Abstract

Exploring the value of multi-source information fusion to predict small and medium-sized enterprises’ (SMEs) credit risk in supply chain finance (SCF) is a popular yet challenging task, as two issues of key variable selection and imbalanced class must be addressed simultaneously. To this end, we develop new forecast models adopting an imbalance sampling strategy based on machine learning techniques and apply these new models to predict credit risk of SMEs in China, using financial information, operation information, innovation information, and negative events as predictors. The empirical results show that the financial-based information, such as TOC, NIR, is most useful in predicting SMEs’ credit risk in SCF, and multi-source information fusion is meaningful in better predicting the credit risk. In addition, based on the preferred CSL-RF model, which extends cost-sensitive learning to a random forest, we also present the varying mechanisms of key predictors for SMEs’ credit risk by using partial dependency analysis. The strategic insights obtained may be helpful for market participants, such as SMEs’ managers, investors, and market regulators.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The development of small and medium-sized enterprises (SMEs) has attracted attention from scholars and practitioners over the globe. However, because of the tightening of credit criteria for corporate loans, SMEs are facing significant challenges, mainly including capital constraints, high operational costs, and ambiguous information (Yan & He, 2020). As a major component of the economy in China, SMEs contribute almost 90% of the number of enterprises, 80% of urban employment, 70% of GDP, 60% of technological innovation, and 50% of tax revenue (see https://www.ndrc.gov.cn/ for more detail). SMEs in China also face problems mainly including high financial distress, high financing costs, high operational risks, tightening financing channels, high fraud risks, and asymmetric financing information (Weng et al., 2016; Zhu et al., 2019).

As a popular financing channel, supply chain finance (SCF) defined by Hofmann (2005) as the inter-firms optimization of financing and the integration of financing processes with customers, suppliers, and service providers to increase the value of all participating firms, has attracted attention from both practitioners and scholars alike. The Chinese government has developed some new financial policies to ease the financing pressure on SMEs, e.g., Promoting SME Development Plan (2016–2020), which seek to “promote more supply chains to join the financing service platform of SMEs”. Similar initiatives are underway in other countries and regions, such as the United States, United Kingdom, Japan, Canada, South Korea, Europe, and Mexico. SCF is also being used to promote the development of SMEs. For example, the Office of the United States Trade Representative (USTR) is implementing a series of initiatives to address the financing problems of SMEs, including SCF.

In practice, credit risk is the main challenge for SMEs in SCF, with a large number of fraud event occurring; for example, the Noah Wealth fraud event and the ‘black hole’ Huainan Mining Logistics Corporation fraud event (see Zhu et al., 2019). Strengthening financial risk management is conducive to promoting the stable development of SMEs, thereby forecasting SMEs’ credit risk has become an increasingly popular topic in SCF (Jia et al., 2020; Lam & Zhan, 2021b; Mai et al., 2019). Developing credit risk prediction methods for SMEs in SCF not only help investors to draft different financial products for SMEs, but also help managers to master the developing trends in SME financing. Generally, in the process of digital transformation, three questions of SCF are considered crucial to address: (1) which variables should be considered predictors of credit default? (2) which model most accurately forecasts credit default? and (3) how does the probability of credit default vary with predictors?

Previous studies have shown that information asymmetry is the biggest barrier to decision-making on SMEs’ credit in SCF (Angilella & Mazzù, 2015; Jia et al., 2020; Saito & Tsuruta, 2018; Xu et al., 2020). In response to this, researchers have added a series of variables from different perspectives, mainly contains financial information (e.g. Zhu et al., 2019), market information (e.g. Zhu et al., 2017), operation information (e.g. Wetzel & Hofmann, 2019), innovation information (e.g. Pederzoli et al., 2013), new technology adoption (e.g. Chen et al., 2021), industry structure (e.g. Wang, Yan, et al., 2021), and network characteristics (e.g. Song, 2019; Wu & Liao, 2020), to increase the forecasting accuracy of SMEs’ credit risk. However, given this wide variety of potential influencing variables from different perspectives in SCF, the question of which variables should be considered to forecast SMEs’ credit risk is still not answered. Some redundant variables have little marginal effect to increase the credit value of the SMEs, but impose a significant cost in terms of the practical work.

Therefore, it is necessary to select key predictors from the available options. Surprisingly, little research discusses this issue for SMEs’ credit risk with a few exceptions. Sariannidis et al. (2020) select key variables from 23 variables for credit card default, by comparing six machine learning techniques, the K-nearest neighbor, a logistic regression, linear support vector clustering, support vector clustering, decision trees, random forests, and a naive Bayes approach. Zhu et al. (2017) compare the performance of individual machine learning technique and ensemble machine learning technique to predict SMEs’ credit risk in SCF, respectively. Zhu et al. (2019) construct a new hybrid ensemble approach, RS-multi boosting, to forecast SMEs’ credit risk in SCF.

Although a few studies (e.g. Sariannidis et al., 2020) have explored the issue of key variable selection, another important issue in SMEs’ credit risk forecasting, namely, imbalanced class has been largely ignored. Specifically, the default enterprises (negative sample) comprise the minority, while the trustworthy enterprises (positive sample) account for the majority, thus, the sample proportion of positive and negative SMEs are extremely imbalanced. In an extremely imbalanced sample, since the classifier is trained for each dataset, the amount of information carried by most samples (trustworthy enterprises) is larger than that of the minority (default enterprises), which could cause misleading results in the learning process of the classifier. Four methods for imbalanced sample modelling: undersampling (US), oversampling (OS), synthetic minority oversampling technique (SMOTE), and cost sensitive learning (CSL), have been extensively studied and widely applied in many fields, such as biostatistics, social sciences, macroeconomics, fault events, and P2P lending (He & Garcia, 2009; Thai-Nghe et al., 2010).

Considering the key variable selection and the sampling strategies for imbalanced class within the SCF of SMEs’ credit risk, we develop the new forecast models via an imbalance sampling strategy based on machine learning techniques. We then apply these to predict SMEs’ credit risk in SCF, to select the key predictors and the optimal model. By using partial dependency analysis for the selected key predictors, we present strategic insights for SMEs’ managers, investors, and market regulators. Generally, our study contributes to the literature on SMEs’ credit risk in SCF in several five important ways: First, in contrast to previous work using only one type of predictor, we develop a more comprehensive information set for forecasting SMEs’ credit risk in SCF, which includes financial information, operation information, innovation information, and negative events. Second, by using six classic machine learning techniques, we select key predictors from 40 potential predictors for SEMs’ credit risk in SCF. Third, considering the extremely imbalance class, the new forecast models are developed via an imbalance sampling strategy based on machine learning techniques, which is helpful to improve the forecasting accuracy of SMEs’ credit risk. Fourth, we capture the varying mechanisms of key variables for SMEs’ credit risk, by using partial dependency analysis on the preferred CSL-RF model, which presents a specific perspective on SMEs’ credit risk in SCF. Last but not least, we provide some strategic insights that may be helpful for market participants.

The paper is organized as follows: Sect. 2 reviews related works on potential predictors and forecasting methods. Section 3 present the six classic models to select key variables and four sampling strategies for the predictors, and develops the new forecasting models via an imbalance sampling strategy on machine learning techniques. Section 4 describes the dataset information and the descriptive statistics. Section 5 presents the empirical results from key predictors selected, prediction performances and the partial dependency analysis. Section 6 presents strategic insights for SME managers, investors and market regulators. Section 7 offers the conclusions of this research.

2 Related works

The credit risk of SMEs in SCF, both predictors and prediction models, has been extensively studied. For predictors, the literature has demonstrated the relevance of financial, operation, innovation and negative events information; in terms of methodologies, the literature has mainly explored statistical methods and machine learning approaches.

2.1 The relation between credit forecast and SCF decisions

Bals (2019) proposes six dimensions for an SCF ecosystem: (1) supply chain collaboration dimension to underline the importance of intra- and inter-firm collaboration for an effective SCF implementation. Some key topics of trust and power among different stakeholders play an important role in the previous SCF researches (e.g. Wang, Yan, et al., 2021); (2) organization dimension emphasizing the influence of organizational setup and organizational structure on SCF programs, e.g., senior management team composition of SCF (e.g. Wandfluh et al., 2016); (3) financial dimension, emphasizing the importance of financing schemes, e.g., cost optimization, working capital, and credit risk in the SC decision (e.g. Zhu et al., 2019); (4) technological dimension focusing on the role of information technology in the SCF programs, e.g., digital technology, platform and ERP system (e.g. Jia et al., 2020) (5) market and regulation dimension focusing on the topics of tax, regulation, potential market and market competition in the SCF programs (e.g. Martin & Hofmann, 2017); and (6) product dimension underlining the topics of inventory finance, (reverse) factoring, pre-shipment financing, dynamic discounting, post-shipment financing and invoice auction (e.g. Caniato et al., 2016). In essence, as SCF programs are centred on information and financial flows management between multiple stakeholders in supply chains, each stakeholder of a SCF programs makes decisions that have ramifications throughout the entire ecosystem, thereby the risk evaluation and/or prediction taking a SCF ecosystem perspective is important.

