Abstract

Using firm-level data from the U.S. manufacturing industry, this paper examines the relationship among inventory leanness, structural strategies for supply chains, and the carbon intensities of a firm and its suppliers. We formulate hypotheses on and empirically test whether this internal characteristic (inventory leanness) and these two structural strategies can influence the intensities of firm-level and supply chain environmental impacts. We examine inventory leanness because it not only reflects a manufacturer’s operational efficiency but also markedly influences manufacturers’ financial performance. We also focus on two closely related structural strategies (outsourcing and product diversification) that can influence the scope and ownership of the supply chain process, resulting in changes in emission allocation and, more importantly, how resources are utilized and shared in a firm. Based on multi-year carbon inventory data from U.S. manufacturing firms, we find that manufacturers with greater inventory leanness and a parsimonious process structure (i.e., a high level of outsourcing but low product diversification) tend to attain lower firm-level and supply chain carbon intensities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Over the years, elevated pressure from stakeholder groups has forced firms to not only maintain their profitability but also monitor greenhouse gas (GHG) emissions in their supply chains (Comas Martí and Seifert 2013). Several major governments, such as the European Union and the United States, have implemented or planned to enact GHG regulations to mitigate the social and economic impact caused by anthropogenic GHG emissions (IPCC 2014). Under growing institutional pressure, reducing the carbon footprint of supply chains becomes increasingly important. Operating a carbon-intensive supply chain can increase a firm’s production and operating costs, incur legal liabilities, tarnished firm reputation, and reduce its appeal to environmentally aware customers (Soyka 2012; Plambeck 2012). More and more companies start to work with their suppliers to jointly reduce carbon emissions, and suppliers are increasingly requested by their customers to share environmental data (Jira and Toffel 2013). This trend can be perceived as a testament to the value and importance of managing carbon emissions in a firm’s supply chain. However, reducing carbon emissions may divert productive resources and influence corporate financial performance (FP) (Wang et al. 2014). A deeper understanding of the trade-off between profits and carbon reduction can also help us understand firms’ motivation for reducing carbon emissions, because most firms engage in GHG reduction primarily in anticipation of the concomitant financial benefit (CDP 2013).

Pressure to manage carbon emissions creates an impetus to implement strategic changes and adopt operational innovations for a sustainable and responsible supply chain (Isaksson et al. 2010; Wolf 2011). Because carbon emissions arise from business operations, a firm’s overall carbon footprint hinges on its resource efficiency. In this regard, the operations literature has a prevalent view that lean operations, which focus on waste minimization in production processes, can enhance resource efficiency and reduce firm-level environmental impacts (Florida 1996; King and Lenox 2001; Rothenberg et al. 2001; Kleindorfer et al. 2005). Several studies also found that operational leanness is positively correlated with a firm’s FP (Chen et al. 2007; Eroglu and Hofer 2011; Modi and Mishra 2011). However, the extant leanness literature has two potential limitations. First, these two streams of research have advanced separately and have not generated overarching research findings; the leanness-FP literature has not considered the impact on environmental performance (EP) and, similarly, studies on the environmental impacts of leanness have largely overlooked the financial impact (except for the potential cost savings due to waste reduction). Integrating views on EP and FP is crucial because research has suggested a potential trade-off between these two performance dimensions (e.g., Blanco et al. 2009; Busch and Hoffmann 2011; Dixon-Fowler et al. 2013). Second, prior research has not explored the impact of leanness on suppliers’ EP. The literature did not examine the effect of leanness strategy on suppliers’ environmental and operational burdens. Answering these questions can shed new light on the effectiveness of leanness as a waste reduction and profitable strategy from a supply chain viewpoint. The first goal of this paper is to investigate how a firm’s operational leanness is related to its and its supply chain’s carbon intensities.

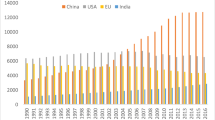

While leanness and resource efficiency are important contributing factors in superior environmental and business performances, maintaining a lean production environment is often a necessary but not sufficient condition for sustained competitive performance. For example, supplying goods that have no demand, even if the production process is efficiently executed, will add no value or even cause damage to the producer, natural environment, and society. To achieve sustained performance and economic efficiency, firms should also select the right collection of products and focus on the strategically advantageous processes in their value chain (Saloner et al. 2001). Strategies about these two decisions—product portfolio and outsourcing/integration—can also individually affect firms’ overall performance through process coordination, resource allocation, and the ability to develop core competency (Fine 2000; Bozarth et al. 2009; Espino-Rodriguez and Padrón-Robaina 2006; Wan et al. 2011). Furthermore, these two supply chain strategies may alter supply chain structure, confounding allocation of carbon emissions in a supply chain. For example, a vertically integrated firm should expect a higher percentage of direct carbon emissions from its total carbon emissions than a less integrated firm. A diversified firm producing multiple products typically is not comparable with single-product firms because of the intra-firm synergy effect (Teece 1980; Barney 1991; Barney et al. 1992). Figure 1 illustrates the effect of the two strategies on carbon allocation in a supply chain. Because outsourcing brings changes to a firm’s assets and that diversification influences how resources are used and shared, these two strategies are likely to have a close interactive relationship. However, prior research on outsourcing and diversification does not suggest how these two strategies may jointly affect either FP or EP, which the current paper will examine.

This paper aims to provide an integrated view on internal leanness, product diversification, and outsourcing strategies in their relations to carbon intensity—the ability to “create more profits with less carbon,” attaining both financial and environmental sustainability. Drawing on literature on operations management and strategic management, we hypothesize that more leanness and less diversification are associated with lower carbon intensity, and that the effect of diversification is moderated by outsourcing intensity. We conduct the empirical analysis based on a matched set of financial accounting and carbon inventory data from U.S. manufacturing firms. We examine the changes in carbon intensity based on firm-level carbon emissions and the focal firm’s first-tier suppliers’ carbon emissions. Our results suggest that operational leanness and limited process scope (i.e., more outsourcing and less diversification) are associated with lower carbon intensity.

Theory and Hypotheses

In this section, we present our hypotheses regarding how leanness, supply chain structural strategies, and some firm-level characteristics may be associated with carbon intensities. We define carbon intensity as the ratio between a firm’s carbon emissions and profits. For carbon emissions, we consider the manufacturer’s firm-level and first-tier (suppliers’) emissions. We define first-tier suppliers as those who supply products or services to the focal firm, and first-tier emissions as first-tier suppliers’ emissions generated in connection with supplying goods to the focal firm. To organize our discussion of how the strategies in question may (or may not) affect the carbon intensity ratio, we will first discuss the impacts on FP and carbon performance separately.

Leanness and Carbon Intensity

Leanness is a fundamental concept in operations management. One of its core ideas is to identify and eliminate waste in different forms and ensure a continuous flow of production (Ohno 1988). Specifically, waste can be operational (e.g., set-ups, queues, and unnecessary movement and operational steps) or material (e.g., inventory, scrap, and resource use that does not provide added-value). Waste reduction can be realized through a wide range of activities, including employee education, process redesign, and reduction of inventory buffers and unnecessary resource usage. A leaner operational environment also enables managers to identify more opportunities for process improvement and pollution prevention (King and Lenox 2001; Berchicci and King 2007).

For these reasons, lean operations often improve cost efficiency and productivity, adding to financial gain. Among different lean practices, reduction of production inventory plays a key role in creating a positive effect on FP. A lower inventory level reduces a firm’s asset base and therefore enhances profitability (e.g., as measured by returns on assets; see Fullerton et al. (2003)). Excess inventory also represents unnecessary spending, because producing inventories requires capital, material, and labor inputs. The positive link between inventory leanness and FP has been confirmed in several empirical studies based on large panel data of U.S. publicly traded firms (Chen et al. 2005, 2007; Swamidass 2007; Eroglu and Hofer 2011; Modi and Mishra 2011).

