Abstract

Uncertainty plays a significant role in evaluating climate policy, and fat-tailed uncertainty may dominate policy advice. Should we make our utmost effort to prevent the arbitrarily large impacts of climate change under deep uncertainty? In order to answer to this question, we propose a new way of investigating the impact of (fat-tailed) uncertainty on optimal climate policy: the curvature of the optimal carbon tax against the uncertainty. We find that the optimal carbon tax increases as the uncertainty about climate sensitivity increases, but it does not accelerate as implied by Weitzman’s Dismal Theorem. We find the same result in a wide variety of sensitivity analyses. These results emphasize the importance of balancing the costs of climate change against its benefits, also under deep uncertainty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Everything about climate change is uncertain. Although this has been acknowledged for a long time, a recent paper by Weitzman (2009a) emphasized the importance of conceptualizing climate policy as risk management. Weitzman (2009a) formalizes an earlier suspicion by Tol (2003): there is good reason to believe that the uncertainty about the impacts of climate change is fat-tailed.Footnote 1 That is, the variance or even the mean of the distribution of the objective value (welfare) may not exist. This violates the axioms of decision making under uncertainty, leading to an arbitrarily large willingness to pay for the reduction of carbon dioxide emissions (Weitzman’s Dismal Theorem).

Weitzman (2009a) and Tol (2003) diagnose the problem but do not offer a solution. Moreover, Weitzman’s characterization of climate policy is incomplete because it considers the impacts of climate change but ignores the impacts of greenhouse gases (GHG) emissions reduction. As shown by Hennlock (2009), this materially affects the results. Intuitively, the reasoning is something as follows. Weitzman (2009a) argues that the certainty-equivalent of the marginal damage cost of carbon dioxide emissions and thus the willingness to pay for emission reduction are arbitrarily large (or infinite). Taken at face value, this implies that an arbitrarily large carbon tax should be imposed—or that emissions should be driven to zero immediately.Footnote 2 That is a repugnant implicationFootnote 3 given that it is currently impossible to grow sufficient amounts of food to feed the world population and transport crops from the fields to the population centres without fossil fuels. It may well be possible to do without fossil fuels in 50 years time, but imposing a carbon-neutral economy in 50 days time would lead to widespread starvation. In the short term (but not in the long term), fossil fuels are a necessary input. Put differently, the costs of ultra-rapid abatement are arbitrarily large as well, with the difference that they are known with less uncertainty than the impacts of climate change. The theoretical argument of Weitzman could thus be reversed in case of very high costs of ultra-rapid abatement since the expectation of the damages of a rapid emissions reduction policy may be infinite. This raises the question of how policy makers should weight two extreme (or infinite) costs in their decision-making.

Several approaches have been investigated to circumvent the problem raised by Weitzman’s Dismal Theorem in the literature. Major response to the Dismal Theorem is to investigate ways to set a bound on the willingness to pay at a finite value. For instance, Newbold and Daigneault (2009) and Dietz (2011) opt for the approach suggested by Weitzman (2009a) that imposes a lower bound on consumption. Costello et al. (2010) put an upper bound on temperature increases, and Pindyck (2011) places an upper bound on marginal utility. Ikefuji et al. (2010) use a bounded utility function (e.g. ‘Burr’ function) instead of the constant relative risk aversion (CRRA) function. One the other hand, some studies propose an alternative decision-making criterion or an alternative way out of economic catastrophes induced by climate change. For example, Anthoff and Tol (2010) use various alternative criteria such as the mini-max regret, the tail risk, and the Monte Carlo stationarity. Tol and Yohe (2007) investigate the effects of an international aid to a devastated country suggested by Yohe (2003).

In the current paper, we follow a different track: we keep the standard decision-making criterion of utility maximization, and then investigate how the uncertainty around key parameters affects the optimal decision of economic agents who consider both the impact of climate change and the costs of GHG emissions reduction. This is a worthwhile course of action because Weitzman (2009a) and Tol (2003) only consider the impact of climate scenarios without accounting for the negative effects of climate policy (that is the costs of emissions control). It may be that GHG emissions reduction thins the tail.

There are some numerical models incorporating fat-tailed uncertainty within the framework of the expected utility (e.g. Newbold and Daigneault 2009; Ackerman et al. 2010; Costello et al. 2010; Dietz 2011; Pycroft et al. 2011). However, their models are different from ours in that they generally focus only on the impacts (damage costs) of climate change. For instance, Newbold and Daigneault (2009), Costello et al. (2010), Weitzman (2010), and Pindyck (2011) use simplified climate-change impacts models so that they do not account for emissions control.Footnote 4 Dietz (2011) and Pycroft et al. (2011) introduce fat-tailed distributions of climate sensitivity and of damage-function parameters into the PAGE model, and then calculate the marginal damage cost of carbon emissions or the social cost of carbon. However, their models are based on exogenously given emission scenarios (e.g. IPCC SRES scenario) and thus they do not represent optimal decisions made by the agent who chooses the amount of emissions each time-period. Ackerman et al. (2010) use the business as usual version of the DICE model, which does not account for emissions control, to investigate the Weitzman effect.Footnote 5 In addition, their approach is more a wide sensitivity analysis than a real definition of the optimal choice under uncertainty. They generate samples of draws of key parameters assuming a fat-tailed distribution and then simulate the model. It gives the optimal choice for each possible value of the parameters but does not say what would actually be the optimal decision given this uncertainty. That is, it allows for computing the expectation of maximum welfare rather than maximizing the expected welfare.Footnote 6

Our model is different from the literature in that GHGs emissions (in turn, temperature increases, damage costs, abatement costs, outputs, and utility) are determined by the choice of a social planner (via emissions control rates and investment). Emissions control rate chosen by the decision maker plays a role preventing consumption from going to zero.

Some analytical works consider this possibility. For instance, basing its analytical model on a modified version of the DICE model, Hennlock (2009) uses a max-min expected decision criterion with ambiguity aversion and proves that the optimal level of abatement (or the optimal carbon tax) is finite under deep uncertainty. The abatement rule in Hennlock (2009) is determined as the following equation. \(\upmu =-\alpha (\partial W/\partial M)/(\partial W/\partial K)\), where \(\upmu ,\;W,\;M\), and \(K\) denote abatement efforts, social welfare, the carbon stock, and the capital stock, respectively, and \(\alpha \) is a constant. He proves that the denominator as well as the numerator in the equation tends to infinity as the decision maker’s aversion to ambiguity—or structural uncertainty in the terminology of Weitzman (2009a): both of them focus on the imperfect measurement of uncertainty—approaches infinity. In addition, \(\upmu \) is finite in that case. Note that the carbon tax in our model is determined in a similar way as the Hennlock (2009)’s abatement rule. With a different model, Horowitz and Lange (2008) prove that the marginal willingness to pay today for a sure unit of additional consumption in the future becomes negative as the level of investment today (options of transferring income from today to the future) approaches 100 % of the current level of production.

