Abstract

The paper analytically explores the optimal allocation of investments into mitigation and environmental adaptation against climate change damages at a macroeconomic level. The economic-environmental model is formulated as a social planner problem where adaptation and abatement investments are separate decision variables. The existence of a unique steady state is proven. A comparative static analysis of optimal investments leads to essential implications for associated long-term environmental policies. It is shown that the optimal policy mix between adaptation and mitigation is lower for countries with higher economic efficiency for all applicable parameter ranges. Data calibration and numerical simulations are provided to estimate practical validity of theoretical outcomes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Confronted to the expected adverse effects of climate change, policy-makers from many countries have now understood that implementing measures to reduce the vulnerability of their countries may be an appealing option. This is known as adaptation. The IPCC Fourth Assessment Report defines adaptation to climate change as “an adjustment in natural or human systems in response to actual or expected climatic stimuli or their effects, which moderates harm or exploits beneficial opportunities”. By contrast, mitigation is defined as “an anthropogenic intervention to reduce the sources or enhance the sinks of greenhouse gases” (IPCC 2007, chap. 18, p. 750).Footnote 1 Society has two main long-term potential strategies to deal with climate change: to mitigate greenhouse gas emissions or to adapt to global warming.Footnote 2 What is the right balance between adaptation and mitigation? This question will be addressed in this paper. The economic and environmental science literature has extensively analyzed the cost and effectiveness of mitigationFootnote 3 while only little attention has been paid to adaptation. In practice, the term adaptation covers a large range of actions such as investment in a coastal protection infrastructure, diversification of crops, implementation of warning systems, improvement in water resource management, development of new insurance instruments, air-cooling devices, etc. The purpose of this paper is to develop a theoretical dynamic general equilibrium model to analyze the interplay between adaptation and mitigation in long term climate policies.

Although difficult to evaluate, the economic cost of adaptation measures is significant. According to the World Bank (2009), the studies available in the literature provide a wide range of estimates: adapting between 2010 and 2050 to a \(+2^\circ \text{ C}\) warmer world by 2050 would cost between 75 and 100 billion USD per year. This range is confirmed by the survey of Fankhauser (2009). Such an amount is of the same order of magnitude as the foreign aid that developed countries currently provide to developing countries each year, but is still a very low percentage of the developed countries’ GDP. Another recent study conducted on behalf of the UNFCCC focuses on five sectors (water supply, human health, coastal zones, forestry, and fisheries) until the year 2030. It estimated the average cost of adaption to be between 28 and 67 billion USD per year in developing countries (UNFCCC 2007). There also exists an extensive literature, though uneven and not exhaustive, on adaptation costs and benefits at the sector level. For example, Rosenzweig and Parry (1994); Adams et al. (2003); Reilly et al. (2003) consider the agricultural sector, Morrison and Mendelsohn (1999), Sailor and Pavlova (2003), Mansur et al. (2005) the energy demand, and Fankhauser (1995); Yohe and Schlesinger (1998), and Nicholls and Tol (2006) sea-level rising. Less attention has been given to water resource management (EEA 2007), transportation infrastructure (Kirshen et al. 2007), health, or tourism. Those examples show that adaptation occurs at every level of human activity. It starts nationwide and trickles down to cities, municipalities, and households. For these reasons, adaptation has now reached the top of the policy agenda in most countries, in contrast to the sparse economic literature devoted to it.Footnote 4

As stressed by the IPCC (2007, chap. 18) the UNFCCC (2007) or Agrawala and Fankhauser (2008), adaptation displays many appealing and innovative characteristics to combat climate change. Three of them are relevant to our analysis. First, some adaptation measures are drawn by private agents’ self-interest (e.g., air cooling in dwellings) while others have the property of a public good (e.g., dams). This implies that the right incentives must be found to reach the optimal adaptation level. The second characteristic is that some developing countries do not have the financial capacity to address adequate adaptation measures. This can prevent such countries from implementing the optimal policy and impede their participation in international agreements.Footnote 5 However, the third most crucial issue is that, while people might be able to protect themselves, they cannot fully avoid the adverse impacts of climate change. Because adaptation does not tackle the cause of climate change (the concentration of greenhouse gases in the atmosphere), the world cannot afford to neglect the mitigation of greenhouse gas emissions. Thus, a key issue is to find the optimal balance between adaptation and mitigation in order to implement an effective and efficient long-term climate policy.

Despite a recently growing interest for these questions, the economic literature on adaptation remains scarce. Lecocq and Shalizi (2007) stress the need for an integrated portfolio of policy actions to minimize the climate bill, but only a few studies explicitly consider adaptation and mitigation as complementary policy responses to climate change. Some papers are purely descriptive (e.g. Kane and Yohe 2000; Smit et al. 2000; Agrawala and Fankhauser 2008; EEA 2007; UNFCCC 2007). Other papers use game-theoretic frameworks, either static (Shalizi and Lecocq 2009; Kane and Shogren 2000) or dynamic (Buob and Stephan 2011). The analytic economic-environmental models of (Bretschger and Valente 2011) and (Millner and Dietz 2011) analyze the optimal choice of adaptation expenses but do not consider abatement or mitigation. Millner and Dietz (2011) provide a thorough analytic and numeric study of a Ramsey-Koopmans optimal growth model with productive and adaptive capital stocks. They conclude that the optimal investment ratio between adaptive and productive capitals for developing countries is large at the beginning of planning horizon and declines later. Bretschger and Valente (2011) analytically study the effects of climate change and climate adaptation on long-run economic development using two models with endogenous capital, stock pollution and adaptation expenditures. A distinguished feature of their model is the assumption that physical capital depreciates faster under the climate change.

Computational integrated assessment models have also been used for applied analysis of optimal adaption (Bosello et al. 2010; De Bruin et al. 2009; Agrawala et al. 2011). These papers address two key questions. First, are mitigation and adaptation substitutes or complementary policy instruments? Second, does the country’s stage of development affect the optimal policy mix between mitigation and adaptation? To date, the first question still remains open. Buob and Stephan (2011) partially answer the second question by arguing that high-income countries should invest in both mitigation and adaptation, while low-income countries should invest only in mitigation. In this paper we elucidate this result by showing how the substitutability between the two instruments depends on the country’s stage of development. For this purpose, we develop a macroeconomic growth models with environmental quality and investment. Gradus and Smulders (1993) are among the first who analyze long-term growth models with pollution, which involve spending on abatement activities. They model pollution as a flow rather than a stock. Stokey (1998) analyzes the optimal technology choice in alternative models with pollution as both a flow and a stock, but with no directed spending on abatement or pollution clean-up. Her models include an endogenous “technology index” that linearly impacts the output and nonlinearly impacts pollution. The abatement process is modeled in Byrne (1997) and Vellinga (1999) similarly to an environmental clean-up process. More recently, Economides and Philippopoulos (2008) examine optimal clean-up and public infrastructure policies through a distorting tax in a general equilibrium model with renewable natural resources and compare outcomes with the corresponding social planner’s problem. Their approach is close to Stokey (1998), but they consider renewable natural resources rather than pollution. In this paper we follow the commonly accepted abatement description of Gradus and Smulders (1993) and their followers (for example, Chen et al. 2009). Our approach is also close to Chimeli and Braden (2005) who use the central planner framework and steady-state analysis to explore the relationship between a country’s per-capita income and environmental quality. In contrast to the aggregate “environmental protection expenditure” of Chimeli and Braden (2005), we distinguish between abatement and adaptation investments and disentangle their specific impact on the economy and the environment.

This paper contributes to the literature by developing a long-term dynamic model of the economy with accumulation in physical capital, adaptation capital, and greenhouse gases. Along with capital accumulation to promote growth, the policy instruments available to combat climate change are mitigation and adaptation. In order to keep the model tractable, we shall rule out the role of endogenous risk and consider a one-country model (further research will extend the analysis to the case of several countries).

The model encompasses all the ingredients required to characterize an economy with respect to its stage of development, its technology, and its preferences: technology dirtiness, global factor productivity, and the degree of impatience. Furthermore, to adequately address the issue of adaptation, a vulnerability function reflects the physical characteristics of the country under study. Vulnerability is bounded from above (no adaptation) and from below (maximal adaptation). Given that this function translates global warming into welfare losses, it can be understood as the opportunity cost of no-adaptation in terms of welfare. Related to this function, a potential for adaptation in the economy is also defined. It represents the range of physical adaptation opportunities, i.e. the benefits in terms of vulnerability reduction associated with adaptation measures. Again, depending on the physical characteristics of the country under study, this range will differ, and it will shape the optimal policy. Combining these two elements in a dynamic general equilibrium setting allows us to introduce an indicator of environmental harmfulness (dubbed, the \(\kappa \)-indicator) that encompasses both the (objective) pressure of the economy on the environment and the (subjective) pressure of the environmental quality on welfare. This indicator will help us characterize specific cases depending on the importance of each of these two dimensions (in particular, technology, physical characteristics of the country, and preferences).

