Abstract

We examine whether and how CEO foreign experience affects firm’s green innovation. Using a sample of Chinese public companies and hand-collected CEO foreign experience data, we document a positive association between CEO foreign experience and corporate green innovation. Furthermore, consistent with the view that CEOs with foreign experience would play a more significant role when provided with more resources, we find that the positive relationship is more pronounced in less financially constrained firms, in state-owned enterprises, and in less competitive industries. Additional analyses indicate that enhanced environmental ethics and general competency are two potential mechanisms through which CEO foreign experience affects corporate green innovation. Finally, we find that CEO foreign experience is positively related to green innovation quality and internationalization. Collectively, these findings suggest that CEO foreign experience is a significant factor for corporate green innovation in emerging markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In this paper, we examine whether and how CEO foreign experience obtained in developed countries affects corporate green innovation in developing countries. There has been a surge in international migration of human capital, specifically managerial professionals (Harrington & Seabrooke, 2020). Many people from developing countries go aboard to pursue academic degrees and/or work for companies in developed countries and then return to their home countries (Cho & Lee, 2014; Kenney et al., 2013; Roberts & Beamish, 2017; Waddell & Fontenla, 2015).Footnote 1 Because the modern concepts of corporate social responsibility (CSR) and environmental protection are widely institutionalized in developed countries first, those societies, including their firms, tend to have better environmental ethics. According to imprinting theory in the management literature (Marquis & Tilcsik, 2013), these returnee CEOs, after the exposure to the social norms of developed countries, are more likely to internalize the high valuation of environmental protection and seek to improve their firms’ environmental ethics, which helps promote green innovation.Footnote 2 In addition, prior studies suggest that foreign experience enhances the general competencies of CEOs that are helpful in green innovation development (Caligiuri & Tarique, 2009; Carpenter et al., 2001; Dragoni et al., 2014; Leung et al., 2008; Suutari & Makela, 2007). Thus, we expect CEOs with foreign experience in developed countries are more likely to promote green innovation.

This research is important and timely because it has implications for many countries, especially developing countries. For the foreseeable future, global climate change and environmental deterioration will continue to be two great challenges facing human beings. The problem is more severe in emerging economies because the tremendous economic development in these economies during the last several decades was accompanied by huge environmental costs (To et al., 2019; Wang & Li, 1999). Green innovation is perhaps one of the most important strategies to achieve sustainable growth because it enables firms to create competitive advantage while protecting the environment (Berry & Rondinelli, 1998; Porter & van der Linde, 1995). The issue now is how to effectively improve and promote corporate green innovation in emerging economies. As more and more talents who have foreign experience choose to come back to their home countries, their impact on firms has become an area of academic interest. The literature shows that these returnee executives/directors differ in many ways from their local peers (Cao et al., 2019; Dai et al., 2018; Giannetti et al., 2015; Iliev & Roth, 2018; Wen et al., 2020). However, no study has examined the impact of returnee CEOs on firms’ green innovation. Thus, the findings of this study may generate rich policy implications.

As the largest emerging economy, China provides a good setting for us to study this issue for two reasons. First, economic growth in China over the last two decades has attracted significant returnee talent.Footnote 3 Many of these returnee managers now hold top executive positions and might play an important role in promoting green innovation. Second, the Chinese government has recognized that fast economic growth also caused serious environmental problems, such as air and water pollution, and enacted environmental policies encouraging green practices. Therefore, the setting should increase the likelihood of detecting the impact of CEOs with foreign experience on their firms’ green innovation.

Using a sample of Chinese public companies and hand-collected CEO foreign experience data, we document a positive association between CEO foreign experience and corporate green innovation. The result holds to a series of robustness tests. Consistent with the resource-based view, we find that the impact of CEO foreign experience on green innovation varies depending on the availability of resources and other supports. Specifically, we find that the positive relation is more pronounced in less financially constrained firms, in state-owned enterprises (SOEs), and in less competitive industries. Additional analyses show that enhanced environmental ethics and general competency are two mechanisms through which CEO foreign experience affects corporate green innovation. Finally, we show that green innovations for firms having CEOs with foreign experience are of higher quality and are more likely to be filed overseas.

Our study contributes to the literature in several ways. First, we add to the literature documenting the economic benefits of hiring talents with foreign experience. Several recent studies have examined the impacts of returnee managers on value creation (Giannetti et al., 2015), information transparency (Liao et al., 2016), and investment efficiency (Dai et al., 2018). We complement these studies by providing evidence that CEOs with foreign experience promote green innovation, which suggests that CEOs with foreign experience also perform better ethically. Second, we extend the determinants of green innovation literature. While most prior studies on the determinants of green innovation typically focus on institutional and firm-level characteristics (Amore & Bennedsen, 2016; Berrone et al., 2013; Hart, 1995; Lin et al., 2013), we show that foreign experience, a CEO-level characteristic, matters in firms’ green innovation.Footnote 4 Third, our findings have important implications for other emerging markets on how to effectively improve green innovation and economic sustainability. Our evidence suggests that CEOs with foreign experience from developed countries have better awareness of environmental protection and are more likely to promote green innovation in their firms. Thus, if a developing country wants to enhance its green innovation, one strategy might be to incentivize firms to actively attract and retain returnee talent.

The remainder of the paper is organized as follows. Section Literature Review and Hypothesis Development reviews the related literature and develops our hypotheses. We discuss sample selection, variable definitions, and research design in Sect. Method. Section Results reports main results and robustness tests. Section Moderating Effects reports results of moderating effects. Section Additional Tests explores potential mechanisms and presents additional tests. Section Summary and Discussion concludes and discusses policy implications.

Literature Review and Hypothesis Development

Related Literature

The Determinants of Green Innovation

This study is related to the literature on green innovation. Green innovation has important strategic value to the sustainable development of firms and society (Huang & Li, 2017; Xie et al., 2016). Given this importance, scholars began to investigate factors that influence firms’ green innovation. Some studies examine the “institutional level” factors and document the positive effects of environmental regulations, pressure from non-government organizations, and government support on green innovation (e.g., Berrone et al., 2013; Li et al., 2017, 2018). Other studies examine the impacts of firm characteristics (e.g., corporate governance in Amore & Bennedsen, 2016) and stakeholders (Kassinis & Vafeas, 2006; Peng & Lin, 2008; Qi et al., 2010) on green innovation. For example, it has been documented that pressure from different stakeholders such as consumers (Chen et al., 2012; Lin et al., 2013), suppliers (Hart, 1995; Horbach, 2008; Rehfeld et al., 2007; Van den Bergh, 2008), and competitors (Rennings & Rammer, 2011) are determinant factors for firms’ green innovation decisions.

Recently, a growing body of literature based on the upper echelons theory has examined how executives’ characteristics affect green innovation. Studies find that executives’ gender (He & Jiang, 2019), hubris (Arena et al., 2018), temporal cognition (Liao, 2016), and hometown identity (Ren et al., 2021) affect engagement in green innovation. These findings echo the central tenet of the upper echelons theory that executives' experiences, values, and personalities affect their vision, selective perception, interpretation, strategic choices, and ultimately outcomes (Hambrick & Mason, 1984). Even though studying and/or working abroad are important experiences that might shape CEO’s values and competencies, which can ultimately affect green innovation development, there remains a lack of research that provides direct empirical evidence of the relationship between a CEO’s foreign experience and its impact on firm’s green innovation.

The Impact of Executive/Director Foreign Experience

Recent years witnessed a surge in international migration of talents (Harrington & Seabrooke, 2020). Early literature calls the relocation of highly trained individuals from a developing nation to a developed nation as a “brain drain.” “Brain drain” was initially seen as a way for the U.S. to attract the best talents globally (Adams, 1968; Bhagwati & Hamada, 1974). However, in recent years, more and more talents return to their home countries from developed countries where they studied and worked (Cho & Lee, 2014; Kenney et al., 2013; Roberts & Beamish, 2017; Waddell & Fontenla, 2015). Noticing this phenomenon, academia began to examine the influence of such foreign experience on firms. For example, studies find that firms managed by boards or executives with foreign experience tend to converge to the governance characteristics and board practices of foreign firms (Iliev & Roth, 2018), are less likely to avoid taxes (Wen et al., 2020), are more efficient with investments (Dai et al., 2018), are less likely to have crash risk (Cao et al., 2019), and tend to have higher valuations (Giannetti et al., 2015). Among the reasons mentioned is that the foreign experience of executives or directors improves corporate governance and management practice by enhancing the expertise and international knowledge of managers.

