Abstract

Transition economies have become a new frontier for multinational enterprises (MNEs). This has introduced a highly dynamic competitive environment for domestic firms operating with such less developed institutions, especially those facing the threat of MNEs with superior capabilities. Drawing on the awareness-motivation-capability framework from the competitive dynamics literature, this paper develops a three-round framework that explores the evolution of the dynamic capabilities of domestic and foreign firms and the related competitive dynamics between them in (and eventually out of) transition economies. While previous research tends to focus on MNEs or domestic firms within transition economies, ours is one of the first efforts that systematically model the competitive interaction between them with a longitudinal perspective.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

In 1991, a Chinese entrepreneur founded Mindray Medical International in a competitive landscape populated by established foreign brands. Against intense rivalry from resourceful multinationals, Mindray focused on being “the first Chinese company to market home-grown, high quality products” and eventually overcame all the odds and evolved into a leading manufacturer of medical devices in China. Now it is a major player in the industry with a rapidly growing international presence (Park, Zhou, & Ungson, 2013). In 2011, a start-up firm Xiaomi started selling smart phones in China, where Apple and Samsung had entered earlier. Intense competitive battles took place. In 2014, Xiaomi rocketed ahead of both Apple and Samsung to become the market leader in China. Charging out of China, Xiaomi also became the market leader in India (Peng, 2016). These examples illustrate how some domestic firms in transition economies with initially inferior resource endowments can leverage their unique domestic skills to establish a global presence by embracing the competitive challenge posed by multinationals from developed economies. Then, questions remain: Do multinational enterprises (MNEs) always outperform domestic firms (DFs) in transition economies? Alternatively, under what conditions do DFs outperform MNEs?

It is often taken for granted that multinationals entering transition economies possess stronger organizational capabilities, more advanced technologies, and better brand management skills (Jiang, Peng, Yang, & Mutlu, 2015). However, there are signs that over time, some of these advantages may erode because of the rise of local rivals (Bhattacharya & Michael, 2008; Economist Intelligence Unit, 2011; Peng, 2016; Spencer, 2008). As a result, the competitive outcome of the rivalry between MNEs and DFs is hard to predict, triggering intense scholarly and practitioner interest. In response to this interest, this paper draws on the competitive dynamics literature to shed light on the competitive processes unfolding between MNEs and DFs in (and eventually out of) transition economies.

Competitor analysis is the study of market commonality and resource similarity (Chen, 1996). Evolving from central planning to market competition, transition economies have become a new frontier for MNEs (Luo & Peng, 1999). Thus, the rivalry between MNEs and DFs in transition economies introduces a context where both firms (1) share the same market, (2) have asymmetrical resources, and (3) face institutional dynamism. As a subset of emerging economies, transition economies are those formerly socialist countries undergoing institutional transitions toward more market competition (Peng, 2000).Footnote 1 Some of these institutional transitions include market liberalization, macroeconomic stabilization, and privatization (IMF, 2000; Peng & Heath, 1996). Despite uneven progress across countries, the social, political, legal, and economic infrastructures have been going through tremendous transformations (Uhlenbruck, Meyer, & Hitt, 2003). The revolutionary changes in the institutional and macroeconomic structure combined with the threat of competition by MNEs have compelled many DFs to undertake serious changes despite the risk of institutional upheaval (Domadenik, Prašnikar, & Svejnar, 2008; Newman, 2000). MNEs have also been going through a transformation process in response to the institutional transitions and the corresponding transformation of the domestic rivals (Luo, 2007). Yet, prior research has not yielded sufficient understanding into such dynamic relationships between DFs and MNEs in transition economies. In this paper, we intend to tackle this challenge with a unique and dynamic theoretical framework. Our motivation stems from the unique setting that the mutual organizational learning, transformations, and competitive dynamics permit to extend the literature on how MNEs and DFs compete dynamically during institutional transitions.

Our paper endeavors to contribute to the literature in two ways. First, we leverage competitive dynamics research to explore the rivalry and the spillover effects between MNEs and DFs in transition economies. Defining strategy as an aggressive sequence of competitive actions, Ferrier (2001) points out the scarcity of strategy research on the dynamic processes of competitive interaction. In general, this gap is even larger when it comes to research on competitive dynamics in transition economies. Following Ndofor, Sirmon, and He (2011), we develop our propositions based on two complementary perspectives: the resource-based view (RBV) (Barney, 2001) and the competitive dynamics perspective (Chen, 1996).

Second, drawing on the awareness-motivation-capability framework (Chen, 1996; Meyer & Sinani, 2009), we explore the evolution of rivalry between MNEs and DFs in transition economies with a longitudinal perspective in three rounds. The literature has mainly focused on the rivalry among MNEs, and overlooks the rise of some DFs that may capitalize on capability building and may outperform some established foreign rivals over extended periods (Gaur, Kumar, & Singh, 2014; Hoskisson, Wright, Filatotchev, & Peng, 2013; Park et al., 2013). Although there is some conceptual research on strategic responses of different types of firms in transition economies (Peng, 2003; Peng & Heath, 1996), the literature seems to focus on the strategic choices and responses of each category of firms (either MNEs or DFs) during institutional transitions. The assumption seems to suggest that firms—foreign or local—strategically respond to the shifts in institutional transitions separately without considering the dynamics that are pervasive in the competition between foreign and local rivals (Peng, Tan, & Tong, 2004). This view is inconsistent with the competitive dynamics literature that focuses on the dynamic interaction between rivals (Chen & Miller, 1994; D’Aveni, 1994; Smith, Grimm, & Gannon, 1992; Yu & Cannella, 2007). Thus, we endeavor to bring together the much-needed competitive dynamics perspective to the research on strategic choices in transition economies.

Competitive dynamics between MNEs and DFs in transition economies

Schumpeter (1947) pointed out that to truly understand competition, one must examine the interplay and consequences of action and reaction. Building on these insights, competitive dynamics research focuses on competitive actions and reactions (Smith et al., 1991; Smith, Ferrier, & Ndofor, 2001). However, thus far, most research on competitive dynamics has been limited to firms in developed economies with relatively stable institutional contexts (Chen, Smith, & Grimm, 1992; Smith et al., 1991; Yu & Cannella, 2007). In addition to the general paucity of competitive dynamics research in transition economies, the limited number of studies typically examines cross-sectional data and hence lacks a much-needed dynamic interaction dimension (Chang & Park, 2012). In order to unveil the dynamic interaction between domestic and foreign firms, we need to understand the evolution of their awareness, motivation, and capabilities, which are the underlying components of competitive actions.

The dynamic awareness-motivation-capability (AMC) framework

The AMC framework is one of the most widely used frameworks in competitive dynamics (Chen, 1996; Ferrier, 2001; Ferrier, Smith, & Grimm, 1999; Meyer & Sinani, 2009; Yu & Cannella, 2007). Competitive actions are “externally directed, specific, and observable competitive moves initiated by a firm to enhance its competitive position” (Ferrier, 2001: 859). Response is “a counteraction taken by a competing firm to defend or improve its relative position” (Chen et al., 1992: 440). The AMC framework suggests that competing firms will respond to competitive actions only if they are aware of these actions and have the motivation and capabilities to respond (Smith et al., 2001; Yu & Cannella, 2007). Awareness is the capacity of the firm to understand the consequences of its own and its rivals’ actions. Awareness cannot turn into action without motivation. Competitive pressures are the main motivation sources to respond (Miller & Chen, 1996). Finally, a firm needs to have capabilities that enable actions to gain a competitive advantage against its rivals (Ndofor et al., 2011; Yu & Cannella, 2007). In short, awareness, motivation, and capabilities must co-exist in order to respond to competitive moves and formulate counter-movers.

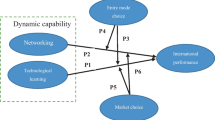

Most of the competitive dynamics literature examines competitive interactions between rival firms over certain periods (Smith et al., 1991). Transitions from plan to market provide a dynamic context in which the unfolding competition between rival firms depends on highly volatile factors, such as evolving institutions and firm capabilities (Meyer & Sinani, 2009; Peng, 2003). Therefore, rather than a static AMC approach, we explore the rivalry between MNEs and DFs in transition economies with a dynamic approach in three rounds (see Fig. 1).

