Abstract

Using data from a household survey carried out in the French overseas territory of Réunion, we investigate the price of drinking-water perceived by households faced with an increasing, multi-step pricing scheme. To this purpose we use an improved version of the method introduced by Shin (Rev Econ Stat 67(4):591–598, 1985) to estimate the demand for residential water when consumers are imperfectly informed about their pricing schedule. The empirical results suggest that Réunion households underestimate the price of water and thus consume more than what is economically rational. Providing information to households about the marginal price of water may be an innovative means of inducing them to respond to pricing policies designed to promote water conservation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As shown by the number of surveys published in the literature, the estimation of residential demand for water is a major issue in environmental economics (see Arbuès et al. 2003; Dalhuisen et al. 2003; Worthington and Hoffman 2008; Nauges and Whittington 2010). A large part of this empirical literature aims at obtaining consistent estimates of the price elasticity of demand for water as a prerequisite to analyzing the relevance of pricing policies for a demand-side management of water consumption.

As water tariff schedules are often complex, with increasing or decreasing block rates and fixed charges, an important issue discussed in the literature is the choice of a relevant specification of the price variable for residential water consumption analysis. The discussion generally focuses on whether to use the average price or the marginal price measured as the block rate charged on the last unit of water consumed. A perfectly informed rational consumer should react to the marginal price, but there is a strong presumption that imperfect information may confuse consumer perception of block rates. Therefore, the consumer may respond to other price indicators, in particular the average price which can be obtained easily by dividing the water bill by water consumption.

To date, the determination of the price variable to which consumers respond has been tackled as an empirical issue. The price providing the best fit is presumed to be the price perceived by consumers. Howe and Linaweaver (1967) were the first to discuss and compare average and marginal prices for water demand analysis. In a first approximation, Foster and Beattie (1981) compare average and marginal prices using \(\hbox {R}^{2}\) criterion and hypothesis testing to assess significant differences between the parameter estimates of the two alternative model specifications. Ruijs et al. (2008) provide a more recent study comparing the use of average versus marginal prices in water demand modelling. More formal statistical tests of average versus marginal prices have been developed by Opaluch (1982) and Shin (1985) to gain a better insight into the issue of consumer price perception. Nieswiadomy and Molina (1991) first used Shin’s methodology to identify, through a time series approach, the price perception of residential water consumers faced with a multi-step block rate schedule. To the best of our knowledge, with the exception of the working paper by Kavezeri-Karuaihe et al. (2005), no recent studies have used this methodology. More recently, Borenstein (2009) and Ito (2012) investigated this issue in relation to residential electricity consumption by examining whether consumers cluster at the kink points of a non linear block rate schedule. Such bunching would be observed if consumers respond to marginal price.Footnote 1

This paper intends to contribute to the literature on empirical demand analysis for residential water by using a unique micro data set collected on an island where the use of water resources has become a source of increasing controversy. We use an unbalanced panel of water bills collected through a household survey conducted in the French overseas territory of Réunion. Our research relies on a testing approach developed by Davidson and Mc Kinnon (1984); Davidson and Mc Kinnon (2004) for discriminating between non-nested models. We apply this approach to provide a rationale for, and a generalization of the perception price approach developed by Shin (1985). This improved Shin approach allows one to discriminate between average versus marginal price water demand models, and furthermore provides an identification and measurement of the price of water perceived by households imperfectly informed about their pricing schedule. The application of this approach to the above mentioned data set shows that faced with an increasing, multi-step pricing scheme, Réunion households tend to strongly underestimate their actual marginal price of water. We conclude that improving the information provided to households on the cost of water would be an innovative means to induce them to rationally respond to pricing policies aiming to promote water saving behaviour.

This paper proceeds as follows. In Sect. 2, we describe the main real-world practices used to price drinking-water. In Sect. 3, we outline the rationale of the microeconomic model of household demand for drinking-water under increasing block rates and comment on the criticisms of the use of this model for real-world analysis. Section 4 presents and criticizes the method used for testing the price specifications to which water consumers respond and develops the methodology we suggest for measuring and testing imperfect price perception under increasing block pricing. Section 5 describes the data used in our empirical analyses. Section 6 presents and discusses the results of our empirical analyses. Section 7 concludes by outlining recommendations intended to provide innovative pricing policies to induce household water saving behaviour.

2 Water Pricing Practices

Due to the important investment costs involved in the construction of infrastructure for water collection, conveyance, storage, treatment and distribution (see Carlevaro and Gonzalez 2011), the supply of drinking water to human settlements has traditionally been viewed as a public service that should be entrusted to a public utility acting as a monopoly. As such, the public utility is relatively free to fix tariffs according to various objectives, ranging from simple cost recoveryFootnote 2 to economic efficiency, environmental protection and social equity.

As OECD (2010) mentions, despite widely diverse forms of organization and management, a large number of countriesFootnote 3 actually price drinking water with a two-part tariff made up by a fixed charge and a single, flat rate, volumetric charge. From the point of view of cost recovery, the fixed charge primarily is intended to cover the investment costs of setting up the network’s capacity to deliver the desired volume of water to each household water connection. This charge may be staggered over time by computing an annual equivalent cost, namely the constant annuity to be paid during the network life cycle to refund the investment cost at a given discount rate. On the other hand, the flat rate, volumetric charge is intended to cover the running costs of the infrastructure, which are assumed to vary with the volume of water provided to final users. Therefore, the flat rate represents the running costs per \(\hbox {m}^{3}\) delivered to final users.

While a two-part tariff is used widely, it is not universal. The first difficulty in implementing a two-part tariff lies in the need to meter household water consumption. In many urban and rural communities where the rate of a \(\hbox {m}^{3}\) of water is low, the cost of installing and operating such a metering system may be out of all proportion to the volumetric charge for those households with low water consumption. To avoid such water overpricing, the utility may allow water meters to be voluntary, and offer a flat fee to those customers who do not want to install a meter. This is in particular the case for Argentina and the United Kingdom where, in the absence of a meter, water billing is based on a flat fee charge assessed on the basis of an estimated value (property or rental value, for example) of the connected accommodation. This pricing method, which is falling out of use (see OECD 2010), is strongly criticized because the amount billed is unrelated to the volume of water consumed, and therefore does not encourage water conservation.