The main results of this paper can be summarized as follows. We show that the relevance of adaptation depends on the stage of development of the country. First, there exists a threshold of economic efficiency and environmental vulnerability under which it is not optimal to invest in adaptation. This means that it is not optimal for a highly vulnerable country with very low global productivity to engage itself in adaptation. However, estimation of applicable parameter ranges and numeric simulation demonstrate that this critical threshold is very low and out of the range of model applicability. It is demonstrated that the optimal policy mix between adaptation and mitigation is lower for countries with higher economic efficiency for all reasonable model parameters.

Second, it is shown that, when the economy has reached some stage of development (and, consequently, some level of environmental pressure), it is too late for the economy to avoid adverse effects, even if the full range of adaption measures were to be implemented. This is a strong definition of “unavoidable damages”. When comparing the economy with and without adaptation, it turns out that the capital stock is larger, abatement efforts are smaller and the pollution level is larger in the adaptation case. We show that, because of its stock nature, the benefits of adaptation increase as the natural decay rate of pollution decreases or the discount rate decreases.

The rest of the paper is organized as follows. In Sect. 2 we present the specifications of production, pollution processes and social preferences in our model and formulate the problem under study. In Sect. 3 we prove the existence of a unique steady state in a benchmark model without adaptation and we derive some preliminary conclusions about optimal abatement policies. In doing so, we use perturbation techniques to obtain approximate analytic formulas for the steady state, which allows for further comparative static analyses of the optimal policies. In Sect. 4 we analyze the full-fledged model with abatement and adaption, prove our main results, and stress their economic implications. Sect. 5 depicts numeric simulation outcomes and Sect. 6 concludes.

2 The Model

We employ the Solow–Swan one-sector growth framework, in which the economy uses a Cobb–Douglas technology with constant returns to produce a single final good \(Y\). The social planner allocates the final good across consumption \(C\), investment \(I_{K}\) in physical capital \(K\), investment \(I_{D}\) in environmental adaptation \(D\), and emission abatement expenditures \(B\) in order to maximize the utility of an infinitely lived representative household:

subject to the following constraints:

where \(\rho >0\) is the rate of time preference, \(A>0\) and \(0<\alpha <1\) are parameters of the Cobb–Douglas production function, \(\delta _{K}\ge 0, \delta _{D}\ge 0\) are scrapping coefficients for physical capital and adaptation capital. Environmental quality is characterized by the pollution stock \(P\). The utility \(U\) depends on the consumption, pollution, and environmental adaptation capital.

The choice of a law of motion for environmental pollution \(P\) is critical in the problem under study (Toman and Withagen 2000; Jones and Manuelli 2001). Following Stokey (1998); Hritonenko and Yatsenko (1999), and some more recent works (e.g., Chen et al. 2009), and because of our interest in climate change, we shall assume that pollution is accumulated as a stock.Footnote 6 The pollution inflow (net emission) is assumed to be proportional to the output \(Y\). The abatement activity \(B\) is also a flow (Gradus and Smulders 1993; Vellinga 1999) determined by Eq. (2) under given controls \(C, I_{K}\), and \(I_{D}\). The pollution stock grows with net emissions and declines as the abatement expenditures \(B\) increase. Despite its simplicity, our specification captures the major qualitative features of the abatement activity \(B\) (see Gradus and Smulders 1993).Footnote 7 The law of pollution motion is thus given by:

The emission factor \(\gamma >0\) in (5) reflects the environmental dirtiness of the economy. To be more precise, it gives the net flow of pollution, that is, the flow resulting from productive activity net of abatement efforts. The pollution stock increases with this flow and deteriorates in time at a constant natural decay rate \(\delta _{P}>0\).

Remark

An alternative specification of emissions in Eq. (5) could be \(\gamma \text{ Y}(\text{ t})/(B_{0}+B(t))\), where \(B_{0}\) is a positive constant.Footnote 8 However, a preliminary analysis of the corresponding problem shows that this specification makes the steady state analysis of our model analytically intractable. On the other hand, the current choice of \(Y/B\) is reasonable from a practical viewpoint: if we consider that a certain environmental cleanup work always takes place (like installing/replacing air filters, cleaning water drains, planting trees) then, formally, it means that \(B\ge B_{0}>0\). Also, as it will be clear later on, the optimization problem (1)–(5) itself rejects the optimal choice of \(B=0\). Under our model specifications the optimal steady state \(B\) is always strictly positive because the value of the objective function is getting worst as \(B\) approaches 0. In particular, a steady state with the infinite GHG concentration is not possible.

The model (1)–(5) incorporates the key ingredients of the problem we are interested in. In particular, it allows us to discuss the optimal policy mix between emission abatement and adaptation with respect to the stage of development of the economy. Hereafter, we shall discuss two polar cases. On one hand, a developing country is characterized by both a low global factor productivity (small \(A\)) and a high impatience degree (high \(\rho \)). On the other hand, a developed (industrialized) country has a high global productivity and is more patient.Footnote 9 The question behind this comparison is whether the role of adaptation changes with a country’s stage of development. The discussion of this issue shall also involve the pollution intensity of the economy, \(\gamma \). Empirically, the link between pollution intensity and global factor productivity is not straightforward. Economic development may yield a higher carbon intensity, but it may also lead to decarbonization because of increased global productivity, energy or carbon saving technological progress, dematerialization, etc.

The problem (1)–(5) includes three decision variables \((I_{K},\;I_{D}, C)\) and four state variables \((K, D, B, P)\) due to the presence of four constraints-equalities (2)–(5).Footnote 10 The novelty of the problem is the dependence of \(U(C, P, D)\) on the adaptation capital stock, \(D\). In line with theoretic environmental literature (Gradus and Smulders 1993; Stokey 1998;Footnote 11 Byrne 1997; Hritonenko and Yatsenko 1999; Economides and Philippopoulos 2008, and others), we assume the utility function to be additively separable: \(U({C,P,D})=U_1 (C)-U_{2} ({P,D})\). Simulation IAMs use a multiplicative utility \(U(C\times G({P,D})),\) where \(0<G({P,D})\le 1\) is a damage function, that translates the temperature increase into global product output losses (Agrawala et al. 2011). Physical impacts (such as sea rise level, snow melting, and others) are increasing and convex in the average temperature increase. The welfare losses due to these impacts depend on a vulnerability function that translates physical impact into welfare losses, which also depends on adaptation measures. We thus consider the following utility function

where the function \(\eta (D)\) represents the environmental vulnerability of the economy. This function captures the idea that environmental vulnerability can be reduced by investing in adaptation measures. In that sense, the function \(\eta (D)\) can also be interpreted as the efficiency of adaptation measures to protect people from climate change adverse impacts. The functional form for \(\eta (D)\) will be discussed in Sect. 4. In (6), the parameter \(\mu >0\) reflects the negative increasing marginal utility of pollution (which is a common assumption in such models).

3 A Benchmark Model with Abatement and No Adaptation

In order to grasp the dynamic properties of the model (1)–(6), let us begin with a benchmark version with pollution abatement, but without adaptation, \(i.e\)., with \(\eta =\)const and \(D=0\). The model (1)–(6) becomes:

where \(\delta =\delta _{K}\). The present-value Hamiltonian for the problem (7)–(10) is given by

where the dual variables \(\lambda _{1},\lambda _{2},\lambda _{3}\) are associated with equalities (8)–(10), and \(\mu _{1},\mu _{2}\) are related to the irreversibility constraints \(I_{K}\ge 0\), \(C\ge 0\). The first order extremum conditions for the two decision variables \(I_{K}\) and \(C\) are:

or, in the case of an interior solution,

The first order conditions for the state variables \(K, B\) and \(P\) are, respectively:

and the transversality conditions take the form of \(\mathop {\lim }\limits _{t\rightarrow \infty } \lambda _2 (t)=\mathop {\lim }\limits _{t\rightarrow \infty } \lambda _3 (t)=0\). Excluding \(\lambda _{1}\;\lambda _{2}\;\lambda _{3}\) from (15)–(16) and using (8)–(10), we obtain the system in \(K,B,C\) and \(P\):

The system (18)–(21) determines the interior optimal dynamics. In the case of small values of \(\eta \), this dynamics should be close to the Solow–Swan model (Barro and Sala-i-Martin 1995), which has an asymptotically stable steady–state equilibrium at \(\alpha <1\). A similar result is stated in the following Proposition.

Proposition 1

The problem (7)–(10) possesses the unique steady state:

where \(\bar{{K}},0<\bar{{K}}<\left( {\alpha A/(\delta +\rho )} \right)^{\frac{1}{1-\alpha }}\), is found from the nonlinear equation

Proof

. See “Appendix 1”. \(\square \)

Proposition 1 establishes the existence of a unique steady state \((\bar{{K}}, \bar{{B}}, \bar{{C}}, \bar{{P}})\), but it does not guarantee convergence of optimal trajectories \(K(t), B(t), C(t)\), and \(P(t)\) to the steady state. Such convergence is possible (as in the Solow–Swan model) but difficult to prove because of the larger number of variables and is out of the scope of this paper. As shown in “Appendix 1”, the nonlinear Eq. (25) has a unique solution \(\bar{{K}}\) that satisfies

The last term of this inequality is the maximal capital stock level: the size of the economy with parameters \(A,\;\alpha ,\;\delta ,\;\rho \) in the case when pollution does not matter. Setting a maximum limit \(\bar{{P}}\) for the pollution contamination \(P\) is commonly accepted in environmental economic literature to avoid a further degeneration of the environmental quality (see Smulders and Gradus 1996; Bovenberg and Smulders 1996; Elbasha and Roe 1996; Hritonenko and Yatsenko 2005, 2011).