Inspired by the Star Wars movie series, we label the three rounds as (1) “attack of the MNE,” (2) “a new hope,” and (3) “the DF strikes back.” The first round begins with the entry (invasion) of the MNE in the transition economy that significantly attacks the market base of the DF. The second round is an intense and mutual learning period, during which the DF strives to narrow the gap in terms of both technology and management through imitation and learning to compensate for its competitive disadvantage. Likewise, the MNE also invests in improving local expertise and building managerial ties to minimize liabilities of foreignness. During the third round, because of mutual spillovers, the resource similarity between both firms is heightened and the intensity of rivalry increases. However, this round also points to a key event that changes the nature of competition from single-market to multi-market. Having survived the previous two rounds, in this round, the DF with improved capabilities may expand abroad to exploit new markets and gain international capabilities. Thus, we witness the rise of the DF, which has evolved to become an emerging MNE in itself and a major competitor for the old-line MNE from the developed economy. In the meantime, the old-line MNE is also consolidating its operations in the transition economy. In short, the second round represents an intense and mutual learning phase, whereas the third round represents a mutual-transformation stage for both the MNE and the DF. Table 1 summarizes our arguments.

Boundary conditions and assumptions

Although we acknowledge other possible outcomes of competitive interactions, our propositions are based on a set of boundary conditions and assumptions, which have allowed us to focus on the core issue at hand but can be potentially relaxed for future research that deals with more complex dynamics. First, we examine the competitive dynamics between MNEs and DFs in transition economies, which are a subset of emerging economies (Peng, 2003: 277). Although our framework may apply to other emerging economies, we solely focus on transition economies as the managerial challenges regarding firm strategic choices are heightened in these countries due to the historical absence of competitive markets that dramatizes the effect of transitions (Peng, 2000; Peng & Heath, 1996). In other words, the heterogeneity of the rest of emerging economies may limit the validity of our propositions (Hoskisson et al., 2013). Therefore, our “geographic bracketing” approach, which limits the geographic coverage, may increase the precision of our predictions, at least within the specific context of transition economies (Meyer, Mudambi, & Narula, 2011). Second, although we acknowledge the strategic interactions between and among numerous domestic and foreign rivals, we zoom in the competitive dynamics between a single MNE and a single DF. Our most critical assumption here is that the MNE and the DF do not engage in collaboration (neither alliance nor collusion). While there is some learning and spillover (Luo & Peng, 1999; Spencer, 2008), we also assume that they do not engage in merger with (or acquisition of) each other (Lin et al., 2009). Third, while there are a number of performance measures such as return on assets and sales growth, our proxy for performance is market share. Market share is preferred over other measures as it is an antecedent of financial performance and a reflection of customer satisfaction (Eccles, 1991). It is also relatively easier to empirically observe and measure.

Competitor analysis in general—intensity of rivalry in particular—focuses on market commonality and resource similarity (Chen, 1996). Therefore, we also need to identify the boundary conditions of the market and resource conditions of the MNE and the DF. Market commonality refers to the number of markets in which firms compete against each other—in our case, geographic (country) markets. Resource similarity refers to “the extent to which a given competitor possesses strategic endowments comparable, in terms of both type and amount, to those of the focal firm” (Chen, 1996: 107). As illustrated in Fig. 2, the intensity of rivalry changes based on how rival firms differ along the continuum of market commonality and resource similarity (Chen, 1996; Gimeno & Woo, 1996). Accordingly, firms with a high degree of resource similarity tend to formulate similar competitive actions that intensify rivalry. On the other hand, a high degree of market commonality reduces rivalry due to mutual forbearance (Boeker et al., 1997; Edwards, 1955).

Specifically, our boundary conditions for the three rounds regarding resource endowments and market commonality are as follows:

-

1.

We assume that the DF is a privately owned, medium sized independent enterprise with no strategic alliances with more resourceful local or foreign firms. Thus, the gap in terms of resource similarity between the MNE and the DF is at its highest during the first round.

-

2.

The MNE faces a tension between the pressures to globalize and the need to stay local and to serve individual customers (Peng, 2016). Given this tension and the need to stay competitive against domestic rivalry, the MNE deploys multidomestic strategy (i.e., high local responsiveness and relatively lower pressure for cost reductions).

-

3.

Particularly during the second round, spillovers help reduce the gap in terms of resource similarity, which then elevates the intensity of rivalry significantly. The elevated rivalry during the second round leads the DF to search for new markets to gain new capabilities and exploit its extending resources. Thus, the DF is likely to start competing with the MNE in more than one (country) market resulting in multimarket competition.

-

4.

During the third round, the intensity of rivalry between the MNE and the DF may decrease (or become more moderate) due to multimarket contact or increased market commonality.

In sum, using a set of boundary conditions and assumptions, we argue that multimarket competition may control or limit the positive effect of increasing resource similarity on the intensity of rivalry during and after the third round. We believe that this argument is critical and needs to be explored further in contrast to most of the studies that focus on the seemingly “ever increasing” competition between MNEs and DFs in transition economies (Luo, 2007).

Round 1: Attack of the MNE

The first round begins with the entry of the MNE in the transition economy, triggering “dynamic strategic interactions” with the DF (D’Aveni, 1994). Due to low levels of resource similarity between the MNE and the DF, the intensity of rivalry is relatively low during the first round such that the MNE may not even perceive the DF as a major threat (Peng et al., 2004; Spencer, 2008). Attacked by the MNE, the response of the DF is an attempt to defend its market position. On the other hand, for the MNE, success lies in limiting its liabilities of foreignness. Overall, the first round is a period with factors that limit the awareness, motivation, and capabilities of both firms to compete.

MNEs are firms that operate with value-added activities in at least two countries. As the initiator of the competition and incurring investment costs, the MNE is highly motivated to compete in the transition economy (Spencer, 2008). Thanks to the MNE’s advanced technologies that enable production at a lower marginal cost, it poses a serious threat to the DF (Harrison & Aitken, 1999). However, the MNE’s superior capabilities and awareness about the outcomes of its actions are limited by certain competitive disadvantages specific to the transition economy. Therefore, we argue that during the first round of the rivalry, the MNE, as a novice player in the transition economy, has a medium level of awareness about the outcomes of its and its rivals’ actions, a high level of motivation to compete, and a medium-to-high level of capabilities.

We can summarize the competitive advantages of MNEs under two categories as superior technical expertise (technological, manufacturing, and marketing) and superior managerial capabilities. First, developed and tested across different locations, superior technical expertise enables MNEs to operate flexibly across borders (Lee & Makhija, 2009; Michailova & Wu, 2015). Second, managerial capabilities enable the effective management of assets and operations in multiple countries (Nachum, 2010; Rugman & Verbeke, 2001). As an important part of the human capital assets of the firm, managers represent the key personnel responsible for strategy implementation. Specifically, the expatriate management systems supply MNEs with managers and other key employees, who can apply the knowledge of the firm across different locations (Chang, Gong, & Peng, 2012). The MNE’s ability to access global networks may generate a higher value than the DF’s insight about the local market (Doz, Williamson, & Santos, 2001).

The MNE also bears certain competitive disadvantages in the transition economy. First, the MNE carries dual responsibilities for (1) its internal hierarchy (especially the global headquarters) and (2) the realities of the host country. Dual responsibilities introduce a potential tension and require strategies to manage differences between headquarters and local expectations without being overwhelmed by such tension (Lunnan & Zhao, 2014; Meyer et al., 2011). Second, the MNE suffers from the liabilities of foreignness, which include limited knowledge about local realities, discriminative actions by key stakeholders, and additional costs imposed by governments (Nachum, 2010; Zaheer, 1995). While managerial ties are crucially important to combat liabilities of foreignness, lack of these strategic networks is another competitive disadvantage for the MNE that further adds to the initial costs of doing business in the transition economy (Peng, 2003; Peng & Heath, 1996).

