Abstract

Environmental research has usually highlighted that the existence of slack resources in an organization helps allocate investment to innovative initiatives. However, the existing literature has paid very limited attention to how slack resources can influence the effects of focused and diversified innovations in different ways. Agency theory scholars claim that a manager’s first preference when confronted with discretionary resources will not generate positive investments for the firm, but their own opportunistic preferences. The differences between focused and diversified environmental innovations allow us to gain a better understanding of the financial impact of being focused and how slack resources matter in this context. We analyze a longitudinal sample of 5845 environmental patents from the 75 largest companies in the electrical components and equipment industry worldwide. Our results show that high levels of slack resources reduce the existing positive relationship between focused environmental innovations and a firm’s financial performance. These results contribute to delineating the theoretical and empirical implications of focused versus diversified environmental innovations and extend the literature on ethical dilemmas concerning managers’ use of slack resources in the firm.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Research has highlighted that environmental innovations are not only tools for reducing the pollution that firms produce, but are also central aspects of firm strategy (e.g., Anastas and Warner 1998; Hahn et al. 2007; Hart 1995; Voegtlin and Scherer 2017). Other authors have shown a positive relationship between a firm’s environmental innovations and its financial performance (e.g., Marcus 2015; Russo and Fouts 1997). Even so, it is generally accepted that environmental innovations differ from other innovations within the firm in that their joint technological, legal, and ethical roots generate riskier investments (Berrone et al. 2013; Cainelli, De Marchi, and Grandinetti 2015). Thus, managers’ preferences (e.g., Alessandri and Pattit 2014; Sharma 2000) are particularly relevant in delimiting the orientation of environmental innovations in firms.

Recent works have called for a more fine-grained analysis of different environmental innovations to gain a better understanding of their financial implications and the ethical dilemmas around the necessary investments (Alessandri and Pattit 2014). In this context, different works have highlighted the importance of analyzing whether focused or diversified environmental innovations influence firms’ financial performance differently (e.g., Berrone et al. 2013; Scharfstein 1998). Drawing on previous traditions in the environmental innovation literature (e.g., Berrone et al. 2013; Cainelli et al. 2015; Chen 2008), we define focused environmental innovations as those whose main purpose is to improve a known environmental technology, learning or capability of the firm, whereas diversified environmental innovations are those unfamiliar to the firm.

The importance of slack resources for analyzing the implications of firms’ environmental innovations has prompted some debate. Slack resources are those resources accumulated by the firm to operate efficiently (Davis and Stout 1992; Greenley and Oktemgil 1998). While the innovation literature has traditionally highlighted that managers use slack resources to increase the number and positive effects of diversified innovations in firms (e.g., Alessandri and Pattit 2014; Wu and Tu 2007), agency perspective scholars claim that slack resources are mainly used to generate opportunistic value for top managers (e.g., Amihud and Lev 1981; Jensen and Murphy, 1990). Hence, the existing literature is unclear on both the financial implications of focused environmental innovations and the influence of slack resources in reinforcing or eroding the impact of focused environmental innovations on financial performance.

Our paper analyzes the moderating role of slack resources in the relationship between focused environmental innovations and financial performance. Our results contribute to the environmental innovation literature by showing that slack resources exert a different influence on the financial effects of focused and diversified environmental innovations. Specifically, our results support the proposition that moderate levels of slack resources in the firm reinforce the positive relationship between focused environmental innovations and financial performance. However, high levels of slack resources generate a negative relationship between focused environmental innovations and firm performance. This finding is counterintuitive because slack resources should provide convenient opportunities to exploit environmental innovations, and supports ethical dilemmas concerning the existence of slack resources in the firm and the possibility of managerial opportunismFootnote 1 (e.g., Douglas and Wier 2000, 2005).

After this introduction, our paper continues as follows. We present the theoretical background and our hypotheses and then describe our methodology and a longitudinal sample of 5845 environmental patents in the electrical components and equipment industry worldwide. The results section details our findings, which support the hypotheses in our paper. Finally, we discuss the implications and limitations of this research, and directions of future research.

Theoretical Background

Innovation and the Agency Theory Framework: Focused Versus Diversified Innovation

The agency perspective analyzes the conflict that may arise when one party, the principal, i.e., the shareholders, contracts with another, the agent, i.e., the manager, to make decisions on behalf of the former (Fama and Jensen 1983). Conflicts arise because the organization’s and manager’s interests may not be aligned. This misalignment is generated because of the information asymmetries between principals and agents, as well as the bounded rationality of both parties, which can ultimately result in moral hazard for the managers (Gómez-Mejia and Wiseman 2007).

While agency theory has been applied to a wide variety of topics, it has become particularly relevant in the innovation literature (e.g. Balkin, Markman and Gomez-Mejia 2000), as managers have a direct influence on the organization’s research and development (R&D) portfolio, thus shaping the firm’s innovation strategy (e.g., Alessandri and Pattit 2014; Gomez-Mejia et al. 2014; Hoskisson et al. 2002; Wu and Tu 2007). For instance, Alessandri and Pattit (2014) found that managers’ may pursue innovations that maximize their own utility, even when this strategy does not maximize the company’s long-term financial performance. Similarly, Hoskisson et al. (2002) found that when a firm has short-term negative earnings, managers will be more concerned to reduce the risk to their own human capital (e.g., personal image and short-term achievements) than to consider the potential positive long-term effects for the organization.

Focused and diversified innovations have different outputs and implications, and while the focus versus diversification debate is not new, the lack of a consensus on the implications of the two has made this one of the most relevant topics in management (e.g., Kaul 2012; Toh 2014). Focused innovations are those that invest in a well-known technology, extending existing competencies that are proximate and predictable; in contrast, diversified innovations spread investment into unrelated technologies that require experimentation, offering new but uncertain alternatives (Cohen and Levinthal 1990; Nooteboom et al. 2007). While the focused approach usually allows a firm to increase the speed and efficiency of innovations in a specific field (e.g., Cohen and Levinthal 1990; Moorman and Slotegraaf 1999), the diversified approach fosters the development of breakthrough innovations that, despite a less predictable probability of success, have the potential to notably increase financial returns (e.g., Prahalad and Hamel 1990; Spencer 2003). The agency perspective has identified some moral hazards related to the decision about which approach to adopt.

