution of pollution and capital as follows:

Note that the specification above suggests that the trend growth of pollution is time-varying even in absence of environmental policy and uncertainty. This is due to the role played by the capital excess rate of growth in the short run which, by being the source of economic activities and thus pollution, tends to accelerate pollution accumulation. This effect tends to fade away in the long run, when capital grows at its trend rate (which remember we have normalized to unity); in such a framework the capital excess rate of growth is null (that is \(\gamma _t=0\)) and the model turns out to be equivalent to what discussed earlier.

It is possible to prove that, provided that the excess of capital growth is bounded from both above and below, then also the dynamics of the optimal policy is bounded, and in particular \(\tau _t^*\) will lie within a specific range \([\underline{\tau }_t, \overline{\tau }_t]\), whose size depends upon the model’s parameters. This clearly implies that something very similar holds true also for what concerns the dynamics of pollution, and specifically \(p_t^*\) will lie between an upper and lower bound, \(\underline{p}_t\) and \(\overline{p}_t\), respectively. The results are summarized in the next proposition.

Proposition 4

Suppose that \(1+\gamma _t\in [\underline{\gamma }, \overline{\gamma }]\); then the optimal rule for the taxation rate falls in the following range, \(\tau ^*_t \in [\underline{\tau }_t, \overline{\tau }_t]\), where:

while the optimal dynamic path of pollution falls in the range, \(p^*_t \in [\underline{p}_t, \overline{p}_t]\), where:

Proof

See “Appendix 4”. \(\square \)

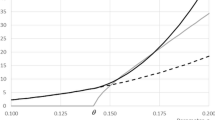

Differently from what discussed in Sect. 3 where we could obtain an explicit expression for the HJB, the optimal tax rate and the optimal pollution dynamics, the results are now clearly more complicated and less neat in order to account for a time-varying capital growth. Indeed, a closed form solution for the HJB equation in this case cannot be found, thus also an explicit expression for the optimal control and state variables cannot be derived; however, Proposition 4 shows that even in absence of analytical solutions we can identify some lower and upper bounds for both the policy instrument and the optimal pollution path, and these bounds are strictly dependent upon the model’s parameters, and in particular upon the degree of sustainability concern and the degree of uncertainty. In order to understand to what extent the results that we discussed in the previous sections hold true also in our extended framework in which the growth rate of capital is not constant, we need to rely on numerical methods to derive the optimal tax rate. The results are shown in the figure below, which is based on the same parameter values employed in the previous section and a decreasing capital growth rate function (which for a matter of graphical clarity is assumed to be \(\gamma _t=(\underline{\gamma }-\overline{\gamma })t +\overline{\gamma }\), with \(\underline{\gamma }=-0.1\) and \(\overline{\gamma }=0.1\)).

Figure 6 shows the optimal tax rate for different values of the degree of sustainability concern, both in the \(\sigma =0\) and \(\sigma >0\) cases, and the lower and upper bounds (18) and (19).Footnote 10 As Proposition 4 suggests the optimal tax rate also lies between the two bounds, both in the deterministic and stochastic case. We can also see that the behavior of the optimal tax rate is consistent with what discussed in the previous sections, that is it increases with both the degree of sustainability concern (i.e, \(1-\theta \)) and the degree of uncertainty (i.e., \(\sigma ^2\)). These results show thus that the conclusions that we derived in our baseline model are robust, since holding true even in a more complicated framework with time-varying capital dynamics. Thus, even in a more realistic framework in which the capital growth rate is not always constant we can conclude the following: the current trend of a growing environmental and sustainability concern might be effective in achieving a more sustainable development path in the long run, and the optimal taxation in the stochastic case is always greater than in the deterministic one consistently with a precautionary motive.