Moreover, several studies find that foreign experience not only enhances executives’ international knowledge or management expertise, but also enhances general cognitive competencies including creativity, problem solving, leadership, and information processing (Caligiuri & Tarique, 2009; Carpenter et al., 2001; Dragoni et al., 2014; Leung et al., 2008; Suutari & Makela, 2007). These general competencies should be important and helpful in developing green innovation. Building on this evidence, we examine the impact of executive foreign experience on green innovation.

Hypothesis Development

Compared with traditional innovation, green innovation has both the traditional knowledge externalities in the R&D phase and the externalities of positive environmental impact in the adoption and diffusion phases (Oltra, 2008). Therefore, green innovation has the dual characteristics of innovation and environmental social responsibility. Inspired by these dual characteristics of green innovation, we develop our hypotheses along two lines: (1) how foreign experience affects a CEO’s value/attitude toward environmental social responsibility; and (2) how foreign experience influences the general competencies crucial to innovation. We then examine factors that moderate the relation between CEO foreign experience and green innovation from the perspective of resource-based view. The theoretical framework is shown in Fig. 1.

Main Hypothesis

Environmental Ethics and Green Innovation

According to imprinting theory, CEOs’ values and cognitions can be largely shaped by their foreign experience. According to Marquis and Tilcsik (2013), there are three essential features of imprinting theory: (1) the existence of a temporally restricted sensitive period characterized by high susceptibility to environmental influences; (2) the powerful impact of the environment during the sensitive period such that the focal entity reflects elements of the environment at that time; and (3) the persistence of the characteristics developed during the sensitive period, even in the face of subsequent environmental changes. Thus, studying or working abroad can be considered as a process of being “imprinted” because it represents an important transition period for an individual. As Higgins (2005, p. 338) notes, transitions of any kind are marked by anxiety that individuals want to reduce as they extend themselves into new roles and new identities. Such vulnerable times amplify the potential for imprinting. Given the anxiety and cognitive unfreezing experienced during transition periods, individuals become especially open to environmental stimuli (Schein, 1971). As a result, various “means of reducing such anxiety, including looking to peers, to mentors, to leaders, can provide powerful cues as to how to behave” (Higgins, 2005, p. 338). Consequently, individuals are particularly likely to adopt new behaviors, cognitive models, and norms at these times, causing their subsequent behaviors to bear the stamp of the environment they experienced during a sensitive period (Azoulay et al., 2017; Kacperczyk, 2009; Tilcsik, 2012).

Because the modern concepts of CSR, environmental protection, and green innovation are widely institutionalized in developed countries, returnee managers from these countries and regions are more likely to recognize social responsibility and environment protection as a norm due to the imprinting effects of studying or working abroad. For instance, returnee managers may have learned about the importance of CSR engagement and environment protection during their educational experiences (Huang, 2013; Matten & Moon, 2004). Alternatively, returnee managers may be influenced by an ethical organizational climate stemming from overseas work experiences (Hegarty & Sims, 1978; Posner & Schmidt, 1984; Wimbush & Shepard, 1994).Footnote 5 Consistent with imprinting theory, studies demonstrate that returnee managers tend to be influenced by their experiences in developed countries and become more ethical and socially responsible. For example, Wen and Song (2017) and Zhang et al. (2018) find some evidence that returnee managers/directors direct their firms to invest more in CSR activities. Therefore, CEOs with foreign experience may be more likely to promote green innovation because of their enhanced environmental ethics.

General Competency and Green Innovation

Enhanced competency from foreign experience may also facilitate green innovation. Compared with other green practices, green innovation is riskier, requires better knowledge and greater financial commitment, and usually can only accrue returns in the long term (Ahuja et al., 2008; Scherer, 1999). Moreover, unlike other green practices that are often off-the-shelf alternatives that can be obtained quickly in the open market (Berrone et al., 2010), green innovation is typically developed within the firm in a long process full of uncertainties. Thus, it requires the executives, especially the CEO, to be creative, determined, and capable of leading a diverse group of people from different functional backgrounds and coordinating internal and external resources. Moreover, due to the high uncertainty involved, it further requires the CEOs to be capable of processing complex and dynamic information.

Learnings theories suggest that foreign experiences help enhance the general competencies of CEOs and are often used to explain the outcomes of foreign experience (e.g., Caligiuri & Tarique, 2009; Fee et al., 2013; Li et al., 2013). Learning theories posit that individuals are motivated to learn when they experience cognitive dissonance between themselves and the environment (Bandura, 1977; Kolb, 1984; Piaget, 1955). Cognitive dissonance occurs when individuals encounter new, meaningful, critical, and/or contradictory behaviors (Bandura, 1977) and experiences (Kolb, 1984) that cannot be understood within the context of their existing knowledge or beliefs (Endicott et al., 2003). The cognitive dissonance motivates individuals to learn and adapt to the environment in order to diminish the dissonance (DeRue & Wellman, 2009). Foreign countries provide stimuli that create dissonance. The resulting dissonance stimulates learning that improves general competencies (Endicott et al., 2003; Suutari & Makela, 2007).

According to learning theories, learning occurs in two distinct processes: assimilation and accommodation (Fee et al., 2013; Piaget, 1955). Assimilation involves adding to existing schemas (knowledge and other memories). Accommodation involves developing new, sophisticated schemas and fundamental changes in cognitive structure. While the former results in greater domain-specific knowledge, the latter results in greater general cognitive competencies (Endicott et al., 2003). Regarding CEOs’ foreign experience, domain-specific knowledge includes knowledge of international markets, global networks, and intercultural communication, while general cognitive competencies include creativity, problem solving, leadership, and information processing that can be used in many different arenas (Endicott et al., 2003; Godart et al., 2015).Footnote 6

When abroad, individuals must develop new solutions as issues arise because falling back on proven strategies that are effective in more familiar territory is not feasible (Ricks et al., 1990), which will enhance problem-solving abilities. Living in a foreign country also affords the individual with a high level of autonomy that instills confidence in personal decisions as successful solutions are found (Suutari & Makela, 2007). Previous studies document several forms of general competencies increased through foreign experience, including creativity (Leung et al., 2008), managers’ end-state competencies and strategic thinking (Dragoni et al., 2014), leadership effectiveness (Caligiuri & Tarique, 2009), and processing complex and dynamic information (Carpenter et al., 2001). All of these CEO qualities are important and helpful for green innovation.Footnote 7 Based on the above discussion, we state our main hypothesis as follows:

H1

There is a positive association between CEOs’ foreign experience and their firms’ green innovation.

The Moderators

Prior literature suggests that the foreign experience of a CEO is a valuable, rare, inimitable, and non-substitutable resource and capability to the firm (Carpenter et al., 2001). Resource-based and capability-based theorizing suggests that even though a resource itself may be valuable, rare, and inimitable, it most likely results in competitive advantage only when bundled with complementary resources (Amit & Schoemaker, 1993; Barney, 1992; Teece et al., 1997), which suggests that the impact of CEO foreign experience on green innovation will vary depending on the availability of support and other resources.

Below, we first discuss firm-level factors that affect a firm’s resources and support for green innovation, such as financial conditions and the nature of ownership. Then we explore industry-level factors measured by the industry competition.

