Abstract

Ethical debate exists on the effect of gender diversity of the top management teams (TMTs) on organizations. This study aims to contribute to this debate by analyzing the effects of gender diversity of TMTs on the relationship between knowledge combination capability and organizations’ innovative performance. We use a sample of 205 small- and medium-sized enterprises (SMEs) belonging to the sector of Spanish technology-based firms (TBFs). Our results indicate that gender diversity positively moderates the relationship between knowledge combination capability and innovation performance. Implications for theory and practice are discussed—among them, ways to contribute to more equal gender distribution and to the benefits of gender diversity in top management positions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent decades, researchers have considered knowledge to be the most important intangible resource that firms possess and a key factor for value creation and entrepreneurial success (Grant 1996; Nonaka and Takeuchi 1995). Previous studies show that most organizations that manage and combine their knowledge have obtained benefits in different areas (e.g., Camelo-Ordaz et al. 2011; Nonaka and Takeuchi 1995). Knowledge combination capability can be defined as “the capability of individuals to absorb and integrate exchanged information in the organization” (Carmeli and Azeroual 2009, p. 87). In addition, Collins and Smith (2006) and Grant (1996) argue that this capability enables organizations to innovate and surpass their rivals in dynamic environments, as well as to create new knowledge reflected in new opportunities that generate income and competitive advantages (Carmeli and Azeroual 2009). Studies that examine the relationship between knowledge and innovation performance seem to conclude that knowledge is an essential element in optimizing innovation performance (e.g., Camelo-Ordaz et al. 2011; Collins and Smith 2006).

According to the literature, innovation is a social process, not one performed in isolation (Østergaard et al. 2011). In the process of innovation, individuals participate and interact with each other. The characteristics of the individuals involved seem to influence organizations’ innovation performance (Homan et al. 2008). In fact, some studies show that the composition of top management teams (TMTs) affects innovation (Bantel and Jackson 1989; Talke et al. 2010). Top managers are the individuals who make strategic decisions in the organization, decide how to allocate the firm’s resources, and choose the projects, goals, and objectives to be achieved. For firms in technological sectors, decisions related to innovation in products and processes are an essential element of strategic orientation (Balkin and Swit 2006).

Previous studies have analyzed how diversity of different demographic characteristics—such as age, education, or entrepreneurial experience of the TMT’s members—influence firms’ innovation (e.g., Alexiev et al. 2010; Escribá-Esteve et al. 2009; Hambrick 2007). In addition, there is a significant gap in the literature when it comes to understanding the effect of gender diversity in the TMT on the organization’s results (Krishnan and Park 2005; Nielsen and Huse 2010). In fact, very few studies focus on the contribution of gender diversity to innovation in the organization (Miller and Triana 2009; Østergaard et al. 2011; Torchia et al. 2011). Further studies in this specific context are needed, however, to better understand how the presence of women affects firms’ behavior and innovation performance. For this reason, this study aims to contribute to the debate on the presence of gender diversity in the TMT and to study empirically the effects of gender diversity on the TMT. Specifically, this study examines the influence of gender diversity on the relationship between knowledge combination capacity and innovation performance in organizations. In other words, we seek to answer the following research question: Is the gender diversity of the TMT a factor that encourages the relationship between knowledge combination capacity and innovative performance?

We focus our analysis specifically on technology-based SMEs in Spain, because innovation is crucial to this sector and can be a key to creating competitive advantages. The Spanish context is a good example, as there has been intense debate in Spain about the presence of women in top positions in firms and organizations following the Spanish government’s introduction in 2007 of gender diversity quotas to foster representation of women in these positions. Further, SMEs provide more direct environments than other companies in which to investigate empirically the effects of TMT characteristics on firms’ innovation (Escribá-Esteve et al. 2009). SMEs frequently lack the amount of slack resources and administrative systems that help large companies in their decision-making processes and must therefore rely more on the skills of their managers (Lubatkin et al. 2006; Sen and Cowley 2013). Furthermore, SMEs are important to the economy for their substantial contribution to job creation and economic and social progress. Our study attempts to determine how these companies can improve their innovation performance.

The remainder of the paper is structured as follows. We first present a conceptual framework and develop our hypotheses. The subsequent section describes our data, variables, and methods. Our findings and analyses are reported in the following section. The paper concludes with a final section that discusses our results and our paper’s contribution.

Theoretical Background and Hypotheses

The Relation Between Knowledge Combination Capability and Innovation Performance

The prior literature defines the concept of innovation as the transformation of the knowledge that the firm possesses into new products and processes, or even into significant changes in existing processes and products to be introduced on the market (Damanpour 1991). This definition specifies product innovation and process innovation as two primary forms of innovation performance. Thus, innovation performance summarizes the impact of the innovation activities and the organization’s ability to adopt and implement new ideas, processes, or products successfully.

The origin of any innovation, whether product or process, is found in the knowledge developed or acquired and stored by the firm (Henderson and Cockburn 1994; Subramanian and Nilakanta 1996). Knowledge is one of the keys to fostering innovation, since it promotes activities of creation and improvement of the firm’s products and processes (Kumar et al. 2000). In fact, recent studies in the literature analyze the positive relationship between knowledge and innovation performance (Camelo-Ordaz et al. 2011; Collins and Smith 2006). As an inestimable source of distinctive capabilities that are difficult to imitate and accumulate and that are not transferred easily, knowledge is an intangible resource that enables the achievement of a sustainable competitive advantage (Nonaka and Takeuchi 1995).

According to Carmeli and Azeroual (2009), knowledge combination capability is a part of this process, which permits individuals in the organization to absorb and combine information that has been exchanged. Thanks to this capability, the firm’s members collaborate to access critical information and find the best way to transfer and combine the useful knowledge, thereby achieving creative solutions and improving effectiveness. Knowledge combination capability is similar to absorption capability, which is defined as the firm’s ability to identify, assimilate, and replicate new knowledge gained from external sources. Combination capability focuses, however, on individuals’ ability to absorb and integrate knowledge (Carmeli and Azeroual 2009). Grant (1996) gives a hospital’s capability for heart surgery as an example of knowledge integration capability. This capability depends on the integration of the specialized knowledge possessed by surgeons, radiologists, anesthesiologists, and nurses, among other professionals. Organizations’ employees combine their knowledge when they have the ability not only to absorb this knowledge but also to integrate it to generate new knowledge, giving rise to opportunities to improve the functioning of the firm.

