Abstract

How externally acquired resources may become valuable, rare, hard-to-imitate, and non-substitute resource bundles through the development of dynamic capabilities? This study proposes and tests a mediation model of how firms’ internal technological diversification and R&D, as two distinctive microfoundations of dynamic technological capabilities, mediate the relationship between external technology breadth and firms’ technological innovation performance, based on the resource-based view and dynamic capability view. Using a sample of listed Chinese licensee firms, we find that firms must broadly explore external technologies to ignite the dynamism in internal technological diversity and in-house R&D, which play their crucial roles differently to transform and reconfigure firms’ technological resources.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The traditional resource-based view (RBV) emphasizes how the heterogeneity of firms’ resources, which are arguably the source of firms’ competitive advantage (Barney, 1991), explain differences in performance among firms. The dynamic capabilities view (DCV) focuses on how firms’ internal capabilities help transform resources into advantaged firm performance (Barney, 1991; Teece, Pisano, & Shuen, 1997). The recent theoretical development recognizes that it is the combination of valuable, rare, imperfectly imitable, and non-substitutable (VRIN) resources and capabilities that lead to a firm’s renewed/reconfigured resource base, which eventually creates competitive advantages (Eisenhardt & Martin, 2000; Helfat & Peteraf, 2009).

Researchers have largely recognized two pathways for resource development: either building from a firm’s prior path or acquiring from external sources that are of value to the focal firm (Schmidt & Keil, 2013). The former is a result and a reinforcement of path dependency, whereas the latter creates new paths for a firm in idiosyncratic situations by externally searching for new knowledge (Ahuja & Katila, 2001). Although the traditional RBV and the DCV may well explain the internal path of resource development, it remains unclear in the literature how externally acquired resources may become VRIN in combination with organizational capabilities (West & Bogers, 2014). For instance, from an outside-in perspective of open innovation (Enkel, Gassmann, & Chesbrough, 2009), researchers are interested in how firms utilize externally sourced technologies to enhance their technological innovation performance (Chesbrough, 2003; Stuart, 2000; Tsai, Hsieh, & Hultink, 2011), assuming a direct link between externally sourced technological resources and enhanced performance among technology-acquiring firms (Ahuja & Katila, 2001; Caloghirou, Kastelli, & Tsakanikas, 2004; Johnson, 2002; Li, 2011; Lin, 2003; Tsai & Wang, 2007). In these studies, researchers often adopt a static RBV and primarily treat the technology-acquiring firm as a “black box,” in which enhanced performance is assumed to be a direct result of acquiring external technological resources. This perspective reveals a clear discrepancy between the RBV and DCV (Ambrosini & Bowman, 2009). Few empirical studies have integrated the RBV and DCV to investigate how external sourcing of resources, which are not necessarily VRIN for a firm, can be transformed into VRIN resource bundles through accordingly developed dynamic capabilities. How this process takes place and which capabilities may play their roles differently, therefore, are the focus of this study.

Building upon the foundations of RBV and DCV (Eisenhardt & Martin, 2000), we conceptually link external technology sourcing, dynamic capabilities, and subsequent renewed and reconfigured internal resources within a mediation model: A firm’s dynamic capabilities mediate the relationship between the breadth of external technology sourcing and firms’ technological innovation performance (TIP), which is conceptualized as a set of renewed and reconfigured technological resources created through the combination of externally acquired resources and internal dynamic capabilities, instead of as a performance measure. The empirical context of this study is a sample of large Chinese firms that licensed patents during the period 2000–2012.

The contribution of this paper to the literature is twofold. First, we advance the RBV and DCV by answering how the access to valuable external resources alone leads to renewed VRIN resources through a process in which certain dynamic capabilities play a mediating role. Second, this study sheds light on the call in the open innovation literature for a better understanding of how firms using an outside-in approach can capture the value of external resources (West & Bogers, 2014). This is achieved by highlighting the nuanced differences between the two microfoundations of firms’ dynamic technological capabilities with respect to their roles of transforming firms’ external resource bundles.

In the next section, we discuss the theoretical background through the lenses of the RBV and DCV, based on which we formulate certain hypotheses. Next, the data and methods used in the empirical analysis are introduced, and the results of the empirical analysis are then presented. Finally, we discuss our findings, address some limitations, and offer some conclusions.

Theoretical background and hypotheses

Resource-based view vs. dynamic capabilities view

Both the RBV and the DCV have a long tradition in the literature in explaining firm performance. The RBV argues that firms can be conceptualized as bundles of resources that are heterogeneously distributed across firms (Barney, Wright, & Ketchen, 2001; Nelson & Winter, 1982). When these resources are considered VRIN, firms can develop a competitive advantage that in turn leads to superior performance. A firm’s resource base determines its strategic position in relation to the changing external environment (Teece et al., 1997). The DCV focuses on a firm’s abilities to purposefully create, extend or modify its resource base (Helfat et al., 2007). This view suggests that resources can influence performance only to the extent that a firm can leverage and renew those resources with organizational capabilities. Recently, it has been suggested that the RBV and the DCV must be understood as complementary perspectives that explain firms’ performance to avoid the use of underspecified models and erroneous conclusions (Sirmon & Hitt, 2009).

Resources can be either developed within a firm or acquired externally (Ahuja & Katila, 2001; Schmidt & Keil, 2013). Researchers have suggested that both internally developed and externally acquired resources are equally important for sustaining firms’ competitive advantages (Chesbrough, 2003; Lin, 2003). Internally developed resources are based on a firm’s prior paths and reinforce path dependency (Sydow, Schreyögg, & Koch, 2009); externally acquired resources, however, face challenges in being integrated into a firm’s existing resource base and becoming renewed VRIN resource bundles (West & Bogers, 2014). Although the traditional RBV and the DCV may well account for the resources derived from the prior paths of a firm and its performance, we know much less about certain idiosyncratic situations in which a firm searches for external resources that are valuable (for some purposes) but not necessarily rare, inimitable, and non-substitutable for the knowledge-seeking firm and how these resources can eventually be “transformed” to become reconfigured internal VRIN resource bundles. Figure 1 conceptually illustrates the rationale behind this study, which aims to explain the underexplored pathway of external resource acquisition and dynamic capabilities. The key logic underlying the proposed conceptual framework for the external resource path is that a firm’s dynamic capabilities will change and develop in response to the attributes of external access to valuable resources, a process through which a firm’s VRIN resource configurations could be renewed. This conceptual positioning is in line with the recent theoretical development regarding the DCV, which suggests that dynamism exists in the interplay between a firm’s dynamic capabilities and resource base, allowing for the modification of the resource base (Ambrosini & Bowman, 2009; Chen, Su, & Marcott, 2007; Sirmon & Hitt, 2009).

Conceptualization of dynamic capabilities

It has been widely accepted that dynamic capabilities are a series of routinized activities that are performed to reconfigure firms’ resource base. Dynamic capabilities are “routines” because they are repetitious and purposefully patterned (Teece et al., 1997; Winter, 2003); they are also “activities” because they are continuously “in action” in response to changes in a firm’s resource configuration and external environment (Ambrosini & Bowman, 2009; Zollo & Winter, 2002). Scholars have studied various actionable microfoundations of dynamic capabilities, such as research and development (R&D) investments (Lane & Lubatkin, 1998; Tsai et al., 2011), integrating activities (Sen & Rubenstein, 1989), and technology diversification (Argyres, 1996).

Dynamic capabilities is a multi-level concept. In Collis’ (1994) taxonomy, competitive advantage is a result of combined effects of dynamic capabilities at different levels in a process that leads to infinite regress with ever higher orders of capabilities. At the most basic level, capabilities are performable routines that enable a firm to earn a living. These capabilities involve those administrative, operational, or governance-related functions that are highly likely to be widely adopted by firms across industries (Teece, 2014). These capabilities have been labeled differently, with rubrics of “zero-level” (Winter, 2003) and “ordinary” capabilities (Teece, 2014). At the next level are capabilities that allow firms to change the base-level capabilities and resources. These capabilities are often referred to as “first-order” capabilities (Schilke, 2014).Footnote 1 Collis (1994) further theoretically suggests that the relevance of a given level of capabilities is dependent on the competitive context: In some cases, zero-level capabilities are necessary, and in other cases, first-order capabilities are more decisive for sustaining competitive advantage. In general, higher-order dynamic capabilities are more difficult to be imitated than lower-order ones (Teece, 2014); however, higher-order capabilities are also more difficult to be developed within an organization because they are derived from repeated learning and experiences, based on the performance of lower-order capabilities (Bingham, Eisenhardt, & Furr, 2007).

