Abstract

In the digital era, achieving economic sustainability requires proper management of risk with deployment of technologies. In this paper, we discuss how the popular blockchain technology can be applied for risk analysis and optimization (RAO) in real-world oriented operations research (OR) problems. We first present the OR approach and examine the related literature for some critical topics and key research issues in RAO. Then, we present the features and functions of blockchain technology. After that, we propose how the blockchain technology can be applied to support different steps in the OR approach and enhance our investigation and real-world applications of RAO models. Finally, we discuss future research directions and establish a research framework.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

1.1 Background

In Operations Research (OR) for business and industrial systems, risk analysis (Sorrill, 1987; Choi, 2021) and optimization (RAO) is a critical area (Govindan & Jepsen, 2016; Borgonovo et al., 2018; Fattahi et al., 2020; Fattahi & Govindan, 2018). The major reason is that, in decision making, there are all sources of uncertainty which would lead to all kinds of unfavorable outcomes. In business operations, it is commonly known that “risk” relates to uncertainty and the presence of unfavorable outcomes. By employing a scientific modelling approach, we can conduct risk analysis and derive the optimal decisions in a turbulent market environment. Having a proper RAO is hence the necessary condition to achieve economic sustainability.

For modeling risk in business operations, there are different approaches. For example, traditionally, in supply chain operations with inventory control, prior studies commonly view “inventory risk” as the over-stocking risk and under-stocking risk and quantify them by using expected inventory cost. Despite being intuitive, measuring risk by using expected cost fails to capture the uncertainty associated with the cost and hence does not fully reflect the stochastic nature of the problem. As a result, borrowing the findings in economics and finance, researchers have proposed other measures and modeling framework over the past few decades. One popular approach is the higher moment analysis. For instance, Choi et al. (2008) adopt the mean–variance approach to study newsvendor based problems in supply chains in which risk is modelled by using the variance of profit. Recently, Zhang et al. (2020b) further generalize the mean–variance formulations in newsvendor supply chains by using the mean–variance-skewness-kurtosis “four moments” approach. Of course, exploring risk in business operations is more than just studying the higher moments. Many other issues, such as the proper use of information, using the right risk measures and adopting the systems approach for optimization, are all critically important.

Nowadays, business operations have entered the digital age (Choi et al., 2021) and all kinds of disruptive “information technologies”, such as artificial intelligence (AI) (Luo et al., 2019), machine learning (ML), big data analytics (BDAs) (Choi et al., 2018a), blockchain, etc., exist. In particular, when we talk about risk, especially with financial matters, blockchain technology (BcT) is undoubtedly a core technology in the spot light. BcT is commonly viewed as a “distributed ledger” which is highly secure. Its origin can be dated back to the time when bitcoin (Jiménez et al., 2020) was first established. Owing to the need to support cryptocurrency like bitcoins, BcT is made to be transparent (especially the public BcT) and data being stored can be regarded as permanent. Each blockchain is supported by the corresponding consensus algorithm. Popular consensus algorithms (Du et al., 2017) include Proof of Work (PoW), which is used in bitcoins, and Proof of Stake (PoS), which employs the concept of coin-age in its algorithm. Blockchains can roughly be divided into the public blockchains (e.g., the blockchain for bitcoins) and private blockchains (e.g., Hyperledger Fabric) which use the incentivized consensus and non-incentivized consensus, respectively. BcT’s applications have now gone beyond finance, but can be applied in different kinds of business operations.

In terms of identifying the topics and research issues from the literature in this paper, we focus on the well-established journals in OR, including Annals of Operations Research, Computers and Operations Research, European Journal of Operational Research, International Transactions in Operational Research, Journal of the Operational Research Society, Mathematics of Operations Research, Operations Research, and Operations Research Letters, etc. We supplement the searching results with various additional papers from our own acquaintance. Note that for the reviews, we aim at having a critical review with high relevance and quality. We do not aim to conduct an exhaustive searching. In fact, a few review and discussion papers are available in the literature. For example, Chapman and Cooper (1983) review risk analysis related OR studies. The focal points are on the risk related to nuclear energy, thermal power, natural gas, etc. Moskowitz and Bunn (1987) examine the tread of risk analysis in decision making and modeling research. Wahlström (1994) reports a classic study regarding OR modeling for risk analysis. It lays the solid foundations for scientific research in risk analysis. Choi et al. (2016) examine various risk analysis related issues in service supply chain operations. Borgonovo et al. (2018) discuss how risk analysis relates to decision analysis. This is in line with some classic prior studies (e.g., Hämäläinen & Karjalainen, 1992). The authors consider the important “risk-triplet” approach and highlight how it can be applied for conducting risk analysis. This paper is different from them in which we focus on highlighting the most recent state-of-the-arts OR studies in RAO as well as uncovering how blockchain can be used to support OR analysis and applications for risk analysis.

1.2 The six-step OR approach

OR is a well-established discipline in science. Despite having slightly different perspectives, it is commonly believed that OR applies mathematical modeling and analyses in deriving optimal solutions. However, this is in fact only a part of the whole OR approach in conducting real-world analyses. Following the classic literature (see Chapter 2, Hillier & Liberman, 2004), the OR approach includes six steps as we describe below.

-

Step 1. Problem definition: the OR process starts by clearly defining the problem of interest and collecting the needed data. This is a non-trivial step as we cannot take for granted that the given OR problem (such as those in RAO) is well structured and clearly presented. We need to make sure the problem under investigation is the correct one with clear objectives. As a remark, OR commonly relates to the whole company’s welfare [see Hillier and Liberman (2004)]. Thus, the systems approach is essentially important. One important way to define the right problem involves the proper collection and utilization of data because with real-world data, we can better understand the real involved problem. Moreover, data would be critical for the subsequent steps. Nowadays, to collect data requires the use of computing devices, databases, and solid many information systems in the company. Traditionally, ERP systems would be a big help. To enhance presentation, in this paper, we call the defined problem “Problem (RO)” [P.S.: R stands for risk, O stands for optimization].

-

Step 2. Analytical modeling: by using mathematics, capture the essential elements and tradeoffs of the defined problem, i.e. Problem (RO). As a standard norm in any analytical modeling OR projects, we need to build the model by (i) specifying the decision variables (i.e., endogenous control variables), objective function and constraints, and (ii) defining the model parameters (i.e., the exogenously given parameters). As a common case in virtually all practical OR projects, model parameters are usually estimates based on relevant data. They are far from perfect. As a consequence, it is necessary to conduct a sensitivity analysis to reveal how changes of parameters would affect the optimal decisions. The most sensitive parameters should deserve deeper attention. Furthermore, in order to have tractable results, there are model assumptions. It is hence critical to ensure the model is sufficiently sophisticated to be a valid representation of Problem (RO) in the real world. It is in fact a common practice to try simpler models first and then increase the sophistication until the best possible model is obtained. This will make the constructed analytical model a well-balanced one with respect to real-world sophistication and tractability. Another remark is about the objective function. In many cases, an OR problem may involve multiple objectives. It is a common practice to transform them into a “composite performance measure” and use it in building Problem (RO).

-

Step 3. Deriving the solution: this step involves exploring the structural properties of Problem (RO) and finding the optimal solution. In most cases, it involves the use of computing tools and programmable algorithms to help find the optimal solution efficiently. Several remarks are listed as follows: (i) In many cases, the globally optimal solution might not be easy to find. Thus, in OR, we have the term “satisficing” solution which represents a solution which is good enough (by combining the words “satisfactory” and “optimizing”). (ii) It is critically important to make sure the optimal decisions are valid and remain robust. Thus, the sensitivity analysis mentioned in Step 2 should be conducted to see how valid the optimal decisions are.

-

Step 4. Model testing and refinement: models and solution methods are seldom perfect. Thus, it is critical to test for the validity of the constructed model and revise if needed. A standard method of model testing is via conducting the retrospective test. The retrospective test means constructing the past and test the proposed model and solution using historical data. It may involve simulation experiments.

