Abstract

Climate change tends to negatively affect the power sector, inter alia, by causing cooling problems in power plants and impairing the water supply required for hydropower generation. In the future, when global warming is expected to increase, autonomous adaptation to climate change via international electricity markets inducing reallocations of power generation may not be sufficient to prevent supply disruptions anymore. Furthermore, the consequent changes of supply patterns and electricity prices might cause an undesirable redistribution of wealth both between individual power suppliers and between suppliers and consumers. This study ascertains changes in European power supply patterns and electricity prices caused by on-going global warming as well as the associated redistribution of wealth for different climate change scenarios. The focus of the analysis is on short-term effects. Our results confirm that autonomous adaptation in the power sector should be complemented by planned public adaptation in order to preserve energy security and to prevent undesired distributional effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Vulnerability of energy supply infrastructures to climate change is an important topic in the literature on the adaptation to climate change, since all (economic) activity requires the input of energy. Consequently, these infrastructures (generation as well as distribution) are critical for the functioning of economies, and the adaptation of the energy systems to climate change–in turn–is crucial for their maintenance.

In the recent past, disruptions of energy supply induced by extreme weather events have been observed recurrently. An obvious connection between weather extremes and energy supply is found in the hydropower sector. Water is an essential factor for hydropower generation and the “lack of sufficient water inflows may thus have sizeable consequences on the electricity supply in markets where hydropower is of some importance” (Haddad 2011: 168). Extreme events like droughts cut the supply of streaming water and therefore cause a shortage of the required factor ‘water’. Extreme weather patterns are supposed to occur more frequently in future due to ongoing climate change and they might also cause damage to energy supply infrastructuresFootnote 1 or peak electricity shortfalls.Footnote 2

Extreme weather patterns can also negatively affect the power generation in fossil fuel and nuclear power plants (see e.g., Koch and Vögele 2009; Kopytko and Perkins 2011; Mideksa and Kallbekken 2010; Flörke et al. 2011). Such plants require water for cooling processes,Footnote 3 and as Förster and Lilliestam (2010) show, power generation could be severely constrained by typical climate impacts such as increasing river temperatures and decreasing stream flow. According to the IPCC (2007), the frequency of periods characterized by water shortages and by high water temperatures will increase in Europe in future. Although all thermal power plants are negatively affected by high ambient temperatures, nuclear power and hydropower plants are especially vulnerable (Linnerud et al. 2011: 150).

Currently, nuclear power has a share of about 28 % in the electricity supply in the EU while the respective share of hydropower is about 12 % (EUROSTAT 2010). Therefore, disruptions in the use of both nuclear power and hydropower plants may have significant impacts on the electricity supply system. In our analysis of the potential impacts of ongoing climate change on power supply in Europe, we will focus on these two important subsectors of electricity generation.

Adaptation to negative climate-induced impacts on power supply might take place autonomously via the European electricity market. International trade of electricity renders possible that the loss of power generation capacity in one subsector or plant location of the European energy system can be replaced by an increase in power generation in another sector/location. Yet, due to ongoing climate change, such autonomous adaptation might not be sufficient in the future and advanced strategic policy intervention might be required to reduce vulnerabilities of the European energy system. Unfortunately, as Seo (2011: 825) stresses, “[a]daptation measures that should be publicly coordinated for the provision have not received a proper attention up until now.” Due to the long lifetime of infrastructures and the magnitude of investments in the electricity sector, public adaptation strategies should be developed at an early stage.

In order to demonstrate the potential necessity for public adaptation strategies in the European electricity sector, we conduct an analysis of the autonomous short-term adaptation of this sector, i.e. we investigate short-term and temporary changes in power generation and national import–export balances for electricity induced by extreme climatic conditions. Furthermore, we analyse distributional impacts of such autonomous adaptation, i.e. we also regard the redistribution of consumer and producer rents in order to identify the main losers and potential beneficiaries of climate change induced energy insecurity. Potentially undesired redistribution of wealth, either between consumers and producers or between individual countries, can be identified and thus public adaptation strategies to prevent such adverse developments could be launched in advance.