Next, because of the nature of routinization and multi-levelness, dynamic capabilities do not necessarily guarantee competitive advantage (Ambrosini & Bowman, 2009; Winter, 2003). Instead, lower-order capabilities are likely to be commonly distributed among firms in an industry such that even “best practices” may be duplicated across firms (Teece, 2014). Therefore, what is essential for sustaining competitive advantage is the resource configurations created and renewed by dynamic capabilities, not the capabilities themselves (Eisenhardt & Martin, 2000).

A mediation model

Based on the RVB and the DCV, we propose that dynamic capabilities mediate the relationships between external valuable technological resources and a firm’s subsequent renewed technological resource configurations. Instead of conceptualizing a moderating role of dynamic capability in this case, a mediation model is more logically consistent and conceptually sound because by proposing a moderating model, one implicitly assumes that dynamic capabilities are given rather than responsive. Such an assumption obviously violates the responsive nature of dynamic capabilities, which are enabled by a firm’s resource position and are “in action” along with the change in resource configurations (Eisenhardt & Martin, 2000; Helfat & Peteraft, 2009). Therefore, a moderating model is disregarded in this study.

We move on to explain the key concepts in the mediation model in a specific context. First, concerning external resources, scholars have highlighted the importance of technological resources in developing innovative products and processes (Grant, 1996; Miller, 2006; Patel & Pavitt, 1997). Technological resources developed externally can be sourced-in by, for instance, licensing, merger and acquisitions (M&A), or spillover effects (Wang & Li-Ying, 2014). Externally acquired technologies may not be VRIN resources for the technology-acquiring firm if a firm does not have the capabilities to subsequently create and reconfigure its own new technological resources. For instance, when a firm licenses technologies for manufacturing purposes, the licensed technologies are of value for the firm but not necessarily rare, inimitable, and non-substitutable. It is up to the licensee firm to accordingly develop organizational capabilities and eventually “transform” licensed technologies into a reconfigured resource base.

In this paper, we empirically focus on one type of external technological resource—patent licensing. To be more specific, we first focus on the breadth of Chinese firms’ external technology access in terms of the technological domains covered by licensed patents. A well-established stream of literature has demonstrated that firms generally need to search broadly or deeply to adapt to change and therefore innovate (Katila & Ahuja, 2002; Laursen & Salter, 2006). Although search depth denotes how intensively and repeatedly a firm exploits external technological resources, search breadth represents how broadly a firm explores various domains of external technologies (Chiang & Hung, 2010). The reason why this study focuses only on the breadth instead of depth is twofold: (1) Chinese industrial R&D has lagged behind those in Western countries since the 1980s and 1990s. Thus, learning from external technology sources through an effective technology market has been promoted in China as a primary means of reducing the country’s technological deficiency and catching up with the Western world. Given limited internal technological knowledge bases of industrial firms and a strong incentive for economic growth, the breadth of external technology access seems to be more relevant and more important than the depth of technology exploitation in China (Li-Ying & Wang, 2015; Li-Ying, Wang, & Salomo, 2014). (2) Although broadening might be a relevant and prevailing strategy of external technology search for Chinese firms, it functions in a confined fashion with respect to technical domains, geography and timing (Li-Ying et al., 2014). Prior studies have not taken a firm’s internal capabilities into consideration when addressing the breadth issue in this specific context.

Second, drawing on the literature on the technological aspect of dynamic capabilities (Eisenhardt & Martin, 2000; Henderson & Clark, 1990; Teece et al., 1997), in this study we introduce the concept of dynamic technological capabilities as a natural response to the broadened external technological domains through licensing. The multi-level perspective of organizational capabilities (Collis, 1994) provides us with a foundation for conceptualizing a firm’s dynamic technological capabilities and defining its measurable microfoundations. We focus on two microfoundations of dynamic technological capabilities—in-house R&D investment (Chandler & Hikino, 1990; Chesbrough, 2003) and technological diversification (Sen & Rubenstein, 1989). First, in-house R&D is essential to enhancing an industrial firm’s technological innovation performance (Li-Ying & Wang, 2015). Even though in-house R&D might be routinized activities that are commonly adapted among most industrial firms, the intensity and practices of in-house R&D can still vary to a great extent from one firm to another (Eisenhardt & Martin, 2000; Teece, 2007). Second, technological diversification refers to a firm’s capabilities to learn from the interaction between its internal knowledge base and externally acquired technologies and further diversify its technology bases (Agryres, 1996). Both in-house R&D and technological diversification are conceptualized as first-order capabilities because they are performable organizational routines that are heterogeneously distributed among industries and their functions are to reconfigure and renew a firm’s technological resources.

Teece (2007) described the fundamental components of dynamic capabilities as a firm’s capacities (1) to sense opportunities and threats, (2) to seize opportunities, and (3) to maintain competitiveness through transforming and reconfiguring the business enterprise’s intangible and tangible assets (Teece, 2007). Viewing in-house R&D through Teece’s lens of conceptualization, we suggest that in-house R&D tends to reflect the microfoundations of sensing and seizing because firms with strong R&D should be able to sense and seize technological opportunities and their commercialization potential, whereas technological diversification conceptually leans towards transforming because it entails a firm’s resources and (ordinary) capabilities being transformed into new trajectories of potential growth. It is our intention to investigate how these two microfoundations of technological capabilities directly contribute to firms’ reconfigured technological resources and how they mediate the relationship between the breadth of external technologies and firms’ reconfigured technological resources. More importantly, to better represent the “responsive” nature of dynamic capabilities, we measure technological capabilities in this study as the change in a firm’s technological diversification and in-house R&D investment rather than a static value at a particular point in time.

Next, the reconfigured technological resource base, as a result of the deployment of dynamic capabilities, is refined to a firm’s technological innovation performance (TIP) in this study. Often measured by the number of a given firm’s new patent applications or granted patents (Acs & Audretsch, 1989; Li-Ying & Wang, 2015; Li-Ying et al., 2014; Stuart & Podolny, 1996), TIP is usually regarded as a component rather than an enabler of competitive advantage. In our opinion, this definition is imprecise from the RBV. On the one hand, compared with other firm performance measures that focus on the product-market side of firm advantage (e.g., sales of new products, market share, and return on assets), TIP at most represents a set of renewed and reconfigured technological resources. For TIP to be further translated into firm performance, a firm surely needs other types of dynamic capabilities, such as product development and design, user needs assessment, and marketing, which are beyond the scope of this study. On the other hand, TIP represents a renewed resource configuration, which, together with the corresponding dynamic capabilities, becomes rarer, less imitable, and less substitutable. Therefore, we conceptually position TIP as a set of renewed and reconfigured technological resources rather than a measure of firm performance.

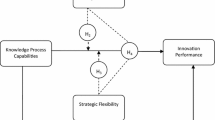

Overall, a mediation model is specified to connect the breadth of external technological resources, the change in a firm’s technological diversification and in-house R&D, and TIP. A full illustration of the empirical model is presented in Fig. 2. Hypotheses are developed accordingly to test these relationships in the next section.

