Abstract

The increased environmental awareness of consumers has led supply chains (SC) to green their operations. To extract a higher portion from the expanded demand due to greening activities, SC parties may hide key information regarding their green activities. This paper investigates the channel coordination problem in a green SC consisting of a manufacturer who sells a green product through a retailer. Both parties may involve in greening operations to expand an environmental-aware market; however, the retailer is privy to the information about his green sales effort. The analysis of the first-best outcome characterizes the conditions for (i) hold-up problem under which the retailer benefits from free ride on the manufacturer's greening operations effort, (ii) commitment strategy from the retailer to cover for the market expansion due to the manufacturer’s underinvestment in greening operations, and (iii) synergy in greening efforts. We then solve for the optimal incentive contracts under asymmetric information. Our analysis suggests that the manufacturer can include her greening effort in the contract to work as an incentive-fee; the higher level of greening effort by the manufacturer incentivizes the retailer to increase his green sales effort. We also show that the wholesale price term works as a screening tool to avoid the low efficient retailer from mimicking the high efficient one. Finally, we show that information asymmetry reduces the social welfare in a green market; it leads to a higher market price and a lower greening effort level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Green Supply Chain Management (GSCM) has attracted rapidly increasing attention in recent years due to increasing pressures from governments, customers, regulators, and competitors (Li et al., 2020b). In general, GSCM seeks to integrate SC players' green activities, including procurement, production, delivery, marketing, and recycling. Engaging in GSCM is not only environmentally sound but also improves profitability by increased demand. Several surveys have confirmed that a considerable amount of customers take into account sustainability issues while purchasing products.Footnote 1 Also, recent studies indicate that several customers prefer to pay a higher amount for an environmentally-friendly product than a regular one (Raza & Govindaluri, 2019). Hence, the environmental awareness of customers plays a key role in GSCM as a crucial market-driven. Accordingly, each SC party tries to improve the customer’s green purchasing behavior. Typically, manufacturers design and produce green items to meet environmentally-conscious customers' demand, while retailers utilize green sales to promote green items in marketplaces. Walmart has formed the sustainability consortium aiming to address and enhance all three aspects of sustainability. This consortium includes retailers, manufacturers, suppliers, third-party companies, and all other SC members. All SC members are involved to ensure a sustainable collaboration network by proposing a sustainability assessment and reporting system for supply networks, innovative products, and retail channels.Footnote 2

Green sale is proved to be useful as it enables SCs to turn customers' green consciousness into actual purchasing behavior by environmental advertisement, using green materials, customer environmental education, etc. (Rahbar & Wahid, 2011). For example, emphasizing its new product's low energy consumption through green marketing, Philips could enhance its sales in the US by up to 12% (Hong & Guo, 2019). Furthermore, the well-known clothing manufacturer and retailer, Timberland, exploits sustainable retailing to introduce and promote its products. According to its director of business development, customers prefer their products most of the time because of their green element.Footnote 3

Despite the aforementioned benefits of sustainable development for SCs, firms usually encounter some problems that are inherent to green activities (Yuan et al., 2018). As greening the operations involves all members of the SC; therefore, the problems such as sharing greening costs, determining the optimal level of greening activities, level of cooperation, and transparency of sustainability information may arise in GSCM. Among the above obstacles, the transparency of environmental information tends to be a major problem in GSCM since contracting and coordinating seems impossible without the right amount of information. Note that environmental information is often a person’s information and firms are reluctant to disclose it to other SC partners. This is because SC actors are autonomous firms and seek to maximize their own profits (Choi et al., 2014). For example, the brand values of some well-known companies were negatively impacted because their suppliers refused to declare the release of emissions information. In this regard, well-known companies like Armani and Zara in the field of clothing, and Disney in the area of media faced the loss of reputation and profit because of their private green information (Vosooghidizaji et al., 2019). Nevertheless, the phenomenon of green private information is frequent in green SCs. For example, Volkswagen was accused of exaggerating the amount of emission reduction to receive more grants from the government (Kautish, 2016). To tackle this issue, firms use incentive and/or disincentive strategies to assure transparency of greening operations throughout the channel. Motivated by the above facts, the focus of this paper is to design green incentives in a decentralized SC in the presence of asymmetric information.

In a decentralized SC, each member aims to maximize its profit which results in a sub-optimal solution. The autonomous behavior of the SC members drives the entire SC out of optimality, which indicates the vital role of coordinated decision-making in SCs (Heydari et al., 2009). Various contracts are proposed to coordinate the channel (Cachon, 2003; Zhao et al., 2014; Guo et al., 2017). Applying these contracts requires that key information is symmetrically shared between channel parties—for example, production cost information, market demand information, the information regarding each member’s cost factors, etc. However, in the real world, firms are inclined to voluntarily reveal their private information (Hosseini-Motlagh et al., 2019; Shen et al., 2019, Liu et al., 2021). Therefore, the implementation of these contracts comes with its own challenges. To address this issue, a stream of research has been appeared to deal with asymmetric information scenarios. Under such scenarios, one SC member has private information that may affect the decisions taken by the other parties; hence it affects the profits of all members as well as the performance of the channel.

There is a big body of research that studied the channel coordination where the private information was defined on supplier’s production cost (Corbett & de Groote, 2000) or retailer’s demand information (Burnetas et al., 2007). A more recent research stream addressed the information asymmetry on topics such as collection effort level, default risk, lead time, and social responsibility costs (Shen et al., 2018). One of the fields in GSCM that, surprisingly, has not been extensively addressed in the literature is when the parties have private information about their greening efforts. Consideration of the green issues increases the complexity of coordination in the SCs. Combined with the information asymmetry, coordinating the channel in GSCM will be more complicated. Fortunately, a proper incentive contract can alleviate the effects of information imbalance in SCs and help SCs achieve better results.

In this paper, we study the coordination of a green dyadic SC with a manufacturer and a retailer who both invest to green their operations. An environmentally aware market is considered where consumers prefer green goods over non-green ones. Therefore, the demand is affected by the level of greening efforts. The environmental characteristics of the item are assessed by product greenness. A higher level of greenness requires more investment in production and marketing (Basiri & Heydari, 2017). In our model, the retailer possesses private information on her green sales effort level, which requires the manufacturer to design incentive-compatible menu of contracts. Our paper aims to address the following research questions:

-

What is the impact of information asymmetry on the manufacturer and retailer’s greening operations as well as the channel performance?

-

How can the manufacturer induce the desired level of green sales effort on the retailer?

-

What are the optimal levels of green efforts, pricing decisions, and green market demand under asymmetric information?

Addressing the above research questions, we build a Stackelberg game with a manufacturer (the leader) who offers a contract to the retailer (the follower). The contract terms are wholesale price and the manufacturer’s greening effort. The retailer then decides on his green sales effort and market price. The market size is realized, and each party collects its own profit. The analysis of the first-best outcome reveals that the parties use a commitment strategy to contribute to greening operations. Namely, if a SC member encounters a higher cost of greening operation, he may increase his greening effort level (to commit to greening operations) as long as the other SC member has a high-impact market expansion greening operation. By comparing the equilibrium characterization under symmetric and asymmetric information, we then extract some insights. First, our comparative analysis suggests that the whole channel is worse off under information asymmetry. This is aligned with the existing literature; the principal (i.e., manufacturer) trades off between channel efficiency (level of greening effort) and information rent (due to unobservability of the retailer’s green sales effort). Consequently, she may reduce the incentives (reduce the level of greening effort) to reduce the information rent collected by the low-type retailer. Second, the manufacturer includes her greening effort in the contract to work as an incentive; the higher level of greening effort by the manufacturer incentivizes the retailer to increase his green sales effort. Whereas, the wholesale price works as a screening tool to avoid a low-type retailer (who may exert a low level of green sales effort) from mimicking a high-type retailer. Specifically, in the equilibrium, the manufacturer exerts a higher level of greening effort when the retailer is of high type. This is to incentivize the high-type retailer to exert a higher level of green sales effort. However, to avoid the low-type retailer picking the contract designed for the high-type, the manufacturer charges a higher wholesale price for the high-type than that for the low-type.

