Abstract

Using private benefits of control and earnings management data from 41 countries and regions, we provide strong evidence that cultures, together with legal rules and law enforcement, play a critical role in shaping corporate behavior. More specifically, we find that private benefits of control are larger and earnings management is more severe in collectivist as opposed to individualist cultures, consistent with the argument that agency problems between corporate insiders and outside investors are severe in collectivist culture. These results are robust to the inclusion of controls for country wealth, economic heterogeneity across countries, and international differences in ownership concentration.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

It is well-known that the social context (comprising legal rules, law enforcement, and cultures) in which a corporation operates may influence the ethical quality of its behavior. Although economic scholars have examined the role of legal institutions in corporate governance, with few notable exceptions they have largely failed to investigate the role of culture. Stulz and Williamson (2003) point out that differences in cultures cannot be ignored when examining why investor protection differs across countries. Licht et al. (2005) argue that grouping countries according to legal families provides only a partial depiction of the universe of corporate governance regimes. These studies indicate that a merely legal interpretation of responsibility and ethics often leads to systematic exploitation of the existing legal vacuum, prompting even immoral or illegal behaviors if the perceived risk is low. Motivated by the literature, this study investigates how cultures affect corporate insiders’ private benefits of control (PCB) and shape their financial reporting incentives.

Reforms in legal institutions have been undertaken for decades. For example, in reaction to a number of major corporate and accounting scandals, including those affecting Enron, Tyco International, Adelphia, Peregrine Systems and WorldCom, the U.S. Congress passed the Sarbanes–Oxley (SOX) Act in 2002. The SOX Act created new standards for corporate accountability and new penalties for acts of wrongdoing. It specifies new financial reporting responsibilities, including adherence to new internal controls and procedures designed to insure the validity of their financial records. However, despite the enforced independence of compensation committees and greater disclosure of managers’ earnings, the salaries of chief executives continue to soar in the U.S. and elsewhere. Companies continue to restate financial results at a prodigious rate, and balance sheet and income statement surprises persist even though the SOX Act has tightened the rules for investor protection. These phenomena indicate that conformity with legal rules and procedures is insufficient to prevent a company’s financial and managerial scandals; thus moral hazard has received increasing attention since the recent financial crisis.

This study explores the role cultures play in corporate governance. Specifically, we focus on the individualism-versus-collectivism (I/C) dimension of cultures, which has proven to be a concise, coherent, integrated, and empirically testable dimension of cultural variation. Furthermore, it is linked to both moral judgment and moral behavior. Individualism pertains to societies in which the ties between individuals are loose; everyone is expected to look after himself or herself and his or her immediate family. As its opposite, collectivism stands for societies in which people are integrated into strong, cohesive in-groups from birth that continue to protect them in exchange for unquestioning loyalty (Hofstede 1980). Individualist cultures evaluate morality in terms of concepts of rights and fairness based on judgments and equality, merit and equity (Colby and Kohlberg 1987), while collectivist cultures are based on relationships (Husted and Allen 2008). In terms of behavior, people in individualist cultures are more likely to behave in accordance with judgments formulated as a result of moral reasoning than their collectivist counterparts (Husted and Allen 2008). Based on these theories, we assume that compared with individualist cultures, managers in collectivist cultures are relatively less likely to follow social norms such as honesty, integrity, and law obedience. When there is a conflict of interest between corporate insiders (the in-group) and outside investors (the out-group), managers may prefer corporate insider interests, resulting in higher agency costs in collectivist cultures. Using PCB data from Dyck and Zingales (2004) and earnings management (EM) data from Leuz et al. (2003), we find that PCB are larger and EM is more severe in collectivist cultures, supporting our conjecture.

This study contributes to the literature on the role of cultures in corporate governance (Stulz and Williamson 2003; Licht et al. 2005, 2007). Prior studies indicate that cultures affect corporate governance through legal institutions, i.e., cultures play an indirect role in corporate governance. We extend this literature by examining the relationship between the I/C dimension and PCB and EM after controlling for legal environments. Our results suggest that cultures play a critical and direct role in addition to legal environments in corporate governance.