Qualitative properties of the economy and relations between the optimal long-term abatement policy and model parameters follow from the comparative statics analysis of formulas (22)–(25). First, a lower pollution intensity \(\gamma \) increases the size of the economy \(\bar{{K}}\). It also leads to smaller abatement efforts \(\bar{{B}}\)and to a smaller pollution level \(\bar{{P}}\). Thus, a cleaner technology is unambiguously good for the economy. When \(\gamma \) tends to 0 (strong decarbonization), then \(\bar{{K}}\) tends to its maximum level \(({\alpha A/(\delta +\rho )} )^{\frac{1}{1-\alpha }}\), while \(\bar{{B}}\) and \(\bar{{P}}\) tend to zero. Second, the economy is larger (larger \(\bar{{K}})\), abatement expenditure is smaller, and the pollution level is larger for a smaller vulnerability \(\eta \) of the economy to climate change. Third, the economy also depends on the natural decay rate of pollution, \(\delta _{P}\). If the environmental decay rate \(\delta _{P}\) becomes smaller, then the pollution level \(\bar{{P}}\) increases and the size of the economy \(\bar{{K}}\) shrinks. Indeed, it is even more difficult to control a pollution stock as its decay rate becomes very small. This feature results from our specification of the limited abatement efficiency in pollution motion (10), where the abatement can only keep the pollution emission stable, but cannot decrease it to zero, which is realistic.Footnote 12 So, the natural decay rate plays a critical role in our problem. In reality, greenhouse gases remain in atmosphere for a very long period and the natural decay rate of this stock is very low.Footnote 13

Let us now turn to the optimal use of the single policy instrument available in this section to cope with climate change, \(\bar{{B}}\). Equations (22) and (25) show that both optimal steady-state capital level \(\bar{{K}}\) and abatement level \(\bar{{B}}\)increase with \((A)^{\frac{1}{1-\alpha }}\) when the global productivity \(A\) increases.Footnote 14 Consequently, the optimal ratio \(\bar{{B}}/\bar{{K}}\) is independent of global productivity.

In order to provide further comparative static analyses, an explicit formula for the solution \(\bar{{K}}\) of Eq. (25) is required. To find it, we use perturbation techniques (a “small parameter method”), which is not common in the economic literature but is widely used in applied sciences. Some examples in economics are provided by Araujo and Scheinkman (1977), Boucekkine et al. (2011), Cosimano (2008), Gaspar and Judd (1997), Hritonenko and Yatsenko (2005), Judd and Guu (1997), Khan and Rashid (1982), Santos (1994) or Wagener (2006). The general idea of this method is to reduce the problem under study to a simpler problem with a known solution (or a solution algorithm). In economics, such techniques are usually followed by a numeric solution, but they can also lead to an approximate analytic solution.

One of the major challenges of the perturbation techniques is to find a key parameter that reduces the problem to a simpler one when the value of this parameter is zero. As shown in “Appendix 1”, the convenient choice for such a parameter in our model is

The parameter \(\kappa \) displays some appealing economic interpretations directly related to the objectives of our paper. It encompasses the net pressure of human activity on the environment, that is, the pollution intensity \(\gamma \) of economic activity compared to the natural decay rate \(\delta _{P}\) of the pollution stock. It is weighted by the vulnerability of the economy, \(\eta \). Because (27) combines both the (objective) pressure of the economy on the environment (\(\gamma /\delta _{P})\) and the (subjective) pressure of the environmental quality on welfare \((\eta )\), the parameter \(\kappa \) will be interpreted it as an indicator of environmental harmfulness.

Using the perturbation technique, we can obtain the following approximate formulas for \(\bar{{K}}\) (see “Appendix 1” for the proof):Footnote 15

The optimal size of the economy is related to its harmfulness, as expressed by the \(\kappa \)-indicator. This dependence is weak when the environmental pressure is small (\(\kappa \)-indicator \(\ll \) 1), but it becomes stronger as the pressure increases \((\kappa > 1)\).Footnote 16

In the following sections, we will focus on the case (28) of a large \(\kappa \) because it represents the current world situation: the environmental self–cleaning capability \(\delta _{P}\) is negligible compared to the emission impact factor \(\gamma \) and the environmental vulnerability \(\eta \). This will be formally expressed as an assumption in the next section and empirically discussed in Sect. 5. As already mentioned, the decay rate for atmospheric greenhouse gases concentrations is extremely small. In addition, the current vulnerability to climate change turns out to be more important than it was expected a few years ago, notably, because of a faster pace of global warming and more local extreme events than predicted (hurricanes, droughts, floods).Footnote 17 Finally, current power generation and transportation systems are mainly based on fossil fuel technologies. Because a breakthrough carbon-free technology does not come out yet, our economies are bound to spend money on reducing their carbon dependence (i.e., abatement expenditures), which is also captured by the choice of (28).

Let us now introduce the possibility of alleviating the adverse impacts of climate change by investing in adaptation.

4 A Model with Abatement and Adaptation

In this section, we consider the original problem (1)–(6) and analyze how adaptation shapes the qualitative results obtained in Sect. 3. For tractability, let \(\delta _{K}=\delta _{D}=\delta \). The current-value Hamiltonian for the problem (1)–(6) becomes:

where the dual variables \(\lambda _{1},\lambda _{2},\lambda _{3},\lambda _{4}\), are associated with equalities (2)–(5), and \(\mu _{1}, \mu _{2},\mu _{3}\) reflect the irreversibility constraints. The first order conditions for \(I_{K}, I_{D}\) and \(C\) are:

which, in the case of interior solutions, lead to

The first order conditions for the state variables \(K, B, P\) and \(D\) are, respectively:

Excluding \(\lambda _{1},\lambda _{2}, \lambda _{3}\) and \(\lambda _{4}\) from (35)–(38) and using (2)–(5), we obtain the system

for the optimal interior solutions \(K, B, C, D,\) and \(P\).

Before proceeding further in our analysis, we need to specify the vulnerability function \(\eta (D)\). We will consider the following exponential function:

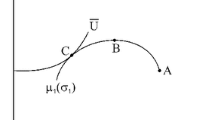

The function (44) is monotonically decreasing in adaptation efforts from a maximum value \((h(0)=\bar{{\eta }}>\underline{\eta })\) when there is no adaptation at all, to a minimum value \((h(\infty )=\underline{\eta }>0)\) when adaptation efforts tend to infinity. A graphical illustration of this function is provided in Fig. 1. Its first derivative \(\eta ^{\prime }(D)=-a(\bar{{\eta }}-\underline{\eta })e^{-aD}\) suggests defining the new parameter

as the technological potential for adaptation in the economy. In (45), the term \((\bar{{\eta }}-\underline{\eta })\) is the range of physical adaptation opportunities, i.e. the benefits in terms of vulnerability reduction associated with adaptation measures. Depending on the physical characteristics of the economy (altitude, importance of coastal areas, etc.), the range of adaptation measures may differ widely. As a consequence, the potential welfare gain between no adaptation and full adaptation can vary depending on the country, which is captured by the difference \((\bar{{\eta }}-\underline{\eta })\) in (45). The exponential form of (44) reflects the assumption of decreasing returns of the adaptation investment \(D\), which is natural in technological and economic applications. Indeed, first adaptation measures are supposed to be the most efficient ones in terms of vulnerability reduction. In other words, the parameter \(a\) represents the marginal efficiency of adaptation, which is higher for the first adaptation measures, and then decreases gradually with the amount of investment (see Fig. 1).

The dependence of the environmental vulnerability \(\eta \) on adaptation \(D.\) It approaches horizontal asymptote \(\eta =\underline{\eta }>0\) when \(D\) grows indefinitely. The dashed curve has a larger adaptation efficiency parameter \(a\) than the solid curve. The dotted curve has a smaller parameter \(a\) than the solid one

So, as in (Agrawala et al. 2011), our vulnerability function \(\eta (D)\) (48) reflects the following realistic qualitative features of adaptation investments: (i) no damages are reduced without adaptation; (iii) the infinite adaptation can reduce all damages (at \(\underline{\eta }=0\)); (ii) the more adaptation is used, the less effective it will be (decreasing marginal returns of adaptation). In particular, highly acclaimed recent adaptation-related IAM models (Agrawala et al. 2011) empirically estimate and use the adaptation efficiency function of the form \(1/(1+D)\). This function possesses the same above properties (i)–(iii).

4.1 Existence and Properties of the Steady State

To keep the analysis tractable we will restrict ourselves to the long-term dynamics (steady state) with no capital depreciation. The existence and uniqueness of a steady state in the economy with adaptation are stated in the following proposition.

Proposition 2

The economy given by Eqs. (39)–(43) possesses a unique steady state:

where the steady state components \(\bar{{K}},0<\bar{{K}}<(\alpha A/r)^{1/({1}_{-a})},\) and \(\bar{{D}}\ge 0\).

If \(\bar{{K}}\) is small, then optimal \(\bar{{D}}=0\). Otherwise, \(\bar{{K}}>0\) and \(\bar{{D}}>0\) are determined by the following system of two equations:

Proof

See “Appendix 2”. \(\square \)

As in Sect. 3, this proposition establishes the existence of a unique steady state (\(\bar{{K}},\bar{{C}}, \bar{{B}}, \bar{{D}}, \bar{{P}})\), but does not show the convergence of optimal trajectories to this state, which is out of the scope of this paper. One of the essential outcomes of Proposition 2 is that engaging in adaptation is not optimal when the capital level \(\bar{{K}}\) is small and lies within a certain interval [0, \(\bar{{K}}_c \)]. Then, the optimal capital level \(\bar{{K}}\)is determined by the same formula (28) as in the model without adaptation described by Proposition 1. The critical value \(\bar{{K}}_c \) is the solution of nonlinear Eq. (49) at \(\bar{{D}}=0\) and is determined in the next section. Proposition 2 provides the range for a positive level of adaptation in terms of the endogenous variable \(\bar{{K}}\) but says nothing about the optimal level of adaption when it is positive. This is the purpose of the following section.

4.2 On the Range of Positive Optimal Adaptation

To find out the formula for a positive optimal adaptation, we will consider the case where the value of the \(\kappa \)-indicator is high while the environmental vulnerability is minimal, i.e., when no adaptation measures are implemented (\(\eta (D)=\eta (0)=\bar{{\eta }})\). This translates into the following assumption.

Assumption A1

Empirical support to this assumption will be provided in Sect. 5. Under this assumption, the following proposition holds.

Proposition 3

Under Assumption A1 and the restriction

the system (49)–(50) has a unique solution \((\bar{{K}},\;\bar{{D}})\) with a positive optimal adaptation level given by

If condition (52) does not hold, then the optimal adaptation level \(\bar{{D}}\) is the corner (zero) solution and the optimal \(\bar{{K}}\) is determined from (49) at \(\bar{{D}}=0\) as:

Proof

See “Appendix 2”.

Remark

Substituting \(\bar{{K}}\) into formula (48), we obtain that, under Assumption A1, the optimal steady-state pollution \(\bar{{P}}\) does not increase when the productivity \(A\) (and the optimal steady-state output \(\bar{{Y}})\) increases. It is a clear result of the chosen specification of pollution motion law (5) that allows for the efficient pollution clean-up proportional to the output. Indeed, by (46), the optimal abatement \(\bar{{B}}\) increases in \(A\) in the same way as \(\bar{{Y}}\), so the optimal ratio \(\bar{{Y}}/\bar{{B}}\) in Eq. (5) does not depend on \(A\).

Equation (54) directly follows from (27) and (28) where \(\eta \) is replaced by \(\bar{{\eta }}\) reached in the absence of adaptation. It appears that the adaptation level is positive only under some restriction on the model parameters. This restriction suggests a balance between the technological potential for adaptation (\(a(\bar{{\eta }}-\underline{\eta }))\) and the global factor productivity \((A)\), on one side, and the environmental vulnerability \((\bar{{\eta }})\), the pollution intensity \((\gamma )\), and the natural pollution assimilation rate \((\delta _{P})\), on the other. When the adaptation opportunities or their marginal efficiency are too small, then (52) does not hold and the optimal adaptation level is zero. In other words, there exists a minimal level of the adaptation potential below which (52) does not hold. Let us introduce the critical value of the adaptation potential

Equation (55) comes from (52) with the equality sign instead of inequality. The following corollary provides the main properties of this critical value.

Corollary 1

(on the critical value of the adaptation potential). The critical adaptation potential \(\text{ M}_{{\eta }cr} =[a(\bar{{\eta }}-\underline{\eta })]_{cr}\) increases with the global productivity A and decreases with the discount rate \(\rho \), ceteris paribus. If \(\text{ M}_\eta >\text{ M}_{\eta cr}\), i.e., (52) holds, then the optimal adaptation level D increases with the global productivity and decreases with the discount factor.

The economic interpretation of this corollary runs as follows. If the economy is very productive, then, in addition to the optimal mitigation (abatement) efforts, it can support less efficient adaptation measures and, on the other side, the opportunity cost of adaptation (which is the future consumption) is less important compared to the environment quality in the utility function. Further, it turns out that the threshold value \(\text{ M}_{\eta cr}\) is smaller for smaller discount rates \(\rho \).

Two other properties of the threshold value (55) of adaptation efficiency also deserved to be mentioned. First, it is smaller for a smaller pollution intensity \(\gamma \).Footnote 18 Indeed, a small \(\gamma \) also means less efficient abatement activities, which opens opportunities for the early adaptation. Second, (55) is larger for smaller natural pollution depreciation factors \(\delta _{P}\) because the adaptation measures accumulate as a stock, while abatement measures last just one time period. Thus, the benefits of investing in long-lasting measures such as adaptation increase as the stock property of the pollutant increases (\(\delta _{P}\) is small). When the pollution does not accumulate itself, or when it self-cleans rapidly, then flow-abatement measures are more efficient. The optimal policy arbitrage between spending the resources of the economy in a stock (adaptation measures) or in a flow (abatement measures) depends on the nature of specific pollutant.

If restriction (52) does not hold, then the optimal adaptation level is zero and the optimal capital level has the unique solution given by (54). If (52) holds then, as established by Proposition 2, there exists a unique optimal capital level \(\bar{{K}}\) such that \(0<\bar{{K}}<(A/\rho )^{1/(1-{\alpha })}\), and the corresponding unique optimal adaptation level \(\bar{{D}}>0\) is given by Eqs. (49) and (50).

4.3 On the Optimal Policy Mix Between Adaptation and Mitigation

Solving nonlinear Eqs. (49)–(50) will enable us to find out more specific policy recommendations. Such an explicit approximate solution can be obtained under the following assumptions about the economic and adaptation efficiency, which are stricter than condition (51):

Assumption A2

Assumption B

Assumption A2 implies that even when the economy has reached its minimal level of vulnerability, the value of its \(\kappa \)-indicator of environmental pressure remains high enough. Assumption A2 is thus stricter than Assumption A1 because it includes the minimal possible vulnerability \(\underline{\eta }\) rather than the maximal vulnerability \(\bar{{\eta }}\) as in (51). This means that the economy cannot fully avoid the adverse effects of pollution, even when all the adaptation measures are implemented. In the literature it is acknowledged as “unavoidable damages”. Assumption B says that the ratio of the global productivity \(A\) and the adaptation efficiency \(a\) to the discount factor \(\rho \) must be larger than the value of the \(\underline{\kappa }\)-indicator of environmental harmfulness (which is already large by Assumption A2). Empirical support for Assumptions A2 and B is provided in Sect. 5. Under Assumptions A2 and B, the optimal steady state capital \(\bar{{K}}\) and adaptation \(\bar{{D}}\) levels are determined by the approximate formulas (see “Appendix 2” for the proof):

The only difference between the approximate formulas (58) and (54) is that (58) includes the vulnerability level \(\underline{\eta }\) (reached at large \(\bar{{D}}\gg 1\)), and that (54) has the vulnerability level \(\bar{{\eta }}\) (reached at \(\bar{{D}}=0\)). To demonstrate the benefits of adaptation and abatement management versus the case with no adaptation, let us denote the optimal steady state solutions (58), (46)–(48) as (\(\bar{{K}}_D ,\bar{{C}}_D , \bar{{B}}_D , \bar{{P}}_D )\) and the corresponding optimal steady state solutions (28), (22)–(24) in the model with no adaptation as \((\bar{{K}}_{ND} ,\bar{{C}}_{ND} , \bar{{B}}_{ND} ,\bar{{P}}_{ND} )\).

Corollary 2

(on cases with and without adaptation). Under Assumptions A2 and B, if adaptation is positive, then

-

(i)

the size of the economy is larger, \(\bar{{K}}_D >\bar{{K}}_{ND}\);

-

(ii)

the pollution level is higher, \(\bar{{P}}_D >\bar{{P}}_{ND} ,\)

-

(iii)

abatement efforts are relatively smaller, \((\bar{{B}}/\bar{{K}})_{D}<(\bar{{B}}/\bar{{K}})_{ND}\).

Proof

Dividing formulas (58) and (46)–(48) by corresponding (28), (22)–(24), we obtain

\(\square \)

Since adaptation enhances the flexibility of the economy and allows it to suffer less from a given level of pollution, a suitable level of adaptation is beneficial for the economy as a whole. As a consequence, the pollution abatement efforts are smaller and the pollution level is larger in the case of adaptation. Because the size of the economy is different (larger) with adaptation, an adequate comparison is to express abatement efforts per unit of capital, \(\bar{{B}}/\bar{{K}}\). As in recent adaptation-related IAM models (Agrawala et al. 2011), the abatement and adaptation seems to be substitutes, for positive adaptation reduces emission abatement efforts. Actually, the interaction between adaptation and abatement is not that straightforward because it also depends on the country’s characteristics. The optimal policy mix \(\bar{{D}}/\bar{{B}}\) is non-monotonically shaped with the global factor productivity and the optimal adaptation level may also be zero. These results are stated in the following corollary.