The rest of the paper is organized as follows. A comprehensive literature review on channel coordination under asymmetric information, with a specific focus on GSCM, is reported in Sect. 2. We then present the problem description in Sect. 3. We analyze the problem and derive the equilibrium under symmetric and asymmetric information in Sects. 4 and 5, respectively. To extract managerial insights, we then build a comprehensive numerical study in Sect. 6. Extensions of the proposed model in terms of green sales effort function and greening cost function are presented in Sect. 7. Finally, Sect. 8 concludes the paper and presents the directions for future research avenues.

2 Literature review

To position our work in the body of literature, we categorize the related literature review into two parts. By merging our findings from these two categories, we identify the research gap.

2.1 Role of information in GSCM

As SCs move toward environmental sustainability, firms must extend their efforts to enhance environmental practices. A crucial aspect of GSCM is channel coordination, where coordinating the greening efforts of SC members is essential to promote sustainable core values. One of the well-known obstacles to achieve channel coordination is the lack of information transparency among SC parties. The literature in GSCM has hardly addressed the green SC coordination under different information settings. Our paper contributes to this research stream by exploring the impact of information asymmetry in GSCM. The effects of a carbon footprint tax on sourcing decisions are studied by Choi (2013). By designing incentive strategies, he showed that the information updating process can improve SC performance. Liu et al. (2016) illustrated the effects of cost information sharing on the manufacturer's market channel decision considering both direct and retail channels. Zhang et al. (2018) developed a Stackelberg game theory model to obtain a green product's optimal pricing and sustainability level. By comparing the non-information sharing and information sharing scenarios, they highlighted the undeniable role of information in green product channel coordination. Shen et al. (2018) conducted a holistic literature review of contracting with information considerations, highlighting the importance of information in SC contracting, considering information updating and information asymmetry. Kim and Kim (2017) investigated GSCM trends and firms' strategic decisions regarding sustainability in the apparel industry based on information disclosure. More recently, Li et al. (2020a) introduced information as an intangible resource of firms that can create a competitive advantage to implement GSCM, especially in innovative industries. Our paper differs from this research stream by modeling a green SC with both manufacturer and retailer contributing to the greening operations, where the manufacturer suffers from the lack of information about the retailer’s green sales effort.

2.2 Asymmetric information in green SCs

In practice, it is difficult to assume a SC in which the information is symmetrically distributed among parties (Kostamis & Duenyas, 2011). A growing body of research has been conducted asymmetric information models to cope with this problem. The majority of the research in this regard assumed cost and demand information asymmetry. Various cost factors have been considered as the asymmetric information, including production cost (Cakanyıldırım et al., 2012), holding cost (Kerkkamp et al., 2018), recycling cost (Yang et al., 2018b), social responsibility costs (Liu et al., 2019), retailing cost (Cao et al., 2013) and supply cost (Cachon & Zhang, 2006; Fang et al., 2014). One of the earliest studies in this area is Ha (2001), which considered the newsvendor problem where the buyer possesses private information about its marginal cost. Ha (2001) showed how the manufacturer trades off between channel efficiency loss and paying information rent to the buyer. More recently, Li et al. (2012) considered a SC with a buyer and a vendor and analyzed the impact of lead time on achieving coordination under the buyer's asymmetric cost information. Mobini et al. (2019) modeled a supplier's problem as the uninformed member of the SC, offering a set of contracts to the retailer who has private information about his cost and market demand. Other studies defined information asymmetry on market demand (e.g., Gümüş, 2014; Akan et al., 2011; Babich et al., 2012; Ma et al., 2018; Li et al., 2020d). Feng et al. (2015) analyzed asymmetric information on demand in a two-echelon SC consisting of a buyer and a seller. They examined the situation in which the buyer confidentially gains a demand signal which can be low or high. Then, the buyer can signal information through a bargaining game. Signaling theory is also applied by other researchers to explain two SC members' behaviors when they have different information levels. Based on signaling theory, one SC member analyzes the signals and situations in which the other member used them. Mavlanova et al. (2012) explored certain signals that e-commerce sellers apply to encourage online buying. They designed a three-dimensional framework to categorize website signals. Considering high- and low-quality type sellers, they concluded that high quality type ones are more willing to send expensive and difficult-to-verify signals compared to low-quality type sellers.

Other SC performance measures have recently been modeled as a source of information asymmetry in this research stream. This includes supplier’s capacity (Nazerzadeh & Perakis, 2016), profit sharing parameter (Giovanni, 2016), supply risks (Gan et al., 2004, 2009), supplier’s reliability (Yoon et al., 2019), disruption risk (Li et al., 2020c), and quality information (Li & Cao, 2021). Different from the above studies, holding private information in the context of green SCs may result in undesirable consequences due to its adverse impact on the environment and social welfare. Yang et al. (2018a) studied the design of consumers’ credit payment reward policy to encourage them to buy green products. They assume that the supplier is privy to the customer's credit level information. Their analysis indicates that incomplete information makes the supplier more conservative; leading to less greening efforts. Ma et al. (2017) addressed the contract design for a two-echelon SC where the manufacturer possesses information asymmetry on its corporate social responsibility (CSR) cost coefficient. They investigated the interaction between the CSR efforts and the marketing efforts under both wholesale price contract and two-part tariff contract. Yuan et al. (2018) studied a sustainable SC where a manufacturer possesses asymmetric information on carbon emissions. They proposed an incentive contract, offered by the retailer, to induce the manufacturer to give the correct carbon emission information. Carbon reduction efficiency also was considered as private information by Wang and He (2018). In addition, several studies designed incentive contracts for the recycler to reveal its private collection effort level in closed-loop SCs (Yang et al., 2018b; Sane-Zerang et al., 2019). Recently, Chen and Li (2020) studied a principal-agent model using the spot-check mechanism to maximize a supplier's profit in an SC where the manufacturer has private information on the green product's cost information.

To identify the contribution of this paper to the related literature, we have summarized the specifications of the most relevant studies and compare them to our model in Table 1. Accordingly, one can verify the following contributions of this study:

-

1.

Although asymmetric information has been addressed in green SCs by researchers in recent years, none of them studied the case where the retailer holds private information about his green sales effort.

-

2.

To the best of our knowledge, our paper is the first to design incentive contracts in a decentralized channel where all members contribute to greening operations. We study how a coordination mechanism can be achieved.

-

3.

We contribute to incentive design in GSCM literature by exploring how effective is the principal’s (manufacturer’s) greening effort level as the incentive-fee in the contract to induce a desired level of green sales effort on the agent (retailer).

3 Problem description

A two-stage supply chain with a single manufacturer (referred to “she”) and a single retailer (referred to “he”) is analyzed in this study. The manufacturer sells the product through a retailing channel in a rational and green-sensitive market, which means that the customers are environmentally aware, and, therefore demand is sensitive to the green activities of the SC partners. Therefore, both members have motivation for greening their operations. The manufacturer determines the wholesale price to charge the retailer and her greening effort level, while the retailer decides the retail price and his green sales effort level.

We assume that the retailer chooses between low or high green sales efforts, which are not observable to the manufacturer. The manufacturer only has a prior belief about the retailer’s green sales efforts defined by \(\theta \in \left\{ {H, L} \right\}\). That is to say with probability \(\nu\) the retailer chooses a high level of green sales effort (hence he is of \(H\)-type) and with probability \(1 - \nu\) he chooses a low level of green sales effort (hence he is of \(L\)-type). The manufacturer, therefore, needs to design a menu of contracts to screen the retailer’s type. Two sets of constraints should be met: (i) it should guarantee the participation of the retailer, and (ii) it should prevent the retailer from giving false information about his effort level. The former requires Individual Rationality (IR) constraints, whereas the latter requires Incentive Compatibility (IC) constraints. The timing of events and decisions is presented in Fig. 1 and is explained in the following.

