Abstract

Although the composition of the board of directors has important implications for different aspects of firm performance, prior studies tend to focus on financial performance. The effects of board composition on corporate social responsibility (CSR) performance remain an under-researched area, particularly in the period following the enactment of the Sarbanes-Oxley Act of 2002 (SOX). This article specifically examines two important aspects of board composition (i.e., the presence of outside directors and the presence of women directors) and their relationship with CSR performance in the Post-SOX era. With data covering over 500 of the largest companies listed on the U.S. stock exchanges and spanning 64 different industries, we find empirical evidence showing that greater presence of outside and women directors is linked to better CSR performance within a firm’s industry. Treating CSR performance as the reflection of a firm’s moral legitimacy, our study suggests that deliberate structuring of corporate boards may be an effective approach to enhance a firm’s moral legitimacy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although the composition of the corporate board of directors is an important research subject in the literature, the impact of board composition on firms’ corporate social responsibility (hereafter CSR) performance remains a relatively under-researched area. This assessment is based on two observations. Existing studies appear to present inconsistent findings. In particular, some studies report that outside directors are positively associated with CSR performance (e.g., Johnson and Greening 1999; Webb 2004); others report the opposite or no effects (e.g., Coffey and Wang 1998; McKendall et al. 1999; Wang and Coffey 1992). Likewise, although prior research generally supports a positive relationship between women directors and CSR performance (e.g., Wang and Coffey 1992; Webb 2004; Williams 2003), some studies show mixed or no effects (e.g., Post et al. 2011; Stanwick and Stanwick 1998).

In addition, most of the existing studies were conducted before the enactment of Sarbanes-Oxley Act (hereafter SOX) of 2002 (e.g., Coffey and Wang 1998; Johnson and Greening 1999; Wang and Coffey 1992; Webb 2004; Williams 2003) with only a handful exceptions (e.g., Post et al. 2011). In the Post-SOX era, board composition has entered a new reality—most public corporations in the U.S. now have a substantial presence of outside and women directors on their boards (Dalton and Dalton 2010; Linck et al. 2009). In addition to increased presence, outside and women directors have obtained membership on influential board committees and gained substantial leadership positions on corporate boards in the Post-SOX era (Dalton and Dalton 2010). These changes call for an update on our knowledge about the relationship between board composition and firm CSR performance.

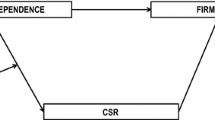

In this article, we focus on two important aspects of board composition: (a) the presence of outside directors and (b) the presence of women directors, and examine their relationships with CSR performance in the Post-SOX era. Based on legitimacy theory, we view CSR performance as the reflection of a firm’s moral legitimacy (Scherer and Palazzo 2007). This legitimacy is given by the firm’s various stakeholders and thus is defined as the extent to which the firm is accepted by its stakeholders as a moral corporate citizen. We argue that outside and women directors contribute to the effective management of stakeholders through (a) raising stakeholder salience and (b) augmenting firm resources to better address stakeholder claims. Enhanced stakeholder management helps the firm obtain stakeholder acceptance and thus leads to elevated CSR performance. We, therefore, propose that greater presence of outside and women directors is related to better CSR performance. We test the proposed relationships using a large-scale data set that consists of more than 500 of the largest U.S. and international companies spanning over 60 different industries.

Our work attempts to make several contributions to the literature. Empirically, we constructed within-industry CSR measures to better account for the different operating contexts and different stakeholders across industries (Cottrill 1990; Moore 2001). In addition, multiple CSR measures from different data sources were utilized to capture the multidimensionality of CSR. With these considerations in methodology, our findings from the Post-SOX era offer a timely update to the existing literature. Conceptually, our study contributes to legitimacy theory by showing that deliberate structuring of corporate boards may be an effective strategy to enhance firm moral legitimacy. Although prior work on strategic management has underscored the impact of board directors on firm legitimacy (Higgins and Gulati 2003, 2006), little existing work specifically links board structure to firm moral legitimacy. This particular type of legitimacy emerges from the stakeholders’ conscious judgment of how a firm’s behaviors are consistent with their moral principles (Palazzo and Scherer 2006).

Conceptual Framework

The Sarbanes-Oxley Act of 2002 and Its Impact on Board Composition

With the enactment of the Sarbanes-Oxley Act of 2002, both the membership and certain functions of corporate boards are explicitly regulated. Specifically, each public company is now required to have a majority of directors on the board to be independent. In addition, the three most influential committees of the board—the audit, compensation, and corporate governance committees—shall be entirely composed of directors who satisfy the independence requirements. In practice, public firms generally have added outside directors to their boards to meet the independence requirements of SOX (Linck et al. 2009), leading to a significant increase of outside directors on corporate boards in the Post-SOX era.

Although none of the SOX-related guidelines directly address gender issues on corporate boards, SOX had an important impact on women directors on boards. Dalton and Dalton (2010) point out that the increasing presence of women directors on corporate boards has been a trend for the past two decades. Nevertheless, SOX and the requirements from stock exchanges acted as a catalyst for corporations to increasingly institutionalize this trend, creating “conditions conducive to the continued advancement of women to corporate boards” (Dalton and Dalton 2010, p. 262). While the increase of women director presence has been evident both before and after SOX, women directors’ leadership and responsibilities have notably improved in the Post-SOX era. According to Dalton and Dalton (2010), in the Post-SOX era, board membership by women on Fortune 500 boards rose by roughly 30 %. During the same period, women’s membership on influential board committees and women’s leadership roles on corporate boards rose over 200 %.

In sum, SOX, as a major regulatory intervention in corporate governance, has had a major impact on the structure of corporate boards. In the Post-SOX era, most public corporations now have a substantial presence of outsider and women directors, in sharp contrast to board composition before SOX (e.g., Linck et al. 2009; Valenti 2007). This new reality calls for an update regarding outside and women directors’ roles in influencing firm performance.