Considering that the information asymmetry is the biggest barrier to decision-making on SMEs’ credit in SCF, the accurate information is critical for the SCF decision to operate effectively. In fact, credibility is the key topic in the SCF ecosystem, and the corresponding credit risks have aroused widespread concern in supply chain management (e.g. Zhu et al., 2019). However, credibility is hardly established in some SCF ecosystem, it is more elusive. Therefore, it is especially important to accurately forecast the credit risk of partners, because the high credit risks aroused by information asymmetry usually causes huge losses for SCF stakeholders.

This study thus develops new models to accurately predict the credit risk of SMEs in the SCF ecosystem presenting the various solutions by considering the varying risk attitude of SCF stakeholder, to decrease the financial losses and/or improve financial performance. Moreover, we also notice that the risk preference of SCF investors is diversified. Usually, one class tends to make investment decisions to minimize potential risk, and constructs the SCF scheme according to the Type IΙ error (lower risk preference); the other is willing to choose investment to maximize potential return, thereby designs the SCF scheme based on the Type Ι error (higher risk preference). The Type I error means incorrectly classifies the positive samples into negative samples; type II error means incorrectly classifies the negative samples into positive samples; type IΙ error thus exposes the SCF investors with higher risks and losses. We finally select the optimal predict model based on the Type ΙΙ error in this paper (Zhu et al., 2019).

2.2 SMEs’ credit risk in SCF

Considering the value of multi-source information fusion, an information set composed of a variety of basic attributes and their attribute values, and the big data era, this paper analyzes the potential predictors of SMEs credit risk in SCF from four aspects: financial-based information, operation-based information, innovation-based information, and negative events.

2.2.1 Financial-based information

Financial-based information is typically accrued as a set of accounting variables and financial variables for forecasting SMEs’ credit risk in SCF (for a summary of the research, see Bals (2019). Zhu et al. (2017) predict SMEs’ credit risk in SCF using a set of financial variables, mainly including current ratio, turnover, rate of return on total assets, total assets growth rate, and profit margin on sales. Song and Zhang (2018) explore the credit risk of SMEs, using profitability, liquidity, and leverage, respectively. Gupta and Gregoriou (2018) assess SMEs’ financing failures in terms of liquidity, solvency, activity, profitability and interest coverage. Fantazzini and Figini (2009) compute 16 financial ratios, including liquidity ratio, debt ratio, equity ratio, and capital tied up, to measure SMEs’ credit risk. Andrikopoulos and Khorasgani (2018) predict unlisted SMEs’ default using market-based and accounting-based factors. Lam and Zhan (2021a) explore the firm’s operating risk using the SCF initiatives provided by service providers listed in the US. In light of the above, this paper incorporates financial-based variables to forecast the credit risk of SMEs in SCF, in particular, capital capabilities, management capabilities, profit capabilities, growth capabilities, and solvency capabilities.

2.2.2 Operation-based information

Operation-based information, consisting of operating characteristics and industrial structure variables, is also typically used for forecasting SMEs’ credit risk in SCF. Research has shown that operation-based information is the main factors for SMEs’ credit risk in SCF. Zhang et al. (2015) establish an index system for credit risk assessment in SCF, and operation-based variables such as cooperative relationships in the supply chain, the stability of the supply chain, the level of the supply chain development, are assessed for SMEs’ credit to repay on time. Zhu et al. (2017) predict SMEs’ credit risk by using industry trends, transaction time, and transaction frequency. Hirsch et al. (2018) explore the credit value between banks and SMEs by considering agency costs. In this paper, we incorporate the information value of operation-based variables for SMEs’ credit risk in SCF by including, among others, related transactions, the performance of the top five suppliers, the performance of the top five customers.

2.2.3 Innovation-based information

Many scholars believe that innovation-based information, such as R&D investment and patents, are potential influencing factors for SMEs’ credit risk in SCF. Pederzoli et al. (2013) explore the value of innovative assets, such as patents, for SEMs’ credit risk mitigation in SCF. Specifically, the authors use indicators to measure innovation, such as patent in the related industries of software and other information technologies, to add the signaling value of innovative assets, and explore those value for SMEs’ credit risk. Based on the dataset of innovative performance, this research indicates that an enterprise’s credit risk can be reduced only by patent value coupled with an appropriate equity level. Inspired by Pederzoli et al. (2013), this paper also considers the information value of innovative assets for SMEs’ credit risk in SCF by using, among others, patent and R&D investment.

2.2.4 Negative events

Some scholars believe that negative events are potential factors affecting the performance of SMEs, and thereby, their credit risk in SCF. Wu et al. (2016) investigate the relationship between earnings performance and media reports, and evaluate the role of the media in determining reputation. Szutowski (2018) confirms the role of innovation announcements on the credit performance of SMEs. In this paper, we also consider the signaling value of negative events for SMEs credit risk in SCF, by using litigation disputes, penalty information, executives’ behavior, media coverage, and so on. The authors finally present the different types of indicators in Table 1.

2.3 Predictive models for SMEs’ credit risk in SCF

In addition to considering the potential influencing variables, another major challenge is to choose the appropriate model to accurately predict the credit risk of SEMs in SCF. To this end, two kinds of prediction models have been widely studied. The first type comprises the conventional statistical methods and assessment approaches, e.g., principal component regression, logistic regression, survival analysis, data envelopment analysis, partial least squares regression, and Granger causality. Ju and Young (2015) employ survival analysis and stress test to analyze technology used for credit guarantee funds for SMEs. Zhang et al. (2015) develop a credit risk assessment model for SMEs in SCF. Schwab et al. (2019) explore financial sustainability of SMEs by using a simulation method. Wu and Liao (2020) develop a utility-based hybrid fuzzy axiomatic design and its application in SCF decision-making with credit risk assessments. Yu et al. (2020) develop a novel SCF strategy with self-guarantee for a multi-sided platform with blockchain technology. Reza-Gharehbagh et al. (2020) develop a three-level Stackelberg game model to jointly evaluate four different SCF scenarios through the lens of local SC, P2P financing platforms, and government indicating that the government and the P2P financing platforms can examine the alternative SCF schemes to achieve a mutually agreeable agreement. Reza-Gharehbagh et al. (2021) investigate the moderating role of a host government that promotes a multi-sided platform (MSP) as an alternative SCF solution; policy makers are urged to reframe existing SCF schemes by leveraging their moderating influence and prioritizing social welfare over their short-term economic goals.

As an alternative, machine learning techniques, including the neural networks, K-nearest neighbor, support vector regression, naive Bayes classifiers, decision trees, support vector clustering, linear support vector clustering, bagging, boosting, random forests, random survival forests, and ensemble learning techniques, play an important role in SMEs’ credit risk forecasting (Fantazzini & Figini, 2009; Jiang et al., 2019; Sariannidis et al., 2020). Compared with conventional statistical methods and assessment approaches, the machine learning techniques are usually more suitable for exploring complex relationship in the large-scale data; thus, we select a benchmark model from machine learning techniques. Considering that the selection of key predictors from a series of potential predictors is another purpose of this paper, we focus on the following six models to forecast SMEs credit risk in SCF: support vector machines (SVM), neural networks (NN), decision trees (DT), random forests (RF), bagging and gradient boosting (GB) (Sariannidis et al., 2020; Zhu et al., 2019).

3 Methodology

This section presents the six classic machine learning techniques and four sampling strategies for imbalanced classes, develops the new forecasting models via an imbalanced sampling strategy on machine learning techniques, and presents the varying mechanism for credit risk mitigation by using partial dependency analysis.

3.1 Baselines: six machine learning techniques for selecting variables

Many machine learning techniques can be used to simultaneously classy SME default and select key predictors. These advanced methods emphasize predicting the debt-paying ability of enterprises with high accuracy and at low cost. On the other side, inspired by Sariannidis et al. (2020), which suggest that machine learning techniques, such as SVM-based, NN-based, DT-based, and RF-based, are helpful for predicting default in the credit card market; and inspired by Zhu et al., (2019), which indicated that ensemble machine learning techniques, such as Bagging, and GB, are helpful for predicting credit risk in SCF market, we thus compare six machine learning techniques –SVM, NN, DT, RF, bagging, and GB—to achieve the most cost-effective forecasting for SMEs’ credit risk in SCF.

