Abstract

Business groups dominate the economic landscape in many economies around the world. While business groups overcome the institutional voids arising due to inefficiencies of external markets, they also possess market power, which could be economically and socially counterproductive, especially for unaffiliated firms. Drawing on the transaction cost and industrial organization economics, we examine whether the presence of business group affiliated firms in industries restricts the entry of unaffiliated firms or firms affiliated with small- and medium-size business groups. Findings based on Indian firms suggest that investments by business group affiliated firms in an industry have an inverted U-shaped relationship with the investment by unaffiliated firms. However, investments by firms affiliated with large-sized business groups have a U-shaped relationship with the investment by affiliates of small and medium business groups. These findings suggest that the market power of business groups and entry barrier relationship is contingent on the size of the business groups.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Business groups, a group of legally independent firms often controlled by a family dominate the industrial landscape of most emerging market economies. These groups are diversified horizontally into unrelated industrial sectors and vertically from one stage of production to another through their affiliated firms. For example, the top 20 business groups in India controlled US$ 390 billion of assets (Kant 2016) and top 10 business groups own more than 27 percent of all business assets in South Korea (Pae 2018). Such concentration of industrial activities by few business groups have potential negative socio-economic (Posner 1975; Khanna 2000) and ethical consequences (Cottrill 1990; Paine 1990; Hemphill 2004; Nelson 1994).

How do business groups affect competition in an industry in emerging markets? Despite a large body of literature on business groups, we have a relatively limited understanding of the consequences of the market power possessed by business groups on the standalone firms in emerging markets (Leff 1978; Khanna 2000; Khanna and Yafeh 2007). Scholars have primarily utilized the institutional voids arguments to explain the emergence, growth, and competitiveness of business groups (Khanna and Palepu 1997; Singh et al. 2018). As per institutional voids argument, business groups are microeconomic responses to market failure in emerging economies (Gaur and Delios 2015; Khanna and Rivkin 2001). Business groups play an efficiency-enhancing role by internalizing market transactions in the product, capital, and managerial labor markets. Consequently, much of the research on business groups has focused on the value-enhancing consequences of business group affiliation for the affiliated firms (Gaur and Delios 2015; Khanna and Palepu 2000; Khanna and Rivkin 2001).

However, considering the dominance of business groups in the corporate landscape of emerging economies, it is plausible that business groups may contribute or even reinforce these imperfections because of the well-known distortions associated with monopoly and market power (Feenstra et al. 2002, 2003; Singh et al. 2018). In other words, while business groups may thrive by internalizing the markets through the network of affiliated firms, the dominance of group affiliated firms in an industry may also erect entry barriers for unaffiliated firms. Business groups may thus reinforce the structural market imperfections as argued in the structure–conduct–performance paradigm (Bain 1956).

There is anecdotal evidence to this effect. For example, Reliance Industries, one of the largest business groups in India, entered the telecom industry in 2016 through its subsidiary Reliance Jio. In the following year, the industry witnessed massive consolidation with many smaller players such as Idea Cellular, Reliance Communication, Aircel, Telenor ASA, Tata Teleservices, and Tikona Digital Networks exiting the market either by merging with other firms or closing their operations. Such examples are also evident in other newly liberalized industries in post-economic reforms in India (Rajakumar and Henley 2007) and Korea where authorities regulate the concentration of business groups to restrict entry barriers (OECD 2014, 2016).

Prior research on business groups alludes to the fact that business groups usually have a considerable degree of market power in the industries in which they operate (Chang and Choi 1988). While such concerns are being raised in the business group literature, there is limited theoretical discourse and empirical evidence on the potential negative consequences of business groups in emerging economies (Lee et al. 2017; Khanna 2000; Khanna and Yafeh 2007). Studying market power of the business group is important considering its negative consequences for the larger society, resulting from reduced competitive intensity (Bain 1956), higher consumer prices, lack of innovation (Mahmood and Mitchell 2004), reduced social welfare (Khanna 2000; Posner 1975), and potentially unethical behavior.

While the negative consequences of market power have been examined primarily in law and economics literature due to its relevance to industry competition (e.g., antitrust policy), it has important implications for business ethics literature (Hemphill 2004; Nelson 1994). Conventional business ethics literature suggests that free-market capitalism requires ‘natural duty of civility’ (Rawls 1971) which includes an obligation against the abuse of market power and not to manipulate the system that supports fair competition (Nelson 1994). Denial of this duty is to undermine the moral foundation of the market system. However, in the free-market economy, firms tend to exceed the bounds of fair competition. Therefore, in order to establish ideals of positive competition, there needs to be an independent and constructive effort to succeed through own right without eliminating competitors from the industry, respect for rules that govern relations among competitors and establishment of a level playing field irrespective of the size of the competitors (Paine 1990). Considering that the market power of business groups has potential to violate such important rules of fair completion, there is a need to examine this issue in depth.

We address this oversight by focusing on the effect of the market power of business group affiliated firms on industry entry barriers. Specifically, we examine whether the market power resulting from industry entry by group affiliated firms deters entry of unaffiliated firms. Integrating the transaction cost and the industrial organization economics perspective we argue that there is a curvilinear (inverted U shape) relationship between the investments by group affiliated and unaffiliated firms in an industry. In the early phases, investments by group affiliated firms signal the potential opportunity for unaffiliated firms, encouraging more entry by such firms. However, this effect tapers off, and there are fewer entries by unaffiliated firms after a threshold once group affiliated firms wield considerable market power, creating entry barriers for unaffiliated firms.

We further argue that such entry barrier is not confined to unaffiliated firms, but is also felt by affiliated firms depending on the size of their corresponding business groups. The size of a business group is related to the ease of access to finance (Shin and Park 1999), intermediate products (Leff 1978), brands and reputations (Mukherjee et al. 2018), as well as non-market resources such as government connections (Gaur et al. 2018; Khanna and Yafeh 2007). In the early phases of investment in industry by a small set of large business groups, there is a potential for collusion to create entry barriers for smaller business groups. This effect, however, diminishes as the opportunity for collusion declines with the entry of sizable number affiliates of large business groups. Thus, we propose a curvilinear (U shape) relationship between investments by large business group affiliated firms in an industry and investment by firms affiliated with small and medium business group in that industry.

