Abstract

In this study, we examine whether corporate environmental responsibility (CER) plays a role in enhancing operating performance in the financial services sector. Because achieving success with CER investing is often a long-term process, we maintain that by effectively investing in CER, executives can decrease their firms’ environmental costs, thereby enhancing operating performance. By employing a unique environmental dataset covering 29 countries, we find that the reducing of environmental costs takes at least 1 or 2 years before enhancing return on assets. We also find that reducing environmental costs has a more immediate and substantial effect on the performance of financial services firms in well-developed financial markets than in less-developed financial markets. These results are economically and statistically significant and robust even after alleviating endogeneity and using an additional performance measure. We interpret our empirical results as supporting the social impact and reputation-building hypothesis. Our findings also suggest that policy makers dealing with corporate sustainability management should pursue an environment-centered industry policy not only at the manufacturing sector but also at the financial services sector, as firms in both sectors with lower environmental costs perform better.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Recently, an increasing number of financial institutions are accepting the idea that there is room to increase their social and environmental responsibilities. Commercial banks are becoming increasingly aware that their clients’ mismanagement of environmental and social risks may in turn dampen their own business as lenders (De la Cuesta-González et al. 2006). In addition, diverse stakeholders are requiring financial institutions to improve their social and environmental performance. As a result, some banks are developing corporate social responsibility (CSR) programs, corporate environmental responsibility (CER) policies, and management systems to reduce potential social and environmental risks, and improve their performance. These activities by banks are often observed even though they do not produce hazardous chemicals or discharge toxic pollutants and thus apparently they might not be viewed as involved with environmental issues (Cowton and Thompson 2000). Their clients’ involvement in environmental degradation, however, will not only invite public criticism and adverse customer reaction, but also might make regulations more stringent which can impair the bank profitability by curbing market for the products of their customers.

Consequently, financial institutions can even be held responsible for their clients’ environmental impacts. Thus, banks have strong prudential reasons for trying to avoid lending in ways that expose them to environmental risk and have clear incentive to incorporating environmental criteria, such as CER policies, into the lending decision-making process (Islam et al. 2012). Similarly, in the retail deposit market side, various financial institutions in many developed countries offer specialized savings accounts to the public. They promote that the savings will be used to finance environmentally sound projects and/or for operations of social entrepreneurs who find it hard to get access to finance from conventional institutions because private households have the opportunity to save or invest their money not only on the basis of financial rewards, but also in the face of the nonmonetary value of savings and investments (Scholtens 2006, 2009).

Banks increasingly admit the responsibility of indirect involvement in environmental damages and recognize their environmental sustainability, which is one part of their CER and CSR, to strike a balance between economic and social goals to encourage the efficient use of resources (Islam et al. 2012). The integration of environmental sustainability into the banking sector has typically taken two key directions: (i) The pursuit of environmental and social responsibility in a bank’s operations through environmental initiatives (such as recycling programs or improvements in energy efficiency and environmental cost reduction by CER investing in clean technology) and socially responsible initiatives (such as support for cultural events, improved human resource practices, and charitable donations); and (ii) The integration of sustainability into a bank’s core businesses through the integration of environmental and social considerations into product design, mission policy, and strategies. Examples include the integration of environmental criteria into lending and investment strategy, and the development of new products that provide environmental businesses with easier access to capital (International Institute for Sustainable Development 2013).Footnote 1

In this paper, we examine how environmental costs reduction by CER investing affects the operating performance of firms in the financial services industries over the long term.Footnote 2 Achieving success with CER is often a long-term process, taking years to fully develop, institute, and pay off financially. Yet most existing research is based on a short-time horizon and shows mixed results in linking CER to profitability. Our study, thus, further extends Wu and Shen’s (2013) recent CSR–CFP work by exploring the relationship between CER and CFP in a broader financial industry sector.Footnote 3 We focus on environmental costs because a key driver of CER engagement is the potential for environmental cost savings associated with measures such as energy, materials, and waste reductions (King and Lenox 2002).Footnote 4 The environmental costs–CFP association has been largely overlooked in the previous literature. To the best of our knowledge, there is little evidence from an international set of firms on the significance or economic magnitude of the relation between environmental costs and CFP in the financial services sector. We examine the total environmental costs (TEC)–CFP association to investigate whether a firm’s engagement in CER activities does reduce environmental costs and enhance CFP while determining the relative importance of the social impact and reputation building compared with a trade-off and negative synergy or a positive synergy as an explanation.Footnote 5 We employ dynamic generalized method of moment (GMM) methodology that is less prone to endogeneity concerns that usually taint the previous estimation of relationship between CSR (and, therefore, possibly CER as well because CER is an important subset of CSR) and CFP (McWilliams and Siegel 2000). The environmental costs–CFP relation is examined by mitigating the endogeneity problem due to reverse causality and autocorrelation using Arellano and Bond’s (1991) dynamic GMM and the dynamic system generalized methods of moment (GMM), following Blundell and Bond (1998) and Wintoki et al. (2012).

There are ongoing debates in the previous literature about investment in CER and its effect on corporate financial performance (CFP), although their main focus is not on financial institutions. Proponents of CER argue that firms invest too little in it (Derwall et al. 2005; Guenster et al. 2006; Weber et al. 2008). They assert that firms can improve their CFP by increasing their investment in CER. Opponents claim that firms invest too much in CER, arguing that such investments waste valuable resources and that firms can enhance their CFP by decreasing their investment in CER.Footnote 6 Still others maintain that firms should invest just enough in CER, not too much and not too little, adjusting CER levels up or down to maximize CFP (Kim and Statman 2012). We expect our investigation to contribute to the existing literature by providing empirical evidence from financial services sector. We also offer additional insights into the question and mitigate some of the measurement problems experienced in previous research. We extend this line of research by investigating the effects of environmental costs on firm’s operating performance in the financial services sector including banks, securities, real estate, and insurance firms following Lown et al. (2000) across multiple countries, regions, and industries along with levels of financial market development.

The remainder of this paper is organized as follows. In the following section, we discuss the literature examining the relation between environmental management and financial performance. We also review the literature on environmental costs and corporate finance to formulate the associated hypotheses. Next, we describe the sample data and discuss the empirical methodologies used to test our hypotheses. Empirical results are provided in the following section. We then summarize our findings, limitations, and implications of this paper in the discussion section and conclude the paper in the last section.

Literature Review and Hypotheses Development

CER and CFP

While researchers have long examined the relationship between environmental management and CFP, the evidence is inconclusive (Porter 1990; Nehrt 1996; Russo and Fouts 1997; Miles and Covin 2000; Margolis and Walsh 2003; Thomas et al. 2007; Jo et al. 2014). Academic research on the relationship between environmental management and CFP is indeed still in an early stage despite the fact that this issue has become significantly important in recent years. Porter (1990) maintains that environmental regulations lead to technology innovation and enhance companies’ competitiveness in the long term. He also notes that environmental innovation technology can minimize the costs generated by inefficient production processes. Thus, innovation related to environmental improvement is likely to maintain relatively low production costs, allowing firms to be more competitive. Based on 50 chemical bleached paper pulp firms in 8 countries, Nehrt (1996) suggests that firms investing earlier in pollution-reducing technologies have a greater financial advantage. He argues that pollution-reducing technologies may enable firms to reduce unit production costs and enhance sales in the long term.