3.1 Contracting stage

In the beginning, the manufacturer, as the Stackelberg leader, designs and offers a menu of contracts: \(\left( {w_{\theta } ,\tau_{m\theta } } \right)_{{\theta \in \left\{ {H,L} \right\}}}\). The first term \(w_{\theta }\) is wholesale price, and the second term is the manufacturer’s greening effort level. Using the extended version of the revelation principle, because there are two types of retailers, the manufacturer needs at least two contract terms to be able to screen the retailer’s type (Myerson, 1982). Given the menu of contracts, the retailer decides whether to accept or reject the contract. If rejected, the retailer ends up to outside option, which is normalized to zero, and the game is terminated. Otherwise, since the menu of contracts is incentive compatible (Corbett et al., 2004), he picks a contract based on his type \(\theta\).

3.2 Green operations stage

The manufacturer decides on the level of greening effort \(\tau_{m\theta }\) and runs the production of the green product. She then sells the product to the retailer at the wholesale price \(w_{\theta }\)/unit. Next, the retailer decides on his green sales effort \(\tau_{r\theta }\) to promote the green product in the market and sells it at market price \(p_{\theta }\) to the final customer. We assumed that both the manufacturer’s and retailer’s costs due to green efforts are a quadratic function of their level of greening efforts. A similar cost structure has been used in literature (See Savaskan & Van Wassenhove, 2006 and the citations therein).

3.3 Demand realization stage

Given the manufacturer’s greening effort level \(\tau_{m\theta }\) and retailer’s green sales effort \(\tau_{r\theta }\), the market demandFootnote 4 is realized

where \(\gamma\) is the base market size, \(k\) is the price elasticity coefficient, \(\alpha_{m}\) is the demand elasticity to the manufacturer’s greening effort, and \(\alpha_{r}\) is demand elasticity to the retailer’s green sales effort. Note that the retailer is the follower of the game who observes the manufacturer’s greening effort level \(\tau_{m\theta }\) and then chooses his green sales level \(\tau_{r\theta }\) to maximize his own profit. Therefore, the retailer’s decision on green sales effort is affected by the manufacturer’s greening effort level. To incentivize the opportunistic retailer from exerting a low level of green sales effort and to make him truthfully reveal his level of green sales effort, the manufacturer includes her greening effort level as a screening tool.

Table 2 summarizes the list of parameters and decision variables.

4 Two benchmarks under full information scenario

To appreciate the role of information asymmetry, we first establish two benchmarks under full Information. First, we study the centralized regime under which the greening efforts would be decided by an integrated firm. We then study a decentralized regime in which the manufacturer, who decides on the greening effort, and the retailer, who decides on the green sales effort, play a sequential game under the full information scenario.

4.1 Centralized channel analysis

In this section, we analyze the problem in the context of complete information where the manufacturer and the retailer work together as an integrated firm and make greening decisions in a centralized fashion. Let index “C” indicate the centralized level of efforts made under such conditions. The integrated firm’s optimization problem is then to find the optimal level of greening investments in both the manufacturing \(\tau_{m}\) and retailing \(\tau_{r}\) levels as well as the retail price \(p\):

By applying backward induction and satisfying the first-order conditions, the optimal values of \(\tau_{r}\), \(\tau_{m}\), and \(p\) under the centralized scenario are characterized as presented in Proposition 1.

Proposition 1

In a centralized channel, the greening investments in manufacturing and retailing levels, and retail price are as follow:

Proof

See Appendix.

The solutions of the centralized setting are obtained by satisfying the first-order condition of the SC’s profit function. Since they allow the SC to derive its full potential, they would serve as a basis for our model comparisons under asymmetric information. Intuitively, from Proposition 1, the greening effort of both members are increasing in their respective demand elasticity (\(\alpha_{r}\) and \(\alpha_{m}\)), but decreasing in their greening cost coefficients (\(\beta_{r}\) and \(\beta_{m}\)). As we will show later, such intuitive results may not be always the case under the decentralized setting where SC parties may have conflict of interest, hence they need to take each other’s cost parameters into account when deciding on their greening effort levels.

4.2 Decentralized channel analysis

To better analyze and interpret the effect of the information asymmetry, in this section, we solve the benchmark under decentralized symmetric information scenario. Namely, we assume that the retailer’s green sales effort level is observable by the manufacturer. Let index “d” indicate the equilibrium under the decentralized condition. Given the two-term contract \(\left( {w,\tau_{m} } \right)\) offered by the manufacturer, in a similar way to Swami and Shah (2013), the retailer decides on the green sales effort \(\tau_{r}\) and the market price \(p\) to maximize his profit, which is given by:

We use backward induction to characterize the retailer’s best response in Lemma 1.

Lemma 1

Given \(\left( {w ,\tau_{m} } \right)\) offered by the manufacturer, the retailer’s optimal green sales effort \(\tau_{r}\) and the market price \(p\) are:

Proof

See Appendix.

The main takeaways from Lemma 1 are as follows. First, given the realized market demand, the retailer sets the market price to maximize his profit, i.e., \(p^{{\text{d}}}\) is the solution of the first-order-condition \(\partial {\Pi }_{r} /\partial {\text{p}} = 0\). One can also observe the double marginalization phenomenon; the consumer pays for the retailer’s marginal cost (i.e., wholesale price \(w\)) plus his marginal profit (i.e., \(\gamma + \alpha_{m} \tau_{m} + \alpha_{r} \tau_{r}^{{\text{d}}}\)). Second, the retailer’s green sales effort is always increasing in his demand elasticity factor \(\alpha_{r}\). This is expected because a higher demand elasticity means a bigger market if the retailer increases its green sales effort. With the assistance of Lemma 1, we can now formulate the manufacturer’s optimal contract design problem. The manufacturer decides on the greening effort \(\tau_{m}\) and wholesale price \(w\) to maximize her profit:

Proposition 2 characterizes the equilibrium under symmetric information scenario:

Proposition 2. Under the decentralized symmetric information scenario, the manufacturer’s and retailer’s greening operations levels, wholesale price, and retail price, are as follow:

Proof See Appendix.

From Proposition 2, we can study the impact of greening cost coefficients on each party’s level of greening operation. Corollary 1 indicates how the manufacturer adjusts her greening effort based on cost coefficients.

Corollary 1. The impacts of greening cost coefficients on each SC party’s greening operation are as follows:

-

Manufacturer’s greening effort \(\tau_{m}^{{\text{d}}}\) always decreases in the retailer’s greening cost coefficient \(\beta_{r}\) , and also the retailer’s green sales effort \(\tau_{r}^{{\text{d}}}\) always decreases in the manufacturer’s greening cost coefficient \(\beta_{m}\) ,

-

Manufacturer’s greening effort \(\tau_{m}^{{\text{d}}}\) increases in her greening cost coefficient \(\beta_{m}\) if \(\alpha_{r} \ge 2\sqrt {\beta_{r} }\) ,

-

Retailer’s green sales effort \(\tau_{r}^{{\text{d}}}\) increases in his greening cost coefficient \(\beta_{r}\) if \(\alpha_{m} \ge 2\sqrt {\beta_{m} }\) .

Proof See Appendix.

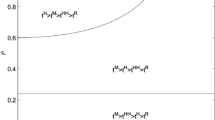

Corollary 1 reveals an interesting interaction between the level of greening operations, cost of greening operations, and consumer’s response to greening operations (measured by the demand elasticity). From the first part of Corollary 1, one can verify that when the retailer’s (resp. manufacturer’s) cost of greening activity \(\beta_{r}\) (resp. \(\beta_{m}\)) increases, the manufacturer (resp. retailer) reduces its level of greening effort \(\tau_{m\theta }^{{\text{d}}}\) (resp, \(\tau_{r\theta }^{{\text{d}}}\)). To extract insights from Corollary 1, we use Fig. 2, which studies the impact of demand elasticity and cost of greening operations on each party’s level of investment in greening operations. The second part of Corollary 1 helps to characterize the hold-up problem under which the retailer benefits from free ride on the manufacturer's efforts. This happens when the manufacturer’s investment in greening operations is not efficient (i.e., \(\alpha_{m} < \sqrt {2\beta_{m} }\)) but the retailer’s green sales effort is efficient (i.e., \(\alpha_{r} \ge \sqrt {2\beta_{r} }\)). This corresponds to region 3 in Fig. 2 where the manufacturer increases investment in greening operations (\(\tau_{m} \uparrow\)) while the retailer underinvests in green sales effort (\(\tau_{r} \downarrow\)).