6 Conclusions

The rising interest that we are witnessing among policymakers and academics towards sustainable development and the high uncertainty associated with future environmental outcomes naturally raise the question about how environmental policy should be determined in order to take into account such factors. In order to give a preliminary answer to this question we analyze a finite horizon problem of pollution control under uncertainty in which the planner is (partially) moved by sustainability concern. Despite the model’s simplicity, the problem turns out to be all but trivial. We show that the optimal level of environmental policy is non-constant and it is clearly affected by both the degree of uncertainty and sustainability concern. Specifically and intuitively, both larger degrees of sustainability concern and larger degrees of uncertainty lead to a stricter environmental policy, reducing thus the environmental burden imposed on the society both in the short and long run. Clearly the degree of sustainability concern may be effectively affected through specific (education or advertising) policies, thus it represents an important tool to achieve a more sustainable and greener future. However, the reduction in the environmental burden associated with pollution control comes at the cost of a reduction in consumption possibilities, thus assessing the net impact on social costs of further increases in the suststainability concern is not straightforward. These results hold true both in our baseline model in which capital and output grow at a constant rate and in our extended framework in which their growth rate is time-varying; the only noticeable difference between these two frameworks is that in the baseline model we can explicitly derive the optimal dynamics of the policy instrument, while in the extended model only some upper and lower bounds for the optimal policy can be explicitly obtained (however, the behavior of the numerically-derived policy instrument is qualitatively identical to what derived in the baseline setup).

This work represents a first attempt to analyze the impact of uncertainty and sustainability issues in a pollution control model, thus the analysis cannot be considered exhaustive. Indeed, for the sake of simplicity we have to introduce some simplifying assumptions which might have limited our model’s ability to describe in full the nature of the problem. In particular, since we have assumed capital growth to be exogenously given (constant first and time-varying in the extended model) we cannot comment on the endogenous effects of uncertainty and the degree of sustainability concern on both economic performance and pollution in growing economies. Moreover, the model’s setup does not allow to distinguish between the notion of uncertainty and that of risk, thus it is not possible to disentangle their relationships with the degree of sustainability concern. Extending the analysis to allow for endogenous economic growth (as in van der Ploeg and Withagen 1991) and for a Knightian concept of uncertainty (as in Athanassoglou and Xepapadeas 2012) is left for future research.

Notes

Very few papers analyze economic dynamics in a framework of stochastic pollution (Kijima et al. 2011; Saltari and Travaglini 2011; Privileggi and Marsiglio 2013). However, differently from our goals, these works either do not focus on environmental policy (Privileggi and Marsiglio 2013), or take it exogenously given (Kijima et al. 2011) or assume the evolution of pollution to be completely exogenous (Saltari and Travaglini 2011).

Specifically, the presence of a positive discount factor (a necessarily requirement of any infinite horizon optimal control problem) is the source of the problem. Indeed, a positive discount factor means that less and less weight is attached to generations further away in the future, thus the notion of intertemporal equity is automatically ruled out.

Strictly related to our approach, even if with different objectives and methodologies, see recently Colapinto et al. (2015). They propose a multicriteria model in order to assess the implications of different degrees of sustainability concern on the optimal dynamics of economic policy and natural resources.

Such an assumption that capital accumulation is completely exogenous is clearly a simplification of reality, but it is instrumental to the need of developing a tractable model. Allowing for a more sophisticated and endogenously determined capital accumulation as in van der Ploeg and Withagen (1991) will substantially complicate the analysis. Note that even in its current form the problem is all but trivial (see Proposition 1), thus extending the analysis to consider a richer dynamic evolution of capital will make the search for an explicit solution of the Hamilton–Jacobi–Bellman equation even harder. It seems convenient to start the analysis of uncertainty related issues in the simplest possible pollution control problem.

Note that our pollution specification suggests that the growth rate of pollution and the growth rate of output are related one-for-one by a factor \(\eta \). This is in line with a common approach in literature where pollution is often assumed to be proportional to output or capital (see Dinda 2005; Economides and Philippopoulos 2008), meaning that the growth rate of pollution is proportional to the growth rate of output, which is equal to the growth rate of capital in our setup. This assumption implies that economic activities through the production process are the primary source of pollution.

Note that this new formulation precludes us to analyze the case in which \(\theta =0\), which as we will discuss more in depth later, represents a framework consistent with Chichilnisky et al.’s (1995) green golden rule. However, from a calculus of variations exercise it is straightforward to show that in the \(\theta =0\) case, the problem (1), (2) and (3) admits the trivial solution \(\tau _t^*=\tau ^*=1, \forall t\). Intuitively, if the long run cost of pollution is the unique concern it is optimal to reduce pollution as much as possible; since the short term economic costs are not considered, this can be done by relying on a maximal value of the policy instrument at any point in time.