In detail we proceed as follows. In Section 2, we discuss different aspects of energy security which are relevant for our subsequent analysis of the consequences of future power supply disruptions and explain, from an ex-post perspective (i.e., expectations do not play a role in this analysis, but we consider the effects after a disruption took place), how disruptions in energy supply might affect rents of agents acting on the markets for energy. In Section 3, we present the methodology of and the scenarios regarded in our analysis. In Section 4, the results concerning changes in electricity generation and trade and the distributional effects are displayed and discussed. Section 5 puts these results in a broader context and draws conclusions.

2 Climate change and energy security: the price component

According to the IEA (2007: 12), energy insecurity “stems from the welfare impact of either the physical unavailability of energy, or prices that are not competitive or overly volatile.” In general, the change in availability of energy influences the price of energy via market interaction and vice versa, i.e. price and energy availability changes are interrelated. Via the price mechanism demand (supply) for energy is equalized to the supply (demand), except for extraordinary and rare cases where energy is indeed physically unavailable (e.g., due to embargos or wars). If we therefore focus on the normal cases, energy (in-)security is mostly an issue of price changes and not of complete unavailability of energy. As Helm (2002: 176) points out: “The complementarity of energy with the rest of the economy means that customers will typically want stable and predictable prices, in line with their investments in durables, housing and capital stock at a point in time”. Expressed in welfare terms, which is of major importance in the IEA definition of energy insecurity above, consumers of energy perceive energy insecurity because they suffer welfare losses which might be either due to 1) higher total energy expenses caused by rising energy prices, 2) sharp rises in energy prices (volatility) or–in some rare cases 3) unavailability of energy supply.

The consequences of energy insecurity on the rents of energy suppliers are more complex. Let us consider the change in their rents from an ex-post perspective and by focusing on price level aspects (ignoring the influence of price volatility itself on welfare) in the simplified illustration of Fig. 1. We assume that there is a temporary loss in energy supply by the amount L caused, e.g., by extreme-event-related problems in the generation process. Let us temporarily suppose that there are linear energy demand and supply functions for the regarded economy. Initially, i.e. before this supply side shock, the initial supply curve (thin line fading to the short bold line intersecting the axis of ordinates) and the demand curve intersect at A. The loss in energy supply by L (see the associated marginal supply costs in this supply range) causes a modification of the supply curve. Since the cheapest supply options still prevail (left hand side of the lost supply range), the new supply curve coincides with the old one in the respective supply range. Beyond this low-cost range, the new supply curve is located above the old one; it is depicted by the bold line passing through the new market equilibrium B.

The decline in consumer-rent, due to higher market prices for energy and the cutback in energy consumption, is depicted by the striped, chequered and dotted areas. The striped and chequered areas reflect the loss in consumer rents caused by the increase in the market price for energy. The dotted area stands for the loss resulting from the shrinking of the level of consumed energy.

In contrast, the suppliers obtain additional rents due to the increase in the market price for energy and these additional rents are depicted by the striped trapezium. The chequered triangle also depicts additional revenues due to higher energy prices, but these are immediately sapped by the higher supply cost: the loss L in supply has to be partly replaced by alternative supply at higher cost. This loss due to higher supply cost is depicted by the area between the new and the initial supply curve up to the new quantity (associated with B) of energy sold on the market. Finally, the grey shaded area depicts supplier rent losses due to the decline in energy sold on the market. The overall change of supplier rents depends on the slope of the supply function and the change in surpluses within the supply sector will differ, as those suppliers facing a decline in their supply (e.g., due to extreme weather events) tend to lose profits, while those suppliers replacing the respective supply loss tend to gain additional rents.

As consumers of energy always suffer from energy-insecurity related price effects, energy security with respect to certain forms of energy like oil might even be considered to be a global or international public good from their point of view. From an economic perspective it is irrelevant where a country’s consumers acquire their oil which is due to its fungibility. Yet, with respect to electricity supply, interrelations between regional shortages, price effects and redistribution of rents are different from those related to oil supply, amongst other things because electricity is not traded in global but in regional networks, i.e. there is a limited fungibility of electricity.

After this rather general description of changes in consumer and producer rents caused by supply side shocks, in the subsequent sections we more specifically consider rent redistributions in Europe that are caused by electricity supply shocks induced by climate-change related extreme weather events.