Hypotheses

Prior work has strongly suggested that with a broad scope of external technology search, firms can benefit from more opportunities for novel combinations (Fleming, 2001; Prencipe, 2000). In addition, a large breadth of external technology resources allows firms to conduct more experiments in new technological fields, which help firms avoid “lock-in” problems and remain flexible in the face of external technological and market changes (Cowan & Foray, 1997; Grant, 1996; Zahra & George, 2002). A broad scope of external technology search may increase the chance for a firm to develop VRIN resources derived from externally acquired technologies (Laursen & Salter, 2006). Moreover, we note that a prior study has also suggested that technological over-search, which potentially imposes high degrees of learning risk and management challenges for a knowledge-seeking firm, is not common for Chinese firms (Li-Ying et al., 2014). Thus, we do not expect inverted U-shaped behavior as suggested by the literature (Laursen & Salter, 2006; Nooteboom, Vanhaverbeke, Duysters, Gilsing, & van den Oord, 2007). Therefore, from the RBV, a baseline hypothesis is straightforward: The breadth of external technologies and TIP are positively associated. We formulate the first hypothesis as follows:

-

Hypothesis 1 The breadth of a firm’s external technological resources positively influences its technological innovation performance.

The addition of broad external resources will eventually be “competence destroying” if a firm does not develop internal capabilities to create, extend, or modify its resource configurations (Laursen & Salter, 2006). Therefore, accordingly developing internal technological capabilities by technological diversification and in-house R&D are essential for a firm to capture the innovation value of broadened external technological resources.

First, the diversification of a firm’s technological base refers to the expansion of its knowledge base into a large range of technological areas, expanding its technological innovations over more than one technological domain (Breschi, Lissoni, & Malerba, 2003). By technological diversification, a firm can exploit novel combinations of its internal technologies in combination with unfamiliar external technologies and create new innovation value through discoveries in related areas (Garcia-Vega, 2006; Granstrand, Bohlin, Oskarsson, & Sjöberg, 2007). If it has a diversified knowledge base, a firm can achieve a high level of cross-fertilization between different yet related technologies (Garcia-Vega, 2006; Granstrand & Sjölander, 1990). A diversified knowledge base demonstrates a firm’s strong capabilities to recognize and mobilize the real option value of knowledge embedded in licensed technologies and further allow itself to establish “architectural competence” by integrating dispersed knowledge from various sources into a coherent whole (Henderson & Cockburn, 1996). Therefore, technological diversification should be positively related to a firm’s TIP.

When a firm licenses technologies from other organizations, it requires a process through which the licensee firm accesses other firms’ knowledge bases and integrates them with its own current knowledge bases (Li & Wu, 2010). According to cybernetic theory (Ashby, 1965), the only way to handle increasing complexity in a system is to increase the complexity of an adjacent/coupling system. Therefore, as the breadth of external technology resources widens, a firms needs increasingly strong capabilities to diversify its own technology bases to cope with the increasing complexity and broadened technological opportunities introduced by external technology resources. In other words, if a firm fails to change the current scope of its knowledge base, it may not be able to capture as many opportunities as it intends to in an attempt to recombine its existing and newly in-sourced technologies (Fleming, 2001) and reap the economies of scope that are created by applying the same technologies to different product-market contexts (Durand, Bruyaka, & Mangematin, 2008). In this respect, technological diversification becomes a first-order capability, broadening a firm’s resource and ordinary capabilities that are sufficient to “earn a living” based on existing technologies and existing product/service offerings (Argyers, 1996; Silverman, 1999). To summarize, we observe the following pattern of relationships: The broadening of a firm’s external technological resources forms an idiosyncratic position that requires a firm’s dynamic capabilities to diversify its current technology bases. Technological diversification, thus, modifies, extends, or creates new technological resources within a firm. The dynamism lies in the interconnected changes among a firm’s technological resource configurations and the capability to reconfigure these resources. Thus, the following hypothesis regarding the mediating role of technological diversification is formulated:

-

Hypothesis 2 The change in a firm’s internal technological diversification mediates the relationship between the breadth of external technological resources and the firm’s technological innovation performance.

Firms’ in-house R&D has long been recognized as a major contributor to technological innovation (Chandler & Hikino, 1990; Chesbrough, 2003). In-house R&D is a prerequisite for firms to exploit the knowledge elements that they are familiar with and recombine internal knowledge in novel ways. Accumulated R&D experience may reduce the time and costs of external learning (Fleming, 2001). R&D also enhances a firm’s ability to capture the value of its internal know-how (Chandrashekhar, 2006). Today, even in an increasingly collaborative innovation environment, it is still widely accepted that the sheer size of internal R&D expenditure itself is one of the main determinants of firms’ superior TIP (Li-Ying & Wang, 2015; Kogut & Zander, 1996).

Moreover, in-house R&D investments are needed to improve a firm’s ability to absorb, assimilate, and extend external technological resources because of the complex nature of technology acquisition. This functionality of in-house R&D is usually referred to as a part of “absorptive capacity” (Cohen & Levinthal, 1990). When a firm licenses technologies with a broad scope, it must invest in its in-house R&D to cope with the increasing complexity of external technologies and realize their full potential (Huber, 1991; Matusik & Hill, 1998). Helfat (1997) argued that R&D is one of the dynamic capabilities that may change the way how a firm configures its technological resources. If a firm fails to routinely invest in R&D and keep its current scope of knowledge base up-to-date, externally sourced technologies may not become VRIN for the firm because the external technological and market environments rapidly change (Rosenkopf & Nerkar, 2001; Teece, 2007). Studies based on economies with successful catch-up strategies, such as Japan, South Korea, Singapore, and Taiwan, have repeatedly demonstrated the critical role of latecomer firms’ own R&D efforts to absorb, assimilate, and diffuse imported technologies (Katrak, 1990; Kim & Nelson, 2000). Therefore, we propose that the broadening of a firm’s external technological resources forms an idiosyncratic position that requires a firm to have dynamic capabilities to strengthen its in-house R&D, which in turn modifies, extends, or creates new technological resources within a firm. Thus, a third hypothesis regarding the mediating role of in-house R&D is formulated:

-

Hypothesis 3 The change in a firm’s in-house R&D investment mediates the relationship between the breadth of external technological resources and the firm’s technological innovation performance.

Methodology

Data and sample

Patent licensing has been one of the most important ways in which firms gain access to new technological knowledge (Chen & Sun, 2000). After entering a technology license agreement, a licensee must have the ability to internalize the in-licensed technologies through a learning process (Cummings & Teng, 2003). A firm’s licensing activities, thus, are embedded in its overall search strategy and positioning (Kollmer & Dowling, 2004). Because researchers and practitioners have long recognized that patent information can be best analyzed and appropriated for strategic technology management (Argyres, 1996; Ernst, 2003), this study probes the interplay among firms’ external technological resources, dynamic capabilities, and renewed resource configurations through the lens of patent in-licensing.

The empirical base in this study is set in China. The dataset we use in this paper was obtained from the State Intellectual Property Office of China (SIPO). Since 2000, the SIPO has been authorized to register technology-licensing contracts within 3 months after a contract is signed between the licensor and licensee, according to Chinese legislation. Each technology transfer record registered at the SIPO contains the following information: licensor name, licensing patent number, patent name, licensee name, contracting number and date, and license type. License agreements can be signed between individuals and firms in various forms. The licensors of a licensing agreement can be either Chinese or foreign individuals/firms, but all licensees are Chinese individuals/firms. To date, this dataset only includes patent licensing agreements. The complete records from 2000 to date are available to the public on the SIPO website in Chinese (http://www.sipo.gov.cn/). The SIPO also provides the public with a patent retrieval system with which to search for a firm’s patent applications and granted patents (http://search.cnipr.com/). Several prior studies have used this dataset to study issues related to technology licensing and innovation performance of Chinese firms (e.g., Li-Ying, Wang, Salomo, & Vanhaverbeke, 2013; Wang & Li-Ying, 2014; Wang, Zhou, & Li-Ying, 2013).

The second dataset is drawn from the Chinese Stock Market and Accounting Research (CSMAR) database to collect information for formulating firm-level variables. Information on the listed Chinese firms regarding the following can be found in the CSMA dataset: firm name, location, industrial classification, ownership, number of employees, total sales, annual profit, sales through export, R&D investment, year of establishment, and other important indicators. The CSMAR dataset is currently one of the most official, reliable, and comprehensive firm-level data sources in China and has been widely used in previous studies (see Wang, Jin, & Yang, 2015). In addition, we also draw on the WIND database, a Compustat-style database used in China to identify the names of listed Chinese firms, their former names (if any), and their subsidiaries (see http://www.wind.com.cn). This approach is necessary because listed firms often change their names or establish new subsidiaries when ownership structure changes.

A sample of 508 indigenous Chinese firms is established, following the selection process illustrated in Fig. 3. First, during the period 2000–2012, 60,405 patents covered by 22,631 license contracts were licensed in China. Based on the objective of this study, we focus on firm licensees. Thus, we first exclude all licensing contracts involving only licensees who are individuals (411 cases) and education and research institutes (1989 cases) from the sample. These criteria result in 19,500 firm licensees involved in 21,659 license contracts, which cover 58,934 licensed patents. In a second step, to ensure reliable and consistent firm-level information on licensee firms for subsequent analyses, we limit our sample to the Chinese listed firms. Naturally, we identify all Chinese listed firms involved in patent licensing as licensees during the period of interest, checking firms’ names or their former names based on the WIND database. As a result, 269 listed firms (parent) and 487 subsidiaries of listed firms are identified. These firms engaged in 4120 licensed patents covered by 1442 license contracts. Because patent licensing between a parent firm and its subsidiaries can be considered a firm’s internal knowledge transfer, these cases are not part of our sample. Therefore, we further exclude 12 parent firms and 184 subsidiaries. After this step, we obtain a sample of 257 parent firms and 303 subsidiaries who were involved in patent licensing as licensees. Finally, we attribute subsidiaries’ licensing activities in a particular year to their parent firms, yielding a sample of 508 listed firms as licensees, involving 1694 licensed patents covered by 828 license contracts. Each observation in our data regarding the independent variables is a record of a firm’s patent licensing activities in a particular year. Because some firms had more than one patent licensed in a particular year, our final sample is composed of 666 firm-year observations of patent licensing for 508 licensee firms. The observations regarding the dependent variables for these firms are lagged for 3 years.Footnote 2 Thus, our data have a cross-sectional nature with a lagged effect on the observation of dependent variables.

These 508 licensee firms include a number of well-known Chinese firms, such as Haier, BYD, ZTE, TCL, and Datang Communication. The firms are disproportionately located in 31 different provinces and municipalities in China. The top five locations are Guangdong (77 firms), Zhejiang (58 firms), Jiangsu (57 firms), Beijing (41 firms), and Shanghai (32 firms). The licensee firms are distributed between 79 different industries, which were denoted by the China Securities Regulatory Commission (CSRC) in 2012. Among these industries, the top four are the pharmaceutical manufacturing industry (code: C81), which accounts for 11.22% of the sampled firms; the chemical raw materials and chemical products manufacturing industry (9.65%; code: C43); the electrical machinery and equipment manufacturing industry (6.3%; code: C51); and the electronic components manufacturing industry (4.72%; code C67). With respect to the licensor firms in our sample, 11.75% of the licensing agreements were made with licensor firms from advanced foreign countries, including the Netherlands, Japan, the United States, France, Germany, and Austria. The most active licensors are Philips Electronics, Mexico Petroleum Group Co., Ltd., and Sumitomo Special Metals Co., Ltd.

Measurement of variables

Dependent variable

Technological innovation performance (TIP)

Two commonly used measures for TIP have been considered in the literature: new product sales and new patent applications. We have reason to discard the former and choose the latter in this study. First, using “new product sales” to measure TIP in China will introduce a severe bias because in China, when a product is designated by the government as “new,” the firm can obtain a tax subsidy from the provincial or central government. Therefore, firms have a strong incentive to over-record their new product sales (Liu & White, 1997). Moreover, it is difficult to compare this measure across different provinces because the level of newness is not evaluated based on a nationally standardized scheme (Li & Wu, 2010). Additionally, because we conceptually position TIP as reconfigured resources instead of a measure for firm performance, new product sales does not appropriately represent a renewed pool of resources. Therefore, we turn our attention to an alternative measure of TIP, new patent applications.

Scholars have repeatedly discussed the strengths and weaknesses of using patent counts to measure innovation performance (Ahuja & Katila, 2001; Griliches, 1992; Singh, 2008). Nonetheless, patents have been found to be a reliable proxy for technological innovation performance (e.g., Acs & Audretsch, 1989; Henderson & Cockburn, 1996; Li-Ying et al., 2014; Pakes & Griliches, 1980; Wang & Li-Ying, 2014). The reasoning is that patents contain reliable information that indicates the generation of inventions that are industrially useful and non-obvious to an individual who is knowledgeable in the relevant technical field and the ownership of intellectual properties as firm resources (Ernst, 2003; Lin, Chen, & Wu, 2006). Thus, patents have generally been regarded as a signaling mechanism for firms to credibly publicize information about their R&D focus, technology portfolio, and potential market access (Ernst, 2003; Lin et al., 2006), making them a good proxy for (reconfigured) technological resources (Coombs & Bierly, 2006; Stuart & Podolny, 1996). Compared with the new product sales measure, from the RBV, a firm’s patent applications better represent the ownership of a renewed set of technological resources that are VRIN for the firm. Therefore, we use the licensee firm’s new patent applications to measure TIP.

The procedure for filing patents is unified and standardized across all provinces and industries in China. In this paper, TIP is measured by the number of patent applications filed within 3 years succeeding the licensing year, including the licensing year. New patent applications filed by subsidiaries are aggregated into their parent companies. This 3-year period is chosen because it is in line with prior studies that analyze the effects of other types of organizational learning activities on firms’ subsequent patent applications (Ahuja & Katila, 2001; Hausman & Griliches, 1984; Leone & Reichstein, 2012).

Independent variables

External technology breadth is defined as the range of knowledge areas of a firm’s in-licensed technologies. In the literature, this variable is commonly measured by patent classes, based on which the knowledge embodied in a patent can be entered into a coherent classification system (Fleming, 2001). The more unique patent classes within a licensed patent are, the broader the technology scope a firm tends to have. However, it is highly likely that the more patents a firm licenses, the more unique patent classes it has. Therefore, we use the average number, instead of the total number, of unique patent classes to avoid a potentially high correlation between the number of licensed patents and the number of unique classes. As in previous studies, we measure this variable by counting the average number of unique patent classes (using the four-digit patent classification code for Chinese invention and utility types of patent) of a firm’s yearly in-licensed patents (Granstrand & Sjölander, 1990; Zhang & Baden-Fuller, 2010).

Technological diversification

To measure the change in technological diversification before and after a firm’s licensing, we first follow the work of Hall et al. (Hall, Jaffe, & Trajtenberg, 2001; Jaffe, 1986; Li-Ying et al., 2014) in calculating the similarity of a firm’s patent portfolios within 3 years before and after its licensing. We then use 1 minus the value of similarity to indicate a firm’s technology diversification driven by its external technology sourcing. The detailed formula for the similarity is as follows:

P i and P j represent a firm’s vectors of Chinese patent applications in patent class k over the 3 years before and after the licensing year, respectively. R ij represents technological similarity, which has a value between “0” and “1.” The value of “1− R ij ” thus measures technological diversity. A high value means that compared with that 3 years before the licensing, a firm’s technology portfolio is much more diversified during the 3 years after the licensing. Patent classes are adopted from the International Property Classification. For invention and utility patents, we use the first four categorical characters (i.e., a section symbol plus a two-digit number and a subclass letter). For design patents, we use the two-digit main class number.

In-house R&D refers to a firm’s technological efforts that can be roughly indicated by measuring its R&D expenditures. We first calculate the licensee firms’ R&D investment per employee in each year within a 3-year period after the licensing year. To capture the change in R&D investment, we then measure the difference between the average R&D investments in the 3 years after licensing and the R&D investments of the licensing year.

There is a clear limitation with respect to the gap between the construct of dynamic technological capabilities and the manner in which we measure its two microfoundations. It is established that capabilities are performable organizational routines and activities, which our measures of technological diversification and in-house R&D we are not directly measuring. Instead, both measures appear to indirectly measure the outcome of performing dynamic technological capabilities. However, we argue that these capabilities might still be satisfactory proxies for a number of reasons. First, for tech diversification, the measure is a direct indication of diversified technological domains of a firm as a consequence of its continuous exploration of new combinations of technological elements. Thus, the measure is an outcome measure, but it is also a good proxy that closely reflects organizational routines and activities. Second, firms’ R&D activities usually focus on lab testing, quality control, hiring new scientists and engineers, identifying alternative uses, and introducing new product/process prototypes (Helfat, 1997). Eisenhardt and Martin (2000) also identified cross-functional R&D teams, new product development routines, quality control routines, technology transfer and/or knowledge transfer routines, and certain performance measurement systems as important elements of R&D routines. They all certainly cost money. One may fairly argue that an innovating firm may differentiate itself by seeking new ways of performing R&D that are different from the majority of the industry such that what matters is how to carry out R&D instead of how much to spend on R&D. However, it is important to emphasize that differentiating a firm’s R&D means deviating from industrial best practices and standards, which requires substantial investment in R&D to achieve. Therefore, we believe that R&D expenditure itself represents a substantial portion of the quality and innovativeness of a firm’s R&D activities. Given the limitation of our data, which do not allow us to directly observe micro-level R&D activities, R&D expenditure might be a second best proxy for measuring capabilities.

Control variables

We control for several variables that are widely used in studies on innovation. At the firm level, we control for firm age, measured by the number of years between a firm’s year of establishment and the licensing year, and firm size, measured as the number of employees. Next, the export orientation of firms is controlled for and measured by the sales derived from exports divided by total sales. When this ratio is greater than 5%, we set this variable to “1”; otherwise, the variable is set to “0.” Licensee firms’ existing technology scale, measured by the total number of patent applications filed within the 3-year period before the licensing year, is controlled for as well. We also control for the intensity of co-patenting with local university/research institutes and co-patenting with local industrial firms, measured by the number of co-patents made by the licensee firms accordingly. To avoid a potential endogeneity problem caused by correlations among independent variables, we set a 1-year lag for the value of firm size, export orientation, co-patenting with universities/research institutes, and co-patenting with industrial firms.

At the industry level, we control for firms’ industry sector. Because the licensee firms are distributed among 79 industries according to the CSRC code, it is not feasible to incorporate so many dummy variables into the regression models. To avoid over-restricting the models by introducing too many dummy variables, we alternatively categorize the firms into five groups: four groups for the top four representative industries in the sample (see earlier discussions) and a fifth group for all other industries. We thus use four dummy variables to represent these five categories of industries.

In addition, we control for the technology source origin. The value of this variable is coded as follows: When the licensed technology originates from foreign licensors, we denote a dummy (origin) as “1,” and we denote the dummy as “0” otherwise. We also use a dummy variable to control for the licensor types (coded as “1” when a licensor is a firm and “0” otherwise). Finally, to control for the time effect caused by any unobserved variance associated with time in the rapid transition process in China, we introduce year dummies for the period 2000 to 2012, with 2000 omitted as the reference year.

Estimations

A mediated model is established between the breadth of external technologies, (technological) dynamic capabilities, and technological innovation performance as a reconfiguration of resources. To test for a mediation effect, three conditions must be met: (1) The independent variable must significantly impact the dependent variable(s); (2) the independent variable must significantly influence the mediator(s); and (3) the mediator(s) must significantly affect the dependent variable(s) after the influence of the independent variable is controlled for (Baron & Kenny, 1986). The last step involves demonstrating that when the mediator and the independent variable are used simultaneously to predict the dependent variable, the previously significant path between the independent and dependent variables will be reduced. Alternative tests for a mediation effect exist and will be used in this study as well (Clogg, Petkova, & Shihadeh, 1992; Freedman & Schatzkin, 1992; Sobel, 1982).

Our data are cross-sectional with a time-lag effect on the dependent variables. The dependent variable, TIP, is a count variable in this study. A Poisson model is appropriate for modeling discrete rare events such as those observed in our sample and is particularly suitable for patents (Hausman & Griliches, 1984). However, in Poisson models, unobserved heterogeneity in the sample might result in overdispersion, a condition in which the variance exceeds the mean, causing the underestimation of standard errors and the inflation of significance levels. A negative binomial regression is introduced to overcome this drawback. Because α tests indicate that overdispersion is present in our data, we decide to use the negative binomial regression as the estimation model.

When testing the effect of the independent variable on the two mediators, two additional models are needed to regress “technological diversification” and “internal R&D” on external technology breadth. The two mediators, “technological diversification” and “in-house R&D,” are continuous variables with limited values (the former is bounded within “0” and “1,” and the latter is bounded on the right by “0”). The normal distribution assumption is therefore violated. Thus, we need to employ generalized estimating equations (GEEs) to estimate the parameters for these two models. It has been proved that the use of GEEs is more efficient than other panel data methodologies because it provides multiple correlation matrix structures with which to best match data (Liang & Zeger, 1986). Prior work has shown that the “independent” matrix option that we use in this study is more appropriate than fixed- or random-effects models (Hilbe, 2011).

Results

Table 1 summarizes the descriptive statistics and correlations of all variables in the empirical analyses. The independent variables are not highly correlated among themselves or with the control variables. Further tests of the variance inflation factor (VIF) yielded a value that is less than 2.07 for all cases, which is much less than the critical point of 10, indicating no severe multicollinearity (Belsley, 1980). Table 2 presents the statistical analysis results obtained based on negative binominal regression (for Models 1, 2, 3, and 6) and GEE models (for Models 4 and 5). All models are reported by using the Wald chi-square test. Model 1 is the base model, which includes only the control variables.

Hypothesis 1 predicts that the breadth of external technology resources will positively influence TIP. In Model 2, external technology breadth is positive and significant (β = .0997, p < .01). Hypothesis 1, thus, is supported. Hypotheses 2 and 3 predict the mediation effects of technological diversification and internal R&D, respectively, on TIP. We first regress the dependent variable, TIP, on these two mediators in Model 3 in Table 2. The coefficients of both mediators are positive and significant (for technological diversification β = .0705, p < .01; for internal R&D, β = .00789, p < .01). Next, we regress technological diversification in Model 4 and in-house R&D in Model 5 on external technology breadth. The coefficients of technological diversification in Model 4 and in-house R&D in Model 5 are both positive and marginally significant (β = .0425, p < .10, and β = 3.280, p < .10, respectively). Finally, we insert the independent variable and two mediators in the full model, Model 6. We find that their positive and significant effects still hold, but the coefficient of external technology breadth in Model 6 (β = .0978, p < .01) is reduced compared with its effect in Model 2 (β = .0997, p < .01). All conditions of Baron and Kenny’s (1986) method are confirmed to detect a mediation effect.

In addition, because the popular and traditional method for testing mediation models suggested by Baron and Kenny (1986) has been increasingly criticized (Edwards & Lambert, 2007) and the reduced effects of external technology breadth in Model 6 do not appear to be highly significant compared with those in Model 2, we decide to conduct two alternative tests to check the mediation effects. First, the Sobel test is commonly used (Sobel, 1982) as a product of coefficients approach (MacKinnon, Lockwood, Hoffman, West, & Sheets, 2002). Second, the Clogg and Freedman test is commonly used as a difference in coefficients approach (Clogg et al., 1992; Freedman & Schatzkin, 1992).

According to the Sobel test, if the Z-value is significant and the effect ratio is less than .8, then the mediation relationship is partial. Otherwise, a significant Z-value and an effect ratio greater than .8 indicate a full mediation relationship (Sobel, 1982). Table 3 reports the results of the Sobel test: For technological diversification and in-house R&D, the Z scores are significant and the effect ratios are .022 and .25, respectively, providing support for the presence of partial mediation effects. Moreover, the test results of the Clogg and Freedman methods are presented in Table 4, supporting the presence of a partial mediation relationship between external technology breadth, technological diversification, in-house R&D, and TIP. To conclude, we find partial mediation effects of two key indicators of dynamic capability—technological diversification and internal R&D—on the licensee firms’ TIP as an indicator of reconfigured firm resources.

