Abstract

India is the emerging country with the world’s greatest social banking program, so Indian banks are required to finance the weaker sectors of society that are excluded from the traditional financial system (priority sectors), while also providing mainstream banking services to non-priority sectors. For social banks to promote the ethical–social management of their dual mission and to be successful in today’s business environment, they must be as efficient as possible in both dimensions of their banking activity. Whereas the efficiency of Indian banks in the financial dimension is well understood, to date there has been no research evaluating their double bottom-line of achieving social and financial goals. Our study applies an innovative Network Slack-Based DEA model to evaluate how efficient Indian public banks are when providing credit to priority and non-priority sectors. We also explore the main factors influencing bank efficiency. Results suggest that Indian public banks have performed relatively well in both activities, although social efficiency has been slightly greater than financial efficiency. Moreover, their commitment to priority sector lending has not come into conflict with the profit-seeking objectives of mainstream banking services. As regards determinants of social and financial efficiency, there are countervailing forces played by regional wealth, bank size, branch networks, and rural location. Our findings are therefore useful for stakeholders of Indian public banks as they indicate if these entities have adequately managed their double bottom-line, and hence if they are critical for poverty alleviation and development in India.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A recent study by Krause and Battenfeld (2017) defines “social banking” as banks that apply an ethical-social approach to their banking practice. Thus, social banks are hybrid forms of banking institutions that pursue a double social and financial bottom-line, placing greater emphasis on socially desired outcomes than on profit maximization (Cornée and Szafarz 2014). Since the success of these singular institutions does not depend solely on their financial performance but also on their social goals, they are required to effectively achieve both missions. However, these dual objectives are not necessarily aligned and are often contradictory. Social banks therefore face the challenge of how to handle the trade-offs between their social and for-profit domains (Ebrahim et al. 2014).

Social banking is an essential cog in the sustainable development of emerging economies, particularly in India where certain strategic sectors of the economy, namely agriculture and small-scale industries, and people with low income have been marginalized by the traditional banking system for many years. Consequently, Indian commercial banks have been called upon by the government to set up special schemes for deploying credit at preferential rates to vulnerable sections of society (Thorat et al. 2017). This is the origin of the priority sector lending whereby commercial banks provide inclusive financial services in India, the country with the more ambitious public program of social banking in the world.

Broadly speaking, priority sectors in the Indian economy are those which, though viable and creditworthy, may not receive timely and adequate credit in the absence of this special dispensation. Typically, credit takes the form of small loans for farmers and low-income population, and for micro and small enterprises, scheduled castes, and other weak sections of society. In contrast, non-priority sectors cover all the remaining sectors towards which financial institutions are always ready to lend, charging higher interest rates than in priority sectors to earn higher returns on loans. Indian commercial banks, therefore, are social banks with a harmonious blend of banking services in both priority and non-priority sectors, so they have become key actors in alleviating poverty and improving quality of life in India (Das and Kumbhakar 2012; Srinivasan and Thampy 2017).

At present, much attention is being given to the role of efficiency in social banks as a means of ensuring ethically and socially responsible management of their dual mission, and as a way of better understanding their ability to survive in an increasingly competitive environment (Mia and Chandran 2016; Smith 2018). As a result, Indian commercial banks must be as efficient as possible in both dimensions of their activity to manage their banking practice with ethical-social responsibility towards their main stakeholders, and at the same time to compete and thrive in the global marketplace. Unfortunately, there have been no studies on their efficiency considering their social and for-profit missions separately. So, Indian banks’ efficiency needs to be evaluated by determining both their global performance and their performance according to the double bottom-line approach.

This paper aims to give evidence on how efficiently Indian commercial banks use their resources to deploy credit in both priority (social efficiency) and non-priority (financial efficiency) sectors. In particular, it focuses exclusively on public banks for two reasons: (a) they dominate the financial market in India; (b) they account for the highest percentage of priority sector lending in total credit of the Indian commercial banks. More specifically, we use a homogeneous sample of 26 public banks over the period 2011–2014 to determine whether they were socially and financially efficient during the last years of the post-crisis period. To do so, we apply a Network Slack-Based DEA model with undesirable outputs (U-NSBM) to obtain both the overall and divisional efficiencies of each bank as a whole and of its banking activity in both priority and non-priority sectors separately. Then, robust regression analyses are performed to examine the main determinants of efficiency.

Our paper makes four significant contributions to the literature. First, it is relevant for the study of ethical-social aspects of commercial banks in India because it evaluates, for the first time, their social and financial efficiency separately according to a double bottom-line approach. Stakeholders of these institutions have different expectations and goals, so that while some of them focus on social banking services, others emphasize for-profit services. Specifically, those more interested in their social mission (users of the priority sector lending scheme, staff, government, etc.) are showing growing interest in measuring their social performance because information on financial performance alone gives an incomplete view of their global results. Second, our study also explores the determinants that influence social and financial efficiency because it is crucial for Indian banks to know the factors that may affect both types of efficiency in order to survive and thrive in today’s environment. Third, this study assesses efficiency in Indian public banks during the last years of the post-crisis period (2011–2014), providing new evidence for a banking segment and a stage that have not been analyzed before. Finally, from a methodological perspective, this study extends previous research on Indian banking efficiency by employing a U-NSBM model followed by robust regression-type models, which allow us to offer more robust and meaningful policy conclusions.

The Banking Sector in India

The Country Context: An Overview (2011–2014)

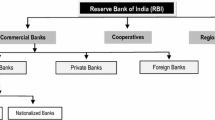

The banking sector in India consists of commercial banks, cooperatives, and regional rural banks. The former comprise three types of financial institutions: (a) public banks, including the State Bank of India and its associates, and nationalized banks; (b) private banks, which are the old and new private-sector banks; and (c) foreign banks. All banking operations in India are controlled by the Reserve Bank of India (RBI), a governing body that took over the responsibility of formally regulating the Indian banking system in 1935 and has played an important part in the development strategy of the government of India.

Indian commercial banks are a unique example of the combination of social and mainstream banking services, and they hold more than 95% of the total financial market. Table 1 summarizes information about the total number of entities, branches, and employees in the three types of Indian commercial banks over 2011–2014. It shows that the number of public banks remained constant throughout this period (26 entities), but their branches and employees increased by 23 and 10%, respectively. In fact, public banks had a substantially higher number of branches and workers than the other two types of Indian commercial banks. In contrast, the number of private and, especially, foreign banks grew. Private banks became stronger during this period, with increases in branches and employees of 77 and 57%, respectively. Although the number of foreign banks rose substantially, their branches only increased by 5% while their staff decreased by almost 11%.