Hart and Ahuja (1996) examine the relation between emissions reduction and firm performance using data drawn from the Investor Responsibility Research Center (IRRC)’s corporate environmental profile. They use IRRC’s environment profile as an independent variable that provides a summary of the reported emissions of selected pollutants from U.S. manufacturing facilities, and use ROA as a measure of CFP. The result indicates that reducing emissions increases efficiency, saves money, and gives firms a cost advantage. Russo and Fouts (1997) test the relation between CER and economic performance with an analysis of 243 firms over 2 years. They use the environmental ratings of Franklin Research and Development Corporation (FRDC), which uses four specific questions to evaluate companies. Their results indicate that firms with environment-friendly management tend to achieve higher economic performance.

Miles and Covin (2000) further examine the interrelationships between environmental performance, company reputation, and financial performance. They find that corporate reputation is one of the most important intangible assets related to marketing and firm performance. They conclude that good environmental management provides firms with a reputational advantage that leads to increased marketing and financial performance. Similarly, Konar and Cohen (2001) show that poor environmental performance has a negative effect on intangible asset values such as the reputations of manufacturing firms in the S&P 500. They argue that good environmental management may provide firms with better reputations that subsequently help increase firm performance. They conclude that good environmental management provides firms with a reputational advantage that leads to increased marketing and financial performance. We call this effect the social impact and reputation-building hypothesis.

Using the Trucost database exclusively for 33 U.S. electric power companies on environmental costs for the 2004, Thomas et al. (2007) investigate the difference between economic value-added (EVA) and environmental costs-adjusted EVA (i.e., TruEVA). They find that the majority of firms experience a positive EVA that turns into a negative TruEVA after considering the environmental costs. In contrast, Dawkins and Fraas (2011) investigate the relation between environmental performance and voluntary climate change disclosure using the Trucost data of S&P 500 companies. They find a positive relation between environmental performance and disclosure. Their study also identifies the importance of media visibility in disclosure types and recognizes other factors that interact with environmental performance to influence corporate responses. Mahoney and Roberts (2007) perform empirical analyses on a large sample of publicly held Canadian firms. Based on tests using 4 years of panel data, they find significant relations between environmental activities and CFP. Jo et al. (2014) examine how environmental costs affect the CFP of manufacturing firms around the world.

Existing literature, however, does not explore whether and why CER matters for financial firms. In order to learn further from previously accumulated wisdom, we next briefly review the extant literature on the relation between CSR and CFP as CER is an important subset of CSR.

CSR and CFP

Although the existing empirical evidence on the relation between CSR and CFP is, at best, mixed, there is well-documented literature that CSR and CFP are positively related (Marom 2006; Beurden and Gossling 2008; Jo and Harjoto 2011, 2012; Cheng et al. 2013, among others). Extant studies broadly report that firms with a higher level of CSR are associated with greater CFP. This suggests that although CSR activities incur costs, their positive effects on CFP typically surpass the costs. Preston and O’Bannon (1997) further discuss that there are intermediate mechanisms for CSR activities including enhancing firms’ reputations, decreasing business failure and risk premiums, reducing the costs of capital, increasing profit opportunities, and ultimately positively influencing CFP. This is often called the social impact hypothesis, which is based on stakeholder theory and argues that serving the implicit claims of stakeholders enhances company reputation and positively affects CFP (Freeman 1984; Makni, Francoeur and Bellavance 2009).Footnote 7 Marom (2006) also points out that this positive effect can come from hiring more qualified employees, increased sales from satisfied customers, improved reputation, and easier access to raising capital.Footnote 8

Using data from a sample of U.S. commercial banks, Simpson and Kohers (2002) extend the research on corporate social performance and financial performance by providing empirical support for a positive CSR–CFP link. They find that the positive link between CSR and CFP is a universal phenomenon which ranges from the manufacturing sector to the financial services sector. De la Cuesta-González et al. (2006) maintain that a typical banking system can generate ethical engagements, not only for its customers, but also for society through the marketing of ethical financial products. Hence, De la Cuesta-González et al. (2006) conclude that CSR activities by firms in the financial services sector reduce the potential risks of the financial system and can improve firm performance.

In addition, there is evidence that CSR activities can reduce the firm's borrowing costs. Heinkel et al. (2001) explore the effect of exclusionary ethical investing on corporate behavior in a risk-averse, equilibrium setting. They show that exclusionary ethical investing leads to polluting firms being held by fewer investors since green investors eschew polluting firms’ stock. This lack of risk sharing among non-green investors leads to lower stock prices for polluting firms, thus raising their cost of capital. If the higher cost of capital more than overcomes a cost of reforming (i.e., a polluting firm cleaning up its activities), then polluting firms will become socially responsible because of exclusionary ethical investing. Bassen et al. (2006) report that, on the risk side, CSR commitment tends to lead to lower regulatory risk. Assuming that risk is a major cost driver, companies with a good CSR performance can reduce their cost of capital.

CSR is also considered important non-financial information (Dhaliwal et al. 2011, 2012). The relation between CSR and CFP is widely discussed both in academia and in practice. Beurden and Gossling (2008) provide an extensive review of this literature and report that the majority of research finds a positive relation between CSR and CFP. They present an overview of the results from 35 published studies on the relation between CSR and CFP, revealing that the majority (23 studies) find a positive relation, but two find a negative relation and ten find a non-significant relation.

Our brief review of the prior literature on CER and CFP as well as CSR and CFP relations suggests that there have been quite a few theoretical and empirical debates on the relations between CER and CFP and between CSR and CFP. Both the relations between CER (CSR) and CFP can be positive, neutral, or negative. The debates on the relations between CER (CSR) and CFP involve two important issues: direction and causality (Preston and O’Bannon 1997). Preston and O’Bannon (1997) distinguish the causal sequence (does CSR affect CFP, does CFP cause CSR, or is there a synergistic relation between the two) from the direction of the CSR–CFP relation. They develop six possible causal and directional hypotheses: social impact, slack resources, trade-off, managerial opportunism, positive synergy, and negative synergy. Among those six hypotheses, we consider three, slightly modified, to be most relevant in the CER–CFP link within the financial services industries; that is, (i) the social impact and reputation building, (ii) trade-off and negative synergy, and (iii) positive synergy hypotheses. Below we formulate our three hypotheses based on the extant literature on the relations between CER and CFP and between CSR and CFP.

Hypotheses Formulation

Our hypotheses have been largely developed from the well-established organization literature on stakeholder theory. Specifically, the social impact and reputation-building hypothesis suggests that meeting the needs of diverse stakeholders will lead to favorable CFP (Freeman 1984). According to this hypothesis, serving the implicit claims of stakeholders enhances a company’s reputation in a way that positively influences its CFP (Freeman 1984; Makni et al. 2009). Conversely, disappointing stakeholders may have a negative effect on CFP (Preston and O’Bannon 1997). Based on this explanation, a company perceived by its stakeholders as having a decent reputation will produce a better CFP through the reputation–CFP market mechanism.

This reputation building is particularly important in the financial services sector because financial institutions are repetitive players in the credit and financial market.Footnote 9 In particular, maintaining qualified personnel is crucial for firms in the financial services industry to remain competitive. Firms can hire competent staff through outstanding CSR activities. Turban and Greening (1997) and Albinger and Freeman (2000) argue that through CSR activities a typical firm can gain reputation, and this will in turn let the firm look attractive to employee applicants. Greening and Turban (2000) present some interesting signaling theory which shows that a firm’s CSR sends positive signals to prospective job applicants about what it would be like to work for a firm. Social impact theory further suggests that job applicants have higher self-images when working for socially responsive firms over their less responsive counterparts.