3.1.1 Support vector machines (SVM)

SVM, a classic method to perform both variable selection and regularization, originated as an implementation of Cortes and Vapnik (1995) to develop binary classifications. The main idea of SVM is to construct a hyperplane as the decision surface, such that the margin of separation between positive and negative examples is maximized (Xu et al., 2020). The pseudocode of SVM for the decision function is shown in Appendix A, \(N_{in}\) represent the number of input vectors, \(N_{sv}\) represent the number of support vectors, and \(N_{ft}\) represent the number of features in input and support vectors. \(SV[ \cdot ]\) is an array of a structure, each of which includes an array called \(feature\) for a support vector and a scalar variable called \(alpha\) for the multiplication of the corresponding Lagrange multiplier and class label.

3.1.2 Neural networks (NN)

Inspired by biological networks (Tkáč & Verner, 2016), NN consists of hidden neurons following a sigmoidal function and output neurons. Artificial neural networks (ANN), a typical classification model in NN, consists of an input layer, an output layer, and \(n{\text{ - hidden}}\;{\text{layers}}\). For the given network, the input layer contains \(I\) units corresponding to the input training vector \({\mathbf{x}} = (x_{1} ,x_{2} , \cdots ,x_{I} )\), \(I\) inputs may be the \(N\) spatial coordinates or a normalized vector of dimension \(I = N{ + }1\) computed from the \(N\) spatial coordinates, a number of normalization procedures exist. The input to the ANN is a vector, \({\mathbf{x}}\), of real-valued numbers representing the coordinates of any point of interest. This information is transformed by the “hidden” Kohonen layer and the output Grossberg layer, more detail can see (Rizzo & Dougherty, 1994). The pseudocode of the ANN is described in Appendix B.

3.1.3 Decision trees (DT)

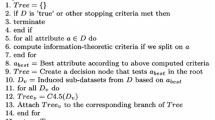

DT, a popular classifier, are composed of inverted trees including root nodes, internal nodes, and leaf nodes (Sariannidis et al., 2020). Nodes and branches are the key components of the decision trees; the splitting, stopping, and pruning the trees, are three important steps in decision tree modeling. The C4.5 DT, one of the most widely used and practical methods, is a classifier for approximating discrete-value functions (Sariannidis et al., 2020) via the following pseudocode in Appendix C.

3.1.4 Random forest (RF)

RF, which consist of independent classification trees, can be used to rank the importance of variables in the binary classification problem. In contrast to ensemble methods such as \({\text{bagging}}\) and \({\text{boosting}}\), which can generally work with any type of base learner, RF work with a particular type of learner: the classification and regression tree (Breiman, 2001). The pseudocode of RF is presented in Appendix D.

3.1.5 Bagging

Bagging is a way to generate versions of predictors and use these versions to obtain aggregate predictors, which can be used with any basic classification technique, usually the decision tree, and learned iteratively by selectively re-sampling from the training data (Bauer & Kohavi, 1999). Bauer and Kohavi, (1996) argue that bagging has remarkable consistency in reducing errors and greatly improving accuracy. The pseudocode of Bagging in shown Appendix E.

3.1.6 Gradient boosting (GB)

Based on the weak learning, GB produces a new ensemble learning, which build the model in a stage-wise fashion and generalizes them by allowing any loss function to be optimized. Based on classifiers that have been previously built, GB constantly changes the weights of the training instances, as in the Appendix F.

3.2 New models from the sampling strategy for machine learning techniques

In binary classification prediction, class imbalance usually means that the majority class is more than the minority class. This phenomenon also appears in the credit risk of SMEs, but has been ignored. In this paper, we extend the imbalance sampling strategy to baseline models, and develop new models for forecasting SMEs’ credit risk in SCF.

3.2.1 Imbalance sampling strategy for baseline models

Considering the extremely imbalanced classes of SMEs’ credit risk in SCF, in which default SMEs from the minority class and trustworthy SMEs the majority, we introduce a sampling strategy for such imbalanced classes and develop new models for the baselines. Four sampling methods are generally applied for imbalance classes: (1) US, which usually uses a subset from the majority class to generate balanced data in the training set for a classifier; (2) OS, which increases the size of the minority class to generate balanced data in the training set for a classifier; (3) SMOTE, which generates balanced data according to the feature space similarities of existing minority; and (4) CSL, which use different cost matrices to describe the costs for misclassifying any particular data example (He & Garcia, 2009).

In this study, we introduce these four re-sampling methods—US, OS, SMOTE, and CSL—to deal with imbalanced classes, and develop a series of new models based on the baseline models, developing SVM to US-SVM, OS-SVM, SMOTE-SVM, and CSL-SVM; NN to US-NN, OS-NN, SMOTE-NN, and CSL-NN; DT to US-DT, OS-DT, SMOTE-DT, and CSL-DT; RF to US-RF, OS-RF, SMOTE-RF, and CSL-RF; bagging to US-Bagging, OS-Bagging, SMOTE-Bagging, and CSL-Bagging; and GB to US-GB, OS-GB, SMOTE-GB, and CSL-GB.

3.2.2 Performance measures

For a two-class problem, most of performance evaluation criteria can be easily derived from confusion matrix as that given in Table 2.

where TP is true positive: the class of positive applicant, correctly predicted as positive; TN is true negative: the class of negative applicant, correctly predicted as negative; FP is false positive: the class of negative applicant, wrongly predicted as positive; and FN is false negative: the class of positive applicant, wrongly predicted as negative. To evaluate the forecasting performances of the different models, six evaluation criteria based on Table 2—average accuracy, precision rate, recall rate, Type I error rate, Type II error rate, and area under curve (AUC)—are adopted, as follows:

Specially, average accuracy is given in Eq. (1), refers to the ratio of all the correctly predicted samples (both good and bad cases) to the whole sample, i.e. the ratio of True Positive and True Negative (which are correctly predicted) on specific datasets. Precision rate means to the ratio of ‘true positive’ to the number of ‘predicted positive’, given in Eq. (2); Recall rate refers to the proportion of ‘false positive’ to real positive cases, given in Eq. (3); AUC means area under the ROC curve, such that an excellent model has AUC close to the 1 (Zhu et al., 2019). Moreover, we also adopt Type I error given in Eq. (4), the rate of positive applicants being incorrectly predicted as negative; Type II error given in Eq. (5), the rate of negative applicants being incorrectly classified as positive. In evaluation criteria of credit risk prediction, the Type I error results in financial institutions losing potential customers, while the Type II results in financial institutions facing risks, thereby the misclassification cost of Type II error causes the financial institution with high risks and losses, the Type ΙΙ error is more important than Type Ι error, we thus should pay more attention to the Type ΙΙ error in the SCF practices (Zhu et al., 2019a).

3.2.3 Partial dependency analysis for key predictors

To capture the varying mechanisms between the predicted variable and the selected key predictors, we draw the partial dependency analysis, as developed in Arevalillo (2019). We adopt the most common approach, changing one factor at a time, to assess the effect this produces on credit risk. The procedure is as follows: first, we choose a key predictor, with the preferred model chosen based on the results of Sect. 4.2; second, sequential values of the selected key predictor are taken from its minimum to its maximum, and then fed into the preferred model to predict SMEs’ credit risk; third, we restore the predictor to its real value, and repeat for each of the other key predictors in the same way.

3.3 The whole experimental step

Based on the above analysis, the forecast process of SMEs’ credit risk in SCF using all potential 40 predictors can be divided into four steps, as shown in Fig. 1:

- Step 1::

-

building a knowledge database for forecasting SMEs’ credit risk in SCF. We collect data for 40 potential predictors over four aspects: financial-based information, operation-based information, innovation-based information, and negative events.

- Step 2::

-

selecting key predictors for SMEs’ credit risk in SCF. We feed 40 potential predictors into six classic machine learning techniques to predict SMEs’ credit risk in SCF, and retrieve the predicted results to identity the key predictors.

- Step 3::

-

forecasting SMEs’ credit risk by using the new models. Using the new forecast models via an imbalance sampling strategy on machine learning techniques, we predict the SMEs’ credit risk based on the all-potential predictors and the selected key predictors, separately; we compare those results with the original predicted results based on all potential predictors.

- Step 4::

-

capturing the varying mechanisms of the key variables. Using the partial dependency analysis on the preferred model, we present the specific varying mechanisms for key predictors in SMEs’ credit risk.