The second inconvenience of a two-part tariff designed to achieve cost recovery lies in the imbalance between the amount of the fixed charge and that of the volumetric charge. This arises from the relative importance of fixed costs in relation to variable costs of water supply,Footnote 4 which contributes to increasing the share of captive expenses in the household budget. For this reason, it may appear suitable to renounce the fixed charge and opt for a wholly volumetric tariff by which water is priced at a single flat rate per \(\hbox {m}^{3}\) corresponding to the so-called average incremental cost (see Carlevaro and Gonzalez 2011, p. 128). This unit cost of water per \(\hbox {m}^{3}\) produced is computed by dividing the full cost present value of the water supply system by a measure of its life-cycle production that discounts water production provided in the future at the same discount rate used for discounting future costs. The main limitation of this pricing method, which is actually used in many countries, lies in the income transfers that it can induce between big and small water consumers, the big consumers supporting a larger share of fixed costs than the smaller ones.Footnote 5

To achieve goals of environmental protection and social equity, more complex tariff schemes enforcing increasing rate volumetric charges have been introduced in many countries where these issues deserve special attention. In its conventional form, this pricing scheme breaks down the metered volume of water during the billing period by ordered blocks and prices each block by means of rates which are flat within a block but increasing between two successive blocks. This increasing block rate pricing scheme, which may include a fixed charge, is presently used in USA, notably in California where it is complemented by a seasonal tariff, Latin America, where many countries have introduced a “social rate” for pricing the first block corresponding to basic water needs, and many European countries (Belgium, Spain, Greece, Italy, Malta, Portugal) at a local level. In France, this pricing scheme is quite uncommon (4–6 % of urban and rural districts according to Coutelier and Le Jeannic 2007), but the current government is considering generalizing the scheme in accordance with its economic program. Finally, one should note the example of Tunisia and Turkey, where a super-increasing block rate pricing scheme is used to manage a scarcity of water resources. Under this pricing scheme, a household pays for its entire water consumption at the rate of the last block reached (see Limam 2007).

3 Housing Water Demand Under Increasing Block Rates

From an economic point of view, water is a sui generis consumption good as its consumption requires equipment, namely water-using appliances, such as tap, cooker, shower, lavatory, dishwasher, watering system and so on, converting water into services for food processing, personal hygiene, washing, cleaning and gardening. As a result, water demand analysis can be tackled according to two time scales. In the short run, the demand for water is constrained by the equipment already possessed by the user. A short-run analysis of water demand thus will aim to identify and quantify the impact of the factors influencing the duration and the frequency of equipment use. In the long run, on the other hand, the limitations imposed by the actual stock of appliances vanish because the stock can be modified. A long-run analysis of water demand hence will emphasize the role of the determinants responsible for changes in the size and water-efficiency of the stock of appliances.

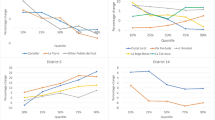

Whatever the time scale chosen for the analysis, economic modelling of household demand for drinking-water must first refer to consumer microeconomic theory, which assumes that there is perfect information on household preferences, income and prices, and that household choices are rational. Given the local context in which our empirical analyses were conducted, the microeconomic model of demand must also incorporate, on top of the fixed charge, an IBT (increasing block tariff) because these are used in Réunion, as shown in Fig. 1a–c.

To make the presentation clear, consider a block rate schedule consisting of two consumption blocks with increasing prices \(\pi _1 \) and \(\pi _2 \) and a fixed charge \(F\). The consumer’s budget constraint can be written as follows:

if the consumer’s actual water consumption, denoted by \(q\), is located in consumption block 1 and as:

if \(q\) is located in consumption block 2, with \(b_1 \) the consumption threshold beyond which the price of water per cubic meter is stepped up from \(\pi _1 \) to \(\pi _2 (\pi _2 >\pi _1 )\). \(X\) and \(p\) are respectively an aggregate of other private consumption goods and its implicit price index (such that \(pX\) is the expenditure on other consumption goods), while \(Y\) is the household income. According to Nordin (1976), in both cases the budget constraint can be rewritten as a standard budget constraint in the form:

with

and \(\pi \) the “marginal price” of water, namely either \(\pi _1 \), if \(0\le q<b_1 \), or \(\pi _2 \), if \(q\ge b_1 \). Formula (3) claims that a perfectly informed water consumer whose consumption is located in block 2 should react not only to marginal price, but also to changes in the infra-marginal price \(\pi _1 \) through an income effect generated by adding to net income \(Y-F\) the Nordin’s difference variable \(D\), expressing the refunding to which the consumer is entitled if he had paid his entire water consumption at the marginal price \(\pi _2 \).

Referring to the consumer’s rational choice problem, this reformulation of the budget constraint allows the household demand for water to be written as \(q=\phi (\pi _1 ,p,Y-F)\) in consumption block 1, and \(q=\phi (\pi _2 ,p,Y-F+D)\) in consumption block 2. In the economic literature, these functional relationships are referred to as “conditional” demand functions as they specify the household’s optimal choices of water consumption as a function of its economic determinants within a given pricing block. The “unconditional” demand for water is obtained by relating these two conditional demand functions by means of a corner solutionFootnote 6 \(q=b_1 \) appearing over a range of incomes bound by the solutions \(\overline{{Y}}_1 \) and \(\underline{Y}_2 \), with respect to \(Y\), of the following equations: \(\phi (\pi _1 ,p,Y-F)=b_1 \) and \(\phi (\pi _2 ,p,Y-F+D)=b_1 \). Thus, the demand for water is inelastic with regard to income and prices when \(\overline{{Y}}_1 \le Y\le \underline{Y}_2 \). All of this formalization can be easily generalized to the case of a multi-block rate schedule.

This theoretical model of water demand has been challenged in the literature with arguments that consumer choices are based on more limited information than presumed. The two main assumptions concerning, on one side, the consumer’s proper knowledge of the price of water, on the other side, the consumer’s proper knowledge of his consumption of water, can be (and have been) disputed.