Lean manufacturing systems generate fewer direct carbon emissions because waste reduction generally increases resource productivity and conserves energy. Leaner firms have less waste due to overproduction, defective products, and the interruption of production flow, which are all major sources of carbon emissions (Rothenberg et al. 2001). For example, set-up time may contribute to “non-value-added” carbon emissions, because workstations still consume fuel and electricity when idle. Energy, in the forms of refrigeration, heating, and lighting, may also be needed to store perishable raw materials and (semi)finished goods. Maintaining consistent quality in production output also reduces raw material, resource, and energy waste, and may therefore lower both a firm’s direct operating costs, and direct and supply chain carbon emissions. Because energy supply and price are increasingly erratic, leaner firms are in an advantageous position to manage their costs of production. The operational benefits associated with lean operations can also enhance their market performance, because lean manufacturers tend to be more flexible in their product and service provision (in terms of response and product variety) and have better product quality. Both of these areas are essential to ensuring customer satisfaction and sustained revenue. Therefore, lean manufacturing firms are expected to have lower carbon emissions and better overall FP, and thus better direct carbon efficiencies.

In addition to the direct cost and carbon savings associated with lean practices, lean operations create an organizational culture and environment that are conducive to better carbon performance. Lean manufacturing firms have lower marginal costs for environmental improvements (King and Lenox 2001), because once lean operational principles are disseminated within the firm, the firm will enjoy greater coherence and lower resistance when introducing new environmental management systems. Lean manufacturing firms also tend to be more active in engaging in pro-environment and self-regulatory initiatives because of the cost incentives and the accumulation of knowledge in lean operations (Anton et al. 2004). To summarize, the preceding discussion notes that manufacturers with leaner inventories should have lower firm-level carbon emissions, operating costs, and superior FP. Therefore, we formulate the following hypothesis:

Hypothesis 1a

A firm’s leanness is negatively related to its firm-level carbon intensity.

In contrast, the relationship between leanness and first-tier carbon emissions is less transparent. We can find arguments supporting either a positive or a negative relationship. The arguments for a positive relationship contend that a lean buyer can benefit from working with lean suppliers and therefore be more willing to support suppliers to adopt lean manufacturing practices (King and Lenox 2001; Reinhardt 1999). The main reason is that lean operations require a high level of operational coordination, which lean suppliers are in a better position to accommodate (MacDuffie and Helper 1997; Vachon and Klassen 2007). Thus, working with lean suppliers can lower the buyer’s transaction costs and increase joint productivity (Wu 2003; MacDuffie and Helper 1997). Lean buyers in practice tend to either develop lean suppliers out of their existing supply base, or simply switch to leaner suppliers (Klassen and Vachon 2003). We would then expect that firms adopting lean practices also tend to have lean suppliers, which according to Hypothesis 1a will have below-average carbon emissions.

However, the focal firm’s operational leanness may sometimes increase its suppliers’ emissions. For example, keeping inventory low may require frequent small orders (with shortened lead-time) for replenishment. Suppliers therefore must make more frequent deliveries and in some cases resort to expedited modes of transportation. Small-quantity orders can also make some suppliers choose a smaller production lot and then undertake changeovers more frequently. All of these effects can potentially increase supply chain carbon emissions (Plambeck 2012). However, because we predict that leanness can positively influence FP, the focal firm’s first-tier carbon intensity will also be lower unless its first-tier emissions greatly exceed those of their competitors. We argue that, much like a buying firm has an incentive to work with lean suppliers, lean suppliers also have a similar incentive to search for lean customers (Womack et al. 1990). For suppliers that do not adopt lean practices, the focal firm are expected assist these suppliers in implementing lean strategies, because as noted above, the focal firm can benefit from working with lean suppliers and lowering suppliers’ operating costs. The Japanese auto industry (MacDuffie and Helper 1997) and Walmart’s Supplier Energy Efficiency Program (SEEP)Footnote 1 are two good examples of the purposeful diffusion of lean practices in a supply chain.

Thus, we expect to see a two-way incentive for lean buyers and lean suppliers to bond and stay bonded, which will result in lower overall carbon emissions. The situation in which lean operations increase suppliers’ emissions arise most likely when the focal firm’s suppliers do not adopt lean practices, which lean buyers are expected to avoid. The above discussion leads to the following hypothesis.

Hypothesis 1b

A firm’s leanness is negatively related to its first-tier carbon intensity.

Product Diversification

Below we will discuss how product diversification is related to carbon intensity. We will develop our hypothesis in a two-pronged approach. First, we will discuss the impact of diversification on FP and then operational performance. When discussing the operational impact, we argue that process inefficiency in business operations will lead to excess carbon emissions.

Product Diversification and Financial Performance

The performance outcome of product diversification depends on the net result of the synergy effect, coordination costs, and adjustment costs resulted from a firm’s diversification strategy (Barney 1991; Barney et al. 1992). To explain the performance differences among diversifying firms, several studies propose a curvilinear relationship between the degree of diversification and FP (Palich et al. 2000; Zahavi and Lavie 2013). The curvilinear relationship is assumed to exist because product diversification (measured as a continuous scale) will initially provide more synergy benefits than the coordination and adjustment costs due to suboptimal resource sharing. However, as firms pass their optimal diversification level and gradually diversify to produce unrelated products, economies-of-scope will diminish exponentially and the costs of over-diversification will prevail (Narasimhan and Kim 2002; Palich et al. 2000).Footnote 2 Empirical evidence also suggests that managers typically are not aware of the optimal diversification levels for their firms (Montgomery 1994), partly because coordinating resource sharing as in related diversification is a complex problem (Wernerfelt 1984; Hoskisson and Hitt 1988; Rawley 2010; Levinthal and Wu 2010; Wan et al. 2011; Hashai 2015). Moreover, managers may have incentives to over-diversify, because some managers view diversification as a means to hedge risks and glamorize their personal performance (Shleifer and Vishny 1989; Denis et al. 1997). Summarizing the findings from these studies, we posit that most diversifying firms will surpass their optimal diversification points. Thus, the observed degree of diversification will exhibit a negative correlation with FP.

Product Diversification, Plant Operations, and Carbon Emissions

Several studies on diversification further examine plant operations and find that plant productivity is negatively correlated with firm-level product diversification, which may in turn results in excessive carbon emissions. Using plant-level data from the U.S. Census Bureau, Lichtenberg (1992) found that plant productivity declines when the parent firm operates in more business segments. Schoar (2002) and Maksimovic and Phillips (2001) used longer panel data to study the diversification–productivity link and found that the average productivity of diversified firms is higher than the productivity of single-business firms, but that firm-level productivity is negatively correlated with the level of diversification. Furthermore, these two studies both observed that almost all new plants that are acquired or built for diversification show productivity improvements over time, but that most existing plants experience productivity losses after diversification. One implication is that managers may often shift excess resources and managerial attention to new product lines and businesses, resulting in increased inefficiency. Because the focal firm must coordinate increasingly complex inter-plant operations under diversification, its firm-level productivity loss due to diversification may be much higher than all plant-level productivity losses combined, resulting in excess carbon emissions.

Considerable empirical evidence has been found in the operations literature to support that a “focused” strategy helps enhance production efficiency and product quality (Skinner 1974; Singh and Terwiesch 2011). Mukherjee et al. (2000), for example, found that the labor productivity and conformance quality of a production line are lower when the production line produces heterogeneous products. From a production viewpoint, product diversification could potentially increase the number of changeovers in production lines for a firm and the number of products and suppliers that the firm must manage. With more products included in the product portfolio, production planning and inventory decisions become increasingly difficult to optimize. Moreover, firms with highly diversified product portfolios may need to pool production for differentiated products into a small number of production facilities to improve scale efficiency, and the average distance to customers will increase as a result (Randall and Ulrich 2001). With a longer distance to customers, the likelihood of resorting to more carbon-intensive transportation modes will rise especially when demand uncertainty and substitution for related products are pronounced. These logistic activities and coordination problems will increase both internal and first-tier supply chain emissions.