Board Composition, Stakeholder, and Moral Legitimacy

The Post-SOX era represents a critical time to update our understanding about outside and women directors. Within this new context, we pose the question: do the reported effects of outside (women) directors on CSR performance, positive or negative, still exist? If they do, what are their theoretical underpinnings? Through the lens of legitimacy theory and stakeholder management, we propose a conceptual framework linking board composition to CSR performance.

Based on the legitimacy theory, we view CSR performance as the reflection of a firm’s moral legitimacy (Scherer and Palazzo 2007). We further define this legitimacy as the extent to which the firm is accepted by its stakeholders as a moral corporate citizen. Moral legitimacy secures social acceptance from stakeholders when this legitimacy may or may not be congruent with a firm’s business interest or objectives. In this sense, moral legitimacy reflects a firm’s “prosocial logic that differs fundamentally from… narrow self-interest” (Suchman 1995, p. 579).

It is important to note that a firm’s moral legitimacy is rooted in its industry context, as stakeholders’ judgment and expectations of moral principles are often industry-specific. Firms in different industries may face different stakeholders (Cooper et al. 2001; Moore 2001). Different stakeholders may stress different moral principles. Even within a single group of stakeholders, there may be different moral expectations for different industries, as each industry develops its own social norms and standards to which participating members are expected to adhere (Campbell 2006; Logsdon and Yuthas 1997). As a result, firm–stakeholder “behavioral routines within industries are similar, while interactions across industries are dissimilar. What becomes legitimate in one industry is not legitimate in another industry (Beliveau et al. 1994, p. 732).” In this article, our definition of CSR performance refers specifically to within-industry performance.

Having defined CSR performance, we now discuss how board members can help a firm manage its stakeholders and secures their acceptance. In a boardroom, each director’s experiences and associations with stakeholders impact how he or she views the importance of stakeholder claims, and how he or she secures the necessary resources to help address important claims (Boeker and Goodstein 1991; Mitchell et al. 1997). More formally, in the context of managing stakeholder relationships, board directors can potentially play two important and distinct roles: (a) identifying salient stakeholder claims and (b) augmenting firm resources.

In terms of stakeholder salience, board members’ experiences with various external stakeholders, such as not-for-profit organizations, may increase the salience of the claims made by these stakeholders. According to stakeholder salience theory, a firm prioritizes the claims made by various stakeholders according to three criteria: the perceived power of the stakeholders, the urgency of the claim, and the legitimacy of the claim (Mitchell et al. 1997). Board directors’ backgrounds and experiences may facilitate a good understanding of the urgency and legitimacy of stakeholder claims, and thus may help raise the salience of these claims (Saiia 2007). The increased salience encourages the management to take actions to address these claims. Proper response to such claims in turn promotes stakeholder approval and acceptance.

In terms of resource augmentation, board members’ experiences with a firm’s stakeholder groups may help the firm gain access to critical external resources useful to stakeholder management. No organizations are self-sufficient (Pfeffer and Salancik 1978). Outside directors help connect a firm with its external constituencies, or stakeholders (Boeker and Goodstein 1991; Pfeffer and Salancik 1974, 1978). Board members with previous relationships with certain external stakeholders can enhance the communication between the firm and these stakeholders, and thus facilitate the acquisition of resources from them (Ayuso and Argandona 2009). In sum, the above analyses suggest that board directors can be valuable assets in managing stakeholders and securing stakeholder acceptance. Next, we discuss the roles of outside and women directors separately.

Outside Directors

Research shows that outside directors have a different CSR orientation from their inside counterparts. This differed orientation helps broaden a firm’s hearing of stakeholder claims and thus increase their salience. For example, Wang and Dewhirst (1992) found that outside directors have a stronger employee orientation. Ibrahim and Angelidis (1995) and Ibrahim et al. (2003) suggest that outsiders tend to lean toward philanthropic activities. Relative to insiders, outside directors are also found to be more interested in complying with environmental standards (Johnson and Greening 1999).

In addition, outside directors are representatives of external stakeholders (Johnson and Greening 1999; Wang and Dewhirst 1992). They often have more diverse backgrounds in law, education, and not-for-profit organizations than do corporate insiders (Williams 2003). Outside directors’ external focuses and unique backgrounds aid to augment a firm’s resources to manage its stakeholders. For example, Goldschmidt and Finkelstein (2001) report that a majority of American research university presidents serve on corporate boards, with such affiliations concentrated in financial, manufacturing, and technology industries. They point out that, for corporations, placing university presidents on boards is a strategy to obtain expertise and resources, manage and integrate community interests, and thus “seek legitimacy from the external environment (p. 37).”

In sum, a greater presence of outside directors likely elevates a firm’s effectiveness in managing its stakeholders through heightened salience of stakeholder claims and augmented resources to address stakeholder claims. Enhanced stakeholder management, in turn, leads to increased stakeholder acceptance and legitimacy in the firm’s operating context. We thus hypothesize:

H1

The proportion of outside directors is related to better CSR performance within a firm’s industry.

Women Directors

Women directors add to a firm’s moral legitimacy by enhancing the salience of stakeholder claims in the firm’s industry context. Unlike their male counterparts, the most common paths for women to reach the boardroom are usually through community services and academia (Terjesen et al. 2009; Williams 2003). Directors’ occupational backgrounds and experiences often determine their expertise on the board and their sensitivity to decisions related to pro-social issues (Boeker and Goodstein 1991; Harrigan 1981; Kesner 1988). For example, previous studies have found that the presence of women directors on the board increases corporate charitable giving to the areas of community services, arts, and cultural activities (Williams 2003).

Besides their occupational backgrounds, women directors tend to possess certain psychological characteristics that may facilitate their hearing of certain stakeholders’ claims, and thus heighten the salience of such claims. Relative to men, women possess more communal traits: they are affectionate, helpful, kind, sympathetic, interpersonally sensitive, nurturing, and concerned about others’ welfare (Eagly et al. 2003). In the context of women directors, Nielsen and Huse (2010) suggests that “women’s attention to and consideration of the needs of others, may lead to women’s active involvement in issues of strategic nature that concern the firm and its stakeholders (p. 138).” Hence, women may be particularly sensitive to “certain organizational practices, such as corporate social responsibility and environmental politics (p. 138).”

In addition to their role in enhancing stakeholder salience, women directors may provide unique resources for the firm to connect to certain stakeholder groups, helping obtain stakeholder acceptance. Prior research argues that firms with women directors tend to be viewed as diversity-friendly employers. They are therefore likely to gain legitimacy among both existing and prospective female and minority employees (Ibrahim and Angelidis 1994). Firms with women directors tend to be viewed as offering career opportunities to advance women to senior management positions (Catalyst 2005). In fact, Bilimoria (2006) finds empirical evidence supporting a positive relationship between women directors on Fortune 500 boards and women in the management positions with significant responsibilities.

In sum, women directors, through their professional backgrounds and their unique psychological traits, tend to attend to certain types of stakeholder claims. Women directors’ heightened sensitivity to these claims raises their salience. In addition, women directors may also extend a firm’s resources to relate to certain key stakeholder groups. They thus play unique roles in enhancing a firm’s moral legitimacy in its operating context. We therefore hypothesize:

H2

The proportion of women directors is related to better CSR performance within a firm’s industry.

Empirical Analysis

Data

To test our hypotheses, we collected data from several archival sources including: (a) the IRRC that publishes corporate director data, (b) COMPUSTAT that provides financial data for public companies, and (c) FORTUNE magazine’s America’s Most Admired Corporations (FAMA) that compiles CSR performance data. More specifically, IRRC publishes detailed listings of corporate governance provisions for individual firms. Prior research finds IRRC database a reliable source for academic research (Gompers et al. 2003). COMPUSTAT is a commonly used source for firm-level financial data. FAMA is a large-scale annual survey conducted by FORTUNE magazine since 1980s. Many previous studies (e.g., Fombrun and Shanley 1990; Houston and Johnson 2000; McGuire et al. 1988) have confirmed the validity and reliability of the FAMA data.

In compiling data, FAMA first sorts the largest U.S. and foreign companies operating in the U.S. into industries. Within each industry, FAMA asks executives, directors, and financial analysts in this industry to rate companies on social responsibility along with other aspects of firm performance. FAMA then ranks firms according to their ratings and publishes firms’ rankings in their own industries. If a firm’s ranking is among the top half of its industry, FAMA labels the firm as the “most admired.” Otherwise, a firm is named as a “contender.” This ranking offers a comparison among major competitors within a given industry. This industry context is particularly meaningful in measuring CSR performance, as different industries may have different stakeholders (Cooper et al. 2001; Moore 2001), standards (Boutin-Dufresne and Savaria 2004), and levels of disclosure of CSR priorities (Waddock and Graves 1997).

The CSR measure from FAMA is based on perceptions or reputations. Compared to more objective measures (e.g., disclosed firm-level CSR activities), reputation-based CSR measures fit better with our conceptualization of CSR—a firm’s acceptance by its stakeholders as a moral corporate citizen. Stakeholder acceptance, in our opinion, is reflected in a firm’s CSR reputation in its industry. In addition, many prior studies prefer subjective CSR measures over objective ones (e.g., Fombrun and Shanley 1990; Luo and Bhattacharya 2006; Margolis and Walsh 2003; McGuire et al. 1988), as the latter may suffer from some validity issues, such as the lack of consensus on what should be included or excluded in CSR activities (Margolis and Walsh 2003; Orlitzky et al. 2003).

Our data collection started with FAMA 2008 (published in the March 2008 issue of FORTUNE) which included a total of 611 companies in 64 industries. Out of the 611 companies, approximately 15 % of these firms were not covered by IRRC, and, in a few cases, not included by COMPUSTAT. The resulting final sample consists of 516 firms in 64 industries, which represents a large-scale data set that covers U.S. and international firms listed on the U.S. stock exchanges. The covered industries appear in Table 1. FAMA 2008, which reports the results of 2007, was the most recent survey at the time of our data collection. In addition, as the global financial crisis starting in 2008 may interfere with firm CSR and financial performance, FAMA 2008, which predates this crisis, also represents a good choice.

Model Development

The dependent measure in this study (CSR), as reported by FAMA, is a dichotomous variable (i.e., a firm is ranked among the top or bottom half of its industry). We therefore use a logistic regression to model the likelihood that a firm outperforms its industry peers. In our model, we control for the effects of several types of idiosyncratic characteristics of firms, including managerial control of the board, firm financial performance and leverage, and firm capability in product/service quality and innovativeness. Mathematically, our model can be described as:

In (1), Prob(firm i ranked in top half of its industry) denotes the probability that firm i is ranked by FAMA in the top half of this firm’s industry in the dimension of CSR performance; α denotes the intercept. \( \chi_{i}^{'} \) is the transposed vector of independent variables. β denotes the vector of parameters to be estimated. In the process of model development, we included in the χ vector eight independent variables. We describe these variables below.

Proportion of outside directors and Proportion of women directors. These two variables measure two aspects of corporate board composition, relating to H1 and H2. Both variables were obtained from IRRC for the year 2007. These two variables were calculated as the percentage of outside directors and the percentage of women directors, respectively, in the total number of board members.

Proportion of stock owned by inside directors and Ratio of stock owned by outside to inside directors. These two variables account for the effects of managerial control of the board, as stock ownership between insiders and outsiders may affect the dynamics of board decision-making. Following Wang and Coffey (1992) and Coffey and Wang (1998), we include these two control variables in our model. Both variables were compiled from COMPUSTAT for the year 2007. The first variable is the number of stock shares owned by inside directors divided by the total shares outstanding; the second is the number of stock shares owned by outside directors divided by the number of shares owned by inside directors.

ROA and Financial leverage. These two variables control for firm financial performance and leverage. Prior research suggests that firm profitability and financial leverage may be linked to CSR performance (e.g., Mahoney and Thorn 2006; McGuire et al. 2003). We thus included ROA (Return on Assets) and Financial leverage, both of which were drawn from COMPUSTAT for the year 2007. ROA is a firm’s net income divided by total assets. Leverage is a firm’s total liability divided by total assets.

Product/Service Quality and Innovativeness Capability

These two variables capture different aspects of firm capability. Research shows that, in understanding the relationship between CSR performance and financial performance, two types of firm capability—to produce a quality product/service and to innovate—should be controlled for (Cho and Pucik 2005; Luo and Bhattacharya 2006; McWilliams and Siegel 2000). For instance, McWilliams and Siegel (2000) argue that statistical models without accounting for the effect of a firm’s innovativeness result in misspecification. Both Product/service quality and Innovativeness capability were provided by FAMA 2008. Of these two variables, the first is defined as the minimum condition or threshold of product/service attributes that a firm must meet when offering its products or service in competitive markets; the second is defined as a firm’s ability to apply its internal knowledge stock to produce new technology, new products/services, and other new fronts.

Descriptive statistics of the variables above appear in Table 2. In our data, the proportion of outside directors varies from 46 to 100 %, while the proportion of women directors varies from 0 to 45 %. These large dispersions enhance the reliability of estimates in statistical models. Next, we present more details of model development.

In fitting our statistical models, we first included all six control variables that were suggested by the prior literature discussed above. This created Model 1 (reported in Table 3). In addition, we consulted a statistical approach—stepwise variable selection (Hair et al. 1995)—to determine whether any control variables could be eliminated without a substantial loss of model goodness-of-fit. Our goal was two-folded: (a) we aimed to find a parsimonious yet adequate model to explain our data; (b) we examined the robustness of our key results (i.e., board composition variables) when different control variables were included in our analyses.

The stepwise process started with Model 1 (a.k.a., the full model), and gradually removed control variables to arrive at various intermediate reduced models. The selection of models relied on several model diagnostic criteria: AIC and SC statistics (smaller values indicate better models), and the likelihood ratio test (a statistically significant χ2 value indicates materially worsened model goodness-of-fit).Footnote 1 At the end of this process, we identified Model 2 (reported in Table 3) as being statistically preferred. Further reducing this model would significantly worsen model goodness-of-fit.

As in prior studies (e.g., Zhang et al. 2010), we only report Model 1 (the full model) and the statistically preferred Model 2 for brevity. In addition, we examined an alternative model that substituted present year data (i.e., year 2007) with lag year data (i.e., year 2006) for our independent variables. This model did not yield substantially different results. In Table 3, we report lag-year model as Model 1a.

It is important to note that, in our empirical analyses, the coefficient estimates for our key variables (Proportion of outside directors and Proportion of women directors) are consistent in direction and generally consistent in effect size across various model specifications (e.g., Models 1, 1a, and 2), suggesting the robustness of model estimates. Consequently, conclusions based on any of these models do not substantially differ. That said, we prefer Model 2 over Model 1. The non-significant financial variables were removed from the preferred model for parsimony without the loss of the overall model goodness-of-fit.Footnote 2 In the following sections, we focus our discussion on Model 2.

Results

According to Model 2 in Table 3, the coefficient estimates for board composition variables, Proportion of outside directors and Proportion of women directors, are 4.74 (p < 0.05) and 3.36 (p < 0.05), respectively. These results offer statistically significant evidence that greater presence of outside and women directors on corporate boards is related to better CSR performance in an industry, supporting both H1 and H2.

More specifically, we explain our results following the recommendations by Dobson (2002). Our results suggest that a 5 % increase in the percentage of outside directors increases the odds ratio (defined by the probability of a firm being ranked in the top half of its industry in CSR performance/the probability of a firm being ranked in the bottom half of its industry) by approximately 26 % (exp(4.74 × 5 %) − 1 = 0.26), while a 5 % increase in the percentage of women directors increases the odds ratio by approximately 18 % (exp(3.36 × 5 %) − 1 = 0.18). To put it differently, when all the variables are held at their sample mean levels, a 5 % increase in the percentage of outside directors leads to a 9.93 % increase in the probability that this firm’s CSR performance will be ranked in the top half of its industry. Similarly, a 5 % increase in the percentage of women directors leads to a 1.25 % increase in the probability of this firm being ranked in the top half of its industry.

Concerning the control variables, the relationships between the stock ownership by directors and CSR performance seem to be consistent with the findings of prior studies (e.g., Coffey and Wang 1998). However, these relationships are not statistically significant in our data. In addition, our data analyses reveal positive associations between several aspects of firm performance (product/service quality and innovativeness) and CSR performance. These results also are consistent with prior studies (e.g., McGuire et al. 2003; McWilliams and Siegel 2000).

In sum, our results suggest that two important aspects of board composition, namely the proportions of outside and women directors, have significant positive associations with CSR performance within an industry. Our data from more than 500 largest firms across 64 industries in the Post-SOX era provide strong empirical evidence to support both H1 and H2.

Supplementary Study Using KLD Ratings

Although our conceptualization of CSR performance fits well with the reputation-based CSR measure from FAMA, past research has suggested that the construct of CSR may be complex and multidimensional (e.g., Griffin and Mahon 1997; Mattingly and Berman 2006; McWilliams and Siegel 2000). Researchers have, therefore, called for the use of multiple sources and multiple measures to better capture the multidimensionality of CSR (Carroll 1994; Chiu and Sharfman 2011; Graves and Waddock 1994). In light of this, we supplemented our FAMA-based study with another widely used CSR data source—the Kinder, Lydenberg and Domini (KLD) CSR ratings.

KLD Data

In comparison to the reputation-based FAMA CSR measure, KLD ratings are mostly based on firms’ reported actions and/or events. Thus, prior research considers KLD ratings to be more objective in nature (Liston-Heyes and Ceton 2007), lending triangulation to our conclusions based on subjective FAMA data. KLD ratings include seven large categories (e.g., community and environment issues) and approximately 80 items which are further categorized into either strengths or concerns.

As a supplementary study, we started our data collection with the final sample in our FAMA study (516 firms). For each firm in this sample, we attempted to locate its 2007 KLD ratings. A small number of firms were not covered by the KLD ratings, reducing our sample size to 481 firms.

CSR Measure from KLD

In order to adapt the KLD ratings to capture stakeholder management, we followed the CSR operationalization described by Hillman and Keim (2001). More specifically, KLD items were chosen from five existing categories of KLD ratings: employee relations, diversity issues, product issues, community relations, and environmental issues. As theoretical work in stakeholder management literature has yet to identify the relative importance of various stakeholder groups and issues (Mitchell et al. 1997), we chose to simply sum up all the items in the five categories with strengths being treated as positives and concerns as negatives. This simple sum procedure produced a composite CSR score, which was named “CSR_KLD.” This procedure again mirrored the one described by Hillman and Keim (2001). One exception, however, was the exclusion of two items in the category of diversity issues (i.e., “Board of Directors” and “Non-Representation” in the KLD item definition). Both account for the representation of women, minorities, and the disabled on corporate boards, relating to one of our key independent variables: Proportion of women directors. The remaining items in the diversity category do not relate to board composition.

With the CSR_KLD measure, we ranked firms within their own industries. We denoted a firm ranked in the top half of its industry as a top performer with “1” in value, and a firm in the bottom half as a contender with “0” in value. This dichotomization, though it might have led to reduced variation in the dependent variable, was critical to capturing the industry-specific context of CSR. Firms in a particular industry may be more engaged in CSR activities than others simply due to the industry’s nature (Boutin-Dufresne and Savaria 2004). Thus, simply adding up actions or events reported in KLD ratings without accounting for industry differences is inadequate (Cottrill 1990). Moore (2001) made this point simply: “comparing CSR performance of an oil company, where environmental and employee safety issues are likely to be paramount, with a high street retailer in effect makes no sense (p. 304).”

Analyses and Results

We followed the same statistical procedure described in our FAMA study to analyze the data (i.e., logistic regression and stepwise variable selection). More specifically, we started with the full model (S1), and then gradually reduced this model to the statistically preferred model (S2) based on the model diagnostic statistics previously described (i.e., AIC, SC, and likelihood ratio test). Both Models S1 and S2 appear in Table 3.Footnote 3

According to Model S2 in Table 3, the coefficient estimates for the board composition variables, Proportion of outside directors and Proportion of women directors, are 0.94 (p = 0.5) and 2.99 (p < 0.05), respectively. Although the direction of the parameter estimate associated with Proportion of outside directors is as expected (“+”), this parameter is not statistically significant. The estimate associated with Proportion of women directors is statistically significant, suggesting that greater presence of women directors on corporate boards is related to better CSR performance—measured by CSR actions and events—within an industry. This result supports H2.

The results of this supplementary study offer additional evidence to strengthen our conclusions regarding women directors (H2) and some control variables (e.g., Innovativeness capability). This study, however, does not offer statistically significant results to support the effects of outside directors (H1).

As discussed earlier, stakeholders’ perception of a firm’s CSR reputation fits well with the key notion of stakeholder acceptance. We thus prefer the reputation-based FAMA measure over the action/event-based KLD measure. Firm actions/events should be viewed as a firm’s efforts to gain stakeholder acceptance, representing a more remote proxy for CSR in our research context. In light of the above, the supplementary study is viewed as a meaningful attempt to better capture the multidimensionality of CSR. The results of this study, however, are exploratory in nature. As prior research points out, several important methodological issues need to be resolved for KLD-based CSR measures. For example, the relative importance of each stakeholder group or issue across industries should be considered (Mitchell et al. 1997).

Discussion and Implications for Future Research

In this research, we examined the relationship between the composition of a firm’s board of directors and its CSR performance. Following legitimacy theory, we view CSR performance as a reflection of a firm’s moral legitimacy among its stakeholders. We argue that outside and women directors contribute to effective stakeholder management. Enhanced stakeholder management fosters stakeholder acceptance and thus helps establish a firm’s legitimacy among its stakeholders. Our empirical results show that greater presence of outside and women directors is related to better CSR performance within a firm’s industry. In the Post-SOX era, most public firms now have a substantial presence of outside and women directors on their boards. Given this new reality of corporate board structure, our results are particularly meaningful in affirming the continued importance of selecting outside and women directors as a means to influence CSR performance. Our main study supports both our hypotheses (H1 and H2); our supplementary study supports H2.

Our study makes several important empirical contributions. In our analyses, we utilize two measures of within-industry CSR performance: the FAMA-based measure that reflects firm reputation in the industry, and the KLD-based measure that reports firm actions/events. As firms in different industries may encounter different stakeholders and operating contexts, our conceptualization as well as operationalization of CSR performance makes most sense within the industry context. Our empirical analyses make a contribution in this regard by utilizing two within-industry CSR measures. The construct of CSR is complex and multidimensional. Thus, using an alternative CSR measure from a different data source in our supplementary study aids in triangulation (Carroll 1994; Graves and Waddock 1994), representing another contribution to the empirical analysis of CSR performance.

Other aspects of our empirical analyses also contribute to the literature. Both our main and supplementary studies use overall CSR performance. That is, performance accounts for both the strengths and weaknesses of CSR and across multiple issues of CSR. This approach is notably different from some prior studies that focus on either strengths or weaknesses of CSR (e.g., Post et al. 2011), as well as other studies that focus on specific areas of CSR like charitable giving and green issues (e.g., Post et al. 2011; Wang and Coffey 1992). In addition, both our studies use large samples of approximately 500 firms across 64 different industries, in contrast to previous research of substantially smaller sample sizes (e.g., Bear et al. 2010; Post et al. 2011; Wang and Coffey 1992). Thus, our empirical studies represent macro-level and large-scale analyses of outside and women directors’ relationships to CSR performance, adding to the field new and meaningful empirical evidence.

Besides empirical importance, our work contributes to legitimacy theory by suggesting board member selection as a possible means to enhance a firm’s moral legitimacy. Although a large body of organizational legitimacy research exists within the literature on corporate governance (Certo et al. 2001; Filatotchev and Bishop 2002), strategic management (Higgins and Gulati 2003, 2006), and CSR (Palazzo and Scherer 2006, 2008; Scherer and Palazzo 2011), there is little existing work explicitly linking board structuring to firms’ moral legitimacy. In the studies of organizational legitimacy, most attention is directed to two other types of legitimacy, namely pragmatic and cognitive legitimacies,Footnote 4 as they tend to be related directly to financial performance (Scherer and Palazzo 2011). Yet, as business actions increasingly become the important subjects of social, political and moral debates, there is a pressing need for firms to identify strategies and mechanisms that help them secure moral legitimacy in the eyes of their stakeholders (Palazzo and Scherer 2006, 2008; Scherer and Palazzo 2011). Our research makes a meaningful attempt to offer insights in this area; our empirical analyses support the proposed relationships.

Our research offers implications for both stakeholders and businesses. For stakeholders, participation in board operations may be a good strategy to ensure that firms adequately hear and respect stakeholder voices and claims. This implication is consistent with previous research (Frooman 1999). For businesses, failure to recognize stakeholder claims may damage firms’ acceptance by their stakeholders and thus reduce a firm’s moral legitimacy in their operating environments. Under certain conditions, the loss of moral legitimacy may suspend a firm’s “license to operate.” Monsanto’s failure to commercialize its sterilized seed technology after worldwide protests against it vividly demonstrates this point (Hart and Sharma 2004). In order to avoid Monsanto’s mistakes, we concur with previous studies (e.g., de Graaf and Herkströter 2007) that firms should improve stakeholder management by institutionalizing certain CSR behaviors through careful structuring of corporate boards. Although careful selection of board members is only one factor in effective stakeholder management, it is the board’s job to bring coherence to the operations or investments related to stakeholder management, because the board “can bring a visionary assessment of how such activities, when properly integrated, can deliver future value for the firm (Leonard and Rangan 2006, p. 12).”

Several limitations in our study may help suggest directions for future research. First, the concept of CSR is known to be complex and somewhat ambiguous (Vaaland et al. 2008). In fact, the CSR concept has been evolving ever since it was first introduced in the 1950s (Carroll 1999). This lack of a clear definition may bring unwanted noise to the FAMA survey. For KLD ratings, it becomes difficult to decide what items should be included/excluded and what relative weights should be applied to accurately reflect a firm’s CSR performance. Future research that allows us to fine tune CSR measures would be particularly meaningful. This is also the premise to design longitudinal studies assessing CSR performance before and after SOX.

Second, our empirical analyses are based on the correlations among variables. The directionality of the relationship between outside (women) directors and CSR performance is established through our conceptual analysis based on the literature of legitimacy theory and stakeholder management. Future research utilizing designs that better identify the cause and effect (e.g., field experiments) would also greatly complement our work.

Finally, as a director’s gender and inside/outside membership are not necessarily mutually exclusive, the two board composition variables in our study may have some overlap (e.g., women directors include both inside and outside directors). We, therefore, fitted models that partitioned the effects of the two board composition variables.Footnote 5 The results of these models seem to be generally consistent with those of Model 1. We found some empirical evidence that women outside directors, among other types of directors, have the largest effect on CSR performance.Footnote 6 Although this is not unexpected, our conceptual framework does not inform the interaction between the two board composition variables (e.g., our conceptual work does not predict the difference between women inside directors and men outside directors). The findings from such modeling efforts are therefore mostly exploratory, thus calling for future research—especially conceptual work—to guide a more nuanced analysis of the interaction of various characteristics of board directors.

In closing, board directors’ roles and functions are of great interest to both academics and practitioners. Our work adds to the field by showing that outside and women directors help enhance a firm’s management of its stakeholders and thus establish a firm’s moral legitimacy among its stakeholders. In addition, our work should motivate interesting future studies that further our understanding of this critically important but relatively under-researched area.

Notes

As an example of illustration, we first eliminated the least statistically significant control variable, Financial leverage (p = 0.96) in Model 1 (i.e., the full model), to arrive at an intermediate reduced model. Both AIC and SC statistics indicate that this reduced model is preferred (AICfull = 327.49 vs. AICreduced = 325.49; SCfull = 363.45 vs. SCreduced = 357.46). The likelihood ratio test also suggests that this reduced model is preferred because the exclusion of Financial leverage does not significantly worsen model goodness-of-fit (χ2 = 0.003, df = 1, p = 0.96). We continued the process as we selected the next variable to remove until model diagnostic criteria indicated otherwise.

Model 1 does not find a significant relationship between firm CSR performance and financial performance. This finding is documented in prior literature. McWilliams and Siegel (2000), with a specific focus on this issue, suggest that, after firm innovativeness is controlled for, the relationship between firm CSR performance and financial performance is “neutral” (i.e., statistically non-significant) (p. 603).

In addition to Models S1 and S2, we also conducted data analyses with CSR_KLD retained as a continuous variable. Results from these analyses (not reported for brevity) are not substantially different.