Financial Constraints

Capital is arguably the most important resource for companies developing green innovation and the lack of capital will hinder the impact of CEO foreign experience on green innovation. The development of green innovation requires significant R&D investment that requires capital (Brown et al., 2012; Hall & Lerner, 2010). R&D also often requires a large amount of continuous resource input, especially capital, to prevent innovation interruption (García-Quevedo et al., 2018; Hyytinen & Toivanen, 2005). Firms with financial constraints may find it difficult to provide the sufficient and continuous capital input required for green innovation. Moreover, green innovation usually involves high risk and years of work. Financially constrained firms may not be able to tolerate such risks and uncertainties and thus are less likely to invest in green innovations. Lastly, CEOs in financially constrained firms need to rely more on external resources due to limited internal resources. However, relative to their local counterparts, CEOs with foreign experience typically have limited connections with critical local constituents in their home countries (Qin, 2007; Xin & Pearce, 1996). Thus, CEOs with foreign experience may find it more difficult than their local peers to get external capital from local institutions, which further hinders green innovation.Footnote 8 Because of these reasons, we predict that financial constraints will negatively moderate the relation between CEO foreign experience and green innovation. We present the hypothesis as follows:

H2

The positive association between CEOs’ foreign experience and their firms’ green innovation is less pronounced for firms with financial constraints.

Nature of Ownership

The nature of ownership usually reflects the incentives and attitudes of the largest shareholder. For Chinese companies, it also reflects the resources available for CEOs to promote green innovation. Compared to non-state-owned enterprises (non-SOEs), state-owned enterprises (SOEs) usually have more resources. Moreover, the resources provided by SOEs are usually complementary to the resources processed by CEOs with foreign experience. The government remains a critical influence on strategic resource allocations in China. Firms closely linked with the government have institutional and resource advantages compared with those without these close links (Tan et al., 2007). For example, literature shows that SOEs more easily obtain financing and government subsides (Brandt & Li, 2003; Faccio, 2006). Thus, compared to non-SOEs, returnee managers in SOEs have more resources for green innovation, which would lead to more successful green innovations. Moreover, while institutional and resource advantages offered by the government are useful to all companies, they are particularly important to those led by returnees because returnees may lack local ties and local knowledge. For example, returnees may rely on government ties precisely to facilitate competition in China’s market (Solinger, 1991). According to the resource-based view, CEOs with foreign experience would play a more important role in green innovation when they are in an organization where they can get the support they need and the available resources are complementary to their own. Thus, we expect the relationship between CEO foreign experience and green innovation will be stronger for state-owned enterprises. We present the third hypothesis as follows:

H3

The positive association between CEOs’ foreign experience and their firms’ green innovation is more pronounced in state-owned enterprises.

Market Competition

Studies show that market competition has an impact on corporate environmental behavior, as it affects both the resources available to firms and the benefits that corporations might gain from investment (Zou et al., 2015). Competition threatens the profit and even the survival of firms, which in turn requires firms to devote more attention and resources to deal with inter-firm competition. Intense competition results in lower profit margins and thus a decreased ability for firms to make social investments (Bagnoli & Watts, 2003). Prior studies find that intense competition may cause firms to reduce the resources they devote to socially beneficial goals (e.g., Fernández-Kranz & Santaló, 2010). As a result, firms in more competitive industries are less able to pay attention to and provide resource for green innovation.

In industries where competition is not fierce, companies will have more resources for and pay more attention to green innovation. CEOs with foreign experience would play a more important role in green innovation when they are in an organization where they can get the support and resources they need. Thus, we expect the relationship between CEO foreign experience and green innovation will be stronger for less competitive industries. We present the fourth hypothesis as follows:

H4

The positive association between CEOs’ foreign experience and their firms’ green innovation is more pronounced in less competitive industries.

Method

Sample Selection and Data

Our initial sample includes all public manufacturing firms listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange from 2007 to 2018. We start in 2007 to make sure the accounting information is comparable across years because a new accounting standard became effective in 2007. Following prior literature, we apply several criteria to screen the sample. First, we delete observations that are under special treatment by stock exchanges (labeled as ST/*ST/PT).Footnote 9 Second, we eliminate observations without the necessary regression variables. Finally, firm-year observations with CEO turnovers are excluded. After these steps, our final sample consists of 12,653 firm-year observations.

CEO foreign experience data are hand-collected from their companies’ annual reports. The information is further verified and supplemented by additional information from public media, including Sina Financial and Baidu. Innovation data are downloaded from the website of the Chinese National Intellectual Property Administration. Other financial and corporate governance data are retrieved from the China Stock Market & Accounting Research (CSMAR) database.

Measuring Green Innovation

In this study, we use two measures to proxy for green innovation (Berrone et al., 2013; Li et al., 2017). The first is the number of green patents. Patent data are downloaded from the website of the Chinese National Intellectual Property Administration. For each patent, we apply two criteria to determine whether it is “green.” First, we screen the patent code according to the International Patent Classification (IPC) Green Inventory. If the patent code matches one of the IPC Green Inventory codes, it is treated as a green patent. Second, we apply textual analysis to the patent application title. If the patent title has at least one of the 25 keywords listed in Appendix A, it is considered a green patent. If a patent satisfies either of the two criteria above, we consider it a green patent.Footnote 10

The second is the number of green invention patents. For each patent approved, the National Intellectual Property Administration classifies it into one of the following three categories: “Invention Patent”, “Utility Model”, or “Appearance Design.”Footnote 11 Compared to “Utility Model” and “Appearance Design”, it typically requires more commitment and advanced skills of CEOs to develop “Invention Patent”. Thus, we use the number of green invention patents to ensure the robustness of our results.

To summarize, Green Patent equals the natural logarithm of one plus the number of patents that are “green.” Green Invention Patent equals the natural logarithm of one plus the number of patents that are “green” and belong to the “Invention Patent” category.

Measuring CEO Foreign Experience

CEO foreign experience (Foreign Experience) is a dummy variable equal to 1 if a Chinese CEO has studied or worked in a developed country or region and 0 otherwise.Footnote 12 Consistent with prior literature (e.g., Giannetti et al., 2015; Wen et al., 2020), we consider both studying and working experience as foreign experience. We require the foreign experience to be obtained in developed countries because one important channel through which that foreign experience influences green innovation is environmental ethics. We believe that foreign experience in developed countries is more likely to enhance environmental ethics than in developing countries. Moreover, because we are interested in the impact of foreign experience of returnee CEOs, we exclude foreign CEOs (CEOs who are foreigners, i.e., non-Chinese) from our analyses.Footnote 13

Measuring the Moderators

The two moderators representing the firm-level factors are financial constraint (Financial Constraint) and state-owned enterprises (SOE). Financial constraint is measured by the SA index developed in Hadlock and Pierce (2010).Footnote 14 A higher Financial constraint value suggests that the firm is more financially constrained. SOE is a dummy variable that equals 1 if a firm is state-owned and 0 otherwise.

The industry-level factor is the industry competition. We measure the competition faced by a firm using the Herfindahl index. Specially, Herfindahl Index equals the sum of the squared share of each company’s sales to total sales in the same industry. A higher Herfindahl Index value suggests less competition.

Empirical Model

We use the following model to test the effects of CEO foreign experience on green innovation.

Green Patent (Green Invention Patent) is the natural logarithm of one plus the number of green patents (green invention patents). Foreign Experience is a dummy variable equal to 1 if a Chinese CEO studied or worked in a developed country or region and 0 otherwise.

The control variables are taken from prior studies examining factors that affect green innovation (e.g., Amore & Bennedsen, 2016; Ba et al., 2013; Lee & Min, 2015). At the firm level, we control for firm characteristics including firm size (Firm Size), firm age (Firm Age), sales growth (Growth), profitability (ROA), leverage (Leverage), and capital intensity (Capital Intensity). We control for the impact of corporate governance by including variables reflecting board structure (e.g., Board Size and Board Independence) and ownership structure like the percentage of largest shareholder (Largest Shareholder) and the percentage of institutional shareholders (Institutional Ownership). Lastly, we include a variable that indicates firms’ commitment to green and sustainable development (Green Disclosure). At the CEO level, we control for CEO gender, age, and highest education level (CEO Gender, CEO Age, and CEO Education). Year and industry fixed effects are included as well. Standard errors are clustered at the CEO and year level. Detailed variable definitions are presented in Appendix B.