In sum, factors such as limited local knowledge and lack of managerial ties reduce the awareness of the MNE about the potential outcomes of its competitive actions (Peng et al., 2004). Thus, the MNE explores competitive actions to combat its competitive disadvantages. In particular, the MNE aims to improve its strategic networks and key connections with local businesses and the government. For example, collaborating with a local partner may enable access to managerial ties and local knowledge (Meyer & Peng, 2005; Shi, Sun, & Peng, 2012).Footnote 2 On the other hand, success is not guaranteed. The survival of the MNE is likely to be in question if the costs of doing business outweigh its benefits. In other words, the MNE may have to quit the transition economy unless it minimizes liabilities of foreignness through local partnership or other competitive actions (Shi, Sun, Pinkham, & Peng, 2014; Song, 2014).

Proposition 1

During the first round, the survival of the MNE depends on minimization of liabilities of foreignness via means such as developing strategic networks and alliances. Otherwise, the MNE exits the transition economy.

On the one hand, there is an asymmetry of capabilities between the MNE and the DF during the initial round of rivalry. In general, having less exposure to world-class competition, the DF suffers from a lack of competitive abilities, which limits its comprehension of competitive attacks and ability to formulate reactions. Although the entry of the MNE is highly visible, little experience of rivalry with the MNE may limit the DF’s comprehension of the potential impact of competition on its own business (Meyer & Sinani, 2009). Furthermore, the differences in capabilities and market scope between the MNE and the DF make it unlikely that the MNE will even perceive the DF as a major threat at this point (Spencer, 2008). Similarly, the DF tends to view its main competitors as other DFs as opposed to the MNE (Peng et al., 2004). Thus, we argue that during the first round the DF has a low-to-medium level of awareness of its rivalry with the MNE that in turn limits the motivation to react. The motivation to react is expected to rise as the impact of the MNE’s attack becomes more visible for the DF. Eventually, the DF needs to reduce the capability gap to be able to formulate and execute competitive actions against the threat of the MNE (Peng, 2012; Peng & Heath, 1996).

On the other hand, the MNE and the DF may have some complementary capabilities. For example, as the MNE suffers from a lack of managerial ties, a major asset for the DF is its business and political connections and familiarity with the local institutions (Li, Peng, & Macaulay, 2013; Peng & Luo, 2000). Assuming the role of weak institutional systems, managerial ties enable the coordination of business exchanges (Sheng, Zhou, & Li, 2011). However, the effect of managerial ties on firm performance can be conditional and temporal (Gupta, 2011). Managerial ties are not always advantageous for MNEs in transition economies as they are to DFs (Li, Poppo, & Zhou 2008a). In addition, the effect of managerial ties on performance does not necessarily increase as the level of competition increases (Li, Chen, Liu, & Peng, 2014). Specifically, firms are likely to gain superior returns by using network strategies in the early phases of institutional transitions (Peng & Heath, 1996). However, as the institutions gradually evolve to a rule-based structure from a network-based structure (Zhou & Peng, 2010), both types of firms are likely to rely more on competitive resources as opposed to network strategies. In short, the DF will leverage its managerial ties in the first round of the rivalry. This advantage is likely to decrease as the MNE builds own managerial ties and as the market institutions develop (Peng, 2003).

A major disadvantage for the DF is the lack of managerial capabilities, which leads to operational inefficiency (Spencer, 2008; Stan, Peng, & Bruton, 2014). The old rules of the planned economy inhibited the development of capable managers with sufficient entrepreneurial and managerial skills to survive in a market economy. An extension of this disadvantage is the lack of innovative capabilities that led a majority of DFs to develop imitation strategies (Luo, Sun, & Wang, 2011). Despite these disadvantages, the overwhelming threat of transitions is also a stress test that provides opportunities to develop unique capabilities (Ismail, Ford, Wu, & Peng, 2013). In this regard, MNEs in transition economies are also sources of new capabilities for DFs (Meyer & Sinani, 2009; Spencer, 2008). Another factor is the heterogeneity of institutional transitions in different transition economies that resulted in different outcomes regarding capability building. For example, less stable institutional settings in Russia may lead Russian managers to focus on relatively short-term goals rather than acquiring new skills and capabilities. On the other hand, Chinese managers may maintain a relatively long-term orientation due to a more stable institutional environment with more incremental change (Hitt et al., 2004).

In the first round, the attack of the MNE may be life threatening for the DF. “As a local firm loses market share to more efficient foreign competitors, it must spread its fixed costs over a smaller volume, which can raise costs and lower productivity; many local firms will have little choice but to exit the market altogether” (Spencer, 2008: 354). As this threat becomes more visible, the DF’s awareness and motivation to respond increases. The DF then analyzes the new market conditions and its competitive assets to develop the most appropriate strategic response. However, to stay in business, the DF needs to possess initial resource endowments that enable capability development and help increase market presence (Dawar & Frost, 1999). For instance, some successful DFs beat foreign rivals based on such strategies as a high degree of customization, business model innovation, and the deployment of the latest technology as a “leap-frog” strategy (Bhattacharya & Michael, 2008). Therefore, we assert that the DF with certain competitive assets stays in business and responds to the competitive actions of the MNE.

Proposition 2

During the first round, the DF with strong competitive assets responds to the attack of the MNE. Otherwise, the DF either sells out to another firm or goes out of business.

There are two sides of competitive strategy as the creation of competitive advantage and the neutralization of the opponent’s competitive advantage. In order to survive, the DF rushes to develop competitive advantages to fight against the attack of the MNE. Similarly, the MNE will invest its efforts to minimize the liabilities of foreignness. In the later rounds, when both firms develop certain advantages, the role of neutralization of opponents’ advantages will become a more dominant strategy. In other words, asymmetry of capabilities has a more visible impact during the first round where both firms are “strangers in the night,” coping with the new, ambiguous rivalry setting that can be life threatening. Like their capabilities, the competition is also asymmetrical. Thus, the MNE and the DF do not pose the same level of threat to each other (Chen, 1996). In sum, superior capabilities of the MNE may enable it to make a successful entry into the transition economy once the liabilities of foreignness are minimized. In the short run, increased competition from the MNE may reduce the DF’s market share, even as it induces the DF to upgrade its capabilities and improve its competitiveness (Sinani & Meyer, 2004). Thus, having relatively lower levels of awareness, motivation, and capabilities, the DF is likely to be powerfully challenged by the MNE, which may capture a large portion of the market by the end of the first round.

Proposition 3

At the end of the first round, the MNE is likely to outperform the DF.

Shown in Fig. 2, competitive dynamics research suggests that given the relatively low levels of resource similarity and market commonality (the DF focuses on one country and the MNE many countries), the intensity of rivalry, while increasing, is still relatively moderate in this round (Chen, 1996; Gimeno & Woo, 1996). It is in the next round that competition heats up.

Proposition 4

The intensity of rivalry is relatively lower in Round 1 than it is in Rounds 2 and 3.

Round 2: A new hope

We label the second round “a new hope” since it points to the learning race between the MNE and the DF. Such learning race offers hope to both contestants. This round is an intense learning period where interactions between the MNE and the DF lead to the dynamic evolution of their respective capabilities. Spencer (2008) argued that the entry of MNEs may have two negative externalities: (1) crowding out weak DFs due to MNEs’ superiority in product, labor, and financial markets; and (2) generating positive spillovers that enable strong DFs to develop new capabilities. To have a more complete understanding of the effects of strategic interactions between domestic and foreign rivals, we need to understand how firms’ awareness of the competitive landscape evolves that in turn determines their motivation to develop new capabilities and take competitive actions.

During the second round, the awareness of the DF regarding the competitive threats posed by the MNE increases. Specifically, we argue that both the awareness and the motivation of the DF increase to a medium-to-high level during the second round. Yet, because of its relatively inferior capabilities, the DF is still not an aggressive competitor for the MNE. Thus, the DF would heavily invest in organizational learning to develop capabilities that will enable competitive actions (Lyles & Salk, 1996; Spencer, 2008). Similarly, the MNE would improve its limited local awareness, which, due to volatility and uncertainty in the institutions, baffles the MNE’s understanding of the local environment and weakens the link between its superior capabilities and competitive actions (Li et al,. 2008a, b).