Innovation requires employees to be willing to share and combine this knowledge and experience in the firm (Kogut and Zander 1992; Nonaka and Takeuchi 1995), since they are the individuals who ultimately use the knowledge and their abilities to improve innovation performance. Combining each fragment of knowledge possessed by the members of the organization stimulates new knowledge creation (Tolstoy 2009), and the application of this new knowledge leads to creativity and the development of new innovations (Taylor and Greve 2006). The knowledge combination capability generated through the exchange of knowledge among individuals and work teams is a process that permits the transfer of knowledge to the organization and that can be applied to develop new products, services, and processes (Camelo-Ordaz et al. 2011; Rhee et al. 2010). Thus, knowledge combination can be an effective way for innovation performance to develop and succeed in organizations.

The study by Shu et al. (2012) of a sample of 270 industrial firms demonstrates empirically that knowledge combination has a positive influence on innovation. Specifically, a firm that has the capability to combine its knowledge has a high potential for innovative performance, since combining knowledge can enable the firm to connect different ideas, generate new knowledge, and profit from innovation. Based on the foregoing, we believe that knowledge combination capability drives the development of innovations, permitting the exchange and generation of ideas that act to encourage and support sustained growth of innovation performance in organizations. We therefore hypothesize that

Hypothesis 1

The greater the knowledge combination capability, the better the firm’s innovation performance.

The Moderating Effect of Gender Diversity of TMTs

Diversity refers to the degree of heterogeneity distributed among the attributes of the members of the work unit or organization (Simons et al. 1999). Diversity thus consists of the differences in the composition of a group of individuals (Kearney et al. 2009). Demographic diversity includes characteristics that are often clearly noticeable, such as sex, race, nationality, educational level, and age (Harrison and Klein 2007).

Numerous studies have focused on analyzing the influence of TMT diversity on a broad typology of organizational results (Nielsen and Huse 2010). The TMT’s characteristics have been shown to impact firm strategy and resulting innovation outcomes (e.g., Bantel and Jackson 1989; Escribá-Esteve et al. 2009; Hambrick 2007). Upper Echelons Theory suggests that executives make decisions that influence organizations’ performance and that these decisions are consistent with their cognitive base or executive orientation (Finkelstein and Hambrick 1996; Hambrick and Mason 1984). According to this theory, observable experiences—that is, demographic measures—are systematically related to the psychological and cognitive elements of executive orientation (Knight et al. 1999). Based on this approach, the characteristics of TMTs determine how they gather and filter the information in their environment (Finkelstein and Hambrick 1996), interpret this information (Dutton and Jackson 1987), and decide to act based on their interpretation of it (Hambrick 2007).

Very few studies focus on the specific influence of gender diversity on the innovative results of the firm, although the existing studies find positive effects of gender diversity on other variables in the organization. Studies like those by Greene et al. (2003) show that the presence of women in decision-making positions is to a certain extent positive in the firm’s performance. More recent studies confirm this position. The results of the research by Smith et al. (2006) show that the proportion of women in top management jobs tends to have positive effects on firm performance, even after controlling for numerous characteristics of the firm and the direction of causality. Krishnan and Park (2005) also find a positive relationship between the proportion of women in the TMTs and organizational performance. Women on the boards bring distinctive viewpoints, experiences, and working styles that may differ from those of their male counterparts; they bring different knowledge and expertise (Huse 2007). This broader choice of ideas and perspectives helps the team to combine varied knowledge and experience and enables detection of new innovative opportunities (Miller and Triana 2009). The varied knowledge increases the TMTs’ capacity to make innovative linkages, combinations, and associations; informational diversity can enhance the innovation performance.

The study by Torchia et al. (2011) stresses the importance of gender diversity in the corporate boards for innovation and suggests that a board composed of at least three women will be more heterogeneous and will have greater interaction, enabling high-quality decision making and generating more innovative solutions than in homogeneous groups. In addition, (Dezso and Gaddis 2012) examine the effect of gender diversity in the top management on the firm’s performance; they find that women’s representation in top management enhances firm performance, whether a firm’s strategy also focuses on innovation. They claim that the presence of women in top management provides different benefits to the TMT, such as social and informational diversity. Díaz-García et al. (2013) demonstrate that gender diversity within R&D teams generates certain dynamics that foster novel solutions leading to innovation. According to the authors, gender diversity permits a team to be more innovative and adaptive, because the diverse knowledge or perspectives stemming from individuals with different socialization and career paths can combine to enrich the knowledge base and create new knowledge, ultimately leading to an increase in creativity and innovation.

Prior studies that relate gender diversity to innovation focus on the benefits derived from the existence of more heterogeneous knowledge in the firm. The firm that possesses a diverse human team will have a heterogeneous knowledge base that enables increase in and improvement of the capability to combine and exploit the knowledge that the firm possesses. Individuals possess knowledge and interact among themselves to develop, discuss, and modify new ideas and make them reality (Østergaard et al. 2011). The diversity of the individuals thus affects the development of new forms of knowledge combination and the generation of new innovations in the organization (Østergaard et al. 2011; Woodman et al. 1993). In fact, several authors suggest that divergent types of knowledge and thought are necessary to achieve innovative results that enable the firm to satisfy the diverse, changing needs of customers (Benner and Tushman 2003) and to face changes in the environment (Alexiev et al. 2010).

A study by Alexiev et al. (2010) confirms empirically that heterogeneity in the TMT facilitates development of new products and services in the organization. Finally, the members of the TMT have the task of allocating resources and determining the general strategic direction of the firm. Members are a necessary factor in supporting all of the innovation activities that the firm performs (Kor 2006; Zahra and Stanton 1988).