Figure 1 shows the relative market share of each type of bank in the commercial banking sector in India over 2011–2014. Public banks on average held 76.3% of total loans compared to 19.2% in private banks and 4.5% in foreign banks. Specifically, regarding loans to priority sectors, public banks held 76.2% of total credit from all commercial banks, as opposed to 19.1% held by private banks and 4.7% by foreign banks. They represented 77.5% of total deposits in this sector in comparison with 18.4 and 4.1% in private and foreign banks, respectively, and 72.9% of total banking assets as opposed to 20.3% in private banks and 6.8% in foreign banks. So, public banks dominate the Indian financial sector and have the highest rate of participation in priority sector lending schemes. They have therefore made a larger contribution to social welfare in India than their private and foreign counterparts.

Source Compiled by authors with data from RBI (2012–2015)

Average market share in the Indian commercial banking sector (2011–2014).

The Evolution of the Social Banking Policy in India

India has been blessed with the largest social banking experiment in the world, and priority sector lending has continued to be an integral part of the public policy to support sustainable development and poverty alleviation (Burgess and Pande 2005; Das and Kumbhakar 2012). Specifically, the banking program launched by the Indian government with the aim of channeling financial resources towards greater social inclusion is divided into four main phases (Srinivasan and Thampy 2017): in the first one (Pre-nationalization: prior to 1969), the Indian financial market was not governed by clear policy requirements regarding equitable deployment of credit and was dominated by large private banks with very narrow spatial and sectorial coverage.

In the second phase (Nationalization and consolidation: 1969–1990), all commercial banks were called upon by the Indian government to allocate a portion of their lending to the weaker sectors of the economy as part of an overall nationalization policy. With a view to enabling banks to promote financial inclusion in priority sectors and rural areas, reforms in the banking sector started with the nationalization of 14 major private banks in 1969 and six additional banks in 1980. As a result, public banks gained an overwhelmingly dominant position in the Indian banking system. This nationalization and consolidation process brought many advantages for the economy of the country, although in fact it ending up lowering the efficiency of Indian commercial banks.

In the third phase (Banking sector reforms and partial liberalization: 1991–2004), the Indian government launched a series of financial reforms following a policy of liberalization to create a more competitive financial system. These reforms were based on the recommendations of the Narasimhan Committee in 1991 and 1998. The first phase of reforms focused on enhancing bank efficiency and profitability, and the second one on aligning Indian banking standards with internationally recognized best practices. During this period, the entry of private and foreign banks was liberalized with a view to enhancing efficiency in the banking sector.

Finally, in the last phase (Increased liberalization: 2005-onwards), since the mid-2000s, several government committees have pointed out relevant problems in the priority sector lending of Indian banks (i.e., political intervention, low profitability), recommending its alignment with the national priorities for greater liberalization of the sector. However, these suggestions have not been implemented by the Indian government. Recently, the RBI has reinforced and extended the priority sector lending policy with to the aim of developing a more inclusive financial system.

Literature Review

Theoretical Background

Ethically Responsible Management, the Double Bottom-Line and Efficiency in Social Banking

Social banking refers to banks that apply an ethical-social approach to their banking practice (Krause and Battenfeld 2017). Such banks therefore engage in sustainable investments and lending practices that produce a better quality of life for individuals and society (Ebrahim et al. 2014). Thus, social banking can refer, in a broad sense, to the hybrid form of banking institutions that combine both social and financial missions. The important question here is how can social banks be managed with adequate attention to socio-ethical concerns without compromising their financial stability? The main approach to this question is loosely referred to as Stakeholder Theory (Freeman 1984; Freeman et al. 2010), according to which ethically and socially responsible management pays careful attention to the potentially divergent interests of stakeholders in the decision-making process.

The double bottom-line is a concept that is closely associated to ethically responsible management in social banking, where performance is measured in both social and economic terms, hence the double social and financial bottom-line (Cornée and Szafarz 2014; Crowther and Lauesen 2016). Social performance is the effective conversion of a bank’s social mission into practices in line with accepted ethical-social values, such as serving larger numbers of poor and excluded people, improving the quality and appropriateness of financial services, or improving the bank’s social responsibility. Financial performance forms the basis for analyzing most for-profit activity and it is especially important to a bank’s owners, although other stakeholders, like the bank’s employees and the society at large, are also deemed to benefit from such performance, albeit less directly. Thus, the double bottom-line combined with stakeholder engagement can successfully help a social bank to re-balance its positioning between wealth generation and social value creation (Ramus and Vaccaro 2017).

Recent literature also considers efficiency as a means of guaranteeing ethically responsible management in social banking. In particular, it is argued that efficiency cannot be fully separated from the planning and intentions of business managers as long as they manage their firms in an ethically and socially responsible fashion (Smith 2018). Accordingly, as social banks work towards a double bottom-line, they must be as efficient as possible in both social and financial dimensions of their banking activity. For this reason, a key concern of policymakers is to enable bank leaders to make more productive use of resources to achieve social outreach and financial sustainability (Bagnoli and Megali 2009; Wijesiri et al. 2015).

Social and Financial Efficiency in Social Banking

Two main concepts of efficiency can be used as a basis for study (Farrell 1957). Firstly, technical efficiency is the ability of an organization to use minimum inputs to produce a given quantity of outputs or to maximize outputs from a given set of inputs. Secondly, allocative efficiency reflects the ability of an organization to use inputs in optimal proportions given their respective prices and the available production technology. In particular, this study focuses on technical efficiency (hereinafter referred to as “efficiency”).

As social banking has a dual mission, “social efficiency” (that is, technical efficiency in social banking activity) can be defined as the degree of optimization achieved in the use of inputs for providing banking services aimed at improving quality of life for individuals and society as a whole, whereas “financial efficiency” (that is, technical efficiency in for-profit banking activity) refers to the degree of optimization achieved in the use of inputs for providing mainstream banking services (Martínez-Campillo et al. 2016; Mia and Chandran 2016).

Empirical Evidence: Efficiency in Social Banking in India

Since the second half of the 1990s, there has been extensive research on the efficiency of the banking sector in India. However, to date little empirical evidence has been found specifically on the technical efficiency of commercial banks, which are the main social banks in this emerging country. Moreover, the scarce previous research has used the aggregated values of outputs provided to priority and non-priority sectors to obtain only global efficiency estimates. To sum them all up, we could say that the efficiency of Indian commercial banks dropped during the early stages of liberalization (Bhattacharyya et al. 1997). Most of the studies focusing on trends in efficiency conclude that banking reforms since 1992 had a positive impact on the global efficiency of Indian commercial banks as a whole (Das and Ghosh 2006; Sahoo and Tone 2009; Das and Kumbhakar 2012; Tzeremes 2015). Only one of them finds exactly the opposite (Fujii et al. 2014), and another one indicates that the initial phase of reform had a favorable effect on efficiency while the later phase adversely affected it (Bhattacharyya and Pal 2013). In addition, while most of the prior research finds that public banks performed better than their private and foreign counterparts (Bhattacharyya et al. 1997; Das and Ghosh 2006; Das and Kumbhakar 2012; Bhattacharyya and Pal 2013), two more recent studies find that foreign banks can be considered more efficient than the others (Fujii et al. 2014; Tzeremes 2015).