Firms not only learn from their own experiences but also from outside factors, such as effective interactions with competitors (Luo & Peng, 1999). Therefore, suffering from relatively inefficient capabilities, the DF aims to maximize its exposure to the MNE’s knowledge, technologies, and organizational practices. As speed is critical in formulating competitive actions, the DF is likely to imitate the technologies and organizational practices of the MNE that may positively influence the DF’s short or medium term performance (Spencer, 2008). Another way to access the knowledge base of the MNE is to attract and hire the key employees of the MNE as knowledge is held by individuals and is transferable across firms (Child & Czegledy, 1996; Kogut & Zander, 1996; Park, Mezias, Lee, & Han, 2014). Overall, the MNE also engages in all types of activities to enhance its local insight and develop strategic networks (Luo & Peng, 1999; Meyer et al., 2009; Williams & Du, 2014).

Organizational learning capability is indeed a fundamental component of the rivalry between the DF and the MNE (Uhlenbruck et al., 2003). Similar to the awareness-motivation-capability framework in competitive dynamics, learning race between firms is a function of firms’ (1) absorptive capacity, (2) motivation to share knowledge, and (3) organizational transfer capability (Chang et al., 2012; Easterby-Smith, Lyles, & Tsang, 2008). Absorptive capacity is the ability to understand the value of new knowledge and to execute it (Cohen & Levinthal, 1990). The motivation of the interacting firms is also critical as the mutual interest of accessing each other’s expertise increases the motivation of both the DF and the MNE to transfer knowledge (Ko, Kirsch, & King, 2005). Specifically, the DF aims to learn from its rival’s superior technical and managerial expertise, while the MNE’s motivation stems from its desire to access the local insight of its domestic competitor (Shi et al., 2012; Williams & Du, 2014). Finally, the key to successful transfer and execution of the expertise lie in the adaptive capability of firms (Liu, Wang, & Wei, 2009; Lyles & Salk, 1996). Adaptive capability of firms, on the other hand, is a function of the economic and institutional development of the host country. Overall, the effectiveness of interfirm knowledge spillovers and organizational learning depends on firm capabilities, mutual interest and motivation to share knowledge (Feinberg & Majumdar, 2001; Sinani & Meyer, 2004), and the economic and institutional development of the host country (Blomstrom & Kokko, 2003; Meyer & Sinani, 2009).

As a result, the entry of MNEs, which may drive some weak DFs out of business, is not necessarily a death sentence for all DFs. Intense competition strongly motivates certain DFs to survive and succeed. Interestingly, this motivation introduces the reverse side of the competition coin in our arguments: not only do MNEs pose a threat to DFs, DFs also increasingly pose a great red flag to MNEs. For example, in China local Internet search engines Baidu and Tencent are now better than their global rivals Yahoo and Google. Similarly, travel agency Citrp.com International has defeated both MNEs and state-owned travel companies in China (Bhattacharya & Michael, 2008). Other studies also show that domestic brands are gaining popularity compared to foreign brands in transition economies (Gao et al., 2006).

Overall, successful organizational learning may lead to a breakthrough and successful catch-up for some DFs (Li & Kozhikode, 2008). We further argue that the effect of learning is highly transformative for the DF that previously has relatively inferior capabilities compared to the MNE that already leverages its capabilities in multiple locations and does not still consider the DF as a major threat (Peng et al., 2004; Spencer, 2008). Furthermore, the risk of survival combined with lower levels of capabilities urges the DF to develop new capabilities to protect its market power. Therefore, we argue that organizational learning is expected to have a higher impact on the performance of the DF than on the performance of the MNE.

Proposition 5

During the second round, the effectiveness of organizational learning from each other is expected to be higher for the DF compared to the MNE.

During the second round, the awareness, motivation, and capabilities of both the DF and the MNE rise because of the strategic interactions and the intense learning race. The marginal effect of learning on performance is likely to be higher for the DF, which mostly imitates the technologies and strategies of the MNE. However, it takes time and effort to build up the sources of competitive advantage such as technology, innovation, brand name, and managerial capabilities for the DF (Spencer, 2008). In other words, the DF’s competitive disadvantages cannot be compensated by the strong awareness and motivation to learn in the short run. From the MNE’s perspective, investing in the transition economy not only provides access to markets or efficient resources, but also access to the local knowledge of DFs (Williams & Du, 2014). Then, due to such mutual learning, the MNE also takes advantage of domestic expertise spillovers in a host transition economy that improves MNE productivity (Luo & Peng, 1999; Wei, Liu, & Wang, 2008). Therefore, despite the rise of competitive pressures by its domestic rival, the MNE is still likely to outperform the DF.

Proposition 6

At the end of the second round, the MNE is still likely to outperform the DF.

Key to success for both the DF and the MNE lies in the ability to analyze each other’s actions and decide on the most effective response strategy (Chang & Park, 2012). The new era of competition is formulated around accelerated interaction (Grimm, Lee, & Smith, 2006). Thus, the speed of decision-making and execution of competitive actions rises as a critical component of success (Baum & Wally, 2003; Lee et al., 2000). Finally, the number of competitive actions plays a significant role in addition to speed and effectiveness of competitive actions (Young, Smith, & Grimm, 1996). Therefore, given its improving capabilities and increasing resource similarity, the DF starts to attack the market position of the MNE with increasingly aggressive and frequent actions (Ferrier et al., 1999). In return, increasing its local insight and familiarity with the institutions, the MNE needs to react to the rising challenge of the DF.

In sum, during the second round, diffusion of capabilities and adaptation to their new environment lead both firms to develop new strategies to compete more aggressively. Shown in Fig. 2, given the gradual convergence of resource similarity and the continued low level of market commonality, the level of rivalry is likely to be the most intense during this round (Chen, 1996; Gimeno & Woo, 1996). While the DF has been enhancing its resources, it is still “stuck”—for lack of a better word—in one country, while the MNE can cross-subsidize its actions by leveraging the earnings and expertise generated from its many other markets. As a result, the DF may be motivated to break out the straightjacket in the next round.

Proposition 7

The intensity of rivalry is relatively higher in Round 2 than it is in Rounds 1 and 3.

Round 3: The DF strikes back

During this round, both sides have high levels of awareness, motivation, and capabilities. This round is labeled “the DF strikes back” as it points to a key competitive action that alters the direction of the rivalry: the DF is now transformed into an MNE in its own right. During this round, the MNE from the developed economy has a new rival that starts to possess international capabilities and local advantages.

Resource heterogeneity and strategic flexibility are two drivers of competition that provides competitive edge to firms over their rivals. Operating in multiple countries provides a diverse set of resources and operational flexibility to the MNE. Although the DF can learn from the MNE through spillover effects in the DF’s home country, it needs to have access to a broader range of resources to gain similar advantages that the MNE enjoys. In other words, the DF needs to enhance its resource diversity and flexibility to achieve the competitive edge over the MNE, which has access to both tangible and intangible resources in multiple countries.

As outlined above, the DF uses international expansion as a “springboard” to compensate for its competitive disadvantages (Luo et al., 2011). In terms of internationalization, the DF becomes an emerging MNE by using international expansion as a competitive action to acquire strategic resources and reduce its institutional and market constraints at home. In so doing, the DF (the emerging MNE) overcomes its latecomer disadvantage in the global stage via a series of aggressive, risk-taking measures such as acquiring or buying critical assets from mature MNEs to compensate for its competitive weaknesses (Choi & Williams, 2014).

On the one hand, international expansion has its own costs embodied in liabilities of foreignness (Nachum, 2010; Zaheer, 1995). On the other hand, when successful, international expansion helps the DF to access complementary resources when current resources are inadequate for competition (Björkman, Stahl, & Vaara, 2007; Dunning, 2000; Yamakawa et al., 2013). Then, how can the DF expand abroad? Luo et al. (2011) discussed the competitive strategies of DFs from emerging economies by defining them as “copycats.” Utilizing the expertise they learn from MNEs, DFs initially copy and afterwards expand this expertise using their location-specific advantages. In line with our three-round competitive framework, DFs live through three stages as (1) duplicative imitation, (2) innovative imitation, and (3) novel innovation. Parallel to these stages, the breadth of their operations gradually grows from domestic to international.