-

Step 5. Preparing for the application: it is important to get prepared for the application of the developed model and solution methods, usually with the advice of the operations managers. In particular, in modern OR projects, the problem and solution algorithm should be modelled and programmed into a business analytics tool, which is traditionally called the decision support system. In order to let staff members of the company to understand the features and “know-how”, the business analytics tool must be well-documented. The database must be efficient and provide the needed data to support decision making. Step 5 is a non-trivial step and involves building a process for the using and maintaining the business analytics tool in the future.

-

Step 6. Implementation: putting the business analytics tool into real working environment is the last step. It requires the proper project management skills in business analytics. For example, the company has to ensure users are involved throughout the implementation process to reduce their resistance as well as the standard “user-designer communication gap”. Feedbacks from users and related managers of all levels should be collected through the whole duration when the new business analytics tool is put into real application. It will also be a good strategy to provide a performance based incentive to users and managers when they cooperate and work with the new business analytics tool derived from the OR project.

Note that the above six steps are well-established in the OR literature and are relevant to RAO problems. In this paper, we will explore how blockchain technology can help in this six-step OR approach for RAO problems.

1.3 Paper’s structure

In this paper, we first discuss and review some related literature for various important problems and the respective solution methods for RAO in Sect. 2. After that, we discuss several functions of BcT which are pertinent to enhance business operations in Sect. 3. Then, we propose how BcT can be applied to enhance explorations and developments of the mentioned RAO problems, solution methods and the six-step OR approach in Sect. 4. Finally, we establish a research framework for future research in Sect. 5. To enhance presentation, the abbreviations used in this paper are listed in Table 1.

This paper focuses on economic sustainability, and hence different from the traditional “triple bottom line” kind of sustainability. As such, the term “risk” mainly refers to business risk related to operations. Moreover please note that Risk Analysis (RA) is a very important field which involves many different methodologies and scopes (Chiu et al., 2012; Choi, 2021; Cui et al., 2018; Haimes & Li, 1991; Haimes et al., 1990; Kuzminski et al., 1995; Lambert et al., 1994; Li et al., 1993). Thus, RAO includes many different steps (e.g., empirical risk assessment, qualitative analyses, etc.) and can be viewed from different perspectives (DuHadway et al., 2019). This paper focuses more on the modeling part with a focal point on the use of blockchain technology (BcT).

2 Topics and key research issues in RAO

Upon searching the OR literature, we have identified a few topics and some corresponding key research issues. They are discussed one by one in the following.

2.1 Risk sensitivity

RAO in business operations involves a right perspective towards risk. As we know, each decision maker in general has his/her own risk sensitivity. Here, risk sensitivity has two meanings: (i) The risk preference (or risk attitude), and (ii) the degree of risk sensitivity. Risk preference (Chiu & Choi, 2016; Choi et al., 2018b; Wang et al., 2019) is commonly described by simple terms such as risk averse (i.e., dislikes risk), risk neutral (i.e., indifferent to risk), and risk prone (i.e., love risk, such as the behavior of gamblers). For a given risk preference, the degree of risk sensitivity varies among different decision makers. For example, a decision maker who is risk averse can be mildly risk averse whereas another risk averse decision maker can be very risk averse. As a very simple model, we can express the mean-risk objective function of a risk sensitive decision maker (e.g., an operations manager) as follows.

where \(\pi\) is a random profit, \(E(\pi )\) is the expected profit (i.e., mean), \(R(\pi )\) is a risk measure (e.g., variance of profit if we adopt the mean–variance approach), and \(\lambda\) is the risk sensitivity coefficient. In (1) when the decision maker is risk averse if \(\lambda\) is positive, risk neutral if \(\lambda\) is zero and risk prone (which is the same as risk seeking) if \(\lambda\) is negative.

In the OR literature, Agrawal and Seshadri (2000) study the role of middleman for supply chain risk management. Gómez-Limón et al. (2003) study risk averse behaviors of farmers. The authors derive a multiple criteria decision making optimization model to explore the problem with the incorporation of “absolute risk averse” measures. The additive multi-attribute utility approach is adopted to estimate risk aversion. A real Spanish case study is reported and show the risk averse preferences of Spanish farmers. Eskandarzadeh and Eshghi (2013) study conditional value-at-risk (CVaR) based risk analysis in discrete scenario situation. The authors explore from the decision tree perspective how decision making under risk aversion can be modelled and implemented. Disruptions, such as the ones brought by machine breakdown (Shi et al., 2014), are a major hurdle to economic sustainability. Ray and Jenamani (2016) conduct risk analysis via the “mean–variance” approach for purchasing problems in the presence of disruptions. The authors model a supply chain with a risk-averse retailer sourcing from several unreliable suppliers. They model the problem by the newsvendor model. The authors identify the Pareto non-inferior efficient frontier. They derive an algorithm which can yield the optimal solution in a tractable manner. Cai et al. (2019) analytically explore the optimal warranty and pricing decisions in supply chains with risk averse consideration. Guo and Liu (2020) investigate the impacts of different risk preferences for mass customization operations.

Observe that to model risk sensitivity, various approaches can be adopted. For example, in the literature, risk sensitivity has been quantified by using the coherent risk measure (Choi & RuszczyńSki, 2008) mean–variance approach (Chiu et al., 2018; Choi 2002; Xue et al., 2016), mean standard-deviation approach (Choi, 2020a; He et al., 2017), mean downside-risk (Choi and Chiu 2012b), conditional value at risk (CVaR) (Gao et al., 2017; He et al., 2017; Strub et al., 2019), value at risk (VaR) (Cui et al., 2018; Sun et al., 2020a), mean–variance-skewness-kurtosis (Zhang et al., 2020b), etc. Note that another related issue is on time consistency (Shapiro, 2009) and time inconsistency (Cui et al., 2012). In a multi-period decision making problem, time inconsistency is usually related to, e.g., “a need for immediate satisfaction” (or the so called “present bias”). Many decision makers exhibit the present-biased features and would put heavier weight on the decision which brings higher utility at the present.

Key research issues: despite being intuitive, conducting RAO for business operations with the considerations of risk sensitivity is in fact challenging in the real world. One critical issue is: How to estimate the risk sensitivities of decision makers (e.g., operations managers)? Is the risk sensitivity of a decision maker stable? How do we know? Considering time inconsistency, how to measure the discount factor related to the present bias?

2.2 Use of information

Information is crucial for business operations. Traditionally, if we regard a supply chain system as river, we have product flow, information flow and capital flow in both forward and reverse directions. Nowadays, information is not just one of the three flows, it is essentially the lifeblood of modern supply chains.

The use of information can enhance the implementation of many strategies in business operations. For example, the well-established quick response program (Choi et al., 2003; Li et al., 2020; Zhang et al., 2020a) is the cornerstone operations strategy to improve supply chain operations via shortening lead times. In data-driven operations, such as the one using big data analytics (Choi & Lambert, 2017; Guha & Kumar, 2018), the use of real time information is even more critical.

In OR, Bayesian decision analysis is one important theory which helps decision makers to make use of information to improve decision making. In the context of a decision tree and based on conditional probability (i.e., the “Bayes Rule”), Bayesian decision analysis helps us estimate the (expected) value of information (including the expected value of perfect information). See (2) for a standard formula for the Bayes’ rule (X and Y are random variables which can be discrete or continuous; Pr = Probability).

If X and Y are both continuous random variables with probability density functions \(f_{X} (x)\) and \(f_{Y} (y)\), and we add (I) and (II) to represent the types of distributions for \(f_{X} (x)\) and \(f_{Y|X = x} (y)\), respectively. For instance, “I” can denote the Normal distribution, and “II” in general can be another type of distribution. Using Bayes’ rule, we have (3).

In (3), if we take \(f_{X} (x)\) as the prior distribution, then \(f_{Y|X = x} (y)\) is called the likelihood function and \(f_{X|Y = y} (x)\) is known as the posterior distribution. When the posterior distribution belongs to the same type of distribution as the prior distribution [i.e., Type I is the same as Type II in (3)], we call them Bayesian conjugate distributions or Bayesian conjugate pairs. The prior distribution is commonly called the conjugate prior for the likelihood function. A well-known example for Bayesian conjugate distribution is the Normal distribution with an unknown mean and known variance (see, e.g., Choi et al., 2003). Note that Bayesian conjugate pairs need not rely on the fact that both X and Y are continuously. For example, in the Bernoulli process with Beta prior distribution, the process (and observation) is discrete and the posterior distribution is also Beta.