Results

Descriptive Statistics

Table 1 Panel A reports descriptive statistics. The mean value of Green Patent is 0.209, indicating that firms in our sample have, on average, 0.232 green patents every year.Footnote 15 For our testing variable, Foreign Experience, the mean suggests that, on average, 7.9% of firm-year observations have CEOs with foreign experience. In terms of control variables, the firms in our sample have an average firm size of 21.768 (translates to total assets of RMB 2.84 billion), logarithm of firm age of 2.687 (translates to firm age of 13.69 years), sales growth of 0.149, ROA of 0.016, leverage of 0.351, capital intensity of 12.466, board size of 2.135, board independence of 37.2%, largest shareholder ownership of 35.1%, institutional ownership of 33.2%, Green Disclosure of 18.7%. The statistics also indicate that 94.2% of the CEOs are male, and the average logarithm of CEO age is 3.883 (translates to CEO age of 48.57 years).

The Pearson correlation matrix is reported in Table 1 Panel B. The correlation between Foreign Experience and Green Patent is significantly positive at the 1% level as is the correlation between Foreign Experience and Green Invention Patent. Other correlations between regression variables are largely consistent with those reported in prior studies (e.g., Wen et al., 2020). For instance, Green Patent is positively correlated with Firm Size, Leverage, Growth, and Firm Age, and negatively correlated with ROA. To check for a potential multicollinearity problem, we calculate variance inflation factors (VIF) for all regression variables. The mean is 1.21, with maximum of 1.58. As these numbers are well below the threshold of 10, we believe that multicollinearity is not a severe problem for this study.

Table 1 Panel C reports univariate testing results. For firms with CEOs having foreign experience, the mean of Green Patent is 0.33, compared to 0.20 for firms with CEOs having no foreign experience. The difference is statistically significant at the 1% level. For Green Invention Patent, the pattern is similar. Thus, the correlation and univariate results provide preliminary support for our hypothesis. Note that the comparison suggests that the two groups of firms are different in many dimensions, suggesting the necessity of using a regression model to control other factors.

CEO Foreign Experience and Green Innovation

Table 2 reports the main results. The dependent variables are Green Patent and Green Invention Patent in columns 1 and 2, respectively. In column 1, the coefficient on Foreign Experience is positive and statistically significant at the 5% level (0.078, t = 2.48). It is also economically significant, indicating that a firm having a CEO with foreign experience has 0.081 more patents (after log transformation) than a similar firm with no such CEO. Such an increase in innovation translates to about a 34.9% increase (= 0.081/0.232) relative to the mean number of green patents. The coefficient on Foreign Experience in column 2 is significantly positive as well and the economic magnitude is at a similar level (44.8% = 0.043/0.096). These results support hypothesis H1 that CEO foreign experience is positively associated with firm green innovation.

The coefficients on control variables are largely consistent with those reported in prior studies (e.g., Lin et al., 2014; Xie et al., 2019). For example, green innovation is positively related to Firm Size and Leverage, but negatively related to Firm Age, Growth, and Capital Intensity.

Robustness Checks

Alternative Measure of Foreign Experience and Firm Fixed Effects Regression

The generalization of our findings hinges on the measures we use to capture foreign experience. For robustness checks, we first use an alternative measure of foreign experience and run the regression model again. Specifically, we exclude from our analyses the observations where the CEO foreign experience is less than 6 months because a relatively short foreign experience may not have much impact on CEOs. The results using this updated foreign experience variable as the independent variable are reported in Table 3 Panel A. For brevity, we do not report the coefficients on the control variables. The coefficients on Foreign Experiences in the two columns remain positive and significant at the 5% and 10% levels, respectively. Moreover, the magnitudes of coefficients are quite similar as those reported in Table 2.

Although we control for many characteristics that may affect firms’ green innovation, we may omit some unobservable firm-level characteristics. To mitigate this problem, we adopt a firm fixed effects regression model to control for time-invariant firm-level characteristics. The results of using this regression specification are reported in Table 3 Panel B. The coefficients on Foreign Experience in the two columns remain positive and significant at the 10% and 5% levels, respectively.Footnote 16

Propensity Score Matching (PSM) Sample

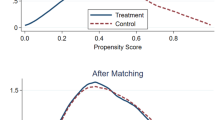

The univariate test reported in Table 1 Panel C reveals that firms having CEOs with foreign experience are different in many dimensions from firms without such CEOs. Although we control for these characteristics in our linear OLS model, the model is not adequate for controlling potential non-linear effects. To mitigate this concern, we re-run our model using a propensity score matched sample.

Specifically, we use a logit model to regress our indicator variable Foreign Experience on control variables in model (1) and estimate the propensity score that a firm has a CEO with foreign experience. Next, we match each treatment firm (Foreign Experience = 1) with a control firm (Foreign Experience = 0) with the closest propensity score. We require the caliper to be 0.01 and perform the matching without replacement. We successfully match 970 treatment observations. A covariate check between treatment and control observations (untabulated) suggests the matching is generally well balanced as the differences across them in almost all characteristics are insignificant. We then run the regression with the matched sample and report the results in Table 4. The coefficients on Foreign Experience remain positive and statistically significant at the 1 or 5% levels. Thus, the finding is unlikely to be driven by inadequate control of non-linearity.

Heckman Selection Model

While we document a positive association between CEO foreign experience and green innovation, our results may be subject to self-selection bias. That is, firms with certain characteristics might be more likely to hire CEOs with foreign experience and tend to have more green innovations. In other words, the hiring decision is not a random choice, which can introduce self-selection bias. To mitigate this potential issue, we apply the Heckman selection model.

In the first stage, we use a logit model to estimate firms’ likelihood of having CEOs with foreign experience. Following prior studies (e.g., Wen et al., 2020), we include the following variables: firm size (Firm Size), firm age (Firm Age), sales growth (Growth), profitability (ROA), leverage (Leverage), board size (Board Size), board independence (Board Independence), the largest shareholder’s ownership (Largest Shareholder), institutional shareholders’ ownership (Institutional Ownership), state-owned enterprises dummy (SOE), CEO/chairman duality dummy (Duality), CEO gender (CEO Gender), CEO age (CEO Age), the education level of CEO (CEO Education), and the industry-year mean percentage of firms having CEOs with foreign experience (Ind. Foreign Experience). We use the mean percentage of CEOs with foreign experience within a year and within the firm’s industry (excluding the firm itself) as the instrumental variable. We believe this variable satisfies the exogenous variable requirement of Heckman’s model. Since firms in the same industry are likely to have similar incentives for hiring CEOs with foreign experience, such an industry-level mean variable is likely to be positively associated with Foreign Experience, but is less likely to affect firms’ green innovation directly.

We report the results in Table 5. The first stage regression results are in Panel A (left). As expected, the coefficient on Ind. Foreign Experience is significantly positive at the 1% level. The Inverse Mills Ratio (IMR) generated in the first stage is then included in the second stage regression to control for self-selection bias. Panel B (right) reports the second stage results. The coefficients on Foreign Experience remain positive and statistically significant at the 5 or 10% levels, respectively. To summarize, these results suggest that our findings are unlikely due to self-selection bias.

The 2SLS Approach

Although we control for many factors documented in prior literature that affect green innovation and even use a firm fixed effects regression specification in the previous subsection, we may still suffer from the omission of unknown variables that might affect green innovation and foreign experience. To further address this concern, we use the instrumental variable (IV) approach.

We adopt two instrument variables and the 2SLS approach to adjust the potential bias. Starting in the late 1990s, provincial governments adopted policies to attract highly skilled emigrants and did so at different points in time (Zweig, 2006). The introduction of the provincial policies led to an exogenous change in the supply of potential CEOs with foreign experience for firms in those provinces (Giannetti et al., 2015). Thus, our first IV, Talent Policy, is a dummy variable that equals 1 if the province the company located adopts a policy encourage the return of highly skilled emigrants before 2000 and 0 otherwise. The introduction of the provincial policies should have a positive impact on Foreign Experience but is less likely to influence green innovation directly.