Empirical evidence suggests that firm CSR activities will raise reputation of the firm and hence consumers and other stakeholders will have favorable attitude on its products, thereby increasing sales and gaining consumer loyalty. For example, Creyer (1997) shows that firms with the high standard of business ethics provide significantly positive impact on consumer purchase decision. Certain consumers prefer products of ethical firms than unethical firms. Mohr et al. (2001) further suggest that the level of CSR activities affects consumer’s purchase decision making along with firm investment decision. In particular, they report that consumers frequently base their purchasing decisions on such factors that whether firms protect the environment and behave ethically. Finally, in the services industry, Crespo and del Bosque (2005) provide evidence that ethical codes and a clear philosophy of social commitment, respect for the environment, and honesty in its relationships with the stakeholders are more likely to achieve better economic performance.

In addition, El Ghoul et al. (2011) examine firms in the US manufacturing as well as financial service sector and find evidence that superior CSR and CER activities can reduce the costs of equity. In particular, investment in improving responsible employee relations, environmental policies, and product strategies contributes substantially to reducing firms’ cost of equity. These findings support arguments in the literature that firms with socially and environmentally responsible practices have higher valuation and lower risk.

The existing literature broadly has a notion that CSR (CER) activities and CFP are positively related both in the manufacturing sector and in the financial services sector. Since CER constitutes a crucial part of CSR, we maintain that CER investments such as environmental innovation technology can decrease and minimize direct and indirect environmental costs. Taken together, we expect the following hypothesis.

Hypothesis 1

To the extent that the social impact and reputation-building hypothesis is valid in the financial services sector and/or to the extent that the CER reduces the borrowing costs in the financial services sector, we expect a positive (inverse) association between investing in CER (environmental costs) and CFP.

Next, the trade-off and negative synergy hypothesis predicts that higher levels of CSR (or CER) lead to decreased CFP and deals with the neo-classical economists’ position, which holds that socially responsible behavior will offset few economic benefits due to its numerous costs (Waddock and Graves 1997). ‘‘This hypothesis reflects the classic Friedman’s (1970) position and is supported by the well-known early finding of Vance (1975) that corporations displaying strong social credentials experience declining stock prices relative to the market average’’ (Preston and O’Bannon 1997, p. 421). This is due to the socially responsible behavior, which is likely to net economic benefits while its various costs reduce profits and shareholder wealth, forming a vicious circle (Makni et al. 2009). Brammer et al. (2006) investigate the relation between CSR and CFP for a sample of U.K. companies and find that firms with higher CSR ratings tend to experience diminishing financial returns. Firms with low CSR, however, considerably outperform the market. Boyle et al. (1997) also find a similar inverse relation between CSR and CFP. Analogously, if CER is viewed as a trade-off and negative synergy, CER investing will decrease CFP while our positive stance of a CER investing–environmental cost savings remains valid. Taken together, we expect the following.

Hypothesis 2

To the extent that CER is viewed as a trade-off and negative synergy, we expect a negative (positive) association between CER investing (environmental cost) and CFP.

Clearly, in relation to Hypotheses 1 and 2, the null hypothesis is that CER investing is not associated with CFP. In contrast to the trade-off and negative synergy hypothesis, the positive synergy hypothesis supposes that higher levels of CSR (or CER) lead to an improvement of CFP and offers the possibility of reinvestment in socially responsible activities. Therefore, there may be a simultaneous and interactive positive relation between CSR (or CER) and CFP (Waddock and Graves 1997; Ruf et al. 2001; Makni et al. 2009). Waddock and Graves (1997) investigate the empirical link between CSR and CFP and find that CSR is positively associated with prior and future CFP, suggesting the possibility of bi-directional causality, i.e., CSR causing CFP, and vice versa. It is notable that they measure CSR with a constructed index based on five factors related to stakeholders and three factors with responsiveness to significant external pressure.

Barnett and Salomon (2006) measure the financial–social performance link within mutual funds that practice socially responsible investing (SRI) through a panel of 61 SRI funds from 1972 to 2000. They find that as the number of social screens used by an SRI fund increases, financial returns initially decline and then rebound as the number of screens reaches a maximum. Ruf et al. (2001) examine how changes in CSR relate to changes in financial accounting measures from a stakeholder perspective. This provides better control over extraneous factors and a more sensitive test than examining the levels of CSR. They find that changes in CSR are positively related to growth in sales for the current and subsequent years, which again indicates bi-directional causality. Waddock and Graves (1997), Ruf et al. (2001), and Makni et al. (2009) suggest the possibility that CSR not only follows CFP, but also drives it, forming a virtuous circle. Following this stream of studies, we postulate that this bi-directional causal effect may also affect CER–CFP association. Consequently, we expect the following.

Hypothesis 3

To the extent that CER is viewed as a positive synergy, we expect CER investing (environmental cost) to positively (inversely) affect CFP while CFP positively influences CER investing.

Whether Hypothesis 1, 2, or 3 has greater validity is an open empirical question, so in the following sections, we examine the effect that environmental costs have on CFP, and vice versa, using empirical data.

Data and Methodology

Data Description

The unique environment cost data used here are provided by Trucost Plc for listed firms around the world over the 2002–2011 period.Footnote 10 Trucost is the largest database of greenhouse emissions. Their model includes the six main greenhouse gases regulated by the Kyoto Protocol—carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6). The quantity of profile of a company is calculated and a damage cost is applied to each resource and emission to generate an external environmental cost profile. The costs represent the quantities of natural resources used or pollutants emitted multiplied by their environmental damage costs to society. External costs are incurred whenever a natural resource is used or emissions are made to air, land, or water. Trucost prices the damage that is done to society and human capital by pollutants and natural resource use, including quantifying associated with health costs. By applying a price to each environmental resource, based on the environmental impact of that resource, the input/output-based model analyzes, in financial terms, the productivity and environmental performance of each sector.

By multiplying its physical quantity by a notional price based on economic estimates of the marginal damages, Trucost Plc calculates the total direct and indirect external environmental costs. The total direct environmental costs are imposed on the rest of the economy by the firm’s operations and based on six direct emissions: greenhouse gases’ direct cost, water direct cost, waste direct cost, land and water pollutants’ direct cost, air pollutants’ direct cost, and natural resource use’ direct cost. The total indirect environmental costs are the environmental effects of six indirect emissions: greenhouse gases’ indirect cost, water indirect cost, waste indirect cost, land and water pollutants’ indirect cost, air pollutants’ indirect cost, and natural resource use’ indirect cost (see the details of Trucost data explanation in Appendix 1). We use total environmental costs, which are the sum of total direct and indirect environmental costs. In the financial service industries, however, total environmental costs are mostly composed of indirect environmental costs. Total direct environmental costs are the direct environmental effects that a company has on the environment through their own activities while total indirect environmental costs are the consequences of the activities of the reporting entity that occur in sources owned or controlled by another entity. For example, the water that a company uses from a river would be a direct impact, whereas water provided by a utility company would be an indirect impact. Using input/output modeling, Trucost Plc calculates these direct environmental impacts in quantity terms (i.e., tonnes, cubic meters, etc.), and financial terms, so that they can be ranked accordingly as direct external costs. The quantities of all direct emissions are multiplied by their respective environmental damage costs as calculated by Trucost and its academic panel. Similarly, Trucost Plc calculates total indirect environmental costs by multiplying the quantities of all indirect emissions and their respective environmental damage costs as obtained by Trucost and its academic panel. For instance, water purchased by the company from utility companies and abstracted water were estimated to be used in the whole upstream supply chain. This quantity of water is multiplied by its associated indirect external cost. The other main sources of total indirect environmental costs are the costs of CO2 emissions from the consumption of purchased electricity and employees’ business trips. See more details of each component of total environmental costs in Appendix 1.

