Abstract

The 2010–2011 Canterbury earthquakes, which involved widespread damage during the February 2011 event and ongoing aftershocks near the Christchurch Central Business District, left this community with more than $NZD 40 billion in losses (~20 % GDP), demolition of approximately 60 % of multi-storey concrete buildings (3 storeys and up), and closure of the core business district for over 2 years. The aftermath of the earthquake sequence has revealed unique issues and complexities for the owners of commercial and multi-storey residential buildings in relation to unexpected technical, legal, and financial challenges when making decisions regarding the future of their buildings impacted by the earthquakes. The paper presents a framework to understand the factors influencing post-earthquake decisions (repair or demolish) on multi-storey concrete buildings in Christchurch. The study, conducted in 2014, includes in-depth investigations on 15 case-study buildings using 27 semi-structured interviews with various property owners, property managers, insurers, engineers, and government authorities in New Zealand. The interviews revealed insights regarding the multitude of factors influencing post-earthquake decisions and losses. As expected, the level of damage and repairability (cost to repair) generally dictated the course of action. There is strong evidence, however, that other variables have significantly influenced the decision on a number of buildings, such as insurance, business strategies, perception of risks, building regulations (and compliance costs), and government decisions. The decision-making process for each building is complex and unique, not solely driven by structural damage. Furthermore, the findings have put the spotlight on insurance policy wordings and the paradoxical effect of insurance on the recovery of Christchurch, leading to other challenges and issues going forward.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

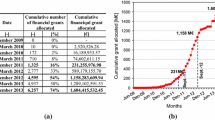

The aftermath of the 2010–2011 Canterbury earthquakes has revealed the complexity and uniqueness of the decision-making process leading to the demolition or repair of building structures in a post-disaster environment. In particular for Christchurch, the circumstances of the earthquake sequence exposed several unique features compounded by complicating issues for building owners. First of all, the high intensity of ground shaking (including strong vertical acceleration, widespread soil liquefaction and lateral spreading), the number of strong aftershocks, and the extended period over such events repeatedly caused substantial damage were unexpected in Christchurch and unprecedented elsewhere in the world (Bradley et al. 2014; King et al. 2014). Additionally, the changes in building regulations following the earthquake sequence, the establishment and longevity (2½ years) of the Central Business District (CBD) exclusion zone, and the relatively high insurance penetration level (i.e. the high ratio of insured losses to economic losses) are among the factors that have exacerbated the complexities of the decisions and challenges for building owners (Chang et al. 2014). The Christchurch CBD encompasses approximately 600 hectares and is defined by the grid road network bounded by the four avenues: Deans, Bealey, Fitzgerald, and Moorhouse. There are at least 3000 buildings within the Christchurch CBD, consisting of predominantly commercial and light-industrial buildings (58 %) in addition to a significant number of residential buildings (42 %), particularly towards the north and east edges of the CBD (Pampanin et al. 2012). The response of modern (mid-1980s and onwards) multi-storey reinforced concrete structures, the dominant type of multi-story commercial building in the CBD, was satisfactory from the perspective of expected design performance and life safety, in particular when considering the high intensity of shaking, high inelastic behaviour, and large displacement demands (Kam and Pampanin 2011). As per capacity design principles, plastic hinges formed in discrete regions, allowing the buildings to dissipate energy and people to evacuate. However, a significant number of modern multi-storey buildings with a low damage ratio (defined here as the estimated cost of repairing the damage to cost of replacing the structure) were deemed uneconomic to repair, declared a total insurance loss, and consequently demolished. In September 2014, the Canterbury Earthquake Recovery Authority (CERA) reported that approximately 150 “significant” buildings (generally commercial and multi-unit residential buildings over five storeys in the CBD) had been demolished, representing about 65 % of the significant buildings in the CBD and immediately surrounding neighbourhoods. This number includes Civil Defence (CD) demolitions immediately after the February earthquake and compulsory acquisitions under the Christchurch Central Development Unit (CCDU) recovery plan, accounting for 5 and 10 % of the demolitions of significant buildings, respectively. The geographical distribution of commercial and residential building demolitions (including partial demolitions, i.e. the removal of part of a building for immediate safety reasons) within Christchurch CBD is presented in Fig. 1.

CERA was established in April 2011 to lead and coordinate the ongoing recovery effort in the city, and has issued demolition notices (Section 38 Notice) on approximately 65 significant buildings which have been identified as dangerous (out of 150 demolitions). According to the CERA database, a similar number of demolitions (62 significant buildings) were initiated by the owners, although the buildings were not declared dangerous by CERA and the majority of them (~80 % or 51 buildings) presented a damage ratio from Level 2 assessments (NZSEE 2009) of <30 %. The majority (~80 %) of demolished significant buildings were reinforced concrete structures, with the dominant seismic force resisting systems being moment frames (MF) and shear wall (SW), representing approximately 46 and 29 % of the considered buildings, respectively (Fig. 2). Only nine steel structures with more than 5-storeys were recorded in the CBD and three such buildings have been demolished.

These outcomes suggest that the complexity of post-earthquake decisions should be considered in the determination of expected losses for building structures. The level of damage is typically a good indicator of the seismic performance of a building, however, other multifaceted variables may be involved in the repair or demolish decision. The course of action for each building is complex and unique, not solely driven by structural damage. This study also brings evidence that research is needed to better understand the relationship between damage and residual capacity, and that repairability guidelines, if they exist, need to be aligned with earthquake insurance policies.

This paper describes the methodological approach for data collection conducted in Christchurch in 2014 and summarizes a framework to explore the steps and associated issues in the decision-making process leading to the demolition or repair of buildings. The study includes in-depth investigations on case-study multi-story concrete buildings using semi-structured interviews. Last, it describes several outstanding issues that need to be addressed by future research and outlines potential strategies for moving forward. The conclusions argue that a better understanding of the factors influencing financial losses from urban earthquakes will contribute to clear, consistent, and acceptable performance objectives for individual buildings and, ultimately, enhance community resilience.

2 Methodological approach and data collection

With the assistance of locally-based research partners, the research team conducted 27 interviews to gather in-depth qualitative and quantitative data on the decision-making process regarding the demolition or repair of buildings, including resulting impacts on building stakeholders, lessons learned, and challenges going forward. For exploratory analysis, interviewees were grouped into four categories by their relation to the decision, the building, and type of organisation (Appendix 1). The sample of stakeholders selected sought to balance different views and opinions from building owners and senior representatives, engineers, insurers, and governmental organisations that have been involved with post-earthquake decisions. The focus was on multi-storey concrete buildings in the Christchurch CBD. All of the interviews were conducted in-person in Christchurch, Wellington, or Auckland from September to November 2014. The majority of the interviews, which typically lasted for 90 min, were audio-recorded with permission and transcribed. Interview questions focused on the respondents’ perspectives on post-earthquake decisions, sought to document building damage data, and enabled the interviewees to ‘tell the story’ for specific case-study concrete buildings. Case studies were chosen to achieve variation on relevant features such as age, size, structural systems, occupancies, damage levels, ownership, and outcome. All of the interviewees were asked about their own roles in the post-earthquake response and recovery, how well they considered Christchurch’s recovery to be proceeding, what steps and issues were involved in the decision making process, and finally what lessons the disaster had provided in terms of risk mitigation strategies. The questions were similar for all the participants but a few questions were reworded to reflect the different stakeholders’ perspectives. The interviewees were selected on the basis of either their professional decision-making roles in relation to the case-study buildings or their roles as representatives of groups influencing post-earthquake decisions. The study also includes the collection of detailed data (structural drawings, damage evaluation reports, insurance policies, financials, etc.) to explore the range of factors influencing the decision, offering explanations regarding the relationships found among the identified factors. Data were also collected through other methods: extraction of information at Christchurch City Council (Level 2 rapid assessments, building consents, and property details) and CERA (Silverfish database), technical reports from research organisations, popular media articles, and data sharing with structural engineering consultants.