Our second IV, Christian, is a dummy variable that equals 1 if at least one college was founded by Christian missionaries in the province as of 1920 and 0 otherwise. The reasoning is that regional culture affects people’s way of thinking. These regions have been exposed to Western culture and religious culture earlier, so people in these provinces will be more accustomed to Western culture and are more likely to go abroad. After returning to China, they will choose to live in areas with a strong western cultural atmosphere; that is, return to work locally. However, because these data are 100 years older than our research sample, they will no longer be relevant to the company's current behavior.

The results of this analysis are reported in Table 6. Panel A (left) presents the first stage results. The coefficients on both Talent Policy and Christian are positive and significant at the 1% level, suggesting that the instruments we adopt are highly correlated with firms’ likelihood of having CEOs with foreign experience. The Durbin–Wu–Hausman test results show that the p-value is significant at the 1% level, indicating that there is indeed an endogeneity problem and the instrumental variable regression result is more accurate. We also test the validity of the instrumental variables. The p-value of Sargan’s test is 0.54 and 0.21 when the dependent variable is Green Patent and Green Invention Patent in the second stage, respectively. Therefore, the test fails to reject the joint exogeneity of the instruments. Hence, the instruments are valid.

Panel B of Table 6 (right) presents the results of the second stage regression. The coefficients on Foreign Experience are still positive and significant at the 5% level. Once again, the results suggest that our findings are unlikely due to an omitted variable problem.

Moderating Effects

In this subsection, we examine the impact of moderators on the relation between CEO foreign experience and green innovation. We first investigate how financial constraints might affect the association between CEO foreign experience and green innovation (H2). Columns 1 and 4 of Table 7 report the results. In column 1, using Green Patent as the dependent variable, we find a significantly negative coefficient on Foreign Experience *Financial Constraint (-0.122, t = − 1.76), suggesting the positive effect of CEO foreign experience is attenuated when firms are financially constrained. The result using Green Invention Patent as the dependent variable (column 4) is qualitatively similar (− 0.189, t = − 3.72). Overall, we find that financial constraints weaken the impact of CEO foreign experience on green innovation, consistent with H2.

We next examine how the nature of ownership affects the relation between CEO foreign experience and green innovation. The results of this analysis are reported in columns 2 and 5 of Table 7. Column 2 reports the results using Green Patent as the dependent variable. Consistent with H3, we find that the coefficient on Foreign Experience *SOE is positive and statistically significant at the 1% level (0.231, t = 3.63). Column 5 reports the results using Green Invention Patent as the dependent variable. The coefficient on Foreign Experience *SOE is significantly positive. Overall, the results suggest that the positive relationship between CEO foreign experience and green innovation is more pronounced in SOEs. H3 is supported.

Finally, we examine how the industry competition, Herfindahl Index, moderates the relationship between CEO foreign experience and green innovation (H4). We expect the relationship is more pronounced in less competitive industries. Columns 3 and 6 of Table 7 report the results using Green Patent and Green Invention Patent as the dependent variables, respectively. Consistent with H4, we find the coefficient on Foreign Experience*Herfindahl Index to be positive and statistically significant at the 1% level (1.056, t = 3.32). We find similar results using Green Invention Patent as the dependent variable (0.837, t = 3.13). These results indicate that the positive relationship is more pronounced in less competitive industries, which is consistent with H4.

Additional Tests

Potential Mechanisms

In this subsection, we explore two potential mechanisms through which CEO foreign experience positively affects corporate green innovation: enhanced environmental ethics and enhanced general competency.

Enhanced environmental ethics One mechanism we discussed in the hypothesis development section is “enhanced environmental ethics.” We expect that returnee managers are more likely to act in such a way that prioritizes environmental protection and thus enhance their firms’ green innovation. We test this mechanism by examining whether firms with returnee CEOs are more likely to get ISO 14001 certification. ISO 14001 as an Environmental Management System (EMS) is certified by a third party. Prior studies suggest that ISO 14001 certification is typically viewed as a strong signal of a firm’s commitment to environmental protection (Potoski & Prakash, 2005).

The results are reported in Table 8 Panel A. The dependent variable is ISO14001, which equals 1 if the firm obtains certification and 0 otherwise. We adopt a logit model to run the regression. Control variables are adopted from prior research (e.g., Lin et al., 2014). We include Performance (average sales per employee), No. of Employee (the number of employees), Firm Size, Firm Age, Asset Turnover (asset turnover ratio), Green Disclosure, and High Pollution (an indicator variable for industries with high pollution levels). Moreover, we include the CEO characteristics variables (CEO Gender, CEO Age, and CEO Education) as controls. Consistent with our prediction, we find that CEO foreign experience is positively associated with the likelihood of obtaining ISO 14001 certification. The coefficient on Foreign Experience is 0.157 and significant at 5% level, which indicates the marginal effect of Foreign Experience on ISO 14001 is 0.027.

Enhanced general competency Another mechanism discussed in the hypothesis development section is “enhanced general competency.” We expect foreign experience enhances CEO’s general competency. If that is the case, one might expect the positive effect of foreign experience on green innovation to be more pronounced in firms with more complex businesses. To test this prediction, we follow prior literature and use business segments as a proxy for business complexity (Hutton, 2005; Tong, 2011). If a firm has more than one segment, we code Complex as 1, meaning that the firm has diversified operations, and 0 otherwise. We partition the sample into subsamples based on Complex. Panel B of Table 8 reports the results. Consistent with our expectation, testing the coefficient difference suggests that the positive effect of CEO foreign experience is more pronounced in firms with diversified operations.

Characteristics of Green Innovation

While we examine green innovation by looking at the number of green patents and green invention patents, it is not clear whether the increase in the number is at the expense of quality. To investigate this possibility, we collect the number of citations for all patents and use it as a proxy for patent quality (e.g., Fang et al., 2014). We run the same regression model except for replacing the dependent variable with the number of citations.

Table 9 Panel A reports the results. The dependent variables are Green Patent Cites and Green Invention Patent Cites in columns 1 and 2, respectively. In both columns, the coefficients on Foreign Experience are positive and significant at the 10% level. This suggests not only that firms having CEOs with foreign experience have more green innovations, but also that their green innovations are of higher quality.

Finally, we examine whether CEO foreign experience affects innovation strategy; specifically, the internationalization of innovation. The innovation internationalization trend gained momentum in the last decade (Dachs & Pyka, 2010). We measure the extent of internationalization by checking if a green (invention) patent is also filed overseas (i.e., filed in other countries). Filing a green patent in other countries not only signals the quality of the patent (because the patent is recognized by other countries), but also reflects the firm’s strategic choice to explore overseas markets and to become internationally competitive. For a firm during a year, if at least one green (invention) patent is classified as international, we code the indicator variable I18NGP (I18NGIP) as 1 and 0 otherwise. We use a logit model and regress I18NGP (I18NGIP) on Foreign Experience and all control variables. The results are presented in Table 9 Panel B. The coefficients on Foreign Experience are positive and significant at the 10% and 5% levels, respectively. Because this test is only performed on the sample with green (invention) patents, the number of observations reduces to 1954 (977). The results suggest that for firms having CEOs with foreign experience, their green innovations are more likely to be filed in multiple nations and their firms intend to compete internationally.

Summary and Discussion

We examine the impact of CEO foreign experience on green innovation. Using a sample of Chinese public companies from 2007 to 2018 and hand-collected CEO foreign experience data, we find that CEO foreign experience is positively associated with the level of corporate green innovation, suggesting that CEOs with foreign experience are more likely to promote green innovation. Consistent with the resource-based view, we find that the positive association between CEO foreign experience and green innovation is more pronounced when CEOs with foreign experience are more likely to get support and resources. For example, we find the relationship is more pronounced in less financially constrained firms, in state-owned enterprises, and in less competitive industries.

The main result is robust to a battery of tests, including alternative measures of foreign experience, firm fixed effects regression specifications, PSM matching procedure, Heckman selection model, and instrumental variable approach. Moreover, our tests suggest that the potential mechanism behind our finding is that CEOs with foreign experience have greater awareness of environmental protection and better general competencies relative to their domestic peers. Additional tests also reveal that CEO foreign experience is associated with higher citations of green patents and a higher likelihood to register the green patents overseas.