The financial statement data used in our analyses are collected from the Worldscope database by Thomson Financials and S&P Capital IQ for 29 countries over the 2002–2011 period. We change the monetary unit of each country’s data to U.S. dollars and include banks, security corporations, and insurance companies as non-bank financial institutions (NBFIs) and firms in real estate development in our financial services sector, following Lown et al. (2000). Specifically, our sample comprises 4,924 firm-year observations, 1,783 of which belong to 11 countries in the Asia Pacific region; 1,836 of which are from 16 European countries; and 1,305 of which are affiliated with the U.S. and Canada. This is a largely expanded dataset and sample period from earlier studies, such as that of Thomas et al. (2007), who examine 33 U.S. electric power companies. We winsorize the dependent variable and explanatory variables at 1 and 99 % to take into account the extreme outlier observations.

Empirical Design

We use panel data regression analyses similar to those used by Barclay and Smith (1995) and Benson and Davidson (2009) due to the endogenous characteristics embedded in the panel data. To solve this problem, we use a least-square dummy variables method (LSDV) with clusters, Arellano–Bond GMM, system GMM, and the first-difference regressions. To determine the appropriate model (fixed- or random-effects), we perform the Hausman specification test (Wooldridge 2002), which gives a χ 2 of 108.23 (p = 0.000), which indicates the usage the fixed-effects model. We also perform a robustness test using an additional dependent variable such as EBIT to total assets. Our basic fixed-firm effect regression equation for LSDV is as follows:

where Ln total environmental costs is the logarithm of total environmental costs with lags by one and two periods. Market to book is the sum of the book value of assets and the market value of equity minus the book value of equity divided by total assets. Ln total assets is the logarithm of total assets. Stock return volatility is the standard deviation of monthly stock returns over the prior 2 years. Because our sample firms are from the financial services industries, we follow the empirical approach of bank merger study by Cornett and Tehranian (1992).

Capital to assets is defined as total equity capital divided by total assets. Expenses to revenues is operating expenses divided by operating revenue.Footnote 11 This variable is particularly important in our multivariate analysis as it allows us to control for the accounting perspective of costs when lagged environmental costs are used as our main explanatory variables. Asset growth rate is the change in book value of total assets to total assets in the previous year.Footnote 12 Later, we also use interaction terms and industry clusters in our regression analysis. The regression equation is given as follows:

We multiply the industry dummy by Ln total environmental costs it−1(it−2) to investigate industry-wide variations. The industry dummy comprises Bank, Securities, Real Estate, and Insurance dummies.

Endogeneity issue could arise due to the dynamic nature of the CER–ROA relation. Thus, in order to address the endogeneity issue, we adopt a well-developed dynamic panel GMM estimator following Arellano and Bond (1991) and Wintoki et al. (2012), and employ the Arellano–Bond and system GMM method for the determinants of ROA, and compare the results to those obtained from traditional LSDV:

We further conduct the first difference to difference regression approach to address any remaining endogeneity problems.

Empirical Results

Summary Statistics

Panel A of Table 1 reports the summary statistics for the variables used in this study. The variables include total assets, revenues, ROA, EBIT, net income, total environmental costs, total direct environmental costs, total indirect environmental costs, operating expenses, market to book, stock return volatility, capital to assets, expenses to revenues, and asset growth rate. The sample comprises 4,924 firm-year observations for 29 countries during the 2002–2011 period. The mean (median) of total assets is US $121.5 (17.8) billion, while the mean (median) of revenues is US $9.4 (2.0) billion. Table 1 also provides information on environmental costs. The mean (median) of total environmental costs is US $30.7 (8.0) million. The mean (median) of total direct environmental costs is US $3.0 (0.2) million and the total indirect environmental cost is US $27.7 (7.5) million. Thus, in the financial services industries, total indirect environmental costs account for most total environmental costs.

Panel B of Table 1 shows summary statistics by firms in different regions. The median values of firm size scaled by total assets in Asia Pacific and European countries are US $15.9 and 17.3 billion, which are similar; whereas the median of total assets for the North American firms is US $22.5 billion, which is much larger than that in other regions. Profitability and environmental costs, however, vary by region. North American firms show the highest median net income at US $575 million, while Asia Pacific firms have a median net income of only US $14 million (Panel B of Table 1). Interestingly, Asia Pacific firms have the lowest median total environmental costs at only US $5.9 million. These firms also have the lowest median operating expenses (US $739 million), as reported in Panel B of Table 1.

In Panel A of Table 2, we find that the mean (median) ROA for the Asia Pacific region is 1.04 (0.10) %. The results for countries in Europe are reported in Panel B of Table 2.

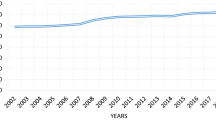

Using information in Panel B of Table 2 and the ratios of total environmental costs to total assets, Fig. 1 graphically shows the levels of financial market development and total environmental costs for European countries during the 2002–2011 period. The countries in white (black) represent well-developed (less-developed) financial markets and total environmental costs above (below) the median. The countries in lighter (darker) gray have well-developed (less-developed) financial markets and total environmental costs below (above) the median. Although there are several exceptions, Southern European countries including Portugal, Italy, Greece, and Spain (PIGS) generally have less-developed financial markets with low total environmental costs. Western European countries have well-developed financial markets with high total environmental costs.

Financial market development and environmental costs in Europe. This figure graphically shows the levels of the financial market development and total environmental costs by countries in Europe during 2002–2011. The countries in white (black) have the well-developed (less-developed) financial markets and have total environmental costs above (below) the median. The countries in lighter (darker) gray have the well-developed (less-developed) financial markets and have total environmental costs below (above) the median

Panel C of Table 2 reports the results of North American countries. The mean (median) ROA for the U.S. is 4.22 (2.64) %, which is higher than that in other countries. Table 2 also reports the proportion of total indirect environmental costs to total environmental costs. The mean (median) Ind EC/TEC for the total sample is 0.94 (0.97).Footnote 13 Thus, total indirect environmental costs account for most of the total environmental costs in the financial services industries.

Univariate Tests

Table 3 further shows differences in firm and environmental cost-adjusted performance by region and level of financial market development. In Panel A of Table 3, firms in the Asia Pacific region have a mean (median) of ROA of 1.04 (0.10) % and the mean (median) of ROA for European firms is as high as 4.60 (1.93) %, leading to a mean (median) difference of −3.56 (−1.83) % between the two regions. European firms have somewhat greater ROA than those in North America. Table 3 further shows that the total environmental costs to total assets are highest for European firms. The mean (median) of this ratio is 0.34 (0.05) %, whereas the means (medians) of these ratios for firms in the Asia Pacific region and North America are 0.19 (0.05) and 0.15 (0.06), respectively. There is no significant mean difference between the Asia Pacific region and North America.Footnote 14

Panel B of Table 3 shows the results of univariate tests between firms in well-developed financial markets and those in less-developed financial markets. We divide the group based on the median of FD score. Firms in well-developed financial markets have a mean (median) of ROA of 4.43 (2.10) % while the mean (median) of ROA for firms in less-developed financial markets is 1.26 (0.15) %. Interestingly, the mean (median) of total environmental costs to total assets for companies with well-developed financial markets is 0.31 (0.07) %, which is more than two times higher than companies with less-developed financial markets. The mean (median) difference in total environmental costs to total assets between the two groups is also substantially large at 0.19 (0.05) % and significant at a p value of <1 %. Hence, firms in well-developed financial markets have much greater total environmental costs to total assets than those in less-developed financial markets.