As social banking is considered a relatively new field in academic research, there are no prior studies evaluating the social and financial efficiency of Indian commercial banks separately according to a double bottom-line approach. Nor, unfortunately, has there been any academic contribution assessing exclusively the performance of Indian public banks. Therefore, to the best of our knowledge, the technical efficiency of these social banks when providing credit to priority and non-priority sectors has not yet been separately measured.

Methodology

The Network Slack-Based DEA Model (NSBM)

The DEA methodology is a non-parametric linear programming-based technique for measuring relative efficiency of a set of comparable Decision Making Units (DMUs) that convert multiple inputs into multiple outputs. Among different DEA models, CCR (Charnes et al. 1978) and BCC (Banker et al. 1984) are the most widely used ones: (a) the CCR model assumes that each DMU operates with constant returns to scale (CRS) and provides the measurement of global technical efficiency. This model is only appropriate when all DMUs operate at an optimal scale; and (b) the BCC model provides the measurement of pure technical efficiency under the variable returns to scale (VRS) assumption. These conventional DEA models view each DMU as a “black box” that use all inputs to produce all outputs without considering the intermediate products generated by various stages within the system. Consequently, they can yield biased efficiency measures from DMUs, each of which is composed of several divisions operating independently.

The studies by Färe and Grosskopf (1996, 2000) solve this issue by proposing a Network DEA model (NDEA) that offers a general framework for endogenizing the internal working of the “black box” by providing both overall and divisional efficiency measures of each DMU, allowing managers identify which stage is more efficient. This model utilizes a radial measure of efficiency and hence it stands on the assumption that inputs or outputs undergo proportional changes. One extension of the NDEA model is the Network Slacks-Based DEA model (NSBM) proposed by Tone and Tsutsui (2009), which is a non-radial method for measuring efficiency when inputs and outputs may change non-proportionally. Specifically, our study applies the NSBM approach.

Production Possibility Set

As in Tone and Tsutsui (2009), we deal with \(n\) DMUs \((j=1, \ldots n)\) consisting of \(K\) divisions \((k=1, \ldots K)\). Let \({m_k}\) and \({r_k}\) be the numbers of inputs and outputs to Division k, respectively. We denote the link leading from Division k to Division h by \(\left( {k,h} \right)\) and the set of links by \(L.\) The observed data are as follows:

The production possibility set \(\left\{ {\left( {{x^k},{y^k},{z^{(k,h)}}} \right)} \right\}\) is given by:

where \({\lambda ^k} \in R_{{+~}}^{n}~\) is the intensity vector corresponding to Division k. The above model explicitly assumes VRS between inputs and outputs.

\(DM{U_o}\left( {o = 1, \ldots ,n} \right)~\) can be represented by

where

and \({s^{k - ~~}}\)\(({s^{k+}})\) are the input (output) slack vectors.

Although linking variables may be constrained in many ways, two possibilities stand out:

(a) The “free” link value case, when the linking activities are freely determined (discretionary) while keeping continuity between inputs and outputs:

where

This case can serve to see if the current link flow is appropriate or not in the light of other DMUs’, i.e., the link flow may increase or decrease in the optimal solution of linear programs.

(b) The “fixed” link value case, when the linking activities are kept unchanged (non-discretionary):

In this case, the intermediate products are beyond the control of DMUs.

Efficiency

Based on Eq. (12) in the study by Tone and Tsutsui (2009), we apply the non-oriented NSBM model under the VRS assumption and the “fixed” link restriction. When studying bank efficiency, Holod and Lewis (2011) point out that bank managers seek to simultaneously decrease input levels and increase output levels, so it is better to evaluate non-oriented efficiency. Following them, we also measure non-oriented efficiency under the VRS assumption because it seems unfair to compare large banks to small banks and vice versa. Finally, we used the “fixed” link as a constraint for explaining bank network structure because bank managers are assumed to have less discretionary power over the intermediate products, deposits in our case (Huang et al. 2014).

Specifically, accounting for both input- and output-slacks, we can evaluate the non-oriented overall efficiency for each \(DM{U_o}\) as follows:

subject to (2) and (4b), where \(\mathop \sum \limits_{{k = 1}}^{K} {W^k} = 1,~~{W^k} \geq 0~\left( {\forall k} \right),\) and \({W^k}\) is the relative weight of Division k which is determined by its importance. Weights can be specified either endogenously by the model or exogenously by the decision-maker. When defined exogenously, ratio criteria with respect to the importance of the stage to the overall process can be taken into account. Alternative approaches can also be considered. Equal weights can be used when it is not possible to affirm the importance of one stage to the detriment of the others. This is the approach chosen for our analysis.

To estimate efficiency, this fractional program is transformed into a linear programming problem using the Charnes and Cooper transformation. The non-oriented overall efficiency score \(~\rho _{o}^{*}\) is a weighted mean of the divisional efficiency scores but is neither their arithmetic nor their harmonic mean. In particular, based on Eq. (13) in the study by Tone and Tsutsui (2009), we can define the non-oriented divisional efficiency score by

where \({s^{k{ - ^*}}}\) and \({s^{k{+^*}}}\) are the optimal input- and output-slacks for (6).

The NSBM Model with Undesirable Outputs (U-NSBM)

Undesirable outputs are very common in production processes but are not considered in the NSBM model proposed by Tone and Tsutsui (2009), which leads to biased estimates of efficiency in their presence. Recently, Fukuyama and Matousek (2017) have suggested that it is appropriate to analyze both desirable and undesirable outputs in order to credit the good outputs in the model and to penalize firms for producing bad outputs. The study by Huang et al. (2014) extends the NSBM model to a new one that deals with undesirable outputs to measure bank efficiency (U-NSBM)Footnote 1. Specifically, overall efficiency can be computed using a simple linear program that takes into account the weak disposability of the undesirable (bad) outputs, making it possible to expand desirable outputs while simultaneously contracting undesirable outputs and inputs (Lozano 2016).

Let \(~{Y^g}=\left( {y_{1}^{g}, \ldots ,y_{n}^{g}} \right) \in {R^{{r_{k1}} \times n}}\) be the desirable outputs matrix, and \({Y^b}=\left( {y_{1}^{b}, \ldots ,y_{n}^{b}} \right) \in {R^{{r_{k2}} \times n}}\) the undesirable outputs matrix, where \({r^{k1}}\) is the number of desirable outputs for stage k, \({r^{k2}}\) is the number of undesirable outputs for stage k, and \({r_k}\) = \({r_{k1}}+{r_{k2}}\). In this context, based on Eq. (6) in the study by Huang et al. (2014), our NSBM in Eq. (6) can be replaced by a U-NSBM model to evaluate the non-oriented overall efficiency of DMUo as follows:

subject to

where \({s^{k - }}{\text{~and~}}{s^{gk}}{\text{~}}({s^{bk}}){\text{~}}\) represents the slack vectors of inputs and of the desirable (undesirable) outputs, respectively, and \({W^k}\) is the relative weight of Division k. Specifically, a DMU is efficient when \({\text{~}}[U]\rho _{o}^{*}=1\), i.e., all slacks are zero.