Our paper contributes to the literature on the consequences of CEO foreign experience and to the literature on the determinants of green innovation. More importantly, our results have implications for firms and governments interested in promoting green innovations. When firms appoint CEOs with foreign experience as a member of their management teams, their green innovation activities tend to increase. Moreover, our findings suggest that the government should consistently implement policies to attract and retain talent with foreign experience because these returnee managers positively contribute to the green innovation of local firms. Our results are relevant to other emerging economies, especially those that want to promote green innovations to protect the environment and maintain sustainable economic growth.

There are several avenues for future research. First, with more complete CEO background information, one might examine whether the improvement in green innovation is more pronounced when CEOs have STEM (Science, Technology, Engineering, and Math) background. Currently, due to data limitation, the educational background is not complete for many CEOs. Second, it will be interesting to explore the potential spillover effect of CEO foreign experience. While the central and local governments may keep attracting oversea talents to return to China for business leadership positions through various policies and incentives, it is also critical to have domestic managers to understand the importance of green innovation toward sustainable economic growth. Thus, one can explore whether and how the practices by returnee CEOs are adopted by domestic CEOs. If yes, how fast is this process? If no, what are the factors that impede such adoption? Third, while we only focus on CEOs’ foreign experience in this paper, future research can explore the international background of top management team members, including CFO, COO, and CIO, and how the diversity of top management team’s international background affects the impact of foreign experience on green innovation.

Notes

Throughout the paper, we call this group of people “returnee managers” and use it interchangeably with “CEOs with foreign experience”.

The China Statistical Yearbook 2016 shows that the number of individuals who received foreign training and then returned to China increased from about 5000 in 1995 to over 400,000 in 2015.

While Post et al. (2011) find that boards with a higher proportion of Western European directors are more likely to implement environmental governance structures or processes, we differ from Post et al. (2011) in the following ways. First, Post et al. (2011) focus on board composition/diversity and look at 78 firms from the Fortune 1000 that have more Western European directors. Thus, their focus is on the monitoring/advisory role played by directors, which is related to corporate governance. We, on the other hand, focus on the role played by CEOs. Second, the concept of “foreign” in their paper is nationality. In contrast, we examine the effect of social interactions through learning/working in foreign countries/regions on executives with the same ethnicity who return to work in their home countries. Post et al. (2011) does not have this “returnee” concept. Third, in addition to the “environmental ethics” argument Post et al. (2011) explored, we also propose that foreign experience enhances the general competencies of CEOs. Finally, it is not clear where the companies in Post et al. (2011) are located. Therefore, it is possible that their findings are driven by the geographic location of firms. We do not have this issue because our sample includes Chinese public firms only.

Literature also finds that foreign experience may lead to an increased interest in world economic conditions, greater open-mindedness and tolerance of differences, increased empathy (Black & Duhon, 2006; Thomlison, 1991), and increased sense of responsibility and respect for others (Chieffo & Griffiths, 2004). Many of these personality outcomes may influence a CEO’s motivation toward pursuing socially responsible activities.

Domain-specific knowledge also includes better management practice and managerial skills if the returnee CEOs have chances to observe or experience them.

Foreign experience also increases the CEO’s global network (Edström & Galbraith, 1977; Suutari & Makela, 2007). As new and difficult demands during the innovation process arise, the CEO with foreign experience has a novel and valuable network on which to draw for advice and assistance. Moreover, Giannetti et al. (2015) suggest that hiring managers/directors who have gained either education or work experience while living abroad in developed countries help transmit knowledge about management practices and corporate governance to firms in emerging markets.

In footnote 7, we mentioned that foreign experience increases the CEO’s global network. Global networks would be very helpful when CEOs with foreign experience need advice or assistance. However, when it comes to capital, since most companies raise funds from financial institutions in their own country, CEOs with foreign experience are at a disadvantage compared to their local peers because they usually have limited connections with critical local constituents.

According to the securities laws in China, a company reporting losses in two consecutive fiscal years should be labeled with a special treatment sign (ST/*ST). These firms are subject to a daily price fluctuation limit of 5% and will be terminated from listing if they report losses in four consecutive years and report negative net assets in three consecutive years. Stocks labeled with PT are those that are suspended from trading.

While the IPC Green Inventory List is usually used to identify green innovations, we do find patents that are obviously “green”, but their IPC numbers are not in the IPC Green Inventory List. To be as comprehensive as possible, we use textual analysis method to further identify green innovations. Our results are robust, however, if we only rely on the IPC Green Inventory List to identify green innovations.

Invention patents refer to new technical solutions for products, methods, or improvements. A utility model refers to a new technical solution suitable for practical use proposed for the shape, structure, or combination of the product. Appearance design refers to a new design that is esthetically pleasing and suitable for industrial applications based on the overall or partial shape of the product, its combination, and the combination of color, shape, and group.

We follow Development Policy and Analysis Division (DPAD) and Social Affairs of the United Nations Secretariat (UN/DESA) to define the developed country or region.

There are 72 observations with foreign CEOs. It accounts for 0.57% of our sample.

SA index is calculated with the following equation: \(SA=-0.737*Size+0.043*{Size}^{2}-0.04*Age\), where size is the logarithm of total assets (in million RMB) and age is the firm age (in years). We calculate FC as the logarithm of the absolute value of SA.

Note the measure is the natural logarithm of one plus the number of green patents, so the raw number is 0.232 (= e0.209− 1).

We did another robustness check. We reduce the panel dataset to one observation per CEO by taking average of all the variables at the CEO level and re-run the regression. Consistent with our main finding, we find that the CEO foreign experience is positively related to green innovation measures.

References

Adams, W. (1968). The brain drain. New York: Macmilllan.

Ahuja, G., Lampert, C. M., & Tandon, V. (2008). Moving beyond Schumpeter: Management research on the determinants of technological innovation. Academy of Management Annals, 2(1), 1–98.

Amit, R., & Schoemaker, P. J. (1993). Strategic assets and organizational rent. Strategic Management Journal, 14(1), 33–46.

Amore, M. D., & Bennedsen, M. (2016). Corporate governance and green innovation. Journal of Environmental Economics and Management, 75, 54–72.

Arena, C., Michelon, G., & Trojanowski, G. (2018). Big egos can be green: A study of CEO hubris and environmental innovation. British Journal of Management, 29(2), 316–336.

Azoulay, P., Liu, C. C., & Stuart, T. E. (2017). Social influence given (partially) deliberate matching: Career imprints in the creation of academic entrepreneurs. American Journal of Sociology, 122(4), 1223–1271.

Ba, S., Lisic, L. L., Liu, Q., & Stallaert, J. (2013). Stock market reaction to green vehicle innovation. Production and Operations Management, 22(4), 976–990.

Bagnoli, M., & Watts, S. G. (2003). Selling to socially responsible consumers: Competition and the private provision of public goods. Journal of Economics & Management Strategy, 12(3), 419–445.

Bandura, A. (1977). Social learning theory. Prentice Hall.

Barney, J. (1992). Integrating organizational behaviour and strategy formulation research: A resource based analysis. Advances in Strategic Management, 8(1), 39–61.

Berrone, P., Cruz, C., Gomez-Mejia, L. R., & Larraza-Kintana, M. (2010). Socioemotional wealth and corporate responses to institutional pressures: Do family-controlled firms pollute less? Administrative Science Quarterly, 55(1), 82–113.

Berrone, P., Fosfuri, A., Gelabert, L., & Gomez-Mejia, L. R. (2013). Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strategic Management Journal, 34(8), 891–909.

Berry, M. A., & Rondinelli, D. A. (1998). Proactive corporate environmental management: A new industrial revolution. Academy of Management Executive, 12(2), 38–50.

Bhagwati, J., & Hamada, K. (1974). The brain drain, international integration of markets for professionals and unemployment: A theoretical analysis. Journal of Development Economics, 1(1), 19–42.