The first issue relates to the complexity of the water tariff, which may lead the consumer to summarize it with an appropriate indicator, such as the average price \(\overline{{\pi }}\) computed by dividing the invoiced cost of waterFootnote 7 by the total consumption of water, as long as these figures appear clearly on the water bill. This perceived price of water differs from its marginal price by a unit “rate structure premium” (Shin 1985) which, in the case of the above two-block rate schedule, is written as:

Note that for an increasing block pricing scheme, \(\overline{{\pi }}\) is lower than marginal price \(\pi \) as soon as \(D>0\). As emphasized by Liebman and Zeckhauser (2004), this behaviour, which they call “ironing”, can emerge mainly because bills are presented in consumption units that are not directly observed by the consumer (“obscure price units”). In other words, the units for which consumers are charged are different from the units on which consumers base their consumption choices. Insofar as most of a household’s water demand is a derived demand for the production of water-consuming services, the link between the decisions made and the volume of water consumed may be difficult to assess. At the same time, another perception bias involves the presentation of the bills. Details of the tariff often are not shown on the bill and it can be difficult to understand. And, water utilities sometimes print the average price paid by the household on the bill, or simply the average price calculated for a typical household consumption of 120 \(\hbox {m}^{3}\)/year. The way this information is presented to consumers may lead to persistent misperceptions. Finally, the fact that the payment is made after consumption has taken place, and that tariffs vary considerably between towns, likely adds to the confusion.

Another perception bias that challenges the classical model of demand is that consumers are not perfectly informed about their actual consumption. One reason may be that, as household consumption results from many different individual decisions, it is hard to control. Moreover, remaining informed requires a household to regularly measure its consumption, what may require considerable effort.Footnote 8 From an analytic point of view, the fact that consumers do not know with certainty their consumption means they do not know with certainty the marginal price they face, and this holds true even when they know the tariffs. Borenstein (2009) develops a formal model where a risk-neutral consumer responds to an expected marginal price whose computation may involve several prices of the tariff. Intuitively, this kind of stimulus is more likely the closer the consumption is to a pricing threshold and the greater the demand shocks are.

To summarize, the two approaches we consider state that consumers do not respond to the marginal price, mainly because they do not know it accurately, but rather to an average price indicator computed from all or part of the tariff. If this is so, the effect of a marginal price increase on consumption will be much weaker since it passes through the average price. Moreover, a consumer who “irons” may over-consume with increasing block pricing and is bothered by failing to optimize. Nonetheless, in the expected marginal price model, a decision appears to be optimal ex ante, but it should be emphasized that any improvement in information should improve the situation of the consumer.

At this stage, it should be clear that the issue of the perceived price is an open question that must be dealt with empirically. Indeed, it is not sufficient to state that consumers do not know currently their consumption to assert that they behave as if they were operating in a truly risky environment (in the real world, many decisions are taken by consumers as if the environment was deterministic although it is not). Indeed, if the socio-economic environment is relatively stable, a consumer may consider that total consumption over the billing cycle exhibits little volatility and, provided that the consumption is sufficiently different from a pricing threshold, may regard marginal price as completely known. Similarly, it is not sufficient to state that individuals make suboptimal choices when they misperceive prices to promote an approach based on the marginal price. Indeed, the low prices of water can make the costs associated with optimization errors quite small, in which case information policies intended to encourage consumers to adopt a perfectly-optimizing behaviour will fail. From this point of view, the magnitude of these costs surely plays an essential role concerning the degree of attention paid by households.

4 Testing and Measuring Imperfect Price Perception Under Increasing Block Rate Pricing

In this section, we first present and criticize the statistical tests developed by Opaluch (1982) and Shin (1985) to discriminate between average and marginal price water demand models. Then, using an artificial nesting, we embed these two non-nested demand models into a more general model to provide a rationale for and a generalization of Shin’s approach which allows one to empirically estimate a perceived price of water by households and statistically compare this with average and marginal price assumptions.

4.1 Opaluch’s Test

To test which of the two alternative measures of price, average or marginal, water consumers actually respond to, Opaluch (1982) uses a linearized version of the theoretical demand function presented in Sect. 3 by adding to this specification, as an extra-explanatory variable, the unit structure rate premium previously defined by formula (5). Assuming an increasing two-block rate schedule as in Sect. 3, and using the same notations of that section, Opaluch’s water demand specification can be expressed as:

where \(\rho =\overline{{\pi }}-\pi _2 =-D/q\) is the unit structure rate premium and \(c_0 , \ldots , c_4 \) are parameters to be estimated. Accordingly, to support the hypothesis that water consumers respond to marginal price \(\pi _2 \), Opaluch suggests performing the significance test \(c_2 =0\) against \(c_2 \ne 0\) and, conversely, to support the hypothesis that water consumers respond to average price \(\overline{{\pi }}=\pi _2 +\rho \), the significance test \(c_1 -c_2 =0\) against \(c_1 -c_2 \ne 0\) .

This simple testing procedure has at least two major drawbacks. On one hand, assuming \(c_2 =0\) actually leads to a linear specification of the conditional demand for water in consumption block 2. However, imposing \(c_1 =c_2 \) leads to \(q=\hbox {c}_0 +c_1 \overline{{\pi }}+c_3 p+c_4 (Y-F+D)\), which is not a linearized specification of the demand for water of a consumer responding to the average price, namely \(q=\phi (\overline{{\pi }},p,Y-F)\). Furthermore, such a linear specification of the conditional demand function \(q=\phi (\pi _2 ,p,Y-F+D)\) does not necessarily comply with the theoretical restrictions of a demand function derived from the maximization of a utility function, like the zero homogeneity with respect to prices and income, except if we reformulate it as a function of relative prices and income, i.e. as \(q=\hbox {c}_0^*+c_1^*{\pi _2 }/p+c_2^*\rho /p+c_3^*{(Y-F+D)}/p\). On the other hand, used as a discrimination test between two alternative model specifications, this testing procedure leads to a clear cut conclusion when one of the two null hypotheses is accepted and the other rejected, while it fails to conclude when both null hypotheses are accepted or rejected (which is the case here when we apply this test to our data).

4.2 Shin’s Approach

The testing approach suggested by Shin (1985) gives an economic rationale to Opaluch’s test by introducing the concept of “perceived price” to which the water consumer is supposed to actually respond. The perceived price \(\pi ^*\) is defined as a parametric function of the average and marginal prices and of a “perception parameter” \(k\) leading to marginal price \(\pi _2 \) or to average price \(\overline{{\pi }}\) depending on whether \(k\) is equal to zero or to one.

More precisely, the functional form used by Shin (1985) to specify the perceived priceFootnote 9 to which an imperfectly informed water consumer responds is expressed by the following formula:

The choice of this formula is motivated by the particular functional form used by Shin to specify the demand for water of a consumer responding to its perceived price, namely \(q=\phi (\pi ^*,p,Y-F)\), which is of the double-logarithmic linear type:Footnote 10

in order to benefit from the use of linear regression techniques for parameter estimation and testing.