Accordingly, we can define the non-oriented divisional efficiency score as follows:

where \({s^{k - *}}\), \({s^{gk*}}{\text{and}}~{s^{bk*}}~\)are the optimal input-, desirable output-, and undesirable output-slacks for (9).

Robust Regression Models: A Comparison Between Beta and Simplex Regressions

When modeling values within the open interval (0–1), such as efficiency scores, the normality assumption is frequently not supported in the ordinary regression framework, biasing conclusions derived from statistical analysis. Few models are suitable for fitting such data, but two alternative approaches of robust regression have been developed. On the one hand, the Beta regression model has been proposed for explaining rates or proportions, and is directly related to the extended Generalized Linear Models for joint modeling of means and dispersions (see Ferrari and Cribari-Neto (2004) for details). On the other hand, the Simplex regression model, which is part of a wider class of so-called Dispersion Models, is more robust for analysis of continuous proportional data (see Zhang and Qiu (2014) for details).

Sample, Models and Variables

Sample

The target population comprises all public-sector banks in India between 2011, when the national GDP decelerated significantly after growth rebounded sharply during the immediate post-crisis years, and 2014, the last year for which information is available. Specifically, there are 26 Indian public banks during the 4-year period 2011–2014, which constitute our sample. Thus, we have an unbiased sample that exactly represents the population. Regarding our final dataset, observations in each sampled year are pooled to make up a total of 104 DMUs (n = 26 banks × 4 years).

All public banks sampled provide both priority and non-priority banking services. They are classified by size and regional location of head office in Table 2. Overall, the sample is dominated by small size banks, many of which are located in the most developed Indian states.

Models

Public banks in India work towards a double bottom-line of achieving social and financial goals, so they must be as efficient as possible in both dimensions of their banking activity. Specifically in our study, their social and financial efficiency refers to the degree of optimization achieved in the use of their inputs for providing credit to priority and non-priority sectors, respectively.

One of the main challenges for estimating efficiency in the financial sector is to define the banking function, which determines the selection of input and output variables. Berger and Humphrey (1997) distinguished between the production approach in which they use a set of production factors (inputs) to offer services to their customers (outputs), and the intermediation approach in which financial entities are intermediaries between savers and investors. In this context, the treatment of deposits has been the subject of considerable debate in literature. Deposits are outputs under the production approach and inputs under the intermediation approach. Unfortunately, whether deposits enter a model as an input or an output may have a significant effect on efficiency estimates. Our study extends the previous evidence on Indian banking efficiency by considering deposits as an intermediate product, which means that they are an output from the first stage of the banking function—the production stage—and an input in the second one—the intermediation stage—emphasizing their dual role (Holod and Lewis 2011; Huang et al. 2014; Lozano 2016).

We developed a new analytical framework based on two models, the Social Model and the Financial Model, to appropriately evaluate the performance of Indian public banks in providing credit to priority (social efficiency) and non-priority (financial efficiency) sectors, respectively. In both models, the production and the intermediation stages are considered by applying a U-NSBM model in order to determine both overall and divisional efficiency scores of each banking activity. Specifically, the two models use the same inputs (physical capital, labor, and operating expenses) to produce in the first division the same intermediate output (deposits), which is then utilized as an intermediate input in the second division where final outputs are generated. In addition to desirable outputs, undesirable outputs are also included in both models given the growing volume of risky assets in the Indian banking industry. Specifically, loans (desirable outputs) and non-performing loans/NPLsFootnote 2 (undesirable outputs) in priority and non-priority lending schemes are used separately to construct social and financial outputs, respectively. Inputs and the intermediate output/input are similar for financial and social models because they refer to resources that are common in both banking activities, but the final outputs vary depending on whether Indian public banks provide credit to the priority or non-priority sectors. Finally, we construct a third model, the Full Model, which is based on the same inputs and intermediate product, and in which all desirable and undesirable outputs considered in social and financial models are jointly introduced, allowing evaluation of the overall and divisional efficiencies of each bank at a global level. Figure 2 illustrates the two-stage network framework of our three models.

Variables

Input and output variables for measuring bank efficiency were selected according to a number of earlier studies (Fukuyama and Weber 2010; Zha et al. 2016; Fukuyama and Matousek 2017), based on data available on the Indian banking industry.

Input variables (first stage):

-

Physical capital This variable measures the physical capital associated with the activity carried out by banks, and is proxied by the value of fixed assets (in millions of Indian rupees). The use of fixed assets as an input is important in this study given the considerable investments in Information and Communications Technology and Automated Teller Machines by Indian public banks with the aim of increasing the financial inclusion.

-

Labor This refers to the human resources employed by banks for performing their activity, and is measured as the number of employees. Human resources are one of the main inputs in any banking activity and play a key role in customers’ final decisions, especially in Indian banks, which mostly use a traditional distribution channel that is labor-intensive and involves direct relations between employees and customers.

-

Operating expenses This is an indicator of the costs generated by banks in maintaining their daily business, and is quantified as total operating expenses (in millions of Indian rupees).

Intermediate output variable (first stage)—intermediate input variable (second stage):

-

Deposits This defines the funds placed in an account that are payable on demand to the depositor, and is measured by total deposit values (in millions of Indian rupees).

Final output variables (second stage):

- (a)

Social outputs

Loans to priority sectors This variable refers to the main desirable output from social banking services, and is quantified by the gross loan portfolio to priority sectors (in millions of Indian rupees).

NPLs to priority sectors This variable defines the main undesirable output from social banking services, and is captured by the total volume of risky loans in priority sectors, that is, when interest and/or an installment of the principal has remained “past due” or unpaid for more than 90 days (in millions of Indian rupees).

- (b)

Financial outputs

Loans to non-priority sectors This variable refers to the main desirable output from for-profit banking services, and is measured by the gross loan portfolio in non-priority sectors (in millions of Indian rupees).

NPLs to non-priority sectors This variable defines the main undesirable output from for-profit banking services, and is quantified by the total volume of risky loans in non-priority sectors (in millions of Indian rupees).

The data about physical capital, labor, operating expenses, and deposits were collected from the Annual Reports of the RBI (RBI 2012–2015), while the information on loans and NPLs of priority and non-priority sectors was obtained from Indiastat Database (Datanet India 2017). Data expressed in monetary units are deflated, at constant prices for 2011, using the GDP deflator. Table 3 presents the main descriptive statistics for all input and output variables.

According to Cooper et al. (2007), in order for the efficiency estimates to be robust and reliable, the number of DMUs must be at least the maximum between m * s or 3 * (m + s), with m and s being the number of inputs and outputs, respectively. In this study, all efficiency models to be estimated meet this requirement.

