Abstract

Many natural systems involve thresholds that, once triggered, imply irreversible damages for the users. Although the existence of such thresholds is undisputed, their location is highly uncertain. We explore experimentally how threshold uncertainty affects collective action in a series of threshold public goods games. Whereas the public good is always provided when the exact value of the threshold is known, threshold uncertainty is generally detrimental for the public good provision as contributions become more erratic. The negative effect of threshold uncertainty is particularly severe when it takes the form of ambiguity, i.e. when players are not only unaware of the value of the threshold, but also of its probability distribution. Early and credible commitment helps groups to cope with uncertainty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Individuals and groups often find themselves in the need to cooperate to avoid negative outcomes for all. Yet, they often lack precise information about how much effort is needed to prevent those adverse outcomes. The scientific literature offers striking examples of uncertainty of this kind, with anthropogenic environmental changes threatening to trigger irreversible damages and societies being unaware of the critical thresholds. Critical areas such as climate change, biodiversity loss, fish stocks, ocean acidification, global freshwater, or land use change have been identified as involving “planetary boundaries” that if crossed would lead to unacceptable environmental change (Rockström et al. 2009; Barnosky et al. 2012). It is very difficult, if not impossible, to identify the location of these thresholds. For example, climate tipping points, such as the collapse of the Atlantic Thermohaline Circulation and the rapid melting of the Greenland ice sheet, are inherently uncertain due to the complexity of the climate system and the presence of numerous feedback and interaction effects (Alley et al. 2003; Kriegler et al. 2009; Lenton et al. 2008). Some studies have attempted to define a range for critical climate thresholds in terms of mean global temperature (Lenton et al. 2008) or atmospheric \(\hbox {CO}_{2}\) concentrations (Rockström et al. 2009) but those ranges tend to be uncertain themselves. The potentially disastrous and irreversible consequences have led to widespread political consensus about the urge of avoiding such thresholds. However, the inherent uncertainty surrounding the magnitude of the required effort may adversely affect the willingness and ability to pursue the ensuing collective goals.

In this work, we explore the effect of threshold uncertainty on agents’ cooperation to prevent a collective damage in an experimental setting. Our experiment involves a number of threshold public goods games which vary in the degree of uncertainty about the threshold. In a typical threshold public goods game, each player in a group receives an endowment and decides how much of it to contribute to a public good. If the aggregate contribution exceeds a certain threshold, the public good is provided and each player receives a fixed amount of money, no matter how much he or she has contributed to the public good (for a review see Croson and Marks 2000). Threshold public goods games have been studied theoretically for decades, and it is known that, different from linear public goods games, Pareto-efficient outcomes are supportable as Nash equilibria (Bagnoli and Lipman 1989; Palfrey and Rosenthal 1984). Uncertain thresholds, however, can restore the free-riding incentives and lead to Pareto-inefficient equilibria (Barrett 2013; McBride 2006; Nitzan and Romano 1990; Suleiman 1997).

Experimental studies have tried to shed further light on how threshold uncertainty affects cooperative outcomes, primarily in the context of discrete public goods (e.g. Au 2004; Suleiman et al. 2001; McBride 2010; Wit and Wilke 1998) and common pool resources (e.g. Gustafsson et al. 1999, 2000; Rapoport et al. 1992). These experiments suggest that uncertainty makes cooperation harder.Footnote 1 Earlier studies on common pool resources have shown that a bias in the perception of uncertainty can cause collective action to fail; the more uncertain people are regarding the size of the available resource, the more likely they are to overestimate the size and so to overharvest the resource. One explanation for this bias is that people perceive the variability and central tendency of a probability distribution to be positively correlated (Rapoport et al. 1992). Other explanations include an optimism bias and an egoism bias (Gustafsson et al. 1999, 2000). More recent experiments with a special focus on climate tipping points have shown that incentives to free-ride can cause collective action to collapse even in the absence of such biases (Barrett and Dannenberg 2012, 2014).Footnote 2

These previous studies on the effect of threshold uncertainty have modeled uncertainty as risk, i.e. as a known probability distribution over a range of possible threshold values. Uncertainty was manipulated by changing the width of the threshold range. However, in the real world, agents sometimes even lack information about the probability distribution of the threshold that needs to be reached for the public good to be provided or a public bad to be avoided. In this work, we study whether uncertainty in the threshold probability distribution affects collective outcomes above and beyond uncertainty regarding its value. To the best of our knowledge, this is the first study that investigates ambiguous thresholds. The debate on the distinction between risk (known probability distribution) and ambiguity (unknown probability distribution) has a long theoretical tradition (Knight 1921). Since the formulation of the Ellsberg paradox (Ellsberg 1961), researchers have explored extensively individuals’ attitudes and behavioral responses toward ambiguity, typically revealing aversion to situations in which probabilities are unknown (see Camerer and Weber 1992 for a review).Footnote 3

In our laboratory experiment, we compared how collective action in a threshold public goods game was affected by whether the provision threshold was known or not. In particular, we employed two different forms of threshold uncertainty: Whereas one experimental treatment involved risk, as the threshold was operationalized as a random variable with known probability distribution, the other treatment involved ambiguity, as also the probability distribution of the threshold was unknown.