4 Dataset information and predictors

4.1 Data sources

To achieve our research goal, we require a comprehensive dataset for SMEs’ credit risk in SCF. Although more and more enterprises have adopted it as an operational solution, the private transaction data of the SMEs’ in SCF are not publicly available; thus, it is very difficult to obtain a complete data for private firms. It is also impossible to gather adequate data on China’s SEMs in SCF from the literature. However, there are many SMEs listed on the Small and Medium Enterprise Board of China’s Shenzhen Stock Exchange, and many of those have adopted a real trading pattern by using SCF. For example, Shenzhen Pluton Supply Chain Management, a quoted enterprise on China’s Shenzhen Stock Exchange (stock code: 002,769), is an integrated SCM service provider specializing in supply chain design, SCF, and other related business. Thus, we focus on Chinese quoted enterprises on the Small and Medium Enterprise Board in searching for a proper dataset.

In this paper, inspired by Zhu et al. (2019), the sample selection criteria mainly from four aspects. First, all quoted firms must be listed on the Small and Medium Enterprise Board of the China’s Shenzhen Stock Exchange, which are representative of Chinese SMEs, and is facing the same problems. Second, all quoted firms must have disclosed real transaction relationships with the financial institution in their annual report, indicating that those must be either financial institution’s supplier or its consumer. Third, all quoted firms must have disclosed the transaction information of major suppliers and customers, which reflects, to some extent, the operating information. Fourth, all quoted firms must have disclosed the operating information for related transactions.

4.2 Variable definitions and descriptive

As mentioned in Sect. 2.1, in this paper, 40 variables are chosen as the predictors to forecast SMEs’ credit risk in SCF, including supply chain capabilities, related transactions, capital capabilities, profit capabilities, growth capabilities, solvency capabilities, innovation capabilities, and negative events. These 40 variables serve as predictors for the six classifier models in this paper (see Appendix G). To ensure adequate training samples, based on the above sample selection criterion, we finally obtain 1,975 observations over January, 1, 2014–December, 31 2018. Our data were mainly collected from the CSMAR database (http://www.gtarsc.com) and the Wind database (http://www.wind.com.cn/); some predictors, such as PAS, PRP, PTC, PSP, and MRT, were collected manually. More specially, we manually collect the annual report for each firm in our sample, calculate the PAS according to the proportion of the total purchase amount from the top five suppliers, and calculate the PAS based on the proportion of the total purchase amount from the top five suppliers. For PRP and PSP, we first obtain the corporate names of top five suppliers and top five customers from CSMAR database, and then search their official website to confirm whether they are listed firms or not, respectively. If they are listed firms, the corresponding index will be increased by one; if they are not, the corresponding index will remain unchanged. We collect MRT by adding the total currency number of related transactions for each firm in our sample. Finally, we merge all raw data according to the firm’s stock code.

Deleting the data points with incomplete information, we finally obtain 1185 data points that can be used for model prediction, which is composed of 74 Special Treatment (ST) listed enterprises and 1111 non-ST listed enterprises. ST listed SMEs are defined as companies listed on the Small and Medium Enterprise Board that have suffer suffered operating losses for two consecutive years and been issued a delisting warning. Usually, the ST SMEs release a ‘negative signal’ with the extremely high credit risk, and non-ST SMEs release a ‘positive signal’ with extremely low credit risk (Zhu et al., 2017). We then match the sample data with a one-year lag; for example, we predict the ST risk of an enterprise in 2018 by using the predictors in 2017. Descriptive statistics for all predictors for SMEs are presented in Table 3.

5 Results

The experimental results consist of selecting the key predictors from the 40 potential predictors based on the baseline models; comparing the prediction performances across 24 new models based on all predictors and the selected key predictors, respectively; and capturing the varying mechanism of the selected key predictors based on the preferred model.

5.1 Selecting key predictors based on the baselines

To make all data comparable across different models, we calculate the standardized value for each predictor by using min–max normalization. We predict the SMEs credit risk with one year lagged, by using SVM, NN, DT, RF, bagging, and GB, respectively. We compare the prediction performances across six baseline models, by using the six criterions of accuracy, precision, recall, Type I error, Type II error, and AUC, separately. Based on the selected predictors from six baseline models, we finally identify the key predictors via ensemble learning. The basic experimental steps are as follows:

- Step 1::

-

randomly divide the data into a training set (two-thirds of observations) and a test set (one-third of observations), and ensure that the positive and negative samples are also distributed according to this proportion.

- Step 2::

-

feed the baselines using the 40 potential predictors as covariates and the binary variables (‘ST’ and ‘non-ST’) as a response in the training set, and tune the parameter/hyper-parameter for the baselines using tenfold cross-validation. Specifically, we use package best.tune in R to fit SVM, package train with method = ‘nnet’ in R to fit the neural networks, package rpart in R to fit the decision tree, package randomForest in R to fit the random forest, package train with method = ‘treebag’ in R to fit the bagging, package train with method = ‘xgbTree’ in R to fit the gradient boosting.

- Step 3::

-

compare the prediction performances across the baselines for all 40 potential predictors in the test set. We present the results in terms of the six criteria—accuracy, precision, recall, Type I error, Type II error and AUC—in Table 4.

- Step 4,:

-

calculate the relative importance of all 40 predictors. For each baseline models, we use package varImp to calculate the relative importance for each predictor (see http://topepo.github.io/caret/variable-importance.html) and present the results in Appendix H.

- Step 5:

-

choose the key predictors (presented in Appendix I). We first select key variables from a single model based on the results of Appendix H whose added value is greater than the average of each predictor (\(40{/100 = 2}{\text{.5}}\)), and then select the key predictors form all baseline models via ensemble learning (voting) (Sariannidis et al., 2020).

- Step 6:

-

present the prediction performances of the six baseline models in Table 4, according to the selected key predictors.

Several conclusions can be drawn from the results of Appendices H and I. First, we obtain PTC, SCR, TRC, ROA, ITD, NIR, TOC, GTR, GRA, CAS, RDR, CPR, and MRT as the key predictors. Second, based on the results of Appendix I, we find that the most important variable is TOC (the proportion of operating costs to operating revenue), with the average value of 10.57(%); the next important variable is NIR (the ratio of the sum of net profit and shareholders’ profit to main business revenue), with the average value of 9.41(%). Third, among the 13 selected key variables, the CAS, SCR, TRC, ROA, ITD, NIR, TOC, GTR, and GRA represent financial-based information, PTC and MRT represents operation-based information, CPR represent negative events, and the RDR represents innovation-based information. These results indicate that financial-based information is the main source to predict the SEMs’ credit risk in SCF, and the predictors should be comprehensive rather than a single source; in other words, multi-source information fusion is of great significance in predicting the credit risk of SEMs in SCF.

Several conclusions can be drawn from the results of Table 4. First, based on the predictors of VA, the AUC as a comprehensive indictor related to the other five evaluation indictors, thereby it as the main evaluation criterion in Bequé and Lessmann (2017), the RF models achieve the best forecasting performance among the six models. Second, based on the predictors of VS, when AUC as the main evaluation criterion, the RF also achieve the best forecasting performance among the six baseline models. Third, notably, as for AUC, the performances of the models based on VA are worse than those based on VS. However, the forecasting performances of the gradient boosting based on VA are better compared with those of the models based on VS.

5.2 Prediction performance across the new models

To compare predicting accuracy across the new models, we predict SMEs’ credit risk with one-year lagged predictors, based on all potential predictors and selected key predictors, respectively. The basic experimental steps are as follows:

- Step 1::

-

following Step 1 of the basic experimental steps in Sect. 5.1, randomly divide the data into a training set and a test set for the 1,185 observations.

- Step 2::

-

conduct the sampling techniques, CSL, US, OS, and SMOT, on all predictors to generate the new balanced data in training set. Specifically, considering the 49 (\({74} \times {2/3 = 49}\)) negative samples and the 741 (\({1111} \times {2/3 = 741}\)) positive sample in training set, we generate new balanced data for US by using the package ovun.sample in R with method = ‘over’, N = 1,482; generate new balanced data for OS by using the package ovun.sample in R with method = ‘under’ and N = 98; generate new balanced data for SMOTE by using the package ovun.sample in R with method = ‘both’; and generate new balanced data for CSL by using the package ROSE in R.

- Step 3:

-

use all potential predictors and selected key predictors, respectively, apply the new training set to fit different models, and tune the hyperparameters/parameters, as in Step 2 of the basic experimental steps in Sect. 5.1.

- Step 4:

-

based on the optimal parameters/hyper-parameters, use the criteria to compare the prediction results across all potential predictors and selected key predictors in the test set, and present the results in Table 5.

Several conclusions can be drawn from the results of Table 5. First, the forecasting performances of the new models, the performances of baselines are worse than those of the new models based on VA and VS, respectively. Second, based on the predictors of VA and VS, the RF models achieve the best performance among the six models, respectively. Third, when AUC is the main evaluation criterion (Bequé & Lessmann, 2017), the CSL-RF model achieves a better forecasting performance, based not only on VA but also on VS, than other new methods. Fourth, the CSL-RF model achieves a better forecasting performance among the 24 schemes, based not only on VA but also on VS, than other new approaches.