Arguments from social cognitive theory suggest that men and women have different socialization experiences, such as professional experience or affiliation with social networks, and that these experiences give shape to different strategic options in the organization (Manolova et al. 2007). Several studies analyze different management styles in women and men (Eagly 2005; Greene et al. 2003; Oakley 2000; Rosener 1995) For example, Greene et al. (2003) find differences between men’s and women’s skills in managing personnel, relationships, and the generation of ideas. They observe that women possess these abilities to a greater extent than their male counterparts. Additionally, Rosener (1995) claims that women solicit input from other people in an effort to make people feel included and create open communication flows. It seems that women create a more flexible environment, fostering exchange of ideas and knowledge (Sandberg 2003). For all of these reasons, gender diversity of the TMT fosters innovation performance, since individuals with different social skills and professional trajectories can provide different knowledge to the organization. In fact, once this knowledge is combined, it can develop new knowledge and encourage creativity and innovation performance.

Further, several differences exist in the way men and women perceive power. Men see power in terms of influence and tend to use more repressive, genuine, and experiential power to achieve their objectives (Johnson 1976). Women, on the other hand, perceive power in terms of dissemination of information and knowledge (Krishnan and Park 2005), increasing the likelihood that greater representation of women in the TMT will improve the knowledge combination capability of the organization. Women in the TMT also increase the diversity of points of view within the team (Eagly 2005), which contributes positively to the level of innovation in the organization (Torchia et al. 2011).

Since gender diversity implies additional heterogeneity related to gender-specific experience, knowledge, and capabilities, gender diversity should stimulate the relationship between knowledge combination capacity and innovation. As explained above, diversity in teams affects the way in which organizations combine and use knowledge to generate innovations (Van der Vegt and Janssen 2003). Further, gender diversity can contribute to achieving greater complementarity among the members of the management team, compensating for the weaknesses of some members with the strengths of others (Krishnan and Park 2005) and reinforcing knowledge combination capability to generate new innovations. In this sense, gender diversity in the management team contributes not only more heterogeneous, idiosyncratic knowledge but also the combination of different managerial styles, which can complement each other to generate new combinations of knowledge and new ideas in the firm.

Hypothesis 2

The positive relationship between knowledge combination capability and innovation performance is stronger at higher levels of gender diversity in the firm’s TMT.

Method

Sample

The study population includes SMEs belonging to the sector of Spanish technology-based firms (TBFs). This kind of firm participates in a technologically intensive industry measured by its degree of innovation, research, and development. Companies in technology-based sectors require managers who explore their firms’ resources and capital to innovate constantly and face rapid and discontinuous changes in their environment (Makri and Terri 2010).

The definition of TBFs follows the criterion proposed by the National Statistics Institute. This institute classifies TBFs as those firms located in sectors in the pharmaceutical industry, aeronautical construction, sectors for production of communications and office equipment and computer materials, the technology manufacturing industry, the chemical industry, and all sectors involved in producing goods related to transportation equipment and material. Finally, high-technology services include telecommunications and research and development activities. As to size, this study defines SMEs as firms that fulfill the criteria of the European Commission: firms that employ fewer than 250 workers and whose billing volume does not exceed 40 million euros.

The contact data of the firm’s CEO and the general firm data are taken from a random sample of TBFs in the SABIFootnote 1 database. This database contains over 940,000 Spanish firms. The information on the study variables was obtained from a specially designed questionnaire addressed to the CEO, the person most likely to have holistic knowledge of the firm’s situation. The data were collected using a telephone interviews carried out by the CATIFootnote 2 system. We used some procedural remedies to minimize the potential effects of common method variance (Podsakoff et al. 2003). To control for the problem of ambiguous items, we performed the pre-test mentioned above, since a clear understanding of the concepts and items helps prevent the respondents from developing their own idiosyncratic meanings for them. Second, the questionnaire had instructions that stressed the anonymity and confidentiality of the dataset and the fact that there were no correct or incorrect answers. These procedures aimed to reduce people’s evaluation apprehension and make them less likely to edit their responses to be more socially desirable, lenient, acquiescent, and consistent with how they think the researcher wants them to respond.

The data were gathered in May of 2010. From the total of 998 TBFs contacted randomly, 224 responses were obtained, giving a response rate of 22.44 %. Of the 224 questionnaires answered, 19 were discarded because the respondent was not the CEO of the firm to which they were addressed. Thus, 205 usable questionnaires were obtained and form the basis of the current investigation. Table 1 shows the main characteristics of the sample of firms.

Measurements

Innovation Performance

This study’s measurement of innovation performance derives from the studies by Deshpande et al. (1993), and Subramanian and Nilakanta (1996). The items used were (1) “The degree of newness of our firm’s new products/services;” (2) “The use of the latest technological innovations in our new products/services;” (3) “The speed of development of new products/services;” and (4) “The number of new products/services that our firm has introduced on the market.” We chose this scale because it had been previously validated in technological environments (Prajogo and Ahmed 2006). It fulfills the psychometric properties required and is perfectly adapted to the environment studied. In addition, this scale is associated with the strategy that organizations use in response to demands and opportunities on the market and evaluates innovation and level of technological innovation speed. The scale provides the most appropriate focus for our study, since special emphasis is placed on innovative performance through technological issues. For each of the items, the person interviewed was asked to evaluate the results of the firm’s innovation as compared to its main competitors in the sector. Responses were recorded on a Likert scale from 1 to 7, where 1 represents “much lower than its main competitors” and 7 “much higher than its main competitors.” An explanatory factor analysis confirmed the scale’s one-dimensionality. The Alpha Cronbach obtained was α = 0.85 (the lowest acceptable level recommended is 0.7, according to Hair et al. 2004), which confirmed the scale’s internal consistency. To complete validation of the scale, we performed a confirmatory factor analysis (CFA) using LISREL to assess dimensionality and convergent validity, all of which were higher than the established minimums.

Knowledge Combination Capability

Knowledge combination capability was measured by adapting the scale developed and validated by Smith et al. (2005) and subsequently by Carmeli and Azeroual (2009). We decided to use the scale proposed by Carmeli and Azeroual (2009) in this investigation, both because it is the only scale on this capability that has been used previously and due to the ease of adapting it to the sector studied. This scale measures the degree to which the members of the firm are able to absorb and combine the information and knowledge transferred. The indicators used to measure this scale were (1) “Our employees are highly capable of collaborating and of combining and exchanging ideas among themselves to diagnose and solve problems and create opportunities;” (2) “Our employees share their individual ideas to achieve new ideas, products, or services,” (3) “Our employees are able to share their experiences to carry out new projects or initiatives successfully;” (4) “Our employees have learned to share their ideas and knowledge;” (5) “It is common for our employees to share and exchange ideas to find solutions to problems.” As with the previous scale, responses were measured on a Likert scale from 1 to 7, where 1 represents complete disagreement and 7 represents complete agreement. The scale’s reliability was also good, yielding an Alpha Cronbach of α = 0.84 and thus confirming the scale’s internal consistency. This scale was subjected to a confirmatory factor analysis (CFA) using LISREL to assess dimensionality and convergent validity, all of which were higher than the established minimums.