Shin’s conceptual contribution to the debate on which price of water is more relevant for empirical water demand analysis is now clear. It consists in assuming that households have a subjective perception of the price of drinking-water, and specifies a measurement model for this perceived price that allows one to estimate its level jointly with the model of water demand. This perceived price measurement renders it possible not only to better estimate the actual price elasticity of water demand, but also to shed light on the impact of misperceptions of the actual water tariff on water demand. Indeed, for an increasing block pricing scheme \(\overline{{\pi }}<\pi _2 \) implying that the perceived price is all the more lower than marginal price that perception parameter \(k\) is greater than zero and, accordingly, the water demand greater than that resulting from perfectly optimizing consumer behaviour. Despite these merits, Shin’s approach still entails some of the drawbacks of Opaluch’s approach, notably that setting \(k=0\) in formula (8) does not lead to the right specification of the demand for water of a consumer responding to marginal price, which should be written as: \(lnq=b_0 +b_1 \ln \pi _2 +b_2 \ln p+b_3 \ln (Y-F+D)\).

4.3 Generalization of Shin’s Approach

To avoid the above mentioned drawbacks of Shin’s approach, we embed the two alternative specifications of water demand respectively responding to marginal and average price in a more general model by means of an artificial nesting. More precisely, writing these two model specifications in double-logarithmic form:

and combining them linearly by means of a single nesting parameter \(k\) leads to the hybrid model:

where \(\pi ^*\) is Shin’s perceived price and \((Y-F)^*=(Y-F+D)\left[ {({Y-F)}/{(Y-F+D)}} \right] ^{k}\) a perceived net income corrected by Nordin’s \(D\). As expected, this model encompasses models (9) and (10) as special cases which can be obtained when the nesting parameter \(k\) is set equal to 0 and 1, respectively. Accordingly, the economic interpretation of this model parallels that of Shin’s model (8) with the notable difference that in this model, the observable net income variable \(Y-F\) is replaced by a corresponding latent perceived net income variable modelled similarly to perceived price. The value of this latent variable decreases with that of the perceived parameter \(k\), from \(Y-F+D\) to \(Y-F\) when \(k\) varies from 0 to 1 and below \(Y-F\) towards 0 when \(k>1\).

5 Empirical Data

Our empirical analyses are based on a unique survey dataset covering the entire territory of Réunion island. We first offer a description of the survey context and sampling design, then we introduce the data selected for empirical analyses.

5.1 The Réunion Household Water Consumption Survey

Réunion is a French overseas territory lying in the Indian Ocean. The island is 70 km long and 50 km wide with a population in 2004 estimated to be approximately 700,000 inhabitants, most of whom are young (40 % are under the age of 40). The population growth rate and the unemployment rate (about 30 %) are both high. The climate is rather humid and tropical. The rainy season (December–April) follows the dry season (May–November). Rainfall differs considerably according to the geographical location: the northeast of the island receives about 70 % of the total rainfall. Urban development mainly occurs in the northwest of the island, where the weather is dry. Lastly, household water use in 2004 appears quite high; the water consumption level per inhabitant in Réunion, computed with aggregate data, is 269 l per day compared to an average of 150 l per day on mainland France (Coutelier and Le Jeannic 2007).

Water therefore has become a source of increasing controversy in Réunion because supply is failing to meet demand in many areas, especially in the western part of the island. In this context, the Regional Directorate for the Environment (so-called DIREN from the French term ‘DIrection Régionale de l’ENvironnement’) was given the important task of setting up an overall water management plan intended to secure the future supply of water in Réunion. The long-term objective of the water management plan is to reduce water consumption by 30 % over 20 years.

This paper analyzes data from a household survey carried out by the authors in Réunion on behalf of DIREN. The objective of the survey was to identify the reasons for the over-consumption of water on the island compared to consumption in mainland France. For this purpose, a two-phase sampling was conducted in 2004. The first phase consisted of selecting a quite large sample of households to collect information on their characteristics, habitat and water-using appliances. The second phase was devoted to collecting water consumption data by asking the households that were in a position to do so to provide us with their last three invoices presenting their actual (not estimated) consumption. These households were encouraged to answer by means of a bonus of 15 Euros paid to the first 100 questionnaires received.

To optimize the first-phase sample size, we used a stratified sampling based on a clustering of the Réunion household population by municipality. This sampling design was recommended by a preliminary study of Binet et al. (2003) which established that, given the limited data on hand to set a sampling frame, the most suitable sampling technique was a stratified sampling with a proportional allocation of sample size between strata. According to this study, a survey sampling 2,000 homes with a water connection (sampling rate less than 1 %) would achieve an estimate of the residential water consumption on the island with a margin of error of \(\pm 1\,\% \) at a 95 % confidence level.

Carried out by telephone, this first-phase sampling was followed by a mailing to those households (a little under 1,000 households) that volunteered to provide data collected on their three most recent, non-provisional invoices. But we had to comply with the French data privacy law applied to the collection, storage and use of personal data. Therefore, the volunteer households were asked to self-report the volume of water consumption, the invoicing period, and the amount of the invoice using a questionnaire where the place of data to be reported were clearly indicated on an invoice copy of their water utility. This recording procedure minimizes (but not excludes), a priori, any error of transcription by respondents. This second-phase survey of volunteers provided 173 reliable responses (representing a rate of response of about 20 %) and supplied us with 449 useful invoices. For each of these, we computed an average daily consumption of water per household.

Using data provided on a volunteer basis to estimate residential water demand may generate selection biases. This would be the case if the probability to volunteer depended on the household’s water consumption. However, some preliminary econometric analyses intended to bring out the determinants of this probability suggest that this self-reported sample can be considered to be a simple random sample drawn from a population of volunteers.

5.2 Water Tariffs

The 24 municipalities on Réunion Island have the choice of either assuming the responsibility for supplying drinking water or delegating the task to a private firm. The majority (i.e. 20 municipalities, encompassing 98 % of Réunion customers) have chosen the latter option. In France, each municipality determines its own tariff structure based on a goal of cost recovery. In Réunion, increasing block tariffs (IBTs) prevail but their design varies in terms of the number (between 1 and 4 consumption blocks) and size of the blocks. Five municipalities have chosen a two-tier IBT, seven have a three-tier IBT, and eight have a four-tier IBT. Data on rates and the size of the consumption blocks were available from DIREN.