Focusing on the market power aspect of business groups, this study provides several implications for the socio-economic welfare and ethical aspect of business group dominance in emerging economies. First, by examining the entry barrier implications of business groups, this study contributes to a growing literature which provides a balanced view of the business groups. While business groups emerge in response to the economic and socio-cultural environment, they shape the environment through their powerful positions in these economies. Existing literature has emphasized their positive role in economic development through exports (Gaur and Delios 2015; Kumar et al. 2014; Singh 2009), compensating for market inefficiencies (Khanna and Palepu 1997), regional development (Fisman and Khanna 2004), technological development (Hobday and Colpan 2010; Singh and Gaur 2013), and the like. However, their persistence leads to detrimental social and economic effects due to their continued rent-seeking behavior (Ghemawat and Khanna 1998), and their opposition to much needed economic reforms (Chari and Gupta 2008) and privatization (Cuervo-Cazurra et al. 2018).

Second, most studies on business groups confine themselves to examining the impact of business groups as compared to independent firms, ignoring the inter-group variations in business groups (Gaur et al. 2014; Mukherjee et al. 2018; Piepenbrink and Gaur 2013). While business groups share many common characteristics, substantial differences exist among the business groups (Kumar et al. 2012; Singh and Delios 2017). For example, the socio-economic implications of few large business groups which dominate the economy are different compared to small- and medium-sized business groups (Feenstra et al. 2003). Following the tradition of the business group as a unitary phenomenon, it is assumed that the impact of business groups is mostly confined to independent firms. This line of conceptualization overlooks the possibility that certain types of business groups are impacted in a similar manner as the independent firms. We examine the entry barrier implications of affiliates belonging to large and diversified groups on affiliates of small and medium business groups. Such emphasis provides implications for future studies to disentangle the effect of business groups by moving beyond the binary classification, and looking at specific characteristics of business groups.

Theory and Hypotheses

Institutional Voids, Market Power, and Business Groups

Scholars have advanced multiple theoretical perspectives to explain the evolution and continued dominance of business groups in emerging economies. A systematic review of the business group literature (Gaur and Kumar 2018) suggests that the institutional void perspective has been a dominant theoretical lens to study business groups (Khanna and Yafeh 2007). Studies based on the institutional voids argument conceptualize the emergence of business groups as a response to inefficient external markets (Leff 1978; Khanna and Rivkin 2001). Other explanations view business groups emerging as a result of state-led economic development (Amsden 1989), policy distortions (Ghemawat and Khanna 1998), trust-based social networks (Granovetter 1994), and prevailing authority structure in a society (Hamilton and Biggart 1988).

There is a consensus that business groups continue to persist and dominate the corporate landscape of emerging market economies despite the dissipation of market imperfections and reduction in favorable government support and policies (Gaur and Delios 2015; Khanna and Yafeh 2007). However, the implication of persistent dominance of business groups for social welfare in emerging economies are yet to be examined (Khanna 2000). One aspect of business group dominance is potential entry barriers for other firms (Bain 1956; Lawrence 1993; Weinstein and Yafeh 1995). Even though business groups emerge in response to inefficient and underdeveloped external markets, their market power in an industry may create barriers to entry for new entrants. Therefore, the consequence of overcoming the transactional market imperfection may lead to reinforcement of structural market imperfection through their market power and entry deterrence for unaffiliated firms (Boutin et al. 2013; Khanna 2000).

In the case of emerging economies such as India, there is a high level of information asymmetry between the buyer and seller, misguided regulations and inefficient judicial system to enforce contracts, collectively known as institutional voids, which restrict efficient market-based exchanges (Kedia et al. 2006; Khanna and Palepu 1997). Business groups overcome the external market inefficiencies by relying on the internal market for capital, products, and labor through a network of affiliated, but legally independent firms. Moreover, in the absence of markets for risk and uncertainty, business groups pursue horizontal and vertical integration through forward and backward integration (Leff 1978; Ghemawat and Khanna 1998).

Such actions of business groups lead to the affiliated firms wielding considerable market power, partly due to their large market share in a number of industries (Chang and Choi 1988; Khanna 2000; Lawrence 1993). There are several mechanisms through which market power accrues to group affiliated firms. First, group affiliated firms often have easier access to external as well as internal sources of finance, which helps them consolidate their position in industry (Dieleman and Sachs 2008; Fisman 2001). Second, vertical and horizontal integration in business groups to overcome the paucity of suppliers affects the industry structure by increasing or preserving the market power of affiliated firms (Harrigan 1985; Leff 1978). Third, business groups with their access to governments through political connection indulge in political rent-seeking by obtaining licenses to operate in certain industries (Bhagwati 1982; Ghemawat and Khanna 1998), and influencing the government to erect protectionist industry barriers to restrict competition (Chari and Gupta 2008).

Feenstra et al. (2003) provide a market power based model of business groups by incorporating the horizontal and vertical integration of affiliated firms within the business groups. They argue that by horizontally integrating, groups achieve the benefits of multimarket contact and collusion which contribute to higher prices and profits. By vertically integrating operations within the business groups, groups can effectively sell the intermediate input at marginal cost while covering fixed costs through transfers between firms that jointly maximize profits. Clearly, the efficiency of business groups in overcoming institutional voids through market internalization has potential to increase market power which can reinforce the market imperfection through erecting entry barriers (Caves 1989; Caves and Porter 1977). In the following section, we utilize these arguments to develop our hypotheses focusing on the entry deterrence imposed by business group affiliates.

Business Groups and Entry Barrier

Entry of new firms in an industry is crucial for the efficient functioning of the market economy. New entrants bring new ideas and production processes, increase competition, and contribute to the dynamic efficiency of the market. Prevention of entry through entry barriers is detrimental to industry dynamism and economic and social welfare (Posner 1975). Bain (1956, p. 3) defined entry barriers as “the advantage of established sellers in an industry over potential entrant sellers, their advantages being reflected in the extent to which established sellers can persistently raise their prices above a competitive level without attracting new firms to enter the industry.” Bain (1956), identified two types of market entry barriers—structural and strategic.