Gender Diversity in the TMT

We used Blau’s index of heterogeneity to measure the gender diversity index. Blau’s index is often used to measure demographic heterogeneity (Ruigrok et al. 2007; Smith et al. 2006); and numerous studies in the literature use this index to measure gender diversity in organizations (e.g., Ali et al. 2013; Harjoto et al. 2014). The equation is [B = 1−∑(pi)^2], where B is the Blau index and p is the percentage of TMT members in each ith category of the existing k-values (in this case, for each sex, meaning that k = 2). The higher the value of B, the greater the degree of diversity in the TMT. Since the values vary from 0 to (k-1)/k, the maximum diversity will occur when B is 0.5, which occurs when the TMT comprises an equal number of men and women. We contacted the CEO of each firm to identify all members of the TMT.

Control Variables

The control variables were the size and age of the firm and the firm’s investment in research and development (R&D). Many prior studies use the organization’s size, since large organizations may have a greater propensity to develop more innovations, due to their wide base of resources and capabilities (Henderson and Cockburn 1994). A positive influence is thus expected. The SABI database provided the date on which the firm was founded, enabling calculation of the number of years the firm had been in existence, or its age. This variable was used because older organizations do not usually undertake great innovations, due to their strategic conservatism (Rhee et al. 2010). R&D expenditure was measured through the average percentage of total sales devoted to R&D in the last 3 years. This variable is a proxy of the firm’s search activities and inputs into innovation efforts (e.g., Greve 2003; Katila 2002; Katila and Ahuja 2002). This measurement was obtained by surveying the managers of the firms studied. Several authors have shown that R&D investments can provide new knowledge or delve more deeply into the knowledge that firms already possess (Herrera and Sánchez-González 2012), which contributes to generating new innovation (Damanpour 1991; Kor 2006). Oli et al. (2012) demonstrate empirically that R&D investments enhance firm innovativeness. The R&D investments permit the firm to tap into knowledge bases that reside in the company and to transform knowledge into new designs and innovation. Such transformation contributes to fine-tuning new technologies (Oli et al. 2012) and to creating competitive advantages. Finally, the percentage of total sales devoted to R&D in the last 3 years is a factor that affects innovation, such that we expect a positive relationship between this figure and the firm’s innovative performance. The control variables used have been included in prior studies that addressed this topic (e.g., Carmeli and Azeroual 2009; Smith et al. 2005).

Analysis

Before the analysis, we performed outlier analysis and data cleaning to eliminate the extreme values that could have a strong influence on the conclusions to be drawn from the data in question. Extreme values can bias the correlation coefficients and the lines of best fit in the wrong direction. We used the statistical program SPSS 15 to perform these analyses. First, we determined that we have 205 valid cases and 0 lost cases. Second, we identified the percentiles and extreme values of the variable. We then applied the formula used by Hoaglin and Iglewicz (1987) to calculate the lower and upper bounds. In analyzing our bounds, we verified that the extreme values were found to be between the lower and upper bounds.

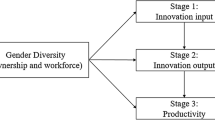

The relationships proposed in the current research were studied using hierarchical linear regression analysis and comparison of different models to accept or reject the hypotheses proposed. The different models consider innovation performance as the dependent variable and knowledge combination capability and gender diversity of the firm’s management as the independent variables. Further, size, firm age, and the average percentage of sales devoted to R&D in the last 3 years constituted the control variables.

Before estimating the model, we confirmed that the data used for the estimation fulfilled the assumptions required for regression analysis concerning linearity and normality for the variables that compose the different relationships. For linearity, the partial regression figures show that the residuals do not indicate curvilinear distribution, enabling us to explain the behavior of the dependent variable through a linear regression. By graphing the P–P-type residuals, we analyzed whether the dependent variable fulfills the assumption of normality. The analysis of normality shows that the distribution tends to become unified along the line of the normal distribution, fulfilling the assumption of normality. Once we confirmed the basic assumptions for the linear regression analysis, we evaluated the presence of multicollinearity for the set of independent variables.

Results

Table 2 provides a broad overview of our sample by presenting descriptive statistics and correlations. It appears that there are no multicollinearity problems. We also observe significant positive correlations between knowledge combination and innovation performance; and between percentage of sales devoted to R&D and innovation performance. Likewise, in Table 2, the mean value for gender diversity was 0.32. We measured this value using the Blau index, which ranges from zero (no gender diversity in the TMT) to 0.5 (half of the members of the TMT are women). This value implies that the presence of women in the TMT is high in our sample. The mean value for firm age was 24.16, indicating that firms in our sample were already set up in business. Finally, the mean of employee and the average percentage of sales devoted to R&D in the last 3 years were 36.36 employees and 8.74 %, respectively.

Subsequently calculating the tolerance indexes and variance inflation factors (VIFs) for each variable confirmed this issue. Tolerance values between 0.96 and 0.99 and VIFs from 1.01 to 1.04 were obtained. The tolerance values (close to 1, threshold fixed at 0–1) and VIFs (close to 1, threshold fixed at 10) are within the acceptable levels, indicating that no problems of multicollinearity exist.

Table 3 shows the results for the multiple hierarchical regression analysis for each of the models proposed. In Step 1 of the hierarchical regression, control variables were entered; in Step 2, the variable knowledge combination capability was entered; and in Step 3, the gender diversity of the firm’s management was entered. Finally, in Step 4 the interaction between knowledge combination capability and gender diversity of the firm’s management was entered. Significant interaction indicates a moderating effect (Baron and Kenny 1986)

Model 1 shows the effects of the control variables, highlighting the strong positive and significant influence of the percentage of sales dedicated to R&D (β = 0.17, p < 0.05). The results also show that the age and size of the firm do not have a statistically significant influence on innovation performance in any of the three models. Omitting these variables would not, therefore, affect the model, since the F-statistic does not change significantly, nor does the R2 coefficient increase. The analysis thus verifies the relationships proposed independently of the firm’s size and age. Previous studies that use the organization’s age and size as moderating variables obtain similar results (Smith et al. 2005; Carmeli and Azeroual 2009; Rhee et al. 2010).