Pragmatic legitimacy is based on stakeholders’ calculation of self-interest. Cognitive legitimacy is based on taken-for-granted social assumptions. See more discussion in Suchman (1995).

The partitioning is done through using three variables to account for the four types of directors: the proportion of women outside directors, proportion of women inside directors, proportion of men outside directors, and proportion of men inside directors.

For instance, we found that among outside directors, women have greater effects on CSR performance than men. The difference (β = 2.96) is statistically significant at the 10 % level.

Abbreviations

- CSR:

-

Corporate social responsibility

- SOX:

-

The Sarbanes-Oxley Act of 2002

References

Ayuso, S., & Argandona, A. (2009). Responsible corporate governance: Towards a stakeholder board of directors? Corporate Ownership & Control, 6(4), 9–19.

Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207–221.

Beliveau, B., Cottrill, M., & O’Neill, H. M. (1994). Predicting corporate social responsiveness: A model drawn from three perspectives. Journal of Business Ethics, 13(9), 731–738.

Bilimoria, D. (2006). The relationship between women corporate directors and women corporate officers. Journal of Managerial Issues, 18(1), 47–61.

Boeker, W., & Goodstein, J. (1991). Organizational performance and adaptation: Effects of environment and performance on changes in board composition. Academy of Management Journal, 34(4), 805–826.

Boutin-Dufresne, F., & Savaria, P. (2004). Corporate social responsibility and financial risk. Journal of Investing, 13(1), 57–66.

Campbell, J. L. (2006). Institutional analysis and the paradox of corporate social responsibility. American Behavior Scientist, 49(7), 925–938.

Carroll, A. B. (1994). Social issues in management research: Experts’ views, analysis, and commentary. Business & Society, 33(1), 5–29.

Carroll, A. B. (1999). Corporate social responsibility: Evolution of a definitional construct. Business & Society, 38(3), 268–295.

Catalyst. (2005). 2005 catalyst census of women board directors of the fortune 500. New York: Catalyst.

Certo, S. T., Covin, J. G., Daily, C. M., & Dalton, D. R. (2001). Wealth and the effects of founder management among IPO-stage new ventures. Strategic Management Journal, 22(6–7), 641–658.

Chiu, S. C., & Sharfman, M. (2011). Legitimacy, visibility, and the antecedents of corporate social performance: An investigation of instrumental perspective. Journal of Management, 37(6), 1558–1585.

Cho, H. J., & Pucik, V. (2005). Relationship between innovativeness, quality, growth, profitability, and market value. Strategic Management Journal, 26(6), 555–575.

Coffey, B., & Wang, J. (1998). Board diversity and managerial control as predictors of corporate social performance. Journal of Business Ethics, 17(14), 1595–1603.

Cooper, S., Crowther, D., Davies, M., & Davis, E. (2001). Shareholder or stakeholder value: The development of indicators for the control and measurement of performance. London: CIMA Publishing.

Cottrill, M. T. (1990). Corporate social responsibility and the marketplace. Journal of Business Ethics, 9(9), 723–729.

Dalton, D. R., & Dalton, C. M. (2010). Women and corporate boards of directors: The promise of increased, and substantive, participation in the post Sarbanes-Oxley era. Business Horizons, 53(3), 257–268.

de Graaf, F. J., & Herkströter, C. A. J. (2007). How corporate social performance is institutionalized within the governance structure: The Dutch corporate governance model. Journal of Business Ethics, 74(2), 581–597.

Dobson, A. (2002). An introduction to generalized linear models (2nd ed.). Boca Raton, FL: Chapman & Hall/CRC.

Eagly, A. H., Johannesen-Schmidt, M. C., & van Engen, M. L. (2003). Transformational, transactional, and laissez-faire leadership styles: A meta-analysis comparing women and men. Psychological Bulletin, 129(4), 569–591.

Filatotchev, I., & Bishop, K. (2002). Board composition, share ownership, and ‘underpricing’ of U.K. IPO firms. Strategic Management Journal, 23(10), 941–955.

Fombrun, C., & Shanley, M. (1990). What’s in a name? Reputation building and corporate strategy. Academy of Management Journal, 33(2), 233–258.

Fortune. (2008). America’s most admired companies. (March 17), 65–67.

Frooman, J. (1999). Stakeholder influence strategies. Academy of Management Review, 24(2), 191–205.

Goldschmidt, N. P., & Finkelstein, J. H. (2001). Academics on board: University presidents as corporate directors. Academe, 87(5), 33–37.

Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107–156.

Graves, S. B., & Waddock, S. A. (1994). Institutional investors and corporate social performance. Academy of Management Journal, 37(4), 1035–1046.

Griffin, J., & Mahon, J. (1997). The corporate social performance and corporate financial performance debate: 25 years of incomparable research. Business & Society, 36(1), 5–31.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1995). Multivariate data analysis (4th ed.). Englewood Cliffs, NJ: Prentice-Hall Inc.

Harrigan, K. R. (1981). Numbers and positions of women elected to corporate boards. Academy of Management Journal, 24(3), 619–625.

Hart, S. L., & Sharma, S. (2004). Engaging fringe stakeholders for competitive imagination. Academy of Management Executive, 18(1), 7–18.

Higgins, M. C., & Gulati, R. (2003). Getting off to a good start: The effects of upper echelon affiliations on underwriter prestige. Organization Science, 14(3), 244–263.

Higgins, M. C., & Gulati, R. (2006). Stacking the deck: The effects of top management backgrounds on investor decisions. Strategic Management Journal, 27(2), 1–25.

Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal, 22(2), 125–139.

Houston, M. B., & Johnson, S. A. (2000). Buyer–supplier contracts versus joint ventures: Determinants and consequences of transaction structure. Journal of Marketing Research, 37(1), 1–15.

Ibrahim, N. A., & Angelidis, J. P. (1994). Effect of board members’ gender on corporate social responsiveness orientation. Journal of Applied Business Research, 10(1), 35–41.