The last part of Corollary 1 indicates that if manufacturer’s investment in greening operations is efficient (\(\alpha_{m} \ge 2\sqrt {\beta_{m} }\)) but expensive (i.e., \(\partial \tau_{m} /\partial \beta_{m} < 0\)), which may result in underinvestment in greening operations, then the retailer increases its investment in the green sales effort. This corresponds to region 2 in Fig. 2 where one can verify a tacit commitment from the retailer to cover for the market expansion due to the manufacturer’s underinvestment in greening operations. Finally, when greening operations are efficient for both parties (i.e., region 4) then one can observe that there is a synergy in the greening operations along the supply chain. Namely, even with the higher cost coefficients, the leader (manufacturer) increases investment on greening effort in order to incentivize the follower (retailer) to increase his contribution to market expansion.

5 Contracting under asymmetric information

In this section, we explore the scenario where the manufacturer cannot observe the green sales effort taken by the retailer. As discussed in the model formulation, the manufacturer has only a prior belief about the type of retailer; he exerts a high level of green sales effort (hence, he is of type \(H\)) with probability \(v \in \left[ {0,1} \right]\), or he exerts a low level of green sales effort (hence, he is of type \(L\)) with probability \(1 - v\). Consequently, the manufacturer needs to design a menu of contracts \(\left( {w_{\theta } ,\tau_{m\theta } } \right)_{{\theta \in \left\{ {H,L} \right\}}}\) to screen the retailer’s type. Therefore, by the revelation principle, the manufacturer can focus on a direct revelation mechanism (Ha, 2001). It means that the manufacturer should offer the retailer a menu such that the rational \(L\)-type retailer selects the contract \(L:\left( {w_{L} ,\tau_{mL} } \right)\), and the rational \(H\)-type retailer selects the contract \(H:\left( {w_{H} ,\tau_{mH} } \right)\).Footnote 5 The type of the retailer is determined based on his claim regarding his type. Note that, given the menu of contracts offered by the manufacturer, the \(\theta\)-type retailer picks contract \(\tilde{\theta }\) that maximizes his payoff:

where, term \(\beta_{r} \tau_{r\theta }^{2}\) is the retailer’s cost of the green sales effort. If the term designed for him is picked (i.e., \(\tilde{\theta } = \theta\)), she gets equilibrium payoff \(\Pi_{r} \left( \theta \right) \equiv \Pi_{r} \left( {\theta ,\tilde{\theta }} \right)\). The \(\theta\)-type retailer then decides on green sales effort and market price to maximize his profit:

Now, to design the optimal contract, the manufacturer must account for two types of retailer behaviors. First, the \(\theta\)-type retailer is individual rational; he will participate in the game and accepts the contract only if it is more profitable than his outside option, which is normalized to zero:

Second, the retailer is strategic; if possible, he seeks to advance his own interest; e.g., retailer-\(L\) may misreport, pretending to be retailer-\(H\) for higher profit. So, the manufacturer must ensure incentive compatibility; in equilibrium, it must be in the retailer’s best interest to self-select the contract term designed for him. In other words, the \(\theta\)-type retailer would select \(\theta\)-type contract since he gains a lower expected profit by choosing the \(\tilde{\theta }\)-type contract (\(\theta\), \(\tilde{\theta } \in\){\( H\),\( L\)},\( \theta \ne\) \(\tilde{\theta }\)). Thus, the retailer is induced to disclose his true private information type (Chiu et al., 2015; Yang et al., 2018a). This requires that truth-telling \(\tilde{\theta } = \theta\) must be the retailer’s best response:

The incentive compatibility constraint of the \(\theta\)-type retailer implies that the utility that he obtains by reporting his true type is higher than that if mimicking the \(\tilde{\theta }\)-type retailer. i.e.:

Note that the left-hand side of the Eq. (18) is the profit of the \(\theta\)-type retailer when he tells the truth, while the right-hand side corresponds to his profit when he lies and reports him as the \(\tilde{\theta }\)-type retailer.

Given the retailer’s type \(\theta\), the manufacturer’s profit can be written as follows:

where term \(\beta_{m} \tau_{m\theta }^{2}\) is the manufacturer’s cost of greening activities. When writing the contract, the manufacturer must account for all two behaviors. She solves the following contract design problem:

The developed contract design problem cannot be solved using the standard method of principal-agent models in the economics literature (Laffont & Martimort, 2009). This is because, in our model, both the principal (manufacturer) and the agent (retailer) decide on continuous variables in a sequential game. Note that, different from the symmetric information scenario, the contract design problem has additional incentive compatibility constraints (17). Therefore, we apply the Lagrangian relaxation method to find the optimal solutions. The method penalizes violations of inequality constraints (i.e., incentive compatibility and participation constraints) using the Lagrange multipliers, which imposes a cost on violations. These added costs are used instead of the strict inequality constraints in the optimization.

Proposition 3. Under asymmetric information, the optimal values for the manufacturer’s greening effort \(\tau_{m\theta }^{*}\) , wholesale price \(w_{\theta }^{*}\) , the retailer’s green sales effort \(\tau_{r\theta }^{*}\) , and market price \(p_{\theta }^{*}\) are characterized below and Table 3 .

Proof See Appendix.

Due to the complexity of the equilibrium under information asymmetry, we apply the equilibrium characterization in Proposition 3 through a comprehensive numerical study.

6 Numerical illustration

We now study the impact of information asymmetry on channel performance by comparing the equilibrium characterization in Propositions 1, 2, and 3. As a benchmark, the optimal decisions of the full information scenario are extracted and then the solutions are examined under asymmetric information scenario. The base parameters for our numerical study are: \(\gamma = 100\); \(k\) = 1; \(c = 20\); \(\beta_{r} = 0.5\); \(\beta_{m} = 1\); \(\alpha_{r} = 0.5\); \(\alpha_{m} = 1\). Applying the equilibrium characterization in Propositions 1 and 2, the optimal contract terms, greening effort levels, market price, and each party’s profit under the full information scenario are presented in Table 4.

Suppose the manufacturer cannot observe the retailer’s level of green sales effort. The concern for the manufacturer is “whether the retailer acts based on his selected contract?”. What if the manufacturer wants to induce a high level of the green sales effort, but, the retailer pretends to exert a high level of green sales effort and actually exerts a low level of green sales effort. To assure the retailer acts truthfully, we need to apply the equilibrium characterization derived from Proposition 3. Suppose the manufacturer wants to induce a high level of green sales effort (i.e., \(\tau_{r} = 30\)) to the retailer. Consequently, the manufacturer should offer a better deal (by adjusting wholesale price \(w\) and greening effort \(\tau_{m}\)) to induce such a high level of green sales effort. The concern is due to information asymmetry; the retailer accepts the deal but exerts a low level of green sales effort, i.e., \(\tau_{r} = 20\). The manufacturer, therefore, needs to offer a menu of contracts; one for the retailer who ends up exerting a low level of sales effort (to induce \(\tau_{rL} = 20\)), and one for the retailer who exerts a high level of sales effort (to induce \(\tau_{rH} = 30\)). Suppose the retailers are equally distributed to \(H\)- and \(L\)-type; \(v = 0.5\). Table 5 characterizes the equilibrium under asymmetric information.

The set of parameters in numerical study is consistent with the previous works and aligned with the theoretical models developed in Sects. 4 and 5. Taking this into account, the results from illustrative numerical study prove the robustness of our developed model which meets the requirements discussed in Ketokivi and Choi (2014); i.e. sense of generality and situationally grounded. Moreover, to illustrate the validity of the results, in Table 6, we have extended the space of base parameters to cover all potential relationships between \(\alpha_{r}\), \(\alpha_{m}\), \(\beta_{r}\) and \(\beta_{m}\).

By comparing the equilibrium under symmetric (Table 4) and asymmetric information (Tables 5 and 6), one can observe the following results:

-

The manufacturer uses her greening effort as an incentive to induce a higher level of green sales effort on the high-type retailer (i.e., \(\tau_{mH} > \tau_{mL}\)). However, to avoid the \(L\)-type retailer (who exerts a low level of green sales effort) from cheating by mimicking the \(H\)-type retailer, the manufacturer uses the wholesale price as a screening tool; \(w_{H} > w_{L}\).

-

The market demand decreases under information asymmetry. This can be verified by comparing the demand function \(D = \gamma - kp_{\theta } + \alpha_{m} \tau_{m\theta } + \alpha_{r} \tau_{r\theta }\) derived from Tables 4 and 5. Specifically, the demand under first-best outcome is \(D^{{\text{d}}} = 26.5\) units, while the expected demand under asymmetric information is \({\mathbb{E}}_{\theta } \left[ D \right] = \left( {0.5 \times 27.5} \right) + \left( {0.5 \times 25} \right) = 26.2\) units. The reason behind this observation is twofold. First, the average market price is higher under information asymmetry, i.e., \(p^{{\text{d}}} = 93.3 < 99.3 = {\mathbb{E}}_{\theta } \left[ p \right] = \nu \times p_{H} + \left( {1 - \nu } \right) \times p_{L}\). Second, the manufacturer’s investment in greening effort under asymmetric information is less than that under the first-best outcome, i.e., \(\tau_{m}^{{\text{d}}} = 13.3 > 13.1 = {\mathbb{E}}_{\theta } \left[ {\tau_{m\theta } } \right] = \nu \times \tau_{mH} + \left( {1 - \nu } \right) \times \tau_{mL}\). This result is aligned with the well-known trade-off between channel efficiency loss and information rent in SC contracting literature (Ha, 2001). This also explains the reason for why the channel is worse off under asymmetric information; the manufacturer decreases investment on greening effort to lower the information rent collected by the \(L\)-type retailer.

6.1 The impact of consumer’s environmental awareness

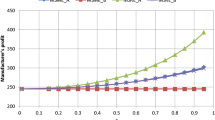

A key concern for SC members is to what extent the greening operations affect the market expansion. This depends on the consumer’s environmental awareness. Therefore, in this section, we study the impact of demand elasticity coefficients on greening operations (refer to Fig. 3).

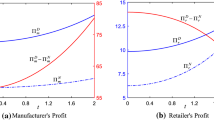

According to Fig. 3, the greening efforts put by the parties, wholesale price, and retail price increase with the demand elasticity factor. This is true because demand elasticity is representative of the customer’s environmental awareness, hence, with higher demand elasticity, both parties increase the level of greening effort to expand the market. Consequently, the retailer is better off by increasing his marginal revenue (i.e., \(p \uparrow\)). Anticipating this, the manufacturer also increases the wholesale price to take her share from expanded demand. Therefore, one can expect that all SC members are better off with a higher level of demand elasticity. This can be verified from Fig. 4. The main takeaways from Fig. 4 are twofold. First, a higher demand elasticity of green sales effort means customers are more environmental-conscious. Consequently, with the same level of greening effort, the market demand expands more resulting in a higher SC surplus. Second, an increase in demand elasticity of the green sales effort of the retailer has more impact on the manufacturer’s profit, and vice versa. This is because, with higher \(\alpha_{r}\), the retailer increases his green sales effort to expand the market demand; this is costly for the retailer but costless for the manufacturer.

Considering Figs. 3 and 4, one can say that both SC members can benefit from providing a green product at a more sustainable level. This indicates that the SC members, in line with governments, seek to enhance society's environmental awareness. This also sheds light on the importance of information transparency of green sales investment taken by the downstream parties (e.g., retailer) to the upstream ones (e.g., manufacturer). In practice, retailers can take various measures to promote green products. Improving the demonstration of green products at the store, using non-plastic bags, improving customer experience, conducting informant advertisements, and hiring people with environmental knowledge are all practical measures for the retailer to enhance the customer's environmental awareness and sensitivity. These initiatives help to attain the sustainable development goal of GSCM.

The other insight from Fig. 4 is that when demand elasticity is small, which corresponds to the introduction stage of the green product life cycle, the SC's profit increases slowly. Once the concept of the green product is well received, the SC’s surplus increases at a faster rate. This indicates that the SC parties should be patient to gain from their greening investments. Likewise, governments and policymakers should take this point into account when regulating green initiatives.

7 Extensions

Green efforts and their correspondent costs may be modeled in different forms. Note that, in the base model, we assumed green sales effort as a continuous variable with a quadratic-form greening cost function. In this section, we extend our analysis by considering other functions for green sales effort and correspondent costs. In what follows, we first analyze the case where the green sales effort of the retailer is binary. We then extend our analysis for other forms of greening cost functions rather than the commonly assumed quadratic function.

7.1 Green sales effort

This section investigates how a binary choice of retailer’s green sales effort decision may impact our results related to the SC parties. Suppose retailer’s green sales effort can take two discrete values, which represent the two states of high and low efforts as

A binary sales effort indicates that the retailer has to choose between a high or low levels of effort. In reality, \(H\) and \(L\) values of the retailer’s effort can be predetermined depending on the business environment and available practices and technologies. Lemma 2 characterizes the retailer’s green sales effort decision:

Lemma 2. Given the contract \(\left( {w_{\theta } ,\tau_{m\theta } } \right)\) offered by the manufacturer, under a binary choice the retailer exerts high green sales effort if \(w_{\theta } - {\upalpha }_{m} \tau_{m\theta } < \gamma\) .

Proof See Appendix.

Lemma 2 characterizes the required conditions for contract terms (\(w_{\theta } ,\tau_{m\theta }\)) to induce a high level of green sales effort on the \(\theta\)-type retailer. Similar to our earlier results in the base model, one can identify synergy between greening operations; i.e., the higher the green effort from the manufacturer (\(\tau_{m\theta } \uparrow\)), the more likely the condition in lemma 2 is satisfied for the retailer to exert a high level of green sales effort. Moreover, Lemma 2 indicates that the retailer’s decision on his green sales effort depends also on the potential of the market and the demand elasticity for the manufacturer’s greening activities, i.e. \(\gamma\) and \({\upalpha }_{m}\), respectively. This means that the retailer takes the share of the manufacturer’s greening effort on the demand expansion (due to \(\gamma\), \({\upalpha }_{m}\), and \(\tau_{m\theta }\)) into account when deciding on his green sales effort level.

From Lemma 2 we can also derive interesting insights about consumer and social welfare.Footnote 6 The former can be achieved when the manufacturer induces a high level of the retailer’s green sales effort by investing in improving consumers’ purchasing behavior resulting in higher market size \(\gamma\). For instance, conducting green advertisement, green education campaigns, and promoting green consumption are some effective strategies to improve the consumer’s green purchasing behavior. Besides, she can concentrate on market reach strategy and improving brand awareness of the consumers in order to enhance the market potential. All the mentioned activities not only lead to demand expansion but also influence the retailer to intensify his green sales effort. The social welfare can be also improved as a result of a motivated retailer who puts a higher green sales effort due to either the synergy between green efforts or a side strategy (increasing \({\upalpha }_{m}\) and \(\gamma\)). From the condition in lemma 2, one can verify that a higher greening effort from the manufacturer, or any strategy that increases the manufacturer’s demand elasticity \({\upalpha }_{m}\), may incentivize the retailer to insert a high level of green sales effort. This synergy increases social welfare due to offering a greener product.

Considering a binary state of whole or nothing (e.g., 0 and 1) condition is a common approach in SC literature (Nikoofal and Gumus, 2020). Similarly, we normalize the low-type retailer’s green sales effort to 0, and the high-type retailer’s green sales effort to 1 to characterize the decision of the SC members:

Lemma 3. Given the contract ( \(w_{\theta }\) , \( \tau_{m\theta }\) ) offered by the manufacturer, the retailer exerts high green sales effort if \({\upalpha }_{r}\) > 2 \(\beta_{r}\) .

Proof Similar to the proof of Lemma 2, thus omitted.