Structural barriers to entry arise when new entrants have to overcome incumbent’s inherent advantages such as economies of scale, technological advantage, cost advantages, switching costs for consumers, legal protection, and brand loyalty to compete with the incumbent. Strategic barriers refer to incumbent firm’s deliberate actions to prevent entry by newcomers through investment in capacity, predatory pricing, threat to cut prices to discourage a new entrant or investment in advertising. Porter (1979) further expanded this conceptualization to include several other forms of entry barriers such as capital requirements, economies of scale, switching costs, product differentiation, access to distribution channels, incumbent cost advantages, and government policy.

The presence of business groups has both positive and negative effect when it comes to entry by other firms. Business groups can encourage entry into an industry by helping develop the soft and hard infrastructure for the industry (Fisman and Khanna 2004; Singh et al. 2018). The diversified portfolio and multiunit structure of business groups enable superior sensing and seizing of new growth opportunities in existing as well as emerging industries (Singh et al. 2018). Entry by group affiliated firms in an industry reduces uncertainty and provides confidence to other entrants. Other entrants can, to some extent, free ride on group affiliated firms as unaffiliated firms do not need to invest in gathering information and creating the basic infrastructure (Fisman and Khanna 2004).

However, business groups also erect structural and strategic entry barriers (Mahmood and Mitchell 2004). The structural factors such as cost and technological advantages, economies of scale, and preferential access to resources accrue naturally to group affiliated firms due to the very structure of the business groups as discussed earlier (Khanna and Rivkin 2001; Khanna and Yafeh 2007). The institutional environment in emerging economies such as India augments these structural advantages due to the relative inefficiency of external markets on which unaffiliated firms must rely (Singh and Delios 2017). Internal capital markets of groups enable affiliated firms to finance profitable investments when such investments are not financed by the external capital market due to information asymmetry and agency costs (Singh et al. 2018).

Studies on investment cash follow sensitivity suggest that investment of business segments of diversified firms is sensitive to the cash flow of other segments (Shin and Stulz 1998). Extending the notion of investment cash flow sensitivity to business groups, empirical evidence suggests that investment activities of a business group affiliated firm is significantly impacted by the cash flow of other firms within the same business group even though they are independent legal entities (Shin and Park 1999; Gopalan et al. 2007). Moreover, access to internal capital market allows affiliated firms to invest in innovation (Belenzon and Berkovitz 2010; Lee et al. 2017), international expansion (Delios et al. 2009; Gaur and Kumar 2009; Gaur et al. 2014), increase the scale by new plant acquisitions (Singh et al. 2018) and invest in capital-intensive industries (Belenzon et al. 2013). While investment in innovation and plants is a group-specific advantage, recent evidence suggests that such advantages lead to entry deterrence for unaffiliated firms. For example, Boutin et al. (2013) showed that internal capital markets of business groups enabled affiliated firms in restricting the product market entry of unaffiliated firms.

Another key structural advantage of business groups is their high levels of horizontal and vertical integration (Feenstra et al. 2003). While groups achieve product differentiation through horizontal diversification to benefit from scope economies (Khanna and Rivkin 2001), they achieve scale economies through vertical integration (Leff 1978; Chang and Choi 1988). Moreover, groups use their reputation and the umbrella brand to signal the quality of products, creating switching cost for consumers. For example, Mukherjee et al. (2018) argued that business group reputation helps affiliated firms expand their reach to new customer segments and increases prospective customers’ perceptions of affiliates’ reputation. These advantages associated with vertical and horizontal integration enable affiliated firms to set predatory pricing, use product differentiation and brand equity to increase the customer switching costs, and restrict access to distribution channels (Bain 1956).

In emerging economies, groups also possess preferential access to non-tradeable assets such as political connections which can provide them with easy access to enter and consolidate their position in the industry (Ghemawat and Khanna 1998). For example, Dieleman and Sachs (2008) showed that the Salim Group leveraged managers’ personal relationships with Indonesian government officials to secure exclusive access to particular markets. During the pro-market reform, business groups increase their role as market intermediaries to influence the reform process and restrict the entry of foreign firms (Chari and Gupta 2007). Additionally, business groups, through their affiliates compete in multiple markets. This enables groups to have multimarket contact with unaffiliated firms, which leads to long-lasting mutual forbearance (Bernheim and Whinston 1990). Such mutual forbearance discourages unaffiliated firms to enter industries dominated by business group affiliates.

Considering the positive and negative impacts of business groups on industry entry by unaffiliated firms, we argue that when the level of investment by group affiliated firms is low to moderate, unaffiliated firms may not be deterred to enter a new industry. In fact, a low level of investment by group affiliated firms may signal to other firms about potential opportunities, and encourage them to make investments. Initial investments by group affiliated firms may also help create the basic infrastructure needed for a new industry, encouraging entry by other firms. Gaur et al. (2014) suggest a similar mechanism in the case of Chinese firms’ acquisition behavior. However, beyond a threshold, as the investment by business groups rises, the entry barriers become strong, creating deterrence for new entry by unaffiliated firms. Based on these rationalizations we propose that the investment by business group affiliated firms will have a curvilinear (inverted U shape) relationship with the likelihood of independent firms entering the industry. Accordingly, we propose the following hypothesis:

Hypothesis 1

The investments by business group affiliated firms in an industry have a curvilinear relationship (inverted U shape) with the likelihood of new investments by unaffiliated firms such that the likelihood of investment increases with the share of investment by the business group, and then declines after the group share crosses a threshold.

Business Group Size and Entry Barrier

In the previous section, we discussed the entry barrier implications between firms affiliated with business groups and unaffiliated firms. In this section we focus on the entry barrier between business groups, focusing on the size of the groups.

While the early conceptualizations about entry barriers were mostly confined to firm-specific factors as discussed in the previous section, subsequent studies extended the entry barrier literature to subgroups of firms within an industry (Caves and Porter 1977). Within an industry, a group of firms, known as strategic groups, share substantial structural and strategic characteristics and resemble one another to recognize their mutual dependence. Due to such similarities, firms in a strategic group are likely to respond to firms outside the group in a similar way (Caves and Porter 1977; McGee and Thomas 1986). Therefore, strategic group-specific entry barriers protect the members of one strategic group against the entry by a member of another strategic group. The strategic group-specific character of entry barriers implicates that the entry barriers are erected by the entire strategic group, and are targeted against a particular strategic group rather than an individual firm.