3 Methodology and scenarios

In our analysis, the impacts of global warming on European electricity supply are supposed to arise from changes in air and water temperatures as well as changes in water availability. We focus on electricity supply stemming from nuclear and hydropower plants for two reasons: 1) they are major electricity sources in Europe and 2) these sources revealed a high vulnerability to changes in air/water temperature and water availability in the past. In the case of nuclear power the vulnerability of each power plant to climate change can be assessed by using statistics of the IAEA (2004, 2008). In the case of hydropower there is a very strong correlation between water availability and electricity production. Therefore the vulnerability of hydropower plants to climate change can be assessed quite well. In contrast, for other power plants (e.g. gas and coal power plants) specific information about their vulnerability to climate change is usually not available.

In recent years, nuclear power plants in France, Germany and Spain faced cooling problems caused by water scarcity and increases in the temperature of river water. Water scarcity was also the reason why the electricity production of hydropower plants was reduced. To take the different characteristics of rivers regarding water availability into account we evaluate the situation at the different power plant sites using data of the IAEA (2008). The sites where power plants had cooling problems in recent years are identified as critical ones and analyzed in more detail.

In order to assess the impacts of climate change on nuclear power plants in Europe, we use an approach developed by Koch and Vögele (2009) (see also Rübbelke and Vögele 2011). Like in other thermal power plants, in nuclear power plants only a part of the energy input is converted to electricity. The rest of the energy is transformed to heat. That part of heat which is not used for district heating has to be disposed either to the air or by using cooling water. As shown in Koch and Vögele (2009) the demand for freshwater of a thermal power plant can be assessed by

with

- Q F :

-

cooling water demand [m3]

- KW :

-

installed capacity [kW]

- h :

-

operation hours [hours]

- 3.6:

-

factor to convert kWh to megajoules

- η total :

-

total efficiency [%]

- η elec :

-

electric efficiency [%]

- α:

-

share of waste heat not discharged by cooling water [%]

- β :

-

share of waste heat released into air [%]

- ω :

-

correction factor accounting for the effects of changes in air temperature and humidity within a year [−]

- ϑ :

-

water density [t/m3]

- c :

-

specific heat capacity of water [MJ/t K].

- AS :

-

permissible temperature increase of the cooling water [K]

- EZ :

-

densification factor [−]

Equation (1) describes the links between use of fuels, energy conversion, production of waste heat and demand for cooling water. Based on information on the electricity produced in a period (KW . h) and data on efficiencies, the amount of total waste heat can be calculated. In Eq. (1), the amount of waste heat that has to be removed by using cooling water results from total waste heat (KW . h . 3.6.(1-ηtotal)/ηelec) multiplied by different correction factors accounting for, e.g., the share of waste heat released into the air. The first part of the denominator in Eq. (1) describes how much energy is absorbed if one m3 of water is heated up by one degree centigrade and the second part (AS) of the denominator depicts the degrees centigrade the water is heated. The return water results from the waste heat divided by the heating up potential of the water which is calculated by multiplying heat capacity and permissible temperature increase. For the calculation of the freshwater demand it has to be taken into account that, if a cooling tower is used, additional water will be necessary to avoid an increase in salinity caused by water evaporation. By using EZ as densification factor we take this aspect into account.

If no cooling tower is used, the waste heat will be released into the receiving surface water. Using a cooling tower, the waste heat will be released mainly into the air. In the latter case, the demand for cooling water results from losses of water evaporated in the cooling tower. The amount of evaporated water depends on air temperature and humidity as well as on the amount of freshwater which is needed to prevent the build-up of minerals and sediments in the cooling cycle.

The impacts of cooling water shortages and limitations on the increase in water temperature can be assessed by transforming Eq. (1) to

Assuming limitations in the available amount of cooling water (\( Q_{{\max }}^F \)) and a lower permissible temperature increase of the cooling water (AS max), the capacity has to be reduced to

with

- KW max :

-

usable capacity [kW]

For analyzing different scenarios, we need information about installed power plant capacities, electricity exchange capacities, cost figures and the demand for electricity at a given point in time.

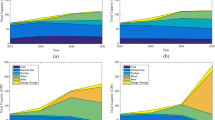

In our study we use figures provided by the Union of the Electricity Industry (EURELECTRIC) for the description of the power plant stock in 2030 (EURELECTRIC 2011). In the scenario of EURELECTRIC, the installed capacity for electricity generation in the EU-27 will increase in the next 20 years by more than 34 % whereby the share of nuclear power will decrease.