Here we assess this hypothesis numerically by using a well-established numerical Integrated Assessment Model (IAM), namely the DICE model. While less general, our approach is more flexible, more realistic, more tractable, and more accessible than an analytical research. Moreover, it allows for going beyond a qualitative diagnostic by evaluating the quantitative impact of increasing uncertainty on the optimal policy. As uncertainty is bounded by definition in a numerical framework, we introduce a method for analyzing fat-tails using thin-tailed distributions, and then investigate how the optimal choice behaves as uncertainty increases. More precisely, we fatten the tails of the parameter distribution and look at the evolution of the optimal carbon tax in order to answer the following questions. Does the optimal carbon tax increase to an arbitrarily high number if uncertainty increases? Is the link between the optimal tax and uncertainty sensitive to the model-specification? For simplicity, we ignore learning effects, the fact that at least a part of uncertainty vanish over time, which would complicate the resolution of the maximization program.Footnote 7

The paper proceeds as follows. Section 2 considers the role of emissions control in optimization problem under deep uncertainty. It shows that the absence or the presence of emissions control crucially affects social welfare, implying that the Dismal Theorem may only arise in the absence of climate policy. Section 3 presents the model and the scenarios. Section 4 discusses the results for the case in which climate sensitivity is the only uncertain parameter. Our main finding is that the strong implication of Dismal Theorem never arises when we consider both the impacts of climate change and the costs of emissions control. Section 5 shows various sensitivity analyses that confirm the robustness of the main results and Sect. 6 concludes.

2 Deep Uncertainty and the Cost of Emissions Control

2.1 A Simplified Model

In this section, we investigate the effect of abatement costs on the optimal carbon tax using a simplified climate-economy model based on the DICE model. The decision maker’s problem is to choose the optimal time path of investment and the rate of emissions control so as to maximize the social welfare defined as in Eq. (1). The net income, which is the level of production after damage costs from temperature increases and abatement costs from abatement efforts are subtracted, is allocated into consumption and investment. The carbon stock increases in emissions and thus it decreases in abatement efforts \(\left( {\frac{\partial M}{\partial E}>0,\frac{\partial M}{\partial \upmu }<0} \right) \). We assume that the marginal damage cost increases in uncertainty and the expectation of the marginal damage cost does not exist \(\left( {\frac{\partial \varOmega }{\partial s}>0,E_s \frac{\partial \varOmega }{\partial s}=\infty } \right) \). In addition, we assume that utility is increasing and concave in consumption and the marginal utility becomes infinite as consumption approaches zero \(\left( {\frac{\partial U}{\partial C}>0,\frac{\partial ^{2}U}{\partial C^{2}}<0,\mathop {\lim }\limits _{c\rightarrow 0} \frac{\partial U}{\partial C}=\infty } \right) \). The damage cost increases in temperature and the abatement cost increases in emissions control as usual \(\left( {\frac{\partial \varOmega }{\partial TAT}>0,\frac{\partial \varLambda }{\partial \upmu }>0} \right) \).

where \(K\) and \(M\) are the state variables representing the capital stock and the carbon stock, respectively, \(I\) and \(\upmu \) are the control variables denoting investment and the rate of emissions control, respectively, \(F,\;\varOmega ,\;\varLambda ,\;E,\;L,\;TAT,\;C,\;U,\;\text{ and }\;W\) are the production function, the damage function, the abatement-costs function, carbon emissions, labor force, temperature changes, consumption, utility, and social welfare respectively, \(\delta _K \) and \(\delta _M \) are the depreciation rates of the capital and the carbon stock, respectively, \(E_s \) is the expectation operator, \(s\) is the uncertain variable having a fat-tailed distribution, \(\dot{X}\) denotes the first derivative of \(X\) with respect to time \(t\), and \(\rho \) is the discount rate.

In order to solve the problem, we construct the current-value Hamiltonian as in Eq. (4) and assume that there is an interior solution satisfying the optimality conditions. We only present the first-order conditions with respect to control variables (Eqs. (5), (6)) since they are enough for the purpose of our analysis of investigating the analytical property of the optimal carbon tax. For the purpose of simplicity, we omit time notation \(t\) below.

where \(H_c\) is the current-value Hamiltonian, \(\lambda _K \) and \(\lambda _M \) are the shadow prices of capital and carbon, respectively. From Eqs. (5) and (6), we obtain the optimal carbon tax as in Eq. (7).

With the above-mentioned assumptions on each function, the optimal carbon tax increases in the marginal damage costs and decreases in the marginal abatement costs.

If we do not consider abatement costs or set \(\varLambda (\upmu )=0\), the optimal carbon tax becomes infinite since the marginal damage costs goes to infinity under fat-tailed uncertainty. This is the result shown in many articles reviewed in Sect. 1, and it is also confirmed in the specification of our model (see Sect. 2.2). In this case, the social cost of carbon can be increasing and convex in uncertainty. However, if we consider emissions control, the optimal carbon tax depends not only on the marginal damage costs but also on the marginal abatement costs. As illustrated in Eq. (7) they have counteracting effects on the optimal carbon tax. Regarding this, Hennlock (2009) proves that the optimal carbon tax is finite under deep uncertainty with a more detailed model.

2.2 Options for Emissions Control and Welfare Effects

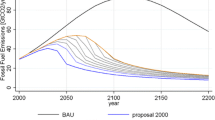

In order to see the effects of emissions control, we run the (deterministic) original DICE model with a variety of values for climate sensitivity and then see how per capita consumption changes in climate sensitivity over time.Footnote 8 The analysis for business as usual (BAU) scenarios is also found in the recent literature (e.g. Ackerman et al. 2010). However, we compare the BAU scenario with the optimal climate-policy scenario. This provides an intuitive interpretation about the importance of emissions control in analyzing the effect of uncertainty. During simulations, we use the default parameter values in the DICE model except for climate sensitivity.

Figure 1 shows the results. Without emissions control (in this case, we fix the control rates to be zero throughout the whole time horizon), per capita consumption increases until the mid-22nd century, but thereafter it declines. With emissions control, however, per capita consumption continuously increases. Applying a more reactive form of damage function into the model, the effect of emissions control on consumption becomes more distinctive. We use the damage function proposed by Weitzman (2012) (see Section 5.1.3 for the function in detail) and do a deterministic simulation. With no emissions control, damage costs approach to the level of gross production in some periods of time (after the mid-21st century) in case of high climate sensitivity, and thus per capita consumption goes down to a subsistence level.Footnote 9 Investment, the only available policy instrument, cannot prevent catastrophe in this scenario. However, consumption increases smoothly with emissions control.

Consumption flow according to climate sensitivity. (upper left) No emissions control with Dice damage function (upper right) With emissions control with DICE damage function (lower left) No emissions control with Weitzman’s damage function (lower right) With emissions control with Weitzman’s damage function

Although this experiment is not a formal treatment on uncertainty, it points out important elements worth considering as follows. First, if the probability of high climate sensitivity is not negligible, in the sense of the Dismal Theorem, economic catastrophe is possible in the business as usual scenario. Second, consumption is highly sensitive to the damage function in the no abatement case. It is possible to make consumption grow for a substantial time-period even if we live in a rapidly warming world according to the damage function in the original DICE model. By contrast, if the damage function of Weitzman (2012) is used, consumption collapses in the long term unless the true climate sensitivity is small. Third, if the decision maker has an option to control emissions, she can effectively lower the possibility of economic catastrophes by adjusting actions or balancing the costs incurred from emissions control and the damage costs from climate change.

With these implications in mind, we run the model under uncertainty. We do our main simulations with the damage function of DICE in the reference case and then investigate the sensitiveness of the results to the damage function of Weitzman (2012). We find that the main results of our paper do not fundamentally change according to the choice of damage function.

3 The Model

3.1 The Revised DICE Model

This section describes the (slight) revisions made to the original DICE model. Interested readers in the specification of the original model are referred to Nordhaus (2008). We introduce uncertainty into the DICE model using the notion of state of the world. Although almost all parameters in an economic model of climate change are more or less uncertain, we focus on the equilibrium climate sensitivity for the following reasons. First, the computational limits of a numerical model do not allow for including simultaneously all uncertainties in IAMs. Second, climate sensitivity plays a significant role in the results of IAMs. Third, the uncertainty about climate sensitivity has been relatively well investigated, whereas very little is known about the uncertainty surrounding most other parameters.