Finally, to ensure the robustness of new models, we adopt the paired t-test of forecasting performance to compare S1 (new models) with S0 (baseline models) based on the predictors VA and VS, respectively. In the scenario of baselines models (S0), we forecast the SMEs’ credit risk by using the baseline models, while in the scenario of new models (S1), we add an imbalance sampling strategy on the baseline models. We should note that the parameter ‘alternative’ in R function ‘t.test’ is set to be ‘greater’. In this multiple testing, let \(H_{0}^{(1)} ,H_{0}^{(2)} , \cdots ,H_{0}^{(m)}\) be a family of null hypotheses indicating that the performance of S1 and S0 are equivalent. Regarding the alterative hypothesis \(H_{1}^{(i)}\), it means that S1 is statistically superior to S0 in each scenario for \(i = 1,2, \cdots ,m\). We then adopt a Bootstrap sampling strategy to obtain 49 (\({74} \times {2/3 = 49}\)) negative samples and the 741 (\({1111} \times {2/3 = 741}\)) positive sample as training set in each time, and where \(m = 50\) (Wang, Yan, et al., 2021). Considering that AUC is a comprehensive indictor that related with the other five evaluation indictors (Bequé & Lessmann, 2017), we finally present the paired t-test results of AUC in Table 6. All the paired t-test results are statistically significant at the level of 5%, except for the result of NN based on VA predictors and SMOTH sampling techniques. We mark p values that rejected the null hypotheses in boldface, which indicate that these scenarios perform better with an imbalance sampling strategy. On the whole, imbalance sampling strategy is an important way to improve predict performance of SME’s credit in SCF, but this finding is not always supported in multiple testing.

5.3 Partial dependency analysis of selected predictors via the preferred model

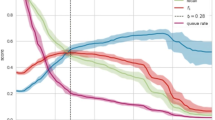

However, in the SCF of SMEs, market participants usually not only want to know the key predictors and the prediction performances of the optimal model, but also pay attention to the varying mechanism of key predictors to trustworthy behavior. In this way, managers would know how to improve financing capacities, investors how to reduce the investment risk, and regulators how to ease the financing difficulties of SMEs. The partial dependency analysis can capture the change mechanism between the predictor and the predictive response through a specific model, and visually analyze how the predictor affects the predictive response in all potential ranges. In this paper, the authors adopt the partial dependency analysis, based on the preferred CSL-RF model, to analyze how the key predictors affect the probability of credit risk in SMEs. We present the results of partial dependency analysis in Figs. 2 and 3, in which each panel facet shows the bivariate relationship between credit risk and the chosen predictor.

Figure 2a indicates that the larger the SCR, the lower the probability of non-credit risk SME; Fig. 2b indicates that the larger the TRC, the higher the probability of non-credit risk SME; Fig. 2c indicates that the larger the ROA, the higher the probability of non-credit risk SME; Fig. 2d indicates that the larger the ITD, the lower the probability of non-credit risk SME; Fig. 2e indicates that the larger the NIR, the lower the probability of non-credit risk SME; Fig. 2f indicates that the larger the TOC, the lower the probability of non-credit risk SME; Fig. 2g indicates that the larger the GTR, the lower the probability of non-credit risk SME; Fig. 2h indicates that the larger the GRA, the lower the probability of non-credit risk SME; Fig. 2i indicates that the larger the CAS, the higher the probability of non-credit risk SME.

The predicted responses in Fig. 2 reflect influencing mechanisms of key predictors and present potential managerial implications. Based on the probability of non-risky SMEs, the marginal influence effects of key financial-based information can be divided into two categories. The first group contains key financial-based information usually predicts as non-risky SMEs (the non-risky probability usually over 0.5), mainly contains SCR and CAS. Figure 2a shows a non-linear behavior of SCR. Normally, a higher sales cash ratio means a stability sources of the cash flows of enterprises in a certain period, thereby it can decrease the financial risk of SEMs at a certain level; however, the profitability of enterprises is poor when extremely SCR, because it usually at the expense of lowest prices. Therefore, although the SCR usually add the non-risky of SEMs, we also suggest the managers keeping a reasonable range to obtain a stability cash flows as well as a higher profit, which potentially decreases the operational risk of SMEs. Figure 2i indicates that a higher cash ratio (CAS) of SMEs signifies a higher probability of non-risky SMEs in the general trend. Thereby, to improve their financing ability, SMEs need to improve their rate of the sum of cash to total current.

The second group is the largest category, which contains predictors of TRC, ROA, ITD, NIR, TOC, GTR, and GRA of non-risky SMEs and risky SMEs (the non-risky probability usually around 0.5). Specifically, Fig. 2b indicates that a higher turnover rate of liquid assets (TRC) of SMEs signifies a higher probability of non-risky SMEs, thereby managers should improve the TRC to increase the probability of non-risky. Figure 2c indicates that a higher rate of return on total assets (ROA) of SMEs signifies a higher probability of non-risky SMEs in the general trend. Therefore, to improve their financing ability, SMEs need to improve their rate of return on total assets. Figure 2d indicates that a higher inventory turnover number of days (ITD) signifies a higher probability of non-risky SMEs in the general trend, however, the probability of non-risky SMEs reaches the platform 0.48 when the ITD of SMEs is above 0.2. Figure 2f shows a non-linear behavior of TOC, normally, a higher TOC means a higher operating costs of SMEs, therefore managers should decrease the operational risk by reducing operating costs, although SMEs usually face the issue of high operating costs in a short period. Figure 2h indicates that a non-linear behavior of GRA, a higher cash ratio of SMEs signifies a higher probability of non-risky SMEs in the general trend, managers thus need to control the growth rate of total assets within reasonable range. In essence, the marginal influence effects of different key financial-based information in the credit risk prediction are obvious and heterogeneous, thereby managers should put more attention on those key financial-based information and more carefully for those influence mechanism.

In Fig. 3, in the general trend, Fig. 3a indicates that the larger the PTC, the higher the probability of non-credit risk SME; Fig. 3b indicates that the larger the RDR, the higher the probability of non-credit risk SME, Fig. 3c indicates that the larger the CPR, the lower the probability of non-credit risk SME, Fig. 3d indicates that the larger the MRT, the lower the probability of non-credit risk SME. More specifically, Fig. 3a indicates that a higher revenue ratio from five customers (PTC) of SMEs signifies a higher probability of non-risky SMEs in the general trend, thus managers should pay more attention to the role of main customers and suppliers to reduce the operation risk, and managers can improve their financing ability by cooperating with main customers and suppliers that has strong credit standing and financial standing in SCF.

Figure 3b indicates that a higher ratio of R&D investment (RDR) of SMEs signifies a higher probability of non-risky SMEs in the general trend, it’s reasonable to say that innovation is the foundation of the firm’s sustainable development, managers thus should put for more resources on R&D and innovation within firm’s operation schemes. Figure 3c indicates that a larger punished number (CPR) signifies a lower probability of non-risky SMEs in the general trend, because the administrative penalties decrease the reputation of SMEs and improve the credit risk of SMEs, managers should pay more attention to firm’s reputation to improve the financial capability. Figure 3d indicates a non-linear behavior of related transactions amount (GRA), managers thus need to control the total amount of related transactions within reasonable range. In essence, the marginal influence effects of different key non-financial-based information for forecasting the SMEs’ credit risk are obvious and heterogeneous, thereby the managers should put more attention on those key non-financial-based information and more carefully for those influence mechanism.

6 Discussions

This research explores credit risk forecasting solutions for SMEs in SCF from a multi-source information fusion perspective. These solutions are different from traditional schemes and provide insights for both SMEs managers, investors, and market regulators involved in SCF.

6.1 Theoretical implications

First, we propose a series of new hybrid machine learning approaches by extending the imbalance sampling strategy to baseline models, which is useful in handling imbalance datasets and nonlinear relationship in the SCF simultaneously. Since the sample proportion of positive (non-ST) and negative (ST) SMEs are extremely imbalanced (1111:74), the baseline machines are trained for each dataset. The amount of information carried by the positive sample is larger than that of the negative one and this causes misleading results in the learning process of the baseline classifiers. To achieve the balanced ratio between ST and non-ST SMEs, we propose a series of new hybrid machine learning approaches by considering an imbalance sampling strategy based on six classic classifiers. The empirical results indicate that the proposed CSL-RF model is the optimal solution, both in terms of robustness and accuracy. Therefore, first, our research contributes to the SMEs’ credit risk prediction approach of SCF literature by addressing the imbalance datasets and nonlinear relationship in the SCF simultaneously (Zhu et al., 2019).