Our work also adds to the growing literature on the role of social networks in shaping director monitory effectiveness (Hwang and Kim 2009; Barnea and Guedj 2009). Prior studies suggest that social networks mitigate directors’ monitory efficiency. Because I/C is more fundamental and the strength of social networks seems to be affected by the I/C dimension, this study explores the effect of the I/C dimension on the PCB and earnings quality. Our results suggest that a country’s perception of relationships among its people influences the degree of PCB and hence managers’ incentives for financial reporting.

In addition, this study provides implications for international investors, auditors, and financial analysts. The findings suggest that cultures, especially their I/C dimension, shape corporate insiders’ incentives in financial reporting. Market participants, especially international participants, need to be aware of the effects of cultures on accounting numbers.

The remainder of this paper is organized as follows. Section 2 discusses how the I/C dimension of cultures relates to PCB and EM. In Sect. 3, we describe the sample and provide descriptive statistics. Empirical tests and results are presented in Sect. 4. Section 5 concludes the paper.

Theoretical Framework

The I/C dimension is actually a complex of attributes that differentiates cultures. It describes the prevailing relationship between the individual and the collective in a given society. It is not only a matter of how people live together but is also intimately linked with societal norms (in the sense of value systems of major groups of the population). Since Hofstede’s seminal work, I/C has been viewed as a key dimension of national cultures.

The Differences Between Individualist and Collectivist Cultures

According to Hofstede (1980, 2001), the features of individualist and collectivist cultures are summarized as follows.

People in individualist societies look after themselves and their immediate nuclear families. A person’s identity is determined on an individual basis. Speaking one’s mind is respected. Education is aimed at learning to learn, and academic and professional diplomas increase self-respect and potential economic worth. In such societies, individuals are assumed to be rational and able to use reason to make personal choices; as such, they should each be given the right to choose freely and define their own goals. At the interpersonal level, individuals are considered to be discrete, autonomous, self-sufficient, and respectful of the rights of others. From a societal point of view, individuals are considered abstract and universal entities. Their status and roles are not predetermined or ascribed, but defined by their achievements (e.g., educational, occupational, and economic status). They interact with others utilizing rational principles such as equality, equity, non-interference, and detachability. Individuals with similar goals are brought together into groups. Laws, rules, and regulations are institutionalized to protect individual rights, with everyone being able to assert his or her rights through informal or formal channels (such as the legal system). As a result, people in individualist cultures are likely to comply with the legal rules.

In contrast, people in collectivist societies are born into and protected by extended families with which they exchange loyalty. One’s identity is based on his or her belongingness to a social group or network. Children are taught to think in terms of “we” rather than “I.” Rather than speak one’s mind, harmony should be maintained and direct confrontation should be avoided. The purpose of education is to learn how to do, and diplomas provide an entry into groups of higher status. Collectivism represents a modification of an ascribed, communal, and traditional social order. For example, in East Asian societies, Confucianism has provided a moral and philosophical basis for self-construal and social order. Collectivist societies that support the basic tenets of Confucianism prioritize the common good and social harmony over individual interests. All individuals are assumed to be linked in a web of inter-relatedness and embedded and situated in particular roles and statuses. They are bound by relationships that emphasize common fate. Individuals are encouraged to put the group’s interests before their own. From a societal point of view, duties and obligations are prescribed by roles, and individuals lose face if they fail to fulfill these duties and obligations. Concession and compromise are essential ingredients in promoting role-based and virtue-based conceptions of justice. Social order is maintained when everyone fulfills his or her roles and duties. Institutions are seen as an extension of the family, and paternalism and legal moralism (i.e., moral values institutionalized in legal codes) reign supreme. To promote collective welfare and social harmony, individuals are encouraged to suppress any individualist and hedonistic desires. As a result, people in collectivist societies are likely to be loyal to the groups they belong to.