Ibrahim, N. A., & Angelidis, J. P. (1995). The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? Journal of Business Ethics, 14(5), 405–410.

Ibrahim, N. A., Howard, D. P., & Angelidis, J. P. (2003). Board members in the service industry: An empirical examination of the relationship between corporate social responsibility orientation and directorial type. Journal of Business Ethics, 47(4), 393–401.

Johnson, R. A., & Greening, D. W. (1999). The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42(5), 564–576.

Kesner, I. F. (1988). Directors’ characteristics and committee membership: An investigation of type, occupation, tenure, and gender. Academy of Management Journal, 31(1), 66–84.

Leonard, H. B., & Rangan, V. K. (2006). Corporate social responsibility strategy and boards of directors. Directors & Boards, 3(4), 12–14.

Linck, J. S., Netter, J. M., & Yang, T. (2009). The effects and unintended consequences of the Sarbanes-Oxley Act on the supply and demand for directors. Review of Financial Studies, 22(8), 3287–3328.

Liston-Heyes, C., & Ceton, G. (2007). An investigation of real versus perceived CSP in S&P-500 firms. Journal of Business Ethics, 89(2), 283–296.

Logsdon, J. M., & Yuthas, K. (1997). Corporate social performance, stakeholder orientation, and organizational moral development. Journal of Business Ethics, 16(12–13), 1213–1226.

Luo, X., & Bhattacharya, C. B. (2006). Corporate social responsibility, customer satisfaction, and market value. Journal of Marketing, 70(4), 1–18.

Mahoney, L., & Thorn, L. (2006). An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. Journal of Business Ethics, 69(2), 149–162.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268–305.

Mattingly, J. E., & Berman, S. L. (2006). Measurement of corporate social action: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Business & Society, 45(1), 20–46.

McGuire, J., Dow, S., & Argheyd, K. (2003). CEO incentives and corporate social performance. Journal of Business Ethics, 45(4), 341–359.

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854–872.

McKendall, M., Samchez, C., & Sicilian, P. (1999). Corporate governance and corporate illegality: The effects of board structure on environmental violations. International Journal of Organizational Analysis, 7(3), 201–223.

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: Correlation or misspecification? Strategic Management Journal, 21(5), 603–609.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22(4), 853–886.

Moore, G. (2001). Corporate social and financial performance: An investigation in the U.K. Supermarket industry. Journal of Business Ethics, 34(3–4), 299–315.

Nielsen, S., & Huse, M. (2010). The contribution of women on boards of directors: Going beyond the surface. Corporate Governance: An International Review, 18(2), 136–148.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3), 403–441.

Palazzo, G., & Scherer, A. G. (2006). Corporate legitimacy as deliberation: A communicative framework. Journal of Business Ethics, 66(2), 71–88.

Palazzo, G., & Scherer, A. G. (2008). Corporate social responsibility, democracy, and the politicization of the corporation. Academy of Management Review, 33(3), 773–775.

Pfeffer, J., & Salancik, G. R. (1974). Organizational decision making as a political process: The case of the university budget. Administrative Science Quarterly, 19(2), 135–151.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. New York: Harper & Row.

Post, C., Rahman, N., & Rubow, E. (2011). Green governance: Boards of directors’ composition and environmental corporate social responsibility. Business & Society, 50(1), 189–213.

Saiia, D. H. (2007). Stakeholder salience, issues management and mapping new ways to sustainability. In S. Sharma, M. Starik, & B. Husted (Eds.), Organizations and the sustainability mosaic: Crafting long-term ecological and societal solutions. Cheltenham: Edward Elgar.

Scherer, A. G., & Palazzo, G. (2007). Toward a political conception of corporate responsibility: Business and society seen from a Habermasian perspective. Academy of Management Review, 32(4), 1096–1120.

Scherer, A. G., & Palazzo, G. (2011). The new political role of business in globalized world: A review of a new perspective on CSR and its implications for the firm, governance, and democracy. Journal of Management Studies, 48(4), 899–931.

Stanwick, P. A., & Stanwick, S. D. (1998). The determinants of corporate social performance: An empirical examination. American Business Review, 16(1), 86–93.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3), 571–610.

Terjesen, S., Sealy, R., & Singh, V. (2009). Women directors on corporate boards: A review and research agenda. Corporate Governance: An International Review, 17(3), 320–337.

Vaaland, T. I., Heide, M., & Grønhaug, K. (2008). Corporate social responsibility: Investigating theory and research in the marketing context. European Journal of Marketing, 42(9/10), 927–953.

Valenti, A. (2007). The Sarbanes-Oxley Act of 2002: Has it brought about changes in the boards of large U.S. Corporations? Journal of Business Ethics, 81(2), 7–18.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18(4), 303–319.

Wang, J., & Coffey, B. (1992). Board composition and corporate philanthropy. Journal of Business Ethics, 11(10), 771–778.

Wang, J., & Dewhirst, H. D. (1992). Boards of directors and stakeholder orientation. Journal of Business Ethics, 11(2), 115–123.

Webb, E. (2004). An examination of socially responsible firms’ board structure. Journal of Management and Governance, 8(3), 255–277.

Williams, R. J. (2003). Women on corporate boards of directors and their influence on corporate philanthropy. Journal of Business Ethics, 42(1), 1–10.

Zhang, J. Q., Craciun, G. C., & Shin, D. S. (2010). When does electronic word-of-mouth matter? A study of consumer product reviews. Journal of Business Research, 63(12), 1336–1341.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhang, J.Q., Zhu, H. & Ding, Hb. Board Composition and Corporate Social Responsibility: An Empirical Investigation in the Post Sarbanes-Oxley Era. J Bus Ethics 114, 381–392 (2013). https://doi.org/10.1007/s10551-012-1352-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-012-1352-0