EURELECTRIC assumes that in countries like Bulgaria, Czech Republic, Romania and Switzerland new nuclear power plants will be put into operation while in Germany nuclear power will be phased out. A great number of new gas fired power plant will be built not only to satisfy increases in electricity demand but also as backup capacity for wind and PV power plants. Because of the increases in the use of wind power plants and the related demand for backup capacities, the rise in the installed capacity will be higher than the increase in the demand for electricity (see Fig. 2). Information on the share of unavailable capacity (capacity which is non-usable, not available because of outage, maintenance or because it is needed as system service reserve) as well as on electricity exchange constraints and on load figures are extracted from publications of the European Network of Transmission System Operators for Electricity (ENTSO-E 2010, 2011a, 2012).

In our study we group the power plants into the following categories: “hard coal”, “lignite”, “gas”, “oil”, “nuclear”, “conventional hydro”, “hydro–pumped and mix”, “wind”, “PV” and “other”. Beside information on the different types of power plants which will be available in different countries, EURELECTRIC also provides information which helps to assess the vintage structure of the power plant stock. This data was used to divide “hard coal”, “lignite”, “gas” and “oil” into 9 vintage subgroups. Using information of EURELECTRIC, we draw inferences on power plant efficiencies for each subgroup or category and calculate power plant specific production costs by taking expected changes in fuel prices into account. Data on fuel prices and variable costs are calculated based on data of the IEA (IEA 2011a, b).

In addition to the assumptions on electricity exchange capacities we take charges for the transnational electricity transfer into account. According to data of ENTSO-E, changes in the spot market prices for electricity usually do not induce significant changes in the overall electricity demand in the short-term (ENTSO-E 2011b). Taking this as well as our study’s focus on short term impacts into account, we assume a price elasticity of 0 for the demand of electricity. Data of the IAEA (2008) is used to assess the possibilities to postpone inspections and maintenance periods of nuclear power plants to periods in the summer when plants’ cooling systems tend to be at high risk. The employed climate change scenario corresponds to a projection of the Canadian Centre for Climate Modeling and Analysis (CCCMA) for the “A1” emission storyline of the IPCC. The projection is provided with a spatial resolution of a square kilometer which makes it possible to extract power plant site specific data (Govindasamy et al. 2003; WORLDCLIM 2010); see Figs. 3 and 4 for respective air temperature data and projections for Europe.

The data of the climate scenario are used to assess the impacts of higher evaporation rates (caused by changes in air temperature) on the water demand of power plants and to assess increases in the river water temperatures at individual power plant sites. The interaction between air and water temperatures is assessed by using the following equation:

where

- T s :

-

stream water temperature [°C]

- T α :

-

air temperature [°C]

- μ :

-

estimated minimum stream temperature [°C]

- α :

-

maximum stream temperature [°C]

- γ :

-

steepest slope of the function [°]

- β :

-

air temperature at the inflection point [°C]

(see Mohseni et al. 1998; Webb et al. 2003; Morrill et al. 2005; Pedersen and Sand-Jensen 2007; WWF 2009).

The parameters for the air/water temperature relationship are derived from the literature (Morrill et al. 2005; WWF 2009): The minimum stream temperature is assessed to be 0 °C, the maximum stream temperature 29 °C, the steepest slope 0.14 and the air temperature at the inflection point 16.5 °C. For each power plant site, specific data on air temperature is extracted from the climate model. The data are inserted in Eq. (4) in order to calculate the power plant site specific water temperatures. Due to a lack of data and in order to limit the complexity of our study, we assume that all nuclear power plants have the same efficiency. In addition, we assume a densification factor of 3 for all power plants with closed-circuit cooling system. These assumptions have been chosen in accordance with DOE/NETL (2007) and the World Nuclear Association (2010).

The “Reference” scenario describes the situation without climate change and in the scenario “Climate Change/Slight Water Scarcity” the situation with changes in air and water temperatures is considered. In accordance with Umweltbundesamt (2008), we assumed for this scenario a reduction in the runoff of rivers of up to 10 %. The impacts on the electricity supply of a more serious water scarcity are analyzed in the third scenario (“Climate Change/More Serious Water Scarcity”). Here we assumed a reduction in the runoff of rivers of up to 25 %.