Obviously, with more information, decision makers can enhance the quality of their decisions using the Bayesian approach. However, there are challenges as indicated below. In the literature, Bigün (1995) empirically evaluates risk for aeroplane accidents with the use of expert advice. The author adopts the Bayesian approach to conduct the risk analysis. They also introduce different methods to help determine the errors in risk assessment. Roponen et al. (2020) examines “adversarial risk analysis” from the perspective of stochastic dominance and partial incomplete information. The authors present a military management problem to support their proposals.

Key research issues: information updating under Bayesian decision analysis requires high quality of data. An efficient and effective data acquisition and processing system hence becomes essential. However, this cannot be taken for granted.

2.3 Solving the “unsolvable” RAO problems

Compared to optimization problems without considering risk, RAO problems are in general more complex because we need to “consider more” (e.g., multiple objectives (Li & Haimes, 1987)). For example, in multi-period business investment problems, if we do not consider risk, the analysis will be much simpler than the case when we consider risk with the incorporation of risk measures into the optimization problem. This raises one challenge in dynamic programming: non-separable features.

To show the point, let’s consider the multiple-period mean–variance optimization problems which can be an investment problem such as Li and Ng (2000) or an inventory problem like Choi et al. (2011). In these problems, the optimization problem aims to maximize an objective function including both mean and variance of the total payoff in a multiple-period setting. Now, the key challenge is, when we want to solve the above problems using dynamic programming, we must first ensure the problems are well-structured and separable. However, “variance” is a non-separableFootnote 1 measure and hence we cannot solve the above posed RAO problems using dynamic programming directly.

As a solution, Li and Ng (2000) propose the primal–dual approach. The idea is to solve the problem indirectly by solving a “mirror image” problem. The approach starts by first developing an auxiliary problem of the original problem (called “primal problem”) which is separable in the sense of dynamic programming. Then, establish the conditions in which the solution of the auxiliary problem and the solution of the primal problem converge. Once the conditions are found, the primal problem can be solved by first solving the auxiliary problem and then mapping the auxiliary problem’s solution back to the primal problem. Choi et al. (2011) apply a similar approach in exploring a multi-period inventory control problem.

For example, let’s take Choi et al. (2011) as an example. The authors consider a n-period inventory control policy in which a firm needs to decide the ordering quantity for every period \(i = 0,1,...,n - 1\). We represent \(E[ \cdot ]\) and \(V[ \cdot ]\) as the expectation and variance operators, respectively. For \(i = 0,1,...,n - 1\), we denote the quantity by \(Q_{i}\) and profit at period \(i\) by \(\pi_{i}\). The original problem is denoted as Problem (PR) as follows [P.S.: PR denotes primal] where \(\lambda_{n} > 0\) reflects the firm’s degree of risk aversion over the n-period horizon (which is similar to the risk sensitivity coefficient in (1) but here we focus on the risk averse case and the coefficient is set for the total profit over n periods):

where \(\Pi_{n - 1} = \sum_{i = 0}^{n - 1} {\pi_{i} }\).

Obviously, the presence of \(V[\Pi_{n - 1} ]\) makes Problem (PR) non-separable and hence we cannot solve this problem directly using dynamic programming. In Choi et al. (2011), the authors attempt to solve this problem by building an “auxiliary problem” called Problem (AU) which can be solved:

The authors establish then the analytical conditions governing the parameter \(\phi_{n}\) so that the optimal dynamic policy for Problem (AU) will become the optimal policy for Problem (PR). For more details behind the variance minimization problems, please refer to Li et al. (2002) and Choi et al. (2011).

Similar to the challenges mentioned above for having the non-separable multi-period RAO problems, many RAO problems are non-convex. Non-convex features make analytical explorations more difficult and naturally become a hurdle to many scientific studies and investigations. Fortunately, in the literature, there are suggested solutions to deal with this non-convex problem. The core insight of this stream of literature [see, e.g., Wu et al. (2007)] is that, many seemingly non-convex problems can be transformed into convex problems by some properly set transformations. Once the convex counterpart is found, we can solve the “non-convex” problem via first solving the transformed convex problem and then determine the solution for the original problem by a proper mapping.

Note that in the literature of RAO, there are also some advances of methodologies. For example, Johnson (1998) analytically studies how to determine the mean and variance from the 3-point distribution of a random variable. The findings are very helpful for conducting risk analysis. Johnson (2002) proposes a methodology of using triangular approximation scheme for risk analysis. They show that the use of a “Pearson–Tukey mean approximation” scheme can yield very accurate estimation for the underlying distribution. Van Dorp (2005) constructs a statistical based model with the use of expert judgment and inputs. The author argues that the joint distribution may be useful in risk analyses for random variables with a well-bounded support. Bier and Gutfraind (2019) innovatively create a new index, called defensibility, to conduct risk analysis for systems. The authors call a system as highly defensible if a relatively modest investment would yield a relatively significant reduction of damages from a systems disruption. The authors show the factors, including threat’s nature and defender’s asset valuation, which affect the systems defensibility.

Key research issues: the primal–dual approach is powerful and important to overcome many RAO problems which appear to be “unsolvable”. However, the conditions governing the equivalence of primal–dual solutions are challenging to find. The same complexity issue appears for non-convex problems. The estimation of risk-related modeling parameters (e.g., the risk tolerance thresholds) in a multi-period setting is less straightforward compared to the single-period counterpart.

2.4 Financial problems in operations

In business operations, managers need to face many RAO problems. For example, in supply chain operations, consider the case when an upstream manufacturer offers a supply contract to the downstream retailer who reacts by determining the ordering quantity. If the manufacturer and retailer care about profit risk, then how would this behavior affect the optimal contract setting and ordering decisions as well as performances of the supply chain and its members (i.e., manufacturer and retailer)? In other words, if the manufacturer and retailer are risk averse towards profit, what is the optimal contracting mechanism? In the literature, Pareto optimality (P.S.: a theory from group decision making in economics) is commonly viewed as the most proper way to define the optimal supply chain in which the contracting game players are risk averse. By exploring Pareto optimality, the findings are obtained. In the literature. Niu et al. (2016) study in the context of supply chain management with the considerations of risk. The authors comment on how channel structure plays a role. Zhao et al. (2017) apply the mean-risk approach to study the performance of a pure wholesale pricing contract in supply chains. The authors consider the case when price is a decision.

Another problem is about getting financed for operations. A consideration can be, e.g., whether financing from banks is a wise decision. Choi (2020b) studies the financing model for new product development under the traditional banking model in which the bank is risk averse. The author uses the mean-risk approach in formulating the RAO problem. Other related recent studies in OR include Choi (2020a), Saha et al. (2020), Shen et al. (2020), Yuan et al. (2020), etc.

In addition, in finance, lots of RAO problems have been reported in the literature. For instance, Pietrabissa (1987) report a mixed method approach for risk analysis of banks’ lending operations in different countries. Doumpos et al. (2002) explore the assessment of credit risk via the multi-criteria decision making approach. Using loan data from a bank in Greece, the authors explore their proposed multigroup hierarchical discrimination (MHD) method. They conduct a computational comparison to highlight the performance of using the MHD method compared to other conventional methods. Semper and Clemente (2003) estimate the value-at-risk (VaR) through the “autoregressive conditional heteroskedastic” (ARCH) factor method. The authors apply the proposed method for portfolio management in the exchange market. Mari and Renò (2005) report a case study on mortgage risk analysis in Italy. The authors build an “affine-reduced” model to examine the credit risk associated with mortgage. Im et al. (2012) investigate a “time-dependent proportional hazards survival (TDPHS)” model which is helpful for conducting credit risk analysis. The authors also establish a maximum likelihood algorithm to help fit the TDPHS model. Borgonovo and Gatti (2013) explore default risk of contractual terms called “covenants”. The authors establish a simulation based framework which helps model “technical and material breaches (TMBs)” for the lenders. They prove that TMBs have a proven effect on the distribution of “net present value. Cillo and Delquié (2014) investigate the mean-risk analytical models by using the “disappointment theory with multiple reference points”. The authors theoretically derive the if and only if conditions under which the mean-risk model is a “convex risk measure”. They argue that their proposed model outperforms other traditional models such as expected utility model and mean–variance model. They support their arguments using a portfolio optimization problem. Simper et al. (2017) reports a case study on bank risk analysis in South Korea. Tsai and Wang (2017) study financial risk using soft text-based information in financial documents and reports. The authors adopt the regression method and ranking method for conducting the experimental analyses. They uncover the relationships between finance related risk and some specific texts. Shanker and Satir (2019) investigate how “foreign exchange risk” can be reduced by the proper setting of supply chain contract. Gupta et al. (2020) create a “balance sheet network (BSN)” model to examine the systemic risk in banks. The authors apply a simulation based tool to highlight the interconnectedness of the banking system. Bakoben et al. (2020) propose how cluster analysis can be applied for risk management in credit cards. The authors model the account behavior and show that their proposed approach has very promising performance. Sorkhi and Paradi (2020) adopt the Bayesian approach for estimating short-term risk of initial public offering of equity securities. The authors show that the proposed risk analysis approach is effective via a retrospective test.