The I/C Dimension, Moral Judgment, and Moral Behavior

Moral Judgment

Moral judgment is “a mode of prescriptive valuing of the obligatory or right” (Colby and Kohlberg 1987). Thus, it deals with duties and responsibilities rather than personal preferences. The relationship between the individual and the collective in human society is intimately linked with societal norms. Hence, it affects both people’s mental programing and the function of family, educational, religious, political, and utilitarian institutions. Because they are tied to value systems shared by the majority, I/C issues carry strong moral implications. In collectivist cultures, people are more likely to define themselves in terms of group membership and place great value on their group’s welfare (Triandis 1995). In contrast, in individualist cultures, people are more likely to perceive themselves as autonomous and place a higher value on their individual interests. Hence, while duty, hierarchy, and interdependency are at the crux of what is moral in collectivist cultures, harm, and rights form the basis of an individualist moral domain (Shweder 1990). In collectivist cultures, non-life-threatening violations of social responsibilities are likely to be viewed in moral terms, whereas in individualist cultures they are viewed as matters of personal choice (Miller et al. 1990). Thus, individualist cultures evaluate morality in terms of concepts of rights and fairness based on judgments and equality, merit and equity (Colby and Kohlberg 1987), while collectivist cultures base them on relationships (Husted and Allen 2008).

Moral Behavior

Moral behavior and moral motivation often appear disconnected from explicit moral reasoning processes (Bergman 2004; Blasi 1999, 2004). After a person makes a judgment about whether a particular action is ethical, he or she engages in behavior that may or may not be consistent with his or her judgment. Reviews of the literature indicate that I/C moderates the relationship between moral reasoning and behavior (Trevino 1986). In individualist cultures, personal beliefs are more important in decision-making than group norms (Iwao and Triandis 1993); while in collectivist cultures, people may hold personal beliefs (private self) that differ significantly from the group norm (public self), but will behave in accordance with the group norm (Triandis 1995; Chen et al. 1998). In addition, they tend to accept the discrepancy between their public and private selves (Iwao and Triandis 1993). In individualist cultures, people are likely to view this difference as hypocritical and try to reduce such discrepancies. As a result, there tends to be greater consistency between personal attitudes and behavior in individualist rather than collectivist cultures (Kashima et al. 1992; Volkema 1998). Cultural psychologists argue that the trait-related behavioral consistency is greater in individualist than collectivist cultures because behavior in collectivist cultures is more strongly influenced by contextual factors (Heine 2001; Markus and Kitayama 1998; Triandis 1995). Furthermore, Church et al. (2006) document that people in individualist cultures report less self-monitoringFootnote 1 of their own behavior, while people in collectivist cultures, whose behavior is more contextual or adaptive to situational cues, report greater self-monitoring. Thus, in individualist cultures people are more likely to behave in accordance with judgments formulated as a result of moral reasoning than their collectivist counterparts (Husted and Allen 2008).

In addition, social network theory suggests that beyond the dichotomic view of the individual, organizational, and societal aspects behind ethical decision-making there is “an important additional consideration: relationships among actors” (Brass et al. 1998). By interacting with these aspects, interpersonal relationships influence the behavior of actors within organizations. Brass et al. (1998) examine how different types and structures of relationships lead to network effects and how these effects influence organizational integrity. They conclude that strong relationships between organizational actors may outweigh the impact of personal and contextual aspects of organizational integrity. In a network of strong ties, an individual might, for instance, act against his or her convictions.

I/C Culture, Agency Costs, Private Benefits of Control, and Earnings Management

Prior studies suggest that cultures play an important role in investor protection around the world (Stulz and Williamson 2003) and that investor legal rights are stronger in individualist societies (Licht et al. 2005, 2007). However, it also indicates that cultures affect corporate governance through legal system channels. Furthermore, Dyck and Zingales (2004) provide weak evidence that PCB are large in countries with high moral norms (proxied by violent crime rate). Haw et al. (2004) find that extra-legal institutions, such as diffusion of the press, shape accounting numbers. These studies indicate that some factors beyond legal environments matter in corporate governance.

Jackson (2007) states that people in individualist cultures are more likely to adhere to a universal application of rules and laws, while those in collectivist cultures are more likely to apply rules according to the relationships they have with the persons with whom they are dealing. As such, this dimension may be a possible predictor of adherence to corporate policy on ethical behavior.

Managers in individualist cultures make moral judgments based on justice and fairness. They are likely to comply with legal rules and behavior in accordance with their moral reasoning. In contrast, in collectivist cultures, collective interests prevail over the individual interests of group members (Hofstede 2001). Reinforcement of group interests and alignment of individual interests within a group are inherently greater in these societies. People exhibit a stronger preference for cooperative strategies (Steensma et al. 2000); hence, collectivist cultures may facilitate corporate insider trading. As managers treat in-group members (insiders) differently than out-group members (outside investors), the agency costs between corporate insiders and outside investors are significant in collectivist cultures. Thus, corporate insiders in these societies enjoy a large amount of PCB (e.g., Zingales 1994; Shleifer and Vishny 1997). Managers and controlling shareholders tend to manage reported earnings to mask true firm performance and conceal their private benefits from outsiders. This argument is consistent with the conclusion that accountants from collectivist cultures agree more with questionable behavior choices (Smith and Hume 2005).

Data and Descriptive Statistics

Data Collection

The data on individualism/collectivism are taken from Hofstede (1980, 2001). To facilitate interpretation, the Hofstede individualism index is subtracted from 100; hence, in the transformed I/C index (H-I/C), a higher score represents more collectivism. Although Hofstede’s I/C index has been used very often in the literature, some researchers have questioned its reliability and validity. Because of this, we use an alternative I/C index from the GLOBE research project (G-I/C), as GLOBE asserts that its I/C index tries to overcome Hofstede’s weaknesses. The PCB measure is taken from Dyck and Zingales (2004), while the EM data are taken from Leuz et al. (2003). PCB are measured at the country level using the median block premiumFootnote 2 estimated by Dyck and Zingales (2004) based on transfers of controlling blocks of shares. The EM index is constructed for each country based on four sub-indices: (1) smoothing reported operating earnings using accruals; (2) smoothing and the correlation between changes in accounting accruals and operating cash flows; (3) discretion in reported earnings: the magnitude of accruals; and (4) discretion in reported earnings: small loss avoidance. For each of these four EM measures, countries are ranked with a higher score representing a higher level of EM. The aggregate EM score is computed by averaging the country rankings for the four individual EM measures. The PCB and EM measures are country-level indices. We select country-level measurements because Hofstede (1980) suggests that when they provide a basis for data (e.g., GNP), cross-culture comparisons are valid, whereas when data are based on individual-level measurements (e.g., values, attitude), researchers should limit their interpretations to within-culture analysis. The sample includes 41 countries and regions around the world. We use revised anti-director rights (ADR) and anti-self-dealing (ASD) from Djankov et al. (2008) to proxy for investor protection rules, and efficiency of judicial system (EJS) and rule of law (RoL) from La Porta et al. (1998) to proxy for law enforcement. The primary religion data are obtained from Stulz and Williamson (2003), referring to the religion practiced by the largest fraction of a country’s population. Other data including ownership concentration (Owner) and GNP per capita (GNPP) are taken from La Porta et al. (1998).

Descriptive Statistics

Table 1 reports the cross-country differences in culture orientations, legal systems, PCB, and EM. The H-I/C index ranges from individualism (0) to collectivism (100). The U.S. is the lowest (9), Peru scores the highest (89) and India performs in the middle (52). Table 1 shows that large variations exist in the measures of cultures, legal rules, and law enforcement across countries.

Table 2 presents correlations among culture and legal measures. It shows that the correlation coefficient between PCB and the H-I/C index is 0.195, while the correlation coefficient between EM and the H-I/C index is 0.552, significant at 1 % level, which is consistent with our hypothesis that PCB and EM are positively related to the I/C index. The correlation coefficient between PCB (EM) and the G-I/C index shows a similar pattern. Table 2 also shows that the correlation coefficient between the I/C indices and law enforcement (EJS and RoL) are high (−0.581 for H-I/C and EJS; −0.587 for H-I/C and RoL; −0.682 for G-I/C and EJS; and −0.715 for G-I/C and RoL) and significant at the 1 % level, suggesting that the I/C indices and law enforcement measures are highly correlated. Furthermore, owner is positively related to the two I/C indices, indicating that ownership is highly concentrated in collectivist as opposed to individualist cultures.

Empirical Results

The Relationship Between Private Benefits of Control (Earnings Management) and the I/C Index

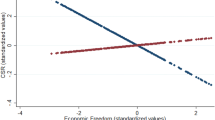

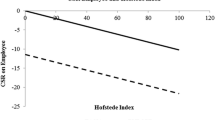

As mentioned previously, corporate behavior is influenced by the social context (comprising legal rules, law enforcement, and culture) in which it operates. This section examines the relation between PCB (EM) and I/C culture after controlling for the effects of legal environments. As discussed earlier, we hypothesize that the PCB are larger and EM is more severe in collectivist culture. Because I/C culture and law enforcement are complementary (for example, law enforcement is generally strong in individualist culture), we orthogonalize the I/C indices and law enforcement variables using the Modified Gram-Schmidt methodFootnote 3 to isolate the effect of I/C culture from law enforcement.

Column 1 of Table 3 shows the relationship between PCB and the H-I/C index after controlling for legal rules and law enforcement. The coefficient on the H-I/C index is 0.031 (significant at 1 % level), consistent with our conjecture. In the meantime, the coefficients on the legal variables are significantly negative, which is consistent with Dyck and Zingales (2004). Moreover, the R 2 is 36.3 %, suggesting that the social context, including cultures, legal rules, and law enforcement, explains a substantial portion of the variation in PCB. These results indicate that cultures together with legal rules and law enforcement play critical roles in curbing corporate insider incentives for PCB.

As the PCB are large in collectivist culture, corporate insiders tend to conceal these benefits through EM. Column 2 of Table 3 reports the relationship between EM and social context. The coefficient on the H-I/C index is 5.005 (significant at 1 % level), suggesting that EM is more severe in collectivist as opposed to individualist culture. Moreover, the coefficients on the legal variables are significantly negative, supporting the results of Leuz et al. (2003). The R 2 is 58.3 %, indicating that the social context explains a large portion of the variation in EM. Importantly, the inclusion of the I/C index increases the R 2 from 39 % [in Leuz et al. (2003)] to 58.3 %. These results suggest that cultures, legal rules, and law enforcement play complementary roles in shaping corporate insiders’ reporting incentives.

Robustness Checks

GNP Per Capita and Ownership Concentration

Prior work shows that per capita GNP explains differences in financing, ownership, and payout policy across countries. In addition, Dyck and Zingales (2004) and Leuz et al. (2003) document that Owner matters. Hence, we re-estimate our primary regressions using GNPPin US$ in 1994 and Owner constructed by La Porta et al. (1998) as additional explanatory variables. The results are reported in columns 1, 2, 7, and 8 of Table 4, respectively. The coefficients on the I/C index remain unchanged.

Other Culture Dimensions

Our second concern is that national cultures have different dimensions that might correlate with each other. The effects of I/C on PCB and EM may be a reflection of the effects of other dimensions. Hence, we re-estimate our main regressions using power distance, uncertainty avoidance and religion as additional variables. Power distance and uncertainty avoidance are collected from Hofstede (1980, 2001), while the religion measures (Protestant and Catholic) are obtained from Stulz and Williamson (2003). The results are reported in Columns 3, 4, 5, 9, 10, and 11 of Table 4, respectively. The coefficients on the I/C index remain consistent.

Finally, we incorporate all the controlling variables into the regressions simultaneously. The results are shown in columns 6 and 12 of Table 4. The coefficients on the I/C index remain significantly positive.

Using Alternative Institutional Factors

Our third concern is whether our results are robust when other institutional factors are used as proxies for legal environment. To confirm this, we use ASD as a proxy for legal rules and RoL for law enforcement. The regression results are presented in columns 1, 2, 5, and 6 of Table 5. Not surprisingly, our results remain consistent with previous results.

Using an Alternative I/C Index

Our fourth concern is the validity of Hofstede’s I/C index. To insure this validity, we re-estimate the regressions using the I/C index constructed by Gelfand et al. (2004) in the GLOBE project. The results are reported in columns 3 and 7 of Table 5. The coefficients on the G-I/C index are consistent with those using Hofstede’s I/C index.

Causality Checks

Our final concern is the reverse causality between PCB, EM, and I/C culture. Given our research setup, we believe that reverse causality is highly unlikely. First, while Hofstede collected the I/C data mostly between 1968 and 1973, the private benefits of control data are estimated on control transactions from 1990 to 2000 and earnings management data from 1990 to 1999. This large time lag decreases the probability that causality goes from PCB or EM to the I/C index. Second, several scholars (Hofstede 2001; Licht et al. 2005) underpin the long-term persistence of national culture fundamentals.

Nevertheless, performing an instrumental variable analysis establishes an exogenous source of variation in culture and deals with potential causality and measurement errors. Following Kwok and Tadesse (2006), the continent of each country is used as an instrument for I/C culture. The two-stage least squares (2SLS) estimation results are reported in columns 4 and 8 of Table 5. The coefficient on the H-I/C index for EM is significant, consistent with the previous results. However, while the coefficient on the H-I/C index for PCB is positive, it is not significant. There are two plausible reasons for this problem: either there are measurement errors in PCB because the private benefits are unobservable, or finding valid instruments for the I/C index presents too big a challenge.

Conclusions

This paper examines how PCB and reported accounting numbers are shaped by I/C culture across 41 countries and regions. Our main objective is to gain deeper understanding into the nature of financial reporting incentives created by an economy’s cultural context. The underlying premise of our analysis is that I/C culture influences both the moral judgment and moral behavior of corporate insiders, hence corporate governance.

Consistent with this hypothesis, the regression results show that both PCB and EM are positively associated with the degree of collectivism and negatively with investor protection. These findings highlight an important link between I/C culture and agency costs.

Our findings are robust enough to include controls for investor protection, country wealth, and economic heterogeneity across countries as well as international differences in Owner. However, because I/C culture dimensions are often complementary with these factors, it is difficult to fully control for the potential impact of other factors and to disentangle them from the direct effect of I/C. Moreover, the existence of complementarities raises concerns about endogeneity bias. Although we have addressed this concern with a 2SLS estimation, we acknowledge that other endogenous interactions may still exist.

Notes

Snyder (1974) delineated five components of self-monitoring: (a) concern for appropriateness of social behavior; (b) attention to social comparison information; (c) ability to modify self-presentation; (d) use of this ability in particular situations; and (e) cross-situational variability of social behavior. Snyder (1974) proposes that high-self-monitoring individuals, due to their concern about the situational appropriateness of their behavior, are relatively trait free and show cross-situational variability in their behavior. In contrast, low-self-monitoring individuals, because they are less sensitive to situational cues and more guided by internal dispositions, are relatively trait-related in their behavior and show greater behavioral consistency across trait-relevant situations.

Analysis is also conducted using the mean block premium estimated by Dyck and Zingales (2004) and consistent results are obtained.

The modified Gram–Schmidt process is a method for orthonormalizing a set of vectors in a Euclidean space. This method is used to decompose a matrix into an orthogonal and triangular matrix. In this study, because I/C index and law enforcement variables are highly collinear, to separate the effect of culture on private benefits of control and earnings management, we decompose the I/C index into two components using the modified Gram-Schmidt method: one component is perfectly collinear with and another is orthogonal to law enforcement. The orthogonal component is used in our analyses to represent the separate effect of the I/C dimension of cultures.

References

Barnea, A., & Guedj, I. (2009). Director networks. Working paper.

Bergman, R. (2004). Identity as motivation: Toward a theory of the moral self. In D. K. Lapsley & D. Narvaez (Eds.), Moral development, self and identity (pp. 21–46). Mahwah: Lawrence Erlbaum.

Blasi, A. (1999). Emotions and moral motivation. Journal for the Theory of Social Behavior, 29, 1–19.

Blasi, A. (2004). Moral functioning: Moral understanding and personality. In D. K. Lapsley & D. Narvaez (Eds.), Moral development, self and identity (pp. 335–348). Mahwah: Lawrence Erlbaum.

Brass, D. J., Butterfeild, K. D., & Skaggs, B. C. (1998). Relationships and unethical behavior: A social network perspective. Academy of Management Review, 23, 14–31.

Chen, C. C., Chen, X. P., & Meindl, J. R. (1998). How can cooperation be fostered? The cultural effects of individualism. Academy of Management Review, 23, 285–304.

Church, A. T., Katigbak, M. S., Prado, A. M. D., Ortiz, F. A., Mastor, K. A., Harumi, Y., et al. (2006). Implicit theories and self-perceptions of traitedness across cultures. Journal of Cross-Cultural Psychology, 37, 694–716.

Colby, A., & Kohlberg, L. (1987). The measurement of moral judgment. Cambridge: Cambridge University Press.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2008). The law and economics of self-dealing. Journal of Financial Economics, 88, 430–465.

Dyck, A., & Zingales, L. (2004). Private benefits of control: An international comparison. The Journal of Finance, 59, 537–600.