Indeed many studies find evidence that the presence of MNEs helps DFs increase their foreign market access (Buckley, Clegg, & Wang, 2002; Cui, Meyer, & Hu, 2014; Sun, Peng, Lee, & Tan, 2015; Yiu, Lau, & Bruton, 2007). As a result, in the third round, the DF is likely to become an MNE itself. To avoid confusion, in this round we label the new MNE “emerging MNE” and the traditional MNE from the developed economy “old-line MNE.” To summarize:

Proposition 8

During the third round, the DF may expand abroad to access overseas markets, gain new capabilities, and increase resources.

During and after this round, the emerging MNE not only enjoys its local advantages in the transition economy, but also exploits its developing skills internationally (Yamakawa et al., 2013). Given the competitive pressures, the internationalization of the emerging MNE is a predictable competitive action and not a surprise for the old-line MNE (Chen et al., 1992). Essentially, the old-line MNE has created a rival that has potential to challenge itself in multiple markets (including the transition economy), resulting in multimarket contact.

In terms of the specific pattern of multimarket contact, emerging MNEs seem to follow the conventional stage model where they enter close countries first in order to reduce the liability of foreignness and costs of doing business, and then gradually enter distant countries following the step-by-step approach. As a result, the emerging MNE will typically go to other emerging markets in the early phases where it can exploit its ownership advantages such as frugal innovation advantages developed at home. The degree and scope of competitive dynamics between the old-line MNE and the emerging MNE might still be minimal because at least in the early stages these outward ventures may be unlikely to meet with the old-line MNE. However, as the emerging MNE expands to relatively distant and more developed countries and become more ambitious and aggressive, the eventual multimarket contact may go a more circuitous route.

According to the mutual forbearance hypothesis, competition in multiple markets may reduce rivalry (Boeker et al., 1997; Chen, 1996; Gimeno & Woo, 1996; Karnani & Wernerfelt, 1985; Parker & Roller, 1997). Yu, Subramaniam, and Cannella (2009) argued that multimarket contact reduces rivalry while cultural and regulatory distance and the presence of local competitors increase it. In contrast to the general belief that markets are becoming more global and require more integrated strategies by MNEs, in reality distance still matters (Ghemawat, 2001). The institutional distance between transition economies and Western countries encompasses both formal and informal institutions that entail both cultural and regulatory differences (Xu & Shenkar, 2002). This distance may add to the liabilities of foreignness requiring more intense and aggressive competitive actions. On the other hand, multimarket contact may reduce the likelihood of aggressive actions, as the rivals perceive a higher probability of counter-attack in multiple markets. Thus, we argue that during the third round, multimarket contact with the emerging MNE may reduce the aggressiveness of the old-line MNE in the transition economy.

Proposition 9

During the third round, mutual forbearance reduces the aggressiveness of the old-line MNE in the transition economy due to multimarket contact with the emerging MNE in multiple countries.

Internationalizing is a critical strategic decision that enables the DF to increase its performance by utilizing its domestic competitive advantages through capability exploitation. However, capability possession and exploitation are not sufficient unless the firm invests in further learning and developing new capabilities. Capability upgrading now becomes paramount in order to reach the goal of sustainable performance internationally (Yamakawa et al., 2013).

However, neutralization of rivals’ competitive advantage is now as critical as creation of competitive advantage that was vital for survival in the first two rounds. Neutralization of rivals’ competitive advantage negatively affects the sustainability of competitive advantage for both the old-line and the emerging MNE. Ferrier et al. (1999) discussed that the number and speed of competitive actions help market leaders defend their positions against challengers. As such, the old-line MNE is likely to lose the game if it takes a hubristic “hare nap,” while the emerging MNE competes more persistently and vigorously (Li, Lin, & Arya 2008b). Resting on its competitive advantages will inevitably make the old-line MNE vulnerable to the competitive actions of the emerging MNE, which unleashes locally sensitive strategies and neutralizes the competitive advantages of the old-line MNE (Chang & Park, 2012; Dawar & Frost, 1999). In response, the old-line MNE may transform from being a foreign investor to a strategic insider. Luo (2007: 19) characterized MNEs as strategic insiders in transition economies, when “they are no longer opportunistic experimenters and . . . are perceived as local players by the public, market leaders by consumers, and long-term contributors by the government.”

The transformation of the old-line MNEs into strategic insiders is indeed aligned with the institutional transformation in transition economies, as institutions co-evolve along with the major actors within them. Despite problems with the weak regulatory environment, many transition economies have made great progress compared to the first decade of transitions (Peng, 2003). Today, many transition economies have relatively low inflation rates and high rates of private sector contribution in total GDP. Moreover, business surveys show that financial markets and competitive structures are rapidly converging towards those in developed countries (AmCham, 2010). Therefore, despite the initial institutional shortcomings, transition economies have often become growth engines for foreign investors due to the growth of the middle class with a growing appetite for consumption. As a result, many MNEs from developed economies no longer view transition economies merely as low-cost manufacturing sites but as promising markets. Thus, the old-line MNE is likely to increase its investments in the transition economy to respond to the competitive moves of its new rival.

Proposition 10

During the third round, attacked by the competitive actions of the emerging MNE (the DF), the old-line MNE increases its resources and investment in the transition economy to defend its competitive position.

In this round, the emerging MNE is no longer a mere imitator of the old-line MNE. Naming such emerging MNEs as “dragon multinationals,” Mathews (2006) argued that the international success of these firms offers new insights to traditional research on the success of the major global players. In a way, the international success of emerging MNEs is driven by the alignment of their strategic and organizational innovations and the characteristics of the global economy. For example, Zeng and Willamson (2007) pointed out the emergence of some Chinese enterprises that outperform firms from developed countries based on a unique competitive advantage: cost innovation. The authors identified how successfully Chinese firms combine cheap labor, competitive domestic markets, and technological innovation into a strong competitive edge, which changes the rules of the game in global business. These firms attack the loose bricks in rivals’ defense, which carries these firms from the periphery gradually to the core of global economic expansion. Thus, the emerging MNE, which accepted the challenge of the MNE from the developed world in the first round, now responds back with a new challenge (Hoskisson et al., 2013). To exploit its fresh capabilities, the emerging MNE is hungry for further resources and markets, and needs flexibility in its operations. As such, evolving into an MNE is an initial step of becoming a global challenger.

However, the emerging MNE may still lack novel innovation capabilities and be at the incremental innovation stage, which is a big step beyond imitation stage (Luo et al., 2011). This stage marks the recognition by the emerging MNE that innovation is at the heart of long-term competitiveness. Many successful Chinese MNEs, for example, have adopted such strategies as “from copying to fit for purpose,” “from followers to world standards,” and “from seeking new resources to seeking new knowledge” (Yip & Mckern, 2015a). But, a majority of them still lack an understanding of sophisticated markets and the full range of scientific and engineering expertise needed for radical or novel innovation capability.

In sum, the competitive pressure from foreign rivals may have a stimulating impact on the performance and internationalization of DFs in transition economies (Buckley et al., 2002; Sun et al., 2015). On the one hand, it is the dynamism of the market economy leading to competition and improved performance (Nickell, 1996). On the other hand, sustainability of superior profits may be difficult due to increased market competition thanks to pro-market reforms (Chari & David, 2012; Cuervo-Cazurra & Dau, 2009; Dau, 2012). The emerging MNE and the old-line MNE are now competing in multiple countries. The negative effect of multimarket competition and the positive effect of institutional distances may play opposite roles on the intensity of rivalry between two firms, making it hard to predict which side will win. However, having an inherited understanding of the local markets in transition economies, the emerging MNEs are increasing their strengths and fighting against MNEs from developed economies—both at home and abroad (BCG, 2011). Thus, with its new international capabilities, improved managerial skills, local insights, strategic connections, and cost innovative strategies, the emerging MNE may pose a great threat to the competitive position of the old-line MNE in transition economies. For instance, many successful Chinese MNEs have adopted various forms of innovation including cost innovation, process innovation, application innovation, supply chain innovation, product innovation, technological innovation, and business model innovation (Yip & Mckern, 2015b). To outperform the local and international competitive advantages of the emerging MNE, the old-line MNE needs to increase its local sensitivity and evolve into a strategic insider in the transition economy (Luo, 2007).