One of the important factors determining a strategic group membership is the size of the member organizations (McGee and Thomas 1986). Size is a particularly salient characteristic of business groups in emerging economies as several of the group advantages are primarily based on their size. Literature suggests that in the case of business groups in emerging economies, size is an important determinant of their strategic orientation and performance (Khanna and Palepu 2000; Khanna and Rivkin 2001; Carney et al. 2011). Anecdotal evidence suggests that larger business groups dominate the corporate landscape of Korea with 44 business groups in accounting for about 40% of manufacturing output, 32% in utilities, and 24% in transportation (Feenstra et al. 2003), and in India top 50 business groups accounting for 39% of the stock market capitalization (Rajakumar and Henley 2007). Despite the dominance of large business groups, there are also a large number of smaller business groups in India and many other economies. For example, the business groups in Taiwan are mostly small and account for only 16% of total manufacturing output (Feenstra et al. 2003).

Clearly, not all business groups behave the same way. The importance of inter-group variability is largely ignored in literature even though some scholars in recent years have advocated to examine this variability (Gaur et al. 2014; Kumar et al. 2012). The size of a business group relates to the economy of scale and scope (Porter 1979) which provides several advantages to business groups. Business groups with large size gain bargaining power through their group brand and reputation to access critical resources to establish market power. The brand name and reputation of a large group is leveraged by affiliated firms to access finance from the stock market through the underwriting securities by other affiliates and alleviating investor concern about the credibility of the business venture. Group reputation is also used to provide debt guarantees to affiliates while borrowing capital from banks (Chang and Hong 2000). Similarly, talented human resources are attracted to large reputed groups (Mahmood and Mitchell 2004). Large groups also have the advantage of infrastructure for lobbying government for political favors and preferential market access (Encarnation 1989). In certain instances, the large business groups may become too powerful as government becomes dependent on them. In such circumstances, large business groups act as a strategic group and create entry barriers for small- and medium-sized business groups.

When a small number of affiliates of large business groups dominate the industry, they may collude with each other to thwart competition from small and medium business groups. However, when the number of affiliates from large business groups increase, such collusion may not be possible. For collusion to be effective, there should be a fairly small number of firms in the industry as cartels are more stable with fewer firms due to the free rider problem with a large number of firms (Posner 1975; Demsetz 1968). Therefore, we expect that when the industry is dominated by investments from few affiliates of large business groups, the entry barrier for smaller business groups will be highest. However, such entry barriers decline as more affiliates from large business groups enter the industry reducing the collusive behavior. Accordingly, we propose:

Hypothesis 2

The investments by large business group affiliated firms in an industry have a curvilinear relationship (U shape) with the likelihood of new investments by affiliated firms of small and medium business groups such that the likelihood of investment decreases with the share of investment of the large business group, and then increases after the large group investment share crosses a threshold.

Methods

Empirical Context

We test the above hypotheses on Indian firms due to the prevalence of business groups and non-group firms in India. Prior to Indian independence in 1947, merchant families invested in diversified industries by floating joint stock companies and consolidated them under a single group umbrella by entrusting the management of the joint stock companies to their families (Pattnaik et al. 2013). This structure allowed group companies to expand vertically and horizontally to overcome the deficiencies of underdeveloped external markets. Adoption of socialist economic policies after independence further reinforced market imperfections. The import substitution policy forced existing firms to float new ventures for products they could not import. Further, industrial licensing policy, with its aim to limit concentration, and antitrust regulation, led to significant industrial diversification (Ghemawat and Khanna 1998).

In 1991, India introduced market-based economic reforms in a gradual manner providing adequate opportunity for business group firms to adapt to the market-based economic system. As a result, business groups retained their competitiveness through their efficient use of internal capital, labor, and product markets. Given these characteristics of the Indian economy, India provides an ideal context to study the role of business group market power on industry entry barriers. Several studies have used the Indian context to understand the competitiveness of business groups (Khanna and Palepu 2000), tunneling of financial resources among group affiliates (Bertrand et al. 2002), ownership and corporate governance (Khanna and Palepu 2000), and corporate diversification (Ghemawat and Khanna 1998).

Sample

We collected the data from two databases compiled by the Center for Monitoring Indian Economy (CMIE). We obtained the investment-specific data from the Capex database, which provides reliable information on the corporate expansion of Indian companies (Singh et al. 2018). CMIE compiles this database by obtaining information on new investments through company releases, media reports, and other public sources. We obtained the detailed information for all the investments from the year 1995 till 2014. We obtained data on the name of the company, name of the investment announced, total investment cost, investment industry, ownership status, the status of the investment, year of announcement, and year of completion. The ownership information helps us identify whether the company undertaking an investment is affiliated with a business group, MNC subsidiary, state-owned enterprise, or standalone firm. We only considered investments which were completed, removing the abandoned investments to arrive at information on 5922 investments.

We obtained information on the company background and financials from the PROWESS database compiled by CMIE. PROWESS is the most comprehensive database on Indian companies used in several previous studies (Elango and Pattnaik 2007; Khanna and Rivkin 2001; Khanna and Palepu 2000; Singh and Gaur 2013). The data on GDP growth and FDI inflow in India were obtained from the Worldbank database website. After matching information from the two databases, our final sample consists of 546 companies in 68 industries. The unit of analysis in our empirical models was at the firm-year level as we aggregated the count of the investments by years for each firm in our sample.

Measures

Dependent Variable

Considering the objective of the study is to assess the entry barrier into an industry, we measured the likelihood of launching a new investment into an industry by unaffiliated firms (and affiliates of small and medium business groups for hypothesis 2). We constructed a dichotomous variable representing the new investment into an industry (\({New invest}_{ijy})\)which takes a value of 1 when new investments are launched into an industry and 0 otherwise.