Companies in highly developed financial markets should have easy access to capital that facilitates obtaining large-scale funds. Investors in well-developed financial markets also enjoy better availability of financial services. Therefore, in well-developed financial markets, financial dealings such as stock trading and derivative transactions can be more active than in less-developed financial markets. Business activities such as business trips may also be more common in well-developed financial markets. Indirect environmental costs are composed mainly of the costs of CO2 emissions from consumption of electricity and employees’ business trips. Thus, the environmental costs of firms in well-developed financial markets may be larger than those of other firms in less-developed financial markets. We also use Organization for Economic Cooperation and Development (OECD) as an additional proxy when measuring the development of financial markets because countries in OECD generally have well-developed financial markets. They also have higher total environmental costs to total assets than countries that are not in OECD, as reported in Panel B of Table 3.

Interesting industry variations in environmental cost-adjusted performance can be found in Panel C of Table 3. As expected, the securities industry has the largest total environmental costs to total assets with a mean (median) of 0.48 (0.32) %. The substantial environmental costs of the securities industry may be mainly due to the indirect environmental costs, as the industry essentially has large amounts of CO2 emissions from the consumption of purchased electricity during a lot of stock trading and derivative transactions. However, Panel C shows that the banking industry has the lowest total environmental costs to total assets at only 0.01 (0.01) %. In other words, the banking industry is the most eco-friendly sector in the financial service industries. Overall, Panel C suggests that there are large variations in the financial and environmental costs-adjusted performance of different industries.

Multivariate Tests

The overall sample results of our multivariate analysis are provided in Tables 4 and 5, which report the results using a LSDV method, Arellano–Bond GMM, system GMM of ROA against total environmental costs, and the first-difference regression approach during the 2002–2011 period. ROA is used in a number of studies of CSR and climate change including Hart and Ahuja (1996), Makni et al. (2009), and Pae and Choi (2011). In models (1)–(3) of Table 4, we report the results of the LSDV method. These results show that the logarithms of total environmental costs at times t−1 and t−2 have statistically significant negative coefficients when estimated separately and simultaneously.Footnote 15 In models (4)–(6) of Table 4, regressions use year-fixed effects, firm-fixed effects, and firm clusters. Models (4)–(6) of Table 4 indicate a statistically significant negative relationship between ROA and the logarithm of total environmental costs at times t−1 and t−2 after clustering. Notice that accounting costs are not considered in measuring the Trucost environmental costs. We also control for operating costs by “expenses to revenues” and thus the negative relation between total environmental costs and ROA is not from reducing accounting costs, but from the effects of CER investing. Overall, these results support our Hypothesis 1 of the social impact and reputation building.

In terms of economic significance, using models (1) and (4) of Table 4, a one-standard deviation decrease in Ln Total Env. Costs t−1 is associated with an increase in ROA of 1.28 % of its mean. Based on models (2) and (5), a one-standard deviation decrease in Ln Total Env. Costs t−2 would increase ROA by 1.43 % of its mean. Similarly, in models (3) and (6), one-standard deviation increases in Ln Total Env. Costs t−1 and Ln Total Env. Costs t−2 decrease ROA to 1.28 and 0.80 %, respectively.

Models (1)–(2) of Table 5 show the Arellano–Bond GMM results. Using this method allows us to control for the potential endogeneity problems caused by the endogenous variables and time-invariant unobserved effects in our panel data. ROA, Ln Environmental Costs, and Increase (Decrease) in Total Environmental Dummy are used as instrumental variables for the third and fourth periods in Arellano–Bond GMM. In models (3) and (4), we also report the system GMM results of two specification tests in Table 5: the AR(2) second-order serial correlation tests and the Hansen J over-identification tests. The first AR(2) test yields a p value of 0.694–0.962, suggesting that the null hypothesis of no second-order serial correlation cannot be rejected. The second test reveals a Hansen J statistic with a p value of 0.139–0.201. Thus, we cannot reject the hypothesis that our instruments are valid. In addition, we report the results from a test of the exogeneity of a subset of our instruments. The system GMM estimator makes an additional exogeneity assumption such that any correlation between our endogenous variables and the unobserved (fixed) effect is constant over time. This assumption enables us to include the level equations in our GMM estimates and use lagged differences as instruments for these levels. Eichenbaum et al. (1988) and Wintoki et al. (2012) suggest that this assumption can be directly tested based on a difference-in-Hansen test of exogeneity. This test also yields a J statistic that is distributed as χ 2 under the null hypothesis that the subsets of instruments in the level equations are exogenous. The results show a p value of 0.395–0.518 for the J statistic produced by the difference-in-Hansen test. This suggests that we cannot reject the null hypothesis that the additional subset of instruments used in the system GMM estimates is exogenous.

Table 5 reveals statistically significant negative coefficients that are similar to the results in Table 4. This implies that reducing environmental costs will enhance firm financial performance even after alleviating endogeneity and potential autocorrelation problems. Reducing environmental costs has many advantages such as leading to higher company reputation, enabling firms to hire more qualified employees, improving production efficiency and competitiveness, decreasing business failure and risk premium, facilitating easier access to raising capital, reducing the costs of capital, and increasing profit opportunities. In addition, after mitigating endogeneity and potential autocorrelation problems, the economic significance of the estimates becomes more substantial. Based upon the Arellano–Bond GMM coefficients, a one-standard deviation increase in Ln Total Env. Costs t−1 decreases ROA by 17.56 and 27.62 % of its mean, based on models (1) and (2), respectively. Similarly, a one-standard deviation decrease in Ln Total Env. Costs t−2 increases ROA further to 11.00 and 14.03 %, based on models (1) and (2), respectively. Using System GMM, the economic significances of Ln Total Env. Costs t−1 and Ln Total Env. Costs t−2 are also nontrivial. For example, a one-standard deviation decrease in Ln Total Env. Costs t−1 is associated with a 14.05 and 19.80 % increase of ROA, based on models (3) and (4). In the same models, a one-standard deviation decrease in Ln Total Env. Costs t−2 increases ROA by 10.36 and 12.27 % of its mean.

Overall, our dynamic system GMM results support the social impact and reputation-building hypothesis, but not the trade-off and negative synergy hypothesis. We also show that reducing environmental costs is expected to take 1 or 2 years to enhance firm performance. This suggests that there exists some time lag in improving firm performance after reducing the environmental costs. These results are consistent with Miles and Covin (2000) and Konar and Cohen (2001) in the sense that good environmental management improves firms’ reputations and increases their financial performance in the long term.

One caveat on our estimation thus far is that we can only control for observable firm characteristics. It is possible that the negative association between environmental costs and firm performance is driven by unobservable firm characteristics. To address this concern, we examine the first difference and explore the relation between changes in environmental costs and changes in ROA. If the unobserved firm characteristics are time invariant, then our first-difference test will address such endogeneity concerns. We run difference regressions with the first difference in each variable. Table 6 summarizes the change regression results, which suggest that the change in environmental costs has a negative effect on the change in ROA, with t values of −2.85 to −3.87 (all significant at the 1 % level) in various samples with the change in environmental costs at times t−1 and t−2, respectively, in addition to the changes in environmental costs for both periods together. Regarding the economic significance of the change regressions, a one-standard deviation decrease in Ln Total Env. Costs t−1 increases ROA further to 1.44 %, based on model (1). In model (2), a one-standard deviation decrease in Ln Total Env. Costs t−2 would increase ROA by 2.07 % of its mean. Similarly, using model (3), a one-standard deviation decrease in Ln Total Env. Costs t−1 is associated with an increase in ROA of 1.60 % of its mean. Furthermore, a one-standard deviation decrease in Ln Total Env. Costs t−2 increases ROA by 2.23 % of its mean. Overall, these results are again supportive of the social impact and reputation-building explanation.