As mentioned in Sect. 3, Fig. 1a–c illustrate these IBTs. Figure 1a displays the IBTs of the municipalities which have adopted an increasing two-block rate schedule while Fig. 1b, c show the IBTs of municipalities which have opted for a tariff with more than two consumption blocks. Generally, it is expected that an IBT with more than two consumption blocks renders it possible to break down water consumption into three types of uses: basic, less essential, and luxury. First, we observe that 90 \(\hbox {m}^{3}\) is a common consumption threshold beyond which the highest tariff is applied. Accordingly, this water consumption level seems to define the threshold for luxury uses. Next, if we consider the municipalities applying an IBT with more than two blocks, the consumption threshold giving access to block 2, potentially covering the basic needs for water, is often lower than 50 \(\hbox {m}^{3}\) (equal to 30 \(\hbox {m}^{3}\) in five municipalities and to 45 \(\hbox {m}^{3}\) in six others).

Moreover, Réunion drinking-water rates are lower than water rates in mainland France. If the fixed part of the tariff is removed, the average price of a \(\hbox {m}^{3}\) of water is around 2.5 Euros in France against 0.67 Euros in our sample (see Table 1). Municipalities with only two increasing block rates exhibit a low tariff progressivity as the difference between the two rates vary from \(+\)20 to \(+\)50 %, depending on the municipality considered. However, the progressivity is higher in municipalities offering IBTs with more than two consumption blocks. Indeed, the ratio obtained of the last rate to the first rate may be greater than 2.

To conclude, we shall now examine the distribution of consumersFootnote 11 across the different block rates. Three of the biggest municipalities on Réunion island are studied here as they apply distinctive tariffs schedules. In Saint Pierre, among consumers facing a two-tier IBT, 77.2 % of them are observed in the first block rate (the corresponding consumption threshold is \(b_1 =90 m^{3})\), which corresponds to 53.9 % of the total water consumption of the sample of consumers living in this municipality. The percentage of consumers observed in the first block is 59.6 % in Saint Denis (where a three-tier IBT is used, with \(b_1 =45 m^{3})\), corresponding to 40.7 % of total water consumption of the sample of consumers living in this municipality. Again in Saint Denis, the consumption of 38.2 % of consumers falls in the second block (with \(b_2 =90 m^{3}\)), which corresponds to 54.1 % of the total water consumption of the sample of consumers living in this municipality. Very few consumers fall in block 3. In Saint Paul, where a four-tier IBT is applied, 78.1 % of the sampled consumers fall in the first block (where \(b_1 =75 m^{3}\)), and 13.7 % in the second block (where \(b_2 =150 m^{3}\)), the latter corresponding to 18.3 % of the water consumption of the sample in the municipality. Finally, 5.5 % of consumers are in the third block, representing 16.8 % of the water consumption of the sample in the municipality.

5.3 Household Income Imputation

The first-phase of the DIREN survey recorded household income levelFootnote 12 as an ordered qualitative variable belonging to one of the following five income intervals (in Euros per month): [0;750[, [750;1500[, [1500;3000[, [3000;4500[ and [4500; +\(\infty \)[. Unfortunately, this income information is not relevant to estimate the water demand function specifications contemplated in Sect. 4 as such estimations require the use of a quantitative measurement of income. To overcome this income data limitation, we devised an imputation method of the household income levels detailed in Carlevaro et al. (2007). This method is based on an econometric model describing the observed qualitative information on household income according to an ordered multinomial model, where the unobserved household income level is specified as a latent variable. This unobserved variable is assumed to be distributed, within the household population, according to a log-normal random variable. Furthermore, the household income distribution is influenced by some household income indicators, recorded by the DIREN survey, to characterize the household standard of living. Finally, an individual income level estimate for each household of the DIREN sample was obtained by computing an estimate of the mean square error predictor of this latent variable, namely its expected value given all the available information at hand, including the income interval declared by the household.

5.4 Weather Conditions

Outdoor uses are assumed to be influenced by weather conditions. We therefore decided to analyze the impact of the presence of a garden on water consumption assuming that rain is an effective substitute for watering. The impact of climate on residential water use can be measured in different ways. In the literature, precipitation and temperature often are assumed to influence residential water demand. Schleich and Hillenbrand (2009) provided some evidence that households respond to whether it rains or not rather than to the total amount of rainfall. More precisely, we chose to use the percentage of non-rainy days over the invoicing period, with the expectation that the demand for watering the garden will rise with a rise in the percentage of non-rainy days.

We used daily observations recorded by Meteo France (the French national weather agency, which operates about one hundred stations in Réunion). These geographical distributed observations allowed us to compute, for each self-reported consumption, the number of days without rainfall recorded at the closest weather station.

6 Empirical Analyses

The adopted water demand model specification and estimation method are described in Sect. 6.2 after a brief section devoted to bunching analysis (6.1). The empirical results then are reported and discussed in Sect. 6.3.

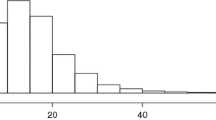

6.1 Bunching Analysis

Following Borenstein (2009) and Ito (2012), we examine whether consumers cluster at the kink points of IBTs where marginal prices increase. Such bunching should be observed if consumers react to marginal price since the unconditional demand for water of such a consumer presents, before each IBT’s kink point, a demand flat (equal to the consumption threshold of access to the next pricing block) inelastic to income and prices over a range of incomes which is an increasing function of the marginal price change, as we already mentioned in Sect. 4. Furthermore, at these consumption thresholds, the clustering of consumers is all the more dense that the increase of the marginal price is large (Fig. 2).

To detect such a possible bunching, we produced box plots of the distribution of self-reported household water consumption. Three of the biggest municipalities of Réunion Island applying distinctive tariffs schedules are studied here (Saint Denis, which uses a three-tier IBT, Saint Pierre, with a two-tier IBT, and Saint Paul with a four-tier IBT). From these diagrams, it seems clear that no systematic clustering close to the kink points, represented by vertical lines, can be distinguished. In particular, if consumers cluster slightly before the first kink on panels \(a\) and \(b\), no bunching seems to occur for others kinks. More precisely, if we use as a criterion for bunching detection an unusually high frequency (with respect to a uniform distribution within the consumption block) of self-reported household consumption within the last tenth part of a consumption block, we observe that for the first consumption block this frequency is 14.4 % in Saint DenisFootnote 13 (where \(b_1 =45\hbox { m}^{3})\), 9.6 % in Saint Paul (with \(b_1 =75\hbox { m}^{3})\) and 10.1 % in Saint Pierre (with \(b_1 =90\hbox { m}^{3})\). We therefore conclude that there is no empirical evidence to support the bunching assumption and accordingly the theoretical hypothesis of perfectly informed, rational consumers responding to their marginal price.