Second, we develop an SME credit risk forecasting model in SCF by broadening multi-sources information fusion from financial-based to a wider range including operation, innovation, and negative events and presenting key variable selection schemes. On the one hand, we identify different sources of information of SMEs that can be used as effective predictors for credit risk in SCF. On the other hand, from the results of key variable selection, multi-sources information of financial, operation, innovation, and negative events are selected. This is different from previous research findings, which tend to adopt financial-based information, e.g., (Lin et al., 2018), whereas this study finds that other information including operation information, innovation information, and negative events, is also necessary for credit risk prediction of SMEs in SCF. Moreover, key predictors selected are also meaningful, as Sariannidis et al. (2020) suggest that some redundant variables have little marginal effect in increasing the credit value of the SMEs, but impose a great cost.

Third, the accuracy level achieved is quite satisfactory; in the optimal cases, it reached over 97.22%. The proposed framework thus could be used for a thorough understanding in SEM’s credit risk market (Jiang et al., 2019). The results indicate that the proposed CSL-RF model is the optimal solution, both in terms of robustness and accuracy. As the performances of the proposed CSL-RF model is satisfactory, investors can use less information—just PTC, SCR, TRC, ROA, ITD, NIR, TOC, GTR, GRA, CAS, RDR, CPR, and MRT—instead of dealing with a large amount of financial information, operational information, innovation information and negative events (reduced the original 40 basic variables to 13 key variables), to classify potential customers to provide more appropriate solutions for SCF. These methods can be further developed by analysts, financial institutions and SME’s managers to facilitate classification process for prospective SMEs according to their preferred characteristics.

6.2 Practical implications

First, SME mangers need to continuously realign organizational models with stakeholder interests based on multi-source information of credit risks, because this research shows that the reliability and sustainability of SMEs are the key factors for investors to make financing decisions, and not just rely on financial-based information. In addition, to attract more investors’ attention of SMEs, managers should put more emphasis on profitability, market capabilities, and enterprise reputation.

Second, we distinguish that the financial-based information of SMEs should be given more attention than operation-based information, innovation-based information, and negative events; particularly, capital capabilities, management capabilities, profit capabilities, growth capabilities, and solvency capabilities. This is in line with Weng et al. (2016), who find that SMEs’ financial capabilities ensure their debt repayment capabilities, which also affect the reliability and sustainability of the whole SCF. Therefore, to improve the financing capability of SMEs, we also suggest that SME managers should develop multi-channel financing service platforms with suppliers and consumers, such as providing diversified supply chain financial products, constructing better credit evaluation and dishonoring punishment mechanism to ease the financing difficulties. Therefore, designing multi-channel financing platforms may be one of the primary measures to promote the sustainable development of SMEs.

Third, we explore the varying mechanisms of how selected key variables enhance the creditworthiness of SMEs in SCF, which is different from Zhu et al. (2019), who capture the varying mechanisms from traditional financing factors and SCF factors. In this research, we capture the varying patterns of key information from financial and non-financial aspects of SMEs’ credit risk, and present the marginal influence effects of different key information in detail. Considering that the heterogeneous effects of different key variables, thereby, SME’s mangers should control the key variables within reasonable range and build flexible solutions with different predictors. For example, managers could construct a credit system for different customers to carry out SCF individually. Some specific scenarios may be created by market regulators, such as constructing a credit guarantee system for SMEs, promoting financial markets for SMEs, and optimizing the financing environment for SMEs (Arevalillo, 2019).

7 Conclusions

To our best knowledge, this is the first study to consider the value of multi-source information fusion to predict the SMEs’ credit risk in SCF, and presents some managerial implications. We predict the credit risk of SMEs in SCF with an imbalance sampling strategy on machine learning techniques. Considering the value of multi-source information fusion in the big data era, we construct a broader knowledge base, including financial information, operation information, innovation information, and negative events, to predict the credit risk of SMEs in China, and develop new models to simultaneously solve for key predictor selection and imbalance classes. We then adopt six evaluation criteria to compare the prediction performances of the six machine learning techniques—SVM, NN, DT, RF, bagging, and GB—based on the data of VA and VS, respectively. We compare the results of new models via a re-sampling strategy for baseline models on VA and VS; the results indicate that the proposed CSL-RF model is optimal in terms of accuracy and robustness. The empirical results indicate that the financial-based information is the main source to predict SEMs’ credit risk in SCF, and the multi-source information fusion is meaningful. In addition, based on the preferred CSL-RF model, we also present the varying mechanisms of key predictors for SMEs’ credit risk by using partial dependency analysis. Finally, we generate strategic insights for market participants, such as regulators, investors, and managers.

Notwithstanding the above implications, this study has some limitations, which imply future research. First, although we select the optimal predict model based on the AUC and Type ΙΙ error (risk averse), because the cost of Type II error causes the SCF investors with high risks and losses, some investors are more risk taking, they tend to select the SCF scheme to maximize potential return based on the Type I error (risk taking). Second, as multi-source information fusion is a feasible scheme for dealing with information asymmetry in SMEs’ credit risk in SCF, we could also explore this issue from broader information fusion perspectives considering information regarding industrial network structure (e.g. Wang, Yan, et al., 2021), supply chain leadership (e.g. Chen et al., 2021), and supply chain network structure (e.g. Wang, Jia, et al., 2021). Third, recent development of trade tensions, such as the U.S.–China trade dispute, Japan–South Korea trade conflict, and other business dynamics towards reglobalization are readily affecting global supply chain. Future research could explore the role of new technologies in facilitating SCF in the era of reglobalization, focusing on topics such as supply chain governance, competition, and cooperation (e.g. Reza-Gharehbagh et al., 2021). Moreover, considering that multiple SCF platforms are emerging in the digital era, although some challenges of SCF platforms such as intelligent credit risk forecasting based on multi-source information fusion have been addressed in this research, other emerging credit risk topics, e.g., the credit risk forecasting of SCF platforms are still under-explored in SCF. We thus call for the new SCF solutions in managing information sharing, integration, and alignment for SCF platforms. We also suggest that future works can develop new models, both multi-sources information and multi-methods fusion, to explore the potential topics within the scopes of multi-sided crowdfunding platforms and peer-to-peer financing choice of SME entrepreneurs.

References

Andrikopoulos, P., & Khorasgani, A. (2018). Predicting unlisted SMEs’ default: Incorporating market information on accounting-based models for improved accuracy. British Accounting Review, 50, 559–573.

Angilella, S., & Mazzù, S. (2015). The financing of innovative SMEs: A multicriteria credit rating model. European Journal of Operational Research, 244, 540–554.

Arevalillo, J. M. (2019). A machine learning approach to assess price sensitivity with application to automobile loan segmentation. Applied Soft Computing Journal, 76, 390–399.

Bals, C. (2019). Toward a supply chain finance (SCF) ecosystem-proposing a framework and agenda for future research. Journal of Purchasing and Supply Management, 25, 105–117.

Bauer, E., Kohavi, R. (1996). An empirical comparison of voting classification algorithms: Bagging, boosting, and variants[J]. Machine learning, 36(1), 1–38.

Bauer, E., & Kohavi, R. (1999). An empirical comparison of voting classification algorithms: Bagging, boosting, and variants. Machine Learning, 36, 105–139.

Bequé, A., & Lessmann, S. (2017). Extreme learning machines for credit scoring: An empirical evaluation. Expert Systems with Applications, 86, 42–53.

Breiman, L. (2001). Random forests. Machine Learning, 45, 5–32.

Caniato, F., Gelsomino, L. M., Perego, A., & Ronchi, S. (2016). Does finance solve the supply chain financing problem? Supply Chain Management: an International Journal, 21, 534–549.

Chen, J., Chan, K. C., Dong, W., & Zhang, F. (2017). Internal control and stock price crash risk: Evidence from China. European Accounting Review, 26, 125–152.

Chen, L., Jia, F., Li, T., & Zhang, T. (2021). Supply chain leadership and firm performance: A meta-analysis. International Journal of Production Economics, 235, 108082.

Cortes, C., & Vapnik, V. (1995). Support vector networks. Machine Learning, 20, 273–297.

Fantazzini, D., & Figini, S. (2009). Random survival forests models for SME credit risk measurement. Methodology and Computing in Applied Probability, 11, 29–45.

Gupta, J., & Gregoriou, A. (2018). Impact of market-based finance on SMEs failure. Economic Modelling, 69, 13–25.

He, H., & Garcia, E. A. (2009). Learning from imbalanced data. IEEE Transactions on Knowledge and Data Engineering, 21, 1263–1284.