Finally, several studies have found that operational inefficiency and managerial indiscretion are accountable for a high proportion of preventable energy waste (e.g., Blass et al. 2014; Suresh et al. 2013). As the operational complexity due to product diversification can be associated with increased process inefficiency for the focal firm and its suppliers, this inefficiency should lead to higher carbon emissions from both sides. Summarizing the above discussion, diversified firms may not secure financial benefits and in some cases will incur financial loss. They are also likely to have higher firm-level and first-tier carbon emissions than their nondiversifying counterparts. Therefore, we make the following prediction:

Hypothesis 2

Product diversification is positively associated with the firm-level and first-tier carbon intensities.

Moderating Effect of Outsourcing on Product Diversification

As discussed in the preceding section, the product portfolio of a firm is typically constructed based on the firm’s current resources. Meanwhile, outsourcing strategies redraw a firm’s corporate boundaries and change the ownership of resources available for production. Therefore, we expect that outsourcing may moderate the performance impact of diversification through its implications for organizational resources.

To understand the effect of outsourcing on diversification, we use the resource-based view (RBV) as the theoretical basis to predict a firm’s outsourcing decisions. RBV addresses how a firm may create competitive advantage through utilizing the resources at its disposal (Wernerfelt 1984). RBV suggests that resources that create competitive advantage are usually those that are firm-specific, inimitable, and less fungible (Barney 1991). To better identify and utilize these resources, firms often use outsourcing as a “focus” strategy to better concentrate their financial, human, and physical assets on competency-building processes (Buzzell 1983; D’Aveni and Ilinitch 1992; Das et al. 2006; Heshmati 2003). Therefore, for outsourcing firms, resources that are not central to the creation of a firm’s competitive advantage (e.g., nonunique resources for which an established market exists) are more likely to be outsourced first (Espino-Rodriguez and Padrón-Robaina 2006; Amit and Schoemaker 1993) to prevent suppliers from entering the market (Eggers 2014), and to lower transaction costs (Cesaroni 2004). The above discussion suggests that the order in which firms outsource should follow the perceived strategic importance of the resources and that with more intensive outsourcing, the retained resources and capabilities are more likely to be those that are more firm-specific and less fungible. Therefore, resource specificity should increase under a high level of outsourcing, hindering resource sharing.

Based on the above discussion, the retained resources after outsourcing are more suitable for developing related products that, as noted above, mostly occur at the initial phase of product diversification. As the benefit of diversification mainly stems from the benefit of resource sharing, resource specificity could diminish scope economies that the firm could have garnered when the resource stock was high and fungible. As a result, outsourcing reduces the synergy benefit and increases the costs associated with product diversification. We therefore expect that the higher the outsourcing level is, the stronger the effect of product diversification on increasing firm-level and first-tier carbon intensities will be (and vice versa).

Hypothesis 3

Product diversification has a stronger (more positive) effect on increasing firm-level and first-tier carbon intensities when outsourcing intensity is higher.

Empirical Models

Sample and Data

Our sample includes U.S. manufacturing firms (NAICS codes 31 through 33) for the period between 2006 and 2012, and is constructed by matching annual data from Standard and Poor’s Compustat with data from Trucost (http://www.trucost.com/). We obtain firm-level financial variables from Standard and Poor’s Compustat, segment information from Compustat Segment Data, and environmental variables from the Trucost database (i.e., carbon emissions and environmental disclosure status). We also use archival data from the U.S. Bureau of Labor Statistics (http://www.bls.gov) to estimate labor expenses, which are used to calculate the outsourcing index (see “Key Independent Variables” section).

Trucost is a comprehensive environmental database that contains the firm-level and supply chain environmental footprints of over 4000 companies listed in the S&P 500 or MSCI World Index. Trucost compiles figures from companies that disclose their environmental profiles to the public in company reports or other publicly available sources such as the Toxic Release Inventory of the U.S. Environmental Protection Agency (EPA) and Carbon Disclosure Project (CDP). We use firms’ self-reported environmental data compiled by Trucost. The Trucost data were previously used in several studies on management issues related to carbon emissions, including for example Jira and Toffel (2013) and Knight (2011). Our sample data are created by merging Trucost and Compustat with CUSIP codes. The final sample contains an unbalanced panel for 126 manufacturing firms and 388 firm-year observations.

Dependent Variable: Carbon Intensity

We use carbon intensity, which is the ratio between a firm’s carbon emissions (in million tonnes) and its operating profit (million dollars), as our dependent variable. The ratio reflects how much carbon emissions are generated on a per dollar profit basis. We use a profit measure in the intensity measure instead of sales to partially capture the firm-level productivity improvement and resource efficiency, which are mostly reflected in the cost figures. Several studies that use information carbon emissions adopt the carbon-to-sales ratio as the intensity. In that ratio, sales are meant to be a normalizer that reflects the company scale. We use the carbon-to-profit ratio because, as noted above, profitability is an important aspect of carbon management practices. Using the carbon-to-sales ratio, for example, we would not be able to distinguish companies with high sales but high cost due to inefficiency, versus companies with a similar amount of sales but low cost.

We calculate the operating profit as sales (Compustat item SALE) less operating expenses (Compustat item XOPR). Observations in our matched sample all have positive operating profits, requiring special consideration. We create three intensity variables for each firm-year observation: the firm-level carbon intensity when firm-level emissions are considered and the first-tier carbon intensity when the first-tier suppliers’ carbon emissions are considered.

-

Firm-level carbon intensity = direct carbon emissions/operating profit

-

First-tier carbon intensity = first-tier suppliers’ carbon emissions/operating profit

Therefore, a higher carbon intensity would signify lower overall performance (i.e., either the firm generates more carbon emissions, lower profits, or both, than its competitors do). As noted above, we define first-tier emissions as the first-tier suppliers’ firm-level emissions generated to supply goods to the focal firm. Firms in our sample all have positive operating profits over the sample period (see Table 1).

Note that we attribute emissions due to electricity usage, i.e., the scope 2 emissions, as part of the direct emissions. The reason that we relegate the scope 2 emissions to direct emissions is because electric emissions mostly depend on the on-site processes, operational efficiency and control in a firm, rather than the technologies adopted by the electric utility companies to generate electricity, which is exogenous for the focal firm. We focus on emissions of first-tier suppliers only because first-tier suppliers are those with direct transactional relationship with the focal firm and represent a more traceable cohort to test our research hypotheses.

Key Independent Variables

Inventory “Fatness”

Excess inventories is one of the most commonly used indicators of leanness in the operation literature, as excessive inventories represent a major form of waste and are indicative of the incoordination and inefficiency of the purchasing, production, and distribution systems. Lower inventory levels are often associated with reduced waste, operating costs and process variability; lower inventory can also reveal improvement opportunities to streamline processes and increase productivity (Lieberman and Demeester 1999; Shah and Ward 2003). Another advantage of using the inventory, as compared with other qualitative and circumstantial measures of lean operation (e.g., ISO 9001 certification as used in King and Lenox (2002)), is that the annual inventory of listed companies is available for open access (e.g., Compustat), allowing researchers to objectively carry out a longitudinal comparison of lean performance (e.g., Gaur et al. 2005; Chen et al. 2005, 2007). Finally, the amount of inventories can also reflect the intensity of the production activities taking place in a company; as such, inventories are closely related to carbon emissions. We use the inventory-to-sales (IS) ratio to reflect the degree of inventory fatness (i.e., the degree to which the inventory is not lean). The annual IS ratio was used in a number of studies (e.g., Chen et al. 2005; Rumyantsev and Netessine 2007). To reflect within-year changes in inventory performance, we consider the average of four preceding quarterly inventory-to-sales ratios. We consider total inventory (Compustat item INVT) because different types of inventories can all potentially affect carbon emissions and operating profit. As a higher value of the IS ratio indicates lower level of leanness, we use the term inventory fatness to make a better distinction between the measure and leanness.

Note that we use outsourcing intensity to control for the confounding effect of integration on our inventory measure. This confounding effect can arise when, given the same throughput and production processes, the average inventory would tend to be higher for the more integrated firm, because its processing time will be longer due to integration. Therefore, the more integrated firm will have more inventory due to integration.