Proposition 11

At the end of the third round, enjoying its inherited local know-how and new international skills, the emerging MNE (the DF) is likely to attack the old-line MNE and outperform it, if the old-line MNE cannot transform itself to keep up with the transformation of the emerging MNE (the DF).

Shown in Fig. 2, given the high levels of resource similarity and market similarity during this phase, the level of rivalry may reach some sort of equilibrium, in which both sides increasingly understand each other and unleash fewer surprise attacks and actions (Chen, 1996; Gimeno & Woo, 1996). In other words, from a resource-based view, we can suggest that while competition goes on, neither side has any decisive advantage (Barney, 2001). The result may be competitive parity.

Discussion

Contributions

While strategy in transition economies has been an important topic, prior studies have been focusing on either the strategy of the MNE in transition economies or the strategy of the DF in and out of transition economies (Peng, 2000; Young et al., 2014). While there has been no shortage of studies exploring such important topics, the competitive dynamics between the MNE and the DF across time remains largely overlooked. Therefore, drawing from the competitive dynamics literature and the resource-based view, this paper makes two contributions.

First, we explore the rivalry between MNEs and DFs by leveraging and extending competitive dynamics research to the context of competition in transition economies. While competitive dynamics has received significant attention in strategic management (Chen, 1996; Ndofor et al., 2011; Yu & Cannella, 2007), there is little research integrating the competitive dynamics research with the domain of international business. Despite their fundamental importance, the dynamic processes of competitor interaction have been a relatively underexplored area of strategy research. There is even less research on competitive dynamics in transition economies. To the best of our knowledge, our paper is one of the first conceptual efforts that systematically model the competitive dynamics of MNEs and DFs in transition economies, thereby responding to calls for greater cross-fertilization of ideas between strategy and international business. Specifically, our paper delineates how the competitive interactions between the MNE and the DF evolve across time. In addition, we map out the competitive (dis)advantages of both firms cross time, and how dynamic capabilities shape the evolution of the competitive (dis)advantages. Embracing this comparative, dynamic, longitudinal, and integrative approach enriches our understanding of and insights into the competitive dynamics of MNEs and DFs in transition economies.

Second, we contribute to the literature by exploring the evolution of the rivalry between MNEs and DFs in transition economies with a longitudinal perspective in three rounds using the awareness-motivation-capability framework. In other words, rival firms’ levels of awareness, motivation, and capability to compete co-evolve with the institutional setting in transition economies and the strategic interactions between MNEs and DFs. While some earlier work explores the relationship between institutional transitions and strategic choices (Peng, 2003; Peng & Heath, 1996), the literature seems to focus on the separate strategic responses of firms such as MNEs vis-à-vis other MNEs and DFs vis-à-vis other DFs. However, firms compete and interact during institutional transitions, calling for a dynamic and interactive approach to understanding competitive dynamics. Overall, driven by our interest in understanding how MNEs and DFs dynamically interact, we have gone beyond earlier work by conceptualizing the evolution of dynamic capabilities and the associated competitive (dis)advantages of MNEs and DFs across three rounds.

Managerial relevance

A number of implications for practice emerge. Both MNEs and DFs need to transform and renew themselves to stay alive. As phases of competition change, managers of MNEs and DFs must understand the shifts in institution, competition, and strategy (Luo, 2007). The inability to apply a simple linear model suggests that managers—both domestic and foreign—need new tools to model such nonlinear complexity and competitive dynamics (Peng, 2003). The key challenge is to anticipate changes when possible, probe aggressively, and react quickly. The best managers expect strategy to shift over time by constantly deciphering the changes in the “big picture” and by being willing to take advantage of new opportunities. For example, managers of MNEs should expect some of the strong DFs are likely to emerge to become new MNEs, which will fundamentally change the competitive dynamics from single market to multimarket. Similarly, managers of DFs should expect some of the MNEs are likely to substantially transform themselves though emulating the best DFs. In a sense, MNEs already possess competitive advantages such as innovation, branding, management, and global integration. If they could combine these advantages with low cost, speed and flexibility, localization, and learning desire, they might become transformed MNEs which are likely to beat DFs. In the competitive dynamics, therefore, the result will depend on the awareness, motivation, and capability of MNEs and DFs to anticipate and formulate competitive actions and reactions.

Overall, as transition economies evolve, the best-performing firms seem to be those that can utilize the dynamic capabilities to maximize the competitive advantages and minimize the competitive disadvantages. Firms that fail to transform themselves are likely to fall behind or go out of business.

Limitations and future research directions

The limitations of this paper suggest a number of fruitful future research directions. First, our theorizing has a survival bias. Specifically, our single MNE and single DF will need to be strong enough to have survived all three rounds. Of course, in reality many weak DFs are washed out. Likewise, numerous MNEs fail to crack the tough nut of transition economies. For example, in the attractive but intensely competitive Chinese retail market, Best Buy from the United States and Media Markt from Germany painfully withdrew recently.

Second, given our assumptions, we have not considered alternative scenarios, such as (1) the possible collaboration between the DF and the MNE (Williams & Du, 2014; Yu, Subramaniam, & Cannella, 2013), (2) the possibility that the MNE acquires the DF (Uhlenbruck, 2004), (3) the possibility that the DF buys the MNE’s operations in the transition economy (Lin et al., 2009), and/or (4) the scenario that the DF may even acquire the MNE in its entirety (Sun et al., 2012). While our stylized and focused framework has allowed us to capture the essence of the dynamics between MNEs and DFs, rach above boundary conditions is a realistic scenario that needs to be explored in future work.

Third, our propositions have not taken into account the industry-based view. Industry structures vary in transition economies, resulting in different competitive dynamics patterns. In some industries such as auto industry in China, MNEs seem to still dominate at Round 3 in the face of the challenge of and “strike back” of DFs. In fact, MNEs seem to strike back and dominate the industry again. In the white goods industry in China, however, it seems that DFs have successfully challenged MNEs. Given the complexity of transition economies, it is also important to apply the general framework developed in this paper to specific industry contexts in future research. We propose that the industry type may moderate the competitive dynamics and the evolution of competition patterns.

Fourth, future research is expected to incorporate the institution-based view more deeply, which could add the impact of the institutional context to the competitive dynamics between the DF and the MNE in transition economies (Autio & Fu, 2015; Gaur et al., 2014; Meyer et al., 2011; Peng, 2003). Micro-institutional changes in host countries may alter the institutional frameworks under which the MNE and the DF compete against each other. Both firms must take into account the transition of institutions which will impact their competitive (dis)advantages across time. As argued by Li et al. (2013), both domestic and foreign firms need to develop the market-political ambidexterity including market capabilities and nonmarket (political) capabilities during institutional transitions. While we focus on market capabilities, a complete analysis should incorporate those nonmarket capabilities, which are associated with institutional evolution (Yu, Lee, & Han, 2015). In short, more attention can be devoted to explore the combination of the industry-based view, the resource-based view, and the institution-based view in investigating the competitive dynamics.

Our propositions can be tested in different transition economies. Since transition economies are at different stages of institutional transitions, the general propositions proposed in this paper may be moderated by the different stages of such transitions (Young et al., 2014). A complete picture that consists of MNE-MNE, DF-DF, and MNE-DF competitive dynamics will be fascinating. As transition economies gradually become “mid-range” emerging economies with better developed institutions and infrastructure as well as higher income (Hoskisson et al., 2013) whether our propositions can be generalized to other emerging economies that are not generally viewed as transition economies will be an interesting direction for future research.