3 Conceptual framework

The literature provides various models and frameworks for understanding the factors influencing decision-making processes in relation to the selection of earthquake risks mitigation strategies and implementation of seismic retrofit (Egbelakin et al. 2011; Petak and Alesch 2004). Furthermore, a number of studies present practical guidance and tools for assessing the repair costs and residual capacity of earthquake-damaged buildings (FEMA 308 1998; Polese et al. 2014; Yang et al. 2009). Very few researchers have studied, however, organisational behaviours and decision-making schemes in a post-earthquake environment for infrastructure owners and property managers. It is of critical importance to appreciate how building owners actually make decisions after a disaster, when time, money, resources, or other factors may impose pressures and influence the decision-making process. The examination of this process will provide opportunities for understanding the factors affecting property owners’ decisions in relation to earthquake-damaged buildings, and consequently provides insights into how to enhance seismic resilience by preventing demolition of potentially salvageable buildings and substantial loss of the built environment. A conceptual multi-phase framework was developed prior to the interviews and refined based on observations from the interviews and data collection (Fig. 3). The framework is a tool to study how building owners and organisations responded to the Canterbury earthquakes and made decisions on the future of their buildings, with consideration given to the different players involved in the process (engineers, insurers, tenants, etc.).

The sequential phases of the framework facilitated the organisation of the data collection process in a chronological order, from post-earthquake visual inspections to subsequent impacts on building stakeholders, together with possible outcome scenarios. For the sake of completeness, a contextualisation phase defines the pre-earthquake conditions of the building, ground conditions, ownership details, and insurance policy (material damage and business interruption). The framework adopts a holistic perspective by providing the necessary background for a specific building, in addition to taking into account any particularities of the built environment or socio-economic conditions that may have influenced the final decision. Although some variables may be more significant than others in relation to a specific building, findings from the study suggest that decision-making variables influencing the course of action on earthquake-damaged buildings may be grouped into four themes: insurance, damage and residual capacity, decision-making strategies, and legislation. Observations from the interviews revealed that the interrelation of these factors, in addition to the unique features of the earthquake sequence and uncertainties in the recovery of Christchurch, added complexity in determining appropriate courses of action. Results are organised based on these four themes and discussed in Sects. 6.2, 6.3, 6.4 and 6.5 accordingly. Further details on the development of the framework are provided in Marquis (2015).

4 Christchurch context

In order to understand the factors influencing demolition decisions in Christchurch, it is important to appreciate the context of the Christchurch physical, regulatory, and economic environment. The following sections summarise unique aspects of the earthquake sequence, CBD building ownership, building regulations, the earthquake recovery act, and building assessments.

4.1 Canterbury earthquake sequence

The most significant events of the 2010–2011 Canterbury earthquake sequence occurred on 4 September 2010 (M7.1, 10 km deep, 35 km W of Christchurch CBD), 26 December 2010 (M4.9, 12 km deep, within 5 km of the Christchurch CBD), 22 February 2011 (M6.2, 5 km deep, 10 km SE of Christchurch CBD), 13 June 2011 (2 events: M6.0 and M5.2, 9 and 6 km deep, 10 km SE of Christchurch CBD), and 23 December 2011 (2 events: M5.9 and M5.8, 8 and 6 km deep, 20 km E and 10 km E of Christchurch CBD). The 22 February 2011 event occurred at 12.51 p.m. during a weekday and was the most severe and damaging event of the sequence due to the proximity of the epicenter to the CBD, shallow depth, distinctive directionality effects (steep slope angle of the fault rupture), and incremental damage from preceding earthquakes (September and December 2010) (Bradley et al. 2014). The February earthquake caused significant shaking across Christchurch, especially in the CBD, eastern suburbs, Lyttleton, and the Port Hills. Substantial damage to multi-storey commercial and residential buildings, including permanent tilting due to ground deformation, occurred in the CBD (Pampanin et al. 2012). Two multi-storey concrete buildings collapsed and hundreds of unreinforced masonry buildings (URM) experienced partial or total collapse, resulting in 185 fatalities and many seriously injured. The government declared a state of national emergency and Civil Defence became lead agency, with a cordon established around the whole CBD area. Chang et al. (2014) provides a detailed description of the impacts of the CBD cordon which had been reduced to about half its original size by July 2011 and removed entirely in June 2013. The continued aftershocks contributed to the longevity of the cordon, with the 13 June 2011 earthquakes causing further damage to previously damaged structures (including partial collapse of at least two CBD buildings) and the 23 December 2011 earthquake also causing substantial land damage around Christchurch.

4.2 Building ownership profile in Christchurch CBD

Property ownership in Christchurch is important to understand as it provides historical background of the commercial property market which existed prior to the Canterbury earthquake sequence. According to a study conducted by Colliers (Ernst and Young 2012), the vast majority of commercial office buildings in the CBD were owned by local investors and developers, which comprise a mix of high net worth individuals and families and informal groups of individuals, including a number of farmers. Only 13.4 % of owners (by net lettable floor area) were based overseas (Fig. 4). Because of the nature of the local economy (largely driven by agriculture with very few large corporate headquarters located in Christchurch) and the pre-earthquake surplus of commercial office space in a large CBD area, Christchurch (population of 370,000 in 2011) had a low rent commercial office market in comparison to Auckland or Wellington. As a result, major corporate and institutional investors have withdrawn from office building ownership in the CBD over the last three decades due to the inability to attract higher rent tenants. In relation to this study, the economic context prior to the earthquakes may have also influenced post-earthquake decisions, since lower income streams generated from office buildings may have incentivized investors to demolish (and rebuild differently).

The city and region also operate as a hub for the South Island tourism industry. Prior to the earthquakes, a significant proportion of hotel rooms were situated within the CBD, including international hotel chains such as Grand Chancellor, Millennium Hotels and Resorts, Holiday Inn, Accor, Rydges, Rendezvous, and Intercontinental (Ernst and Young 2012).

4.3 Building regulations and local government policy

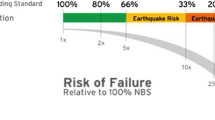

The Building Act (2004) governs the building industry in New Zealand and requires all new building work to comply with the New Zealand Building Code (DBH 2011). The Act applies to the construction of new buildings as well as the alteration and demolition of existing buildings; however, this document does not explicitly consider the repair of earthquake damaged buildings. With regard to this study, some sections of the Building Act need to be highlighted in order to clarify the regulatory framework which existed throughout the Canterbury earthquake sequence. First, Section 122 deems a building to be “earthquake prone” if its ultimate capacity would be exceeded in a “moderate earthquake” and it would be likely to collapse, causing injury or death, or damage to other property. For the purpose of the Act, a moderate earthquake is “an earthquake that would generate shaking at the site of the building that is of the same duration as, but that is one-third as strong as the earthquake shaking (determined by normal measures of acceleration, velocity, and displacement) that would be used to design a new building at that site” (Building Act 2004). For simplicity, an earthquake-prone building is commonly considered to refer to structures with a lateral resistance <33 % of the New Building Standard (NBS). If a building is found to be earthquake prone, the territorial authority (e.g. Christchurch City Council) has the power under Section 124 of the Act to require strengthening work to be carried out, or to close the building and prevent occupancy. Furthermore, an important amendment to the New Zealand Building Code clause for Structure (B1) was published following the February earthquake (DBH 2011). This amendment contained changes to the seismic design loads for Canterbury, including a 36 % increase in the basic seismic design load for Christchurch. As a result, a building constructed in 2010 to comply with the Building Code could have a capacity of 73 % in comparison with the new seismic load levels.