Empirical Results

This study applies the U-NSBM model to estimate if Indian public banks are relatively efficient compared to each other, both globally (Full Model) and when providing credit to priority (Social Model) and non-priority (Financial Model) sectors. Overall and divisional efficiencies are provided for the three models.

Global, social, and financial efficiency scores are then regressed using Beta and Simplex regression models. The following control variables are included in all regressions as factors that may affect efficiency: (a) Regional wealth (REGWEA), measured in terms of annual GDP per capita of the Indian states where the banks have their headquarters (in USD); (b) Bank size, proxied by two dummies for large (LARGE) and medium (MEDIUM) banks, as data on total bank assets were divided into three tertiles (the reference category is “small banks”); (c) Branch network (BRANCH), measured by the total number of branches; and (d) Rural location (RURAL), proxied by a dummy that takes the value of 1 when the proportion of branches in municipalities with less than 10,000 inhabitants in the total number of branches is greater than the annual average for all the banks analyzed, and 0 otherwise. Table 4 presents correlation coefficients and variance inflation factor (VIF) scores for the control variables.Footnote 3 We observe that there are two low, positive and statistically significant correlations, but analysis of the VIFs reveals that multicollinearity is not a problem (all values are below 5).

Average Overall Efficiency Estimates: Full, Social, and Financial Models

The results of the U-NSBM model are provided in Table 5, which presents an overview of the average overall efficiency scores of each Indian public bank in the Full, Social and Financial Models over the period 2011–2014. All banks are assigned scores between 0 and 1 with higher values indicating more efficient organization relative to other organizations in the sample. These efficiency scores must therefore be interpreted cautiously as they are relative to best observed practice within our particular sample. Specifically, we present the total 26 banks in order of their mean overall efficiency, from the most to the least efficient.

Regarding the Full Model, the average overall efficiency of Indian public banks as a whole over the 4-year period is 78.25%, well above 50% which is the minimum tolerable value for estimates of technical efficiency (Cooper et al. 2007), and ranges between 46.07% and 100%. Thus, in order to be totally efficient at a global level, these entities should have increased their social and for-profit banking services by 21.75%, given the resources at their disposal. Fig. 3 shows a Pareto chart with the positions of the 26 banks regarding the estimates of global efficiency reported in Table 5, which are classified in four categories: total efficiency \(~~([U]\rho _{o}^{*}\) = 1); low inefficiency \(~(0.75 \leq [U]\rho _{o}^{*}<{\text{1}})\); moderate inefficiency \(~(0.5 \leq [U]\rho _{o}^{*}<0.{\text{75}})\); and high inefficiency \(~([U]\rho _{o}^{*}<0.{\text{5}})\). As the graph shows, only seven banks were totally efficient at a global level (26.9% of the total). The remaining banks were inefficient, albeit to different extents. Specifically, 96.1% of Indian public banks achieved an acceptable efficiency level \(~(0.5 \leq [U]\rho _{o}^{*})\), whereas only 3.9% were highly inefficient.

When the overall efficiency of the 26 Indian public banks is evaluated in the Social and Financial Models separately, they are seen to have achieved a quite adequate level of performance in both priority and non-priority sectors. More specifically, the mean score for overall social efficiency (74.96%) is slightly higher than that for overall financial efficiency (71.97%), which means that banks provided around 25 and 28% less, respectively, than the maximum flow of credit to priority and non-priority sectors that might be expected if they had used their inputs better. Scores for social efficiency ranged between 41.79 and 100%, and run from 41.35% for financial efficiency. Figure 4 compares two Pareto charts based on the scores for social and financial efficiency, respectively. In both cases, 69.2% of the banks presented either moderate or low levels of inefficiency, while 11.5% were highly inefficient at a social level and 15.4% at a financial level. Only five banks were totally efficient in providing credit to priority sectors (19.2% of the total) and four to non-priority sectors (15.4% of the total).

Based on the average overall efficiency estimates, we located the most efficient public banks in India according to the regional location of their headquarters to gain a better insight into how they are distributed among the different Indian states. As shown in Fig. 5, the seven globally efficient banks are headquartered in Gujarat, Maharashtra, Karnataka, Rajasthan, Kerala, and Delhi states. All these states are on the western side of India, except for the southern state of Kerala. Among them, three banks—Bank of Baroda, State Bank of India, and State Bank of Mysore—(11.5% of the total sampled banks) simultaneously achieved their dual mission of financial sustainability and social outreach, so they can be used as ideal benchmarks for their peers. Specifically, their headquarters are in Gujarat, Maharashtra, and Karnataka states, respectively, that is, the Indian states where economic growth and development have been fastest. Moreover, two banks—State Bank of Bikaner and Jaipur and State Bank of Travancore—were deemed socially efficient but financially inefficient. They are located in Rajasthan and Kerala states, respectively, both of which are among the states that are making most progress in reducing poverty and raising living standards. Only one bank—IDBI Bank Limited—was rated as financially efficient but socially inefficient. It is in Maharashtra state. The last globally efficient bank—Punjab and Sind Bank—headquartered in Delhi, that is, the major commercial and banking center of India, is neither socially nor financially efficient.

Finally, when the efficiency dynamics during the period 2011–2014 are analyzed, results indicate that the last years of the post-crisis period damaged public banks performance in India. Figure 6 shows the annual trend in mean overall efficiency scores, indicating that global, social, and financial performance decreased, mainly after 2012. As economic activity may be a factor influencing efficiency, the figure also depicts the annual evolution of Indian GDP per capita (in USD). On average, the global efficiency of Indian public banks was quite stable, with a slight drop of about 1.4% over the period. Both financial and social efficiencies dropped by about 2.4 and 5.1%, respectively, and the latter showed a continuous decline from 2012. Finally, the national economy also fell by about 0.6% between 2011 and 2013, but it increased by 8.3% in 2014.

The Relation Between Social and Financial Efficiency Scores

Next, we searched for a synergy between overall social and financial performance in Indian public banks by analyzing the correlation between both variables. The Spearman’s coefficient showed that overall social and financial efficiency scores are positively and significantly correlated (ρSOC−FIN = 0.830; p < 0.01). A positive sign suggests the existence of compatibility between them. Moreover, the coefficient is high and significantly different from zero at the 1% level, indicating a strong association between both variables in Indian public banks.

In order to obtain a visual picture of this result, we plotted the average overall efficiency measures obtained from the social model against those obtained from the financial one for all sampled banks. As Fig. 7 depicts, Indian public banks are dispersed along a line going from the bottom left to the top right corner providing further evidence of the synergy between social and financial efficiency. Specifically, the three banks located at the top right corner are socially and financially efficient (Bank of Baroda, State Bank of India, and State Bank of Mysore), while those in the middle perform relatively low in both efficiency dimensions. No banks are located at the bottom right or at the top left corner. This suggests that the commitment to development and poverty alleviation goals through social banking services to priority sectors does not conflict with the profit-seeking objectives associated with providing loans to non-priority sectors.