From lemma 3, the retailer’s effort level depends on the relationship between his green sales effort’s demand elasticity (\({\upalpha }_{r}\)) and his green effort’s cost coefficient (\(\beta_{r}\)). The former can be related to the green awareness of the consumers, while the latter is directly related to the adopted green activities. This implies that the environmental consciousness of the society affects the retailer’s green sales effort level. In particular, the retailer performs a cost–benefit analysis when deciding on green sales effort level; a high level of green sales effort is preferable as long as its efficacy in increasing consumer’s awareness dominates its marginal cost (i.e., \({\upalpha }_{r} > 2\beta_{r}\)).

7.2 Greening cost

It is a common assumption in the literature to assume that the greening investment is quadratic in nature (see Savaskan & Van Wassenhove, 2006, and citations therein). In this section, we consider other functions for greening costs to study its impact on our analysis. Therefore, in what follows, we consider two different greening effort costs for both the retailer and the manufacturer; (i) linear and (ii) cubic functions. We first analyze and then compare the results to those in the baseline model (i.e., quadratic greening costs) to verify the robustness of our findings.

7.2.1 Linear greening cost function

Suppose the greening cost incurred by the channel members is linear; \(\beta \times \tau\). Consequently, the profit function of the retailer and the manufacturer are as follows, respectively:

The manufacturer’s optimization problem can be written as:

s.t.

where objective function (Eq. 31) aims to maximize the expected profit of the manufacturer (\(\nu {\Pi }_{mH} + \left( {1 - \nu } \right){\Pi }_{mL}\)). Constraints (32–33) assure incentive compatibility, while constraints (34–35) assure participation of the retailer.

7.2.2 Cubic greening cost function

Under this condition, the greening cost incurred by the members is assumed to be \(\beta \times \tau^{3}\). Consequently, the profit functions of the retailer and the manufacturer would be:

The manufacturer’s optimization problem in this case is similar to the case of linear greening cost function except for the greening cost functions that are cubic. To verify the robustness of findings against different greening cost functions, in the next section, we numerically compare the outcome of models.

7.2.3 Comparison between different greening cost functions

To check the impact of greening cost function on the outcome of the model, we solve the models with different greening cost functions (linear, quadratic, cubic) with the same parameters. Based on Table 7, a cubic-form cost function results in the lowest level of manufacturer’s greening effort while a linear-form cost function results in its highest level. It is an intuitive result; the manufacturer decreases investment on greening effort when greening cost increases. Generally speaking, Table 7 indicates that decision variables and profits of SC members show similar patterns (but with different values) under all green cost functions. Hence, one can conclude that although the optimal value of decision variables may vary under different greening cost functions, the main observations and results would not change.

Finally, to better understand the behavior of the SC partners under different greening cost functions, we compare both parties’ profits in Fig. 5. The similar trend of profits under three considered greening cost functions implies that the nature of greening cost function does not impact the underlying interaction between SC members.

8 Discussions and conclusion

In this section, we provide several implications from the numerical illustrations and extended analyses. We then conclude our paper and provide potential directions for future research.

8.1 Implications

Our analysis helps us provide SC parties and sustainable policymakers with several recommendations and managerial implications:

-

1.

Information transparency: Our results shed light on the importance of information transparency about greening operations. It is a well-established result that lack of information transparency harms the channel efficiency. However, our proposed mechanism helps SC parties to benefit from green market expansion, although in the presence of information asymmetry. Indeed, the manufacturer can use her greening effort as an incentive tool to induce a higher level of green sales effort on the retailer; a so-called synergy in our analysis. Due to the demand expansion effect of the green efforts, consumers are willing to buy more green products which, in turn, improves the profits of the both SC members. This incentive strategy can partially compensate for the profit loss as a result of the information asymmetry.

-

2.

Adoption of green products by the consumer is a time-consuming practice. The retail chains are the final channel node for direct relationship with consumers. Therefore, retailer's green sales effort is a critical market-driven factor in GSCM that can significantly enhance consumers’ green awareness. Our analysis indicates that the greening activities have a small impact on demand expansion in the early introduction stage when consumers’ attitude towards the introduced green product is not yet such positive. This stage corresponds to the consumers’ intention-action gap. Managers and policymakers should take this into account, and keep their green promotions to narrow this gap.

-

3.

Our extended analyses show that in addition to the contract terms (\(w_{\theta }\), \(\tau_{m\theta }\)), the manufacturer can boost the retailer’s green sales effort by elaborating on some market characteristics. In this regard, she can improve her greening activities’ demand elasticity and the market potential (e.g., by spending on promotional activities for enhancing consumers environmental awareness) in order to incentivize the retailer to conduct high or low green sales effort.

-

4.

By applying different greening cost functions (linear, quadratic, cubic), we show that our findings are robust to different realization of cost functions. Regardless of the type of the greening cost function, the developed models are capable of inducing the retailer to accept the contract.

8.2 Conclusion

As the consumers’ environmental awareness increases, special attention should be paid to the green SCs. One of the concerns in this regard is channel coordination. This becomes more challenging when the information is not symmetrically distributed among SC parties. This is because all SC members are responsible for greening operations; thus, determining the role of each SC party is a key decision. This paper explores the effects of green activities asymmetric information on achieving channel coordination in a green SC.

A Stackelberg game has been developed with a manufacturer (the leader) who offers a contract to the retailer (the follower). The contract terms are wholesale price and manufacturer’s greening effort. The retailer then decides on his green sales effort and market price. The market size is realized and each party collects its own profit. The analysis of first-best outcome reveals that the parties use a commitment strategy to contribute to greening operations. Namely, if a SC member encounters a higher cost of greening operation, he may increase his greening effort level (to commit to greening operations) as long as the other SC member has a high-impact market expansion greening operations. By comparing the equilibrium characterization under symmetric and asymmetric information we then extract some insights. First, our comparative analysis suggests that the whole channel is worse off under information asymmetry. This is because the manufacturer who trades off between channel efficiency (level of greening effort) and information rent (due to unobservability of retailer’s green sales effort), may reduce the level of greening effort to reduce the information rent collected by the low-type retailer. Second, the manufacturer includes her greening effort in the contract to work as an incentive; the higher level of greening effort by the manufacturer incentivizes the retailer to increase his green sales effort. Whereas, the wholesale price works as a screening tool to avoid a low-type retailer (who may exert a low level of green sales effort) from mimicking a high-type retailer. Specifically, in the equilibrium, the manufacturer exerts a higher level of greening effort when the retailer is of high type. This is to incentivize the high-type retailer for to exert a higher level of green sales effort. However, to avoid the low-type retailer to pick the contract designed for the high-type, the manufacturer charges a higher wholesale price for the high-type than that for the low-type.

This study can be extended in different ways. For example, incorporating the price premium effect of the greening operations, which means green efforts affect the demand and price simultaneously, is an interesting future study that can move the models one step closer to reality. Moreover, considering bilateral asymmetric information, where the manufacturer's green effort level is also unknown to the retailer, is another interesting research extension.

Notes

Refer to https://learn.g2.com/green-marketing.

Similar to Swami & Shah (2013), the market demand is negatively related to the retail price but positively related to the greening efforts of both the retailer and the manufacturer.

If the retailer claims his type as \(H\) then he has to pick contract \(H:\left( {w_{H} ,\tau_{mH} } \right)\) and if he claims his type as \(L \) then he has to pick contract \(L:\left( {w_{L} ,\tau_{mL} } \right)\). However, the retailer can make a false claim and therefore it is necessary to consider appropriate feature in the model to prevent the retailer to make false claims.

Previous works have considered social welfare as the function of the consumer welfare and the environmental impacts (Choi and Luo, 2019). Hence, any activity that can enhance these two factors contributes to the increase of the social welfare.

References

Akan, M., Ata, B., & Lariviere, M. A. (2011). Asymmetric information and economies of scale in service contracting. Manufacturing and Service Operations Management, 13(1), 58–72.

Babich, V., Li, H., Ritchken, P., & Wang, Y. (2012). Contracting with asymmetric demand information in supply chains. European Journal of Operational Research, 217(2), 333–341.

Basiri, Z., & Heydari, J. (2017). A mathematical model for green supply chain coordination with substitutable products. Journal of Cleaner Production, 145, 232–249.

Burnetas, A., Gilbert, S. M., & Smith, C. (2005). Quantity discounts in single period supply contracts with asymmetric demand information. IIE Transactions, 39(5), 465–479.