Black, H. T., & Duhon, D. L. (2006). Assessing the impact of business study abroad programs on cultural awareness and personal development. Journal of Education for Business, 81(3), 140–144.

Brandt, L., & Li, H. (2003). Bank discrimination in transition economies: Ideology, information, or incentives? Journal of Comparative Economics, 31(3), 387–413.

Brown, J. R., Martinsson, G., & Petersen, B. C. (2012). Do financing constraints matter for R&D? European Economic Review, 56(8), 1512–1529.

Caligiuri, P., & Tarique, I. (2009). Predicting effectiveness in global leadership activities. Journal of World Business, 44(3), 336–346.

Cao, F., Sun, J., & Yuan, R. (2019). Board directors with foreign experience and stock price crash risk: Evidence from China. Journal of Business Finance & Accounting, 46(9–10), 1144–1170.

Carpenter, M. A., Sanders, W. G., & Gregersen, H. B. (2001). Bundling human capital with organizational context: The impact of international assignment experience on multinational firm performance and CEO pay. Academy of Management Journal, 44(3), 493–511.

Chen, Y. S., Chang, C. H., & Wu, F. S. (2012). Origins of green innovations: The differences between proactive and reactive green innovations. Management Decision, 50(3), 368–398.

Chen, Y. S., Lai, S. B., & Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics, 67(4), 331–339.

Chieffo, L., & Griffiths, L. (2004). Large-scale assessment of student attitudes after a short-term study abroad program. Frontiers: the Interdisciplinary Journal of Study Abroad, 10(1), 165–177.

Cho, Y. S., & Lee, J. H. (2014). Returnee directors in Korean firms: Drivers and influence. Strategic Management Research, 17(1), 113–136.

Dachs, B., & Pyka, A. (2010). What drives the internationalisation of innovation? Evidence from European patent data. Economics of Innovation and New Technology, 19(1), 71–86.

Dai, Y., Kong, D., & Liu, S. (2018). Returnee talent and corporate investment: Evidence from China. European Accounting Review, 27(2), 313–337.

DeRue, D. S., & Wellman, N. (2009). Developing leaders via experience: The role of developmental challenge, learning orientation, and feedback availability. Journal of Applied Psychology, 94(4), 859.

Dragoni, L., Oh, I. S., Tesluk, P. E., Moore, O. A., VanKatwyk, P., & Hazucha, J. (2014). Developing leaders’ strategic thinking through global work experience: The moderating role of cultural distance. Journal of Applied Psychology, 99(5), 867–882.

Edström, A., & Galbraith, J. R. (1977). Transfer of managers as a coordination and control strategy in multinational organizations. Administrative Science Quarterly, 22, 248–263.

Endicott, L., Bock, T., & Narvaez, D. (2003). Moral reasoning, intercultural development, and multicultural experiences: Relations and cognitive underpinnings. International Journal of Intercultural Relations, 27(4), 403–419.

Faccio, M. (2006). Politically connected firms. The American Economic Review, 96, 369–386.

Fang, V. W., Tian, X., & Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? The Journal of Finance, 69(5), 2085–2125.

Fee, A., Gray, S. J., & Lu, S. (2013). Developing cognitive complexity from the expatriate experience: Evidence from a longitudinal field study. International Journal of Cross Cultural Management, 13(3), 299–318.

Fernández-Kranz, D., & Santaló, J. (2010). When necessity becomes a virtue: The effect of product market competition on corporate social responsibility. Journal of Economics & Management Strategy, 19(2), 453–487.

García-Quevedo, J., Segarra-Blasco, A., & Teruel, M. (2018). Financial constraints and the failure of innovation projects. Technological Forecasting and Social Change, 127, 127–140.

Giannetti, M., Liao, G., & Yu, X. (2015). The brain gain of corporate boards: Evidence from China. The Journal of Finance, 70(4), 1629–1682.

Godart, F. C., Maddux, W. W., Shipilov, A. V., & Galinsky, A. D. (2015). Fashion with a foreign flair: Professional experiences abroad facilitate the creative innovations of organizations. Academy of Management Journal, 58(1), 195–220.

Hadlock, C. J., & Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. The Review of Financial Studies, 23(5), 1909–1940.

Hall, B. H., & Lerner, J. (2010). The financing of R&D and innovation. Handbook of the Economics of Innovation. North Holland, 1, 609–639.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9, 193–206.

Harrington, B., & Seabrooke, L. (2020). Transnational professionals. Annual Review of Sociology, 46, 399.

Hart, S. L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20(4), 986–1014.

He, X., & Jiang, S. (2019). Does gender diversity matter for green innovation? Business Strategy and the Environment, 28(7), 1341–1356.

Hegarty, W. H., & Sims, H. P. (1978). Some determinants of unethical decision behavior: An experiment. Journal of Applied Psychology, 63(4), 451.

Higgins, M. C. (2005). Career imprints: Creating leaders across an industry (Vol. 16). Wiley.

Horbach, J. (2008). Determinants of environmental innovation—New evidence from German panel data sources. Research Policy, 37(1), 163–173.

Huang, J. W., & Li, Y. H. (2017). Green innovation and performance: The view of organizational capability and social reciprocity. Journal of Business Ethics, 145(2), 309–324.

Huang, S. K. (2013). The impact of CEO characteristics on corporate sustainable development. Corporate Social Responsibility and Environmental Management, 20(4), 234–244.

Hutton, A. P. (2005). Determinants of managerial earnings guidance prior to regulation fair disclosure and bias in analysts’ earnings forecasts. Contemporary Accounting Research, 22(4), 867–914.

Hyytinen, A., & Toivanen, O. (2005). Do financial constraints hold back innovation and growth? Evidence on the role of public policy. Research Policy, 34, 1385–1403.

Iliev, P., & Roth, L. (2018). Learning from directors’ foreign board experiences. Journal of Corporate Finance, 51, 1–19.

Kacperczyk, A. (2009). Inside or outside: The social mechanisms of entrepreneurships choices. Evidence from the mutual fund industry. University of Michigan.

Kassinis, G., & Vafeas, N. (2006). Stakeholder pressures and environmental performance. Academy of Management Journal, 49(1), 145–159.

Kenney, M., Breznitz, D., & Murphree, M. (2013). Coming back home after the sun rises: Returnee entrepreneurs and growth of hightech industries. Research Policy, 42(2), 391–407.

Kolb, D. A. (1984). Experiential learning: Experience as the source of learning and development (Vol. 1). Prentice Hall.

Lee, K. H., & Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. Journal of Cleaner Production, 108, 534–542.

Leung, A. K., Maddux, W. W., Galinsky, A. D., & Chiu, C. (2008). Multicultural experience enhances creativity: The when and how. American Psychologist, 63(3), 169–181.

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., & Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. Journal of Cleaner Production, 141, 41–49.

Li, M., Mobley, W. H., & Kelly, A. (2013). When do global leaders learn best to develop cultural intelligence? An investigation of the moderating role of experiential learning style. Academy of Management Learning & Education, 12(1), 32–50.

Li, Z., Liao, G., & Wang, Z. (2018). Green loan and subsidy for promoting clean production innovation. Journal of Cleaner Production, 187, 421–431.

Liao, G., Ma, M. S., & Yu, X. (2016). Transporting transparency: Director foreign experience and corporate information environment. Working Paper

Liao, Z. (2016). Temporal cognition, environmental innovation, and the competitive advantage of enterprises. Journal of Cleaner Production, 135, 1045–1053.

Lin, H., Zeng, S. X., Ma, H. Y., Qi, G. Y., & Tam, V. W. (2014). Can political capital drive corporate green innovation? Lessons from China. Journal of Cleaner Production, 64, 63–72.

Lin, R. J., Tan, K. H., & Geng, Y. (2013). Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. Journal of Cleaner Production, 40, 101–107.

Marquis, C., & Tilcsik, A. (2013). Imprinting: Toward a Multilevel Theory. Academy of Management Annals, 7(1), 195–245.

Matten, D., & Moon, J. (2004). Corporate social responsibility. Journal of Business Ethics, 54(4), 323–337.