Independent Variables

The key independent variables used in this study are the number of new investment by business group affiliates in an industry per year and the number of new investment by affiliates of the large business groups. The number of new investment by the business groups \({(Business Group Investment}_{jy-1})\) is a count variable of the total number of new investments launched by the business group affiliates in the previous year. The number of new investment by the large business groups \({(Large Business Group Investment}_{jy-1})\) is a count variable of the total number of new investment by top 10% of the business groups (based on assets) in a year. To identify whether a firm belonged to business group or not, we relied on the classification provided in the Prowess database (Khanna and Palepu 2000; Popli et al. 2017).

Control Variables

We included several control variables which may impact the investment decisions of the unaffiliated firms and affiliates of small and medium groups in an industry. We controlled for industry size (\(Industry~Siz{e_j}\)) which is the average industry sales, industry growth (\(Industry~Growt{h_j}\)) which is the rate of industry sales growth from previous year. We also controlled for number of business group firms in the industry (\(Industry~Group~Firm{s_j}\)) which provides an indication about the competition from the business groups. Additionally, we control for industry competition by including the C4 (\(Industry~Concentration~Rati{o_j}\)), which is measured as the ratio of sales by the four largest firms divided by industry sales.

At the business group level, we included several controls to capture the group related effects on competition in an industry. \(Business~Group~Diversification{~_{jy - 1}}\) is the average number of industries in which business groups have invested, \(Business~Group~Age{~_{jy - 1}}\) is the average age of business groups in the industry, and \(Business~Group~Establishment{~_{jy - 1}}\) is the proportion of business groups established before 1991 in the industry. This control represents the groups that were established prior to the introduction of economic reforms in India who are more experienced and well-endowed to restrict investment from unaffiliated firms.

We also included several firm-level controls. \(Firm~ag{e_{iy}}\) is the number of years since incorporation of the firm. \(Firm~cas{h_i}\) is the cash holding of the firm which takes a value of 1 if the firm is among the top 20% of the firms in the industry, and 0 otherwise. \(Firm~deb{t_i}\) is the firm’s total liability divided by total assets which takes a value of 1 if the firm is among the top 20% of the firms in the industry, 0 otherwise. \(Firm~current~rati{o_i}\) is the total current assets of the firm divided by the total assets which takes a value of 1 if the firm is among the top 20% of the firms in the industry, 0 otherwise. \({\text{Firm~R}}\& D~Intensit{y_i}\) is the firm’s R&D expenditure divided by total sales which takes a value of 1 if the firm is among the top 20% of the firms in the industry, 0 otherwise.

Macro-level factors have also been controlled in our study. \(Political~Regime~{1_y}\) is the time dummy for the period 1998–2004 which represents the national democratic alliance (NDA) government, and \(Political~Regime~{2_y}\) is the time dummy for the period 2005–2014 which represents the united progressive alliance (UPA) government. \(GDP~Growth{~_y}~and~FDI~Inflow{~_y}\) are the GDP growth rate and FDI inflow into India. Table 1 presents the description of these variables.

Empirical Model

To investigate the impact of new investments by business groups, we run five logit models (models 1–5). The dependent variable is a firm’s new investment decision, which is modeled as follows:

\({\text{New}}\;{\text{inves}}{{\text{t}}_{ijy}}=\alpha +{\beta _1}{\text{Business}}\;{\text{Group}}\;{\text{Investmen}}{{\text{t}}_{jy - 1}}{\text{~}}+{\beta _2}{\text{Business}}\;{\text{Group}}\;{\text{Investment}}{2_{jy - 1}}+{\gamma _1}{\text{IN}}{{\text{D}}_j}+{\gamma _2}{\text{FIR}}{{\text{M}}_i}+{\gamma _3}{\text{Macr}}{{\text{o}}_y}+{\gamma _4}{\text{B}}{{\text{G}}_{jy - 1}}+{e_{ijy}}\)

\({Business \;Group\; Investment}_{jy-1}\)is the number of new investments announced by business group affiliates in the industry j in the previous year y−1, and \({Business Group Investment2}_{jy-1}\)is the quadratic term. These two variables are used to capture the impact of new investments announced by business group affiliates. If the coefficient \({\beta }_{1}\) is positive and significant and the coefficient \({\beta }_{2}\) is negative and significant, the impact is a concave curve (inverted U-shaped). If the coefficient \({\beta }_{1}\) is negative and significant and the coefficient \({\beta }_{2}\) is positive and significant, the impact is a convex curve (U-shaped). \({IND}_{j}\) is the industry-specific control variable vector, \({FIRM}_{i}\) is the firm-specific control variable vector, \({Macro}_{y}\) is the macro factor vector including political regimes, GDP growth, and FDI inflow, and \({BG}_{jy-1}\) is the business group-specific control variable vector.

The probability of starting a new investment by firm i in industry j in year y is

\({\text{Pro}}{{\text{b}}_{ijy}}=\frac{{{\text{exp}}({\text{New}}\;{\text{inves}}{{\text{t}}_{ijy}})}}{{1+{\text{exp}}({\text{New}}\;{\text{inves}}{{\text{t}}_{ijy}})}}\)

We run separate logit models to check the impact of the new investment activities by large business groups on smaller business groups. In these models, the key independent variables are the number of new investments by top 10% business groups \({Large Business Group Investment}_{jy-1}\) and its quadratic term. The dependent variable in models 2 is the new investment decision by the small and medium business group firms.

Results

Table 2 presents the descriptive statistics and correlation matrix of the key variables used in this study. On average, there are 0.845 new investments by business groups in an industry in a year with a maximum of 26 new investments. There are 0.283 new investments by the 10% largest business groups. The firms’ average age is 13.4 years, and the average industry growth is 1.23%.

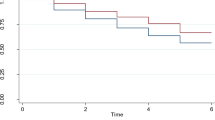

Table 3 presents the results for Models 1–5, which are used to test Hypothesis 1. The coefficients for the number of new investments by business groups in an industry in all five models are positive and significant (Table 3, Model 1: β = 0.523, p < 0.01). This positive coefficient on the linear term suggests that the likelihood of investment by unaffiliated firms increases with the share of investment by business groups. The coefficients for the quadratic term (the squared number of new investments by business groups) in all five models are negative and significant (Table 3, Model 1: β=− 0.023, p < 0.01), suggesting that the investment likelihood of unaffiliated firms decreases after a threshold. Therefore, hypothesis 1 is supported.