A prominent goal of our study is to reproduce those real-world setups in which agents such as individuals or communities need to act collectively in order to prevent an undesirable event. Accordingly, our setup deviates from traditional threshold public goods games in three important ways. First, players contribute to the common account not to realize a gain but to avoid a loss. If the group contribution does not reach a certain amount of money, all members lose almost all of their remaining endowments. Second, the provision of the public good is sequential, as the assessment of the group effectiveness in preventing the public bad is carried out only after multiple stages of contributions. This allows us to examine how players react to their fellows’ behavior under different uncertainty configurations. Third, there is a simple possibility to communicate, as players can propose a non-binding target for the collective contribution before they choose their individual contributions. The experimental literature on threshold uncertainty has in large part ignored the effects of communication and rather focused on tacit coordination. However, decision-makers in reality can, and often do, communicate.

2 The Experimental Games

At the beginning of the experiment, participants were endowed with €40 each and randomly assigned to groups of six anonymous players. The groups remained unchanged throughout the session, and played for 10 consecutive rounds. In each round, players decided how much of their private endowment to contribute to a common account, choosing between €0, €2, and €4. Players knew that if the group contribution at the end of the 10 rounds failed to reach or exceed some threshold, all players would lose 90 % of their remaining endowment. After each round, players were informed about the individual and aggregate contributions, both in the current round and up to it. Before round 1 and round 6, players could make non-binding proposals for what the group as a whole should contribute to avoid the public bad.Footnote 4 This basic design and the chosen parameters closely follow Milinski et al. (2008) and Tavoni et al. (2011). Milinski et al. (2008) developed this design to show the effect of changing the impact of missing the threshold on contributions. Tavoni et al. (2011) extended the design to capture the effects of communication and player inequality. In this paper, we investigate how contributions depend on the uncertainty about the threshold.

Subjects were randomly assigned to one of three treatments. In a control treatment (“Certainty”), the contribution threshold was certain. Players knew that if the group failed to contribute €120 or more after 10 rounds, all members would be paid only 10 % of their remaining private endowments. In the other two treatments players did not know in advance the threshold that had to be reached in order to prevent the public bad. Specifically, players knew that each of several potential thresholds could become the actual threshold with some probability, which was known or not depending on the treatment. Unlike previous experiments on threshold uncertainty, we kept the threshold range constant across treatments. In particular, the discrete threshold probability functions were described over 13 potential thresholds ranging from €0 to €240 in €20 increments. Note that the [€0, €240] range implied both that the public bad might be avoided with zero contributions and that the public bad might occur even if all six players contribute their entire €40 endowment (thus making them indifferent to the occurrence of the public bad).

In the two treatments featuring uncertainty, the threshold was determined through a ball picking task at the end of the session: A participant volunteered to publicly pick one plastic ball out of many, the value of which determined the threshold value. Subjects were paid either 100 or 10 % of their remaining endowments, depending on whether their group had reached the threshold contribution or not. The “Risk” treatment was based on a uniform distribution, where all potential threshold values were equally likely (4 balls per potential threshold value) with an expected value of €120. In the “Ambiguity” treatment, players were not only unaware of the threshold, but also ignorant of the probability distribution. Before the game, one randomly selected participant was asked to go into another room in order to complete a brief task and wait until the end of the session. The task was to distribute 52 balls by filling out an empty \(13\times 50\)-cell-matrix on a paper sheet (without knowing the purpose). The student was explicitly informed that he or she had complete freedom of choice and that the balls could be distributed in any way, for instance symmetric or asymmetric. At the end of the session, the 52 balls were put into a bag according to the distribution on the completed matrix. Thus, the resulting distribution determined the probability distribution of the threshold. The remaining participants were informed about this procedure and thus played the game without knowing the threshold probability distribution.Footnote 5 Table 1 summarizes the experimental design.

The experiment was conducted in a computer lab at the University of Magdeburg, Germany. In total, 180 subjects participated in the experiment, recruited from the general student population. Subjects earned €15.20 on average, including a show-up fee of €2.00. Sixty subjects participated in each treatment. Subjects in each experimental session were assigned to the same treatment. They were seated at linked computer terminals that were used to transmit all decisions and payoff information (game software Z-tree, Fischbacher 2007). Once subjects were seated, a set of written instructions was handed out. Experimental instructions included numerical examples and control questions in order to ensure that subjects understood the game (see “Appendix” for the experimental instructions). After the final round, subjects completed a short questionnaire that elicited their motivation and emotions during the game.

3 Efficiency and Predictions

The game can be analyzed in the framework of expected payoff maximization, as follows. In each round belonging to \(R=\{1,\ldots ,r\}\), a set \(N\) of \(n=|N|>1\) players have symmetrical action sets \(|C_i|\) and make simultaneous contribution choices. Individual contributions over the \(r\) rounds determine a player’s action set in the whole game. Since each player can choose between \(|C_i|\) actions in each round, there are \(|C_i|^{r}\) different actions, increasing exponentially with \(r\). The threshold \(T\) needed to avoid the public bad (after the final round has been played and \(r\) successive contributions \(c_i^t \) have been made in each round \(t\in R\) by the \(n\) players, yielding \(I=\sum _{t=1}^r {\sum _{j=1}^n {c_j^t}})\), comes from a cumulative distribution function \(F_I (T)\). Given a profile \(c\) of contributions in the entire game, player \(i\)’s expected payoff is \(\pi _i (c)=F_I (T)(w-\sum _{t=1}^r {c_i^t})+(1+F_I (T))(w-\sum _{t=1}^r {c_i^t})d\), where \(w\) is players’ endowment and \(d\) is the percentage of private money that a player keeps if the threshold is not reached.