Oltra, V. (2008). Environmental innovation and industrial dynamics: the contributions of evolutionary economics. Cahiers du GREThA, 28, 1–27.

Peng, Y. S., & Lin, S. S. (2008). Local responsiveness pressure, subsidiary resources, green management adoption and subsidiary’s performance: Evidence from Taiwanese manufactures. Journal of Business Ethics, 79(1–2), 199–212.

Piaget, J. (1955). The child’s construction of reality. Routledge.

Porter, M. E., & van der Linde, C. (1995). Green and competitive: Ending the stalemate. Harvard Business Review, 73(5), 120–134.

Posner, B. Z., & Schmidt, W. H. (1984). Values and the American manager: An update. California Management Review, 26(3), 202–216.

Post, C., Rahman, N., & Rubow, E. (2011). Green governance: Boards of directors’ composition and environmental corporate social responsibility. Business and Society, 50(1), 189–223.

Potoski, M., & Prakash, A. (2005). Green clubs and voluntary governance: ISO 14001 and firms’ regulatory compliance. American Journal of Political Science, 49(2), 235–248.

Qi, G. Y., Shen, L. Y., Zeng, S. X., & Jorge, O. J. (2010). The drivers for contractors’ green innovation: An industry perspective. Journal of Cleaner Production, 18(14), 1358–1365.

Qin, F. (2007). Transnational mobility, social embeddedness, and new institutions: The return of Chinese engineers from the US. Working Paper MIT.

Rehfeld, K. M., Rennings, K., & Ziegler, A. (2007). Integrated product policy and environmental product innovations: An empirical analysis. Ecological Economics, 61(1), 91–100.

Ren, S., Wang, Y., Hu, Y., & Yan, J. (2021). CEO hometown identity and firm green innovation. Business Strategy and the Environment, 30(2), 756–774.

Rennings, K. (2000). Redefining innovation: Eco-innovation research and the contribution from ecological economics. Ecological Economics, 32(2), 319–332.

Rennings, K., & Rammer, C. (2011). The impact of regulation-driven environmental innovation on innovation success and firm performance. Industry and Innovation, 18(03), 255–283.

Ricks, D. A., Toyne, B., & Martinez, Z. (1990). Recent developments in international management research. Journal of Management, 16(2), 219–253.

Roberts, M. J., & Beamish, P. W. (2017). The scaffolding activities of international returnee executives: A learning based perspective of global boundary spanning. Journal of Management Studies, 54(4), 511–539.

Schein, E. H. (1971). The individual, the organization, and the career: A conceptual scheme. The Journal of Applied Behavioral Science, 7(4), 401–426.

Scherer, F. (1999). New perspectives on economics growth and technological innovation. Brookings Institution Press.

Solinger, D. (1991). Urban reform and relational contracting in post-Mao China. In R. Baum (Ed.), Reform and reaction in Post-Mao China: The road to Tiananmen (pp. 104–123). Routledge.

Suutari, V., & Mäkelä, K. (2007). The career capital of managers with global careers. Journal of Managerial Psychology, 22(7), 628–648.

Tan, J., Li, S., & Xia, J. (2007). When ‘iron fist’, ‘visible hand’, and ‘invisible hand’ meet: Firm-level effects of varying institutional environments in the Chinese economy. Journal of Business Research, 60, 786–794.

Teece, D. J., Piasno, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 5(2), 171–180.

Thomlison, T. D. (1991). Effects of a study-abroad program on university students: Toward a predictive theory of intercultural contact. Paper presented at the annual intercultural and communication conference, 22 February 1991, Miami, FL.

Tilcsik, A. (2012). Remembrance of things past: Individual imprinting in organizations. Harvard University.

To, A. H., Ha, D. T. T., Nguyen, H. M., & Vo, D. H. (2019). The impact of foreign direct investment on environment degradation: Evidence from emerging markets in Asia. International Journal of Environmental Research and Public Health, 16(9), 1636.

Tong, Z. (2011). Firm diversification and the value of corporate cash holdings. Journal of Corporate Finance, 17(3), 741–758.

Van den Bergh, J. C. (2008). Environmental regulation of households: An empirical review of economic and psychological factors. Ecological Economics, 66(4), 559–574.

Waddell, B. J., & Fontenla, M. (2015). The Mexican Dream? The effect of return migrants on hometown development. The Social Science Journal, 52(3), 386–396.

Wang, X., & Li, J. (1999). Levying of eco-environmental compensation fees in China: An analysis and proposals. Environmental Management, 24(3), 353–358.

Wen, W., Cui, H., & Ke, Y. (2020). Directors with foreign experience and corporate tax avoidance. Journal of Corporate Finance, 62, 101624.

Wen, W., & Song, J. (2017). Can returnee managers promote CSR performance? Evidence from China. Frontiers of Business Research in China, 11(1), 12.

Wimbush, J. C., & Shepard, J. M. (1994). Toward an understanding of ethical climate: Its relationship to ethical behavior and supervisory influence. Journal of Business Ethics, 13(8), 637–647.

Xie, X., Huo, J., Qi, G., & Zhu, K. X. (2016). Green process innovation and financial performance in emerging economies: Moderating effects of absorptive capacity and green subsidies. IEEE Transactions on Engineering Management, 63(1), 1–12.

Xie, X., Zhu, Q., & Wang, R. (2019). Turning green subsidies into sustainability: How green process innovation improves firms’ green image. Business Strategy and the Environment, 28(7), 1416–1433.

Xin, K. R., & Pearce, J. L. (1996). Guanxi: Connections and substitutes for formal institutional support. Academy of Management Journal, 39, 1641–1658.

Zhang, J., Kong, D. M., & Wu, J. (2018). Doing good business by hiring directors with foreign experience. Journal of Business Ethics, 153, 859–876.

Zou, H. L., Zeng, S. X., Lin, H., & Xie, X. M. (2015). Top executives’ compensation, industrial competition, and corporate environmental performance: Evidence from China. Management Decision, 53(9), 2036–2059.

Zweig, D. (2006). Competing for talent: China’s strategies to reverse the brain drain. International Labor Review, 145, 65–89.

Acknowledgements

We would like to thank Shuili Du (Section Editor), three anonymous reviewers, Yong Du, Lijie Yao, Xiaojian Tang, Qingbo Yuan, Frank Zhang, Junsheng Zhang, and workshop participants at Soochow University and Tongji University for helpful comments. We appreciate the support by the Research Funds of National Natural Science Foundation of China (Grant No. 71772131), Research Funds of National Social Science Foundation of China (Grant No. 18BGL065). Any errors that remain are our own.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

The Classification of Green Patents

We use two criteria to determine whether a patent is a green patent. If a patent meets either of the following two criteria, we define it as a green patent.

-

(1)

We use the text analysis method to read the patent title. If the title of the patent declaration contains one or more of the twenty-five keywords listed below, the patent is classified as a green patent. The keywords are: garbage, environmental protection, waste water, waste gas, waste liquid, three wastes, sewage, waste, recovery, dust, odor, solid waste, pollution, flue gas, particles, sulfur dioxide, dust removal, desulfurization, new energy, smoke, dust emission, energy conservation, emission reduction, recycling, and green.

-

(2)

We then use the IPC Green Inventory list to identify green patents. The IPC Green Inventory is developed by the IPC Committee of Experts to facilitate searches for patent information related to Environmentally Sound Technologies (ESTs). As shown in Table 10 below, if the IPC classification number is C10L3/00, F02C3/28, H01M4/86, H01M8/00, H01M12/00, F03D, F24J1/00, F24J3/00, F24J3/06, B61, H02J, E04B1/62, E04B1/74, E04B1/88, E04B1/90, or F03G7/08, we classify the patent as a green patent.

Appendix B

See Table 11.

Rights and permissions

About this article

Cite this article

Quan, X., Ke, Y., Qian, Y. et al. CEO Foreign Experience and Green Innovation: Evidence from China. J Bus Ethics 182, 535–557 (2023). https://doi.org/10.1007/s10551-021-04977-z

Received: