Abstract

In this article, we studied the Corporate Sustainability Index (ISE) of the Brazilian Mercantile, Futures and Stock Exchange (BM&FBOVESPA), with the main objective of analyzing the performance of sustainable investments in the Brazilian stock market, during the period from December 2005 to December 2010. To achieve this aim, we characterized ISE portfolios and we compared its performance with the IBOVESPA (representing the market portfolio) and other BM&FBOVESPA sectoral indices. In the performance comparison, we used level of liquidity, return and risk indicators, as well as the following measures: Sharpe, Treynor, Sortino, and Omega. Our results show that although sustainable investments have presented some interesting characteristics, such as increasing liquidity and low diversifiable risk, they did not achieve satisfactory financial performance in the analysis period. This indicates that the constraints imposed by this type of investment in capital allocation in Brazil may be harming their return and risk attractiveness.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Sustainability is increasingly evident in the capital markets and has had consequences for investment activities and the missions of the global stock exchanges. The most important consequence of the inclusion of sustainability in capital markets was the creation of a new type of investment—the sustainable investment (SI)—which primarily aims at including environmental, social, and corporate governance (ESG) factors in traditional investment activities.

With the objective of stimulating this investment approach, in 2006, the United Nations established the Principles for Responsible Investment Initiative (PRI), which consists of an international network that puts into practice six basic ESG principles. These principles reflect the view that ESG factors may affect the performance of investments and, therefore, that they should be taken into account by all investors.

In addition, because of the evolution of SIs, financial reports have undergone an integration process, as it began to be necessary to incorporate new, relevant, non-financial information so that investors could check the real performance and risk of companies. In this context, thousands of companies have already adhered to initiatives such as the Global Reporting Initiative (GRI), the Carbon Disclosure Project (CDP), and the Greenhouse Gas Protocol Initiative (GHG Protocol).

According to the WFE (2010), stock exchanges worldwide have become increasingly active regarding sustainability-oriented issues. In this context, several things stand out most: initiatives regarding the incentive to have high standards of sustainability among listed companies, the promotion of products and services to sustainable investors, and the development of specific markets for SIs niches.

As for the incentive to have high standards of sustainability, stock exchanges have been encouraging companies to disclose their ESG performance and have been enhancing stricter listing rules regarding ESG issues. In relation to sustainable products and services, there has been a growing release of stock indices of companies selected on the basis of their ESG performances. Regarding the development of specific markets for SIs niches, greater attention to issues related to climate change is currently observed. The global commitment to mitigating climate change, for example, has resulted in the implementation of control systems for greenhouse gas emissions, thus introducing specific carbon markets to stock exchanges.

In past years, sustainability issues have become important in emerging markets. For instance, although Brazil is the seventh largest world economy (World Bank 2011), it still faces great ESG challenges. On social-environmental aspects, the country has very unsatisfactory levels of income distribution, access to basic utilities, and greenhouse gas emissions (CIA 2011; UNDP 2011; McKinsey and Company 2009). For corporate governance, although the field has improved significantly in past years, the country still has issues that need to be addressed to continue this progress (IBGC 2010). Therefore, in Brazil, the expansion of SIs in its stock market may contribute significantly to improve this ESG situation. This improvement is normally induced by the investors that practice SI and that demand high ESG performance of the invested companies.

However, given that the aim of investors is to maximize their wealth, they will not feel motivated to perform SIs if there is no evidence that such applications will bring satisfactory returns for their assumed risk. Therefore, the research question relies on whether SIs are actually attractive applications in the Brazilian stock market.

Considering these arguments, the main objective of our work is to analyze the historical performance of SIs in the Brazilian stock market. To do so, we characterize the portfolios of the Corporate Sustainability Index (ISE) of the Brazilian Mercantile, Futures and Stock Exchange (BM&FBOVESPA) and compare its performance against the benchmark and against other sectoral indices. The ISE is regarded as the most important BM&FBOVESPA index that represents a portfolio constructed on the basis of sustainability guidelines.

The importance of this work is its ability to support governmental and academic sectors, companies, investors, and other players interested in the disclosure of SIs results in the Brazilian stock market, thus stimulating its transparency and development. Our results also hold particular importance for companies who can benefit from the analysis to determine whether or not they will submit to this type of index.

This article is divided into six sections. The first section approaches the sustainability scenario in the capital markets, the problem situation, the research question, and the main objective of our work. The second section explains the main concepts. The third section reports a literature review. The fourth section describes our research methodology. The fifth section presents and discusses the results. Finally, the sixth section summarizes the main results and conclusions of the study and proposes topics for future papers.

Concepts

Sustainable Investment

The term sustainable became globally known in 1987 after the introduction of the concept of sustainable development in the Brundtland report of the United Nations World Commission on Environment and Development (WCED). Based on this document, sustainable development meets the needs of the present without compromising the ability of future generations to meet their own needs (Brundtland 1987).

Sustainable investing, in turn, is a concept in evolution and can be defined as a process that integrates ESG factors into investment analysis, stock selection, and active ownership practices, into the belief that these factors can improve long-term risk management and, therefore, that they may increase the investments’ expected returns (IFC 2011a). According to the IFC (2011b), companies with good ESG performances may benefit by reducing their costs and risks, strengthening their brands, and improving their growth, thus providing added value to their investors.

However, there are several other concepts similar to SI, such as socially responsible investment, ethical investment, impact investment, and green investment. Although they use different expressions, all these concepts share concerns about incorporating ESG factors into investment analysis and management. Because the term sustainable comprises, in a broader sense, issues related to ESG factors, we use SI terminology in this article.

Strategies

According to the US SIF (2010), there are three main SI strategies: ESG incorporation, shareholder advocacy, and community investing. Table 1 briefly describes these strategies.

The ESG incorporation strategy comprises three main sub-strategies. Negative screening excludes stocks of companies which the main source of income is related to sale of goods and services that generate negative externalities to society (“sin” stocks). Positive screening selects stocks of companies that have the best ESG performance based on pre-selected criteria (this sub-strategy includes the best-in-class approach, which aims to select stocks of companies with the best ESG performance in each economic sector). ESG integration explicitly includes ESG risks and opportunities in traditional financial analysis.

The three main SI strategies are non-excludable and may be used in a supplemental manner.

Evolution

According to the US SIF (2010), the first signs of the use of SI strategies occurred centuries ago and originated with religious investors, who predominantly used negative screening strategies in the capital allocation process. In the beginning of the twentieth century, it was possible to observe the establishment of the first SI mutual funds, still strongly based on negative screening strategies. From the 1970s on, SI strategies became more active. Sustainable shareholders and investors began to adopt negative screening strategies on a smaller scale, acting more actively regarding the ESG issues of invested companies and considering several sustainability dimensions in investment analysis.

However, in the last few decades, there has been an improvement in the discussion of SI, and such concepts have been substantially consolidated. This development may be corroborated by the growing establishment of local and regional organizations that promote such types of investments. Table 2 lists these main organizations, indicating their acronyms, countries/regions of origin, and years of establishment.

Table 3 shows the resources allocated to SI worldwide. Although the data were obtained in different periods and the methodologies of the respective survey reports are still under consolidation processes, the volume of SI worldwide is notable. There is also great potential for growth, mainly in emerging markets.

Sustainability Indices in the Stock Market

According to the IFC (2011b), the sustainability indices in the stock market have the objective of representing a portfolio of shares from local, regional, or multinational companies selected on the basis of ESG factors, and thus in compliance with SI strategies (notably ESG incorporation). The organizations that provide these indices are mostly stock exchanges, private companies that offer financial services and, on rare occasions, non-governmental organizations specializing in sustainability.

When stock exchanges launch such indices, they mainly aim at promoting sustainability in corporate strategies, and they stimulate the disclosure of companies’ ESG performance. Private companies, in turn, launch these indices to provide investment solutions to their clients because they provide input to the development of SI products, such as mutual funds and exchange-traded funds. Other important players in the implementation of these indices are organizations specializing in sustainability-oriented issues, which provide indicators and data analysis methodologies to verify companies’ ESG performances.

Sustainability indices typically use the three main SI factors (environmental, social, and corporate governance) to assess companies’ performances. However, some indices use only one or two factors. Moreover, some relevant issues derived from a specific ESG factor may be regarded as different factors. For example, in the case of climate change, because of its substantial relevance to global sustainability, it has been separated from the environmental factor.

These ESG factors are broken down into assessment metrics that define, in a more accurate manner, the ESG issues upon which the indices will be based. For instance, within the environmental factor context, potential assessment metrics would include the management of solid waste, the management of water resources, and energy efficiency.

Assessment metrics are broken down into indicators, the aim of which is to quantify the ESG performance of the assessed companies, rank them, and indicate whether the companies stay or are excluded from the index.

According to the WFE (2010), the two main sustainability index categories are the following:

-

(i)

broad-based—these indices select stocks of companies that have the best ESG performance, without sectoral constraints; and

-

(ii)

sector-specific—these indices select stocks of companies that have the best ESG performance and that offer solutions to the main ESG challenges, such as those challenges related to clean technologies, clean energy, and environmental services.

The first sustainability index in the world—the Domini 400 Social Index (DSI)—was launched in 1990 and is currently known as the MSCI KLD 400 Social Index. Over the last decade, several sustainability indices were launched, with the Dow Jones Sustainability Index (DJSI) series (in 1999) and the FTSE4Good Index series (in 2001) being the most prominent. In emerging markets, the first launched index was the Johannesburg Stock Exchange Socially Responsible Investment Index (JSE SRII, in 2004). The second was the Corporate Sustainability Index (ISE, in 2005).

Although sustainability indices are more common in developed countries, the establishment of such indices in emerging markets has grown significantly in recent years (IFC 2011b).

The ISE was launched in December 2005 by means of financial and technical support from the World Bank’s International Finance Corporation (IFC), and its main objective is to be a broad-based, voluntary adhesion index that reflects the return of a portfolio composed of stocks of a maximum of 40 companies selected on the basis of sustainability guidelines.

To participate in the ISE, the stock of a prospective company must belong to the group of the 200 most-traded stocks in the BM&FBOVESPA and have been traded in at least 50 % of the trading sessions occurring during the 12 months before the beginning of the reassessment process of the portfolio. In addition, the company must not be under a regime of court-supervised reorganization, in bankruptcy proceedings, in a special situation, or even have suffered or been under a long period of suspended negotiation.

The ESG performance of prospective companies is assessed using a specific questionnaire developed by the Getúlio Vargas Foundation Center for Sustainability Studies (GVces),Footnote 1 which is constantly upgraded. The information provided in the questionnaire is supported by official documentation and is checked by the GVces before defining the portfolio of the index. The evaluation is based on seven basic factors: environmental, social, economic, nature of the product, corporate governance, climate change, and general.

The questionnaires’ answers are statistically analyzed using cluster analysis, which identifies groups of companies with similar performances and indicates the group with the best general performance. This selected group is analyzed by the ISE Deliberative Council, chaired by the BM&FBOVESPA.Footnote 2

The methodology used to compose the ISE portfolio does not, therefore, adopt a negative screening strategy. This fact was decided by the index council and caused great repercussions in the Brazilian media and society. Because of this decision, the Brazilian Institute of Social and Economic Analyses, which was a member of the council, decided to withdraw. To reduce this conflict, the factor nature of the product was included in the selection questionnaire for the assessment of the impact of the companies’ products on the population and on the environment (Marcondes and Bacarji 2010).

The ISE portfolio is renewed on an annual basis, and since it was launched (December 2005), the index has had its effectiveness measured over the period from the first business day of December of each year to the last business day of November of the following year. However, from December 2010 on, the effectiveness of the ISE portfolio has been measured over the period from the first business day of January of each year to the last business day of December of the same year.

To increase the degree of diversification of the ISE portfolio, the council established in December 2009 that the participation of one specific economic sector must not be greater than 15 %.

Literature Review

Rudd (1981), Grossman and Sharpe (1986), Diltz (1995), and Bello (2005) undertook financial analyses of the return and risk characteristics of portfolios formed on the basis of the first SI strategy (Table 1). Grossman and Sharpe (1986) suggested that any constraint imposed on a selection of assets would only reduce or maintain investors’ maximum possible utility. Therefore, when SI portfolios face constraints, they may only obtain some incremental risk premiums if they are sub-optimal. Rudd (1981) pointed out that screening strategies (negative or positive) bias portfolios, as they exclude assets and force concentration into other assets. In addition, Rudd (1981) stated that, because of the constraints imposed by screening strategies, SIs increase a portfolio’s diversifiable risk, which is not necessarily offset by an increase in expected return, thus harming the portfolio’s performance. Diltz (1995) and Bello (2005) carried out empirical tests and observed that SIs have statistically similar financial performances as compared with other investments.

According to Fowler and Hope (2007), there were very few relevant academic studies that analyzed the performance of sustainability indices, mainly due to their short period of existence. Schröder (2007) pointed out that most of the studies focused on SI fund performance analysis. Therefore, Sauer (1997) compared the DSI with two benchmarks and observed that the index presented neither positive nor negative differentials. Statman (2000) observed that the DSI performed better than its benchmark, although the difference was not statistically significant. Consolandi et al. (2009) analyzed the European DJSI and observed that the index slightly underperformed its benchmark. In addition, Fowler and Hope (2007) observed that the DJSI has a sectoral composition that is very close to its benchmark, which may indicate that the index does not faithfully represent the companies with the most sustainable practices. Schröder (2004) compared the European FTSE4Good Index with a benchmark and observed that the index underperformed. Conversely, Collison et al. (2008) compared the indices of the FTSE4Good series with their benchmarks and observed that the indices outperformed. Machado et al. (2009) and Cavalcante et al. (2009) analyzed the ISE and observed that the index had a statistically similar financial performance compared with its benchmark. It has not been possible to identify studies on the JSE SRII to date.

Methodology

To achieve the aim of this work, the analysis is carried out in two main sections. In the first section, we characterize ISE portfolios. To do so, we discuss the companies and the sectoral composition of the index. In the second section, we compare the ISE’s performance with the IBOVESPA (representing the market portfolio) and other BM&FBOVESPA sectoral indices existing since it was launched (see Table 4). For this, we use level of liquidity, return and risk indicators, as well as the following performance measures: Sharpe, Treynor, Sortino, and Omega. These performance measures are based on different assumptions regarding return probability distribution and risk, and they are discussed in “Portfolio performance measures” section. For the performance analysis, we use the Brazilian Interbank Deposit Certificate (CDI) as the risk-free rate.

The study covers the period from December 1, 2005, to December 30, 2010 (which includes the first five ISE portfolios). Therefore, there are 1,257 daily observations of the returns of the indices.

We divided the study period into three sub-periods: a pre-crisis period, a crisis period, and a post-crisis period. This was to better understand the performance of the indices and accommodate any impact of the financial crisis starting in 2008. The pre-crisis period began on December 1, 2005, and finished on May 20, 2008, when the IBOVESPA reached its maximum performance of 73,516.81 points. The crisis period began on May 21, 2008, and finished on March 2, 2009, when the last valley of the highest IBOVESPA volatility period occurred with 36,234.69 points. The post-crisis period began on March 3, 2009, and finished on December 30, 2010. Performance and returns volatility of the IBOVESPA through the total covered period are shown in Fig. 1.

Performance and returns volatility of the IBOVESPA. Source BM&FBOVESPA (2011). Made by the authors

Table 5 details the study’s three sub-periods and shows the number of observations of the indices’ returns (represented by T).

The daily quotations of the indices mentioned in Table 4 and of the CDI were taken from the BM&FBOVESPA (2011) and from the CETIP (2011) websites and were statistically manipulated to generate a database that became the basis for the development of the results in the following section. These data are displayed in tables and figures.

Portfolio Performance Measures

Sharpe’s Measure (ShM)

Sharpe’s measure (Sharpe 1966) represents the differential return of a portfolio by unit of total risk, as shown in Eq. 1:

where ShM i is the portfolio’s Sharpe’s measure; R i is the portfolio’s return; R f is the risk-free return; and σ i is the standard deviation of the portfolio’s returns.

Treynor’s Measure (TM)

Treynor’s measure (Treynor 1965) represents the differential return of a portfolio by unit of systematic risk,Footnote 3 as shown in Eq. 2:

where TM i is the portfolio’s Treynor’s measure; and β i is the portfolio’s systematic risk.

Sortino’s Measure (SoM)

Sortino’s measure (Sortino and Price 1994) represents the differential return of a portfolio by unit of downside risk,Footnote 4 as shown in Eq. 3:

where SoM i (R min) is the portfolio’s Sortino’s measure as a function of R min; R min is the minimum expected return by the investorFootnote 5; and \( \sigma_{{{\text{DR}}_{i} }} \) is the portfolio’s downside risk.

Omega Measure (Ω)

The three previous measures are performed in the mean–variance framework and, therefore, require assumptions about the investor’s utility function (namely a quadratic utility function) or about the normality of the assets’ returns distribution.

However, it is well known that a quadratic utility function is inconsistent with rational human behavior. Moreover, returns distributions are usually far from normally distributed (Favre-Bulle and Pache 2003). Thus, the mean–variance framework may not appropriately capture the risk and reward properties of securities, and alternative measures capturing all of the moments of the distribution must be introduced.

Omega is a new measure proposed by Keating and Shadwick (2002a, b) that reflects all of the statistical properties of the returns distribution, and which does not require any of the assumptions above. This measure is a function of the portfolio’s return, and is calculated by dividing the probability of obtaining a return superior to a minimum expected return by the probability of obtaining a return inferior to it,Footnote 6 as shown in Eq. 4:

where Ω i (R min) is the portfolio’s Omega measure as a function of R min; and F(x) is the cumulative distribution function of the portfolio’s returns defined by the interval [a,b].

According to Favre-Bulle and Pache (2003), the minimum sample size to entail consistent results with the Omega measure is 200 observations.

Normality and Stationarity Tests

As discussed in “Omega measure (Ω)” section, assuming assets’ returns are normally distributed may compromise the financial performance analysis based on traditional mean–variance measures, such as those of Sharpe, Treynor, and Sortino.

Moreover, when the assets’ returns time series are non-stationary, the basic conditions of the linear regression model—which is used to calculate the assets’ beta (β) in Treynor’s analysis—are not satisfied. When this characteristic is observed, spurious regression may occur and transformation series procedures may be necessary for the reliable use of the beta estimator.

To verify whether SIs are actually attractive applications in the Brazilian stock market, robust results based on these performance measures are important. Therefore, it is necessary to test if the conditions mentioned above are present in this study. Two important tests are commonly used: the Jarque–Bera test and the Dickey-Fuller test.

Jarque–Bera Test

The Jarque–Bera statistic (Jarque and Bera 1987) aims to test the normality characteristics of probability distributions. The statistic follows a Chi-square distribution with two degrees of freedom and indicates that the analyzed distribution is normal where its value is significantly equal to zero. Eq. 5 describes this indicator:

where JB i is the Jarque–Bera statistic of the portfolio; T is the number of observations; and S i and K i are the coefficients of asymmetry and kurtosis, respectively.

Dickey-Fuller Test

The tau statistic (τ), developed by Dickey and Fuller (1979), aims to test the stationarity characteristics of time series. When the result of the indicator (τ calculated ) is less than the critical value (τ critical ) tabulated by the authors, the null hypothesis that the analyzed time series has a unit root is rejected and, therefore the conclusion that the series is stationary can be made. The tau statistic may be used in the analysis of assets’ returns time series, and may be described by Eq. 6:

where τ i is the tau statistic of the portfolio returns’ time series; δ is the coefficient of the regression between the first differences of the portfolio returns at time t (\( \Updelta R_{i,t} \)) and its previous value at time t − 1 (\( R_{i,t - 1} \)); and \( \sigma_{{R_{i,t - 1} }} \) is the standard deviation of \( R_{i,t - 1} \).

Results and Discussion

Characterization of ISE Portfolios

Companies

Table 6 shows the permanence of the 56 companies that comprised the ISE. Eleven companies comprised the index portfolios during the covered period. Three companies originating from the merger of other companies of the index have managed to maintain their participation in the ISE. In addition, six companies that were excluded from the index returned at some point to the portfolio in further renewals. Such facts may indicate that the companies regard their permanence in the index as important to disclose their ESG performance, improve their image before their clients, and provide added value to their shareholders.

Therefore, the numbers of companies that comprised the ISE portfolios were, in chronological order, 28, 34, 32, 30, and 34. In addition, bearing in mind that some of those companies have more than one type of stock, the quantities of shares that comprised the index portfolios were, in chronological order, 34, 43, 40, 38, and 43.

Moreover, in December 2000, the BM&FBOVESPA launched special listing segments, which aim at selecting those companies that have high levels of corporate governance. The segment with the strictest listing rules is the Novo Mercado (New Market), followed by Nível 2 (Level 2) and Nível 1 (Level 1).

Figure 2 shows the percentage of companies that comprised the ISE portfolios and that were part of these special levels of corporate governance. This figure shows that the companies in the index increased their levels of corporate governance year after year. Such a fact may contribute to the reduction of information asymmetries and risk for their investors.

Sectoral Composition

Table 7 lists the ISE’s and IBOVESPA’s sectoral compositions based on the market value of the shares included in them. We see that the ISE was historically concentrated in some sectors, such as electric energy, financial intermediation, oil, gas, and biofuel, although the portfolio has become very diversified since December 2009, because of the sectoral constraint established by the ISE council, as shown in “Sustainability indices in the stock market” section.

We additionally note that, unlike what occurs with the DJSI—as observed by Fowler and Hope (2007)—the ISE has a very different sectoral structure from its benchmark. Such a fact may indicate that the ISE has been successful in selecting shares of companies that have the best ESG performances instead of selecting those companies that best represent the market.

In this type of analysis, it is important to take into account the Brazilian stock exchange’s own characteristics. As may be observed in other emerging markets, the BM&FBOVESPA is extremely concentrated in some stocks and economic sectors. For example, the shares of the two largest companies listed in the BM&FBOVESPA, Petrobras (PETR3 and PETR4—oil, gas and biofuel) and Vale (VALE3 and VALE5—mining), constitute approximately 30 % of IBOVESPA’s market value.

The inclusion of Petrobras in the composition of the second and third ISE portfolios was the reason for the high participation of the oil, gas, and biofuel sector in the index. The state-owned company was not selected for the fourth portfolio, in December 2008, possibly because of its failure to comply with Brazilian National Commission for the Environment (CONAMA) resolution no. 315/2002, which sets limits for particulate material in vehicular fuels (Marcondes and Bacarji 2010).

Comparison of ISE Performance

Before initiating the performance comparison, it is important to analyze the characteristics of the probability distribution of the analyzed indices’ returns and the stationarity of their time series. Therefore, Table 8 shows the coefficients of asymmetry (S) and kurtosis (K) of these indices, as well as their Jarque–Bera (JB) and tau (τ) statistics.

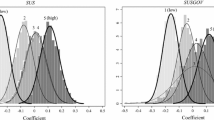

Disregarding the INDX, our results show that the indices have positive asymmetry (S > 0) and leptokurtosis (K > 3). The probability distributions of the indices returns do not follow a normal distribution (JB ≠ 0). Moreover, all the indices have stationary returns series (τ calculated < τ critical ).

The non-normality of the distribution indicates that the Omega measure tends to present more relevant results compared with the results of the other performance measures. The stationarity of the returns series indicates that the use of beta in Treynor’s analysis is reliable.

Figure 3 represents the plot of the ISE’s return probability distribution and shows its asymmetry, leptokurtosis, and non-normality characteristics.

Figure 4 represents the ISE’s returns series and shows its stationarity characteristics.

Level of Liquidity

Table 9 classifies the analyzed indices based on their liquidity levels, represented by the average number of daily trades. The ISE and the IGC obtained the highest variations of this measure. Such a fact may indicate that investors preferred to trade stocks of companies with high ESG performances and, therefore, these assets may have had their market risk (β) reduced.

Basic Return and Risk Performance

Tables 10a–d classify the analyzed indices based on their average daily return (\( \overline{R} \)), total return (R total ), standard deviation (σ), systematic risk (β), and diversifiable risk (σ ε ²/σ²),Footnote 7 regarding the three sub-periods (pre-crisis, crisis, and post-crisis) and the total period.

The ISE had an intermediate return and risk performance in the pre- and post-crisis periods, and a very unsatisfactory performance in the crisis period. However, its diversifiable risk was one of the lowest in the three sub-periods. In the total period, the index did not obtain a great differential of return and risk, although it obtained a low diversifiable risk. Such a fact may indicate that the adoption of SI screening strategies increases the diversification of portfolios.

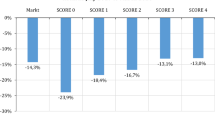

The radar graph in Fig. 5 shows the total returns of the analyzed indices (in the total period) and compares them with the IBOVESPA’s performance. This reveals that the ISE performed very close to its benchmark, but slightly inferior.

Figure 6 represents the ISE’s, the IBOVESPA’s, and the CDI’s (risk-free rate) performance during the total analysis period. As can be seen from the graph, the ISE had a very similar performance to that of the IBOVESPA, although it demonstrated a worse recovery during and after the 2008 financial crisis. However, both performed above the risk-free rate for most of the period.

Marcondes and Bacarji (2010) related this inferior return of the ISE to the exclusion of Petrobras in the index portfolio renewal of December 2008. Table 11 shows that the oil company stocks performed worse than the ISE and the IBOVESPA after the exclusion. Therefore, it is not possible to state that the absence of Petrobras negatively impacted the performance of the index.

Table 12 shows the stock price changes of the 11 companies that comprise the ISE portfolio since it was launched, as discussed in “Companies” section. These stocks had very distinct price changes, but they were predominantly negative. Also of note is that the stocks with the highest average relative participations in the index value were the same ones to obtain the most expressive negative price changes. Such a fact may have contributed to the inferior performance of the ISE in relation to the IBOVESPA. In addition, it may also indicate that the efforts of these companies to keep good ESG performances were not sufficient to increase their market values substantially.

Table 13 displays the correlation coefficients of the returns of the analyzed indices. The ISE returns have a high correlation with those of the IGC and of the IBOVESPA. The high correlation with the IGC returns can be justified by this index representing shares of companies that have high levels of corporate governance (a criterion considered in the ISE screening strategies, as discussed in “Sustainability indices in the stock market” section), thus reinforcing the conclusion made through the analysis of Fig. 2. The high correlation with IBOVESPA returns reinforces the idea that the index has a low diversifiable risk, as observed in Tables 10a-d.

Figure 7 displays the dispersion plot of ISE and IBOVESPA returns, and also represents the expected ISE returns calculated by the linear regression model of these variables. Because of the high correlation of the returns of the indices, the model explains their variations significantly (R 2 = 91.34 %).

Sharpe and Treynor Analyses

Tables 14a–c classify the analyzed indices based on Sharpe’s and Treynor’s measures, regarding two sub-periods (pre-crisis and post-crisis) and the total period. In the crisis period, there was no classification because both measures calculated negative values.

The ISE had a satisfactory performance only in the pre-crisis period, when it outperformed the benchmark in Treynor’s approach. In the post-crisis period, the ISE did not have a relevant performance, although the index outperformed the benchmark in both approaches. In the total period, the ISE obtained a total risk premium and a systemic risk premium only superior to those of the ITEL. Such results show that the ISE obtained an unsatisfactory performance in these approaches.

Sortino Analysis

Tables 15a–d classify the analyzed indices based on Sortino’s measure, regarding the three sub-periods (pre-crisis, crisis, and post-crisis) and the total period. For this analysis, we used three values of R min : −3, 0, and +3 %.

In the pre- and post-crisis periods, the ISE outperformed the benchmark for the lowest R min (−3 %) and zero R min (0 %). In the crisis period, the index had an intermediate performance for the lowest R min (−3 %). In the total period, the ISE outperformed the benchmark only for the lowest R min (−3 %), and for the zero R min (0 %), the index obtained an unsatisfactory position. These observations show that the index may be a good choice for risk-loving investors and a poor option for risk-neutral investors.

Omega Analysis

For the Omega analysis, we only consider the total period, with the objective to have a better representation of the probability distribution of the analyzed indices’ returns. Moreover, the number of returns in the crisis period is less than that required for the minimum sample size to have a consistent result (195 < 200) and, therefore, sub-period segmentation could compromise the analysis.

Furthermore, we use the same values of R min established in the Sortino analysis (−3, 0, and +3 %). As shown in Table 16, the probability of the analyzed indices’ returns falling within the interval [−3 %; +3 %] is, on average, very high (90.46 %), which supports the choice of this range.

Table 17 classifies the analyzed indices based on the Omega measure. As seen, the ISE had a satisfactory performance for the lowest R min (−3 %), which shows that the index may be a good choice for risk-loving investors. Such a fact reinforces the result obtained in the Sortino analysis. For risk-neutral (R min = 0 %) and risk-averse (R min = +3 %) investors, the ISE proved to be an intermediate option.

Figure 8a, b display the sensitivity of the ISE’s and the IBOVESPA’s Omega measure results in relation to R min, for return intervals of [−3 %; 0 %] and [0 %; +3 %], respectively. The results of this measure have more significant differentiation for the range of R min between −3.0 and −2.1 %. In this range, the ISE obtained a superior return and risk performance, which reinforces the notion that the index may be a good choice for risk-loving investors.

Conclusion and Directions for Further Research

In this study, we analyzed the Corporate Sustainability Index (ISE) with the main objective of analyzing the historical performance of sustainable investments in the Brazilian stock market. Below are the main results of the study, subsequent conclusion, and a recommendation of topics for further studies.

In the characterization of ISE portfolios, we observed that the companies that comprised the ISE must regard their permanence in the index as important to disclose their ESG performance, improve their image before their clients, and provide added value to their shareholders. In addition, these companies increased their levels of corporate governance year after year, which may contribute to the reduction of information asymmetries and risk for their investors. We found the ISE to be historically concentrated in some sectors, such as electric energy; financial intermediation; oil, gas, and biofuel; although the portfolio has become very diversified since its last revision because of the selecting rule imposed by the index council. Moreover, unlike what occurs with the DJSI, the ISE has a very different sectoral structure compared with its benchmark. Such a fact may indicate that the ISE has been successful in selecting shares of companies that have the best ESG performances, instead of selecting those companies that best represent the market.

Comparing the ISE’s performance with those of other sectoral indices, we observed that it did not present any significant return and risk differential using Sharpe’s and Treynor’s measures, although it has obtained a low diversifiable risk, and its liquidity has increased substantially. We also observed that the ISE had a very similar performance to that of the IBOVESPA, although the ISE demonstrated a worse recovery during and after the 2008 financial crisis. This underperformance may have been caused by the expressive negative price changes in the stocks that had greater participation in the ISE’s value. In the Sortino and Omega approaches, we observed that the index may be a good choice for risk-loving investors.

Therefore, we conclude that, although SIs have presented some interesting characteristics in the Brazilian stock market, such as increasing liquidity and low diversifiable risk, they did not achieve satisfactory financial performance in the analysis period. This indicates that the constraints imposed by this type of investment in capital allocation in Brazil may be harming their return and risk attractiveness. Therefore, SIs may not yet be sufficient to improve the Brazilian ESG situation. Such a fact may be explained by the following aspects:

-

(i)

foreign investors, whose applications represent roughly one-third of the total volume traded in the BM&FBOVESPA, may prefer to invest sustainably their resources regionally in emerging markets rather than in a particular country, such as Brazil;

-

(ii)

the Brazilian financial market is still not convinced of the importance of sustainability in the performance of its investments; and

-

(iii)

there is no effective regulation in Brazil that imposes sustainability restrictions in the capital market, which could force non-sustainable companies to internalize their ESG costs.

For further research, we recommend a detailed study of the historical performance of other sustainability indices in emerging markets which have existed for a reasonable period of time, such as the Johannesburg Stock Exchange Socially Responsible Investment Index (launched in 2004) and the ECPI Ethical Emerging Markets Tradable Equity Index (launched in 2006).

Notes

GVces is the largest foundation specializing in sustainability studies and the best business school in Brazil.

The Deliberative Council is composed of the Brazilian Association of Pension Funds (ABRAPP); the Brazilian Financial and Capital Markets Association (ANBIMA); the Association of the Analysts and Investment Professionals of the Capital Market (APIMEC); the National Association of Investment Banks (ANBID); the Brazilian Mercantile, Futures and Stock Exchange (BM&FBOVESPA); the Brazilian Institute of Corporate Governance (IBGC); the International Finance Corporation (IFC); the Ethos Institute of Business and Social Responsibility; the Brazilian Ministry of the Environment (MMA); and the United Nations Environment Programme (UNEP).

Thus, because TM uses the systematic risk as a unit of risk, it measures the success of a portfolio under the assumption that investors hold well-diversified portfolios.

The downside risk is based on modern portfolio theory and may be defined as a way of calculating the risk of a portfolio, considering only its probability of incurring a return inferior to that acceptable by the investor (R min). Note that SoM is similar to TM and ShM, in the sense that it calculates the premium (R i − R f ) per unit of risk. It differs from the other measures, however, in its choice of index risk. While ShM uses the risky asset’s standard deviation (σ i ), TM uses its beta (β i ), and SoM uses its downside risk (\( \sigma_{{{\text{DR}}_{i} }} \)).

R min can also be defined as a loss threshold, and for any investor returns less than their specific loss threshold are considered losses and returns greater than the threshold as gains.

Therefore, it is noticeable that the Omega measure is in compliance with modern portfolio theory, as well as Sortino’s measure.

Diversifiable risk was calculated by dividing the variance of the regression errors in the analyzed index returns (σ ε²), based on the single index model, by its total risk (σ ²).

Abbreviations

- BM&FBOVESPA:

-

Brazilian Mercantile, Futures and Stock Exchange

- ESG:

-

Environmental, social, and corporate governance

- IBOVESPA:

-

BOVESPA Index (market portfolio)

- ISE:

-

Corporate Sustainability Index

- R min :

-

Minimum expected return

- SI:

-

Sustainable investment

References

Bello, Z. Y. (2005). Socially responsible investing and portfolio diversification. The Journal of Financial Research, 28(1), 41–57.

BM&FBOVESPA (Brazilian Mercantile, Futures and Stock Exchange). (2011). http://www.bmfbovespa.com.br/. Accessed May 7, 2011.

Brundtland, G. (1987). Our common future: the world commission on environment and development. Oxford: Oxford University Press.

Cavalcante, L. R. M. T., Bruni, A. L., & Costa, F. J. M. (2009). Sustentabilidade empresarial e valor das ações: uma análise na bolsa de valores de São Paulo. Revista de Gestão Social e Ambiental, 3(1), 70–86.

CETIP (Organized Over-the-Counter Assets and Derivatives). (2011). http://www.cetip.com.br/. Accessed May 7, 2011.

CIA (Central Intelligence Agency). (2011). https://www.cia.gov/. Accessed May 22, 2011.

Collison, D. J., Cobb, G., Power, D. M., & Stevenson, L. A. (2008). The financial performance of the FTSE4Good indices. Corporate Social Responsibility and Environmental Management, 15(1), 14–28.

Consolandi, C., Jaiswal-Dale, A., Poggiani, E., & Vercelli, A. (2009). Global standards and ethical stock indexes: The case of the Dow Jones Sustainability Stoxx Index. Journal of Business Ethics, 87(1), 185–197.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431.

Diltz, J. D. (1995). The private cost of socially responsible investing. Applied Financial Economics, 5(2), 69–77.

Eurosif (European Sustainable Investment Forum). (2010). 2010 European SRI Study. Paris: EUROSIF.

Favre-Bulle, A., & Pache, S. (2003). The omega measure: Hedge fund portfolio optimization. MBF Master’s Thesis, University of Lausanne.

Fowler, S. J., & Hope, C. (2007). A critical review of sustainable business indices and their impact. Journal of Business Ethics, 76(3), 243–252.

Grossman, B. R., & Sharpe, W. F. (1986). Financial implications of South African divestment. Financial Analysts Journal, 42(4), 15–29.

IBGC (Brazilian Institute of Corporate Governance). (2010). Panorama da governança corporativa no Brasil. São Paulo: IBGC.

IFC (International Finance Corporation). (2009). Investimento sustentável no Brasil 2009. Washington, DC: IFC.

IFC (International Finance Corporation). (2011a). http://www.ifc.org/. Accessed July 1, 2011.

IFC (International Finance Corporation). (2011b). Assessing and unlocking the value of emerging markets sustainability indices. Washington, DC: IFC.

IFC (International Finance Corporation). (2011c). The state of sustainable investment in key emerging markets. Washington, DC: IFC.

Jarque, C. M., & Bera, A. K. (1987). A test for normality of observations and regression residuals. International Statistical Review, 55(2), 163–172.

Keating, C., & Shadwick, W. (2002a). A universal performance measure. Journal of Performance Measurement, 6(3), 59–84.

Keating, C., & Shadwick, W. (2002b). An introduction to omega. London: The Finance Development Centre London.

Machado, M. R., Machado, M. A. V., & Corrar, L. J. (2009). Desempenho do Índice de Sustentabilidade Empresarial (ISE) da bolsa de valores de São Paulo. Revista Universo Contábil, 5(2), 24–38.

Marcondes, A. W., & Bacarji, C. D. (2010). ISE: Sustainability in the capital market. São Paulo, Brazil: ed. Report.

McKinsey & Company. (2009). Caminhos para uma economia de baixa emissão de carbono no Brasil. São Paulo: McKinsey & Company.

RIAA (Responsible Investment Association Australasia). (2010). Responsible Investment 2010. Sydney: RIAA.

Rudd, A. (1981). Social responsibility and portfolio performance. California Management Review, 23(4), 55–61.

Sauer, D. A. (1997). The impact of social-responsibility screens on investment performance: Evidence from the Domini 400 Social Index and Domini Equity Mutual Fund. Review of Finance Economics, 6(2), 137–149.

Schröder, M. (2004). The performance of socially responsible investments: Investment funds and indices. Financial Markets and Portfolio Management, 18(2), 122–142.

Schröder, M. (2007). Is there any difference? The performance characteristics of SRI equity indices. Journal of Business Finance and Accounting, 34(1–2), 331–348.

Sharpe, W. F. (1966). Mutual fund performance. The Journal of Business, 39(1), 119–138.

SIF-Japan (Social Investment Forum Japan). (2010). 2009 Review of Socially Responsible Investment in Japan. Tokyo: SIF-Japan.

SIO (Social Investment Organization). (2011). Canadian Socially Responsible Investment Review 2010. Toronto: SIO.

Sortino, F. A., & Price, L. N. (1994). Performance measurement in a downside risk framework. The Journal of Investing, 3(3), 59–64.

Statman, M. (2000). Socially responsible mutual funds. Financial Analysts Journal, 56(3), 30–39.

Treynor, J. (1965). How to rate management of investment funds. Harvard Business Review, 43(1), 63–75.

UNDP (United Nations Development Programme). (2011). Human Development Report 2011. New York: UNDP.

US SIF (Forum for Sustainable and Responsible Investment). (2010). 2010 Report on socially responsible investing trends in the United States. Washington, DC: US SIF.

WFE (World Federation of Exchanges). (2010). 2009 Annual report and statistics. Paris: WFE.

World Bank. (2011). http://www.worldbank.org/. Accessed August 10, 2011.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Arias Fogliano de Souza Cunha, F., Samanez, C.P. Performance Analysis of Sustainable Investments in the Brazilian Stock Market: A Study About the Corporate Sustainability Index (ISE). J Bus Ethics 117, 19–36 (2013). https://doi.org/10.1007/s10551-012-1484-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-012-1484-2