The Christchurch City Council (CCC) is the local government authority for Christchurch. As required by Section 131 of the Building Act (2004), CCC had in place an Earthquake-Prone Building Policy (Earthquake-Prone, Dangerous and Insanitary Building Policy 2006). Before the 2010 September earthquake, this policy required all earthquake-prone buildings for which there was a change of use or significant modification to be strengthened at least up to 34 % NBS within a timeframe varying from 15 to 30 years. As a result of the 2010 September earthquake, CCC amended their policy and raised the level that a building was required to be strengthened to from 34 to 67 % NBS (CCC 2010). This requirement was qualified as a ‘target level’ specifying that the actual strengthening level for each building deemed earthquake-prone should be determined in conjunction with the owners on a building-by-building basis. The amendment also included a section covering the repair of buildings damaged by an earthquake, also including a target of 67 % NBS for a repaired building. Furthermore, the repair of earthquake damage was considered as an alteration under the Building Act (because of the absence of any specific legislation for the repair of damaged buildings) and as a result, the assessment and upgrade of fire systems and accessibility features were also triggered. The consequence is that even minor repairs of earthquake damage often required the installation of new fire systems and/or access ramps/lifts, especially for older buildings.

4.4 Canterbury Earthquake Recovery Authority (CERA)

The Canterbury Earthquake Recovery Authority (CERA) was established in April 2011 under the Canterbury Earthquake Recovery (CER) Act 2011 to facilitate the recovery of Christchurch. The CER Act provided CERA with a range of powers to enable a focused and expedited recovery. In accordance with CERA’s lead role in recovery, the Christchurch Central Development Unit was created to develop and implement the Central City Recovery Plan (CCDU 2012). The key principle in design was a central city delivering a more compact core, including a new urban frame and several anchor projects (e.g. Precincts, Stadium, Bus Interchange, Central Library, etc.). Under the CER Act 2011, CCDU has the power to acquire parcels of land for earthquake recovery related purposes and provide compensation for the compulsory acquisitions. Furthermore, under this Act, CERA has powers with respect to verifying building safety and requiring demolition. Particularly relevant sections for this study are:

-

Section 38-Works and Section 39-Provisions relating to demolition or other works

CERA may carry out or commission works, including (a) erection, reconstruction, placement, alteration, or extension of all or any part of any building, (b) the demolition of all or part of a building, and (c) the removal and disposal of any building. CERA does not require building consents from City Council for such works within the CBD.

Under Section 38, CERA can require a building owner, with 10 days’ notice, to identify how and when they intend to demolish a building. If the owner fails to respond in 10 days then CERA may commission the demolition and may recover the costs of carrying out the work from the owner. The amount to be recovered becomes a charge on the land on which the work was carried out. Building owners may also elect to have CERA manage the demolition work for them. Under Section 39 (Urgent Demolition) no notice needs to be given if the work is necessary because of (a) sudden emergency causing or likely to cause (1) loss of life or injury to a person; or (2) damage to property; or (3) damage to the environment; or (b) danger to any works or adjoining property.

-

Section 51-Requiring structural survey

CERA may require any owner, insurer, or mortgagee of a building that has or may have experienced structural change in the Canterbury earthquakes to carry out a full structural survey of the building before it is re-occupied for business or accommodation.

4.5 Post-earthquake building evaluation process

After each earthquake event, safety evaluations were conducted and the degree of damage was evaluated in accordance with Guidelines for Building Safety Evaluation (NZSEE 2009). The Guidelines include Level 1 and Level 2 assessments, which were developed based on the ATC-20-2 (ATC 1995). A Level 1 rapid assessment involves a brief external visual inspection of the building to assess the type and extent of a building’s structural damage. A Level 2 rapid assessment is still relatively brief but importantly, requires access to the interior of the building for more extensive observations plus reference to available drawings, and is typically required on all critical facility buildings, multi-storey buildings, and any other buildings where the Level 1 identified the need for further and detailed inspection (Galloway and Hare 2012). As part of the response to the national emergency following the February earthquake, Civil Defence placed placards on residential and commercial buildings indicating that a rapid assessment had been carried out on the structure. As shown in Table 1, a Level 1 assessment resulted in a building being tagged Inspected (Green), Restricted Use (Yellow), or Unsafe (Red), whereas the Level 2 included further classifications into six grades (Green: G1, G2, Yellow: Y1, Y2, Red: R1, R2) (Uma et al. 2013). Some buildings were red tagged (and categorized as R3) despite having suffered little damage, because of threat from adjacent damaged buildings and ground liquefaction. Under Section 45 of the CER Act, CERA has also prohibited or restricted access to commercial buildings which were previously subject to a Civil Defence placard (CERA issued yellow and red placards only). Furthermore, the rapid assessments (Level 1 and Level 2) include a visual estimate of the damage ratio. Typically, this metric is not intended to be an exact indicator of the repair costs, but provides an estimate to interpret and compare the results, and will be used as a standard damage measure for the case study buildings in Sect. 5.

Last, detailed engineering evaluations (DEE) culminate the post-earthquake building evaluation process and were typically carried out regardless of the outcome of a Level 1 or Level 2 rapid assessment. A DEE is completed in two parts (qualitative and quantitative) and involves a full structural survey of the building to determine the %NBS of the building (pre- and post-earthquake), in addition to a completed standardised spreadsheet. An initial evaluation procedure (IEP) may also be completed as an initial step (qualitative procedure). Further details and guidance on the DEE are provided in EAG (2012). Under Section 51 of the CER Act, CERA required all commercial and multi-unit residential building owners in the CBD to provide a DEE of their building. The DEE spreadsheets were designed to provide a consistent and reliable standard damage measure. According to a companion study (Kim 2015), only 35 % of the multi-storey concrete buildings in the Christchurch CBD had on file a DEE spreadsheet at the time of the interviews. Heavily damaged buildings did not have DEE data because demolitions on these buildings were initiated prior to full development of the DEE spreadsheet. Also, a DEE was not necessary if the building was going to be demolished. Reportedly, CERA stopped requiring DEEs to be completed in November 2014 as they no longer contributed to the recovery process. Many moderately damaged buildings had no DEE spreadsheet because of the difficulty to accurately quantify the residual capacity and categorically state the exact strength of the building in terms of % NBS. The poor availability of DEE data across a range a damage states considerably limited the value of this data source to compare damage levels across a large subset of buildings.

5 Case studies

A multiple case studies research approach was chosen to allow different building owners and other stakeholders to describe the complexities of post-earthquake decisions on specific buildings. Fifteen multi-story reinforced concrete buildings distributed throughout the Christchurch CBD and immediately surrounding neighbourhoods were selected and specific information such as structural drawings, insurance coverage, detailed engineering evaluations, and damage assessment reports were collected (if available) for each building (Tables 2, 3). According to a companion study (Kim 2015), this subset is found to be roughly representative of the CBD concrete building stock having similar characteristics. Approximately half of the case-study buildings have been repaired (7), while the balance has been demolished (8), including a mix of owner-initiated and authority-mandated demolitions (required by CERA under s38). Two buildings are yet to be demolished at the time of writing (D201, D210). Among the five owner-initiated demolitions, being out-of-plumb (between 130 and 230 mm) due to foundation settlement was reported as the governing damage for three buildings (D11, D49, and D201), and demolition and reconstruction of the entire structure appeared to be the only viable option because of the high degree of risk and uncertainty associated with grout injection and soil stabilisation. Two demolished buildings (D73, D210) suffered limited structural damage, however, significant strengthening would have been required to achieve the owner’s desired performance level which rendered the repair uneconomic or impractical. Three significantly damaged buildings (D117, D192, and D196) have been demolished under a Section 38 of the CER Act due to safety concerns and the risk of partial collapse, based on the observed structural damage and the likely behaviour of the structure in future aftershocks. Among the buildings that have been repaired, four buildings (R74, R86, R202, and R902) performed relatively well (limited structural damage, however extensive non-structural damage) and the final repair costs varied between 10 and 20 % of the sum insured. Specifically for building R902, the owner took the opportunity to upgrade the foundation system (base isolation) and therefore the overall costs (repair and improvements) were much higher. One property (R163) was found to be earthquake-prone (<33 % NBS) in its damaged condition and the restoration costs, including strengthening to achieve compliance to building regulations, represented approximately 65 % of the sum insured. The final cost of repair for two buildings (R113, R901) was not available at the time of the interviews. For the demolished cases, the final estimated repair costs were typically much higher than the cost ratio provided from the Level 2 rapid assessment forms, in part because of the approximate nature of the Level 2 assessment and uncertainties in the repair costs, but also due to post-disaster demand surges and resources shortages in the construction industry not taken into account in the Level 2 forms. For instance, the repair and strengthening costs for building D73 ranged between 45 and 70 % of the sum insured (estimate).