Key research issues: in supply chain operations with risk averse agents, does Pareto optimality always exist when the contracting mechanism can take any form? If yes, how to determine it? If no, how to find the optimal supply chain contracting mechanism? For financing models, if the traditional bank model does not work, are there any other alternatives?

2.5 Systems theory

If we look at business operations as systems, then systems theory (Li, 1993; Li & Haimes, 1992) applies. Among many principles and philosophies, systems theory commonly advises us to make a globally optimal decision by taking the systems perspective. Here, the systems perspective means we holistically look at all relevant parties and performance measures when we decide the optimal decision. In supply chain management, the systems theory advises us to consider all members of the supply chain system when making the optimal decisions.

In the literature, various studies are reported to talk about systems risk analyses. For example, González-Ortega et al. (2019) make use of the “bi-agent influence diagram” to analyze adversarial risk. The authors establish a systematic procedural approach and demonstrate its applications with a protection problem for infrastructures.

In industrial systems, RAO is also widely explored in different sectors. For example, in logistics related industries, Von Lanzenauer et al. (1992) report a risk analysis for natural gas supply problems. The authors conduct a case study using day from Canada and explore the respective optimal policies in facility planning and inventory stocking problems. Erkut and Ingolfsson (2005) explore the transportation problem for dangerous materials. The authors reexamine various risk analysis models. Fan et al. (2015) analytically conduct risk analysis for port operations with container logistics. The authors build a network flow model and derive the stochastic distribution of container shipments from the American market. In terms of applications, the authors argue that the stochastic distributions of container shipments are important for decision making in port operations. Cano et al. (2016) investigate the proper protection and risk management schemes for airport operations. Govindan and Chaudhuri (2016) explore risks of 3PL (“third party logistics”) service providers by using the “DEMATEL” approach. Fattahi et al. (2017) examine the optimal resilient network planning problem facing disruptions. The authors explore the case when customers are sensitive to the time of delivery. Lim et al. (2018) propose novel models and solutions schemes for solving risk analysis problems in maritime logistics. The authors report a literature review of lots of papers related to safety risk in maritime. Bruni et al. (2020) derive a heuristic algorithm to solve the “k-traveling repairman problem”. The authors incorporate risk averse attitude into the optimization problem. Song et al. (2020) explore “schedule risk analysis” for project management. The idea is to identify a group of activities which are highly sensitive to the actions and then focus on them. This will improve outcomes of the project. The novelty of this study is to incorporate constraints of resources into the analysis and the deployment of a new metric. Most recently, Sun et al., (2020b) conduct a risk analysis for crew scheduling problems in aviation. In software and high tech industries, Clark and Chapman (1987) report a real case on conducting risk analysis for software product development. Techniques such as the “common interval and memory” approach are applied. Bennett et al. (1996) investigate the analytical methods for conducting risk analysis of software systems development. The focal point is on software safety assessment and ways to uncover faults in software development. Tavares and da Silva (2019) report an OR study on risk analysis for software development projects. Sodhi and Lee (2007) investigate the global supply chain risk management problem for the “consumer electronics” industry. They use Samsung as an example to demonstrate their points. RAO is also relevant to industries such as healthcare, energy and construction. For instance, in the context of healthcare, Fu et al. (2012) report an empirical based two-stage statistical model for risk analysis for studying “chronic disease progression (CDP)”. They establish a regression model and reveal that the delayed diagnosis phenomenon should be considered in conducting the respective risk analysis of CDP and conducting related risk analysis. In the energy sector, Hämäläinen and Karjalainen (1992) study the applications of decision analyses for risk management. The authors report a case study based on the Government of Finland. Çavuş et al. (2021) explore the hydro-power based energy operations. The authors highlight the impacts of having the risk-averse preference in the optimization model. In construction and building, Taroun and Yang (2013) propose the use of Dempster–Shafer Theory of Evidence’s approach for risk analysis for construction industrial projects. The authors examine the use of spreadsheet to establish an application for implementing the model.

There are some challenges. First, if the system (e.g., a certain industrial system) is huge and very complex, such as the case with a system of systems, it will be impossible to make the globally optimal decision. Then, what can be done? Second, even if a globally optimal decision can be found, do we have access to the information to support the corresponding decision making process?

In systems engineering, Choi et al. (2019a) propose the use of system of systems management principles to establish sustainable operations for global supply chains in the fashion apparel industry. The authors analytically quantify the values of these principles by using Bayesian information updating models. They also propose a managerial framework and an action matrix to guide the decision making of operations managers.

Key research issues: to establish the globally optimal business operations system, systems transparency is critical. How to make sure high quality information is available for decision makers is a big challenge. For complex systems, how to enhance coordinationFootnote 2 is another critical issue to address.

A summary of key research issues of all the above examined topics is shown in Table 2. Some related studies are also listed.

3 Blockchain technology

In Sect. 1, we briefly mention the features of BcT. In this section, we elaborate further on many features of BcT.

3.1 Data and systems security under decentralized control

BcT based systems are decentralized, distributed and well supported by carefully designed consensus algorithms which ensure Sybil protection, adversary tolerance and denial of service (DoS) resistance. This relates to the original application of BcT which is for bitcoins. Even though a few attack cases and security threats happened in the past, BcT systems can in principle be regarded as very secure ones. This is especially true for the systems supporting common day-to-day business operations and the respective transactions. Since it is distributed and decentralized, its data will not be fabricated by any single individual (i.e., in big contrast if we look at the centralized system in which the controller can control everything).

3.2 Permanent data

BcT has the features of keeping permanent data. In principle, once the data records are established by having the blocks added to the blockchain, the block is permanently there. Any change will require the consent of all related stakeholders in the distributed ledger. Thus, like the case of a public blockchain, the data records are commonly viewed as permanent. As a consequence, everybody can view the data associated with all transactions. This feature helps to foster trust in business transactions and avoid cheating problems (see Cai et al., 2020).

3.3 Systems traceability, visibility and data quality (STVDQ)

One way to foster trust for supporting cryptocurrency like bitcoins is to ensure visibility, transparency and traceability (VTT). As a core technology for bitcoins, blockchain systems by default have all the needed functions to enhance supply chain VTT. This is achieved by the fact that the blockchain’s state and each interaction among participating parties, can be checked and verified (by the authorized parties). This becomes crucial for real-world applications. For example, in the food industry, BcT has been used by companies like Amazon and IBM for enhancing origin information disclosure for food products. The same function is important for drugs and fashion (Choi et al., 2020a). In the diamond industry, Everledger platform provides full product provenance information of each certified diamond (Choi, 2019). Since the BcT supported systems are traceable and transparent, data retrieved from them are also of higher quality (Choi & Luo, 2019). This is crucial for business operations. In short, BcT facilities data storage and ensures data authenticity. This is supported by its rule in which public key cryptography is deployed for each transaction.