Product Diversification (PD)

We use an entropy-based index to measure the degree of product diversification. Traditionally, segment sales are used to compute the index; see, e.g., Palepu (1985). However, sector sales may not reflect the production process, facilities, and other emission sources implicated by a diversified product portfolio. In this study, we instead use segment identifiable total assets (Compustat item IAS) from Compustat Segment Data to compute our entropy index. IAS is the total assets used by or directly associated with each business segment for the product. The entropy index therefore can capture the underlying asset distributions related to multiple market segments.

The entropy index is computed as \(PD_i=\sum _{j=1}^N p_j*\ln (1/p_j)\), where \(p_j\) is equal to firm i’s identifiable assets in sector j divided by its total assets. A higher index value is indicative of a higher degree of diversification. The index depends on both the number of segments and the relative weight (expressed as the percentage of assets from one sector). Thus, the entropy index reflects both the breadth and depth of diversifications across sectors that the company has engaged in. Suppose company i has N different types of products (distinguished by NAICS codes). The index increases as the number of product lines N increases. For a given N, the index value is concave in \(p_j\) and is maximized when \(p_1=p_2=\ldots =p_n\); i.e., when the company’s assets are distributed evenly from N diversified product lines. As such, the index is lower when the company’s concentrates on a subset of the N sectors.

Outsourcing Intensity

We next explain how we construct our outsourcing intensity index from the value-added to sales ratio. Then, we explain how we estimate value added in the ratio from archival data.

(a) Value-added to sales (VA/S) ratio Our outsourcing measure draws on the value-added to sales (VA/S) ratio used in the management and economics literature to measure the degree of vertical integration (Adelman 1955; Tucker and Wilder 1977; Balakrishnan and Wernerfelt 1986; Perry 1989; Barney et al. 1992; Hutzschenreuter and Gröne 2009; Lajili et al. 2007; Lieberman and Dhawan 2005). Specifically, we measure outsourcing intensity as “one minus the degree (%) of vertical integration.” We provide a detailed discussion and illustration of the VA/S approach in the Appendix.

The value added of a firm represents the economic value created by the firm. It can be calculated as the difference between its sales revenue and purchasing costs paid to external suppliers of products or services (Adelman 1955). Therefore, sales include the value added created by the focal firm and all of its upstream suppliers, while purchasing costs represent the aggregated value added created by all upstream suppliers. The VA/S index is applicable when the firm has multiple cross-sector transactions, and it is nondecreasing after vertical integration.

(b) Estimating value added To estimate value added, we follow previous studies and use the income approach (Tucker and Wilder 1977; Barney et al. 1992; Li and Tang 2010). This approach originates from the classical macroeconomics method to measure national income accounts, in which the national income can be approximated by aggregating the total value added from all industries, individuals’ factor incomes, or total expenditures on final goods in the economy (Williamson 2014). These three methods should in theory lead to the same estimate for national income. The income approach considers the following income components: the compensation of employees, rental income, corporate profits, interest, tax, and depreciation of productive capital. These income components encapsulate the main productive sources of value added creation, and value added is approximated as the sum of these income components.

The income approach to corporate value added rests on a similar idea that value added created by the firm should in theory be equal to the firm’s payment to (also the income of) the factors owners that contribute to the production of products. The income components considered, as noted, include net income, depreciation and amortization, pension and retirement expenses, staff expenses, interest expenses, income taxes, and rental expenses (Tucker and Wilder 1977; Barney et al. 1992). We obtain data for all income components except for the staff expenses from Compustat (including XINT, DP, XRENT, XPR, NI, and TXT in Compustat). In addition to these variables considered in the traditional income approach, we also consider finished goods inventories (Compustat item INVFG) as part of a firm’s value added. This can mitigate the confounding effect of overproduction on the index. Note that the classical income approach in macroeconomics also includes finished goods inventories in the calculation of total value added for the national income account (Williamson 2014).

For our sample periods, however, the staff expense variable contains many missing values in Compustat: among all manufacturing firms that appear in Compustat between 2006 and 2012, only approximately 7 % of the observations reported their total staff expense (Compustat item XLR). Therefore, we use the product of the number of employees (Compustat item EMP) and annual average three-digit NAICS wage obtained from the U.S. Bureau of Labor Statistics website (http://data.bls.gov) as a proxy for the wage expense of each sample firm.

The income method for calculating value added has one limitation. Factors other than vertical integration, most notably changes in profitability and taxation rules, may also influence the result from the income approach (Tucker and Wilder 1977; Maddigan 1981; Buzzell 1983). To avoid such inconsistencies, we follow previous studies in using the adjusted VA/S index, in which the profit (Compustat item NI) and taxation components (Compustat item TXT) are removed from the value-added to sales index (Tucker and Wilder 1977; Barney et al. 1992; Hutzschenreuter and Gröne 2009; Buzzell 1983):

and we define the outsourcing intensity for a firm-year observation to be \(1-(\mathrm VA/S)_{it}\).

Control Variables

Firm Size and Industry Effect

Size and industry can both affect profits. In addition, firm size can affect the adoption of proactive environmental practices and influence stakeholder pressure on companies’ sustainability issues (Darnall et al. 2010). We use the log of total assets (Compustat item AT) as a control for company’s size. Firms in different manufacturing sub-sectors may have distinct supply chain characteristics and processes, and some sub-sectors may be more sensitive to environmental pressure than are others (such as chemical manufacturing firms). To control for unobserved inter-sector heterogeneity, we include dummy variables based on the three-digit NAICS codes.

R&D Intensity

R&D investment has been found to enhance product innovation, market share and valuation (Ettlie 1998). Investment in R&D has also been found to be strongly associated with green product design and environmental patent counts (Florida 1996; Carrión-Flores and Innes 2010). Stronger R&D capability can encourage process innovation and improve productivity and technological capability, which can reduce the cost of and organizational resistance to undertaking voluntary activities to enhance a firm’s EP (Anton et al. 2004). We measure R&D intensity by the R&D expenses-to-sales ratio (Compustat items XRD divided by SALE). A logarithmic transformation is used to reduce skewness (original \(\alpha _3=4.95\)).

Slack Resources

Firms with more slack resources are less restrained when investing in environmentally and socially responsible projects and are more likely to develop operational capabilities in favor of the environment (Bansal 2005). Following Bansal (2005) and Strike et al. (2006), we measure a company’s slack resources by its liquidity ratio, which is equal to current assets divided by short-term debt.

Internationalization

A firm’s degree of international diversification can substantially affect its environmental standards, strategies, and stock price performance (Hendricks et al. 2009; Christmann 2004; Strike et al. 2006). We use the ratio between foreign sales and U.S. domestic sales to control for a firm’s internationalization. We obtain the foreign sales information from Compustat Segment Data (Compustat item SALES).

Environmental Disclosure

Previous studies indicate that the propensity toward higher environmental disclosure and transparency is positively related to environmentally responsible behavior and stakeholder stewardship, both of which have significant effects on a firm’s EP (Jacobs et al. 2010; Clarkson et al. 2008; Reid and Toffel 2009). We use the following ratio to control for environmental disclosure. We measure the intensity of environmental disclosure by a ratio between the number of pollutants that a firm discloses to the public through various channels (e.g., voluntary disclosure programs, corporate environmental reports, and reports filed to the government agency) and the maximum number of pollutants disclosed by firms in the same NAICS six-digit segment.

Results

The Empirical Model

To test our hypotheses, we estimate the following regression:

Tables 1 and 2 report the descriptive statistics and correlation for the variables in our empirical model. In Model (2), the independent variables include inventory fatness, productive diversification (PD), outsourcing, and the control variables X introduced in “Control Variables” section. We mean-centered the PD and Outsourcing variables to mitigate the multicollinearity effect due to the interaction term. Following the Wald test at the 1 % level, we also include year dummies to control for temporal variations of carbon intensities. The \(\zeta _i\sim _{iid}N(0,\sigma ^2_\zeta )\) is the firm-specific random effect for firm i, and \(\epsilon _{i,t}\sim _{iid}N(0,\sigma ^2_\epsilon )\) is the noise term independent of \(\zeta _i\) for all i. All dependent variables and control variables are lagged by one year to avoid the simultaneity problem.