In Table 4, Models 1–5 present the results for hypothesis 2. The coefficients for the number of new investments by the top 10% business groups (by size) in all five models are negative and significant (Table 4, Model 1: β = − 0.249, p < 0.01). The coefficients for the quadratic term (the squared number of new investments by the top 10% business groups) in all five models are positive and significant (Table 4, Model 1: β = 0.030, p < 0.01). Therefore, the results suggest that the investments by top 10% business groups (by size) have a U-shaped relationship with the likelihood of new investments by small and medium business groups. Hypothesis 2 is supported.

Robustness Tests

To check the sensitivity of our results, we conducted extensive robustness tests. We used several statistical methods to investigate whether our results are sensitive to the method. Specifically, we have conducted (1) Generalized Linear Model for the binomial family, (2) Probit model, and (3) Random effects Probit model. The results, shown in Tables 5 and 6 are consistent with our main results, supporting the two hypotheses.

In addition, we checked the robustness of our curvilinear relationship following the process suggested by prior research (Haans et al. 2016). Specifically, for H1, the lower end of the curve is positive and significant (β = 0.344, p < 0.05), and the upper end is negative and significant (β=− 0.390, p < 0.05). This confirms the inverted U-shaped relationship proposed in H1. Similarly, for H2, the lower end is negative and significant (β=− 0.283, p < 0.05), and the upper end is positive and significant (β = 0.610, p < 0.05) which confirm the U-shaped relationship.

Discussion and Conclusion

Considering the ubiquity of business groups and their continued persistence in emerging economies, there is a debate in existing literature on the positive and negative aspects of business groups, categorizing them as paragons or parasites and heroes or villains (Khanna and Yafeh 2007). Such categorization restricts our understanding of the complexity of business groups and their socio-economic welfare and ethical implications. In this study, we attempted to uncover this complexity by examining the positive and negative consequences of business groups on industry entry barriers for unaffiliated firms as well as for firms belonging to small and medium business groups.

Drawing on the institutional voids and market power hypotheses, we find an inverted U-shaped relationship between the investment by business group affiliates and the investment by unaffiliated firms. This suggests that business group affiliates facilitate and restrict entry depending on the magnitude of their presence in the industry. Small to moderate share of investment by business group facilitates entry of the unaffiliated firms. However, when their share becomes large, the barriers to entry into that industry become higher. We further examine inter-group variation by looking at the impact of larger groups on small and medium groups. We find that investments by large business groups impact the investments of small and medium business groups in a U-shaped manner. These findings provide important insights on the role of business groups in creating industry entry barriers. Our findings suggest that the role of business groups in creating entry barriers is more complex than what has been argued in prior literature (Lawrence 1993; Weinstein and Yafeh 1995).

Overall, we find that concentration of industrial investment activities by business groups is economically counterproductive in the long run due to the entry barriers that they create for unaffiliated firms. Moreover, larger business groups also negatively impact entry by smaller business groups. With a focus on market entry behavior, this study complements prior studies which highlight the role of business groups in restricting institutional reforms (Chari and Gupta 2008; Guillén 2000), efficiency of capital market (Pattnaik et al. 2013), and factor market development. While the literature has demonstrated the role of business groups in facilitating industrial development (Amsden 1989; Fisman and Khanna 2004) and overcoming market imperfections (Khanna and Palepu 1997), the issue of business group market power has been neglected, particularly in the context of emerging economies. This is partly due to the emphasis on economic growth and output in emerging market economies compared to market distortion which inhibits allocative efficiency and income distribution (Leff 1979).

The market-based economic system adopted by emerging economies through pro-market reforms has posed an obvious problem for policymakers on how to mitigate the numerous welfare distortions created by business group market power without losing their role in industrial development. While the institutional voids argument predicts that with the growth of national economy, development of external market, and intensity of competition the market power of business groups will gradually decline, recent evidence shows that business groups have thrived due to their organizational structure, cumulative experience, technological and managerial know-how vis-à-vis the standalone firms (Lee and Gaur 2013; Singh and Gaur 2009). However, easy entry and exit of firms is prerequisite of the market economy which leads to entrepreneurship, innovation, and competition. One of the primary approaches adopted by the policymakers in emerging economies to reduce the entry restrictions is through introducing antitrust regulations. However, due to the political realities of close government–business relations, such regulations are often weak or relaxed to foster rapid economic growth, and even promote selected business groups (Amsden 1989; Guillén 2000; Keister 2000).

It is in this context that there is a greater need to shift the academic discourse to examine the ethical implications of firm behavior, instead of only efficiency-enhancing role of firms in society. Business ethics literature recommends moral managerial model and moral market model (Boatright 1999) in support of positive ideals of competition (Paine 1990). While the moral managerial model emphasizes the morality of business managers in their decision making, the moral market model emphasizes the responsibility to encourage a market system and a system of corporate governance that minimizes individual discretion and favors rules. In order to encourage free and fair competition, both the moral market model and the moral manager model of ethical business behavior are necessary to be exercised by all stakeholders to restrict barriers to entry and anti-competitive behavior (Hendry 2001; Hemphill 2004).

With our attempt in this study to refocus the academic discourse on important social aspects of business group presence, we provide several avenues for future research. While this study examined the entry barrier implications of business groups to demonstrate the benefits and costs of business groups in emerging economies, our focus was on the product market. Future studies may extend this to the capital and labor markets. The internal capital market is an important characteristic of business groups through which group affiliates access finance from each other. Existing studies have shown that continued dependence on internal capital market reduces the motivation of group affiliates to disseminate corporate information to information intermediaries such as stock analysts which restrict the development of external capital market (Pattnaik et al. 2013; Chang and Hong 2000).

There is a need to extend this inquiry by examining whether domination of business groups in the stock market restricts the unaffiliated firms and affiliates of small and medium groups to raise capital from the stock market. Does the larger share of lending to business group affiliates reduces the borrowing by unaffiliated firms and affiliates of small and medium groups? In the labor market, business groups which train their managers internally may lock in the best managerial talents through long-term employment contract. This may increase the rigidity of the labor market, making it difficult for unaffiliated firms and affiliates of small and medium groups to source the best managerial talents from the market. Second, this study examined one of the dimensions (i.e., size) of inter-group variation to demonstrate the entry barrier impact of large business groups on small and medium business groups. Future studies may pursue other dimensions such as level of diversification, ownership structure, and governance mechanisms to tease out inter-group variations.