Findings from this study suggest several key conclusions and areas of further investigation. First, there is no evident correlation between the type (and design ductility) of the lateral system and the decision (either repair or demolish). Structural damage is typically assumed to be associated with the design ductility level, however, this correlation is not observed with the small sample size considered in this study. Second, the %NBS (pre-earthquake) appears to be a strong indicator of the decision. Buildings at <67 % NBS have been demolished, while buildings above 67 % NBS have been repaired (with one exception). Two earthquake-prone buildings (<33 % NBS pre-EQ) were included in the study (D49, D73) and both have been demolished. Third, the level of insurance coverage varies greatly between the case studies (for both repaired and demolished buildings), with some well-insured and others under-insured (as discussed in Sect. 6.2). All demolished buildings have cash-settled. Finally, placarding does not appear to be a good measure of the likelihood of demolition. Two buildings with low damage ratios that were considered safe to occupy (i.e. green placard) have been demolished, however, all red placard buildings have been demolished. As shown in Table 3, CERA-mandated demolitions presented a concentration of severe damage whereas the majority of owner-initiated demolitions had similar damage states in comparison to repaired buildings (most damage descriptors have a minor/moderate hazard). The concentration of severe damage for authority-mandated demolitions suggests that recommendations from CERA were primarily based on the dangerous nature of the building caused by earthquake damage. An earthquake prone building should not be deemed dangerous in terms of the CER Act if it remained undamaged. Specifically for building D49, the level of observed damage was relatively severe in comparison to other owner-initiated demolitions, however the building was not declared dangerous since the seismic force resisting system remained relatively undamaged and the building was expected to perform in a ductile manner without collapse in future aftershocks. Moreover, one demolished building (D210) suffered minor structural/non-structural damage, however a significant strengthening upgrade was desired by the owner which rendered the repair uneconomic or impractical.

6 Summary of findings and discussion of results

This section briefly describes the results from the interviews in relation to the decision-making themes identified in the framework (Fig. 3). As the framework suggests, the four themes address the major considerations for building owners and property managers in the process of determining the fate of earthquake-damaged structures. The following sections discuss the conditions in Christchurch and how the factors are interrelated in arriving at the final decision. The first section (recovery progress) does not explicitly relate to the decision-making framework variables, but provides a necessary background to examine how the government and the community response to the earthquakes may have influenced the whole context of decision-making for earthquake-damage structures in the central city.

6.1 Recovery progress

Interviewees were asked to rank how well they considered Christchurch’s recovery to be proceeding, on a scale of 1–7, with 1 being “extremely poorly” and 7 being “extremely well.” Interviewees were asked to rate recovery and then elaborate on their reasons. The average score was 4.3. The average response from building owners (categories A and B from Appendix 1) was 4.0, while the interviewees speaking on the topic of insurance (category C) gave an average response of 4.7, and government authorities (category D) reported an average score of 5.0. Several respondents reported that the recovery progress was uneven geographically, where specific areas, including the CBD, were described to be going extremely well compared to largely residential eastern suburbs. The ‘central city’ has temporarily shifted to other western suburbs (e.g. Addington, Riccarton), resulting from a decentralisation of economic activities and movement of businesses. Some participants highlighted the government had too much control in the CBD and argued the recovery could have been managed more effectively with a better engagement of the private sector and the community in the early days. Interestingly, a similar question was asked to a different subset of interviewees in 2012 and an average score of 4.2 was reported (Chang et al. 2014).

In 2014, the city has seen the initiation of a number of major construction projects including the new $NZD 325 million Justice Precinct, the redevelopment of the $NZD 250 million Burwood Hospital, and the new $NZD 50 million Bus Interchange (CCDU 2012). A number of multi-storey commercial buildings have begun construction or have been completed to the west and north of the CBD along Victoria and Colombo Street, and plans are underway for other medium and large new build commercial projects within the CBD. However, the opinions were divided as to whether the CCDU recovery plan will be beneficial for the recovery of the city and the community. There are fears that the redevelopment of the CBD will result in a surplus of new office buildings for premium tenants (lawyers, accountants, governments) and unaffordable commercial rents for small businesses, which may slow down the economic growth of the property market in Christchurch in the near future. One interviewee reported that many new developments in the CBD were initiated without a full pre-commitment of tenants (as low as 50 % space commitment) because of the availability of insurance payouts to reduce the amount of mortgage financing required to rebuild. Also, there are concerns with regard to public funding, cost escalation, resource availability, and the viability of new development in the CBD in consideration of the lower height limits imposed by the recovery plan (generally 7 storey buildings in the Core and 4 storey buildings elsewhere). Last, as discussed below, interviewees revealed that the disaster has created benefits to certain stakeholders, such as building owners and the construction industry, in part because of the insurance structure.

6.2 Insurance

In contrast to other countries with high seismic risk, a much greater percentage of the damage caused by the Canterbury earthquakes was insured and therefore a high percentage of the losses were borne by the insurance industry. According to Swiss Reinsurance Company (2012), approximately 80 % of the economic losses in Christchurch were covered by insurance, considerably higher than other major earthquake disasters worldwide (e.g. 17 % for 2011 Tohoku (Japan) earthquake and tsunami, 4 % for 2011 Van (Turkey) earthquake, and 14 % for 2009 L’Aquila (Italy) earthquake). The high earthquake insurance penetration for commercial property in New Zealand was primarily explained by lower premiums in comparison to other earthquake prone countries around the world, the typical requirement of earthquake insurance as a condition of bank financing, and the high level of activity of insurers through various distribution channels. As a side note, residential property earthquake insurance is also dominant in New Zealand (through the Earthquake Commission—EQC—scheme), which may have contributed to promote public education on earthquake risks and the availability of insurance in the country. In contrast to residential insurance, earthquake insurance schemes for commercial buildings are not automatically provided with fire insurance, and commercial property owners can decide on the type of insurer and policy plan (EQC 2012).

In New Zealand, commercial property insurance policies are written on an all-risks basis and provide either reinstatement cover, indemnity, or a combination of both (Axco 2014). Typically, reinstatement cover includes the cost of replacing the building with its equivalent in new condition. If the building is repairable, reinstatement cover will provide for the restoration of the damaged portion of the property to a “condition substantially the same as, but not better or more extensive than, its condition when new” (Vero 2007; Zurich 2009). In other words, the policy-holder is entitled (subject to certain conditions) to receive a repaired property which is largely the same in appearance, quality, and working order as it was “when new”. In addition, the repairs have to comply with current building regulations. Very few policies include a “constructive total loss” clause which covers for total loss where a property is repairable but cannot be occupied for its original purpose (observed for only one case-study building) (Brown et al. 2013). For indemnity cover, the insurer is only responsible for paying for the cost of repairing the building to the condition it was in before the damage. Therefore, indemnity value is in most cases less than the reinstatement (replacement) value because of depreciation. The exact definitions depend on the wording of the insurance policy. Furthermore, damage covered by insurance typically included a) damage occurring as the direct result of earthquake, but also b) fire occasioned by or through or in consequence of earthquake, and c) damage occurring (whether accidentally or not) as the direct result of measures taken under proper authority to avoid the spreading or reduce the consequences of any such damage, excluding any damage for which compensation is payable under any Act (Vero 2007). The vast majority of commercial building owners in Christchurch (and all the case-study buildings) held reinstatement cover (replacement) for the Material Damage policy with extensions such as Loss of Rents or Business Interruption. Most commercial policies typically specify a sum insured (as shown in Table 2) which is the maximum insurer’s liability for each earthquake occurrence during the policy period. The sum insured was typically based on a percentage of the depreciated value of the asset (building value) and should reflect the replacement value of the building (equivalent building as nearly as practicable) including demolition costs in order for the policy-holder to receive full reinstatement.

The aftermath of the earthquake sequence revealed that the sum insured was less than the actual rebuild cost for most commercial properties, and therefore the policy was not adequate to provide for replacement of the building. This situation was explained in part because of inadequate valuations, including not accounting for demand surge and high demolition costs in a post-earthquake environment. One interviewee from the insurance industry estimated that only two buildings out of 1000 commercial buildings were more than adequately insured. Based on observations from the interviews, experience of local engineers, and actual construction cost for new buildings in Christchurch (RLB 2014), we estimate that 1980s–1990s office and hotel buildings with less than approximately 320 % sum insured (expressed as a ratio of the building value, including depreciation) were not fully covered for replacement (demolition and rebuild) (Table 4). This threshold is greater for older or heritage buildings (e.g. the rebuilding cost for building R74 was about 850 % of the building value according to the 2014 insurer’s valuation) and lower for more recent buildings (between 150 and 200 %). Therefore, only two case-study buildings are estimated to have had sufficient coverage to rebuild (D192, R113) when accounting for demolition costs, contingency, furniture, fixture and equipment (FF&E), professional fees, permits, and taxes (GST). The actual cost of demolition for each building was considered when available and a cost of 200 $/m2 of gross floor area (excluding taxes) was used otherwise (when demolition costs were not available or for repaired buildings). Further details and hypotheses for the calculation of the estimated replacement costs are provided in Marquis (2015).

A sufficient sum insured is also critical to achieve appropriate repairs, including strengthening for earthquake-prone buildings, and as a result, underinsurance has influenced the prevalence of building demolitions in Christchurch. Repairing and possibly strengthening was usually not economic from an investment perspective if the sum insured was inadequate to cover both repair and building code compliance costs. Unique aspects of the NZ insurance market, such as policy wordings (e.g. replacement as “when new” policy) and local practices (e.g. absence of condition of average, where the claim is paid in proportion to the underinsurance), rendered repairs uneconomic and facilitated demolitions in terms of cost (Drayton and Verdon 2013). As already reported in the literature, most commercial demolitions were not because the buildings were dangerous and damaged beyond repair, but because they were uneconomic to repair (Brown et al. 2013; Miles et al. 2014).

Despite widespread underinsurance, some commercial owners have financially benefited from the insurance structure, some doubling or tripling their equity. Reportedly, if the estimated repair costs were beyond 80–85 % of the sum insured (in some cases as low as 60 % of the sum insured), building owners and insurers favoured cash settlements without reinstatement of the property. Cash settlement provided maximum flexibility for building owners and was typically less risky than repairs and rebuilds for insurers. Although cash settlement was not an entitlement under most policies, this outcome was by far the most common because of the reasons above and the incapacity for insurers to actually do reinstatement on thousands of claims. In case of repair, building owners usually did not want to cash settle because the risks of escalating costs during repairs were typically carried by the insurer. Even though cash settlement was usually reached by negotiation, one interviewee reported that insurers in the early days would not make a cash settlement over 85 % of the sum insured, but by 2014 the majority of cases were cash settled at 100 % of the sum insured. Many policy-holders made claims for successive earthquakes which in aggregate exceeded the fixed sum insured and even the full replacement cost of the building; however, a Supreme Court decision (Ridgecrest vs IAG New Zealand) ruled that building owners cannot recover more than the replacement cost of their building through insurance claims (NZSC 2013). Sometimes final settlements exceeded 100 % of the sum insured if there was a policy renewal between two damaging events. Some owners sold their properties after cash settlement, sometimes with the building in place, thus avoiding the uncertainties of the Christchurch CBD rebuild. Therefore, this pragmatism around doing cash settlements generally provided a good financial outcome for the policy-holder (observed to varying degrees among the case-study buildings), however, the details were usually confidential.

Material damage insurance for commercial buildings is now harder to secure than prior to the earthquakes, especially for earthquake-prone buildings. Initially after the February earthquake, insurance companies shifted the financial risks from themselves to property owners by increasing the cost of insurance premiums (up to 500 % in some cases) and changing the deductibles (excess) from a percentage of damage to a percentage of the sum insured (as high as 10 %). In some cases, insurance premiums became unaffordable for businesses and different responses have been observed (e.g., switching insurance companies, obtaining insurance on the international market, reducing cover to indemnity value, buying down insurance on deductibles, etc.). Such changes in the insurance contracts may have incentivized investors already financially suffering from a low-rent market to demolish rather than repair. Insurers have also modified their policy wordings and introduced coverage restrictions. For instance, the extra cost of bringing a damaged building into compliance with current earthquake construction standards or any cost in connection with the seismic performance of the building is now typically explicitly excluded. Automatic reinstatement of loss cover is no longer available and policies are subject to annual aggregate loss limits (Axco 2014; Vero 2013). Insurance premiums follow, however, the dynamics of international reinsurance markets (Middleton 2012). Reportedly, international insurers with no losses to recover from the Canterbury earthquakes are now coming to New Zealand offering lower premiums. Interestingly, one interviewee reported that the price of insurance had actually come down even to levels lower than before the earthquake, and deductibles are also back down in some instances. Nevertheless, the self-retention of risks in the case of an event is much greater than it has been in the past, and as a consequence, a combination of risk mitigation strategies is now being used by property owners and developers (e.g., seeking increased seismic performance, damage-resistant technologies, diversification of the risk portfolio, etc.) instead of relying on insurance to fully cover losses in the case of future disasters.

6.3 Damage and residual capacity

The first challenge for city officials, building owners, insurers, and structural engineers was to ensure appropriate investigation of damage in order to define the relative safety of buildings for public access and initiate insurance claims. The investigation process generally includes a review of the existing documentation for the building, damage assessments, scope of repair or reinstatement, quantification of the expected seismic performance (pre and post-earthquake), and estimation of costs to determine if it is economic to repair. There were many technical challenges around the investigation phase; examples include the assessment of damage to reinforcement in reinforced concrete structural elements, quantification of residual capacity and loss of fatigue life. Logistical challenges have been reported in relation to the impacts of the cordon around the CBD, availability of appropriate resources, and international assessors not familiar with New Zealand standards and policies. Most interviewees stressed that the level of damage was a fundamental variable in the decision to either repair or demolish. Building owners sought technical advice from structural engineers to benchmark possible options and provide their insurers with detailed damage assessments and repair cost estimates reflecting their strategy.

Although less damage was generally found in repaired buildings, a wide range of damage was observed among the demolished buildings. As shown in Table 2, among the case-study buildings, the overall damage ratio ranged from 2 to 30 % for the demolished cases compared to <10 % for the repaired cases. For heavily damaged buildings, demolition was typically the preferred option due to uncertainties in the assessment of the residual capacity, repair methodologies and costs. Differential movement of foundation systems was observed across a significant proportion of multi-storey buildings in the CBD. According to Muir-Wood (2012), approximately 25 % of all buildings in the CBD were found to be no longer vertical, with tilts of 25 mm or greater. In most cases, out-of-plumb buildings (with varying degrees) were declared “uneconomic to repair” and demolished. Four case-study buildings (D11, D49, D201, and R902) had substantial foundation differential settlement and as a result three have been demolished.