We followed Clark and Linzer (2014) and Bell and Jones (2014) to select our empirical model based on data characteristics. Our sample consists of an unbalanced short panel with an average of only \(\bar{T}=3.08\) years. With such a short panel, the fixed-effects model might create the incidental parameter problem (Cameron and Trivedi 2005, p. 781), which would make its coefficient estimators inconsistent. In addition, the key independent variables in our model all have low within-unit variances over time: the average within variance of the three key independent variables is only approximately 28 % of their total variances. Low within-unit variances will further inflate the fixed-effect estimators’ variances. This situation means that fixed-effects estimates will have a wider spread in the sampling distributions. Thus the coefficient estimates will have a high probability being far off, and the significance of the estimates will be diluted. See Plümper and Troeger (2007) for a detailed discussion of the consequence of low within variances. Considering our sample characteristics, the random-effects model would be a much better choice in terms of estimation efficiency and consistency; however, it may produce biased estimates. One critical assumption of the random-effects model (a weakness compared with the fixed-effects model) is that the firm-specific cluster variable \(\zeta _i\) must not be correlated with the level-1 noise \(\epsilon _{i,t}\), which, if violated, would lead to biased estimates. To reduce the endogeneity concern, we include a diverse set of control variables to avoid such biases. Finally, we also ran the Breusch–Pagan Lagrange multiplier test for random effects. The test result supports the use of a random-effects panel model over a pooled ordinary least square (OLS) regression (\(p<0.01\)). We use Stata to obtain the generalized least square (GLS) estimates with a firm-level robust measure for standard errors.

Estimation Results

Estimation results from the random-effects regression are reported in Table 3. In the first regression, we use the firm-level carbon intensity as the dependent variable (column 1). In the second regression, we use the first-tier carbon intensity as the dependent variable (column 2). To investigate the effect of independent variables on firm-level and first-tier emissions combined, we use supply chain carbon intensity as our dependent variable in the third regression (column 3). Finally, we report the results from robustness checks in columns 4 and 5.

The regression results support our first hypothesis (H1a) on inventory leanness. In the first regression, the coefficient of inventory fatness is positive and significant (β = 1.15, p < 5 %), supporting our prediction that excess inventory is positively related to firm-level carbon intensity (H1a). In the second regression, the coefficient of inventory fatness becomes lower but is still statistically significant (β = 0.56, p < 10 %). This result indicates that local excess inventory is positively associated with first-tier carbon intensity, which follows our prediction that inventory leanness will not affect first-tier carbon intensity (H1b).

Moving to product diversification, we find that Product Diversification is positive and highly significant in the first and second regressions, supporting Hypothesis 2 that product diversification is positively related to both firm-level and first-tier carbon intensities. In both regressions, the interaction term diversification \(\times \) outsourcing is also positive and significant. This result implies that the undesirable impact of product diversification is stronger when outsourcing intensity is higher. Figure 2 visualizes the interaction effect for firm-level and first-tier carbon intensities. We examine the interaction effect for the 10th, 50th, and 90th percentiles of the empirical distribution of outsourcing intensity. We label them as “low,” “medium,” and “high” outsourcing intensities in the figure, respectively. We plot the three outsourcing intensities against the predicted mean carbon intensities for the 10th and 90th percentiles of the empirical distribution of the product diversification index. The figure shows that product diversification generates lower impacts when outsourcing intensity is low, but it aggravates carbon intensity as outsourcing intensity advances. In particular, when outsourcing is set at the 10th percentile level, product diversification has virtually no effect on the mean predicted firm-level carbon intensity (Fig. 2a). Furthermore, the predicted first-tier carbon intensity at the low outsourcing level even decreases when product diversification is higher (see Fig. 2b, although the difference is not statistically significant). These results corroborate our arguments that product diversification can have a stronger, negative effect under high outsourcing level. The results also suggest that, from a carbon intensity standpoint, it would be more advantageous for a firm to diversify when its production process is sufficiently integrated, and that a trade-off exists between these two expansion–contraction strategies.

Among the control variables, Size and R&D intensity are both negative and significant across the three regressions on carbon intensities. The result for Size suggests that larger firms tend to generate lower carbon intensities than small-size firms. The coefficients of Size suggest that a 1 % increase in total assets is associated with an approximately 0.24 % decrease in a firm’s carbon intensities. Thus, maintaining the scale can be important in attaining better firm-level and supply chain carbon performances. However, the regression results for outsourcing, product diversification and their interaction also indicate that staying “focused” in operations (i.e., high outsourcing intensity and low product diversification) may lead to lower carbon intensities. Considering this focused strategy and the finding about Size, manufacturers are suggested to maintain a reasonable business scale for their retained process when shrinking their operational scope and span. Finally, similar to Size, the coefficients of R&D intensity are also significant. The result indicates that a 1 % increase in R&D intensity is related to a 0.38 % decrease in firm-level carbon intensity (0.28 % for first-tier carbon intensity). This evidence suggests that R&D intensity has a similar improvement effect on firm-level and supply chain carbon intensities.

In addition, the regression result also suggests that outsourcing can cause a significant increase in the first-tier carbon intensity and GHG emissions, but the effect size will depend on the level of product diversification. The coefficient of outsourcing intensity is highly significant and positive for first-tier carbon intensity. However, outsourcing intensity is insignificant in the regression on firm-level carbon intensity. One possible explanation is that most of the processes that manufacturers outsourced are not their major emission sources (e.g., auxiliary functions), but suppliers incur additional GHG emissions resulted from operational complexity for coordinating the activities with the focal firm. Therefore, outsourcing did not induce a significant decline in firm-level emissions. As shown in our regression results, however, first-tier emissions increased considerably after outsourcing, suggesting that outsourcing created more first-tier emissions than the reduced firm-level emissions for our sample firms. This result may also suggest that the variation of profits dominates that of carbon emissions in the empirical model.

Robustness Checks

Our empirical analysis thus far uses carbon intensity as the dependent variable. While the intensity-based measure has been popular in the management literature, it is not without limitations. First, changes in carbon intensity may result from changes on the profit side, the emission side, or both. Therefore, the coefficients from the regression can only inform us regarding the independent variables’ effect on a standardized performance measure, but not regarding the main source of variation. More critically, some research suggests that the empirical model can fail when the regression has a ratio dependent variable (including popular financial indicators such as return on assets (ROA) and its variants). This situation arises because the denominator, which usually serves as the scale variable for a performance measure, may alter the distribution of error terms and the functional form of the regression equation (Wiseman 2009).

As a robustness check, we follow Wiseman (2009), who suggests moving the denominator (i.e., operating profit) to the right-hand side as a control variable and using the numerator (i.e., carbon emissions) as the new dependent variable. Thus, the new regression uses the amount of carbon emissions as the dependent variable, while controlling for the operating profits in the same year. However, the contemporaneous operating profit is likely to be endogenous in the regression, as lagged predictors of the regression may also influence the profit. To address this issue, we use a two-stage least square (2SLS) random-effects regression and use the three-period lagged operating profits as the instrumental variable (\(\rho =0.91\)). We choose three-period lagged profits as the instrument because this variable is naturally correlated with profits in t (instrument relevance), and operating profits in \(t-3\) are unlikely to be able to influence carbon emissions in t (instrument exogeneity). We present the estimated coefficients in columns 4 and 5 of Table 3. The estimates from the 2SLS regression are similar to those from the regression on carbon intensity (columns 1 and 2).

Discussion and Conclusion

Discussion

This study examines how inventory leanness and the structural characteristics of a supply chain (i.e., outsourcing and diversification) may influence a firm’s profitability and carbon emissions (i.e., carbon intensity). We predict that inventory leanness is associated with lower firm-level carbon intensity and that product diversification will negatively impact both firm-level and first-tier carbon intensities—but that negative impact will be stronger when the firm engages in more intensive outsourcing.