With a load dispatch model formulated as a linear programming problem, we assess the cost-optimal use of the existing power plants for each country in Europe taking electricity import and export constraints into account.Footnote 4 The following equations show the basic structure of the approach used to assess the impact of changes in the availability of power plants on electricity production. The objective function Z of our model is depicted in the following cost minimization problem:

with

- n,m :

-

index for the country

- i :

-

index for power plant type

- c i :

-

operating cost of power plants of type i [Euro/MWh]

- s i,n :

-

average hourly utilization of power plants of type i in country n, whereas 0 ≤ s i,n ≤ 1 [h]

- X i,n :

-

installed capacity of power plants of type i in country n [MW]

- c l :

-

costs for transferring electricity from one country to another one [Euro/MWh]

- imp n,m :

-

net-imports of electricity of country n from country m [Euro/MWh]

In each country electricity supply has to meet electricity demand. Electricity can be supplied either by using domestic power plants or by importing electricity from a foreign country. The following equation depicts this constraint.

Regarding the imports we take prevailing transfer constraints into account:

with

- NTC n,m :

-

net transfer capacities.

Based on electricity prices calculated for each country and information on the variable costs of the power plants (including fuel costs), country-specific producer surpluses are identified. The producer surpluses are used as indicators for identifying those countries where the electricity suppliers will benefit or suffer from climate change.

4 Results

The results presented in the following are based on calculations for a peak load situation in summer. Therefore, the results reflect a specific extreme situation, as load and weather conditions vary significantly during the year.

Electricity price impacts discussed subsequently refer to a change in marginal cost of generation. In our approach we assume that a liberalized competitive electricity market prevails. At present, some electricity markets in Europe are still highly regulated and marginal cost pricing is only partly observed. The end user prices of electricity are usually significantly higher than marginal cost and depend on a lot of factors (e.g. fees, taxation). In addition, price diversification policy of utilities has to be taken into account. The prices calculated in this paper correspond to prices on spot markets. End user prices of electricity and changes in the prices for electricity at the spot market are not collinear. Therefore the changes calculated in this study should not be interpreted as changes in end user prices and should be used carefully as an indicator for effects on consumer rents.

In our calculations, in the “Climate Change/Slight Water Scarcity” scenario during the peak load time in summer the available capacity of nuclear power plants will be reduced by 5 GW and the available capacity of hydropower plants by 12 GW due to the assumed increases in air and water temperatures and decreases in water availability. In the scenario “Climate Change/More Serious Water Scarcity” the capacity which is unavailable will rise in total by another 18 GW. Figure 5 shows the regional distribution of additional unavailable capacity in the different scenarios. In our scenarios especially in France and in other Southern European countries the electricity sector will be affected by climate change.

Climate change will not only have impacts on electricity production levels but also on electricity prices which in turn implies changes in energy security (in the price component of the concept of energy security). Gas and coal fired power plants will be used to fill supply gaps. Because production costs of these power plants are higher than those of nuclear power and hydropower plants, electricity prices will increase. In the “Climate Change/Slight Water Scarcity”–scenario the prices for electricity rise in Belgium, France, Germany, Great Britain, Hungary, Portugal, Romania and Slovakia. The changes in prices are significantly higher in the climate change scenario with higher water scarcity. In this scenario the electricity prices in Switzerland, for example, rise by 80 % because expensive gas-fired power plants would be put into operation. In the reference scenario, only ‘cheap’ nuclear power and hydropower plants were employed in this country. With the need to raise the use of gas-fired power plants, the electricity prices in other European countries are also expected to increase significantly (Fig. 5).

In both climate change scenarios the use of domestic power plants is extended in countries like Belgium, Germany, Hungary, Italy and Spain. In other countries domestic electricity production decreases because of limitations in the use of nuclear power and hydropower plants caused by limitations in their availability and the induced increases in domestic electricity generation costs. These countries will tend to augment their imports of electricity or reduce their exports.