At this point, it is important to stress that our results do not imply a rejection of the model of a perfectly informed rational consumer presented in Sect. 3. A larger sample size and a quasi experimental environment are necessary to draw such a conclusion, and our data set, in contrast to Ito’s (2012) does not permit us to do so.

6.2 Model Specification and Estimation Method

In addition to price and income, one important explanatory variable is household size, including the number of children and the number of adults in the family. If we consider the entire family’s daily needs, we expect that water consumption will increase with household size. However, we expect a greater impact for non-working than for working adults since the former spend more time at home. For this reason, in addition to household size \((N)\), we include the share of non-working adults with respect to the total number of adults \((SNWA)\) in our water demand model.

Outdoor water uses for gardening and swimming pools usually is a major determinant of residential water consumption in Réunion (see Carlevaro et al. 2007 for further discussion). Indeed, the individual house with garden is very widespread in Réunion; in 2004, 77 % of households lived in such accommodations compared to 30 % in mainland France. In addition, 5 % of households in Réunion own a swimming-pool.

In the first-phase survey, the presence of a garden (GARD) and of a swimming pool (SWIM) were recorded as dichotomous variables taking the value of one if the household owns this equipment and zero otherwise. As already mentioned in Sect. 5.4, gardening uses of water are assumed to be influenced by weather conditions measured by the share of non-rainy days over the invoicing period (WEATHER). Accordingly, we modelled the impact of the presence of a garden on water consumption by means of the interaction variable GARD times WEATHER, expressing the needs for garden watering given weather conditions (GARD.WEATHER).

Adding these new explanatory variablesFootnote 14 to the double-logarithmic functional form (11) of Sect. 4.3, and assuming no spatial variations of the implicit price index of other private consumption goods, leads to the following conditional demand specification for a consumption of drinking-water belonging to consumption block \(j=1,2,\ldots \), namely \(b_{j-1} \le q<b_j (b_0 =0)\):

where \(\pi _j \) is the marginal price of water in consumption block \(j, D_j =(\pi _2 -\pi _1 )b_1 +\cdots +(\pi _j -\pi _{j-1} )b_{j-1} \) the Nordin’s virtual refunding to a consumer whose consumption is located in block \(j\), and \(\varepsilon \) a zero expectation random disturbance accounting for errors of specification inherent in the choice of the functional form and of the explanatory variables. Table 1 displays some sample summary statistics for the set of variables of this model specification. Note also that regression model (12) is non linear with respect to parameter \(k\).

Turning now to the estimation method, the main problem we must address with multi-block tariffs is that of endogeneity of the explanatory variables expressing the pricing scheme because these variables are jointly selected with the quantity of water. Accordingly, a non-zero correlation exists between the random disturbance \(\varepsilon \) and the marginal price of water on one hand and the Nordin D on the other. The same is true for household income which, resulting from imputation, is marred by a measurement error likely correlated with \(\varepsilon \). It is therefore advisable to estimate model (12) by means of an instrumental variable method. In order to account for the presence of heteroscedasticity, we chose to implement the optimal GMM (Generalized Method of Moments) estimator programmed in TSP (2009). In the spirit of Hausman and Wise (1976), prices associated with fixed levels of consumption (the three first quartiles of the water consumption distribution) were used as instruments for marginal and average prices. To instrument the imputed household income, we apply Durbin’s (1954) rank method using the income class rank stated by the household at the time of the first-phase survey. These four instrumental variables were complemented by the seven exogenous variables of model (12) (\(F, N\), SNWA, GARD, SWIM, WEATHER, GARD.WEATHER). The relevance of these eleven instrumental variables, which must be correlated with the explanatory variables and uncorrelated with the disturbance term, was assessed by performing the Hansen test of over identifying restrictions (OIR).Footnote 15

6.3 Model Estimates and Analysis

Four different specifications of the water demand model (12) were compared to verify the robustness of the results. Specification I includes as explanatory variables only perceived net income and perceived price. Specification II includes all of the explanatory variables included in model (12). Specification III is obtained by excluding the explanatory variables whose impact coefficient turned out to be statistically the less significant in specification II, namely the binary variable indicating the presence or absence of a garden. Finally, specification IV modifies specification III by replacing the current average and marginal prices used to define the perceived price of water by their one-period lagged value to account for the fact that consumers cannot instantaneously and perfectly monitor their consumption and implied price. The optimal GMM estimate of these specifications is presented in Table 2.

Whatever the specification, Hansen’s test statistic of over identifying restrictions indicates that the population moment conditions are not rejected, supporting the validity of the chosen instruments. As usual with microeconomic data, the adjusted \(\hbox {R}^{2}\) is quite low but the substantial increase of this coefficient from specification I to specifications II and III shows the poor explanatory power of a purely economic specification of water demand.Footnote 16

The parameter estimates of the specification III deserve the following comments:

-

The income elasticity has the expected positive sign but is statistically significant at the 10 % level only.Footnote 17 This weak statistical significance is probably due to measurement errors generated by the imputation method used to quantify this explanatory variable. Its low numerical value, equal to 0.25, reflects the basic need character of water consumption for the majority of households.

-

The estimated perceived price elasticity is equal to \(-0.31\) and is statistically different from zero. This value is in the range of the estimates found in the applied econometric literature and expresses the difficulty of substituting water with other goods in an already built accommodation, except through household water saving behaviour.

-

We observe a positive and highly significant impact of household size on water consumption. According to our estimate, an increase of 10 % in the family size will result in an increase of 4.8 % in its daily consumption of water. This result can be understood by the existence of household economies of scale in the use of water (Garcia-Valiñas 2005).

-

As expected, a working adult consume less water at home than a non-working adult, and this impact is statistically significant. Indeed, the impact of an increase of 10 % points in the share of non-working adults with respect to the total number of adults in the household increases the household consumption of water by 4.4 %.