This paper offers several unique views on sustainable operations in a supply chain. First, this paper considers the impact of inventory leanness on carbon intensity, integrating the two streams of leanness literature on EP and FP. This integrated view is essential, as controversies still exist regarding the trade-off in the relationship between these two performance dimensions (e.g., Blanco et al. 2009; Busch and Hoffmann 2011; Dixon-Fowler et al. 2013). Second, distinct from existing studies on sustainable operations, this paper expands the scope of analysis to include suppliers’ carbon emissions. We examine how a firm’s operations strategies might influence suppliers’ carbon emissions. Finally, this study focuses on carbon emissions, which in most state jurisdictions are not regulated. Other studies on the operations-environment link use variables such as waste generation and treatment, total toxic chemical releases, which are subject to regulation or industrial codes of conduct, and the impact of pollutants limited to a local community. Manufacturers’ perception of these substances can have lower uncertainty than that of GHGs, whose impact is considered global and which only build up in the long term. Therefore, this study also has implications for the literature on firms’ strategic actions under regulatory uncertainty (e.g., Marcus et al. 2011). Carbon emissions are distinct from other pollutants in terms of the environmental technologies and managerial practices that can be used for pollution reduction. Unlike other environmental outputs, which can be either prevented or treated before release, carbon emissions in most manufacturing companies can only be “prevented” but not treated.

The empirical analysis also provides several important contributions. We discover that inventory leanness is associated with lower firm-level carbon intensity. Our finding is largely consistent with the established view that lean manufacturing can create environmental benefits (e.g., Rothenberg et al. 2001; King and Lenox 2001; Kleindorfer et al. 2005). However, we find support that benefits in terms of carbon reduction are not realized at the expense of profitability. We also find evidence that product diversification is associated with higher carbon intensities and carbon emissions. While there is a rich body of management literature on product diversification, few studies examine how diversification may affect operational efficiency and none has examined its association with EP (Dooley and Fryxell 1999; Novak and Eppinger 2001; Randall and Ulrich 2001). This paper therefore contributes to the literature by developing a theoretical framework that links these two important strategies. As discussed earlier, diversification and outsourcing are related because they both influence a firm’s core resources: diversification hinges on resource sharing, while outsourcing influences the resource stock. These two strategies are also related from the product portfolio viewpoint. Some early studies on diversification view integration as a special form of diversification, in which firms “...branch out into production of components, parts, and materials [that the firm needs].” (Ansoff 1957, p. 118). The market for “in-sourced” products is almost exclusively devoted to internal customers. Therefore, if we include intermediate products in the product portfolio, one can view outsourcing as a diversification reduction strategy. However, recent management literature often views decisions to outsource and diversify separately as two independent strategies and overlook their interaction effect on firm performance and operational efficiency (e.g., Espino-Rodriguez and Padrón-Robaina 2006; Wan et al. 2011). Our study revisits the theoretical link between these two resource-changing decisions and expands the scope of previous studies to analyze the joint impact of these decisions on a firm’s profitability and carbon performance. This paper is also the first to examine diversification’s implications for supply chain carbon performance.

This study also makes several methodological contributions. The existing empirical literature on operations management often uses plant distance and scale measures to characterize a supply chain. Randall and Ulrich (2001) focused on the cost trade-off between the size of production facilities and the distance to customers. Stock et al. (2000) considered the geographic dispersion of suppliers and channel governance (ownership of suppliers and supplier relationships) for suppliers as the two theoretical elements of the supply chain structure. Awaysheh and Klassen (2010) used transparency in the supply chain, dependency on supply chain partners, and geographic distance of suppliers to characterize a supply chain structure. This study provides another framework to characterize a firm’s upstream supply chain structure with its suppliers through archival data. Finally, the management literature traditionally uses indexes based on segment sales to measure product diversification. However, the sales-based index may not fully reflect changes in the production process. In this study, we use segment assets to measure product diversification from the production side.

Practical Implications

This study suggests several strategic factors that are useful for building a sustainable supply chain. First, prior studies have provided ample evidence that inventory leanness can contribute to financial competitiveness. Our empirical analysis further shows that inventory can also reduce firm-level carbon intensity. The benefit from lean inventory management is still statistically significant when we consider the carbon intensity of suppliers’ emissions. In addition to keeping a lean inventory, our results also suggest that maintaining a strategic focus on core processes, products, and businesses may help companies attain lower carbon intensity. Our study also has implications with regard to inventory management practices. To reduce excess inventory, firms may decompose larger internal processes into smaller sub-processes to create more opportunities. Firms can also consider consolidating duplicated sub-processes across the company to limit the diversification or proliferation of processes or functions.

We find that outsourcing can aggravate the performance impact of product diversification because the cross utilization of organizational resources can cause inefficiency. We also find that firms implementing a focus strategy can benefit from increasing their company scale. Based on these findings, we propose a three-step strategic roadmap for improving carbon intensity. First, manufacturers should identify their competency-building processes from a holistic supply chain viewpoint. Second, manufacturers should concentrate their resources on and optimize their core processes through outsourcing and lean practices; they should also refrain from product proliferation and producing unrelated products at this stage. Finally, manufacturers should scale up their core processes. They may engage in more extensive product diversification at this stage if deemed appropriate. However, manufacturers are advised to exploit the potential synergy effect from sharing the core processes across products.

Although currently carbon emissions are unregulated in most countries, an increasing number of regulatory attempts have been put in place to curb the growth of GHGs emissions (e.g., Adler 2011), such as technology mandates, emissions reporting requirements, and fuel efficiency standards. Therefore, we expect to see a higher correlation between carbon emissions and FP, as well as a greater opportunity to achieve superior FP through reduction the firm-level and supply chain carbon emissions.

Limitations and Future Research

This study has several limitations. In our outsourcing hypothesis (H3), we follow previous studies (e.g., Narasimhan and Kim 2002; Palich et al. 2000) by assuming that firms will rationally determine the sequence of outsourcing according to the level of strategic importance. Further work should be performed to collect data of higher granularity and investigate the linkage between the types of outsourced processes and their implications for carbon intensity.

We use firm-level aggregate emission data in our analysis. Because different electricity grids might have unique energy mixes, a firm’s emissions due to electricity consumption may depend on the regional grids from which its plants or offices obtain electricity.Footnote 3 However, the interconnectedness of some of these regional grids makes it difficult to analyze the location effect without comprehensive plant-level information. Further research should study the long-term effect of factors such as national grid development on decisions about facility location and capacity planning.

Finally, we did not control for supplier-side heterogeneity in our empirical model. As a result, we cannot infer how idiosyncratic supplier-side factors might influence supplier-side carbon emissions (or FP or the focal firm), and our empirical analysis reflects the average tendency of first-tier carbon emissions and its relation to the focal firm’s FP. We encourage more research to be conducted to understand the mechanism through which a supplier’s environmental strategy and performance are influenced by its customers’.

Conclusion

In a carbon-constrained world, managing carbon emissions in the supply chain can have long-term implications for profitability. This study investigates how a manufacturing firm’s leanness level and supply chain structural factors may affect the carbon intensities of the supply chain. Our initial evidence shows that carbon intensities correlate negatively with inventory leanness, and positively with product diversification. We also find that the impact of product diversification is moderated by outsourcing intensity: product diversification can inflict a higher percentage increase in carbon intensity when outsourcing intensity is high, but is almost innocuous when outsourcing intensity is low.

In conclusion, our empirical results suggest that, to achieve low carbon intensities or high carbon efficiencies, a firm should focus on its resource efficiency (i.e., producing goods efficiently), diversification portfolio (i.e., producing the goods that the market needs), and process choice (i.e., focusing on the value-added processes in which the firm has the largest competitive advantage).

Notes

See, e.g., the U.S. EPA eGrid database at http://www.epa.gov/cleanenergy/energy-resources/egrid/index.html

References

Adelman, M. (1955). Concept and statistical measurement of vertical integration. In: Business concentration and price policy (pp. 281–330). Princeton: Princeton University Press.