Hypothesis 1 predicted a positive relationship between knowledge combination capability and innovation performance. As shown in Model 2, this hypothesis is supported (β = 0.14 p < 0.05). In this model, the percentage of sales devoted to R&D (t = 2.44, p < 0.05) was also found to have a significant and positive effect on the innovation performance.

Model 3 adds the variable of gender diversity of the TMTs. The corresponding beta coefficient is negative but not statistically significant (β = −0.07, p < 0.1), showing the absence of a direct effect of gender diversity on innovation performance. On introducing this variable, the effect of knowledge combination capability remains positive and statistically significant (β = 0.15, p < 0.05). As with the percentage of sales devoted to R&D (β = 0.16, p < 0.05), we find positive effects on innovation performance.

Finally, Model 4 introduces the interaction effect between gender diversity and knowledge combination capability, which improves the explanation of innovation performance (R2 increasing to 0.09). The results show that the beta coefficient corresponding to the interaction between gender diversity and knowledge combination capability was statistically significant and positive (β = 0.18, p < 0.05) for innovation performance. This result thus confirms the part of the first study hypothesis concerning the moderating effect of gender diversity (H2). Further, knowledge combination capability maintains its positive and statistically significant influence on innovation performance (β = 0.14, p < 0.05) and on sales devoted to R&D (β = 0.17, p < 0.05).

The results show that gender diversity has a statistically significant moderating effect on the relationship between knowledge combination capability and innovation performance but no direct influence on innovation performance. For higher levels of gender diversity, innovation performance increases as the level of knowledge combination capability increases (Fig. 1). All of the results support H1 and H2. To develop a more in-depth interpretation of these results, we have represented the interactions visually in Fig. 1. We use procedures by Aiken and West (1991), Dawson and Richter (2006), and Dawson (2013) to plot the moderating effect. Figure 1 demonstrates that the relationship of knowledge combination capability to innovation performance varies according to the level of gender diversity in the firm’s management. Although the relationship between knowledge combination capability and innovation performance is different for high and low gender diversity, high gender diversity has a much greater positive capability to generate high levels of knowledge combination capability and thus potential to enhance innovation performance. In order to confirm the interpretation of these results in greater depth, we have also performed the graphical analysis suggested by Cohen et al. (2003). This result supports the argument that a positive relationship between knowledge combination capability and innovation performance is stronger at higher levels of gender diversity in the firm’s management, supporting Hypothesis 2.

Discussion

This study analyzes the influence of gender diversity on the connection between knowledge combination capability and innovation performance. Our research contributes to prior literature on gender diversity and innovation in several ways. Firstly, knowledge combination capability stimulates the development of innovation in technology-based firms. Knowledge combination capability may be necessary for technology organizations’ innovative performance, since they function in a sector where innovation is crucial and may thus be a key for creating competitive advantage. This result is consistent with prior studies that demonstrate the efficacy of knowledge combination capability as an organizational resource for generating new innovations in the firm (e.g., Camelo-Ordaz et al. 2011; Carmeli and Azeroual 2009; Smith et al. 2005). This capability helps firms to manage and reconfigure their base of resources and capacities, which are considered to be a source of the creation of competitive advantage. Firms must also pay close attention to the fact that knowledge combination capability can contribute to overcoming the resource limitations that SMEs can face by making better use of the knowledge generated or acquired by the firm.

Secondly, this study shows that gender diversity in the TMT moderates positively the relation between knowledge combination capability and innovation performance. Our study explains, and provides evidence for, how the TMT’s behavior influences innovation due to the presence of mixed teams of men and women. Previous research has shown that gender diversity in TMTs leads to higher innovation performance (Torchia et al. 2011), which is likely to have beneficial effects on organizational performance (e.g., Dezso and Gaddis 2012). This wider choice of ideas and perspectives helps combine different knowledge and experience and detect new innovative opportunities (Miller and Triana 2009). Varied knowledge increases TMTs’ capacity to make novel linkages, combination, and associations; informational diversity can enhance the ability to innovate. The results show that knowledge combination capability encourages innovative performance of the organization and that this relationship can be more intense if there is greater gender diversity in the TMT.

Finally, the control variables, age, and number of employees in the firm do not influence the firm’s innovative performance significantly. As expected, however, the average percentage of total sales devoted to R&D in the last 3 years has a significant influence on innovation in technology-based firms. These results corroborate the conclusion that organizations that invest in R&D may encourage the development of innovations in the organization. Some authors have suggested that investments in R&D are often a precursor to innovative outcomes and that they help firms to broaden their knowledge base (Oli et al. 2012) and to create competitive advantage.

Theoretical Implications

Some significant theoretical contributions emerge from this research. First, this study extends the Upper Echelons framework postulated by Hambrick and Mason (1984) in different ways. Although this theory has grounded a significant body of literature analyzing diversity of the members of the TMT, most research has ignored the effect of gender (Carpenter et al. 2004). In combination with the literature on gender, this study contributes to strengthening the significant role of women’s participation in top management and its influence on strategic decision-making and organizational results. A second contribution of this study to Upper Echelons Theory is its application to the context of SMEs in technology sectors. Studies like those by Ensley et al. (2003) and Patzel et al. (2008) suggest that this theory not only explains the behavior of TMTs in large corporations but is also useful for smaller firms. Many studies that have analyzed gender diversity have done so for large companies (e.g., Ali et al. 2013; Joecks et al. 2013; Peterson and Philpot 2007; Post et al. 2014). Our study shows that the premises of this theory are also applicable to SMEs.

Second, taking as a reference the body of literature on gender diversity in TMTs, this study joins the line of research that demonstrates its positive effect in the organization (e.g., Dezso and Gaddis 2012; Joecks et al. 2013; Krishnan and Park 2005; Smith et al. 2006; Torchia et al. 2011). As Dezso and Gaddis 2012 propose, gender diversity provides benefits to organizations and leads to improvement in their performance. Although our study does not examine organizational performance directly, the results reinforce the idea that gender diversity in TMTs has beneficial effects.