-

As expected, a low occurrence of rainfall has a positive impact upon water consumption for watering the garden. More precisely, a 10 % increase of the days without rainfall increases the water consumption of households living in a house with garden by 3.7 %, and this impact is statistically significant. Similarly the presence of a swimming pool generates an average increase of daily water consumption of households of about 12 %. For the 42 households of our sample owning a swimming pool, which average daily consumption of water varies between 85 and 520 l, such a leisure use of water may range between 10 and 60 l per day.

-

The perception price parameter estimate is equal to 1.5, reflecting a perceived price not only less than the marginal price but also to the average price (without fixed charges). From a statistical point of view, the price perception parameter is significantly different from zero (the value for which perceived price is equal to marginal price), but not significantly different from 1 (the value for which the perceived price is equal to the average price). This indicates that Réunion households strongly underestimate the marginal price of water and even (but less strongly) their average price. This result contradicts those of Nieswiadomy and Molina (1991), as they concluded that under increasing block rates, water consumers react to marginal price. However, their analysis is based on a monthly time series (from 1976 to 1985) of total water consumption of the city of Denton (Texas, USA). Therefore, their conclusion could be the consequence of an aggregation bias. Assuming that water consumers respond to the marginal price of water if such information is provided to them, our result can be explained by the presentation of the bills in Réunion showing that it does not enable a customer to have a clear perception of the marginal price of water.

-

Finally, replacing the current average and marginal prices with their one-period lagged values to define the perceived price of water as it has been done in specification IV does not result in any significant change of parameter estimates with respect to those of specification III. This result is consistent with our finding that water invoices carry poor information on the way water is priced.

To gain a better insight on the cost of imperfect price perception, in terms of excessive water consumption, we compare the predicted levels of self reported household water consumptions using the estimate of model specification III to the predicted levels of water consumption using the same model but by setting the perception price parameter \(k\) equal to zero (meaning that water consumers in Réunion respond to marginal price). Our simulations show that the predicted water consumption levels would decrease from 615 to 538 l per day, which corresponds to a drop of 12.5 %.

Consequently, increasing the billing information provided to Réunion households on the actual marginal price of water they pay may reduce their consumption of water and therefore may contribute to a sustainable use of this scare resource on the island. At this stage, our proposal is purely qualitative, as a quantification of such an information policy will require to design carefully the policy and experiment in a real-world context. But an analysis of the precise effects of clearer water prices falls outside the scope of this article. To our knowledge, Gaudin (2006) was the first to analyze the effects of billing price information on residential water demand. Her study shows that billing price information increases the value of water price elasticity.

7 Conclusions

This article examines the household’s perception of the price of water under an increasing block rate schedule by assuming that residential water consumers are not well-informed about the marginal price at which a rational consumer should respond. To estimate an unbiased value for the price elasticity of water, we use a methodology developed by Shin (1985). This methodology is based on a specification of the water price perception as a weighted geometric average of marginal and average prices, where the weight plays the role of a price perception parameter leading to one of these two prices depending on whether its value is 0 or 1. Thus, the relevant price perception specification can be identified by estimating and testing the value of the price perception parameter within an econometric specification of residential water demand.

In this paper we improve Shin’s method by providing a rationale for the choice of the functional form of perceived price, using the artificial nesting principle proposed by Davidson and Mc Kinnon (1984) for discriminating between non nested econometric models. This rationale allows correcting a specification error in Shin’s model that may be a source of inferential biases in model estimation and testing.

Using a unique sample of water bills collected from a household survey on the French overseas territory of Réunion to estimate this improved model, we find that the perceived price to which consumers respond strongly underestimate the marginal price. Consequently, the consumption of drinking-water by Réunion households appears to be noticeably higher than if they were behaving as well informed rational consumers, as the simulations from our estimated model show. Faced with a potential waste of a scarce resource due to a market failure, we conclude that the use of clearer information on marginal prices should be considered in conservation policy as it should lead to lower water use for all the consumers who reduce water consumption.

From a policy perspective, this price information policy could be extended, as recommended by Thaler and Sunstein (2008), to “nudge” consumers to adopt water conservation behaviours. The general idea is that water can be saved simply by suggesting the right options to households without imposing constraints. For example, the Southern California Edison Company succeeded in reducing household electricity consumption by 40 % by providing an ‘ambient orb’ which turns red when consumption is excessive and green when moderate. Another application of such a policy also involves electricity consumption. In California, electricity bills include information about small electricity users’ average consumption to encourage electricity saving by mimicking these consumption targets. To conclude, future analyses based on behavioural economics could provide more insights into the sensibility of water users to billing information and effective changes in water consumption behaviour.

Notes

Borenstein (2009) and Ito (2012) use another price concept: the expected marginal price. However, the analysis of the expected marginal price falls outside the scope of this article for at least two reasons. First, it deals with uncertainty about consumption (and not about the structure of prices) and its estimation requires time series data. Ito (2012), for example, uses monthly panel data on electricity billing from 1999 to 2007.

From a social point of view, the costing of drinking water should not include only the costs of implementing, operating and maintaining the water supply network but also the costs of the external effects or the use of public goods generated by this activity.

In France, 94 % of urban and rural districts and 93 % of the population are concerned by this tariff (Coutelier and Le Jeannic 2007).

For France, fixed costs are estimated to represent 80 % of the total cost of water supply.

The use of an average unit cost instead of a marginal cost is often indicated as a source of economic inefficiency in the allocation of resources to satisfy the needs of an entire community. However, practicing a marginal cost pricing of a public service involves the simultaneous solution of three interconnected issues, namely the determination of the demand for the service, that of the service production process and finally the pricing scheme to which the service demand reacts. We doubt that such an approach is used in practice by many public water supply utilities, except as a general guiding principle for pricing some special features of water demand like seasonality or randomness, which requires some spare capacity to be set up.

At the corner solution, the marginal rate of substitution of \(q\) by \(x\) is greater than the marginal price ratio \({\pi _1 }/p\) and lower than \({\pi _2 }/p\). Accordingly, it is neither optimal to consume a quantity of water lower than \(b_1 \) nor is it optimal to consume a quantity larger than \(b_1 \).

We assume that fixed charges are processed as a lump sum payment deducted from household income as suggested by Taylor et al. (2004).

As emphasized by Borenstein (2009), having a water meter is not sufficient to monitor charged consumption. To do so well, one also needs to know the start date of the billing period.

To fit in an Opaluch linear form of water demand, Shin’s perceived price specification must be rewritten as: \(\pi ^*=\pi +k\rho \).