Examples of the impacts of climate change on suppliers’ rents are presented in Fig. 6, which displays the electricity supply of Switzerland and Germany. In the reference scenario, power plants with an overall capacity of 16 GW are in use in Switzerland and with an overall capacity of 78 GW in Germany. Assuming that electricity prices correspond to the marginal generation cost at the deployed power plant which exhibits the highest marginal cost, the electricity prices will reach 25 Euro/MWh in Switzerland and 47 Euro/MWh in Germany. In the “Climate Change/More Serious Water Scarcity” scenario fewer nuclear power and hydropower plants will be available. Therefore, the merit order curves calculated on basis of the short-term (marginal) costs of the different power plants (and therefore reflecting supply curves as those used in a simplified way in Fig. 1) move to the left and consequently the electricity prices increase. The augmentation of prices induces a lower demand of other countries for electricity produced in Switzerland and France, because other countries can generate additional electricity in a cheaper way. Germany will import less electricity from France and Switzerland and will expand the use of domestic power plants.

Figure 6 shows the changes in the suppliers’ rents in Switzerland and Germany. On the one hand, the increase in prices causes an augmentation of suppliers’ rents. On the other hand, the reduction in domestic supply diminishes suppliers’ rents. All in all suppliers’ rents in Switzerland will increase by 190 % and in Germany by 9 %.

Figure 7 gives an overview of the suppliers’ rents in individual European countries.Footnote 5 Electricity suppliers in Germany will belong to the beneficiaries of climate change while rents of suppliers, e.g. in Austria, Spain and the UK will decrease due to changes in the electricity supply curves and a decline in the capacity for electricity exports. In Switzerland the change in suppliers’ rents depends on the extent of water scarcity. They only decline in the climate change scenario with slight water scarcity, because in this scenario the Swiss production will be reduced whereas the electricity price will remain almost on the level of the reference scenario.

Again it has to be highlighted that the analysis focuses on a very short time span. As long as complex climate models with high spatial and temporal resolution are lacking, calculations of annual effects of climate change on the electricity system are more or less speculative.

5 Conclusions

Nuclear energy is frequently regarded as a vehicle to reduce CO2 emissions and thus to combat global warming. Yet, there is also a reverse interrelation: the nuclear power sector is negatively affected by climate change, since cooling processes of power plants are likely to be impaired by climate-change related extreme weather events like droughts and heat waves. Such incidences also interfere with hydropower generation. Consequently, while representing options for climate change mitigation, these two energy sources–which were in the focus of our analysis–both require adaptation to ongoing climate change.

Autonomous adaptation in the energy sector takes place via international electricity markets by balancing demand and supply when climate change causes local or regional supply disruptions. In order to assess climate change impacts on induced rent redistributions both between power suppliers and between suppliers and consumers, we considered such temporary autonomous adaptation in response to extreme weather patterns (heat waves and droughts) for different climate change scenarios.

We found that strong declines in electricity generation due to climate change tend to occur, e.g. in Austria, France and Switzerland. By modifications of European power generation patterns as well as by changes in import and export balances, local electricity shortages can be overcome. Yet, then electricity prices tend to rise significantly in some European countries, e.g. in Switzerland by more than 80 % and in France by more than 30 % in one of our scenarios. However, depending on the degree of global warming, the emerging effects might be even stronger.

While consumers throughout Europe will lose welfare due to the rise in electricity prices, some European suppliers might gain from the climate-change induced disruptions of hydropower and nuclear power. The change in suppliers’ rents depends on the severity of global warming as can be easily observed from the Swiss case, where a moderate climate change scenario implies a decline in respective rents, while stronger global warming tends to augment these rents. The latter is due to the fact that electricity prices will increase much more in the case of strong global warming, and the Swiss suppliers can therefore usurp additional rents, so-called windfall profits, at the expense of the consumers of electricity.

Hence, besides the possibility that solely autonomous adaptation to climate change might become insufficient for preventing power supply disruptions in the future,Footnote 6 there is a second reason for also executing advance strategic public policy intervention concerning adaptation as a complement to autonomous adaptation: the short-term, temporary reallocation of power generation might cause an undesired redistribution of wealth.