3.4 Smart contracting

Contracting between sellers and buyers is always a pertinent issue in business operations (Dutta et al., 2020). Traditional contracting mechanisms are usually slow and involve lots of human factors (e.g., politics, bargaining power, and deliberate delay and tricks, etc.) To overcome these problems from happening, smart contracting emerges. Smart contracting is in fact a small computer application program which operates on a BcT based platform. The contract agreements and execution plans are all programmed in the smart contract. Once the corresponding case or situation appears, the smart contract will automatically operate and the agreed terms will be executed. This speeds up many business procedures. Since it is a BcT based application, the details of transactions are traceable and transparent. Smart contracting also helps to avoid arguments and conflicts, which usually happen in traditional contracting, between the business partners.

3.5 Platforms for financial applications (FAs)

BcT was established initially for bitcoins. Since then, it has continued to be used in finance related areas. For example, it is basically the core technology for virtual currencies. It is also used in projects under initial coin offerings (ICOs) (Chod et al., 2020; Choi, 2020a, b). ICOs can be regarded as a scheme for crowd funding. By issuing tokens, the firms can get financial support. Investors who have the tokens can enjoy some services (e.g., the priority of using the platforms established by the firms). They may also make a benefit when the tokens’ values go up in the market.

Based on the above discussions, Table 3 shows a summary of the core functions and related details of BcT. Note that the points in Table 3 are “digested” based on the points raised above (and hence not exactly the same as the paragraph headings).

4 What blockchain technology can help?

4.1 The six-step OR approach

From Sect. 1.2, we can see that there are six steps involved in a standard OR project. Many important remarks associated with each step are also presented. In the following, we discuss how the functions of blockchain can be applied to these steps.

-

Step 1. Problem definition: this step requires the collection and utilization of data. BcT helps a lot by providing verifiable and permanent data to assist the proper problem definition of the real-world problem. BcT also enhances systems traceability and hence it is easier for the OR project team to see through the whole company’s operational challenges and define the right problem.

-

Step 2. Analytical modeling: since BcT can provide high quality data, it helps tremendously with the estimations of model parameters.

-

Step 3. Deriving the solution: to obtain the optimal decision, we need the availability of accurate data. BcT helps a lot in this regard. Moreover, BcT in general offers a computing platform to develop the business analytics tool which is also secure if the BcT consensus algorithms are well-constructed (Du et al., 2017).

-

Step 4. Model testing and refinement: testing the model and revising it requires data and a way to keep track of testing history. The functions of BcT fit this need and help much. In addition, as BcT keeps a permanent record of the testing results, they can always be available for the reference of the OR project team in the long run for model refinement.

-

Step 5. Preparing for the application: BcT provides the ideal platform for disseminating the “know-how” of the business analytics tool. It can also provide all the needed information to the related stakeholders in the company for their reference in a transparent way. The activities involved in Step 5 are also well-recorded in the blockchain so that future references can be made.

-

Step 6. Implementation: BcT provides the ideal platform for implementing the derived business analytics tool as it is secure and helps keep high quality and permanent data by its nature. As it is important to provide the performance based incentive to users and managers, BcT can help provide trust to them in making sure all their performances are permanently recorded in the system and calculations can be verified. Moreover, the company can even implement smart contracts to automatically grant the users and managers the performance based incentive.

From the above discussion, we can clearly see how BcT can be applied in the six-step OR approach. Table 4 shows a summary of what BcT can help in the six-step OR approach. In the following sub-section, we further discuss how BcT can help in the RAO related topics and the corresponding key research issues.

4.2 Topics and key research issues

From the discussion in Sect. 4.1, we can clearly see that BcT is helpful in the general six-step OR approach. Now, focusing on RAO related topics, we propose what BcT can help. To better illustrate the points, we use the classic newsvendor problem as an example. Note that the newsvendor problem is a cornerstone inventory problem for many important operations problems and it has been widely used in the OR literature over the past decades.

4.2.1 Risk sensitivity

For the issue on how risk sensitivities of decision makers (e.g., operations managers) can be estimated, we first need to have a good tool to store and provide high quality data. BcT hence provides the needed help in offering a permanent data record which allows for checking and auditing. As such, the corresponding data (e.g., covering historical business transactions from smart contracts) can be regarded as high quality. Using the data from BcT supported systems provides the ground for estimating risk sensitivities of decision makers in the related business operations. If we refer to (1), the use of BcT can help to better estimate the distribution for the random profit (i.e., \(\pi\)). Moreover, it can also help to more accurately find the risk sensitivity coefficient (i.e., \(\lambda\)). Note that in practice, the risk sensitivities of decision makers can be stochastic (see Choi et al., 2018b). If this uncertainty is inherent (i.e., cannot be reduced), blockchain can help to reduce the other sources of uncertainties which can be termed as noises (e.g., in the data collected). As a result, the stochastic nature and randomness associated with the decision maker’s risk sensitivity can be more accurately estimated using blockchain.

In the literature, Choi et al. (2020b) analytically highlight how using BcT to estimate risk sensitivities of customers can help improve on-demand platform operations. Note that the risk sensitivities of decision makers need not be stable. Having high quality data can further help measure the stochastic risk sensitivity associated with the decision makers [P.S.: see Choi et al., (2018b) for the impacts brought by stochastic risk sensitivity on quick response programs in supply chains]. This also applies for the estimation of the discount factor related to the present bias under the modeling analysis with time inconsistency considerations (Cui et al., 2012; Strub & Li, 2020).

In the newsvendor problem, the use of blockchain can help estimate the demand distribution as well as the value of \(\lambda\) more accurately. Directly putting the estimated results into (1) will yield the result. Of course, using blockchain is not free and hence a unit operations cost and a fixed cost should be added to the newsvendor problem.

4.2.2 Bayesian information updating

Using data (e.g., market demand observations) to enhance our knowledge base is important for risk analysis. We have discussed in the above section the importance of Bayesian analysis. In the operations literature, it is commonly assumed that the information updating process is perfect and the market observations are accurate. However, this is far from true because there are lots of noises and even bugs during the data acquisition and storage process. This is why management information systems (MIS) auditing, which includes data cleansing, is crucial. As BcT can bring in high quality of data (Choi & Luo, 2019), this directly facilitates the efficiency and effectiveness of data acquisition and processing. In the literature, Choi et al. (2019b) explore how BcT can be used to improve the use of information for conducting mean–variance analysis for aviation-logistics operations. The authors propose many models based on the Bayesian normal conjugate pairs theory (Choi et al. 2003).

For the newsvendor problem, Bayesian conjugate pair analyses (e.g., see Choi et al., 2003, 2004) can also be conducted. The use of blockchain can improve the observation process by dampening the noise from the samples. This will directly improve the expected value of information (EVI) that can be derived by Bayesian information updating.

4.2.3 Solving the “unsolvable” problems

In RAO, duality control (Li, 1999; Li et al., 2002; Zheng et al., 2010), which requires the establishment of an alternative optimization model and problem (called the dual problem), is a great idea to overcome many challenges such as non-separability and non-convexity of the given “unsolvable” primal problems. However, the analytical conditions governing the equivalence of primal–dual solutions are uneasy to find. For real-world industrial applications using the duality control theory, the basic requirements would be a computing platform which offers high quality data. Ideally, for the corresponding business operations, there is a high degree of transparency so that real time accurate data are available to provide the best estimate of the needed modeling parameters. BcT hence can help by: (i) being the needed computing platform and (ii) serving as the skeleton technology for the business operations so that operations visibility and transparency can be enhanced.

For the newsvendor problem, if we consider the situation in which the newsvendor operates in multiple periods (say “N” periods) and the optimization objective involves the minimization of the variance of profit over the N periods, then the proposed primal–dual solution methodology can be applied. See Choi et al. (2011) for the way how this can be done. For the use of blockchain, it helps to support the optimization algorithm by providing high quality data.

4.2.4 Functions in finance

As we have highlighted in Sect. 2, whether Pareto optimality always exists is a big issue for RAO of supply chain operations with risk averse members. In fact, Zhang et al. (2021) find that depending on objective functions of the risk averse supply chain members, Pareto optimality may or may not be found. For example, if the objective functions are given by mean–variance, mean-semi-variance, CVaR, VaR or exponential utility, then Pareto optimality exists. However, if the objective function is modelled by mean–variance-skewness-kurtosis (four moments), then we cannot guarantee the existence of Pareto optimality in all cases. The core reason is termed as the “contract-dependence” feature of Pareto optimality and highlighted by Zhang et al. (2021). As a solution, Zhang et al. (2021) propose an algorithm in which we can find the (near optimal) Pareto optimality in a finite set of contract candidates. BcT’s traceability features and smart contracting function can help decision makers to find the set of contract candidates, which facilitates the derivation of the Pareto optimality and optimal contracting mechanism.