Managers face an ethical dilemma when they have to make decisions about a firm’s approach to innovation, comparing their own interest in increasing their reputation and influence with the owners’ conflicting demands concerning risk aversion and profitability. Specifically, agency theory scholars have shown that some managers exhibit a tendency toward diversified innovations because they may increase information asymmetries between managers and the firm, so that the former become less replaceable and have more freedom to take decisions based on personal preferences (e.g., Alessandri and Pattit 2014; Kaul 2012; Toh 2014). In this regard, moral hazard occurs when managers take extra risks because the shareholders (and not the managers personally) will bear the cost of them. More specifically, moral hazard can occur when the agent—i.e., the party with more information about its actions and implications—has a tendency or incentive to behave inappropriately from the perspective of the party with less information (the principal or shareholders), thus taking advantage of the information asymmetry between them (e.g., Alessandri and Pattit 2014; Fama and Jensen 1983). Regarding the moral hazards associated with a diversified approach to innovation, diversifying into unrelated technologies makes shareholders less able to fully understand them. Principals have more difficulty with diversified innovation since the new investments are a departure from the traditional fields in which the firm invests; it is more complicated for shareholders to evaluate the real implications and risks of this innovation strategy. Given this difficulty of understanding exhibited by principals, diversifying increases managers’ autonomy as well as their professional reputation thanks to this extra complexity. In this context, managers may have an incentive to pursue their personal preferences and increase information asymmetries by diversifying, even when the benefits for shareholders may suffer as a consequence (Hoskisson et al. 2002). We try to shed some light on this by analyzing environmental innovations.

Environmental Innovations

Environmental innovations can be defined as “measures of relevant actors, which: (i) develop new ideas, behavior, products and processes, apply or introduce them; and (ii) contribute to a reduction of environmental burdens or to ecologically specified sustainability targets” (Rennings 2000: 322). Similarly, the Eco-Innovation Observatory (EIO) defines environmental innovations as “the introduction of any new or significantly improved product (goods or services), process, organizational change or marketing solution that reduces the use of natural resources (including materials, energy, water and land) and decreases the release of harmful substances across the whole life-cycle” (EIO 2011: 7). From these two seminal definitions, it follows that the objective of reducing the firm’s negative environmental impact is the main characteristic that differentiates a general from an environmental innovation. Nevertheless, some scholars have argued that there are other differences between environmental and general innovation.

Environmental innovations are characterized by a long-term orientation (Wang and Bansal 2012) and a high level of uncertainty compared with other innovations in the firm (Cainelli et al. 2015; Huang and Li 2017). This long-term orientation may provoke a misalignment between principals’ and agents’ preferences, since the later tend to “shun efforts that have the potential to upset short-term operations and profits” (Robeson and O’Connor 2013:611), resulting into managers’ moral hazard. Regulation is particularly relevant in the environmental arena and is also one of the main sources of uncertainty for environmental innovations (Brunnermeier and Cohen 2003; Marcus et al. 2011; Voegtlin and Scherer 2017). Therefore, some managers could be reluctant to commit a large amount of resources (i.e., financial, labor, time) to improving their environmental R&D portfolio due to the instability of the economic, institutional, and regulatory factors associated with environmental issues (Brunnermeier and Cohen 2003). The recent withdrawal of the US from the Paris Climate Agreement illustrates that firms (especially US firms) that have invested with the aim of fulfilling the requirements of this international treaty may now consider that their efforts have been a waste of resources. In this regard, although shareholders and boards may be ready to accept a commitment to developing environmental innovations that preserve long-term corporate viability, the uncertain nature of environmental investments may lead managers to select environmental innovations that prioritize their own preferences. This might include securing investments that enable them to maintain their reputation as successful executives (Alessandri and Pattit 2014) or provide them with the opportunity to extend their professional relevance or autonomy in the firm.

This moral hazard, related to the uncertain financial implications of a firm’s environmental innovations, may be partially mitigated by the differences between focused and diversified environmental innovations. Chen (2008: 533) defines green core competence as “the collective learning and capabilities about green innovation and environmental management in an organization.” In this context, the main aim of focused environmental innovations is to improve on the firm’s known environmental technology, learning or capability; in contrast, diversified environmental innovations involve investing in a variety of new environmental technologies, learning, or capabilities unfamiliar to the firm. Focused environmental innovations are more likely to overcome the risky nature of environmental innovation to a greater extent than diversified environmental innovations because of their relationship with a core of specific resources in the firm.

Developing focused environmental innovations around the firm’s existing resources or competences increases the efficiency of its operations. Berrone et al. (2013) have shown the importance of the initial dotation of resources in the firm to understand its environmental innovations. The firm’s specific assests are central to developing focused environmental innovations (Cainelli et al. 2015; Tatikonda and Rosenthal 2000), whereas they are only the initial reference on which diversified environmental innovations are built. In this regard, the development of focused environmental innovations may have positive effects on the firm’s financial performance, and this relationship can be strengthened or weakened by the firm’s level of slack resources.

Slack Resources

Slack resources can be defined as “the pool of resources in an organization that is in excess of the minimum necessary to produce a given level of organizational output” (Nohria and Gulati 1996: 1246). These resources may include an excess of inputs, such as labor and machinery, that are not working at full capacity, opportunity costs derived from underinvestment in technologies that may generate greater margins and revenues, or financial slack (Burgeois and Singh 1983; Meyer 1982; Tan 2003). Our work follows the perspective of most studies that have maintained a focus on financial slack resources as a measure of excess resources within organizations (e.g., Arora and Dharwadkar 2011; Harrison and Coombs 2012).

Whereas certain levels of slack resources are considered positive for the organization, in that they constitute a financial cushion that protects the company against unpredicted losses or cash flow shortages (e.g., Rajagopalan 1997), there is still an enduring debate over the optimal level of slack resources, since some scholars consider that an “excess of slack” is associated with loss of efficiency (e.g., Wu and Tu 2007). Thus, companies that exhibit high levels of slack may overlook their production and management approaches, since an inefficient use of slack resources, although suboptimal, is it not translated into negative results (Nohria and Gulati 1996).

Hypotheses

The Financial Implications of a Firm’s Focused Environmental Innovations

An increasing number of organizations are investing in environmental innovations because their managers identify strategic opportunities around environmental innovation, and its potential to confer long-term advantages instead of unrecoverable costs (Antolin-Lopez et al. 2013; Huang and Li 2017; Russo and Fouts 1997). The fact that voluntary pollution-prevention innovations rely more heavily on organizational and knowledge-based resources and capabilities increases the likelihood that these organizations will gain competitive advantage (Hart 1995; Russo and Fouts 1997). In addition, organizations that produce greener technologies may take advantage of the current trend toward environmentally friendly production and may push governments toward more stringent regulation, increasing the production costs for their rivals, and simultaneously attracting customers and improving their reputation (Chen et al. 2006; Figge and Hahn 2002; Porter and van der Linde 1995; Shrivastava 1995; Spencer 2003). These arguments suggest that the pursuit of environmental innovation may not necessarily represent an additional cost that organizations must shoulder in responding to more stringent regulation, but rather has positive effects that may improve financial performance. The different financial implications of developing focused versus diversified environmental innovations have received limited attention in the existing literature.

Although the financial literature has traditionally highlighted that diversification may spread financial risks (Rong and Xiao 2017), numerous empirical studies have shown that the relationship between diversified innovations and financial performance may be negative (e.g., Lu and Jinghua 2012; Rong and Xiao 2017). Drawing on agency theory, the exponential risks of diversified innovations are often regarded as a personal choice made on the basis of managers’ self-interest, which has a negative effect on financial performance (Aggarwal and Samwick 2003; Denis et al. 2002; Jiraporn et al. 2008). The agency perspective identifies diversification as a moral hazard, since managers do not diversify to reduce the firm’s exposure to financial risk, but to increase the range of resources under their control (Scharfstein 1998). This reduces the managers’ human capital risk because it will be more difficult to replace them with other managers due to a range of complex operations (Denis et al. 1997). In addition, diversified innovations will reduce the managers’ familiarity with the new innovations incorporated, resulting in loss of efficiency (Lu and Jinghua 2012). In this context, focused innovation appears to be a more financially rational approach, whereas diversificated innovation is more closely linked to managers’ personal interests, according to the agency perspective.

In contrast to diversification, focusing on a well-known technology reduces information assymetries, as this technology is easier for the principal to understand and evaluate, reducing the possibility of unethical behavior on the part of the manager (Gómez-Mejia and Wiseman 2007). Moreover, focusing on a well-known technology reduces risks by allowing the organization to master specific knowledge and generates first-order competence, which “is considered to be a distinctive competence if it is superior to competition and leads to competitive advantage” (Rosenkopf and Nerkar 2001: 288). This first-order competence may position the organization as a reference with regard to a specific technology within its industry, so competitors may avoid the pursuit of alternative technologies and follow the leader, reinforcing the organization’s market position (Rosenkopf and Nerkar 2001; Spencer 2003). Calza et al. (2017) have recently shown several examples of how firms could leverage these first-order competences related to environmental innovation in the automotive sector. For instance, BMW, the German vehicle manufacturing company, has used environmental innovations around traditional auto-technology by implementing high-efficiency exterior lighting, solar reflective glass, active seat and cabin ventilation, active engine warm-up, and the stop–start ignition system, among others (Calza et al. 2017).

Finally, while the benefits of investing in environmental innovations are often achieved over the medium or long term (e.g., Hull and Rothenberg 2008; Wang and Bansal 2012), the focused versus diversified nature of environmental innovations may substantially alter the time implications for recovery of the investment. A higher level of diversification increases the need for coordination and control and consequently requires a complex and longer period of adoption and adaptation (Lu and Jinghua 2012). In contrast, focused environmental innovations will need a shorter period of time to generate returns because of the more limited initial investment and relatively simple management.

Consequently, our baseline in this paper is that the level of focus in a firm’s environmental innovations is positively related to its financial performance. We hypothesize:

H1

There is a positive relationship between the degree of focused environmental innovation in a firm and its financial performance.

Slack Resources and Their Moderating Influence

As previously mentioned, slack resources are understood as an excess of resources for producing a level of organizational output (Nohria and Gulati 1996). There is a longstanding debate in the innovation literature regarding the role of slack resources, drawing upon agency theory (Alessandri and Pattit 2014; Wu and Tu 2007). On the one hand, the buffer argument considers that the existence of slack is positively related to increases in R&D investment. Advocates of slack argue that it encourages strategic behavior, eases adaptation to new environments, fosters long-term thinking, and allows the exploration of uncertain investment opportunities that would otherwise never be used (e.g., Burgeois and Singh 1983; Rajagopalan 1997).

On the other hand, the waste perspective takes agency theory to argue that the existence of slack could result in R&D investment in which managers do not pay sufficient attention to potential net present returns (Wu and Tu 2007). Furthermore, slack could be understood as an inefficient use of available resources by managers, because greater levels of slack could lead to less intense negotiations, the pursuit of overly risky investments, excessive diversification, a less intensive search for alternative options, and so on (e.g., Bowman 1982; Nohria and Gulati 1996). Within these opposing views, both supporters and detractors have paid limited attention to the influence of available slack resources on the relationship between focused environmental innovations and performance.

While most of the existing literature has recognized the positive influence of slack resources on generating innovation, we expect that a high level of slack resources reduces the relationship between focused environmental innovation and financial performance. The potential financial benefits emerging from focused environmental innovations are related to the reinforced capacity to increase the firm’s efficiency by paying attention to details in well-known processes. In this context, firms with little slack are usually more aggressive in negotiating with suppliers, evaluate present and future projects more extensively, and exhibit greater control and monitoring of current projects (Wu and Tu 2007). In fact, the agency theory literature has argued that in some cases managers of companies with a high level of financial slack tend to enjoy a quiet life (Bertrand and Mullainathan 2003), which could result in a loss of efficiency due to lower levels of effort in the evaluation, selection, and termination of investment projects. Hence, a lower level of slack contributes to focused environmental innovations by driving managers to maximize the firm’s resources as they are not in excess.

In contrast, organizations with higher levels of slack resources may be less intensive in negotiations, relax their investment requirements, and allocate resources to “dubious projects, such as pet R&D projects and unrelated acquisitions” (Nohria and Gulati 1996: 1248). While slack resources may provide the necessary financial power to push diversified efforts in the firm, exploration of new avenues is a deviation from the company’s core competences (Denis et al. 2002) and may give free rein to managers’ personal preferences, thus leading to the pursuit of projects of dubious value for the organization (Jensen 1996). However, a high level of slack resources may aid in communication and heterogeneous activities, as a result of which diversified environmental innovations translate into higher financial performance. We argue that lower levels of slack reduce the risk of moral hazard in a context of environmental innovations, as managers do not have a safety net that allows them to pursue personal choices at the expense of the organization, thus aligning their interests.

Consequently, we expect that a lower level of slack increases the positive relationship between focused environmental innovations and financial performance because of the reinforced interest in generating efficient use of resources. However, this relationship may be less positive when levels of slack are higher because of the more limited interest in contributing to the efficiency of efforts in the firm. Thus, we hypothesize:

H2

Focused environmental innovations are more positively related to financial performance when the organization has lower levels of slack, and less positively when slack levels are higher.

Methods

Sample

We decided to focus on the electrical components and equipment sectorFootnote 2 because it has faced multiple new environmental challenges in recent decades, including energy efficiency in the production and use of its products, the intensive use of raw materials, and large amounts of electronic waste (e.g., European Commission 2012). A good example of this could be the European Directive on the Restriction of the Use of Certain Hazardous Substances in Electrical and Electronic Equipment (RoHS) and Waste of Electrical and Electronic Equipment (WEEE). This environmental law has been applied since 2003 in all member states of the European Union, and its obligations include the substitution of heavy metals (e.g., mercury, lead, cadmium, flame retardants, etc.) with safer alternatives, and the collection of at least “65% of the average weight of electrical and electronic equipment placed on the market over the two previous years” (European Commission 2012).

We searched for patented environmental innovations issued between 2006 and 2009 by any company in the industry making at least $1 million in net sales during the first year of our analysis (2006), a threshold that is in line with previous studies of patents (e.g., Peeters and de la Potterie 2006). By selecting the period 2006–2009, we ensured that all the patents analyzed had been granted, i.e., validated by the European Patent Office (EPO). An earlier time window might have provided similar advantages, but we selected the most recent period offering the possibility of analyzing all patents when our analysis began. Given that not all companies issued environmental patents during the period analyzed and that COMPUSTAT had no market information for some companies, the final sample provided unbalanced panel data on 75 companies, comprising 216 observations from 2006 through 2009, and 5845 patents (additional information is displayed in Table 1).

Dependent Variable

Our dependent variable is financial performance. Consistent with previous studies (e.g., Doidge et al. 2004; Varaiya et al. 1987), we consider Tobin’s Q a valid measure for assessing financial performance. Tobin’s Q is defined as the ratio of the market value of a firm to the replacement cost of its assets. We calculated Tobin’s Q using data from COMPUSTAT (Chung and Pruitt 1994).Footnote 3 We employed a 1-year ahead Tobin’s Q because the positive/negative effects of innovations on financial performance may not be immediate (Pakes and Griliches 1984). The use of Tobin’s Q for assessing financial performance has several advantages over other variables, such as accounting measures, because the latter can be more easily modified by organizations (Ernst 2001). In addition, unlike accounting ratios, Tobin’s Q captures subtle dimensions of financial performance, such as intangible assets. In technological companies, for instance, the replacement cost of intangible assets is far greater than the cost of tangible assets, whereas accounting measures assume that such replacement costs are equal to book values (Varaiya et al. 1987).

Explanatory Variable

In line with innovation studies in general (e.g., Carnabuci and Bruggeman 2009; Miller et al. 2007; Shin and Jalajas 2010; Wagner 2007), and those on environmental innovation in particular (e.g., Brunnermeier and Cohen 2003; Lee et al. 2011; Nameroff et al. 2004), we used patent data to analyze environmental innovationsFootnote 4 (Veefkind et al. 2012). Environmental patented innovations have grown by more than 30% during the past few years, replacing those related to higher polluting sources, such as fossil fuels and nuclear energy (Bennett 2010; EPO 2010). The establishment of long-term goals, such as a 20% target for renewables by 2020 in multiple countries, indicates that environmental innovations will continue to be developed in the future.

We based our analysis on the European Patent Office (EPO) Global Patent Index (GPI) for three reasons: (1) using several databases might yield conflicting results because of the different standards and different systems of granting patents, as well as patentability requirements; hence, focusing on a single database is “necessary to maintain consistency, reliability, and comparability” (Ahuja and Katila 2001: 205); (2) the EPO database contains patents from companies worldwide (e.g., Europe, North America, Japan, Korea.) that patent in Europe (GPI 2009, User Manual); (3) the EPO recently created a new classification, Y02, for green technologies and applications developed to reduce impact on climate change (EPO 2010). Instead of using a qualitative abstract-based keyword to determine which patents have environmental content (e.g., Anastas and Warner 1998; Lee et al. 2011; Nameroff et al. 2004; Wagner 2007), we used the original environmental delimitation of patents developed by the EPO, thus ensuring that we would not miss any environmental patents.

In addition, during our search, we filtered all patents using the European classification system (ECLA) provided by the EPO. The ECLA is divided into eight sections (A–H), each of which is subdivided into classes, sub-classes, groups, and sub-groups. With regard to environmental innovations, the EPO has adapted the aforementioned ECLA codes for green technologies, which contain dozens of sub-groups, including over 17,000 patents to date (EPO 2010). Because the same application can be published several times, we searched for only one document, the family representative,Footnote 5 per application.

In line with the existing literature regarding innovation and patents, we employed the number of environmental patents as a proxy for innovative activitiesFootnote 6 (Hagedoorn and Cloodt 2003). The number of patents presented by a firm in a specific domain indicates the degree of interest in focusing on this domain. In contrast, a firm exhibiting patents in different technological areas indicates that the firm uses a more diversified strategy.

To evaluate the focused/diversified approach to environmental innovation, we developed the frequency of focused knowledge (FFK) variable. This variable measures the degree of focus exhibited by a firm in its environmental patented innovations. The FFK is calculated as the standard deviation of all of the ECLA codes contained in the patents issued by an organization, where the following holds:

N: the number of different ECLA codes in the firms’ patents, xi: the number of patents that contain a given ECLA code, \( \bar{x} \): the gross number of ECLA codes divided by the number of different ECLA codes

The higher the value of FFK, the more frequently focused knowledge is observed in the patents issued by a firm (focused pattern). Conversely, if a firm has the same number of each ECLA code (diversified pattern), the value of the FFK will be zero. In our analysis, we sorted ECLA codes using six digits, or groups, according to the EPO classification (GPI 2009, User Manual).

Moderating and Control Effects

Different empirical studies have used multiple indicators with different quantitative financial data. For instance, Miller and Leiblein (1996) reviewed the slack literature and found 13 accounting-based slack measures aimed at focusing on different dimensions of organizational slack. Consistent with Burgeois and Singh (1983) work, we distinguished between available and potential slack, employing the current ratio (i.e., current assets divided by current liabilities) for the former and return on assets (ROA) as an indicator of potential slack because “a high ROA would suggest that the [firm] was profitable and had the potential to generate slack” (George 2005: 667).

In our study, we controlled for firm size and age. The former is measured by the natural logarithm of net sales, provided by the COMPUSTAT database, whereas firm age is determined by the foundation year of the organization according to the information displayed on the Bloomberg and JP Morgan databases.

Procedure

We employed the Hausman procedure (in the statistical software STATA 12) to test our hypotheses. The Hausman test (Hausman 1978) endorses the use of fixed effects instead of random effects to estimate our model. Fixed-effect models provide a more reliable estimation of the regression parameters because they eliminate the unobservable variables in conventional ordinary least squares (OLS) regression estimates (Ernst 2001). Since we have panel data—i.e., multiple observations per firm—we accounted for serial correlation and heteroskedasticity among the variables by clustering standard errors at the firm level.Footnote 7 Because high multicollinearity may create problems in terms of the accuracy and stability of the model, we centered both measures of slack (i.e., available and potential slack) before building a multiplicative index between slack and the FFK index to test our prediction regarding a moderating influence (Cohen and Cohen 1983). Table 1 shows the descriptive statistics and the correlations for the study variables.

Results

Table 2 shows the findings of our regression for Tobin’s Q as the dependent variable. The relationship between financial performance and focused environmental innovation is positive, thus supporting Hypothesis 1, which stated that there is a positive relationship between the degree of focused environmental innovation and financial performance. Therefore, it appears that the manner in which an organization combines its domains of knowledge (i.e., focused rather than diversified) confers higher financial performance in our sample.

Consistent with previous studies (Burgeois and Singh 1983; Miller and Leiblein 1996; Nohria and Gulati 1996), we employed several measures of slack in our empirical work, such as current and potential slack. Although the managers in our sample may not have considered the current level of slack when making decisions about their environmental investments, potential slack showed a significant moderating influence on the relationship between focused environmental innovation and financial performance. A firm’s level of potential slack had a significant moderating effect on the relationship between environmental innovation and financial performance.

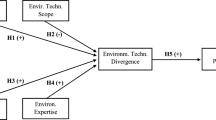

Figure 1 plots this moderating effect using the procedures outlined in Venkatraman (1989) to delimit its specific influence. Our results show a positive relationship between focused environmental innovation and financial performance when a firm has a low level of potential slack (upper line), and a negative relationship when the potential slack is high (lower line). This supports Hypothesis 2, which stated that focused environmental innovations are more positively related to financial performance when the organization has lower levels of slack, whereas the relationship is less positive when slack levels are higher. Regarding our control variables, firm age and the number of patents show a significant relationship with financial performance (− 0.12, p < 0.05, and − 0.01, p < 0.01, respectively).

Robustness Checks

To check the robustness of our findings, we use two exploratory analyses comparing the compensation orientation of the managers and the firms’ approaches to innovation. The agency theory logic is that a short-term orientation toward managers’ compensation will increase their incentives for self-interested behavior, i.e., moral hazard, while a more long-term orientation will reduce agency problems (Alessandri and Pattit 2014; Balkin et al. 2000; Gómez-Mejia and Wiseman 2007). Because our paper argues that diversified environmental innovation is related to managerial opportunism, we analyze the correlation between two different indicators of managers’ compensation and the firm’s environmental innovative diversification. A high correlation between long-term compensation and focused environmental innovation would show that our interpretation of the variables in our research is appropriate. Specifically, we use both the value of option-related awards and the number of restricted shares awarded to managers during the year as indicators of long-term compensation. We use the available information for these two variables in our sampled firms from the COMPUSTAT EXECUCOMP database (cases with missing information were removed for this robustness analysis). The correlation results show a positive and significant relation between focused environmental innovations (i.e., our FFK variable) with the value of vested options (correlation: 0.508; p value = 0.026), and similarly with the number of acquired shares (correlation: 0.4498. p value = 0.0533). These results suggest that our agency theory interpretation of the hypothesized relationships is correct.

Discussion and Conclusions

Previous research has recognized the importance of analyzing the ad hoc implications of environmental innovations because of the greater risk they represent compared to other corporate innovations. Our results contribute to the literature on environmental innovations in at least two ways. On the one hand, we show that a focused approach to environmental innovation leads organizations to achieve superior financial performance within the context of the sampled firms. Focused innovation reinforces understanding among internal units, fosters absorptive capacity (Carnabuci and Bruggeman 2009; Daim 2013), and minimizes risk to a greater extent than innovations in a diversified context (Lu and Jinghua 2012; Rong and Xiao 2017). These results contribute by confirming the importance of specific competences in the firm’s generation of environmental innovations. While the general innovation literature has found mixed results regarding the financial implications of focus and diversification, our results suggest that focused environmental innovations contribute to reducing the risks linked to environmental innovations in general.

On the other hand, while the positive role of slack resources in generating room for environmental innovations has been widely recognized in the corporate social responsibility (e.g., Orlitzky et al. 2003) and innovation literature (e.g., Nohria and Gulati 1996), agency theory scholars have traditionally highlighted that managers tend to use slack resources for their own particular interests while destroying shareholders’ value (e.g., Amihud and Lev 1981; Jensen and Murphy 1990). In this regard, our results suggest that the personal preferences pursued by managers who enjoy higher level of slack resources may increase the financial uncertainty of environmental innovations, which are already more uncertain than non-environmental innovations (Huang and Li 2017). In other words, the additional availability of resources may not be only used by managers to explore new environmental innovations that are potentially positive for both the firm and society, but also to increase investment in specific fields that increase their own professional reputation and result in managerial moral hazard, as theorized by agency scholars.

Additionally, our analysis distinguishes between focused and diversified environmental innovations, stating that traditionally the former have been assumed as less uncertain than the latter and yield positive financial performance. However, our results and the agency perspective also contribute by showing that the existence of slack resources increases managers’ moral hazard and also reduces the strength of the positive relationship between focused environmental innovations and financial performance in the sampled firms.

While we recognize that the availability of slack resources may be still useful in the context of diversified environmental innovations, by generating a pool of resources for riskier and personally oriented innovations, our results contribute by confirming that managers are not able to use slack resources to increase the effectiveness of focused environmental innovations.

Consequently, our results extend the existing literature on agency theory and managers’ ethical dilemmas concerning the use of slack resources (e.g., Amihud and Lev 1981; Jensen and Murphy 1990) by showing that potential slack resources have a robust and moderating negative effect on the relationship between focused environmental innovation and financial performance. Specifically, our results show that lower levels of slack positively affect the relationship between focused environmental innovation and financial performance, whereas an increase in slack resources has a negative effect on this relationship in the sampled firms. Using the agency theory lens, one of the most relevant reasons for this counterintuitive moderating effect may be that managers with lower levels of slack are more concerned with the implications of resource deviation than their own managerial reputation and stability; they tend to negotiate with third parties more intensively, monitor current projects more strictly, and evaluate future projects more extensively than firms with higher levels of slack (e.g., Miller and Leiblein 1996).

It is important to point out that our measure of current levels of slack (i.e., current ratio) yields results that are not significant, whereas potential slack is shown to influence the relationship between focused environmental innovation and financial performance. These results highlight the importance of considering a long-term approach when analyzing environmental innovations, reinforcing the value of the longitudinal nature of our analysis.

Our research partially answers previous calls to develop a bridge between agency theory and the behavioral views of managers (e.g., Fontrodona and Sison 2006; Shahzad et al. 2016; Shankman 1999). We show that a high level of slack resources can make it difficult to convert environmental innovations into financial performance, even if those innovations can be a source of financial improvement. These results suggest that managers may perceive there are fewer incentives to care about the implications of environmental innovations for their firms’ financial performance when high levels of slack resources are available, as they may act as a financial cushion.

Limitations, Future Research, and Alternative Interpretations

To complement our empirical analysis, future research would benefit from gaining a deeper understanding by analyzing several concerns that have emerged from this work. First, although focusing on a single sector helps control better for firms’ technological characteristics, enhancing and easing comparisons between firms (Cohen, Nelson and Walsh 2000), further studies should examine different sectors, and compare the results and differences between them. For example, such studies should determine whether certain sectors show a different relationship between diversification and financial performance (e.g., Shin and Jalajas 2010), and whether some sectors are more inclined to use more focused approaches than others. If this is the case, what other circumstances explain such behavior? Moreover, future studies should consider that indicators such as financial ratios may not be generalized across industries (Miller and Leiblein 1996).

Second, future studies may extend the range of performance variables, considering not only financial performance but also other measures of firm performance, such as corporate environmental performance. In fact, with high levels of slack resources, the development of innovations with stronger environmental benefits could be more likely to take place because, due to this slack, the pressure to generate immediate financial returns is lower, creating more leeway for innovations focusing on positive environmental effects in the first place.Footnote 8 This is a new line of research that our study leaves open for future work.

Third, future studies could analyze innovative environmental outputs other than patents in smaller corporations and compare their results with those for larger firms, as in our work. Fourth, this work is focused on the relationship between environmental innovation and financial performance. However, it might be especially interesting to analyze whether our results can be extrapolated to other types of innovation. In contrast with these, environmental innovations are not only focused on reducing firms’ negative environmental impacts, but also usually generate particularly high uncertainty about future-oriented returns. Consequently, it might be interesting to analyze whether the managers’ perceptions of the risks of innovation affect the role of slack resources.

Fifth, and finally, this work theoretically draws upon agency theory and our reasoning rests on its postulates. However, we are aware that the agency theory motive is not easily observable from an empirical point of view, and consequently we acknowledge that other theoretical interpretations of our results cannot be ruled out. For instance, leaving the agency view aside, the usual justification for having financial slack is the “precautionary saving” motive, i.e., the desire to have a buffer of cash in case something goes wrong. From this angle (which is not based on agency theory), it could be that companies with high slack resources are less likely to take risks, which translates into more predictable but less valuable innovation.Footnote 9 This argument is consistent with our results. Consequently, future studies will be responsible for using other theoretical perspectives to analyze the role of slack resources in firms’ innovation choices.

Managerial Implications

The managerial implications of our results are also relevant. Managers might want to consider that an increase in R&D spending on environmental innovations could have a positive effect on financial performance. It is particularly interesting that our results show that focused environmental innovations may be particularly effective in investment decisions making.

In fact, our results support the growing practical interest in allowing for the possibility of analytical distinctions between different types of environmental innovation. For instance, in 2009, the United States Patent Office (USTPO) created the “green technologies” category, and in the same year the United Nations Environment Program (UNEP) and the International Centre for Trade and Sustainable Development (ICTSD) launched a “joint project on the role of patents in the transfer of climate change mitigation technologies” (EPO 2010: 6). As an adjunct to that project, the EPO elaborated the “clean energy technologies” patent category. This confirms that interest in the implications of different types of environmental innovation exists not only in the academic field, but also in practice.

Furthermore, the robust moderating negative influence of slack resources suggests some counterintuitive implications. The existing literature has insisted on the positive influence of slack resources on managers’ readiness to initiate innovations in general and environmental innovations in particular. However, paradoxically, our results show that managers may be able to generate more positive financial performance using focused environmental innovation when faced with limited slack resources, as opposed to when firms have higher levels of slack resources.

Our results raise practical doubts about the appropriate level of resources required for managers to generate and exploit environmental innovation. A simple increase in available resources is not sufficient: managers should play a more active role in analyzing the composition of innovation projects conducted by their organizations.

Notes

While agency theory offers an appropriate framework for explaining our results, we acknowledge that they are consistent with several alternative interpretations. Thus, we have included them in our discussion section. We thank an anonymous reviewer for this suggestion.

This sector is numbered 6190 in the COMPUSTAT database.

Since this variable may be subject to outliers, we corrected it through the winsorizing approach (Dixon 1980). We thank an anonymous reviewer for this suggestion.

A patent is “a legal title that protects a technical invention for a limited period. It gives the owner the right to prevent others from exploiting the invention in the countries for which it has been granted” (EPO 2010: 8).

According to the GPI User Manual, the same application can be filed in different countries and thus can be published by several authorities. These publications have similar content, and together form a simple patent family. When filtering one representative per family, we ensure that the same patent does not appear several times.

The innovation literature has used the term “patent portfolio race” to mean that companies apply for a patent as soon as possible, right after the innovation is developed, i.e., there is no time lapse between generating an innovation and filing a patent application (for further detail, see Hall and Ziedonis 2001; Hegde et al. 2009; Joshi and Nerkar 2011).

We want to thank an anonymous reviewer for this suggestion.

We thank an anonymous reviewer for noting this future research line.

We wish to thank an anonymous reviewer for this suggestion.

References

Aggarwal, R. K., & Samwick, A. A. (2003). Why do managers diversify their firms? Agency reconsidered. Journal of Finance, 58, 71–118.

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strategic Management Journal, 22, 197–220.

Alessandri, T. M., & Pattit, J. M. (2014). Drivers of R&D investment: The interaction of behavioral theory and managerial incentives. Journal of Business Research, 67, 151–158.

Amihud, Y., & Lev, B. (1981). Risk reduction as a managerial motive for conglomerate mergers. The Bell Journal of Economics, 12(2), 605–617.

Anastas, P., & Warner, J. (1998). Green chemistry: Theory and practice. New York: Oxford University Press.

Antolin-Lopez, R., York, J., & Martinez-del-Rio, J. (2013). Renewable energy emergence in the European Union: The role of entrepreneurs, social norms and policy. Frontiers of Entrepreneurship Research, 33(14), 1.

Arora, P., & Dharwadkar, R. (2011). Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corporate Governance: An International Review, 19(2), 136–152.

Balkin, D. B., Markman, G., & Gomez-Mejia, L. R. (2000). Is CEO pay in high-technology firms related to innovation? Academy of Management Journal, 43, 1118–1130.

Bennett, J. (2010). Are we headed toward a green bubble? Entrepreneur. https://www.entrepreneur.com/article/205494.

Berrone, P., Fosfuri, A., Gelabert, L., & Gomez-Mejia, L. R. (2013). Necessity as the mother of “green” inventions: Institutional pressures and environmental innovations. Strategic Management Journal, 34, 891–909.

Bertrand, M., & Mullainathan, S. (2003). Enjoying the quiet life? Corporate governance and managerial preferences. Journal of Political Economy, 111(5), 1043–1075.

Bowman, E. (1982). Risk seeking by troubled firms (pp. 33–42). Summer: Sloan Management Review.

Brunnermeier, S. B., & Cohen, M. A. (2003). Determinants of environmental innovations in US manufacturing industries. Journal of Environmental Economics & Management, 45, 278–293.

Burgeois, L. and Singh, J. V. (1983). Organizational slack and political behavior within top management groups.In Academy of management proceedings, pp. 43–49.

Cainelli, G., De Marchi, V., & Grandinetti, R. (2015). Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. Journal of Cleaner Production, 94(1), 211–220.

Calza, F., Parmentola, A., & Tutore, I. (2017). Types of green innovations: Ways of implementation in a non-green industry. Sustainability, 9(1301), 1–16.

Carnabuci, G., & Bruggeman, J. (2009). Knowledge specialization, knowledge brokerage and the uneven growth of technology domains. Social Forces, 88(2), 607–641.

Chen, Y. (2008). The driver of green innovation and green image—Green core competence. Journal of Business Ethics, 81(3), 531–543.

Chen, Y. S., Lai, S. B., & Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics, 67(4), 331–339.

Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s q. Financial Management, 23(3), 70–74.

Cohen, J., & Cohen, P. (1983). Applied multiple regression/correlation analysis for the behavioral sciences (2nd ed.). Mahwah: Erlbaum.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Cohen, W. M., Nelson, R., and Walsh, J. (2000). Protecting their intellectual assets: Appropriability conditions and why US manufacturing firms patent (or not). NBER working paper 7552, National Bureau of Economic Research, Cambridge, MA.

Commission, European. (2012). Recast of the waste electrical and electronic equipment (WEEE) directive. Brussels: European Commission.

Daim, T. U. (2013). Are formal technology integration processes needed for successful product innovations? International Journal of Innovation Management, 17(04), 1350016.

Davis, G. F., & Stout, S. K. (1992). Organization theory and the market for corporate control: A dynamic analysis of the characteristics of large takeover targets, 1980–1990. Administrative Science Quarterly, 37(4), 605–633.

Denis, D. J., Denis, D. K., & Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. Journal of Finance, 52(1), 135–160.

Denis, D. J., Denis, D. K., & Yost, K. (2002). Global diversification, industrial diversification, and firm value. Journal of Finance, 57, 1951–1979.

Doidge, C., Karolyi, G. A., & Stulz, R. M. (2004). Why are foreign firms listed in the U.S. worth more? Journal of Financial Economics, 71, 205–238.

Douglas, P. C., & Wier, B. (2000). Integrating ethical dimensions into a model of budgetary slack creation. Journal of Business Ethics, 28(3), 267–277.

Douglas, P. C., & Wier, B. (2005). Cultural and ethical effects in budgeting systems: A comparison of US and Chinese managers. Journal of Business Ethics, 60(2), 159–174.

EIO. (2011). The eco-innovation challenge: Pathways to a resource-efficient Europe. Brussels: Eco-Innovation Observatory.

EPO (2010). Patents and clean energy: Bridging the gap between evidence and policy. Final report. European Patent Office, Munich.

Ernst, H. (2001). Patent applications and subsequent changes of performance: Evidence from time-series cross-section analyses on the firm level. Research Policy, 30, 143–157.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301–324.

Figge, F., & Hahn, T. (2002). Environmental shareholder value matrix. Anwendung: Konzeption.

Fontrodona, J., & Sison, A. J. G. (2006). The nature of the firm, agency theory and shareholder theory: A critique from philosophical anthropology. Journal of Business Ethics, 66(1), 33–42.

George, G. (2005). Slack resources and the performance of privately held firms. Academy of Management Journal, 48(4), 661–676.

Gomez-Mejia, L. R., Campbell, J. T., Martin, G., Hoskisson, R. E., Makri, M., & Sirmon, D. G. (2014). Socioemotional wealth as a mixed gamble: Revisiting family firm R&D investments with the behavioral agency model. Entrepreneurship Theory and Practice, 38(6), 1351–1374.

Gómez-Mejia, L. R., & Wiseman, R. M. (2007). Does agency theory have universal relevance? Journal of Organizational Behavior, 28, 81–88.

GPI (2009). Global patent index user manual. European Patent Office. EPO—Dept.5411. European Patent Office, Munich.

Greenley, G. E., & Oktemgil, M. (1998). A comparison of slack resources in high and low performing British companies. Journal of Management Studies, 35(3), 377–398.

Hagedoorn, J., & Cloodt, M. (2003). Measuring innovative performance: Is there an advantage in using multiple indicators? Research Policy, 32, 1365–1379.

Hahn, T., Figge, F., & Barkemeyer, R. (2007). Sustainable value creation among companies in the manufacturing sector. International Journal of Environmental Technology and Management, 7(5–6), 496–512.

Hall, B. H., & Ziedonis, R. H. (2001). The patent paradox revisited: An empirical study of patenting in the U.S. semiconductor industry, 1979–1995. RAND Journal of Economics, 32(1), 101–128.

Harrison, J. S., & Coombs, J. E. (2012). The moderating effects from corporate governance characteristics on the relationship between available slack and community-based firm performance. Journal of Business Ethics, 107(4), 409–422.

Hart, S. L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20, 874–907.

Hausman, J. (1978). Specification tests in econometrics. Econometrica, Econometric Society, 46(6), 1251–1271.

Hegde, D., Mowery, D. C., & Graham, S. J. H. (2009). Pioneering inventors or thicket builders: Which U.S. firms use continuations in patenting? Management Science, 55(7), 1214–1226.

Hoskisson, R. E., Hitt, M. A., Johnson, R. A., & Grossman, W. (2002). Conflicting voices: The effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Academy of Management Journal, 45(4), 697–716.

Huang, J. W., & Li, Y. H. (2017). Green innovation and performance: The view of organizational capability and social reciprocity. Journal of Business Ethics, 145(2), 309–324.

Hull, C. E., & Rothenberg, S. (2008). Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strategic Management Journal, 29(7), 781–789.

Jensen, M. C. (1996). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76, 323–329.

Jensen, M. C., & Murphy, K. J. (1990). Performance pay and top-management incentives. Journal of Political Economy, 98(2), 225–264.

Jiraporn, P., Kim, Y. S., & Mathur, I. (2008). Does corporate diversification exacerbate or mitigate earnings management? An empirical analysis. International Review of Financial Analysis, 17, 1087–1109.

Joshi, A. M., & Nerkar, A. (2011). When do strategic alliances inhibit innovation by firms? Evidence from patent pools in the global optical disc industry. Strategic Management Journal, 32, 1139–1160.

Kaul, A. (2012). Technology and corporate scope: Firm and rival innovation as antecedents of corporate transactions. Strategic Management Journal, 33(4), 347–367.