Cachon, G. P. (2003). Supply Chain Management: Design, Coordination and Operation. International Journal of Production Economics, 11, 227–339.

Cachon, G. P., & Zhang, F. (2006). Procuring fast delivery: Sole sourcing with information asymmetry. Management Science, 52(6), 881–896.

Cakanyıldırım, M., Feng, Q., Gan, X., & Sethi, S. P. (2012). Contracting and coordination under asymmetric production cost information. Production and Operations Management, 21(2), 345–360.

Cao, E., Ma, Y., Wan, C., & Lai, M. (2013). Contracting with asymmetric cost information in a dual-channel supply chain. Operations Research Letters, 41(4), 410–414.

Chen, W., & Li, L. (2020). Incentive contracts for green building production with asymmetric information. International Journal of Production Research. https://doi.org/10.1080/00207543.2020.1727047

Chiu, C., Choi, T. M., Hao, G., & Li, X. (2015). Innovative menu of contracts for coordinating a supply chain with multiple mean-variance retailers. European Journal of Operational Research, 246, 815–826.

Choi, T. M. (2013). Local sourcing and fashion quick response system: The impacts of carbon footprint tax. Transportation Research Part e: Logistics and Transportation Review, 55(1), 43–54.

Choi, T. M. (2019). Data quality challenges for sustainable fashion supply chain operations in emerging markets: Roles of blockchain, government sponsors and environment taxes. Transportation Research Part e: Logistics and Transportation Review, 133, 135–152.

Corbett, C. J., & de Groote, X. (2000). A supplier’s optimal quantity discount policy under asymmetric information. Management Science, 46(3), 444–450.

Corbett, C. J., Zhou, D., & Tang, C. S. (2004). Designing Supply Contracts : Contract type and information asymmetry. Management Science, 50(4), 550–559.

Fang, X., Ru, J., & Wang, Y. (2014). Optimal procurement design of an assembly supply chain with information asymmetry. Production and Operations Management, 23(12), 2075–2088.

Feng, Q., Lai, G., & Lu, L. X. (2015). Dynamic bargaining in a supply chain with asymmetric demand information. Management Science, 61(2), 301–315.

Gan, X., Sethi, S. P., & Yan, H. (2004). Coordination of supply chains with risk-averse agents. Production and Operations Management, 13(2), 135–149.

Gan, X., Sethi, S. P., & Yan, H. (2009). Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Production and Operations Management, 14(1), 80–89.

Giovanni, P. D. (2016). Closed-loop supply chain coordination through incentives with asymmetric information. Annals of Operations Research, 253(1), 133–167.

Gümüş, M. (2014). With or without forecast sharing: Competition and credibility under information asymmetry. Production and Operations Management, 23(10), 1732–1747.

Guo, S., Shen, B., Choi, T. M., & Jung, S. (2017). A review on supply chain contracts in reverse logistics: Supply chain structures and channel leaderships. Journal of Cleaner Production, 144, 387–402.

Ha, A. Y. (2001). Supplier-buyer contracting: Asymmetric cost information and cutoff level policy for buyer participation. Naval Research Logistics, 48(1), 41–64.

Heydari, J., Chaharsooghi, S. K., & Alipour, L. (2009). Animation supply chain modelling and diagnosis: A case study in animation industry of Iran. International Journal of Business Performance and Supply Chain Modelling, 1(4), 319–332.

Hong, Z., & Guo, X. (2019). Green product supply chain contracts considering environmental responsibilities. Omega, 83, 155–166.

Hosseini, M. M. (2020). A decision support contract for cost-quality trade-off in projects under information asymmetry. International Journal of Business and Management, 15, 4.

Hosseini-Motlagh, S. M., Nouri-Harzvili, M., Choi, T. M., & Ebrahimi, S. (2019). Reverse supply chain systems optimization with dual channel and demand disruptions: Sustainability, CSR investment and pricing coordination. Information Sciences, 503, 606–634.

Kautish, P. (2016). Volkswagen AG: Defeat device or device defeat? IMT Case Journal, 7, 19–30.

Kerkkamp, R. B. O., Heuvel, W. V. D., & Wagelmans, A. P. M. (2018). Two-echelon supply chain coordination under information asymmetry with multiple types. Omega, 76, 137–159.

Ketokivi, M., & Choi, T. (2014). Renaissance of case research as a scientific method. Journal of Operations Management, 32(5), 232–240.

Kim, D., & Kim, S. (2017). Sustainable supply chain based on news articles and sustainability reports: Text mining with Leximancer and DICTION. Sustainability, 9(6), 1008.

Kostamis, D., & Duenyas, I. (2011). Purchasing under asymmetric demand and cost information: When is more private information better? Operations Research, 59(4), 914–928.

Laffont, J.-J., & Martimort, D. (2009). The theory of incentives: The principal-agent model. Princeton University Press.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2020a). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management, 66(7–8), 958–988.

Li, G., Lim, M. K., & Wang, Z. (2020b). Stakeholders, green manufacturing, and practice performance: Empirical evidence from Chinese fashion businesses. Annals of Operations Research, 290(1), 961–982.

Li, G., Liu, M., Bian, Y., & Sethi, S. P. (2020c). Guarding against Disruption Risk by contracting under information asymmetry. Decision Sciences, 51(6), 1521–1559.

Li, G., Zheng, H., Sethi, S. P., & Guan, X. (2020d). Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sciences, 51(3), 691–719.

Li, H., & Cao, E. (2021). Competitive crowdfunding under asymmetric quality information. Annals of Operations Research. https://doi.org/10.1007/s10479-021-03939-y

Li, Y., Xu, X., Zhao, X., Yeung, J. H. Y., & Ye, F. (2012). Supply chain coordination with controllable lead time and asymmetric information. European Journal of Operational Research, 217(1), 108–119.

Liu, A., Luo, S., Mou, J., & Qiu, H. (2021). The antagonism and cohesion of the upstream supply chain under information asymmetry. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03881-5

Liu, H., Sun, S., Lei, M., Leong, G. K., & Deng, H. (2016). Research on cost information sharing and channel choice in a dual-channel supply Chain. Mathematical Problems in Engineering, 2016, 4368326.

Liu, Y., Li, J., Quan, B., & Yang, J. (2019). Decision analysis and coordination of two-stage supply chain considering cost information asymmetry of corporate social responsibility. Journal of Cleaner Production, 228, 1073–1087.

Ma, P., Shang, J., & Wang, H. (2017). Enhancing corporate social responsibility: Contract design under information asymmetry. Omega, 67, 19–30.

Ma, X., Wang, S., Islam, S. M. N., & Liu, X. (2018). Coordinating a three-echelon fresh agricultural products supply chain considering freshness-keeping effort with asymmetric information. Applied Mathematical Modelling, 67, 337–356.

Mavlanova, T., Benbunan-Fich, R., & Koufaris, M. (2012). Signaling theory and information asymmetry in online commerce. Information and Management, 49(5), 240–247.

Mobini, Z., van den Heuvel, W., & Wagelmans, A. (2019). Designing multi-period supply contracts in a two-echelon supply chain with asymmetric information. European Journal of Operational Research, 277(2), 542–560.

Myerson, R. B. (1982). Optimal coordination mechanisms in generalized principal–agent problems. Journal of Mathematical Economics, 10(1), 67–81.

Nazerzadeh, H., & Perakis, G. (2016). Technical note: Nonlinear pricing competition with private capacity information. Operations Research, 64(2), 329–340.

Nikoofal, M. E., & Gümüş, M. (2020). Value of audit for supply chains with hidden action and information. European Journal of Operational Research, 285(3), 902–915.

Rahbar, E., & Wahid, N. A. (2011). Investigation of green marketing tools’ effect on consumers’ purchase behavior. Business Strategy Series, 12, 73–83.

Raza, S. A., & Govindaluri, S. M. (2019). Greening and price differentiation coordination in a supply chain with partial demand information and cannibalization. Journal of Cleaner Production, 229, 706–726.

Sane-Zerang, E., Razmi, J., & Taleizadeh, A. A. (2019). Coordination in a closed-loop supply chain under asymmetric and symmetric information with sales effort-dependent demand. Journal of Business Economics, 90, 303–334.