Adler, J. H. (2011). Heat expands all things: The proliferation of greenhouse gas regulation under the Obama administration. Harvard Journal of Law & Public Policy, 34(2), 421–452.

Amit, R., & Schoemaker, P. (1993). Strategic assets and organizational rent. Strategic Management Journal, 14(1), 33–46.

Ansoff, H. (1957). Strategies for diversification. Harvard Business Review, 35(5), 113–124.

Anton, W., Deltas, G., & Khanna, M. (2004). Incentives for environmental self-regulation and implications for environmental performance. Journal of Environmental Economics and Management, 48(1), 632–654.

Awaysheh, A., & Klassen, R. (2010). The impact of supply chain structure on the use of supplier socially responsible practices. International Journal of Operations and Productions Management, 30(12), 1246–1268.

Balakrishnan, S., & Wernerfelt, B. (1986). Technical change, competition and vertical integration. Strategic Management Journal, 7(4), 347–359.

Bansal, P. (2005). Evolving sustainably: A longitudinal study of corporate sustainable development. Strategic Management Journal, 26(3), 197–218.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barney, J., Edwards, F., & Ringleb, A. (1992). Organizational responses to legal liability: Employee exposure to hazardous materials, vertical integration, and small firm production. Academy of Management Journal, 35(2), 328–349.

Bell, A.., & Jones, K. (2014). Explaining fixed effects: Random effects modeling of time-series cross-sectional and panel data. Political Science Research and Methods Forthcoming.

Berchicci, L., & King, A. (2007). 11 Postcards from the edge. Academy of Management Annals, 1(1), 513–547.

Blanco, E., Rey-Maquieira, J., & Lozano, J. (2009). The economic impacts of voluntary environmental performance of firms: A critical review. Journal of Economics Surveys, 23(3), 462–502.

Blass, V., Corbett, C. J., Delmas, M. A., & Muthulingam, S. (2014). Top management and the adoption of energy efficiency practices: Evidence from small and medium-sized manufacturing firms in the us. Energy, 65, 560–571.

Bozarth, C., Warsing, D., Flynn, B., & Flynn, E. (2009). The impact of supply chain complexity on manufacturing plant performance. Journal of Operations Management, 27(1), 78–93.

Busch, T., & Hoffmann, V. (2011). How hot is your bottom line? Linking carbon and financial performance. Business and Society, 50(2), 233–265.

Buzzell, R. (1983). Is vertical integration profitable. Harvard Business Review, 61(1), 92–102.

Cameron, A., & Trivedi, P. (2005). Microeconometrics: Methods and applications. Cambridge: Cambridge University Press.

Carrión-Flores, C., & Innes, R. (2010). Environmental innovation and environmental performance. Journal of Environmental Economics and Management, 59(1), 27–42.

CDP. (2013). CDP supply chain report 2013–14. Carbon Disclosure Project: Tech. rep.

Cesaroni, F. (2004). Technological outsourcing and product diversification: Do markets for technology affect firms strategies? Research Policy, 33(10), 1547–1564.

Chen, H., Frank, M., & Wu, O. (2005). What actually happened to the inventories of american companies between 1981 and 2000? Management Science, 51(7), 1015–1031.

Chen, H., Frank, M., & Wu, O. (2007). US retail and wholesale inventory performance from 1981 to 2004. Manufacturing and Service Operations Management, 9(4), 430–456.

Christmann, P. (2004). Multinational companies and the natural environment: Determinants of global environmental policy standardization. Academy of Management Journal, 47(5), 747–760.

Clark, T., & Linzer, D. (2014). Should I use fixed or random effects? Political Science Research and Methods forthcoming.

Clarkson, P., Li, Y., Richardson, G., & Vasvari, F. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4), 303–327.

Comas Martí, J., & Seifert, R. (2013). Assessing the comprehensiveness of supply chain environmental strategies. Business Strategy and the Environment, 22(5), 339–356.

Darnall, N., Henriques, I., & Sadorsky, P. (2010). Adopting proactive environmental strategy: The influence of stakeholders and firm size. Journal of Management Studies, 47(6), 1072–1094.

Das, A., Narasimhan, R., & Talluri, S. (2006). Supplier integration: Finding an optimal configuration. Journal of Operations Management, 24(5), 563–582.

D’Aveni, R., & Ilinitch, A. (1992). Complex patterns of vertical integration in the forest products industry: Systematic and bankruptcy risks. Academy of Management Journal, 35(3), 596–625.

Denis, D., Denis, D., & Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. Journal of Finance, 52(1), 135–160.

Dixon-Fowler, H., Slater, D., Johnson, J., Ellstrand, A., & Romi, A. (2013). Beyond “does it pay to be green?” A meta-analysis of moderators of the CEP-CFP relationship. Journal of Business Ethics, 112(2), 353–366.

Dooley, R., & Fryxell, G. (1999). Are conglomerates less environmentally responsible? An empirical examination of diversification strategy and subsidiary pollution in the US chemical industry. Journal of Business Ethics, 21(1), 1–14.

Eggers, J. (2014). Competing technologies and industry evolution: The benefits of making mistakes in the flat panel display industry. Strategic Management Journal, 35(2), 159–178.

Eroglu, C., & Hofer, C. (2011). Lean, leaner, too lean? The inventory-performance link revisited. Journal of Operations Management, 29(4), 356–369.

Espino-Rodriguez, T., & Padrón-Robaina, V. (2006). A review of outsourcing from the resource-based view of the firm. International Journal of Management Review, 8(1), 49–70.

Ettlie, J. (1998). R & D and global manufacturing performance. Management Science, 44(1), 1–11.

Fine, C. (2000). Clockspeed-based strategies for supply chain design. Productions and Operations Management, 9(3), 213–221.

Florida, R. (1996). Lean and green: The move to environmentally conscious manufacturing. California Management Review, 39(1), 80–105.

Fullerton, R. R., McWatters, C. S., & Fawson, C. (2003). An examination of the relationships between JIT and financial performance. Journal of Operations Management, 21(4), 383–404.

Gaur, V., Fisher, M., & Raman, A. (2005). An econometric analysis of inventory turnover performance in retail services. Management Science, 51(2), 181–194.

Hashai, N. (2015). Within-industry diversification and firm performance: An s-shaped hypothesis. Strategic Management Journal, 36(9), 1378–1400.

Hendricks, K., Singhal, V., & Zhang, R. (2009). The effect of operational slack, diversification, and vertical relatedness on the stock market reaction to supply chain disruptions. Journal of Operations Management, 27(3), 233–246.

Heshmati, A. (2003). Productivity growth, efficiency and outsourcing in manufacturing and service industries. Journal of Economic Surveys, 17(1), 79–112.

Hoskisson, R., & Hitt, M. (1988). Strategic control systems and relative R & D investment in large multiproduct firms. Strategic Management Journal, 9(6), 605–621.

Hutzschenreuter, T., & Gröne, F. (2009). Changing vertical integration strategies under pressure from foreign competition: The case of US and German multinationals. Journal of Management Studies, 46(2), 269–307.

IPCC. (2014). Fifth assessment report (ar5): Synthesis report. Tech. rep., Intergovernmental Panel on Climate Change (http://www.ipcc.ch)

Isaksson, R., Johansson, P., & Fischer, K. (2010). Detecting supply chain innovation potential for sustainable development. Journal of Business Ethics, 97(3), 425–442.

Jacobs, B., Singhal, V., & Subramanian, R. (2010). An empirical investigation of environmental performance and the market value of the firm. Journal of Operations Management, 28(5), 430–441.

Jira, C., & Toffel, M. (2013). Engaging supply chains in climate change. Manufacturing and Service Operations Management, 15(4), 559–577.

King, A., & Lenox, M. (2001). Lean and green? An empirical examination of the relationship between lean production and environmental performance. Productions and Operations Management, 10(3), 244–256.