References

Amsden, A. (1989). Asia’s next giant: South Korea and late industrialization. Oxford: Oxford University Press.

Bain, J. S. (1956). Barriers to new competition. Boston, MA: Harvard University Press.

Belenzon, S., & Berkovitz, T. (2010). Innovation in business groups. Management Science, 56(3), 519–535.

Belenzon, S., Berkovitz, T., & Rios, L. A. (2013). Capital markets and firm organization: How financial development shapes European corporate groups. Management Science, 59, 1326–1343.

Bernheim, B., & Whinston, M. D. (1990). Multimarket contract and collusive behavior. Rand Journal of Economics, 21, 1–26.

Bertrand, M., Mehta, P., & Mullainathan, S. (2002). Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics, 117(1), 121–148.

Bhagwati, J. N. (1982). Directly unproductive, profit-seeking (DUP) activities. Journal of Political Economy, 90, 988–1002.

Boatright, J. (1999). Does business ethics rest on a mistake? Business Ethics Quarterly, 9(4), 583–591.

Boutin, X., Cestone, G., Fumagalli, C., Pica, G., & Nicolas, S. (2013). The deep-pocket effect of internal capital markets. Journal of Financial Economics Volume, 109(1), 122–145.

Carney, M., Gedajlovic, E. R., Heugens, P., Van Essen, M., & Van Oosterhout, J. (2011). Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3), 437–460.

Caves, R. (1989). International differences in industrial organization. In R. Schmalensee & R. Willig (Eds.), Handbook of industrial organization. Amsterdam: North-Holland; pp. 1226–1249.

Caves, R. E., & Porter, M. (1977). From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. Quarterly Journal of Economics, 91, 241–262.

Chang, S., & Choi, U. (1988). Structure, strategy and performance of Korean Business Groups: A transactions cost approach. Journal of Industrial Economics, 37, 141–158.

Chang, S. J., & Hong, J. (2000). Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3), 429–448.

Chari, A., & Gupta, N. (2008). Incumbents and protectionism: The political economy of foreign entry liberalisation. Journal of Financial Economics, 88(3), 633–656.

Cottrill, M. T. (1990). Corporate social responsibility and the marketplace. Journal of Business Ethics, 9, 723–729.

Cuervo-Cazurra, A., Gaur, A. S., & Singh, D. (2018). Pro-market institutions and global strategy: The pendulum of pro-market reforms and reversals. Authors’ manuscript.

Delios, A., Gaur, A. S., & Kamal, S. (2009). International acquisitions and the globalization of firms from India. In J. Chaisse & P. Gugler (Eds.), Expansion of Trade and FDI in Asia: Strategic and Policy Challenges. New York, NY: Routledge.

Demsetz, H. (1968). The cost of transacting. The Quarterly Journal of Economics, 82(1), 33–53.

Dieleman, M., & Sachs, W. M. (2008). Coevolution of institutions and corporations in emerging economies: How the Salim Group morphed into an institution of Suharto’s crony regime. Journal of Management Studies, 45(7), 1274–1300.

Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: A study of Indian firms. Journal of International Business Studies, 38(4), 541–555.

Encarnation, D. (1989). Dislodging multinationals: India’s comparative perspective. Cornell University Press: Ithaca, NY.

Feenstra, R., Hamilton, G., & Lim, E. M. (2002). Chaebol and catastrophe: A new view of business groups and their role in the Korean financial crisis. Asian Economic Papers, 1(2), 1–45.

Feenstra, R., Huang, D., & Hamilton, G. (2003). A market-power based model of business groups. Journal of Economic Behavior and Organizations, 51, 459–485.

Fisman, R. (2001). Estimating the value of political connections. American Economic Review, 91, 1095–1102.

Fisman, R., & Khanna, T. (2004). Facilitating development: The role of business groups. World Development, 32(4), 609–628.

Gaur, A. S., & Delios, A. (2015). International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2), 235–253.

Gaur, A. S., & Kumar, M. (2018). A systematic approach to conducting review studies: An assessment of content analysis in 25 years of IB research. Journal of World Business. https://doi.org/10.1016/j.jwb.2017.11.003.

Gaur, A. S., & Kumar, V. (2009). International diversification, firm performance and business group affiliation: Empirical evidence from India. British Journal of Management, 20, 172–186.

Gaur, A. S., Kumar, V., & Singh, D. (2014). Institutions, resources, and internationalization of emerging economy firms. Journal of World Business, 49(1), 12–20.

Gaur, A. S., Ma, X., & Ding, Z. (2018). Perceived home country supportiveness/unfavorableness and Outward Foreign Direct Investment from China. Journal of International Business Studies. https://doi.org/10.1057/s41267-017-0136-2.

Ghemawat, P., & Khanna, T. (1998). The nature of diversified oups: A research design and two case studies. Journal of Industrial Economics, XLVI(1), 35–62.

Gopalan, R., Nanda, V. K., & Seru, A. (2007). Affiliated firms and financial support: Evidence from Indian Business Groups. Journal of Financial Economics, 86, 759–795.

Granovetter, M. (1994). Business groups. In N. J. Smelser & R. Swedberg (Eds.), In: Handbook of Economic Sociology. Princeton, NJ: Princeton University Press.

Guillén, M. F. (2000). Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3), 362–380. 47.

Haans, R. F., Pieters, C., & He, Z. L. (2016). Thinking about U: Theorizing and testing U-and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37, 1177–1195.

Hamilton, G., & Biggart, N. (1988). Market, culture, and authority. American Journal of Sociology, 94, S52–S94.

Harrigan, K. R. (1985). Vertical integration and corporate strategy. Academy of Management Journal, 28, 397–425.

Hemphill, T. A. (2004). Antitrust, dynamic competition and business ethics. Journal of Business Ethics, 50, 127–135.

Hendry, J. (2001). Morality and markets: A response to boatright. Business Ethics Quarterly, 11(3), 537–545.

Hobday, M., & Colpan, A. M. (2010). Technological innovation and business groups. In A. M. Colpan, T. Hikino & J. R. Lincoln (Eds.), The Oxford handbook of business groups: 763–782. Oxford: Oxford University Press.