For a partial mediation effect, it is also important to closely examine the effect size, which is also referred to as the indirect effect in mediation models. In our case, the indirect effect equals the reduction in the effect of the causal variable (“external technology breadth”) on the outcome (“TIP”) and is a measure of the amount of mediation. Although other complex measures for the indirect effect exist, the indirect effect is most often computed directly as the product of the coefficients of path a (causal variable to mediator) and path b (mediator to outcome variable) because this method is sufficiently simple and robust (Imai, Keele, & Tingly, 2010). Because we have two mediators in our model, the indirect effect can be computed as follows, where a 1 b 1 denotes the path for “technological diversification” and a 2 b 2 denotes the path for “in-house R&D”:

A simple and common standard for determining small, medium, and large effect sizes, following Shrout and Bolger (2002), is to assign values of .1, .3, and .5 to small, medium, and large effect sizes, respectively. Apparently, the effect size for the amount of mediation (indirect effect) is very small in our results, whereas a large portion of the effect size is derived from the path of “in-house R&D.” The small effect size of the indirect effect deserves further discussion in relation to the combination of direct and indirect effects.

Note that we use patent applications rather than granted patents because a patent application simply indicates a firm’s effort in knowledge creation and technological innovation with a clear purpose to protect that knowledge for commercial exploitation in the future. In contrast, if information on granted patents is used, researchers must inevitably take into account an external evaluation process conducted by the patent office with respect to the newness and originality of an application, a process that has little to do with the concept of a reconfigured resource base. Nevertheless, to test the robustness of our results, we conduct an additional analysis to perform the same model estimations using granted patents as the dependent variable, measured by the number of granted patents within 3 years succeeding the licensing year. The results are shown in Table 5, which shows a pattern of effects that are similar to the results presented in Table 3 in all models. The Sobel test and Clogg and Freedman test further confirm the partial mediation effects as well, for which the size of the indirect effect is small.

Discussion

We establish a stepwise link between the breadth of external technology search, dynamic technological capabilities, and reconfigured internal technological resources. This relationship conceptually redefines a firm’s technological innovation performance (TIP) as an interim indicator of reconfigured resources instead of a direct firm performance measure to better conceptually connect the RBV and the DCV. The results show that, on the one hand, a broad intake of externally acquired technological resources has a positive impact on a firm’s subsequent resource reconfiguration within the firm; on the other hand, this positive impact needs to be, at least partially, translated and transformed accordingly through changes in dynamic capabilities. This finding also suggests that dynamic capabilities vary in response to the variation in external learning activities and develop accordingly. This variation, in turn, influences a firm’s resource reconfiguration to some degree. When a firm obtains access to a broad range of external technological knowledge, it will be motivated and urged to increase its internal R&D and diversify its internal technology base to cope with the increasing complexity associated with the broadened external knowledge search. Overall, our findings also shed light on reducing causal ambiguity between a task and its performance outcomes by deploying an explicit articulation and codification mechanism to develop dynamic capabilities (Zollo & Winter, 2002).

From the DCV, we argue that R&D expenditures and technology diversification are two microfoundations of a firm’s dynamic technological capabilities, as first-order capabilities. The results suggest that (1) both in-house R&D and technological diversification positively contribute to the resource reconfiguration of a firm; (2) technological diversification makes a much stronger direct positive contribution to TIP than in-house R&D does; (3) however, when the scope of a firm’s external technology resources is broadened, the positive contribution of external technology breadth to TIP relies strongly on in-house R&D (stronger mediation) and much less on technological diversification (weaker mediation). These interesting findings suggest that to effectively reconfigure a firm’s technological resources, a firm can adopt one of two strategies: (1) focus primarily on developing and strengthening technological diversification when the scope of external technology access is not an issue; (2) pay immediate attention to enhancing in-house R&D when the scope of external technology access is broadened.

Furthermore, the effect size of the indirect effect is quite small, and a large portion of the indirect effect is derived from in-house R&D relative to technology diversification. This finding suggests that when a firm broadens its external technology resources, different microfoundations of capabilities change accordingly to different degrees. It is perhaps easier to directly change in-house R&D expenditures, but it might take longer time to realize the desired change in diversification of a firm’s technology base because technology diversification involves a learning process that entails more uncertain outcomes.

In the case of partial mediation, it is necessary to discuss whether indirect effects of other variables could (and probably should) affect the causal effects (Rucker, Preacher, Tormala, & Petty, 2011). We hereby provide two insights for discussion. First, because the indirect effect of technological capabilities in our model is small in effect size, it is reasonable to expect that there might be other first-order capabilities that mediate the potential positive contribution of broad external technology access. For instance, another source of indirect effect might be a function of dynamic managerial capabilities, which are defined as the capabilities with which managers build, integrate, and reconfigure organizational resources and competences (Adner & Helfat, 2003). Firms that seek broad external technological resources likely also need strong capabilities among top managers to unleash the potential of external technological resources. Second, beyond first-order capabilities, the literature suggests that there are second-order capabilities, which are higher-order organizational heuristics of “learning-to-learn” from lower-order capabilities (Schilke, 2014). Although empirical studies on the interplay among different levels of dynamic capabilities and their impacts on firm performance are rare, the idea that various types and levels of dynamic capabilities coexist and co-develop within a firm may provide a reasonable theoretical explanation of why the indirect effect of dynamic technological capabilities alone has a small effect size. This concept could be a highly interesting direction for future research.

The findings presented herein provide practical implications for innovation managers who are interested in taking advantage of external knowledge resources but struggle to determine how to transform external resources into reconfigured internal resources that can lead to competitive advantages. Innovation managers understand the positive contribution of external knowledge acquisition with a broad search scope, but they often need to justify the continuous commitment from top management in terms of internal R&D investment and internal diversification of the firm’s knowledge base. These demanding tasks do not always receive equal attention from top management if they are raised separately before leadership. In this respect, our study enables innovation managers to formulate the sound argument that, first, regardless of how broad the scope of a firm’s external technology resource is, it is usually beneficial to develop technological capabilities, and a premium needs to be put on technological diversification; second, to realize the full potential of accessing a broad scope of external technologies, a company must routinely develop dynamic capabilities in response to the increased exposure to external knowledge sources by primarily following up with increasing R&D expenditures and, at the same time, considering technological diversification. This logic can also be used in reverse. For example, a good way to secure a sufficient level of R&D and technological diversification within a firm is to maintain a sufficient level of external knowledge searching. In this manner, innovation managers may find it helpful to identify and justify the level of R&D expenditure and technological diversification by assessing the existing breadth and complexity of externally acquired knowledge resources.

Limitations and future research directions

This study has limitations. First, it relies on patent licensing as the main channel for accessing external knowledge sources. There are other means through which external knowledge resources can be acquired, such as, joint ventures, merger and acquisitions, and spillover effects from informal knowledge sharing (Ahuja & Katila, 2001). Future research is encouraged to investigate these alternatives and their impacts on dynamic capabilities and resource reconfiguration. Second, in this study, we focus only on the breadth of external technology sources, whereas other characteristics of external technologies are not considered. Future studies should include other characteristics of external technologies in their mediation model, e.g., technology importance, generality, newness, applicability, and maturity (Wang et al., 2013).

Conclusion

This study investigates the relationship between external resources and internal resource reconfiguration via the mediating role of firms’ dynamic technological capabilities based on the RBV and the DCV. We find that the benefits derived from a broad access to external technologies must be, to some extent, translated into and transformed by corresponding dynamic capabilities in the first place. In this sense, capabilities are “dynamic” because they interact with the emerging demands caused by the change in accessible external resources and recurrently define firm performance. More importantly, managers should note that different microfoundations of dynamic technological capabilities play their mediation roles differently in reaction to the changing scope of external technological resources.

Notes

At a higher level, so-called “second-order” capabilities (Schilke, 2014) involve the learning mechanisms that allow firms to engage in “learning to learn,” a concept that is related to double-loop learning (Argyris & Schön, 1978). To avoid conceptual complication and confusion, we do not address the “second-order” capabilities in our empirical model.