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: The case of competing retailers. Management Science, 52(1), 1–14.

Shen, B., Choi, T. M., & Minner, S. (2018). A review on supply chain contracting with information considerations: Information updating and information asymmetry. International Journal of Production Research, 47(21), 6145–6158.

Shen, B., Choi, T. M., & Minner, S. (2019). A review on supply chain contracting with information considerations: Information updating and information asymmetry. International Journal of Production Research, 57(15–16), 4898–4936.

Swami, S., & Shah, J. (2013). Channel coordination in green supply chain management. Journal of the Operational Research Society, 64(3), 336–351.

Vosooghidizaji, M., Taghipour, A., & Canel-Depitre, B. (2019). Supply chain coordination under information asymmetry: A review. International Journal of Production Research, 58(6), 1805–1834.

Wang, K., Zhao, R., & Chen, H. (2018). Optimal credit period and green consumption policies with cash-credit payments under asymmetric information. Journal of Cleaner Production, 205, 706–720.

Wang, Q., & He, L. (2018). Incentive strategies for low-carbon supply chains with asymmetric information of carbon reduction efficiency. International Journal of Environmental Research and Public Health, 15(12), 2736.

Yang, D., Chen, Z., & Nie, P. (2016). Output subsidy of renewable energy power industry under asymmetric information. Energy, 117, 291–299.

Yang, D., Xiao, T., Choi, T. M., & Cheng, T. (2018a). Optimal reservation pricing strategy for a fashion supply chain with forecast update and asymmetric cost information. International Journal of Production Research, 56(5), 1960–1981.

Yang, R., Tang, W., Dai, R., & Zhang, J. (2018b). Contract design in reverse recycling supply chain with waste cooking oil under asymmetric cost information. Journal of Cleaner Production, 201, 61–77.

Yoon, J., Talluri, S., & Rosales, C. (2019). Procurement decisions and information sharing under multi-tier disruption risk in a supply chain. International Journal of Production Research, 58(7), 3263–3283.

Yuan, B., Gu, B., Guo, J., Xia, L., & Xu, C. (2018). The optimal decisions for a sustainable supply chain with carbon information asymmetry under. Sustainability, 10(4), 1002.

Zhang, T., Choi, T. M., & Zhu, X. (2018). Optimal green product’s pricing and level of sustainability in supply chains: Effects of information and coordination. Annals of Operations Research. https://doi.org/10.1007/s10479-018-3084-8

Zhao, Y., Choi, T. M., Cheng, T. C. E., & Wang, S. (2014). Mean-risk analysis of wholesale price contracts with stochastic price-dependent demand. Annals of Operations Research., 257(1–2), 491–518.

Acknowledgements

The authors sincerely thank the Editors for their encouragements and two anonymous referees for all their invaluable comments and suggestions that have helped us significantly improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

The total channel profit under centralized setting would be:

Due to the concavity of the objective function (see Swami & Shah, 2013), the first order conditions result in the following optimal solutions:

1.2 Proof of Lemma 1

The profit of the retailer is:

Due to the concavity of the above objective function, the first best conditions for \( \tau_{r}^{{\text{d}}}\) and \(p^{{\text{d}}}\) yield:

Proof of Proposition 2. Applying backward induction, we first solve the retailer’s profit considering the manufacturer’s decisions are known. i.e.:

So we have:

Now we solve the manufacturer’s optimal response function. Plugging the found solutions into \(\Pi_{m}\), we have:

Applying the first-best conditions for \(\Pi_{m}\), we obtain the optimal values of \(w\) and \(\tau_{m}\):

Inserting the extracted equilibriums into equations (A.10) and (A.11) we get:

Proof of Corollary 1. To study the impact of \(\beta_{r}\) and \(\beta_{m}\) on the manufacturer’s greening effort, we need to find \(\partial \tau_{m\theta } /\partial \beta_{r}\) and \(\partial \tau_{m\theta } /\partial \beta_{m}\), respectively;

Note that, from Eq. (A.17), we have \(\partial \tau_{m\theta } /\partial \beta_{r} < 0\). However, from Eq. (A.18), one can verify that \(\partial \tau_{m\theta } /\partial \beta_{m} \ge 0\) if \(\alpha_{r}^{2} \ge 4\beta_{r}\), or \(\alpha_{r} \ge 2\sqrt {\beta_{r} }\).

Similarly, we need to find \(\partial \tau_{r\theta } /\partial \beta_{m}\) and \(\partial \tau_{r\theta } /\partial \beta_{r}\), respectively;

Note that, therefore, from Eq. (A.19), we have \(\partial \tau_{m\theta } /\partial \beta_{r} < 0\). However, from Eq. (A.20), one can verify that \(\partial \tau_{r\theta } /\partial \beta_{r} \ge 0\) if \(\alpha_{m}^{2} \ge 8\beta_{m}\), or \(\alpha_{m} \ge 2\sqrt {2\beta_{m} }\).

Proof of Proposition 3. The problem can be written as follows:

s.t.

For the sake of simplicity and based on \(\left( {p_{HH}^{*} } \right) = argmax\Pi_{rHH}\) and \(\left( {p_{LL}^{*} } \right) = argmax\Pi_{rLL}\), we have:

Thus, computing the first order derivative over market price and setting it equal to zero, we derive:

Similarly, we define:

So, we have:

Plugging \(p_{HH}\), \(p_{HL}\), \(p_{LL}\), \(p_{LH}\) into \(\Pi_{rHH}\), \(\Pi_{rHL}\), \(\Pi_{rLL}\), \(\Pi_{rLH}\), \(\Pi_{mH}\) and \(\Pi_{mL}\), we derive the retailer and the manufacturer’s profit functions:

Let \(\lambda 1\), \(\lambda 2\), \(\lambda 3\), \(\lambda 4\) denote the Lagrange multiplier of the participation constraints and the incentive compatibility constraints and \(l\) represent the Lagrange function, we have:

We first set all the Lagrange multipliers to zero and derive the optimal solutions from first-order partial derivatives of the first fourth equations of the KKT condition (obtain optimal solutions). Then we check the other KKT conditions to see whether the obtained solution is feasible. Thus, we have:

The KKT condition will be:

As mentioned earlier, because of the complexity of the model, closed-forms are derived where we fix some parameters to specific values. Hence, the parameters that we listed in the numerical illustration section are fixed firstly and then, we checked the KKT condition. In doing so, the values in Table

8 are obtained:

Since we set all the Lagrange multipliers to zero, all the constraints must be positive or zero (\(M_{f} \ge 0\)). However, the first constraint is negative, so the results are infeasible. For the second round, we add the first constraint to the Lagrange function. Thus we have:

Applying KKT conditions we can obtain values illustrated in Table

9.

The obtained results apply in KKT conditions; thus, they are both optimal and feasible. In fact, with this method, since the complexity of the proposed model makes it hard or impossible to check all the KKT conditions, we search for the feasible solution in the optimal area.

Finally, from the KKT conditions with given Lagrange multipliers (\(\lambda_{1} = 0.017,\lambda_{2} = \lambda_{3} = \lambda_{4} = 0\)), we can obtain the closed-form expressions:

By setting the first order derivatives of Lagrange function \(l\) and using the abbreviation Table 3, the optimal solutions can be achieved as:

Finally, by plugging the found solutions into Eq. (A.27) and Eq. (A.28), we can obtain

Proof of Lemma 2. Given \(\left( {w_{\theta } ,\tau_{m\theta } } \right)\), the profit of the \(H\)-type retailer would be:

In a similar way, given \(\left( {w_{\theta } ,\tau_{m\theta } } \right)\), the profit of the \(L\)-type retailer would be:

The retailer is rational, so he exerts high green sales effort if it leads to more profit. By comparing his profit under both \(H\) and \(L\) conditions, we obtain:

Rights and permissions

About this article

Cite this article

Ranjbar, A., Heydari, J., Madani Hosseini, M. et al. Green channel coordination under asymmetric information. Ann Oper Res 329, 1049–1082 (2023). https://doi.org/10.1007/s10479-021-04284-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04284-w