6.4 Decision-making strategies

Building owners generally took a simplistic and pragmatic approach to decide on the future of their buildings. As illustrated in the framework (Fig. 3), there are a number of possible scenarios: a building is repaired to the same performance level; a building is repaired to a higher standard; a building is demolished and replaced with an equivalent building (same site or different location); or a building is demolished and not replaced (cash settlement). Although there are some variations, decisions were usually based purely on economics. Interviewees also reported other decision-making variables, such as business strategies, perception of risks (by owners, tenants and insurers) and uncertainty, technical advice, building regulations (e.g. changes in building code, compliance issues), and government decisions (e.g. cordon, mandatory demolitions, compulsory acquisitions). Access and neighbourhood conditions (expressed as demolition percentage of buildings that are located within a 100 m radius) appeared not to be very significant in the decision to repair or demolish, but very significant in terms of business interruption and speed of the recovery. The majority of commercial property owners in Christchurch were passive investors, but some interviewees reported they had to assume a greater role in property development and day-to-day affairs after the earthquake due to all the complexities of complying with both the insurer’s and government’s requirements. Most investors interviewed considered it a good outcome if their building was declared a total loss and demolished, because of the financial benefits, flexibility, and speed of cash settlements (as explained above). They preferred to demolish their buildings, in part because of uncertainties in the recovery of Christchurch, and move forward more quickly with cash. Building investors and tenants reportedly preferred new buildings over repaired old buildings. One building owner involved in the accommodation sector reported that a repair scenario would be a massive disadvantage to the rest of the market in terms of new build hotels or low-rise hotels moving forward. However, different strategies were observed for heritage buildings and non-investor owners/owner-occupiers. Despite a high degree of damage and costs, some heritage building owners preferred to refurbish an old building in order to preserve unique architectural features or simply because of their emotional attachment to the building. Owner-occupiers have generally considered economics in their decision, however this factor was balanced with the operational importance of the building (continued occupancy) or long-term strategies. The vast majority of investors (local and foreign) appeared to have kept their money in Christchurch while a few walked away with insurance money to other cities or countries, although some investors are holding off before reinvesting in Christchurch due to many uncertainties in the recovery, the difficulty of attracting tenants in the CBD, and the escalation in the construction costs.

Various organisations in Christchurch with large portfolios of buildings have created a structured decision framework as part of their recovery process to guide the decision-making process and balance the impacts and costs of possible options. We highlight here the Canterbury District Health Board (CDHB), University of Canterbury (UC), and Christchurch City Council (CCC). CDHB is responsible for the health services for over 550,000 people, and is also the single largest employer in the South Island, employing close to 10,000 staff and approximately 9500 health sector contract workers. Following the earthquakes, over 700 staff have been displaced, 14,000 rooms had earthquake damage, and the main regional hospital, the Christchurch Hospital which includes the base-isolated Christchurch Women’s Hospital, sustained damage that severely restricted the hospital’s ability to function at regular capacity (Jacques et al. 2014). CDHB owns near 200 buildings across the Canterbury region and had to prioritise capital expenditure, both for earthquake repairs and retrofit or replacement of earthquake-prone buildings. As a result, the Board used a holistic approach and created a decision-making framework to prioritise repairs and/or seismic upgrades in the context of the earthquake damage (Fig. 5). The framework is applied to each building owned by CDHB and considers various factors such as the continued and future role of the building (if the building forms part of the CDHB Facilities Master Plan and will be utilised for the next 10 years), availability of alternative spaces, costs of repair (net of any insurance payouts that can be applied to the repairs on the particular building), and the level of disruptions to clinical services delivered (high, medium, and low) (CDHB 2012). Although not explicitly captured in the decision making framework (Fig. 5), the decision outcome is based on reconciling the trade-off between potential harm to patients and staff in future earthquakes (based on engineering assessments and advice) against immediate harm to patients if services are withdrawn with closure of buildings and relocation of patients and staff. Therefore, a level of pragmatism and assessment of tolerable risk also need to be overlaid as part of the assessment of priorities and progression of the decision. As of September 2014, CDHB occupies eight earthquake-prone buildings (<33 % NBS) and a total of 44 buildings (47,000 m2 of space) have been identified to be demolished in a ten-year timeframe from the 2011 February earthquake. CDHB’s earthquake insurance is part of a national policy with 19 other DHBs. The policy for earthquake-damaged buildings had an annual cap of $NZD 320 million with no discounting and was not tagged to any building which provided flexibility for the repair works. The Board identified more than $NZD 700 million of earthquake-related repairs to its buildings and infrastructure, in addition to the new builds of Burwood and Christchurch Hospital, leaving a substantial gap between the insurance payout and actual repair costs.

CDHB decision-making framework (Source CDHB 2012)

The necessity of continued functionality of critical infrastructure, such as healthcare facilities, makes it challenging to compare and contrast approaches with other decision-making strategies for large portfolios. However, some factors included in the CDHB’s decision-making framework are relevant for other organisations’ models, although the priority level for each factor may change reflecting different business strategies and recovery issues.

The University of Canterbury (UC) campus, located 2 km west of the CBD, has a range of building types built since the late 1950s, predominantly 3–12 storey concrete buildings. UC developed a framework to help inform building repair, retrofit, or replacement decisions, and prioritising work across the portfolio of buildings. The framework specifically relates to buildings that were unoccupied and were not expected to be ready to occupy in the medium term (e.g. 4 months or more) following the 2011 February earthquake. Variables are grouped into four categories and are listed in order of importance to the decision making:

-

1.

repair and retrofit feasibility: damage sustained, expected future performance, ease of repair, ease of retrofit, staff and student perceptions of safety, compliance with minimum performance requirements;

-

2.

financials: age and value, costs, ability to fund;

-

3.

long-term suitability (campus master plan): current functionally of space, future heritage/character, fit with longer term campus vision;

-

4.

operational importance: nature of pre-existing use, availability of alternate space, importance of use to overall recovery and operations.

UC’s earthquake insurance was part of a collective arrangement with other universities in New Zealand, with a cover of $NZD 550 M across all the universities per event.

Similarly, CCC adopted a programme which describes the factors involved in the decision making for earthquake-damage facilities such as the level of damage (including safety hazard), compliance to the current building code and CCC’s occupancy policy (revised in 2014), financials, strategic needs, and public and political actions (including the CCDU’s blueprint). The programme also prioritised facilities for further investigations, funding, and where possible, repairs. Council’s above-ground assets were all insured with Civic Assurance (a self-insurance programme owned by New Zealand councils) on a full re-instatement basis for close to $NZD 1.9 billion, capped to a fixed amount per asset. CCC owns approximately 1600 facilities (residential and non-residential buildings) across greater Christchurch.

6.5 Legislation

As previously discussed, there were two main changes to the building regulations following the earthquakes, and both influenced decisions on earthquake-prone buildings. First, the Christchurch City Council changed its earthquake-prone building policy recommending that building owners must aim to strengthen the buildings to 67 % NBS, as opposed to 33 % pre-earthquake. However, a High Court decision in 2013 (and a Supreme Court decision released in December 2014) ruled that property owners and insurers are only obliged to strengthen the buildings to 33 % NBS, causing confusion as to whether or not insurers were required to pay for the additional remediation (NZSC 2014). Building owners were also confused if they were required or not to upgrade to at least 67 % in order to receive a building consent (permit) for earthquake repairs. Second, the Z factor was increased from 0.22 to 0.3 to take account of greater seismicity in the region, forcing down the NBS seismic rating of many buildings in Canterbury. Both these changes have had a significant effect on post-earthquake decisions and the cost of the repair (and strengthening), which may have led to more building demolitions than would have occurred without the legislation changes. Furthermore, a study published by the Royal Commission (2011) has demonstrated that the overall construction costs for a new build do not appear to significantly rise as a result of increases in the seismic hazard factor, however, it does not account for the costs to strip out an earthquake-damaged building to effect the structural repairs and upgrades, which may involve significant restoration costs with regard to the non-structural components (cladding, building systems, etc.). Because of the absence of any specific legislation or guidance for the repair of damaged buildings, compliance to the building code (including triggering fire protection and disability access) has increased the costs covered by insurance and complexity of claims. Interviewees also stressed that many tenants, banks (mortgage) and insurers are demanding premises to be at least 67 %NBS (in some cases even requiring 100 % NBS), but additional rental income will not necessarily be generated from the expenditure, rendering the repair of older buildings less economic, especially in a market generating a surplus of new office buildings at 100 % NBS (PCNZ 2014). Informed occupants, including large multinational tenants and government tenants, have changed their perception of earthquake risks, which resulted in pressures on building owners to meet higher earthquake strengthening standards than required by the law, which also had repercussions on the property market in other cities in New Zealand. Another factor, although less significant than other factors in this study, is that parcels of land in the central city have been designated for the Anchor Projects under the Central City Recovery Plan, which affected the course of action for a small number of repairable buildings (accounting for <10 % of demolitions of the multi-storey buildings in the CBD) (CCDU 2012; Kim 2015).