We assume that for each state of the world \(s\) climate sensitivity takes a given value and assign the corresponding probability—calculated from the assumed probability distribution described below—to each state. The lower bound of climate sensitivity is set to be \(0^\circ \text{ C }\) and the upper bound ranges from \(25^\circ \text{ C }\) (in the reference scenario) to \(1{,}000^\circ \text{ C }\). These bounds are physically plausible and many physical scientists use even narrower bounds than these (e.g. Forest 2002; Hegerl et al. 2006; Annan and Hargreaves 2011). In the reference scenario, the total number of states is 2,000 and thus the value of each state of the world increases by \(0.0125^\circ \text{ C }\). Although we do not present all the results from the various upper bounds in Sect. 4, we find that the main implications of this paper are unaffected by the choice of the upper bound.Footnote 10

The inclusion of uncertainty expands the specification of the original DICE model. We attribute an additional index \(s\) to each variable whose value changes according to the state of the world. For instance, if the climate sensitivity parameter takes a value CS with a probability \(p(s)\) in state \(s\), it is possible to define the corresponding instantaneous utility \(U(c,s)\) that may occur with the same probability through a series of mapping (from climate sensitivity into temperature, into consumption, and into utility). Consequently, the objective function becomes the expected inter-temporal welfare - that is a sum of discounted utility weighted by the probability of occurrence \(p(s)\)—as follows.

where \(S\) and \(T\) denote the total number of states of the world \(s\) and time periods \(t\) respectively, \(p(s)\) is the probability of each state, \(I(t,s)\) is the level of investment, \(\upmu (t,s)\) is the rate of emissions control, \(U(c(t,s),L(t))=L(t)\left[ {c(t,s)^{1-\alpha }/(1-\alpha )} \right] \) is the population-weighted CRRA utility function, \(c(t,s)\) is per capita consumption, \(L(t)\) is labor force, \(R(t)=(1+\rho )^{-t}\) is the discount factor, \(\rho \) is the pure rate of time preference (= 0.015), and \(\alpha \) is the elasticity of marginal utility of consumption (= 2).

In case of multiple uncertainties in Sect. 5, additional subscripts are added for each uncertain parameter. The other features of multiple-uncertainty runs are the same as mentioned above, except for the method of producing probability density functions (PDFs) of parameters of interest, which is given in Sect. 5.

This paper also calibrates the speed of adjustment of the atmospheric temperature equation so that the modeled temperature-increases from pre-industrial to present times are in line with the observed warming. This procedure also circumvents the infeasibility, reported in an application of DICE when the value of climate sensitivity is lower than \(0.5^\circ \text{ C }\) (e.g., Ackerman et al. 2010). See Appendix A for the method of calibration in detail.

We use the same parameter values as in the original DICE model unless stated otherwise. In order to incorporate possible extreme climate change, we remove the upper bounds of both air temperature increases and ocean temperature increases in DICE. We also remove the fixed value of the initial emissions control rate because it artificially affects the initial carbon tax. We solve the model with the CONOPT, a nonlinear programming algorithm in the GAMS modeling system.

3.2 Uncertainty About Climate Sensitivity

Although we introduce the uncertainty about damage function and abatement cost function in Sect. 5, the main focus in this paper is the effect of uncertainty about climate sensitivity. We model this uncertainty using a PDF derived from the framework of feedback analysis (Hansen et al. 1984). In this framework, the probability distribution of climate sensitivity is derived from the distribution of the total feedback factors.Footnote 11 The total feedback factors are assumed to have the following relationship with the equilibrium climate sensitivity (Roe and Baker 2007).

where \(f\) denotes the total feedback factors, CS denotes the equilibrium climate sensitivity, and \(CS_0 =1.2^{\circ }\text{ C }\) is the climate sensitivity in a reference system (in the absence of any feedback factors).

Assuming \(f\) is normally distributed with mean \(\bar{{f}}\) and standard deviation \(\sigma _f \) the PDF of climate sensitivity is calculated as follows (Roe and Baker 2007).Footnote 12

Figure 2 depicts the PDF of climate sensitivity according to different values of standard deviation \(\sigma _f \). Climate sensitivity is asymmetrically distributed and its upper tail gets fatter as \(\sigma _f \) increases.Footnote 13

Climate sensitivity distribution (Roe and Baker 2007). \(\upsigma \_\mathrm{f}\) denotes the standard deviation of the total feedback factors. The left (resp. right) panel reports the left (resp. right) segment of the PDF. When \(\upsigma _\mathrm{f} =0.05\), the density approaches 0 far faster than the other cases, and thus it does not show up in the right panel. \(CS_0 =1.2^{\circ }\text{ C }\) and \(\bar{{f}}=0.65\) remain unchanged throughout the figure

The probability of each state of the world is calculated as follows: \(p_0 (s)=f(s)\times \varDelta CS\), where \(f(s)\) is the density of each state calculated as in Eq. (10), \(\varDelta CS\) is the level of increases in climate sensitivity between states (\(0.0125^\circ \text{ C }\) in the reference case). This provides a discrete approximation to the continuous density function since the probability of a random variable, for a small interval, is nearly equal to the probability density times the length of the interval. Since there is a computational limit to make the interval arbitrarily small in this kind of numerical simulations, \(\sum _s {p_0 (s)} \) does not equal to 1, however. Therefore, we divide \(f(s)\times \varDelta CS\) by \(\sum _s {p_0 (s)} \) and use the resulting value as \(p(s)\) in the objective function: \(p(s)=[f(s)\times \varDelta CS]/\sum _s {p_0 (s)} \). This method assigns the residual probability (the difference between 1 and \(\sum _s {p_0 (s)} )\) equally to each state of the world, and thus it fattens the tails even more compared to the original continuous PDF. For a given upper bound, the residual probability becomes bigger when the variance of climate sensitivity gets higher. In other words, there is a tradeoff between the residual probability and the variance of climate sensitivity: if we want to approximate PDF more precisely, we can only cover a small range of variance. Thus, we need to set a criterion not to include results affected by the overly fattened tail. We present the results of which the residual probability is less than 0.01. Although it is arbitrary, it covers all results with a less residual so that readers can focus on the data with a smaller variance if they want a more precise approximation: the smaller the variance of CS, the smaller the residual probability in the graphs presented below. Nevertheless, it appears that the 1 % criterion does not affect the results since modifying it provides the same results in terms of carbon tax (not shown for brevity): increasing (resp. reducing) the tolerance, say to 5 %, increases (resp. reduces) the range of the climate sensitivity that can be analyzed but does not alter the value of the optimal carbon tax.

3.3 Economic Impacts of Climate Change

Along with the representation of uncertainty, the economic evaluation of catastrophes is important in the formulation of the Dismal Theorem since the theorem is not only about deep uncertainty, but also about catastrophic impacts. The damage function we use is as follows:

where \(\varOmega (t,s)\) denotes damage function, \(T_{AT} (t)\) is the global mean surface air temperature changes from 1900, \(\pi _1 \) and \(\pi _2 \) are parameters.

Two main criticisms have been arisen about the specification (11) (see Weitzman 2009b; Ackerman et al. 2010; Dietz 2011). The first one concerns the relatively low response of damage costs to temperature increases: with the original parameterization of DICE, a \(20^\circ \text{ C }\) increase in temperature induces a damage cost of 50 % of the gross world output (see Fig. 6). As the relation between temperature and damage costs is highly uncertain given the lack of empirical evidences, we check in Sect. 5 if our main results fundamentally change using a far more reactive damage function proposed by Weitzman (2012).