Corollary 3

(on the optimal adaptation policy). Under Assumptions A2 and B,

-

(i)

the optimal abatement effort \(\bar{{B}}/\bar{{K}}\)is independent of the productivity level A;

-

(ii)

the optimal policy mix \(\bar{{D}}/\bar{{B}}\) is zero when \(0<A<A_{c},(A_{c}>0)\), it is increasing in A until a critical value \(A_{cr }>A_{c}\), and then decreasing in A when \(A>A_{cr}\). The two critical values on global productivity are

Proof

See “Appendix 2”. \(\square \)

The first statement has been already demonstrated for the model without adaptation in Sect. 3. The statement (ii) states that, when the productivity of the economy is very weak (lower than a critical level \(A_{c})\), then it is optimal to focus on abatement and not to spend money on adaptation. The critical productivity level \(A_{c}\) depends negatively on the adaptation potential \(M_{\eta }\) and positively on the minimal vulnerability level \(\underline{\eta }\). Above the critical value \(A_{c}\), adaptation is always positive, but its relative contribution to the optimal policy mix (the adaptation/abatement ratio) first increases with global productivity, and then decreases. The turning point is \(A_{cr}\). If the productivity \(A\) is larger than \(A_{cr}\), then the optimal adaptation/abatement ratio is always smaller for a country with larger productivity. The rationale behind this result is that adaptation has a decreasing marginal efficiency \(\eta ^{\prime }(D)=-a(\bar{{\eta }}-\underline{\eta })e^{-aD}\), while abatement has the constant marginal efficiency \(1/\gamma \).

5 Numeric Simulation

One of the aims of this paper is to compare optimal solutions for countries with different characteristics. So, it is natural to check the empirical relevance of our main assumptions, which is the purpose of this section. Our model includes economic and environmental variables that are expressed in various units of measurement (UOM). A dimensional analysis of these units is, thus, a pre-requisite for a reliable model calibration. The dimensional analysis is rarely used in the environmental economics, but it is quite widespread in applied mathematicians, physics, and engineering for better understanding the relations among different quantities and checking the plausibility of derived equations (see, e.g., Kasprzak et al. 1990). In financial economics, the dimensional analysis is also common in interpreting various financial, economic, and accounting ratios. In this section we use the regular notation [\(x\)] for the UOM of a variable \(x\). We shall present the dimensional analysis first and then discuss parameter values and simulation outcomes.

5.1 Dimensional Analysis of the Model

The natural UOM for economic variables will be the billion US dollar, so that \({[B]=[C]=[D]=[K]=[Y]=10^{9}\$}\) (billion US dollars). The UOM for the pollution level will be \([P]=10^{12}\) tC (trillion tons of carbon).Footnote 19 It is trickier to choose the UOM for the model’s parameters. It is obvious that \(\alpha \) in (2) and \(\mu \) in (6) are dimensionless (without UOM), and that \([ \rho ]=(\text{ time})^{-1}\). Rewriting the pollution Eq. (5) as \((\gamma /\delta _{P})=(P+P^{\prime }/\delta _{P})B/Y\), one can see that \([ \delta _{P}]=(\text{ time})^{-1}\) and \([\gamma /\delta _{P}]=[P]=10^{12}\) tC. Hence, \([\gamma ]=10^{12}\) tC/time. The parameter \(\eta \) needs to be consistent with the objective function (6), which involves the logarithmic utility \(ln(C)\). Following the general rule of the dimensional analysis of transcendental functions such as logarithm, exponent, etc., we consider \(ln(C)\) as dimensionless (for the fixed UOM of the consumption \(C)\). It is natural from an economic viewpoint, because utility is based on household’s preferences. So, we have that \([\eta ]=[P]^{(-1-\mu )}=(10^{12} \text{ tC})^{(-1-\mu )}\). Finally, \([A]=[Y]/[K]^{\alpha }=(10^{9}\$)^{1-\alpha }\) by (2), and \([a]=(10^{9}\$)^{-1}\) by (44).

Now we are ready to check the empirical relevance of our model, specifically, of the Assumptions A1, A2 and B.

5.2 Estimation of Model Parameters and Regulation Ranges

To set up some plausible values for the model parameters \(\rho , \alpha , A,\delta _{P},\gamma , \mu ,\eta \), and \(a\), we use the most recent world data and parameters provided by Nordhaus.Footnote 20 World GDP in billion US dollars in 2005 was 61,100, and capital stock was 137,000. Using \(\alpha =0.66\), we get a global factor productivity of 24.9. Let us also assume that \(\rho =0.01\). The natural decay rate for carbon concentration in the atmosphere is very small (some authors even consider it to be zero). We shall take the decay rate per year \(\delta _{P}=0.0002\). The current carbon concentration is \([P]=808.9 (10^{12}\) tC) and the yearly rate of increase is \(P^{\prime }/P=~0.3\,\%\). Then, the pollution Eq. (5) in the form \((\gamma /\delta _{P})=P[1+P^{\prime }/(P/\delta _{P})]B/Y\) gives us the estimate \(\gamma /\delta _{P}=P(1+0.003/0.0002)B/Y=12942\cdot B/Y (10^{9}\) tC/year). By assuming that \(B/Y=0.15\), we end up with \(\gamma /\delta _{P} \approx 800\).

Let us now turn to the utility function. The parameter \(\mu \) represents the marginal disutility of pollution; we shall take a conservative value \(\mu =1\) and a small value \(\eta =0.003\) of the environmental vulnerability parameter \(\eta \). Then, the \(\kappa \)-indicator of environmental pressure (51) is 37.65, which is much larger than 1 and supports Assumption A1.

Finally, the adaptation efficiency function (45) in Sect. 4 includes two parameters: the adaptation range \(\bar{{\eta }}-\underline{\eta }\) and the marginal efficiency \(a\). For testing purposes, we shall assume that the maximal vulnerability (the one without adaptation) is the current one, so \(\bar{{\eta }}=0.003\), and the minimal vulnerability is twice as small, \(\underline{\eta }=\bar{{\eta }}/2\). Thus, the adaptation range is \(\bar{{\eta }}-\underline{\eta }=0.0015\). Let us further assume that \(a=0.001\).Footnote 21 Then, Assumption A2 holds approximately \((\underline{\kappa }=18.82)\) and Assumption B \(((Aa^{{1}{-\alpha }}/\rho )^{{1}/{\alpha }}=4,008\gg \underline{\kappa }=18.82)\) holds. This calibration shows that our model, although stylized, has a strong empirical relevance. It further shows that all three assumptions A1, A2, and B are supported by the data.

5.3 Estimation of the Validity of Approximate Solution

To analyze the errors and convergence of the analytic approximate solution (58)–(59) for different ranges of model parameters, we find the numeric solution of the system of two nonlinear Eqs. (49)–(50) using Excel simulations for various combinations of model parameters. The results are provided in Figs. 2 and 3 for different values of \(\rho \) and \(A\) (the rest of parameters are from the base scenario of Sect. 5.2). As follows from these figures, the analytic approximate solution is generally larger than the (“more accurate”) numeric solution. As shown in Fig. 2, the approximate solution converges to the numeric one when the discount rate \(\rho \) becomes smaller (than the parameter \(\underline{\kappa }\) becomes larger, from 3.8 at \(\rho =0.05\) up to 88 at \(\rho =0.002\)). By Fig. 3, when the efficiency \(A\) increases, the approximate solution stabilizes at some close levels to the numeric one but does not converge to it. This outcome can be expected because the parameter \(\underline{\kappa }\) does not depend on \(A\) and has the same value 18.82. Therefore, Assumption A2 holds only approximately.

5.4 Qualitative Dynamics of Optimal Adaptation and Abatement

Assumption B starts to fail when the efficiency \({A}\) decreases to small numbers (\(<1\)). As result, the error of our approximate solution increases (as Fig. 3 demonstrates), so, we use the numeric Excel solution to estimate the qualitative dynamics of the optimal policy mix for different parameters. Provided experiments demonstrate that, when the efficiency \({A}\) decreases from 40 to 5, the investment into adaptation increases rapidly from 1 % of capital \(K\) at \(A=40\) to 76 % of \(K\) at \(A=8\) and 260 % at \(A=5\). The last numbers are unreasonable. It happens because the investment into adaptation stock \(D\) is not a part of output \(Y\) during the steady-state analysis of model (1)–(6) at \(\delta =0\). We conclude that our modeling framework (with assumption \(\delta =0\)) is applicable for the range of \(A>8-10\).

Under the chosen set of model parameters, both productivity thresholds \(A_{c}=0.32\) and \(A_{cr}=0.45\) from Corollary 3 are smaller than one and are of the scope of model applicability. In the range \(A\ge 8\), adaptation is always positive. Corollary 3 and both approximate and numeric Excel solutions demonstrate a steady decrease of the optimal ratios \(D/B\) and \(D/K\) between adaptation, abatement, and capital when \({A}\) increases (see Fig. 4). Specifically, the optimal policy mix between adaptation and abatement \(D/B\) changes from 136 % at \(A=10\) to 3 % at \(A=40\). At the same time, the adaptation \(D\) in absolute units increases when \(A\) increases (but \(D\) and \(K\) increase faster).

The optimal abatement effort, expressed as the ratio \(B/K\), amounts to 0.60 in the absence of adaptation, and it drops to 0.31 with adaptation. The numerical simulation also provides an illustration for our Corollary 2. In particular, it shows that the increase in the pollution level due to the presence of adaptation is small (\(P_{D}/P_{ND}=1.02)\) as compared to increase in the size of the economy \((K_{D}/K_{ND}=6.3\; \text{ and}\; Y_{D}/Y_{ND}=3.3)\). All these ratios do not depend on \(A\) in our model (in both approximate analytic and numeric Excel solutions).

A sensitivity analysis can easily be carried out for any economically relevant range of parameter values. Thus, Fig. 5 illustrates that the optimal adaptation investment \(D\) slowly decreases while the ratios \(D/B\) and \(D/K\) increase when the discount rate \(\rho \) increases. For instance, when changing the discount rate \(\rho \) from 0.01 to 0.05, the optimal policy mix \(D/B\) between adaptation and abatement goes up from 0.11 to 0.24.

6 Conclusion

Combining economic-environmental growth models and comparative static analysis with perturbation techniques, we have obtained approximate analytical expressions for the optimal policy mix between emission abatement and environmental adaptation at the macroeconomic level. We have shown that the relevance of adaptation depends on the stage of development of the country. Specifically, the optimal policy mix between abatement and adaption investments (the ratio \(D/B)\) depends on the country’s economic potential. One of theoretic findings here is the inverted U-shape dependence of the optimal ratio \(D/B\) on the economy. If the economic efficiency is very weak (lower than a certain critical level), then the optimal policy may be no adaptation at all. The subsequent estimation of applicable parameter ranges and numeric simulation demonstrate that this critical efficiency level is very low and the optimal adaptation/abatement ratio \(D/K\) is smaller for countries with higher economic efficiency. The optimal investment ratio \(D/K\) between adaptive and productive capitals possesses similar qualitative picture because of Corollary 3. Millner and Dietz (2011) discuss this conjecture but conclude that it is not clear. They argue that the optimal \(D/K\) decreases in time, which cannot be captured in our steady state analysis.

Our modeling results are non-trivial and may conflict with some other studies. As we express in Sects. 4 and 5, these results are driven by the model assumptions and model parameters and are not generic. Buob and Stephan (2011) study the optimal mix of adaptation and mitigation in a two-stage dynamic game of several identical regions with cooperative and non-cooperative behavior. Their model economic is quite different from ours: it ignores production (the income is exogenously given to regions), its “environmental quality level” linearly depends on perfect substitutable adaptation and mitigation, and the cost of adaptation is a priori assumed to depend inversely on the mitigation effort. They arrive to a similar result that, while high income countries invest in both mitigation and adaptation, the low income countries should invest only in mitigation. In contrast, recent adaption-related IAMs conclude that there would be a greater emphasis on adaptation for developing world in earlier decades in response to the impacts of climatic changes (Agrawala et al. 2011). So, the modeling outcomes depend on modeling choice and further research coupled with fair scientific discussion is required to address this global issue.

Our theoretical model may be extended in several directions. Adding population growth will not change the structure of obtained results. Then, the endogenous variables \(I_{K}, I_{D}, C, K, D,B, P\) can be expressed per capita and the actual variables will grow. However, introducing (exogenous or endogenous) technological change and/or learning to the production function (3) would alter the results significantly and probably make them more optimistic. The authors are planning to exploit this issue following (Gradus and Smulders 1993; Bovenberg and Smulders 1996; Stokey 1998), who explored links between environmental quality and economic growth with pollution-augmenting technological change. An imperative avenue for further research is to consider a multiple-country setting. Our model holds for a world economy, or a closed economy. By ‘closed’ we mean not only the absence of external trade but also a closed interaction between the economy and the environment. Extending our model to an \(n\)-country model with strategic behaviors is highly desirable and is planned in our future work.

Notes

There exists a difference between mitigation and abatement: the former refers to a reduction in net emissions of greenhouse gases while the latter refers to a reduction in gross emissions. Most theoretical models integrate only emission abatement opportunities (i.e. no sinks). This will also be the case in this paper.

Two other options, carbon sequestration and geo-engineering, are also available but their potential contribution to solving the problem of global warming is less certain (see IPCC 2007).

For a synthesis of current works devoted to abatement scenarios, see the Energy Modeling Forum 22 in the special issue of Energy Economics, 31, 2009.

For a policy agenda update, see the UNFCCC web page devoted to adaptation: http://unfccc.int/adaptation.

During the UNFCCC Copenhagen conference, and at COP17 in Durban, one of the hottest policy questions was funding of adaptation in developing countries and the required financial transfers from industrialized ones.

Thus, \(P\) represents the concentration of greenhouse gases in the atmosphere. For simplification, we shall consider this as a proxy to temperature increase, the latter is the real (though also approximate) causal factor for climate change welfare losses. This approximation is acceptable as temperature increase depends on the concentration of greenhouse gases, with some lags. See the fourth report of IPCC (2007).

Smulders and Gradus (1996) also consider a more general polluting model as the flow \(Y^{\varpi }B^{-\lambda },\lambda >\varpi \).

We are thankful to the anonymous reviewer for this observation.

Two main determinants of differences in discounting are usually considered to be wealth (or income) and risk—wealth decreases the discount rate while risk increases it. There exist several empirical evidence supporting the idea that the rich are more patient than the poor, e.g., Lawrence (1991), Samwick (1998), Harrison et al. (2002), Carvalho (2010). For example, the results by Carvalho (2010) indicate that poor rural households in Mexico are very impatient. His benchmark estimates for the annual discount factor range from 0.08 to 0.70. Moreover, for almost all model specifications he rules out at a 1 % significance level any annual discount factor above 0.90. In the meantime, the estimates for much wealthier households in the United States range from 0.92 to 0.99 and concentrate around 0.95. Another empirical validation is provided by Fielding and Torres (2009). They estimate the strength of the relationship between several factors, including wealth, for 41 countries, taking income differences into account. Their results are robust across countries.

If we choose \(B\) as a control and \(C\) as a state variable, all qualitative results remain the same.

Stokey (1998) considers a CRRA utility of consumption rather than the logarithmic one.

Similar qualitative dynamics of economic and environmental parameters are common in the economic-environmental models available in the literature, even when a much more detailed description of pollution accumulation and assimilation is considered (see, e.g., Toman and Withagen 2000).

The three main greenhouse gases have the following lifetime in the atmosphere: carbon dioxide (\(\text{ CO}_{2})\): 100–150 years, methane (\(\text{ CH}_{4})\): 10 years, nitrous oxide (\(\text{ N}_{2}\)O): 100 years (IPCC 2007).

Here and thereafter, the notation \(f(\varepsilon )\cong g(\varepsilon )\) means that \(f (\varepsilon )= g(\varepsilon )[1+o(\varepsilon )]\) for some small parameter \(0<\varepsilon \ll \) and \(f(\varepsilon )\rightarrow g(\varepsilon )\) when \(\varepsilon \rightarrow 0\).

In practice, the notation \(\gg \) (“much greater than”) means that one value is larger than another by a factor of 100 or larger (by two or more orders of magnitude).

As IPCC (2007) states, extreme events are becoming more frequent and temperature increase is going faster than expected.

The optimal adaptation \(D\) is always positive at \(\gamma =0\) when the abatement \(B\) does not impact the pollution level.

Or Giga tons of carbon.

Nordhaus’ documentation is available on his web site: http://nordhaus.econ.yale.edu.

Let us recall that \([a]=(10^{9}\$)^{-1}\).