7 Lessons and future research needs

Findings from this study suggest that research is needed to better understand the reparability and post-earthquake residual capacity of buildings. Extensive review and analysis beyond rapid visual inspection is required to understand damage and structural engineers are not well-equipped to assess residual capacity. Uncertainty in residual capacity of buildings has generally led to more conservative assessments because engineers are not comfortable to sign off on the repair of damaged buildings. Research is also needed to understand the adequacy of repair technologies. Specifically for damaged concrete buildings, an improved understanding of damage to reinforcement and fatigue life is required. This lack of understanding exacerbated differences in engineering assessments and technical advice among engineers, particularly in the environment of trying to settle substantial insurance claims. Several respondents highlighted the divergent approaches and views between the owner’s and insurer’s engineers. For instance, one interviewee reported a typical case where company A provided a $24M repair methodology and company B provided a cost estimate of $2M for a building insured at $15M (sum insured for material damage).

The issues associated with the absence of repairability guidelines (compliant repairs to a “condition substantially the same as its condition when new”) and the lack of clarity in the definition of damage (and degrees of damage) in relation to insurance policies suggest that some adjustments are required, especially in the well-insured New Zealand building market. Such issues created situations where building owners had to fight for their entitlement and use different strategies to assess damage for insurance claim purposes to maximise their insurance payout. Insurance had a positive short-term effect in Christchurch, with the creation of new jobs, insurance payouts flowing into the economy and high coverage of losses. However, the lack of clarity in policy wordings and absence of guidelines has resulted in arguments between building stakeholders, causing substantial delays to the claiming and recovery process. From an engineering and societal perspective, the absence of repairability guidelines resulted in demolition of potentially salvageable buildings and substantial loss of the built environment, which arguably counteract resilience and sustainability objectives. Demolition of concrete buildings has a particularly high environmental impact due, not only to waste generation, but also additional CO2 emissions in the production of cement if the replacement is a concrete building. Finally, current building codes protect life safety and minimise the risk of damage to adjacent properties, but they do not mitigate business interruption and economic impacts, or ensure reparability of buildings after design level ground motions. The Christchurch experience suggests that building owners and tenants may now be opting for damage-resistant technologies to reduce disruption, economic impacts, and dependency on insurance.

8 Conclusions

This paper presents a study to investigate the factors influencing the course of action on buildings in a post-earthquake environment, with a specific focus on the 2010–2011 Canterbury earthquakes. Although the level of damage was a fundamental variable, the aftermath of the earthquake sequence exposed several complicating issues in the decision to either repair or demolish. This study suggests that the insurance structure in New Zealand and the lack of clarity in building regulations (including legislation changes following the earthquakes) have influenced the predominance of building demolitions in Christchurch. The complexities of complying with both the insurer’s and government’s requirements, in addition to the uncertainties in the recovery, had a significant effect on post-earthquake decision-making strategies for building owners. Most owners held reinstatement cover entitling the owner to a building in a “condition when new”. However, very few policies included an adequate sum insured; we estimate that only two case-study buildings (out of 15) had sufficient coverage to rebuild. Because of inadequate insurance cover and the difficulty of satisfying the policy wordings, repairing (and possibly strengthening to satisfy the earthquake prone-building policy) was also not typically economically feasible. As a result, many investors preferred to move forward quickly with a cash settlement and demolish their buildings. Interestingly, interviews revealed that insurance, and the pragmatism around doing cash settlements, has created substantial financial benefits for certain building owners.

Important observations during this study suggest several key conclusions. First, insurance coverage and policy wording are critical variables in the repair or demolition outcome for buildings. While insurance plays an important role in disaster mitigation and provides funding for post-disaster reconstruction, a code-compliant building may end up being demolished because of uncertainties in repair costs and insufficient insurance cover, even if technically repairable. Second, improved knowledge in the assessment of residual capacity for reinforced concrete structures will help define clear, consistent, and acceptable performance objectives for individual buildings in line with owners’ expectations. Third, clear regulations and repairability guidelines may potentially reduce the likelihood of demolition by providing confidence in repair methodologies, and facilitate the recovery of a major urban centre. Finally, a better understanding of the financial impacts of urban earthquakes will ultimately enhance community resilience.

References

Applied Technology Council (ATC) (1995) Addendum to the ATC-20 post earthquake building safety evaluation procedures. Redwood City, California

Axco (2014) Insurance market report—New Zealand

Bradley BA, Quigley MC, Van Dissen RJ, Litchfield NJ (2014) Ground motion and seismic source aspects of the Canterbury earthquake sequence. Earthq Spectra 30(1):1–15

Brown C, Seville E, Vargo J (2013) The role of insurance in organizational recovery following the 2010 and 2011 Canterbury earthquakes. Resilient Organisations Research Report 2013/4

Building Act (2004) New Zealand Government, 24 August 2004

Canterbury District Health Board (CDHB) (2012) Built infrastructure policy and decision-making framework. Version 2. Jan 2012

Canterbury Earthquakes Royal Commission (2011) Volume 2: The performance of Christchurch CBD buildings. http://canterbury.royalcommission.govt.nz/Final-Report-Volume-Two-Contents. Accessed Feb 2015

Chang SE, Taylor JE, Elwood KJ, Seville E, Brunsdon D, Gartner M (2014) Urban disaster recovery in Christchurch: the central business district cordon and other critical decisions. Earthq Spectra 30(1):513–532

Christchurch Central Development Unit (CCDU) (2012) The recovery plan. http://ccdu.govt.nz/the-plan. Accessed Jan 2015

Christchurch City Council (CCC) (2010) Christchurch City Council earthquake-prone, dangerous and insanitary buildings policy, 2010. Christchurch City Council, 10 Sept 2010

Department of Building and Housing (DBH) (2011) Compliance document for New Zealand Building code. Clause B1. Structure. Amendment 10 (Canterbury)

Drayton MJ, Verdon CL (2013) Consequences of the Canterbury earthquake sequence for insurance loss modelling. In: Proceedings of the 2013 New Zealand Society for Earthquake Engineering Technical Conference, paper 44, 26–28 April 2013

Earthquake Commission (EQC) (2012) Cover: an insurers guide. http://www.eqc.govt.nz/what-we-do/eqc-insurance/insurers-guide. Accessed March 2015

Egbelakin TK, Wilkinson S, Potangaroa R, Ingham J (2011) Enhancing seismic risk mitigation decisions: a motivational approach. Constr Manage Econ 29(10):1003–1016

Engineering Advisory Group (EAG) (2012) Guidance on detailed engineering evaluation of earthquake affected non-residential buildings in Canterbury. Part 2—evaluation procedure. Revision 7, 2012, Structural Engineering Society New Zealand (SESOC), Christchurch

Ernst, Young (2012) CERA Christchurch Central City—commercial property market study. Released by the minister for Canterbury earthquake recovery, May 2012