Moreover, BcT supports ICOs. This is an important financing mode for business operations. In Choi (2020b), the author studies the financing problem for a new product development project. The author analytically compares between financing under BcT system supported ICOs and getting loan from a traditional risk averse bank. The author derives the conditions under which ICOs are preferred.

For the newsvendor problem, financing is a critical issue. Using blockchain with the features and functionalities mentioned above, similar analyses for the above proposed topics can be conducted. For example, it will be interesting to explore the ICO funding scheme for the newsvendor problem [see Choi (2020b) for the way to do so].

4.2.5 Systems transparency

To achieve the globally optimal solution for RAO problems in business operations, the systems theory is important. For small systems, it is in general easier to find the globally optimal solutions. However, for large scale complex systems such as systems of systems (SoSs), determining the globally optimal solution is basically very difficult or even impossible. In Choi et al. (2019a), the authors discuss how SoS management principles can help enhance sustainable supply chain operations. Choi (2018) explores how BDAs can be used to improve global supply chain management. In particular, from the perspectives of objective, control, SoS structure, uncertainty, and interfaces, the authors proposed how BDAs and ICT technologies can help. Among other proposals, improving supply chain visibility and providing the needed timely information are two important action plans for operations managers’ references. Since BcT can support other ICT (information and communication technology) tools and enhance communication. It is a tool to help in these aspects.

Systems transparency is critical for the newsvendor problem based supply chain. Information asymmetry commonly exists between the manufacturer and the retailer (i.e., newsvendor). To overcome this challenge, one can consider the use of blockchain as a way to achieve information symmetry. Many related benefits in the newsvendor supply chain can hence be explored.

Table 5 presents a concise summary of what BcT can help to support the implementation and applications of RAO models.

5 Conclusion

5.1 Concluding remarks

In OR, there are many recent developments including all kinds of theories in optimization (Li & Sun, 2006; Luo et al., 2020; Wu et al., 2019) and the use of technologies. In particular, in a global market full of uncertainties, business enterprises need to face all kinds of risks. To achieve economic sustainability, proper risk management and deployment of technologies, such as blockchain, are crucial.

In this paper, we have discussed the OR approach and reviewed some related literature for many important RAO problems. We have also examined some solution methods for RAO problems. After that, we have presented several functions of BcT which are evidenced to be very helpful to improve business operations. We have further proposed how BcT can be applied in the six-step OR approach as well as address the issues associated with the mentioned RAO problems. As a conclusion, we further establish a research framework for future research in the following.

5.2 Future research agenda and research framework

5.2.1 Theoretical research

First, in terms of theoretical studies, many topics deserve further explorations. For instance, for supply chain coordination with risk sensitive agents (including risk prone, risk averse and risk neutral), how stochastic risk sensitivities affect the design and coordination mechanism of supply chain systems is an important topic. How BcT may play a role deserves further explorations. For Bayesian information updating, considering both supply side and demand side information updating will be interesting, and how to quantify the values of BcT in the respective business operations will be important. For the duality control theory, more studies on how it can be applied to operations management and OR problems should be conducted. How BcT can support them will also be a meaningful area to investigate. In terms of financial applications, ICOs are very important for technology related start-up projects but there are very limited studies in the operations literature (e.g., Chod et al., 2020; Choi, 2020b). If we conduct a google search, we will find lots of on-going ICO projects.Footnote 3 ICO is very timely and practical. As such, future studies should explore ICOs in more details. Finally, even though the SoS theory is well-established in systems engineering, it is not widely applied in business operations. More studies on the use of SoS theory should be conducted and the roles played by BcT should be deeply explored.

5.2.2 Applications and implementation

BcT is still a relatively new technology for business operations. Enterprises such as Chow Tai Fook Jewelry, LVMH, and Maersk have implemented (or are implementing) it in their business operations. Undoubtedly, using BcT in the real world is very challenging and involves a non-trivial level of risk by itself. Thus, further research should be conducted to examine the technology implementation process and challenges associated with BcT in the six-step OR approach. More real-world industrial cases should be examined with the use of scientifically sound methods.

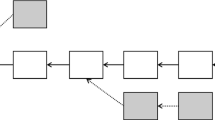

Based on the above discussions and proposed future research directions, Fig. 1 shows the research framework. The RAO topics, key research issues, functions of BcT and the solution and future research agenda are all shown in Fig. 1.

Notes

For non-separable problems, see Li and Haimes (1990) for an early important study.

In the literature, supply chain coordination commonly refers to the case when the supply chain is optimized under the respective gaming structure (Xu et al., 2015).

https://coinmarketcap.com/ico-calendar/ (accessed 19 July 2021).

References

Agrawal, V., & Seshadri, S. (2000). Risk intermediation in supply chains. IIE Transactions, 32, 819–831.

Bakoben, M., Bellotti, T., & Adams, N. (2020). Identification of credit risk based on cluster analysis of account behaviours. Journal of the Operational Research Society, 71(5), 775–783.

Bennett, J. C., Bohoris, G. A., Aspinwall, E. M., & Hall, R. C. (1996). Risk analysis techniques and their application to software development. European Journal of Operational Research, 95(3), 467–475.

Bier, V., & Gutfraind, A. (2019). Risk analysis beyond vulnerability and resilience–characterizing the defensibility of critical systems. European Journal of Operational Research, 276(2), 626–636.

Bigün, E. S. (1995). Risk analysis of catastrophes using experts’ judgements: An empirical study on risk analysis of major civil aircraft accidents in Europe. European Journal of Operational Research, 87(3), 599–612.

Borgonovo, E., Cappelli, V., Maccheroni, F., & Marinacci, M. (2018). Risk analysis and decision theory: A bridge. European Journal of Operational Research, 264(1), 280–293.

Borgonovo, E., & Gatti, S. (2013). Risk analysis with contractual default. Does covenant breach matter? European Journal of Operational Research, 230(2), 431–443.

Bruni, M. E., Beraldi, P., & Khodaparasti, S. (2020). A hybrid reactive GRASP heuristic for the risk-averse k-traveling repairman problem with profits. Computers & Operations Research, 115, 104854.

Cai, K., He, Z., Lou, Y., & He, S. (2019). Risk-aversion information in a supply chain with price and warranty competition. Annals of Operations Research (published online).

Cai, Y. J., Choi, T. M., & Zhang, J. (2020). Platform supported supply chain operations in the blockchain era: Supply contracting and moral hazards. Decision Sciences. https://doi.org/10.1111/deci.12475 Published online.

Cano, J., Insua, D. R., Tedeschi, A., & Turhan, U. (2016). Security economics: An adversarial risk analysis approach to airport protection. Annals of Operations Research, 245, 359–378.

Çavuş, Ö., Kocaman, A. S., & Yılmaz, Ö. (2021). A risk-averse approach for the planning of a hybrid energy system with conventional hydropower. Computers & Operations Research, 126, 105092.

Chapman, C. B., & Cooper, D. F. (1983). Risk analysis: Testing some prejudices. European Journal of Operational Research, 14(3), 238–247.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A technical review. Annals of Operations Research, 240, 489–507.

Chiu, C. H., Choi, T. M., Dai, X., Shen, B., & Zheng, J. H. (2018). Optimal advertising budget allocation in luxury fashion markets with social influences: A mean-variance analysis. Production and Operations Management, 27(8), 1611–1629.

Chiu, M. C., Wong, H. Y., & Li, D. (2012). Roy’s safety-first portfolio principle in financial risk management of disastrous events. Risk Analysis, 32(11), 1856–1872.

Chod, J., Trichakis, N., Tsoukalas, G., Aspegren, H., & Weber, M. (2020). On the financing benefits of supply chain transparency and blockchain adoption. Management Science. https://doi.org/10.1287/mnsc.2019.3434 Published online.