Scatter plot between social and financial efficiency scores. The numbers on the scatter plot refer to Bank Codes in Table 5

As a robustness check for this finding, Beta and Simplex regressions were carried out to make a stronger statistical point for the above graphical observations (Table 6). When overall social efficiency is used as the dependent variable, the results of the two regression models show that social and financial efficiencies are positively and significantly related. If overall financial efficiency is the dependent variable, we also find a positive and statistically significant relation in both models. Accordingly, higher overall social efficiency scores are coupled with higher overall financial efficiency scores, thus predicting a synergy between the social and for-profit missions of Indian public banks.

Our results furthermore demonstrate that regional GDP per capita and large banks have a significant positive impact on financial efficiency, as captured by Beta and Simplex regression models, and a significant negative effect on social efficiency, as detected by the Simplex regression although not confirmed by the other approach. In addition, while the Simplex model shows that the total number of branches positively and significantly influences social performance but has a negative and significant relation with financial performance, the Beta regression detects that a greater proportion of branches in municipalities with low population density has a significant positive impact on social efficiency but a significant negative effect on financial efficiency. Consequently, Indian public banks are more efficient in performing their social mission of financing priority sectors when they are located in the economically weaker states, and when they are small but have a wide network of offices with a large proportion of them in rural areas, thus reaching out to a larger number of poor customers.

The Relation Between Global and Social/Financial Efficiency Scores

We find that, on average, public banks in India managed both their global performance and their social and mainstream banking activities relatively well over the period 2011–2014. Calculation of the Spearman’s correlation coefficients between overall efficiency scores indicates that global and social efficiency values are positively and significantly related (ρGLOB−SOC = 0.950; p < 0.01), as are global and financial efficiency values (ρGLOB−FIN = 0.915; p < 0.01). Both correlation coefficients therefore suggest compatibility and a strong association between the variables analyzed.

Two robust regression models based on Beta and Simplex distributions were performed to explore these relationships in more detail. Results are shown in Table 7. With respect to overall scores, isotonicity holds positively and significantly among global, social, and financial performance, as detected by the two regression approaches. So, greater values for social and financial efficiency are linked with greater global efficiency scores in Indian public banks, enabling better management of their resources in supporting both priority and non-priority sectors.

Finally, global efficiency scores, controlled for social efficiency, are positively and significantly related to regional wealth, as captured by the two regressions, but negatively and significantly associated with branch expansion, as only detected by the Beta model. When controlling for financial efficiency, the results of the Beta regression show a negative and significant impact of rural concentration on global efficiency in Indian banks.

Average Divisional Efficiency Estimates: Full, Social, and Financial Models

Table 5 also reports the divisional efficiency scores of Indian public banks in Full, Social and Financial Models. On average, for all entities and for all years, the three models yield the same efficiency estimate in the production stage (82.09%) because each bank uses the same inputs to produce the intermediate product of deposits. In contrast, mean performance in the intermediation stage is different in each model (94.92, 90.59, and 86.99%, respectively) and higher than in the production stage. More specifically, public banks in India are more efficient in the intermediation stage of their social banking activity than in that of their mainstream banking activity. As a result, on average, they are quite efficient in the production and intermediation stages of both dimensions of their banking activity, but performance is better in the latter stage, especially in the provision of credit to priority sectors.

The Relation Between Overall and Divisional Efficiency Scores

We first calculate the Spearman’s correlation coefficients between overall and divisional average efficiency scores in the three models for the 104 sampled DMUs. Results indicate that global, social, and financial efficiency values are positively and significantly correlated to the efficiency estimates in both the production (ρGLOB−PROD = 0.935; p < 0.01/ρSOC−PROD = 0.907; p < 0.01/ρFIN−PROD = 0.889; p < 0.01) and intermediation stages (ρGLOB−INTERM = 0.581; p < 0.01/ρSOC−INTERM = 0.726; p < 0.01/ρFIN−INTERM = 0.662; p < 0.01). All correlation coefficients therefore indicate compatibility between the variables analyzed, although global, social, and financial efficiencies are more associated with performance in the production stage than in the intermediation stage. Figure 8 illustrates these relations in the 26 Indian public banks of our sample, indicating that the inefficiency of many banks when providing credit to priority and non-priority sectors, both globally and in the social and financial models separately, is mostly caused by their inefficiency in the production stage.

Overall and divisional efficiency scores in full, social, and financial models. Ovef Overall efficiency (global, social, or financial efficiency), Prodef efficiency in the production stage, Interef efficiency in the intermediation stage, Full full model, Soc social model, Fin financial model. The numbers on the horizontal axis refer to Bank Codes in Table 5

In order to provide more rigorous empirical evidence for these relationships, we applied Beta and Simplex regressions. As shown in Table 8, a higher performance in both the production and intermediation stages, that is, a better use of inputs to produce deposits and of deposits to deploy credit in priority and non-priority sectors, would help achieve higher global, social, and financial efficiency scores in Indian public banks, since all coefficients are positive and statistically significant in the two regression approaches.

Once again, global and financial efficiency scores are positively and significantly related to the regional economy and large banks, as captured by the two regressions when controlling for production efficiency, but negatively and significantly related to the number of branches, as detected by the Simplex regression when controlling for production or intermediation efficiency. The results of the Simplex regression also confirm that branch expansion, controlled for production or intermediation efficiency, positively, and significantly affects social performance. One more time, whereas social efficiency increases with rural location, as shown by the Simplex regression when controlling for intermediation efficiency, the opposite is true for financial efficiency, as captured by the two regressions when controlling for production efficiency.

Conclusions

This study aims to evaluate how efficient Indian public banks have been in providing credit to priority (social efficiency) and non-priority (financial efficiency) sectors during the last years of the post-crisis period, and to explore the main factors influencing efficiency. Considering that all efficiency measures of banks are relative to other sampled banks, six main conclusions can be drawn from our research in the framework of an emerging economy:

First On average, Indian public banks have managed their double bottom-line adequately without being equally efficient in all the components of their overall performance. They have performed relatively well in their different banking activities as a whole, and hence have been quite efficient at a global level. Moreover, isotonicity has held positively and significantly among global, social, and financial performance. Specifically, Indian banks’ efficiency in their social mission has been slightly higher than in their financial mission, so they have managed their resources better when supporting priority sectors than when financing non-priority sectors. This is possibly because their main goal is not to maximize profits, as in traditional commercial banks, but to achieve an ethical-social purpose, primarily that of supporting development and quality of life in India.

Second The most efficient public banks are headquartered in Indian states located in the western side of the country. Specifically, the most globally and/or financially efficient banks are situated in the Indian states where economic development has been fastest, whereas the most socially efficient banks are located in the states that have made most progress in promoting human development.