Such strategic public policy intervention concerning adaptation could either target the affected power sector itself or it may (also) address the upstream water supply sector. In the latter case, an improvement of the management of water supply is an option. Improvements in the power sector itself could be attained, e.g., by raising legal standards for power plants’ cooling systems.Footnote 7 These measures tend to have positive consequences for the hydropower and nuclear power supply and consequently may help preventing both power supply disruptions as well as potentially undesired welfare redistributions (which could be perceived to arise, e.g., if large rents are redistributed from consumers to individual suppliers whose supply cost has not or only slightly increased). To put it differently, both the price component as well as the physical availability component of ‘energy security’, which we discussed in Section 2, could be influenced in a positive way.

Another option to prevent power supply disruptions is the diversification of the sources of supply. The augmentation of the use of such power plants that do not require cooling systems (e.g., photovoltaic installations) could contribute to the mitigation of the adverse effects of climate change on the electricity supply system. However, the option of raising the use of expensive photovoltaic installations does not prevent those undesired rent redistributions between consumers and producers we discussed in this paper. Still, it might affect the redistribution of suppliers’ rents among nations.

Furthermore, in order to mitigate unfairness perception, those rents which decision-makers consider to be unfairly usurped by the suppliers at the expense of consumers could be (partly) taxed away. As Verbruggen (2008: 3249) stresses: “Dealing with the phenomenon of excessive profit making is of high political interest because citizens are but willing to contribute to the common good of climate protection when they perceive the burdens and advantages to be distributed fairly over all participants.” The respective tax revenues could be employed for public measures mitigating global warming or helping to adapt to it. In this manner, beneficiaries of (higher electricity prices induced by) climate change could take their share in financing climate policies. Yet, such a tax scheme should be designed with care, because it may adversely as well as positively affect suppliers’ incentive structures. On the one hand, it should not yield disincentives for suppliers to provide sufficient power reserve capacities. The electricity price is an indicator for scarcity and a high price provides incentives for raising investments in the supply infrastructure. On the other hand, a tax levied on rents acquired only due to temporary climate change effects provides disincentives for suppliers to usurp additional rents by manipulating prices via strategically reducing power supply in summer peak-load periods.

Notes

During the 2009-Brazilian blackout, 40 % of the National Interconnected System’s load was interrupted as a consequence of adverse weather patterns (Ordacgi Filho 2010).

Itteilag (2008) states that peak electricity demand in the US, typically for summertime air conditioning, is growing at 2.6 % per year and he discusses options to reduce electricity peaks and to prevent a peak electricity shortfall.

About 43 % of the EU’s water demand is used as cooling water by power authorities (EUREAU 2009: 84).

It should be taken into account that the electricity sector in Europe is not consisting of state-controlled monopolies anymore. Instead electricity supplying companies operate in a liberalised market. Sites for the generation of electricity may be located in another country than the domicile of the supplier owning this site. The attribution of rents to national states where the respective power generation takes place is therefore a simplifying procedure.

Electricity suppliers might also adapt by planned activities, e.g. by improving power plant efficiencies, but might themselves be incapable to reduce the risk of disruptions efficiently. The public sector might support private entities, e.g. by providing better information about climate risks. Individual adaptation is also constrained by institutional processes (Adger et al. 2005: 78).

The power sector may not conduct such adaptation of its own accord because, e.g. it may not hold sufficient information about climate risks and investment cost is high.

References

Adger WN, Arnell NW, Tompkins EL (2005) Successful adaptation to climate change across scales. Global Environ Chang 15(2):77–86

DOE/NETL (2007) Estimating freshwater needs to meet future thermoelectric generation requirements, Pittsburgh

ENTSO-E (2010) Ten-year network development plan 2010–2020, Brussels

ENTSO-E (2011a) Scenario outlook & adequacy forecasts https://www.entsoe.eu/resources/publications/entso-e/saf-soaf/. Accessed 02/03/2011

ENTSO-E (2011b) Consumption data https://www.entsoe.eu/resources/data-portal/consumption/. Accessed 02/03/2011

ENTSO-E (2012) Ten-year network development plan 2012 project for consultation, Brussels

EUREAU (2009) EUREAU statistics overview on water and wastewater in Europe 2008, Brussels

EURELECTRIC (2011) Power statistics, 2010, Union of the Electricity Industry–EURELECTRIC, Brussels

EUROSTAT (2010) Electricity statistics–provisional data for 2009. http://epp.eurostat.ec.europa.eu/portal/page/portal/product_details/publication?p_product_code=KS-QA-10-014