Gelfand, M. J., Bhawuk, D. P. S., Nishii, L. H., & Bechtold, D. J. (2004). Culture, leadership, and organizations: The GLOBE study 62 societies. In R. J. House, et al. (Eds.), Individualism and collectivism. Thousand Oaks: Sage.

Haw, I. M., Hu, B., & Hwang, L. S. (2004). Ultimate ownership, income management, and legal and extra-legal institutions. Journal of Accounting Research, 20, 55–86.

Heine, S. J. (2001). Self as culture product: An examination of East Asian and North American selves. Journal of Personality, 69, 881–906.

Hofstede, G. (1980). Culture’s consequences: International differences in work-related values. Beverly Hills: Sage Publications.

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions, and organizations across nations (2nd ed.). Beverly Hills: Sage Publications.

Husted, B. W., & Allen, D. B. (2008). Toward a model of cross-cultural business ethics: The impact of individualism and collectivism on the ethical decision-making process. Journal of Business Ethics, 82, 293–305.

Hwang, B. H., & Kim, S. (2009). It pays to have friends. Journal of Financial Economics, 93, 138–158.

Iwao, S., & Triandis, H. C. (1993). Validity of auto- and heterostereotypes among Japanese and American studies. Journal of Cross-Cultural Psychology, 24, 428–444.

Jackson, T. (2007). Cross-culture sensitivities in developing corporate ethical strategies and practices. In W Ch. Zimmerli, et al. (Eds.), Corporate ethics and corporate governance. New York: Springer.

Kashima, Y., Siegel, M., Tanaka, K., & Kashima, E. S. (1992). Do people believe behaviors are consistent with attitudes? Toward a cultural psychology of attribution processes. British Journal of Social Psychology, 331, 111–124.

Kwok, C. C., & Tadesse, S. (2006). National culture and financial systems. Journal of International Business Studies, 37, 227–247.

La Porta, R., Lopez de Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of Political Economy, 106, 1113–1155.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69, 505–527.

Licht, A. N., Goldschmidt, C., & Schwartz, S. H. (2005). Culture, law, and corporate governance. International Review of Law and Economics, 25, 229–255.

Licht, A. N., Goldschmidt, C., & Schwartz, S. H. (2007). Culture rules: The foundations of the rule of law and other norms of governance. Journal of Comparative Economics, 35, 659–688.

Markus, H. R., & Kitayama, S. (1998). The cultural psychology of personality. Journal of Cross-Cultural Psychology, 29, 63–87.

Miller, J. G., Bersoff, D. M., & Harwood, R. L. (1990). Perceptions of social responsibility in India and in the United States: Moral imperatives or personal decisions? Journal of Personality and Social Psychology, 58, 33–47.

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. The Journal of Finance, 52, 737–783.

Shweder, R. A. (1990). In defense of moral realism: Reply to Gabennesch. Child Development, 61, 2060–2067.

Smith, A., & Hume, E. C. (2005). Linking culture and ethics: A comparison of accountants’ ethical belief systems in the individualism/collectivism and power distance contexts. Journal of Business Ethics, 62, 209–220.

Snyder, M. (1974). Self-monitoring of expressive behavior. Journal of Personality and Social Psychology, 30, 526–537.

Steensma, H. K., Marino, L., & Weaver, K. M. (2000). Attitudes toward cooperative strategies: A cross-cultural analysis of entrepreneurs. Journal of International Business Studies, 31, 591–609.

Stulz, R. M., & Williamson, R. (2003). Culture, openness, and finance. Journal of Financial Economics, 70, 313–349.

Trevino, L. K. (1986). Ethical decision making in organizations: A person situation interactionist model. Academy of Management Review, 11, 601–617.

Triandis, H. C. (1995). Individualism and collectivism. Boulder: Westview.

Volkema, R. J. (1998). A comparison of perceptions of ethical negation behavior in Mexico and the United States. International Journal of Conflict Management, 9, 218–233.

Zingales, L. (1994). The value of voting rights: A study of the Milan stock exchange experience. Review of Financial Studies, 7, 125–148.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhang, X., Liang, X. & Sun, H. Individualism–Collectivism, Private Benefits of Control, and Earnings Management: A Cross-Culture Comparison. J Bus Ethics 114, 655–664 (2013). https://doi.org/10.1007/s10551-013-1711-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-013-1711-5