The second criticism is about its upper bound imposed in the model, that is, the damage costs in the form of Eq. (11) cannot be greater than the level of production. This is a bold assumption since climate damages include, in addition to market goods, nonmarket goods—or ecological goods. However, this issue is minor here since the crucial point in the Dismal Theorem is not so much about the absolute value of consumption but about the relative behavior of marginal utility to the probability of economic catastrophes when consumption approaches to 0 (Dietz 2011). The bounded damage function used in this paper is therefore compatible with the results found in the Dismal Theorem and does not prevent us from investigating the implications of fat-tails. Nevertheless, the inclusion of nonmarket goods in a model may substantially alter the quantitative nature of the results, and thus we investigate the sensitivity of our main results by using the alternative utility function suggested by Sterner and Persson (2008) in Sect. 5.

3.4 Detecting Arbitrarily High Carbon Taxes

We increase the uncertainty about climate sensitivity by stepwise increments of \(\sigma _f \) while preserving the mean of the total feedback factors. This increases the variance of climate sensitivity, which is a measure of uncertainty in this paper. In order to focus on the effect of increasing uncertainty, we need to isolate it from the effect of increasing mean—or the first moment. Otherwise, the increased mean affects the results in a way that increases carbon tax beyond the effect of uncertainty. With this in mind, we apply a mean-preserving spread (MPS) (Rothschild and Stiglitz 1970) to the total feedback factors distribution (using the Roe and Baker’s distribution) throughout the paper except in Sect. 5.1, where an MPS is applied to the climate sensitivity distribution (using a lognormal distribution). Unfortunately, both distributions have some problems. In case of the Roe and Baker’s distribution, although we preserve the mean of the total feedback factors, the mean of climate sensitivity is not preserved (actually increases). In case of the lognormal distribution, the fattened left tail dominates the effect of the fattened right tail (this is due to the characteristic of the lognormal distribution, compare Figs. 2 and 4). The former problem is not that severe in the following reasons. First, in coherence with the climate model retained in Roe and Baker (2007) where uncertainty is not directly about climate sensitivity but about the total feedback factors, it seems logical to preserve the mean of the total feedback factors instead of the mean of climate sensitivity. Second, theoretically Roe and Baker’s distribution (as a fat tailed distribution) does not have the first moment to preserve.Footnote 14 Third, the results from the Roe and Baker’s distribution, nevertheless, do not disown our main finding: even when the mean of climate sensitivity increases while increasing uncertainty, carbon tax function does not show convex curvature. This overstates the effect of increasing uncertainty on climate sensitivity. In the context of our research, our basic method is therefore conservative.Footnote 15

Increasing uncertainty affects the optimal level of emissions reduction. With a fat-tail distribution for climate sensitivity, an increase in uncertainty calls for stricter climate actions since policy makers should attribute more weight on the negative effect of rare events. Weitzman (2009a) argues that climate policy should be arbitrarily ambitious if the tails of the uncertainty about welfare are fat. We use the carbon tax as our measure of the intensity of climate policy and investigate the quantitative impact of uncertainty on this intensity. The carbon tax is a diagnostic variable in the DICE model. It is calculated as a Pigovian tax by the following equation: \(carbon\, tax=-\alpha (\partial W/\partial E_t )/(\partial W/\partial K_t )\), where \(E_t\) and \(K_t \) denote carbon emissions and the capital stock, respectively, and \(\alpha \) is a constant.

In a numerical model with a finite number of states of the world, fat-tails are necessarily truncated. Therefore, all empirical moments exist and are finite. We devise an alternative way of analyzing the impacts of uncertainty on policy. We increase the variance of climate sensitivity and then plot the resulting optimal carbon tax against the variance. If the optimal carbon tax increases and its curvature is convex (for instance, like that of an exponential function), we can deduce that the carbon tax becomes arbitrarily large when the uncertainty about climate change goes to infinity. This can be translated into an argument that we should put our utmost efforts to reduce emissions at the present time. By contrast, if the carbon tax function is increasing but it is concave in uncertainty and its rate of growth approaches 0 as the uncertainty increases, we can postulate that there is something like an upper bound on the carbon tax even when the uncertainty increases unboundedly. Although a concave carbon tax does not necessarily imply the convergence toward an asymptote, the fact that its first derivative is decreasing imposes a sort of bound at the limit.

4 Optimal Carbon Tax Function of Uncertainty

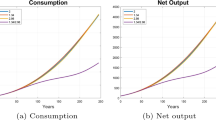

We gradually increase the standard deviation \(\sigma _f \) of the total feedback factors and then calculate the variance of climate sensitivity from the simulated PDF. The cumulative probability across the whole range of climate sensitivity is not equal to 1 because we use the discrete programming and the truncated distribution. For instance, with \(25^\circ \text{ C }\) as the upper bound of climate sensitivity, the residual probability becomes greater than 0.01 when \(\sigma _f \) is greater than 0.14. The mean of climate sensitivity increases from 3.43 to 4.06 while the variance of climate sensitivity increases from 0.002 to 5.51.

Figure 3 illustrates the relationship between the optimal carbon tax and the variance of climate sensitivity. We only present the initial carbon tax (in 2005) because it represents the optimal choice of the current generation. Selecting another time-period reference gives a higher tax level but a similar curvature of the tax function as presented in Fig. 3 (See the results presented in Appendix B). The first thing we can observe in Fig. 3 is that the optimal carbon tax increases as the uncertainty about climate sensitivity increases. The risk-averse social planner would be willing to make more efforts to avoid the adverse impacts of climate change when uncertainty increases. Secondly and more importantly, the carbon tax function is concave in uncertainty and the rate of growth in carbon tax diminishes. This feature holds even when the variance of climate sensitivity goes up to 220, of which the upper bound is \(1{,}000^\circ \text{ C }\).Footnote 16

The behavior of carbon tax in uncertainty. (left) The upper bound of climate sensitivity is \(25^\circ \text{ C }\). (right) The upper bound of climate sensitivity is \(1{,}000^\circ \text{ C }\). Note that growth rates for low values of the variance are much bigger than the other cases and thus we do not present those results in this graph. The growth rate is calculated as follows: \(\Delta (carbon \, tax)_{ij} /variance_i \), where \(i\) and \(j\) denote the neighboring data points

5 Sensitivity Analysis

5.1 Lognormal Distribution

We assume that climate sensitivity has a lognormal distribution given by Eq. (12) with parameter values \(\upmu =1.071\) and \(\sigma =0.527\) as in Ackerman et al. (2010).Footnote 17

We increase \(\sigma \) from 0.05 to 0.90 and then calculate the variance of climate sensitivity from the simulated PDF. The reason why we stop increasing \(\sigma \) at 0.90 is the same as in the previous section. Because of the discrete approximation, there is a difference between the theoretical variance and the simulated variance, especially when \(\sigma \) is large. We use the simulated variance as the measure of uncertainty.Footnote 18 Other assumptions including the number of states of the world, the range of climate sensitivity, and the damage function remain the same as in the previous section.

The PDFs of climate sensitivity following Eq. (12) are depicted in Fig. 4. We also present the case of an MPS. The tails become fatter as the parameter \(\sigma \) increases. One of the main differences between the lognormal distribution and the Roe-Baker distribution is that the lognormal distribution allows for a low value of climate sensitivity (say, below \(1.5^\circ \text{ C }\)) to have a non-negligible density.Footnote 19 This difference affects the abnormal behavior of carbon tax: decreasing carbon tax in uncertainty (see Fig. 5). There is also a loss of information when \(\sigma \) becomes higher, but in this case the loss is mainly from the left tail.