Table 7 shows the results from the LSDV of ROA against total environmental costs by region during the 2002–2011 period. Reducing environmental costs appears to improve firm performance in the Asia Pacific region, Europe, and North America. Thus, the results of a negative association between environmental costs and ROA are not region specific, but rather global phenomena. Table 7 further reports that some dynamic effects exist. Model (1) for the Asia Pacific region suggests that the logarithm of total environmental costs at time t−1 is negative and marginally significant. However, in model (3), the significance of coefficients disappears. This result could be due to the multicollinearity problem between the logarithms of total environmental costs at times t−1 and t−2. Models (4) and (5) in Table 7 show that the logarithms of total environmental costs at times t−1 and t−2 are negative and significant, respectively.

Interestingly, in model (6) for Europe, the coefficient of total environmental costs for time t−2 becomes insignificant while that for time t−1 remains negative and statistically significant. This may be due to fact that the effect of total environmental costs for time t−1 is stronger than for time t−2. However, in model (9) of Table 7, the reducing of environmental costs is expected to take 2 years to enhance ROA for North American firms. These results support the view that lowering environmental costs has a rapid effect on the firm performance of European companies, whereas North American companies are more affected in the long term.

Our results also show that lowering environmental costs has greater and more significant effects on firms in Europe and North America than on those in the Asia Pacific region. This may reflect the differential recognition of environmental problems by executives around the world. Customers in Europe and North America also react positively to environmental management. We further find that the negative relation between ROA and total environmental costs is largest for firms in North America, with a total environmental costs coefficient for time t−2 of −0.017.Footnote 16 It appears that North American firms have the most efficient system for implementing environmental costs savings in firm performance. Our results are broadly consistent with the results of Hart and Ahuja (1996), who use the IRRC’s Corporate Environmental Profile for the U.S. sample firms.

In Table 7, countries with well-developed or less-developed financial markets are mixed in each region. Thus, we divide the sample based on the level of financial market development in Table 8.Footnote 17 We use the sample firms in well-developed financial markets in models (1)–(3) and those in less-developed financial markets in models (4)–(6) of Table 8. In model (3) of Table 8, reducing environmental costs increases firm performance 1 year later, whereas in model (6) of Table 8, lowering environmental costs affects firm performance 2 years later. These results provide the evidence that in well-developed financial markets, lowering environmental costs more rapidly and significantly affects firms’ financial performance.

Table 9 illustrates the role of lowering environmental costs in varying effects on different industries. Models (1) and (2) of Table 9 report that the interaction terms between the bank dummy and the logarithm of total environmental costs at time t−1 (t−2) are statistically and significantly positive at 0.007 (0.008). These results suggest that the effects of lowering environmental costs on financial performance are almost offset by interaction terms in the banking industry. Model (4) of Table 9 shows that the interaction term between the securities dummy and the logarithm of total environmental costs at time t−2 is statistically and significantly negative at −0.005. Thus, the total effect of the logarithm of total environmental costs on ROA for securities is −0.011. These results suggest that the effect is most pronounced in the securities industry, which has the highest level of total environmental costs out of total assets while the effect is weakest in the banking industry.

Additional Tests

So far, as we have examined the environmental costs–CFP relation based on the aggregate total environmental costs. Now we further investigate the impact of the each component emissions on CFP in Table 10. The components include (a) greenhouse gases (GHGs) costs, (b) water costs, (c) waste costs, (d) land and water pollutants costs, (e) air pollutants costs, and (f) natural resource use costs. Similar to the aggregate environmental costs–CFP association, we find that while the coefficients on each component of the logarithm of external environmental costs at time t−1 are all significant, those on each component of the logarithm of external environmental costs at time t−2 are mostly significant and negative except total waste environmental costs and total land and water pollutants’ environmental costs.Footnote 18 These component total environmental cost results are also supportive of the social impact and reputation-building explanation.

One may ask whether our results remain robust even when we use alternative firm performance measures. As a robustness check, we use the dependent variable as EBIT normalized by total assets. We also use LSDV in Table 11. It appears that there is a 2-year lagged effect for firms to enhance financial performance after lowering environmental costs. These results are consistent with our previous results.

Table 12 presents the results of the regression models testing ‘‘Granger causality’’ between the first difference in the environmental costs and the change in ROA, along with the change in EBIT/total assets, respectively. There is no statistically significant relationship between the change in ROA measures or the change in EBIT/total assets measure and the change in environmental costs when the change in environmental costs are dependent variables; that is, the t values are 0.26 and 0.77 in model (1) and 0.60 and −0.42 in model (3), respectively. However, there is a statistically significant and negative relation between the change in ROA and the changes in environmental costs, with t values of −2.47 at time t−1 and −4.47 at time t−2 in model (2). The negative relationship with the change in EBIT/total assets and the change in environmental costs is insignificant at time t−1, but becomes statistically significant at the 1 % level (t = −4.49) in model (4), which gives robustness to our results. Hence, the finding of a unidirectional and negative ‘‘Granger causal’’ relation between the environmental costs and the CFP measures supports the social impact and reputation-building hypothesis, but not the positive synergy hypothesis. Indeed, our findings suggest a negative effect of environmental costs on CFP measures, but the latter does not affect CER investing.

Discussion

We find that the banking industry is the most eco-friendly sector in the financial services industries, whereas the securities industry has the highest level of total environmental costs to total assets out of all financial industry institutions during the 2002–2011 period. In addition, we test for region and industry variation in financial performance and environmental cost-adjusted performance around the world (29 countries). We find that European countries have the largest difference between firm performance and environmental cost-adjusted performance. We also show that countries with well-developed financial markets have higher levels of total environmental costs than other countries. Our regression results show that lowering environmental costs through CER investing enhances firm performance, affecting CFP more significantly and positively in Europe and North America than in the Asia Pacific region. This suggests that the influence of social impact and reputation building is more substantial in well-developed financial markets, which may reflect executives’ differential recognition of environmental problems around the world. Customers in Europe and North America also react more positively to environmental management than those in the Asia Pacific region.

We also find that a reducing of environmental costs is expected to take at least 1 or 2 years before enhancing ROA. The results, however, vary depending on the level of financial market development. Lowering environmental costs has a more immediate effect on CFP in well-developed financial markets than in less-developed financial markets. These results are robust even after applying various panel data regression methods and controlling for endogeneity and additional performance variables. Our findings suggest that policy makers dealing with corporate sustainability management should continue to pursue an environment-centered industry policy, as firms with lower environmental costs consistently perform better. These results also suggest that executives in the financial service industries should lower environmental costs to improve CFP. We use more conventional measures such as the ratio of ROA or earnings before tax and interest (EBIT) to total assets as proxies for firm financial performance.

Our empirical results generally indicate that environmental costs even in the financial services sector have a negative influence on CFP, in spite of some important qualifications we discuss below. This negative association is indicated by the negative correlations between our measure of the main environmental costs and various CFP measures. Our results based on various econometric methods consistently support the social impact and reputation-building hypothesis, our Hypothesis 1, and do neither support the trade-off and negative synergy hypothesis, our Hypothesis 2, nor the positive synergy hypothesis, our Hypothesis 3. Our findings are quite robust.