Third The last years of the post-crisis period have eroded the performance of Indian public banks, decreasing their efficiency, especially their social efficiency. During this period, Indian public banks have reported low profitability, have been prone to political influence and high NPL ratios, and have carried the main burden of the government’s development policies (Mohan and Ray 2017), all of which might help to explain the drop in their efficiency. In addition, banking reforms and growing pressure to prove their financial performance seem to have damaged their social performance to some extent. Thus, although in general these banks have been quite efficient in providing credit to priority sectors, it is crucial that they preserve and build on their singular characteristics to avoid further deterioration of their social efficiency in the future.

Fourth There has been a synergy effect between the social and financial efficiency of public banks in India, suggesting that the commitment to development and poverty alleviation goals through social banking services did not conflict with the profit-seeking objectives associated with mainstream banking activities. The fear of a so-called “mission drift” (Ramus and Vaccaro 2017) resulting from the trade-off between social and financial efficiency is therefore ungrounded in the case of Indian public banks since they have improved access to finance for vulnerable sections of Indian society while maintaining their financial sustainability, showing ethical responsibility towards all their main stakeholders.

Fifth Indian public banks have been quite efficient in both the production and intermediation processes of their social and financial banking activities, although their performance has been higher in the latter than in the former. Moreover, they have been more efficient in the intermediation stage of their social banking activity than in that of their mainstream banking activity, so they have used deposits better when providing credit to priority sectors than when lending to non-priority sectors. Specifically, their inefficiency in both missions has been more influenced by inefficiencies in the production stage than in the intermediation stage, indicating that the transformation of inputs into deposits has been their main weakness. Finally, a higher performance in both the production and intermediation stages has led to higher levels of global, social, and financial efficiency in Indian public banks.

Sixth Regarding efficiency determinants, there has been a trade-off between global/financial and social efficiency levels with respect to regional wealth, bank size, branch networks, and rural location. Whereas the social performance of Indian public banks tends to increase with lower regional economic development, smaller size, more branches, and greater rural concentration, the reverse is true for global and financial efficiencies.

Practical Implications

Overall, the social banking policy launched by the Indian government, by virtue of which public banks have been called upon to combine social and for-profit goals when providing their banking services, has helped these entities to operate competitively by developing efficient solutions to meet community needs while achieving financial viability. However, since any inefficiency implies a lower performance than might otherwise be possible, this study has practical implications for bank leaders and policymakers.

Managerial implications

Indian public banks have had relative social inefficiency of 25% and relative financial inefficiency of 28% during the period 2011–2014, which cannot be ignored. If they want to continue their important social mission of helping weaker sections of society through the priority sector lending scheme, as well as engaging in mainstream banking activities in non-priority sectors, they must reduce their social and financial inefficiencies in order to both ensure ethically responsible management with regard to all their stakeholders and improve their competitiveness in the new international context. Further steps therefore need to be taken to improve bank resource allocation mechanisms. Our analysis leads us to suggest that the managers of the Indian banks that have been underperformers should identify the practices that are benefiting their more successful competitors and take on both the staff and technology necessary to streamline their operations to more efficiently manage their double bottom-line. Moreover, further consolidation in the sector might help eliminate wasteful competition, raise potential economies of scale, and help Indian public banks to serve a larger client base. Finally, since their inefficiency is mainly influenced by inefficiency in the production stage, greater efforts involving, for example, risk-based allocation of inputs and improved governance mechanisms, need to be made to improve bank performance at this stage.

Political implications

As the debate over the value of the priority sector lending scheme intensifies in India, our findings indicate that public banks have performed reasonably well when providing social and for-profit banking services during the last years of the post-crisis period, even achieving greater efficiency in the former. Moreover, both lending schemes have been compatible in terms of performance. So Indian public banks can look forward to continuing to help “build a better world” since they are a driving force for a more sustainable society and economy, even at a time of poor performance of the banking system in India.

However, since their social efficiency has shown a continuous decline over time, it would be advisable for policy makers in India to try to consolidate the social function of these institutions as they are vital for socio-economic development in the territories where they work. More specifically, the Indian government could encourage greater efficiency in their dual mission by reducing politically driven lending, seeking better management skills and practices, and promoting strategic alliances in the sector as a means of coping with the process of globalization and achieving the banks’ double bottom-line.

Limitations and Future Lines of Research

The main limitations of this study are the following: (1) the restricted data available in India, which explains our limited sample period; (2) the selection and measurement of inputs and outputs due to the lack of information on many of these variables for consecutive years; and (3) the implicit assumption that deposits are totally used for providing services either to priority sectors or to non-priority sectors because Indian public banks can only use a share of these intermediate resources as an input in their social function and the remaining share as an input in their financial function.

All this means that for future research we are considering the use of more and better input and output variables wherever possible. In addition, as Indian public banks provide banking services to priority and non-priority sectors using shared inputs, it would be very interesting to apply the so-called “Multi-activity DEA (MDEA) model” to cope with the resource allocation problem and to determine the share of deposits (and/or other intermediate inputs) associated with each activity. Finally, another natural extension for future research would be to analyze if greater social efficiency in Indian public banks, that is, when they use less inputs to provide more loans to priority sectors, boosts the degree of social development in the Indian states where they operate, measuring how the situation of these more vulnerable and weaker sectors of society is impacted after social loans are received (e.g., improved household incomes, more years of schooling, more positive evaluation of quality of life).

Notes

The study by Huang et al. (2014) proposes a new NSBM model with undesirable outputs and super efficiency (US-NSBM) to measure bank efficiency. We only consider the NSBM with undesirable outputs (U-NSBM) because super efficiency is outside of the goals of our research.

Several previous studies have shown that non-performing loans (or NPLs) need to be considered as the main undesirable output of banks (Fukuyama and Weber 2010; Fujii et al. 2014; Lozano 2016; Fukuyama and Matousek 2017). An NPL is a loan that is in default or close to being in default. In India, the RBI states that an asset is considered as “non-performing” when interest and/or installment of principal has remained “past due” or unpaid for more than 90 days.

We use Spearman´s Rho correlation coefficients rather than Pearson correlation coefficients because the latter are subject to biases if all variables are not normally distributed, which is the case in our study.

References

Bagnoli, L., & Megali, C. (2009). Measuring performance in social enterprises. Nonprofit and Voluntary Sector Quarterly, 20(10), 1–17.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30(9), 1078–1092.

Berger, A. N., & Humphrey, D. B. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98(2), 175–212.

Bhattacharyya, A., Lovell, C. K., & Sahay, P. (1997). The impact of liberalization on the productive efficiency of Indian commercial banks. European Journal of Operational Research, 98(2), 332–345.

Bhattacharyya, A., & Pal, S. (2013). Financial reforms and technical efficiency in Indian commercial banking: A generalized stochastic frontier analysis. Review of Financial Economics, 22(3), 109–117.