Hirsch, B., Nitzl, C., & Schoen, M. (2018). Interorganizational trust and agency costs in credit relationships between savings banks and SMEs. Journal of Banking and Finance, 97, 37–50.

Hofmann, E. (2005). Supply chain finance: some conceptual insights', Beiträge Zu Beschaffung Und Logistik (pp. 203–14).

Jia, F., Blome, C., Sun, H., Yang, Y., & Zhi, B. (2020). Towards an integrated conceptual framework of supply chain finance: An information processing perspective. International Journal of Production Economics, 219, 18–30.

Jiang, C., Wang, Z., & Zhao, H. (2019). A prediction-driven mixture cure model and its application in credit scoring. European Journal of Operational Research, 277, 20–31.

Ju, Y., & Young Sohn, S. (2015). Stress test for a technology credit guarantee fund based on survival analysis. Journal of the Operational Research Society, 66, 463–475.

Lam, H. K., & Zhan, Y. (2021a). The impacts of supply chain finance initiatives on firm risk: evidence from service providers listed in the US. International Journal of Operations and Production Management, 41, 383–309.

Lam, H. K. S., & Zhan, Y. (2021b). The impacts of supply chain finance initiatives on firm risk: Evidence from service providers listed in the US. International Journal of Operations and Production Management, 41, 383–409.

Lin, E. M., Sun, E. W., & Yu, M. T. (2018). Systemic risk, financial markets, and performance of financial institutions. Annals of Operations Research, 262, 579–603.

Mai, F., Tian, S., Lee, C., & Ma, L. (2019). Deep learning models for bankruptcy prediction using textual disclosures. European Journal of Operational Research, 274, 743–758.

Martin, J., & Hofmann, E. (2017). Involving financial service providers in supply chain finance practices. Journal of Applied Accounting Research, 18, 42–62.

Pederzoli, C., Thoma, G., & Torricelli, C. (2013). Modelling cedit risk for innovative SMEs: The role of innovation measures. Journal of Financial Services Research, 44, 111–129.

Reza-Gharehbagh, R., Asian, S., Hafezalkotob, A., & Wei, C. (2021). Reframing supply chain finance in an era of reglobalization: On the value of multi-sided crowdfunding platforms. Transportation Research Part E: Logistics and Transportation Review, 149, 102298.

Reza-Gharehbagh, R., Hafezalkotob, A., Asian, S., Makui, A., & Zhang, A. N. (2020). Peer-to-peer financing choice of SME entrepreneurs in the re-emergence of supply chain localization. International Transactions in Operational Research, 27, 2534–2558.

Rizzo, D. M., & Dougherty, D. E. (1994). Characterization of aquifer properties using artificial neural networks: Neural kriging. Water Resources Research, 30, 483–497.

Saito, K., & Tsuruta, D. (2018). Information asymmetry in small and medium enterprise credit guarantee schemes: Evidence from Japan. Applied Economics, 50, 2469–2485.

Sariannidis, N., Papadakis, S., Garefalakis, A., Lemonakis, C. & Kyriaki-Argyro, T. (2020). Default avoidance on credit card portfolios using accounting, demographical and exploratory factors: Decision making based on machine learning (ML) techniques. Annals of Operations Research, 294, 712–739.

Schwab, L., Gold, S., & Reiner, G. (2019). Exploring financial sustainability of SMEs during periods of production growth: A simulation study. International Journal of Production Economics, 212, 8–18.

Song, H. (2019). How do knowledge spillover and access in supply chain network enhance SMEs’ credit quality? Industrial Management and Data Systems, 119, 274–291.

Song, Z. L., & Zhang, X. M. (2018). Lending technology and credit risk under different types of loans to SMEs: Evidence from China. International Review of Economics and Finance, 57, 43–69.

Szutowski, D. (2018). Market reaction to open innovation announcements. European Journal of Innovation Management, 21, 142–156.

Thai-Nghe, N., Gantner, Z. & Schmidt-Thieme, L. (2010) 'Cost-sensitive learning methods for imbalanced data. In The 2010 international joint conference on neural networks (IJCNN). IEEE.

Tkáč, M., & Verner, R. (2016). Artificial neural networks in business: Two decades of research. Applied Soft Computing, 38, 788–804.

Wandfluh, M., Hofmann, E., & Schoensleben, P. (2016). Financing buyer-supplier dyads: An empirical analysis on financial collaboration in the supply chain. International Journal of Logistics Research and Applications, 19, 200–217.

Wang, L., Jia, F., Chen, L., Xu, Q., & Lin, X. (2021). Exploring the dependence structure among Chinese firms in the 5G industry. Industrial Management and Data Systems, 121, 409–435.

Wang, L., Yan, J., Chen, X., & Xu, Q. (2021). Do network capabilities improve corporate financial performance? Evidence from financial supply chains. International Journal of Operations and Production Management., 41, 336–358.

Weng, X., Lu, X., & Wu, Y. (2016). Research on the credit risk management of small and medium-sized enterprises based on supply chain finance. Journal of Finance and Accounting, 4, 245–253.

Wetzel, P., & Hofmann, E. (2019). Supply chain finance, financial constraints and corporate performance: An explorative network analysis and future research agenda. International Journal of Production Economics, 216, 364–383.

Wu, P., Gao, L., & Li, X. (2016). Does the reputation mechanism of media coverage affect earnings management?: Evidence from China. Chinese Management Studies, 10, 627–656.

Wu, X., & Liao, H. (2020). Utility-based hybrid fuzzy axiomatic design and its application in supply chain finance decision making with credit risk assessments. Computers in Industry, 114, 103144.

Xu, Q., Wang, L., Jiang, C. & Liu, Y. (2020). A novel (U)MIDAS-SVR model with multi-source market sentiment for forecasting stock returns. Neural Computing and Applications, 32(1), 5875–5888.

Yan, N., & He, X. (2020). Optimal trade credit with deferred payment and multiple decision attributes in supply chain finance. Computers and Industrial Engineering, 147, 106627.

Yu, Y., Huang, G., & Guo, X. (2020). Financing strategy analysis for a multi-sided platform with blockchain technology. International Journal of Production Research, 59, 4513–4532.

Zhang, L., Hu, H., & Zhang, D. (2015). A credit risk assessment model based on SVM for small and medium enterprises in supply chain finance. Financial Innovation, 1, 14.

Zhu, Y., Xie, C., Wang, G. J., & Yan, X. G. (2017). Comparison of individual, ensemble and integrated ensemble machine learning methods to predict China’s SME credit risk in supply chain finance. Neural Computing and Applications, 28, 41–50.

Zhu, Y., Zhou, L., Xie, C., Wang, G.-J., & Nguyen, T. V. (2019a). Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. International Journal of Production Economics, 211, 22–33.

Acknowledgements

The authors gratefully acknowledge financial support from the National Natural Science Foundation of China (71902159, 72171070, 71729001, 72025101), the Humanity and Social Science Foundation of Ministry of Education of China (20YJA630024), and the Fundamental Research Funds for the Central Universities (No. FRF-DF-20-11) the China Postdoctoral Science Foundation under Grant 2021M700380.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The pseudocode of SVM-based classifier

Appendix B: The pseudocode of ANN-based classifier

Appendix C: The pseudocode of C4.5 DT

Appendix D: The pseudocode of RF

Appedix E: The pseudocode of bagging

Appendix F: The pseudocode of GB

Appendix G: Variables and definition

Abbreviated | Attribute | Definition |

|---|---|---|

Supply chain capabilities | ||

TPS | CON | TPS is total purchases amount of enterprise from the top five suppliers |

PAS | CON | PAS is the proportion of the total purchase amount from the top five suppliers |

PRP | CON | PRP is the number of listed enterprises in the top five suppliers |

TFR | CON | TFR is total revenue of enterprise from the top five customers |

PTC | CON | PTC is the proportion of the total revenue from the top five customers |

PSP | CON | PSP is the number of listed enterprises in the top five customers |

Capital capabilities | ||

SCR | CON | SCR is the ratio of the net cash flows to the enterprise’s sales income |

CIR | CON | CIR is the ratio of cash flows to capital expenditure and cash dividends |

COI | CON | COI is the ratio of operating cash flows to operating cash |

CRA | CON | CRA is the ratio of net operating cash flows to total assets |

Management capabilities | ||

INT | CON | INT is the average times for an enterprise sold its total during a year |

TRA | CON | TRA is a measure for receivables by clients |

TRC | CON | TRC is the times of the current assets are turned over in a year |

ROA | CON | ROA compares the sales of an enterprise to its asset base |

APT | CON | APT refers to the liquidity of accounts payable of an enterprise |

ITD | CON | ITD is the number of days that an enterprise sells its inventory during a given year |