In the experiment, we tested \(n=6,\,C_i =\{0,2,4\}\) in each round \((r=10), w=40\) and \(d=10\,\%\). Whereas in the Certainty treatment \(T=120\) with certainty, in Risk \(T\) is a discrete random variable with \(E(T)=120\) and a large dispersion around the first moment (each threshold, including both extrema in the interval [0, 240], has approximately an 8 % likelihood of being selected).Footnote 6

3.1 Efficiency

When reasoning in terms of the investment \(I^{*}\) that maximizes the group’s expected payoff we find \(I^{*}=120\) for Certainty and \(I^{*}=100\) for Risk. A salient feature of this game is that the value of the public good decreases with contributions. When players have already contributed a substantial share of their endowments, the public good is of low value because they have little left in their private accounts, and thus little to lose. Therefore, the right tail of the distribution does not matter as much as the left tail, where stakes are higher. This is why Risk is characterized by lower optimal contributions than Certainty as highlighted in Table 2. Table 2 reports the expected payoffs achievable by following a pure symmetric strategy and the optimal contribution, i.e. the one leading the group to reach \(I^{*}\).

In Certainty with known threshold \((T=120)\) the maximum group payoff is €120 when the threshold is just met \((I^{*}=120)\). When it is missed, the payoff sharply drops to €24 or less depending on how much the group has invested. In Risk, conversely, the group benefits gradually increase in \(I\in \{0,20,\ldots ,240\}\), as each threshold is equally likely to bind. Therefore, in Risk there is no longer a salient target of 120 and the expected payoff does not change as abruptly as in Certainty. The maximum group payoff in Risk is €72, achieved when \(I^{*}=100\) and implying a 46 % probability of provision.

3.2 Equilibria

Consider Certainty first. There are two symmetric pure strategy Nash equilibria, which entail either contributing nothing or \(c_i =\sum _{t=1}^{10} {c_i^t} =20\forall i\). More generally, each group trajectory leading to \(I=120\), irrespective of individual contributions (provided that each subject invests at most \(w(1-d)=36)\), is a Nash equilibrium, as unilateral deviations are non-profitable.Footnote 7 Depending on the past investment trajectory, a high contribution in the final round bringing player \(i\) to \(c_i >20\) may still be optimal if pivotal in guaranteeing that past investments are not wasted. Conversely, if at a certain stage the target becomes out of reach because of insufficient members’ contributions, one’s best response is to stop contributing and play the odds. In sum, under threshold certainty, the challenge is to coordinate on the Pareto-dominant provision equilibrium at \(I^{*}=120\). Given the high losses from non-provision \((1-d=90\,\%)\), the gains from coordination are high; we thus expect groups to achieve a high provision rate in Certainty.

Let us now focus on the Risk treatment. Analyzing it as if it was a one-shot game, the action set is reduced to the choice of the fraction of endowment one invests in the public good \(c_i \in [0,w]\). By computing reaction correspondences, we can establish whether a player has an incentive to make positive contributions in this game. Given aggregate contributions by the other players \(c_{-i}\), player \(i\)’s best response will be to invest \(c_i >0\) if \(\pi _i (c_i ,c_{-i})>\pi _i (0,c_{-i})\). There are three Nash equilibria at the group level: \(I=0, I=20\) and \(I=40\). Unlike the former, the latter two require (slightly) asymmetric contribution profiles \(c_i\), since they can’t be shared equally among the six players. They also require that inequality in contributions among different players is not excessive: \(c_i \le 10\forall i\) for \(I=20\) to be an equilibrium, and \(c_i \le 8\forall i\) for \(I=40\) to be an equilibrium (so that no single individual has to carry too large a share of the burden).Footnote 8

It should be noted that the above analysis is quite restrictive, in that it ignores the timing of contributions. Consider a player investing half of the endowment. In the above analysis, this is captured by \(c_i =20\); but if we look at the whole game, there are many consistent trajectories, including €2 each round or €4 in the first five rounds and €0 thereafter or vice-versa.Footnote 9 While the two profiles are payoff equivalent, from a strategic point of view they convey different signals to the co-players, as in-game behavior is likely to be influenced by the timing of contributions. For instance, subsequent contributions may hinge on sufficient contributions by a subset of players at the beginning of the game. Numerous experiments have shown that many people are conditional cooperators: They are willing to contribute to the public good if they believe that enough others do so, too (e.g. Fischbacher et al. 2001). One explanation for the phenomenon of conditional cooperation is that people generally want to cooperate but do not like “being the sucker,” the feeling that they have been exploited by others. As a consequence, people are often reluctant to contribute in simultaneous public goods games when they do not know how their fellows will behave. In contrast, cooperation often improves when potential contributors can mutually commit and elicit reciprocal contributions (e.g. Chen and Komorita 1994; Kurzban et al. 2001). Our sequential contribution mechanism allows the players to make small incremental commitments while keeping track of the potential for being exploited by others. Note also that, given a certain provision level by others, it is the best response of purely selfish players to contribute to the public good.Footnote 10

In short, we have established that groups consisting of payoff maximizers will contribute only small amounts to the public good. Groups with at least some conditional cooperators, on the other hand, may reach high contribution levels provided that the burden sharing is not too unequal, which is a precondition for conditional cooperation. We resort to the empirics to study the effects of ambiguous thresholds. Expected utility theory cannot be of much guidance in the ambiguity treatment since the subjects’ priors are unknown. However, we expect similar obstacles to cooperation as the ones described for the probabilistic thresholds, as for most plausible probability distributions payoff maximizing behavior entails gambling and underinvesting in the public good.