This is a surprising finding since it is contrary to what the explicit profit-motive explanations of Friedman (1970) and Jensen and Meckling (1976) would lead one to expect. Previous researchers have suggested what we may call the “shareholder wealth maximization” view (SWM), which holds that the manager’s sole aim is, and should be, to maximize shareholder value through profit maximization. SWM holds, that is, that managers have a fiduciary, moral, ethical, and legal obligation to choose only those projects that have a positive net present value (NPV) and so maximize profits for shareholders (Friedman 1970; Jensen and Meckling 1976). In addition, because managers have a short-term outlook, they will reject projects that do not have a positive NPV over the short term (Bolton et al. 2006). Because CER initiatives typically require initial investments that will not have a short-term payoff and are likely to have no positive payoff at all even in the long run, managers will not invest in environmental initiatives unless legally required to do so. Externalities considerations, therefore, will play no role in the manager’s environmental decisions, which will be governed, instead, by considerations related to maximizing shareholder value or complying with environmental laws. According to the SWM view, then, there should be no systematic relation between managerial decisions related to the environment and CFP. Contrary to the above profit-motive-based intuition, our results suggest that policy makers dealing with corporate sustainability management in the financial services sector, especially those who are considering social and managerial implications should continue to pursue an environment-oriented industry policy, given that firms with lower environmental costs are performing better.

This study suffers from a couple of limitation. First, Trucost data do not provide an exact amount of CER investment associated with each direct and indirect environment costs. Thus, it is difficult to measure how much direct and indirect environment costs are reduced when financial service firms invest in CER activities. Second, it is unclear in which firms, if any, the levels of environmental costs may be a result of legally mandated environmental action programs. Thus, we cannot distinguish internalized operating costs due to the mandated environmental regulation from pure environmental costs. This lack of distinction, however, biases against the finding of an inverse environmental costs–CFP association.

Despite these limitations, our study makes important implications to the literature in a number of domains. First, and of greatest significance, it shows that environmental costs adversely influence a firm’s financial performance in financial service industry firms. Specifically, our study suggests that at least one of the factors underlying managerial decisions related to performance is their environmental costs, a factor that has only rarely been examined in the literature. Second, because environmental activists are one of the key latent stakeholders of a company, the company’s managerial policies toward environmental activities are generally seen in the literature on CSR as part of the company’s CSR stance. Our study shows, therefore, that environmental cost influences a firm’s CSR stance, at least to the extent that CER is one of the factors that play a role in managerial decisions to invest in environmental initiatives. Third, our study provides indirect evidence for the claim that while the environmental scheme of informal beliefs, understandings, and preferences toward humans’ relationships to the rest of the natural world are becoming increasingly important, the exact scientific evidence is a prerequisite to determine the level of environmental initiatives.

Conclusions

Using a unique Trucost dataset, we investigate how environmental costs affect the performances of firms in the financial services industries around the world. We test for region and industry variations in financial and environmental cost-adjusted performance. We find that European countries have the largest difference between firm and environmental cost-adjusted performance. We also show that countries with well-developed financial markets have much greater total environmental costs to total assets than countries with less-developed financial markets. It appears that active transactions and business activities for firms in the financial services industries generate a substantial amount of indirect environmental costs in the well-developed financial markets. We further show that the securities industry has the highest total environmental costs to total assets, while the banking industry is the most eco-friendly sector in the financial service industries.

Our regression results reveal that lowering environmental costs increases financial performance in the long term because, as the social impact and reputation-building hypothesis implies, reducing environmental costs has a lot of advantages such as leading to higher company reputation, enabling firms to hire more qualified employees, improving production efficiency and competitiveness, reducing the costs of capital, and increasing profit opportunities. Furthermore, reducing environmental costs affects firms in Europe and North America more significantly than in the Asia Pacific region. This may reflect the differential recognition of environmental problems by executives around the world. Customers in Europe and North America also react more positively to environmental management than those in the Asia Pacific region.

We also find that the reducing of environmental costs takes at least 1 or 2 years to enhance firm performance using ROA. The effect, however, varies slightly depending on regions and the levels of financial development markets. Reducing environmental costs has a rapid effect on firm performance in well-developed financial markets, but firms in less-developed financial markets are affected in the long term. The effect of lowing environmental costs on firm performance is most pronounced in the securities industry, which has the highest level of total environmental costs out of total assets. These findings are robust even after we use various panel-data regression methods and additional firm performance measures, such as EBIT to total assets.

Notes

Bank of America, for instance, completed $20 billion environmental business initiatives, such as BOA Tower at One Bryant Park in 2010 which they established in 2007 and financed World’s largest distributed solar project in 2011. In addition, they launched their new $50 billion goal to put their capital to achieve many significant environmental milestones (BOA Environmental sustainability 2013). Another example can be found from the BNP Paribas Group that operates in 78 countries and employs nearly 190,000 employees over 7,000 bank branches (of which more than 2,500 are in France). As a participant in the global economy, BNP Paribas has a role to play in protecting the environment. In accordance with this responsibility, acting to combat climate change is one of the BNP Paribas Group’s priorities. As a result, the Group works both to reduce the negative effects and to increase the positive effects that it may have on the environment through (i) financing new infrastructure designed to fight climate change (such as renewable energy, collective urban transportation, water treatment and distribution, the construction of ecological towns, etc.); (ii) in the same way that they encourage their customers to take environmental criteria into account when planning their projects, they take steps to reduce their own ecological footprint as much as possible; and (iii) the “Climate Initiative”—a 3-year program with an endowment of 3 million euros—launched in 2011 by the BNP Paribas Foundation in collaboration with the CSR Delegation, supports five research projects focusing on climate change, its causal factors, and its consequences.

CER investing includes recycling programs and/or clean technology investing.

In a recent work, Wu and Shen (2013) suggest that CSR in the banking industry is positively associated with CFP in terms of return on assets and return on equity. In many developed countries, various financial institutions offer specialized savings accounts to the public while promoting that the savings will be used to finance environmentally sound projects and/or for operations of social entrepreneurs who find it hard to get access to finance from conventional institutions because private households have the opportunity to save or invest their money not only on the basis of financial rewards, but also in the face of the non-monetary value of savings and investments (Scholtens 2006, 2009).

Green (2010), in his U.N. report, suggests that World’s top 3,000 companies created $2.2 trillion environmental damage costs in 2008 year alone. (http://dirt.asla.org/2010/02/24/new-u-n-report-worlds-top-3000-companies-created-2-2-trillion-in-environmental-damage/). According to Vogel (2005), Dupont has saved $2 billion due to energy efficiency practices; BP made $650 million in savings from its energy reduction strategies between 1998 and 2002; and IBM saved $792 million between 1990 and 2002.

Detailed descriptions of the social impact and reputation building versus a trade-off and negative synergy or a positive synergy argument are given in the literature review and hypotheses formulation section.

Karnani (2012) argues that in circumstances in which CFP and social welfare are in direct opposition, an appeal to CER will almost always be ineffective, because top managers are unlikely to act voluntarily against shareholder interests. Jo (2003) suggests, however, that financial analysts have an incentive to follow stocks of socially and environmentally responsible companies, because such stocks meet the growing demands and psychology of the investment community, who want to combine the usual investment goal of maximizing risk-adjusted returns with social and environmental responsibility, the concept persistently advocated by various stakeholders and the investment community for the last five decades.

Mahoney (2012) defines stakeholders as “…those persons and groups who contribute to the wealth-creating potential of the firm and are its potential beneficiaries and/or those who voluntarily or involuntarily become exposed to risk from the activities of a firm… Thus, stakeholders include shareholders, holders of options issued by the firm, debt holders, employees (especially those investing firm-specific human capital), local communities, environment as latent stakeholders, regulatory authorities, the government, inter-organizational alliance partners, customers and suppliers.”

Defining and measuring CSR have also been an important task in the literature. Earlier studies such as Frederick (1994) and Griffin (2000) report that there is no consensus on the content of CSR. However, Beurden and Gossling (2008) analyze existing CSR studies and identify three categories: social concerns; social actions such as philanthropy, social programs, and pollution control; and corporate reputation ratings. Brickley et al. (2002) argue that the stock market can value such intangible assets as a firm’s reputation which is produced by its ethical behavior as a collective.