King, A., & Lenox, M. (2002). Exploring the locus of profitable pollution reduction. Management Science, 48(2), 289–299.

Klassen, R., & Vachon, S. (2003). Collaboration and evaluation in the supply chain: The impact on plant-level environmental investment. Production and Operations Management, 12(3), 336–352.

Kleindorfer, P., Singhal, K., & Wassenhove, L. (2005). Sustainable operations management. Productions and Operations Management, 14(4), 482–492.

Knight, E. (2011). The economic geography of european carbon market trading. Journal of Economic Geography, 11(5), 817–841.

Lajili, K., Madunic, M., & Mahoney, J. (2007). Testing organizational economics theories of vertical integration. Research Methodology in Strategy and Management, 4(1), 343–369.

Levinthal, D., & Wu, B. (2010). Opportunity costs and non-scale free capabilities: Profit maximization, corporate scope, and profit margins. Strategic Management Journal, 31(7), 780–801.

Li, H., & Tang, M. (2010). Vertical integration and innovative performance: The effects of external knowledge sourcing modes. Technovation, 30(7), 401–410.

Lichtenberg, F. (1992). Industrial de-diversification and its consequences for productivity. Journal of Economic Behavior and Organization, 18(3), 427–438.

Lieberman, M., & Demeester, L. (1999). Inventory reduction and productivity growth: Linkages in the Japanese automotive industry. Management Science, 45(4), 466–485.

Lieberman, M., & Dhawan, R. (2005). Assessing the resource base of Japanese and US auto producers: A stochastic frontier production function approach. Management Science, 51(7), 1060–1075.

MacDuffie, J., & Helper, S. (1997). Creating lean suppliers: Diffusing lean production through the supply chain. California Management Review, 39(4), 118–151.

Maddigan, R. (1981). The measurement of vertical integration. Review of Economics and Statistics, 63(3), 328–335.

Maksimovic, V., & Phillips, G. (2001). The market for corporate assets: Who engages in mergers and asset sales and are there efficiency gains? Journal of Finance, 56(6), 2019–2065.

Marcus, A., Aragon-Correa, J., & Pinkse, J. (2011). Firms, regulatory uncertainty, and the natural environment. California Management Review, 54(1), 5–16.

Modi, S., & Mishra, S. (2011). What drives financial performance-resource efficiency or resource slack? Evidence from US based manufacturing firms from 1991–2006. Journal of Operations Management, 29(3), 254–273.

Montgomery, C. (1994). Corporate diversification. Journal of Economic Perspectives, 8(3), 163–178.

Mukherjee, A., Mitchell, W., & Talbot, F. (2000). The impact of new manufacturing requirements on production line productivity and quality at a focused factory. Journal of Operations Management, 18(2), 139–168.

Narasimhan, R., & Kim, S. (2002). Effect of supply chain integration on the relationship between diversification and performance: Evidence from Japanese and Korean firms. Journal of Operations Management, 20(3), 303–323.

Novak, S., & Eppinger, S. (2001). Sourcing by design: Product complexity and the supply chain. Management Science, 47(1), 189–204.

Ohno, T. (1988). Toyota production system: Beyond large-scale production. Cambridge, MA: Productivity press.

Palepu, K. (1985). Diversification strategy, profit performance and the entropy measure. Strategic Management Journal, 6(3), 239–255.

Palich, L., Cardinal, L., & Miller, C. (2000). Curvilinearity in the diversification-performance linkage: An examination of over three decades of research. Strategic Management Journal, 21(2), 155–174.

Perry, M. (1989). Vertical integration: Determinants and effects. In: Schmalensee, R., Willig, R. (Eds.), Handbook of industrial organization, vol 1, Amsterdam: North-Holland, chap 4, pp 183–255.

Plambeck, E. (2012). Reducing greenhouse gas emissions through operations and supply chain management. Energy Economics, 34, 64–S74.

Plümper, T., & Troeger, V. (2007). Efficient estimation of time-invariant and rarely changing variables in finite sample panel analyses with unit fixed effects. Political Analysis, 15(2), 124–139.

Randall, T., & Ulrich, K. (2001). Product variety, supply chain structure, and firm performance: Analysis of the US bicycle industry. Management Science, 47(12), 1588–1604.

Rawley, E. (2010). Diversification, coordination costs, and organizational rigidity: Evidence from microdata. Strategic Management Journal, 31(8), 873–891.

Reid, E., & Toffel, M. (2009). Responding to public and private politics: Corporate disclosure of climate change strategies. Strategic Management Journal, 30(11), 1157–1178.

Reinhardt, F. (1999). Market failure and the environmental policies of firms: Economic rationales for “beyond compliance” behavior. Journal of Industrial Ecology, 3(1), 9–21.

Rothenberg, S., Pil, F., & Maxwell, J. (2001). Lean, green, and the quest for superior environmental performance. Productions and Operations Management, 10(3), 228–243.

Rumyantsev, S., & Netessine, S. (2007). What can be learned from classical inventory models? A cross-industry exploratory investigation. Manufacturing and Service Operations Management, 9(4), 409–429.

Saloner, G., Shepard, A., & Podolny, J. (2001). Strategic Management. New York: Wiley.

Schoar, A. (2002). Effects of corporate diversification on productivity. Journal of Finance, 57(6), 2379–2403.

Shah, R., & Ward, P. (2003). Lean manufacturing: Context, practice bundles, and performance. Journal of Operations Management, 21(2), 129–149.

Shleifer, A., & Vishny, R. (1989). Management entrenchment: The case of manager-specific investments. Journal of Financial Economics, 25(1), 123–139.

Singh, D., & Terwiesch, C. (2011). The effects of focus on performance: Evidence from California hospitals. Management Science, 57(11), 1897–1912.

Skinner, W. (1974). The focused factory. Harvard Business Review, 52(3), 113–121.

Soyka, P. (2012). Creating a sustainable organization: Approaches for enhancing corporate value through sustainability. New York: FT Press.

Stock, G., Greis, N., & Kasarda, J. (2000). Enterprise logistics and supply chain structure: The role of fit. Journal of Operations Management, 18(5), 531–547.

Strike, V., Gao, J., & Bansal, P. (2006). Being good while being bad: Social responsibility and the international diversification of US firms. Journal of International Business Studies, 37(6), 850–862.

Suresh, M., Corbett, C., Shlomo, B., & Bohdan, O. (2013). Energy efficiency in small and medium-sized manufacturing firms: Order effects and the adoption of process improvement recommendations. Manufacturing & Service Operations Management, 15(4), 596–615.

Swamidass, P. (2007). The effect of TPS on US manufacturing during 1981–1998: Inventory increased or decreased as a function of plant performance. International Journal of Production Research, 45(16), 3763–3778.

Teece, D. (1980). Economies of scope and the scope of the enterprise. Journal of Economics Behavior and Organization, 1(3), 223–247.

Tucker, I., & Wilder, R. (1977). Trends in vertical integration in the US manufacturing sector. Journal of Industrial Economics, 26(1), 81–94.

Vachon, S., & Klassen, R. (2007). Supply chain management and environmental technologies: The role of integration. International Journal of Production Research, 45(2), 401–423.

Wan, W., Hoskisson, R., Short, J., & Yiu, D. (2011). Resource-based theory and corporate diversification accomplishments and opportunities. Journal of Management, 37(5), 1335–1368.

Wang, L., Li, S., & Gao, S. (2014). Do greenhouse gas emissions affect financial performance? An empirical examination of australian public firms. Business Strategy and the Environment, 23(8), 505–519.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180.

Williamson, S. (2014). Macroeconomics (5th ed.). London: Prentice Hall.

Wiseman, R. (2009). On the use and misuse of ratios in strategic management research. Research Methodology in Strategy and Management, 5, 75–110.

Wolf, J. (2011). Sustainable supply chain management integration: A qualitative analysis of the German manufacturing industry. Journal of Business Ethics, 102(2), 221–235.

Womack, J., Jones, D., & Roos, D. (1990). The machine that changed the world. New York: Rawson Associates.