4 Results

Table 3 presents the summary statistics of the experimental data averaged across groups and rounds per treatment. The contributions to the public good decrease when moving from Certainty (121.2) to Risk (101.4) and Ambiguity (83.0). We see that the aggregate contribution levels in Certainty and Risk are on average close to the optimal level \(I^{*}\). A Kruskal–Wallis test shows a significant treatment effect (\(p = 0.00\)). A series of Mann–Whitney–Wilcoxon rank-sum tests confirms that players in Certainty contributed significantly more than those in the other two treatments (\(p < 0.01\) each).Footnote 11

To compare group performances, Fig. 1 shows the percentage of groups that would have succeeded in avoiding the damage at different hypothetical thresholds given their contributed amounts in the experiment. All groups would have succeeded at a threshold of €20 and none would have succeeded at €140. Between these two values, there are remarkable differences between the treatments. Consider the focal €120 threshold value. In Certainty, all groups reached it successfully, with 7/10 groups contributing exactly €120. In the Risk treatment, only 2/10 groups would have succeeded at a threshold of €120, while no group would have reached this threshold in Ambiguity. A similar picture evolves for the €100 threshold value; while all groups reached that level in Certainty, only 6/10 groups in Risk and 4/10 groups in Ambiguity did so. Furthermore, for all but one threshold value the percentages of successful groups are lower in Ambiguity than in Risk.

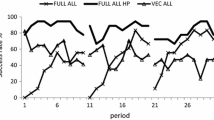

Figure 2 shows the average per-round contributions over time. While contributions in Risk and in particular Ambiguity are decreasing over time, resembling the familiar downward trend of contributions in finitely repeated linear public goods games, they are increasing in Certainty. What is more, the variance of contributions increases substantially from Certainty to Risk and from Risk to Ambiguity (see Table 3). The difference in standard deviations is highly significant between Certainty and each of the uncertainty treatments (Levene test, \(p < 0.01\) each) and it is weakly significant between Risk and Ambiguity (\(p = 0.07\)). That is, the more uncertain the threshold, the larger the variation in group contributions. This seems to be consistent with our theoretical analysis; while a certain threshold provides strong incentives to contribute for any group, an uncertain threshold provides much weaker incentives to contribute and only certain groups manage to overcome the free-riding problem.

Unlike contributions, average proposals for the group target (shown in the first and second column of Table 3) do not significantly differ between treatments (Kruskal–Wallis and Mann–Whitney–Wilcoxon rank-sum tests, \(p > 0.10\) each). With this, players in the two uncertainty treatments proposed significantly more than they actually contributed (Wilcoxon signed-rank test, \(p < 0.01\) each). A series of Pearson correlation tests reveals a weakly significant correlation between the average first proposal and the group investment in Risk (\(\rho = 0.58, p = 0.08\)), but no significant correlation in Ambiguity (\(\rho = 0.24, p = 0.51\)).Footnote 12 The same is true for individual proposals. There is a weakly significant correlation between individual first proposals and individual contributions in Risk (\(\rho = 0.25, p = 0.06\)), while the correlation is not statistically significant in Ambiguity (\(\rho = 0.13, p = 0.32\)). Thus, the proposals do not provide a reliable signal for subsequent contributions, especially when players face an ambiguous threshold.

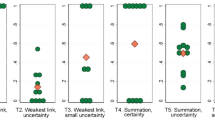

Having said this, let us now consider the first contribution round of the game. Since this round shows players’ decisions without any feedback about their co-players’ actions, it is informative regarding players’ unconditional willingness to contribute. Average group contributions in the first round are not far apart; €11.8 in Certainty, €11.6 in Risk, and €10.6 in Ambiguity. The distribution, however, varies; 80 % of groups playing in Certainty and Risk contributed at least €12 while only 50 % of groups in Ambiguity did so. Early action, defined here as the average group contribution undertaken in the first round, and the contributions provided in all subsequent rounds are positively and strongly correlated in both Risk (\(\rho = 0.72, p = 0.02\)) and Ambiguity (\(\rho = 0.78, p = 0.01\)).Footnote 13 Unlike the proposals, the contributions in the first round implied some costs for the contributors and therefore signaled credible commitment. The presence of uncertainty arguably required costly commitment to induce players to keep investing in the public good. Figure 3 illustrates the comparison between proposals and early action. The top panels show the correlation between the average proposal and the group’s investment made in rounds 2–10. The lower panels show the correlation between the aggregate investment in the first round and subsequent investment in rounds 2–10. The pictures confirm that in Ambiguity early action was a much better predictor for subsequent contributions than was the proposal.

Table 4 presents the results of linear regressions of the cumulative individual contributions [columns (1) and (2)] and cumulative group contributions [columns (3) and (4)] to the public good provided in rounds 2–10. The treatments, the average first proposal, and the group contribution in the first round serve as independent variables.Footnote 14 They are all defined at the group level. Columns (2) and (4) exclude the data from the Certainty treatment in order to highlight the difference between Risk and Ambiguity. The results qualify the relationship we have identified between uncertainty and investment in the public good. The players in Certainty contributed significantly more to the public good than those playing in the uncertainty treatments. The differences in contributions are larger for Ambiguity than for Risk. Both proposals and first round contributions have a significant positive effect on subsequent contributions. The positive effect of the first round contributions is remarkable, in particular under uncertainty.