Focusing on the CSR brand, Ogrizek (2002) argues that CSR branding is also becoming of paramount importance to the financial service industries. If a financial firm mismanages the CSR branding, its reputation can be damaged, which could have direct and indirect negative effects on firm performance. Luo and Bhattacharya (2006) use CSR to investigate the relation between CSR and firm market value. They develop a conceptual framework for predicting that (a) customer satisfaction partially mediates the relation between CSR and firm market value, (b) corporate abilities moderate the financial returns to CSR, and (3) these moderated relations are mediated by customer satisfaction. They find that the results supporting this framework and customer satisfaction play a significant role in the relation between CSR and CFP.

Trucost Plc is a U.K.-based environmental research company that creates databases estimating these externality costs for 3,500 of the world’s largest corporations.

One can argue that accounting operating costs such as expenses might be correlated to total environmental costs. We explore this possibility. The correlations between expenses to revenues and external environmental costs at times t−1 and t−2, however, are very low (0.024 and 0.023) and statistically insignificant.

We use Capital to Assets as a capital adequacy indicator, Expenses to Revenues as an efficiency indicator, and Asset Growth Rate as a growth indicator.

Ind EC/TEC is the total indirect environmental costs to total environmental costs.

In a recent analysis, Jo et al. (2014) show that the Asia Pacific region has the highest total environmental costs to total assets, while Europe has the lowest total environmental costs to total assets in the manufacturing industry.

We estimate a regression with the total environmental costs at times t−3, t−4, and t−5 as well, but the coefficient is insignificant and hence un-tabulated.

This is followed by firms in Europe with the total environmental costs coefficient for time t-1 of −0.012.

We also use the median of FD Score for dividing our sample like Table 3.

When we include all the component total environmental cost items in the same regression, due to serious multicollinearity problem, the coefficients become unstable and insignificant.

References

Albinger, H. S., & Freeman, S. J. (2000). Corporate social performance and attractiveness as an employer to different job seeking populations. Journal of Business Ethics, 28(3), 243–253.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Bank of America. (2013). Leveraging our strengths and leading by example. Global impact: Environment sustainability. http://about.bankofamerica.com/en-us/global-impact/environmental-sustainability.html#fbid=ytz34Z8wJ3f.

Barclay, M. J., & Smith, C. (1995). The maturity structure of corporate debt. Journal of Finance, 50(2), 609–631.

Barnett, M. L., & Salomon, R. (2006). Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strategic Management Journal, 27(11), 1101–1156.

Bassen, A., Meyer, K., & Schlange, J. (2006, November). The influence of corporate responsibility on the cost of capital (Vol. 984406). Available at SSRN: http://ssrn.com/abstract.

Benson, B. W., & Davidson, W, I. I. I. (2009). Reexamining the managerial ownership effect on firm value. Journal of Corporate Finance, 15(5), 573–586.

Beurden, P. V., & Gossling, T. (2008). The worth of values—A literature review on the relation between corporate social and financial performance. Journal of Business Ethics, 82(2), 407–424.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Bolton, P., Scheinkman, J., & Xiong, W. (2006). Executive compensation and short-termist behavior in speculative markets. Review of Economic Studies, 73(3), 577–610.

Boyle, E. J., Higgins, M. M., & Rhee, S. G. (1997). Stock market reaction to ethical initiatives of defense contractors: Theory and evidence. Critical Perspectives on Accounting, 8(6), 541–561.

Brammer, S., Brooks, C., & Pavelin, S. (2006). Corporate social performance and stock return: UK Evidence from disaggregate measures. Financial Management, 35(3), 97–116.

Brickley, J. A., Smith, C. W, Jr, & Zimmerman, J. L. (2002). Business ethics and organizational architecture. Journal of Banking & Finance, 26(9), 1821–1835.

Cheng, B., Ioannou, I., & Serafeim, G. (2013). Corporate social responsibility and access to finance. Strategic Management Journal (forthcoming).

Cornett, M. M., & Tehranian, H. (1992). Changes in corporate performance associated with bank acquisitions. Journal of Financial Economics, 31(2), 211–234.

Cowton, C. J., & Thompson, P. (2000). Do codes make a difference? The case of bank lending and the environment. Journal of Business Ethics, 24(2), 165–178.

Crespo, A. H., & del Bosque, I. R. (2005). Influence of corporate social responsibility on loyalty and valuation of services. Journal of Business Ethics, 61(4), 369–385.

Creyer, E. H. (1997). The influence of firm behavior on purchase intention: Do consumers really care about business ethics? Journal of Consumer Marketing, 14(6), 421–432.

Dawkins, C., & Fraas, J. W. (2011). Coming clean: The impact of environmental performance and visibility on corporate climate change disclosure. Journal of Business Ethics, 100(2), 303–322.

De la Cuesta-González, M., Muñoz-Torres, M. J., & Fernández-Izquierdo, M. Á. (2006). Analysis of social performance in the Spanish financial industry through public data: A proposal. Journal of Business Ethics, 69(3), 289–304.

Derwall, J., Guenster, N., Bauer, R., & Koedijk, K. (2005). The eco-efficiency premium puzzle. Financial Analyst Journal, 61(2), 51–63.

Dhaliwal, D., Oliver, L., Tsang, A., & Yang, G. (2011). Voluntary nonfinancial disclosure and the cost of capital: The initiation of corporate social responsibility reporting. Accounting Review, 86(1), 59–100.

Dhaliwal, D., Radhakrishnan, S., Tsang, A., & Yang, G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility (CSR) disclosure. Accounting Review, 87(3), 723–759.

Eichenbaum, M. S., Hansen, L. P., & Singleton, K. J. (1988). A time series analysis of representative agent models of consumption and leisure choice under uncertainty. Quarterly Journal of Economics, 103(1), 51–78.

El Ghoul, S., Guedhami, O., Kwok, C. C., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388–2406.

Frederick, W. C. (1994). From CSR1 to CSR2 the maturing of business and society thought. Business and Society, 33(2), 150–164.

Freeman, R. E. (1984). Strategic management: A stakeholder approach (p. 46). Boston: Pitman.

Friedman, M. (1970). The social responsibility of business is to increase its profits. The New York times Magazine, September 13.

Green, J. (2010). World’s top 3000 companies created $2.2 trillion in environmental damage. New U.N. Report. http://dirt.asla.org/2010/02/24/new-u-n-report-worlds-top-3000-companies-created-2-2-trillion-in-environmental-damage/.

Greening, D. W., & Turban, D. B. (2000). Corporate social performance as a competitive advantage in attracting a quality workforce. Business and Society, 39(3), 254–280.

Griffin, J. J. (2000). Corporate social performance: Research directions for the 21st century. Business and Society, 39(4), 479–491.

Guenster, N., Derwall, J., Bauer, R., & Koedijk, K. (2006). The economic value of corporate eco-efficiency. Centre for Economic Policy Research (CEPR) Working Paper.

Hart, S. L., & Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Business Strategy and the Environment, 5(1), 30–37.

Heinkel, R., Kraus, A., & Zechner, J. (2001). The effect of green investment on corporate behavior. Journal of Financial and Quantitative Analysis, 36(4), 431–450.

International Institute for Sustainable Development. (2013). Sustainable banking: A global guide. http://www.iisd.org/business/banking/sus_banking.aspx.

Islam, Z., Ahmed, S., & Hasan, I. (2012). Corporate social responsibility and financial performance linkage: Evidence from the banking sector of Bangladesh. Journal of Organizational Management, 1(1), 14–21.

Jensen, M., & Meckling, W. (1976). Theory of firm: Managerial behavior, agency costs, and capital structure. Journal of Financial Economics, 3, 305–360.