Kant, K. (2016). India, 15 of the top 20 business groups are family-owned! Retrieved 01 February, 2018 from http://www.rediff.com/money/report/special-in-india-15-of-the-top-20-business-groups-are-family-owned/20160818.htm.

Kedia, B. L., Mukherjee, D., & Lahiri, S. (2006). Indian business groups: Evolution and transformation. Asia Pacific Journal of Management, 23(4), 559–577.

Keister, L. A. (2000). Chinese business groups: The structure and impact of interfirm relations during economic development. New York: Oxford University Press.

Khanna, T. (2000). Business groups and social welfare in emerging markets: Existing evidence and unanswered questions. European Economic Review, 44, 748–761.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Khanna, T., & Palepu, K. (2000). Is group affiliation profitable in emerging markets? Ananalysis of diversified Indian business groups. Journal of Finance, 55(2), 867–891.

Khanna, T., & Rivkin, J. W. (2001). Estimating the performance effects of business groups inemerging markets. Strategic Management Journal, 22(1), 45–74.

Khanna, T., & Yafeh, Y. (2007). Business groups in emerging markets: Paragons or parasites? Journal of Economic Literature, 45(2), 331–372.

Kumar, V., Gaur, A. S., & Pattnaik, C. (2012). Product diversification and international expansion of business groups: Evidence from India. Management International Review, 52, 175–192.

Lawrence, R. (1993). Japan’s different trade regime: An analysis with particular reference to keiretsu. Journal of Economic Perspectives, 7, 3–19.

Lee, C.-Y., Lee, J.-H., & Gaur, A. S. (2017). Are large business groups conducive to industry innovation? The moderating role of technological appropriability. Asia Pacific Journal of Management, 34(2), 313–337.

Lee, J. H., & Gaur, A. S. (2013). Managing multi-business firms: A comparison between Korean chaebols and diversified US firms. Journal of World Business, 48(4), 443–454.

Leff, N. (1978). Industrial organization and entrepreneurship in the developing countries: the economic groups. Economic Development and Cultural Change, 26, 661–675.

Leff, N. (1979). Entrepreneurship and economic development: The problem revisited. Journal of Economic Literature, 17, 46–64.

Mahmood, I. P., & Mitchell, W. (2004). Two faces: Effects of business groups on innovation in emerging economies. Management Science, 50(10), 1348–1365.

McGee, J., & Thomas, H. (1986). Strategic groups: Theory, research and taxonomy. Strategic Management Journal, 7, 141–160.

Mukherjee, D., Makarius, E. E., & Stevens, C. E. (2018). Business group reputation and affiliates’ internationalization strategies. Journal of World Business, 53(2), 93–103.

Nelson, J. (1994). Business ethics in a competitive market. Journal of Business Ethics, 13, 663–666.

OECD (2014). OECD Economic Surveys: Korea 2014. Paris: OECD Publishing. http://dx.doi.org/10.1787/eco_surveys-kor-2014-en.

OECD (2016). OECD economic surveys: Korea 2016. Paris: OECD Publishing. http://dx.doi.org/10.1787/eco_surveys-kor-2016-en.

Pae, P. (2018). South Korea’s chaebol, bloomberg quicktake. Retrieved 28 February, 2018. https://www.bloomberg.com/quicktake/republic-samsung.

Paine, L. S. (1990). Ideals of competition and today’s marketplace’. In C. C. Walton (Ed.), Enriching business ethics (pp. 91–112). New York: Plenum Press.

Pattnaik, C., Chang, J. J., & Shin, H. H. (2013). Business groups and corporate transparency in emerging markets: Empirical evidence from India. Asia Pacific Journal of Management, 30(4), 987–1004.

Piepenbrink, A., & Gaur, A. S. (2013). Methodological advances in the analysis of two-mode networks: An illustration using board interlocks of Indian business groups. Organizational Research Methods, 16(3), 474–496.

Popli, M., Ladkani, R. M., & Gaur, A. S. (2017). Business group affiliation and post-acquisition performance: An extended resource-based view. Journal of Business Research, 81, 21–30.

Porter, M. E. (1979). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

Posner, R. A. (1975). The social cost of monopoly and regulation. Journal of Political Economy, 83, 807–827.

Rajakumar, J. D., & Henley, J. S. (2007). Growth and persistence of Large Business Groups in India. Journal of Comparative International Management, 10(1), 3–24.

Rawls, J. (1971). A theory of justice. Cambridge, MA: Harvard University Press.

Shin, H., & Stulz, R. (1998). Are internal capital markets efficient? The Quarterly Journal of Economics, 453, 531–552.

Shin, H.-H., & Park, Y. S. (1999). Financing constraints and internal capital markets: Evidence from Korean Chaebols. Journal of Corporate Finance, 5(2), 169–191.

Singh, D. (2009). Export performance of emerging market firms. International Business Review, 18(4), 321–330.

Singh, D., & Delios, A. (2017). Corporate governance, board networks and growth in domestic and international markets: Evidence from India. Journal of World Business, 52(5), 615–627.

Singh, D., & Gaur, A. S. (2013). Governance Structure, innovation and internationalization: Evidence from India. Journal of International Management, 19(3), 300–309.

Singh, D., Pattnaik, C., Gaur, A. S., & Ketencioglu, E. (2018). Corporate expansion during pro-market reforms in emerging markets: The contingent value of group affiliation and unrelated diversification. Journal of Business Research, 82, 220–229.

Singh, D. A., & Gaur, A. S. (2009). Business group affiliation, firm governance and firm performance: Evidence from China and India. Corporate Governance, 17(4), 411–425.

Weinstein, D., & Yafeh, Y. (1995). Collusive or competitive? An empirical investigation of keiretsu behavior. Journal of Industrial Economics, 43, 359–376.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Rights and permissions

About this article

Cite this article

Pattnaik, C., Lu, Q. & Gaur, A.S. Group Affiliation and Entry Barriers: The Dark Side Of Business Groups In Emerging Markets. J Bus Ethics 153, 1051–1066 (2018). https://doi.org/10.1007/s10551-018-3914-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-018-3914-2