Players’ sensitivity to the behavior in the first round helps to explain the poor performance of some groups in the Ambiguity treatment. To illustrate this, consider the group that provided the smallest amount over the ten rounds (€26) of all groups taking part in the Ambiguity treatment (and of all groups taking part in the experiment). This group started in the first round with only €6 allocated to the public good. In contrast, the group with largest investment after ten rounds in Ambiguity (€118) provided €14 in the first round. Note that high contributions in the first round were frequently associated with an equal burden sharing (most often all group members started the game with \(C_{i}^{1}=2\forall i)\). As explained above, an equal burden sharing is a precondition for conditional cooperation. A successful and well-balanced start enabled players to coordinate step by step towards a high contributions level. A slow and unequal start, on the other hand, hampered future cooperation. The students’ responses to our ex-post questionnaire confirm the role of fairness. As can be seen in Table 5, fairness was more important under higher uncertainty. Only 3 % of subjects in Certainty state that they contributed less than initially planned because of low contributions by others, while 25 % said this in Risk and 40 % in Ambiguity.

5 Discussion and Concluding Remarks

It is pressing to understand collective action in the presence of uncertainties about ecological thresholds. The climate system and other natural resources involve thresholds beyond which potentially catastrophic and irreversible consequences may ensue, but the location of such thresholds and the efforts required to avoid them are highly uncertain. Although there is widespread political consensus about the need to avoid passing such thresholds, the willingness to contribute to this collective goal may be seriously affected by uncertainty. We designed an experiment involving a series of threshold public goods games to understand whether and how collective action is affected by the availability of information about the threshold. Our theoretical analysis suggests that, under certainty, the public good is likely to be provided because the certain threshold provides a strong incentive for all players to contribute. In contrast, with an uncertain threshold, contributions may depend on players’ preferences. Pure payoff maximizers will contribute only small amounts, if anything, to the public good. Conditional cooperators, on the other hand, may be able to coordinate their cooperative efforts step by step towards higher contribution levels provided that enough players signal their willingness to do so early on.

Our experimental results confirm these predictions. Threshold uncertainty affected the provision of the public good negatively. Whereas all our experimental groups succeeded in preventing the public bad when the threshold was known, this result was not replicated in presence of uncertainty. Contributions were lower and much more erratic when players did not know the threshold, in particular when they faced an ambiguous threshold. This is bad news since many ecological thresholds are in fact ambiguous. Under ambiguity, proposals failed to be followed by contributions of equal magnitude. Early contributions in the first round of the game, on the other hand, turned out to be crucial for the group performance. Groups facing an ambiguous threshold often performed poorly when they started the game slowly with relatively low first round contributions. When a group happened to start the game with high and equally distributed first round contributions, it was likely to reach an overall high contribution level and to ultimately avert the collective damage. As a consequence, group performances varied widely under this high level of uncertainty. One key result of our experiment therefore is that early action becomes very important in the presence of uncertainty. Early action, as opposed to the non-binding proposals, signaled credible commitment because it implied some costs to the contributors. Although the costs incurred by contributors in the first round were relatively low, we argue that this early initiative could be perceived as diagnostic of the presence of conditional cooperators and future cooperation. This finding presents another important reason for the requirement of a fair burden sharing in international negotiations (Bhatti et al. 2010; Johansson-Stenman and Konow 2010; Ringius et al. 2002).

One obvious implication of our findings is that we should try to reduce the uncertainties surrounding natural thresholds. But some uncertainties are irreducible and, even with more information, they may not be resolved when new unknowns emerge. It follows that a precautionary approach to managing ecosystems may be instrumental in coping with uncertain threshold effects and reducing the likelihood of irreversible regime shifts (Lade et al. 2013). Our findings suggest that the formulation of goals, as long as they are non-binding and costless, is not sufficient to make sure that we stay on the safe side of the threshold. Credible and well-balanced commitments seem much more important. However, our experiment has also shown that this kind of commitment cannot be taken for granted.

For global problems like climate change, which are also characterized by a high degree of uncertainty, large scale pro-social behavior is hard to mobilize. We know from field studies and previous experimental research that pro-social behavior can be expected if groups are able to establish and enforce social norms (Fehr et al. 2002; Ostrom 2000). Unfortunately, norms governing the magnitude of the global effort required to avert climate change, and the distribution of associated burdens, have not yet established. The history of climate negotiations has not been encouraging in this respect and global greenhouse gas emissions are still rising. Our results suggest that for dilemmas entrenched with uncertainty, such as climate change, overly ambitious targets may be detrimental. Rather than striving for the global first-best solution we may have to settle on a number of second-best measures which are easier to enforce (Barrett 2003). It should be a priority for research to investigate how cooperation can be helped when uncertainties cannot be reduced and social norms cannot be relied upon.

Notes

Our paper is also related to the experimental literature on linear public goods games involving uncertainty about the marginal benefits of the public good (Gangadharan and Nemes 2009; Levati et al. 2009; Levati and Morone 2013). Most of these experiments report negative effects of risky or ambiguous marginal benefits on public goods contributions as compared to certain benefits.

Experimental investigations have shown that the fourfold pattern of risk attitude (risk aversion for gains and risk seeking for losses at high probability, and risk seeking for gains and risk aversion for losses at low probability) also extends to ambiguity (Di Mauro and Maffioletti 2004).