Burgess, R., & Pande, R. (2005). Do rural banks matter? Evidence from the Indian social banking experiment. The American Economic Review, 95(3), 780–795.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444.

Cooper, W. W., Seiford, L. M., & Tone, K. (2007). Data envelopment analysis. New York: Springer.

Cornée, S., & Szafarz, A. (2014). Vive la différence: Social banks and reciprocity in the credit marked. Journal of Business Ethics, 125(3), 361–380.

Crowther, D., & Lauesen, L. M. (2016). Accountability and social responsibility: International perspectives. Bingley: Emerald Group Publishing Limited.

Das, A., & Ghosh, S. (2006). Financial deregulation and efficiency: An empirical analysis of Indian banks during the post reform period. Review of Financial Economics, 15(3), 193–221.

Das, A., & Kumbhakar, S. C. (2012). Productivity and efficiency dynamics in Indian banking: An input distance function approach incorporating quality of inputs and outputs. Journal of Applied Econometrics, 27(2), 205–234.

Datanet India (2017). Indiastat: Socio-Economic Statistical Information about India (Banks and Financial Institutions/Public Sector Banks). New Delhi: Datanet India. Retrieved from: https://www.indiastat.com/banksandfinancialinstitutions/3/publicsectorbanks/234/stats.aspx.

Ebrahim, A., Battilana, J., & Mair, J. (2014). The governance of social enterprises: Mission drift and accountability challenges in hybrid organizations. Research in Organizational Behavior, 34, 81–100.

Färe, R., & Grosskopf, S. (1996). Intertemporal production frontiers: With dynamic DEA. Boston: Kluwer Academic Publishers.

Färe, R., & Grosskopf, S. (2000). Network DEA. Socio-Economic Planning Sciences, 34(1), 35–49.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, 120(3), 253–290.

Ferrari, S. L., & Cribari-Neto, F. (2004). Beta regression for modeling rates and proportions. Journal of Applied Statistics, 31(7), 799–815.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., & Colle, S. (2010). Stakeholder theory: The state of the art. New York: Cambridge University Press.

Fujii, H., Managi, S., & Matousek, R. (2014). Indian bank efficiency and productivity changes with undesirable outputs: A disaggregated approach. Journal of Banking & Finance, 38(1), 41–50.

Fukuyama, H., & Matousek, R. (2017). Innovative applications of O.R. Modelling bank performance: A network DEA approach. European Journal of Operational Research, 259(1), 721–732.

Fukuyama, H., & Weber, W. L. (2010). A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega, 38(5), 239–410.

Holod, D., & Lewis, H. F. (2011). Resolving the deposit dilemma: A new DEA bank efficiency model. Journal of Banking & Finance, 35(11), 2801–2810.

Huang, J., Chen, J., & Yin, Z. (2014). A network DEA model with super efficiency and undesirable outputs: An application to bank efficiency in China. Mathematical Problems in Engineering, 9, 1–14.

Krause, K., & Battenfeld, D. (2017). Coming out of the niche? Social banking in Germany. Journal of Business Ethics. https://doi.org/10.1007/s10551-017-3491-9.

Lozano, S. (2016). Slacks-based inefficiency approach for general networks with bad outputs: An application to the banking sector. Omega, 60, 73–84.

Martínez-Campillo, A., Fernández-Santos, Y. & Sierra-Fernández, M. P. (2016). How well have Social Economy financial institutions performed during the crisis period? Exploring financial and social efficiency in Spanish credit unions. Journal of Business Ethics. https://doi.org/10.1007/s10551-016-3192-9.

Mia, A., & Chandran, V. G. R. (2016). Measuring financial and social outreach productivity of microfinance institutions in Bangladesh. Social Indicators Research, 127(2), 505–527.

Mohan, R., & Ray, P. (2017): Indian financial sector: Structure, trends and turns. IMF Working Paper, WP/17/7, International Monetary Fund.

Ramus, T., & Vaccaro, A. (2017). Stakeholders matter: How social enterprises address mission drift. Journal of Business Ethics, 143(2), 307–322.

RBI (2012–2015). Annual Report of the RBI from 2011 to 12 to 2014–2015. Mumbai: Reserve Bank of India (RBI). Retrieved from: https://www.rbi.org.in/Scripts/AnnualReportPublications.aspx.

Sahoo, B., & Tone, K. (2009). Decomposing capacity utilization in Data envelopment analysis: An application to banks in India. European Journal of Operational Research, 195(2), 575–594.

Smith, J. (2018). Efficiency and ethically responsible management. Journal of Business Ethics, 150(3), 603–618.

Srinivasan, A., & Thampy, T. (2017). The effect of relationships with government-owned banks on cash flow constraints: Evidence from India. Journal of Corporate Finance, 46, 361–373.

Thorat, A., Vanneman, R., Desai, S., & Dubey, A. (2017). Escaping and falling into poverty in India today. World Development, 93, 413–426.

Tone, K., & Tsutsui, M. (2009). Network DEA: A slacks-based measure approach. European Journal of Operational Research, 197(1), 243–252.

Tzeremes, N. G. (2015). Efficiency dynamics in Indian banking: A conditional directional distance approach. European Journal of Operational Research, 240(3), 807–818.

Wijesiri, M., Viganò, L. & Meoli, M. (2015). Efficiency of microfinance institutions in Sri Lanka: A two-stage double bootstrap DEA approach. Economic Modelling,47, 74–83.

Zha, Y., Liang, N., Wu, M., & Bian, Y. (2016). Efficiency evaluation of banks in China: A dynamic two-stage slacks-based measure approach. Omega, 60, 60–72.

Zhang, P., & Qiu, Z. (2014). Regression analysis of proportional data using simplex distribution. Science China Mathematics, 44(1), 89–104.

Acknowledgements

A part of the research for this paper was completed while Mahinda Wijesiri was a visiting scholar at the Indira Gandhi Institute of Development Research (IGIDR), India. He gratefully acknowledges the funding and support from the International Development Research Center (IDRC), Canada. The authors would like to thank the Section Editor and the anonymous referees for their useful comments. Any remaining errors are solely the responsibility of the authors.

Funding

This research was funded by the International Development Research Center (IDRC) of Canada (Grant No.: IDRC 107125; Recipient: Mahinda Wijesiri).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Almudena Martínez-Campillo declares that she has no conflict of interest. Mahinda Wijesiri has received a research grant from the “International Development Research Center (IDRC),” Canada. Peter Wanke declares that he has no conflict of interest.

Research Involving Human Participants or Animals

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Martínez-Campillo, A., Wijesiri, M. & Wanke, P. Evaluating the Double Bottom-Line of Social Banking in an Emerging Country: How Efficient are Public Banks in Supporting Priority and Non-priority Sectors in India?. J Bus Ethics 162, 399–420 (2020). https://doi.org/10.1007/s10551-018-3974-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-018-3974-3