Note that, because of what intuitively just discussed and what mentioned earlier, the \(\theta =0\) case represents a degenerate case giving rise to a trivial solution in which the optimal level of policy intervention is always maximal, that is \(\tau ^*=1, \forall t\), even in absence of shocks.

The standard benchmark for thinking about what the excess of capital growth function might look like is to imagine \(\gamma _t\) to be decreasing over time. This is due to the fact that in a typical macroeconomic setup the evolution of capital may be described by a Bernoulli differential equation. This is clearly what we may expect in a Solow-type (1956) framework in which capital dynamics is driven by the economy’s saving behavior, but also in a Ramsey-type (1928) setting in which consumption is endogenously determined the (optimal) capital dynamics would be very similar. In our model, we cannot formally take into account either saving or other determinants of capital accumulation, thus we simply focus on a time-varying capital dynamics to summarize the implications of the relevant macroeconomic factors.

Note that the bounds are dependent upon \(\theta \), thus in order to plot in the same figure the optimal tax rate associated with different values of the degree of sustainability concern, we show only the minimum and the maximum of the lower and upper bounds, respectively.

References

Ansuategi A (2003) Economic growth and transboundary pollution in Europe: an empirical analysis. Environ Resour Econ 26:305–328

Ansuategi A, Perrings CA (2000) Transboundary externalities in the environmental transition hypothesis. Environ Resour Econ 17:353–373

Athanassoglou S, Xepapadeas A (2012) Pollution control with uncertain stock dynamics: when, and how, to be precautious. J Environ Econ Manage 63:304–320

Baker E (2005) Uncertainty and learning in a strategic environment: global climate change. Resour Energy Econ 27:19–40

Bawa VS (1975) On optimal pollution control policies. Manage Sci 21:1397–1404

Bollen J, van der Zwaan B, Brink C, Eerens H (2009) Local air pollution and global climate change: a combined cost–benefit analysis. Resour Energy Econ 31:161–181

Buonanno P, Carraro C, Galeotti M (2001) Endogenous induced technical change and the costs of Kyoto. Resour Energy Econ 25:11–34

Chichilnisky G, Heal G, Beltratti A (1995) The green golden rule. Econ Lett 49:174–179

Chichilnisky G (1997) What is sustainable development? Land Econ 73:476–491

Colapinto C, Liuzzi D, Marsiglio S (2015) Sustainability and intertemporal equity: a multicriteria approach. Ann Oper Res. doi:10.1007/s10479-015-1837-1

Dinda S (2005) A theoretical basis for the environmental Kuznets curve. Ecol Econ 53:403–413

Dlugokencky E, Tans P (2015) NOAA/ESRL. http://www.esrl.noaa.gov/gmd/ccgg/trends/

Economides G, Philippopoulos A (2008) Growth enhancing policy is the means to sustain the environment. Rev Econ Dyn 11:207–219

Etheridge DM, Steele LP, Langenfelds RL, Francey RJ, Barnola J-M, Morgan VI (1998) Historical \(CO_2\) records from the Law Dome DE08, DE08-2, and DSS ice cores. In: “Trends: a compendium of data on global change” (Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy, Oak Ridge, Tenn., USA). http://cdiac.ornl.gov/trends/co2/lawdome.html

Forster BA (1972) A note on the optimal control of pollution. J Econ Theory 5:537–539

Forster BA (1975) Optimal pollution control with a nonconstant exponential rate of decay. J Environ Econ Manage 2:1–6

Framstad NC, Oksendal B, Sulem A (2004) Sufficient stochastic maximum principle for the optimal control of jump diffusions and applications to finance. J Optim Theory Appl 121:77–98

Keeler E, Spencer M, Zeckhauser R (1973) The optimal control of pollution. J Econ Theory 4:19–34

Kijima M, Nishide K, Ohyama A (2011) EKC-type transitions and environmental policy under pollutant uncertainty and cost irreversibility. J Econ Dyn Control 35:746–763