For different methods to implement uncertainty in the experimental lab, see e.g. Hey et al. (2010), Levati and Morone (2013), Morone and Ozdemir (2012). Note that in our experiment there was no information asymmetry between experimenters and subjects, meaning that the former were also ignorant of the probability distribution. This is an important feature of our design because decision makers perceive ambiguity differently when there is somebody else (the experimenter) who has more information than they do (Chow and Sarin 2002). Threshold uncertainty that revolves around ecological tipping points is typically one of the unknowable types, as nobody has nor could obtain additional information. Ecological validity concerns thus imposed to implement a procedure in which subjects and experimenters had the same information regarding the threshold distribution. Moreover, this setup makes our test of ambiguity effects a particularly conservative one with respect to the potential hampering effects of ambiguity, as information asymmetries have been shown to boost ambiguity aversion.

Note that, while in Certainty \(F_I (T)=0\), if \(I<120\) and \(F_I (T)=1\), if \(I\ge 120\), in Risk \(F_I (T)>0\) for each investment level (i.e. there is a positive provision probability even for \(I=0\)). At the other end of the spectrum, only \(I=240\) guarantees provision in Risk, which would leave each player with \(w-\sum _{t=1}^r {c_i^t} =0\).

Note that, while \(I=120\) is payoff-dominant with respect to the free-riding equilibrium, it is also unstable: should there be a “tremble” by one player (e.g. switching from \(C_i =2\) to \(C_i =0\) at a given round), the remaining players’ best response may be to also switch.

Additionally, if all players are (sufficiently) risk averse, some higher provision equilibria obtain. For instance, if we drop risk neutrality and assume \(u_i (x_i)=x_i^{1/6}\) where the argument is the take home money (either \(w-c_i \) when the group is successful or \((w-c_i)d\) when unsuccessful), \(I=60\) is a symmetric Nash equilibrium. That is, given \(c_{-i} =50, u_i (c_i =10)>u_i (c_i =0)\). While the next achievable symmetric equilibrium \(I=120\) is not equilibrium, contributing \(c_i =16\cong 100/6\) when \(c_{-i} =84\) is a dominant strategy. Hence \(I=100\) is also attainable under risk aversion and the bit of asymmetry required to split a burden of 100.

In fact, there are \(\sum _{t=0}^5 {{5!}/{t!^{2}(10-2t)!}} \) profiles consistent with \(c_i =20\).

For instance, take the point of view of a player \(i\) who has follow ed the free-riding strategy \(C_i =0\) for the first nine rounds. Should the other \(j\ne i\) players have contributed \(\sum _{t=1}^9 {\sum _{j=1}^5 {c_j^t}} =96\) collectively, player \(i\)’s best response is to provide enough to reach a higher threshold (and no player has an incentive to deviate). In this case, \(i \)would optimally contribute \(C_i =4\) in the last round, a pivotal contribution in reaching \(I=100\). Similarly, a selfish individual would be willing to switch from \(C_i =0\) to \(C_i =4\) in the last round if instrumental in reaching \(I=120\).

Statistical tests are based on group averages as units of observation. If not stated otherwise, the reported tests are two-sided throughout the paper. Note also that the differences between Certainty and the other treatments are robust to multiple comparison corrections.

All the results on the correlation between variables do also hold if we employ the Spearman’s rank correlation test.

In the Certainty treatment, the correlation between first round contributions and subsequent contributions is also significant but negative (\(\rho = -0.84, p = 0.00\)), reflecting the presence of groups that had a slow start but ultimately strived and managed to reach the threshold.

We do not include the second proposals in the regression models because they were elicited during the game and therefore are likely to be endogenous. We did not find significant relationships between the variables we elicited in our ex post questionnaire and the behavior in the game.

References

Alley RB, Marotzke J, Nordhaus WD, Overpeck JT, Peteet DM, Pielke RA Jr, Pierrehumbert RT, Rhines PB, Stocker TF, Talley LD, Wallace JM (2003) Abrupt climate change. Science 299(5615):2005–2010

Alpizar F, Carlsson F, Naranjo MA (2011) The effect of ambiguous risk, and coordination of farmers’ adaptation to climate change—a framed field experiment. Ecol Econ 70:2317–2326

Au W (2004) Criticality and environmental uncertainty in step-level public goods dilemmas. Group Dyn Theory Res Pract 8(1):40–61

Bagnoli M, Lipman BL (1989) Provision of public goods: fully implementing the core through private contributions. Rev Econ Stud 56(4):583–601

Balliet D (2010) Communication and cooperation in social dilemmas: a meta-analytic review. J Confl Resolut 54(1):39–57

Barnosky AD, Hadly EA, Bascompte J, Berlow EL, Brown JH, Fortelius M, Getz WM, Harte J, Hastings A, Marquet PA, Martinez ND, Mooers A, Roopnarine P, Vermeij G, Williams JW, Gillespie R, Kitzes J, Marshall C, Matzke N, Mindell DP, Revilla E, Smith AB (2012) Approaching a state shift in Earth’s biosphere. Nature 486:52–58

Barrett S (2003) Environment and statecraft. University Press, Oxford

Barrett S (2013) Climate treaties and approaching catastrophes. J Environ Econ Manag 66(2):235–250

Barrett S, Dannenberg A (2012) Climate negotiations under scientific uncertainty. Proc Natl Acad Sci 109(43):17372–17376

Barrett S, Dannenberg A (2014) Sensitivity of collective action to uncertainty about climate tipping points. Nat Clim Change 4:36–39

Bhatti Y, Lindskow K, Pedersen LH (2010) Burden-sharing and global climate negotiations: the cas of the Kyoto protocol. Clim Policy 10(2):131–147