Who will win the competition in the future competitive dynamics? Due to the conceptual nature of this paper, we focus on the competitive dynamics at three rounds. Future studies can advance this line of inquiry by exploring the future of the competitive dynamics. On the one hand, some DFs called “rough diamonds,” which are breakout firms in transition economies such as China and Russia, successfully challenge the MNEs by using a set of Cs strategies (i.e., cultivating profitable growth, capitalizing on late development, crafting operational excellence, and creating inclusive market niches and sectors) (Park et al., 2013). On the other hand, some foreign champions win the competition through stronger control and commitment, focus on precision rather than speed and flexibility, greater aptitude for learning, greater localization such as CISCO in China, reverse and low-cost innovation such as GE in China, and effective base-of-pyramid strategies such as P&G and Unilever (Chang, 2013). We argue in our paper that at Round 3, the DF strikes back. We could propose that at Round 4, which is the phase for the future competitive dynamics, both the DF and the MNE could fight back. As a result, it is significant for future research to explore the competitive dynamics at Round 4. Some interesting research questions are: Can the MNE emulate the common characteristics of successful DFs— speed and flexibility, learning capability, low cost advantages, and strong distribution? Can the DF emulate the successful factors of those foreign champions—control and precision, original innovation, and learning aptitude? What are the resources and capabilities of the MNE (and the DF) that the DF (and the MNE) can (and can’t) emulate? In a sense, at Round 3 (and Round 4), each emulates the other in order to respond to each other’s advantages in their own ways. In the future, these successful MNEs and DFs create enormous competitive pressures on other MNEs and DFs, eventually crowding out the least successful (Chang, 2013). We propose that the winners will be those firms, foreign or domestic, who maximize their competitive advantage and mitigate their competitive disadvantage. We also propose that, in the future competitive dynamics, the MNE (and the DF) will share more common characteristics with the DF (and the MNE) through mutual emulation and transformation.

Conclusion

Do MNEs always outperform DFs in transition economies? It is not sound to maintain that certain resources and capabilities will always yield superior rates of return independent of the context. Therefore, one cannot claim that MNEs always outperform DFs in transition economies. It is the learning race, evolution, and adaptation by both firms that shape the next phases of competition. These capabilities ensure the sustainability of the MNE in the volatile setting of the transition economy, while enabling the DF to develop new strategies to survive and compete with its foreign counterpart in (and ultimately out of) the transition economy.

When competing in (and out of) transition economies, MNEs do not always outperform DFs, nor do DFs always outperform MNEs. It is the awareness, motivation, and capabilities of both firms that enable competitive actions and thus determine the outcomes of the competition. Furthermore, the intensity of rivalry depends on the similarity of resources and market commonality that evolve dynamically. Therefore, it is critical to analyze the evolution of competition between MNEs and DFs in consecutive periods in order to predict the winner of the game. In conclusion, if this paper can contain only one message, we would like it to be a sense of the staggering power unleashed by the rivalry between MNEs and DFs in transition economies that not only involves the focal transition economies, but also spill over to affect other parts of the global economy.

Notes

An emerging economy is defined as a country that has three main characteristics: rapid pace of economic development, government policies favoring economic liberalization, and the adoption of free-market system (Hoskisson, Eden, Lau, & Wright, 2000). Going through the transformation from state socialism to capitalism, transition economies include the former socialist countries in East Asia, Central and Eastern Europe, and the newly independent states of the former Soviet Union (Peng, 2000).

It is important to note that the domestic competitor that is our focal DF is not the alliance partner of our focal MNE.

References

AmCham. 2010. 2010–2011 China business report. Shanghai: AmCham.

Autio, E., & Fu, K. 2015. Economic and political institutions and entry into formal and informal entrepreneurship. Asia Pacific Journal of Management, 32(1): 67–94.

Barney, J. B. 2001. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. Journal of Management, 27: 643–650.

Baum, J. R., & Wally, S. 2003. Strategic decision speed and firm performance. Strategic Management Journal, 24: 1107–1129.

Bhattacharya, A., & Michael, D. C. 2008. The BCG 50 local dynamos: How dynamic RDE-based companies are mastering their home markets and what MNCs need to learn from them. Boston: The Boston Consulting Group.

Björkman, I., Stahl, G., & Vaara, E. 2007. Cultural differences and capability transfer in cross-border acquisitions: The mediating roles of capability complementarity, absorptive capacity, and social integration. Journal of International Business Studies, 38: 658–672.

Blomstrom, M., & Kokko, A. 2003. The economics of foreign direct investment incentives. Working paper no. 9489, National Bureau of Economic Research, Cambridge, MA.

Boeker, W., Goodstein, J., Stephan, J., & Murmann, J. P. 1997. Competition in a multimarket environment: The case of market exit. Organization Science, 8: 126–142.

Boston Consulting Group BCG. 2011. The 2011 BCG global challengers: Companies on the move. Rising stars from rapidly developing economies are reshaping global industries.

Buckley, P. J., Clegg, J., & Wang, C. 2002. The impacts of FDI on the performance of Chinese manufacturing firms. Journal of International Business Studies, 334: 637–655.

Chang, S.-J. 2013. Multinational firms in China: Entry strategies, competition, and firm performance. Oxford: Oxford University Press.

Chang, S.-J., & Park, S. H. 2012. Winning strategies in China: Competitive dynamics between MNCs and local firms. Long Range Planning, 45: 1–15.

Chang, Y., Gong, Y., & Peng, M. W. 2012. Expatriate knowledge transfer, subsidiary absorptive capacity, and subsidiary performance. Academy of Management Journal, 55: 927–948.

Chari, M. R. D., & David, P. 2012. Sustaining superior performance in an emerging economy: An empirical test in the Indian context. Strategic Management Journal, 33: 217–229.

Chen, M.-J. 1996. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Academy of Management Review, 21: 100–134.

Chen, M.-J., & Miller, D. 1994. Competitive attack, retaliation, and performance: An expectancy-valence framework. Strategic Management Journal, 15: 85–102.

Chen, M.-J., Smith, K. C., & Grimm, C. 1992. Action characteristics as predictors of competitive responses. Management Science, 38: 439–455.

Child, J., & Czegledy, A. P. 1996. Managerial learning in the transformation of Eastern Europe: Some key issues. Organization Studies, 17: 167–179.

Choi, S. B., & Williams, C. 2014. The impact of innovation intensity, scope, and spillovers on sales growth in Chinese firms. Asia Pacific Journal of Management, 31(1): 25–46.

Cohen, W., & Levinthal, D. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35: 128–52.

Cui, L., Meyer, K. E., & Hu, H. 2014. What drives firms’ intent to seek strategic assets by foreign direct investment? A study of emerging economy firms. Journal of World Business, 49(4): 488–501.

Cuervo-Cazurra, A., & Dau, L. A. 2009. Pro-market reforms and firm profitability in developing countries. Academy of Management Journal, 52: 1348–1368.

D’Aveni, R. 1994. Hypercompetition: Managing the dynamics of strategic maneuvering. New York: Free Press.

Dau, L. A. 2012. Pro-market reforms and developing country multinational corporations. Global Strategy Journal, 2: 262–276.

Dawar, N., & Frost, T. 1999. Competing with giants: Survival strategies for local companies in emerging markets. Harvard Business Review, March–April: 119–129.

Domadenik, P., Prašnikar, J., & Svejnar, J. 2008. Restructuring of firms in transition: Ownership, institutions and openness to trade. Journal of International Business Studies, 394: 725–746.

Doz, Y., Williamson, P., & Santos, J. 2001. From global to metanational: How companies win in the knowledge economy. Boston: Harvard Business School Press.

Dunning, J. H. 2000. The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review, 9: 163–190.

Easterby-Smith, M. P. V., Lyles, M. A., & Tsang, E. W. K. 2008. Inter-organizational knowledge transfer: Current themes and future prospects. Journal of Management Studies, 45: 677–690.

Eccles, R. G. 1991. The performance measurement manifesto. Harvard Business Review, Jan.–Feb.: 131–137.

Economist Intelligence Unit. 2011. Multinational companies and China: What future?. London: The Economist Group.

Edwards, C. D. 1955. Conglomerate bigness as a source of power. In G. J. Stigler (Ed.). Business concentration and price policy: 331–352. Princeton: Princeton University Press.

Feinberg, S. E., & Majumdar, S. K. 2001. Technology spillovers from foreign direct investment in the Indian pharmaceutical industry. Journal of International Business Studies, 32(42): 14–37.

Ferrier, W. J. 2001. Navigating the competitive landscape: The drivers and consequences of competitive aggressiveness. Academy of Management Journal, 44: 858–877.