To enforce zero homogeneity with respect to prices and income, Shin’s functional form should be rewritten as: \(\hbox {ln}q=b_0^*+b_1^*\ln \left( {\frac{\pi _2 }{p}} \right) +b_1^*k\ln \left( {\frac{\overline{{\pi }}}{\pi _2 }} \right) +b_3^*\ln \left( {\frac{Y-F}{p}} \right) \).

By consumer we intend a volunteered billed volume of water consumption disregarding the household who provided it.

Households were asked to include all their income sources, including wages, welfare benefits, property revenues\(\ldots \)

For Saint Denis, the use of this bunching detection criterion can hardly be considered relevant as the marginal price differential between the first two blocks is so small that it generates a practically inexistent demand flat at this consumption threshold.

We tested other explanatory variables, in particular those measuring invoicing frequency, housing characteristics, consumption habits and the presence of water consuming appliances like dishwasher or washing machine. However, all this variables turned out to be statistically non significant in all our empirical analyses of water demand.

It is worthwhile noting that an OLS estimation of model (12) leads to a positive estimate of price elasticity while with GMM estimation, this elasticity has the expected negative sign.

Note that the highest value of the adjusted \(\hbox {R}^{2}\) is obtained for model specification IV, but this is simply due to the sensible reduction of the sample size which results in a decrease of the sample variance of the dependent variable.

References

Arbuès F, Garcia-Valinas MA, Martinez-Espineira R (2003) Estimation of residential water demand: a state-of-the-art review. J Socio Econ 32(1):81–102

Binet ME, Carlevaro F, Durand S, Paul M (2003) Planification de l’enquête par sondage pour l’étude des modes de consommation d’eau à La Réunion, mandatée par la Diren. Report to DIREN, 21 p

Borenstein S (2009) To what electricity price do consumers respond? Residential demand elasticity under increasing-block pricing. http://www.econ.yale.edu/seminars/apmicro/am09/borenstein-090514.pdf. Cited 30 April

Carlevaro F, Schlesser C, Binet ME, Durand S, Paul M (2007) Econometric modeling and analysis of residential water demand based on unbalanced panel data. Pricladniaya Ekonometrica (Applied Econometrics), Market DS, Moscow 4(8):81–100

Carlevaro F, Gonzalez C (2011) Costing improved water supply systems for developing countries. Water Manag Proc Inst Civil Eng 164(3):123–134

Coutelier A, Le Jeannic F (2007) La facture d’eau domestique en 2004, 177 euros par personne et par an. Le 4 pages ifen (Institut Français de l’Environnement) 117:1–4

Dalhuisen JM, Florax RJG, De Groot HLF, Nijkamp P (2003) Price and income elasticities of residential water demand: a meta analysis. Land Econ 79(2):292–308

Davidson R, Mc Kinnon J (1984) Model specification tests based on artificial regressions. Int Econ Rev 25(2):485–502

Davidson R, Mc Kinnon J (2004) Econometric theory and methods. Oxford University Press, Oxford

Durbin J (1954) Error in variables. Rev Int Stat Inst 22:23–32

Foster HS, Beattie BR (1981) On the specification of price in studies of consumer demand under block price scheduling. Land Econ 57(4):624–629

Garcia-Valiñas MA (2005) Efficiency and equity in natural resources pricing: a proposal for urban water distribution service. Environ Resour Econ 32(2):183–204

Gaudin S (2006) Effect of price information on residential water demand. Appl Econ 38(4):383–393

Hausman JA, Wise DA (1976) The evaluation of results from truncated samples: the New Jersey income maintenance experiment. Ann Econ Soc Meas 5(4):421–445

Howe CW, Linaweaver FP (1967) The impact of price on residential water demand and its relation to system design and price structure. Water Resour Res 3(1):13–32

Ito K (2012) Do consumers respond to marginal or average price? Evidence from nonlinear electricity pricing. Energy Institute at Haas Working Paper 210R, American Economic Review, forthcoming

Kavezeri-Karuaihe ST, Wandschneider P, Yoder J (2005) Perceived water prices and estimated water demand in the residential sector of Windhoek, Namibia: an analysis of different water market segments. Working Paper number 36289, San Francisco, CA

Liebman J, Zeckhauser R (2004) Schmeduling. http://www.hks.harvard.edu/jeffreyliebman/schmeduling.pdf. Cited October

Limam A (2007) Tarification progressive, outil de gestion de la demande en eau: cas de l’eau potable en Tunisie. Paper presented to the workshop on Gestion de la demande en eau en Méditerranée, progrès et politiques, Plan Bleu, Zaragoza (Spain)

Nauges C, Whittington D (2010) Estimation of water demand in developing countries: an overview. World Bank Res Obs 25(2):263–294

Nieswiadomy ML, Molina DJ (1991) A note of price perception in water demand models. Land Econ 67(3):352–359

Nordin JA (1976) A proposed modification on Taylor’s demand analysis: comment. Bell J Econ 7(2):719–721

OECD (2010) Pricing water resources and water and sanitation services. Series: OECD Studies on Water

Opaluch J (1982) Urban residential demand for water in the United States: further discussion. Land Econ 58(2):225–227

Ruijs A, Zimmerman A, Van Den Berg M (2008) Demand and distributional effects of water pricing policies. Ecol Econ 66(2–3):506–516

Schleich J, Hillenbrand T (2009) Determinants of residential water demand in Germany. Ecol Econ 68(6):1756–1769

Shin JS (1985) Perception of price when price information is costly: evidence from residential electricity demand. Rev Econ Stat 67(4):591–598

Taylor RG, McKean JR, Young RA (2004) Alternative price specifications for estimating residential water demand with fixed fees. Land Econ 80(3):463–475

Thaler RH, Sunstein CR (2008) Nudge: improving decisions about health, wealth, and happiness. Yale University Press, New Haven

TSP (2009) Reference manual version 5.1. TSP International, Palo Alto (CA 94306)

Worthington AC, Hoffman M (2008) An empirical survey of residential water demand modelling. J Econ Surv 22(5):842–871

Acknowledgments

We gratefully acknowledge associate editor Riccardo Scarpa and two anonymous reviewers for their helpful comments and suggestions having led to a substantial improvement of our paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Binet, ME., Carlevaro, F. & Paul, M. Estimation of Residential Water Demand with Imperfect Price Perception. Environ Resource Econ 59, 561–581 (2014). https://doi.org/10.1007/s10640-013-9750-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9750-z