Flörke M, Teichert E, Bärlund I (2011) Future changes of freshwater needs in European power plants. Manag Environ Qual 22(1):89–104

Förster H, Lilliestam J (2010) Modelling thermoelectric power generation in view of climate change. Reg Environ Chang 11(1):211–212

Göransson L, Johnsson F (2009) Dispatch modeling of a regional power generation system–integrating wind power. Renew Energy 34(4):1040–1049

Govindasamy B, Duffy PB, Coquard J (2003) High-resolution simulations of global climate, part 2: effects of increased greenhouse cases. Clim Dyn 21(5–6):391–404

Haddad MS (2011) Capacity choice and water management in hydroelectricity systems. Energy Econ 33(2):168–177

Helm D (2002) Energy policy: security of supply, sustainability and competition. Energ Policy 30(3):173–184

IAEA (2004) Operating experience with nuclear power stations in Member States in 2003, Vienna

IAEA (2008) Operating experience with nuclear power stations in Member States in 2007, Vienna

IEA (2007) Energy security and climate policy–assessing interactions. OECD/IEA, Paris

IEA (2011a) World energy outlook 201,1 OECD/IEA, Paris

IEA (2011b) World energy outlook- investment costs. http://www.worldenergyoutlook.org/investments.asp, Accessed 03/02/2012

IPCC (2007) Climate change 2007: impacts, adaptation and vulnerability. Cambridge University Press, Cambridge

Itteilag RL (2008) Global cooling: electricity peak-shaving techniques to offset climate change. Energ Eng 105(4):66–80

Koch H, Vögele S (2009) Dynamic modeling of water demand, water availability and adaptation strategies for power plants to global change. Ecol Econ 68(7):2031–2039

Kopytko N, Perkins J (2011) Climate change, nuclear power, and the adaptation–mitigation dilemma. Energ Policy 39(1):318–333

Linnerud K, Mideksa T, Eskeland G (2011) The impact of climate change on nuclear power supply. Energy J 32(1):149–168

Mideksa T, Kallbekken S (2010) The impact of climate change on the electricity market: a review. Energ Policy 38(7):3579–3585

Mohseni O, Stefan HG, Erickson TR (1998) A nonlinear regression model for weekly stream temperatures. Water Resour Res 34(10):2685–2692

Morrill JC, Bales RC, Conklin MH (2005) Estimating stream temperature from air temperature: implications for future water quality. J Environ Eng 131(1):139–146

Ordacgi Filho JM (2010) Brazilian blackout 2009, PAC World, March 2010 Issue

Pedersen NL, Sand-Jensen K (2007) Temperature in Lowland Danish Streams: contemporary patterns, empirical models and future scenarios. Hydrol Processes 21(3):348–358

Rübbelke D, Vögele S (2011) Impacts of climate change on European critical infrastructures: the case of the power sector. Environ Sci Pol 14(1):53–63

Seo SN (2011) An analysis of public adaptation to climate change using agricultural water schemes in South America. Ecol Econ 70(4):825–834

Umweltbundesamt (2008) Impacts of climate change on water resources–adaption strategies for Europe, Dessau

Verbruggen A (2008) Windfalls and other profits. Energ Policy 36(9):3249–3251

Webb BW, Clack PD, Walling DE (2003) Water-air temperature relationships in a Devon river system and the role of flow. Hydrol Processes 17(15):3069–3084

World Nuclear Association (2010) Cooling power plants. http://www.world-nuclea.org/info/cooling_power_plants_inf121.html, August 2010

WORLDCLIM (2010) Global climate data. http://www.worldclim.org, June 2010

WWF (2009) Die mögliche Wirkung des Klimawandels auf Wassertemperaturen von Fliessgewässern, Frankfurt am Main

Yongping Y, Rongrong Z, Liqiang D, Masek O, Oakey J (2010) Study on multi-objective optimization of load dispatch including renewable energy and CCS technologies. Int J Energy Res 34(8):702–715

Acknowledgments

We thank Christian Egenhofer, two anonymous referees and the Deputy Editor of this journal, Richard Richels, for their very helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rübbelke, D., Vögele, S. Short-term distributional consequences of climate change impacts on the power sector: who gains and who loses?. Climatic Change 116, 191–206 (2013). https://doi.org/10.1007/s10584-012-0498-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-012-0498-1