Camerer C, Weber M (1992) Recent developments in modeling preferences: uncertainty and ambiguity. J Risk Uncertain 5(4):325–370

Chen XP, Komorita SS (1994) The effects of communication and commitment in a public goods social dilemma. Organ Behav Hum Decis Process 60:367–386

Chow CC, Sarin RK (2002) Known, unknown, and unknowable uncertainties. Theory Decis 52(2):127–138

Croson R, Marks M (2000) Step returns in threshold public goods: a meta- and experimental analysis. Exp Econ 2(3):239–259

Di Mauro C, Maffioletti A (2004) Attitudes to risk and attitudes to uncertainty: experimental evidence. Appl Econ 36(4):357–372

Ellsberg D (1961) Risk, ambiguity, and the savage axioms. Q J Econ 75(4):643–669

Fehr E, Fischbacher U, Gächter S (2002) Strong reciprocity, human cooperation, and the enforcement of social norms. Hum Nat 13(1):1–25

Fischbacher U (2007) Z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fischbacher U, Gächter S, Fehr E (2001) Are people conditionally cooperative? Evidence from a public goods experiment. Econ Lett 71:397–404

Gangadharan L, Nemes V (2009) Experimental analysis of risk and uncertainty in provisioning private and public goods. Econ Inq 47(1):146–164

Gustafsson M, Biel A, Gärling T (1999) Outcome-desirability in resource management problems. Think Reason 5(4):327–337

Gustafsson M, Biel A, Gärling T (2000) Egoism bias in social dilemmas with resource uncertainty. Group Process Intergroup Relat 3:351–365

Hasson R, Löfgren A, Visser M (2010) Climate change in a public goods game: investment decision in mitigation versus adaptation. Ecol Econ 70:331–338

Hasson R, Löfgren A, Visser M (2012) Treatment effects of climate change risk on mitigation and adaptation behaviour in an experimental setting. S Afr J Econ 80(3):415–430

Hey JD, Lotito G, Maffioletti A (2010) The descriptive and predictive adequacy of theories of decision making under uncertainty/ambiguity. J Risk Uncertain 41:81–111

Johansson-Stenman O, Konow J (2010) Fair air: distributive justice and environmental economics. Environ Resour Econ 46:147–166

Knight FH (1921) Risk, uncertainty, and profit, 1st edn. Hart, Schaffner & Marx, Houghton Mifflin Co., Boston, MA

Kurzban R, McCabe K, Smith VL, Wilson BJ (2001) Incremental commitment and reciprocity in a real-time public goods game. Personal Soc Psychol Bull 27(12):1662–1673

Kriegler E, Hall JW, Hermann H, Dawson R, Schellnhuber HJ (2009) Imprecise probability assessment of tipping points in the climate system. Proc Natl Acad Sci 106(13):5041–5046

Lade S, Tavoni A, Levin S, Schlueter M (2013) Regime shifts in a social-ecological system. Theor Ecol 6:359–372

Lenton TM, Held H, Kriegler E, Hall JW, Lucht W, Rahmstorf S, Schellnhuber HJ (2008) Tipping elements in the Earth’s climate system. Proc Natl Acad Sci 105(6):1786–1793

Levati MV, Morone A (2013) Voluntary contributions with risky and uncertain marginal retursn: the importance of the parameter values. J Public Econ Theory 15(5):736–744

Levati MV, Morone A, Fiore A (2009) Voluntary contributions with imperfect information: an experimental study. Public Choice 138:199–216

McBride M (2006) Discrete public goods under threshold uncertainty. J Public Econ 90:1181–1199

McBride M (2010) Threshold uncertainty in discrete public good games: an experimental study. Econ Gov 11(1):77–99

Milinski M, Sommerfeld RD, Krambeck H-J, Reed FA, Marotzke J (2008) The collective-risk social dilemma and the prevention of simulated dangerous climate change. Proc Natl Acad Sci 105(7):2291–2294

Morone A, Ozdemir O (2012) Displaying uncertain information about probability: experimental evidence. Bull Econ Res 64(2):0307–3378

Nitzan S, Romano RE (1990) Private provision of a discrete public good with uncertain cost. J Public Econ 42(3):357–370

Ostrom E (2000) Collective action and the evolution of social norms. J Econ Perspect 14(3):137–158

Palfrey TR, Rosenthal H (1984) Participation and the provision of public goods: a strategic analysis. J Public Econ 24:171–193

Rapoport A, Budescu DV, Suleiman R, Weg E (1992) Social dilemmas with uniformly distributed resources. In: Liebrand WBG, Messick DM, Wilke HAM (eds) Social dilemmas: theoretical issues and research findings. Pergamon Press, Oxford, pp 43–57

Ringius L, Torvanger A, Underdal A (2002) Burden sharing and fairness principles in international climate policy. Int Environ Agreem Polit Law Econ 2:1–22

Rockström J, Steffen W, Noone K, Persson Å, Chapin S III, Lambin EF, Lenton TM, Scheffer M, Folke C, Schellnhuber HJ, Nykvist B, de Wit CA, Hughes T, van der Leeuw S, Rodhe H, Sörlin S, Snyder PK, Costanza R, Svedin U, Falkenmark M, Karlberg L, Corell RW, Fabry VJ, Hansen J, Walker B, Liverman D, Richardson K, Crutzen P, Foley JA (2009) A safe operating safe for humanity. Nature 461:472–475

Suleiman R (1997) Provision of step-level public goods under uncertainty a theoretical analysis. Ration Soc 9(2):163–187

Suleiman R, Budescu DV, Rapoport A (2001) Provision of step-level public goods with uncertain provision threshold and continuous contribution. Group Decis Negot 10(3):253–274

Tavoni A, Dannenberg A, Kallis G, Löschel A (2011) Inequality, communication and the avoidance of disastrous climate change in a public goods game. Proc Natl Acad Sci 108(29):11825–11829

Wit A, Wilke A (1998) Public good provision under environmental and social uncertainty. Eur J Soc Psychol 28(2):249–256

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Experimental Instructions (Risk treatment, translated from German)

Welcome to our experiment!