To check the robustness, we also used 1- and 2-year moving windows for all the estimation models. However, the results show no significant differences regarding the relationships among key variables. These complementary analyses are available upon request.

References

Acs, Z. J., & Audretsch, D. B. 1989. Patents as a measure of innovative activity. Kyklos, 42(2): 171–180.

Adner, R., & Helfat, C. E. 2003. Corporate effects and dynamic managerial capabilities. Strategic Management Journal, 24(10): 1011–1025.

Ahuja, G., & Katila, R. 2001. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strategic Management Journal, 22(3): 197–220.

Ambrosini, V., & Bowman, C. 2009. What are dynamic capabilities and are they a useful construct in strategic management?. International Journal of Management Reviews, 11(1): 29–49.

Argyres, N. 1996. Capabilities, technological diversification and divisionalization. Strategic Management Journal, 17(5): 395–410.

Argyris, C., & Schön, D. A. 1978. Organizational learning: A theory of action perspective. Reading: Addison-Wesley.

Ashby, W. R. 1965. An introduction to cybernetics. Methuen: Routledge.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1): 99–120.

Barney, J., Wright, M., & Ketchen, D. J., Jr. 2001. The resource-based view of the firm: Ten years after 1991. Journal of Management, 27(6): 625–641.

Baron, R. M., & Kenny, D. A. 1986. The moderator-mediator variable distinction in social psychological research. Journal of Personality and Social Psychology, 51(6): 1173–1182.

Belsley, D. A. 1980. On the efficient computation of the nonlinear full-information maximum-likelihood estimator. Journal of Econometrics, 14(2): 203–225.

Bingham, C. B., Eisenhardt, K. M., & Furr, N. R. 2007. What makes a process a capability? Heuristics, strategy and effective capture of opportunities. Strategic Entrepreneurship Journal, 1(1): 27–47.

Breschi, S., Lissoni, F., & Malerba, F. 2003. Knowledge-relatedness in firm technological diversification. Research Policy, 32(1): 69–87.

Caloghirou, Y., Kastelli, I., & Tsakanikas, A. 2004. Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance?. Technovation, 24(1): 29–39.

Chandler, A. D., & Hikino, T. 1990. Scale and scope: The dynamics of industrial capitalism. Cambridge: Belknap.

Chandrashekhar, G. R. G. 2006. Examining the impact of internationalization on competitive dynamics. Asian Business & Management, 5(3): 399–417.

Chen, M.-J., Su, K.-S., & Marcott, W. 2007. Competitive tension: The awareness-motivation-capability perspective. Academy of Management Journal, 50(1): 101–118.

Chen, X., & Sun, C. 2000. Technology transfer to China: Alliances of Chinese enterprises with western technology exporters. Technovation, 20(7): 353–362.

Chesbrough, H. W. 2003. Open Innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business School Press.

Chiang, Y.-H., & Hung, K.-P. 2010. Exploring open search strategies and perceived innovation performance from the perspective of inter-organizational knowledge flows. R&D Management, 40(3): 292–299.

Clogg, C. C., Petkova, E., & Shihadeh, E. S. 1992. Statistical methods for analyzing collapsibility in regression models. Journal of Educational and Behavioral Statistics, 17(1): 51–74.

Cohen, W. M., & Levinthal, D. A. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1): 128–152.

Collis, D. J. 1994. Research note: How valuable are organizational capabilities?. Strategic Management Journal, 15: 143–152.

Coombs, J. E., & Bierly, P. E. 2006. Measuring technological capability and performance. R&D Management, 36(4): 421–438.

Cowan, R., & Foray, D. 1997. The economics of codification and the diffusion of knowledge. Industrial and Corporate Change, 6(6): 595–622.

Cummings, J. L., & Teng, B.-S. 2003. Transferring R&D knowledge: The key factors affecting knowledge transfer success. Journal of Engineering and Technology Management, 20(1/2): 39–68.

Durand, R., Bruyaka, O., & Mangematin, V. 2008. Do science and money go together? The case of the French biotech industry. Strategic Management Journal, 29(12): 1281–1299.

Edwards, J. R., & Lambert, L. S. 2007. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychological Methods, 12(1): 1–22.

Eisenhardt, K. M., & Martin, J. A. 2000. Dynamic capabilities: What are they?. Strategic Management Journal, 21(10/11): 1105–1121.

Enkel, E., Gassmann, O., & Chesbrough, H. 2009. Open R&D and open innovation: Exploring the phenomenon. R&D Management, 39(4): 311–316.

Ernst, H. 2003. Patent information for strategic technology management. World Patent Information, 25(3): 233–242.

Fleming, L. 2001. Recombinant uncertainty in technological search. Management Science, 47(1): 117–132.

Freedman, L. S., & Schatzkin, A. 1992. Sample size for studying intermediate endpoints within intervention trials or observational studies. American Journal of Epidemiology, 136(9): 1148–1159.

Garcia-Vega, M. 2006. Does technological diversification promote innovation?: An empirical analysis for European firms. Research Policy, 35(2): 230–246.

Granstrand, O., Bohlin, E., Oskarsson, C., & Sjöberg, N. 2007. External technology acquisition in large multi-technology corporations. R&D Management, 22(2): 111–134.

Granstrand, O., & Sjölander, S. 1990. The acquisition of technology and small firms by large firms. Journal of Economic Behavior & Organization, 13(3): 367–386.

Grant, R. M. 1996. Toward a knowledge-based theory of the firm. Strategic Management Journal, 17(S2): 109–122.

Griliches, Z. 1992. The search for R&D spillovers. Scandinavian Journal of Economics, 94: 29–47.

Hall, B. H., Jaffe, A., & Trajtenberg, M. 2001. The NBER patent citations data file: Lessons, insights, and methodological tools. In A. Jaffe & M. Trajtenberg (Eds.). Patents, citations, and innovations. Cambridge: MIT Press.

Hausman, J. A., & Griliches, Z. 1984. Econometric models for count data with an application to the patents-R&D relationship. Economic and Political Weekly, 27: 909–938.

Helfat, C. E. 1997. Know-how and asset complementarity and dynamic capability accumulation: The case of R&D. Strategic Management Journal, 18(5): 339–360.

Helfat, C. E., Finkelstein, S., Mitchell, W., Peteraf, M., Singh, H., Teece, D., & Winter, S. 2007. Dynamic capabilities: Understanding strategic change in organizations. London: Blackwell.

Helfat, C. E., & Peteraf, M. A. 2009. Understanding dynamic capabilities: Progress along a developmental path. Strategic Organization, 7(1): 91–102.

Henderson, R., & Clark, K. B. 1990. Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35(1): 9–30.

Henderson, R., & Cockburn, I. 1996. Scale, scope, and spillovers: The determinants of research productivity in drug discovery. Rand Journal of Economics, 27(1): 32–59.

Hilbe, J. M. 2011. Negative binomial regression. Cambridge: Cambridge University Press.

Huber, G. P. 1991. Organizational learning: The contributing processes and the literatures. Organization Science, 2(1): 88–115.

Imai, K., Keele, L., & Tingley, D. 2010. A general approach to causal mediation analysis. Psychological Methods, 15(4): 309–334.

Jaffe, A. 1986. Technological opportunity and spillovers of R&D: Evidence from firms’ patents, profits, and market value. American Economic Review, 76(5): 984–1002.

Johnson, D. K. N. 2002. ‘Learning-by-licensing’: R&D and technology licensing in Brazilian invention. Economics of Innovation & New Technology, 11(3): 163–177.

Katila, R., & Ahuja, G. 2002. Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45(6): 1183–1194.

Katrak, H. 1990. Imports of technology and the technological effort of Indian enterprises. World Development, 18(3): 371–381.

Kim, L., & Nelson, R. R. 2000. Technology, learning and innovation: Experiences of newly industrializing economies. Cambridge: Cambridge University Press.

Kogut, B., & Zander, U. 1996. What firms do? Coordination, identity, and learning. Organization Science, 7(5): 502–518.

Kollmer, H., & Dowling, M. 2004. Licensing as a commercialisation strategy for new technology-based firms. Research Policy, 33(8): 1141–1151.