Climate sensitivity distribution (lognormal distribution). \(\upsigma \) denotes the standard deviation of the logarithm of climate sensitivity, mps denotes a PDF drawn from the method of mean-preserving spread. The mean of the logarithm of climate sensitivity is set to \(1.071^\circ \text{ C }\) for all distributions. The panel in the left (resp. right)-hand side reports the left (resp. right) segment of the PDF. The densities of the cases, \(\upsigma = 0.2\) and \(\upsigma = 0.2\) (mps), approach 0 far faster than the other cases and are asymptotic with the x-axis in the 10 to 25 segment in the right panel

The left panel in Fig. 5 shows the relationship between the optimal carbon tax and the uncertainty (non-MPS case). For a low variance, the optimal carbon tax decreases in the variance. This is because the fattened left tail dominates the effect of the fattened right tail. If the variance of climate sensitivity is low (resp. high) – below (resp. above) 0.58 in our parameterization—the fattening of the left (right) tail dominates, and the carbon tax falls (rises) as the variances increases. For the substantial uncertainty about climate sensitivity, however, the optimal carbon tax increases and its growth rate falls as the variance of climate sensitivity becomes higher. The relation between the tax and the variance of climate sensitivity is thus concave as in the main scenario.

We also run our model with an MPS procedure. Since the mean (mode) and the variance of the lognormal distribution exist, we can preserve the mean (mode) while we increase the variance by adjusting the parameter values. Applying mean-preserving spread, the optimal carbon tax decreases as the variance increases (the green line in the right panel of Fig. 5). This is because, during the MPS, the mode (and the shape of PDF) changes a lot (more than the non-MPS procedure) and the left tail becomes far fatter than the right tail (see Fig. 4). To be specific, the low climate sensitivity gets more density than necessary, and consequently the carbon tax is biased to be low. Running the model with mode-preserving spread instead, the optimal carbon tax increases and its rate of growth decreases in uncertainty.Footnote 20

5.2 Weitzman’s Damage Function

The functional form of damage function is also uncertain and it is somewhat controversial (see Weitzman 2010, 2012; Tol 2012). If we apply a multi-polynomial form of damage function like Eq. (13) suggested by Weitzman (2012), the damage costs become much higher than in the DICE damage function, especially in the range of high temperature increases (see Fig. 6).

where \(\pi _1 =0, \pi _2 =0.0028388, \pi _3 =0.0000050703\), and \(\pi _4 =6.754\).

As shown in Fig. 7, applying Weitzman (2012)’s damage function with the Roe and Baker’s distribution therefore makes our model much more reactive to fat tails. As one would expect, the carbon tax calculated from the more reactive form of damage function is higher (from \(42{\$}\)/tC to \(54{\$}\)/tC) than the less reactive damage function (from \(32{\$}\)/tC to \(34{\$}\)/tC)—compare the left panel of Fig. 7 and the left panel in Fig. 3. When the upper bound of climate sensitivity is \(25^\circ \text{ C }\), the concavity is hardly visible, but it becomes visually detectable when the upper bound increases to \(100^\circ \text{ C }\). The growth rate of carbon tax is decreasing in uncertainty in both cases.

The behavior of carbon tax in uncertainty (Weitzman’s damage function). (left) The upper bound of climate sensitivity is \(25^\circ \text{ C }\). (right) The upper bound of climate sensitivity is \(100^\circ \text{ C }\). The growth rate is calculated as in Fig. 3

5.3 Multiple Uncertainties

A number of studies estimate damage costs from climate change, and the parameter values for damage function vary according to their estimates. For instance, Nordhaus (2008) calibrates \(\pi _1 =0, \pi _2 =0.0028388\) to his own estimates for climate damages: the ratio of damages to global output for a warming of \(2.5^\circ \text{ C }\) equals to 1.77 %. We introduce the uncertainty about damage costs through a PDF of the coefficient of quadratic term \(\pi _2 \) in the damage function of DICE.Footnote 21 In specific, we use the estimates for climate damages induced by a warming of \(2.5^\circ \text{ C }\) surveyed by Tol (2009). We assume that each estimate is a random draw from a normal distribution. The mean and the standard deviation of the fractional damage costs are 0.40 and 1.37 % of gross world output, respectively. The mean of damage costs (0.40 %) and \(+\)1 standard deviation of damage costs (1.77 %) correspond to \(\pi _2 =0.00064\) and \(\pi _2 =0.00283\), respectively. Since our model does not allow net benefits from temperature increases, we adjust the density of a negative damage ratio to zero.Footnote 22

The left panel in Fig. 8 shows the behavior of the carbon tax under the joint uncertainties about climate sensitivity and damage function, which is calculated by the recalibrated Nordhaus (2008)’s damage function and the PDF of Roe and Baker (2007).Footnote 23 The optimal carbon tax increases and it is concave in uncertainty about climate sensitivity and damage costs.

The estimation of abatement costs is also uncertain. Since the cost of backstop technology affects the abatement costs in the DICE model (see Eq. 14), we introduce the uncertainty about abatement costs through a PDF for the cost of backstop technology.

where \(\varLambda (t,s)\) is abatement costs, \(\upmu (t,s)\) is the rate of emission control, \(\theta _1 (t)\) is the adjusted cost of backstop technology defined as \(\theta _1 (t,s)=\left[ {\theta _0 (s)r_{eo} (t)/\theta _2 } \right] \times \left[ {\theta _3 -1+\text{ exp }(-\theta _4 (t-1))} \right] /\theta _3 \) where \(\theta _0 (s)\) is the cost of backstop technology, \(r_{eo} (t)\) is the \(\text{ CO }_{2}\)-equivalent-emissions output ratio, \(\theta _2 \), \(\theta _3 \), and \(\theta _4 \) are parameters.

The behavior of carbon tax in multiple uncertainties. (left) damage costs and climate sensitivity. Note that the expected value of damage ratio in this simulation is 0.4 %, which is lower than in the DICE model (1.77 %), so that the carbon tax in this graph is lower than the one in Fig. 3. (right) abatement costs and climate sensitivity

We derive a PDF of the abatement costs from published results. Tavoni and Tol (2010) conduct a meta-analysis of abatement costs from the Energy Modeling Forum 22 data (Clarke et al., 2009). The mean and the standard deviation of the fractional abatement costs (relative to gross world output) for the 650 \(\text{ CO }_{2}\) equivalent concentration target in 2100 are \(\upmu =0.15\,\% \) and \(\upsigma =0.08\% \), respectively.Footnote 24 These values correspond to the cost of backstop technology of 6.5 thousand US\({\$}\)/tC (for 0.15 %), 11.0 thousand US\({\$}\)/tC (for 0.23 %), and so on. We assume a normal distribution for abatement costs and assign zero density to a negative abatement cost as we do for the uncertainty about damage costs.

The right panel in Fig. 8 depicts the optimal carbon tax under the joint uncertainties about climate sensitivity and abatement costs.Footnote 25 We only add the uncertainty about abatement costs to the results of Sect. 4. That is, we apply Nordhaus (2008)’s damage function and the PDF of Roe and Baker (2007). The effect of the uncertainty about abatement costs is not as big as the effect of the uncertainty about climate sensitivity or the effect of the uncertainty about damage costs. Consequently, the uncertainty about climate sensitivity dominates the behavior of the carbon tax. The resulting shape of the carbon tax function is increasing and concave in multiple uncertainties of abatement costs and climate sensitivity.