Ferrier, W. J., Smith, K. G., & Grimm, G. 1999. The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers. Academy of Management Journal, 42: 372–388.

Gao, G. Y., Pan, Y., Tse, D. K., & Yim, C. K. 2006. Market share performance of foreign and domestic brands in China. Journal of International Marketing, 14: 32–51.

Gaur, A. S., Kumar, V., & Singh, D. 2014. Institutions, resources, and internationalization of emerging economy firms. Journal of World Business, 49: 12–90.

Ghemawat, P. 2001. Distance still matters: The hard reality of global expansion. Harvard Business Review, 79(8): 137–147.

Gimeno, J., & Woo, C. 1996. Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organization Science, 7: 322–341.

Grimm, C. M., Lee, H., & Smith, K. G. 2006. Strategy as action: Competitive dynamics and competitive advantage. New York: Oxford University Press.

Gupta, A. K. 2011. The relational perspective and East meets West: a commentary. Academy of Management Perspectives, 253: 19–27.

Harrison, A. E., & Aitken, B. J. 1999. Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3): 605–618.

Hitt, M. A., Ahlstrom, D., Dacin, M. T., Levitas, E., & Svobodina, L. 2004. The institutional effects on strategic alliance partner selection in transition economies: China vs. Russia. Organization Science, 15: 173–185.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43: 249–267.

Hoskisson, R. E., Wright, M., Filatotchev, I., & Peng, M. W. 2013. Emerging multinationals from mid-range economies: The influence of institutions and factor markets. Journal of Management Studies, 50(7): 1295–1321.

IMF. 2000. Transition economies: An IMF perspective on progress and prospects. http://www.imf.org/external/np/exr/ib/2000/110300.htm, Accessed May 13, 2013.

Ismail, K. M., Ford, D. L., Wu, Q., & Peng, M. W. 2013. Managerial ties, strategic initiatives, and firm performance in Central Asia and the Caucasus. Asia Pacific Journal of Management, 30(2): 433–446.

Jiang, Y., Peng, M. W., Yang, X., & Mutlu, C. C. 2015. Privatization, governance, and survival: MNE investments in private participation projects in emerging economies. Journal of World Business, 50: 294–301.

Karnani, A., & Wernerfelt, B. 1985. Multiple point competition. Strategic Management Journal, 6: 87–96.

Ko, D. G., Kirsch, L. J., & King, W. R. 2005. Antecedents for knowledge transfer from consultants to clients in enterprise system implementations. MIS Quarterly, 29: 59–85.

Kogut, B., & Zander, I. 1996. What firms do? Coordination, identity, and learning. Organization Science, 7: 502–518.

Lee, H., Smith, K., Grimm, C., & Schomburg, A. 2000. Timing, order, and durability of new product advantages with imitation. Strategic Management Journal, 21: 23–30.

Lee, S.-H., & Makhija, M. 2009. Flexibility in internationalization: Is it valuable during an economic crisis?. Strategic Management Journal, 30: 537–555.

Li, J. J., Poppo, L., & Zhou, K. Z. 2008a. Do managerial ties in China always produce value? Competition, uncertainty, and domestic vs. foreign firms. Strategic Management Journal, 29: 383–400.

Li, J. T., & Kozhikode, R. 2008. Knowledge management and innovation strategy: The challenge for latecomers in emerging economies. Asia Pacific Journal of Management, 25(3): 429–450.

Li, L., Lin, Z., & Arya, B. 2008b. The turtle-hare story revisited: Social capital and resource accumulation for firms from emerging economies. Asia Pacific Journal of Management, 25(2): 251–275.

Li, Y., Chen, H., Liu, Y., & Peng, M. W. 2014. Managerial ties, organizational learning, and opportunity capture: A social capital perspective. Asia Pacific Journal of Management, 31(1): 271–291.

Li, Y., Peng, M. W., & Macaulay, C. D. 2013. Market-political ambidexterity during institutional transitions. Strategic Organization, 11(2): 205–213.

Lin, Z., Peng, M. W., Yang, H., & Sun, S. L. 2009. How do networks and learning drive M&As? An institutional comparison of China and the United States. Strategic Management Journal, 30: 1113–1132.

Liu, X., Wang, C., & Wei, Y. 2009. Do local manufacturing firms benefit from transactional linkages with multinational enterprises in China?. Journal of International Business Studies, 40: 1113–1130.

Lunnan, R., & Zhao, Y. 2014. Regional headquarters in China: Role in MNE knowledge transfer. Asia Pacific Journal of Management, 31(2): 397–422.

Luo, Y. 2007. From foreign investors to strategic insiders: Shifting parameters, prescriptions and paradigms for MNCs in China. Journal of World Business, 42: 14–34.

Luo, Y., & Peng, M. W. 1999. Learning to compete in a transition economy: Experience, environment, and performance. Journal of International Business Studies, 30: 269–296.

Luo, Y., Sun, J., & Wang, S. L. 2011. Emerging economy copycats: Capability, environment, and strategy. Academy of Management Perspectives, 25: 37–56.

Lyles, M. A., & Salk, J. E. 1996. Knowledge acquisition from foreign parents in international joint ventures: An empirical examination in the Hungarian context. Journal of International Business Studies, 27: 877–903.

Mathews, J. A. 2006. Dragon multinationals: New players in 21st century globalization. Asia Pacific Journal of Management, 23(1): 5–27.

Meyer, K. E., & Peng, M. W. 2005. Probing theoretically into Central and Eastern Europe: Transactions, resources, and institutions. Journal of International Business Studies, 36: 600–621.

Meyer, K. E., & Sinani, E. 2009. When and where does foreign direct investment generate positive spillovers? A meta-analysis. Journal of International Business Studies, 40: 1075–1094.

Meyer, K. E., Estrin, S., Bhaumik, S. E., & Peng, M. W. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30: 61–80.

Meyer, K. E., Mudambi, R., & Narula, R. 2011. Multinational enterprises and local contexts: The opportunities and challenges of multiple embeddedness. Journal of Management Studies, 48: 235–252.

Michailova, S., & Wu, Z. 2015. Dynamic capabilities and innovation in MNC subsidiaries. Journal of World Business (in press).

Miller, D., & Chen, M. J. 1996. The simplicity of competitive repertoires: An empirical analysis. Strategic Management Journal, 17: 419–440.

Nachum, L. 2010. When is foreignness an asset or a liability? Explaining the performance differential between foreign and local firms. Journal of Management, 36: 714–739.

Ndofor, H., Sirmon, D. G., & He, X. 2011. Firm resources, competitive actions, and performance: Investigating a mediated model with evidence from the in-vitro diagnostics industry. Strategic Management Journal, 32: 640–657.

Newman, K. 2000. Organizational transformation during institutional upheaval. Academy of Management Review, 25: 602–619.

Nickell, S. J. 1996. Competition and corporate performance. Journal of Political Economy, 104: 724–746.

Park, N. K., Mezias, J. M., Lee, J., & Han, J.-H. 2014. Reverse knowledge diffusion: Competitive dynamics and the knowledge seeking behavior of Korean high-tech firms. Asia Pacific Journal of Management, 31(2): 355–375.

Park, S. H., Zhou, N., & Ungson, G. 2013. Rough diamonds: Four Cs for sustaining high performance in BRICs. Report by Skolkovo Business School and Ernst & Young.

Parker, P. M., & Roller, L. H. 1997. Collusive conduct in duopolies: Multimarket contact and cross-ownership in the mobile telephone industry. RAND Journal of Economics, 28: 304–322.

Peng, M. W. 2000. Business strategies in transition economies. Thousand Oaks: Sage.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28: 275–296.

Peng, M. W. 2012. The global strategy of emerging multinationals from China. Global Strategy Journal, 2: 97–107.

Peng, M. W. 2016. Global business, 4th ed. Cincinnati: Cengage Learning.

Peng, M. W., & Heath, P. S. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21: 492–528.

Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43: 489–501.

Peng, M. W., Tan, J., & Tong, T. 2004. Ownership types and strategic groups in an emerging economy. Journal of Management Studies, 41: 1105–1129.