References

Adams RM, Mc Carl BA (2003) The effects of spatial scale of climate scenarios on economic assessments: an example from U.S. agriculture. Clim Change 60:131–148

Agrawala S, Bosello F, Carraro C, de Cian E, Lanzi E (2011) Adapting to climate change: costs, benefits, and modelling approaches. Int Rev Environ Resour Econ 5:245–284

Agrawala S, Fankhauser S (2008) Economic aspects of adaptation to climate change: costs. Benefits and Policy Instruments OECD, Paris

Araujo, Scheinkman J (1977) Smoothness, comparative statics and the turnpike property. Econometrica 45:601–620

Barro RJ, Sala-i-Martin X (1995) Economic Growth. McGraw Hill, NewYork

Bosello F, Carraro C, de Cian E (2010) Climate policy and the optimal balance between mitigation, adaptation and unavoided damage. Clim Change Econ 1(2):71–92

Bovenberg L, Smulders S (1996) Transitional impacts of environmental policy in an endogenous growth model. Int Econ Rev 37:861–893

Boucekkine R, Hritonenko N, Yatsenko Yu (2011) Scarcity, regulation and endogenous technical progress. J Math Econ 47(2):186–199

Bretschger L, Valente S (2011) Climate change and uneven development. Scand J Econ 113:825–845

Buob S, Stephan G (2011) To mitigate or to adapt: how to combat with global climate change. Eur J Political Econ 27:1–16

Byrne M (1997) Is growth a dirty word? Pollution, abatement and economic growth. J Dev Econ 54:261–284

Carvalho LS (2010) Poverty and time preference. RAND Working Paper Series WR-759

Chen J, Shieh J, Chang J, Lai C (2009) Growth, welfare and transitional dynamics in an endogenously growing economy with abatement labor. J Macroecon 31:423–437

Chimeli AB, Braden JB (2005) Total factor productivity and the environmental Kuznets curve. J Environ Econ Manag 49:366–380

Cosimano T (2008) Optimal experimentation and the perturbation method in the neighborhood of the augmented linear regulator problem. J Econ Dyn Control 32:1857–1894

De Bruin K, Dellink R, Tol R (2009) AD-DICE: an implementation of adaptation in the DICE model. Clim Change 95(1):63–81

Economides G, Philippopoulos A (2008) Growth enhancing policy is the means to sustain the environment. Rev Econ Dyn 11:207–219

EEA (2007) Climate change and water adaptation issues, European Environment Agency, Technical report no 2/2007

Elbasha EH, Roe TL (1996) On endogenous growth: the implications of environmental externalities. J Environ Econ Manag 31:240–268

Fankhauser S (1995) Protection versus retreat: the economic costs of sea-level rise. Environ Plan A 27:299–319

Fankhauser S (2009) The range of global estimates. In: Parry M, Arnell N, Berry P, Dodman D, Fankhauser S, Hope C, Kovats S, Nicholls R, Satterthwaite D, Tiffin R, Wheeler T (eds) Assessing the costs of adaptation to climate change. International Institute for Environmental and Development and Grantham Institute for Climate Change, London

Fielding D, Torres S (2009) Health, wealth, fertility, education and inequality. Rev Dev Econ 13(1):39–55

Gaspar J, Judd KL (1997) Solving large-scale rational expectation models. Macroecon Dyn 1:45–75

Gradus R, Smulders S (1993) The trade-off between environmental care and long-term growth-pollution in three prototype models. J Econ 58:25–51

Harrison GW, Lau I, Williams MB (2002) Estimating individual discount rates in Denmark: a field experiment. Am Econ Rev 92:1606–1617

Hritonenko N, Yatsenko Yu (1999) Mathematical modeling in economics, ecology and the environment. Kluwer Academic Publishers, Dordrecht/Boston/London

Hritonenko N, Yatsenko Yu (2005) Turnpike properties of optimal delay in integral dynamic models. J Opt Theory Appl 127:109–127

Hritonenko N, Yatsenko Y (2011) Energy substitutability and modernization of energy-consuming technologies. Energy Econ. doi:10.1016/j.eneco.2011.11.014

IPCC (2007) Climate Change 2007. Cambridge University Press, fourth assessment report of the Intergovernmental Panel on Climate Change

Jones LE, Manuelli RE (2001) Endogenous policy choice: the case of pollution and growth. Rev Econ Dyn 4:369–405

Judd KL, Guu S-M (1997) Asymptotic methods for aggregate growth models. J Econ Dyn Control 21:1025–1042

Kane S, Yohe G (2000) Societal adaptation to climate variability and change: an introduction. Clim Change 45:1–4

Kane S, Shogren JF (2000) Linking adaptation and mitigation in climate change policy. Clim Change 45:75–102

Kasprzak W, Lysik B, Rybaczuk M (1990) Dimensional analysis in the identification of mathematical models. World Scientific, Singapore

Khan M, Rashid S (1982) Approximate equilibria in markets with invisible commodities. J Econ Theory 28:82–101

Kirshen P, Ruth M, Anderson W (2007) Interdependencies of urban climate change impacts and adaptation strategies: a case study of Metropolitan Boston USA. Clim Change 86:105–122

Lawrence EC (1991) Poverty and the rate of time preference: evidence from panel data. J Polit Econ 99:54–75

Lecocq F, Shalizi S (2007) Balancing expenditures on mitigation of and adaptation to climate change, Policy research working paper 4299. World Bank, Washington, DC

Mansur ET, Mendelsohn R Morrison W (2005) A discrete-continuous choice model of climate change impacts on energy. Social Science Research Network, Yale School of Management working paper no ES-43, Yale University, New Haven

Millner, Dietz S (2011) Adaptation to climate change and economic growth in developing Countries. Grantham Research Institute on Climate Change and the Environment working paper no. 60, London School of Economics, London

Morrison W, Mendelsohn R (1999) The impact of global warning on US energy expenditures. In: Mendelsohn R, Neumann J (eds) The impact of climate change on the United States economy. Cambridge University Press, Cambridge, pp 209–236

Nicholls RJ, Tol RSJ (2006) Impacts and responses to sea-level rise: A global analysis of the SRES scenarios over the 21st Century. Philos Trans Ro Soc A 364:1073–1095

Prieur F, Bréchet T (2012) Can education be good for both growth and the environment? Macroeconomic Dynamics forthcoming

Reilly J, Tubiello F, McCarl B, Abler D, Darwin R, Flugie K, Holliger S, Izaurralde C, Jagtap S, Jones J, Mearns L, Ojima D, Paul E, Paustina K, Riha S, Rosenberg N, Rosenzweig C (2003) US agriculture and climate change: new results. Clim Change 57:43–69

Rosenzweig C, Parry ML (1994) Potential impact of climate change on world food supply. Nature 367:133–138

Sailor DJ, Pavlova AA (2003) Air conditioning market saturation and long term response of residential cooling energy demand to climate change. Energy 28:941–951

Samwick A (1998) Discount rate homogeneity and social security reform. J Dev Econ 57:117–146

Santos MS (1994) Smooth dynamics and computation in models of economic growth. J Econ Dyn Control 18:879–895

Shalizi S, Lecocq F (2009) To mitigate or to adapt; is that the question? Observations on an appropriate response to the climate change challenge to development strategies. World Bank Res Obs 2:1–27

Smit B, Burton I, Klein JT, Wandel J (2000) An anatomy of adaptation to climate change and variability. Clim Change 45(1):223–251

Smulders S, Gradus R (1996) Pollution abatement and long-term growth, European. J Polit Econ 12:505–532

Stokey N (1998) Are there limits to growth? Int Econ Rev 39:1–31

Toman MA, Withagen C (2000) Accumulative pollution, “clean technology”, and policy design. Resour Energy Econ 22:367–384

UNFCCC (2007) Climate change: impacts. vulnerabilities and adaptation in developing countries. United Nations Framework Convention on Climate Change, New York City

Vellinga N (1999) Multiplicative utility and the influence of environmental care on the short-term economic growth rate. Econ Model 16:307–330

Wagener F (2006) Skiba points for small discount rates. J Opt Theory Appl 128:261–277

World Bank (2009) The costs to developing countries of adapting to climate change: new methods and estimates. The global report of the Economics of Adaptation to Climate Change Study, Consultation Draft

Yohe GW, Schlesinger ME (1998) Sea-level change: The expected economic cost of protection or abandonment in the United States. Clim Change 38:447–472

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was partially written when Yuri Yatsenko was a visiting professor at the Center for Operations Research and Econometrics, Université catholique de Louvain. It has been finalized while Thierry Bréchet was a visiting research fellow at the Grantham Institute for Climate Change, Imperial College London, and a visiting professor at the European University at St Petersburg. Natali Hritonenko acknowledges the support of NSF-DMS-1009197. The authors are grateful to two anonymous reviewers, their colleagues Kirill Borissov, Raouf Boucekkine, Joerg Leib, Mirabelle Muuls, and participants of the Workshop “Uncertainty in Climate Prediction: Models, Methods and Decision Support” at the Isaac Newton Institute for Mathematical Sciences (University of Cambridge, UK, December 2010) for useful comments.

Appendices

Appendix 1: Analysis of Model (7)–(10)

1.1 Proof of Proposition 1

Let us analyze the possibility of a steady state

in the model (7)–(10). The substitution of (61) into (18)–(21) leads to

Using (62) we express the steady state \(\bar{{B}},\;\bar{{C}}\), and \(\bar{{P}}\) in the terms of \(\bar{{K}}\) as (22)–(24). Substituting these formulas into (63), we obtain the following equation for \(\bar{{K}}\):

To show that (64) has a unique solution, let us introduce the new unknown variable \(x=\frac{\delta +\rho }{\alpha A}\bar{{K}}^{1-\alpha }\) and use notation (27) for the parameter \(\kappa \), Then Eq. (64) takes the following dimensionless form:

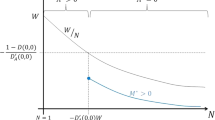

It is easy to see that Eq. (65) has a unique solution \(x^*,\,0<x^*<1\). Indeed, the left-hand side \(F(x)=\frac{(1-x)^{2+\mu }}{x}\) of (65) strictly decreases from \(\infty \) at \(x\)=0 to \(F(1)=0\) and intersects the horizontal line \(G(x)=\kappa >0\) at some point \(x^*\) (see Fig. 6). Then, Eq. (64), or (25) in the theorem, has a unique solution \(\bar{{K}},0<\bar{{K}}<({\alpha A/(\delta +\rho )})^{\frac{1}{1-\alpha }}\). \(\square \)

Proof of Formulas (28)–(29)

For the purposes of our future analysis, we need an approximate analytic solution of (64). Let us consider two situations when it is possible.