Federal Emergency Management Agency (FEMA) 308 (1998) Repair of earthquake damaged concrete and masonry wall buildings. Federal Emergency Management Agency, Washington DC

Galloway BD, Hare HJ (2012) A review of post-earthquake building control policies with respect to the recovery of the Christchurch CBD. In: Proceedings of the 2012 New Zealand Society for Earthquake Engineering Technical Conference, paper 036, 13–15 April 2012

Jacques CC, McIntosh J, Giovinazzi S, Kirsch TD, Wilson T, Mitrani-Reiser J (2014) Resilience of the Canterbury hospital system to the 2011 Christchurch earthquake. Earthq Spectra 30(1):533–554

Kam WY, Pampanin S (2011) General performance of buildings in Christchurch CDB after the 22 Feb 2011 earthquake: a contextual report, (prepared for the Department of Building and Housing) Department of Civil and Natural Resources Engineering, University of Canterbury

Kim J (2015) Quantitative analysis of factors influencing post-earthquake decisions on concrete buildings in Christchurch. Master’s Thesis, University of British Columbia, Vancouver, Canada. (In Preparation)

King A, Middleton D, Brown C, Johnston D, Johal S (2014) Insurance: its role in recovery from the 2010–2011 Canterbury earthquake sequence. Earthq Spectra 30(1):475–491

Marquis F (2015) A framework for understanding post-earthquake decisions on multi-storey concrete buildings in Christchurch, New Zealand. Master’s Thesis, University of British Columbia, Vancouver, Canada. (In Preparation)

Middleton D (2012) Insurance shocks: market behaviour and government responses: international case studies with relevance to New Zealand, Kestrel Group, June 2012

Miles S, Brechwald D, Davidson R, Demeter K, Johnston D, Pampanin S, Wilkinson S (2014) Building back better. Case study of the 2010–2011 Canterbury, New Zealand earthquake sequence. EERI report with the NZSEE and the natural hazards platform for the global facility for disaster reduction and recovery of the World Bank. Oakland CA: EERI, February

Muir-Wood R (2012) The Christchurch earthquakes of 2010 and 2011. The Geneva risk reports. Risk and insurance research. Extreme events and insurance: 2011 Annus horribilis. Courbage C, Stahel WR Geneva. http://www.genevaassociation.org. Accessed Jan 2015

New Zealand Society for Earthquake Engineering (NZSEE) (2009) Building safety evaluation during a state of emergency: guidelines for territorial authorities. New Zealand Society for Earthquake Engineering, August 2009

New Zealand Supreme Court (NZSC) (2013) Ridgecrest NZ Limited V IAG New Zealand Limited [27 August 2014] NZSC 117

New Zealand Supreme Court (NZSC) (2014) University of Canterbury v Insurance Council of New Zealand [22 Dec 2014] NZSC 193

Pampanin S, Kam WY, Akguzel U, Tasligedik S, Quintana-Gallo P (2012). Seismic performance of reinforced concrete buildings in the Christchurch CBD under the 22nd February earthquake. Report prepared for Christchurch City Council and University of Canterbury, Civil and Natural Resources Engineering

Petak WJ, Alesch DJ (2004) Organizational decision making with respect to extreme events: healthcare organizations respond to California’s SB 1953. In research progress and accomplishments: 2003–2004 (MCEER-04-P01). University of Buffalo, State University of New York, Buffalo

Polese M, Di Ludovico M, Marcolini M, Prota A, Manfredi G (2014) Assessing reparability: simple tools for estimation of costs and performance loss of earthquake damaged reinforced concrete buildings. Earthq Eng Struct Dyn. doi:10.1002/eqe.2534

Property Council of New Zealand (PCNZ) (2014) Submission on the building (earthquake-prone buildings) amendment Bill. http://www.propertynz.co.nz/index.php/news. Accessed Jan 2015

RLB (2014) International report—construction market intelligence. Third Quarter

SwissRe (2012) Lessons from recent major earthquakes. Economic research and consulting. Jan 2012

Uma SR, Nayyerloo M, Dhakal RP (2013) Vulnerability assessment of Christchurch buildings in Canterbury earthquakes. GNS Science Report 2013/20. May 2013, p 35

Vero (2007) Business plan policy. Version 6. Policy wording. https://www.vero.co.nz/business-insurance. Accessed Jan 2015

Vero (2013) Business plan policy endorsement, July 2013. Policy wording. https://www.vero.co.nz/business-insurance. Accessed Jan 2015

Yang TY, Moehle J, Stojadinovic B, Der Kiureghian A (2009) Performance evaluation of structural systems: theory and implementation. ASCE J Struct Eng 135(10):1146–1154

Zurich (2009) Material damage and business interruption insurance. Policy wording. http://www.zurich.co.nz/content/zurich_nz/insurance/property-insurance/material-damage-business-interruption-insurance.html. Accessed Jan 2015

Acknowledgments

This research was conducted in collaboration with CERA, the Christchurch City Council, GNS Science, the Ministry of Business, Innovation, and Employment (MBIE), and the University of Auckland. The authors gratefully acknowledge the contribution of Erica Seville and Dave Brunsdon from Resilient Organisations in discussing the research design and context, developing an appropriate list of interviewees, and providing logistical assistance. We also acknowledge the generous cooperation and time provided by the interviewees and local engineers throughout this study. Support for the University of British Columbia research team was provided by the Natural Sciences and Engineering Research Council of Canada.

Compliance with ethical standard

The primary research for this paper received ethics approval from the University of British Columbia Behavioural Ethics Research Board (ID: H14-01332) as well as the University of Auckland Human Participants Ethics Committee (ID: 012911).

Author information

Authors and Affiliations

Corresponding author

Appendix 1

Appendix 1

List of interviewees by category | Interview location and date |

|---|---|

Category A: Building executive officers/owner’s representatives | |

Connal Townsend, Chief Executive: Property Council of New Zealand | Auckland, 14 October 2014 |

Darren Moses, Unit Manager: Christchurch City Council | Christchurch, 29 October 2014 |

David Meates, Chief Executive: Canterbury District Health Board | Christchurch, 24 September 2014 |

Gary Jarvis, Group Operations Manager: Heritage Hotel Management | Auckland, 13 October 2014 |

Jeff Field, University Registrar: University of Canterbury | Christchurch, 26 September 2014 |

Josie Ogden-Schroeder, Chief Executive: YMCA Christchurch | Christchurch, 25 September 2014 |

Mark Youthed, Senior Commercial Asset Manager: Knight Frank | Christchurch, 24 September 2014 |

Miles Romanes, Project Manager: Pace Project Management | Christchurch, 24 September 2014 |

Participant A1, Structural Engineer | Christchurch, 23 September 2014 |

Category B: Building developers/property investors | |

Chris Gudgeon, Chief Executive: Kiwi Income Property Trust | Auckland, 15 October 2014 |

Ernest Duval, Trust Manager/CEO: ETP/Fortis Construction | Christchurch, 24 September 2014 |

Glen Boultwood, Fund Manager: Eureka Funds | Auckland, 15 October 2014 |

Lisle Hood, Property Investor: Business Building Systems | Christchurch, 22 October 2014 |

Miles Middleton, Property Investor: Viewmount Orchards | Christchurch, 25 September 2014 |

Participant B1, General Manager | Christchurch, 5 November 2014 |

Peter Rae, Chairman and Managing Director: Peter Rae Industries | Christchurch, 23 September 2014 |

Philip Burdon, Property Investor and Developer | Christchurch, 5 November 2014 |

Shaun Stockman, Managing Director: KPI Rothschild Property | Christchurch, 22 September 2014 |

Category C: Insurance | |

Jimmy Higgins, Executive GM—Earthquake Programme: Vero NZ | Auckland, 15 October 2014 |

John Lucas, Insurance Manager: Insurance Council of New Zealand | Wellington, 17 October 2014 |