Lee, J., Veloso, F. M., & Hounshell, D. A. (2011). Linking induced technological change, and environmental regulation: Evidence from patenting in the US auto industry. Research Policy, 40, 1240–1252.

Lu, Z., & Jinghua, H. (2012). The moderating factors in the relationship between ERP investments and firm performance. Journal of Computer Information Systems, 53(2), 75–84.

Marcus, A. (2015). Innovations in sustainability: Fuel and food. Cambridge University Press, Cambridge.. https://doi.org/10.1017/cbo9781139680820.

Marcus, A., Aragon-Correa, J. A., & Pinkse, J. (2011). Firms, regulatory uncertainty, and the natural environment. California Management Review, 54(1), 5–16.

Meyer, A. D. (1982). Adapting to environmental jolts. Administrative Science Quarterly, 27(4), 515.

Miller, D., Fern, M., & Cardinal, L. (2007). The use of knowledge for technological innovation within diversified firms. Academy of Management Journal, 50(2), 308–326.

Miller, D., & Leiblein, M. (1996). Corporate risk-return relations: Returns variability versus downside risk. Academy of Management Journal, 39(1), 91–122.

Moorman, C., & Slotegraaf, R. J. (1999). The contingency value of complementary capabilities in product development. Journal of Marketing Research, 36(2), 239–257.

Nameroff, T. J., Garant, R. J., & Albert, M. B. (2004). Adoption of green chemistry: An analysis based on US patents. Research Policy, 33, 959–974.

Nohria, N., & Gulati, R. (1996). Is slack good or bad for innovation? Academy of Management Journal, 39(5), 1245–1264.

Nooteboom, B., Van Haverbeke, W., Duysters, G., Gilsing, V., & van den Oord, A. (2007). Optimal cognitive distance and absorptive capacity. Research Policy, 36, 1016–1034.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3), 403–441.

Pakes, A., & Griliches, Z. (1984). Patents and R&D at the firm level: A first look. In Z. Griliches (Ed.), R&D, patents and productivity (pp. 55–72). Chicago: The University of Chicago Press.

Peeters, C., & de la Potterie, B. V. P. (2006). Innovation strategy and the patenting behavior of firms. Journal of Evolutionary Economics, 16(1–2), 109–135.

Porter, M. E., & van der Linde, C. (1995). Green and competitive. Harvard Business Review, 73(5), 120–134.

Prahalad, C. K., & Hamel, G. (1990). The core competence of the organization. Harvard Business Review, 90(3), 79–93.

Rajagopalan, N. (1997). Strategic orientations, incentive plan adoptions, and firm performance: Evidence from electric utility firms. Strategic Management Joumal, 18(10), 761–785.

Rennings, K. (2000). Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecological Economics, 32, 319–332.

Robeson, D., & O’Connor, G. C. (2013). Boards of directors, innovation, and performance: An exploration at multiple levels. Journal of Product Innovation Management, 30(4), 608–625.

Rong, Z., & Xiao, S. (2017). Innovation-related diversification and firm value. European Financial Management, 23(3), 475–518.

Rosenkopf, L., & Nerkar, A. (2001). Beyond local search: Boundary-spanning, exploration and impact in the optical disc industry. Strategic Management Journal, 22(4), 287–306.

Russo, M. V., & Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40, 534–559.

Scharfstein, D. S. (1998). The dark side of internal capital markets II: Evidence from diversified conglomerates. NBER working paper. no. 6352.

Shahzad, A. M., Mousa, F. T., & Sharfman, M. P. (2016). The implications of slack heterogeneity for the slack-resources and corporate social performance relationship. Journal of Business Research, 69(12), 5964–5971.

Shankman, N. A. (1999). Reframing the debate between agency and stakeholder theories of the firm. Journal of Business Ethics, 19(4), 319–334.

Sharma, S. (2000). Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Academy of Management Journal, 43(4), 681–697.

Shin, J., & Jalajas, D. (2010). Technological relatedness, boundary-spanning combination of knowledge and the impact of innovation: Evidence of an inverted-U relationship. Journal of High Technology Management Research, 21(2), 87–96.

Shrivastava, P. (1995). Environmental technologies and competitive advantage. Strategic Management Journal, 16(Special issue), 183–200.

Spencer, J. W. (2003). Firms’ knowledge-sharing strategies in the global innovation system: Empirical evidence from the flat panel display industry. Strategic Management Journal, 24(3), 217–233.

Tan, J. (2003). Curvilinear relationship between organizational slack and firm performance: Evidence from Chinese state enterprises. European Management Journal, 21(6), 740–749.

Tatikonda, M. V., & Rosenthal, S. R. (2000). Technology novelty, project complexity, and product development project execution success: A deeper look at task uncertainty in production innovation. IEEE Transactions on Engineering Management, 47(1), 74–87.

Toh, P. K. (2014). Chicken, or the egg, or both? The interrelationship between a firm’s inventor specialization and scope of technologies. Strategic Management Journal, 35(5), 723–738.

USTPO (2009). Pilot program for green technologies including greenhouse gas reduction. Federal Register, 74(234), 64666–64669.

Varaiya, N., Kerin, R. A., & Weeks, D. (1987). The relationship between growth, profitability, and firm value. Strategic Management Journal, 8, 487–497.

Veefkind, V., Hurtado-Albir, J., Angelucci, S., Karachalios, K., & Thumm, N. (2012). A new EPO classification scheme for climate change mitigation technologies. World Patent Information, 34(2), 106–111.

Venkatraman, N. (1989). The concept of fit in strategy research: Toward verbal and statistical correspondence. Academy of Management Review, 14(3), 423–444.

Voegtlin, C., & Scherer, A. G. (2017). Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalized world. Journal of Business Ethics, 143(2), 227–243.

Wagner, M. (2007). On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Research Policy, 36, 1587–1602.

Wang, T., & Bansal, P. (2012). Social responsibility in new ventures: Profiting from a long-term orientation. Strategic Management Journal, 33(10), 1135–1153.

Wu, J., & Tu, R. (2007). CEO stock option pay and R&D spending: A behavioral agency explanation. Journal of Business Research, 60, 482–492.

Acknowledgments

The authors thank the section editor, Cory Searcy, and three anonymous reviewers for their constructive suggestions. The authors are grateful to the competitive research grant ECO2016-75909-P for funding a portion of this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflict of interest.

Ethical Approval

This article does not concern any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Leyva-de la Hiz, D.I., Ferron-Vilchez, V. & Aragon-Correa, J.A. Do Firms’ Slack Resources Influence the Relationship Between Focused Environmental Innovations and Financial Performance? More is Not Always Better. J Bus Ethics 159, 1215–1227 (2019). https://doi.org/10.1007/s10551-017-3772-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-017-3772-3