5.4 CES Utility Function

Introducing nonmarket goods in a model may substantially change its economic implications (Sterner and Persson 2008). Weitzman (2009b) argue that an additive form of the utility function may be preferable to the traditional multiplicative form to account for ecological losses because the former emphasizes that the market and nonmarket goods are more complementary than substitutable. This can be generalized using a constant elasticity of substitution (CES) utility function that embodies a large range of possibilities of substitution. Thus we replace the utility function of the DICE model with the CES utility function proposed by Sterner and Persson (2008):

where \(E(t,s)\) denotes nonmarket goods, \(\alpha \) is the elasticity of marginal utility of consumption, \(\gamma (=0.1)\) is the share of nonmarket goods in utility function, \(\sigma (=0.5)\) is the elasticity of substitution between market goods and nonmarket goods, \(E_0 =\gamma C_0 \) is the initial consumption of nonmarket goods (in 2005), \(a(=0.0028388)\) is the calibration parameter. See Anthoff and Tol (2011) for a discussion on this parameterization. The specification of the rest of the model remains unchanged compared to Sect. 4 (DICE damage function and the Roe and Baker distribution).

As previously found by Sterner and Persson (2008) when plugging their CES utility function into the DICE model, the inclusion of nonmarket goods in the utility function so drastically increases abatement efforts that it plays a more significant role than the pure rate of time preference \(\rho \) (see the left panel in Fig. 9). Nevertheless, we find that introducing nonmarket goods does not disown the implication of our main results: the carbon-tax function of uncertainty is increasing and concave (see the right panel in Fig. 9). A lower value of the pure rate of time preference makes the magnitude of changes bigger, but it does not alter the curvature of the function.

The results of CES utility function. (left) Time profile of air temperature increases. N refers to the results from the original DICE model’s specification, SP refers to the results with the Sterner and Persson (2008)’s utility function, \(\uprho \) denotes the pure rate of time preference. (right) The behavior of carbon tax in uncertainty. Note that the carbon tax is normalized to the value at the lowest variance of climate sensitivity. The initial carbon tax for the lowest variance for each \(\uprho \) is 316US$/tC (\(\uprho =0.00\)), 142US$/tC (\(\uprho \)=0.01), 81US$/tC (\(\uprho =0.02\)), 52US$/tC (\(\uprho =0.03\)), respectively

5.5 Alternative Risk Aversion

We run the model with various values for the measure of relative risk aversion \(\alpha \). We apply the DICE damage function and the Roe and Baker’s distribution as in Sect. 4. From Fig. 10, we can first observe that the higher \(\alpha \) is the smaller the initial carbon tax is. This is because \(\alpha \) plays the similar role as the pure rate of time preferences in increasing the discount rate in a growing economy.Footnote 26 Second, the behavior of the carbon tax is increasing and concave in uncertainty when \(\alpha \) is lower than 3. However, if \(\alpha \) is greater than or equal to 3, the optimal carbon tax decreases in uncertainty. For a high rate of risk aversion and a large uncertainty about climate sensitivity, the perception is that of a high probability of a dismal future—and, more importantly, it is hard to avoid such a future through greenhouse-gas emissions reduction. Therefore, the optimal action is to maximize consumption in the short run—enjoy the good times while they last. Importantly, here as well, the conclusion found with our core results is not affected by this sensitivity analysis.

The behavior of carbon tax in uncertainty (various risk aversion). \(\alpha \) denotes the coefficient of constant relative risk aversion. Note that the optimal carbon tax is normalized to the value at the lowest variance of climate sensitivity. The initial carbon tax for the lowest variance for each \(\alpha \) is 72US$/tC (\(\alpha \) \(=\)1), 32 US$/tC (\(\alpha \) \(=\)2), 19 US$/tC (\(\alpha =3\)), 14 US$/tC (\(\alpha =4\)), respectively

6 Conclusion

In this paper, we investigate the optimal choice of the carbon tax under fat-tailed uncertainty using the revised DICE model. Since a numerical model cannot fully incorporate a fat-tailed distribution, we propose an alternative way of analyzing the impacts of fat-tails: the curvature of carbon-tax function according to uncertainty. We find that the optimal carbon tax increases as the uncertainty about climate sensitivity increases and that its curvature is concave.Footnote 27 Our main results are generally robust to the alternative assumptions about the model specification, including highly reactive damage function, multiple uncertainties about damage function and abatement function, and the presence of nonmarket goods. Although our results are sensitive to a high value of the coefficient of constant relative risk aversion, that is, \(\alpha \ge 3\) Footnote 28, the implication of Dismal Theorem never arises in a wide variety of plausible assumptions.

The conclusion of this paper is in line with those of Anthoff and Tol (2010), who use alternative decision criteria such as the mini-max regret, the tail risk, and the Monte Carlo stationarity together with the welfare maximization. Although the two studies use different methods and different models, they both confirm the results found in the mathematical analysis of Hennlock (2009). That is, although fat-tailed uncertainty implies a more stringent action for abatement, an ultra-rapid abatement like the arbitrarily large carbon-tax or the instant phase-out of fossil fuels is not justified even when the impacts of climate change are fat-tailed.

Finally, we add some caveats. Since we limited our analysis to values of climate sensitivity up to \(1{,}000^\circ \text{ C }/2\times \text{ CO }_{2}\), we cannot rule out the possibility that the carbon tax may become convex for infinite value of climate sensitivity. Footnote 29 However, this caveat is very limited for two reasons. First, there is an analytical work about the convergence for the optimal carbon tax (Hennlock 2009) and our result is consistent with it. Second, we used an upper bound up to \(1000^\circ \text{ C }/2\times \text{ CO }_{2}\) which is largely above any admitted value for climate sensitivity (value above are nearly against the law of physics). Even if the carbon tax became convex for infinite value of CS, it would thus be only for nearly impossible scenarios. Therefore, it is highly improbable that this caveat limit the robustness of our main results, which is that there is no evidence found for arbitrarily large carbon tax under deep uncertainty, when we consider the possibility of emissions control. In order to keep our analysis on the climate impact of deep uncertainty in the context of climate policies tractable, we have neglected potentially important issues that should be considered in further research such as learning, ecological inertia, policy delay, and incomplete participation.

Notes

There is no consensus on the exact definition of the term ‘fat tail’. However, most climate-change economists use the term as the following: “a PDF has a fat tail when its moment generating function is infinite - that is, the tail probability approaches 0 more slowly than exponentially” (Weitzman 2009a: 2). We follow this definition in this paper.

We do not mean to say that the Dismal Theorem is repugnant. The meaning of the term ‘repugnant’ in this sentence is not ‘disgusting’, but ‘repellent to the senses’. We use such strong language to emphasize that one of the implications that an arbitrarily large carbon tax should be imposed—or that emissions should be driven to zero immediately is repellent to the senses. In this case, there is a risk of starvation to death of a large part of the world population.

As an illustration, Costello et al. (2010) compute the willingness to pay (as a fraction of consumption) equating the expected utility without considering emissions control (see Eq. 3 in their paper) and a discounted utility from reduced consumption (i.e. net of willingness to pay) (see Eq. 4 in their paper). Since the expected utility in the absence of emissions control tends to infinity under fat tails, willingness to pay approaches 100 % of consumption. The results we present in Sect. 2 in the current paper also support this finding.

They also run the optimal policy version of the DICE model, but show the Weitzman effect only in the business as usual case.

Indeed \(\mathop {\text{ max }}\limits _\mathrm{c} \text{ E }_\mathrm{s} U(c;s)\) is generally not equal to \(E_s \mathop {\text{ max }}\limits _\mathrm{c} U(c;s)\), where \(E_{s}\) is the expectation operator over a state of the world s and c is a control variable.

For the effect of learning on climate policy, see Hwang et al. (2013).

Applying Weitzman’s damage function with no emissions control in our model in Sect. 3 does not have a feasible solution, probably because the model is no longer convex. We present here consumption flow in the deterministic model instead.