Marsiglio S (2011) On the relationship between population change and sustainable development. Res Econ 65:353–364

Nordhaus W (1982) How fast should we graze the global commons? Am Econ Rev 72:242–246

Olivier JGJ, Greet JM, Peters JAHW (2012) Trends in global CO2 emissions—2012 report. PBL Netherlands Environmental Assessment Agency. http://www.pbl.nl/.../publicaties/PBL_2012_Trends_in_global_CO2_emissions_500114022

Porter ME, van der Linde C (1995) Toward a new conception of the environment–competitiveness relationship. J Econ Perspect 9:97–118

Privileggi F, Marsiglio S (2013) Environmental shocks and sustainability in a basic economy–environment model. Int J Appl Nonlinear Sci 1:67–75

Ramsey F (1928) A mathematical theory of saving. Econ J 38:543–559

Saltari E, Travaglini G (2011) Optimal abatement investment and environmental policies under pollution uncertainty. In: de La Grandville O (ed) Frontiers of economic growth and development. Emerald Group Publishing Limited, Bingley

Saltari E, Travaglini G (2016) Pollution control under emission constraints: switching between regimes. Energy Econ 53:212–219

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

U.S. Energy Information Administration (2014) International energy outlook 2014 (Washington DC, USA). http://www.eia.gov/forecasts/ieo/pdf/0484(2014)

van der Ploeg F, Withagen C (1991) Pollution control and the Ramsey problem. Environ Resour Econ 1:215–236

World Commission on Environment and Development (1987) Our common future. Oxford University Press, Oxford

Xepapadeas A (2010) Modeling complex systems. Agric Econ 41:181–191

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Optimal Solution and Sufficiency

By denoting with \(\mathcal {J}(t,p_t)\) the value function associated to our stochastic problem (4), (5) and (6) and by omitting the time subscript for sake of clarity, the HJB equation reads as:

while the corresponding terminal condition as:

The first order necessary (and sufficient; see below) condition for \(\tau \) yields:

We proceed by guessing the form of the value function and verifying that our guess is correct. Our sophisticated guess is:

where V is a variable to be determined. By computing its derivatives:

and substituting (25) into (22), we obtain:

By plugging (24), (25) and (26) into (20) and simplifying the expression, we obtain the following ordinary differential equation in V:

with the boundary condition \(V_T=\frac{1-\theta }{\theta } \ge 0\), from evaluating (21) and (23) at T. The solution of the above differential equation can be used to derive the path of the optimal tax rate [from (27)] and finally the expected path of pollution [from (5)]. Indeed, by solving (28) along with its boundary condition for \(V_t\) and substituting into (27) we get the optimal dynamics of the tax rate:

where \(M=[2(\eta -\delta )+ \sigma ^2-\rho ]^2+4\eta ^2\), \(\tanh (z)=(e^z-e^{-z})/(e^z+e^{-z})\) is the hyperbolic tangent function and \({{\mathrm{arctanh}}}(z)=\frac{1}{2}[\log (1+z)-log(1-z)]\), with \( -1<z<1\), its inverse. By plugging the above expression in (5), which describes a geometric Brownian motion with time-dependent coefficients, it is possible to determine the time evolution of pollution, whose closed form expression is given in Eq. (11).

In order to verify the correctness of our guess, we use the stochastic maximum principle proposed by Framstad et al. (2004) to show that the policy rule identified in (29) is optimal. By defining \(m_t \equiv \partial \mathcal {J}/ \partial p\) and \(n_t \equiv \partial ^2 \mathcal {J} / \partial p^2\), it is possible to rewrite (20) as:

where:

where denotes the the stochastic Hamiltonian. Theorem 2.1 of Framstad et al. (2004) states that, for an admissible set of state and controls, if the minimized Hamiltonian \(\hat{\mathcal {H}}\) (that is the Hamiltonian \(\mathcal {H}\) evaluated at the value of the optimal control \(\tau ^*\)) is convex in p for all t in [0, t], then the pair \((\tau ^*, p)\) represents an optimal pair for the problem. Note that \(\mathcal {H}\) is strictly convex in \(\tau \) since \( \partial ^2 \mathcal {H}/ \partial \tau ^2 =p^2e^{-\rho t } > 0\). The control which minimizes \(\mathcal {H}\) is given by Eq. (22) and so the minimized Hamiltonian is:

which is strictly convex in p, since \( \partial ^2 \hat{\mathcal {H}}/ \partial p^2= e^{-\rho t}+ n\sigma ^2 >0\).