Third, very few studies focus on the contribution of gender diversity to innovation in the organization (Miller and Triana 2009; Torchia et al. 2011), and the research on innovation continues to ignore this topic. In this study, we test empirically the impact of gender diversity in the TMT on the relationship between knowledge combination capacity and innovative performance. Our investigation thus further enriches the diversity, management, and innovation literature.

Managerial Implications

Among implications for management, this study suggests actions, first to reinforce the exchange and combination of knowledge among employees as a source of innovation, and second to increase gender diversity in TMTs.

As to the first issue, not all firms succeed in making their employees perceive the benefits of sharing and exchanging ideas to generate new ones. For many firms, fostering a culture that promotes the generation of knowledge combination capability should be a first step toward improving their innovation results. Authors like Cabrera and Cabrera (2002) confirm that many firms encounter difficulties in encouraging their employees to use systems to share their ideas. These authors cite the results of study by KPMG (2000), which indicate that workers are hesitant to share ideas due to lack of time or lack of compensation, or simply because they think it is a waste of time. The knowledge-sharing dilemmas that some workers express can be resolved with interventions that restructure the pay-offs for contributing, interventions that try to increase perceptions of efficacy, and interventions that lead employees to perceive group identity and personal responsibility as more salient (Cabrera and Cabrera 2002). On the other hand, in the context of the SMEs in which this study was developed, knowledge combination capability can be strengthened by the use of different formal and informal communications media that can be supported by the use of new information and communications technologies. In SMEs, in contrast to larger firms, greater fluidity of contacts among workers can give rise to greater speed and flexibility in the use of knowledge to generate innovations.

Another important implication of this study for management lies in the field of hiring employees for the TMT. The results suggest that the TMT should include both men and women, since the TMT’s gender diversity seems to increase the probability of combining and exchanging knowledge within the organization to form new ideas and innovations. Further, there has been debate within the European Union concerning the idea of establishing quotas for the minimum participation of women in firms’ top management to correct for current inequality on the labor market and to improve firms’ results. Our study supports the idea that greater presence of women in top positions in organizations would benefit the firms’ results. Our results have major implications for the career development of women in organizations. Given the scarcity of women on TMTs in organizations, women need opportunities to ascend to the upper echelons of the organization. Studies like that by Hoobler et al. (2011) on U.S. companies suggest that one reason women are not reaching the top jobs is that their managers assume that their family responsibilities interfere with their performance of work roles, a phenomenon the authors call the family–work conflict bias. Firms and political authorities should thus contribute to establishing mechanisms that reduce the obstacles that women encounter in attempting to progress in their professional careers in sectors in which they have traditionally been in the minority. Firms should stimulate actions to enable greater reconciliation of work and family life for women and men by encouraging the values associated with equity and family corresponsibility. On the other hand, performance appraisals and promotion decisions should take into account results and talent, not only seniority in the firm and schedule availability, which for many women imply a negative perception of their capabilities. Incorporating women into TMTs in high-technology firms can also help generate new role models for other women and men in the organization that can break masculine stereotypes associated with characteristics that a “good manager” should fulfill. All of the changes needed to advance in incorporating women into the top management of firms also require government programs that grant greater visibility to women in technology sectors. It is necessary to promote new management models that incorporate different professional experiences and values than those traditionally adopted by men. As Simard et al. (2008, p. 6) argue, “Diversity breeds diversity. A diverse leadership team is essential to fostering a culture that values diversity. One of the most powerful ways to improve retention and advancement rates for women is to promote women to senior technical positions.”

Limitations and Suggestions for Future Research

This study is not without limitations. First, the research performed is cross-sectional in character. This limitation requires analyzing the results with caution and prevents reaching a solid conclusion on the direction of the causality between the variables studied. Future research could tackle this deficiency through longitudinal study in order to examine these variables in different periods of time. Second, we have only analyzed the influence of gender diversity on the TMT. To grasp the full picture, we must analyze gender diversity in all levels of the firm; analysis of the new relationships in the different management levels of firm. Future studies could tackle this issue. Finally, our analysis focuses on firms in a specific context, and the limited geographical extension of the sample advises caution when extrapolating our findings to different countries.

Conclusion

This paper aims to advance the gender diversity literature’s understanding of the relation of knowledge combination to innovation performance in TMTs. It focuses more on the role of gender diversity in top team dynamics than on a direct cause–effect relationship between the number of women and general performance. Specifically, it shows that the gender diversity of the TMT encourages a positive relationship between knowledge combination capacity and innovative performance in SMEs in the technology sector. In other words, our study shows that incorporating a greater number of women at the levels of top management in technology sectors is not only a question of moral justice or social equity, but it also contributes positively to the quality of the decisions made by the TMT to stimulate the development of organizational capabilities. Finally, this study can contribute to both theory development and the design of practical interventions with regard to gender.

Notes

This database is similar to the Amadeus database.

Computer-Assisted Telephone Interviewing (CATI) is a telephone survey technique in which the interviewer follows a text provided by a software application. The software can customize the flow of the questionnaire based on the answers provided, as well as information already collected about the interviewee.

References

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park, London: Sage.

Alexiev, A. S., Jansen, J. P., Van den Bosch, A. J., & Volberda, H. W. (2010). Top management team advice seeking and exploratory innovation: The moderating role of TMT heterogeneity. Journal of Management Studies, 47, 1343–1364.

Ali, M., Lu Y., & Kulik, C. (2013). Board age and gender diversity: A test of competing linear and curvilinear predictions. Journal of Business Ethics, doi:10.1007/s10551-014-2343-0.

Balkin, D., & Swift, M. (2006). Top management team compensation in high-growth technology ventures. Human Resource Management Review, 16, 1–11.

Bantel, K. A., & Jackson, S. E. (1989). Top management and innovations in banking: Does the composition of the top team make a difference? Strategic Management Journal, 10, 107–124.

Baron, R., & Kenny, D. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182.

Benner, M. J., & Tushman, M. (2003). Process management and technological innovation: A longitudinal study of the photography and paint industries. Administrative Science Quarterly, 47, 676–706.