The consumption constraint (the total consumption in society, \(\text{ C }_\mathrm{t} \ge 20\) trillion US$ (in 2005) in the original DICE model) starts to bind after a certain time-period (e.g. from the year 2245 when climate sensitivity is \(8^\circ \text{ C }\)).

There is a computational limit for running the model. For instance, in our system (with 8GB RAM and Intel\({^\circledR }\) \(\text{ Core }^{\mathrm{TM}}\) i5-3210M CPU @ 2.50GHz) running the model with 2,000 states of the world and the time horizon of 600 years was not possible. Considering the memory constraint and the computation time, we here set the time horizon to 300 years (as opposed to 600 years in DICE). We run the model with many combinations of the number of states of the world and the time horizon within the computational limit, but greater numbers of states of the world and longer time horizons than our choice do not affect the results qualitatively.

The term ‘feedback factor’ refers to the impact of a physical factor such as water vapor and cloud on the total radiative forcing in a way of amplifying the response of climate system (Hansen et al. 1984).

The total feedback factors are assumed to be strictly lower than 1 because an equilibrium cannot be reached if is greater than or equal to 1 (Roe 2009).

Since increasing \(\bar{{f}}\) has a similar effect on the distribution of climate sensitivity, we only look at the effect of increasing \(\sigma _{f}\) .

Applying an MPS to a fat-tailed distribution raises some technical difficulties. First, it is not possible to apply the method to a fat-tailed distribution because, by definition, a fat-tailed distribution does not have a moment generating function, and thus there is no mean (first moment) to preserve. Second, even if we truncate the distribution so that we can calculate the mean and the standard deviation from the simulated PDF, it does not suit for the purpose of our paper. One may think of an iterative way of taking densities from the centre and transferring them into the tails (e.g. Mas-Colell et al. 1995: ch.6), but this may produce several discontinuous jumps on the probability distribution.

In addition, the Roe and Baker’s distribution is more scientifically founded than the lognormal distribution (note that the Roe and Baker’s distribution is suggested by physical scientists, whereas the lognormal distribution we used is due to economists, namely Ackerman et. al.). Furthermore, applying the lognormal distribution produces an abnormal decreasing carbon-tax pattern in uncertainty as we see in Fig. 5. Thus we use the Roe and Baker’s distribution as our reference PDF.

When we apply an upper bound of 1,000, the variance and the mean of the CS distribution changes, so does the point at which we stop increasing the variance.

If we use the theoretical variance in Fig. 5, then the concave property of carbon tax function is more transparent.

As we can see from the left panel in Fig. 4, during an MPS, both tails become fatter. Fattening only the right tail may be possible (by holding the left tail and adjusting the right tail), but it would produce a discontinuous jump around the mean (or the mode). The problem is that such a discontinuous PDF is not realistic for the CS distribution.

One of the alternative ways to avoid decreasing carbon tax is to use a much bigger upper bound. If we use a higher upper bound, the density added to the right tail during the MPS is more considered, and thus the effect of the imbalance of the newly added densities between the left and the right tail becomes smaller.

Calibrating to the estimated damage costs gives a similar result to calibrating the exponent, of which default value is 2 in the DICE model, to the estimated damage costs because both calibrations should give the same damage costs at the calibrated data points.

A lognormal or a gamma distribution may be used instead of this truncated normal distribution. For our purpose, however, those distributions did not perform better than the truncated normal distribution used here.

Because of memory constraints, we reduced the number of states of the world on climate sensitivity to 100. In this case, climate sensitivity increases by \(0.25^\circ \text{ C }\) from 0 to \(25^\circ \text{ C }\). The number of states on damage costs is 25, of which value increases by 0.4 % from \(-\)4.2 to 5.0 %. Thus, the total number of states is 2,500.

Models surveyed in Tavoni and Tol (2010) have three alternative stabilization targets (450, 550, 650 \(\text{ CO }_{2}\)eq ppm in 2100). Since the DICE model does not have such corresponding targets, we used the results of the models, which have the similar characteristics with the DICE optimal run.

The number of states of the world is 100 for climate sensitivity and 25 for abatement costs, which increases by 0.025 % from \(-\)0.15 to 0.45 %.

Recall the Ramsey formula: \(r=\rho +\alpha \times g\), where \(r, g, \rho \) are the discount rate, the growth rate of consumption per capita, the pure rate of time preferences, respectively.

As we have seen in Sect. 2, if we do not consider the option of emissions control—or in the business as usual scenario - the social cost of carbon can be increasing and convex in uncertainty. Notice that the social cost of carbon is not equal to the optimal carbon tax in the presence of emissions control (Tol 2012).

Note that conventional values for the coefficient of constant relative risk aversion are \(\alpha \approx 2\pm 1\) (Weitzman 2007).

Note that the equilibrium climate sensitivity of \(1,000^\circ \text{ C }/2\times \text{ CO }_{2}\) means that the average atmospheric temperature increases \(1{,}000^\circ \text{ C }\) when carbon concentration is doubled.

The historical data used for this calibration are as follows: atmospheric temperature (Hadley center, CRUTEM3), ocean temperature (NOAA, global anomalies and index data), radiative forcing (Hansen et al. 2007).

Air temperature may decrease over time if \(\text{ CS } <1.2^\circ \text{ C }\) (Baker and Roe 2009), but in this experiment the sign of the slope changes at \(\text{ CS }=1.5^\circ \text{ C }\). This may be caused by the sign of radiative forcing in the slope equation or observational-errors of the data used (Slope \(=\) \(\beta _1 [T_{AT} (t)-T_{AT} (t-1)]/F(t-1)\), where \(\beta _1 >0\) is a constant).

References

Ackerman F, Stanton EA, Bueno RN (2010) Fat tails, exponents, extreme uncertainty: simulating catastrophe in DICE. Ecol Econ 69:1657–1665

Annan JD, Hargreaves JC (2011) On the generation and interpretation of probabilistic estimation of climate sensitivity. Clim Chang 104:423–436

Anthoff D, Tol RSJ (2010) Climate Policy under fat-tailed risk: an application of FUND. Economic and Social Research Institute (ESRI) Working Paper 348

Anthoff D, Tol RSJ (2011) Schelling’s conjecture on climate and development: a test. Economic and Social Research Institute (ESRI) Working Paper 390

Baker MB, Roe GH (2009) The shape of things to come: why is climate change so predictable? J Clim 22(17):4574–4589

Clarke L, Edmonds J, Krey V, Richels R, Rose S, Tavoni M (2009) International climate policy architectures: overview of the EMF 22 International Scenarios. Energy Econ 31:S64–S81

Costello CJ et al (2010) Bounded uncertainty and climate change economics. Proc Natl Acad Sci 107(18):8108–8110

Dietz S (2011) High impact, low probability? An empirical analysis of risk in the economics of climate change. Climatic Change 108:519–541

Forest CE et al (2002) Quantifying uncertainties in climate system properties with the use of recent climate observations. Science 295(5552):113–117

Hansen J et al (1984) Climate sensitivity: analysis of feedback mechanisms. Geographysical Monograph Series 29:130–163

Hansen J et al (2007) Dangerous human-made interference with climate: a GISS modelE study. Atmospheric Chem Phys 7(9):2312

Hegerl GC et al (2006) Climate sensitivity constrained by temperature reconstructions over the past seven centuries. Nature 440:1029–1032

Hennlock M (2009) Robust control in global warming management: an analytical dynamic integrated assessment. RFF Discussion Paper No. 09–19 University of Gothenburg