Choi, S., & RuszczyńSki, A. (2008). A risk-averse newsvendor with law invariant coherent measures of risk. Operations Research Letters, 36(1), 77–82.

Choi, T. M. (2002). Mean-variance analysis for supply chain management models. Doctoral Dissertation, The Chinese University of Hong Kong.

Choi, T. M. (2018). A system of systems approach for global supply chain management in the big data era. IEEE Engineering Management Review, 46(1), 91–97.

Choi, T. M. (2019). Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transportation Research Part E: Logistics and Transportation Review, 128, 17–29.

Choi, T. M. (2020a). Creating all-win by blockchain technology in supply chains: Impacts of agents’ risk attitudes towards cryptocurrency. Journal of the Operational Research Society (published online).

Choi, T. M. (2020b). Financing product development projects in the blockchain era: Initial coin offerings versus traditional bank loans. IEEE Transactions on Engineering Management (Published online).

Choi, T. M. (2021). Risk analysis in logistics systems: A research agenda during and after the COVID-19 pandemic. Transportation Research Part E: Logistics and Transportation Review, 145, 102190.

Choi, T. M., Cai, Y. J., & Shen, B. (2019a). Sustainable fashion supply chain management: A system of systems analysis. IEEE Transactions on Engineering Management, 66(4), 730–745.

Choi, T. M., Chiu, C. H., & Fu, P. (2011). Periodic review multiperiod inventory control under a mean–variance optimization objective. IEEE Transactions on Systems, Man and Cybernetics—Part A, 41(4), 678–682.

Choi, T. M., Feng, L., & Li, R. (2020a). Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. International Journal of Production Economics, 221, 107473.

Choi, T. M., Guo, S., Liu, N., & Shi, X. (2020b). Optimal pricing in on-demand-service-platform-operations with hired agents and risk-sensitive customers in the blockchain era. European Journal of Operational Research (Published online).

Choi, T. M., Kumar, S., Yue, X., & Chan, H. L. (2021). Disruptive technologies and operations management in the industry 4.0 era and beyond. Production and Operations Management. https://doi.org/10.1111/poms.13622.

Choi, T. M., & Lambert, J. H. (2017). Advances in risk analysis with big data. Risk Analysis, 37(8), 1435–1442.

Choi, T. M., Li, D., & Yan, H. (2003). Optimal two-stage ordering policy with Bayesian information updating. Journal of the Operational Research Society, 54(8), 846–859.

Choi, T. M., Li, D., & Yan, H. (2008). Mean–variance analysis of a single supplier and retailer supply chain under a returns policy. European Journal of Operational Research, 184(1), 356–376.

Choi, T. M., & Luo, S. (2019). Data quality challenges for sustainable fashion supply chain operations in emerging markets: Roles of blockchain, government sponsors and environment taxes. Transportation Research Part E: Logistics and Transportation Review, 131, 139–152.

Choi, T. M., Wallace, S. W., & Wang, Y. (2016). Risk management and coordination in service supply chains: Information, logistics and outsourcing. Journal of the Operational Research Society, 67(159–164), 2016.

Choi, T. M., Wallace, S. W., & Wang, Y. (2018a). Big data analytics in operations management. Production and Operations Management, 27(10), 1868–1883.

Choi, T. M., Wen, X., Sun, X., & Chung, S. H. (2019b). The mean-variance approach for global supply chain risk analysis with air logistics in the blockchain technology era. Transportation Research Part E: Logistics and Transportation Review, 127, 178–191.

Choi, T. M., Zhang, J., & Cheng, T. C. E. (2018b). Quick response in supply chains with stochastically risk sensitive retailers. Decision Sciences, 49(5), 932–957.

Cillo, A., & Delquié, P. (2014). Mean-risk analysis with enhanced behavioral content. European Journal of Operational Research, 239(3), 764–775.

Clark, P., & Chapman, C.B. (1987). The development of computer software for risk analysis: A decision support system development case study. European Journal of Operational Research, 29(3), 252–261.

Cui, X., Li, D., Wang, S., & Zhu, S. (2012). Better than dynamic mean-variance: Time inconsistency and free cash flow stream. Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics, 22(2), 346–378.

Cui, X., Sun, X., Zhu, S., Jiang, R., & Li, D. (2018). Portfolio optimization with nonparametric value at risk: A block coordinate descent method. INFORMS Journal on Computing, 30(3), 454–471.

Doumpos, M., Kosmidou, K., Baourakis, G., & Zopounidis, C. (2002). Credit risk assessment using a multicriteria hierarchical discrimination approach: A comparative analysis. European Journal of Operational Research, 138(2), 392–412.

Du, M., Ma, X., Zhang, Z., Wang, X., & Chen, Q. (2017). A review of consensus algorithm of blockchain. In IEEE International Conference on Systems, Man, and Cybernetics (SMC), Banff Center, Banff, Canada, October 5–8, 2017 (pp. 2567–2572).

DuHadway, S., Carnovale, S., & Hazen, B. (2019). Understanding risk management for intentional supply chain disruptions: Risk detection, risk mitigation, and risk recovery. Annals of Operations Research (Published online).

Dutta, P., Choi, T. M., Somani, S., & Butala, R. (2020). Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transportation Research Part E: Logistics and Transportation Review, 142, 102067.

Erkut, E., & Ingolfsson, A. (2005). Transport risk models for hazardous materials: Revisited. Operations Research Letters, 33(1), 81–89.

Eskandarzadeh, S., & Eshghi, K. (2013). Decision tree analysis for a risk averse decision maker: CVaR Criterion. European Journal of Operational Research, 231(1), 131–140.

Fan, L., Wilson, W. W., & Dahl, B. (2015). Risk analysis in port competition for containerized imports. European Journal of Operational Research, 245(3), 743–753.

Fattahi, M., & Govindan, K. (2018). A multi-stage stochastic program for the sustainable design of biofuel supply chain networks under biomass supply uncertainty and disruption risk: A real-life case study. Transportation Research Part E: Logistics and Transportation Review, 118, 534–567.

Fattahi, M., Govindan, K., & Farhadkhani, M. (2020). Sustainable supply chain planning for biomass-based power generation with environmental risk and supply uncertainty considerations: a real-life case study. International Journal of Production Research (Published online).

Fattahi, M., Govindan, K., & Keyvanshokooh, E. (2017). Responsive and resilient supply chain network design under operational and disruption risks with delivery lead-time sensitive customers. Transportation Research Part E: Logistics and Transportation Review, 101, 176–200.

Fu, B., Wang, W., & Shi, X. (2012). A risk analysis based on a two-stage delayed diagnosis regression model with application to chronic disease progression. European Journal of Operational Research, 218(3), 847–855.

Gao, J., Zhou, K., Li, D., & Cao, X. (2017). Dynamic mean-LPM and mean-CVaR portfolio optimization in continuous-time. SIAM Journal on Control and Optimization, 55(3), 1377–1397.

Gómez-Limón, J. A., Arriaza, M., & Riesgo, L. (2003). An MCDM analysis of agricultural risk aversion. European Journal of Operational Research, 151(3), 569–585.

González-Ortega, J., Insua, D. R., & Cano, J. (2019). Adversarial risk analysis for bi-agent influence diagrams: An algorithmic approach. European Journal of Operational Research, 273(3), 1085–1096.

Govindan, K., & Chaudhuri, A. (2016). Interrelationships of risks faced by third party logistics service providers: A DEMATEL based approach. Transportation Research Part E: Logistics and Transportation Review, 90, 177–195.

Govindan, K., & Jepsen, M. B. (2016). Supplier risk assessment based on trapezoidal intuitionistic fuzzy numbers and ELECTRE TRI-C: A case illustration involving service suppliers. Journal of the Operational Research Society, 67(2), 339–376.

Guha, S., & Kumar, S. (2018). Emergence of big data research in operations management, information systems, and healthcare: Past contributions and future roadmap. Production and Operations Management, 27(9), 1724–1735.

Guo, S., & Liu, N. (2020). Influences of supply chain finance on the mass customization program: Risk attitudes and cash flow shortage. International Transactions in Operational Research, 27(5), 2396–2421.

Gupta, A., Wang, R., & Lu, Y. (2020). Addressing systemic risk using contingent convertible debt—A network analysis. European Journal of Operational Research, 290(1), 263–277.

Haimes, Y. Y., & Li, D. (1991). A hierarchical-multiobjective framework for risk management. Automatica, 27(3), 579–584.

Haimes, Y. Y., Li, D., & Tulsiani, V. (1990). Multiobjective decision-tree analysis. Risk Analysis, 10(1), 111–127.

Hämäläinen, R. P., & Karjalainen, R. (1992). Decision support for risk analysis in energy policy. European Journal of Operational Research, 56(2), 172–183.

He, C. F., Li, D., & Chen, Y. Y. (2017). Stochastic control for optimal execution: Fast approximation solution scheme under nested mean-semi deviation and conditional value at risk. Journal of the Operations Research Society of China, 5(2), 161–176.

Hillier, F. S., & Liberman, G. J. (2004). Introduction to operations research (7th ed.). McGraw Hill.

Im, J. K., Apley, D. W., Qi, C., & Shan, X. (2012). A time-dependent proportional hazards survival model for credit risk analysis. Journal of the Operational Research Society, 63(3), 306–321.

Jiménez, I., Mora-Valencia, A., & Perote, J. (2020). Risk quantification and validation for Bitcoin. Operations Research Letters, 48(4), 534–541.

Johnson, D. (1998). The robustness of mean and variance approximations in risk analysis. Journal of the Operational Research Society, 49(3), 253–262.

Johnson, D. (2002). Triangular approximations for continuous random variables in risk analysis. Journal of the Operational Research Society, 53(4), 457–467.

Kuzminski, P., Eisele, J. S., Garber, N., Schwing, R., Haimes, Y. Y., Li, D., & Chowdhury, M. (1995). Improvement of highway safety I: Identification of causal factors through fault-tree modeling. Risk Analysis, 15(3), 293–312.

Lambert, J. H., Matalas, N. C., Ling, C. W., Haimes, Y. Y., & Li, D. (1994). Selection of probability distributions in characterizing risk of extreme events. Risk Analysis, 14(5), 731–742.

Li, D. (1993). Hierarchical control for large-scale systems with general multiple linear-quadratic structure. Automatica, 29(6), 1451–1461.

Li, D. (1999). Zero duality gap in integer programming: P-norm surrogate constraint method. Operations Research Letters, 25(2), 89–96.

Li, D., Dolezal, T., & Haimes, Y. Y. (1993). Capacity reliability of water distribution networks. Reliability Engineering & System Safety, 42(1), 29–38.

Li, D., & Haimes, Y. Y. (1987). The envelope approach for multiobjective optimization problems. IEEE Transactions on Systems, Man, and Cybernetics, 17(6), 1026–1038.

Li, D., & Haimes, Y. Y. (1990). New approach for nonseparable dynamic programming problems. Journal of Optimization Theory and Applications, 64(2), 311–330.

Li, D., & Haimes, Y. Y. (1992). A decomposition method for optimization of large-system reliability. IEEE Transactions on Reliability, 41(2), 183–188.

Li, D., & Ng, W. L. (2000). Optimal dynamic portfolio selection: Multiperiod mean-variance formulation. Mathematical Finance, 10(3), 387–406.

Li, D., Qian, F., & Fu, P. (2002). Variance minimization approach for a class of dual control problems. IEEE Transactions on Automatic Control, 47(12), 2010–2020.

Li, D., & Sun, X. (2006). Nonlinear integer programming. Springer.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2020). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management, 66(7–8), 958–988.

Lim, G. J., Cho, J., Bora, S., Biobaku, T., & Parsaei, H. (2018). Models and computational algorithms for maritime risk analysis: A review. Annals of Operations Research, 271, 765–786.

Luo, H., Ding, X., Peng, J., Jiang, R., & Li, D. (2020). Complexity results and effective algorithms for worst-case linear optimization under uncertainties. INFORMS Journal on Computing. https://doi.org/10.1287/ijoc.2019.0941 Published online.

Luo, S., Lin, X., & Zheng, Z. (2019). A novel CNN-DDPG based AI-trader: Performance and roles in business operations. Transportation Research Part E: Logistics and Transportation Review, 131, 68–79.

Mari, C., & Renò, R. (2005). Credit risk analysis of mortgage loans: An application to the Italian market. European Journal of Operational Research, 163(1), 83–93.

Moskowitz, H., & Bunn, D. (1987). Decision and risk analysis. European Journal of Operational Research, 28(3), 247–260.

Niu, B., Liu, L., & Wang, J. (2016). Sell through a local retailer or operate your own store? Channel structure and risk analysis. Journal of the Operational Research Society, 67(2), 325–338.

Pietrabissa, E. (1987). Management of banks’ international lending: Country risk analysis and country exposure measurement and control. European Journal of Operational Research, 30(1), 42–47.

Ray, P., & Jenamani, M. (2016). Mean-variance analysis of sourcing decision under disruption risk. European Journal of Operational Research, 250(2), 679–689.

Roponen, J., Insua, D. R., & Salo, A. (2020). Adversarial risk analysis under partial information. European Journal of Operational Research, 287(1), 306–316.

Saha, A. K., Paul, A., Azeem, A., & Paul, S. K. (2020). Mitigating partial-disruption risk: A joint facility location and inventory model considering customers’ preferences and the role of substitute products and backorder offers. Computers & Operations Research, 117, 104884.

Semper, J. D. C., & Clemente, I. M. (2003). Value at risk calculation through ARCH factor methodology: Proposal and comparative analysis. European Journal of Operational Research, 150(3), 516–528.

Shanker, L., & Satir, A. (2019). Managing foreign exchange risk with buyer–supplier contracts. Annals of Operations Research (Published online).

Shapiro, A. (2009). On a time consistency concept in risk averse multistage stochastic programming. Operations Research Letters, 37(3), 143–147.

Shen, B., Wang, X., Cao, Y., & Li, Q. (2020). Financing decisions in supply chains with a capital-constrained manufacturer: Competition and risk. International Transactions in Operational Research, 27(5), 2422–2448.

Shi, X., Shen, H., Wu, T., & Cheng, T. C. E. (2014). Production planning and pricing policy in a make-to-stock system with uncertain demand subject to machine breakdowns. European Journal of Operational Research, 238(1), 122–129.

Simper, R., Hall, M. J., Liu, W., Zelenyuk, V., & Zhou, Z. (2017). How relevant is the choice of risk management control variable to non-parametric bank profit efficiency analysis? The case of South Korean banks. Annals of Operations Research, 250, 105–127.

Sodhi, M. S., & Lee, S. (2007). An analysis of sources of risk in the consumer electronics industry. Journal of the Operational Research Society, 58(11), 1430–1439.

Song, J., Martens, A., & Vanhoucke, M. (2020). Using schedule risk analysis with resource constraints for project control. European Journal of Operational Research, 288(3), 736–752.

Sorkhi, S., & Paradi, J. C. (2020). Measuring short-term risk of initial public offering of equity securities: A hybrid bayesian and data-envelopment-analysis-based approach. Annals of Operations Research, 288, 733–753.

Sorrill, C. M. (1987). Risk analysis for large projects: Models, methods and cases. Journal of the Operational Research Society, 38(12), 1217–1217.

Strub, M. S., & Li, D. (2020). Failing to foresee the updating of the reference point leads to time-inconsistent investment. Operations Research, 68(1), 199–213.

Strub, M. S., Li, D., Cui, X., & Gao, J. (2019). Discrete-time mean-CVaR portfolio selection and time-consistency induced term structure of the CVaR. Journal of Economic Dynamics and Control, 108, 103751.

Sun, X., Chung, S. H., Choi, T. M., Sheu, J. B., & Ma, H. L. (2020a). Combating lead-time uncertainty in global supply chain’s shipment-assignment: Is it wise to be risk-averse? Transportation Research Part B: Methodological, 138, 406–434.

Sun, X., Chung, S. H., & Ma, H. L. (2020b). Operational risk in airline crew scheduling: Do features of flight delays matter? Decision Sciences, 51(6), 1455–1489.