Case 1: the parameter \(\kappa \) is large, \(\kappa \gg 1\). Then, presenting (65) as \(\kappa x=(1-x)^{2+\mu }\), we see that \(0<x\ll 1\). Using the Taylor expansion of \((1-x)^{2+\mu }\), we obtain \(\kappa x=1-(\mu +2)x+o(x)\) or \(x=\frac{1}{\kappa +\mu +2}+o(x)=\frac{1}{\kappa }+o(x,\kappa ^{-1})\) or \(x\cong \frac{1}{\kappa }\), which justifies (28). The condition \(\kappa \gg 1\) can be replaced with \(\eta \gamma ^{\mu +1}\gg (\rho +\delta _P )\delta _P ^{\mu }\) because the parameter \(\alpha \) is fixed and \(\alpha <1\) (in real economies, \(\alpha \approx 0.8)\).

Case 2: the parameter \(\kappa \) is small, \(\kappa \ll 1\). Then, rewriting (65) as \(\frac{z^{2+\mu }}{1-z}=\kappa \) with respect to the unknown \(z=1-x\), we see that \(z\ll 1\). Using the Taylor expansion of \((1-z)^{-1}\), we obtain that \(z^{\mu +2}[1+O(z)]=\kappa \) or \(z\cong \kappa ^{1/(\mu +2)}\), which leads to (29). \(\square \)

Appendix 2: Analysis of Model (1)–(6) with Adaptation

1.1 Proof of Proposition 2

With no capital depreciation, \(\delta =0\), equalities (39)–(43) produce the following equations

for the steady state \(K\left( t \right)=\bar{{K}},C\left( t \right)=\bar{{C}},B\left( t \right)=\bar{{B}},P\left( t \right)=\bar{{P}},D\left( t \right)=\bar{{D}}\). The explicit formulas (46)–(48) are obtained from (66). Combining (46)–(48) and (67), we can write the following nonlinear equation

where \(\bar{{D}}\) should be found from the nonlinear Eq. (68). Combination of (44) and (69) gives (49).Then, differentiating (44) and using (68) and (48) we obtain (50).

Let us notice that \(\bar{{C}}\rightarrow 0\) by (47) and \(\bar{{P}}\rightarrow \gamma /\delta _P \) by (48) as \(\bar{{K}} \rightarrow 0\). Since \(-b\le \eta ^{\prime }(D)<0\) by (44), the Eq. (68) cannot have a solution \(\bar{{D}}>\)0 for small values of \(\bar{{K}}\). It means that the extremum condition (43) for the interior optimal \(\bar{{D}}>\)0 is not satisfied and the optimal \(\bar{{D}}\) is boundary, that is,\(\bar{{D}}=0\), for small \(\bar{{K}}\). Hence, there is no adaptation (\(\bar{{D}}=0\)) and \(\eta (D)=\eta (0)=\bar{{\eta }}\) in (69) for some small \(\bar{{K}}>0\). In this case, Eq. (69) has the unique positive solution \(\bar{{K}}\), which satisfies the approximate formulas (28)–(29) at \(\eta =\bar{{\eta }}\) [as the similar Eq. (25)]. \(\square \)

1.2 Proof of Proposition 3

Let us analyze the possibility whether Eq. (68) can have a solution \(\bar{{D}}>0\). Let (68) hold a priori. Then from equations (44), (46)–(48), and (68) we get

and, substituting (70) into (45),

As in Appendix 1, we use dimensionless variables to simplify the further analysis. Substituting (71) into (69) and using the unknown \(x=\frac{\rho }{\alpha A}\bar{{K}}^{1-\alpha }\) and the parameter

we obtain one dimensionless equation

with respect to the optimal value \(x^*,\; 0<x^*<1\). The left-hand function \(F(x)=\frac{(1-x)^{2+\mu }}{x}\) strictly decreases from \(\infty \) at \(x=0\) to \(F(1)=0\) and is the same as in Eq. (65). The right-hand function

strictly decreases from \(\infty \) at \(x=0\) to \(\underline{\kappa }\) at \(x=1\) (see Fig. 4). Moreover, \(G(x)\le \bar{{\kappa }}\) by inequality (71), where \(\bar{{\kappa }}=\frac{\bar{{\eta }}\gamma ^{1+\mu }}{(\delta _P +\rho )\delta _P ^{\mu }}\). Therefore, we are interested only in solutions \(x^*\) from the interval [\(x_{cr},1\)], where \(x_{cr}>0\) is such that \(G(x_{cr})=F(x_{cr})=\bar{{\kappa }}\). So, the value \(x_{cr}\) is the solution of the equation

The decreasing function \(y=F(x)\) represents the left-hand side of the nonlinear Eq. (73) and the decreasing function \({y=G(x)}\) represents its right-hand side (74). Their intersection point \({x^*}\) is the unique solution of the equation under condition (76). The dotted curve show the case when \(G(x)\) is close to \({\underline{\kappa }}\) near \({x^{*}}\) (then \({x^{*}}\) is given by the approximate formula (58)). The gray function \(y=G(x)\) demonstrates the situation when condition (76) fails

It is easy to see that the functions \(F(x)\) and \(G(x)\) intersect at \(x^*\ge x_{cr}\) and the Eq. (73) has a unique solution \(x_{cr}\le x^*<1\), if and only if \(G(x_{cr}) \le \bar{{\kappa }}\)(see Fig. 7) or

To obtain a priori condition for the solvability of Eq. (73) in the terms of given model parameters, let us consider the special case \(\bar{{\kappa }}\gg 1\) (Case 1 of Sect. 3). Then, the Eq. (75) has the approximate solution \(x_{cr} \approx \bar{{\kappa }}^{-1}\). Its substitution into (76) leads to \(a(\bar{{\kappa }}-\underline{\kappa })\ge \frac{\alpha \delta _P (\mu +1)\bar{{\kappa }}^{\frac{1}{1-\alpha }}}{(\delta _P +\rho )(\alpha A/\rho )^{\frac{1}{1-\alpha }}}\), and, after routine transformations, to

which gives the formula (52) in the terms of the original parameters \(\bar{{\eta }},A, \gamma \) and \(\delta _{P}\).

This concludes the proof.\(\square \)

1.3 Proof of formulas (58)–(59)

To find an approximate explicit formula for \(x\) and \(\bar{{K}}\), we assume that

that is, \(G(x^*)=\underline{\kappa }+o(\underline{\kappa })\) (see Fig. 7). Then, Eq. (73) becomes

which is Eq. (65). To obtain its approximate solution, let us assume additionally that \(\underline{\kappa }\gg 1\). Then, as shown in Sect. 3, Eq. (78) has the unique positive solution \(x^*\cong \underline{\kappa }^{-1}\), that leads to formula (58). Finally, substituting \(x^*\cong \underline{\kappa }^{-1}\) and (72) into the inequality (77) and combining the obtained result with \(\underline{\kappa }\gg 1\), we get the condition (56). The approximate formula (59) for \(\bar{{D}}\) follows from substituting (58) into (53) and the condition \(x^*\ll 1\).\(\square \)

1.4 Proof of Corollary 3

Using (46) and (58), we represent the ratio\(\bar{{B}}/\bar{{K}}\)as

that justify the first part of Corollary 3.

In order to prove part (ii) of Corollary 3, we analyze the ratio \(\bar{{D}}/\bar{{B}}\) obtained from (46), (58), and (59). First of all, (59) is valid if \(\left( {\frac{M_\eta }{\mu +1}} \right)^{1-\alpha }\frac{A(\rho +\delta _P )\alpha ^{\alpha }}{\underline{\eta }\rho \gamma ^{\alpha (\mu +1)}\delta _P ^{1-\alpha (\mu +1)}}>1\), that is,

The last relation is the first formula (60). If (79) is not satisfied, then \(\bar{{D}}=0\). Otherwise,

To investigate the monotonicity of the ratio \(\bar{{D}}/\bar{{B}}\), let us look at its first derivative in \(A\):

The ratio \(\bar{{D}}/\bar{{B}}\) increases if \(\left( {\bar{{D}}/\bar{{B}}} \right)_A^{\prime } >0\) or, in terms of (79), if

and decreases if \(A>A_{cr} \), which proves statement (ii) of Corollary 3.

(80) gives us the second formula of (60) and concludes the proof of Corollary 3.\(\square \)

Rights and permissions

About this article

Cite this article

Bréchet, T., Hritonenko, N. & Yatsenko, Y. Adaptation and Mitigation in Long-term Climate Policy. Environ Resource Econ 55, 217–243 (2013). https://doi.org/10.1007/s10640-012-9623-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-012-9623-x