Profit capabilities | ||

NPT | CON | NPT is the ratio of net profit to total profits |

NIR | CON | NIR is ratio of the sum of net profit and shareholders’ profit to main business revenue |

TOC | CON | TOC is the proportion of operating costs to operating revenue |

MER | CON | MER is the management fee to revenue of main business |

CTP | CON | CTP is the ratio of cash to total profits |

Growth capabilities | ||

GTR | CON | GTR is the growth rate of total operating revenue for an enterprise |

NPR | CON | NPR is the year-on-year growth rate of net profit for an enterprise |

GTL | CON | GTL is the growth rate of total liabilities for an enterprise |

GRA | CON | GRA is the growth rate of total assets for an enterprise |

Solvency capabilities | ||

CUR | CON | GUR is a liquidity ratio that a firm has resources to meet its short-term obligations |

QUR | CON | QUR is the ratio that quick assets to extinguish its current liabilities immediately |

CAS | CON | CAS is the ratio of the sum of monetary to total current |

RBA | CON | RBA is the ratio of long-term borrowing to total assets |

Innovation capabilities | ||

NPA | CON | NPA is the total number of invention patent applications |

NPO | CON | NPO is the total number of invention patent granted |

RDP | CON | RDP is the ratio of R&D personnel to total employees |

RDR | CON | RDR is the ratio of R&D investment to total revenue |

Negative events | ||

NLD | BIN | NLD = 1 if the enterprise is involved in litigation disputes, else 0 |

CPR | BIN | CPR = 1 if the enterprise is punished by the regulator, else 0 |

EPR | BIN | EPR = 1 if the executives is punished by the regulator, else 0 |

MNN | BIN | MNN = 1 if the enterprise disclosed by the media with negative news, else 0 |

Related transactions | ||

TRT | MUL | TRT = 1 is loans; TRT = 2 is sell products; TRT = 3 is purchase assets; TRT = 4 is accept services; TRT = 5 is purchase goods; TRT = 6 is equity; TRT = 7 is provision of goods or services; TRT = 8 is rents; TRT = 9 is payment of expenses; TRT = 10 is asset transaction; TRT is fee; TRT = 12 is financial dealings; TRT = 13 is investment; TRT = 14 is proxy; TRT = 15 is construction; TRT = 16 is technical services; TRT = 17 is hydropower supply; TRT = 18 is receivable and payable; TRT = 19 is consulting services; TRT = 20 is transfer of assets; TRT = 21 is others |

MRT | CON | MRT is the total currency amount of related transactions |

CRR | BIN | CRR = 1 if the control relationship occurred between related enterprise and the enterprise, else 0 |

Appendix H: Relative importance for each predictor (%)

Variable | SVM | NN | DT | RF | BA | BO | Variable | SVM | NN | DT | RF | BA | BO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

TPS | 0.00 | 0.00 | 1.86 | 2.05 | 3.63 | 1.55 | CTP | 0.00 | 0.00 | 2.11 | 2.01 | 1.38 | 1.51 |

PAS | 2.44 | 2.41 | 0.00 | 2.52 | 1.24 | 1.87 | GTR | 9.80 | 9.79 | 5.05 | 8.71 | 5.64 | 9.14 |

PRP | 0.07 | 0.07 | 0.00 | 0.60 | 0.21 | 0.01 | NPR | 0.28 | 0.00 | 7.78 | 1.93 | 1.39 | 4.34 |

TFR | 0.87 | 0.10 | 3.20 | 1.73 | 1.76 | 1.42 | GTL | 0.00 | 0.00 | 3.20 | 2.86 | 1.78 | 2.72 |

PTC | 2.64 | 1.60 | 4.90 | 3.80 | 2.34 | 1.57 | GRA | 4.02 | 5.61 | 7.12 | 4.85 | 3.57 | 6.08 |

PSR | 0.03 | 0.03 | 0.00 | 0.43 | 0.41 | 0.03 | CUR | 1.35 | 1.79 | 0.00 | 1.99 | 1.43 | 1.44 |

SCR | 2.79 | 3.82 | 0.00 | 4.09 | 2.75 | 5.26 | QUR | 0.80 | 1.08 | 0.00 | 2.16 | 4.55 | 1.51 |

CIR | 0.00 | 0.00 | 3.74 | 1.64 | 2.66 | 1.64 | CAS | 5.17 | 6.13 | 8.21 | 4.38 | 5.57 | 3.76 |

COI | 2.88 | 2.66 | 0.00 | 2.08 | 2.13 | 2.45 | RBA | 1.72 | 1.67 | 0.00 | 2.53 | 2.09 | 2.97 |

CRA | 5.58 | 5.80 | 1.87 | 1.53 | 1.55 | 2.04 | NPA | 0.00 | 0.04 | 1.97 | 1.98 | 1.83 | 0.86 |

INT | 0.00 | 0.00 | 0.00 | 1.74 | 4.21 | 2.69 | NPO | 0.18 | 0.18 | 0.00 | 1.29 | 1.58 | 0.93 |

TRA | 0.00 | 0.03 | 4.84 | 1.83 | 2.88 | 0.84 | RDP | 2.00 | 1.43 | 0.00 | 2.46 | 4.39 | 2.99 |

TRC | 3.19 | 3.16 | 2.22 | 2.58 | 3.43 | 3.42 | RDR | 2.53 | 2.53 | 0.00 | 2.87 | 3.53 | 3.21 |

ROA | 4.96 | 5.81 | 1.85 | 2.72 | 2.76 | 3.63 | NLD | 0.31 | 0.00 | 0.00 | 0.25 | 0.00 | 0.08 |

APT | 1.31 | 1.30 | 2.36 | 2.27 | 1.26 | 3.89 | CPR | 4.58 | 4.14 | 2.52 | 0.72 | 3.01 | 1.06 |

ITD | 4.63 | 3.77 | 4.84 | 3.70 | 3.78 | 2.14 | EPR | 1.44 | 1.75 | 2.79 | 0.57 | 0.30 | 0.18 |

NPT | 0.00 | 0.00 | 0.00 | 3.14 | 2.11 | 2.91 | MNN | 2.28 | 2.28 | 0.00 | 0.90 | 0.32 | 0.11 |

NIR | 13.25 | 12.27 | 14.106 | 5.17 | 6.13 | 5.51 | TRT | 0.48 | 0.47 | 0.00 | 1.12 | 1.93 | 0.69 |

TOC | 14.66 | 15.65 | 13.53 | 6.36 | 4.40 | 8.82 | MRT | 2.83 | 0.74 | 0.00 | 3.83 | 3.44 | 3.39 |

MER | 0.82 | 0.81 | 0.00 | 2.20 | 1.54 | 1.22 | CRR | 0.15 | 0.27 | 0.00 | 0.39 | 0.00 | 0.17 |

Appendix I: The selected key predictor via ensemble learning

Models | TPS | PAS | PRP | TFR | PTC | PSR | SCR | CIR | COI | CRA | INT | TRA | TRC | ROA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

SVM | X | X | X | X | √ | X | √ | X | √ | √ | X | X | √ | √ |

NN | X | X | X | X | X | X | √ | X | √ | √ | X | X | √ | √ |

DT | X | X | X | √ | √ | X | √ | √ | X | X | X | √ | X | X |

RF | X | √ | X | X | √ | X | X | X | X | X | X | X | √ | √ |

BA | √ | X | X | X | √ | X | √ | √ | X | X | √ | √ | √ | √ |

BO | X | X | X | X | X | X | √ | X | X | X | √ | X | √ | √ |

EM | X | X | X | X | √ | X | √ | X | X | X | X | X | √ | √ |

Models | APT | ITD | NPT | NIR | TOC | MER | CTP | GTR | NPR | GTL | GRA | CUR | QUR | CAS |

SVM | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

NN | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

DT | X | √ | X | √ | √ | X | X | √ | √ | √ | √ | X | X | √ |

RF | X | √ | √ | √ | √ | X | X | √ | X | X | √ | X | X | √ |

BA | X | √ | X | √ | √ | X | X | √ | X | X | √ | √ | √ | √ |

BO | √ | X | √ | √ | √ | X | X | √ | √ | √ | √ | X | X | √ |

EM | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

Models | RBA | NPA | NPO | RDP | RDR | NLD | CPR | EPR | MNN | TRT | MRT | CRR | ||

SVM | X | X | X | X | √ | X | √ | X | X | X | √ | X | ||

NN | X | X | X | X | √ | X | √ | X | X | X | X | X | ||

DT | X | X | X | X | X | X | √ | √ | X | X | X | X | ||

RF | √ | X | X | X | √ | X | X | X | X | X | √ | X | ||