Horowitz J, Lange A (2008) What is wrong with infinity-a note on Weitzman’s dismal theorem. University of Maryland Working Paper

Hwang IC, Reynès F, and Tol RSJ (2013) The effect of learning on climate policy under fat-tailed uncertainty. Unpublished manuscript (submitted for publication)

Ikefuji M et al. (2010) Expected utility and catastrophic risk in a stochastic economy-climate model. CentER Discussion Paper Series No. 2010–122 Tilburg University

Karp LS (2009) Sacrifice, discounting and climate policy: five questions. CESifo Working Paper Series No. 2761 Center for Economic Studies & Ifo Institute for economic research

Marten A (2011) Transient temperature response modeling in IAMs: the effects of over simplification on the SCC. Econ Open-Access Open-Assessment E-J 5:2011–2018

Mas-Colell A, Whinston MD, Green JR (1995) Microeconomic theory. Oxford university press, New York

Newbold SC, Daigneault A (2009) Climate response uncertainty and the benefits of greenhouse gas emissions reductions. Environ Resour Econ 44:351–377

Nordhaus WD (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven

Nordhaus WD (2011) The economics of tail events with an application to climate change. Rev Environ Econ Policy 5:240–257

Phillips AW (1957) Stabilisation policy and the time-forms of lagged responses. Econ J 67:265–277

Pindyck RS (2011) Fat tails, thin tails, and climate change policy. Rev Environ Econ Policy 5:258–274

Pycroft J et al (2011) A tale of tails: uncertainty and the social cost of carbon dioxide. Econ Open-Access Open-Assessment E-J 5:2011–2022

Roe GH, Baker MB (2007) Why is climate sensitivity so unpredictable? Science 318(5850):629–632

Roe GH (2009) Feedbacks, timescales, and seeing red. Annu Rev Earth Planet Sci 37:93–115

Rothschild M, Stiglitz JE (1970) Increasing risk: I. A definition. J Econ Theory 2:225–243

Salmon M (1982) Error correction mechanisms. Econ J 92:615–629

Schneider SH, Thompson SL (1981) Atmospheric \(\text{ CO }_{2}\) and climate: importance of the transient response. J Geophys Res Oceans (1978–2012), 86(C4):3135–3147

Solomon S et al (2007) Climate change 2007: the physical science basis. Contribution of working group I to the fourth assessment report of the Intergovernmental panel on climate change. Cambridge University Press, New York

Sterner T, Persson UM (2008) An even sterner review: introducing relative prices into the discounting debate. Rev Environ Econ Policy 2:61–76

Tavoni M, Tol RSJ (2010) Counting only the hits? The risk of underestimating the costs of stringent climate policy. Climatic Change 100:769–778

Tol RSJ (2012) Targets for global climate policy: an overview. Economics Department Working Paper Series No. 37–2012 University of Sussex

Tol RSJ (2003) Is the uncertainty about climate change too large for expected cost-benefit analysis. Climatic Change 56:265–289

Tol RSJ, Yohe GW (2007) Infinite uncertainty, forgotten feedbacks, and cost-benefit analysis of climate policy. Climatic Change 83:429–442

Tol RSJ (2009) The economic effects of climate change. J Econ Perspect 23:29–51

Weitzman ML (2007) Subjective expectations and asset-return puzzles. Am Econ Rev 1102–1130

Weitzman ML (2009a) On modeling and interpreting the economics of catastrophic climate change. Rev Econ Stat 91:1–19

Weitzman ML (2009b) Additive damages, fat-tailed climate dynamics, and uncertain discounting. Econ Open-Access Open Assess E-J 3:29–39

Weitzman ML (2010) What is the damages function for global warming-and what difference might it make? Climate Change Econ 1:57–69

Weitzman ML (2011) Fat-tailed uncertainty in the economics of catastrophic climate change. Rev Environ Econ Policy 5:275–292

Weitzman ML (2012) GHG targets as insurance against catastrophic climate damages. J Public Econ Theory 14(2):221–244

Yohe GW (2003) More trouble for cost-benefit analysis. Climatic Change 56:235–244

Yohe GW, Tol RSJ (2010) Precaution and a dismal theorem: implications for climate policy and climate research. In: Geman H (ed) Risk management in community markets. Wiley, New York

Acknowledgments

Funding by the CEC-DG RTD FP7 project ClimateCost is gratefully acknowledged. William Nordhaus deserves praise for making his model code freely available. The authors of this paper are also very grateful to three anonymous reviewers and David Popp, the associate editor of the journal Environmental and Resource Economics, for valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

1.1 Appendix A: Calibration of the Atmospheric Temperature Equation

The DICE model represents the climate system by a multi-layered system consisting of the atmosphere, the upper oceans, and the lower oceans. It adopts a box-diffusion model (Schneider and Thompson, 1981). This representation is a simple way of incorporating climate system into IAMs but has some problems. Apart from the criticism that it fails to capture the real mechanism of the climate system (Marten 2011), one of the practical problems encountered during simulations is that the model does not produce a feasible solution when the value of climate sensitivity is lower than around \(0.5^\circ \text{ C }\). We find that this problem is induced by the fact the original specification creates a fast cyclical adjustment when we change only the parameter on climate sensitivity. To see this, notice that the air-temperature evolution equation can be rearranged with simple algebra into Eq. (17), which is an error-correction model (Phillips 1957; Salmon 1982) with an adjustment speed \(\alpha _1 \) and target \(\alpha _2 F(t)-\alpha _3 \left[ {T_{AT} (t-1)-T_{LO} (t-1)} \right] \):

Where \(T_{AT} (t)\) is the global mean surface air temperature increases, \(T_{LO} (t)\) is the global mean lower ocean temperature increases, \(F(t)\) is the total radiative forcing increases, \(\alpha _1 ,\alpha _2 \), and \(\alpha _3 \) are calibrated parameters. Since \(\alpha _2 \) is defined as climate sensitivity (CS) divided by the constant (the estimated forcing of equilibrium \(\text{ CO }_{2}\) doubling), decreasing climate sensitivity artificially increases the adjustment speed, \(\alpha _1 =\xi _1 /\alpha _2 \). With the default value of the DICE model (\(\text{ CS }=3^\circ \text{ C }\)), the adjustment speed \(\alpha _1 \) is 0.22. For CS lower than 0.8, the adjustment speed becomes higher than one. This leads to a cyclical adjustment to the equilibrium temperature, which does not make much sense scientifically speaking. Assuming \(\text{ CS } = 0.5^\circ \text{ C }, \alpha _1 =1.7\) implies important and irrelevant jumps up and down in the temperature every period and leads to an infeasible solution.

To avoid this problem, we recalibrate the parameter values in the air-temperature evolution equation so as to ensure a coherent adjustment process. We calculate atmospheric temperature \(T_{AT} (t)\) according to Eq. 17 using various values of adjustment-speed \(\alpha _1 \) and climate sensitivity CS. Then we fit \(T_{AT} (t)\) against the historical observation data.Footnote 30 Through the experiment we find that the adjustment-speed is linearly related to the inverse of climate sensitivity and the slope of the function changes around \(\text{ CS }=1.5^\circ \text{ C }\) and \(\text{ CS }=3^\circ \text{ C }\).Footnote 31 Thus, we obtain three different functional forms according to the range of CS as follows.

Appendix B: The Behavior of Carbon Tax in Uncertainty

See Fig. 11.

Rights and permissions

About this article

Cite this article

Hwang, I.C., Reynès, F. & Tol, R.S.J. Climate Policy Under Fat-Tailed Risk: An Application of Dice. Environ Resource Econ 56, 415–436 (2013). https://doi.org/10.1007/s10640-013-9654-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9654-y