Appendix 2: Proof of Proposition 2

The derivative of the optimal policy \(\tau ^*\) with respect to \(\theta \) reads as:

where \(M=[2(\eta -\delta )+ \sigma ^2-\rho ]^2+4\eta ^2\) and \(B=2(1-\theta )\eta ^{2} -2(\eta -\delta )\theta +\rho \theta -\sigma ^2\theta \). The sign of the above derivative is determined by the product of three terms, \(\frac{\sqrt{M}}{2}\) and the two terms in the curly brackets. Provided that the hyperbolic tangent function is well defined, as per condition (9), the first term, \(\frac{\sqrt{M}}{2}\), is clearly non-negative. The second term, namely \(\left\{ 1- \tanh \left[ \frac{\sqrt{M}}{2}(T-t) +{{\mathrm{arctanh}}}\left( \frac{B}{\sqrt{M}}\right) \right] ^{2}\right\} \), is non-negative too since the hyperbolic tangent takes values in \([-1,1]\). After some algebra, the third term, \(\left\{ \left( \frac{-2\eta ^2-\sigma ^2+2\delta -2\eta +\rho }{\theta \sqrt{M}}-\frac{B}{\theta ^2 \sqrt{M}}\right) \left[ (1-\frac{B}{\theta ^2 (\sqrt{M})^2})\eta \right] ^{-1}\right\} \), can be rearranged to obtain:

Since the numerator in (32) is clearly non-negative, the sign of its denominator determines the sign of (31): if this is positive then the whole derivative will be negative, while it will be positive otherwise. It turns out that the conditions for the hyperbolic tangent function to be well defined, as in Eq. (9), ensure that the denominator of the above expression is positive, such that the sign of (31) is overall negative.

Appendix 3: Proof of Proposition 3

From Eq. (10) it is clear that what complicates the determination of the sign of \(\frac{\partial \tau ^*}{\partial \sigma ^2}\) is the argument of the inverse hyperbolic tangent. Indeed, apart from this term whose derivative has an uncertain sign, all other terms suggest the existence of a monotonically increasing relationship between the optimal taxation and the degree of uncertainty. Thus, we can undoubtedly assess the sign of \(\frac{\partial \tau ^*}{\partial \sigma ^2}\) only whenever also the argument of the inverse hyperbolic tangent rises with \(\sigma ^2\). In the following we denote the argument of the inverse hyperbolic tangent with \(\Omega \), which from Eq. (10) reads as:

After some algebra the derivative of the above term with respect to \(\sigma ^2\) yields:

Since the denominator in above expression is clearly non-negative, the sign of its numerator determines the sign of \(\frac{\partial \Omega }{\partial \sigma ^2}\): whenever this is negative then the whole derivative will be positive. This happens whenever the condition stated in Proposition 3, \(\sigma ^2 \le \rho -2(\eta -\delta )-\frac{2\theta }{1-\theta }\), holds.

Appendix 4: Proof of Proposition 4

Let us first notice that the following equation:

admits a closed-form solution given by:

By repeating the same calculations as in Sect. 3, one can reduce the problem of solving the HJB equation to the following ordinary differential equation:

where \(\gamma _t\) measures the excess of capital growth. Some algebra yields to the following inequalities:

and, in an analogous way:

By using the above Eq. (33) and the classical comparison theorem for differential equations, we obtain the lower and upper bounds as in (18) and (19).

Rights and permissions

About this article

Cite this article

La Torre, D., Liuzzi, D. & Marsiglio, S. Pollution Control Under Uncertainty and Sustainability Concern. Environ Resource Econ 67, 885–903 (2017). https://doi.org/10.1007/s10640-016-0010-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-016-0010-x