Lane, P. J., & Lubatkin, M. 1998. Relative absorptive capacity and interorganizational learning. Strategic Management Journal, 19(5): 461–477.

Laursen, K., & Salter, A. 2006. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2): 131–150.

Leone, M. I., & Reichstein, T. 2012. Licensing fosters rapid innovation! The effect of the grant-back-clause and technological unfamiliarity. Strategic Management Journal, 33(8): 965–985.

Li, X. 2011. Sources of external technology, absorptive capacity, and innovation capability in Chinese state-owned high-tech enterprises. World Development, 39(7): 1240–1248.

Li, X., & Wu, G. 2010. In-house R&D, technology purchase and innovation: Empirical evidences from Chinese hi-tech industries, 1995–2004. International Journal of Technology Management, 51(2): 217–238.

Liang, K.-Y., & Zeger, S. L. 1986. Longitudinal data analysis using generalized linear models. Biometrika, 73(1): 13–22.

Lin, B.-W. 2003. Technology transfer as technological learning: A source of competitive advantage for firms with limited R&D resources. R&D Management, 33(3): 327–341.

Lin, B. W., Chen, C. J., & Wu, H. L. 2006. Patent portfolio diversity, technology strategy, and firm value. IEEE Transactions on Engineering Management, 53(1): 17–26.

Liu, X., & White, R. S. 1997. The relative contributions of foreign technology and domestic inputs to innovation in Chinese manufacturing industries. Technovation, 17(3): 119–125.

Li-Ying, J., & Wang, Y. 2015. Find them home or abroad? The relative contribution of international technology in-licensing to the ‘indigenous innovation’ in China. Long Range Planning, 48(3): 123–134.

Li-Ying, J., Wang, Y., & Salomo, S. 2014. An inquiry on external technology search through patent in-licensing and firms’ technological innovations: Evidence from china. R&D Management, 44(1): 53–74.

Li-Ying, J., Wang, Y., Salomo, S., & Vanhaverbeke, W. 2013. Have Chinese firms learnt from their prior technology in-licensing? An analysis based on patent citations. Scientometrics, 95(1): 183–195.

MacKinnon, D. P., Lockwood, C. M., Hoffman, J. M., West, S. G., & Sheets, V. 2002. A comparison of methods to test mediation and other intervening variable effects. Psychological Methods, 7(1): 83.

Matusik, S. F., & Hill, C. W. L. 1998. The utilization of contingent work, knowledge creation, and competitive advantage. Academy of Management Review, 23(4): 680–697.

Miller, D. J. 2006. Technological diversity, related diversification, and firm performance. Strategic Management Journal, 27(7): 601–619.

Nelson, R. R., & Winter, S. G. 1982. An evolutionary theory of economic change. Boston: Belknap.

Nooteboom, B., Vanhaverbeke, W., Duysters, G., Gilsing, V., & van den Oord, A. 2007. Optimal cognitive distance and absorptive capacity. Research Policy, 36(7): 1016–1034.

Pakes, A., & Griliches, Z. 1980. Patents and R&D at the firm level: A first report. Economics Letters, 5(4): 377–381.

Patel, P., & Pavitt, K. 1997. The technological competencies of the world’s largest firms: Complex and path-dependent, but not. Research Policy, 26(2): 141–156.

Prencipe, A. 2000. Breadth and depth of technological capabilities in CoPS: The case of the aircraft engine control system. Research Policy, 29(7/8): 895–911.

Rosenkopf, L., & Nerkar, A. 2001. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strategic Management Journal, 22(4): 287–306.

Rucker, D. D., Preacher, K. J., Tormala, Z. L., & Petty, R. E. 2011. Mediation analysis in social psychology: Current practices and new recommendations. Social and Personality Psychology Compass, 5(6): 359–371.

Schilke, O. 2014. Second-order dynamic capabilities: How do they matter?. Academy of Management Perspectives, 28(4): 368–380.

Schmidt, J., & Keil, T. 2013. What makes a resource valuable? Identifying the drivers of firm-idiosyncratic resource value. Academy of Management Review, 38(2): 206–228.

Sen, F., & Rubenstein, A. H. 1989. External technology and in-house R&D’s facilitative role. Journal of Product Innovation Management, 6(2): 123–138.

Shrout, P. E., & Bolger, N. 2002. Mediation in experimental and nonexperimental studies: New procedures and recommendations. Psychological Methods, 7: 422–445.

Silverman, B. S. 1999. Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Management Science, 45(8): 1109–1124.

Singh, J. 2008. Distributed R&D, cross-regional knowledge integration and quality of innovative output. Research Policy, 37(1): 77–96.

Sirmon, D. G., & Hitt, M. A. 2009. Contingencies within dynamic managerial capabilities: Interdependent effects of resource investment and deployment on firm performance. Strategic Management Journal, 30(13): 1375–1394.

Sobel, M. E. 1982. Asymptotic confidence intervals for indirect effects in structural equation models. Sociological methodology. Sociological Methodology, 13: 290–312.

Stuart, T. E. 2000. Interorganizational alliances and the performance of firms: A study of growth and innovation rates in high-technology industry. Strategic Management Journal, 21(8): 791–811.

Stuart, T. E., & Podolny, J. M. 1996. Local search and the evolution of technological capabilities. Strategic Management Journal, 17(S1): 21–38.

Sydow, J., Schreyögg, G., & Koch, J. 2009. Organizational path dependence: Opening the black box. Academy of Management Review, 34(4): 689–709.

Teece, D. J. 2007. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic management journal, 28(13): 1319–1350.

Teece, D. J. 2014. The foundations of enterprise performance: Dynamic and ordinary capabilities in an (economic) theory of firms. Academy of Management Perspectives, 28(4): 328–352.

Teece, D. J., Pisano, G., & Shuen, A. 1997. Dynamic capabilities and strategic management. Strategic Management Journal, 18(7): 509–533.

Tsai, K.-H., Hsieh, M.-H., & Hultink, E. J. 2011. External technology acquisition and product innovativeness: The moderating roles of R&D investment and configurational context. Journal of Engineering and Technology Management, 28(3): 184–200.

Tsai, K.-H., & Wang, J.-C. 2007. Inward technology licensing and firm performance: A longitudinal study. R&D Management, 37(2): 151–160.

Wang, Y., Jin, P., & Yang, C. 2015. Relations between the professional backgrounds of independent directors in state-owned enterprises and corporate performance. International Review of Economics & Finance. doi:10.1016/j.iref.2015.10.011.

Wang, Y., & Li-Ying, J. 2014. When does inward technology licensing facilitate firms’ NPD performance? A contingency perspective. Technovation, 34(1): 44–53.

Wang, Y., Zhou, Z., & Li-Ying, J. 2013. The impact of licensed knowledge attributes on innovation performance of licensee firms: evidence from Chinese electronic industry. Journal of Technology Transfer, 38(5): 699–715.

West, J., & Bogers, M. 2014. Leveraging external sources of innovation: A review of research on open innovation. Journal of Product Innovation Management, 31(4): 814–831.

Winter, S. G. 2003. Understanding dynamic capabilities. Strategic Management Journal, 24(10): 991–995.

Zahra, S. A., & George, G. 2002. Absorptive capacity: A review, reconceptualization and extension. Academy of Management Review, 27(2): 185–203.

Zhang, J., & Baden-Fuller, C. 2010. The influence of technological knowledge base and organizational structure on technology collaboration. Journal of Management Studies, 47(4): 679–704.

Zollo, M., & Winter, S. 2002. Deliberate learning and the evolution of dynamic capabilities. Organization Science, 13(3): 339–351.

Acknowledgments

This study is supported by the social science (innovation management theme) research funding of the Sino-Danish Centre 2014–2015. The second author is grateful for support from the National Science Foundation of China (71302133), Youth Project of Ministry of Education, Humanities and Social Sciences Planning Funding(13YJC790154), Funding of Sichuan University (skqx201502), and the Key Research Base of Sichuan Social Science (Xq15B02).

Author information

Authors and Affiliations

Corresponding author