Cabrera, A., & Cabrera, E. (2002). Knowledge-sharing dilemmas. Organization Studies, 23, 687–710.

Camelo-Ordaz, O. C., García-Cruz, C. J., Sousa-Ginel, G. E., & Valle-Cabrera, C. R. (2011). The influence of human resource management on knowledge sharing and innovation in Spain: The mediating role of affective commitment. The International Journal of Human Resource Management, 22, 1442–1463.

Camisón, C., & Forés, B. (2010). Knowledge absorptive capacity: New insights for its conceptualization and measurement. Journal of Business Research, 63, 707–715.

Carmeli, A., & Azeroual, B. (2009). How relational capital and knowledge combination capability enhance the performance of work units in a high technology. Strategic Entrepreneurship Journal, 3, 85–103.

Carpenter, M., Geletkanycz, M., & Sanders, W. (2004). Upper echelons research revisited: Antecedents, elements and consequences of top management team composition. Journal of Management, 30, 749–778.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective in learning and innovation. Administrative Science Quarterly, 17, 178–184.

Cohen, J., Cohen, P., West, S. G., & Aiken, L. S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences (3rd ed.). Hillsdale: Erlbaum.

Collins, C., & Smith, K. (2006). Knowledge exchange and combination: The role of human resource practices in the performance of high technology firms. Academy of Management Journal, 49, 544–560.

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34, 555–590.

Dawson, J. F. (2013). Moderation in management research: What, why, when and how. Journal of Business and Psychology, 7, 1–47.

Dawson, J. F., & Richter, A. W. (2006). Probing three-way interactions in moderated multiple regression: Development and application of a slope difference test. Journal of Applied Psychology, 91, 917–926.

Deshpande, R., Farley, J. U., & Websterjr, F. E. (1993). Corporate culture, customer orientation and innovativeness in Japanese firms: A quadrad analysis. Journal of Marketing, 57, 23–27.

Dezso, C. L., & Gaddis, R. D. (2012). Does female representation in top management improve firm performance? A panel data investigation. Strategic Management Journal, 33, 1072–1089.

Díaz-García, C., González-Moreno, A., & Sáez-Martínez, F. (2013). Gender diversity within R&D teams: Its impact on radicalness of innovation. Innovation: Management, Policy & Practice, 15, 149–160.

Dutton, J. E., & Jackson, S. E. (1987). Categorizing strategic issues: Links to organizational action. Academy of Management Review, 12, 76–90.

Eagly, A. H. (2005). Achieving relational authenticity in leadership: Does gender matter? Leadership Quarterly, 16, 459–474.

Ensley, M. D., Pearson, A., & Pearce, C. L. (2003). Top management team process, shared leadership, and new venture performance: A theoretical model and research agenda. Human Resource Management Review, 13, 329–346.

Escribá-Esteve, A., Sánchez-Peinado, L., & Sánchez-Peinado, E. (2009). The influence of top management teams in the strategic orientation and performance of small and medium-sized enterprises. British Journal of Management, 20, 581–597.

Finkelstein, S., & Hambrick, D. C. (1996). Strategic Leadership. Minneapolis/St Paul, MN: West Publishing.

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Greene, P. G., Hart, M. M., Gatewood, E. J., Brush, C. G., & Carter, N. M. (2003). Women entrepreneurs: Moving front and center an overview of research and theory. Coleman White Paper Series, 3, 1–47.

Greve, H. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46, 685–702.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (2004). Análisis Multivariante (4th ed.). Madrid: Pearson Prentice Hall.

Hambrick, D. C. (2007). Upper echelons theory an update. Academy of Management Review, 32, 334–343.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9, 193–206.

Harjoto, M., Laksmana, I., & Lee, R. (2014). Board diversity and corporate social responsibility. Journal of Business Ethics. DOI 10.1007/s10551-014-2343-0.

Harrison, D., & Klein, K. (2007). What’s the difference? Diversity constructs as separation, variety, or disparity in organizations. Academy of Management Review, 32, 1199–1228.

Henderson, R., & Cockburn, I. (1994). Measuring competence? Exploring firm effects in pharmaceutical research. Strategic Management Journal, 15, 63–84.

Herrera, L., & Sánchez-González, G. (2012). Firm size and innovation policy. International Small Business Journal, 31, 137–155.

Hoaglin, D. C., & Iglewicz, B. (1987). Fine tuning some resistant rules for outlier labeling. Journal of American Statistical Association, 82, 1147–1149.

Homan, A. C., Hollenbeck, J. R., Humphrey, S. E., Van Knippenberg, D., Ilgen, D. R., & Van Kleef, G. A. (2008). Facing differences with an open mind: Openness to experience, salience of intragroup differences, and performance of diverse work groups. Academy of Management Journal, 51, 1204–1222.

Hoobler, J., Lemmon, G., & Wayne, S. (2011). Women’s underrepresentation in upper management: New insights on a persistent problem. Organizational Dynamics, 40, 151–156.

Huse, M. (2007). Boards, governance and value creation: The human side of corporate governance. Cambridge: Cambridge University Press.

Joecks, J., Pull, K., & Vetter, K. (2013). Gender diversity in the boardroom and firm performance: What exactly constitutes a “critical mass?”. Journal of Business Ethics, 118, 61–72.

Johnson, P. (1976). Women and power: Toward a theory of effectiveness. Journal of Social Issues, 32, 99–110.

Katila, R. (2002). New product search over time: Past ideas in their prime? Academy of Management Journal, 45, 995–1010.

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45, 1183–1194.

Kearney, E., Gebert, D., & Voelpel, S. C. (2009). When and how diversity benefits teams: The importance of team members need for cognition. Academy of Management Journal, 52, 581–598.

Knight, D., Pearce, C., Smith, K., Olian, J., Sims, H., Smith, K., & Flood, P. (1999). Top management team diversity, group process, and strategic consensus. Strategic Management Journal, 20, 445–465.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combination capabilities, and the replication of technology. Organization Science, 3, 383–397.

Kor, Y. Y. (2006). Direct and interaction affects of top management team and board compositions on R&D investment strategy. Strategic Management Journal, 27, 1081–1099.