-

1.

General information

In our experiment, you can earn money. How much you earn depends on the gameplay, or more precisely on the decisions you and your fellow players make. Regardless of the gameplay, you will receive €2 for your participation. For a successful run of this experiment, it is absolutely necessary that you do not talk to other participants or do not communicate in any other way. Now read the following rules of the game carefully. If you have any questions, please give us a hand signal. It is important that you read up to the STOP sign only. Please wait when you get there, as we will give you a brief oral explanation before we continue.

-

2.

Game rules

There are six players in the game, meaning you and five other players. Each player is faced with the same decision problem. In the beginning of the experiment, you receive a starting capital of €40, which is credited to your personal account. During the experiment, you can use the money in your account or let it be. In the end, your current account balance is paid to you in cash. Your decisions are anonymous. For the purpose of anonymity, you will be allocated a pseudonym which will be used for the whole duration of the game. The pseudonyms are chosen from the names of moons in the Solar System (Ananke, Telesto, Despina, Japetus, Kallisto or Metis). You can see your pseudonym in the lower left corner of your display.

The experiment has exactly ten rounds. In each round, you can invest your money in order to try and prevent damage. The damage will have a considerable negative financial impact on all players. In each round of the game, all six players are asked the following question at the same time:

‘How much do you want to invest to prevent damage?

You can answer with €0, €2 or €4. After each player has made her or his decision, the six decisions are displayed at the same time. After that, all money paid by the players is booked to a special account for damage prevention.

At the end of the game (after exactly ten rounds), the computer calculates the total investments made by all players. If the investments have reached a certain minimum, the damage is prevented. In this case, each player is paid the money remaining in her or his account, meaning the €40 starting capital minus the money the player has invested in preventing damage over the course of the game. However, if the total investments are lower than the minimum, the damage occurs: All players lose 90 % of the remaining money in their personal accounts. The minimum to be reached in order to prevent damage will be drawn randomly. We will draw the minimum after the game in your presence. The draw goes like this: The minimum can take the values 0, 20, 40, 60 etc. up to 240 (always in steps of 20). For each of these 13 values, a certain number of balls in different colors is put into a bag. One ball is drawn from the bag and the value shown on the ball is the minimum value for the game. The following figure shows the distribution of the different balls. There are 52 balls altogether. These balls are put into a bag, and one is drawn randomly.

For each possible value, four balls are put into a bag. The probability of being drawn is thus equal for every value and comes to 4/52 (\(\approx \)8 %). Assuming that a light blue ball with the value 100 was drawn, all players together must have invested at least €100 in order to prevent damage. If a single player has invested, say, a total of €10 in damage prevention after ten rounds, he or she has a credit of €30 on his or her personal account. If the group of players as a whole has invested €100 or more in damage prevention, the damage will not occur and this player will receive €30 from the game. However, if the group has invested less than €100, the damage will occur and the player will receive €3 (10 % of €30) from the game.

Please note the following feature of the game: Before the players decide how much they want to invest into preventing damage, they exchange non-binding suggestions for their common investment goal. Each player makes a suggestion of how much the group as a whole should invest into preventing damage over the total of ten rounds. After that, the suggestions made by all players and an average value from all suggestions are shown on the monitor. After round 5, all players can make a new suggestion for the total investments to be made by the group over the ten rounds. After that, the suggestions made by each player and an average value for all suggestions are shown on the monitor.

-

3.

Example

Here, you can see an example of the decisions made by the six players in one round (round 3).

The right column shows the investments made in the current round (round 3). The players Ananke and Kallisto have invested €2 each, the players Telesto and Japetus have invested €4 each and Despina and Metis have not made any investments. In total, €12 were invested in this round. The middle column shows the cumulative investments made by each player from the first to the current round (rounds 1–3). The players Ananke and Telesto have each invested €6 in the first three rounds. Despina, Kallisto and Metis have each invested €4 and Japetus has invested €10 in the first three rounds. In total, €34 were invested in the first three rounds.

The left column shows the suggestions made by each player as to how much the group as a whole should invest into preventing damage over the ten rounds in total. For example, Metis suggests that the group should invest €140. The average of all suggestions is €108. In the game, you will see this information after each round.

“STOP sign” (oral explanation of the game)

-

4.

Control questions

Please answer the following control questions.

Please give us a hand signal after you have answered all control questions. We will come to you and check the answers. The game will begin after we have checked the answers of all players and answered any questions you may have. Good luck!

Rights and permissions

About this article

Cite this article

Dannenberg, A., Löschel, A., Paolacci, G. et al. On the Provision of Public Goods with Probabilistic and Ambiguous Thresholds. Environ Resource Econ 61, 365–383 (2015). https://doi.org/10.1007/s10640-014-9796-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9796-6