KPMG (2000). Knowledge Management Research Report. KPMG Consulting Reports.

Krishnan, H. A., & Park, D. (2005). A few good women-on top management teams. Journal of Business Research, 58, 1712–1720.

Kumar, N., Scheer, L., & Kotler, P. (2000). From market-driven to market-driving. European Management Journal, 18, 129–141.

Lubatkin, M. H., Ling, Y., & Veiga, J. (2006). Ambidexterity and performance in small- to medium-sized firms: The pivotal role of top management team behavioral integration. Journal of Management, 32, 646–672.

Makri, M., & Terri, A. (2010). Exploring the effects of creative CEO leadership on innovation in high-technology firms. The Leadership Quarterly, 21, 75–88.

Manolova, T. S., Carter, N. M., Manev, I. M., & Gyoshev, B. S. (2007). The differential effect of men and women entrepreneurs: Human capital and networking on growth expectancies in Bulgaria. Entrepreneurship Theory and Practice, 31, 407–426.

Miller, T., & Triana, M. C. (2009). Demographic diversity in the boardroom: Mediators of the board diversity-firm performance relationship. Journal of Management Studies, 46, 755–786.

Nielsen, S., & Huse, M. (2010). Women directors’ contribution to board decision-making and strategic involvement: The role of equality perception. European Management Review, 7, 16–29.

Nonaka, I., & Takeuchi, H. (1995). The knowledge-creating company. New York: Oxford University Press.

Oakley, J. (2000). Gender-based barriers to senior management positions: Understanding the scarcity of female CEOs. Journal of Business Ethics, 27, 321–334.

Oli, R. M., Justin, J. J. P., Jansen, F. A., Van Den, B., & Henk, W. V. (2012). Offshoring and firm innovation: The moderating role of top management team attributes. Strategic Management Journal, 33, 1480–1498.

Østergaard, C., Timmermans, B., & Kristinsson, K. (2011). Does a different view create something new? The effect of employee diversity on innovation. Research Policy, 40, 500–509.

Patzelt, H., Knyphausen-Aufseß, D., & Nikol, P. (2008). Top management teams, business models, and performance of biotechnology ventures: An upper echelon perspective. British Journal of Management, 19, 205–221.

Peterson, C. A., & Philpot, J. (2007). Women’s roles on U.S. Fortune 500 boards: Director expertise and committee memberships. Journal of Business Ethics, 72, 177–196.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioural research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 8, 879–903.

Post, C., Rahman, N., & McQuillen, C. (2014). From board composition to corporate environmental performance through sustainability-themed alliances. Journal of Business Ethics, doi: 10.1007/s10551-014-2231-7.

Prajogo, D. I., & Ahmed, P. K. (2006). Relationships between innovation stimulus, innovation capacity and innovation performance. R&D Management, 36, 499–515.

Rhee, J., Taekyung, P., & Do Hyung, L. (2010). Drivers of innovativeness and performance for innovative SMEs in South Korea: Mediation of learning orientation. Technovation, 30, 65–75.

Rosener, J. B. (1995). America’s competitive secret: Utilizing women as a management strategy. New York: Oxford University Press.

Ruigrok, W., Peck, S., & Tacheva, S. (2007). Nationality and gender diversity on Swiss corporate boards. Corporate Governance: An International Review, 15, 546–557.

Sandberg, K. W. (2003). An exploratory study of women in micro enterprises: Gender-related differences. Journal of Small Business and Enterprise Development, 10, 408–417.

Sen, S., & Cowley, J. (2013). The relevance of stakeholder theory and social capital theory in the context of CSR in SMEs: An Australian perspective. Journal of Business Ethics, 118, 413–427.

Shu, C., Page, A. L., Gao, S., & Jiang, X. (2012). Managerial ties and firm innovation: Is knowledge creation a missing link? Journal of Product Innovation Management, 29, 125–143.

Simard, C., Henderson, A. D., Gilmartin, S. K., Shiebinger, L., & Whitney, T. (2008). Climbing the technical ladder: Obstacles and solutions for mid-level women in technology. Anita Borg Institute for Women and Technology.

Simons, T., Pelled, L. H., & Smith, K. A. (1999). Making use of difference: Diversity, debate, and decision comprehensiveness in top management teams. Academy of Management Journal, 42, 662–674.

Smith, K., Collins, C., & Clark, K. (2005). Existing knowledge, knowledge creation capability and the rate of new product introduction in high technology firms. Academy of Management Journal, 48, 346–357.

Smith, N., Smith, V., & Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2,500 Danish firms’. International Journal of Productivity and Performance Management, 55, 569–593.

Subramanian, A., & Nilakanta, S. (1996). Organizational innovativeness: Exploring the relationship between organizational determinants of innovation, types of innovations and measures of organizational performance. Omega, 24, 631–647.

Talke, K., Salomo, S., & Rost, K. (2010). How top management team diversity affects innovativeness and performance via the strategic choice to focus on innovation fields. Research Policy, 39, 907–918.

Taylor, A., & Greve, H. (2006). Superman or the fantastic four? Knowledge combination and experience in innovative teams. Academy of Management Journal, 49, 723–740.

Tolstoy, D. (2009). Knowledge combination and knowledge creation in a foreign-market network. Journal of Small Business Management, 47, 202–220.

Torchia, M., Calabrò, A., & Huse, M. (2011). Women directors on corporate boards: From tokenism to critical mass. Journal of Business Ethics, 102, 299–317.

Van der Vegt, G., & Janssen, O. (2003). Joint impact of interdependence and group diversity on innovation. Journal of Management, 29, 729–751.

Woodman, R., Sawyer, J., & Griffin, R. (1993). Toward a theory of organizational creativity. Academy of Management Review, 18, 293–321.

Zahra, S., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27, 185–203.

Zahra, S., & Stanton, W. (1988). The implications of board of directors, composition for corporate strategy and performance. International Journal of Management, 5, 261–272.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ruiz-Jiménez, J.M., Fuentes-Fuentes, M.d.M. & Ruiz-Arroyo, M. Knowledge Combination Capability and Innovation: The Effects of Gender Diversity on Top Management Teams in Technology-Based Firms. J Bus Ethics 135, 503–515 (2016). https://doi.org/10.1007/s10551-014-2462-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-014-2462-7